- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Home Loans | June | 0.0% | 0.6% |

| 02:00 | New Zealand | RBNZ Interest Rate Decision | 1.5% | 1.25% | |

| 02:00 | New Zealand | RBNZ Rate Statement | |||

| 03:00 | New Zealand | RBNZ Press Conference | |||

| 06:00 | Germany | Industrial Production s.a. (MoM) | June | 0.3% | -0.4% |

| 06:45 | France | Trade Balance, bln | June | -3.3 | -4 |

| 07:00 | Switzerland | Foreign Currency Reserves | July | 759 | |

| 07:30 | United Kingdom | Halifax house price index | July | -0.3% | 0.3% |

| 07:30 | United Kingdom | Halifax house price index 3m Y/Y | July | 5.7% | 4.4% |

| 13:30 | U.S. | FOMC Member Charles Evans Speaks | |||

| 14:00 | Canada | Ivey Purchasing Managers Index | July | 52.4 | 53.0 |

| 14:30 | U.S. | Crude Oil Inventories | August | -8.496 | -3.313 |

| 19:00 | U.S. | Consumer Credit | June | 17.09 | 16 |

| 23:50 | Japan | Current Account, bln | June | 1594.8 | 1140 |

The main US stock indexes rose due, first of all, to the rebound in shares of the industrial goods sector after China took action to stabilize the renminbi.

The People’s Bank of China (NBK) set the average RMB exchange rate at 6.9683 yuan for $ 1, compared with analysts forecast 6.9871 yuan for $ 1. This happened just a few hours after the US Department of the Treasury called China the “currency manipulator” for the first time since 1994, after which it allowed the yuan against the dollar to fall below the important mark of 7 yuan for $ 1 after Trump’s threat to introduce new tariffs on Chinese imports .

The last step of the Chinese central bank was seen as an attempt to ease tensions between the two largest economies in the world. He reassured currency markets, which were shocked by fears that a trade war between the United States and China would develop into a currency war.

Meanwhile, White House adviser Larry Kudlow said US President Donald Trump still wants to continue negotiations with China. “The reality is that we would like to come to an agreement,” Kudlow told CNBC. “We plan that the Chinese delegation will come here in September. The situation may change with respect to tariffs. ”

Investors also analyzed the Job vacancy and labor turnover survey (JOLTS), which showed that in June the number of vacancies fell to 7.348 million from 7.384 million in May. Analysts had expected the number of vacancies to drop to 7.317 million. At the same time, the level of vacancies fell by 0.1% to 4.6%.

Most DOW components recorded an increase (25 out of 30). The biggest gainers were NIKE Inc. (NKE; + 2.87%). Outsiders were shares of Dow Inc. (DOW; -1.00%).

Almost all S&P sectors completed trading in positive territory. The industrial goods sector grew the most (+ 1.5%). Only conglomerate sector decreased (-0.3%)

At the time of closing:

Dow 26,029.52 +311.78 + 1.21%

S&P 500 2,881.77 +37.03 + 1.30%

Nasdaq 100 7,833.27 +107.22 + 1.39%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Home Loans | June | 0.0% | 0.6% |

| 02:00 | New Zealand | RBNZ Interest Rate Decision | 1.5% | 1.25% | |

| 02:00 | New Zealand | RBNZ Rate Statement | |||

| 03:00 | New Zealand | RBNZ Press Conference | |||

| 06:00 | Germany | Industrial Production s.a. (MoM) | June | 0.3% | -0.4% |

| 06:45 | France | Trade Balance, bln | June | -3.3 | -4 |

| 07:00 | Switzerland | Foreign Currency Reserves | July | 759 | |

| 07:30 | United Kingdom | Halifax house price index | July | -0.3% | 0.3% |

| 07:30 | United Kingdom | Halifax house price index 3m Y/Y | July | 5.7% | 4.4% |

| 13:30 | U.S. | FOMC Member Charles Evans Speaks | |||

| 14:00 | Canada | Ivey Purchasing Managers Index | July | 52.4 | 53.0 |

| 14:30 | U.S. | Crude Oil Inventories | August | -8.496 | -3.313 |

| 19:00 | U.S. | Consumer Credit | June | 17.09 | 16 |

| 23:50 | Japan | Current Account, bln | June | 1594.8 | 1140 |

Jane Foley, the senior FX strategist at Rabobank, notes that with the escalation in the trade war between the U.S. and China in the past few days, the question is whether recent events will trigger a full-blown currency war and how far the crossfire will extend.

- “By setting the daily fix for USD/CNY a little lower than expected this morning, the PBoC has breathed a little calm into global markets. Anxiety levels, however, are running deep. The decision by the US Administration to label China a “currency manipulator’ yesterday is a hugely charged political statement.

- It is possible that Trump has a desire to be seen to be taking a firm stance against China for his domestic audience ahead of next year’s election. It is also possible that China’s decision to allow USD/CNY to slide above the 7 level yesterday was a warning to the US, that the currency could be used as a weapon in the ongoing trade war between the two countries.

- According to the US “in recent days, China has taken concrete steps to devalue its currency”. USD/CNY is trading over 2% higher than its level at the start of this month. Arguably, however, the CNY was due a depreciation in reflection of the slowdown in domestic growth and the policy easing announced this year by the PBoC.

- A significant and rapid move lower in the CNY could send shockwaves through the global economy. China is the world’s largest importer of commodities and a considerable consumer of goods produced in the Asian region. A weaker CNY could thus prompt a broader currency war.

- Although the topic of whether the US Treasury would intervene in the FX market is topical, this would go against the grain of years of G7 accords which maintain that markets should set exchange rates.

- While it is impossible to second guess Trump, US FX intervention is thus still unlikely. That said, a currency war is a clear threat and the signals made by both the US and China over the next few days and weeks will be watched closely.”

The Job

Openings and Labor Turnover Survey (JOLTS) published by the Labor Department on

Tuesday showed a slight drop (-0.5 percent m-o-m) in the U.S. job openings in

June.

According to

the report, employers posted 7.348 million job openings in June, compared to

the May’s figure of 7.384 million (revised from 7.323 million in original

estimate) and economists’ expectations of 7.317 million. The job openings rate

was 4.6 percent in June, down from a revised 4.7 percent in the prior month. The

report showed that the number of job openings was little changed for total

private and for government. The job openings level rose in real estate and

rental and leasing (+38,000 jobs in June) as well as state and local government

education (+20,000).

Meanwhile, the

number of hires declined to 5.702 million in June from 5.760 in May. The hiring

rate was 3.8 percent, unchanged from May. The number of hires was little

changed for total private and for government. Hires rose in accommodation and food services (+76,000).

The separation

rate in June was at 5.481 million or 3.6 percent, compared to 5.557 million or

3.7 percent in May. Within separations, the quits rate was 2.3 percent (flat

m-o-m), and the layoffs rate was 1.1 percent (-0.1 pp m-o-m).

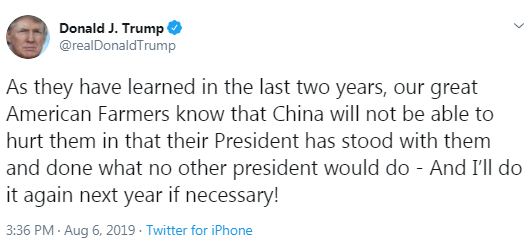

- U.S. is still expecting China talks in September

- Presidet Trump would like to continue talks

- The President is determined to defend the American economy

- We're in great shape, the Chinese are not

- I don't understand why the Chinese can't seem to stop the fentanyl

- If there's no progress on the deal, the tariffs might get worse

- Consumer spending is booming

- The Chinese economy is crumbling

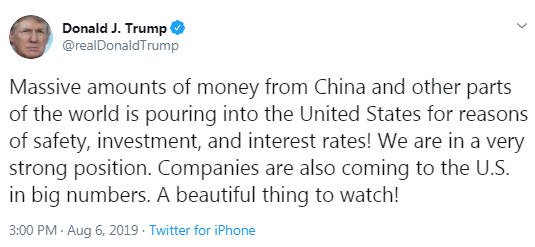

- Weakening yuan may push money out of China

- We've seen China in the past, defending the currency, we don't see that now

- U.S. capital goods orders non-defense ex-air are "starting to boom"

U.S. stock-index futures rose on Tuesday as investors sought beaten-down stocks after China stepped in to steady its currency.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,585.31 | -134.98 | -0.65% |

Hang Seng | 25,976.24 | -175.08 | -0.67% |

Shanghai | 2,777.56 | -43.94 | -1.56% |

S&P/ASX | 6,478.10 | -162.20 | -2.44% |

FTSE | 7,219.69 | -4.16 | -0.06% |

CAC | 5,275.37 | +33.82 | +0.65% |

DAX | 11,694.63 | +36.12 | +0.31% |

Crude oil | $54.84 | +0.27% | |

Gold | $1,476.90 | +0.03% |

Ned Rumpeltin, the European head of FX strategy at TD Securities, points out that in a surprise move, the US Treasury has designated China as a currency manipulator.

- “Given the deterioration in relations between the two countries in recent days, a further escalation was expected – particularly with USDCNH above the key 7.00 threshold. The question was what form that would take.

- The situation remains highly fluid and complex, but it appears China has opted for a more measured initial response. The official USDCNY "fixing" for Tuesday came in at a relatively tame 6.9683. We think the PBOC has broadcast its desire for a more restrained reaction in FX markets. This is, however, highly dependent on how developments evolve from here.

- That said, we do not see the light at the end of this tunnel. We are concerned that as we get deeper into a tit-for-tat cycle between these two governments. This suggests it will become increasingly difficult for both sides to back down and find room to compromise on their ongoing trade dispute. This, we think, could see markets continue to reprice for weaker global growth and rising political tensions.”

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 165.5 | 0.79(0.48%) | 3553 |

ALCOA INC. | AA | 20.16 | 0.01(0.05%) | 113 |

ALTRIA GROUP INC. | MO | 47 | 0.35(0.75%) | 3569 |

Amazon.com Inc., NASDAQ | AMZN | 1,781.00 | 15.87(0.90%) | 111348 |

American Express Co | AXP | 120.82 | 0.10(0.08%) | 3303 |

AMERICAN INTERNATIONAL GROUP | AIG | 53.43 | 0.62(1.17%) | 121 |

Apple Inc. | AAPL | 195.5 | 2.16(1.12%) | 847976 |

AT&T Inc | T | 33.72 | 0.23(0.69%) | 87438 |

Boeing Co | BA | 333.12 | 2.06(0.62%) | 29649 |

Caterpillar Inc | CAT | 123 | 1.35(1.11%) | 9609 |

Chevron Corp | CVX | 118.76 | 0.02(0.02%) | 3692 |

Cisco Systems Inc | CSCO | 51.5 | 0.13(0.25%) | 70910 |

Citigroup Inc., NYSE | C | 65.74 | 0.56(0.86%) | 17630 |

Deere & Company, NYSE | DE | 152.51 | 1.45(0.96%) | 1565 |

Exxon Mobil Corp | XOM | 70.51 | 0.23(0.33%) | 13508 |

Facebook, Inc. | FB | 182.9 | 1.17(0.64%) | 179176 |

FedEx Corporation, NYSE | FDX | 158.5 | 1.24(0.79%) | 4865 |

Ford Motor Co. | F | 9.4 | 0.17(1.84%) | 402676 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.19 | 0.12(1.19%) | 9336 |

General Electric Co | GE | 9.74 | 0.08(0.83%) | 217681 |

General Motors Company, NYSE | GM | 39.15 | 0.14(0.36%) | 8524 |

Goldman Sachs | GS | 203 | 1.32(0.65%) | 8390 |

Google Inc. | GOOG | 1,159.93 | 7.61(0.66%) | 9331 |

Hewlett-Packard Co. | HPQ | 19.38 | 0.22(1.15%) | 1105 |

Home Depot Inc | HD | 205.85 | 0.91(0.44%) | 6245 |

HONEYWELL INTERNATIONAL INC. | HON | 164 | 1.99(1.23%) | 681 |

Intel Corp | INTC | 47.26 | 0.61(1.30%) | 87749 |

International Business Machines Co... | IBM | 141.75 | 0.99(0.70%) | 39076 |

International Paper Company | IP | 40.5 | 0.30(0.75%) | 1076 |

Johnson & Johnson | JNJ | 130.18 | 0.02(0.02%) | 5504 |

JPMorgan Chase and Co | JPM | 110.25 | 0.68(0.62%) | 10010 |

McDonald's Corp | MCD | 211 | 0.55(0.26%) | 9121 |

Merck & Co Inc | MRK | 83.2 | 0.08(0.10%) | 3704 |

Microsoft Corp | MSFT | 133.3 | 1.09(0.82%) | 262926 |

Nike | NKE | 79.35 | 0.38(0.48%) | 35176 |

Pfizer Inc | PFE | 37.11 | 0.15(0.41%) | 23216 |

Procter & Gamble Co | PG | 113.06 | -0.02(-0.02%) | 7393 |

Starbucks Corporation, NASDAQ | SBUX | 94.08 | 0.38(0.41%) | 11352 |

Tesla Motors, Inc., NASDAQ | TSLA | 231.21 | 2.89(1.27%) | 130107 |

The Coca-Cola Co | KO | 51.94 | 0.29(0.56%) | 10940 |

Travelers Companies Inc | TRV | 144.2 | 0.27(0.19%) | 1695 |

Twitter, Inc., NYSE | TWTR | 40.78 | 0.41(1.02%) | 245459 |

United Technologies Corp | UTX | 126.12 | 0.37(0.29%) | 3015 |

UnitedHealth Group Inc | UNH | 245.17 | 0.11(0.04%) | 4111 |

Verizon Communications Inc | VZ | 55.4 | 0.18(0.33%) | 4923 |

Visa | V | 171.7 | 2.84(1.68%) | 50613 |

Wal-Mart Stores Inc | WMT | 106.4 | 0.58(0.55%) | 10683 |

Walt Disney Co | DIS | 140.7 | 2.40(1.74%) | 107492 |

Yandex N.V., NASDAQ | YNDX | 37.01 | 0.67(1.84%) | 27644 |

Ford Motor (F) upgraded to Overweight from Equal-Weight at Morgan Stanley; target raised to $12

Exxon Mobil (XOM) upgraded to Hold from Sell at DZ Bank

- Fed should not react to "tit-for-tat trade war"

- Political pressure has not changed Fed's decision-making

Frances Cheung, an analyst at Westpac, notes that the PBoC is sending signals that it would like to mitigate RMB depreciation pressure by fixing USD/CNY somewhat low, and by announcing that it would issue offshore PBoC bills again.

- “The PBoC does not mind letting the yuan weaken, but would still want to smooth market movement. Tuesday’s USD/CNY fixing was 6.9683, up from 6.9225 on Monday but importantly, below 7.00 (and the spot close of 7.0507). We do not view this as a response to the US naming China an FX manipulator, on the notion that China may see much-reduced need to keep USD/RMB below a certain cap as a nice gesture ahead of/amid trade talks. Indeed the chances of another round of trade talks near-term look slim, and China appears to be preparing itself for a no-trade-deal scenario.

- We expect China to shift its focus further onto supporting domestic growth, via a combination of policies – FX adjustment alone is not enough to counteract the impact from tariffs. The PBoC maintains its stance that the RMB will stay stable around appropriate equilibrium levels (in Chinese, literally, it can be interpreted as “an appropriate equilibrium level” or “appropriate equilibrium levels” and we chose the latter).

- Our view has been that these equilibrium levels are not static. Looking ahead, USD/CNH may be trading in a gradually rising range. While the PBoC had previously made it clear that there was no “red line” - no hard FX level to defend, and more controls on capital flows are probably in place than before 2015, the breaking of a psychological level can still potentially trigger undesirable capital outflows. This may explain why the PBoC wants to mitigate “herd behaviour” around the RMB.

- Near-term, USD/CNH has faced resistance around 7.10 intra-day, and this pair is likely to hover around this level. Selected Asian currencies may get a temporary respite from the lower-than-expected USD/CNY fixing on Tuesday. However, upward pressure on Dollar/Asia shall return.

- First, the signal that the Chinese authorities are not defending a hard FX level has been sent. Second, the impact from trade tariffs is persistent, affecting regional trade flows. Third, there are tensions elsewhere in the region including trade tensions between Korea and Japan, and geopolitics.”

- U.S. labeling China as a currency manipulator is wrong

- Hopes that U.S. will resolve the trade spat in a rational manner

ANZ's analysts note that Australia’s monthly trade balance climbed to a new high in June, coming in at an AUD 8,036m surplus, the highest on record by some margin.

- “Underlying this was a 1.4% m/m rise in exports and a 3.6% m/m fall in imports. This surplus was an export and import goods story, with service exports and imports broadly unchanged for the month.

- Resource exports continued to grow, up 2.6% m/m in June. Metal ores and minerals, which were up 4.9% in the month, are the primary drivers of this increase. We expect iron ore prices to remain elevated, helping maintain Australia’s strong surplus over the coming months. Rural goods sales were lower: cereals down 35.7%, meat exports up 8.0% and wool down 18.6%.

- Capital goods imports were down 4.7% m/m, reflecting falls across most categories. Civil aircraft imports were down 45.8% m/m, following the surge of 67.1% in the previous month. Intermediate goods imports were broadly unchanged. With oil prices down throughout most of June, fuel imports fell 10.8%. Consumption goods imports were down 5.1% m/m, reflecting declines across most categories.”

Sean Callow, an analyst at Westpac, thinks that the U.S. Treasury’s announcement of China to be a currency manipulator is likely to make little difference, given how far the U.S.-China trade tensions have already escalated.

- “In terms of how Treasury reached the manipulator designation, its own report in May 2019 concluded that China only met one of the three criteria – a very large bilateral goods surplus with the US. Its current account surplus was not above 2% of GDP and the US conceded that China has not been engaging in persistent intervention to weaken the yuan.”

- Commission is open to talk if UK wants to clarify its position on Brexit

- EU is prepared for no-deal Brexit but says it is not the preferred option

TD Securities' analysts note that German factory orders surged by 2.5% m/m in June, led by a surprising 5.0% m/m jump in foreign orders.

- “Given the global backdrop, this is more likely to be a one-off rather than a turnaround in the trend. Other details of the report show manufacturing shipments posting a -0.1% drop on the month. This is roughly consistent with the consensus forecast of -0.5% for tomorrow's German IP data, but we continue to look for downside risks as the relationship between the two series has broken down lately.”

FX Strategists at UOB Group noted the greenback remains in a negative phase while USD/JPY could still slip back to the mid-105.00s and 104.96.

24-hour view: “As expected, USD maintained its ‘downside bias’ and traded one yen lower from yesterday’s reference. That said, signs are showing that downside momentum is abating. As such, further declines are unlikely to sustain below 105.10 at least for today. Resistances are expected at 106.25 and 106.50”.

Next 1-3 weeks: ““In our previous report (2-Aug, spot 107.45), we cited a further risk of markets ‘repositioning for a lower USD/JPY going forward’ and that a NY close below 107.00 would warrant a ‘negative phase’ for USD (closing price on Fri: 106.58). Here, price action is likely to stay volatile and should USD drops below 106.00, key support at 105.50 and Jan’s flash crash low of 104.96 would quickly come into focus. On the upside, resistance is expected at 107.10 and only a recovery above 107.90 would indicate that downside pressures on the USD have eased“.

Global growth headwinds justified last week's rate cut

Trade uncertainty has amplified, could chill business investment

Doesn't see the economy heading into a recession

Continued headwinds from trade, lower policy rates from other central banks could justify lower rates

A freer-floating yuan could be a positive for China’s sovereign credit rating, agency Fitch said, by helping preserve its foreign exchange reserves and cushioning some of the negative effects of U.S. trade tariffs.

Andrew Fennell, a director in Fitch's sovereign ratings arm, said Monday's fall in the yuan past the seven-per-dollar level was "not meaningful from a sovereign credit perspective."

"In fact, to the extent that moves are orderly and do not destabilize currency expectations or precipitate capital outflows, greater currency flexibility could even be viewed as positive from a credit perspective."

The Chinese authorities have been seeking to introduce greater currency flexibility for some time, he added, while the Chinese currency has tended to weaken during periods of trade war escalation and strengthen during cooling-off periods.

Fitch rates China at A+ with a 'stable' outlook, in line with both S&P Global and Moody's.

Analysts at TD Securities expect that in the RBNZ's Monetary Policy Statement, downgrades to the Bank's GDP and potentially CPI forecasts are likely to pave the way for the RBNZ to cut the cash rate to a record low 1.25%.

“This is in line with 18/21 analysts in Bloomberg, with 3 forecasters looking for rates to remain unchanged. The deteriorating trade outlook means the Bank is unlikely to shut the door on further easing, instead offering a contingent easing bias.”

China firmly opposes a U.S. decision to label it a currency manipulator, its central bank said on Tuesday, adding that Beijing has not used and will not use the yuan to cope with trade frictions with the world’s biggest economy.

Designating China as a currency manipulator seriously harms international rules, the People’s Bank of China (PBOC) said in a statement.

The U.S. labeling China a currency manipulator is nothing but an “empty threat,” said Stephen Roach, a senior fellow at Yale University.

The formal designation came a day after China allowed its currency to breach a psychologically important level, with the yuan falling to 7 against the dollar on Monday — the first time since 2008 that’s happened.

“I don’t think Beijing is going to really respond to this name-and-shame approach by the Trump administration ... I think this in and of itself is an empty threat, ” Roach told.

“But if the U.S. does escalate further on the tariff front, or try other sanctions, then as we saw overnight, there will once again be intensification of pressure coming back from the Chinese. They have plenty of options to consider as the recent move in the bilateral exchange rate demonstrates,” Roach said.

Goldman Sachs said it no longer expects the United States and China to agree on a deal to end their prolonged trade dispute before the November 2020 presidential election as policymakers from the world's largest economies are "taking a harder line".

The bank now expects two back-to-back rate cuts from the U.S. Federal Reserve (Fed) "in light of growing trade policy risks, market expectations for much deeper rate cuts, and an increase in global risk related to the possibility of a no-deal Brexit".

The comment came after U.S. President Donald Trump said last week he would impose a 10% tariff on $300 billion of Chinese imports from Sept. 1,

The move by Washington "suggests that both sides in the trade conflict are taking a harder line, reducing the odds of a resolution in the near term," Goldman Sachs chief economist Jan Hatzius wrote in a note. Hatzius said expects the new set of tariffs to remain in place on election day in November.

Hatzius sees a 75% chance of a rate cut by the Fed in September and a 50% chance in October, following the reduction last week. He had previously only expected two cuts this year.

According to Danske Bank analysts, the recent escalation in the trade war pushed USD/CNY above the psychological level of 7.0 on Monday and market participants are increasingly discussing if China is using the currency in the trade war.

“Trump has little doubt about it when he tweets and overnight the US Treasury officially named China a currency manipulator. The move came outside the normal semi-annual updates. The labelling is primarily symbolic given the new tariffs already in place, but the move is certainly yet another escalation of the trade war and markets reacted negatively to the move. However, importantly, the People's Bank of China did not let the yuan weaken further overnight and USD/CNY stabilised slightly above 7 this morning. China has been selling yuan-denominated bills and the mid-point for onshore trading was set a stronger level than expected this morning. The stronger yuan level has helped stabilise US equity futures. Officially, the Chinese central bank says the weakening on Monday reflects market moves in light of the protectionist measures from the US. We argue that China will not pull the currency weapon as it could (1) backfire as capital outflow could accelerate, (2) China wants to be a reliable economic power in the global economy and (3) China will see a significant setback in its intention of moving towards a market-based currency. It does not mean that the CNY cannot weaken further, as we expect. In our view market flows point to a move towards 7.20 in 6M time.”

David Plank, head of Australian economics at ANZ, points out that the RBA kept the cash rate at 1% in August, but retained an explicit easing bias.

“The Board will continue to monitor developments in the labour market closely and ease monetary policy further if needed to support sustainable growth in the economy and the achievement of the inflation target over time. We note that “adjust monetary policy” in the July statement has become “ease monetary policy” in August. While the change is not of great significance, it reinforces the fact there is only one direction for the cash rate at present. The growth forecasts for 2019 and 2020 are in line with what we expected from the RBA. In terms of inflation, we expect the RBA to round its published numbers to 2% for both 2020 and 2021, but 2¼% for 2021 is a possibility given the RBA’s description.”

The latest escalation in tensions between the U.S. and China has reduced the chances that both sides could reach a trade deal this year, a former American diplomat said.

Trump’s latest actions are “a step away from a solution,” said Frank Lavin, U.S. ambassador to Singapore from 2001 to 2005. He added that it’s “unlikely” both sides would reach a deal by the end of this year.

“This tariffs war has gone on for over a year, so you see a deterioration in environment, a deterioration in trust and communication,” Lavin, who’s now chief executive at business consultancy Export Now, told.

Despite Trump’s tariff threat, some analysts have predicted that the president still wants a deal with China — because that could help him win a second a term in the White House. Many analysts have said a large part of Trump’s re-election chances hinge on the strength of the U.S. economy.

Karen Jones, analyst at Commerzbank, EUR/USD saw only a brief slide below 1.1100 last week and has quickly recovered.

“It is contained longer term within a down channel the top of which lies at 1.1377 and is reinforced by the 55 week ma at 1.1360. Shorter term the market has recovered to overcome pivotal resistance at 1.1176/88 (mid-June low and March low) and we will assume a near term attempt on the highs from last week at 1.1285 and the 200 day ma at 1.1299 is likely. Dips lower are likely to find some support circa 1.1150.06. Key support is the 1.0967 2018-2019 support line and below here lies the 78.6% retracement at 1.0814/78.6% retracement. The market will need to regain the 55 week ma and channel at 1.1360/77 to generate upside interest.”

Michael Gordon, senior economist at Westpac, points out that New Zealand’s labour market has defied expectations of a slowdown, with the unemployment rate falling to an 11-year low of 3.9% in the June quarter.

“Employment growth was solid, with the surprise being the lack of an accompanying rise in labour force participation. Wage growth was boosted by this year’s large increase in the minimum wage, but underlying growth looks to have picked up a little as well. Today’s results won’t stand in the way of an OCR cut tomorrow, though they reduce the risk of a follow-up move in September.”

The U.S. Treasury Department designated China as currency manipulator, a historic move that no White House had exercised since the Clinton administration.

“Secretary Mnuchin, under the auspices of President Trump, has determined that China is a Currency Manipulator,” the Treasury Department said in a release. “As a result of this determination, Secretary Mnuchin will engage with the International Monetary Fund to eliminate the unfair competitive advantage created by China’s latest actions.”

The formal designation - the first since President Bill Clinton’s administration in 1994 - came after China on Monday allowed its currency to breach a psychological level.

“In recent days, China has taken concrete steps to devalue its currency, while maintaining substantial foreign exchange reserves despite active use of such tools in the past,” the Treasury Department added. “The context of these actions and the implausibility of China’s market stability rationale confirm that the purpose of China’s currency devaluation is to gain unfair competitive advantage in international trade.”

According to the provisional data from Federal Statistical Office (Destatis), price-adjusted new orders in manufacturing had increased in June 2019 a seasonally and calendar adjusted 2.5% on the previous month. Economists had expected a 0.5% increase. For May 2019, revision of the preliminary outcome resulted in a decrease of 2.0% compared with April 2019 (provisional: -2.2%). Price-adjusted new orders without major orders in manufacturing had decreased in June 2019 a seasonally and calendar adjusted 0.4% on the previous month.

Domestic orders decreased by 1.0% and foreign orders increased by 5.0% in June 2019 on the previous month. New orders from the euro area were down 0.6%, new orders from other countries were up 8.6% compared to May 2019.

In June 2019 the manufacturers of intermediate goods saw new orders increase by 1.3% compared with May 2019. The manufacturers of capital goods showed increases of 3.7% on the previous month. For consumer goods, a decrease in new orders of 0.4% was recorded.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1280 (1986)

$1.1258 (1920)

$1.1242 (710)

Price at time of writing this review: $1.1206

Support levels (open interest**, contracts):

$1.1181 (2450)

$1.1142 (3090)

$1.1097 (5063)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 9 is 76697 contracts (according to data from August, 5) with the maximum number of contracts with strike price $1,1100 (5063);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2354 (228)

$1.2308 (255)

$1.2266 (435)

Price at time of writing this review: $1.2163

Support levels (open interest**, contracts):

$1.2080 (560)

$1.2040 (290)

$1.1995 (354)

Comments:

- Overall open interest on the CALL options with the expiration date August, 9 is 17000 contracts, with the maximum number of contracts with strike price $1,3000 (2051);

- Overall open interest on the PUT options with the expiration date August, 9 is 20314 contracts, with the maximum number of contracts with strike price $1,2450 (2362);

- The ratio of PUT/CALL was 1.19 versus 1.23 from the previous trading day according to data from August, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 59.85 | -2 |

| WTI | 54.86 | -0.6 |

| Silver | 16.38 | 1.24 |

| Gold | 1463.657 | 1.6 |

| Palladium | 1420.35 | 1.03 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -366.87 | 20720.29 | -1.74 |

| Hang Seng | -767.26 | 26151.32 | -2.85 |

| KOSPI | -51.15 | 1946.98 | -2.56 |

| ASX 200 | -128.3 | 6640.3 | -1.9 |

| FTSE 100 | -183.21 | 7223.85 | -2.47 |

| DAX | -213.93 | 11658.51 | -1.8 |

| Dow Jones | -767.27 | 25717.74 | -2.9 |

| S&P 500 | -87.31 | 2844.74 | -2.98 |

| NASDAQ Composite | -278.03 | 7726.04 | -3.47 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67521 | -0.65 |

| EURJPY | 118.445 | 0.06 |

| EURUSD | 1.12127 | 0.96 |

| GBPJPY | 128.256 | -1.02 |

| GBPUSD | 1.21423 | -0.11 |

| NZDUSD | 0.65107 | -0.33 |

| USDCAD | 1.32047 | 0.03 |

| USDCHF | 0.97165 | -1.08 |

| USDJPY | 105.629 | -0.9 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.