- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- The Kiwi has seen two consecutive down days, pulling the NZD down from 0.6200.

- Market risk appetite has turned south this week, pushing investors into safe havens.

- Investor focus squarely on US data this week with NFP in the pipe.

The NZD/USD heads into the Wednesday market session struggling near the 0.6130 level as the kiwi (NZD) locks in two consecutive days of declines against the US Dollar (USD).

Market sentiment soured early Tuesday after Moody’s downgraded China’s sovereign debt outlook, with the ratings agency citing the Chinese government’s looming expenses should China need to start bailing out beleaguered local governments and drowning state-owned agencies.

US data came in mixed on Tuesday, with the Institute for Supply Management’s Services Purchasing Managers’ Index (PMI) came in at 52.7 for the annualized period into November, compared to the median market forecast of 52, and the Services sector PMI showed a step up from October’s 51.8.

US JOLTS Jobs Openings showed still-tightening labor market conditions with the report printing 8.733 million job postings, a two-and-a-half-year low and undercutting the previous month’s 9.35 million (revised down slightly from 9.553 million).

With a still-tight labor market weighing down investors hopes for a sooner-rather-than-later Federal Reserve rate cut cycle, market sentiment has knocked back on multiple fronts, sending the US Dollar higher against most major currencies heading into the midweek.

Wednesday brings US ADP Employment Change, and Friday will close the trading week out with another round of the US’ Nonfarm Payrolls (NFP); both labor indicators are expected to show improving employment conditions and a still-tightening labor market. The ADP Employment Change is expected to print at 130K in November compared to the previous 113K, while the NFP is forecast to come in at 185K vs October’s 150K.

NZD/USD Technical Outlook

The Kiwi has backslid straight into the 200-hour Simple Moving Average (SMA) near 0.6130, and intraday price action is set to get hung up near the price level with exposure risk tilting firmly to the downside as the 50-hour SMA turns bearish into 0.6160, capping off upside bids.

Daily candlesticks have the NZD/USD is set to confirm a bearish pullback to the 200-day SMA just below 0.6100, and Monday’s four-month peak just below 0.6225 represents the nearest technical ceiling for near-term bids.

NZD/USD Daily Chart

NZD/USD Technical Levels

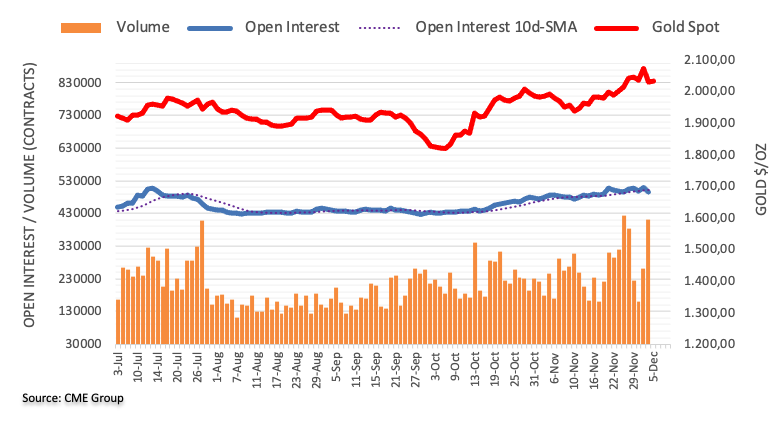

- Gold price trades in negative territory for the third consecutive day.

- The US ISM Services PMI exceeded expectations; JOLTS Job Openings declined to their lowest level since March 2021.

- The negative economic outlook in China might cap gold's upside.

- US ADP private employment, Unit Labor Cost data will be released on Thursday.

Gold price (XAU/USD) loses momentum during the early Asian session on Wednesday. The renewed US Dollar (USD) demand drag the yellow metal lower. Meanwhile, the US Dollar Index (DXY), the gauge of the value of the USD against a weighted basket of currencies used by US trade partners, rebounds to 104.00. The Treasury yields edge higher, with the 10-year yield dropping to 4.16%. The gold price currently trades near $2020, up 0.01% for the day.

The US Dollar Index (DXY) recovers from monthly lows despite lower US Treasury bond yields. Data released on Tuesday showed that the November ISM Services PMI exceeded expectations, with an increase of 52.7 from the previous reading of 51.8. Meanwhile, JOLTS Job Openings declined by 617,000 to 8.73 million in October, falling in October to their lowest level since March 2021, according to a Bureau of Labour Statistics report. The figure registered the lowest level since March 2021.

Furthermore, a gloomy picture of China's economic prospects dampened optimism across the commodities market and create headwinds for gold price. On Tuesday, the rating agency Moody’s cut its outlook on China’s sovereign credit rating to negative, citing the increasing risks to growth and a property sector crisis in the country. This, in turn, might cap the upside in gold prices as China is the world’s major gold consumer.

Gold traders will keep an eye on the US ADP private employment and Unit Labor Cost data on Wednesday. Later this week, the Chinese Trade Balance for November will be due on Thursday. The attention will turn to the US employment data on Friday, including the Nonfarm Payroll (NFP), Average Hourly Earnings, and Unemployment Rate.

x

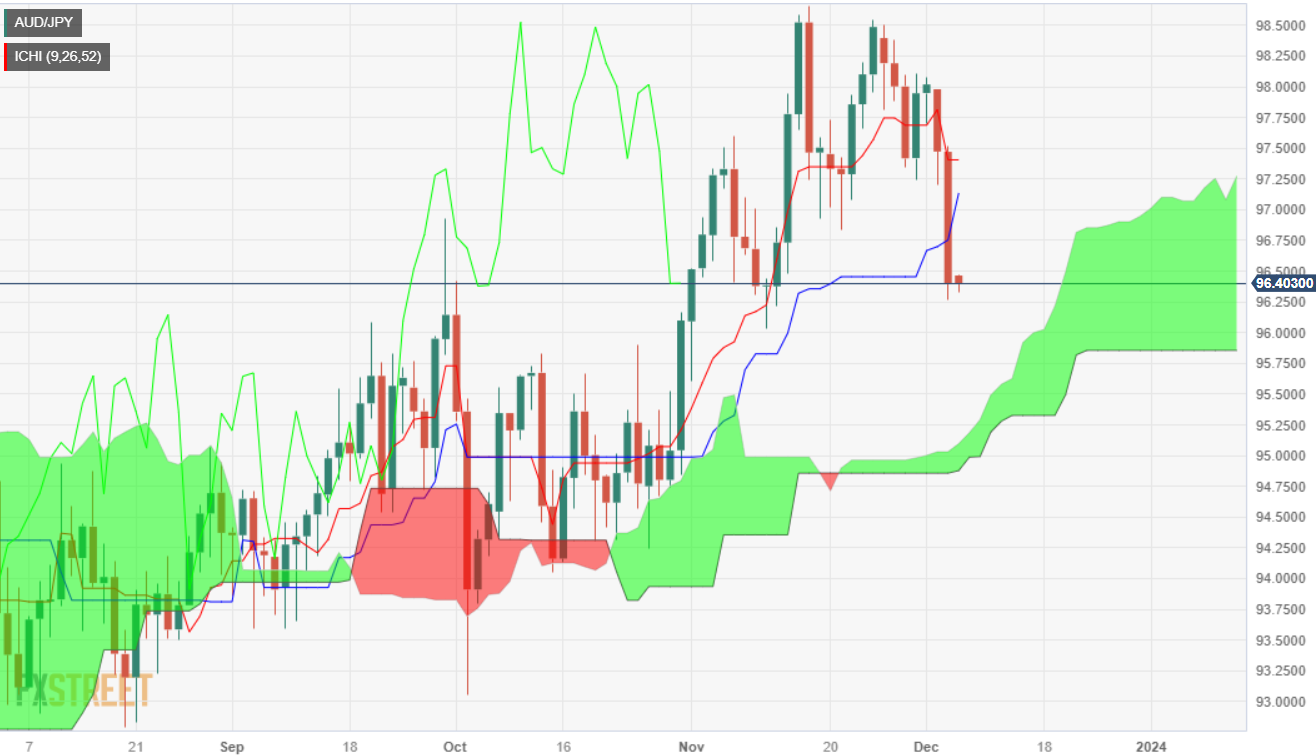

- AUD/JPY dipped below key support levels, like the Kijun-Sen, and Senkou Span.

- The Chikou Span crossing below price action, and narrowing distance between Tenkan and Kijun-Sen, signals bears are gaining traction.

- If AUD/JPY buyers reclaim 97.00, a rally to 98.00 is on the cards.

The AUD/JPY began Wednesday’s Asian session with a negative tone after registering losses of more than 1% on Tuesday. This is courtesy of the Reserve Bank of Australia (RBA), which held rates unchanged, though market participants perceived the decision as a “dovish hold,” so Aussie Dollar (AUD) sellers exerted downward pressure on the currency. At the time of writing, the pair is exchanging hands at 96.36, down 0.02%.

Despite registering solid losses, the AUD/JPY remains neutral to upward bias, but downside risks are emerging. The Chikou Span is crossing below the price action, turning bearish, and the distance between the Tenkan and Kijun-Sen is narrowing. If the pair slides below the November 10 low of 96.28, that will exert downward pressure on the pair. The next support would be the top of the Ichimoku Cloud (Kumo) at around 95.15/25, followed by the bottom of the Kumo at 94.95.

On the flip side, in the outcome of the AUD/JPY reclaiming the 97.00 figure, buyers could regain control. The next spotted resistance level is the Tenkan-Sen at 97.40, and if the pair gains additional momentum, it could rally toward the 98.00 figure.

AUD/JPY Price Analysis – Daily Chart

AUD/JPY Technical Levels

The credit rating agency Moody's cut its outlook on China’s sovereign credit rating to negative on Tuesday, citing the increasing risks to growth and a property sector crisis in the world’s second-largest economy, per Reuters.

Moody's downgraded China's A1 debt rating to "negative" from "stable" less than a month after lowering the US' remaining triple-A grade from a credit rating agency. This development sends a warning to lenders that the likelihood of a default has grown over the last year.

Market reaction

At the time of press, the AUD/USD pair was up 0.01% on the day at 0.6554.

- AUD/USD loses momentum near 0.6550 on the firmer USD.

- US ISM Services PMI grew to 52.7 vs. 51.8 prior, better than the 52.0 expected.

- The Reserve Bank of Australia (RBA) board members decided to maintain the rate unchanged at 4.35% at its December meeting.

- The Australian growth number Q3 report will be a closely watched event on Wednesday.

The AUD/USD pair extends its downside around the mid-0.6500s during the early Asian session on Wednesday. The downward momentum is driven by the renewed US Dollar (USD) demand. Investors await the Australian Gross Domestic Products for the third quarter (Q3) for fresh impetus, which is expected to remain steady at 0.4% YoY. AUD/USD currently trades around 0.6551, down 0.01% on the day.

The US Dollar gains ground above 104.00, its highest daily close in two weeks, despite lower US Treasury yields and mixed US data. The US job openings data, as measured by the Job Openings and Labour Turnover Survey (JOLTS) dropped by 617,000 to 8.733M in October. This figure could offer some hints about November’s ADP job report on Thursday, with an expected rise of 130K in private sector workers.

Additionally, the US ISM Services PMI came in better than expected, growing to 52.7 from 51.8 in the previous reading. The figure registered the 11th consecutive month of expansion in the services sector and suggested the economy is still some way from recession.

On Tuesday, the Reserve Bank of Australia (RBA) board members decided to keep the rate steady at 4.35% at its December monetary policy meeting. Following the meeting, the Australian Dollar (AUD) has edged lower against its rivals. The RBA’s Governor Michele Bullock said whether additional monetary policy tightening is necessary to ensure that inflation returns to target would be determined by the data and the developing risk assessment.

Looking ahead, market players will closely monitor the Australian growth number for Q3. The attention will shift to the US ADP private employment and Unit Labor Cost data, is due on Wednesday. These figures could give clear direction to the AUD/USD pair.

- The GBP/JPY has closed in the red for six of the last seven consecutive trading days.

- Broad-market risk-off market sentiment is seeing a firm bid into safe havens like the Yen.

- Wednesday brings the BoE's latest Financial Stability Report, early Friday sees Japan quarterly GDP.

The GBP/JPY slid for the third straight trading day on Tuesday, closing down for six out of the seven consecutive days. The Guppy is grinding down towards the 185.00 handle as the Pound Sterling (GBP) waffles against the Japanese Yen (JPY).

Early Tuesday saw the UK's BRC Like-For-Like Retail Sales for the year into November beat expectations, printing at 2.6% versus the forecast steady reading at 2.5%.

Broader market sentiment saw little pick-up on the UK mid-tier data beat, with investors backing into safe havens as risk appetite sours heading into the midweek following a Moody's credit downgrade of China.

With China set to begin bailing out struggling local governments and state-owned companies behind the bamboo curtain, Moody's sees weak points in the Chinese government's funding flows moving forward. The open view into a steepening slowdown in Asia markets has hobbled risk appetite across broader markets.

Wednesday will pose new challenges for risk sentiment with the Bank of England (BoE) set to deliver its latest Financial Stability Report, where investors will get a closer look at the BoE's hawkish or dovish stance on the UK's economic outlook, while early Friday sees Japan's latest Gross Domestic Product (GDP).

Japan's QoQ GDP growth is expected to hold steady at a contractionary -0.5%.

GBP/JPY Technical Outlook

With the GBP/JPY grinding towards the 185.00 handle heading into Wednesday's trading session, the Pound Sterling is down four-tenths of a percent against the Yen, and the GBP/JPY is down nearly 2% from November's multi-year highs at 188.66.

Long-term technical support for the GBP/JPY is coming from a rising 200-day Simple Moving Average (SMA) lifting into the 178.00 handle, though the pair is set for a continued slide into the 50-day SMA near 184.00, a confluence technical support level with the last swing low.

GBP/JPY Daily Chart

GBP/JPY Technical Levels

- EUR/JPY is diving almost 3% since November 27, when the pair hit a high of 163.72

- The downtrend remains intact, though it could accelerate further with a drop below 157.55.

- If EUR/JPY buyers reclaim 159.00, that could pave the way for gains.

The EUR/JPY extends its losses for the seventh straight day and hovers just above the top of the Ichimoku Cloud (Kumo), at around 158.89, down by 0.36% daily after reaching a daily high of 159.71. The main drivers behind the move have been market sentiment shifting sour, favoring appetite for the safe-haven status of the Japanese Yen (JPY), which appreciated against most G8 FX currencies, except for the Greenback.

EUR/JPY downtrend remains intact even though it bottomed at around 158.50s, which could open the door for some consolidation as bears take a respite. Nevertheless, the crossing of the Tenkan-Sen below the Kijun-Sen, along with the Chikou Span shifting bearish, means the Euro (EUR) is not out of the woods.

Given the backdrop, the EUR/JPY first support is the top of the Kumo at around 158.40/50. A decisive break could drag prices toward the bottom of the Kumo at 157.55, which, once taken out, would cement the pair’s bearish bias. The next demand area would be a support trendline at around 157.00, followed by the October 3 swing low of 154.34.

On the other hand, if buyers reclaim 159.00, that could pave the way for a recovery toward the confluence of the Senkou Span A, and the Tenkan and Kijun-Sen at around 161.13/20.

EUR/JPY Price Analysis – Daily Chart

EUR/JPY Technical Levels

- The EUR/GBP mildly softened to 0.8570, seeing mild losses,

- Daily chart indicators signal strong bearish momentum; RSI hints continue standing near overbought conditions while MACD showcases flat red bars.

- The bears seem to be taking a breather to consolidate losses.

In Tuesday's session, the EUR/GBP mildly retreated to the 0.8570 region. The daily and four-hour chart suggests a cooling off of the recent selling momentum, which favors a neutral to a bearish outlook for the short term.

The daily Relative Strength Index (RSI) lies deep in negative territory, while the Moving Average Convergence Divergence (MACD) showcases flat red bars, reinforcing the bearish hold. Additionally, the asset's position under the 20, 100, and 200-day Simple Moving Averages (SMAs) emphasizes the ongoing bearish control, marking a challenging landscape for buyers.

Shifting to the shorter time frame, the four-hour chart dynamics still present the bears in recoup mode. The four-hour Relative Strength Index (RSI) remains in the negative territory, while MACD's flat red bars favor the case of a bearish consolidation. Hence, the short-term bias leans towards further downside, albeit the sellers may pause to catch their breath after the recent run.

Support Levels: 0.8550, 0.8500, 0.8480.

Resistance Levels: 0.8600, 0.8639 (100-day SMA), 0.8700.

EUR/GBP Daily chart

-638374102469503820.png)

- The EUR/USD has broken through the 1.0800 handle as the market pulls back into safe havens.

- The Euro is set for a fifth straight day of declines against the US Dollar.

- Markets breezed right past better-than-expected Eurozone economic data.

The EUR/USD is down around four-tenths of a percent on Tuesday, with the Euro (EUR) declining 0.65% peak-to-trough against the US Dollar (USD) as markets see a fresh round of risk-off flows into safe havens.

Eurozone economic data broadly beat the street early Tuesday, but with the majority of investors seeing souring risk appetite following a Moody’s credit downgrade on China, data releases had limited impact and sentiment flows dominated the FX charts.

Tuesday’s selloff sees the Euro touching chart paper south of 1.0800, but the pair is seeing some rebalancing heading into the trading day’s closing bell.

The Eurozone HCOB Composite Purchasing Managers’ Index (PMI) printed above expectations in November, coming in at 47.6 MoM versus the forecast hold at October’s reading of 47.1.

US Data: good news is bad news narrative holds for market risk appetite

US data extended the overall dour market sentiment, with JOLTS Job Openings dipping to a two-and-a-half-year low amidst a tight US labor market, and the Institute for Supply Management’s (ISM) Services PMI came in higher than expected at 52.7 for November, compared to the market’s median forecast of 52.0 versus October’s 51.8.

The US services sector, one of the largest contributors to US Gross Domestic Product (GDP), is continuing to show a firm healthy trend and a tight labor market with fewer jobs on offer means economic conditions within the US are too tight for the Federal Reserve (Fed) to even begin to consider a rate cut cycle. With investors broadly hungry for an accelerated path towards declining interest rates, a bumping US economy pushes away rate cut expectations further out, and thus good news is bad news for markets burdened with rising borrowing and financing costs on the back of higher interest rates.

Wednesday brings Eurozone Retail Sales, which are forecast to improve but still print in negative territory, slated for a rebound from -2.9% to -1.1% for the annualized period into October.

Thursday will follow up with Eurozone Gross Domestic Product (GDP) figures, and the third quarter is expected to hold flat at 0.1% on a YoY basis, and Friday will close out the trading week with another print of US Nonfarm Payrolls (NFP), which is forecast to print another increase from 150K to 185K.

EUR/USD Technical Outlook

The EUR/USD's decline below 1.0800 on Tuesday sees the pair chalking in a fifth straight day of declines, and the Euro is down a little over two percent against the US Dollar from last week's peak bids near 1.1020.

The Euro's backslide sees the EUR/USD slipping through the 200-day Simple Moving Average (SMA) currently treading water near 1.0820.

Continued bearish pressure will see a technical barrier from the 50-day SMA which has turned bullish and is rising into the 1.0700 handle, while bidders will be looking to stage a recovery back over the 200-day SMA before the EUR/USD slides too deep into retracement territory between 1.0750 and 1.0700.

EUR/USD Daily Chart

EUR/USD Technical Levels

The main focus remains on US labor market data. ADP will report on private employment on Wednesday, and the Unit Labor Cost data will also be important. Before US figures, during the Asian session, Australia will report Q3 GDP, while Eurozone Retail Sales will be released during European hours. The Bank of Canada is expected to keep rates unchanged.

Here is what you need to know on Wednesday, December 6:

The US Dollar strengthened despite lower US Treasury yields and mixed US data. In the short term, the trend remains positive for the Greenback, however most currency pairs show overbought technical conditions. The US Dollar Index recorded its highest daily close in two weeks, around 104.00, and continued to rebound from monthly lows.

Data released from the US on Tuesday revealed a larger-than-expected decline in JOLTS Job Openings, dropping by 617,000 to 8.73 million in October, indicating a more balanced labor market. The November ISM Services PMI exceeded expectations, with an increase to 52.7. More labor market data will be released on Wednesday with the ADP Employment Report and Q3 Unit Labor Costs.

Analysts at Wells Fargo after US data, ahead of next week’s FOMC meeting:

With prices still firmly in expansion and employment rising slightly, it suggests that recent expectations for rate cuts might have been pulled too far forward (…) We anticipate the fed funds rate probably has reached its terminal level of this cycle. But we still expect the Fed to keep the door open to the possibility for additional tightening at its policy meeting next week, particularly in the context of the recent loosening in financial conditions. Ultimately the Fed will need to see more progress on inflation before it begins to outright ease policy.

EUR/USD has declined to the 100-day Simple Moving Average (SMA), falling below 1.0800, which marks the lowest level in two weeks. This drop extends the downward movement for the fifth consecutive day, indicating a need for consolidation. However, the Euro is not showing many positive signs, despite the positive revision of Eurozone PMI data for November. On Wednesday, Eurozone Retail Sales data will be released.

The Australian Dollar weakened on Tuesday following the pause from the Reserve Bank of Australia (RBA). AUD/USD tumbled toward the 0.6550 area, falling below the 200-day Simple Moving Average (SMA) while AUD/NZD fell below 1.0700 and posted the lowest daily close since mid-October. On Wednesday, Australia's Q3 GDP data is due.

USD/CAD continued its upward trend for the second day in a row, extending its recovery from two-month lows and climbing towards 1.3600. The Bank of Canada will announce its decision on Wednesday, and market expectations point towards the key interest rate remaining unchanged at 5%. As there will be no accompanying Monetary Policy Report or press conference, the impact on the market may be limited.

Analysts at TD Securities:

We look for the BoC to stay the course and hold rates at 5.00%, as a softer economic backdrop drives some dovish tweaks in the statement. However, its desire to maintain tight financial conditions sets a high bar for more significant changes to its guidance.

Bitcoin continued to drift higher and surpassed $43,000, reaching its highest level since April 2022. Similarly, Ethereum has climbed above $2,250, marking its highest point since May 2022.

Meanwhile, metals remain under pressure. Gold failed to benefit from lower Treasury yields, resulting in XAU/USD dropping to $2,010, the lowest level in a week. Silver tumbled to $24.00.

Like this article? Help us with some feedback by answering this survey:

- USD/JPY posts gains for the second straight day but loses some steam.

- Mixed economic data from the US tumbled US bond yields and boosted the US Dollar.

- The latest Tokyo inflation report pushed back expectations of monetary policy normalization by the Bank of Japan.

USD/JPY is virtually unchanged late in the North American session, hovers at around the current week's highs after hitting a daily low of 146.55, exchanges hands at around 147.28, and gains 0.05%.

Sour market sentiment keeps USD/JPY trapped at around 147.20

Wall Street is posting losses, except for the Nasdaq 100, which is up 0.15%. Economic data in the United States (US) was mixed as the JOLTs Job Opening report revealed the labor market is cooling after the data registered a two-and-a-half-year low, missing estimates and September’s figures. Nevertheless, the Institute for Supply Management (ISM) announced that business activity in the services sector expanded and smashed forecasts. The Non-Manufacturing PMI in November rose by 52.7, above the 52 foreseen and October’s 51.8.

Following the data, the US Dollar Index (DXY) seesawed but resumed its uptrend, posting two-week highs at 104.10. Contrarily, US bond yields tumbled, with the 10-year benchmark note coupon, closely correlated to the USD/JPY pair, dropping nine basis points to 4.16%, a headwind for the major.

Despite that, traders continued to reinforce their view the US Federal Reserve (Fed) finished its tightening cycle. They estimate the Fed would slash 137 basis points to the Federal Funds Rate (FFR), suggesting that reference rates will be at around 4%.

Aside from this, Tokyo’s CPI report showed that prices are cooling, pushing out expectations for a Bank of Japan (BoJ) liftoff.

The focus turns to the release of further US employment data. The ADP Employment Change would be released on Wednesday, followed by Thursday’s unemployment claims and Friday's Nonfarm Payrolls.

USD/JPY Technical Levels

- The USD/NOK rallied and settled near the 10.935 level.

- US JOLTs Job Openings for October where lower than expected. The ISM Services PMI in November came in better than expected.

- The US Dollar Index rose to its highest since mid-November.

In Tuesday's session, the USD/NOK edged higher, trading around 10.935 seeing 0.80% gains following the reports of robust Institute for Supply Management (ISM) reading and softer-than-anticipated JOLTs Openings figures. The USD managed to shrug off the week's labor market figures and capitalized on the positive figures of the service sector, which fueled the DXY index to its highest since mid-November.

In that sense, the JOLTs Job Openings reported by the U.S. Bureau of Labor Statistics for October decreased to 8.733 million, falling from the previous 9.35 million and below the 9.3 million consensus expectation. On the positive side, the Institute for Supply Management (ISM) Services PMI for November had a consensus forecast of 52 and increased from 51.8 to 52.7, indicating a slight expansion in the services sector.

As the Federal Reserve (Fed) noted that it still needs additional evidence of the economy cooling down, the strong economic activity evidence doesn’t favor the dovish rhetoric as it could push the Fed to take a more aggressive approach. That being said, the focus now shifts to Friday, where the US will report the expected Average Hourly Earnings from November at 4% YoY vs the previous 4.1%. The Nonfarm Payrolls are also due and expected to have accelerated to 180,000, compared to the previous 150,000, while the Unemployment rate is seen coming in at 3.9% YoY.

Those key labor market metrics will play a bigger role in the next decisions of the Federal Reserve (Fed), so the pair price dynamics may see volatility based on their outcome.

USD/NOK levels to watch

The daily chart indicators reveal that the bulls have gathered strong momentum. On one side, the fact that the pair is stationed firmly above the 20, 100, and 200-day Simple Moving Averages (SMAs) indicates dominant bullish sentiment and persistent buying momentum. This observation is further validated by the current rising red bars of the Moving Average Convergence Divergence (MACD) and the positive slope marked in the Relative Strength Index (RSI).

Support Levels: 10.840 (20-day SMA), 10.710 (200-day SMA), 10.670 (100-day SMA).

Resistance Levels:11.000, 11.130, 11.250.

USD/NOK daily chart

-638374024955627899.png)

- The USD/CHF is grinding higher to eke out a second daily high, but momentum remains thin.

- The US Dollar remains steeply sold-off against the Swiss Franc.

- Economic calendar data leans heavily into the US side this week, culminating in another NFP print.

The USD/CHF is continuing to climb for a second trading day, with the US Dollar (USD) getting propped up by broad-market risk-off flows rather than any specific weakness in the Swiss Franc (CHF), which is up over 3% against the USD since early November.

The USD/CHF has seen one-sided trading, closing flat or in the red for fifteen straight trading days before hitting a near-term bottom of 0.8666. With Tuesday seeing meager gains for the US Dollar, the USD/CHF is set to close with back-to-back meaningful gains since October.

US JOLTS Job Openings in October missed market forecasts, dipping to a two-and-a-half-year low of 8.733 million job postings, slipping past the forecast 9.3 million, and declining even further away from September's print of 9.35 million (revised down slightly from 9.553 million).

The US labor market remains tight, which makes it harder for the Federal Reserve (Fed) to accelerate the pace towards a rate cut cycle, and investors are ogling market data in the hopes of finding the cracks in the dataset that will signal Fed rate cuts sooner rather than later.

As it stands, markets are anticipating rate cuts from the Fed in the first half of next year, though still-high economic indicators make it hard for the Fed to execute on market hopes. On the downside, investors are walking a knife-edge when it comes to data expectations: if US economic data goes too red, too quick, a full-blown recession will be terrible for markets.

USD/CHF Technical Outlook

The USD/CHF remains steeply in the red in the medium-term despite intraday gains this week, and the US Dollar is down against the Swiss Franc looking out across 2023.

The USD/CHF saw an accelerated decline after dropping through in 0.8900 handle in November, and the pair has continued to swirl the drain ever since, shedding another 200 pips to hit chart territory near the 0.8700 handle.

The 200-day Simple Moving Average (SMA) has steadily declined through the 0.9000 major handle as long-term momentum leans into the Dollar-bearish side. The 50-day SMA is set for a bearish crossover of the 200-day SMA after the shorter moving average failed to see a bullish market shift materialize after a short-lived bullish crossover in November.

USD/CHF Daily Chart

USD/CHF Technical Levels

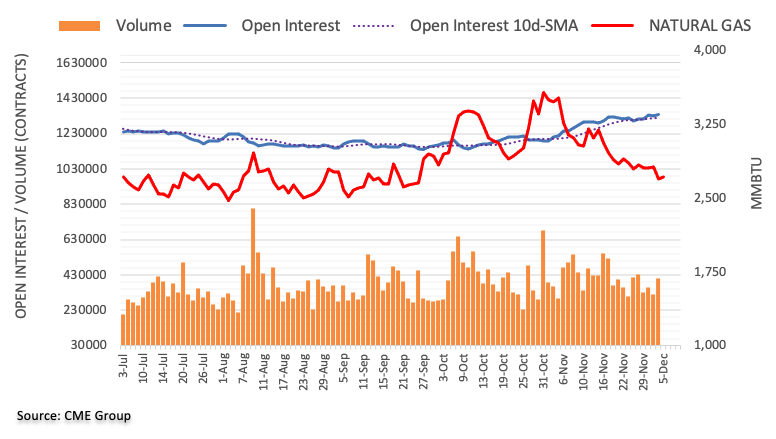

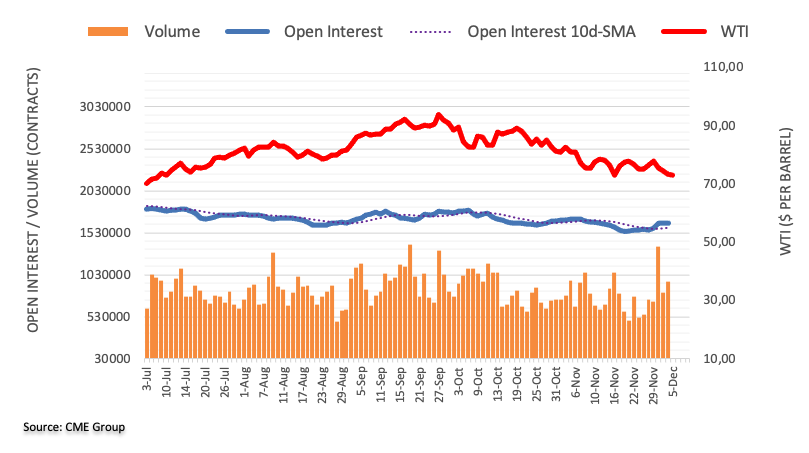

- WTI marks a four-day decline, impacted by Greenback's recovery and demand-supply dynamics.

- OPEC+ agrees on 2.2 million bpd cuts for Q1 2024; Russia hints at potential deeper production cuts to curb speculation.

- Putin's caution on delayed impact of cuts follows November's revenue dip, Saudi Arabia cuts prices to Asian customers in January 2024.

Due to several factors, the US Crude Oil benchmark, known as WTI, extended its losses to four straight days. Firstly, the Greenback is staging a recovery, while Oil’s seesawed after demand concerns offset supply worries after Russia said OPEC+ was ready to deepen cuts in the first quarter of 2024. WTI is trading at $72.72 per barrel, down 0.41%.

Oil markets face headwinds as demand worries counter OPEC+ supply cuts; WTI trades at $72.72, down 0.41%

In the latest OPEC+ meeting on November 30, members agreed to output cuts of 2.2 million barrels per day (bpd) for the first quarter of 2024, with 1.3 million of those provided by an extension of Saudi Arabia and Russia's voluntary cuts already in place since August 2023.

Despite that, Russian Deputy Prime Minister Alexander Novak stated that OPEC+ could deepen production cuts, to eliminate “speculation and volatility.”

Recently, Russia’s President Vladimir Putin said that cuts would take time to begin, as its revenues in November fell to 961.7 billion roubles ($10.53 billion) from 1.635 trillion roubles in the previous month.

In the meantime, Saudia Arabia is curbing its prices to Asian customers in January 2024 for the first time since June 2023.

WTI Price Analysis: Technical outlook

From a technical perspective, WTI is testing the lows of November 2023 and is about to form a double bottom if prices remain firm above $72.00. In that outcome, WTI's first resistance would be today’s high at $74.00, followed by the December 4 high at $75.00. A breach of those two levels would expose the 200-day moving average (DMA) at $78.03, ahead of the $80.00 threshold.

- EUR/GBP is losing momentum as the tug-of-war reaches a midpoint.

- The Euro is struggling to build up momentum for a rebound after steep declines.

- EUR markets to pull towards the midrange ahead of Wednesday's Eurozone Retail Sales.

The EUR/GBP is flatlining on the trading week, cycling near 0.8570 with Eurozone Retail Sales due early Wednesday.

The Euro (EUR) has shed two and a quarter percent against the Pound Sterling (GBP) since late November's peak of 0.8765, losing chart ground in one-sided action, closing in the red for nine of the last eleven trading sessions.

Tuesday saw mid-tier data for both the EUR and the GBP, which all beat expectations across the board, but sending both currencies nowhere quickly as markets focused elsewhere.

The UK's BRC Like-For-Like Sales for the year into November held steady at 2.6% versus the expected 2.5%, and the Eurozone's HCOB Composite Purchasing Managers' Index (PMI) for November beat expectations to climb to 47.6 versus the forecast 47.1.

Wednesday will land a bit harder on the economic calendar, with the UK's latest Financial Stability Report at 07:00 GMT, followed by Eurozone Retail Sales for October at 10:00 GMT.

Investors will be keeping an eye on the Financial Stability Report for finer details on the hawkish or dovish lean to the Bank of England (BoE) over the state of the UK's domestic economy.

Eurozone Retail Sales are expected to see a rebound but still remain in contraction territory with the headline annualized figure to print at -1.1% compared to the previous period's -2.9%.

EUR/GBP Technical Outlook

The EUR/GBP is seeing little rebound after falling within sight of 2023's low bids near 0.8500 and the pair is now kidding along the bottom of familiar technical levels near 0.8550.

The pair's recent drop from the 0.8750 neighborhood leaves the EUR/GBP stranded below the 200-day Simple Moving Average (SMA) near 0.8675, and any bullish rebounds will be facing a technical ceiling from the 50-day SMA, which is set to confirm a bearish cross of the longer 200-day SMA.

EUR/GBP Daily Chart

EUR/GBP Technical Levels

- The DXY Index sees upward movements threatening the 20-day SMA near the 104 level.

- The US service sector expanded in November, according to the ISM.

- Investors keenly await the Unemployment Rate and Nonfarm Payrolls reports due this Friday.

The US Dollar (USD), gauged by the US Dollar Index (DXY), is edging higher, currently trading near 104.00 while posing a threat to the 20-day SMA at 104.05. This movement has been largely attributed to releasing a better-than-expected Institute for Supply Management (ISM) Services PMI for November.

Meanwhile, investors are focusing on key employment figures due for release this Friday – specifically the November Unemployment Rate and Nonfarm Payrolls data – as they could suggest further directional moves for the greenback.

Despite cooling inflation in the US economy and mixed labor market and economic activity signals, the Federal Reserve (Fed) continues to refrain from ruling out further policy tightening. This somewhat hawkish stance coincides with the release of key labor data this week, which could dramatically shift market expectations.

Daily Market Movers: US Dollar gains momentum with boost from strong ISM Services PMI

- US Dollar trades with a strong note on Tuesday, threatening the 20-day SMA near the 104.00 mark.

- The Institute for Supply Management’s November report revealed the ISM Services PMI exceeded consensus and previous figures by coming in at 52.7, further propelling the US Dollar's advance.

- The latest report from US Bureau of Labor Statistics indicated that October JOLTs Job Openings fell by nearly 600K to 8.733 million. This figure was well below the consensus of 9.35 million.

- Looking ahead, important upcoming economic releases include the Unemployment Rate, Nonfarm Payrolls, and Average Hourly Earnings on Friday. These figures will hold significant implications for investors and the US Dollar's trajectory as they could shape the next Fed decisions.

- Current market expectations from the CME FedWatch Tool indicate that a no hike is priced in for the December meeting and that markets are now pricing in rate cuts for mid 2024.

Technical Analysis: US Dollar bullish momentum strengthens, buyers threaten the 20-day SMA

The indicators on the daily chart clearly depict a strengthening of bullish momentum for the US Dollar. Although in negative territory, the Relative Strength Index (RSI) shows a positive slope, while the Moving Average Convergence Divergence (MACD) is printing rising green bars, offering confirmation of prevailing bullish strength.

Evaluating the longer-term scenario, the index is currently positioned beneath the 20 and 100-day Simple Moving Averages (SMAs) but above the 200-day SMA. This means that overall, whilst experiencing some pressure in the short-term, bulls persistently show their presence in the broader picture. That picture hints at a firm upward trajectory. In case buyers advance and conquer the 20-day SMA, further green may be seen in the short term.

Support levels: 103.60, 103.30, 103.15, 103.00.

Resistance levels: 104.10 (20-day SMA), 104.40 (100-day SMA), 104.50.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Gold's two-day plunge, down $100, defies traditional safe-haven status amidst rising Greenback appeal.

- The US Dollar Index (DXY) gains 0.29%, reaching 103.93, highlighting a shift in market sentiment towards the Greenback.

- The US economy remains resilient after the ISM Non-Manufacturing PMI exceeded expectations at 52.7.

- JOLTs report reveals record-low vacancies, suggesting the labor market is easing.

Gold price extended its losses for the second straight day after reaching an all-time high (ATH) above the $2,100 figure, and it has dived more than $100.00 in two days of trading. Even though a risk-off impulse is the primary driver and usually bolsters appetite for the yellow metal, traders are shifting to the Greenback. Consequently, the XAU/USD is trading at $2018.00, down 0.54% after hitting a daily high of $2041.

Gold’s at the mercy of sellers, which had turned US Dollar bulls, as US bond yields also fell

Market sentiment remains sour, with flows going to the Greenback, as shown by the US Dollar Index (DXY). The DXY, which tracks the currency’s performance against six rivals, posted gains of 0.29% at 103.93. On the contrary, US Treasury bond yields are reversing some of their Monday gains and dropping with no fundamental reasons behind them.

On the data side, the US JOLTs report for October revealed that vacancies hit their lowest level in more than two and a half years, showed the Department of Labor. JOLTs stood at 8.733M, below forecasts of 9.3M and September’s 9.35M. Other data suggests the economy remains solid, even though the Atlanta GDP Now continues to show the economy in the fourth quarter, most likely growing below the 2% threshold. The ISM Non-Manufacturing PMI in November expanded to 52.7, exceeding estimates of 52, and the latest reading is 51.8.

Ahead of the week, additional jobs data will be revealed, as traders look for further data that could clear the path on Gold’s direction. On Wednesday, the ADP Employment Change would be followed by Thursday’s Initial Jobless Claims, to finish on Friday’s Nonfarm Payrolls report.

XAU/USD Price Analysis: Technical outlook

After diving below $2,050, the XAU/USD tested the October 27 high of $2,009.42 before reversing its course toward the current spot price. If buyers reclaim $2,040, that could open the door to tests of the November 29 high of $2,052.13. A breach of the latter would expose the previous YTD high of $2,081.82 before rallying to $2,100. On the flip side, if the non-yielding metal slips below $2,009.42, a drop to $2,000 is on the cards.

- The GBP/USD is seeing continued selling pressure, declining below 1.2600.

- The Pound Sterling is descending into new lows for the week.

- Mixed US data is propping up the US Dollar on Tuesday as market sentiment shifts underfoot.

The GBP/USD held mostly flat on Tuesday before seeing a decline below the 1.2600 handle during the American trading session, slipping to a one-week low and shedding a third of a percent on Tuesday.

Broader markets are seeing a favorable bid for the US Dollar (USD), with the Greenback climbing against most of the major currencies on Tuesday.

US data came in mixed, complicating market flows but keeping the US Dollar bid through the American trading session.

The Institute for Supply Management's (ISM) Services Purchasing Managers' Index (PMI) for November showed a slight uptick in outlook, printing at 52.7 compared to the forecast of 52, and climbing over the previous month's reading of 51.8.

US data mixes, markets keep US Dollar bid

The US JOLTS Job Openings declined to a two-and-a-half-year low of 8.733 million in October, down from the previous month's 9.35 million (revised down from 9.553 million). The US job market remains tight, despite a rapid rate hike cycle, and employment slack continues to remain elusive, weighing on investor expectations of Federal Reserve (Fed) rate cuts in the coming quarters.

The US Dollar is set to be the main driver through the mid-week, with Wednesday bringing the latest ADP Employment Change report for November, forecast to show an uptick from the previous month from 113K to 130K.

The Bank of England (BoE) will also be dropping their latest Financial Stability Report early Wednesday, which will give investors an eye into how far the BoE is leaning into hawkish or dovish territory.

GBP/USD Technical Outlook

The GBP/USD's decline below 1.2600 sees the pair slipping out of recent consolidation, and setting the pair up for a further decline towards the 200-day Simple Moving Average (SMA) below 1.2500.

The near-term cap on upside momentum remains the upper bound of recent consolidation near 1.2700, and bearish pullbacks will meet a bullish 50-day SMA currently rising from 1.2300.

The GBP/USD has lifted nearly six percent from October's lows near 1.2040, but the bullish momentum could be wrapping up as the pair sees an extended struggle to chalk in further gains on the chart paper.

GBP/USD Daily Chart

GBP/USD Technical Levels

- The Canadian Dollar sees new lows but seeks a foothold in the American session.

- Bank of Canada rate call on Wednesday to draw CAD traders’ attention.

- Shifts in risk appetite have the markets moving in and out of the safe havens.

The Canadian Dollar (CAD) eased back further on Tuesday before making a late rebound on the day, shedding a third of a percent against the US Dollar (USD) before paring back the day’s declines to a more manageable level. Market sentiment rattled through early Tuesday trading after Moody’s downgraded China’s credit outlook, sending the US Dollar broadly higher on the day.

The Bank of Canada (BoC) makes an appearance on Wednesday with the Canadian central bank’s latest rate call, and money markets expect another rate hold with dovish tweaks from the BoC.

Crude Oil markets are mixed on Tuesday as West Texas Intermediate (WTI) slumps through the day before a recovery back to the high side during the American market session.

Daily Digest Market Movers: Canadian Dollar tracks Crude Oil in both directions as markets weigh risk positioning

- Canadian Dollar traders are sidelined ahead of the BoC’s Wednesday rate call, US Dollar flows drive the bids.

- Money markets expect the BoC to stand pat on interest rates this week, though some dovish tweaks to the Canadian central bank’s talking points are expected.

- BoC overnight rate to remain at 5%, BoC Governor Tiff Macklem expected to omit comments about inflationary risks and focus on weaker Q3 performance instead.

- Broad-market sentiment took a hit early on Tuesday after Moody’s downgraded China’s credit outlook from stable to negative, pushing markets into the US Dollar and forcing down the Canadian Dollar as a knock-on effect.

- US data is mixed on Tuesday with the Institute for Supply Management’s (ISM) Services Purchasing Managers Index (PMI) coming in better than expected, while the JOLTS Job Openings for October printed less available job postings than expected.

- The US job market remains tight with the JOLTS posting its lowest job openings in over two and a half years.

- Crude Oil markets are mixed on the day with fossil fuel bids under pressure from declining global demand and rising crude stocks.

- Russia, UAE to discuss achieving broader unity on OPEC production cuts, backstopping Crude Oil bids on Tuesday by preventing further declines.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.41% | 0.27% | 0.22% | 0.94% | -0.08% | 0.48% | 0.33% | |

| EUR | -0.41% | -0.14% | -0.17% | 0.53% | -0.49% | 0.07% | -0.07% | |

| GBP | -0.28% | 0.15% | -0.03% | 0.67% | -0.33% | 0.22% | 0.06% | |

| CAD | -0.23% | 0.18% | 0.02% | 0.68% | -0.29% | 0.23% | 0.10% | |

| AUD | -0.93% | -0.52% | -0.67% | -0.71% | -1.01% | -0.46% | -0.61% | |

| JPY | 0.11% | 0.44% | 0.32% | 0.28% | 1.00% | 0.56% | 0.39% | |

| NZD | -0.48% | -0.06% | -0.20% | -0.24% | 0.46% | -0.56% | -0.15% | |

| CHF | -0.33% | 0.08% | -0.06% | -0.10% | 0.61% | -0.42% | 0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Outlook: Canadian Dollar splits the rally, planted in Tuesday’s midrange

The Canadian Dollar (CAD) is stuck somewhere in the middle on Tuesday, down a fifth of a percent against the US Dollar (USD) and a third of a percent against the Japanese Yen (JPY). On the upside, the Loonie outperformed the Antipodeans, up two-thirds of a percent and a quarter of a percent against the Aussie (AUD) and the Kiwi (NZD), respectively.

The USD/CAD set a new high for the week near 1.3590 before the Canadian Dollar pared away some of the day’s losses to land near 1.3560, and intraday price action remains capped by the 200-hour Simple Moving Average (SMA) dropping through the 1.3600 handle.

The USD/CAD is still within shooting range of a technical bounce from the 200-day SMA just north of the 1.3500 handle, and a continued recovery from the US Dollar will see the pair taking a run at the 50-day SMA near 1.3700.

On the downside, a break below the week’s bottom bids of 1.3480 will see bearish momentum accelerate, and bears’ sights will be set on 2023’s lows just beyond 1.3100.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- AUD/USD falls below the 200-DMA, as bears eye 0.6500.

- S&P Global and ISM, revealed the US economy remains resilient, as business activity in the sector segment, gathers traction.

- RBA´s decision to hold rates, tumbled the AUD/USD below the 0.6600 figure, on a perceived dovish hold.

The AUD/USD prolonged its agony during the North American session after the Reserve Bank of Australia (RBA) kept interest rates unchanged, setting the Aussie Dollar (AUD) faith, spurring losses of more than 0.70%. The pair is trading at 0.6565 after diving from daily highs of 0.6621.

AUD/USD on the defensive after RBA’s decision, while US data boosts the Greenback

The Greenback (USD) remains on the offensive, while data from the United States (US) triggered volatility in the buck, as shown by the US Dollar Index (DXY), which seesawed in the last hour from around 103.57 to 103.91 to settle at about 103.83.

An early report by S&P Global revealed that Services and Composite PMIs rose as expected, with the latter standing at 50.7, unchanged compared to October’s data. Recently, the Institute for Supply Management (ISM) revealed that activity in Non-Manufacturing businesses rose from 51.8 a month ago to 52.7, exceeding projections of 52.

At the same time, the US Department of Labor revealed that Job Openings fell to 8.733 million in October, below the estimated 9.3 million and close to 600,000 less than September’s figures.

Given that the recently released data suggests the US economy remains resilient, traders shift towards the release of employment data, with the ADP Employment Change on Wednesday and Initial Jobless Claims on Thursday.

Following the data, traders had priced in 137 basis points of rate cuts by the Federal Reserve (Fed) for the following year.

Aside from this, the RBA decided to keep rates at 4.35%, in a decision perceived as a dovish hold, per the market’s reaction, despite the RBA’s language that “whether further tightening of monetary policy is required…” they will act. The central bank said they don’t have enough data, which means the next meeting in February 2024 would be a “live one.”

AUD/USD Price Analysis: Technical outlook

AUD/USD daily chart shows bulls encountered solid resistance at a downslope supply trendline, which capped the last leg-up from October 26 lows, which witnessed the pair hitting a high of 0.6690. Since then, the pair lost a step as sellers dragged prices below the 0.6600 figure, eyeing a daily close below the 200-day moving average (DMA) at 0.6578. In that outcome, further downside is expected, with the following demand area at 0.6523, the November 6 high, and a previous resistance area that turned support.

- The XAG/USD is riding a downward rally and trades near the $24.20 level.

- November's US ISM Services PMI was reported at 52.7, exceeding consensus. JOLTs Job opening disappointed.

- The USD DXY recovered after the data and the US yields, which still tally daily declines.

- US yields slightly recovered, but they still tally daily declines.

In Tuesday's session, the XAG/USD metal is experiencing a downtrend, trading around the $24.18 mark. This downward movement was seen after the report of robust Institue For Supply Management (ISM) Services PMI and somewhat softer JOLTs opening figures as investors seem to have recalled that the Federal Reserve (Fed) remains data-dependent, so strong figures from the US economy may fuel a more hawkish stance from the bank.

In line with that, the US. Service sector as the Institute for Supply Management (ISM) Services PMI for November registered an expansion coming in at 52.7 against the consensus of 52 from the previous 51.8. On the other hand, data from the U.S. Bureau of Labor Statistics reported that JOLT's Job Openings for October dropped to 8.73M, lower than the 9.3M expected.

As a reaction, US Treasury bond yields trended downwards but gained momentum after the data. The 2-year rate is 4.60%, while the 5-year and 10-year rates are at 4.15% and 4.19%, respectively. This recovery in yields impacts negatively on the price of non-yielding metals such as these bond rates often represent the opportunity cost of holding them. On the other hand, the US Dollar, measured by the DXY index, is up with mild gains at 103.75 also adding pressure to the price.

That said, as the focus is set on incoming data, the investor's attention shifts to the upcoming labor market reports. On Wednesday, the US will release its Automatic Data Processing Inc. (ADP) Employment Change report, and on Friday, three important labor market metrics will be released, including Average Hourly Earnings, Unemployment Rate, and Nonfarm Payrolls. In that sense, the health of the sector may likely shape the expectations on the Fed’s next moves ahead of the next December 15 meeting, which will have an impact on the bond market and on the metal’s price dynamics.

XAG/USD levels to watch

On the daily chart, the Relative Strength Index (RSI) displays a negative slope in positive territory, indicating the receding momentum of buyers. Furthermore, gaining red bars in the Moving Average Convergence Divergence (MACD) denote sellers are beginning to stamp their authority, introducing additional selling momentum.

While there are indeed some strong sell signals in the short term, the metal continues to reside above the 20,100,200-day Simple Moving Averages (SMAs), an indicator that suggests buyers still hold the reins on larger time frames. In that sense, despite the bearish roar in the short term, the long-term picture painted by the SMAs cautions against prematurely declaring a bearish dominance.

Support Levels: $24.00, $23.76 (20-day SMA), $23.00.

Resistance Levels: $25.00, $25.50, $26.00.

XAG/USD daily chart

-638373888335718478.png)

- Mexican Peso maintains a negative tone as the USD/MXN hovers below the 200-day SMA.

- Mexico's economic data will reveal inflation figures on Thursday, widely expected to rise, which could prevent Banxico from easing policy.

- USD/MXN traders are eyeing important US jobs data ahead of the important Nonfarm Payrolls on Friday.

Mexican Peso (MXN) falls on Tuesday, extending its losses against the US Dollar (USD) in the early morning North American session after the USD/MXN briefly tested the 200-day Simple Moving Average (SMA), a critical resistance level. Nevertheless, the pair retraced somewhat, though it remains trading in the green at around 17.47, gaining 0.14% on the day.

Mexico’s economic calendar remains light on Tuesday, but it will gather some pace on Wednesday, with the release of Consumer Confidence for November, after October’s data printed 46. If confidence slips below the prior month’s figure, it would be the third straight reading that Mexican households are shifting pessimistic on the economic outlook. On Thursday, the National Statistics Agency, known as INEGI, will reveal inflation for November, with most economists expecting a higher rate than in October. That could prevent the Bank of Mexico (Banxico) from easing policy, despite recent comments by Governor Victoria Rodriguez Ceja and Deputy Governor Heath.

Aside from this, the Mexican currency remains stressed as market sentiment turns sour. The financial markets narrative suggests traders had become overly optimistic about rate cuts by the Federal Reserve (Fed). Market participants are awaiting a tranche of US labor data. On Tuesday, the JOLTs report is expected to show the jobs market remains tight, followed by Wednesday’s ADP Employment Change and Thursday’s jobless claims, ahead of Friday's crucial Nonfarm Payrolls report.

Daily digest movers: Mexican Peso remains weak as traders await Mexico’s inflation report

- Banxico revised economic growth upward from 3% to 3.3% for 2023 and projects the economy will rise 3% in 2024, from 2.1% previously forecast.

- Regarding inflation prospects, the Mexican central bank foresees headline inflation at 4.4% in Q4 2023 (5.3% for core), while at the end of 2024, it is estimated at 3.4% (3.3% for core). The central bank forecasts headline and core inflation not to hit the 3% target imposed by the institution until 2025.

- The Federal Reserve's favorite inflation gauge in October, the Core PCE Price Index rate softened from 3.7% to 3.5% YoY. Moreover, headline PCE inflation dropped from 3.4% to 3.0% YoY for the same twelve-month period.

- On November 27, Banxico’s Deputy Governor, Jonathan Heath, commented that core prices must come down more, adding that one or two rate cuts may come next year, but “very gradually” and “with great caution.”

- Mexico's annual inflation increased from 4.31% to 4.32%, while core continued to ease from 5.33% to 5.31%, according to data on November 23.

- A Citibanamex poll suggests that 25 of 32 economists expect Banxico's first rate cut in the first half of 2024.

- The poll shows “a great dispersion” for interest rates next year, between 8.0% and 10.25%, revealed Citibanamex.

- The same survey revealed that economists foresee headline annual inflation at 4.00% and core at 4.06%, both readings for the next year, while the USD/MXN exchange rate is seen at 19.00, up from 18.95, toward the end of 2024

Technical Analysis: Mexican Peso weakens further, as the USD/MXN hovers around the 200-day SMA

The USD/MXN popped and printed a three-week high of 17.56, piercing the 200-day SMA at 17.56, before retracing below the 17.50 area, with bulls taking a breather, as volatility continues to pick up. A decisive breach above the 200-day SMA could open the door to challenging the 50-day SMA at 17.69, ahead of the May 23 swing high at 17.99.

On the other hand, if the exotic pair fails at the 200-day SMA, that could pave the way to challenge the 100-day SMA at 17.37. The next demand zone would be the December 4 daily low of 17.16

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- US ISM Service PMI increases to 52.7 in November from 51.8 in October.

- Dollar slides after JOTLS report and ISM Service PMI.

Economic activity in the services sector expanded in November for the 11th consecutive month. The ISM Services PMI stood at 52.7, up from 51.8 in October and above market expectations of 52.0.

Further details of the publication revealed that the Business Activity Index registered 55.1 up from 54.1 in October. The Employment Index rose from 50.2 to 50.7. The Prices Index decline from 58.6 to 58.3.

A different report showed that the final reading of the S&P Global Service PMI stood at 50.8 in November, unchanged from the preliminary reading.

Market reaction

The US Dollar Index pulled back from the highest level in almost two weeks near 104.00, to 103.55, affected by the JOLTS report.

- EUR/USD loses further momentum and challenges 1.0800.

- Extra declines look likely once 1.0800 is cleared.

EUR/USD retreats further and puts the 1.0800 support to the test on Tuesday.

A drop below the latter should pave the way for a deeper retracement to, initially, the intermediate 100-day SMA at 1.0774 ahead of the 55-day SMA at 1.0684.

So far, while above the significant 200-day SMA at 1.0819, the pair’s outlook should remain constructive.

EUR/USD daily chart

- DXY adds to Monday’s advance and surpasses 103.80.

- Further gains look on the cards above the 200-day SMA.

DXY extends the upside bias so far this week and flirts with multi-session tops in the 103.80/85 band on Tuesday.

If the key 200-day SMA (103.57) is surpassed on a sustainable fashion, the index is expected to face more sustained gains to, initially, the weekly top of 104.21 (November 22) ahead of the transitory 100-day SMA at 104.41.

In the meantime, above the key 200-day SMA, the outlook for the index is expected to shift to bullish.

DXY daily chart

- EUR/JPY breaks below the 159.00 support on Tuesday.

- Extra pullbacks could see the 157.70 region revisited.

EUR/JPY retreats for the seventh session in a row and breaches the key support at 159.00 the figure on Tuesday.

The continuation of the downward bias appears on the cards for the time being. Against that, the loss of the provisional 100-day SMA at 158.66 could pave the way for a move to the minor support at the weekly low of 157.69 (October 30) prior to the October low of 154.34 (October 3).

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA at 153.78.

EUR/JPY daily chart

UOB Group’s Head of Research Suan Teck Kin, CFA, and Associate Economist Jester Koh comment on the recent publication of Q3 GDP readings in India.

Key Takeaways

India’s real GDP expanded by 7.6% y/y in 2QFY23-24 (Jul-Sep quarter), stronger than Bloomberg and UOB’s expectations for a 6.8% y/y increase but a tad lower than 1QFY23-24’s (Apr-Jun quarter) reading of 7.8% y/y.

Outlook – We expect 3Q (Oct-Dec) GDP to be driven by strong year-end festival demand and ongoing public infrastructure spending. Private sector investments could pick up after the 18th Lok Sabha (lower house) elections (Apr-May 2024) as election uncertainty abates alongside continued progress of public infrastructure projects with the newly formed cabinet. We upgrade our FY23-24 GDP forecast to 6.9% (prev: 6.5%) and expect growth to moderate to 6.4% in FY24-25, as tight financial conditions gradually weigh on economic activity.

- Dollar recovery fails at 147.45 and keeps bears in charge.

- Speculation about Fed cuts in March is limiting USD’s upside attempts.

- Hopes of some BoJ monetary policy normalisation support the Yen.

The US Dollar’s recovery from Monday’s lows met resistance at 147.45, and the pair has been trading on a moderate bearish tone on Tuesday. Investor’s cautious mood ahead of a slew of key US employment figures has cushioned the Japanese Yen’s reversal.

Fed rate cuts hopes are weighing on the US Dollar

increasing speculation that the Fed is done with hikes and that the US central bank will start trimming rates in March is weighing on the US Dollar.

On the contrary, the Bank Of Japan is expected to exit its ultra-loose monetary policy in the coming months. This coupled with the risk-off market sentiment is cushioning the safe-haven Japanese Yen’s losses.

In the calendar, today the US Services ISM and the Jolt Openings will lay the ground to Wednesday’s ADP and Friday’s Nonfarm Payrolls, the main event of the week.

From a technical point of view, the 4-hour char shows the pair trading within a falling wedge, with in a bearish trend from Mid-November highs. Price action remains well below the main SMAs and the RSI has turned lower below its middle line suggesting that further decline is on the cards.

The next supports are 146.30 and 146.00. Resistances re the mentioned 147.45 and 148.50, the 38.2% retracement of the November - December decline.

Technical levels to watch

- Euro recovery attempts fail below 0.8600.

- Eurozone Services PMI revised higher, yet into contraction levels.

- The broader trend remains bearish with 0.8550 support in play.

The euro remains depressed near three-month lows against the Pound Sterling. The pair;’s mild recovery attempt seen during Tuesday’s early European session has found resistance at 0.8590 before easing to the mid-range of 0.8900.

UK services activity increases beyond expectations

Eurozone’s November Services PMI data has been revised upwards, with all major country members registering better than expected levels than previously estimated. Business activity in the sector, however, has contracted for the fourth consecutive month which is not good news for the Euro.

In contrast,, the UK services sector activity expanded in November and has been revised to 50.9 from the previously estimated 50.5 from 49.5 in October, which has provided some support to the Pound.

The technical picture shows a bearish Euro with no clear sign of a trend change on sight. Next support is at 0.8550 and below here, 0.7500 and 0.8455.

On the upside, 0.8590 and 0.8620 are the nearest resistance levels.

Technical levels to watch

Economist at UOB Group Enrico Tanuwidjaja and Junior Economist Agus Santoso review the latest inflation figures in Indonesia.

Key Takeaways

Indonesia's headline inflation in Nov rose to 2.9% y/y vs 2.6% in Oct on the back of higher food and transportation components, while the rest continued to moderate. The main driver of higher food prices is the El Nino phenomenon that has been occurring since the beginning of 3Q23, resulting in less water supply on farmland. In addition, the transition of the dry season to the rainy season in Nov also affected the rice harvest. On the other hand, higher inflation in the transportation component was driven by higher airfares and car fares due to a surge in logistics services towards the end of the year.

We maintain our view for 2023 inflation to ease compared to last year (2022: 4.2%) due to several reasons such as moderation in household consumption and higher for longer interest rate. However, we expect that the lingering El Nino risk and the transition from dry to rainy season could potentially add some upside to the food inflation in the near term. In addition, the trend of increasing people mobility in Dec to celebrate the new year also seasonally impact to the higher airfares. These factors are expected to deliver some upside risks to the headline inflation in 4Q23.

- The US Dollar soars as Moody’s downgrades China credit outlook.

- Traders brace for ISM Services PMI and Jolts data on Tuesday.

- The US Dollar Index jumps to 104.00, snapping crucial resistance levels.

The US Dollar (USD) appreciates significantly in the European trading session on Tuesday after rating agency Moody’s downgraded China’s credit outlook from stable to negative due to rising debt. More US Dollar Strength comes from European Central Bank (ECB) member Isabel Schnabel, who said she is surprised by the substantial decline in inflation and no more interest-rate hikes are further needed.

On the economic front, the calendar is starting to pick up some steam with the Institute for Supply Management (ISM) Services PMI on the wires this Tuesday. Traders will also get to see how healthy the demand for labor is with the US JOLTS job openings data. The S&P Global Purchasing Managers numbers are not expected to move the needle, though any beat on expectations might give the US Dollar more impulse.

Daily digest: Pressure building to Nonfarm Payrolls

- Rating agency Moody’s has issued a negative outlook for China, a downgrade from the previous “stable” label.

- European Central Bank (ECB) board member Isabel Schnabel said that she is surprised by the shere speed of decline in inflation in the Eurozone, and no further hikes should be needed. Schnabel is considered to be a hawk, which makes these comments even more important and signals a change in the stance and outlook of the ECB.

- At 13:55 GMT, the Redbook Index is due to be released. Previous was at 6.3%.

- At 14:45 GMT, the S&P Global Purchasing Managers Indices are expected:

- The Services PMI is expected to stay stable from its preliminary reading at 50.8.

- The Composite flash reading for November stood at 50.7.

- Chunky batch of data at 15:00 GMT:

- The Institute for Supply Management (ISM) will release its November numbers:

- Headline Services PMI for November expected to increase from 51.8 to 52.

- Services Employment Index for October was at 50.2. No forecast.

- Services New Orders Index for October was at 55.5. No forecast pencilled in.

- Services Prices Paid for October was at 58.6. No forecast.

- JOLTS Job Openings for October is expected to decline a little from 9.553 million to 9.3 million.

- Equities are bleeding severely this Tuesday with nearly all Asian equity indices down over 1%, with China’s leading indices down more than 2%. European equities are trading in the red, and US futures trade directionless.

- The CME Group’s FedWatch Tool shows that markets are pricing in a 97.5% chance that the Federal Reserve will keep interest rates unchanged at its meeting next week.

- The benchmark 10-year US Treasury Note steadies at 4.23%. Yields in Europe, on the other hand, are falling.

US Dollar Index technical analysis: Back to summer levels

The US Dollar trades around 103.74 and has the next level, 104.00, in sight. Elements like the sudden shift to no-hikes from the ECB widens further the rate differential between the US Dollar and other currencies. In this favourable context, the US Dollar Index (DXY) is rallying as well. With a few landmark resistances being challenged and broken, more room for Dollar strength is in the pipeline.

The DXY has performed a daily close on Monday and an opening just above the 200-day Simple Moving Average (SMA), which is near 103.58. The DXY could still make it further up, should employment data trigger rising US yields again. A two-tiered pattern of a daily close lower followed by an opening higher would quickly see the DXY back above 104.28, with the 200-day and 100-day SMA turned over to support levels.

To the downside, historic levels from August are coming into play, when the Greenback summer rally took place. The lows of June make sense to look for some support, near 101.92, just below 102.00. Should more events take place that initiate further declines in US rates, expect to see a near-full unwind of the 2023 summer rally, heading to 100.82, followed by 100.00 and 99.41.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Gold is pulling moderately lower, with the US Dollar favoured by the risk-off sentiment.

- The precious metal loses footing as the market focuses on US data for more cues into the Fed's future rate-hike path.

- Speculation that the Fed will start to cut rates in March keeps Gold near record highs.

Gold prices (XAU/USD) are ticking lower during the European morning session on Tuesday. Bullion’s mild recovery attempt from the $2,020 area has been contained at $2,040, with US Dollar regaining lost ground, favoured by a risk-averse market sentiment.

Investors have adopted a cautious stance, awaiting the release of key US macroeconomic data this week, with a special interest on Friday’s Nonfarm Payrolls report. These figures will be observed with interest to confirm the end of the Federal Reserve (Fed) tightening cycle and increased expectations of rate cuts in the first quarter of 2024.

Monday’s data showed that US Factory Orders contracted beyond expectations in October, adding to evidence that the economic growth in the US is losing pace in the last quarter of the year.