- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | ANZ Job Advertisements (MoM) | July | 4.6% | |

| 01:30 | Australia | Trade Balance | June | 5.745 | 6 |

| 03:00 | New Zealand | Expected Annual Inflation 2y from now | Quarter III | 2.01% | |

| 04:30 | Australia | Announcement of the RBA decision on the discount rate | 1% | 1% | |

| 04:30 | Australia | RBA Rate Statement | |||

| 05:00 | Japan | Leading Economic Index | June | 94.9 | 93.6 |

| 05:00 | Japan | Coincident Index | June | 103.4 | |

| 06:00 | Germany | Factory Orders s.a. (MoM) | June | -2.2% | 0.4% |

| 14:00 | U.S. | JOLTs Job Openings | June | 7.323 | 7.268 |

| 17:05 | U.S. | FOMC Member James Bullard Speaks | |||

| 22:30 | Australia | AiG Performance of Construction Index | July | 43.0 |

Major US stocks fell significantly as fears of a worsening US-China trade war and slowing global economic growth intensified after Beijing devalued the yuan against the dollar to its lowest level since 2008 in response to Washington’s latest threat to introduce new tariffs on Chinese imports.

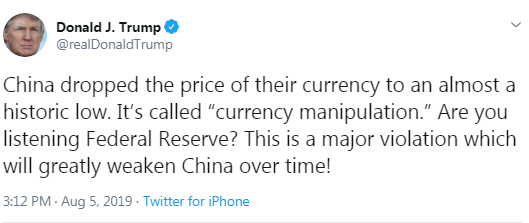

China allowed the national currency to break the important mark of 7 yuan per dollar on Monday for the first time in more than ten years, and US President Donald Trump called the move a “serious violation.” In addition, Bloomberg reported that China asked state-owned companies to suspend US agricultural imports.

These steps followed US President Donald Trump's statement last week that Washington intends to introduce a new 10 percent tariff on Chinese imports of $ 300 billion worth of Chinese goods on September 1. Trump's threats came after US and Chinese officials discussed trade issues. at the beginning of last week, when the two countries tried to resume negotiations.

The increasing uncertainty prompted investors to buy government bonds, gold and other safe assets such as the Japanese yen. The yield on 10-year US Treasury bonds fell to 1.73% and reached its lowest level since November 2016. Gold futures rose 1.1%.

At the same time, mixed macroeconomic reports failed to support the market. Data provided by the Institute for Supply Management (ISM) showed that the index of business activity in the US services sector fell in July to 53.7 points compared to 55.1 points in June. The latter value was the lowest since August 2016. Analysts predicted that the indicator would rise to the level of 55.5 points. In contrast, the Markit business activity index for the service sector showed growth to 53 points in July from 51.5 points in June against the economists' forecast of 52.2.

All DOW components recorded a decrease (30 out of 30). Outsiders were Apple Inc. (AAPL; -5.05%).

All S&P sectors completed trading in the red. The largest decline was shown by the technology sector (-3.5%).

At the time of closing:

Dow 25,717.74 -767.27 -2.90%

S&P 500 2,844.75 -87.30 -2.98%

Nasdaq 100 7,726.04 -278.03 -3.47%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | ANZ Job Advertisements (MoM) | July | 4.6% | |

| 01:30 | Australia | Trade Balance | June | 5.745 | 6 |

| 03:00 | New Zealand | Expected Annual Inflation 2y from now | Quarter III | 2.01% | |

| 04:30 | Australia | Announcement of the RBA decision on the discount rate | 1% | 1% | |

| 04:30 | Australia | RBA Rate Statement | |||

| 05:00 | Japan | Leading Economic Index | June | 94.9 | 93.6 |

| 05:00 | Japan | Coincident Index | June | 103.4 | |

| 06:00 | Germany | Factory Orders s.a. (MoM) | June | -2.2% | 0.4% |

| 14:00 | U.S. | JOLTs Job Openings | June | 7.323 | 7.268 |

| 17:05 | U.S. | FOMC Member James Bullard Speaks | |||

| 22:30 | Australia | AiG Performance of Construction Index | July | 43.0 |

Deutsche Bank's analysts determine the major economic events and macro releases for markets this week.

- “Tuesday: It's a fairly light day for data with releases including Japan's June labour earnings, Germany's June factory orders and July construction PMI, and June Jolts job openings in the US. Aside from the data, Fed's Bullard is due to speak on US economy in Washington while Walt Disney will be reporting earnings.

- Wednesday: It's another light day for data with releases of note being China’s July foreign reserves, Germany's June industrial production and the UK's July Halifax house prices. In the US we are due to get latest mortgage approvals and June consumer credit data. We'll also get the BoJ's summary of opinions for the July policy decision while Unicredit, AIG, Commerzbank, Glencore and Booking Holdings will be reporting earnings.

- Thursday: The key highlight of the day is likely to be China's July trade balance data and the ECB will publish its latest economic bulletin. Besides, we will also get Japan's June current account and trade balance data, France's July industry sentiment and in the US, we'll get June wholesale trade sales and wholesale inventories data along with the latest initial and continuing claims. Deutsche Telekom, Zurich Insurance Group and Aviva will be reporting earnings.

- Friday: It’s a busy Friday with a host of data releases lined up including China's July CPI and the release of preliminary Q2 GDP due in Japan and the UK. Other releases include Germany's June trade balance and current account balance, Italy's final July CPI, France's preliminary Q2 wage data and June industrial production along with the UK's monthly GDP for June, trade balance, index of services, industrial production and construction output data. In the US, we are due to get July PPI data. Novo Nordisk will be reporting earnings.”

The Institute

for Supply Management (ISM) reported on Monday its non-manufacturing index

(NMI) came in at 53.7 in July, which was 1.4 percentage points lower than the

June reading of 55.1 percent. The July reading pointed to the slowest expansion

in the services sector since August 2016.

Economists

forecast the index to increase to 55.5 last month. A reading above 50 signals

expansion, while a reading below 50 indicates contraction.

Of the 18

manufacturing industries, 13 reported growth last month, the ISM said, adding

that respondents indicated ongoing concerns related to tariffs and employment

resources.

According to

the report, the ISM’s non-manufacturing business activity measure fell to 53.1

percent, 5.1 percentage points lower than the June reading of 582 percent. That

reflected growth for the 120th consecutive month, at a slower rate in June. The

new orders gauge decreased to 54.1 percent, 1.7 percentage points lower than

the reading of 55.8 percent in June. The Prices Index dropped 24 percentage

points from the June reading of 58.9 percent to 56.5 percent, indicating that

prices increased in July for the 26th consecutive month. Meanwhile, the

employment indicator rose 1.2 percentage points in July to 56.2 percent from

the June reading of 55 percent.

The latest

report by IHS Markit revealed on Monday the seasonally adjusted final IHS

Markit U.S. Services Business Activity Index (PMI) stood at 53.0 in July, up

from 51.5 in June and up from the earlier released “flash” figure of 52.2.

The reading

signaled the fastest business activity expansion across the U.S. service sector

since April.

Economists had

forecast the index to stay unrevised at 52.2.

According to the report, new orders received by service providers increased at the fastest rate since March and new business from abroad grew at the strongest pace for five months. Meanwhile, the rate of job creation was only moderate overall, and inflationary pressures were historically subdued, with rates of both input price and output charge inflation easing.

Analysts at TD Securities are expecting the New Zealand’s unemployment rate to tick back up to 4.3% in Q2, in line with consensus.

- “It's difficult to see anything in this data release though that would change the market's view on this week's expected RBNZ rate cut.

- We also have the fortnightly Dairy auction. The GDT index rose 2.7% at the last auction, putting a stop to falling prices over the prior 4 auctions. Since then milk futures have posted a 5% gain, suggesting stability is returning to the market.”

Before the bell: S&P futures -1.49%, NASDAQ futures -2.06%

U.S. stock-index futures declined sharply on Monday as a trade war between the world’s largest economies intensified after China weakened its currency to its lowest level since 2008 in response to the U.S. President Trump's threat to impose new 10% tariff on $300 billion worth of Chinese imports. In addition, Beijing asked state companies to discontinue purchasing U.S. agricultural products.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,720.29 | -366.87 | -1.74% |

Hang Seng | 26,151.32 | -767.26 | -2.85% |

Shanghai | 2,821.50 | -46.34 | -1.62% |

S&P/ASX | 6,640.30 | -128.30 | -1.90% |

FTSE | 7,244.73 | -162.33 | -2.19% |

CAC | 5,254.00 | -105.00 | -1.96% |

DAX | 11,683.59 | -188.85 | -1.59% |

Crude oil | $54.89 | -1.38% | |

Gold | $1,474.80 | +1.19% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 168.4 | -2.15(-1.26%) | 6586 |

ALCOA INC. | AA | 20.22 | -0.49(-2.37%) | 7623 |

ALTRIA GROUP INC. | MO | 47.53 | -0.40(-0.83%) | 14586 |

Amazon.com Inc., NASDAQ | AMZN | 1,775.15 | -48.09(-2.64%) | 93292 |

American Express Co | AXP | 121.09 | -3.22(-2.59%) | 1453 |

Apple Inc. | AAPL | 198.3 | -5.72(-2.80%) | 401159 |

AT&T Inc | T | 33.83 | -0.34(-1.00%) | 68258 |

Boeing Co | BA | 332.99 | -6.57(-1.93%) | 28865 |

Caterpillar Inc | CAT | 121.76 | -2.78(-2.23%) | 13402 |

Chevron Corp | CVX | 119.36 | -1.37(-1.13%) | 7188 |

Cisco Systems Inc | CSCO | 52.18 | -1.07(-2.01%) | 44977 |

Citigroup Inc., NYSE | C | 65.83 | -1.78(-2.63%) | 70638 |

Deere & Company, NYSE | DE | 155 | -3.70(-2.33%) | 4614 |

E. I. du Pont de Nemours and Co | DD | 67.88 | -1.17(-1.69%) | 1091 |

Exxon Mobil Corp | XOM | 70.91 | -0.84(-1.17%) | 27161 |

Facebook, Inc. | FB | 184.75 | -4.27(-2.26%) | 147290 |

FedEx Corporation, NYSE | FDX | 160.1 | -3.63(-2.22%) | 1439 |

Ford Motor Co. | F | 9.15 | -0.13(-1.40%) | 127660 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.02 | -0.28(-2.72%) | 91888 |

General Electric Co | GE | 9.84 | -0.16(-1.60%) | 194166 |

General Motors Company, NYSE | GM | 38.99 | -0.79(-1.99%) | 15670 |

Goldman Sachs | GS | 204.68 | -4.69(-2.24%) | 12206 |

Google Inc. | GOOG | 1,172.26 | -21.73(-1.82%) | 15398 |

Hewlett-Packard Co. | HPQ | 19.66 | -0.48(-2.38%) | 25384 |

Home Depot Inc | HD | 208.35 | -3.80(-1.79%) | 5151 |

HONEYWELL INTERNATIONAL INC. | HON | 165 | -3.01(-1.79%) | 871 |

Intel Corp | INTC | 47.61 | -1.07(-2.20%) | 83929 |

International Business Machines Co... | IBM | 145.28 | -1.97(-1.34%) | 24481 |

International Paper Company | IP | 41.55 | -0.59(-1.40%) | 1051 |

Johnson & Johnson | JNJ | 130.4 | -0.67(-0.51%) | 10447 |

JPMorgan Chase and Co | JPM | 110.4 | -2.53(-2.24%) | 16551 |

McDonald's Corp | MCD | 212.86 | -1.62(-0.76%) | 7864 |

Merck & Co Inc | MRK | 83.69 | -0.78(-0.92%) | 7819 |

Microsoft Corp | MSFT | 133.55 | -3.35(-2.45%) | 250200 |

Nike | NKE | 79.87 | -1.27(-1.57%) | 9589 |

Pfizer Inc | PFE | 37.68 | -0.32(-0.84%) | 33695 |

Procter & Gamble Co | PG | 115.99 | -0.45(-0.39%) | 6270 |

Starbucks Corporation, NASDAQ | SBUX | 94.8 | -0.71(-0.74%) | 12419 |

Tesla Motors, Inc., NASDAQ | TSLA | 229.2 | -5.14(-2.19%) | 105998 |

The Coca-Cola Co | KO | 52.06 | -0.27(-0.52%) | 10522 |

Travelers Companies Inc | TRV | 146.69 | -0.23(-0.16%) | 886 |

Twitter, Inc., NYSE | TWTR | 41.75 | -1.10(-2.57%) | 105156 |

United Technologies Corp | UTX | 128.81 | -2.00(-1.53%) | 3758 |

UnitedHealth Group Inc | UNH | 246.86 | -3.19(-1.28%) | 6229 |

Verizon Communications Inc | VZ | 55.26 | -0.33(-0.59%) | 26520 |

Visa | V | 172.48 | -4.94(-2.78%) | 38110 |

Wal-Mart Stores Inc | WMT | 108.25 | -1.15(-1.05%) | 11024 |

Walt Disney Co | DIS | 139.45 | -2.26(-1.59%) | 46750 |

Yandex N.V., NASDAQ | YNDX | 37.24 | -0.30(-0.80%) | 57533 |

TD Securities' analysts note the next RBA August cash rate decision is to be released tomorrow and they expect the Australian central bank to keep the cash rate on hold at 1%, following cuts at the two prior meetings.

- “The Bank is unlikely to deviate from its script, waiting to assess the impact of the tax cuts and two cash rate cuts.

- We expect another stonking trade surplus in June thanks to not only a 13% rise in iron ore prices but a 6% increase in iron ore volumes. As for imports, the 10% drop in oil prices in Jun should make a meaningful dent on the import bill.

- We forecast exports +5% m/m but for imports to drop 3%. This should drive the trade surplus to a record of A$8.25b and make it increasingly likely to achieve a surplus on the capital account, the first time in 50yrs.”

Rabobank's analysts note that Friday's U.S. Employment Report had only a minor impact on markets, with Nonfarm payroll growth slowing down to 164,000 in July, from 193,000 in June (revised downward from 224,000).

- “This is still a solid rate of employment growth and enough to absorb the inflow to the labor market. In fact, the unemployment rate remained unchanged at 3.7%.

- Average hourly earnings growth rose modestly to 3.2% from 3.1% in year-on-year terms. This is a wage growth rate that the Fed back in 2015 imagined at the start of the hiking cycle, rather than after the end of the cycle. As such, it is likely not seen as insufficient to boost inflation back to the Fed’s target.

- As far as the sustained inflation undershoot is one of the reasons to cut the policy rate, the average hourly earnings support the case for an additional insurance cut.”

- Says China will not engage in competitive currency devaluation

- Will not use yuan as a tool to cope with external disturbances, such as trade tensions

- Current yuan exchange rate is at an appropriate level

- Will keep yuan exchange rate stable on a balanced and reasonable level

- Will maintain stability and consistency of FX management policies

- Confident that the yuan will continue to be a strong currency

TD Securities' analysts are expecting the US ISM non-manufacturing index to bounce back in July to 56.3, following a decline to a two-year low at 55.1.

- “Regional indices point to an improvement in July, with the Empire, Philly and Dallas Fed surveys suggesting an increase in activity. This would imply further divergence between the economy's services and manufacturing sectors.”

- Says politicians cannot choose which votes they respect

- They have promised to respect the referendum

- Government is significantly upping preparations for a no-deal Brexit, priority is securing a Brexit deal with EU

- Says PM wants to meet EU leaders and negotiate a new deal, hopes that EU changes its position on the backstop

- Absolutely clear we would not create a hard border with Ireland

- Expects communication campaign on no-deal Brexit to begin in a couple of weeks

- Reiterates that Brexit withdrawal agreement is not open for renegotiation

- Says it is open to discuss changes to Brexit political declaration

- Seeks constructive solutions to Brexit, doesn't want to play the "blame game"

- Expects the UK to respect commitment to avoid hard border with Ireland

Analysts at TD Securities note that the UK Services PMI increased just over a point in July to 51.4, hitting its highest level since October 2018.

- “New work helped to support the sector, but businesses remain downbeat about future demand prospects. Large corporate firms reported delayed spending decisions over political uncertainty, but noted that the weaker pound had improved prospects with foreign demand.”

- Says Chinese companies have signed deal on 14 million tons of U.S. soybeans

- Says 2 million tonnes of U.S. soybeans destined for China will be loaded in August

- China bought 130k tonnes of soybeans, 120k tonnes of sorghum, 60k tonnes of wheat, 40k tonnes of pork, 25k tonnes of cotton from U.S. between July 19 and August 2

- Chinese firms have applied for tariff exemptions on various U.S. agriculture products they bought since July

In opinion of Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, occasional rallies in Cacble could falter in the 1.2320 region.

“GBP/USD last week sold off to the base of its short term channel at 1.2022 and the January 2017 low at 1.1988. Last weeks low was 1.2080, but given the 13 count on the daily chart we would allow for this to hold the initial test and prompt a near term rebound. Below here lies the 1.1491 3rd October low (according to CQG). Rallies, if seen, should struggle circa 1.2320. It stays negative while contained by 2 month downtrend at 1.2459 today. Above the downtrend this would introduce scope to the 55 day ma at 1.2555 and the June high at 1.2784”.

According to figures released today by the Society of Motor Manufacturers and Traders (SMMT), the UK new car market declined again in July, with 157,198 vehicles leaving showrooms - the lowest July market since 2012. Registrations fell by -4.1%, the fifth consecutive month of decline, as political and economic uncertainty and confusion over future government policy on different fuel types continued to knock consumer and business confidence. During January to July period, new car sales decreased 3.5% from the same period last year.

Declines were seen across all sectors, with private demand falling -2.0%, while deliveries for fleet and business customers were down -4.7% and -22.5% respectively. Luxury saloons and specialist sports cars experienced a rise in registrations in the month with volumes driven by increased demand for dual purpose vehicles, up 12.8% to take nearly a quarter (24.4%) of the market. All other segments experienced declines in the month, with the biggest falls seen in executive (-21.6%) and supermini (-12.1%) segments.

Sentix survey showed, the sentix economic index for Euroland drops by a whopping 7.9 points to -13.7 points. This is the lowest level since October 2014. The measures announced by the central banks have not caused economic expectations to turn around. On the contrary, the current situation and expectations are literally tearing down, and the pace of deterioration is on the increase. In Germany, the overall index is even falling to its lowest level since October 2009. A recession in Germany is inevitable. The other regions of the world are also struggling with large discounts.

The current assessment and expectations are falling to their knees, and 6-month expectations for the Euro area are falling by 7 points to -20 points. This is the lowest value since August 2012! As Draghis' term of office draws to an end, economic expectations for Euroland have returned to the point where Draghi felt compelled to make his "whatever it takes speech". The vote of the investors is also devastating for the current situation values. The status quo for the economy in Euroland is once again falling by a whopping 9.2 points to its lowest level since January 2015. The pace of deterioration is increasing rapidly, without the latest announcements by the central banks being able to slow the trend. The situation values in particular make it clear that the spectre of recession is going around. The figure is negative again for the first time since February 2015, and expectations for the future do not give the all-clear at -20 points.

Japan's top currency diplomat warned investors against significantly pushing up the yen, signalling that Tokyo was ready to intervene in the currency market if excessive yen gains threatened to hurt the export-reliant economy.

Yoshiki Takeuchi, Japan's vice finance minister for international affairs, said Tokyo was in regular contact with overseas authorities to respond to volatile market moves.

"As we have been saying, it's necessary to take action based on the G7 and G20 agreement if currency moves have a negative impact on the economy and financial markets," Takeuchi told reporters, when asked whether Japan could intervene in the currency market to stem excessive yen rises.

He made the comments after a meeting of top officials from the Ministry of Finance, Bank of Japan and the Financial Services Agency, which is held occasionally to discuss market developments.

Global trade likely to pick up only gradually in the coming quarters

Will remain weaker than overall economic activity

US-China trade war has sapped confidence and held back investment

Downside risks to the outlook for trade have partially materialised in recent months

The threat of further escalation of trade tensions persists

According to the report from IHS Markit/CIPS, July data signalled a slight improvement in the performance of the UK service sector, with a renewed increase in new work supporting the fastest pace of business activity growth since October 2018. However, the rate of expansion remained subdued overall and much softer than seen on average over the past decade. Meanwhile, job creation softened in July and business expectations for the year ahead eased to the weakest since March.

At 51.4 in July, the seasonally adjusted UK Services PMI Business Activity Index registered above the 50.0 no-change mark for the fourth consecutive month and signalled a modest increase in service sector output. The latest reading was up from 50.2 in June and the highest for nine months, but still well below the trend recorded since the recovery from the global financial crisis began in the second half of 2009 (54.4).

Higher levels of business activity were driven by a solid rebound in new work during July. The rate of new business growth was the strongest since September 2018. There were again widespread reports that domestic political uncertainty had held back decision making among clients, particularly large corporates. A number of survey respondents commented on improved sales to clients in external markets, helped by the weak sterling exchange rate against the euro and US dollar. Moreover, the latest survey indicated the fastest increase in new work from abroad since June 2018.

According to the report from IHS Markit, Eurozone PMI Composite Output Index slipped closer to the 50.0 no-change mark during July. Unchanged on the earlier flash reading, the index posted 51.5, a level indicative of only modest growth and down from June’s seven month high of 52.2.

The headline index continue to mask notable differing performances between the manufacturing and services economies. Whilst service sector activity rose at a solid, albeit slightly slower pace, there was a notable and accelerated fall in manufacturing production during July.

Weighing on the performance of the overall eurozone economy in July was ongoing weakness in demand. New work placed with private sector companies rose only slightly, weighed down in the main by another marked reduction in manufacturing order books. July marked a fifth successive monthly fall in backlogs, with the reduction the sharpest since April. Helping firms to keep on top of their workloads was another rise in employment, maintaining a trend that stretches back to November 2014. However, growth in staffing numbers was the weakest since April 2016. Hiring was also limited at a time of waning optimism about the future. Latest data showed that confidence was at its lowest level for just under five years.

The negative bias in USD/CHF is expected to persist while below 0.9976, where sits the 200-day SMA, noted Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank.

“USD/CHF last week rallied to and failed at key resistance, namely the 200 day ma at .9976. While capped here, a negative bias will remain for a slide to .9695, the 25th June low. The .9716 January low is here together with Fibo support at .9692 and we would allow for this to hold the initial test. Failure will target the .9543 September 2019 low. Above the 200 moving average lies the mid-June high at 1.0014 and 1.0123/78.6% retracement. Longer term we target .9211/.9188, the 2018 low”.

China will deepen its regional financial reforms, using various policy tools to lower corporate funding costs, especially for small firms, Chen Yulu, a vice governor of the People's Bank of China, said on Monday.

Chinese policymakers have pledged to maintain support for the slowing economy and prod banks to lend more to small and private firms that are vital for growth and employment.

"We will use a variety of tools and explore effective ways to reduce financing costs of enterprises, especially for small, private firms," Chen told reporters at a briefing.

China has been experimenting with several regional reform schemes, including one on supporting small firms in Zhejiang and Henan, a scheme on green financing in provinces including Zhejiang, Guangdong and Guizhou, the central bank said.

Other schemes aim to promote financing support for the Guangdong-Hong Kong-Macau Greater Bay Area and other key regional development plans, and a pilot on enhancing the yuan's convertibility in Shanghai's free trade zone, it said.

U.S. President Donald Trump’s surprising move to impose more tariffs on China is a serious misreading of China’s pressure points, according to Eurasia Group analysts.

The latest escalation signaled a return to the way Trump negotiated with China — by trying to build more leverage over Beijing amid ongoing talks — before both sides agreed to a ceasefire in late June, Michael Hirson, Paul Triolo and Jeffrey Wright wrote in a Thursday note.

“The threat is a serious gamble for Trump,” they said. “It likely signals that he would prefer to reach a deal on his terms before the 2020 election, and is willing to use the tools at his disposal to build pressure on China to that end.”

Trump said Thursday that the U.S. will put 10% tariffs on another $300 billion worth of Chinese goods starting Sept. 1. The announcement came just a day after both sides wrapped up a round of trade talks in Shanghai, with plans to continue the negotiations in Washington in September.

The Eurasia Group analysts said it is possible that Thursday’s tariff threat is meant to spur China into buying more American agricultural products but, they added, Beijing is unlikely to respond the way Trump hopes. It would be “extremely embarrassing for China to step up imports from the U.S. under the threat of blackmail,” they wrote.

China on Monday let the yuan tumble beyond the key 7-per-dollar level for the first time in more than a decade, in a sign Beijing might be willing to tolerate further currency weakness in the face of an escalating trade row with the United States.

The sharp 1.4% drop in the yuan came after the People's Bank of China (PBOC) set the daily mid-point of the currency's trading band at 6.9225 per dollar, its weakest level since December 2018.

“Today’s fixing was the last line in the sand,” said Ken Cheung, senior Asian FX strategist at Mizuho Bank in Hong Kong. “The PBOC has fully given the green light to yuan depreciation”

The shakeout in the yuan comes days after U.S. President Donald Trump stunned financial markets by vowing to impose 10% tariffs on the remaining $300 billion of Chinese imports from Sept. 1, abruptly breaking a brief month-long ceasefire in the bruising trade war.

With the escalating trade war giving Beijing fewer reasons to maintain yuan stability, analysts said they expect the currency to continue to weaken.

Federal Statistical Office (FSO) said, turnover in the retail sector rose by 0.7% in nominal terms in June 2019 compared with the previous year. Economists had expected a 0.6% decrease. Seasonally adjusted, nominal turnover rose by 1.4% compared with the previous month.

Real turnover in the retail sector also adjusted for sales days and holidays rose by 0.7% in June 2019 compared with the previous year. Real growth takes inflation into consideration. Compared with the previous month, real, seasonally adjusted retail trade turnover registered an increase of 1.5%.

Adjusted for sales days and holidays, the retail sector excluding service stations showed a 0.5% increase in nominal turnover in June 2019 compared with June 2018 (in real terms +0.4%). Retail sales of food, drinks and tobacco registered a decline in nominal turnover of 0.4% (in real terms –0.7%), whereas the non-food sector registered a nominal plus of 1.5% (in real terms +1.7%).

Excluding service stations, the retail sector showed a seasonally adjusted increase in nominal turnover of 1.3% compared with the previous month (in real terms +1.3%). Retail sales of food, drinks and tobacco registered a plus of 1.5% (in real terms +1.4%). The non-food sector showed a plus of 1.7% (in real terms +1.8%).

MUFG Research discusses GBP outlook in light of revising down GBP/USD targets. MUFG now targets GBP/USD around 1.10 and EUR/GBP around 0.97 by year-end.

"We now consider leaving the EU without a deal as the most likely scenario and hence have lowered our GBP forecast levels accordingly. Parliament forcing a general election but then the Conservatives and the Brexit Party winning is our likeliest scenario. We believe rate cuts would be forthcoming and now expect two 25bp cuts in December and January following a no-deal or disruptive departure. With our 60% probability now attached to no-deal , we see GBP/USD decline to close to 1.1000 by year-end. We expect some GBP recovery in 2020 based on measures taken through restarted negotiations to ease the negative impact and based on the assumption of fiscal stimulus implemented to counter the economic impact in the UK," MUFG adds.

According to the report from State Secretariat for Economic Affairs (SECO), consumer sentiment in Switzerland remains slightly below average. Low expectations regarding consumers’ own budgets are clouding the outlook. However, respondents are cautiously optimistic about the future general economic situation. The labour market has still been assessed positively but prospects have deteriorated somewhat.

Swiss consumer sentiment remains subdued. At −8 points, the consumer sentiment index in July 2019 stood slightly below its long term average (−5 points). The assessment has hardly improved in comparison with April’s survey (−9 points).

The subdued sentiment is due in particular to households’ budget situation, with both the past (−13 points) and anticipated financial situation (−8 points) being assessed as well below average (average −6 points and +2 points respectively). Therefore, the likelihood of consumers making major purchases has, unsurprisingly, also remained below average (−11 points; average: −6 points). Based on these survey results, only restrained development of private consumer expenditure is to be expected.

By contrast, respondents have a mildly optimistic view of the future development of the general economic situation. At 0 points, the relevant sub-index exceeds its average (−9 points) but remains considerably lower than in 2017 and 2018, when the economy was growing dynamically. This sub-index’s current level thus points to moderate economic growth.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1211 (1767)

$1.1180 (1052)

$1.1162 (810)

Price at time of writing this review: $1.1127

Support levels (open interest**, contracts):

$1.1045 (2148)

$1.0998 (2343)

$1.0949 (349)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 9 is 76918 contracts (according to data from August, 2) with the maximum number of contracts with strike price $1,1100 (5107);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2356 (226)

$1.2311 (350)

$1.2271 (430)

Price at time of writing this review: $1.2153

Support levels (open interest**, contracts):

$1.2081 (1088)

$1.2039 (289)

$1.1994 (341)

Comments:

- Overall open interest on the CALL options with the expiration date August, 9 is 16890 contracts, with the maximum number of contracts with strike price $1,3000 (2051);

- Overall open interest on the PUT options with the expiration date August, 9 is 20819 contracts, with the maximum number of contracts with strike price $1,2450 (2362);

- The ratio of PUT/CALL was 1.23 versus 1.33 from the previous trading day according to data from August, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 61.06 | 0.26 |

| WTI | 55.17 | 1.34 |

| Silver | 16.17 | -0.8 |

| Gold | 1440.321 | -0.31 |

| Palladium | 1406.2 | -1.49 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -453.83 | 21087.16 | -2.11 |

| Hang Seng | -647.12 | 26918.58 | -2.35 |

| KOSPI | -19.21 | 1998.13 | -0.95 |

| ASX 200 | -20.3 | 6768.6 | -0.3 |

| FTSE 100 | -177.81 | 7407.06 | -2.34 |

| DAX | -380.71 | 11872.44 | -3.11 |

| CAC 40 | -198.41 | 5359 | -3.57 |

| Dow Jones | -98.41 | 26485.01 | -0.37 |

| S&P 500 | -21.51 | 2932.05 | -0.73 |

| NASDAQ Composite | -107.05 | 8004.07 | -1.32 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67972 | 0.01 |

| EURJPY | 118.371 | -0.47 |

| EURUSD | 1.11053 | 0.21 |

| GBPJPY | 129.606 | -0.32 |

| GBPUSD | 1.21574 | 0.33 |

| NZDUSD | 0.6534 | -0.36 |

| USDCAD | 1.32006 | -0.07 |

| USDCHF | 0.98225 | -0.78 |

| USDJPY | 106.596 | -0.67 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.