- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(raw materials / closing price /% change)

Oil 57.73 -0.45%

Gold 1,295.00 +0.01%

(index / closing price / change items /% change)

Nikkei -111.87 22707.16 -0.49%

TOPIX -9.66 1786.87 -0.54%

Hang Seng +64.04 29138.28 +0.22%

CSI 300 +20.72 4018.86 +0.52%

Euro Stoxx 50 +48.67 3576.22 +1.38%

FTSE 100 +38.48 7338.97 +0.53%

DAX +197.06 13058.55 +1.53%

CAC 40 +72.40 5389.29 +1.36%

DJIA +58.46 24290.05 +0.24%

S&P 500 -2.78 2639.44 -0.11%

NASDAQ -72.22 6775.37 -1.05%

S&P/TSX -69.94 15969.03 -0.44%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1865 -0,21%

GBP/USD $1,3479 +0,07%

USD/CHF Chf0,98501 +0,86%

USD/JPY Y112,39 +0,26%

EUR/JPY Y133,36 +0,04%

GBP/JPY Y151,503 +0,33%

AUD/USD $0,7598 -0,14%

NZD/USD $0,6857 -0,41%

USD/CAD C$1,26728 -0,17%

00:30 Australia Current Account, bln Quarter III -9.6 -9.2

00:30 Australia Retail Sales, M/M October 0.0% 0.3%

01:45 China Markit/Caixin Services PMI November 51.2 51.5

03:30 Australia Announcement of the RBA decision on the discount rate 1.5% 1.50%

03:30 Australia RBA Rate Statement

08:50 France Services PMI (Finally) November 57.3 60.2

08:55 Germany Services PMI (Finally) November 54.7 54.9

09:00 Eurozone Services PMI (Finally) November 55 56.2

09:30 United Kingdom Purchasing Manager Index Services November 55.6 55.0

10:00 Eurozone Retail Sales (MoM) October 0.7% -0.7%

10:00 Eurozone Retail Sales (YoY) October 3.7% 1.7%

13:30 Canada Trade balance, billions October -3.18

13:30 U.S. International Trade, bln October -43.50 -47.5

14:45 U.S. Services PMI (Finally) November 55.3 54.7

15:00 U.S. ISM Non-Manufacturing November 60.1 59.3

Major US stock indexes finished trading mostly in the red, amid the fading optimism observed at the beginning of the session due to information that the US Senate approved the largest change in tax legislation since the 1980s.

In addition, it became known that production orders in the US fell by 0.1% in October, mainly due to fewer orders for passenger planes, cars and trucks, a government report showed. The decline was focused on large aircraft and cars, on two volatile categories, which often distort the data of the main indicator. Orders, excluding transport, rose by 0.8%. Orders increased by 1.7% in September and by 1.2% in August.

However, the index of business activity in New York greatly improved last month, exceeding forecasts, and peaking in the last 4 months. This is evidenced by a report published by the Institute of Supply Management (ISM) in New York. According to the data provided, the index, which assesses the economic conditions in the manufacturing and services sectors for companies registered in New York, rose in November to 58.1 points from 51.6 points in October. The latter value was the highest since July (then the index was 62.8 points). It was predicted that the index will rise only to 54.0 points.

Most components of the DOW index finished trading in positive territory (19 out of 30). The leader of growth was the shares of The Walt Disney Company (DIS, + 5.13%). Outsider were shares of Microsoft Corporation (MSFT, -4.11%).

Most sectors of the S & P index recorded an increase. The services sector grew most (+ 0.7%). The greatest decline was shown by the technological sector (-1.6%).

At closing:

DJIA + 0.24% 24,290.39 +58.80

Nasdaq -1.05% 6,775.37 -72.22

S & P -0.11% 2,639.36 -2.86

CAD/CHF has broken the downside trend line recently.

We might see a retracement which may be a price correction because price hasn't tested the trend line yet and therefore, we may expect an opportunity to enter long on CAD/CHF.

New orders for manufactured goods in October, down following two consecutive monthly increases, decreased $0.3 billion or 0.1 percent to $479.6 billion, the U.S. Census Bureau reported today. This followed a 1.7 percent September increase. Shipments, up ten of the last eleven months, increased $2.7 billion or 0.6 percent to $484.2 billion. This followed a 1.1 percent September increase. Unfilled orders, down three of the last four months, decreased $0.2 billion or virtually unchanged to $1,135.1 billion. This followed a 0.3 percent September increase. The unfilled orders-to-shipments ratio was 6.68, unchanged from September. Inventories, up eleven of the last twelve months, increased $1.2 billion or 0.2 percent to $661.6 billion. This followed a 0.6 percent September increase. The inventories-to-shipments ratio was 1.37, unchanged from September.

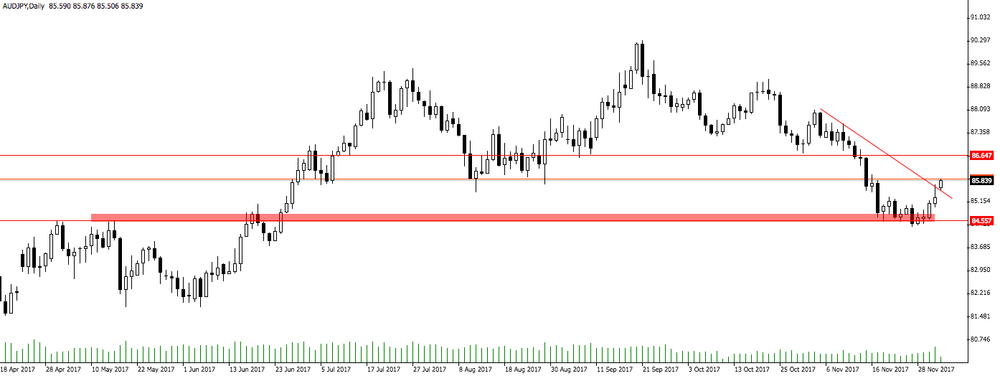

As we can see, if the daily candle closes above the downside trend line, we might expect a further appreciation on AUD/JPY.

Otherwise, if the price doesn't hold above the downside trend line, then we can consider go short when the price breaks the support level (red rectangle).

U.S. stock-index futures advanced on Monday after the U.S. Senate passed its version of a tax reform bill over the weekend.

Global Stocks:

Nikkei 22,707.16 -111.87 -0.49%

Hang Seng 29,138.28 +64.04 +0.22%

Shanghai 3,310.37 -7.25 -0.22%

S&P/ASX 5,985.59 -4.17 -0.07%

FTSE 7,334.98 +34.49 +0.47%

CAC 5,381.33 +64.44 +1.21%

DAX 13,059.01 +197.52 +1.54%

Crude $57.70 (-1.13%)

Gold $1,295.00 (+0.01%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 241.49 | 0.34(0.14%) | 1050 |

| ALCOA INC. | AA | 42 | 0.36(0.86%) | 702 |

| ALTRIA GROUP INC. | MO | 69 | 0.42(0.61%) | 956 |

| Amazon.com Inc., NASDAQ | AMZN | 1,171.00 | 8.65(0.74%) | 53216 |

| American Express Co | AXP | 99.29 | 1.43(1.46%) | 1371 |

| AMERICAN INTERNATIONAL GROUP | AIG | 60.81 | 0.93(1.55%) | 10870 |

| Apple Inc. | AAPL | 172.46 | 1.41(0.82%) | 173955 |

| AT&T Inc | T | 36.84 | 0.34(0.93%) | 41991 |

| Boeing Co | BA | 275.59 | 4.21(1.55%) | 12663 |

| Caterpillar Inc | CAT | 143.2 | 1.68(1.19%) | 9546 |

| Chevron Corp | CVX | 120 | 0.49(0.41%) | 702 |

| Cisco Systems Inc | CSCO | 37.85 | 0.25(0.66%) | 36419 |

| Citigroup Inc., NYSE | C | 77.02 | 1.51(2.00%) | 67663 |

| Deere & Company, NYSE | DE | 151.8 | 1.86(1.24%) | 4141 |

| Exxon Mobil Corp | XOM | 83.59 | 0.13(0.16%) | 3461 |

| Facebook, Inc. | FB | 176.37 | 1.27(0.73%) | 147581 |

| Ford Motor Co. | F | 12.65 | 0.07(0.56%) | 70439 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.21 | 0.10(0.71%) | 11966 |

| General Electric Co | GE | 18.03 | 0.15(0.84%) | 130346 |

| General Motors Company, NYSE | GM | 43.33 | 0.54(1.26%) | 4576 |

| Goldman Sachs | GS | 254.1 | 5.15(2.07%) | 12448 |

| Google Inc. | GOOG | 1,017.18 | 7.01(0.69%) | 6662 |

| Hewlett-Packard Co. | HPQ | 21.5 | 0.09(0.42%) | 1752 |

| Home Depot Inc | HD | 183.3 | 2.88(1.60%) | 15654 |

| HONEYWELL INTERNATIONAL INC. | HON | 157.71 | 3.31(2.14%) | 921 |

| Intel Corp | INTC | 45 | 0.32(0.72%) | 35679 |

| International Business Machines Co... | IBM | 155.87 | 1.11(0.72%) | 9579 |

| Johnson & Johnson | JNJ | 141.1 | 1.12(0.80%) | 3076 |

| JPMorgan Chase and Co | JPM | 107 | 2.21(2.11%) | 46338 |

| McDonald's Corp | MCD | 173.89 | 1.02(0.59%) | 4011 |

| Merck & Co Inc | MRK | 56.3 | 0.43(0.77%) | 5094 |

| Microsoft Corp | MSFT | 84.56 | 0.30(0.36%) | 37704 |

| Nike | NKE | 60.21 | 0.33(0.55%) | 2232 |

| Pfizer Inc | PFE | 36.5 | 0.15(0.41%) | 12133 |

| Procter & Gamble Co | PG | 90.88 | 0.52(0.58%) | 311 |

| Starbucks Corporation, NASDAQ | SBUX | 57.67 | 0.35(0.61%) | 5169 |

| Tesla Motors, Inc., NASDAQ | TSLA | 308.27 | 1.74(0.57%) | 12549 |

| The Coca-Cola Co | KO | 46.06 | 0.09(0.20%) | 3000 |

| Travelers Companies Inc | TRV | 136.93 | 0.72(0.53%) | 1137 |

| Twitter, Inc., NYSE | TWTR | 20.84 | 0.13(0.63%) | 14932 |

| UnitedHealth Group Inc | UNH | 229.11 | 2.33(1.03%) | 6004 |

| Verizon Communications Inc | VZ | 51.53 | 0.28(0.55%) | 24610 |

| Visa | V | 111.6 | 0.87(0.79%) | 11220 |

| Wal-Mart Stores Inc | WMT | 98.3 | 0.95(0.98%) | 9875 |

| Walt Disney Co | DIS | 106.45 | 1.20(1.14%) | 4198 |

| Yandex N.V., NASDAQ | YNDX | 32.66 | 0.13(0.40%) | 1600 |

EUR/USD: 1.1800(426 млн), 1.1900(460 млн), 1.2000(1.01 млрд)

USD/JPY: 111.90-00(999 млн), 112.50-55(914 млн), 113.25(710 млн), 114.00-10(893 млн)

AUD/USD: 0.7500(291 млн), 0.7750(335 млн)

NZD/USD: 0.6920(371 млн)

USD/CAD: 1.2810(290 млн)

EUR/GBP: 0.8789(724 млн)

AUD/JPY: 84.06(260 млн), 85.75(257 млн)

AUD/NZD: 1.1100(847 млн)

Travelers (TRV) initiated with a Sell at Goldman; target $124

DowDuPont (DWDP) resumed with a Buy at Goldman; target $91

Home Depot (HD) target raised to $190 at Telsey Advisory Group

In October 2017, compared with September 2017, industrial producer prices rose by 0.4% in both the euro area (EA19) and the EU28, according to estimates from Eurostat, the statistical office of the European Union. In September 2017, prices increased by 0.5% in both zones. In October 2017, compared with October 2016, industrial producer prices rose by 2.5% in the euro area and by 2.6% in the EU28.

The 0.4% increase in industrial producer prices in total industry in the euro area in October 2017, compared with September 2017, is due to rises of 1.3% in the energy sector and of 0.3% for intermediate goods, while prices remained stable for both capital and durable consumer goods and fell by 0.2% for non-durable consumer goods. Prices in total industry excluding energy rose by 0.2%.

The Sentix Economy Index for the Eurozone concludes its series of rising highs and returns 2.9 points in December. Expectations are responsible for this, with a more pronounced drop of 6.0 points. The assessment of the situation, on the other hand, can even increase slightly (+0.7 points). The values for Germany are also falling. The overall index dropped by 3.3 points to 39.1 points. Economic expectations have fallen by 5.3 points. There is also a calming effect on the global economy. Falling expectations dominate, with the emerging markets losing the least in relative terms.

November data pointed to a moderate rebound in UK construction output, with business activity rising at the strongest rate since June. New orders and employment numbers also increased to the greatest extent in five months. However, the improvement in construction growth was largely confined to residential work. The latest survey revealed sustained reductions in commercial building and civil engineering, with the latter now experiencing its longest period of decline since the first half of 2013.

Adjusted for seasonal influences, the IHS Markit/CIPS UK Construction PMI picked up from 50.8 in October to 53.1 in November, to remain above the 50.0 no-change value for the second month running. The latest reading was the highest for five months and signalled a solid rate of business activity growth across the construction sector.

EUR/USD: 1.1800(426 m), 1.1900(460 m), 1.2000(1.01 b)

USD/JPY: 111.90-00(999 m), 112.50-55(914 m), 113.25(710 m), 114.00-10(893 m)

AUD/USD: 0.7500(291 m), 0.7750(335 m)

NZD/USD: 0.6920(371 m)

USD/CAD: 1.2810(290 m)

EUR/GBP: 0.8789(724 m)

AUD/JPY: 84.06(260 m), 85.75(257 m)

AUD/NZD: 1.1100(847 m)

-

Border is not just a customs issue, it is also a political issue because it was part of the troubles of the past

The number of unemployed registered in the offices of the Public Employment Services has increased in November, +7,255 people in relation to the previous month. Last year, in November 2016, unemployment increased by 24,841 people. In the last 8 years in this same month registered unemployment had increased on average in more than 25,000 people (24,919). In this way, the total number of registered unemployed stands at 3,474,281, thus remaining at its lowest level in the last 8 years. In seasonally adjusted terms, unemployment has dropped by 22,744 people.

-

BoJ will continue to carefully monitor the global economic situation as well as potential risks

-

Among risks to global outlook, I am particularly concerned about protectionist tendency in some countries as well as geopolitical risks

-

We will continue current policy framework in order to achieve 2 pct target around fiscal 2019

-

Our monetary policy strategy changed in september last year to accommodate not just economy but financial stability

-

China resolutely opposes N.Korea actions that violate U.N. resolutions

-

In response to question on unilateral sanctions, says China opposes any actions that run counter to international law, U.N. security council

-

China has open attitude on solutions on Korean peninsula, but parties should be consultative

Stocks across Europe finished lower on Friday, after a late-session slump on reports former U.S. national security adviser will testify about President Donald Trump. Markets had already opened in negative territory after U.S. lawmakers had trouble passing a long-awaited tax bill and pushed the vote back to Friday.

U.S. stocks ended lower on Friday after news surrounding former national-security adviser Michael Flynn added an element of political uncertainty into markets, though the issue wasn't seen as derailing a market rally that gave the Dow its best week of the year.

Asia-Pacific stock markets had a largely muted start to the week, though some buying built into midday, as investors mulled over the U.S. Senate's passing of a tax-reform proposal and the special counsel's probe of President Donald Trump's election campaign.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2021 (5528)

$1.1983 (4088)

$1.1953 (5954)

Price at time of writing this review: $1.1869

Support levels (open interest**, contracts):

$1.1850 (3101)

$1.1822 (2693)

$1.1786 (3091)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 8 is 165326 contracts (according to data from December, 1) with the maximum number of contracts with strike price $1,1500 (8869);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3585 (2658)

$1.3552 (2651)

$1.3527 (1907)

Price at time of writing this review: $1.3462

Support levels (open interest**, contracts):

$1.3421 (1064)

$1.3365 (1374)

$1.3328 (1178)

Comments:

- Overall open interest on the CALL options with the expiration date December, 8 is 51838 contracts, with the maximum number of contracts with strike price $1,3400 (3590);

- Overall open interest on the PUT options with the expiration date December, 8 is 44178 contracts, with the maximum number of contracts with strike price $1,3000 (3978);

- The ratio of PUT/CALL was 0.85 versus 0.85 from the previous trading day according to data from December, 1.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.