- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- Says when he speaks with foreign leaders, he does it in an appropriate way

- Concerns about democratic rival Biden would not be tied to effort to get a trade deal with China

Morten Lund, an analyst at Nordea Markets, notes that the U.S. Nonfarm payrolls rose by 136k in September, underperforming consensus expectations, and suggests that overall, the report was a mixed bag.

- “Nonfarm payrolls increased by 136k in September after a decent (revised) number of 168k in August. The 3-month average payroll number decreased from 171k to 157k, while the 12-month average, on the other hand, rose slightly from 177k to 179k.

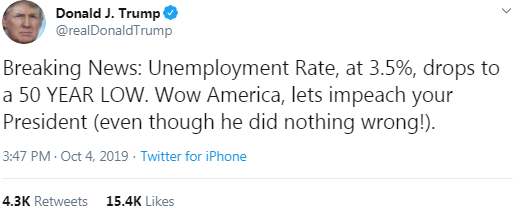

- Despite the somewhat weak headline number, both the U-3 unemployment rate and the broad U-6 unemployment rate decreased to respectively 3.5% and 6.9% due to less strong labour supply.

- The wage component disappointed with no monthly increase (consensus 0.2% m/m), corresponding to 2.9 y/y (August: 3.2%). Hence, recent momentum (as measured by the 3-month chg. AR) came down from the otherwise strongest level post the financial crisis. At the surface, this suggests less inflation pressure ahead, but we are not fully convinced by this single print. Thus, other labour market indicators still point at higher core inflation in the coming months.

- Given the mixed signals, today’s job report does not in itself give a clear signal, whether the Fed will cut or not in October. However, both the very weak ISM manufacturing number and the sharp drop in the ISM non-manufacturing index released earlier this week clearly added more fuel to the very dovish fire burning under the Fed. Markets are currently pricing in around 75% probability of a rate cut at the October meeting.”

- Says there could be some positive surprises coming out of U.S.-China talks, but adds that he's not making any predictions

- Hong Kong democracy protests could impact talks; we are monitoring the situation

The Ivey

Business School Purchasing Managers Index (PMI), measuring Canada’s economic

activity, fell to 60.6 in September from an unrevised 48.7 in August. That was

the lowest reading since March 2015.

Economists had

expected the gauge to hit 54.3.

A figure above

50 shows an increase while below 50 shows a decrease.

Within

sub-indexes, the inventories indicator fell to 50.5 in September from 54.8 in

the prior month and the employment measure dropped to 49.6 from 52.7, while the

supplier deliveries gauge rose to 50.2 this month from 49.9 in August and the

prices index surged to 56.9 from 51.3.

Rannella Billy-Ochieng’, an economist at the Royal Bank of Canada (RBC), notes that Canada's trade deficit narrowed to $1B in August up from a revised $1.4B deficit in July.

- “The details of today’s report were arguably softer than the headline numbers implied. Non-energy export volumes increased about 1% month-over-month by our count, but driven largely from an increase in exports of aircraft and other transportation equipment which grew by 13.2%. That increase is likely not to be repeated in the coming months.

- After accounting for price effects, energy exports were also down 2.2% in August. Despite the fact that import volumes were up - much of which was driven from gold, a pullback in equipment imports does not bode well for near-term business investment growth.

- The notoriously volatile nature of the data makes us hesitant to put too much emphasis on one month’s reading. But the details of today’s trade report were a bit disappointing.”

Statistics

Canada announced on Friday that Canada’s merchandise trade deficit stood at CAD0.96

billion in August, narrowing from a revised CAD1.38 billion gap in July (originally

a CAD1.12-billion gap).

Economists had

expected a deficit of CAD1.00 billion.

According to

the report, the country’s exports rose 1.8 percent m-o-m in August, due mainly

to a gain in exports of energy products (+3.9 percent m-o-m) and aircraft (+38.7

percent m-o-m). Meanwhile, imports increased 1.0 percent m-o-m in August,

mostly on higher imports of non-metallic mineral products (+9.4 percent m-o-m) and

energy products (+9.7 percent m-o-m).

Nathan Janzen, the senior economist at the Royal Bank of Canada (RBC) notes that U.S. September labour market report was a mixed bag, but wasn’t as bad as might have been feared after softer-than-expected ISM manufacturing and non-manufacturing reports this week raised concerns about the health of the underlying growth backdrop.

- “The 136k increase in employment is still slower than the 200k+ readings we have become accustomed to in recent years. But it is still a strong enough pace to put downward pressure on the unemployment rate. And an upward revision to the job count in August (to 168k from 130k previously) also makes recent trends in the often-volatile data look a little better.

- Indeed, the unemployment rate fell to a new cycle-low 3.5% in September, and initial jobless claims data has not flagged any evidence of rising layoffs. Tight labour markets are a reminder that, even without escalating international trade concerns, slower employment growth would be expected given the shrinking pool of workers available to hire from.

- Wage growth was arguably the largest soft spot in the monthly report, slipping back below 3% on a year-over-year basis. But on balance, the data still leaves US labour markets looking relatively solid, at least for now.”

U.S. stock-index futures rose moderately on Friday after the release of the September jobs report, which revealed a moderate increase in job growth and the unemployment rate at 50-year low, diminishing worries of a sharp slowdown in the world’s largest economy.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,410.20 | +68.46 | +0.32% |

Hang Seng | 25,821.03 | -289.28 | -1.11% |

Shanghai | - | - | - |

S&P/ASX | 6,517.10 | +24.10 | +0.37% |

FTSE | 7,117.46 | +39.82 | +0.56% |

CAC | 5,460.30 | +21.53 | +0.40% |

DAX | 11,957.43 | +32.18 | +0.27% |

Crude oil | $53.13 | +1.30% | |

Gold | $1,506.10 | -0.51% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 154.84 | -0.39(-0.25%) | 3644 |

ALCOA INC. | AA | 19.14 | 0.09(0.47%) | 2604 |

ALTRIA GROUP INC. | MO | 40.55 | -0.26(-0.64%) | 12138 |

Amazon.com Inc., NASDAQ | AMZN | 1,725.00 | 0.58(0.03%) | 43641 |

Apple Inc. | AAPL | 225.62 | 4.80(2.17%) | 790103 |

AT&T Inc | T | 37.3 | 0.11(0.30%) | 38990 |

Boeing Co | BA | 372.5 | 0.43(0.12%) | 5501 |

Caterpillar Inc | CAT | 120.48 | 0.44(0.37%) | 3641 |

Chevron Corp | CVX | 113.54 | 0.39(0.34%) | 3694 |

Citigroup Inc., NYSE | C | 66.67 | -0.03(-0.05%) | 26975 |

Exxon Mobil Corp | XOM | 68.16 | 0.18(0.26%) | 4199 |

Facebook, Inc. | FB | 179.59 | 0.21(0.12%) | 68057 |

FedEx Corporation, NYSE | FDX | 141.43 | -0.28(-0.20%) | 1870 |

Ford Motor Co. | F | 8.73 | 0.02(0.23%) | 26148 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 8.84 | -0.02(-0.23%) | 44373 |

General Electric Co | GE | 8.6 | -0.11(-1.26%) | 443221 |

General Motors Company, NYSE | GM | 35.06 | 0.08(0.23%) | 1396 |

Goldman Sachs | GS | 197.25 | 0.01(0.01%) | 2317 |

Google Inc. | GOOG | 1,189.87 | 2.04(0.17%) | 5016 |

Hewlett-Packard Co. | HPQ | 17.3 | -1.10(-5.98%) | 186181 |

Home Depot Inc | HD | 226.35 | -0.46(-0.20%) | 2323 |

Intel Corp | INTC | 50.3 | 0.27(0.54%) | 12525 |

International Business Machines Co... | IBM | 142.28 | 0.26(0.18%) | 355 |

Johnson & Johnson | JNJ | 131.5 | 0.31(0.24%) | 2145 |

JPMorgan Chase and Co | JPM | 112.3 | 0.11(0.10%) | 17360 |

McDonald's Corp | MCD | 212 | 1.97(0.94%) | 54327 |

Merck & Co Inc | MRK | 82.17 | -0.57(-0.69%) | 328 |

Microsoft Corp | MSFT | 136.5 | 0.22(0.16%) | 81693 |

Nike | NKE | 92.19 | -0.03(-0.03%) | 8774 |

Pfizer Inc | PFE | 35.5 | 0.05(0.14%) | 5144 |

Procter & Gamble Co | PG | 122 | 0.26(0.21%) | 5543 |

Starbucks Corporation, NASDAQ | SBUX | 84.7 | 0.03(0.04%) | 3366 |

Tesla Motors, Inc., NASDAQ | TSLA | 232.11 | -0.92(-0.39%) | 40099 |

The Coca-Cola Co | KO | 53.8 | -0.04(-0.07%) | 2615 |

Twitter, Inc., NYSE | TWTR | 40.15 | 0.15(0.38%) | 20357 |

United Technologies Corp | UTX | 130.85 | -0.36(-0.27%) | 481 |

Verizon Communications Inc | VZ | 59.02 | 0.01(0.02%) | 6576 |

Visa | V | 174 | 1.13(0.65%) | 32210 |

Wal-Mart Stores Inc | WMT | 115.98 | -0.33(-0.28%) | 1794 |

Walt Disney Co | DIS | 128.3 | 0.15(0.12%) | 11610 |

Yandex N.V., NASDAQ | YNDX | 35 | 0.07(0.20%) | 2000 |

The U.S.

Commerce Department reported on Wednesday U.S. the goods and services trade

deficit widened to $54.9 billion in August from an unrevised $54.0 billion in the

previous month.

Economists had

expected a deficit of $54.5 billion.

According to

the report, the August increase in the goods and services deficit reflected a

gain in the goods deficit of $0.8 billion to $74.4 billion and a decline in the

services surplus of less than $0.1 billion to $19.5 billion.

Exports of

goods and services from the U.S. rose 0.2 percent m-o-m to $ 207.9 billion in August,

while imports increased 0.5 percent m-o-m to $262.8 billion.

Year-to-date,

the goods and services deficit surged 7.1 percent from the same period in 2018.

Exports fell 0.2 percent, while imports rose 1.2 percent.

Barrick (GOLD) initiated with Outperform at National Bank Financial

HP (HPQ) downgraded to Hold from Buy at Loop Capital; target lowered to $19

Snap (SNAP) upgraded to Equal-Weight from Underweight at Morgan Stanley; target raised to $17

The U.S. Labor

Department announced on Friday that nonfarm payrolls increased by 136,000 in

September after an upwardly revised 168,000 gain in the prior month (originally

an increase of 130,000).

According to

the report, employment rose in health care (+39,000 jobs), professional and

business services (+34,000) and transportation and warehousing (+16,000). Employment

in government also continued on an upward trend in September (+22,000). Meanwhile,

retail trade employment edged down in September (-11,000). Employment in other

major industries, including mining, construction, manufacturing, wholesale

trade, information, financial activities, and leisure and hospitality, showed

little change over the month.

The

unemployment rate fell to 3.5 percent in September from 3.7 percent in August. That was the lowest level since December 1969.

Economists had

forecast 145,000 new jobs and the jobless rate to stay at 3.7 percent.

The labor force

participation rate was unchanged m-o-m at 63.2 percent in September, while

hourly earnings for private-sector workers were little-changed m-o-m (-1 cent) at

$28.09, following an unrevised 0.4 percent m-o-m gain in August. Economists had

forecast a 0.3 percent m-o-m advance in the average hourly earnings. Over the

year, average hourly earnings have increased by 2.9 percent, following an unrevised

3.2 percent rise in August.

The average

workweek remained unchanged at 34.4 hours in September, matching economists’

forecast.

Analysts at TD Securities are expecting Canada’s international merchandise trade deficit to deteriorate to $1.50bn in August from $1.12bn, slightly below the market consensus for $1.20bn.

- “Stronger imports are expected to drive the wider deficit, with a slight offset from a modest increase in exports. Ivey PMI for September will round out the data flow after August saw the first >60 print since 2018.”

- We are ready to talk at any point including over the weekend

- UK PM sees proposals as a broad landing zone in which a deal can take shape

- Will publish the legal text and we have out it forward confidentially and we will consider publication

Bill Diviney, the senior economist at ABN AMRO, notes that the U.S. ISM Nonmanufacturing Index (NMI) declined to a three-year low of 52.6 in September, down from 56.4 in August, and well below ABN AMRO’s (54.5) and consensus (55.0) estimates.

- “The fall was fairly broad-based among sub-indices, but particularly concerning was the drop in Employment (to 50.4 from 53.1) and New Orders (to 53.7 from 60.3) indices, which suggests weak confidence in the manufacturing sector – linked to the trade war – is spreading to the services sector.

- While the relationship between the NMI and services activity (observed for instance in private consumption growth) is not as strong as the relationship between the manufacturing PMI’s new orders index and business investment, directionally it does suggest a slowdown in services is on the horizon.

- This is consistent with our view that the weakness in manufacturing will ultimately drive a broader slowdown – via slower job growth, and in turn consumption. Markets have reacted accordingly, with OIS forwards moving closer to our expectation of two more Fed rate cuts this year; an October cut is now 88% priced (previously 80%), and an additional December now 72% priced (previously 60%).”

Analysts at TD Securities are expecting the U.S. Nonfarm Payrolls to increase by 150k in September, following the below-consensus 130k August print.

- “Reflecting the retrenchment in manufacturing, jobs in the goods sector should stay soft; however, we look for a modest rebound in employment in the services sector. We also note that temporary census hiring for canvassing purposes should continue to boost employment figures this month: we pencil in a 15k increase federal hires.

- All in, the household survey should show the unemployment rate remaining steady at 3.7% in September, while we forecast wages to rise 0.2% m/m, leaving the annual rate unchanged at 3.2% y/y.”

- but realistically we will find out at a meeting of EU27 ministers in Luxembourg next Tuesday whether or not enough progress has been made for an agreement by EC summit

Aline Schuiling, the senior economist at ABN AMRO, notes that the volume of retail sales in the eurozone increased by 0.3% mom in August, following a 0.5% drop the month before.

- “The 3m-o-3m growth rate increased from 0.2% to 0.5%, which suggests that sales will have expanded during the third quarter as a whole. Meanwhile, new car registrations probably also increased during Q3, with the 3m-o-3m change up from 2.1% in July to 5.7% in August.

- The combination of changes in retail sales and car registrations tends to track changes in total private consumption growth relatively well. The data for July and August indicates that private consumption grew at a modest rate of around 0.2-0.3% qoq in Q3, following 0.2% qoq in Q2.

- The modest expansion in private consumption growth is part of a broader trend of the weakness in exports and industry that started more than one-and-a-half years ago, spreading to domestic demand and services. Indeed, the services sector PMI for September was revised lower to 51.6, from a preliminary estimate of 52.0, while the forward-looking new business component of the survey was revised downwards as well.

- Due to the revision in the services sector PMI, the composite PMI declined to 50.1 in September (preliminary estimate 50.4), a level that is consistent with stagnating GDP.”

Danske Bank's analysts think the global economy is at a precarious moment with OECD leading indicators pointing towards further downside, but PMI new orders actually picking up, driven partly by China and stabilizing world trade growth.

- “Geographically, the most weakness is found in euro area manufacturing, not least in German manufacturing orders and the US manufacturing indicators point to an industrial recession.

- The weakness is driven, in particular, by soft investments and business confidence globally, which are both at levels normally seen in G7 recessions, while corporate earnings growth is also waning or even negative in the euro area and emerging markets.

- The stalwart of the global economy so far, the confidence of private consumers, has started to show weakness despite still-robust real income growth. This is evident in China and, to some extent, the US, while euro area consumer confidence remains resilient.

- Monetary easing is showing up around the world: The US financial conditions impulse is still positive (though waning a bit), Chinese M1 and euro area money growth have picked up. There is increasingly solid growth in private sector loans in the euro area.

- This stimuli is an important reason behind our call that the global economy will see a modest pickup next year, provided that the US-China trade war does not escalate.”

The Federal Reserve has more ammunition to fight the next recession than many people think, according to a former leader of the U.S. central bank.

Much has been made by the fact that the Fed historically has been able to cut interest rates by about 5-and-a-half percentage points to revive the economy after a recession.

There is concern in the era of low interest rates. The Fed’s benchmark interest rate is now set in a range between 1.75% and 2%, giving them relatively less space to operate.

All is not lost, according to Ben Bernanke, who led the Fed through the aftermath of the Great Recession.

He estimate the Fed’s so-called unconventional policies, if used wisely, are the equivalent of 3 percentage point of interest rate cuts.

Those policies are forward guidance, bond buying, commonly called quantitative easing, and a new policy-framework that includes a “makeup strategy” for inflation, he said.

“So my sense is as long as nominal neutral rates are 2.5%-3%, that the Fed will be able to do most of what it could do at any point in history,” he said.

If the neutral rate does sink further, the Fed could be in a “difficult situation,” he said.

MUFG Research discusses EUR/USD tactical outlook and adopts a neutral bias expects the pair to maintain its recent 1.08-1.11 range in the near-term.

"One key event for EUR/USD in the week ahead will of course be the payrolls report from the US. The euro has rallied modestly on the back of the weaker than expected ISM Manufacturing print and if that weakness was evident in the jobs report tomorrow, it would likely prompt a further rally for EUR/USD. Talks next week between the US and China will probably be the key macro event of the week but we are sceptical of this providing a catalyst for any notable shift in sentiment and trade uncertainties are set to persist..With the euro-zone calendar very light next week, we expect a relatively narrow trading rang," MUFG adds.

Nick Kounis, head of financial markets research at ABN AMRO, points out that the ECB officials that backed the central bank’s stimulus package warned of the growing risks to the economic outlook.

“Ignazio Visco, the Governor of the central bank of Italy, said that ‘the economic situation is worse than we imagine and therefore we cannot risk losing control of inflation expectations’. Meanwhile, Olli Rehn, Governor of the central bank of Finland asserted that the ECB ‘should take care to avoid the sort of harmful equilibrium that arises from prolonged low inflation and zero interest rates, as this would significantly constrain the capacity for monetary policy to balance the economic cycle’. He added that the inflation outlook is very subdued and that the medium-term inflation rate is seen clearly below the ECB target. Finally, Luis de Guindos, ECB Vice President said that risks are tilted to the downside and noted that the ‘level of economic activity in the euro area remains disappointingly low’. These dire warnings come against the background of weakening economic data on both sides of the Atlantic. At the same time, market-based measures of inflation expectations have fallen further. We continue to expect the ECB to step up the pace of monetary stimulus in the coming months.”

Danske Bank analysts suggest that in another sign that the global economic slowdown is making its mark on the US economy, yesterday it became blindingly obvious that the service sector cannot go unabated amid a widespread manufacturing slump.

“European PMIs came out on the soft side throughout the day, but it was notably a very weak US non-manufacturing ISM that made markets react more profoundly. The headline dropped to 52.6 (from 56.4 last), a 3Y low, as not least, new orders and the employment sub-index witnessed big declines. Taken together, this week's ISM reports now signals US growth of a mere 1% q/q (ar). This adds further support to our call for another Fed cut later this month, even if the Fed's Clarida yesterday reiterated that it is one meeting at a time and that the US economy is in a 'good place'.”

According to figures released today by the Society of Motor Manufacturers and Traders (SMMT), the UK new car market declined by 2.5% in the first three quarters of the year. September saw modest year-on-year growth following a substantial -20.5% decline in the same month in 2018, when new emissions regulations and lack of testing capacity across Europe affected supply.

The growth, representing some 4,421 units, was not enough to recover losses of over 87,000 in last year’s important plate-change month, however, leaving the year-to-date market trailing some 49,000 units behind this time in 2018. It is also in stark contrast to other major European markets, which this September rallied in double digits.

September’s volumes were driven by the fleet sector, which grew 8.6%. Meanwhile, private demand remained stable, up 0.1%, while business registrations declined -44.8%. Diesel registrations fell -20.3%, as petrols experienced a moderate increase of 4.5%.

There was good news for battery electric cars (BEVs), which saw the biggest percentage growth of all fuel types, up 236.4% (5,414 units) as new models boosted registrations.

The European Union is likely to take retaliatory measures in response to new U.S. tariffs on European goods, German Foreign Minister Heiko Maas told.

"The European Union now will have to react and, after obtaining the approval of the World Trade Organisation, probably impose punitive tariffs as well," Maas, a member of Germany's co-governing Social Democrats, told the Funke newspaper group.

"Europe is united on this question. We remain ready to negotiate common rules for subsidies in the aviation industry. We can still prevent further damage." Maas added.

The WTO this week ruled that some subsidies EU states paid to planemaker Airbus were illegal, giving the United States the right to react with tariffs on goods imported from the EU.

September data from IHS Markit pointed to a renewed increase in activity across the eurozone construction sector. The expansion was supported by another rise in staff numbers, although new orders continued to fall. Meanwhile, purchasing activity grew at a slightly faster rate than in August and sentiment towards the business outlook improved. On the cost front, input prices continued to rise markedly, but the rate of inflation remained in line with August's 34 month low.

Up from 49.1 in August, at 50.5 in September, the Eurozone Construction PMI signalled a slight rebound in building activity. The result was driven by further growth in France, and stable trends in Germany and Italy. Of the three monitored sub-sectors, commercial was the strongest-performing category, posting a marginal rise. On the other hand, there were further contractions recorded at both home builders and civil engineers. Notably, the reduction in work undertaken on infrastructure projects was the quickest for four months.

Building companies in the eurozone were optimistic towards the 12 month business outlook in September. Moreover, the degree of positivity was stronger than in the previous survey period and historically elevated. Within the so-called 'big-three', confidence was highest among Italian firms.

British business activity wilted in the third quarter, especially in manufacturing, according to a survey on Friday that boded poorly for the country's economy in late 2019 as it faces the Brexit crisis and a global slowdown.

The British Chambers of Commerce's (BCC) survey of 6,600 companies showed domestic manufacturing sales fell at the fastest pace since late 2011. Growth in the much larger services sector also slowed.

Overall, the survey chimed with other signs of a sharp deterioration in business confidence in Britain as the Oct. 31 Brexit deadline nears with little clarity on how or if the country will leave the EU.

The BCC survey also pointed to the biggest drop in manufacturing export orders in 10 years.

"Our findings point to a worrying drop-off in UK economic activity, with unrelenting uncertainty over Brexit and a notable slowing in global growth prospects dragging down almost all the key indicators in the quarter," BCC head of economics Suren Thiru said.

"Looking forward, weakening orders, confidence and investment intentions suggest that unless action is taken the UK's current weak growth trajectory could drift markedly lower over the near term."

The United States will talk to the European Union before adopting its trade tariffs on European goods, the U.S. Secretary of State Mike Pompeo said in a video interview posted on daily La Stampa website on Friday.

“We will certainly talk to the EU... We will do our best to accommodate each country,” Pompeo said in the video interview.

But he said it was “definitely an unfair trading relationship”.

The U.S. on Wednesday said it would slap 10% tariffs on European-made Airbus planes and 25% duties on French wine, Scotch and Irish whiskies, and cheese from across the continent.

Danske Bank analysts point out that today, it is the day of the jobs report in the US and they expect non-farm payrolls to have grown by 100,000 in September, which is below the Bloomberg consensus of 140,000.

“While the non-farm figure tends to be volatile, the employment indices in the Markit PMI and the ISM reports do not look encouraging (and actually signal that jobs growth was even lower than our expectation of 100,000). A weak jobs report will likely add fuel to the repricing of the Fed seen this week. Today also provides the opportunity to listen to Fed comments from Rosengren, Botstic and Powell, who are scheduled to speak. Powell is only making opening remarks at a "Fed Listen" event though, so we would not get our hopes up too high that he will give out new monetary-policy signals.”

With the European Union appearing lukewarm toward U.K. Prime Minister Boris Johnson’s latest Brexit proposal, the deadline for Britain to leave the bloc could once again be pushed back, according to a British lawmaker.

The U.K. currently has until Oct. 31 to leave the EU. Britain’s departure has been pushed back multiple times from the original March 29 deadline, after British members of parliament thrice rejected former Prime Minister Theresa May’s withdrawal agreement.

If the EU doesn’t agree to Johnson’s proposal, it would have to once again delay the U.K.’s departure to avoid a no-deal Brexit, said Jitesh Gadhia, a member of the House of Lords, the upper chamber of the British parliament.

“If you think about it from the EU perspective and if you look at their choices: Do you seal a deal with Prime Minister Johnson now or do you actually roll the dice on an extension and election hoping that you might have a more favorable counterparty?” Gadhia told CNBC.

He said even though “the omens aren’t great” on getting the EU to agree to Johnson’s deal, the bloc still appeared to be open to further negotiations.

Analysts at TD Securities note that the RBA published its semi-annual Financial Stability Review today and it acknowledged a greater chance of weaker growth.

“Risks revolving around from external shocks (trade and financial links), high household debt (could curtain consumption) and housing (further out risk of rapid growth in prices given low supply but growth in population). Nonetheless the RBA believes the Australian banking system is resilient to downside risks with Banks holding adequate levels of capital/ liquid assets and implementing Loss Absorbing Capacity with APRA’s direction. Given the ability to withstand these shocks, the RBA warned lenders not to be too strict when assessing borrowers as this could dent economic activity.”

Japanese Prime Minister Shinzo Abe pledged to deliver "all possible steps" if risks to the economy intensified, signalling a fiscal-stimulus boost in the event this month's sales tax hike triggers a sharp downturn in growth.

The government rolled out a twice-delayed rise in the sales tax to 10% from 8% on Tuesday, a move that is seen as critical for fixing the country's tattered finances. But there are fears the higher tax could hurt consumer spending and tip the economy into recession.

This has led to speculation that Tokyo will step up fiscal spending, though it has already taken measures to mitigate the pain on consumption, mindful of the severe economic downturn that followed the last increase in the sales tax in 2014.

"Achieving economic growth remains my administration's top priority," Abe said in a speech delivered to an extraordinary parliament session.

"If downside risks materialise, we will take all possible steps flexibly and without hesitation to ensure the economy is on a growth path," he said.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1102 (2501)

$1.1059 (2371)

$1.1035 (1934)

Price at time of writing this review: $1.0972

Support levels (open interest**, contracts):

$1.0949 (4213)

$1.0899 (2354)

$1.0850 (2002)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date October, 4 is 91226 contracts (according to data from October, 3) with the maximum number of contracts with strike price $1,1100 (4452);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2458 (862)

$1.2421 (1180)

$1.2398 (1104)

Price at time of writing this review: $1.2345

Support levels (open interest**, contracts):

$1.2248 (1022)

$1.2199 (1170)

$1.2149 (1201)

Comments:

- Overall open interest on the CALL options with the expiration date October, 4 is 17893 contracts, with the maximum number of contracts with strike price $1,2550 (1533);

- Overall open interest on the PUT options with the expiration date October, 4 is 20620 contracts, with the maximum number of contracts with strike price $1,1900 (1313);

- The ratio of PUT/CALL was 1.15 versus 1.12 from the previous trading day according to data from October, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 57.38 | 0.26 |

| WTI | 52.18 | -0.27 |

| Silver | 17.53 | -0.06 |

| Gold | 1504.754 | 0.33 |

| Palladium | 1656.08 | -1.77 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -436.87 | 21341.74 | -2.01 |

| Hang Seng | 67.62 | 26110.31 | 0.26 |

| ASX 200 | -146.9 | 6493 | -2.21 |

| FTSE 100 | -44.9 | 7077.64 | -0.63 |

| Dow Jones | 122.42 | 26201.04 | 0.47 |

| S&P 500 | 23.02 | 2910.63 | 0.8 |

| NASDAQ Composite | 87.02 | 7872.27 | 1.12 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.6743 | 0.57 |

| EURJPY | 117.258 | -0.15 |

| EURUSD | 1.09701 | 0.09 |

| GBPJPY | 131.857 | 0.08 |

| GBPUSD | 1.23363 | 0.34 |

| NZDUSD | 0.62985 | 0.47 |

| USDCAD | 1.33325 | 0.05 |

| USDCHF | 0.99849 | 0.15 |

| USDJPY | 106.873 | -0.26 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.