- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Trade Balance | July | 8.036 | 7.4 |

| 05:45 | Switzerland | Gross Domestic Product (YoY) | Quarter II | 1.7% | 0.9% |

| 05:45 | Switzerland | Gross Domestic Product (QoQ) | Quarter II | 0.6% | 0.2% |

| 06:00 | Germany | Factory Orders s.a. (MoM) | July | 2.5% | -1.5% |

| 12:15 | U.S. | ADP Employment Report | August | 156 | 149 |

| 12:30 | U.S. | Continuing Jobless Claims | 1698 | 1685 | |

| 12:30 | U.S. | Unit Labor Costs, q/q | Quarter II | 5.5% | 2.5% |

| 12:30 | U.S. | Nonfarm Productivity, q/q | Quarter II | 3.5% | 2.2% |

| 12:30 | U.S. | Initial Jobless Claims | 215 | 215 | |

| 13:45 | U.S. | Services PMI | August | 53 | 50.9 |

| 14:00 | U.S. | ISM Non-Manufacturing | August | 53.7 | 54 |

| 14:00 | U.S. | Factory Orders | July | 0.6% | 1% |

| 15:00 | U.S. | Crude Oil Inventories | August | -10.027 | -2.634 |

| 16:00 | Canada | BOC Deputy Governor Lawrence Schembri Speaks | |||

| 16:00 | Switzerland | SNB Chairman Jordan Speaks | |||

| 22:30 | Australia | AiG Performance of Construction Index | August | 39.1 | |

| 23:30 | Japan | Labor Cash Earnings, YoY | July | 0.4% | |

| 23:30 | Japan | Household spending Y/Y | July | 2.7% | 1.1% |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Trade Balance | July | 8.036 | 7.4 |

| 05:45 | Switzerland | Gross Domestic Product (YoY) | Quarter II | 1.7% | 0.9% |

| 05:45 | Switzerland | Gross Domestic Product (QoQ) | Quarter II | 0.6% | 0.2% |

| 06:00 | Germany | Factory Orders s.a. (MoM) | July | 2.5% | -1.5% |

| 12:15 | U.S. | ADP Employment Report | August | 156 | 149 |

| 12:30 | U.S. | Continuing Jobless Claims | 1698 | 1685 | |

| 12:30 | U.S. | Unit Labor Costs, q/q | Quarter II | 5.5% | 2.5% |

| 12:30 | U.S. | Nonfarm Productivity, q/q | Quarter II | 3.5% | 2.2% |

| 12:30 | U.S. | Initial Jobless Claims | 215 | 215 | |

| 13:45 | U.S. | Services PMI | August | 53 | 50.9 |

| 14:00 | U.S. | ISM Non-Manufacturing | August | 53.7 | 54 |

| 14:00 | U.S. | Factory Orders | July | 0.6% | 1% |

| 15:00 | U.S. | Crude Oil Inventories | August | -10.027 | -2.634 |

| 16:00 | Canada | BOC Deputy Governor Lawrence Schembri Speaks | |||

| 16:00 | Switzerland | SNB Chairman Jordan Speaks | |||

| 22:30 | Australia | AiG Performance of Construction Index | August | 39.1 | |

| 23:30 | Japan | Labor Cash Earnings, YoY | July | 0.4% | |

| 23:30 | Japan | Household spending Y/Y | July | 2.7% | 1.1% |

Как отмечает CNBC, компания Starbucks (SBUX) опубликовала в среду более слабый, чем ожидалось, прогноз прибыли на 2020 финансовый год.

В Starbucks заявили, что ожидают, что показатель компании прибыль на акцию (EPS) в 2020 году будет ниже, заложенного в ее "текущей модели роста на 10%".

Компания представила прогноз в виде слайд-шоу для презентации финансового директора Патрика Грисмера (Patrick Grismer) на конференции Goldman Sachs, посвященной розничной торговле (Global Retailing Conference).

Грисмер отметил, что разовая налоговая скидка, полученная в 2019 финансовом году, будет существенным препятствием для роста прибыли в 2020 финансовом году. Он также сообщил, что Starbucks решила выкупить собственные акции на сумму около $2 млрд. в 2019 финансовом году вместо 2020 финансового года.

"Но я хочу еще раз подчеркнуть, что наша стратегия долгосрочного роста идет вразрез с нашими ожиданиями", - сказал Грисмер. "Я бы сказал, что мы работаем на полную мощность с точки зрения операционной деятельности с акцентом и дисциплиной, необходимыми для стимулирования роста на должном уровне для такой компании, как Starbucks, и наша долгосрочная модель роста EPS более чем на 10% неизменна".

После того, как прибыль компании превзошла прогнозы в третьем квартале, и она повысила прогноз на 2019 финансовый год в июле, некоторые инвесторы могут быть озадачены более слабым прогнозом на 2020 год. Ранее в декабре Starbucks сообщила инвесторам, что ожидает, что показатель EPS вырастет как минимум на 13% в 2020 году.

Starbucks также подтвердил свой прогноз показателя прибыль на акцию на 2019 финансовый год на уровне $2.80-2.82.

Несмотря на обеспокоенность рынка рецессией в ближайшем будущем, генеральный директор Starbucks Кевин Джонсон (Kevin Johnson) заявил в августе CNBC, что компания не видит каких-либо признаков замедления экономического роста в США.

На текущий момент акции SBUX котируются по $94.83 (-2.00%).

Информационно-аналитический отдел TeleTrade

Analysts at Wells Fargo note that the data released today, which showed the U.S. trade deficit narrowed to $54.0 billion in July, do not reflect the most recent escalation in the US-China trade war.

- “With global growth weakening, goods exports are slowing on trend, and not just to China. The export orders component of the ISM manufacturing index suggests exports are set to slow further in coming months.

- The most recent escalation of a 15% tariff on $111B of imports from China that was announced in August went into effect on Sunday. That means the new tranche in the trade war, which affects mostly consumer products, did not affect trade in July.

- There is no denying the trade war is reducing trade flows. Given weakening global growth and further escalation in the trade war set to take place, we do not expect much relief for global trade.”

- Regions CEOs say trade challenging supply chains

- Not surprising that factories are weak when trade is weak

- U.S. economic picture is mixed, manufacturing uncertain, consumer strong

- U.S. consumer is strong, so it's a mixed picture

- Business across industries can't predict how tariffs will be resolved, being more careful is rational, appropriate response

- If you wait for consumer weakness, it might be too late

- I'm watching for psychological effects on consumers

- Risks to forecast are to the downside

- Recent slowing due more to trade uncertainty and global weakness that monetary policy

- Watching credit conditions, which are currently robust, and treasury curve

- It's relevant that the Fed funds is above whole yield curve

- Whole yield curve moving down has eased financial conditions

- Fed staying where it is, below the treasury yield curve, will create distortions, challenges

- Downward move in the curve has been stimulated

The Bank of

Canada (BoC) left its benchmark interest rates unchanged at 1.75 percent on

Wednesday, as widely expected.

In its policy

statement, the Canadian central bank said that the current degree of monetary

policy stimulus remains appropriate. According to the BoC, the Governing

Council will pay particular attention to global developments and their impact

on the outlook for Canadian growth and inflation as escalating trade conflicts

and related uncertainty are taking a toll on the global and Canadian economies.

It also added that Canada’s economy is operating close to potential and

inflation is on target. The country’s growth in the second quarter was strong

and exceeded the Bank’s July expectation, although some of this strength is

expected to be temporary, driven by a recovery in energy production and export

growth. Meanwhile, housing activity has regained strength more quickly than

expected as resales and housing starts catch up to underlying demand, supported

by lower mortgage rates. Wages have picked up further, yet consumption spending

was unexpectedly soft in the quarter. Business investment contracted sharply

after a strong first quarter, amid heightened trade uncertainty. Given this

composition of growth, the BoC expects economic activity to slow in the second

half of the year.

In regard to

price pressure, the Canadian central bank noted that inflation was at the 2

percent target. CPI inflation in July was stronger than expected, largely

because of temporary factors. Measures of core inflation all remain around 2

percent.

- UK not directly in the “sights” of global trade war

- We’re close to manufacturing recession across developed and much of the emerging world.

- Fundamentals in major economies still quite strong, but there are pockets of risk

- China has quite significant imbalances, a cause of concern

- There is a relatively limited policy scope in many central banks.

- We have considerable policy space in the UK. Not just policy space in terms of the conventional policy

- Global economy now less supportive for UK growth. It’s a less supportive backdrop than since I’ve been governor

- We can offset some effects from global economy but can’t fully insulate the UK economy

- Says revisions to payrolls and GDP suggest momentum less robust

- He is ready to act as appropriate to support economy and return to 2% inflation; carefully watching inflation

- Economy is in a good place but he is focused on persistently low inflation, deflationary pressures from abroad

- Fed's policy actions and communications have helped ease financial conditions and could sustain expansion

- His number one goal is to keep US economic expansion on track

- Consumers are robust but manufacturing data is weakening

- Cites Brexit and eurozone as a particular concern

U.S. stock-index futures rose solidly on Wednesday, as investors reacted positively to the reports about the withdrawal of a controversial extradition bill, which triggered months of protests in Hong Kong, as well as encouraging data on activity in China’s service sector, which allayed concerns of slowing global growth in the backdrop of an ongoing trade dispute between Washington and Beijing.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,649.14 | +23.98 | +0.12% |

Hang Seng | 26,523.23 | +995.38 | +3.90% |

Shanghai | 2,957.41 | +27.26 | +0.93% |

S&P/ASX | 6,553.00 | -20.40 | -0.31% |

FTSE | 7,302.16 | +33.97 | +0.47% |

CAC | 5,533.45 | +67.38 | +1.23% |

DAX | 12,046.14 | +135.28 | +1.14% |

Crude oil | $55.09 | +2.13% | |

Gold | $1,547.50 | -0.54% |

Bert Colijn, a senior Eurozone economist at ING, notes that Eurozone's retail sales had a weak start to the quarter as July sales dropped by 0.6% compared to June.

- "This was to be expected though, as sales are a volatile indicator and the reading is by no means cause for alarm. The upward trend in sales is maintained with the start to Q3 and year-on-year numbers being even slightly better than expected at 2.2% growth. The annual growth is broad-based across sales categories, with especially strong readings in electrical goods, furniture and computer equipment. This indicates that even though global risks have affected consumer confidence, durable consumption goods continue to be sold.

- As the Eurozone industrial recession makes the headlines at the moment, it’s important to keep an eye on service sector performance. The latest data is no cause for alarm as sales maintained a solid trend in July and the August services PMI ticked up again. Today’s final reading was slightly better than the preliminary one, causing a small uptick from 53.2 in July to 53.5 in August. While small, it at least indicates that second-round effects from the industrial slump are not yet impacting services that much. While the outlook remains clouded by uncertainty, the current take on the service sector remains decent thanks to modest consumption growth."

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 160.11 | 1.47(0.93%) | 600 |

ALTRIA GROUP INC. | MO | 44.4 | 0.36(0.82%) | 5440 |

Amazon.com Inc., NASDAQ | AMZN | 1,805.89 | 16.05(0.90%) | 47928 |

American Express Co | AXP | 119 | 1.40(1.19%) | 503 |

Apple Inc. | AAPL | 208.4 | 2.70(1.31%) | 124279 |

AT&T Inc | T | 35.44 | 0.06(0.17%) | 23887 |

Boeing Co | BA | 357.25 | 2.83(0.80%) | 10122 |

Caterpillar Inc | CAT | 118.18 | 1.15(0.98%) | 3851 |

Chevron Corp | CVX | 117 | 0.73(0.63%) | 171 |

Cisco Systems Inc | CSCO | 47 | 0.50(1.08%) | 19374 |

Citigroup Inc., NYSE | C | 64 | 0.58(0.91%) | 9219 |

E. I. du Pont de Nemours and Co | DD | 68 | 0.55(0.82%) | 193 |

Exxon Mobil Corp | XOM | 69 | 0.44(0.64%) | 3833 |

Facebook, Inc. | FB | 184.3 | 1.91(1.05%) | 50073 |

FedEx Corporation, NYSE | FDX | 155.82 | 0.45(0.29%) | 1080 |

Ford Motor Co. | F | 9.18 | 0.08(0.88%) | 23012 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.22 | 0.15(1.65%) | 22435 |

General Electric Co | GE | 8.39 | 0.06(0.72%) | 94811 |

General Motors Company, NYSE | GM | 37.3 | 0.39(1.06%) | 1293 |

Goldman Sachs | GS | 201.5 | 2.53(1.27%) | 14588 |

Google Inc. | GOOG | 1,177.50 | 9.11(0.78%) | 8531 |

Home Depot Inc | HD | 224.35 | 1.64(0.74%) | 6149 |

HONEYWELL INTERNATIONAL INC. | HON | 164.9 | 1.37(0.84%) | 202 |

Intel Corp | INTC | 47.52 | 0.54(1.15%) | 24274 |

International Business Machines Co... | IBM | 134.97 | 0.87(0.65%) | 2290 |

Johnson & Johnson | JNJ | 129.5 | 0.76(0.59%) | 1894 |

JPMorgan Chase and Co | JPM | 109.6 | 1.04(0.96%) | 4343 |

McDonald's Corp | MCD | 217.16 | 0.03(0.01%) | 2144 |

Merck & Co Inc | MRK | 87.5 | 0.85(0.98%) | 773 |

Microsoft Corp | MSFT | 137.3 | 1.26(0.93%) | 94419 |

Nike | NKE | 85.5 | 0.83(0.98%) | 2200 |

Pfizer Inc | PFE | 36.47 | 0.35(0.97%) | 7708 |

Procter & Gamble Co | PG | 121.85 | 0.49(0.40%) | 3794 |

Starbucks Corporation, NASDAQ | SBUX | 93.43 | -3.34(-3.45%) | 297481 |

Tesla Motors, Inc., NASDAQ | TSLA | 227.95 | 2.94(1.31%) | 57151 |

The Coca-Cola Co | KO | 55.45 | 0.15(0.27%) | 7683 |

Twitter, Inc., NYSE | TWTR | 42.5 | 0.54(1.29%) | 60085 |

UnitedHealth Group Inc | UNH | 232.9 | 2.28(0.99%) | 399 |

Verizon Communications Inc | VZ | 58.21 | 0.17(0.29%) | 2205 |

Visa | V | 181 | 1.80(1.00%) | 8993 |

Wal-Mart Stores Inc | WMT | 115.25 | 0.61(0.53%) | 3003 |

Walt Disney Co | DIS | 137.38 | 1.07(0.79%) | 5333 |

Yandex N.V., NASDAQ | YNDX | 37.57 | 0.47(1.27%) | 1300 |

Statistics

Canada announced on Wednesday that Canada’s merchandise trade deficit stood at

CAD1.12 billion in July, widening from a revised CAD0.06 billion gap in June

(originally a CAD0.14-billion surplus).

Economists had

expected a deficit of CAD0.40 billion.

According to

the report, the country’s exports decreased 0.9 percent m-o-m in July, due

mainly to decline in energy product exports (-6.7 percent m-o-m). Meanwhile,

imports rose 1.2 percent m-o-m in July, mostly on higher imports of consumer

goods (+2.4 percent m-o-m).

The U.S.

Commerce Department reported on Wednesday U.S. the goods and services trade

deficit narrowed to $54.0 billion in July from a revised $55.5 billion in the

previous month (originally a gap of $55.2 billion).

Economists had

expected a deficit of $53.5 billion.

According to

the report, the July decrease in the goods and services deficit reflected a decline

in the goods deficit of $1.6 billion to $73.7 billion and a drop in the

services surplus of $0.1 billion to $19.7 billion.

Exports of

goods and services from the U.S. rose 0.6 percent m-o-m to $ 207.4 billion in July, while imports edged

down 0.1 percent m-o-m to $261.4 billion.

Year-to-date, the goods and services deficit surged 8.2 percent from the same period in 2018. Exports fell 0.2 percent, while imports rose 1.4 percent.

FX Strategists at UOB Group are expecting a further sideline trading in USD/JPY in the next weeks.

- "24-hour view: Instead of “trading sideways”, USD dropped to 105.72 before ending the day on a soft note at 105.92. Downward momentum has improved albeit not by much and this could lead to USD testing the next support at 105.60. At this stage, a sustained decline below this level is not expected. Resistance is at 106.15 followed by 106.35.

- Next 1-3 weeks: After the spectacular rebound from 104.44 last Monday (Aug 26), the price action in USD has been mixed. The movement offers no fresh clues and for now, we continue to hold the same view since 27 Aug (spot at 106.00) wherein USD is expected to “trade sideways and within a broad range between 105.00 and 107.00 for a while more."

Analysts at TD Securities note that the Bank of Canada (BoC) will publish the September policy statement at 10:00 ET with TD and the wider market looking for no change in rates.

- “Economic data since July has been largely upbeat, however, we expect increased global trade tensions will get more attention in the communique and our base-case includes a dovish tweak to the Bank's forward-looking language that would open the door to cuts should global trade conditions deteriorate further.

- Rounding out the data calendar is international trade for July, where TD looks for the trade balance to erode to a $0.20bn deficit (market: -$-0.35bn) on softer non-energy exports.”

- Will implement broad RRR cut and targeted RRR cut in due time

- Will fine-tune policy in a preemptive way and at the appropriate time

- Will keep consumer prices stable overall

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. fell 3.1 percent in the week ended August 30, following a 6.2 percent

drop in the previous week.

According to

the report, refinance applications declined 7 percent, while applications to

purchase a home rose 4 percent.

Meanwhile, the

average fixed 30-year mortgage rate decreased to 3.87 percent from 3.94 percent.

“Ongoing trade

tensions between the U.S. and China led to volatile, yet declining Treasury

rates last week, causing the 30-year fixed mortgage rate to fall to 3.87%, its

lowest level since November 2016,” notes Joel Kan, MBA’s associate vice

president of economic and industry forecasting.

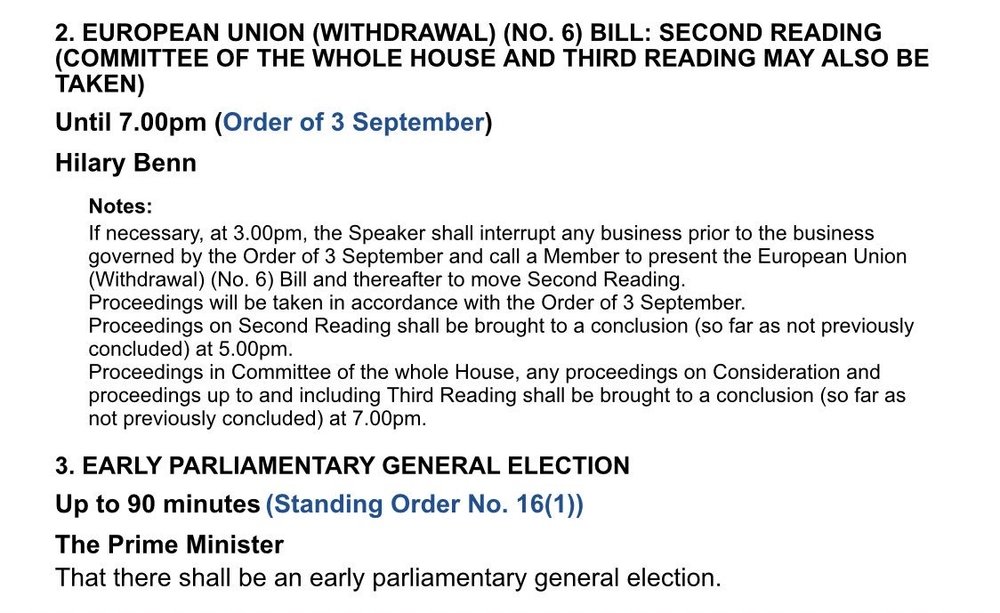

Analysts at Danske Bank believe we are heading for a snap election in the UK, which would be an EU referendum in disguise.

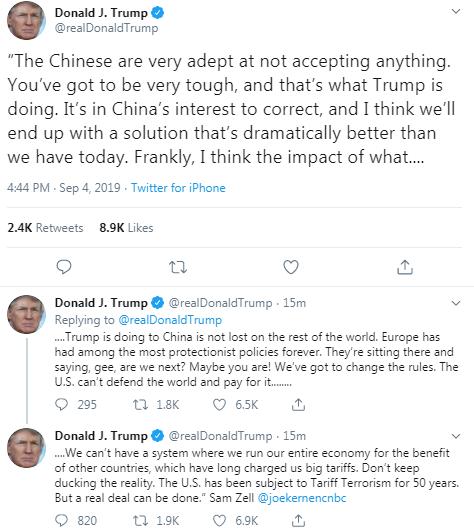

- “Late last night, the Johnson government lost a key vote in the House of Commons meaning there will now be a debate (and later a vote) on a Brexit extension bill forcing the UK government to ask the EU for an extension if the politicians have not agreed to leave the EU with/without a deal by 19 October. There is very likely a majority for the Brexit delay bill. There was no big market reaction to the result, as it was very much anticipated.

- After the defeat, PM Boris Johnson said he would put forward a proposal today, calling for a snap election on 15 October. The opposition parties have rejected supporting this until the Brexit extension bill has passed, which it likely will early next week, possibly Monday. As calling for snap election requires a two-thirds majority, Johnson is probably unable to prevent the Brexit extension bill from passing (despite the attempt to filibuster the bill in the House of Lords).

- If we are right that we are heading for a snap election very soon, the election will be a proxy Brexit referendum.

- The chaotic political situation in the UK (and possible snap election) means it is very hard to imagine any real discussions/negotiations with the EU will take place now.

- Looking at polls, the support for the Conservative Party has surged after PM Boris Johnson took office (at the expense of the Brexit Party). Given the 'winner takes it all' political system, it is difficult to translate the lead into a number of mandates.”

- Brexit deal must be on the basis of the withdrawal agreement

- PM Boris Johnson remains the contact person in the UK

- Willing to work with Johnson on proposals compatible with the Withdrawal Agreement

James Smith, the developed markets economist at ING, notes that UK services PMI stood at 50.6 in August, suggesting that the sector is barely growing.

- "IHS/Markit note that these PMI levels are usually consistent with a fall in output of -0.1% during the third quarter. Given the prospect of further volatility in the inventory numbers, this seems unlikely at this stage – we may see firms build stocks again ahead of the 31 October

- deadline, albeit at a slower pace than back in the first quarter (inventory levels are still reasonably high). This recorded as a positive for economic output, although of course is ultimately a temporary phenomenon.

- However, there’s little doubt that the underlying pace of growth is likely to stay fairly lackluster. Investment has been more-or-less consistently declining since the start of 2018, and this is a trend that is likely to persist. While the outcome of the coming 24-hours will be critical for the Brexit process, it seems unlikely at this stage that this week’s events will fully take the ‘no deal’ risk off the table.

- This uncertainty will continue to limit appetite to expand, and as firms continue to ramp up contingency activities in the run-up to the October deadline, resources available for possible investment projects will also be diminished.

- The upshot is that underlying growth is likely to remain fairly lackluster over coming months. That said, barring a 'no deal' exit in October, we think it's still too early to be pencilling in UK rate cuts over coming months. Equally however, the prospect of further gradual tightening is becoming increasingly distant."

Analysts at Standard Chartered suggest that China’s macro policy this year has prioritized the improvement of financial services for SMEs and private enterprises.

- “China’s policymakers set targets for the big five banks to increase outstanding loans to SMEs by 30% and lower SMEs’ comprehensive cost of financing by 1% in 2019 versus last year. Based on official statistics, we expect banks to meet the annual target and to add CNY 2.8tn of SME lending in 2019. We estimate that big banks have completed c.80% of their annual target, though medium and small-sized banks have much to catch up in H2-2019.

- Our China SMEI, based on a monthly survey of over 500 SMEs nationwide, showed a less sanguine picture. Bank credit access increased significantly in Q1 but has weakened since then, with SMEs’ borrowing costs showing only a transitory improvement.

- The allocation of credit resources to SMEs was disproportionately concentrated in the IT sector and Eastern China, leaving the rest of the sectors and regions short of financing. Our latest SMEI reading reflects rising pressure on SMEs, especially manufacturers and exporters, raising calls for further efforts to address their financing difficulties.

- The central bank is likely to further enhance credit support to SMEs through the flexible use of structural monetary policy instruments, including targeted RRR cuts, MLF, re-lending and re-discounting, MLF rate cuts and Central Bank Bills Swap (CBS), to tackle liquidity, capital and pricing constraints faced by medium and small-sized banks. Banks will need to decrease their funding and operating costs and determine risk premium more accurately, to lower real lending rates for SMEs while maintaining reasonable business returns.”

- Euro-area economy faces near-term risks

- Inflation is persistently too low

- Must be mindful of negative effects of unconventional policies

- ECB needs to listen to and understand markets, but doesn't need to be guided by markets

- Says that a review of monetary framework is warranted

Eurostat, the

statistical office of the European Union (EU) reported on Wednesday that the

seasonally adjusted volume of retail trade in the Eurozone fell by 0.6 percent

m-o-m in July, following a revised 1.2 increase m-o-m in June (originally a 1.1

percent m-o-m gain). That marked the largest monthly drop in retail trade since

December 2018.

In y-o-y terms,

adjusted retail sales grew by 2.2 percent, following a revised 2.8 percent surge

in June (originally a 2.6 percent increase).

Economists had

forecast the Eurozone’s retail sales in July would fall 0.6 percent m-o-m and would

increase 2.0 percent y-o-y.

According to

the report, the July decrease was attributable to the lower retail sales of non-food

products (-1.0 percent m-o-m) and food, drinks and tobacco (-0.3 percent).

Meanwhile, retail sales of automotive fuels remained unchanged.

In y-o-y terms,

the retail sales rose by 2.8 percent for non-food products, by 2.0 percent for

automotive fuel and by 1.3 percent for food, drinks and tobacco.

The report from

IHS Markit and Chartered Institute of Procurement & Supply (CIPS) showed on

Wednesday that activity growth in the services sector of the UK’s economy lost

momentum during August and remained subdued in comparison to the trends seen

over much of the past decade.

According to

the report, the Markit/CIPS UK Services Purchasing Managers' Index (PMI) fell

to 50.6 in August from 51.4 in July, signaling only a marginal expansion of

service sector output. Economists had forecast the indicator to edge down to 51.

The 50 mark divides contraction and expansion.

The latest

reading was the lowest since June and well below the long-run average.

According to

the report, softer growth of service sector output largely reflected a slower increase

in new business intakes during August amid Brexit-related uncertainty and

subdued corporate spending. Elsewhere, backlogs of work were reduced for the

eleventh successive month, which represents the longest period of decline since

2011/12, while growth projections dropped to the lowest level since July 2016

and the employment rose at the slowest pace since the current period of expansion

began in May. On the price front, input price inflation accelerated to its strongest

since January, while prices charged by service providers increased at the

slowest pace for just over three years.

The UK All

Sector Output Index, a weighted average of the UK Manufacturing Output Index,

the UK Total Construction Activity Index and the UK Services Business Activity

Index, came in at 49.7 in August, down from 50.3 in July. The decline in the UK

private-sector output reflected a sharp drop in construction work and another

fall in manufacturing production, which more than offset a marginal rise in

service sector activity.

Chris

Williamson, Chief Business Economist at HIS Markit, which compiles the survey,

noted: "After surveys indicated that both manufacturing and construction

remained in deep downturns in August, the lack of any meaningful growth in the

service sector raises the likelihood that the UK economy is slipping into

recession. The PMI surveys are so far indicating a 0.1% contraction of GDP in

the third quarter.”

The report from

IHS Markit revealed on Wednesday that growth in activity in Eurozone’s services

sector accelerates in August.

According to

the report, the IHS Markit Eurozone PMI Services Business Activity Index came

in at 53.5 in August, up from 53.2 in July. Germany and Ireland recorded the

strongest gains in activity during August, while Italy remained a notable

laggard, recording only a marginal increase in activity since July.

Higher overall

activity was supported by a combination of an increase in new work and a reduction

in levels of work outstanding, the report said. Meanwhile, employment growth

was sustained in August, but at the weakest rate since the start of the year as

worries about future activity grew. Confidence regarding activity in 12-months’

time was the joint-weakest recorded by the survey since June 2013.

The IHS Markit

Eurozone PMI Composite Output Index rose modestly to 51.9 in August from 51.5

in the previous month, supported by a solid expansion of service providers.

Meanwhile, goods producers endured another period of falling output. At the

national level, France performed best, with growth driven by a solid service

sector performance and a renewed rise in manufacturing output. Spain also

registered solid growth, and the fastest in four months, whilst modest gains in

output were seen in both Germany and Ireland. Italy, meanwhile, was the only

nation to experience a slowdown in growth compared to July and, by registering

only a marginal incease in private-sector output, was the weakest-performing

nation.

The report from

IHS Markit revealed on Wednesday that activity in Germany’s services sector expanded

in August at a faster pace than in July.

According to

the report, the headline

seasonally adjusted IHS Markit Germany Services PMI Business Activity Index came

in at 54.8 in August, up from July's six-month low of 54.5 and compared with a

historical series average of 53.3.

Though overall

business activity remained solid, there were signs of underlying demand

becoming increasingly fragile, the report noted. Total volumes of new business

across the service sector rose only modestly and at the weakest rate since

January. In addition, the expectations for future activity reached the lowest

since October 2014 and was only just inside the positive territory. On the price front, input prices

increased steeply and at a rate that was little-changed from the month before. Average

prices charged were raised accordingly, with the rate of inflation likewise

broadly in line with that recorded in the previous survey period and above the

historical average.

Germany

Composite Output Index, a weighted average of the Manufacturing Output Index

and the Services Business Activity Index, tick up to 51.7 in August from July's

50.9, supported by the combination of marginally faster service sector business

activity growth and a slower decline in manufacturing production. Nevertheless,

the latest reading was still one of the lowest seen over the past six years.

The report from

IHS Markit revealed on Wednesday that activity in France’s services sector rose

at the quickest pace for nine months during August.

According to

the report, the headline

seasonally adjusted IHS Markit France Services Business Activity Index came in

at 53.4 in August, up from 52.6 in July. The reading signaled the fastest

expansion in business activity since last November and one that was solid

overall.

The solid result

was supported by stronger new order growth and a further rise in staff numbers,

the report said. Meanwhile, capacity pressures remained evident, with volumes

of outstanding business expanding for the fourth month in a row. On the price

front, input costs continued to increase sharply, with the rate of inflation

accelerating to a three-month high.

FX Strategists at UOB Group suggest there is still a possibility for EUR/USD to visit the 1.0900 area in the next weeks.

- "24-hour view: Yesterday, we expected EUR to “drift lower” but were of the view that “the 1.0930 support is unlikely to come under serious threat”. While EUR moved below 1.0930, it staged a robust rebound after touching 1.0924. Downward momentum has eased with the recovery and the 1.0924 low is deemed a short-term bottom. For today, EUR is expected to trade sideways above 1.0924, likely between 1.0940 and 1.1010.

- Next 103 weeks: While the 1.0930 level that was first highlighted on Monday (02 Sep, spot at 1.0990) came into the picture sooner than expected, the rapid bounce from 1.0924 yesterday (03 Sep) has dented the downward momentum in EUR. For now, there is still chance (albeit not very high) for EUR to test the next support at 1.0900. Overall, the decline in EUR could not afford to ‘dither’ as a prolonged consolidation around these levels would lead to a rapid loss in momentum. On the upside, a break of 1.1045 (no change in ‘key resistance’ level) would indicate that the current weakness in EUR has stabilized."

- “The detail of the report shows that the public sector is punching above its weight, contributing 1.3ppt to the 1.4% growth over the past year. Private sector demand was flat in the quarter and down 0.4% over the past year.

- Q2 is likely to be the low point in the cycle, with stimulus in the form of tax cuts and rate cuts helping to support stronger outcomes in H2. The reality is, however, that the underlying momentum in the economy remains very soft, and further support from monetary policy is likely to be required in time.

- The result will be a disappointment for the RBA, which had forecast 1.7% y/y for the quarter just a month ago, and suggests that another round of growth downgrades is likely in the Bank’s November Statement on Monetary Policy.

- Ultimately, the Q2 GDP data confirm that the economy needs more stimulus to generate stronger growth, lower unemployment and inflation consistent with the RBA’s 2-3% target band.”

Analysts at Danske Bank note that today in the UK, the House of Commons will vote on both a motion to call for a snap election and the Brexit extension bill.

- “Given that the opposition has said they want the latter to come into law before supporting a general election, we think the former will be voted down (requires two-third majority!) and the latter will be approved. We still think we are heading for general election but do not think it will be called for until next week.

- At 10:30 today incoming ECB President Christine Lagarde will face questions from the European Parliament on her appointment. While she signalled policy continuity last week, markets will look out today for more clues on her monetary policy views. ECB Chief Economist Lane will also speak today.

- As the Fed enters the blackout period on Saturday, it is going to be interesting to hear from NY Fed President Williams later today. We think Williams (voter, neutral) will support the message from Clarida and Powell, who stated global (political) uncertainty has risen and the global growth has slowed further since the initial cut in July. We do not think Williams will pre-commit to more easing though. Powell is speaking on Friday.”

- If BoJ were to ease again, it needs to scrutinize benefits, costs of doing so and respond to any problems that may arise

- Don’t need to be too rigid about the range in which BOJ allows long-term yields

- Some global economic risks are materializing, having some effect on Japan’s economy

- BoJ must act in a forward-looking manner, shouldn't wait until the economy worsens in taking action

- Strong yen would have negative impact on Japan's manufacturers, BoJ's efforts to hit price target

- Don't think single step will be enough for Japan to sustainably exit deflation

Markit/Caixin’s

survey revealed on Wednesday that the activity growth in the Chinese services

sector rose in August.

The

Caixin/Markit services purchasing managers' index (PMI) came in at 52.1 last

month on a seasonally adjusted basis, up from the previous month's reading of 51.6.

That marked the strongest rise in services activity since May. The 50 mark

divides contraction and expansion.

According to

the survey, the rate of new order growth was the quickest in four months and

the employment rose at the fastest pace since June 2018. On the price front, service

providers’ operating expenses increased at the strongest pace for three months

amid reports of greater purchasing prices and labour costs, while their output

charges rose the most in 20 months.

Caixin China

Composite PMI, which covers both manufacturing and services, rose from 50.9 in July

to a four-month high of 51.6 in August.

The Australian

Bureau of Statistics (ABS) reported on Wednesday that Australia’s real gross domestic

product (GDP) rose by 0.5 percent q-o-q (in seasonally adjusted terms) in the second

quarter of 2019, matching economists’ forecast. In the first quarter, the GDP

also recorded a 0.5 percent q-o-q expansion (revised from originally reported

increase of 0.4 percent q-o-q).

According to

the ABS, the external sector drove GDP growth this quarter, while the growth in

the domestic economy remains steady. Net exports contributed 0.6 percentage

points to GDP growth in the second quarter, due to strong exports of mining

commodities. At the same time, government spending was the main contributor to

growth in domestic final demand, while the household sector remained relatively

subdued, with a 0.4 percent increase in household expenditure. Dwelling

investment declined by 4.4 percent during the quarter.

In y-o-y terms,

the GDP grew 1.4 percent after a revised 1.7 percent y-o-y surge in the prior

quarter (originally reported advance of 1.8 percent y-o-y). Economists had

forecast a 1.4 percent y-o-y rise in the last quarter. That was the weakest

annual expansion rate since the Global Financial Crisis.

- Personally feels that the need for additional monetary easing has increased

- Rate cut is the most effective tool in stimulating economy, lifting inflation

- Many central banks are shifting towards an accommodative easing stance

- That could have some effect on the global economy

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 57.94 | -0.67 |

| WTI | 53.74 | -1.47 |

| Silver | 19.25 | 4.51 |

| Gold | 1548.536 | 1.31 |

| Palladium | 1541.36 | 0.56 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 4.97 | 20625.16 | 0.02 |

| Hang Seng | -98.7 | 25527.85 | -0.39 |

| KOSPI | -3.5 | 1965.69 | -0.18 |

| ASX 200 | -6 | 6573.4 | -0.09 |

| FTSE 100 | -13.75 | 7268.19 | -0.19 |

| DAX | -42.92 | 11910.86 | -0.36 |

| CAC 40 | -26.97 | 5466.07 | -0.49 |

| Dow Jones | -285.26 | 26118.02 | -1.08 |

| S&P 500 | -20.19 | 2906.27 | -0.69 |

| NASDAQ Composite | -88.72 | 7874.16 | -1.11 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67545 | 0.56 |

| EURJPY | 116.213 | -0.22 |

| EURUSD | 1.09705 | 0.02 |

| GBPJPY | 127.983 | -0.11 |

| GBPUSD | 1.20819 | 0.15 |

| NZDUSD | 0.63266 | 0.31 |

| USDCAD | 1.33366 | 0.13 |

| USDCHF | 0.98665 | -0.34 |

| USDJPY | 105.921 | -0.24 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.