- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 05:00 | Japan | Leading Economic Index | February | 95.9 | 97.3 |

| 05:00 | Japan | Coincident Index | February | 97.9 | |

| 06:00 | Germany | Industrial Production s.a. (MoM) | February | -0.8% | 0.5% |

| 06:45 | France | Trade Balance, bln | February | -4.2 | -4.7 |

| 07:30 | United Kingdom | Halifax house price index | March | 5.9% | -2.4% |

| 07:30 | United Kingdom | Halifax house price index 3m Y/Y | March | 2.8% | 2.3% |

| 08:00 | Eurozone | Eurogroup Meetings | |||

| 12:30 | U.S. | Average workweek | March | 34.4 | 34.5 |

| 12:30 | U.S. | Manufacturing Payrolls | March | 4 | 10 |

| 12:30 | U.S. | Government Payrolls | March | -5 | |

| 12:30 | U.S. | Private Nonfarm Payrolls | March | 25 | 170 |

| 12:30 | U.S. | Labor Force Participation Rate | March | 63.2% | 62.9% |

| 12:30 | U.S. | Average hourly earnings | March | 0.4% | 0.3% |

| 12:30 | Canada | Employment | March | 55.9 | 1 |

| 12:30 | Canada | Unemployment rate | March | 5.8% | 5.8% |

| 12:30 | U.S. | Unemployment Rate | March | 3.8% | 3.8% |

| 12:30 | U.S. | Nonfarm Payrolls | March | 20 | 180 |

| 17:00 | U.S. | Baker Hughes Oil Rig Count | April | 816 | |

| 19:00 | U.S. | Consumer Credit | February | 17.05 | 17 |

| 19:30 | U.S. | FOMC Member Bostic Speaks |

Major US stock indexes ended the session in different directions, as investors waited for the latest information on the US-China trade negotiations.

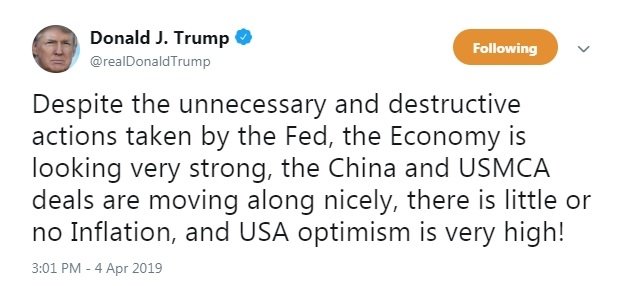

US President Donald Trump should later meet with Chinese Vice Premier Liu He, who is leading the Chinese side at the talks. In The Wall Street Journal reported that Trump can today announce a summit with President Xi. Yesterday, Bloomberg reported that under the terms of the trade deal over which the parties are working, Beijing will have time until 2025 to fulfill its obligations to purchase goods and allow US companies to fully own enterprises in China.

Enthusiasm of market participants was also held back by disappointing data from Europe. The Federal Statistical Office reported that new orders in the manufacturing industry in Germany in February fell at the fastest pace in the last two years. This has rekindled concerns about the global slowdown.

At the same time, US data provided support to the market. A report by the Labor Department showed that the number of Americans applying for unemployment benefits fell to a more than 49-year low last week, indicating a steady strength of the labor market, despite a slowdown in economic growth. According to the report, the number of initial claims for unemployment benefits fell from 10,000 to 202,000, taking into account seasonal fluctuations in the week ending March 30, which is the lowest level since the beginning of December 1969. Economists had forecast an increase in the number of applications to 216,000.

Most of the components of DOW finished trading in positive territory (19 out of 30). The growth leader was the shares of The Boeing Co. (BA; + 3.10%). Outsiders were Merck & Co. (MRK; -1.74%).

Most sectors of the S & P recorded an increase. The industrial goods sector grew the most (+ 0.8%). The largest decline was shown by the health sector (-0.4%).

At the time of closing:

Dow 26,384.63 +166.50 +0.64%

S & P 500 2,879.39 +5.99 +0.21%

Nasdaq 100 7,891.78 -3.77 -0.05%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 05:00 | Japan | Leading Economic Index | February | 95.9 | 97.3 |

| 05:00 | Japan | Coincident Index | February | 97.9 | |

| 06:00 | Germany | Industrial Production s.a. (MoM) | February | -0.8% | 0.5% |

| 06:45 | France | Trade Balance, bln | February | -4.2 | -4.7 |

| 07:30 | United Kingdom | Halifax house price index | March | 5.9% | -2.4% |

| 07:30 | United Kingdom | Halifax house price index 3m Y/Y | March | 2.8% | 2.3% |

| 08:00 | Eurozone | Eurogroup Meetings | |||

| 12:30 | U.S. | Average workweek | March | 34.4 | 34.5 |

| 12:30 | U.S. | Manufacturing Payrolls | March | 4 | 10 |

| 12:30 | U.S. | Government Payrolls | March | -5 | |

| 12:30 | U.S. | Private Nonfarm Payrolls | March | 25 | 170 |

| 12:30 | U.S. | Labor Force Participation Rate | March | 63.2% | 62.9% |

| 12:30 | U.S. | Average hourly earnings | March | 0.4% | 0.3% |

| 12:30 | Canada | Employment | March | 55.9 | 1 |

| 12:30 | Canada | Unemployment rate | March | 5.8% | 5.8% |

| 12:30 | U.S. | Unemployment Rate | March | 3.8% | 3.8% |

| 12:30 | U.S. | Nonfarm Payrolls | March | 20 | 180 |

| 17:00 | U.S. | Baker Hughes Oil Rig Count | April | 816 | |

| 19:00 | U.S. | Consumer Credit | February | 17.05 | 17 |

| 19:30 | U.S. | FOMC Member Bostic Speaks |

The Ivey Business School Purchasing Managers Index (PMI), measuring

Canada’s economic activity, rose to 54.3 in March from an unrevised 50.6 in Februar.

Economists had expected the gauge to hit 51.1.

A figure above 50 shows an increase while below 50 shows a decrease.

Within sub-indexes, the employment measure increased to 54.5 in March from

53.2 in the prior month. At the same time, the inventories indicator dropped to

47.8 in March from 52.2 in February, while the supplier deliveries gauge declined

to 46.2 from 51.9 and the prices index weakened to 58.7 from 59.8.

- Outlook is positive, growth is on track

U.S. stock-index traded flat on Thursday, as lack of fresh developments on the U.S.-China trade talks and worries about global economic growth kept risk appetite in check.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,724.95 | +11.74 | +0.05% |

Hang Seng | 29,936.32 | -50.07 | -0.17% |

Shanghai | 3,246.57 | +30.28 | +0.94% |

S&P/ASX | 6,232.80 | -52.20 | -0.83% |

FTSE | 7,386.58 | -31.70 | -0.43% |

CAC | 5,459.17 | -9.74 | -0.18% |

DAX | 11,984.16 | +29.76 | +0.25% |

Crude oil | $62.54 | +0.13% | |

Gold | $1,287.80 | -0.58% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 212.81 | -0.32(-0.15%) | 532 |

ALTRIA GROUP INC. | MO | 54.35 | 0.37(0.69%) | 9482 |

Amazon.com Inc., NASDAQ | AMZN | 1,818.74 | -1.96(-0.11%) | 20949 |

Apple Inc. | AAPL | 195.03 | -0.32(-0.16%) | 108406 |

AT&T Inc | T | 31.95 | 0.08(0.25%) | 32927 |

Boeing Co | BA | 387.48 | 2.74(0.71%) | 130620 |

Caterpillar Inc | CAT | 139.4 | 0.14(0.10%) | 2057 |

Cisco Systems Inc | CSCO | 55.42 | 0.14(0.25%) | 8910 |

Citigroup Inc., NYSE | C | 64.96 | -0.10(-0.15%) | 2630 |

Exxon Mobil Corp | XOM | 80.85 | -0.05(-0.06%) | 1645 |

Facebook, Inc. | FB | 176.3 | 2.76(1.59%) | 292605 |

FedEx Corporation, NYSE | FDX | 185.5 | 0.31(0.17%) | 482 |

Ford Motor Co. | F | 9.17 | 0.04(0.44%) | 6002 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.04 | -0.12(-0.91%) | 41405 |

General Electric Co | GE | 10.11 | 0.01(0.10%) | 58941 |

Hewlett-Packard Co. | HPQ | 19.8 | 0.05(0.25%) | 3000 |

Intel Corp | INTC | 55.31 | -0.17(-0.31%) | 9089 |

International Business Machines Co... | IBM | 144 | 0.37(0.26%) | 1125 |

Johnson & Johnson | JNJ | 137.39 | 0.22(0.16%) | 251 |

JPMorgan Chase and Co | JPM | 104.75 | 0.20(0.19%) | 8805 |

Merck & Co Inc | MRK | 82.9 | -0.28(-0.34%) | 2437 |

Microsoft Corp | MSFT | 120.01 | 0.04(0.03%) | 22289 |

Nike | NKE | 84.4 | -0.07(-0.08%) | 3255 |

Tesla Motors, Inc., NASDAQ | TSLA | 261.1 | -30.71(-10.52%) | 1587926 |

Twitter, Inc., NYSE | TWTR | 34.51 | 0.13(0.38%) | 48783 |

Verizon Communications Inc | VZ | 58.95 | 0.08(0.14%) | 2754 |

Visa | V | 158.6 | 0.14(0.09%) | 3096 |

Wal-Mart Stores Inc | WMT | 97.02 | -0.17(-0.17%) | 419 |

Walt Disney Co | DIS | 113.25 | 0.73(0.65%) | 27711 |

Yandex N.V., NASDAQ | YNDX | 34.61 | -0.16(-0.46%) | 4900 |

Walt Disney (DIS) resumed with a Buy at Goldman; target $142

Facebook (FB) upgraded to Buy from Neutral at Guggenheim; target raised to $200

The data from the Labor Department revealed the number of applications for unemployment benefits fell to 49-year low last week, suggesting a further tightening in labor market conditions.

According to the report, the initial claims for unemployment benefits decreased 10,000 to 202,000 for the week ended March 30, the lowest level since early December 1969.

Economists had expected 216,000 new claims last week.

Claims for the prior week were revised upwardly to 212,000 from the initial estimate of 211,000.

Meanwhile, the four-week moving average of claims dropped 4,000 to 213,500 last week, the lowest level since early October 2018.

- Baseline view was solid growth to return later this year

- Growth returning to potential through projection horizon might be optimistic

- Risk of inflation expectations de-anchoring seen as low

- Economy is in extended soft patch, length is still unclear

- Uncertainty has elevated, citing trade tensions

- Growth slowdown could weigh on the pass-through from wages to prices

- Some members argued for guidance to stipulate steady rates through Q1 2020 instead

“Hard Brexit is increasingly possible because we don’t know what the alternative is,” Katainen said at news conference, adding that if there was no British backing for the withdrawal agreement then there would be few options left.

“You only know what Britain doesn’t want, but you don’t know what Britain wants and, taking into account the limited number of days we have available, it is logical to think we are rushing toward a hard Brexit. But hopefully I am wrong,” he continued.

- Any meeting between Corbyn and PM will be announced as and when one is needed

- There will need to be compromise on both sides in those talk

- Negotiations are being approached with sense of urgency

- If bill to delay Brexit passes it will place a severe constraint on the negotiations for an extension

- Bill could increase risk of accidental no-deal Brexit

- We want to be in a position to set out with clarity to the EU the path we have to get ratification of the deal as soon as possible

- Government will have to present our position in advance of day of EU Summit

India's ratings balance a strong medium-term growth outlook and relative external resilience stemming from strong foreign reserve buffers, against high public debt, a weak financial sector and some lagging structural factors, the Fitch says.

- Said to target GDP growth of 0.3% to 0.4% for 2019

- Said to see wider 2019 budget deficit at 2.3% to 2.4%

- It is also in the hands of the European Union (EU)

- Says that Cooper bill could also increase risk of no-deal Brexit

- Lords will explore "flaws" in the bill passed by Commons last night

- Ministers will abide by the law, and if that dictates a certain action, we will follow it

- No guarantee UK won’t take part in the European elections

In view of Richard Franulovich, head of FX strategy at Westpac, USD seems to be a good bet here.

“Both recession and Fed easing risk (-18bp by Dec 19 and -50bp by Dec 20) are overstated; financial conditions have by and large reversed the dramatic tightening from late last year and all the bad news appears to be in the rear view mirror, judging by the depressed levels in our US data surprise index. Certainly job openings and surveys point to a bounce back in March payrolls after last month’s steep slowing to +20k. Prospects for a US-China trade détente appear to be firming once again, with officials on both sides touting the latest progress. DXY admittedly has failed at the top of its broad six month 95-98 range but risks still seem skewed to higher USD levels near term.”

Cristian Maggio, head of emerging markets strategy at TD Securities, note that the Reserve Bank of India (RBI) has cut the policy repo rate by 25bps to 6.00% today, in line with their forecast and the almost unanimous consensus.

“As we anticipated, the RBI highlighted a deterioration of global economic activity and a slowdown in India as well. Against this backdrop, the inflation outlook remains benign and CPI projections have been lowered modestly. Risks remain broadly balanced. The decision was voted 4 to 2, with the two dissenters voting for a hold. The stance of monetary policy has remained unchanged at 'neutral,' but weaker economic activity and a soft patch in future CPI may open up to the prospects of further easing.”

Warnings about risks in Switzerland’s property market were taken a notch higher, with the banking regulator calling for measures to curb overheating in parts of the market.

FINMA highlighted dangers within buy-to-let real restate and said the mortgage market was “too big to fail.”

The statement comes after months of warnings from the Swiss National Bank, which has sounded the alarm about loan-to-value and affordability risks for residential investment properties.

“We intervene when individual institutions take on excessive risks, but we believe this is not enough to counteract the generalized overheating trends we are currently seeing,” FINMA CEO Mark Branson said on Thursday.

He said problem could only be tackled via changes to regulation or self-regulation.

China's commerce ministry said that it will roll out measures to support the country's parallel car imports and used automobile markets to boost car sales.

China will expand supply channels to promote parallel car imports and will promote regulations to promote used car transactions, the commerce ministry's spokesman, Gao Feng, said.

Gao added that recent adjustments made to China's value added tax rates, which have prompted a string of car makers to lower their vehicle selling prices in the country, are conducive to promote the consumption of automobiles.

The UK has lost 6.6 billion pounds in economic activity every quarter since voting to leave the European Union, said S&P Global Ratings.

In a report the ratings agency's senior economist, Boris Glass, said the world's fifth biggest economy would have been about 3% larger by the end of 2018 if the country had not voted in a June 2016 referendum to leave the bloc. Quarterly growth rates would have averaged about 0.7%, rather than 0.43%, he said.

"Immediately after the referendum, the pound fell by about 18%. This was the single most pertinent indicator of the impact of the vote and the drag it created, via inflation, has been spreading through the economy," he said.

As imports became more expensive, inflation started to rise, dampening household spending. S&P estimated inflation was 1.8% higher than it would otherwise have been by the third quarter 2017.

if a no-deal Brexit occurs, economic growth this year and next likely to be much lower than we have forecast

Institutes see German consumer price inflation at 1.5 pct in 2019, 1.8 pct in 2020

economist from one of Leading German institutes says the long-term upswing of the German economy has ended

risks for German economy have grown, point to trade dispute between U.S. and China, Brexit

According to figures released by the Society of Motor Manufacturers and Traders (SMMT), UK new car registrations declined by -3.4% last month, as political and economic uncertainty and continuing confusion over diesel affected demand.

Demand fell in both the private and business sectors, with registrations down -2.8% and -44.8% respectively, while fleet demand was stable, up 0.3%. Declines were seen across almost every vehicle segment, including popular Dual Purpose (-1.8%) and small family cars (-4.0%). However, superminis – Britain’s favourite vehicle type – saw a 4.3% increase in demand, taking a third (33.7%) of all registrations.

Following the trend of recent months, diesel registrations fell -21.4% while petrol demand grew 5.1%. Meanwhile, demand for Alternatively Fuelled Vehicles (AFVs) increased by 7.6% with 25,302 registered, the biggest March volume on record.

According to the report from IHS Markit, March data pointed to a slightly softer rise in eurozone construction activity, with the rate of growth easing in two of the three monitored market groups. The result was driven by the slowest increase in new business since a decline last August. Despite this, firms expanded purchasing activity at the quickest pace for nine months and the rate of job creation was unchanged from February's one-year high. Meanwhile, input price inflation softened and firms maintained their optimism towards the business outlook.

Falling from 52.6 in February to 52.2 in March, Eurozone Construction PMI signalled an deceleration in activity growth at eurozone construction firms. That said, the result extended the current sequence of expansion to 29 months and still represented a modest rise overall.

Danske Bank analysts point out that in the euro area, we get minutes from the March ECB meeting, where the ECB announced a new series of TLTRO3, and will be a key economic release for today’s session.

“We are particularly interested in the details of the discussion of the TLTRO3 announcement from members of the Governing Council. Judging from recent communication, the ECB has become increasingly concerned about the side effects of a prolonged period of negative rates on bank profitability. However, we do not expect a discussion on a tiered deposit system to already have taken place. Also markets will continue to monitor Brexit developments and whether there is any breakthrough in the negotiations between PM May and Labour leader Jeremy Corbyn.”

The upper house of Britain’s parliament will start debating on Thursday legislation to force Prime Minister May to seek a Brexit delay to prevent a potentially disorderly departure on April 12 without a deal. The aim is to debate the legislation, which needs the approval of the House of Lords to become law, in a single day.

“For U.S. large cap companies, a recession in the EU is a bigger risk” than an unsuccessful resolution to the U.S.-China trade dispute, Joe Quinlan, head of CIO market strategy at Bank of America’s, told. For companies in the S&P 500 index foreign sales have contributed between 43% and 47% of total revenue, according to S&P Dow Jones Indices.

“Europe remains, by far, the most important market for U.S. multinational companies, with the region accounting for 55% of global foreign affiliate income,” Quinlan wrote. He said U.S. corporate earnings in Europe hit a record $284 billion in 2018, up 7% from the year before. Meanwhile, U.S. affiliates in China earned just $13.3 billion in China, a 1.1% decrease from the year earlier.

“In other words America’s trans-Atlantic partnership with Europe has proven to pay significant dividends,” Quinlan argued, with profits from the EU rising rapidly despite a slowing European economy.

According to Karen Jones, analyst at Commerzbank, USD/CHF pair has started to show signs of failure at the 55 day ma at .9998 and the market is likely to sell off to the 200 day moving average at .9923 and then the January low at .9906.

“We still believe that the market has topped at 1.0228, though. We still look for a slide towards the .9848 6 month support line and the .9716 recent low. Ideally we would expect to see near term rallies falter around the 55 day ma at .9998 and while capped here the market will remain offered. Above 1.0010 neutralises the chart. A break above the 1.0128 November high would introduce scope to the 1.0343 December 2016 peak.”

According to the report from Federal Statistical Office (Destatis), price-adjusted new orders in manufacturing had decreased in February 2019 a seasonally and calendar adjusted 4.2% on the previous month. Economists had expected a 0.3% increase. For January 2019, revision of the preliminary outcome resulted in a decrease of 2.1% compared with December 2018 (provisional: -2.6%). Price-adjusted new orders without major orders in manufacturing had decreased in February 2019 a seasonally and calendar adjusted 2.7% on the previous month.

Domestic orders decreased by 1.6% and foreign orders fell by 6.0% in February 2019 on the previous month. New orders from the euro area were down 2.9%, new orders from other countries decreased 7.9% compared to January 2019.

In February 2019 the manufacturers of intermediate goods saw new orders fall by 0.9% compared with January 2019. The manufacturers of capital goods showed decreases of 6.0% on the previous month. For consumer goods, a decrease in new orders of 3.5% was recorded.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1357 (3006)

$1.1339 (798)

$1.1314 (304)

Price at time of writing this review: $1.1241

Support levels (open interest**, contracts):

$1.1199 (4509)

$1.1150 (5464)

$1.1100 (1565)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date April, 5 is 80433 contracts (according to data from April, 3) with the maximum number of contracts with strike price $1,1150 (5464);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3325 (2084)

$1.3264 (2055)

$1.3229 (431)

Price at time of writing this review: $1.3171

Support levels (open interest**, contracts):

$1.3142 (786)

$1.3112 (411)

$1.3077 (1344)

Comments:

- Overall open interest on the CALL options with the expiration date April, 5 is 24573 contracts, with the maximum number of contracts with strike price $1,3400 (4310);

- Overall open interest on the PUT options with the expiration date April, 5 is 32924 contracts, with the maximum number of contracts with strike price $1,2500 (5046);

- The ratio of PUT/CALL was 1.34 versus 1.26 from the previous trading day according to data from April, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 69.35 | 0.13 |

| WTI | 62.45 | -0.11 |

| Silver | 15.11 | 0.07 |

| Gold | 1289.622 | -0.2 |

| Palladium | 1406.2 | -1.64 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 207.9 | 21713.21 | 0.97 |

| Hang Seng | 361.72 | 29986.39 | 1.22 |

| KOSPI | 26.09 | 2203.27 | 1.2 |

| ASX 200 | 42.6 | 6285 | 0.68 |

| FTSE 100 | 27.16 | 7418.28 | 0.37 |

| DAX | 199.61 | 11954.4 | 1.7 |

| Dow Jones | 39 | 26218.13 | 0.15 |

| S&P 500 | 6.16 | 2873.4 | 0.21 |

| NASDAQ Composite | 46.86 | 7895.55 | 0.6 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71132 | 0.68 |

| EURJPY | 125.23 | 0.42 |

| EURUSD | 1.12357 | 0.3 |

| GBPJPY | 146.621 | 0.33 |

| GBPUSD | 1.31554 | 0.2 |

| NZDUSD | 0.67766 | 0.33 |

| USDCAD | 1.33373 | 0 |

| USDCHF | 0.99683 | -0.07 |

| USDJPY | 111.447 | 0.11 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.