- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

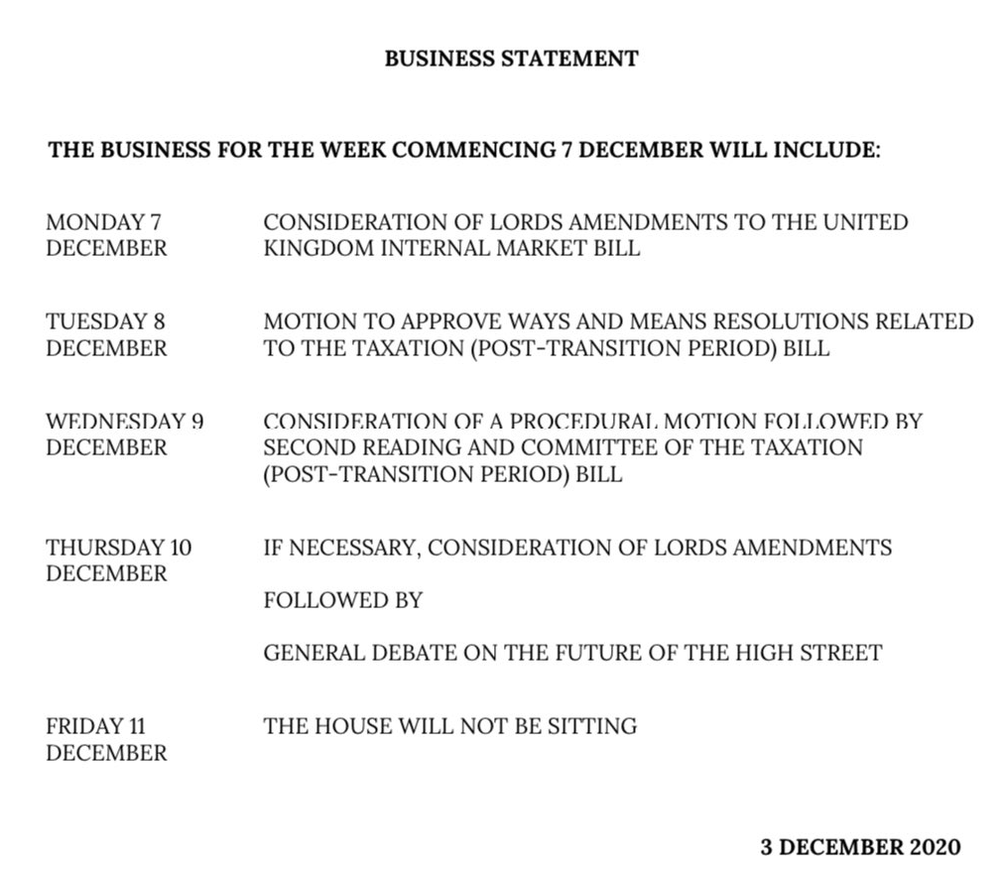

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Retail Sales, M/M | October | -1.1% | 1.6% |

| 07:00 (GMT) | Germany | Factory Orders s.a. (MoM) | October | 0.5% | 1.5% |

| 09:30 (GMT) | United Kingdom | PMI Construction | November | 53.1 | 52 |

| 13:30 (GMT) | U.S. | Average workweek | November | 34.8 | 34.8 |

| 13:30 (GMT) | U.S. | Government Payrolls | November | -268 | |

| 13:30 (GMT) | U.S. | Manufacturing Payrolls | November | 38 | 43 |

| 13:30 (GMT) | U.S. | Average hourly earnings | November | 0.1% | 0.1% |

| 13:30 (GMT) | U.S. | Private Nonfarm Payrolls | November | 906 | 587 |

| 13:30 (GMT) | U.S. | Labor Force Participation Rate | November | 61.7% | |

| 13:30 (GMT) | Canada | Employment | November | 83.6 | 20 |

| 13:30 (GMT) | Canada | Trade balance, billions | October | -3.25 | -3 |

| 13:30 (GMT) | Canada | Unemployment rate | November | 8.9% | 8.9% |

| 13:30 (GMT) | U.S. | International Trade, bln | October | -63.9 | -64.8 |

| 13:30 (GMT) | U.S. | Unemployment Rate | November | 6.9% | 6.8% |

| 13:30 (GMT) | U.S. | Nonfarm Payrolls | November | 638 | 481 |

| 14:00 (GMT) | U.S. | FOMC Member Charles Evans Speaks | |||

| 15:00 (GMT) | U.S. | Factory Orders | October | 1.1% | 0.8% |

| 15:00 (GMT) | U.S. | FOMC Member Bowman Speaks | |||

| 18:00 (GMT) | U.S. | Baker Hughes Oil Rig Count | December | 241 |

Carsten Brzeski, the Global Head of Macro for ING Research, believes that the eurozone economy needs fresh support to get through the second lockdown and to start a recovery next year. However, this is not a crisis in which monetary policy is the main actor but fiscal policy.

"The ECB is very well aware of this situation and knows that excessive new monetary stimulus will hardly be a gamechanger for the economy. Therefore, and even if the ECB might formulate it differently, the ECB has in our view two main objectives: (i) provide enough cheap liquidity so that the eurozone recovery can unfold once the vaccine will be rolled out; and (ii) prevent a new euro crisis from unfolding on the back of widening bond yields."

"With all of the above in mind and also assessing recent official speeches and interviews, we expect the ECB to decide on the following next week:

- An increase in the PEPP programme by up to 500bn euro to extend this programme until the end of 2021

- An increase of the monthly APP purchases from 20bn euro to 40bn euro, open-ended

- An extension of the generous TLTRO interest rate by six to 12 months

- An increase in the tiering facility to exempt a greater part of the banks’ liquidity from the negative deposit rate

- Potentially, including so-called Fallen Angels (corporate bonds downgraded during the crisis) into the corporate bond purchasing programme."

"The aim of all ECB measures will be to extend the current very accommodative monetary stance, rather than increasing it. This current crisis is a crisis in which fiscal policy, not monetary policy, can make the difference for the economy. Therefore, while still vague enough to keep the door open, Christine Lagarde will try to signal next week that this new round of monetary action will really be the last one."

The Institute

for Supply Management (ISM) reported on Thursday that its non-manufacturing

index (NMI) came in at 55.9 in November, which was 0.7 percentage point lower than

the October reading of 56.6 percent. The reading represented growth in the

services sector for the sixth straight month but the slowest since May.

Economists

forecast the index to decrease to 56.0 last month. A reading above 50 signals

expansion, while a reading below 50 indicates contraction.

Of the 18

manufacturing industries, 14 reported increases last month, the ISM said, adding

that respondents' comments were mixed about business conditions and the economy

as most companies were cautious, navigating operations amid the pandemic and

the aftermath of the U.S. presidential election.

According to

the report, the ISM’s non-manufacturing Business Activity measure fell 3.2 percentage

points to 58.0 percent from October’s figure, the New Orders gauge declined 1.6

percentage points to 57.2 percent and the Inventories index dropped 3.8 percentage

points to 49.3 percent. Meanwhile, the Employment Index increased 1.4 percentage

points to 51.5 percent from the October reading, the Prices Index climbed 2.2

percentage points to 66.1 and the Supplier Deliveries Index rose 0.8 percentage

points to 57.0 percent.

Commenting on

the data, the Chair of the ISM Non-Manufacturing Business Survey Committee,

Anthony Nieves, noted, “The past relationship between the Services PMI and the

overall economy indicates that the Services PM for November (55.9 percent)

corresponds to a 2.5-percent increase in real gross domestic product (GDP) on

an annualized basis.”

The latest

report by IHS Markit revealed on Thursday the seasonally adjusted final IHS

Markit U.S. Services Business Activity Index (PMI) stood at 58.4 in November, up

from 56.9 in October and higher than the earlier released “flash” estimate of 57.7.

The latest reading pointed to the sharpest expansion in the services sector since

March 2015.

Economists had

forecast the index to stay unrevised at 57.7.

According to

the report, a marked increase in business activity across the U.S. service

sector was attributable to the rises in output and new business, which

accelerated to the fastest since March 2015 and April 2018, respectively.

- There is a way to go still in EU-UK talks

- "Significant" divergences remain but both sides working hard

- Both sides committed to getting deal

- The outcome is uncertain

U.S. stock-index futures traded little changed on Thursday, as investors digested U.S. weekly jobless claims and monitored progress on a stimulus deal.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 26,809.37 | +8.39 | +0.03% |

Hang Seng | 26,728.50 | +195.92 | +0.74% |

Shanghai | 3,442.14 | -7.24 | -0.21% |

S&P/ASX | 6,615.30 | +25.10 | +0.38% |

FTSE | 6,464.94 | +1.55 | +0.02% |

CAC | 5,564.14 | -18.87 | -0.34% |

DAX | 13,254.43 | -58.81 | -0.44% |

Crude oil | $45.24 | -0.09% | |

Gold | $1,839.50 | +0.51% |

- An increase of 500,000 bpd would start in February and continue through May

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 172.5 | 0.65(0.38%) | 3435 |

ALCOA INC. | AA | 22.62 | 0.25(1.12%) | 19246 |

ALTRIA GROUP INC. | MO | 40.2 | 0.18(0.45%) | 30675 |

Amazon.com Inc., NASDAQ | AMZN | 3,208.00 | 4.47(0.14%) | 24420 |

American Express Co | AXP | 122.37 | 0.04(0.03%) | 3834 |

Apple Inc. | AAPL | 123.5 | 0.42(0.34%) | 773269 |

AT&T Inc | T | 29.08 | -0.01(-0.03%) | 48879 |

Boeing Co | BA | 228 | 4.15(1.85%) | 429822 |

Caterpillar Inc | CAT | 173.17 | -0.70(-0.40%) | 2331 |

Chevron Corp | CVX | 90.59 | 0.72(0.80%) | 10699 |

Cisco Systems Inc | CSCO | 43.74 | -0.15(-0.34%) | 24432 |

Citigroup Inc., NYSE | C | 57.19 | -0.01(-0.02%) | 46679 |

Exxon Mobil Corp | XOM | 40.24 | 0.30(0.75%) | 103059 |

Facebook, Inc. | FB | 286.92 | -0.60(-0.21%) | 46978 |

FedEx Corporation, NYSE | FDX | 294.6 | 2.88(0.99%) | 8399 |

Ford Motor Co. | F | 9.27 | 0.07(0.76%) | 284271 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 24.35 | 0.27(1.12%) | 73039 |

General Electric Co | GE | 10.46 | 0.03(0.29%) | 372485 |

General Motors Company, NYSE | GM | 44.74 | 0.16(0.36%) | 28761 |

Goldman Sachs | GS | 237 | -0.65(-0.27%) | 7566 |

Google Inc. | GOOG | 1,827.10 | -0.85(-0.05%) | 1950 |

Hewlett-Packard Co. | HPQ | 22.76 | -0.06(-0.26%) | 543 |

Home Depot Inc | HD | 271 | -0.10(-0.04%) | 3728 |

Intel Corp | INTC | 49.96 | 0.06(0.12%) | 43380 |

International Business Machines Co... | IBM | 124.21 | -0.41(-0.33%) | 3471 |

International Paper Company | IP | 51.75 | 1.89(3.79%) | 31616 |

Johnson & Johnson | JNJ | 148.18 | 0.04(0.03%) | 8145 |

JPMorgan Chase and Co | JPM | 121.81 | -0.23(-0.19%) | 9191 |

McDonald's Corp | MCD | 211.3 | 0.44(0.21%) | 6934 |

Merck & Co Inc | MRK | 81.91 | 0.08(0.10%) | 5855 |

Microsoft Corp | MSFT | 215.1 | -0.27(-0.13%) | 64741 |

Nike | NKE | 135.02 | -0.56(-0.41%) | 6118 |

Pfizer Inc | PFE | 40.93 | 0.13(0.32%) | 937254 |

Procter & Gamble Co | PG | 138.37 | 0.01(0.01%) | 1581 |

Starbucks Corporation, NASDAQ | SBUX | 99 | 0.09(0.09%) | 6474 |

Tesla Motors, Inc., NASDAQ | TSLA | 589.61 | 20.79(3.66%) | 1610755 |

The Coca-Cola Co | KO | 52.18 | 0.07(0.13%) | 9590 |

Twitter, Inc., NYSE | TWTR | 47.18 | -0.05(-0.11%) | 6655 |

UnitedHealth Group Inc | UNH | 347.5 | -0.06(-0.02%) | 1748 |

Verizon Communications Inc | VZ | 61.63 | 0.27(0.44%) | 23758 |

Visa | V | 209.85 | -0.33(-0.16%) | 4080 |

Wal-Mart Stores Inc | WMT | 150.65 | 0.13(0.09%) | 23140 |

Walt Disney Co | DIS | 153.6 | -0.01(-0.01%) | 22912 |

Yandex N.V., NASDAQ | YNDX | 69 | -0.20(-0.29%) | 2376 |

Tesla (TSLA) upgraded to Buy from Neutral at Goldman Sachs; target raised to $780 from $455

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment decreased more than forecast last week.

According to

the report, the initial claims for unemployment benefits fell by 75,000 to 712,000

for the week ended November 28.

Economists had

expected 775,000 new claims last week.

Claims for the

prior week were revised upwardly to 787,000 from the initial estimate of 778,000.

Meanwhile, the

four-week moving average of claims dropped to 739,500 from an upwardly revised 750,750

in the previous week.

Continuing

claims declined to 5,520,000 million from an upwardly revised 6,089,000 in the

previous week.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 08:50 | France | Services PMI | November | 46.5 | 38 | 38.8 |

| 08:55 | Germany | Services PMI | November | 49.5 | 46.2 | 46 |

| 09:00 | Eurozone | Services PMI | November | 46.9 | 41.3 | 41.7 |

| 09:30 | United Kingdom | Purchasing Manager Index Services | November | 51.4 | 45.8 | 47.6 |

| 10:00 | Eurozone | Retail Sales (MoM) | October | -1.7% | 0.8% | 1.5% |

| 10:00 | Eurozone | Retail Sales (YoY) | October | 2.5% | 2.7% | 4.3% |

USD fell against its major rivals in the European session on Thursday as favorable developments on the vaccine and U.S. fiscal stimulus fronts spurred investors to buy riskier assets.

The U.S. Dollar Index (DXY), measuring the U.S. currency's value relative to a basket of foreign currencies, dropped 0.42% to 90.74.

The market enthusiasm that followed Wednesday's news that the UK became the first western country to approve a COVID-19 vaccine from Pfizer /BioNTech was bolstered further by increased hopes for additional fiscal support, as the U.S. lawmakers resumed stimulus talks.

The media reported that the U.S.House Speaker Nancy Pelosi and Senate Minority Leader Chuck Schumer said that a $908 bln bipartisan stimulus proposal, which was introduced on Tuesday, should be a starting point for negotiations with the Republican leaders. But the Senate Majority Leader Mitch McConnell does not appear to support the bipartisan proposal.

Investors' optimism, however, was tempered by a renewed acceleration in coronavirus infections in the U.S. and fears that the country could face a very hard winter until the COVID-19 vaccines are broadly distributed. Los Angeles Mayor Eric Garcetti issued a new stay-at-home order amid rising coronavirus cases. The U.S. health regulators are expected to make determinations on the vaccines from Pfizer/BioNTech and Moderna later this month.

Bert Colijn, a Senior Economist at ING, suggests that the Eurozone's retail sales are bound to drop sharply in November after a 1.5% increase in October and the services PMI for November confirms this, falling from 46.9 to 41.7.

"Until October, retail was right in the sweet spot for consumer spending. With savings high thanks to the first lockdown and social distancing measures limiting spending on certain services, shopping for goods continued to be elevated. The October retail trade figures confirm that as sales were 3.1% higher than they were in February, before the pandemic hit the eurozone. This makes retail sales one of the few indicators that has experienced a true V-shaped recovery."

"Of course this will not last. November will clearly show a large decline in sales as countries like France and Belgium have closed non-essential retail. Less restrictive measures in other countries will still hamper sales, making October the peak ahead of the second wave decline in retail trade. The services PMI confirmed today that the decline in services activity is substantial. The reading of 41.7 in November corresponds to a significant drop in output. For overall eurozone GDP, we expect a decline of -2.5% in the fourth quarter."

FXStreet reports that in the opinion of Commerzbank’s Karen Jones, Team Head FICC Technical Analysis Research and Axel Rudolph, Senior FICC Technical Analyst, yields of the key US 10-year benchmark are seen climbing to the 1.28 area in the medium-to-longer term.

“The US 10Y yield is heading back up towards the June and November highs at 0.96/0.98 which are expected to be exceeded with the psychological 1.00 mark expected to be reached as well.”

“The next medium-to-longer-term technical upside target is the 1.28 mid-March high.”

“Another one sits at the 1.32/38 2012 and 2016 lows and also at the 1.42 2019 low.”

“Immediate upside pressure should be maintained while the yield remains above the 0.81/0.79 August and early October highs and November 20 low.”

“Our medium-term bullish view will remain intact while the yield stays above the July high, mid-October and November lows at 0.72/0.69.”

FXStreet reports that economist at UOB Group Lee Sue Ann assesses the latest GDP figures in the Australian economy.

“The Australia economy rose 3.3% q/q in the third quarter, as COVID-19 related restrictions eased across most states and territories. This follows the record 7.0% q/q decline in the second quarter. Whilst there was an improvement in 3Q20 GDP, the level of activity in the economy remained lower than prior to the pandemic, reflected in a 3.8% y/y decline.”

“In the details, domestic final demand contributed 4.3ppts to the q/q GDP growth. Household final consumption expenditure contributed 4.0ppts, as restrictions were lifted for households and businesses. Public demand contributed a further 0.3ppts.”

“Looking ahead, the end of Victoria's second lock-down and success in containing the virus domestically will likely support a further rebound in activity in 4Q20. We expect another sizeable increase in the December quarter (around 2.0% q/q, -3.8% y/y), which should take full-year 2020 GDP to -3.0%, before a moderate recovery in 2021 to 2.8%.”

- Major gap still remains on fisheries

- Still not there yet on level playing field

- UK state aid solutions not in a position that we can agree to

- What is needed to agree upon is still quite substantial

- We are milimetres away from touching red lines in talks

- We are not hours away from a deal

- EU-UK negotiators must come with a ready deal if some things still open it means there is no deal

FXStreet reports that FX Strategists at UOB Group said that extra losses in USD/CNH are expected on a break below 6.5319.

Next 1-3 weeks: “We have held the same view for a week wherein USD ‘is in a consolidation and could trade between 6.5400 and 6.6200 for a period of time’. USD weakened sharply yesterday and is approaching the bottom of the range at 6.5400. Downward momentum is beginning to improve but is not strong for now. USD has to stage a NY closing below the year-to-date low of 6.5319 in order to indicate that the next down-leg towards 6.4960 has started. The prospect for such a move is not high for now but it would increase as long a USD does move above 6.5800 within these few days.”

Reuters reports that a Bank of England survey showed that british businesses are more optimistic that their operations will get back to normal in the first half of next year than they were a month ago, following the announcement of new COVID vaccines.

Firms said they expected sales in the second quarter of 2021 to be 2% below pre-COVID levels, compared with 8% below in the previous survey in October.

For the fourth quarter of this year, businesses expect sales to be 15% below normal, and for staffing levels to be 6% lower than pre-COVID.

According to the report from Eurostat, in October 2020, the seasonally adjusted volume of retail trade rose by 1.5% in both the euro area and the EU, compared with September 2020. Economists had expected a 0.8% increase in the euro area. In September 2020, the retail trade volume fell by 1.7% in the euro area and by 1.3% in the EU.

In October 2020 compared with October 2019, the calendar adjusted retail sales index increased by 4.3% in the euro area and by 4.2% in the EU. Economists had expected a 2.7% increase in the euro area.

In the euro area in October 2020, compared with September 2020, the volume of retail trade increased by 2.0% for both non-food products and for food, drinks and tobacco, while automotive fuels fell by 3.7%. In the EU, the volume of retail trade increased by 2.0% for non-food products and by 1.9% for food, drinks and tobacco while automotive fuels fell by 3.4%.

In the euro area in October 2020, compared with October 2019, the volume of retail trade increased by 5.4% for non-food products. Within this category mail orders and internet increased by 28.5%, while textiles, clothing and footwear decreased by 14.0%. The volume of retail trade increased by 5.1% for food, drinks and tobacco, while automotive fuel decreased by 9.6%. In the EU, the retail trade volume increased by 5.7% for non-food products (mail orders and internet +29.2%, textiles, clothing and footwear -13.0%) and by 4.6% for food, drinks and tobacco, while automotive fuel decreased by 9.5%.

According to the report from IHS Markit/CIPS, UK service providers signalled a reduction in business activity during November, which ended a four-month period of sustained recovery. Survey respondents almost exclusively linked lower activity to tighter restrictions on trade and temporary business closures due to the coronavirus 2019 (COVID-19) pandemic. Despite a second national lockdown in England and ongoing curbs on customer-facing enterprises elsewhere across the UK, the speed of the downturn was much softer than the slump recorded during the second quarter of 2020. Service providers often cited resilient spending among businesses in sectors that had remained open in November.

The seasonally adjusted UK Services PMI Business Activity Index dropped to 47.6 in November, from 51.4 in October. As a result, the index was below the crucial 50.0 no-change mark for the first time in five months. The latest reading was higher than the earlier 'flash' estimate in November (45.8) and signalled a much slower downturn in business activity than the survey-record low seen in April (13.4).

Meanwhile, positive news in relation to vaccines and hopes of a better stage ahead in the pandemic situation led to much greater levels of business optimism in November. The degree of confidence towards the year ahead outlook was the highest since February. Around 60% of the survey panel expect a rise in business activity during the next 12 months, while only 15% forecast a reduction.

November data indicated a reduction in UK private sector output for the first time in five months, with weakness across the service economy more than offsetting robust manufacturing growth.

The seasonally adjusted UK Composite Output Index registered 49.0 in November, down from 52.1 in October and below the neutral 50.0 threshold for the first time since June.

According to the report from IHS Markit, driven by sharply reduced services activity, the eurozone’s private sector economy returned to contraction during November for the first time in five months.

Eurozone PMI Composite Output Index which recorded a level of 45.3, down from October’s 50.0 but slightly better than the earlier flash reading. The headline figure was driven lower by a downturn in service sector activity which fell to the greatest degree since May. In contrast, manufacturing output growth was sustained for the fifth month in a row, albeit at the slowest pace since July.

The downturn in private sector output was closely linked to restrictions on activity related to continued efforts to stem the spread of global coronavirus disease 2019 (COVID-19). With mobility and social contact restricted, new business volumes inevitably fell in November.

The overall fall in new work was the greatest recorded by the survey since May, with notable weakness in sectors such as hospitality and tourism. There were also a decline in new export business, albeit only marginally, for the first time in three months.

Employment fell for the ninth month running, albeit at the weakest rate in this sequence with modest declines in both manufacturing and services.

Meanwhile, input prices increased for a sixth successive month during November. The rate of inflation was solid, albeit a little lower than in the previous survey period. In contrast, output charges declined again, extending the current period of deflation to nine months.

The Eurozone PMI Services Business Activity Index fell sharply during November, declining to a level of 41.7 from 46.9 during October. Posting below the 50.0 no-change mark for a third successive month, the index signalled the sharpest contraction in services activity since May.

Reuters reports that Bank of Japan (BOJ) board member Hitoshi Suzuki said the central bank should allow super-long bond yields to rise moderately as part of efforts to make its stimulus programme sustainable.

"Allowing the super-long end of the yield curve to steepen moderately, while keeping 10-year bond yields around zero, would help financial institutions earn more profits," Suzuki told.

"As such, this will be desirable from the standpoint of maintaining financial system stability, as our monetary easing is prolonged," he said.

Suzuki also said the BOJ must seek to make its policy framework "sustainable and flexible", including its purchases of risky assets such as exchange-traded funds.

His remarks underscore a growing concern among policymakers over the rising costs of the BOJ's monetary easing, which has failed to fire up inflation to its elusive 2% inflation target.

FXStreet reports that in opinion of FX Strategists at UOB Group, NZD/USD could have charted a short-term top in the vicinity of the 0.7100 yardstick.

Next 1-3 weeks: “We have held a positive view in NZD for close to one month now. Yesterday, we indicated that ‘while there is still a chance for NZD to move to 0.7100, the month-long rally appears to be over-extended and a break of 0.6980 would indicate that the month-long positive phase has run its course’. NZD subsequently rose to a fresh high of 0.7084. Short term momentum is waning rapidly amid overbought conditions and the risk of a short-term top has increased. A break of 0.7010 (‘strong support’ level previously at 0.6980) would indicate that the month-long positive phase has ended.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Australia | Trade Balance | October | 5.815 | 5.8 | 7.456 |

| 00:30 | Australia | Home Loans | October | 6.0% | 0.8% | |

| 01:45 | China | Markit/Caixin Services PMI | November | 56.8 | 57.8 |

During today's Asian trading, the US dollar consolidated against the euro and rose slightly against the yen.

"The euro is now above $1.2, which could be a headache for the European Central Bank, given the near - zero inflation in the Euro area," said CMC Markets analyst Michael Hewson.

Democratic majority leader in the U.S. House of representatives Steny Hoyer said Wednesday that he hopes to reach a deal on new budget incentives this weekend.

A day earlier, a group of congressmen from both parties proposed a new $908 billion stimulus package. On Wednesday, House speaker Nancy Pelosi and Senate democratic minority leader Chuck Schumer urged McConnell to use the proposal as a basis for negotiations.

The pound rose against the dollar. On the eve of the pound fell against the dollar and the euro after the EU's chief negotiator Michel Barnier said that he was not sure whether he could reach an agreement between the UK and the EU on future relations.

"The pound has fallen from its highest level in three months after recent Brexit - related events revived doubts about the ability of the UK and the EU to reach a trade agreement," said Joe Manimbo of Western Union.

The ICE index, which tracks the dollar's performance against six currencies (the euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), fell 0.2%.

CNBC reports that think tank Peterson Institute for International Economics said that negotiating a new and improved trade deal with Asia-Pacific countries would help the U.S. to reassert its leadership in the region while countering China’s growing dominance.

Frayed U.S. ties with Asian allies is an issue that President-elect Joe Biden should work to reverse “perhaps sooner rather than later,” said Jeffrey Schott, PIIE’s senior fellow.

“The incoming Biden administration’s domestic policies to strengthen US output and employment and to support the most vulnerable in society should not deter it from attending to the dramatic changes in the Asia-Pacific region,” he said.

Over the last few years, countries in Asia-Pacific have moved on without the U.S. while deepening ties with China, said Schott, an expert on international trade policy. That can be seen in the signing of the 15-member Regional Comprehensive Economic Partnership (RCEP) that included China, he said. China is also negotiating new trade deals and upgrading existing agreements with countries in the region, he added.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2254 (656)

$1.2207 (774)

$1.2165 (1294)

Price at time of writing this review: $1.2122

Support levels (open interest**, contracts):

$1.2069 (85)

$1.2038 (172)

$1.1996 (363)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 4 is 107076 contracts (according to data from December, 2) with the maximum number of contracts with strike price $1,1200 (6560);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3512 (2769)

$1.3472 (966)

$1.3439 (1010)

Price at time of writing this review: $1.3393

Support levels (open interest**, contracts):

$1.3297 (854)

$1.3228 (848)

$1.3187 (718)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 223387 contracts, with the maximum number of contracts with strike price $1,3500 (2769);

- Overall open interest on the PUT options with the expiration date December, 4 is 43805 contracts, with the maximum number of contracts with strike price $1,2700 (11992);

- The ratio of PUT/CALL was 1.87 versus 1.85 from the previous trading day according to data from December, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

eFXdata reports that CIBC Research discusses EUR/CHF outlook.

"The upcoming ECB policy recalibration, code for more stimulus could risk putting more pressure on the SNB, especially were the ECB to surprise and look to take rates further into negative territory. However, as such an outcome remains a low probability scenario, we do not anticipate that the SNB will have to materially dial up the scale of intervention," CIBC notes.

"The prospect of a more constructive macro outlook in 2021, predicated upon a vaccine supporting a macro recovery, points towards leveraged CHF long positions, from near six-year highs, being unwound. The position reversal will allow SNB activity to be progressively reduced, this comes as EURCHF should head back towards 1.10 for the first time since November 2019," CIBC adds.

RTTNews reports that survey data from IHS Markit showed that China's service sector expanded strongly in November amid greater customer demand and a sustained recovery in market conditions after the coronavirus disease outbreak.

The services PMI rose to 57.8 in November from 56.8 in the previous month. The rate of growth was the second fastest since April 2010, exceeded only by that recorded in June 2020.

New orders climbed the most since April 2010 as export sales grew for the first time since June. Efforts to expand capacity and rising order volumes led companies to increase their staffing levels for the fourth month in a row.

Input costs increased at the fastest pace since August 2010 due to higher raw material and staffing costs.

Firmer demand conditions enabled firms to partially pass on their increased cost burdens to clients in the form of higher output prices. The rate of charge inflation was the steepest for just over ten-and-a-half years.

Business confidence regarding the year ahead strengthened for the third consecutive month in November. The overall degree of positive sentiment was the highest since April 2011.

The Caixin composite output index came in at 57.5 in November, stronger than 55.7 the previous month. The reading signaled the steepest growth in the private sector since March 2010.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 47.87 | 1.83 |

| Silver | 24.077 | 0.68 |

| Gold | 1830.516 | 0.98 |

| Palladium | 2404.19 | -0.03 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 13.44 | 26800.98 | 0.05 |

| Hang Seng | -35.1 | 26532.58 | -0.13 |

| KOSPI | 41.65 | 2675.9 | 1.58 |

| ASX 200 | 1.7 | 6590.2 | 0.03 |

| FTSE 100 | 78.66 | 6463.39 | 1.23 |

| CAC 40 | 1.37 | 5583.01 | 0.02 |

| Dow Jones | 59.87 | 29883.79 | 0.2 |

| S&P 500 | 6.56 | 3669.01 | 0.18 |

| NASDAQ Composite | -5.74 | 12349.37 | -0.05 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Trade Balance | October | 5.630 | 5.8 |

| 00:30 (GMT) | Australia | Home Loans | October | 6.0% | |

| 01:45 (GMT) | China | Markit/Caixin Services PMI | November | 56.8 | |

| 08:50 (GMT) | France | Services PMI | November | 46.5 | 38 |

| 08:55 (GMT) | Germany | Services PMI | November | 49.5 | 46.2 |

| 09:00 (GMT) | Eurozone | Services PMI | November | 46.9 | 41.3 |

| 09:30 (GMT) | United Kingdom | Purchasing Manager Index Services | November | 51.4 | 45.8 |

| 10:00 (GMT) | Eurozone | Retail Sales (MoM) | October | -2% | 0.8% |

| 10:00 (GMT) | Eurozone | Retail Sales (YoY) | October | 2.2% | 2.7% |

| 13:30 (GMT) | U.S. | Continuing Jobless Claims | November | 6071 | 5915 |

| 13:30 (GMT) | U.S. | Initial Jobless Claims | November | 778 | 775 |

| 14:45 (GMT) | U.S. | Services PMI | November | 56.9 | 57.7 |

| 15:00 (GMT) | U.S. | ISM Non-Manufacturing | November | 56.6 | 56 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.74139 | 0.66 |

| EURJPY | 126.51 | 0.51 |

| EURUSD | 1.21163 | 0.4 |

| GBPJPY | 139.548 | -0.31 |

| GBPUSD | 1.3365 | -0.4 |

| NZDUSD | 0.70637 | -0.01 |

| USDCAD | 1.29211 | -0.09 |

| USDCHF | 0.89473 | -0.5 |

| USDJPY | 104.409 | 0.11 |

© 2000-2024. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.