- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Major US stock indices rose slightly on Friday after October job data, which caused fears of wage growth, while the jump in Apple shares supported the high-tech Nasdaq.

As the report of the Ministry of Labor showed, the US economy added 261,000 jobs in October, as the employment situation continues to improve after the hurricanes Harvey and Irma. Economists predicted an increase in the number of employees by 310 thousand. The report also showed that the unemployment rate fell to 4.1% from 4.2% and approached the 17-year minimum, but the decrease was partly due to a sharp decrease in the workforce by 765 thousand people . At the same time, the average hourly salary remained almost unchanged - $ 26.53 (- $ 0.01 m / m or 0%) - in October. Economists had expected that the unemployment rate would remain at 4.2%, while the average hourly wage would increase by 0.2% in October.

Meanwhile, in September the trade deficit in the US increased slightly, while it was slightly more than economists had forecast. The deficit increased, as imports grew slightly faster than exports. The US Commerce Department reported that the trade balance deficit in the country increased in September to $ 43.5 billion, compared with $ 42.8 billion in the previous month. Economists had expected expansion, although the latter figure was slightly higher than economists expected - $ 43.2 billion.

In addition, the index of business activity in the US services, calculated by the Institute for Supply Management (ISM), rose in October to 60.1 points compared to 59.8 points in September. The latter value was the highest since August 2005. Analysts predicted that the index will deteriorate to 58.5 points. Recall, the indicator is the result of a survey of about 400 firms from 60 sectors across the US. A value greater than 50 is usually considered an indicator of the growth of production activity.

Most components of the DOW index finished trading in positive territory (18 out of 30). The leader of growth was the shares of Apple Inc. (AAPL, + 2.59%). Outsider were shares of Intel Corporation (INTC, -1.53%).

Most sectors of the S & P index recorded an increase. The conglomerate sector grew most (+ 1.9%). The largest decrease was shown in the financial sector (-0.4%).

At closing:

DJIA +22.93 23539.19 + 0.10%

S & P 500 +7.05 2586.90 + 0.27%

NASDAQ +49.49 6764.43 + 0.74%

Economic activity in the non-manufacturing sector grew in October for the 94th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report.

Anthony Nieves, CPSM, Chair of the Institute for Supply Management®: "The NMI® registered 60.1 percent, which is 0.3 percentage point higher than the September reading of 59.8 percent. This represents continued growth in the non-manufacturing sector at a slightly faster rate. This is the highest NMI® reading since the index's debut in 2008. The highest reading among pre-2008 composite index calculations is 61.3 percent in August 2005".

EURUSD: 1.1595-1.1600 (EUR 1.8bln) 1.1670 (850m) 1.1700 (950m)

USDJPY: 114.00 (2.22bln) 114.50(1.14bln) 115.00 (970m)

GBPUSD: 1.2900 (GBP 470m)1.3000 (695m)

EURGBP: 0.8750 (EUR 790m) 0.9000 (E260m)

AUDUSD: 0.7645-50 (485m)

USDCAD: 1.2800 (505m)

AUDNZD: 1.1100 (1.49bln) 1.1300 (2.4bln)

U.S. stock-index futures were slightly higher on Friday as investors assessed the U.S. jobs report for October and Apple's (AAPL) quarterly results.

Global Stocks:

Nikkei -

Hang Seng 28,603.61 +84.97 +0.30%

Shanghai 3,371.21 -12.10 -0.36%

S&P/ASX 5,959.88 +28.17 +0.47%

FTSE 7,557.40 +2.08 +0.03%

CAC 5,506.10 -4.40 -0.08%

DAX 13,464.46 +23.53 +0.18%

Crude $54.67 (+0.24%)

Gold $1,278.00 (-0.02%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 232.99 | 0.76(0.33%) | 437 |

| Amazon.com Inc., NASDAQ | AMZN | 1,094.02 | -0.20(-0.02%) | 15061 |

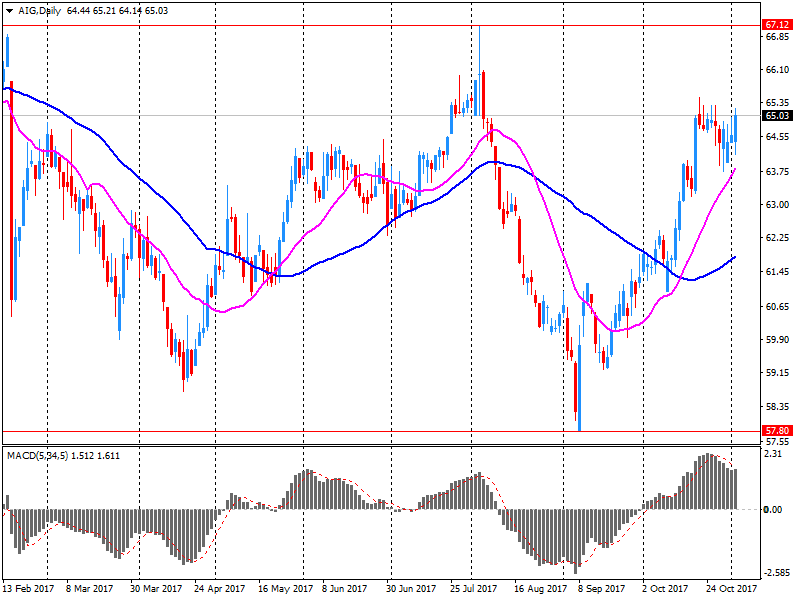

| AMERICAN INTERNATIONAL GROUP | AIG | 62.99 | -1.99(-3.06%) | 35774 |

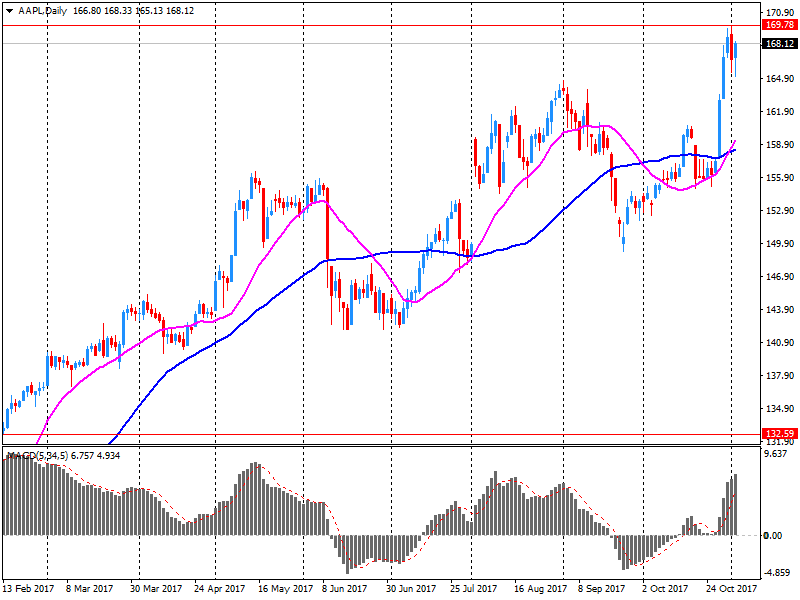

| Apple Inc. | AAPL | 175.2 | 7.09(4.22%) | 2508773 |

| AT&T Inc | T | 33.41 | 0.24(0.72%) | 37522 |

| Barrick Gold Corporation, NYSE | ABX | 14.14 | 0.04(0.28%) | 24662 |

| Boeing Co | BA | 263.29 | 0.66(0.25%) | 896 |

| Cisco Systems Inc | CSCO | 34.1 | -0.11(-0.32%) | 11845 |

| Citigroup Inc., NYSE | C | 74.27 | -0.15(-0.20%) | 50164 |

| Exxon Mobil Corp | XOM | 83.55 | 0.02(0.02%) | 1274 |

| Facebook, Inc. | FB | 179.57 | 0.65(0.36%) | 116137 |

| Ford Motor Co. | F | 12.45 | 0.03(0.24%) | 16285 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.17 | -0.06(-0.42%) | 1500 |

| General Motors Company, NYSE | GM | 42.35 | -0.25(-0.59%) | 6056 |

| Goldman Sachs | GS | 245.95 | -0.93(-0.38%) | 10226 |

| Google Inc. | GOOG | 1,027.44 | 1.86(0.18%) | 2049 |

| Hewlett-Packard Co. | HPQ | 21.62 | 0.18(0.84%) | 640 |

| Home Depot Inc | HD | 164 | 1.29(0.79%) | 3572 |

| Intel Corp | INTC | 47.3 | 0.20(0.42%) | 61346 |

| International Business Machines Co... | IBM | 153.95 | 0.60(0.39%) | 2130 |

| Johnson & Johnson | JNJ | 140 | 0.07(0.05%) | 467 |

| JPMorgan Chase and Co | JPM | 101.24 | -0.35(-0.34%) | 26472 |

| McDonald's Corp | MCD | 168.44 | 0.34(0.20%) | 681 |

| Merck & Co Inc | MRK | 55.71 | 0.34(0.61%) | 1270 |

| Microsoft Corp | MSFT | 84.2 | 0.15(0.18%) | 33394 |

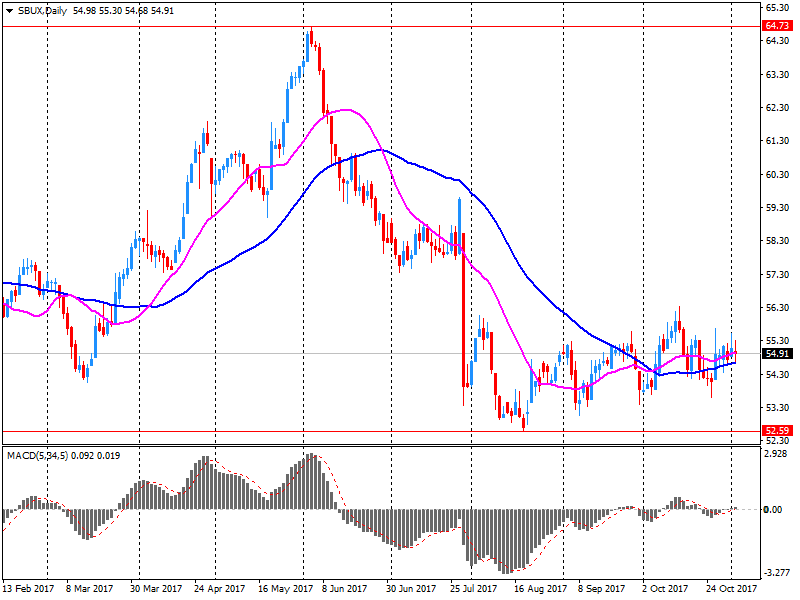

| Starbucks Corporation, NASDAQ | SBUX | 54.3 | -0.57(-1.04%) | 908483 |

| Tesla Motors, Inc., NASDAQ | TSLA | 299 | -0.26(-0.09%) | 28478 |

| The Coca-Cola Co | KO | 45.83 | -0.05(-0.11%) | 320 |

| Twitter, Inc., NYSE | TWTR | 19.99 | 0.28(1.42%) | 206582 |

| Verizon Communications Inc | VZ | 47.73 | 0.27(0.57%) | 587 |

| Visa | V | 111.33 | 0.35(0.32%) | 4851 |

| Wal-Mart Stores Inc | WMT | 89.2 | 0.40(0.45%) | 5220 |

| Walt Disney Co | DIS | 98.38 | 0.03(0.03%) | 405 |

| 3M Co | MMM | 232.99 | 0.76(0.33%) | 437 |

| Amazon.com Inc., NASDAQ | AMZN | 1,094.02 | -0.20(-0.02%) | 15061 |

| AMERICAN INTERNATIONAL GROUP | AIG | 62.99 | -1.99(-3.06%) | 35774 |

| Apple Inc. | AAPL | 175.2 | 7.09(4.22%) | 2508773 |

| AT&T Inc | T | 33.41 | 0.24(0.72%) | 37522 |

| Barrick Gold Corporation, NYSE | ABX | 14.14 | 0.04(0.28%) | 24662 |

| Boeing Co | BA | 263.29 | 0.66(0.25%) | 896 |

| Cisco Systems Inc | CSCO | 34.1 | -0.11(-0.32%) | 11845 |

| Citigroup Inc., NYSE | C | 74.27 | -0.15(-0.20%) | 50164 |

| Exxon Mobil Corp | XOM | 83.55 | 0.02(0.02%) | 1274 |

| Facebook, Inc. | FB | 179.57 | 0.65(0.36%) | 116137 |

| Ford Motor Co. | F | 12.45 | 0.03(0.24%) | 16285 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.17 | -0.06(-0.42%) | 1500 |

| General Motors Company, NYSE | GM | 42.35 | -0.25(-0.59%) | 6056 |

| Goldman Sachs | GS | 245.95 | -0.93(-0.38%) | 10226 |

| Google Inc. | GOOG | 1,027.44 | 1.86(0.18%) | 2049 |

| Hewlett-Packard Co. | HPQ | 21.62 | 0.18(0.84%) | 640 |

| Home Depot Inc | HD | 164 | 1.29(0.79%) | 3572 |

| Intel Corp | INTC | 47.3 | 0.20(0.42%) | 61346 |

| International Business Machines Co... | IBM | 153.95 | 0.60(0.39%) | 2130 |

| Johnson & Johnson | JNJ | 140 | 0.07(0.05%) | 467 |

| JPMorgan Chase and Co | JPM | 101.24 | -0.35(-0.34%) | 26472 |

| McDonald's Corp | MCD | 168.44 | 0.34(0.20%) | 681 |

| Merck & Co Inc | MRK | 55.71 | 0.34(0.61%) | 1270 |

| Microsoft Corp | MSFT | 84.2 | 0.15(0.18%) | 33394 |

| Starbucks Corporation, NASDAQ | SBUX | 54.3 | -0.57(-1.04%) | 908483 |

| Tesla Motors, Inc., NASDAQ | TSLA | 299 | -0.26(-0.09%) | 28478 |

| The Coca-Cola Co | KO | 45.83 | -0.05(-0.11%) | 320 |

| Twitter, Inc., NYSE | TWTR | 19.99 | 0.28(1.42%) | 206582 |

| Verizon Communications Inc | VZ | 47.73 | 0.27(0.57%) | 587 |

| Visa | V | 111.33 | 0.35(0.32%) | 4851 |

| Wal-Mart Stores Inc | WMT | 89.2 | 0.40(0.45%) | 5220 |

| Walt Disney Co | DIS | 98.38 | 0.03(0.03%) | 405 |

UnitedHealth (UNH) initiated with Outperform at Credit Suisse

American Intl (AIG) downgraded to Neutral from Buy at BofA/Merrill

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce,announced today that the goods and services deficit was $43.5 billion in September, up $0.7 billion from $42.8 billion in August, revised. September exports were $196.8 billion, $2.1 billion more than August exports. September imports were $240.3 billion, $2.8 billion more than August imports.

The September increase in the goods and services deficit reflected an increase in the goods deficit of $0.6 billion to $65.4 billion and a decrease in the services surplus of $0.2 billion to $21.9 billion.

Year-to-date, the goods and services deficit increased $34.5 billion, or 9.3 percent, from the same period in 2016. Exports increased $93.0 billion or 5.6 percent. Imports increased $127.5 billion or 6.3 percent.

Apple (AAPL) upgraded to Buy from Neutral at Rosenblatt; target $180

Twitter (TWTR) upgraded to Buy from Hold at Argus; target $25

Employment increased by 35,000 in October, and the unemployment rate rose 0.1 percentage points to 6.3%. Employment gains in the month were driven by full-time work (+89,000), while fewer people worked part time (-53,000).

On a year-over-year basis, total employment rose by 308,000 (+1.7%), with full-time work increasing by 397,000 (+2.7%) and the number of people working part time declining by 89,000 (-2.5%). On a year-over-year basis, total hours worked were up 2.7%.

The unemployment rate trended downwards in the 12 months to October, falling 0.7 percentage points over this period.

Average hourly earnings for all employees on private nonfarm payrolls, at $26.53, were little changed in October (-1 cent), after rising by 12 cents in September.

Over the past 12 months, average hourly earnings have increased by 63 cents, or 2.4 percent. In October, average hourly earnings of private-sector production and nonsupervisory employees, at $22.22, were little changed (-1 cent).

Total nonfarm payroll employment rose by 261,000 in October, and the unemployment rate edged down to 4.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment in food services and drinking places increased sharply, mostly offsetting a decline in September that largely reflected the impact of Hurricanes Irma and Harvey. In October, job gains also occurred in professional and business services, manufacturing, and health

care.

The unemployment rate edged down by 0.1 percentage point to 4.1 percent in October, and the number of unemployed persons decreased by 281,000 to 6.5 million. Since January, the unemployment rate has declined by 0.7 percentage point, and the number of unemployed persons has decreased by 1.1 million.

American Intl (AIG) reported Q3 FY 2017 losses of $1.22 per share (versus earnings of $1.23 in Q3 FY 2016), $0.43 worse than analysts' consensus estimate of -$0.79.

The company noted that "the insurance industry witnessed unprecedented catastrophic events" in Q3.

AIG fell to $62.50 (-3.82%) in pre-market trading.

Starbucks (SBUX) reported Q4 FY 2017 earnings of $0.55 per share (versus $0.56 in Q4 FY 2016), in-line with analysts' consensus estimate of $0.55.

The company's quarterly revenues amounted to $5.698 bln (-0.2% y/y), missing analysts' consensus estimate of $5.807 bln.

SBUX fell to $54.29 (-1.06%) in pre-market trading.

Apple (AAPL) reported Q4 FY 2017 earnings of $2.07 per share (versus $1.67 in Q4 FY 2016), beating analysts' consensus estimate of $1.87.

The company's quarterly revenues amounted to $52.579 bln (+12.2% y/y), beating analysts' consensus estimate of $50.707 bln.

The company also issued in-line guidance for Q1 FY 2018, projecting Q1 revenues of $84-87 bln (versus analysts' consensus estimate of $85.34 bln) and gross margin of 38-38.5% (versus 38.6% estimated and 38.5% last year).

AAPL rose to $174.35 (+3.71%) in pre-market trading.

EUR/USD: 1.1595-1.1600(1.8 b), 1.1645-50(415 m), 1.1670(847 m), 1.1700(947 m), 1.1800(342 m)

GBP/USD: 1.2900(465 m), 1.3000(694 m),

USD/JPY: 113.00(322 m), 113.20-25(586 m), 113.80-85(636 m), 114.00(2.22 b), 114.50(1.13 b), 115.00(966 m)

EUR/GBP: 0.8750(790 m), 0.9000(256 m)

AUD/USD: 0.7600(243 m), 0.7645-50(485 m), 0.7725(274 m)

USD/CAD: 1.2500(509 m), 1.2600(342 m), 1.2800(502 m)

AUD/NZD: 1.0950(857 m), 1.1100(1.49 m), 1.1300(2.39 m)

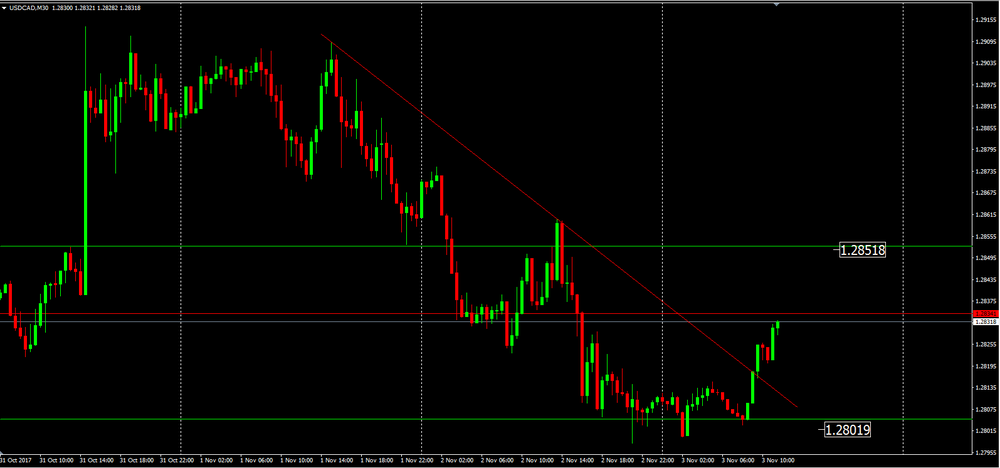

At this moment, on 30 mins time frame chart, we can see that price has broken a downside trend line which it has also been tested.

Therefore, it might be a nice opportunity to see a bullish movement on USD/CAD.

Targets close to 1.2851

UK service providers indicated that business activity growth improved on its recent underwhelming trend in October. The latest expansion of service sector output was the fastest since April, supported by improved order books and resilient client demand.

At 55.6 in October, up from 53.6 in September, the headline seasonally adjusted IHS Markit/CIPS Services PMI Business Activity Index signalled a shift in momentum across the services economy. The latest reading was slightly stronger than the post-crisis trend and signalled the fastest pace of business activity growth for six months.

The Caixin China Composite PMI data (which covers both manufacturing and services) pointed to only a marginal increase in Chinese business activity at the start of the fourth quarter. At 51.0 in October, the Composite Output Index fell from 51.4 in September to signal the weakest pace of expansion since June 2016.

The softer increase in overall output was largely driven by a further slowdown in manufacturing production growth. Output at Chinese goods producers rose at only a marginal pace that was the weakest since June. Meanwhile, growth in Chinese services activity picked up from September's 21-month low, but was modest overall and remained weaker than the historical average. This was highlighted by the seasonally adjusted Caixin China General Services Business Activity Index rising from 50.6 to 51.2 in October.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1756 (2671)

$1.1720 (3023)

$1.1691 (715)

Price at time of writing this review: $1.1653

Support levels (open interest**, contracts):

$1.1597 (5933)

$1.1549 (4552)

$1.1500 (3745)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 120936 contracts (according to data from November, 2) with the maximum number of contracts with strike price $1,2000 (9990);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3157 (2017)

$1.3120 (2849)

$1.3086 (924)

Price at time of writing this review: $1.3054

Support levels (open interest**, contracts):

$1.2992 (3113)

$1.2947 (2176)

$1.2899 (1510)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 49329 contracts, with the maximum number of contracts with strike price $1,3200 (4592);

- Overall open interest on the PUT options with the expiration date November, 3 is 43631 contracts, with the maximum number of contracts with strike price $1,3000 (3113);

- The ratio of PUT/CALL was 0.88 versus 0.87 from the previous trading day according to data from November, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

The trend estimate was relatively unchanged (0.0%) in September 2017 following a relatively unchanged estimate (0.0%) in August 2017 and a relatively unchanged estimate (0.0%) in July 2017.

The seasonally adjusted estimate was relatively unchanged (0.0%) in September 2017. This follows a fall of 0.5% in August 2017 and a fall of 0.3% in July 2017.

In trend terms, Australian turnover rose 2.0% in September 2017 compared with September 2016.

The following industries fell in trend terms in September 2017: Household goods retailing (-0.5%), Cafes, restaurants and takeaway food services (-0.1%) and Department stores (-0.1%). Food retailing rose (0.1%) and Other retailing (0.0%) and Clothing, footwear and personal accessory retailing (0.0%) were relatively unchanged in trend terms in September 2017.

The following states and territories fell in trend terms in September 2017: Victoria (-0.1%), Western Australia (-0.3%), South Australia (-0.1%), the Australian Capital Territory (-0.2%), the Northern Territory (-0.2%), and Tasmania (-0.1%). New South Wales rose (0.1%) and Queensland (0.0%) was relatively unchanged in trend terms.

Asia-Pacific equities struggled for direction Friday, following a lack of movement in most U.S. stocks overnight, as investors seek new drivers after an October to remember. Australian stocks stood out, hitting fresh 2017 highs on gains in commodity prices. The S&P/ASX 200 XJO, +0.43% was recently up 0.5% at 5,964 - hitting a 2017 high for the second day in a row - and moving closer to 2015's peak of 5,996.90. Topping that would put the index at its best level in 10 years.

European stocks ended lower on Thursday, with shares of many exporters under pressure as the euro increased in value. British blue chips, however, climbed as the Bank of England struck a dovish note even as it raised borrowing costs for the first time in a decade. The market continued to have plenty of corporate earnings reports to consider, with Swiss lender Credit Suisse Group AG saying its profit climbed.

The Dow Jones Industrial Average closed at a record on Thursday, but the other main benchmarks saw muted moves, as the much-anticipated tax plan by House Republicans was unveiled and as President Donald Trump nominated Fed. Gov. Jerome Powell to run the Federal Reserve, as had been widely expected.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.