- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Retail Sales, M/M | August | -0.1% | 0.5% |

| 03:20 | Australia | RBA Assist Gov Ellis Speaks | |||

| 12:30 | U.S. | Manufacturing Payrolls | September | 3 | 4 |

| 12:30 | U.S. | Government Payrolls | September | 34 | |

| 12:30 | U.S. | Average workweek | September | 34.4 | 34.4 |

| 12:30 | U.S. | Labor Force Participation Rate | September | 63.2% | |

| 12:30 | U.S. | Private Nonfarm Payrolls | September | 96 | 132 |

| 12:30 | U.S. | Average hourly earnings | September | 0.4% | 0.3% |

| 12:30 | Canada | Trade balance, billions | August | -1.12 | -1 |

| 12:30 | U.S. | International Trade, bln | August | -54 | -54.5 |

| 12:30 | U.S. | Unemployment Rate | September | 3.7% | 3.7% |

| 12:30 | U.S. | Nonfarm Payrolls | September | 130 | 145 |

| 14:00 | Canada | Ivey Purchasing Managers Index | September | 60.6 | 54.3 |

| 14:25 | U.S. | FOMC Member Bostic Speaks | |||

| 17:00 | U.S. | Baker Hughes Oil Rig Count | October | 713 | |

| 18:00 | U.S. | Fed Chair Powell Speaks | |||

| 18:10 | U.S. | FOMC Member Brainard Speaks | |||

| 20:00 | U.S. | FOMC Member Quarles Speaks | |||

| 20:00 | U.S. | FOMC Member Clarida Speaks |

Major US stocks rose moderately amid growing expectations that the Fed will continue to soften monetary policy in order to support the growth of the US economy.

The stock market was under pressure for a short while after the publication of the Institute for Supply Management (ISM) report, which reflected a stronger than expected slowdown in the US services sector for September. According to the report, the non-manufacturing index fell to 52.6 in September from 56.4 in August. Although a value above 50 still indicates an expansion of the services sector, it was expected that the index would show a more modest decline - to 55.1. With a much larger decrease than expected, the index reached its lowest level since August 2016. This reinforced concerns about the growth of the US economy.

However, weak data from ISM contributed to higher expectations for the Fed to lower interest rates this month: according to CME FedWatch, the probability of rate cuts in October jumped to 90.3% from 77% on Wednesday.

Market participants also continued to monitor the development of the situation in trade. US President Donald Trump said today that the Chinese delegation will arrive in Washington next week to hold talks, adding that he has many options for dealing with China. “If they do not want to do what we want, then we have enormous opportunities for this,” Trump said.

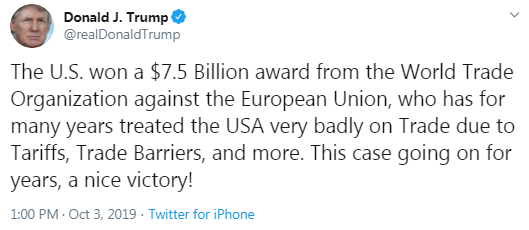

In addition, the Trump administration announced plans to introduce tariffs of 10% for aircraft from the EU and 25% for other EU products, including French wine, Scotch and Irish whiskey, as well as cheese from all over the continent. The decision was made after the World Trade Organization (WTO) decided that the United States could introduce tariffs for European products totaling $ 7.5 billion in response to illegal EU subsidies for the Airbus aircraft manufacturing concern. The EU replied that they would like to reach an agreement with the United States in order to avoid a tariff war, but if the White House introduces new duties on products from the EU, they will be forced to introduce retaliatory measures.

Most DOW components recorded an increase (18 out of 30). Outsider turned out to be shares of JPMorgan Chase & Co. (JPM; -1.23%). The biggest gainers were Pfizer Inc. (PFE; + 1.93%).

All S&P sectors completed trading in positive territory. The conglomerate sector grew the most (+ 1.8%).

At the time of closing:

Dow 26,201.72 +123.10 +0.47%

S&P 500 2,910.66 +23.05 +0.80%

Nasdaq 100 7,872.27 +87.02 +1.12%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Retail Sales, M/M | August | -0.1% | 0.5% |

| 03:20 | Australia | RBA Assist Gov Ellis Speaks | |||

| 12:30 | U.S. | Manufacturing Payrolls | September | 3 | 4 |

| 12:30 | U.S. | Government Payrolls | September | 34 | |

| 12:30 | U.S. | Average workweek | September | 34.4 | 34.4 |

| 12:30 | U.S. | Labor Force Participation Rate | September | 63.2% | |

| 12:30 | U.S. | Private Nonfarm Payrolls | September | 96 | 132 |

| 12:30 | U.S. | Average hourly earnings | September | 0.4% | 0.3% |

| 12:30 | Canada | Trade balance, billions | August | -1.12 | -1 |

| 12:30 | U.S. | International Trade, bln | August | -54 | -54.5 |

| 12:30 | U.S. | Unemployment Rate | September | 3.7% | 3.7% |

| 12:30 | U.S. | Nonfarm Payrolls | September | 130 | 145 |

| 14:00 | Canada | Ivey Purchasing Managers Index | September | 60.6 | 54.3 |

| 14:25 | U.S. | FOMC Member Bostic Speaks | |||

| 17:00 | U.S. | Baker Hughes Oil Rig Count | October | 713 | |

| 18:00 | U.S. | Fed Chair Powell Speaks | |||

| 18:10 | U.S. | FOMC Member Brainard Speaks | |||

| 20:00 | U.S. | FOMC Member Quarles Speaks | |||

| 20:00 | U.S. | FOMC Member Clarida Speaks |

James Knightley, the Chief International Economist at ING, notes the U.S. slowdown signals are multiplying.

- "We were well aware of the problems in manufacturing given the trade war, slower global growth and the competitive disadvantage of a strong dollar, but it is clear that there are problems brewing in other sectors. The ISM non-manufacturing index has come in at 52.6, the weakest reading for over three years, and as the chart below shows the two ISM series are now showing that GDP growth is in a clear weakening channel.

- There was weakness throughout today’s non-manufacturing report with new orders plunging to 53.7 from 60.3 versus a breakeven level of 50. Business activity fell 6.3 points to 55.2 while employment dropped to 50.4 from 53.1. This is the worst employment reading since early 2014 and given the ISM manufacturing employment number was already pointing to a sharp fall we are not optimistic for tomorrow’s all-important jobs number. The consensus is still for employment growth of 147,000, but the labour surveys (including yesterday’s ADP report) suggest 100-120k may be more realistic.

- Payrolls growth has been slowing over the past year. Initially, there was a sense that this was because firms were struggling to fill vacancies due to a lack of workers with the right skill sets. However, the downturn in business activity suggests that it is increasingly becoming a labour demand story. As such the recent pick-up in wage growth may not continue for much longer, which risks undermining consumer spending.

- Given these fears, we cut our US GDP growth forecast for 2020 to 1.3% a couple of months ago. The consensus is still 1.8%, but we imagine that this will be moving lower. The latest developments should add a sense of urgency to talks seeking a resolution to the US-China trade dispute and will keep the pressure on the Fed to ease monetary policy further. We continue to look for a December rate cut and a further move in 1Q20, but the risks are increasingly skewed towards more aggressive action."

- If China doesn't do what U.S. wants, U.S. has "a lots of options"

- Says he would like Ukraine to investigate Biden family

The U.S.

Commerce Department reported on Thursday that the value of new factory orders edged

down 0.1 percent m-o-m in August, following an unrevised 1.4 percent m-o-m gain

in July.

Economists had

forecast a 0.2 percent m-o-m drop.

According to

the report, orders for transportation equipment declined 0.4 percent m-o-m in August

after surging 7.3 percent m-o-m in July. There were also drops in orders for

computers and electronic products and electrical equipment, appliances and

components. Meanwhile, machinery orders grew 0.4 percent m-o-m in August after falling

1.0 percent m-o-m in July.

Total factory

orders excluding transportation, a volatile part of the overall reading, were

unchanged m-o-m in August (compared to a downwardly revised 0.2 percent m-o-m advance

in July), while orders for nondefense capital goods excluding aircraft, a measure

of business spending plans, decreased 0.4 percent m-o-m (compared to a 0.2

percent m-o-m decline in July). The report also showed that shipments of core

capital goods increased 0.3 percent m-o-m in August, following a 0.4 percent m-o-m

climb in July.

In y-o-y terms,

factory orders decreased 0.1 percent in August.

The Institute

for Supply Management (ISM) reported on Thursday its non-manufacturing index

(NMI) came in at 52.6 in August, which was 3.8 percentage points lower than the

August reading of 56.4 percent. The September reading pointed to the slowest

expansion in the services sector since August 2016.

Economists

forecast the index to decrease to 55.1 last month. A reading above 50 signals

expansion, while a reading below 50 indicates contraction.

The 13

non-manufacturing industries reported growth last month, the ISM said, adding

that respondents were mostly concerned about tariffs, labor resources and the

direction of the economy.

According to

the report, the ISM’s non-manufacturing business activity measure fell to 55.2

percent, 6.3 percentage points lower than the August reading of 61.5 percent. That

reflected growth for the 122nd consecutive month, at a slower rate in August.

The new orders gauge dropped to 53.7 percent, down 6.6 percentage points from

the reading of 60.3 percent in August. The Employment indicator decreased 2.7

percentage points in September to 50.4 percent from the August reading of 53.1

percent. Meanwhile, the Prices Index rose 1.8 percentage points from the August

reading of 58.2 percent to 60 percent, indicating that prices increased in

September for the 28th consecutive month.

Robert Rennie, an analyst at Westpac, believes that over the last three weeks we have seen some very clear indications that the BoJ is gearing up for some potentially significant announcements at the October 30/31 meeting.

- “The most obvious of these of course was the Sep 19 MPC statement which noted that “Bank will re-examine economic and price developments at the next MPM”.

- Over and above this, recent action from the BoJ to cut the 25yr+ purchases to 0-50bn (versus 10- 100) and 50-200bn (versus 100-250bn) for 10- 25yr emphasises that the BoJ really is willing to put its money where its mouth is.

- While this has much to do with trying to steepen the yield curve, various speakers including Kuroda and Funo have suggested that a number of options are open for discussion at the “very important meeting” at the end of the month.

- We maintain our negative medium-term view for USD/JPY, but given recent price action and risks surrounding US-China trade talks and US-Europe ‘trade discussions’ over the next few weeks, we would tend to use strength above 108.50 as an opportunity to sell.”

Imre Speizer, an analyst at Westpac, suggests that NZD/USD remains in a multi-month downtrend, the next major downside target being 0.6130 (which was the 2015 low).

- “Multi-month, there’s potential for even lower. Near term it’s looking increasingly stretched, a corrective bounce due.

- While US dollar strength remains the main driver of NZD/USD, NZ fundamentals are also weighing. The NZIER business confidence survey was weak across the board, and it’s a survey the RBNZ watches closely. It signals a further slowdown in NZ GDP growth, our forecasts for Q3 and Q4 being 0.4% and 0.5%, which would take the annual pace down to 2.0%.

- NZD markets have clearly been spooked by the weak business confidence survey (as well as global growth concerns). Pricing for the 13 Nov meeting is now at 27bp, i.e. some chance of a 50bp cut.”

U.S. stock-index futures traded flat on Thursday, as investors awaited the release of ISM Services PMI later in the day.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,341.74 | -436.87 | -2.01% |

Hang Seng | 26,110.31 | +67.62 | +0.26% |

Shanghai | - | - | - |

S&P/ASX | 6,493.00 | -146.90 | -2.21% |

FTSE | 7,045.95 | -76.59 | -1.08% |

CAC | 5,442.79 | +20.02 | +0.37% |

DAX | - | - | - |

Crude oil | $52.50 | -0.27% | |

Gold | $1,506.40 | -0.10% |

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC. | MO | 40.16 | -0.05(-0.12%) | 4316 |

Amazon.com Inc., NASDAQ | AMZN | 1,712.00 | -1.23(-0.07%) | 6491 |

Apple Inc. | AAPL | 218.26 | -0.70(-0.32%) | 118522 |

AT&T Inc | T | 37.05 | -0.03(-0.08%) | 22267 |

Boeing Co | BA | 366.6 | -0.76(-0.21%) | 4802 |

Caterpillar Inc | CAT | 119.75 | -0.21(-0.18%) | 1307 |

Chevron Corp | CVX | 112 | -0.29(-0.26%) | 2323 |

Cisco Systems Inc | CSCO | 46.1 | -0.11(-0.24%) | 12268 |

Citigroup Inc., NYSE | C | 66 | -0.26(-0.39%) | 4058 |

Deere & Company, NYSE | DE | 163 | -0.25(-0.15%) | 200 |

Exxon Mobil Corp | XOM | 67.11 | -0.04(-0.06%) | 8784 |

Facebook, Inc. | FB | 174.65 | 0.05(0.03%) | 21094 |

FedEx Corporation, NYSE | FDX | 141.1 | 0.32(0.23%) | 728 |

Ford Motor Co. | F | 8.58 | -0.03(-0.35%) | 29194 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 8.81 | -0.06(-0.68%) | 29338 |

General Electric Co | GE | 8.5 | -0.01(-0.12%) | 104111 |

General Motors Company, NYSE | GM | 34.46 | -0.22(-0.63%) | 2518 |

Goldman Sachs | GS | 198 | -0.25(-0.13%) | 1199 |

Google Inc. | GOOG | 1,178.00 | 1.37(0.12%) | 2656 |

Home Depot Inc | HD | 225.3 | -0.25(-0.11%) | 818 |

Intel Corp | INTC | 49.21 | -0.18(-0.36%) | 2977 |

JPMorgan Chase and Co | JPM | 112.07 | -0.28(-0.25%) | 7356 |

McDonald's Corp | MCD | 206.3 | 0.03(0.01%) | 937 |

Microsoft Corp | MSFT | 134.39 | -0.26(-0.19%) | 46021 |

Nike | NKE | 91.55 | 0.06(0.07%) | 600 |

Pfizer Inc | PFE | 34.73 | 0.03(0.09%) | 2829 |

Starbucks Corporation, NASDAQ | SBUX | 84.1 | -0.22(-0.26%) | 1313 |

Tesla Motors, Inc., NASDAQ | TSLA | 231.38 | -11.75(-4.83%) | 205095 |

The Coca-Cola Co | KO | 53.16 | 0.08(0.15%) | 7043 |

Twitter, Inc., NYSE | TWTR | 39.56 | -0.14(-0.35%) | 46783 |

United Technologies Corp | UTX | 131 | 0.53(0.41%) | 904 |

Verizon Communications Inc | VZ | 58.98 | 0.07(0.12%) | 1640 |

Wal-Mart Stores Inc | WMT | 115.99 | -0.13(-0.11%) | 1506 |

Walt Disney Co | DIS | 129.13 | -0.01(-0.01%) | 3364 |

Yandex N.V., NASDAQ | YNDX | 34.2 | 0.17(0.50%) | 14192 |

Lyft (LYFT) initiated with a Neutral at MKM Partners; target $45

Uber (UBER) initiated with a Neutral at MKM Partners; target $32

Tesla (TSLA) downgraded to Mkt Perform from Mkt Outperform at JMP Securities

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment benefits increased slightly last week, pointing to sustained labor

market strength.

According to

the report, the initial claims for unemployment benefits rose by 4,000 to a

seasonally adjusted 219,000 for the week ended September 28.

Economists had

expected 215,000 new claims last week.

Claims for the

prior week were revised upwardly to 215,000 from the initial estimate of 213,000.

Meanwhile, the

four-week moving average of claims was unchanged at 212,500 last week.

Analysts at TD Securities note that the U.S. ADP employment data for September largely met estimates, posting a 135k gain versus consensus expectations at 140k.

- “Last month's number was revised lower, which was expected given it overstated the private employment gains in the August payrolls report. In the details, employment in the goods-producing sector rose by 8k in September, while service sector jobs increased by 127k.

- All in, the ADP report supports our and the market's view of a ~150k gain in payrolls for September (out Friday).”

- PM expects to speak to EU's Tusk later today

Analysts at Danske Bank note that the U.S. equities had a rough run on Wednesday after a somewhat weak ADP report spurred fears that the otherwise resilient-looking U.S. consumer is starting to be hit by the global industrial slowdown.

- “ADP employment on the headline came close to expectations at 135K vs consensus 140K but the previous month was revised down to 157K from 195K and thus on balance left the impression of weakening.

- The correlation of ADF to the all-important non-farm payrolls report from month to month is not high, but note that we have a below-consensus call of 100K on the latter for tomorrow. Then signs of a softening labour market will be key for the Fed, as comfort has so far been taken from U.S. private consumption holding up well amid the manufacturing slump on the back of trade woes.”

Analysts at TD Securities are expecting the U.S. ISM non-manufacturing index to drop modestly to 55.1 in September after a notable 2.7 gain to 56.4 in August.

- “This would come on the heels of a sharply lower ISM manufacturing print for September that dragged the index deeper into contractionary territory and would suggest the services sector remains largely healthy despite the worsening outlook for the industrial sector.”

Richard Franulovich, the head of FX strategy at Westpac, believes that, despite a notable marking up of U.S. recession and political risks, sustained USD downside (ex-JPY) remains elusive.

- “Short term DXY weakness likely limited to the base of the 3mth uptrend channel 98.0-98.50.

- A more sustained USD decline would require the Fed ditching their “mid-cycle adjustment” in favour of a more protracted easing cycle. Several Fed officials have said they are not even inclined to cut rates again, though to be fair their calculations will evolve with the incoming data and progress on US-China trade talks.

- A genuine turnaround in Eurozone growth fortunes would also usher in a bout of USD weakness but we are not holding our breath; there’s no end in sight for Brexit and trade uncertainty is likely to linger for many months.

- Impeachment is not a genuine risk for the USD – almost ½ the Senate Republican conference would need to join all 47 Democrat senators to deliver the 67 votes for a conviction; a tall order. Though, the USD will be marked lower if Trump’s re-election odds are battered.”

Analysts at TD Securities note that the UK services PMI declined from 50.6 to 49.5 in September, unexpectedly falling into contraction territory.

- “And like its manufacturing and construction counterparts earlier in the week, the survey noted the fastest rate of job shedding in the services sector since August 2010. The Markit report also "provided evidence that international clients had switched business to other markets amid increased concerns around a potential no-deal Brexit.

- The report mentions that the poor PMI data "push the surveys further into territory that would normally be associated with policy stimulus from the Bank of England," something that we agree with, and we'll be watching comments from MPC members particularly closely over the rest of the month, to see how many of them may be thinking more seriously about rate cuts in the near-term.”

- Welcomes statement from Juncker that EU will examine UK proposals objectively

- Says these proposals don't deliver everything

- Can be no path to a deal except through replacing the backstop

- We are some way from a resolution

- I have given a guarantee that the UK will never conduct checks at the Irish border

- We are ready to leave on October 31st with no deal

Analysts at UOB Group suggest at their Quarterly Global Outlook the RBNZ to refrain from acting on rates for the remainder of the year.

- “The RBNZ delivered a more-aggressive interest rate cut in August, slashing its OCR by 50bps to 1.00%. We had thought the RBNZ would prefer more time to evaluate the impact of the first rate cut in May, and wait out for further developments on the economic front.

- Nonetheless, we see August’s bigger-than-expected move as pre-emptive in nature and the RBNZ is likely to wait it out before considering further cuts in interest rates again. For now, we are keeping our year-end OCR forecast unchanged at 1.00%.

- But just like the RBA, developments in the global backdrop will have important implications on the timing and extent of further easing”.

- Main risk to U.S. economy is struggling manufacturing sector

- Two recent rate cuts were appropriate, but will be open-minded in case adjustment is needed

- Focused on getting a deal

- These are serious proposals (UK PM's submitted plan from yesterday)

- Need to negotiate with the EU on taking these proposals forward

- if there was no deal, checks would have to be put in place by the government

- Delay to Brexit might require the consent of all EU members

Gold prices could surge by about 30% to as high as $2,000 per ounce next year, according to David Roche, president and global strategist at Independent Strategy.

“What my gut says is that cause of the vilification of fiat currencies by central bankers, which is set to get worse — not better, people will look for an alternative currency,” Roche told CNBC.

“Gold is a good alternative currency because it’s safe, and because it costs nothing to own it compared to paying negative rates on deposits,” Roche said.

As a result, gold prices will likely touch $1,600 before the end of this year, before moving higher to $2,000 next year, he said.

Roche’s comments come amid policy moves at major central banks in the past month.

Roche said central banks are now “quite rightly worried” about the next downturn after failing to achieve their inflation targets.

France and the European Union (EU) are ready to respond “with sanctions” if the United States were to reject the hand extended by Europe in the Airbus (AIR.PA) trade dispute, said French Finance Minister Bruno Le Maire said.

“If the American administration rejects the hand that has been held out by France and the European Union, we are preparing ourselves to react with sanctions,” said Le Maire.

The United States on Wednesday said it would slap 10% tariffs on European-made Airbus planes and 25% duties on French wine, Scotch and Irish whiskies, and cheese from across the continent as punishment for illegal EU aircraft subsidies.

In view of analysts at ANZ, the recent decline in the US ISM survey has focussed the market on US economic risks, with recession talk once again rising.

“In recent trading sessions this has also led to a broad under-performance of the USD, with currencies like the AUD managing to hold stable despite the recessionary fears pushing US equities lower. We do not think that this is a sustainable reason to get bearish on the USD. Indeed, we have found that the relative performance of the US industrial sector has been a poor predictor of the direction of the USD. Rather, the overall level of global growth, is the better predictor of the performance of the USD. We do not think that the recent shift is a harbinger for a period of more sustained under-performance of the USD, particularly against the more cyclical currencies. For that to manifest we would need to see more sure signs of a recovery in global growth, particularly outside the US.”

According to estimates from Eurostat, in August 2019 compared with July 2019, the seasonally adjusted volume of retail trade increased by 0.3% in the euro area (EA19) and by 0.2% in the EU28. In July 2019, the retail trade volume fell by 0.5% in the euro area and by 0.4% in the EU28.

In August 2019 compared with August 2018, the calendar adjusted retail sales index increased by 2.1% in the euro area and by 2.5% in the EU28. Economists had expected a 1.9% increase in the euro area.

In the euro area in August 2019, compared with July 2019, the volume of retail trade increased by 0.4% for nonfood products and by 0.1% for automotive fuels, while food, drinks and tobacco remained unchanged. In the EU28, the retail trade volume increased by 0.3% for non-food products, by 0.2% for automotive fuels, and by 0.1% for food, drinks and tobacco.

In the euro area in August 2019, compared with August 2018, the volume of retail trade increased by 4.1% for nonfood products, by 2.1% for automotive fuel and by 0.4% for food, drinks and tobacco. In the EU28, the retail trade volume increased by 4.2% for non-food products, by 3.0% for automotive fuel, and by 0.7% for food, drinks and tobacco.

A separate report from Eurostat showed, in August 2019, compared with July 2019, industrial producer prices fell by 0.5% in the euro area (EA19) and by 0.4% in the EU28. In July 2019, prices increased by 0.1% in the euro area and by 0.2% in the EU28. In August 2019, compared with August 2018, industrial producer prices fell by 0.8% in the euro area and by 0.3% in the EU28.

The latest IHS Markit / CIPS PMI data for the UK service sector signalled a contraction in activity in September, and the biggest cut in employment in over nine years. With both new and outstanding business declining at the end of the third quarter, companies were the least optimistic of future growth of activity since July 2016 following the EU referendum.

The seasonally adjusted UK Services PMI Business Activity Index fell to 49.5 in September, from 50.6 in August, signalling a decline in service sector output. Though indicative of only a marginal rate of reduction, it was only the fifth time in over a decade that the headline index has fallen below the no-change threshold of 50.0.

The overall reduction in service sector output reflected lower volumes of both new and outstanding business. New contracts fell for the sixth time in 2019 so far, albeit only marginally, while backlogs declined for the twelfth successive month and at the fastest rate since January. Firms reported that heightened uncertainty around Brexit had led to the postponement of orders by clients.

Business expectations weakened for the fourth month running in September, the most sustained slide in sentiment since the second half of 2015. The Future Activity Index remained above 50.0 but was the lowest since July 2016, and the second-lowest since March 2009.

According to the report from IHS Markit, the Eurozone PMI Composite Output Index fell in September to a level only slightly above the crucial 50.0 no-change mark. After accounting for seasonal factors, the index recorded 50.1, down from 51.9 (and lower than the earlier flash reading of 50.4). September’s figure was the lowest since June 2013 and signalled a broad stagnation of the private sector economy at the end of the third quarter of 2019.

Weakness remained centred on the manufacturing economy. Latest data showed that the goods producing sector experienced its sharpest fall in output for nearly seven years. In contrast, services experienced a further uplift in activity. However, the rate of growth was modest and the weakest since the start of the year.

September’s Eurozone PMI Services Business Activity Index indicated a notable slowdown in service sector growth. Posting 51.6, down from 53.5 in the previous month, the index signalled the weakest increase in activity since the start of 2019. New business volumes also rose at a slower rate during September, increasing only marginally as demand faltered, especially from foreign clients. Companies were subsequently able to keep on top of workloads, with backlogs of work falling for a second successive month. Firms continued to recruit additional staff, although the rate of growth softened to an eight-month low. Finally, confidence about the year ahead was stronger than in August, but nonetheless remained historically weak and amongst the lowest in the past five years.

According to Karen Jones, analyst at Commerzbank, GBP/USD is finding near term support at the 61.8% retracement at 1.2196.

“Further minor support sits between the early and mid-August lows at 1.2080/15 and major support lies at the 1.1958 current September low. It is not clear cut and we have conflicting signals but we suspect that we will see a deeper near term rally. Intraday rallies are likely to remain capped by 1.2350/85 and further up strong resistance between the seven month resistance line, 200 day ma and the June high at 1.2633/1.2784 caps the market. A slip through the 1.1958 recent low would put the 1.1491 October 2016 low (according to CQG) on the cards.”

Danske Bank analysts point out that PMI services from around the world and US ISM non-manufacturing are due out today.

“In particular, the US ISM non-manufacturing index will be interesting given the sharp fall in the ISM manufacturing index, which caused a repricing by the Fed. ISM non-manufacturing has been robust so far but the risk is the manufacturing recession spreads to the service sector. Also look out for the ISM non-manufacturing employment sub-index ahead of US non-farm payrolls tomorrow. We also have a range of FOMC members speaking, where hints of whether the Fed will ease again later this month or not remain key for market sentiment.”

U.K. Prime Minister Boris Johnson’s latest proposal to take his country out of the European Union would divide Ireland and therefore “is unlikely to work,” a strategist said on Thursday.

The U.K. currently has until Oct. 31 to leave the EU — with or without a deal. That deadline has been pushed back multiple times. One major sticking point in the Brexit process is the so-called Irish backstop. May’s deal had sought to ensure there’s no hard border between the U.K.’s Northern Island and EU member Republic of Ireland. But avoiding customs checks there would bind Britain to the bloc’s trade rules — a point that Brexit supporters had opposed. Johnson’s proposal, meanwhile, includes an “all-island regulatory zone on the island of Ireland” that would involve customs checks that could be carried out away from the border at “other points on the supply chain.”

“I’m not saying it’s a complete sham because it moved forward on one particular point ... Boris did widen the scope, but the actual ins and outs of it are unlikely to work,” David Roche, president and global strategist at Independent Strategy, told CNBC.

“He wouldn’t put customs posts at the border but he would put customs clearance areas close to the border — what’s the difference?” asked Roche. “If you start putting customs posts on the border in Ireland, you’d have divided Ireland. And that’s a great big no-no for the EU and therefore, not going to happen.”

Chicago Fed President Charles Evans responded to the media questions on the recent disappointment in the US ISM Manufacturing PMI.

See's it is an important data point and doesn't think the market has necessarily overreacted.

Fed is 'open minded' about the next Fed rate meeting.

ISM is only one number.

Rate cuts are risk management.

Concerned about inflation outlook.

New car sales in Australia fell for the 18th consecutive month in September, suggesting back-to-back interest rate cuts in June and July had failed to lift consumer spending as banks contain their lending.

Data released by the Federal Chamber of Automotive Industries (FCAI) on Thursday showed total sales for September skidded nearly 7% to 88,181 vehicles from a year earlier. For January-September were down about 8% from the same period in 2018.

The weak data will disappoint the Reserve Bank of Australia (RBA), which cut interest rates for a third time this year on Tuesday to a record low of 0.75% in an effort to revive employment growth, consumer spending and inflation.

In a statement, FCAI chief executive Tony Weber said slower car sales are “in line with the broader economic environment in Australia” while also noting stringent lending standards as a factor.

“Of particular concern to the industry is the restrictive regulatory lending conditions currently facing consumers,” he said.

Weber also said sales figures raise the question of whether “we have made it too difficult for people to finance basic purchases”.

Annual loan growth in Australia fell to an eight-year low of 2.9% in August and total credit card debt was the lowest level in nine years.

Bank of Japan board member Yukitoshi Funo warned against intensifying economic pressure from slowing global growth, and reiterated the central bank's readiness to respond to the broadening hazards.

Funo repeated the BOJ's view in July that it would act "without hesitation" if risks to achieving its 2% inflation target grew. Market expectations of imminent easing grew after the BOJ pledged in July to act preemptively.

"For additional easing measures, various possibilities exist such as cutting short-term and long-term interest rates, boosting asset purchases and accelerating base money expansion," Funo said.

"We are facing a situation where we need to pay more attention than before to the risk that the momentum towards the price stability target will be undermined," Funo said.

"With that situation in mind, we will reexamine economic and price trends at the next policy setting meeting," he added.

Funo flagged rising risks from overseas, such as U.S. economic policy and its impact on global markets, the Sino-U.S. trade war, Brexit, and geopolitical risks. "In particular, protectionist moves are fuelling uncertainty. As the global economy remains unstable, attention must be paid to these risks and their effects on Japanese business and households' sentiment," Funo said.

The World Trade Organization has just authorized the U.S. to go ahead with its tariffs worth billions of dollars on the European Union — that’s “a big deal” that would hopefully bring both sides to the negotiating table, said a former high-ranking trade official under President Donald Trump.

But Washington and Brussels have not achieved much in their past trade negotiations, so the U.S. tariffs on $7.5 billion of European goods could stay in place for many months, said Clete Willems, who was deputy director of the National Economic Council, told CNBC.

“It’s a big deal: $7.5 billion is the largest retaliation number that the WTO has ever authorized. So, it’s a big victory for the United States,” said Willems.

“At the end of the day, what they’d like to do is use these tariffs for leverage to get a negotiated outcome,” he said. “But I do think that the two sides haven’t worked together particularly well when it comes to trade negotiations lately and it may take some time for them to work through these issues ... so you are going to see these tariffs in place for some period of months.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.1103 (2752)

$1.1059 (1865)

$1.1030 (1877)

Price at time of writing this review: $1.0955

Support levels (open interest**, contracts):

$1.0899 (2133)

$1.0849 (2002)

$1.0800 (542)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date October, 4 is 90755 contracts (according to data from October, 2) with the maximum number of contracts with strike price $1,1100 (4450);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2459 (848)

$1.2418 (1181)

$1.2385 (929)

Price at time of writing this review: $1.2296

Support levels (open interest**, contracts):

$1.2237 (1037)

$1.2193 (1177)

$1.2147 (1153)

Comments:

- Overall open interest on the CALL options with the expiration date October, 4 is 18001 contracts, with the maximum number of contracts with strike price $1,2500 (1744);

- Overall open interest on the PUT options with the expiration date October, 4 is 20079 contracts, with the maximum number of contracts with strike price $1,1900 (1315);

- The ratio of PUT/CALL was 1.12 versus 1.14 from the previous trading day according to data from October, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 57.25 | -3 |

| WTI | 52.32 | -2.84 |

| Silver | 17.54 | 1.86 |

| Gold | 1499.759 | 1.38 |

| Palladium | 1686.06 | 1.97 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -106.63 | 21778.61 | -0.49 |

| Hang Seng | -49.58 | 26042.69 | -0.19 |

| KOSPI | -40.51 | 2031.91 | -1.95 |

| ASX 200 | -102.9 | 6639.9 | -1.53 |

| FTSE 100 | -237.78 | 7122.54 | -3.23 |

| DAX | -338.58 | 11925.25 | -2.76 |

| Dow Jones | -494.42 | 26078.62 | -1.86 |

| S&P 500 | -52.64 | 2887.61 | -1.79 |

| NASDAQ Composite | -123.43 | 7785.25 | -1.56 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67045 | 0.05 |

| EURJPY | 117.441 | -0.29 |

| EURUSD | 1.096 | 0.28 |

| GBPJPY | 131.744 | -0.51 |

| GBPUSD | 1.22938 | 0.04 |

| NZDUSD | 0.6269 | 0.5 |

| USDCAD | 1.33253 | 0.8 |

| USDCHF | 0.99696 | 0.41 |

| USDJPY | 107.149 | -0.56 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.