- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Retail Sales, M/M | May | -0.1% | 0.2% |

| 06:30 | Switzerland | Consumer Price Index (MoM) | June | 0.3% | -0.1% |

| 06:30 | Switzerland | Consumer Price Index (YoY) | June | 0.6% | 0.5% |

| 09:00 | Eurozone | Retail Sales (YoY) | May | 1.5% | 1.6% |

| 09:00 | Eurozone | Retail Sales (MoM) | May | -0.4% | 0.3% |

| 22:30 | Australia | AiG Performance of Construction Index | June | 40.4 | |

| 23:30 | Japan | Household spending Y/Y | May | 1.3% | 1.6% |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Retail Sales, M/M | May | -0.1% | 0.2% |

| 06:30 | Switzerland | Consumer Price Index (MoM) | June | 0.3% | -0.1% |

| 06:30 | Switzerland | Consumer Price Index (YoY) | June | 0.6% | 0.5% |

| 09:00 | Eurozone | Retail Sales (YoY) | May | 1.5% | 1.6% |

| 09:00 | Eurozone | Retail Sales (MoM) | May | -0.4% | 0.3% |

| 22:30 | Australia | AiG Performance of Construction Index | June | 40.4 | |

| 23:30 | Japan | Household spending Y/Y | May | 1.3% | 1.6% |

Nordea Markets' analysts believe that the next ECB President will most likely be Christine Lagarde, the French IMF Managing Director.

- “It was expected that the nationality of a candidate played a more important role in the nomination this time than in the previous rounds because the ECB nomination took place at the same time as the other high-level nominations in the EU and Germany and France were expected to have a top-level post each.

- Ms. Lagarde was on the list of candidates, but not among the favorites. After the question on the gender-balance was brought to the table, Lagarde’s nomination should not be a big surprise after all.

- We do not know much about Lagarde’s views on monetary policy. She’s a lawyer and many analysts expect her to rely very much on the analysis that the Eurosystem staff will provide. The system of collective decision-making at the ECB Governing Council further strengthens the view that Lagarde will probably not change the general line of the ECB at the first meetings, at least if economic surprises remain small.

- Lagarde’s nomination does not change our view on the future steps of the ECB. This means that we expect the ECB to add stimulus in September when Draghi is still in place and to be ready to do more if needed soon after Lagarde has taken over.

- The fact that not much is known about Lagarde’s views on monetary policy implies that the markets will be extremely careful in analyzing her comments in the coming months.”

The U.S. Energy

Information Administration (EIA) revealed on Wednesday that crude inventories

declined by 1.085 million barrels in the week ended June 28. Economists had

forecast a fall of 3.000 million barrels.

At the same

time, gasoline stocks decreased by 1.583 million barrels, while analysts had

expected a drop of 2.400 million barrels. Distillate stocks rose by 1.408

million barrels, while analysts had forecast a decline of 1.250 million

barrels.

Meanwhile, oil

production in the U.S. increased by 100,000 barrels a day to 12.200 million

barrels a day.

U.S. crude oil averaged

7.6 million barrels per day last week, up by 929,000 barrels per day from the

previous week.

The U.S.

Commerce Department reported on Wednesday that the value of new factory orders

decreased 0.7 percent m-o-m in May, following a revised 1.2 percent decline in April

(originally a 0.8 percent m-o-m drop).

Economists had

forecast a 0.5 percent m-o-m drop.

According to

the report, orders for transportation equipment fell 4.6 percent m-o-m in May

after plunging 7.6 percent m-o-m in April, while orders for computers and

electronic products and machinery increased.

Meanwhile, total

factory orders excluding transportation, a volatile part of the overall

reading, edged up 0.1 percent m-o-m in May (compared to a 0.2 percent m-o-m

advance in April), while orders for nondefense capital goods excluding

aircraft, a measure of business spending plans, increased 0.5 percent m-o-m

(compared to a 1.1 percent m-o-m decline in April). The report also showed that

shipments of core capital goods climbed 0.6 percent m-o-m in May, following an advance of 0.4 percent m-o-m in April.

In y-o-y terms,

factory orders increased 1.6 percent in May.

U.S.

non-manufacturing sector’s growth decelerates more than expected in June - ISM

The Institute

for Supply Management (ISM) reported on Wednesday its non-manufacturing index

(NMI) came in at 55.1 in June, which was 1.8 percentage points lower than the May

reading of 56.9 percent. The June reading pointed to the slowest expansion in

the services sector since July 2017.

Economists

forecast the index to fall to 55.9 last month. A reading above 50 signals

expansion, while a reading below 50 indicates contraction.

Of the 18

manufacturing industries, 16 reported growth last month, the ISM said.

According to

the report, the ISM’s non-manufacturing business activity measure fell to 58.2

percent, 3.0 percentage points lower than the May reading of 61.2 percent. That

reflected growth for the 119th consecutive month, at a slower rate in June. The

new orders gauge decreased to 55.8 percent, 2.8 percentage points lower than

the reading of 58.6 percent in May. The employment indicator declined 3.1

percentage points in June to 55 percent from the May reading of 58.1 percent.

Meanwhile, the Prices Index rose 3.5 percentage points from the May reading of

55.4 percent to 58.9 percent, indicating that prices increased in June for the

25th consecutive month.

Commenting on

the data, the Chair of the ISM Non-Manufacturing Business Survey Committee,

Anthony Nieves, noted, "The past relationship between the NMI and the

overall economy indicates that the NMI for June (55.1 percent) corresponds to a

2.3-percent increase in real gross domestic product (GDP) on an annualized

basis.”

- The meeting to happen soon

Statistics

Canada announced on Wednesday that Canada’s merchandise trade balance came in

at a surplus of a CAD0.76 billion in May, compared to a revised deficit of CAD1.08

billion in April (originally a CAD0.97-billion deficit). That was the second

trade surplus since December 2016,

Economists had

expected a deficit of CAD1.50 billion.

According to

the report, the country’s exports increased 4.6 percent m-o-m in May, due

mainly to higher exports of motor vehicles and parts (+12.4 percent m-o-m),

aircraft and other transportation equipment and parts (+33.0 percent m-o-m),

and energy products (+5.0 percent m-o-m).

Meanwhile,

imports rose 1.0 percent m-o-m in May, mostly on higher imports of aircraft and

other transportation equipment and parts (+14.2 percent m-o-m), as well as

motor vehicle engines and motor vehicle parts (+9.2 percent m-o-m).

U.S. stock-index futures rose moderately on Wednesday, as bond yields fell on worries of a global recession and expectations of monetary easing by central banks.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,638.16 | -116.11 | -0.53% |

Hang Seng | 28,855.14 | -20.42 | -0.07% |

Shanghai | 3,015.26 | -28.68 | -0.94% |

S&P/ASX | 6,685.50 | +32.30 | +0.49% |

FTSE | 7,609.46 | +50.27 | +0.67% |

CAC | 5,610.90 | +34.08 | +0.61% |

DAX | 12,599.50 | +72.78 | +0.58% |

Crude oil | $56.67 | +0.75% | |

Gold | $1,420.50 | +0.89% |

The U.S.

Commerce Department reported on Wednesday U.S. the goods and services trade

deficit widened to $55.5 billion in May from a revised $51.2 billion in the

previous month (originally a gap of $50.8 billion).

Economists had

expected a deficit of $54.0 billion.

According to

the report, the May increase in the goods and services deficit reflected an

increase in the goods deficit of $4.4 billion to $76.1 billion and an increase

in the services surplus of $0.1 billion to $20.6 billion.

Exports of

goods and services from the U.S. rose 2.0 percent m-o-m to $210.6 billion in May,

while imports surged 3.3 percent m-o-m to $266.2 billion.

Year-to-date,

the goods and services deficit rose $15.7 billion, or 6.4 percent, from the

same period in 2018. Exports increased $5.1 billion, or 0.5 percent, while imports

grew $20.8 billion, or 1.6 percent.

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC. | MO | 48.65 | 0.05(0.10%) | 3792 |

Amazon.com Inc., NASDAQ | AMZN | 1,935.00 | 0.69(0.04%) | 23451 |

American Express Co | AXP | 125.28 | 0.57(0.46%) | 759 |

AMERICAN INTERNATIONAL GROUP | AIG | 54.28 | 0.49(0.91%) | 357 |

Apple Inc. | AAPL | 203.4 | 0.67(0.33%) | 60047 |

AT&T Inc | T | 33.94 | 0.10(0.30%) | 65244 |

Boeing Co | BA | 354.3 | 0.14(0.04%) | 8273 |

Caterpillar Inc | CAT | 136.06 | 0.21(0.15%) | 1352 |

Cisco Systems Inc | CSCO | 55.85 | 0.39(0.70%) | 16322 |

Citigroup Inc., NYSE | C | 70.5 | 0.06(0.09%) | 1206 |

Deere & Company, NYSE | DE | 164.15 | -0.98(-0.59%) | 100 |

Exxon Mobil Corp | XOM | 75.78 | 0.06(0.08%) | 404 |

Facebook, Inc. | FB | 194.17 | -0.83(-0.43%) | 90171 |

FedEx Corporation, NYSE | FDX | 160.5 | 0.71(0.44%) | 308 |

Ford Motor Co. | F | 10.1 | -0.02(-0.20%) | 40239 |

General Electric Co | GE | 10.63 | 0.01(0.09%) | 38967 |

General Motors Company, NYSE | GM | 38.5 | 0.16(0.42%) | 2979 |

Goldman Sachs | GS | 206.99 | 1.01(0.49%) | 5477 |

Google Inc. | GOOG | 1,112.14 | 0.89(0.08%) | 982 |

Intel Corp | INTC | 48.3 | 0.18(0.37%) | 19361 |

International Business Machines Co... | IBM | 140.95 | 0.73(0.52%) | 975 |

International Paper Company | IP | 43.5 | -0.27(-0.62%) | 1218 |

Johnson & Johnson | JNJ | 140.59 | 0.56(0.40%) | 1220 |

JPMorgan Chase and Co | JPM | 113.15 | 0.15(0.13%) | 9848 |

McDonald's Corp | MCD | 209.84 | 0.26(0.12%) | 2903 |

Merck & Co Inc | MRK | 85.94 | 0.43(0.50%) | 588 |

Microsoft Corp | MSFT | 136.9 | 0.32(0.23%) | 43360 |

Nike | NKE | 85.2 | 0.24(0.28%) | 3177 |

Pfizer Inc | PFE | 44.28 | 0.06(0.14%) | 1295 |

Starbucks Corporation, NASDAQ | SBUX | 85.96 | 0.45(0.53%) | 3101 |

Tesla Motors, Inc., NASDAQ | TSLA | 239.5 | 14.95(6.66%) | 392253 |

The Coca-Cola Co | KO | 52.04 | 0.06(0.12%) | 521 |

Twitter, Inc., NYSE | TWTR | 36.29 | 0.07(0.19%) | 19083 |

Verizon Communications Inc | VZ | 58.12 | -0.01(-0.02%) | 5428 |

Visa | V | 175.81 | 0.53(0.30%) | 4309 |

Wal-Mart Stores Inc | WMT | 110.84 | -0.76(-0.68%) | 4818 |

Walt Disney Co | DIS | 142.86 | 0.33(0.23%) | 7392 |

Yandex N.V., NASDAQ | YNDX | 39.55 | -0.14(-0.35%) | 4255 |

The data from the Labor Department revealed on Wednesday the number of applications for unemployment benefits fell more than expected last week, pointing to sustained labor market strength.

According to the report, the initial claims for unemployment benefits decreased 8,000 to a seasonally adjusted 221,000 for the week ended June 29.

Economists had expected 223,000 new claims last week.

Claims for the prior week were revised upwardly to 229,000 from the initial estimate of 227,000.

Meanwhile, the four-week moving average of claims increased 500 to 222,250 last week.

The employment

report prepared by Automatic Data Processing Inc. (ADP) and Moody's Analytics

showed on Wednesday the U.S. private employers added 102,000 jobs in June.

Economists had

expected a gain of 140,000.

The increase

for May was revised up to 41,000 from the originally reported 27,000.

“Job growth

started to show signs of a slowdown,” said Ahu Yildirmaz, vice president and

co-head of the ADP Research Institute. “While large businesses continue to do

well, small businesses are struggling as they compete with the ongoing tight

labor market. The goods-producing sector continues to show weakness. Among

services, leisure and hospitality’s weakness could be a reflection of consumer confidence.”

Meanwhile, Mark

Zandi, chief economist of Moody’s Analytics, said, “The job market continues to

throttle back. Job growth has slowed sharply in recent months, as businesses

have turned more cautious in their hiring. Small businesses are the most

nervous, especially in the construction sector and at bricks-and-mortar retailers.”

Analysts at TD Securities note that the UK’s services PMI declined from 51.0 in May to 50.2 in June, joining the manufacturing and construction PMIs in coming in weaker than conesnsus.

- “Markit noted that the fall in the PMIs is consistent with a contraction of -0.1% q/q for Q2 GDP, which is just a touch stronger than our negative forecast.”

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. edged down 0.1 percent in the week ended June 28, following a 1.3

percent rise in the previous week.

According to

the report, refinance applications dropped 1.2 percent, while applications to

purchase a home climbed 1.1 percent.

Meanwhile, the

average fixed 30-year mortgage rate increased to 4.07 percent from 4.06

percent.

“In a week of

mixed mortgage rate movements across the various loan types, the 30-year fixed

rate finished slightly higher than last week, but was still close to lows last

seen in 2016,” said Joel Kan, an MBA economist.

“A still-strong

job market, improving affordability and lower mortgage rates continue to

support growth,” added Kan.

Analysts at Danske Bank, note the main takeaways from the meeting of Sweden's central bank (Riksbank; RB) was that there is no change to the repo rate path vs. April where a reduction was expected.

- “No change to QE, in line with expectations. No reservations to the decision. Very small changes to the macro forecast, both growth and inflation. In essence, a "wait and see"-meeting.

- Our take: The Swedish economy is described as strong with resource utilization still higher than normal. Riksbank acknowledges that global risks appear to have intensified but this has not been incorporated in the KIX-weighted policy rate forecast (ECB, Fed, BoE and Bank of Norway). That is slightly reduced but sees higher rates in 2021.

- Though the RB remains open to the idea that the trajectory for the repo rate may need to be altered if the outlook for inflation changes, the fact that the RB chose not to adjust their repo rate forecast is no doubt bearish.”

James Smith, a developed market economist at ING, notes the latest UK services PMI came in at 50.2, indicating that the sector barely grew in June and completing a fairly woeful set of PMI releases.

- "First and foremost, this emphasizes that second-quarter growth is likely to come in more-or-less flat. Admittedly most of the drag is likely to come from production, which has fallen back in the aftermath of a stockpiling frenzy earlier in the year. But once the noise surrounding inventories begins to fade, the fact that new orders have ground to a halt in the service sector suggests that underlying economic momentum is unlikely to increase imminently. Attention within firms will also be increasingly turning back to contingency planning for a possible ‘no deal’ Brexit in October, which is often a costly exercise and will inevitably draw some resources away from possible investment projects.

- This means that capital spending is likely to resume its downward trend over the summer (first quarter investment rose, although according to Bank of England Governor Mark Carney, this is down to a change in recording methods).

- If there was one glimmer of light for the BoE in this latest PMI though, it is that employment has regained momentum in the service sector. We suspect this is related to the recent Article 50 extension, which may have provided the impetus to unlock some shorter-term hiring decisions among businesses."

- Says Fed funds rate are about at neutral right now

- Fed doesn't discount markets but looks at many factors

- Says would like to see more inflation expectation data before reaching conclusions

- The most likely outcome is that inflation moves back to 2%

- Trying to assess how much growth is slowing

- Fed is not in a position to give policy advice to the U.S. president Trump

- No reason to think that Trump's nominees will make the Fed more political

Karen Jones, analyst at Commerzbank, suggests that USD/JPY’s correction higher appears to be over already.

“We note that the Elliott wave count is implying a deeper retracement into the 108.65/109.25 band ahead of failure but the market appears to be failing just ahead of here. We continue to look for losses to the 78.6% retracement at 105.87. Minor resistance comes in at the 110.84 April 10 low and the 111.01 200 day moving average. These guard the 2015-2019 downtrend at 112.07. We look for the market to remain capped by its 112.07 2015-2019 downtrend, only above here would target the 114.55 October 2018 high.”

Germany will be willing to explore any ideas put forward by a new British prime minister to break the Brexit deadlock but the Withdrawal Agreement “will stand as it is”, Germany’s ambassador to London said.

“Once there is a new prime minister in this country we will explore the new ideas that are being presented but with a point that is important in mind that the withdrawal agreement will stand as it is,” Peter Wittig told.

Britain’s ruling Conservative Party is due to name either Boris Johnson or Jeremy Hunt as the new prime minister on July 23.

The Swiss government does not see any need for fundamental changes in the way big banks including UBS Group and Credit Suisse are regulated, it said on Wednesday after a review it does every two years.

“However, the Federal Council considers it necessary to make specific adjustments to the gone-concern capital requirements for Swiss units of the two big Swiss banks,” it said.

“The Federal Council also sees a need for clarification regarding the discount system, the staggered timing of bail-in bonds (conversion of debt into equity) and the liquidity requirements for systemically important banks.”

James Smith, developed markets economist at ING, points out that in Sweden, Riksbank has opted to keep the repo rate on hold at -0.25% at its July meeting and has kept its interest rate projection unchanged from April.

“While it’s true the domestic fundamentals haven’t really shifted – for instance inflation has come in pretty much exactly in line with the RB’s forecast – the major change is that global central bank expectations have completely collapsed since the last meeting just over two months ago. All else being equal, we’d have expected that to have modestly lowered the rate path. But following an in-depth look at krona fair value, the central bank is now forecasting a weaker currency over the forecast period and this appears to be the offsetting factor for lower overseas rate expectations. All of this goes to show that the Riksbank is relatively unfazed by the prospect of a dovish ECB. All in all, we expect the Riksbank to keep rates on hold for the foreseeable future.”

According to the report from IHS Markit/CIPS, service providers indicated that business activity was close to stagnation in June, which contrasted with the modest recovery seen during the previous month. The latest survey also revealed subdued client demand and a further reduction in work-in-hand. Despite stalling business activity, staffing numbers picked up at the fastest pace since August 2017. Survey respondents noted that they had started to find it easier to fill long-term vacancies. Some firms also commented on efforts to maintain business expansion plans in the hope of improved business conditions following a resolution to the prevailing political uncertainty.

The seasonally adjusted UK Services PMI Business Activity Index posted 50.2 in June, down from 51.0 in May and the lowest reading for three months. Moreover, the index registered only fractionally above the 50.0 no-change mark and therefore signalled that business activity was close to stagnation in June.

The latest survey also showed that UK private sector output declines for the first time in almost three years. At 49.2 in June, the seasonally adjusted All Sector Output Index fell from 50.7 in May and signalled a reduction in overall private sector business activity for the first time in 35 months. A fractional increase in service sector activity was more than offset by marked declines in manufacturing production and construction output during June.

According to the report from IHS Markit, the Eurozone PMI Services Business Activity Index remained comfortably above the 50.0 no-change mark that separates growth from contraction during June. Moreover, by rising to 53.6, from 52.9 in May, the index indicated the strongest growth of activity since October 2018. Economists had expected an increase to 53.4.

After accounting for seasonal factors, the Eurozone PMI Composite Output Index strengthened to 52.2, up from 51.8 in May (and slightly better than the earlier flash reading of 52.1). June’s PMI reading was also the highest recorded since November 2018, signalling a pick-up in economic growth of the single currency area.

Production amongst goods producers was reported to have fallen for a fifth successive month, and at a rate that was amongst the sharpest seen in the past six years. Solid growth of the eurozone economy was underpinned by a further rise in volumes of new work, the fourth in as many months. Despite being the best recorded since last November, growth in new work was modest overall. As with activity, overall gains in new work were restricted by another month of deteriorating manufacturing order books.

Karen Jones, analyst at Commerzbank, explains that GBP/USD pair continues to hold below the 1.2763/72 resistance (the 7th June high and February low) and they maintain a slightly negative bias.

“It charted a key day reversal on Tuesday last week and the Elliott wave count on the daily chart is negative implying that the market is likely to slide back towards the 1.2559/1.2506 recent lows. Please note that intraday Elliot wave counts are positive, which is contradictory. Below 1.2506 would target the 1.2444 December 2018 low. This is the last defence for 1.2108, the 78.6% retracement of the move up from 2016. The market will have to overcome last weeks high at 1.2784 on a closing basis in order to generate some further upside interest. This will target the 200 day ma at 1.2913, but we are looking for this to then cap the topside.”

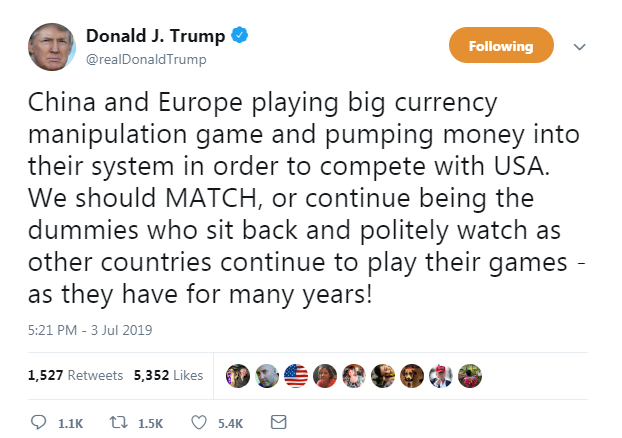

U.S. President Donald Trump has touted his meeting with Chinese President Xi Jinping at the weekend as “far better than expected” — but several trade and investment experts said Beijing appears to have gained the upper hand in the trade war.

Trump and Xi agreed at the G-20 summit in Japan to withhold from slapping additional tariffs on each other’s products as the two sides return to the negotiating table in a bid to finalize a trade agreement. In addition, Trump said he agreed to allow Huawei to purchase U.S. products and China will buy “large amounts” of American farm produce.

“It is looking like, so far, China is coming out as a winner from this G-20,” Francesco Filia, chief executive and chief investment officer at asset management firm Fasanara Capital, told.

“It’s not even clear what they gave up in order to get it,” he said, noting there was a lack of details about what the two leaders agreed on at the meeting.

Filia is not the only one who has expressed skepticism over the U.S.-China trade developments.

Trump standing down on some of his threats to China was “one of the most concerning outcomes at the G-20. It looks as if he obviously gave a lot of ground back to China,” said Danielle DiMartino Booth, chief executive of research firm Quill Intelligence.

The Research Team at Bank of America Merrill Lynch (BAML) offers its near-term view on the Swiss franc, in light of the recent US-China de-escalation.

"In negotiation theory, the zone of possible agreement (ZOPA) refers to a bargaining range outside of which no amount of negotiation will produce an agreement. For us, the key takeaway from the Trump-Xi meeting at the G20 is that Trump's decision to reverse the Huawei ban has brought the two sides back in the ZOPA. Skilled negotiators know that concessions at the right moment can alter perceptions and invoke desired responses. It looks to us that what may be a tactical concession could be calculated to foster the conditions for reaching a "historic" deal. Whether we will be proved right or not, the market will give the two sides the benefit of doubt for 2-3 week we think. During this waiting period, we believe the combination of de-escalation of a trade war and a healthy bounce in the June nonfarm payrolls will place some pressure on crowded positions in safe-haven assets. US rates and USD/CHF could see some retracement."

President Donald Trump intends to nominate Christopher Waller, executive vice president at the Federal Reserve Bank of St. Louis, and Judy Shelton, an economic adviser to the president during his 2016 campaign, to the Federal Reserve’s board.

The announcements come after Trump’s earlier nominees, Stephen Moore and Herman Cain, both withdrew from consideration.

Shelton was earlier speculated to be a pick for the Federal Reserve board. Shelton has previously said that if appointed, she would lower interest rates to 0% in one to two years, echoing calls from Trump to lower rates.

Waller has worked at the Federal Reserve Bank of St. Louis since 2009, and previously was a chair of economics at the University of Notre Dame and a chair in macroeconomics and monetary theory at the University of Kentucky. He has written about the dangers of an inverted yield curve, in which short-term Treasury yields outpace long-term yields.

Both nominees will need Senate confirmation.

Analysts at TD Securities note that after three days of meetings, European leaders finally came to a compromise over the big leadership positions and most important for markets, Christine Lagarde, head of the IMF, was nominated as the next president of the ECB.

“Under her leadership, the IMF was regularly advocating for further stimulus to aid the Eurozone recovery, so we would be inclined to believe that she would be willing to continue cutting rates, and even deliver more QE if need be in order to support growth and inflation. And in case of a recession in the Eurozone, her strong political connections at the highest level will be useful in advocating for further fiscal stimulus, given the limits to further monetary easing.”

Japanese Prime Minister Shinzo Abe said that he was not considering raising the sales tax beyond 10% under his administration, and that he saw no such need at least for a decade.

"I'm not thinking about raising it any more under the Abe administration," he told a debate with other political party leaders.

"I don't think it will be necessary for 10 years," he said, when asked about the possibility of a further hike beyond a scheduled rise to 10% from the current 8% in October.

Bank of Japan board member Yukitoshi Funo said he saw no need to expand monetary stimulus now, as the economy was moving in line with the central bank's projection of a moderate recovery.

"We can expect Japan's economy to recover in the latter half of this year. As such, I see no need to ease policy further now," Funo told a news conference after meeting with business leaders in Hiroshima.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1453 (2604)

$1.1409 (3575)

$1.1363 (4418)

Price at time of writing this review: $1.1288

Support levels (open interest**, contracts):

$1.1248 (2764)

$1.1199 (3049)

$1.1149 (3435)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date July, 5 is 70649 contracts (according to data from July, 2) with the maximum number of contracts with strike price $1,1300 (4418);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2754 (818)

$1.2709 (237)

$1.2674 (326)

Price at time of writing this review: $1.2588

Support levels (open interest**, contracts):

$1.2546 (2041)

$1.2498 (2222)

$1.2449 (811)

Comments:

- Overall open interest on the CALL options with the expiration date July, 5 is 17387 contracts, with the maximum number of contracts with strike price $1,2950 (2622);

- Overall open interest on the PUT options with the expiration date July, 5 is 16087 contracts, with the maximum number of contracts with strike price $1,2500 (2222);

- The ratio of PUT/CALL was 0.93 versus 0.94 from the previous trading day according to data from July, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 62.46 | -3.91 |

| WTI | 56.29 | -4.64 |

| Silver | 15.28 | 1.06 |

| Gold | 1417.815 | 2.46 |

| Palladium | 1560.87 | 1.03 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 24.3 | 21754.27 | 0.11 |

| Hang Seng | 332.94 | 28875.56 | 1.17 |

| KOSPI | -7.72 | 2122.02 | -0.36 |

| ASX 200 | 5.1 | 6653.2 | 0.08 |

| FTSE 100 | 61.69 | 7559.19 | 0.82 |

| DAX | 5.34 | 12526.72 | 0.04 |

| Dow Jones | 69.25 | 26786.68 | 0.26 |

| S&P 500 | 8.68 | 2973.01 | 0.29 |

| NASDAQ Composite | 17.93 | 8109.09 | 0.22 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.6992 | 0.4 |

| EURJPY | 121.804 | -0.48 |

| EURUSD | 1.12886 | 0.02 |

| GBPJPY | 135.882 | -0.83 |

| GBPUSD | 1.25931 | -0.35 |

| NZDUSD | 0.66743 | 0.07 |

| USDCAD | 1.31029 | -0.23 |

| USDCHF | 0.98603 | -0.14 |

| USDJPY | 107.891 | -0.49 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.