- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Trade Balance | October | 5.630 | 5.8 |

| 00:30 (GMT) | Australia | Home Loans | October | 6.0% | |

| 01:45 (GMT) | China | Markit/Caixin Services PMI | November | 56.8 | |

| 08:50 (GMT) | France | Services PMI | November | 46.5 | 38 |

| 08:55 (GMT) | Germany | Services PMI | November | 49.5 | 46.2 |

| 09:00 (GMT) | Eurozone | Services PMI | November | 46.9 | 41.3 |

| 09:30 (GMT) | United Kingdom | Purchasing Manager Index Services | November | 51.4 | 45.8 |

| 10:00 (GMT) | Eurozone | Retail Sales (MoM) | October | -2% | 0.8% |

| 10:00 (GMT) | Eurozone | Retail Sales (YoY) | October | 2.2% | 2.7% |

| 13:30 (GMT) | U.S. | Continuing Jobless Claims | November | 6071 | 5915 |

| 13:30 (GMT) | U.S. | Initial Jobless Claims | November | 778 | 775 |

| 14:45 (GMT) | U.S. | Services PMI | November | 56.9 | 57.7 |

| 15:00 (GMT) | U.S. | ISM Non-Manufacturing | November | 56.6 | 56 |

FXStreet

reports that in the view of Carsten Fritsch, Precious Metals Analyst at

Commerzbank, outflows in the gold-backed exchange-traded funds (ETFs) in

November was the main driver behind the metal’s fall.

“The gold

market saw continued selling pressure last month as investor sentiment was boosted

by news of three potential vaccines for the COVID-19 virus.”

“Gold-backed

exchange-traded funds (ETFs) have been the key driver behind gold's

disappointing price action.”

"News from

India offers a glimmer of hope. Gold demand there apparently picked up

noticeably last week on the back of lower prices. A revival of physical demand

in Asia would make an important contribution to stabilizing the gold price. And

in turn, it would need to stabilize to restore the badly-shaken confidence of

ETF investors in gold."

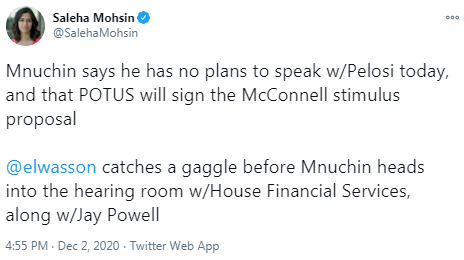

- Fed's officials need "start thinking about how we want to begin to taper or communicate the composition and the size of our asset purchases"

- Broader changes and altering those purchases right now not needed

The U.S. Energy

Information Administration (EIA) revealed on Wednesday that crude inventories

decreased by 0.679 million barrels in the week ended November 27. Economists

had forecast a decline of 2.358 million barrels.

At the same

time, gasoline stocks rose by 3.491 million barrels, while analysts had

expected a gain of 2.386 million barrels. Distillate stocks advanced by 3.238

million barrels, while analysts had forecast a decrease of 0.209 million

barrels.

Meanwhile, oil

production in the U.S. grew by 100,000 barrels a day to 11.100 million barrels

a day.

U.S. crude oil

imports averaged 5.4 million barrels per day last week, up by 171,000 thousand barrels

per day from the previous week.

- We are seeing signs of plateauing in economy

- Forecasts moderate growth for the rest of 2020 and Q1 2021

- Expects growth to pick up in H2 2021 if vaccine becomes available

- Many jobs eliminated during the pandemic will never return

- Adds that he has always said he is confident and comfortable without a deal

- On internal market bill, our position on clauses remains unchanged; we have set out the rationale

- We have been clear that the transition period ends at year-end

- Says that Pandemic Emergency Purchase Programme (PEPP) and Targeted Longer-Term Refinancing Operations (TLTRO) have been a very good for pandemic conditions

- Not growing more worried about inflation due to recent negative readings, big drops this year will partly reverse

- Vaccine reduces chance of more severe economic scenario

- Aims to keep financing conditions "where they are these days"

U.S. stock-index futures fell on Wednesday, correcting after recent rally that pushed the S&P 500 and the Nasdaq to record levels .

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 26,800.98 | +13.44 | +0.05% |

Hang Seng | 26,532.58 | -35.10 | -0.13% |

Shanghai | 3,449.38 | -2.56 | -0.07% |

S&P/ASX | 6,590.20 | +1.70 | +0.03% |

FTSE | 6,410.76 | +26.03 | +0.41% |

CAC | 5,554.38 | -27.26 | -0.49% |

DAX | 13,282.61 | -99.69 | -0.74% |

Crude oil | $44.48 | -0.16% | |

Gold | $1,817.20 | -0.09% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 170.25 | -0.27(-0.16%) | 2193 |

ALCOA INC. | AA | 21.8 | -0.03(-0.14%) | 16305 |

ALTRIA GROUP INC. | MO | 40.45 | -0.04(-0.10%) | 6709 |

Amazon.com Inc., NASDAQ | AMZN | 3,226.16 | 6.08(0.19%) | 51689 |

American Express Co | AXP | 119.25 | -0.68(-0.57%) | 1562 |

AMERICAN INTERNATIONAL GROUP | AIG | 38.81 | -0.50(-1.28%) | 141 |

Apple Inc. | AAPL | 122.03 | -0.69(-0.56%) | 896936 |

AT&T Inc | T | 28.83 | -0.04(-0.14%) | 61183 |

Boeing Co | BA | 213.29 | 0.28(0.13%) | 165181 |

Chevron Corp | CVX | 87.33 | -0.12(-0.14%) | 26581 |

Cisco Systems Inc | CSCO | 43.43 | -0.11(-0.25%) | 19184 |

Citigroup Inc., NYSE | C | 55.48 | 0.01(0.02%) | 28886 |

Exxon Mobil Corp | XOM | 38.44 | -0.06(-0.16%) | 108183 |

Facebook, Inc. | FB | 285.01 | -1.54(-0.54%) | 69462 |

FedEx Corporation, NYSE | FDX | 288 | 0.24(0.08%) | 7937 |

Ford Motor Co. | F | 9.21 | -0.03(-0.32%) | 200162 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 23.52 | -0.12(-0.51%) | 69553 |

General Electric Co | GE | 10.08 | -0.07(-0.69%) | 424524 |

General Motors Company, NYSE | GM | 44.23 | -0.45(-1.01%) | 152784 |

Goldman Sachs | GS | 234.24 | 2.16(0.93%) | 2537 |

Home Depot Inc | HD | 274.82 | -0.28(-0.10%) | 4971 |

Intel Corp | INTC | 49.24 | -0.32(-0.65%) | 96312 |

International Business Machines Co... | IBM | 123.15 | -0.01(-0.01%) | 7434 |

Johnson & Johnson | JNJ | 147.6 | 0.15(0.10%) | 9886 |

JPMorgan Chase and Co | JPM | 119.25 | -0.49(-0.41%) | 5363 |

McDonald's Corp | MCD | 215.04 | -1.10(-0.51%) | 4291 |

Merck & Co Inc | MRK | 82.29 | 0.74(0.91%) | 22440 |

Microsoft Corp | MSFT | 215.31 | -0.90(-0.42%) | 94059 |

Nike | NKE | 135.07 | -0.37(-0.27%) | 581 |

Pfizer Inc | PFE | 40.48 | 1.07(2.72%) | 4347458 |

Procter & Gamble Co | PG | 139.22 | -0.15(-0.11%) | 1712 |

Starbucks Corporation, NASDAQ | SBUX | 98.66 | -0.16(-0.16%) | 1912 |

Tesla Motors, Inc., NASDAQ | TSLA | 562.71 | -22.05(-3.77%) | 1356631 |

The Coca-Cola Co | KO | 52.09 | 0.05(0.10%) | 21184 |

Twitter, Inc., NYSE | TWTR | 46.36 | -0.31(-0.66%) | 45504 |

UnitedHealth Group Inc | UNH | 343 | 1.81(0.53%) | 1150 |

Verizon Communications Inc | VZ | 61.23 | 0.65(1.07%) | 52779 |

Visa | V | 210.7 | -0.50(-0.24%) | 3598 |

Wal-Mart Stores Inc | WMT | 152 | -0.64(-0.42%) | 10921 |

Walt Disney Co | DIS | 150 | 0.56(0.37%) | 29561 |

Yandex N.V., NASDAQ | YNDX | 69.79 | -0.26(-0.37%) | 12655 |

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. decreased 0.6 percent in the week ended November 27, following a 3.9

percent climb in the previous week.

According to

the report, refinance applications declined 4.6 percent, while applications to

purchase a home surged 9.0 percent.

Meanwhile, the

average fixed 30-year mortgage rate remained unchanged at 2.92 percent, a

survey low.

“Purchase

activity continued to show impressive year-over-year gains, with both the

conventional and government segments of the market posting another week of

growth,” said Joel Kan, MBA’s associate vice president of economic and industry

forecasting. “Housing demand remains strong, and despite extremely tight

inventory and rising prices, home sales are running at their strongest pace in

over a decade.”

The employment

report prepared by Automatic Data Processing Inc. (ADP) and Moody's Analytics

showed on Wednesday the U.S. private employers added 307,000 jobs in November. This

was the lowest reading since July.

Economists had

expected an increase of 410,000.

The October

number saw an upward revision to 404,000 from the originally reported 365,000.

“While November

saw employment gains, the pace continues to slow,” noted Ahu Yildirmaz, vice

president and co-head of the ADP Research Institute. “Job growth remained

positive across all industries and sizes.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 10:00 | Eurozone | Producer Price Index, MoM | October | 0.4% | 0.2% | 0.4% |

| 10:00 | Eurozone | Producer Price Index (YoY) | October | -2.3% | -2.4% | -2% |

| 10:00 | Eurozone | Unemployment Rate | October | 8.5% | 8.4% | 8.4% |

GBP fell against its major rivals in the European session on Wednesday as the outcome of the UK-EU negotiations on a post-Brexit trade deal still remains uncertain.

The UK and the EU's trade negotiators continue to engage in intense talks but differences on the key issues - fisheries, state aid, and future dispute resolution - still remain. An EU diplomat told Reuters that the block's chief Brexit negotiator Michel Barnier said the coming days would be decisive for getting a trade deal with the UK but did not set a specific deadline. “He was neither pessimistic nor optimistic. He was saying there’s been a lot of movement. Still, some stuff to be done... level playing field, fisheries,” the source said. In another article, Reuters reported that the EU’s member states urged Barnier not to be rushed into agreeing on an unsatisfactory trade deal with Britain just because the deadline for a deal is looming. The UK's transition period expires on December 31.

However, further declines in the pound were limited by news that Britain became the world’s first country that approved the Pfizer/BioNTech's coronavirus vaccine. The U.K.'s Medicines and Healthcare products Regulatory Agency (MHRA) agreed to the emergency use of the pair's COVID-19 vaccine less than a month after the results of the final clinical trial were released. According to the UK’s Health Secretary Matt Hancock, vaccinations could start as early as next week.

Commenting on vaccine approval, the UK's PM Boris Johnson said that the coronavirus vaccines would allow to reclaim lives and get the economy moving again, but added that it's important that people did not get their hopes up too soon about the speed of the vaccine rollout.

FXStreet reports that Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, suggests that the recent price action in the precious metal hints at the idea that a strong contention area could have emerged around $1,760 per ounce.

“Gold has sold off to, tested and reversed from the 1760/1765.61 May high and 50% retracement. We view the market as having based here, but note that this support is further reinforced by the 1733.26 55 week ma.”

“Rallies will find initial resistance at 1850 (the November low), just to alleviate immediate downside pressure. This guards the 55 day ma at 1910.90 and the mid-September high at 1973.8, for a rally to the 78.6% retracement at 2025 which guards the target band of 2070/2088. This is a combination of Fibonacci extensions and Elliott wave counts.”

- Vaccines will allow us to reclaim our lives, get the economy moving again

- Vaccines should absolutely be on voluntary basis

- Vaccine is by no means the end of the struggle against the virus

- There are logistical challenges to get the vaccine to those who need it

- It is important people do not get hopes up too soon about speed of vaccine rollout

Salesforce (CRM) reported Q3 FY 2021 earnings of $1.74 per share (versus $0.75 per share in Q3 FY 2020), beating analysts’ consensus estimate of $0.75 per share.

The company’s quarterly revenues amounted to $5.420 bln (+20% y/y), beating analysts’ consensus estimate of $5.248 bln.

The company also issued upside guidance for Q4 FY 2021 and Q1 FY 2022, projecting revenues of a respective $5.665-$5.675 bln (versus analysts’ consensus estimate of $5.53 bln) and $5.680-$5.715 bln (versus analysts’ consensus estimate of $5.65 bln). For the full FY 2022, it sees revenues of $25.45-$25.55 bln (versus analysts’ consensus estimate of $24.5 bln). This includes approximately $600 mln related to the acquisition of Slack Technologies (WORK).

CRM fell to $228.35 (-5.39%) in pre-market trading.

According to a senior Brussels diplomat, Barnier was neither pessimistic nor optimistic. He said there had been a lot of movement, but "still some stuff to be done... level playing field, fisheries".

In another article, Reuters reported that Barnier told EU member states’ envoys that talks on a trade deal with the UK were reaching “a make-or-break moment”. He also said that negotiations remained snagged on fishing rights in British waters, ensuring fair competition guarantees and ways to solve future disputes.

FXStreet reports that Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, notes AUD/USD risks a probable correction lower in the near-term.

“AUD/USD continues to falter on its initial test of the .7413 September high, there is some divergence of the daily RSI and we would allow for a near term pullback. We also have a 13 count on the 240 minute chart AND TD resistance at .7410/20. This suggests we may well hold the initial test of the early September peak at .7413 and we are alert to some profit taking there. It guards the long term Fibonacci retracements at .7574 and .7639.”

Bert Colijn, a Senior Economist at ING, notes that big revisions to Eurozone jobs data show that unemployment peaked in July and has since been trending downwards.

"Today’s Eurozone unemployment data show massive revisions for the last few months which reveals a declining unemployment rate since July, instead of an upward inclining trend. The peak was seen in July at 8.7%, moving down to 8.4% in October."

"The largest changes to the data came from France where the July rate was revised up from 6.6% in September to 9.4% now. German data remained unchanged, while Spain and Italy also saw a change in trend for recent months, although smaller than France. The differences may relate to definition issues related to short-time work, which muddies the waters about who is employed and who isn’t."

"The unemployment rate remains a crucial unknown in the outlook for 2021. While the harm done so far seems to be incredibly mild given the scale of the crisis, short-time work schemes still mask some of the harsh labour market realities. Therefore, it seems unlikely that eurozone unemployment will hit double-digits with the start of the recovery around the corner thanks to the quick progress made on vaccines. That brings some upside risk to the economic recovery for 2021 for the job market."

FXStreet reports that economist at UOB Group Lee Sue Ann reviewed the latest RBA meeting (December 1).

“The Reserve Bank of Australia (RBA), at its final monetary policy meeting of the year, decided to retain the current policy settings.”

“Our view remains for the RBA to hold off (for now) in regards to bringing the policy rate into negative territory. If the need for more easing arises, more Quantitative Easing (QE) and yield curve control are likely to follow first. We also see fiscal policy continuing to play a key role in stimulating the economy and expect that the government will need to do more.”

Reuters reports that a government official said that Britain will not agree to extending the transition period with the European Union.

Britain has repeatedly refused to countenance any extension to the talks into next year, saying if there is to be a trade deal, it needs to be done before Dec. 31. If there is no agreement, Prime Minister Boris Johnson has said Britain will "prosper" if it has to trade with the EU on WTO terms.

"The transition period ends on Dec. 31. As the UK has always made clear, this date will not be extended," said the official.

According to the report from Eurostat, in October 2020, industrial producer prices rose by 0.4% in the euro area and by 0.3% in the EU, compared with September 2020. Economists had expected a 0.2% increase in the euro area. In September 2020, prices increased by 0.4% in the euro area and by 0.3% in the EU.

In October 2020, compared with October 2019, industrial producer prices decreased by 2.0% in both the euro area and the EU.

Industrial producer prices in the euro area in October 2020, compared with September 2020, increased by 1.4% in the energy sector and by 0.1% for intermediate goods, capital goods and non-durable consumer goods, while prices remained stable for durable consumer goods. Prices in total industry excluding energy increased by 0.1%.

In the EU, industrial producer prices increased by 0.8% in the energy sector, by 0.2% for intermediate goods and by 0.1% for capital goods and non-durable consumer goods, while prices remained stable for durable consumer goods. Prices in total industry excluding energy increased by 0.1%.

According to the report from Eurostat, in October 2020, the euro area seasonally-adjusted unemployment rate was 8.4%, down from 8.5% in September 2020 and up from 7.4% in October 2019. The EU unemployment rate was 7.6% in October 2020, stable compared with September 2020 and up from 6.6% in October 2019.

Eurostat estimates that 16.236 million men and women in the EU, of whom 13.825 million in the euro area, were unemployed in October 2020. Compared with September 2020, the number of persons unemployed decreased by 91 000 in the EU and by 86 000 in the euro area. Compared with October 2019, unemployment rose by 2.186 million in the EU and by 1.692 million in the euro area.

In October 2020, 3.115 million young persons (under 25) were unemployed in the EU, of whom 2.551 million were in the euro area. In October 2020, the youth unemployment rate was 17.5% in the EU and 18.0% in the euro area, up from 17.4% and 17.9% respectively in the previous month. Compared with September 2020, youth unemployment increased by 46 000 in the EU and by 29 000 in the euro area. Compared with October 2019, youth unemployment increased by 404 000 in the EU and by 319 000 in the euro area

Reuters reports that according to a senior EU diplomat who was present at the closed-door briefing, the European Union's Brexit negotiator told the 27 national envoys to Brussels on Wednesday that differences in UK trade talks persisted.

"Differences still persist on the three main issues," the diplomat said, when asked for the overall thrust of Barnier's update to EU member states on the latest in Brexit trade talks.

FXStreet reports that FX Strategists at UOB Group note USD/CNH could drop further on a breach of the 6.5319 level in the next weeks.

Next 1-3 weeks: “We have held the same view for a week wherein USD ‘is in a consolidation and could trade between 6.5400 and 6.6200 for a period of time’. USD weakened sharply yesterday (01 Dec) and is approaching the bottom of the range at 6.5400. Downward momentum is beginning to improve but is not strong for now. USD has to stage a NY closing below the year-to-date low of 6.5319 in order to indicate that the next down-leg towards 6.4960 has started. The prospect for such a move is not high for now but it would increase as long a USD does move above 6.5800 within these few days.”

Reuters reports that Britain on Wednesday became the first western country to approve a COVID-19 vaccine, jumping ahead of the United States and Europe.

The vaccine will be rolled out from early next week in a major coup for Prime Minister Boris Johnson's government, which has faced criticism over its handling of the coronavirus crisis.

A vaccine is seen as the best chance for the world to get back to some semblance of normality amid a pandemic which has killed nearly 1.5 million people and upended the global economy.

"The government has today accepted the recommendation from the independent Medicines and Healthcare products Regulatory Agency (MHRA) to approve Pfizer-BioNTech's COVID-19 vaccine for use," the government said.

Britain touted the approval as a global win and a ray of good hope amid the gloom as big powers race to approve an array of vaccines and inoculate their citizens.

eFXdata reports that CIBC Research expects shallow GBP rallies after a potential Brexit trade deal.

"As the clock ticks down, the question remains: Is there sufficient time left to conclude a deal? We still expect a deal to be reached, but we will need to see a degree of statecraft (political concessions) in order," CIBC notes.

"Our central case scenario remains a deal being brokered before month end, notably ahead of the final scheduled EU Parliament session of the year, from December 14-17. However, a deal is not the end of the process. Rapid ratification, within necessary protocols, risks becoming a concern," CIBC adds.

FXStreet reports that FX Strategists at UOB Group said that a breakdown of 0.7330 would indicate that the positive phase in AUD/USD could be over.

Next 1-3 weeks: “We highlighted yesterday that a break of 0.7413 would shift the focus to 0.7455. However, AUD retreated quickly from high of 0.7408. Upward momentum has been dented and a break of 0.7330 (no change in ‘strong support’ level) would indicate that the positive phase that started in mid-November has run its course. Barring a sudden surge above 0.7413 within these 1 to 2 days, a break of 0.7330 would not be surprising.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:00 | Australia | RBA's Governor Philip Lowe Speaks | ||||

| 00:30 | Australia | Gross Domestic Product (YoY) | Quarter III | -6.3% | -4.5% | -3.8% |

| 00:30 | Australia | Gross Domestic Product (QoQ) | Quarter III | -7% | 2.5% | 3.3% |

| 05:00 | Japan | Consumer Confidence | November | 33.6 | 33.7 | |

| 07:00 | Germany | Retail sales, real adjusted | October | -2.2% | 1.2% | 2.6% |

| 07:00 | Germany | Retail sales, real unadjusted, y/y | October | 7% | 5.9% | 8.2% |

| 07:30 | Switzerland | Consumer Price Index (MoM) | November | 0% | -0.1% | -0.2% |

| 07:30 | Switzerland | Consumer Price Index (YoY) | November | -0.6% | -0.5% | -0.7% |

During today's Asian trading, the US dollar traded steadily against the euro and rose against the yen.

The exchange rate of the US currency against the euro has been at a minimum since April 2018. The ICE index, which tracks the dollar's performance against six currencies (the euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), fell to its lowest level since April 2018 at the end of trading on Tuesday, given that the euro's weight in the index is about 60%. On Wednesday, the ICE index fell 0.21%.

Growing investor optimism about the economic outlook, driven by the success of a number of pharmaceutical companies in developing COVID-19 vaccines, is contributing to the outflow of investor funds from safe haven assets, which include the dollar, to riskier assets.

In addition, investors are confident that the Federal reserve system will continue to pour money into the economy both by buying assets and by providing cheap loans to banks, given that the situation in the US economy remains difficult amid the second wave of the pandemic, and there are no hopes for the adoption of a new fiscal stimulus package before January.

According to the report from the Federal Statistical Office (FSO), the consumer price index (CPI) fell by 0.2% in November 2020 compared with the previous month, reaching 101.0 points (December 2015 = 100). Inflation was –0.7% compared with the same month of the previous year.

The 0.2% decrease compared with the previous month can be explained by several factors including falling prices for international package holidays. Hotel accommodation also recorded a price decrease, as did fruiting vegetables. In contrast, prices for housing rentals and foreign red wine increased.

In November 2020, the Swiss Harmonised Index of Consumer Prices (HICP) stood at 100.09 points (base 2015 = 100). This corresponds to a rate of change of –0.4% compared with the previous month and of –0.8% compared with the same month the previous year. Due to the effects of the pandemic, the same missing price imputation techniques used for the CPI were introduced for the HICP.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2203 (661)

$1.2157 (1191)

$1.2116 (1718)

Price at time of writing this review: $1.2078

Support levels (open interest**, contracts):

$1.1986 (293)

$1.1944 (260)

$1.1897 (893)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 4 is 106746 contracts (according to data from December, 1) with the maximum number of contracts with strike price $1,1200 (6560);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3526 (2769)

$1.3494 (911)

$1.3469 (974)

Price at time of writing this review: $1.3425

Support levels (open interest**, contracts):

$1.3316 (865)

$1.3235 (798)

$1.3100 (1080)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 23159 contracts, with the maximum number of contracts with strike price $1,3500 (2769);

- Overall open interest on the PUT options with the expiration date December, 4 is 42835 contracts, with the maximum number of contracts with strike price $1,2700 (11992);

- The ratio of PUT/CALL was 1.85 versus 1.77 from the previous trading day according to data from December, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

According to provisional data of the Federal Statistical Office (Destatis), turnover in retail trade in October 2020 was in real terms as well as in nominal terms 2.6% (both adjusted for calendar and seasonal influences) higher than in September 2020. Economists had expected a 1.2% increase in real terms.

In October 2020, the turnover in retail rose by 8.2% (real) and 9.4% (nominal) compared to the same month of the previous year. Economists had expected a 5.9% increase in real terms. In comparison to February 2020, the month before the outbreak of Covid 19 in Germany, the turnover in October 2020 was 5.9% (in real terms, calendar and seasonally adjusted) higher.

Retail sales of food, beverages and tobacco were in real terms 7.3% and 10.3% in nominal terms higher in October 2020 than in October 2019. Turnover in retail sale in supermarkets, self-service department shops and hypermarkets was in real terms 7.9% and in nominal terms 10.9% higher than in the same month last year.

In the non-food retail sector, sales in October 2020 rose in real terms by 9.0% and in nominal terms by 9.4% compared with the same month of the previous year. The largest increase in turnover compared with the previous year's month in real terms by 29.8% and 31.1% in nominal terms was achieved by the internet and mail order business. Trade in furniture, household appliances and building materials also increased, with a real plus of 14.2%.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 47.18 | -1.19 |

| Silver | 23.985 | 6.14 |

| Gold | 1815.126 | 2.16 |

| Palladium | 2409.95 | 1.49 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 353.92 | 26787.54 | 1.34 |

| Hang Seng | 226.19 | 26567.68 | 0.86 |

| KOSPI | 42.91 | 2634.25 | 1.66 |

| ASX 200 | 70.7 | 6588.5 | 1.08 |

| FTSE 100 | 118.54 | 6384.73 | 1.89 |

| CAC 40 | 63.09 | 5581.64 | 1.14 |

| Dow Jones | 185.28 | 29823.92 | 0.63 |

| S&P 500 | 40.82 | 3662.45 | 1.13 |

| NASDAQ Composite | 156.37 | 12355.11 | 1.28 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 (GMT) | Australia | RBA's Governor Philip Lowe Speaks | |||

| 00:30 (GMT) | Australia | Gross Domestic Product (YoY) | Quarter III | -6.3% | -4.5% |

| 00:30 (GMT) | Australia | Gross Domestic Product (QoQ) | Quarter III | -7% | 2.5% |

| 05:00 (GMT) | Japan | Consumer Confidence | November | 33.6 | |

| 07:00 (GMT) | Germany | Retail sales, real adjusted | October | -2.2% | 1.2% |

| 07:00 (GMT) | Germany | Retail sales, real unadjusted, y/y | October | 6.5% | 5.9% |

| 07:30 (GMT) | Switzerland | Consumer Price Index (MoM) | November | 0% | -0.1% |

| 07:30 (GMT) | Switzerland | Consumer Price Index (YoY) | November | -0.6% | -0.5% |

| 10:00 (GMT) | Eurozone | Producer Price Index, MoM | October | 0.3% | 0.2% |

| 10:00 (GMT) | Eurozone | Producer Price Index (YoY) | October | -2.4% | -2.4% |

| 10:00 (GMT) | Eurozone | Unemployment Rate | October | 8.3% | 8.4% |

| 13:15 (GMT) | U.S. | ADP Employment Report | November | 365 | 500 |

| 13:30 (GMT) | Canada | Labor Productivity | Quarter III | 9.8% | |

| 14:00 (GMT) | U.S. | FOMC Member Williams Speaks | |||

| 15:00 (GMT) | U.S. | FOMC Member Harker Speaks | |||

| 15:00 (GMT) | U.S. | Fed Chair Powell Testimony | |||

| 15:30 (GMT) | U.S. | Crude Oil Inventories | November | -0.754 | -2.272 |

| 18:00 (GMT) | U.S. | FOMC Member Williams Speaks | |||

| 19:00 (GMT) | U.S. | Fed's Beige Book | |||

| 21:30 (GMT) | Australia | AiG Performance of Construction Index | November | 52.7 | |

| 21:45 (GMT) | New Zealand | Building Permits, m/m | October | 3.6% |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.73707 | 0.4 |

| EURJPY | 125.895 | 1.22 |

| EURUSD | 1.20683 | 1.19 |

| GBPJPY | 140.022 | 0.79 |

| GBPUSD | 1.34225 | 0.78 |

| NZDUSD | 0.70639 | 0.76 |

| USDCAD | 1.29391 | -0.52 |

| USDCHF | 0.89991 | -0.73 |

| USDJPY | 104.314 | 0.04 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.