- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- EUR/USD bumps back over 1.0900 after bad US NFP print.

- Broad-market concerns of a US slowdown jumped on Friday.

- Coming up next week: US ISM Manufacturing PMI, EU Retail Sales

EUR/USD caught a ride higher on Friday after the Greenback got pummeled following a bad data beat in US Nonfarm Payroll (NFP) figures. Market fears of an accelerating economic slowdown in the US sparked a firm risk-off bid throughout global markets, but with US data going too far into the red too fast, the US Dollar got caught up in the stampede and tumbled across the board.

Forecasting the Coming Week: Focus remains on data and rate cut bets

The latest US NFP labor data revealed that the US added 114K net new jobs in July, falling short of the expected 175K. Additionally, the previous month's figure was revised down to 179K from the initial 206K. The US Unemployment Rate also increased to 4.3%, the highest level since November 2021, while the U6 Underemployment Rate rose to 7.8% from 7.4% as employed individuals faced challenges in securing jobs with sufficient hours.

Average Hourly Earnings growth slowed to 0.2% month-over-month, below the anticipated 0.3%, and the year-over-year wages growth decreased to 3.6% from the previous 3.8%.

Friday’s US NFP labor data dump showed the US added 114K net new jobs in July, well below the forecast 175K and the previous month’s figure was revised to 179K from the initial print of 206K. The US Unemployment Rate also ticked higher to 4.3%, the highest reading since November of 2021, while the U6 Underemployment Rate rose to 7.8% from 7.4% as employed people struggle to find jobs that provide enough hours.

Average Hourly Earnings growth also eased to 0.2% MoM from the expected hold at 0.3%, with YoY wages growth cooling to 3.6% from the previous 3.8%.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Last release: Fri Aug 02, 2024 12:30

Frequency: Monthly

Actual: 114K

Consensus: 175K

Previous: 206K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

With US economic data turning broadly sour, investors extended a two-day decline on growing fears of a broad recession within the domestic US economy, sparking a flight out of risk assets and sending equity indexes broadly lower. According to the CME’s FedWatch Tool, rate traders have fully priced in a rate cut in September, with 70% odds of a double-cut for 50 basis points when the Fed gives its rate call on September 18.

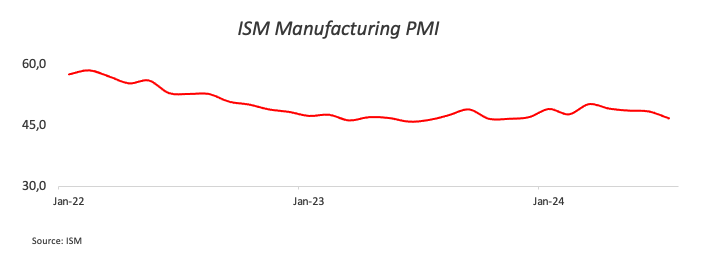

Coming up next week, the US will see July’s ISM Manufacturing Purchasing Managers Index (PMI) Figures on Monday, which is forecast to increase to 51.0 MoM and cross back over into expansion territory compared to June’s contractionary 48.8. Pan-European Retail Sales for the year ended in June are slated for early Tuesday, and median market forecasts expect a slight cooling to 0.2% from the previous 0.3%.

EUR/USD technical outlook

The Fiber’s Friday breakout shot EUR/USD back out the top end of a sloppy descending channel on daily candlesticks, bit price action still has ground to cover before recovering enough ground to make another attempt at cracking through 1.0950.

If bidders are able to extend momentum, EUR/USD is on pace to bake in a technical rejection from the 200-day Exponential Moving Average (EMA) at 1.0802, while sellers will be looking to push bids back down into a short side move back towards the last swing low below 1.0700.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- Despite the predominantly bearish trend, NZD/USD exhibits signs of a mild rebound.

- Key resistance is noted at 0.5980, with a substantial support level observed around 0.5760.

- Daily RSI fluctuates under the 50-mark, indicating lasting bearish sentiment, but a recent recovery above 40 shows traces of bullish momentum.

The NZD/USD pair, while majorly sticking to its bearish course, has been showing signs of a mild uptrend over the end of the week and rose to 0.5960. The lows and highs are reaching slightly higher values, which, coupled with the formation of a slight handle-like pattern, indicates a probable bullish rally in the near future.

The daily Relative Strength Index (RSI) has largely been stationed below the mid-point although recent trading sessions have shown some recovery with the index breaching the 40-threshold mark. This incremental shift from the prevalent trend, while indicating ongoing bearish influence, provides a glimpse of potential bullish sentiment in future sessions.

The Moving Average Convergence Divergence (MACD) continues its stance below the signal line. However, the histogram's diminishing red bars could potentially reveal an impending bullish crossover.

NZD/USD daily chart

The pair has solidified its new support level around 0.5760, 0.5800, and 0.5850, now facing resistance at 0.5980, 0.6000 and 0.6030.

- The NZD/JPY maintains its bearish outlook, shattering key support levels with consistent negative sessions.

- The chance for any salvation relies on the drastic dip in the RSI in the oversold terrain.

The NZD/JPY pair persists in its downward movement, now slipping below the key 89.00 level. The cross pair has consecutively recorded losses, exhibiting a bearish image, and reinforcing a robust bearish momentum. Compared to recent weeks, the currency pair has declined by over 7%, beneath the crucial 200-day Simple Moving Average (SMA).

Even as the pair continues its steady drop, daily technical indicators such as the Relative Strength Index (RSI) are indicating extreme oversold conditions. Such conditions potentially hint towards a nearing phase of stable trading, despite the persistent falling. The RSI is marked well below 20, suggesting a prolonged period of selling pressure. This extended sell-off may also be indicative of an impending reversal in trend. Correspondingly, the Moving Average Convergence Divergence (MACD) reveals a series of rising red bars, illustrating an increase in selling momentum.

NZD/JPY daily chart

Located below the 90.00 level, the pair is striving to hold a significant support level at 87.00, 86.50, and 86.00. Conversely, resistances are observed around 89.00, followed by more robust resistance around the 200-day SMA, potentially near 92.00.

- GBP/USD found a foothold on Friday after wide miss in US data.

- US NFP showed the lowest initial print in years as job market cools.

- Coming up next week: US ISM Services PMI, UK BRC Retail Sales.

GBP/USD wrapped up the trading week with a last-minute win after a misfire in US Nonfarm Payrolls (NFP) kicked the Greenback lower across the board. This gave the Pound Sterling a foothold, but still ended the week lower against the USD.

Forecasting the Coming Week: Focus remains on data and rate cut bets

The Pound Sterling deflated this week after the Bank of England (BoE) delivered a widely-expected quarter-point rate cut early Thursday, while US jobs data flashed further warning signs that the US economy may be turning south quicker than investors initially expected.

The latest US NFP labor data revealed that the US added 114K net new jobs in July, falling short of the expected 175K. Additionally, the previous month's figure was revised down to 179K from the initial 206K. The US Unemployment Rate also increased to 4.3%, the highest level since November 2021, while the U6 Underemployment Rate rose to 7.8% from 7.4% as employed individuals faced challenges in securing jobs with sufficient hours.

Average Hourly Earnings growth slowed to 0.2% month-over-month, below the anticipated 0.3%, and the year-over-year wages growth decreased to 3.6% from the previous 3.8%.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Last release: Fri Aug 02, 2024 12:30

Frequency: Monthly

Actual: 114K

Consensus: 175K

Previous: 206K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Given the generally disappointing US economic data, investors reacted by extending a two-day decline amidst increasing concerns about a potential widespread recession in the domestic US economy. This prompted a move away from risky assets and led to broad declines in equity indexes. As per the CME's FedWatch Tool, rate traders have completely priced in a rate cut in September, with a 70% chance of a double-cut amounting to 50 basis points, when the Fed announces its rate decision on September 18.

Coming up next week, the US will see July’s ISM Manufacturing Purchasing Managers Index (PMI) Figures on Monday, which is forecast to increase to 51.0 MoM and cross back over into expansion territory compared to June’s contractionary 48.8. On the UK side, BRC Like-For-Like Retail Sales for the year ended in July is expected to recover to 0.3% after the previous period’s -0.5% contraction.

GBP/USD technical outlook

The Cable chalked in a third straight down week, falling -2.58% peak-to-trough after setting a 12-month peak of 1.3045 in mid-July. Bidders are coming out of the woodwork to keep GBP buoyed into the 1.2800 handle, but downside momentum remains strong.

Price action continues to hold on the high side of the 200-day Exponential Moving Average (EMA) at 1.2645, but intraday bids are struggling to vault back over the 50-day EMA at 1.2790.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- Silver hits weekly high of $29.22 before stabilizing at $28.49, down 0.02%.

- Technical outlook: Closing above 100-DMA ($28.69) may trigger rally to $29.00 and $29.50.

- Bearish scenario if XAG/USD falls below $28.00, targeting $27.95, July 29 low ($27.31), and 200-DMA ($26.00).

Silver's price was virtually unchanged late in the North American session after whipsawing following US Nonfarm Payrolls data. The grey metal-stabilized below the 100-day moving average (DMA) and traded at $28.49, registering minimal losses of 0.02%.

XAG/USD Price Analysis: Technical outlook

Silver trades at around its opening price after hitting a new weekly high of $29.22, a move that was quickly rejected amid profit-taking in the precious metal segment, led by Gold. The XAG/USD dived below $28.00 following the spike on NFP release before buyers recovered the latter and lifted spot prices to the current price level.

If Silver closes above the 100-DMA at $28.69, that could sponsor a rally toward $29.00 in the upcoming week, followed by the $29.50 mark, which capped prices from July 22 to 24, before collapsing.

Conversely, bears would be in play if they drag XAG/USD below $28.00, exposing the day’s low of $27.95. Further losses hover underneath that level and push Silver to test the July 29 bottom at $27.31, ahead of dropping to the 200-DMA at $26.00.

XAG/USD Price Action – Daily Chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

- AUD/JPY pair sustains a dominant bearish trend, eying significant support around 95.30.

- Daily indicators signal a possible market exhaustion with RSI dropping to 18.

- Pair spirals through the support level of 97.00, directing attention to the critical 95.30 support line.

On Friday, the AUD/JPY pair magnifies the bearish sentiment, recording substantial losses with a 5% weekly loss. The decreasing trading volume reinforces the apparent weakening interest among traders and with the pair breaking through the secondary support of 97.00, the market now keeps an eye on the critical 95.30 benchmark.

The Relative Strength Index (RSI) has dived drastically below the 30 mark and is now deep in the oversold zone. This extreme selling activity hints at a potential price reversal due to market exhaustion. Meanwhile, the Moving Average Convergence Divergence (MACD) continues printing red bars.

AUD/JPY daily chart

Currently, the AUD/JPY pair is trying to establish a strong base around the major support line at 95.30, which will be crucial in minimizing further losses. The loss of this line could send the pair spiralling further downwards towards 94.00 or even 93.00, while a bounce back could see the 99.00 - 101.00 marks functioning as strong resistance levels.

- USD/JPY falls to 146.41, lowest since March, amid worse-than-expected US economic data.

- Technical outlook: Strong support at 146.48; a close below targets 146.00, 145.50, and 145.00 levels.

- RSI indicates potential for upward correction; resistance at 147.00 and cycle low at 151.86 if buyers regain control.

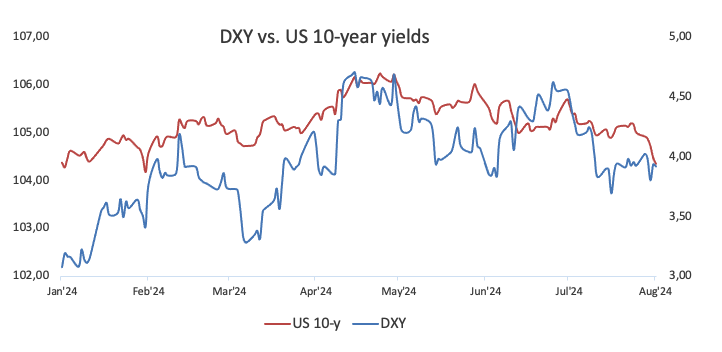

The USD/JPY collapsed to a five-month low of 146.41 on Friday following the release of worse-than-expected US economic data that increased the odds for a Federal Reserve cut at the September meeting. Hence, the US 10-year Treasury bond yield, closely correlated to this pair, tumbled sharply below the 4% threshold, while the major dropped after hitting a daily high of 149.77. At the time of writing, the pair exchanges hands at 146.62, down by more than 1.80%.

USD/JPY Price Analysis: Technical outlook

After clearing key support levels, the USD/JPY is set to test lower prices, though it faces strong support at the March 11 pivot low of 146.48. Sellers will need to push the spot price below the latter so they have the chance to test lower prices.

The Relative Strength Index (RSI) suggests that prices are overextended, which could lead to an upward correction in USD/JPY.

For a bearish continuation, sellers need a daily close below 146.48. Once achieved, the next support would be the 146.00 figure, followed by the 145.50. A further downside lies at the 145.00 mark

On the other hand, if buyers lift the exchange rate past 147.00, they could threaten to push the spot price above until they can face the latest cycle low turned resistance located at 151.86.

USD/JPY Price Action – Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -1.14% | -0.56% | -1.88% | -0.10% | -0.27% | -0.28% | -1.62% | |

| EUR | 1.14% | 0.58% | -0.74% | 1.04% | 0.88% | 0.86% | -0.48% | |

| GBP | 0.56% | -0.58% | -1.33% | 0.47% | 0.28% | 0.29% | -1.04% | |

| JPY | 1.88% | 0.74% | 1.33% | 1.83% | 1.64% | 1.62% | 0.28% | |

| CAD | 0.10% | -1.04% | -0.47% | -1.83% | -0.17% | -0.16% | -1.50% | |

| AUD | 0.27% | -0.88% | -0.28% | -1.64% | 0.17% | 0.00% | -1.35% | |

| NZD | 0.28% | -0.86% | -0.29% | -1.62% | 0.16% | -0.01% | -1.32% | |

| CHF | 1.62% | 0.48% | 1.04% | -0.28% | 1.50% | 1.35% | 1.32% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

- Gold price peaks at $2,477 before falling to $2,430, down 0.60%.

- US Nonfarm Payrolls miss expectations, Unemployment Rate rises, and Average Hourly Earnings dip.

- Weak economic data fuels speculation of Fed rate cuts in September, with US 10-year Treasury yield dropping to 3.815%.

Gold prices are under pressure after hitting a two-week high of $2,477 earlier during the North American session. Data showed that the US jobs market feels the effects of higher borrowing costs set by the Federal Reserve as the number of Americans applying for work dipped. This bolstered the golden metal, which rallied over 1% before retreating. The XAU/USD trades at $2,430, down 0.60%.

Wall Street’s trade with substantial losses, as most equity indices plunged at least 2.20% after the US Bureau of Labor Statistics (BLS) revealed that July’s Nonfarm Payrolls (NFP) figures missed the mark, while June data was revised downward.

Given the backdrop of a dismal Manufacturing PMI report revealed by the Institute of Supply Management (ISM) on Thursday, which was still digested by traders, along with today’s NFP figures, the chances that the Fed might lower interest rates at the September meeting are increasing.

Additional data showed that the Unemployment Rate ticked higher, while Average Hourly Earnings (AHE), a measure of wage inflation, edged lower.

After the data, US Treasury bond yields plummeted sharply, with the US 10-year benchmark note falling 16 basis points to 3.815%, its lowest level since March. and a tailwind for Bullion prices.

Consequently, the US Dollar Index (DXY), a measure of the dollar’s performance against other six currencies, dropped over 1% to 103.23.

US data in the last two days justified Fed Chairman Jerome Powell's statement that the federal fund rates could be cut in September if the US economy cools down.

Another reason driving precious metals prices is geopolitical risks. Tensions in the Middle East remain high as Israel awaits a response from Iran and Lebanon following the assassination of the Hamas leader earlier in the week.

Daily digest market movers: Gold price stumbles amid recession fears

- The Federal Reserve decided to hold rates unchanged but indicated that favorable data on inflation and further weakening in the labor market could prompt action.

- The US Department of Labor revealed that Nonfarm Payrolls (NFPs) were 114K in July, missing estimates of 175K, with previous figures revised downward from 206K to 179K.

- The US Unemployment Rate increased from 4.1% to 4.3%, and Average Hourly Earnings dipped from 0.3% to 0.2%.

- After the data, most banks began to price in more aggressive monetary policy easing by the Fed. Bank of America expects the first cut in September instead of December, while Citi and JP Morgan expect the Fed to lower rates by 50 bps in September and November.

- The CME FedWatch tool shows the odds for a 50 bps Fed rate cut at the September meeting at 70%.

Technical analysis: Gold price retraces from daily highs, below $2,450

Gold price has retreated toward the July 31 lows of $2,404-$2,410, which could be attributed to profit-taking ahead of the weekend, as US yields and the Greenback remain at weekly lows.

From a technical standpoint, XAU/USD is set to remain bullish, and if buyers achieve a daily close above $2,450, this could exacerbate a challenge towards the all-time high, ahead of the $2,500 mark.

On further weakness, prices could fall below $2,400, which could pave the way for a pullback to the 50-day moving average (DMA) at $2,364, before testing the 100-DMA at $2,337.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- Dow Jones plummeted over 900 points top-to-bottom on Friday.

- US NFP jobs data came in well below forecasts, worst initial print since 2019.

- Souring US economic data sends investors piling into rate cut bets.

The Dow Jones Industrial Average (DJIA) plummeted over 900 points peak-to-trough on Friday after the monthly US Nonfarm Payrolls (NFP) printed its lowest initial figure since May of 2019. Steep revisions to previous figures further depressed the market’s outlook on the US employment landscape, and a rising US unemployment rate has sent investors scrambling to bet on an accelerated pace of rate cuts from the Federal Reserve (Fed).

Friday’s US NFP labor data dump showed the US added 114K net new jobs in July, well below the forecast 175K and the previous month’s figure was revised to 179K from the initial print of 206K. The US Unemployment Rate also ticked higher to 4.3%, the highest reading since November of 2021, while the U6 Underemployment Rate rose to 7.8% from 7.4% as employed people struggle to find jobs that provide enough hours.

Average Hourly Earnings growth also eased to 0.2% MoM from the expected hold at 0.3%, with YoY wages growth cooling to 3.6% from the previous 3.8%.

With US economic data turning broadly sour, investors extended a two-day decline on growing fears of a broad recession within the domestic US economy, sparking a flight out of risk assets and sending equity indexes broadly lower. According to the CME’s FedWatch Tool, rate traders have fully priced in a rate cut in September, with 70% odds of a double-cut for 50 basis points when the Fed gives its rate call on September 18.

Dow Jones news

Over two-thirds of the Dow Jones is in the red on Friday, with slim gains getting entirely swamped out by steep losses in key tech stocks. Intel Inc. (INTC) plummeted nearly 30% on Friday, tumbling to almost $21.00 per share after the major software company announced quarterly revenue that missed guidance, earning $12.83 billion in the second quarter, down 1% from the same time last year and missing the analyst forecast of $12.94 billion. Intel also revised their current-quarter revenue forecast to between $12.5 billion and $13.5 billion, less than the analyst expectation of $14.35 billion. In a bid to appeal to the markets, Intel announced plans to lay off 15% of their workforce in the coming months in order to trim labor costs.

Dow Jones technical outlook

Dow Jones plummeted into a second day of losses, falling over 900 points at Friday’s absolute bottom and slipping below the 40,000.00 major price handle. DJIA is struggling to find the brakes as bids fall below the 50-day Exponential Moving Average (EMA) at 39,683.02, and bulls will be looking to restore balance before price action can extend a decline back to the 200-day EMA at 37,982.00.

Dow Jones five minute chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- Aussie finds some relief after mixed Australian PPI figures.

- Traders are keeping vigilance on job data disappointment from the US.

- Markets adjust their stance on the Reserve Bank of Australia's monetary policy and now expect a cut in 2024.

The Australian Dollar shows a minor recovery against the US Dollar (USD), which is experiencing a sharp drop after disappointing US jobs data. That being said, economic frailties in Australia and increasing rate cut expectations for the Reserve Bank of Australia (RBA) provide a limited upside for the Aussie.

Despite high inflation, weaknesses in Australian economic activity have caused markets to amend their expectations from a rate hike to a rate cut from the RBA by the end of the year. Predictions now propose that the RBA will introduce a cut to tackle economic sluggishness, which could potentially limit further escalation for the Aussie.

Daily digest market movers: Aussie gains ground despite increased RBA cut odds

- Australia's Q2 Producer Price Index (PPI) unveiled this week displayed an increase of 4.8% YoY, a substantial leap from Q1's 4.3%.

- This continued acceleration, hitting its highest point since Q1 of 2023, places the RBA under scrutiny to respond accordingly.

- With the market attributing an 80% chance of an RBA cut by year-end, the Aussie’s upside is limited.

- Across the Pacific, US Nonfarm Payrolls increased by 114K, far less than the predicted 175K.

- The Unemployment Rate climbed to 4.3% as compared to June's 4.1%, and the Labor Force Participation Rate noted a marginal increase to 62.7% from the previous 62.6%.

- The Average Hourly Earnings report showed a drop from 3.8% to 3.6% YoY, which has affected the currency market adversely by adding weight to USD.

- In light of this data, the Federal Reserve (Fed) is expected to initiate interest rate reduction measures starting in September, with a 90% chance priced in according to the CME FedWatch Tool.

AUD/USD Technical Analysis: Bearish tendencies challenged, still room for potential corrections

The AUD/USD trading beneath the 20, 100 and 200-day Simple Moving Average (SMA) prolongs predominantly bearish sentiment. The daily Relative Strength Index (RSI) saw values between 30 and 37 during the past week, reinforcing the bearish perspective. The Moving Average Convergence Divergence (MACD) maintains flat red bars, signaling enduring bearish momentum.

However, the AUD/USD pair seems to exhibit resilience near the 0.6480 mark, indicating a potential key support level. Conversely, resistance is speculated to be around the 0.6560-0.6570 zone, where selling pressure has so far capped the rally.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

President of the Federal Reserve (Fed) Bank of Chicago Austan Goolsbee reiterated the importance of the Fed not reacting to a single data point on Friday after US Nonfarm Payrolls came in widely under forecasts, but noted that inflation and jobs data have both made significant progress in recent months.

Key highlights

The jobs data follows the trend of cooling labor market.

We had multiple good months of inflation, broad-based.

If inflation and the job market continue to cool, the Fed should cut.

We need to balance policy with the economy in short order.

- Mexican Peso weakens to a yearly low of 19.22 against the USD amid US economic worries.

- Mixed Mexican data: higher unemployment rate, solid but slowing Gross Fixed Investment.

- US Nonfarm Payrolls and Manufacturing PMI disappoint, heightening recession fears.

The Mexican Peso weakened further throughout the week against the Greenback and hit a new yearly low of 19.22, as fears that the United States (US) economy might slow down further hurt the outlook of its largest partner, Mexico. As market participants shifted risk-averse, the USD/MXN trades at 19.00 and gains over 0.70%.

Data from Mexico was mixed as the unemployment rate ticked higher by two-tenths, while Gross Fixed Investment remained solid in May, yet trailed April’s double-digit figures. Even though this could’ve boosted the Peso, market players were aware of the release of July’s US employment report.

The US Nonfarm Payrolls (NFP) plunged below estimates and trailed June’s data, while the Unemployment Rate edged up and Average Hourly Earnings dipped. Today’s data, along with Thursday’s dismal Manufacturing PMI figures revealed by the Institute for Supply Management (ISM), reignited recession worries.

Following the data, traders ditched risk-sensitive assets in the FX space, which hurt the Peso's emerging market status. Besides that, market participants expect the Federal Reserve (Fed) to cut rates for the first time at the upcoming September meeting, and even some Wall Street banks consider 50 basis points (bps) of easing.

Recently, some Fed officials had crossed the wires. Richmond’s Fed President Thomas Barkin disregarded a 50 bps cut, saying the Fed considers this “with an economy that feels like it’s deteriorating rapidly.” At the same time, Chicago’s Fed Austan Goolsbee stated, “They’d never want to overreact to one month’s data.”

Daily digest market movers: Mexican Peso extends its weekly losing streak to three

- Mexico’s Unemployment Rate in June was 2.8% MoM, exceeding estimates and May’s 2.6% reading. Further data showed that Gross Fixed Investment in May dropped from 0.8% to 0.7% MoM.

- Mexico’s S&P Global Manufacturing PMI for July contracted to 49.60, below June’s 51.10 expansion, underscoring the economy’s undergoing a slowdown.

- Given the backdrop, Mexico’s economy is beginning to weaken further, which could be the reason the Bank of Mexico (Banxico) needs to cut rates.

- The US Department of Labor revealed that NFPs came at 114K in July, missing estimates of 175K, with previous figures downwardly revised from 206K to 179K. Additional data showed the Unemployment Rate increased from 4.1% to 4.3%, and Average Hourly Earnings dipped from 0.3% to 0.2%.

- The Fed decided to hold rates unchanged yet commented that goodish inflation data and further weakening in the labor market could trigger action.

- Following the data release, most banks anticipate more aggressive monetary policy easing by the Fed. Bank of America now expects the first rate cut in September instead of December, while Citi and JP Morgan project the Fed will lower rates by 50 bps in September and November.

- Data from the Chicago Board of Trade (CBOT) shows that the December 2024 fed funds rates futures contract suggests that policymakers will ease policy at least 117 basis points.

Technical analysis: Mexican Peso depreciates sharply as USD/MXN rises above 19.00

The USD/MXN rallied sharply above the 19.00 psychological level and hit a new year-to-date (YTD) high of 19.22 before retreating to the figure. The Relative Strength Index (RSI) shows momentum favors buyers, as the RSI stands in overbought territory. But due to the strength of the uptrend, the most extreme reading will be 80.

If USD/MXN extends its gains past the YTD high, up next would be the 19.50 area. Once cleared, the next stop would be the 20.00 mark.

Conversely, a drop below the August 1 low of 18.42 could sponsor a dip toward the 50-day Simple Moving Average (SMA) at 17.99. In further weakness, the exotic pair could challenge the 17.50 mark.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Canadian Dollar markets swamped out by NFP release.

- Canada has limited data releases on the scope.

- US data broadly softened, fanning the flames of recession fears.

The Canadian Dollar (CAD) was tossed around on Friday as global markets roiled following a broad downside miss in US labor and wages figures released early in the US trading session. US Nonfarm Payrolls (NFP), wages, and unemployment figures all missed forecasts, raising investor concerns that the US may be headed for a “hard landing” scenario in the coming months.

Canada has little of note slated for immediate release on the economic calendar, leaving CAD traders adrift until next Friday’s Canadian labor data. As markets roil under deflating US economic figures, market flows should be expected to continue tossing the CAD around as traders scramble to adjust their exposure.

Daily digest market movers: US NFP misfire all but guarantees Fed rate cut in September

- US NFP jobs data showed the US added 114K net new employment positions in July, well below the forecast 175K and easing back from the previous month’s 179K, which was also revised lower from 206K.

- The US Unemployment Rate ticked higher to 4.3% in July, the highest rate of measured unemployment since November of 2021.

- Average Hourly Earnings also grew by less than expected in July, notching in 0.2% MoM against the forecast hold at 0.3%.

- Annualized wages rose 3.6%, below the forecast 3.7% and easing further back from the previous 3.8% (revised from 3.9%).

- US Factory Orders contracted in June, printing -3.3% MoM versus the forecast for -2.9% and accelerating down from the previous month’s print of -0.5%.

- Rate markets are now pricing in 75% odds of a double cut from the Federal Reserve (Fed) in September, with a rate cut now a forgone conclusion when the Fed delivers its rate call on September 18.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -1.10% | -0.43% | -1.57% | -0.16% | -0.26% | -0.27% | -1.39% | |

| EUR | 1.10% | 0.67% | -0.48% | 0.93% | 0.85% | 0.82% | -0.30% | |

| GBP | 0.43% | -0.67% | -1.17% | 0.27% | 0.16% | 0.16% | -0.96% | |

| JPY | 1.57% | 0.48% | 1.17% | 1.45% | 1.33% | 1.32% | 0.18% | |

| CAD | 0.16% | -0.93% | -0.27% | -1.45% | -0.10% | -0.09% | -1.23% | |

| AUD | 0.26% | -0.85% | -0.16% | -1.33% | 0.10% | 0.00% | -1.13% | |

| NZD | 0.27% | -0.82% | -0.16% | -1.32% | 0.09% | 0.00% | -1.11% | |

| CHF | 1.39% | 0.30% | 0.96% | -0.18% | 1.23% | 1.13% | 1.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Technical analysis: Canadian Dollar finds some upside against deflating Greenback, but overall lower

The Canadian Dollar (CAD) is broadly lower on Friday as traders pivot away from the CAD into more interesting assets. The CAD tumbled a full percent against the Euro, the Japanese Yen, and the Swiss Franc on Friday, but was able to eke out a slim quarter-percent gain against the floundering US Dollar.

USD/CAD continues to splash around the 1.3850 level, churning close to the top end of 2024’s peak bids. The pair is up a little over 2% after the last swing low into the 1.2600 handle rolled over into a technical bounce off of the 200-day Exponential Moving Average (EMA). Bullish momentum appears set to wither as USD/CAD bids fail to capture the 1.3900 region, but short pressure still needs more percolation before knocking bidders off of a three-week winning streak.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- US Dollar suffers following July's disappointing jobs report, which sparks increased expectation in September rate cut.

- If data continues to show progress, the Fed signals readiness to respond to signs of weakness in the US economy.

- CME FedWatchTool indicates a 90% chance of a cut in September.

The US Dollar (USD), as gauged by the DXY index, experienced heavy selling pressure following the July jobs report on Friday, sliding to lows not seen since March near 103.20.

With a September rate cut seemingly in sight, any signs of vulnerability in the US economic landscape could weigh on the USD and increase dovish sentiment toward the Federal Reserve (Fed).

Daily digest market movers: The US Dollar dips on July's weak jobs growth

- US Nonfarm Payrolls (NFP) grew by just 114K in July, falling short of the market expectation of 175K and significantly below June's downwardly revised growth of 179K (from 206K), according to the US Bureau of Labor Statistics (BLS) report on Friday.

- Additional figures from the report showed that the Unemployment Rate inched up to 4.3% in July from 4.1% in June.

- Concurrently, Average Hourly Earnings' annual wage inflation decreased to 3.6% from 3.8%.

- The weak demand for labor in the US, underscored by these figures, has piled pressure on the USD, increasing expectations that the Fed will start to cut interest rates in September.

- The CME FedWatch Tool now shows that traders predict a 90% chance of a half-point Fed rate cut in September.

DXY technical outlook: Index outlook turns bearish amid concerning data

The DXY outlook has taken a turn for the worse after the disappointing jobs report. The index slid significantly below both the 20-day and 200-day Simple Moving Averages (SMAs), which are on the brink of a bearish crossover near 104.00.

The momentum-based Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) also took substantial hits, indicating a surge in selling pressure.

The DXY index now finds support at 103.00, 102.50 and 102.30, with resistance levels positioned at 103.50 and 104.00.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

The Japanese Yen (JPY) started the month of July at the weakest levels seen in over 30 years (162 to the US Dollar (USD)). From there the island-nation currency has surged more than 9%, settling below 148 per USD, NBC FX analysts Stéfane Marion and Kyle Dahms note.

The potential for JPY strength later this year

“The factors underpinning the current bout of strength were twofold, firstly the unwinding of carry trades brought an initial surge which was then compounded by a surprise decision from the Bank of Japan to raise rates to their highest level in 15 years. In addition, the central bank showed a path towards slowing asset purchases, a sizeable shift in stance from previously easy money.”

“With inflation still above target, the contrast in the conduct of monetary policy between Japan and the rest of the world should become more apparent especially if the Federal Reserve (Fed) starts easing in September.”

“The events of July have confirmed our view that the JPY was set for appreciation. We continue to see the potential for JPY strength later this year, but it should be said that a lot of ground has already been covered in little time.”

The Bank of Canada (BoC) lowered the target for the overnight rate by 25 basis points in July. A soft landing scenario for the Canadian economy is not a foregone conclusion, NBC FX analysts Stéfane Marion and Kyle Dahms note.

Global economic growth weighs on the price of commodities

“For the second time in as many meetings, the Bank of Canada lowered the target for the overnight rate by 25 basis points in July. Driving the decision to cut was ‘broad price pressures continuing to ease’ and ‘ongoing excess supply lowering inflationary pressures’.

“In our view, a soft landing scenario for the Canadian economy is not a foregone conclusion. If incoming data soften more in line with our outlook, there will be a strong case for another cut in September.”

“At this stage, we still see USD/CAD rising above 1.40 in the coming months as weaker global economic growth weighs on the price of commodities.”

The US Dollar (USD) is under pressure as the US labour market continues to deteriorate, NBC FX analysts Stéfane Marion and Kyle Dahms note.

Weakness in the USD to be temporary

“The Greenback is under pressure as the US labour market continues to deteriorate. The unemployment rate rose to 4.3% in July, the fourth consecutive month of higher-than-expected readings, shattering the FOMC's year-end projection of 4%.”

“With Mr Powell now openly focusing on the full employment side of his dual mandate, the Fed is likely to feel comfortable easing more than previously envisaged.”

“Nevertheless, we expect the weakness in the USD to be temporary, as a slowdown in the world's largest economy reverberates through global financial markets via the risk-off trade that usually accompanies a strengthening of the greenback.”

- Gold price drops to $2,420 after peaking at $2,477, down nearly 0.80%.

- US Nonfarm Payrolls for July miss expectations, unemployment rate rises to 4.3%.

- Treasury yields and USD plunge, prompting banks to anticipate faster Fed rate cuts.

Gold price reversed its course and tumbled almost 1% after hitting a two-week high of $2477 following weaker-than-expected data from the United States (US). This weighed on the Greenback and sent US Treasury yields plummeting as investors expected the Federal Reserve could cut rates faster than they thought. The XAU/USD trades at $2,420 at the time of writing

XAU/USD whipsaws as disappointing US economic indicators weigh on the Greenback and Treasury yields

Friday’s US Nonfarm Payrolls figures disappointed investors, which were still digesting a dismal ISM Manufacturing PMI report that spurred concerns about the health of the US economy.

The US Department of Labor revealed that 114K people were added to the workforce in July, missing estimates of 175K, and the previous figures were downward revised from 206K to 179K. Further data showed the Unemployment Rate ticked up from 4.1% to 4.3% and Average Hourly Earnings dipped a tenth from 0.3% to 0.2%.

Bullion rallied sharply, capitalizing on the fall of the US 10-year Treasury bond yield, which tanked over 15 basis points to 3.815%. The Greenback was also hurt, collapsing more than 1.13% according to the US Dollar Index (DXY), which is at 103.16.

After the data, most banks began to price in more aggressive monetary policy easing by the Fed. Bank of America expects the first cut in September instead of December, while Citi and JP Morgan expect the Fed to lower rates by 50 bps in September and November.

XAU/USD Price Analysis: Technical outlook

Gold price has retreated toward the July 31 lows of $2,404-$2,410, which could be attributed to profit-taking ahead of the weekend, as US yields and the Greenback remain at weekly lows. From a technical standpoint, XAU/USD is set to remain bullish and if buyers achieve a daily close above $2,450, this could exacerbate a challenge towards the all-time high, ahead of the $2,500 mark. On further weakness, prices could fall below $2,400, which could pave the way for a pullback to the 50-day moving average (DMA) at $2,364, before testing the 100-DMA at $2,337.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

More often than not, central banks have little to gain by shocking markets. That said, on occasion, the element of surprise can be a useful policy tool, Rabobank’s senior FX strategist Jane Foley notes.

USD/JPY bears push to test 145

“Earlier this year, the SNB took full advantage of an unprepared market by cutting rates to undermine the value of the CHF after Swiss CPI inflation fell back to the central bank’s target. This week the hawkishness of the BoJ has led to the market re-evaluating its expectations about its monetary policy outlook through to the end of this year and beyond.”

“This reappraisal has had a significant impact on the value of the Japanese Yen (JPY). In the coming sessions key Japanese economic data releases could either vindicate or undermine the hawkish signals provided by the BoJ. This week’s coincident surge in market expectations about the number of Fed rate cuts before the end of this year has added to the downside pressure on USD/JPY.”

“Our medium-term target is USD/JPY145. This week’s moves suggest that this level may be hit far sooner than we had expected. Dependent on the outcome of next week’s key Japanese economic data, we will be re-evaluating our USD/JPY forecasts.”

- GBP/USD rallies from daily low of 1.2707 to trade above the 1.2800 mark.

- Key resistance levels reclaimed: 50-DMA at 1.2787 and 1.2800 mark; next targets are 1.2860, 1.2900, and 1.2950.

- If GBP/USD falls below 1.2800, it may range between 1.2800 and 1.2700, with further support at 100-DMA (1.2683).

The Pound Sterling rallied sharply against the US Dollar after recent economic data from the United States (US) sparked speculation that the US Federal Reserve might cut interest rates faster than expected. The GBP/USD trades at 1.2833 after hitting a daily low of 1.2707.

The Greenback is being battered, given the backdrop of the July ISM Manufacturing PMI plunging to its lowest level since December 2023 and Nonfarm Payrolls missing the mark. Market participants had begun to price in a larger rate cut at the upcoming September meeting.

GBP/USD Price Analysis: Technical outlook

After diving throughout the week, the GBP/USD reclaimed key resistance levels like the 50-day moving average (DMA) at 1.2787 and the 1.2800 mark. Momentum shifted in buyers' favor as the Relative Strength Index (RSI) turned bullish

If GBP/USD closes above 1.2800, that can pave the way for testing the June 12 high at 1.2860 and expose the 1.2900 psychological figure. Once surpassed, further upside is seen, with the next stop being 1.2950, which capped price action for four consecutive days before buyers could challenge 1.3000.

Conversely, if sellers drag the GBP/USD pair below 1.2800, then the pair could stay range-bound within the 1.2800-1.2700 mark, which, if broken, will expose the 100-DMA at 1.2683.

GBP/USD Price Action – Daily Chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- Silver price refreshes weekly high at $29.20 as weak US NFP data sends US yields down.

- The US NFP report showed that labor demand has slowed and wage growth has softened.

- Investors see the Fed pivoting to policy normalization in September.

Silver price (XAG/USD) posts a fresh weekly high at $29.20 in Friday’s North American trading hours. The white metal gains as US yields sink after the United States (US) Nonfarm Payrolls (NFP) report for July showed signs of cooling labor market conditions.

10-year US Treasury yields witness a bloodbath and dives to multi-month low near 3.82%. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, plunges below 103.30. Lower yields on interest-bearing assets bode strongly for the Gold price as they reduce the opportunity cost of investment in non-yielding assets.

The report showed that labor demand has softened as number of individuals hired by employers in July came in lower at 114K than estimates of 175K and June’s reading of 179K. The Unemployment Rate jumps to 4.3%, the highest since November 2021, from expectations and the prior release of 4.1%. The report clearly indicates that the labor market struggles to bear the consequences of higher interest rates by the Federal Reserve (Fed).

Meanwhile, Average Hourly Earnings have also grown at a slower pace, pointing to a slowdown in consumer spending that eventually cools down inflationary pressures. Annually, the wage growth measure decelerated at a faster-than-expected pace to 3.6%. While the labor market has cooled down, it will add to reasons prompting expectations of sooner rate cuts by the Fed. The Fed is widely anticipated to start reducing interest rates from the September meeting.

Silver technical analysis

Silver price breaks above the horizontal resistance plotted from June 13 low at $28.66 on a four-hour timeframe, which has become a support now. The asset climbs above the 50-period Exponential Moving Average (EMA) near $28.70, suggesting that the near-term trend is upbeat.

The 14-period Relative Strength Index (RSI) moves higher to near 60.00. If the RSI breaks above 60.00, the momentum will shift to the upside.

Silver four-hour chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

EUR/USD edged a little higher in European trade, reflecting the general drift in the US Dollar (USD), and broke above 1.09, Scotiabank’s FX strategist Shaun Osborne notes.

EUR trades above 1.09 intraday

“The Euro (EUR) has steadied against the CHF after the cross fell sharply overall this week as havens have been in demand amid geo-political worries and weak stocks. European sovereign debt spreads have widened somewhat as Italian and Greek debt underperform in the broader wave of risk aversion.”

“The EUR has picked up a little support in European trade, reflecting a firm zone of support for the EUR around the 1.08—where all the major moving averages and retracement support (61.8% of the June/July rally at 1.0774) coalesce. EUR broke above 1.09 intraday and trades around 1.0911 level.”

Soft stocks are helping keep the Canadian Dollar (CAD) tone defensive but whether weaker equity markets are enough of a justification for driving the CAD significantly lower at the moment remains to be seen, Scotiabank’s FX strategist Shaun Osborne notes.

Heightened CAD volatility is possible

“Thinner liquidity Monday, when local markets are closed, might open the door for heightened CAD volatility in response to still weaker equities but that is not necessarily something that is well grounded in fundamentals.”

“Beyond weak stocks, underlying factors (spreads, crude oil and the general USD tone) have moved in the CAD’s favour in the past few days, leaving spot trading a big figure above our fair value estimate (1.3785). That should help constrain the USD’s ability to push higher to some extent but the CAD is unlikely to pick up too much ground while stocks are trading defensively.”

“The CAD got clobbered yesterday, driving spot to near the late 1.2023 high just under 1.39. Spot has consolidated below the figure this morning but there is scant sign of any CAD-positive price developments on the intraday chart. Rather, the USD appears to be pausing ahead of another attempt higher from a technical point of view. Support is 1.3790/00. Resistance is 1.3890/00 and 1.40.”

Although the Copper price has already recovered somewhat, the numerous poor sentiment indicators in the manufacturing sector left their mark, Commerzbank’s commodity analyst Carsten Fritsch notes.

Weak construction sector acts as a brake for Copper