- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold edges higher as Trump challenges EU on tariffs

Gold edges higher as Trump challenges EU on tariffs

- Gold benefits from tailwinds and rallies on the back of tariff headlines.

- US yields tick up after a drop in inflation triggers flight to equities.

- Traders have to deal with changes in trade wars and knee-jerk reactions.

Gold’s price (XAU/USD) is back on its way to new all-time highs after the United States (US) Consumer Price Index (CPI) data came in softer than expected on Wednesday, which triggered a sigh of relief in US markets with odds for a recession or stagflation being trimmed. This in turn caused an outflow in US bonds and an inflow in US equities, with the sell-off in bonds sparking a boost in yields. The precious metal trades around $2,950 at the time of writing on Thursday.

Meanwhile, traders are still trying to oversee the amount of geopolitical headlines taking place. US President Donald Trump commented on Wednesday that the US will impose reciprocal tariffs on Europe coming into effect on April 2. On the other hand, US diplomats are on their way to Russia to negotiate a ceasefire deal that already got support from Ukraine and bears US military support for the country.

Daily digest market movers: Sigh short-lived

- US Consumer Price Index figures for February rose at the slowest pace in four months, and traders are fully pricing in another quarter-point interest-rate cut by the Federal Reserve in June’s meeting. Lower borrowing costs tend to benefit Gold, as the precious metal doesn’t pay interest, Bloomberg reports.

- Gold is set to push to a record above $3,100 in the second quarter of 2025 on rising economic uncertainty due to US President Donald Trump’s tariff policies, according to BNP Paribas SA, Reuters reports.

- A worsening US budget outlook is signaling inflation could increase, which would benefit Gold as a hedge, according to Macquarie Bank, which calls for a $3,500 level by the third quarter of 2025, Bloomberg reports.

- The CME Fedwatch Tool sees a 97.0% chance for no interest rate changes in the upcoming Fed meeting on March 19. The chances of a rate cut at the May 7 meeting currently stand at 39.5%.

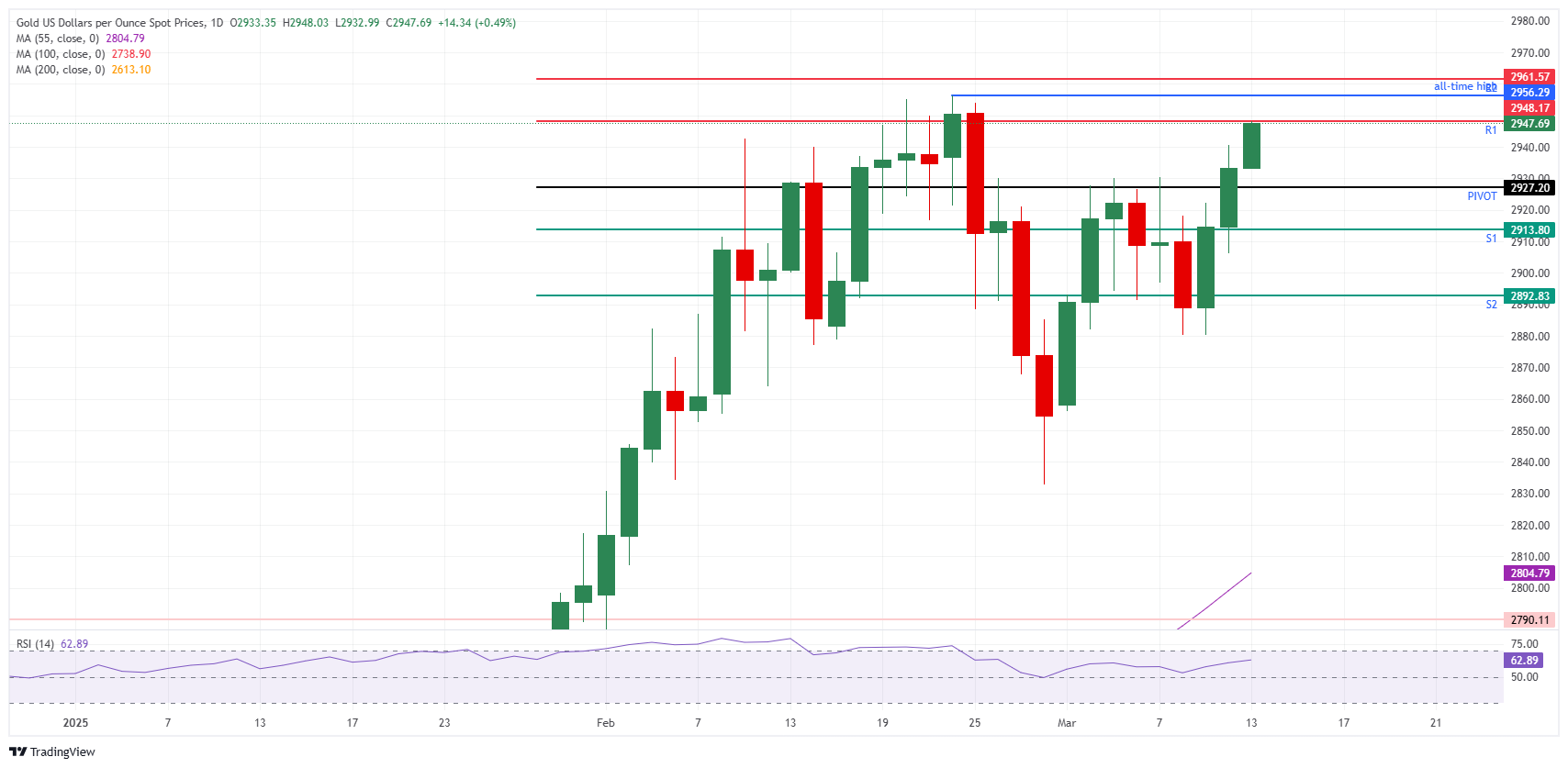

Technical Analysis: Gold pushing higher

Gold is currently knocking on the door of the intraday R1 resistance level at $2,947 at the time of writing on Thursday. The move comes in a bit contradictory, seeing that US yields rallied higher on Wednesday after a softer US CPI release. The move can be explained by the fact that equities saw inflows from the outflow in US bonds, which pushed yields higher. The sigh of relief is quickly fading on Thursday, with markets focusing again on tariffs, Ukraine, and a possible recession or stagflation in the US.

Gold is heading to $2,950, roughly coinciding with the R1 resistance at $2,947. Once through there, the intraday R2 resistance at $2,961 comes into focus, meaning that the previous all-time high of $2,956 is broken.

On the downside, the daily Pivot Point stands at $2,927. In case that level breaks, look at the S1 support around $2,913. Further down, the S2 support stands at $2,892, though the $2,900 big figure should be strong enough to catch any corrections.

XAU/USD: Daily Chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.