- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- US CPI inflation set to rebound slightly in November, core to remain high

US CPI inflation set to rebound slightly in November, core to remain high

- The US Consumer Price Index is set to rise 2.7% YoY in November.

- The core CPI inflation is seen steady at 3.3% last month.

- The Fed is expected to cut interest rates by 25 bps in December.

The US Consumer Price Index (CPI) report for November, a key measure of inflation, will be unveiled on Wednesday at 13:30 GMT by the Bureau of Labor Statistics (BLS).

Markets are buzzing in anticipation, as the release could trigger significant swings in the US Dollar (USD) and influence the Federal Reserve's (Fed) plans for interest rates in the months ahead.

What to expect in the next CPI data report?

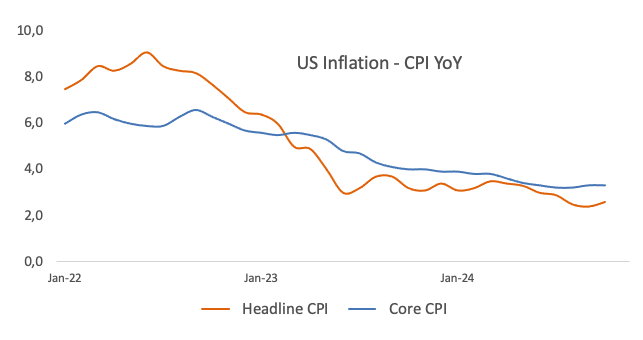

As measured by the CPI, inflation in the US is expected to increase at an annual rate of 2.7% in November, slightly higher than the 2.6% growth reported in the previous month. Core annual CPI inflation, which excludes volatile food and energy prices, is projected to remain steady at 3.3% during the same period.

On a monthly basis, the headline CPI and core CPI are forecasted to rise by 0.3% each.

Previewing the October inflation report, TD Securities analysts said: “We look for core inflation to stay largely unchanged in November, registering another firm 0.3% m/m advance. Rising goods prices are expected to explain most of the strength in the series, while slowing housing inflation is likely to provide some relief. On a y/y basis, headline CPI inflation is expected to inch higher to 2.7% while core inflation likely stayed unchanged at 3.3%.”

In his latest remarks at an event hosted by the New York Times on December 4, Federal Reserve Chair Jerome Powell shared that the central bank's approach to future interest rate adjustments could take a more measured pace, thanks to the economy's stronger-than-anticipated performance this year.

Reflecting on the economic growth, Powell noted that the resilience had surpassed earlier forecasts, allowing the Fed to adopt a more cautious stance as it works toward finding a "neutral" rate policy. He acknowledged that "the economy is strong, and it’s stronger than we thought in September," even as inflation has been running slightly higher than anticipated.

Powell explained that this backdrop is shaping the Fed's outlook as it prepares for its upcoming meeting on December 17-18, a session that markets had widely expected to result in another rate cut.

How could the US Consumer Price Index report affect EUR/USD?

The upcoming Trump administration is expected to adopt a stricter stance on immigration, a more relaxed approach to fiscal policy, and a reintroduction of tariffs on imports from China and Europe. Together, these factors are likely to exert upward pressure on inflation, potentially prompting the Fed to pause or even halt its ongoing easing cycle, thereby providing additional support to the US Dollar (USD).

However, with the gradual cooling of US labour market conditions and the likely persistence of sticky inflation, the November inflation report is unlikely to significantly alter the Fed’s stance on monetary policy.

Currently, markets are pricing in an approximately 85% probability that the Fed will lower rates by 25 basis points in December, according to the CME Group’s FedWatch Tool.

Pablo Piovano, Senior Analyst at FXStreet, provides a brief technical outlook for EUR/USD, arguing: “The December high of 1.0629 (December 6) serves as the initial resistance, followed by the intermediate 55-day SMA at 1.0776 and the more significant 200-day SMA at 1.0842.”

Pablo adds: “On the downside, if the spot price breaks below the December low of 1.0460, it could pave the way for a potential test of the 2024 bottom at 1.0331 (November 22).”

Economic Indicator

Consumer Price Index (MoM)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The MoM figure compares the prices of goods in the reference month to the previous month.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Dec 11, 2024 13:30

Frequency: Monthly

Consensus: 0.2%

Previous: 0.2%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.