- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Canadian Dollar loses momentum on Friday

Canadian Dollar loses momentum on Friday

- The Canadian Dollar treaded water to wrap up the trading week.

- Canada saw a slight decline in home prices, Retail Sales meet expectations.

- Broad-market sentiment supports the Greenback, limiting Loonie options.

The Canadian Dollar (CAD) waffled into the midrange on Friday, testing into the low side but ultimately getting hamstrung as Canadian data comes in mixed and gets overshadowed by sentiment-bolstering US data prints.

Canada saw an unexpected contraction in its New Housing Price Index in October, a welcome sign for Canadians suffering under the weight of home prices that have outrun income for decades despite investors not being able to rely on forever-increasing home prices for investment returns. Headline Canadian Retail Sales came in at expectations, though core Retail Sales excluding automobile purchases accelerated in September.

Daily digest market movers: Canadian Dollar sticks to the midrange on mixed economic data

- Canada’s New Housing Price Index contracted by 0.4% MoM in October, down from the last print of a flat 0.0%, while investors were hoping for a 0.1% uptick. Despite the near-term downtick, Canada’s New Housing Price Index is still up 0.8% YoY.

- Canadian Retail Sales printed unchanged at 0.4% MoM in September, as markets expected.

- Core Canadian Retail Sales excluding automobile purchases lurched high to 0.9% MoM, walking back the previous month’s -0.8% contraction and stepping over the median market forecast of 0.5%.

- Market data reactions were fully absorbed by US Purchasing Managers Index (PMI) survey results that came in higher across the board, bolstering the US Dollar and limiting upside potential for the Loonie.

- It’s a quiet data docket on the cards for next week: Canada is almost entirely absent from the calendar schedule until next Friday’s Gross Domestic Product (GDP) update, with US GDP and Personal Consumption Expenditures Price Index (PCEPI) due on Wednesday.

Canadian Dollar price forecast

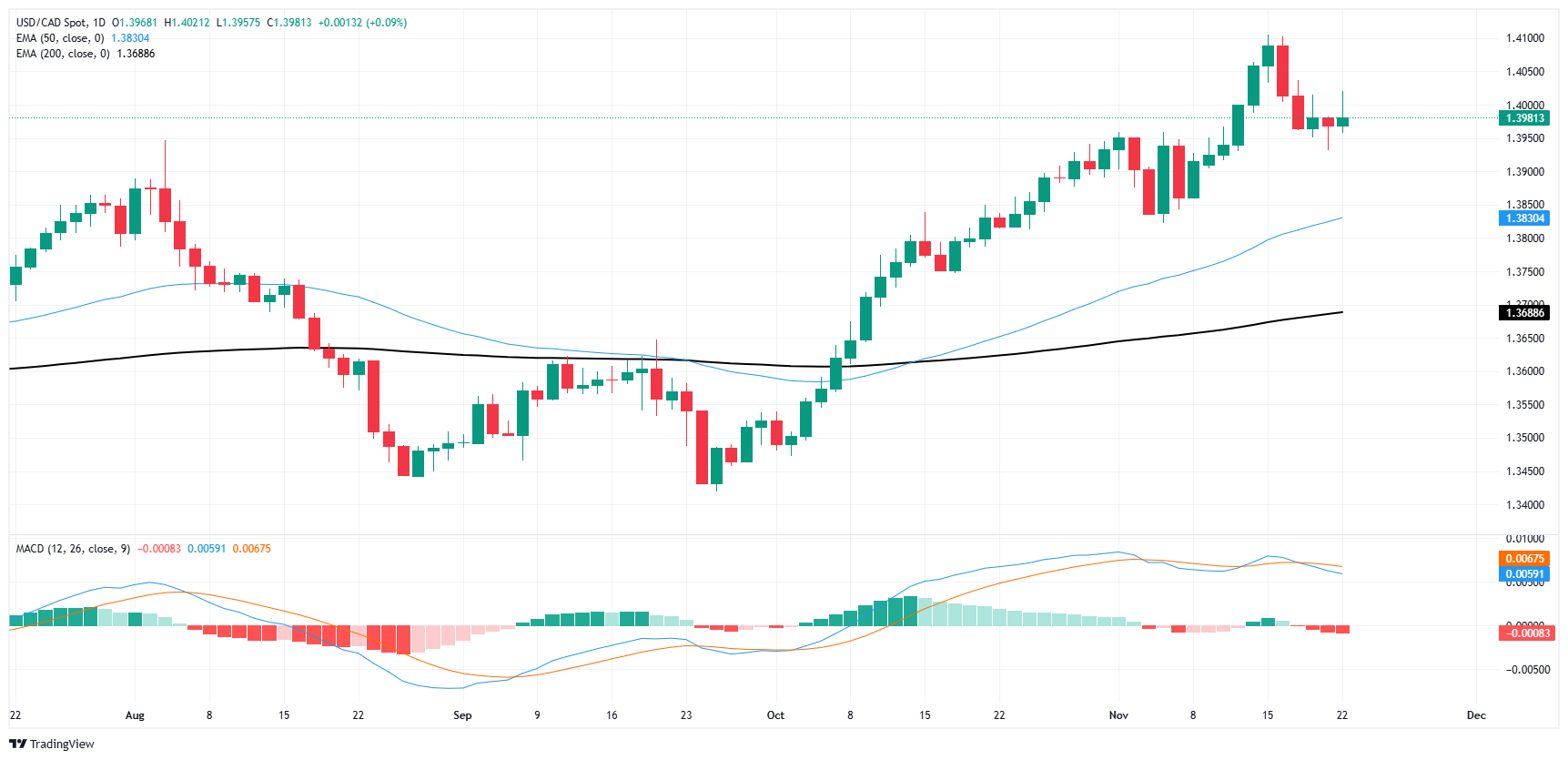

The Canadian Dollar (CAD) found a brief reprieve from Greenback strength this week, paring away recent losses and dragging the USD/CAD chart back below the 1.4000 handle. Despite a recovery in the Loonie’s stance, the pair remains close to recent highs as broad-market bids prop up the US Dollar.

USD/CAD is running the risk of rolling over into a fresh round of Canadian Dollar strength after bulls ran aground of a long-term sideways channel. However, near-term price action has yet to give up ground as bids battle it out well above the 50-day Exponential Moving Average (EMA) near 1.3830.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.