- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- BoC looks set for another interest rate cut, with markets tilting toward 50 basis points trim

BoC looks set for another interest rate cut, with markets tilting toward 50 basis points trim

- Bank of Canada (BoC) is expected to cut its policy rate by 50 bps.

- The Canadian Dollar remains on the defensive against the US Dollar.

- Headline inflation in Canada dropped below the bank’s 2% target.

- The BoC will also release its Monetary Policy Report (MPR).

There is broad anticipation that the Bank of Canada (BoC) will cut its policy rate for the fourth consecutive meeting on Wednesday. Unlike previous moves, there seems to be a consensus for a 50 basis point rate cut this time, taking the benchmark interest rate to 3.75%.

Since the beginning of the year, the Canadian Dollar (CAD) has weakened against the US Dollar (USD), with USD/CAD reaching an almost two-year high near 1.3950 in early August. Following a period of quite a significant appreciation in August, CAD has since then embarked on a firm downward path that currently flirts with the mid-1.3800s against its North American counterpart.

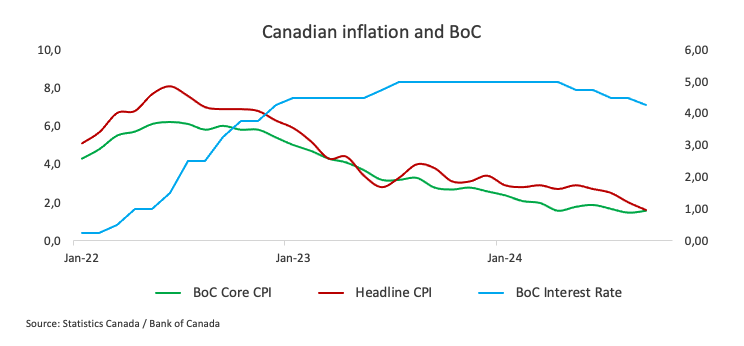

In September, Canada's annual inflation rate, measured by the headline Consumer Price Index (CPI), broke below the central bank’s 2% target for the first time since the Covid-19 pandemic, showing prices rising by 1.6% over the last twelve months. The BoC's core CPI, despite rebounding marginally last month, remained well below the bank’s threshold.

It is worth noting that the BoC aims to maintain consumer prices around the midpoint of the 1%-3% range.

A dovish cut appears well on the horizon

Despite the anticipated rate cut, the central bank's overall stance is expected to lean towards the bearish side, particularly against the backdrop of declining inflation, further cooling of the labour market, and GDP running below the bank’s latest forecasts.

So far, swaps markets in Canada see around a 70% chance of a half-point rate reduction on Wednesday.

According to a BoC survey released on October 11, Canadian firms reported continued weak demand and slow sales growth, though they noted a marginal improvement in conditions during the third quarter. The survey also suggested that rate cuts could potentially provide a further boost to these conditions.

Following the rate cut on September 4, the Minutes published on September 18 revealed that the bank’s Governing Council was divided on the inflation outlook ahead of its decision to cut rates for the third consecutive time. The BoC stated that it was balancing the effects of two conflicting forces on inflation: the ongoing high costs of shelter and services and a slowing economy coupled with rising unemployment.

According to the Minutes, council members expressed the view that if the economy and labour market did not improve as expected in response to lower borrowing costs, it could be necessary to reduce the policy rate more rapidly.

At his latest remarks on September 24, BoC Governor Tiff Macklem indicated that, given the bank’s ongoing progress in bringing inflation back towards the 2% target, further rate cuts are a reasonable expectation. Macklem emphasized the bank’s goal of keeping inflation near the middle of its 1%-3% control range. "We need to stick the landing," he said, adding that the bank is aiming for stronger economic growth to help absorb the remaining slack in the economy.

Previewing the BoC’s interest rate decision, analysts at Standard Chartered noted: “We now expect the Bank of Canada (BoC) to lower the policy rate by 50bps (instead of 25 bps) at both the October and December meetings, taking the year-end rate to 3.25% (3.75% prior). The September headline inflation undershoot and diminishing inflationary pressure from shelter prices are likely to open the door for faster easing. Falling inflation expectations and continued slack in the economy further bolster the case for 50bps moves.”

When will the BoC release its monetary policy decision, and how could it affect USD/CAD?

The Bank of Canada will announce its policy decision at 13:45 GMT on Wednesday, followed by a press conference from Governor Macklem at 14:30 GMT.

With no major surprises anticipated, the impact on the Canadian Dollar (CAD) is expected to stem more from the central bank’s messaging than the actual interest rate decision.

Pablo Piovano, Senior Analyst at FXStreet, notes that USD/CAD has been in a strong upward trend since late September, with the pair hitting October tops near 1.3850 so far this week. The strong rebound came almost exclusively on the back of the robust recovery of the US Dollar (USD).

Pablo adds: "The immediate target emerges at the 2024 peak at 1.3946 recorded on August 5."

He concludes: "Occasional bearish attempts could prompt USD/CAD to retest the provisional 100-day SMA at 1.3664, ahead of the more significant 200-day SMA at 1.3622, all prior to the September bottom of 1.3418 seen on September 25.”

Economic Indicator

BoC Interest Rate Decision

The Bank of Canada (BoC) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoC believes inflation will be above target (hawkish), it will raise interest rates in order to bring it down. This is bullish for the CAD since higher interest rates attract greater inflows of foreign capital. Likewise, if the BoC sees inflation falling below target (dovish) it will lower interest rates in order to give the Canadian economy a boost in the hope inflation will rise back up. This is bearish for CAD since it detracts from foreign capital flowing into the country.

Read more.Next release: Wed Oct 23, 2024 13:45

Frequency: Irregular

Consensus: 3.75%

Previous: 4.25%

Source: Bank of Canada

Bank of Canada FAQs

The Bank of Canada (BoC), based in Ottawa, is the institution that sets interest rates and manages monetary policy for Canada. It does so at eight scheduled meetings a year and ad hoc emergency meetings that are held as required. The BoC primary mandate is to maintain price stability, which means keeping inflation at between 1-3%. Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Canadian Dollar (CAD) and vice versa. Other tools used include quantitative easing and tightening.

In extreme situations, the Bank of Canada can enact a policy tool called Quantitative Easing. QE is the process by which the BoC prints Canadian Dollars for the purpose of buying assets – usually government or corporate bonds – from financial institutions. QE usually results in a weaker CAD. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The Bank of Canada used the measure during the Great Financial Crisis of 2009-11 when credit froze after banks lost faith in each other’s ability to repay debts.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Bank of Canada purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the BoC stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Canadian Dollar.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.