- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Mexican Peso trades flat ahead of Banxico meeting

Mexican Peso trades flat ahead of Banxico meeting

- The Mexican Peso trades flat in its major pairs the day before the Bank of Mexico policy meeting.

- The consensus expectation is for the bank to cut interest rates by 0.25% to 10.50%.

- USD/MXN pulls back from resistance as it steadily climbs within its rising channel.

The Mexican Peso (MXN) trades flat in its major pairs on Wednesday, ahead of the Bank of Mexico (Banxico) September policy meeting on Thursday, which is the main event for the currency this week.

Mexican Peso traders await Banxico’s decision

The Mexican Peso fluctuates between tepid gains and losses against its most heavily-traded peers as traders brace for the Banxico policy meeting on Thursday.

The consensus is for the central bank to cut interest rates by 25 basis points (bps), bringing the official rate down to 10.50% from 10.75% currently.

In a recent survey of 25 economists by Bloomberg, 20 expected a 25 bps cut whilst only one expected no-change.

There is also a growing wild-card bet for a larger 50 bps (0.50%) cut after Mexico’s inflation data, released on Tuesday, registered a deeper-than-expected slowdown in September. Four out of the 25 economists polled by Bloomberg prior to the inflation data expected a 50 bps cut – and this has probably increased after the release.

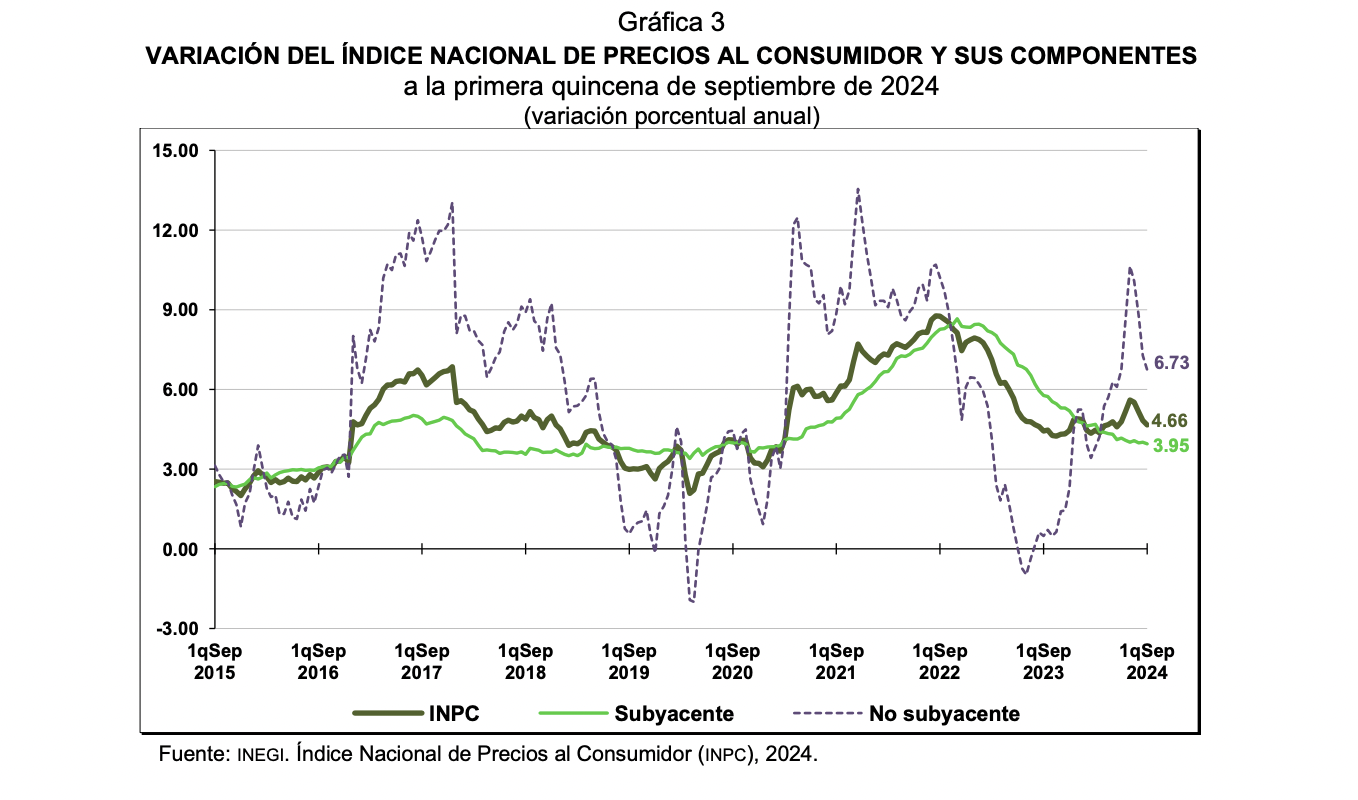

Data out on Tuesday showed headline inflation (INPC) over the last 12 months fell to 4.66% in Mexico in mid-September, and core inflation (Subyacente) to 3.95%, according to data from The Instituto Nacional de Estadística Geografía (INEGI).

At the same time, a greater-than-expected growth in Mexico’s economic activity data for July suggests Banxico may take a more cautious approach, favoring a 25 bps cut over a 50 bps reduction.

“Earlier figures revealed a 3.8% year-on-year expansion in Mexico's economic activity in July, rebounding from a 0.6% decline in the previous month and surpassing market forecasts of a 1.8% rise. This was the sharpest growth in three months and the third-highest increase this year, potentially providing Banxico with more room to moderate its monetary easing, thus lending support to the Peso,” reported Trading Economics.

At the August meeting, Banxico decided to cut interest rates by 0.25%. The fact that the decision was a close call, with only three members voting for the cut versus two who wanted to keep rates unchanged, further makes it unlikely the central bank will opt for a larger 0.50% reduction.

“The larger-than-expected fall in Mexican inflation in the first half of September, to 4.7% y/y, supports our view that Banxico will continue its easing cycle with another 25bp cut on Thursday,” says Kimberley Sperrfechter, Emerging Markets Economist at Capital Economics in a note on Wednesday.

The market is more dovish, however, arguing a higher risk of a 50 bps cut exists, given it expected 75 bps of easing over the next three months and 250 bp of total easing over the next 12 months, according to Dr. Win Thin, Global Head of Markets Strategy and Brown Brothers Harriman (BBH).

Technical Analysis: USD/MXN pulls back from resistance within rising channel

USD/MXN edged higher on Monday to touch resistance (August 22-23 swing high) at 19.52 before pulling back down. Overall, it is in a medium and long-term uptrend within a rising channel.

USD/MXN Daily Chart

There is a possibility USD/MXN has begun a short-term uptrend within the channel. If so, the bias is for higher prices since it is a principle of technical analysis that “the trend is your friend”.

A close above 19.53 (August 23 swing high) on a 4-hour basis would provide bullish confirmation that the pair is in a short-term uptrend.

The 50-day Simple Moving Average is bolstering support at the base of the channel.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.