- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- USD/JPY Price Forecast: Soars past 146.00 boosted by US yields

USD/JPY Price Forecast: Soars past 146.00 boosted by US yields

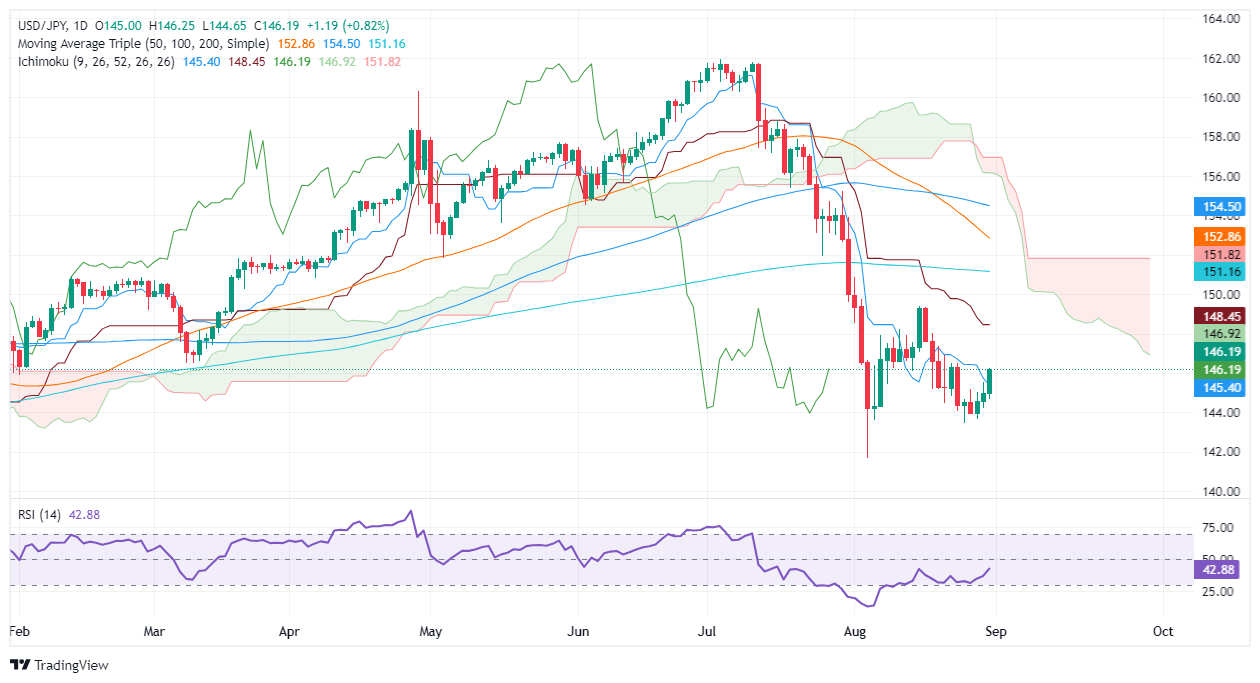

- USD/JPY maintains a downward bias, needing to break key resistances for a bullish shift.

- Short-term buyer momentum faces obstacles at 146.93 (Senkou Span A) and 148.46 (Kijun-Sen), with an eye on the 149.39 peak.

- Mixed RSI signals suggest short-term buyer dominance but an unclear broader trend.

- A drop below 145.39 (Tenkan-Sen) could trigger further losses, with supports at 143.44 (August 26 low) and 141.69 (August 5 low).

The USD/JPY rallied past the 146.00 figure for the first time of the week, as US Treasury bond yields rose sharply following the release of the Fed’s favorite inflation report. The US 10-year Treasury note yield rose four and a half basis points to 3.909%, underpinning the major towards 146.17 after bouncing off daily lows of 145.56.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is downward biased despite surpassing above the Tenkan-Sen lying at 145.39. The Relative Strength Index (RSI) shows that momentum is mixed, with the indicator being at bearish territory but aiming up.

Short-term buyers are in charge, but they must push the USD/JPY spot price above the Senkou Span A at 146.93 and clear the Kijun-Sen at 148.46 before they can clear the latest cycle high at 149.39, the August 15 daily high.

Conversely, a USD/JPY move below the Tenkan-Sen will expose the latest cycle low, seen at 143.44, the August 26 low. The pair could extend its losses past that level, and sellers could target August 5 through 141.69.

USD/JPY Price Action – Daily Chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.