- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- US Dollar alternates gains with losses ahead of Nonfarm Payrolls

US Dollar alternates gains with losses ahead of Nonfarm Payrolls

- The US Dollar Index keeps the vacillating price action in the low 104.00s.

- US slowdown concerns lent support to the Greenback post-Fed.

- The July Nonfarm Payrolls will be the salient event on Friday.

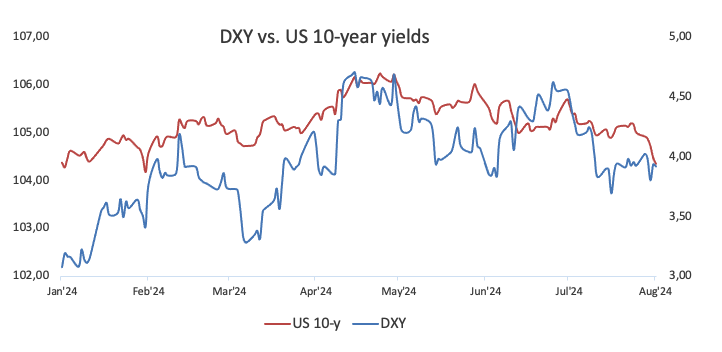

The US Dollar (USD) kicks off the European session in an inconclusive fashion around the 104.20-104.30 band when tracked by the USD Index (DXY) at the end of the week, giving away part of Thursday’s marked advance, although maintaining in place the range-bound trade seen in the past couple of weeks.

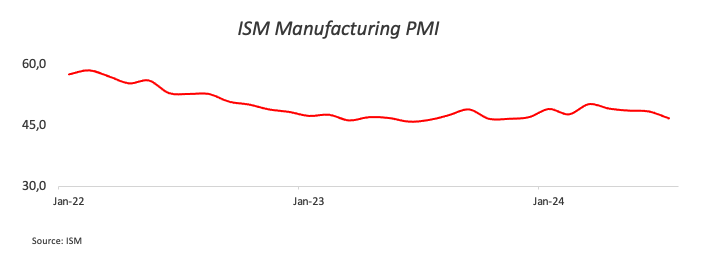

In fact, the Greenback managed to set aside part of the post-FOMC weakness on Thursday, after further cooling of the domestic labour market (as per weekly Jobless Claims), and a disenchanting print from the ISM Manufacturing PMI for the month of July (46.8) reignited fears of a potential slowdown in the US economy, jeopardizing the view of a soft landing following the hiking cycle by the Federal Reserve (Fed).

In addition, the resurgence of geopolitical jitters, especially in the Middle East, favoured the demand for the safe haven US Dollar, which in turn kept the risk-linked complex depressed. The incessant move lower in US yields across different time frames also reinforced the flight-to-safety sentiment.

Moving forward, the FX universe is expected to enter the usual pre-NFP lull around current levels, while the outcome of the jobs report should have a temporary impact on bets around a September interest rate cut.

Absent a FOMC event this month, market participants and the Fed will have two inflation prints and two more labour market reports to further evaluate the likelihood, or not, of an interest rate reduction beyond the summer.

Despite the Fed’s Jerome Powell's dovish message on Wednesday, opening the door to lower rates in September, the statement of the central bank reiterated that further confidence that inflation is heading towards the 2% target is needed to start an easing cycle.

Daily digest market movers: NFP impact could be limited

- Further weakness in the risk complex keeps supporting the US Dollar.

- The US economy is expected to have created 175K jobs in July.

- The US Unemployment Rate is seen holding steady at 4.1% during last month.

- Factory Orders will also be under scrutiny amidst renewed slowdown concerns.

- Yields maintain their firm downtrend and navigate multi-week lows across different maturity periods.

- Unabated geopolitical concerns in the Middle East remain a source of strength for the Greenback for the time being.

- CME Group’s FedWatch Tool continues to fully price in lower rates in September.

Short-term technicals on the US Dollar

The US Dollar Index (DXY) maintains the trade around the key 200-day SMA at 104.29. A convincing breakdown of this region should leave the index vulnerable to extra losses in the short-term horizon. That said, initial support emerges at the July low of 103.65 (July 17) prior to the weekly low of 103.17 (March 21) and the March bottom of 102.35 (March 8).

Bouts of strength, on the other hand, face interim barrier at the 55-day and 100-day SMAs of 104.83 and 104.91, respectively, ahead of the June top of 106.13 (June 26). Once the latter is cleared, DXY could attempt a move to the 2024 peak of 106.51 (April 16).

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Aug 02, 2024 12:30

Frequency: Monthly

Consensus: 175K

Previous: 206K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.