- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- BoE interest rate decision fairly divided ahead of Thursday announcement

BoE interest rate decision fairly divided ahead of Thursday announcement

- Odds for a rate cut by the Bank of England remain divided.

- UK disinflationary pressure stalled in June.

- GBP/USD appears to be supported so far by 1.2800 region.

Consensus among market participants appears pretty divided around the imminent interest rate decision by the Bank of England (BoE) arriving on Thursday. It is worth recalling that the central bank maintained its policy rate unchanged at 5.25% in the last seven meetings, although renewed repricing by investors seems to favour a potential 25 bps rate cut this week.

The BoE’s MPC vote is expected to be a close call

The Bank of England's policy decision is expected to be a close call, while market pricing is now signalling a 63% probability for a quarter-point cut, and the Monetary Policy Committee (MPC) vote could come as close as 5-4 in favouring a reduction of the central bank’s rate.

Let’s remember that at the June gathering, the MPC decided to keep rates unchanged with a 7-2 vote. However, those who voted to hold rates indicated that their decision was “finely balanced," hinting at the idea that a rate cut could be in the offing.

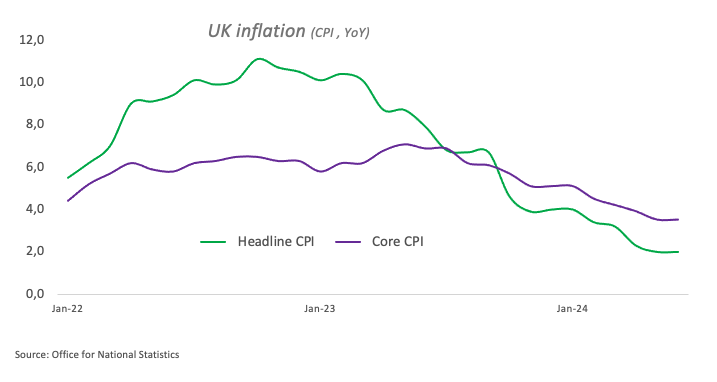

Disinflationary pressure seems to have hit a wall in June after the headline Consumer Price Index (CPI) rose by 2.0% over the previous 12 months, matching May’s reading. The core CPI, which excludes food and energy costs, also matched the previous month’s prints, advancing by 3.5%.

In the same line, service inflation rose by 5.7% YoY from a year earlier and remains quite above the central bank’s 5.1% projection.

Still around inflation, the BoE’s Chief Economist, Huw Pill, argued that the bank was nearing a decision to cut interest rates, though service price inflation and wage growth remained troublingly high. It is worth noting that Pill joined the majority of his colleagues in June in voting to keep interest rates at 5.25%.

Her colleague Catherine Mann emphasized the strong price pressure in the UK economy, signalling that she is unlikely to support an interest rate cut in August. Mann added that the recent drop in domestic inflation was merely "touch and go" and predicted that inflation would likely exceed that rate for the remainder of the year.

Favouring a rate cut this week, Rabobank’s Senior Macro Strategist Stefan Koopman said, “We anticipate a 25bp cut to the Bank rate, bringing it to 5.00%, marking the start of a gradual easing cycle with 25bp cuts each quarter. However, there is a risk that officials may want to see another month of data first.”

Additionally, analysts at TD Securities argued, “We expect a 25bps cut at the August MPC meeting, with a narrow 5-4 vote. That said, uncertainty is high, not only due to sticky service inflation prints but also due to compositional changes on the committee. The message will likely be a cautious one, as the MPC should not want to signal consecutive cuts at this stage.”

How will the BoE interest rate decision impact GBP/USD?

Despite disinflationary pressures losing momentum in June, market participants seem to lean toward a rate cut at the BoE’s monetary policy meeting on August 1 at 11 GMT.

FXStreet Senior Analyst Pablo Piovano sees the British Pound coming under renewed downside pressure in the event of a rate cut, as such a scenario is only partially supported by market forecasts.

Pablo adds that the GBP/USD rally experienced in the first half of July that lifted Cable to fresh 2024 peaks near 1.3050 was almost exclusively on the back of accelerated weakness in the US Dollar (USD) following investors’ repricing of a rate cut by the Federal Reserve (Fed) in September.

Against that backdrop, extra losses could motivate GBP/USD to break below the weekly low of 1.2806 (July 29) and challenge the provisional support at the 55-day and 100-day SMAs at 1.2776 and 1.2682, respectively. The breach of that region exposes a probable slide to the July low of 1.2615 (July 2), which appears reinforced by the proximity of the key 200-day SMA (1.2836).

On the upside, Pablo sees the initial stop for bulls at the 2024 peak of 1.3044 (July 17).

Economic Indicator

BoE Interest Rate Decision

The Bank of England (BoE) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoE is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Pound Sterling (GBP). Likewise, if the BoE adopts a dovish view on the UK economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for GBP.

Read more.Last release: Thu Jun 20, 2024 11:00

Frequency: Irregular

Actual: 5.25%

Consensus: 5.25%

Previous: 5.25%

Source: Bank of England

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.