- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Canadian Dollar flounders on Monday, BoC notes continued pessimistic outlook

Canadian Dollar flounders on Monday, BoC notes continued pessimistic outlook

- The Canadian Dollar broadly weakened on Monday as markets look elsewhere.

- Canada caught in a trap of low expectations feeding even lower expectations.

- Canadian CPI inflation due on Tuesday, could help or hinder CAD.

The Canadian Dollar (CAD) broadly softened on Monday as markets got the new trading week underway. CAD flows fully reversed direction in a follow-through of last Friday’s pullback, sending the Canadian Dollar to an eight-trading-day low against the Greenback.

Canada is set to print the latest iteration of Canadian Consumer Price Index (CPI) inflation on Tuesday, and markets are hoping for a steep drag on headline monthly CPI inflation to help push the Bank of Canada (BoC) into another rate cut after the Canadian central bank delivered a quarter-point trim in June. Canadian Retail Sales and Raw Materials Price Index inflation also loom over the horizon later in the week.

Daily digest market movers: Canadian Dollar stumbles as BoC highlights pessimistic firms

- The BoC’s latest Business Outlook Survey showed many Canadian firms have had weak sales expectations for several quarters, citing still-high equipment costs as a reason to avoid investment spending.

- A notable lack of investment in productivity improvements means Canadian firms are caught in an efficiency trap where firms avoid productivity investment because of a middling economy lacking productivity investment.

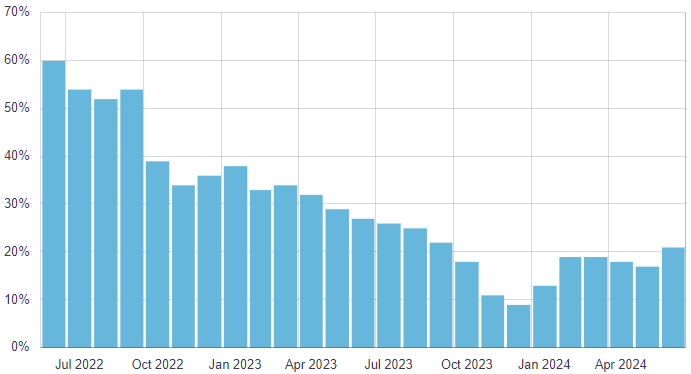

- Despite weak demand and ongoing high costs, the proportion of firms expecting a recession in the coming 12 months continues to decline, down from a high of 45% in Q1 2023 to just 20% in Q2 2024.

- US Retail Sales on Tuesday could complicate things as rate-cut-hungry markets hope for a continued decline in US activity indicators.

- BoC’s Business Leaders’ Pulse, percentage of firms reporting positive sentiment minus the percentage reporting negative sentiment:

Technical analysis: Belly-up CAD finds fresh lows, sends USD/CAD higher after clean 200 EMA bounce

The Canadian Dollar (CAD) has flattened across the board on Monday, declining against all of its major currency peers as the new trading week gets underway. The CAD fell four-tenths of one percent against the Japanese Yen (JPY) and the Swiss Franc (CHF). and shed roughly one-fifth of one percent against the US Dollar (USD).

USD/CAD rallied to af resh eight-day high on CAD weakness on Monday, jumping back above 1.3660 after the pair formed a clean bounce from the 200-day Exponential Moving Average (EMA) at 1.3590. Near-term technical consolidation remains likely as bids challenge the 50–day EMA at 1.3666, and a rough supply zone priced in above the 1.3700 handle could get any bullish extensions stuck in the muck.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.