- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Pound Sterling trades stuck in tight range as US NFP data looms

Pound Sterling trades stuck in tight range as US NFP data looms

- The Pound Sterling trades sideways near 1.2800 against the US Dollar ahead of the US NFP data for May.

- US NFP will significantly influence expectations for Fed interest-rate cuts in September.

- The UK’s strong wage growth remains a major driver of stubborn service inflation.

The Pound Sterling (GBP) consolidates in a tight range near 1.2800 against the US Dollar (USD) in Friday’s European session. The GBP/USD pair struggles for a direction as investors await the United States (US) Nonfarm Payrolls (NFP) report for May, which will provide new clues about the health of the country’s labor market.

The employment report is expected to show that employers added 185K payrolls, higher than the 175K jobs added in April. The Unemployment Rate is estimated to have remained steady at 3.9%. Investors will also pay attention to the Average Hourly Earnings data, which gauges wage growth momentum. Annual Average Hourly Earnings are forecasted to have grown steadily by 3.9%. On a monthly basis, wage growth is estimated to have risen at a higher pace of 0.3% from the former 0.2% increase.

Stronger-than-expected wage growth and payroll data would weaken expectations for the Federal Reserve (Fed) to start reducing interest rates from the September meeting, while weak numbers will boost them.

Daily digest market movers: Pound Sterling trades back and forth ahead of US NFP

- The Pound Sterling ranges near 1.2800 against the US Dollar ahead of the US NFP report, which will influence market speculation for Fed rate cuts in September. The official employment data will show the impact of the Fed’s restrictive monetary policy framework on labor demand.

- Recently, many labor market-related economic indicators have pointed to normalizing job conditions. The US JOLTS Job Openings data for April and ADP Employment Change for May showed that fresh openings and private payrolls, respectively, were lower than expected. Also, the US Department of Labor said on Thursday that Initial Jobless Claims for the week ending May 31 increased more than expected. This adds to evidence that the labor market is losing strength.

- Rising doubts over the US job market have prompted market speculation for the Fed to begin lowering its key borrowing rates in September. The CME FedWatch tool shows that traders see a 68% chance for rate cuts in that month, up from the 54.5% recorded a week ago.

- In the United Kingdom, the Pound Sterling will be guided by the Employment data for the February-April period, which will be published on Tuesday. The country’s number of employed people has declined for three consecutive times. Indication of more layoffs would hurt the Pound Sterling as it would boost traders’ bets for early rate cuts by the Bank of England (BoE).

- Investors will also focus on the UK Average Earnings data, a measure of wage growth. UK’s strong wage growth momentum has remained a major driver to high service inflation, which has been a barrier for price pressures in returning towards the 2% target.

Technical Analysis: Pound Sterling remains sideways near 1.2800

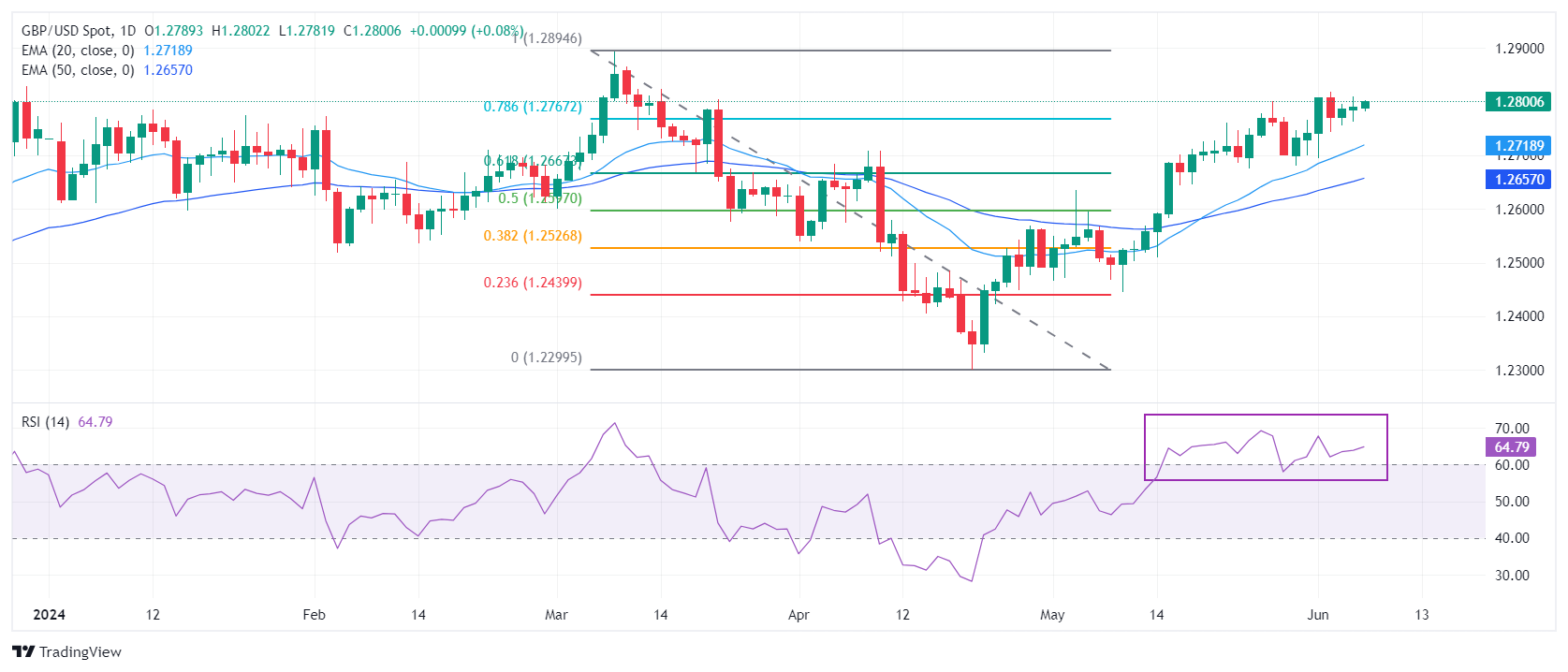

The Pound Sterling trades inside Thursday’s trading range ahead of the US NFP data for May. The GBP/USD pair struggles to break decisively above 1.2800. However, the Cable's near-term outlook remains firm as it trades above 1.2770, the 78.6% Fibonacci retracement support (plotted from the March 8 high of 1.2900 to the April 22 low at 1.2300).

The Cable is expected to remain in the bullish trajectory as the 20-day and 50-day Exponential Moving Average (EMA) at 1.2710 and 1.2650, respectively, are sloping higher, indicating a strong uptrend.

The 14-period Relative Strength Index (RSI) has shifted into the 40.00-60.00 range, suggesting that the momentum has leaned toward the upside.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.