- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- BoC Decision Preview: Interest rates set to remain unchanged as rate cut bets focus on June

BoC Decision Preview: Interest rates set to remain unchanged as rate cut bets focus on June

- The Bank of Canada (BoC) is anticipated to keep its policy rate at 5.0%.

- The Canadian Dollar remains trapped within a consolidative range.

- Inflation in Canada has been losing upward traction since December.

- Investors see a 70% probability of a rate cut in June.

There is widespread anticipation that the Bank of Canada (BoC) will maintain its policy rate at 5.0% for the sixth consecutive time during its upcoming policy meeting on Wednesday. A new Monetary Policy Report (MPR) with updated economic predictions, as well as a news conference, will accompany the bank’s decision on interest rates.

The Canadian Dollar (CAD) has been very slowly depreciating against the US Dollar (USD) since the beginning of the new year, although it appears to have been immersed in a broader consolidative theme since February.

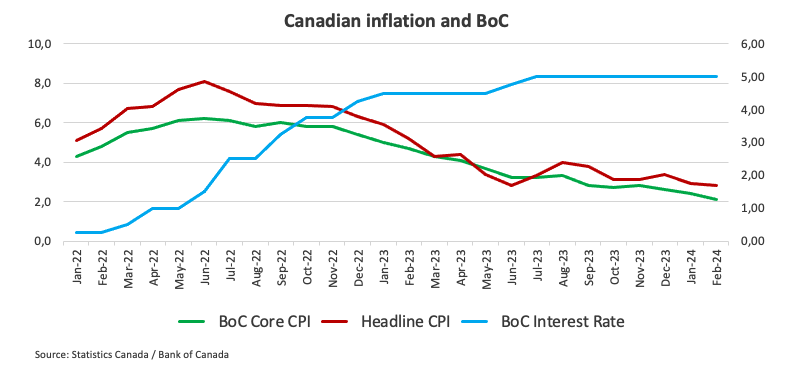

In the second month of the year, the Consumer Price Index (CPI) recorded a continued downward trajectory in headline inflation, while the Bank of Canada's (BoC) Core CPI indicated some sticky price pressures. From the latest meeting, the bank’s statement expects inflation to linger around 3% during the first part of the year before starting to ease, albeit at a gradual pace.

Despite the BoC’s predicted cautious stance, it could also show some permeability in light of the ongoing downward trajectory of domestic inflation. The central bank is also seen reiterating the importance of evaluating additional incoming data and its sustainability before making any decisions regarding interest rates. This perspective aligns with that of most of the central banks in the G10 group, including the US Federal Reserve (Fed), European Central Bank (ECB), Bank of England (BoE), and Reserve Bank of Australia (RBA).

A dovish surprise?

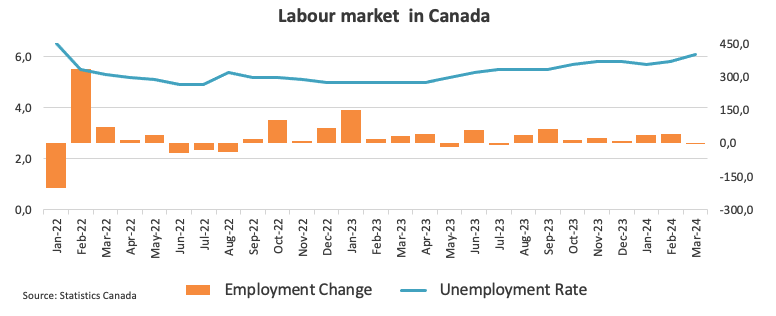

In light of the current downtrend in Canadian inflation and some cooling of the labour market, a soft tone at the BoC event and some bearish message from Governor Tiff Macklem at the subsequent press conference should not be entirely ruled out, along with the palpable possibility that the bank could start its easing cycle at some point in the summer, in tandem with the Fed, the ECB and maybe the BoE.

In addition, the BoC could likely revise its projections for inflation and GDP, expecting it to decline over the bank’s time horizon.

From the BoC’s Q1 Business Outlook Survey (BOS) released on April 1, firms observed a slight improvement in business conditions, with an increase noted broadly across nearly all regions, sectors, and firm sizes. The proportion of firms expecting Canada to enter a recession over the next year decreased to 27%, down from 38% in Q4. Similarly, 40% of firms anticipate inflation to persist above 3% for the next two years, a decline from 54% in Q4. Moreover, only 17% of firms believe it will take longer than four years for inflation to revert to 2%, down from 27% in Q4. While wage growth remains elevated, a majority of firms anticipate a deceleration, with 74% expecting wage growth to normalize by 2025.

Regarding inflation, Governor Tiff Macklem said at his press conference in March that “we are witnessing advancements in the battle against inflation, and we anticipate more strides forward. However, if core inflation measures remain stagnant, then our predictions for overall inflation decreasing may not materialize.” Macklem maintained the belief that the risks associated with the inflation outlook are reasonably balanced. The fact that inflation expectations have stayed firmly anchored is undoubtedly aiding the bank in the effort to bring inflation back under control.

When will the BoC release its monetary policy decision and how could it affect USD/CAD?

The Bank of Canada will announce its policy decision at 13:45 GMT on Wednesday, along with the Monetary Policy Report (MPR). Governor Macklem’s press conference is due at 14:30 GMT.

Eliminating any potential surprises, it is anticipated that the impact on the Canadian currency will be negligible, if at all. Opting for a cautious approach to uphold present circumstances could result in a brief, reflexive drop in the USD/CAD pair in the short term, albeit unlikely to be substantial in duration or scale. It's noteworthy that a significant portion of the upward movement in the spot rate this year is attributed to the dynamics of the USD.

According to Pablo Piovano, Senior Analyst at FXStreet.com, “the gradual uptrend in USD/CAD in place since the beginning of the year appears reinforced by the recent surpass of the key 200-day SMA (1.3506). However, this trend has so far met quite a decent barrier around the year-to-date peaks near 1.3650. A sustainable break above this region could motivate the pair to set sails to the November 2023 top of 1.3898 (November 1).”

Pablo adds: “If sellers regain the upper hand, the 200-day SMA should offer decent contention prior to the March bottom of 1.3419 (March 8). Extra weakness from here could open the door to a move to the weekly low of 1.3358 (January 31).”

Economic Indicator

BoC Interest Rate Decision

The Bank of Canada (BoC) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoC believes inflation will be above target (hawkish), it will raise interest rates in order to bring it down. This is bullish for the CAD since higher interest rates attract greater inflows of foreign capital. Likewise, if the BoC sees inflation falling below target (dovish) it will lower interest rates in order to give the Canadian economy a boost in the hope inflation will rise back up. This is bearish for CAD since it detracts from foreign capital flowing into the country.

Read more.Next release: Wed Apr 10, 2024 13:45

Frequency: Irregular

Consensus: 5%

Previous: 5%

Source: Bank of Canada

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.