- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Dow Jones Industrial Average flatlines ahead of Fed

Dow Jones Industrial Average flatlines ahead of Fed

- Dow Jones goes flat as investors draw into the middle pre-Fed rate call.

- FOMC Interest Rate Projections also dropping on markets.

- Press conference from Fed Chairman Jerome Powell due after FOMC release.

The Dow Jones Industrial Average (DJIA) is churning at the day’s opening prices as investors brace for the latest Federal Reserve (Fed) rate call as well as a much-anticipated update to the Federal Open Market Committee’s (FOMC) Interest Rate Outlook. The FOMC’s rate call and rate forecast are due at the top of the hour at 18:00 GMT, with Fed Chairman Jerome Powell tabling a press conference 30 minutes later at 18:30 GMT.

Dow Jones news

The Dow Jones is mixed on Wednesday, with about half of the 30 listed securities trading into the low side. Boeing Co. (BA) is seeing a brief recovery from recent selling pressure, climbing around 2.3% to trade into $185.00 per share. On the bottom end, Chevron Corp. (CVX) is down nearly 1.5% in midweek trading, testing into $154.00 per share.

The Materials and Industrials Sectors are Wednesday’s early climbers, rising around 0.4% in midday pre-Fed trading. The Health and Energy Sectors are falling into the low side, falling 0.7% and 0.6%, respectively.

Dow Jones Industrial Average technical outlook

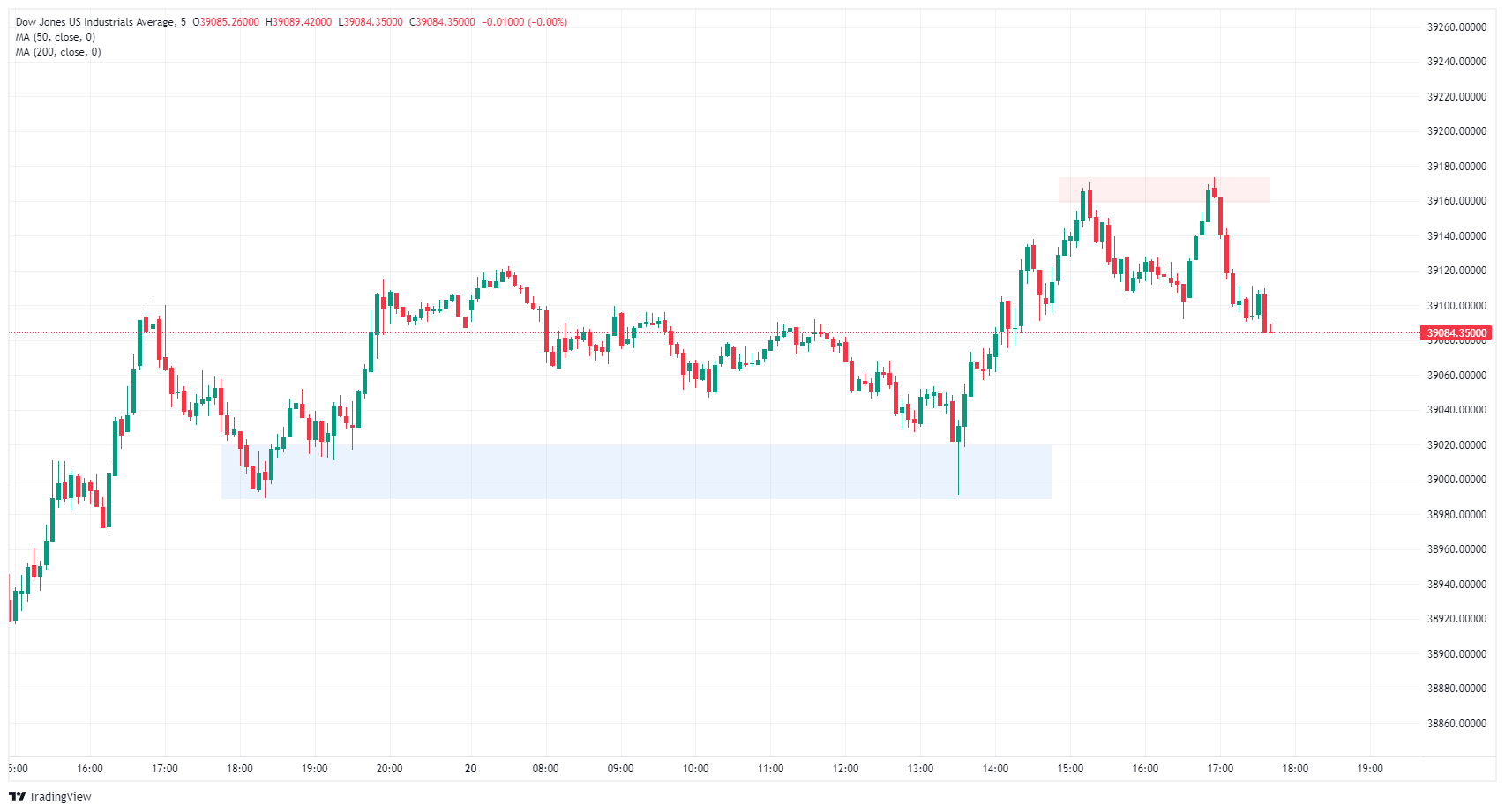

The Dow Jones drifted into an early low near 39,000.00 on Wednesday before recovering into 39,160.00. Bids have pulled back into the day’s opening prices near 39,100.00 as investors buckle down for a spark from the Fed.

The DJIA is trading into the top end of near-term consolidation as the index struggles to gain further ground above the 39,200.00 level. Swing lows have been etching in a higher lows pattern, and an intraday demand zone in priced in near 38,700.00.

Dow Jones Industrial Average 5-minute chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.