- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Swiss Franc could weaken as inflation diverges from SNB forecasts

Swiss Franc could weaken as inflation diverges from SNB forecasts

- Swiss Franc is vulnerable as inflation data continues to undershoot official forecasts.

- The SNB expected inflation to average 1.9% in 2024 in its December forecast, but it currently sits at 1.2%.

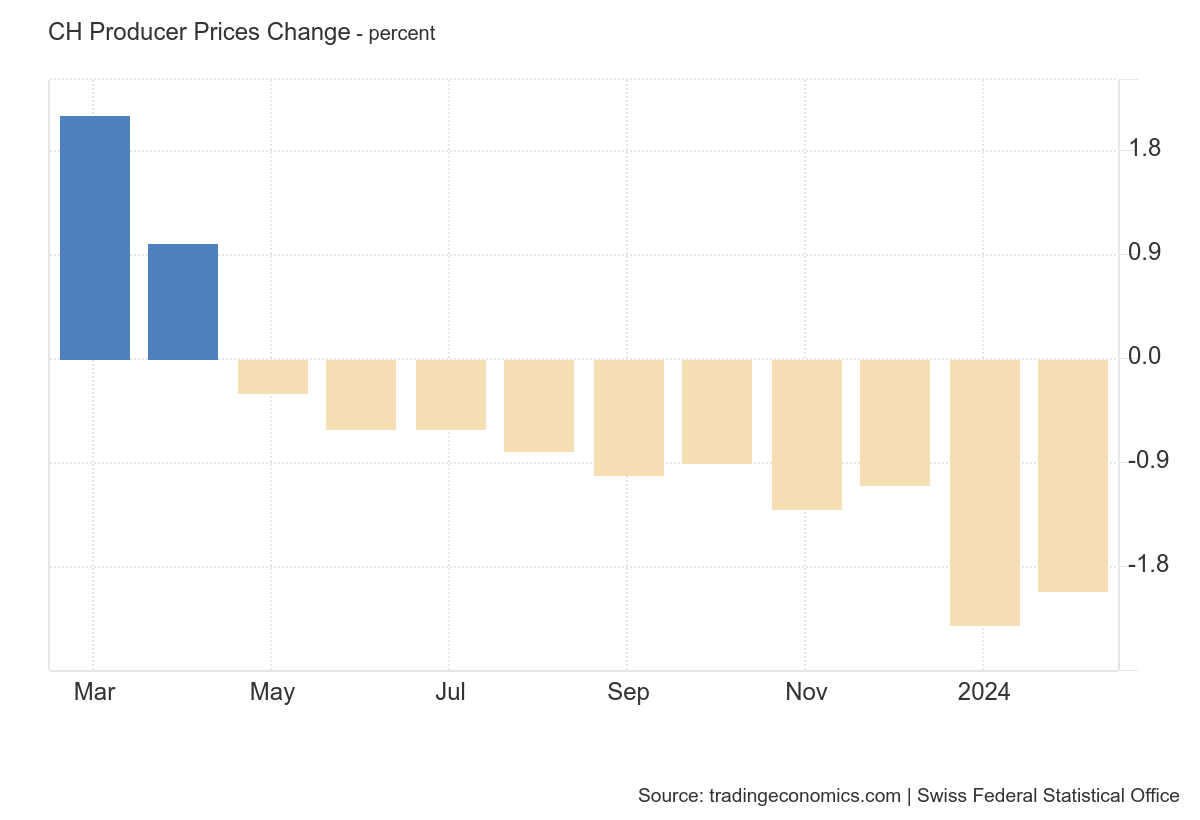

- The latest Producer and Import Prices showed the tenth month of deflation in a row.

The Swiss Franc (CHF) is continuing its overall trend lower at the end of the trading week – down by a few hundredths of a percent in its European crosses but edging higher against the US Dollar (USD).

In its latest macroeconomic data release, Swiss Producer and Import Prices continued their deflationary trend in February, registering deflation for the tenth consecutive month at minus 2.0% (from negative 2.3% in January), according to data from the Federal Statistical Office.

Swiss Franc at risk as inflation remains below SNB forecast

The Swiss Franc could be vulnerable to weakening further as inflation in Switzerland steadily declines and looks increasingly likely to undercut official forecasts.

In its latest batch of data, Swiss headline inflation rose 1.2% YoY in February, down from 1.3% in January, and increased 0.6%, up from 0.2% in January, on a month-on-month basis.

The data shows that inflation is undercutting the Swiss National Bank’s (SNB) own forecasts, which at its December policy meeting expressed the view that inflation would start rising from the 1.4% registered in November.

“However, inflation is likely to increase again somewhat in the coming months due to higher electricity prices and rents, as well as the rise in VAT.” The SNB said in its December policy statement.

The SNB implemented a rate hike of 0.25% in June 2023, raising rates from 1.50% to 1.75% to combat the threat of higher inflation. However, given the opposite has happened and inflation has actually come down quicker than expected, there is now a risk it could cut interest rates, which would be negative for the Swiss Franc, since lower rates attract less inflows of foreign capital.

The possibility of a change in policy is increased by the fact that inflation is running well below the SNB’s 1.9% forecast for 2024. Although there is only two months of data so far, it will have to rise substantially to meet the bank’s forecast before the end of the year. The SNB’s next policy meeting is on March 21.

SNB’s Jordan thinks Swiss Franc is too expensive

The Chairman of the SNB Thomas Jordan has expressed concerns about the Swiss Franc's excessive strength, particularly its impact on Swiss businesses, especially exporters. These concerns are reflected in data from Switzerland's Foreign Exchange Reserves (CHFER), which show a recovery in Forex reserves in 2024, indicating that the SNB may be selling Swiss Francs to bring the exchange rate down.

Technical Analysis: Swiss Franc oscillates in short-term range versus USD

The USD/CHF, which measures the number of Swiss Francs that one US Dollar can buy, has been oscillating within a relatively tight range between roughly 0.8900 and 0.8740 since the middle of February.

The pair is overall in short-term uptrend with the expectation that it will eventually breakout from the current range and start moving higher. However, resistance from a long-term trendline and the 50-week Simple Moving Average (SMA) present considerable obstacles to a prolongation of the trend.

US Dollar versus Swiss Franc: 4-hour chart

For more upside to be confirmed, a decisive break above the range highs at 0.8900 would be required. Such a move would probably then extend to an initial target at 0.8992, the 0.618 Fibonacci ratio of the height of the range extrapolated higher, followed by 0.9052, the full height extrapolated higher.

A decisive break below the range low at 0.8729, however, could indicate a short-term trend reversal and the start of a deeper slide lower. The first target for the move lower would be the 0.618 extrapolation of the height of the range at 0.8632, followed by the full extrapolation at 0.8577, which is also close to the 0.8551 January 31 lows, another key support level to the downside.

Swiss Franc FAQs

The Swiss Franc (CHF) is Switzerland’s official currency. It is among the top ten most traded currencies globally, reaching volumes that well exceed the size of the Swiss economy. Its value is determined by the broad market sentiment, the country’s economic health or action taken by the Swiss National Bank (SNB), among other factors. Between 2011 and 2015, the Swiss Franc was pegged to the Euro (EUR). The peg was abruptly removed, resulting in a more than 20% increase in the Franc’s value, causing a turmoil in markets. Even though the peg isn’t in force anymore, CHF fortunes tend to be highly correlated with the Euro ones due to the high dependency of the Swiss economy on the neighboring Eurozone.

The Swiss Franc (CHF) is considered a safe-haven asset, or a currency that investors tend to buy in times of market stress. This is due to the perceived status of Switzerland in the world: a stable economy, a strong export sector, big central bank reserves or a longstanding political stance towards neutrality in global conflicts make the country’s currency a good choice for investors fleeing from risks. Turbulent times are likely to strengthen CHF value against other currencies that are seen as more risky to invest in.

The Swiss National Bank (SNB) meets four times a year – once every quarter, less than other major central banks – to decide on monetary policy. The bank aims for an annual inflation rate of less than 2%. When inflation is above target or forecasted to be above target in the foreseeable future, the bank will attempt to tame price growth by raising its policy rate. Higher interest rates are generally positive for the Swiss Franc (CHF) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken CHF.

Macroeconomic data releases in Switzerland are key to assessing the state of the economy and can impact the Swiss Franc’s (CHF) valuation. The Swiss economy is broadly stable, but any sudden change in economic growth, inflation, current account or the central bank’s currency reserves have the potential to trigger moves in CHF. Generally, high economic growth, low unemployment and high confidence are good for CHF. Conversely, if economic data points to weakening momentum, CHF is likely to depreciate.

As a small and open economy, Switzerland is heavily dependent on the health of the neighboring Eurozone economies. The broader European Union is Switzerland’s main economic partner and a key political ally, so macroeconomic and monetary policy stability in the Eurozone is essential for Switzerland and, thus, for the Swiss Franc (CHF). With such dependency, some models suggest that the correlation between the fortunes of the Euro (EUR) and the CHF is more than 90%, or close to perfect.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.