- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- EUR/USD drifts into topside resistance zone with rate cut bets pinned

EUR/USD drifts into topside resistance zone with rate cut bets pinned

- EUR/USD finds chart paper near 1.0850.

- European investor confidence recovered on Monday.

- US NFP employment to be key data print this week.

EUR/USD drifted into the high end to kick off the trading week on Monday, finding chart space near 1.0860 and getting mired in near-term technical resistance. The pair has been rangebound for a week, and investors will look to critical US labor figures this week as markets gauge the Federal Reserve’s next move.

This week, central banks loom heavily over the Euro (EUR) and the US Dollar (USD). Fed Chairman Jerome Powell will be testifying before the US Congress’ House Financial Services Committee about the Fed’s Semi-Annual Monetary Policy Report on Wednesday and Thursday. The European Central Bank (ECB) also gives its latest rate call during Thursday’s European market session.

Daily digest market movers: EUR/USD churns in familiar territory as traders await key data

- Europe’s Sentix Investor Confidence for March rose to -10.5 from the previous -12.9, an 11-month high.

- High impact data kicks off on Wednesday with European Retail Sales for January expected to decline to 1.3% YoY versus the previous -0.8% as European economic activity continues to weaken.

- US ADP Employment Change numbers on Wednesday are expected to climb to 150K compared to the previous 107K as a precursor to Friday’s US Nonfarm Payrolls (NFP) print.

- The ECB’s rate call on Thursday is broadly expected to hold the main refi rate at 4.5%.

- Investors are looking for softening US NFP labor figures to bolster odds of a Fed rate cut.

- Tuesday’s US ISM Services PMI is forecast to tick down to 53.0 from 53.4.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the .

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.14% | -0.26% | 0.18% | 0.24% | 0.28% | 0.16% | 0.14% | |

| EUR | 0.13% | -0.13% | 0.32% | 0.38% | 0.41% | 0.31% | 0.28% | |

| GBP | 0.26% | 0.13% | 0.43% | 0.50% | 0.55% | 0.42% | 0.41% | |

| CAD | -0.18% | -0.31% | -0.43% | 0.07% | 0.09% | -0.02% | -0.03% | |

| AUD | -0.24% | -0.38% | -0.50% | -0.06% | 0.04% | -0.07% | -0.09% | |

| JPY | -0.28% | -0.41% | -0.58% | -0.12% | -0.05% | -0.11% | -0.11% | |

| NZD | -0.17% | -0.31% | -0.43% | 0.01% | 0.07% | 0.11% | -0.02% | |

| CHF | -0.15% | -0.29% | -0.41% | 0.03% | 0.09% | 0.13% | 0.02% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: EUR/USD trapped in consolidation as investors await Fed moves

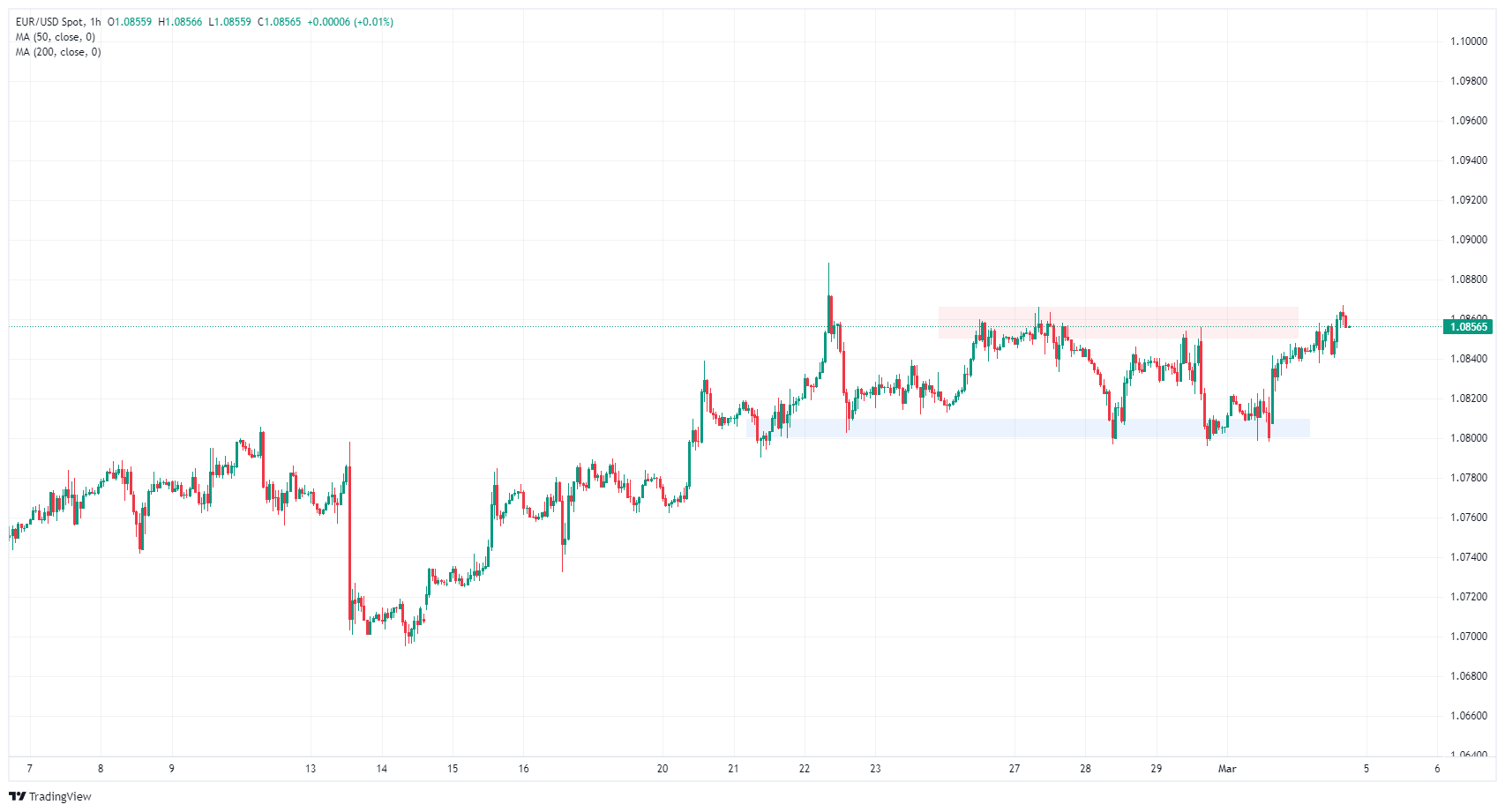

EUR/USD rose into 1.0860 on Monday, knocking into familiar technical bounds and holding onto the high side of near-term consolidation. The pair is corkscrewing through a sideways channel between 1.0860 and the 1.0800 handle.

A lack of meaningful trend on daily candlesticks leaves the EUR/USD swamped into the 200-day Simple Moving Average (SMA) near 1.0830. Despite a 1.5% climb from the last swing low into 1.0700, but the pair remains down 2.6% from December’s peak bids near 1.1140.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.