- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAU/USD rallies above $2000 as the Fed hints rate cuts

Gold Price Forecast: XAU/USD rallies above $2000 as the Fed hints rate cuts

- Gold’s rallied more than 1.30% as traders brace for Powell’s press conference.

- Federal Reserve officials voted unanimously and expect at least three rate cuts for 2024.

- XAU/USD hits a three-day high, eyeing more gains above $2000.

Gold price advanced sharply late in the New York session after the Federal Reserve decided to keep rates unchanged, opening the door for monetary policy easing next year. Buyers saw that as a green light to open fresh positions, as XAU/USD has climbed more than 1.80%, trading at around the $2000-$2020 range at the time of writing.

XUAU/USD extends its rally above $2020 as rate cut expectations climbed

On Wednesday, the Fed stuck to its plan to hold rates at the current rate despite acknowledging that growth and the jobs market have moderated; it stated that inflation. Despite that, Fed officials added that inflation has cooled but remains elevated.

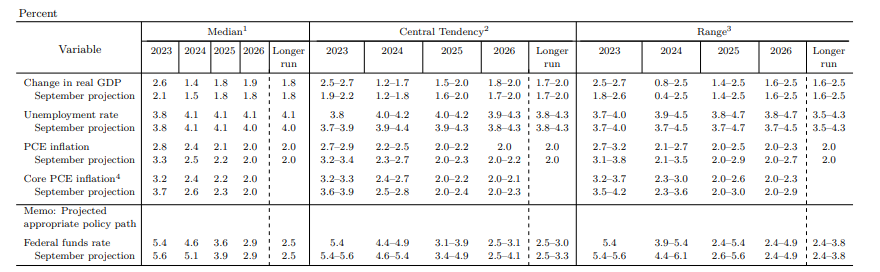

Besides that, the Summary of Economic Projections (SEP) hinted that the Fed is done raising rates and that they expect three 25 basis points for the following year. Further data was reviewed, with growth expected to increase compared to September’s, while inflation would head toward the 2% target.

Source: Federal Reserve

Aside from this, the Chairman of the Fed, Jerome Powell, stated the US Central Bank is fully committed to attaining both of its mandates. Even though he kept the door open for additional hikes, he said, “we likely at or near peak for rates,” sponsoring a leg up on the non-yielding metal. He said rate cuts “is now a topic of discussion” and added that the question is when it would be appropriate to begin easing policy.

When asked about a recession, he said they don’t see that scenario right now but that there’s always a probability next year. Although he welcomed progress on inflation, he said it’s too early to declare victory.

When asked about cutting rates until inflation hits 2%, he said it would be too late, adding that “you need to reduce restriction on economy well before 2%.”

In the meantime, Gold price continued to print gains, sponsored by the Fed’s pivot. Consequently, US Treasury bond yields are plunging more than 15 bps in the short and long end of the curve, with the 10-year benchmark note standing at 4.02%.

The US Dollar Index (DXY) tracks currency performance against a basket of six peers and is sinking 0.84%, down at 102.94. Meanwhile, the Fed’s interest rate probabilities for the next year expect more than 140 basis points of rate cuts, twice the Fed’s projections. That means investors estimate the federal funds rate (FFR) to be 4%.

XAU/USD Hourly Chart after Fed’s decision

XAU/USD Technical Levels

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.