- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Mexican Peso appreciates against the US Dollar, ahead of Powell’s speech

Mexican Peso appreciates against the US Dollar, ahead of Powell’s speech

- Mexican Peso finished November with gains of more than 3.60% and began December in a positive tone.

- Mexico and US interest rate differential favors the Peso, as Fed officials have shifted dovish.

- USD/MXN traders are eyeing several US Federal Reserve Chair Jerome Powell speeches.

Mexican Peso (MXN) stages a comeback against the US Dollar (USD) as the last month of the year begins, even though the Greenback posts solid gains against a basket of six currencies, namely the US Dollar Index (DXY). The USD/MXN slips below the confluence of technical support levels, which turned resistance, and trades below 17.30, down 0.71% on the day.

The Mexican currency had a positive month in November, posting gains of 3.65%, a solid recovery compared to October's 3.60% losses. The main driver for price action continues to be interest rate differentials between both countries, with 600 basis points of spread favoring the Mexican Peso. In addition, market participants seem confident the US Federal Reserve (Fed) ended its tightening cycle after previously “hawks” members delivered dovish remarks. In the meantime, the release of the Fed’s preferred gauge for inflation, the Core Personal Consumption Expenditures (PCE) Price Index, showed the disinflationary process in the US continued. USD/MXN traders are eyeing the Fed Chairman Jerome Powell's speech at 16:00 GMT.

On the Mexican front, the Bank of Mexico (Banxico) revised its economic projections for 2023 and 2024, saying that inflation would reach its 3% target in 2025. Governor Victoria Rodriguez Ceja said discussions to ease monetary policy could begin in the first quarter of 2024. Deputy Governor Jonathan Heath emphasized the bank would be data-dependent and deliver gradual rate cuts. Ahead into the calendar, S&P Global would release the Manufacturing PMI.

Daily digest movers: Mexican Peso on the offensive despite Banxico’s dovish remarks, await Fed Chair Powell

- Banxico revises economic growth upward from 3% to 3.3% for 2023 and projects the economy would rise from 2.1% to 3% in 2024.

- Regarding inflation prospects, the Mexican central bank foresees headline inflation at 4.4% in Q4 2023 (5.3% for core), while at the end of 2024, it is estimated at 3.4% (3.3% for core). The central bank forecasts headline and core inflation not to hit the 3% target imposed by the institution until 2025.

- The US Core Personal Consumption Expenditures (PCE) Price Index, the Fed’s gauge for inflation, rose by 3.5% YoY in October, as expected, below the previous month’s 3.7%.

- Headline inflation measured by the PCE Price Index slowed from 3.4% to 3.0% in the last twelve months, as foreseen by analysts.

- Interest rate traders expect 115 basis points of rate cuts by the US Federal Reserve in 2024.

- On November 27, Banxico’s Deputy Governor, Jonathan Heath, commented that core prices must come down more, adding that one or two rate cuts may come next year, but “very gradually” and “with great caution.”

- On November 24, a report revealed the economy in Mexico grew as expected in the third quarter on an annual and quarterly basis, suggesting the Bank of Mexico would likely stick to its hawkish stance, even though it opened the door for some easing.

- Mexico's annual inflation increased from 4.31% to 4.32%, while core continued to ease from 5.33% to 5.31%, according to data on November 23.

- A Citibanamex poll suggests that 25 of 32 economists expect Banxico's first rate cut in the first half of 2024.

- The poll shows “a great dispersion” for interest rates next year, between 8.0% and 10.25%, revealed Citibanamex.

- The same survey revealed that economists foresee headline annual inflation at 4.00% and core at 4.06%, both readings for the next year, while the USD/MXN exchange rate is seen at 19.00, up from 18.95, toward the end of 2024

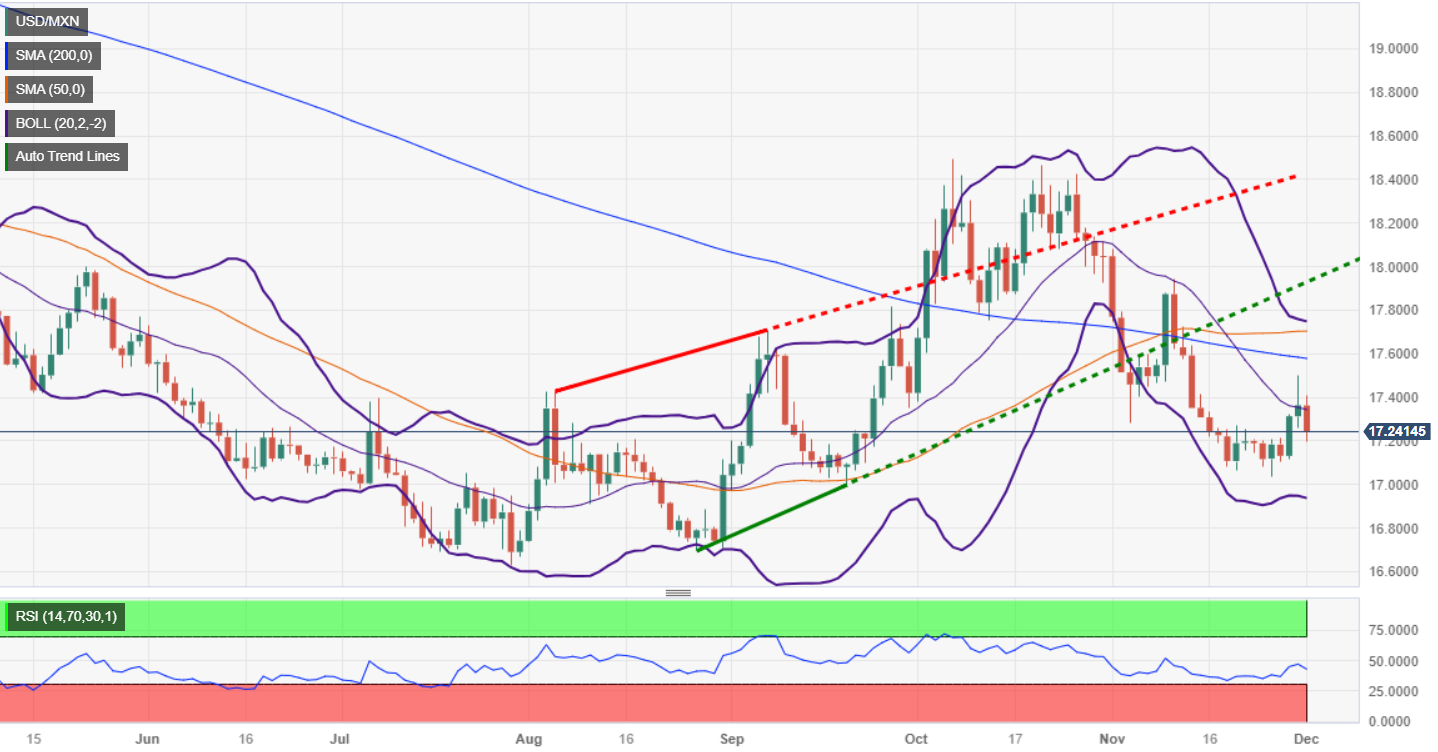

Technical Analysis: Mexican Peso picks up pace as USD/MXN slips below the 20, 100-day SMAs; 17.00 in sight

The USD/MXN resumed its downtrend after briefly piercing above the 20 and 100-day Simple Moving Averages (SMAs) at 17.32 and 17.34, respectively, and reaching a two-week high shy of 17.50. Nevertheless, buyers were unable to cling to gains, and the pair has returned back below the 20 and 100-day SMAs.

For a bearish continuation, the exotic pair needs to break below 17.25, a solid resistance level during the week that turned support. Once breached, the next support would be 17.05, ahead of the psychological 17.00 figure. If bulls regain the 20-day SMA, that could open the door for USD/MXN to reclaim the 100-day SMA at 17.34, ahead of challenging 17.50.

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.