- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- USD/CHF remains flat around 0.8832 ahead of the US key event.

- US PCE inflation matches expectations; Initial Jobless Claims are lower than expected.

- The Swiss Real Retail Sales YoY for July came in at -2.2% versus 1.8% prior.

- Market players await the Swiss Consumer Price Index (CPI), US Nonfarm Payrolls.

The USD/CHF pair oscillates around the 0.8821-0.8836 region in a narrow trading band during the early Asian trading hours on Friday. Markets turn cautious ahead of the key data from the US and Switzerland. At the time of writing, the USD/CHF is trading at 0.8833, unchanged on the day.

Meanwhile, the US Dollar Index (DXY), a measure of the value of USD against six other major currencies, holds above 103.60 and remains on the way to snapping a six-week uptrend. US Treasury yields falls again on Friday. The 10-year yield rebounds to 4.10% after reaching a two-week low of 4.07%

Data released on Thursday showed that the US Core Personal Consumption Expenditure Price Index, the Federal Reserve's preferred gauge of inflation, rose to 4.2% in July from 4.1% in the previous and in line with expectations. Additionally, Initial Claims fell to 228,000, falling short of the market consensus of 232,000. The figure marked the lowest level in four weeks while Continuing Claims reached their highest level in six weeks. The mixed economic data from the US challenged the Fed to keep rates higher for longer as Fed Chairman Jerome Powell said at the Jackson Hole Symposium that a possible further rate rise would be dependent on incoming data.

On the other hand, the Swiss Federal Statistical Office reported on Thursday that the nation's Real Retail Sales YoY for July came in at -2.2% versus 1.8% prior. Earlier this week, the KOF Leading Indicator for August came in at 91.1 versus 92.01 prior and below the market consensus of 91.5. Finally, the ZEW Survey of Expectation for the same period fell to -38.6 from -32.6 the previous month and missed the expectation of -31.3.

The renewed trade war tension between the US and China and the fear of China’s debt crisis might benefit the traditional safe-haven Swiss Franc. On Wednesday, Country Garden, the largest private real estate developer in China, issued a default warning if its financial performance continues to deteriorate.

Looking ahead, traders will take cues from the Swiss Consumer Price Index (CPI) for August ahead of the closely watched event, US Nonfarm Payrolls. The US economy is expected to create 170K jobs in August. Also, the Unemployment Rate and ISM Manufacturing PMI will be released later on Friday. These figures could give a clear direction for the USD/CHF pair.

US inflation expectations can be held responsible for the market’s latest dislike for the US Dollar, after fueling the Greenback to snap a three-day losing streak the previous day.

That said, the inflation expectations, as per the 10-year and 5-year breakeven inflation rates from the St. Louis Federal Reserve (FRED) data, remain on the back foot for the fourth consecutive day while declining to the lowest level since July 19.

With this, the 5-year and 10-year inflation expectations per the aforementioned calculations fall to 2.15% and 2.24% at the latest.

It’s worth observing that the Fed officials’ inability to please markets with a major hawkish surprise at Jackson Hole joins the recently mixed US data to raise concerns about the Fed’s policy pivot. However, today’s US employment data for August will be crucial for immediate directions.

The market forecasts 170K figures of the Nonfarm Payrolls (NFP) versus the previously downbeat outcomes of the JOLTS Job Openings, ADP Employment Change and higher prints of the US Continuing Jobless Claims. Additionally, the three-month average of the US NFP halves to 218K versus a year earlier.

Should the scheduled US employment numbers portray tighter job markets, the Fed officials may defend their bias conveying the “higher for longer” rates, which in turn can allow the US Dollar to pare the weekly losses and weigh on the riskier assets.

Also read: Nonfarm Payrolls Preview: Four scenarios for a jobs report set to test US economic resilience

- Silver Price remains sidelined after confirming one-week-old rising wedge bearish chart pattern.

- Cautious mood ahead of US NFP prods XAG/USD bears on their way to key SMA supports.

- Multiple upside hurdles to test Silver below $25.30 key resistance.

Silver Price (XAG/USD) remains on the back foot around $24.40 despite lacking downside momentum amid the early hours of Friday’s trading. In doing so, the bright metal portrays the market’s cautious mood ahead of the US employment report for August, including the headline Nonfarm Payrolls (NFP).

However, bearish MACD signals and the downbeat RSI (14) line, not overbought, join the confirmation of a one-week-old rising wedge bearish chart formation to keep the XAG/USD sellers hopeful.

With this, the Silver sellers appear well set to drop towards the 50-SMA level of around $24.15, a break of which could direct the XAG/USD toward the 200-SMA support of around $23.85.

It’s worth noting that the XAG/USD weakness past $23.85 will highlight the 38.2% Fibonacci retracement of the July-August downside, near $23.40, ahead of directing the sellers toward the mid-August swing high of around $23.00.

On the flip side, the Silver Price remains on the back foot unless defying the rising wedge chart formation, by crossing the stated wedge’s upper line near $25.05.

Even so, the tops marked during late July and the previous monthly high, respectively near $25.15 and $25.30, will act as the final defense of the Silver bears.

Silver Price: Four-hour chart

-01092023-638291216111641186.png)

Trend: Further downside expected

“More savings accounts are offering higher interest rates as a more competitive market emerges, though regulatory intervention may still be needed to ensure customers are getting fair value,” said the UK’s Financial Conduct Authority (FCA) early Friday morning in Asia per Reuters.

The UK FCA takes steps to make sure that British savings bank account holders get the benefits of higher rates as fast as they’re charged with higher costs while taking a loan. The issue gained the attention of the British regulator after some of the banks appeared lacking to pass on the interest rate hikes to the savings bank accounts per the news.

Reuters also cites the UK FCA order to the nine banks, including HSBC, to ensure the savings account holders got the benefits of higher rates in July.

Market implications

The news may help the GBP/USD pair to regain upside traction, after snapping a three-day winning streak, as it teases the Bank of England (BoE) hawks. However, the GBP/USD pair remains defensive near 1.2675 by the press time.

Also read: GBP/USD Price Analysis: 50-SMA defends Cable bulls below 1.2700, US NFP, BOE’s Pill eyed

- USD/CAD trades nearly flat at 1.3510 as the Asian session begins, despite the US Dollar gaining against most G10 currencies.

- Falling US Treasury bond yields and a surge in oil prices support the Canadian Dollar.

- From a technical standpoint, the pair remains neutral to upward biased but is on the brink of breaking its uptrend, putting the 200-DMA at 1.3461 in focus.

The Canadian Dollar (CAD) remains in charge against the US Dollar (USD) even though the latter appreciated against most G10 FX currencies across the board. However, falling US Treasury bond yields and a jump in oil prices benefitted the CAD. Hence, the USD/CAD is trading at 1.3510, almost flat as the Asian session commences.

USD/CAD Price Analysis: Technical outlook

From a daily chart perspective, the USD/CAD remains neutral to upward biased, as the pair is still above the latest higher low achieved on August 21 at 1.3496, but at the brisk of breaking an uptrend market structure, that would expose the 200-day Moving Average (DMA) at 1.3461. Nevertheless, sellers must achieve a daily close below 1.3496 to remain hopeful of achieving lower lows, as the 50-DMA slope is trending up.

From an intraday standpoint, the pair broke below the August 24 daily ow of 1.3509, putting in play the 1.3500 figure. But one of the latest three candlesticks of August 31 price action drawing a larger wick on the bottom of the body suggests buyers entering the market around the 1.3500 area. Nevertheless, the USD/CAD is downward biased. First support emerges at 1.350, followed by the S1 daily pivot at 1.3488. A breach of the latter will expose the S2 pivot point at 1.3469 before diving to 1.3450. On the flip side, the first resistance would be the daily pivot point at 1.3523, followed by the 50-hour Moving Average (HMA) at 1.3540, before reaching the R1 pivot.

USD/CAD Price Action – Hourly chart

- US Dollar Index treads water after posting the biggest daily gain in a week while snapping three-day downtrend.

- US data, pre-NFP consolidation allows DXY traders to pare weekly losses.

- US employment numbers may help Fed hawks to defend “higher for longer” rates and propel Greenback.

US Dollar Index (DXY) struggles to defend the previous day’s rebound from the 200-DMA while making rounds to 103.60 amid Friday’s Asian session. In doing so, the Greenback’s gauge versus the six major currencies portrays the trader’s cautious mood ahead of today’s US monthly employment report, comprising the headline Nonfarm Payrolls (NFP), for August.

After witnessing downbeat prints of consumer confidence and employment clues, the US economic calendar flashed slightly better data on Thursday. The same joins the pre-data consolidation to help the DXY pare weekly losses, the first in seven, as market players await today’s key US jobs report.

It’s worth noting that the Fed’s preferred inflation gauge, namely the US Core Personal Consumption Expenditure (PCE) Price Index for August, matched market forecasts of 4.2% YoY and 0.2% MoM versus 4.1% and 0.2% respectively priors. Further, the Initial Jobless Claims dropped to 228K from 232K prior (revised) versus 235K market forecasts while the Chicago Purchasing Managers’ Index rose to 48.7 for August compared to 44.1 expected and 42.8 previous readings. Additionally, Personal Spending rose past the 0.6% expected and previous readings to 0.8% for July whereas Personal Income eased to 0.2% for the said month, from 0.3% market forecast and prior.

Apart from the data, Atlanta Fed President Bostic’s defense of keeping rates high also underpins the DXY rebound.

Elsewhere, market players seek more clues to defend the DXY bulls, which in turn highlights today’s US employment report and the risk catalysts comprising China PMIs and stimulus news. That said, the market forecasts 170K figures of the Nonfarm Payrolls (NFP) versus the previously upbeat outcomes of the JOLTS Job Openings, ADP Employment Change and higher prints of the US Continuing Jobless Claims. Additionally, the three-month average of the US NFP halves to 218K versus a year earlier.

Should the scheduled US jobs report print softer figures, the Fed may show readiness to keep the rates high despite turning down the rate hikes. With this, the US Dollar Index (DXY) may witness a lack of buying.

Technical Analysis

The US Dollar Index (DXY) recovers from the 200-DMA, around 103.05 by the press time, but the recovery needs validation from a six-week-old previous support line, now resistance around 104.00.

- NZD/USD struggles to find direction ahead of the key US data.

- US PCE inflation matches expectations; Initial Jobless Claims are lower than expected.

- New Zealand’s consumer confidence rose to 85 in August from 83.7.

- Investors will monitor the US ISM Manufacturing PMI, Nonfarm Payrolls, Unemployment Rate.

The NZD/USD pair trades sideways below the 0.6000 barrier during the early Asian session on Friday. The US Dollar Index posts mixed results following the US economic data. The pair currently trades near 0.5965, down 0.02% on the day. Market participants await the highly anticipated US Nonfarm Payrolls due later in the American session. The figure is expected to show a 170K rise in jobs.

On Thursday, the Federal Reserve's preferred gauge of inflation, the US Core Personal Consumption Expenditure Price Index, rose to 4.2% in July from 4.1% prior, in line with expectations. Additionally, Initial Claims fell to 228,000, falling short of the forecast 232,000 and marking the lowest number in four weeks. Continuing Claims, on the other hand, reached their highest level in six weeks.

On the Kiwi front, the ANZ – Roy Morgan Consumer Confidence for August showed that consumer confidence in New Zealand improved marginally to 85 in August from 83.7 but remained at subdued levels. However, there was more optimism among consumers regarding whether it was a good time to buy household items.

Apart from the data, the chief economist of the Reserve Bank of New Zealand (RBNZ) stated last week that policymakers would cut the OCR earlier than signaled if China experienced a more significant slowdown than the RBNZ anticipates. Investors will keep an eye on the Chinese Caixin Manufacturing PMI due later in the day. The weaker-than-expected result might exert pressure on the China-proxy Kiwi and act as a headwind for the NZD/USD pair.

Moving on, market players will closely watch the US ISM Manufacturing PMI. The figure is expected to improve from 46.4 to 47. The attention will then shift to Nonfarm Payrolls (NFP), followed by the Unemployment Rate. Traders will take cues from the data and find trading opportunities around the NZD/USD pair.

- GBP/USD picks up bids to pare the first daily loss in four, bracing for the weekly gain.

- Cable bounces off 50-SMA after retreating from five-week-old resistance line.

- MACD signals, sustained trading below the key resistance line, 200-SMA keep Pound Sterling sellers hopeful.

- Multiple supports to test bears while buyers can cheer 1.2760 breakout.

GBP/USD portrays the pre-NFP consolidation while bouncing off 50-SMA amid the early hours of Friday’s trading, following the first daily loss in four. That said, the Cable pair picks up bids to 1.2675 by the press time while bracing for the weekly gains.

Despite the latest rebound, the GBP/USD pair remains on the seller’s radar due to the quote’s multiple failures to cross a five-week-long descending resistance line and sustained trading below the 200-SMA. Adding strength to the downside bias is the looming bear cross on the MACD.

With this, the Pound Sterling is likely to portray another attempt to break the 50-SMA support of 1.2660.

Following that, the GBP/USD bears may aim for a slightly descending support line stretched from early August and the previous monthly low, respectively near 1.2610 and 1.2550.

Meanwhile, a downward-sloping resistance line from July 27, near 1.2720, restricts the immediate upside of the Cable pair ahead of the 200-SMA surrounding 1.2760.

In a case where the Pound Sterling remains firmer past 1.2760, the buyers will aim for the previous monthly high of around 1.2830.

Apart from the technical details, the final readings of the UK S&P Global Manufacturing PMI, the US employment report and the ISM Manufacturing PMI for August will also be important to aptly forecast the GBP/USD moves. Also, a speech from the Bank of England (BoE) policymaker Huw Pill will offer additional directions to the pair traders.

GBP/USD: Four-hour chart

Trend: Pullback expected

- US PCE inflation aligns with estimates but shows an uptick, while Initial Jobless Claims come in lower than expected, adding complexity to the Fed’s rate decision.

- ECB board member Isabel Schnabel reignites stagflation fears but doesn’t rule out more rate hikes; EU inflation data mixed, with core HICP falling to 5.3% YoY.

- Market participants now focus on Friday’s US Nonfarm Payrolls report and ISM Manufacturing PMI, which could provide further direction for the EUR/USD pair.

The Euro (EUR) reversed Wednesday’s gains vs. the US Dollar (USD), as the currency pair tanked, despite investors trimming the chances for a US Federal Reserve rate hike in September on a session that witnessed global bond yields falling. Hence, the EUR/USD is trading at 1.0843 after reaching a daily high of 1.0939, down 0.735.

Euro gave back its gains amid mixed EU inflation, ahead of US NFP report

After Wall Street closed, the EUR/USD finished the session in the mid-range of the week, with traders eyeing a drop toward the 200-day Moving Average (DMA) at 1.0815. All that is propelled by data from the United States (US) and the Eurozone (EU), as both economic blocs remain on a tightening cycle.

Beginning with the US, inflation data revealed by the Commerce Department showed the Fed’s favorite inflation gauge, the PCE, came at 3.3% YoY, as expected, but above June’s data at 3%. Core PCE followed the same path of aligning with estimates but increased from 4.1% to 4.2% YoY. Even though the advancement in inflation is not to worry about, solid labor market data justifies the Fed’s need to keep rates higher for longer.

Initial Jobless Claims for the last week came below estimates of 235K, at 229K, contrary to earlier data revealed during the week, namely job openings and the ADP National Employment report, that underscored the labor market was losing traction.

The EU’s agenda showed that inflation in the whole bloc was mixed, while a European Central Bank (ECB) board member, Isabel Schnabel, reignited stagflation fears after acknowledging growth headwinds but didn’t discount the need for more rate hikes. Data from the EU showed inflation remained unchanged at 5.3% YoY in August, but excluding volatile items, core HICP was 5.3%, below July’s 5.5%.

That opened the door for the ECB to take an approach similar to the Fed, of skipping rate hikes, as some voices had taken a cautious approach. Traders should be aware that before Christine Lagarde’s speech at Jackson Hole, ECB sources mentioned that hawks in the committee eased its previous posture.

All that said, market participants’ focus shifts to tomorrow’s US Nonfarm Payrolls report, which is expected to show the US economy added 170K jobs. The Unemployment rate and Average Hourly Earnings are expected at 3.5% and 4.4%, respectively. After that report, the ISM Manufacturing PMI will update the industry status in the world’s largest economy.

EUR/USD Price Analysis: Technical outlook

The EUR/USD is set to extend its losses. Price action in the last couple of days formed a ‘bearish engulfing’ candlestick pattern, warranting further downside. Still, the major will face strong support at the 200-DMA at 1.0815, the 1.0800 figure, and a five-month-old support trendline at around 1.0760/85. If those areas are cleared, sellers will set their eyes on the May 31 low of 1.0635.

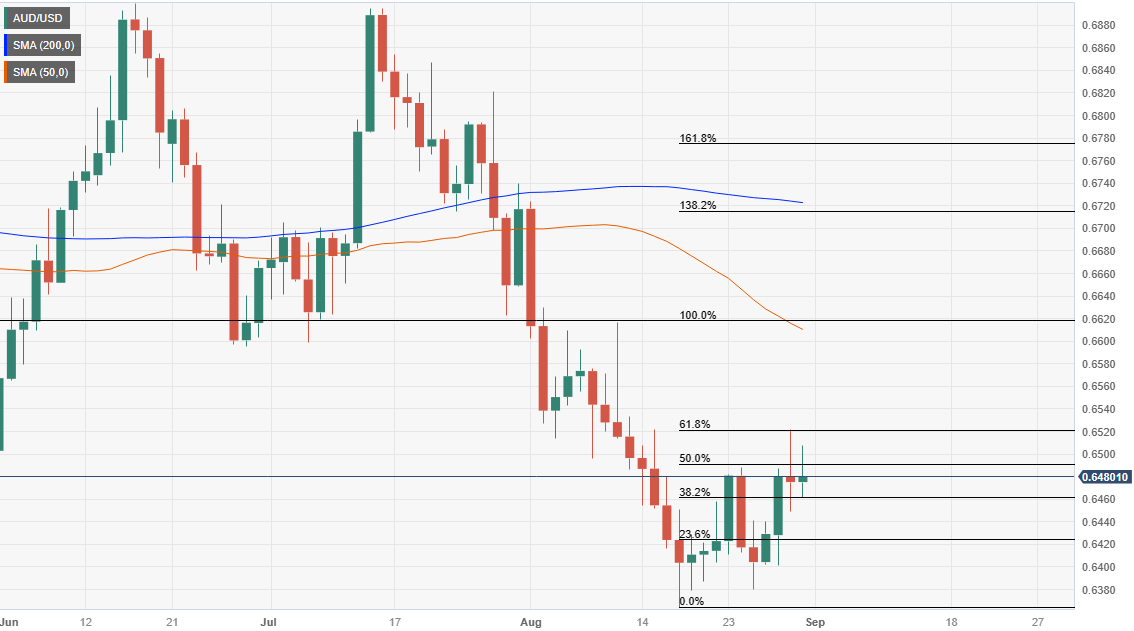

- AUD/USD struggles on the way to posting the first weekly gain in seven.

- Mixed China, Australia data joined cautious mood to prod the bulls despite keeping them in the driver’s seat.

- US inflation, activity and employment clues turn down hawkish concerns but may allow Fed to keep rates higher for longer.

- China Caixin Manufacturing PMI will precede US employment data for August, ISM Manufacturing PMI to provide fresh impulse.

AUD/USD portrays the typical pre-data anxiety as bulls take a breather around 0.6480-85 while marking the repeated attempts to stay beyond the 0.6500 as markets await the US employment report for August. Apart from the US Nonfarm Payrolls (NFP), the presence of China’s Caixin Manufacturing PMI and US ISM Manufacturing PMI also pushes the Aussie pair traders toward being cautious. Furthermore, Australia’s S&P Global Manufacturing PMI for August, expected to remain unchanged at 49.4 also prods the pair buyers.

That said, the Aussie pair remained on the front foot the previous day despite lacking momentum as mixed data from China, Australia and the US failed to offer any clear directions to the traders. Also, geopolitical concerns about the biggest customer China and doubts about its stimulus tested the AUD/USD bulls even as the broadly softer US Dollar allowed the pair buyers to keep the reins.

On Thursday, the US Dollar Index (DXY) recovered from the 200-DMA to print the first daily gain in four while ending the trading day around 103.65. Even so, the Greenback’s gauge versus the six major currencies remains on the way to snapping a six-week uptrend as the latest round of data challenges the Federal Reserve (Fed) hawks.

Among them, the Fed’s preferred inflation gauge, namely the US Core Personal Consumption Expenditure (PCE) Price Index for August, matched market forecasts of 4.2% YoY and 0.2% MoM versus 4.1% and 0.2% respectively priors. Further, the Initial Jobless Claims dropped to 228K from 232K prior (revised) versus 235K market forecasts while the Chicago Purchasing Managers’ Index rose to 48.7 for August compared to 44.1 expected and 42.8 previous readings. Additionally, Personal Spending rose past the 0.6% expected and previous readings to 0.8% for July whereas Personal Income eased to 0.2% for the said month, from 0.3% market forecast and prior.

At home, China’s official NBS Manufacturing PMI for August rose to 49.7 versus 49.4 expected and 49.3 previous readings whereas the Non-Manufacturing PMI came in as 51.0 compared to 51.5 prior readouts and market forecasts of 51.1. Furthermore, Australia’s Private Capital Expenditure and Private Sector Credit numbers failed to impress the Aussie bulls.

Elsewhere, the US-China trade war continues amid Beijing’s dislike of Western help to Taiwan. However, the fears of losing economic recovery from COVID push the policymakers to announce multiple stimulus. On Thursday, the Dragon Nation announced relief on the down payment of first and second home buyers to help the housing market. Previously, the bank cut many rates to infuse liquidity into the nation. However, the market’s doubts about the credibility of such measures make them less important for the AUD/USD pair.

Moving on, PMIs from Australia and China may entertain the AUD/USD pair traders and can allow the Aussie to edge higher. However, more important will be the US data considering the fears of Fed policy pivot, which if confirmed by softer statistics, can propel the pair prices.

Technical analysis

Despite the latest inaction around 0.6500, the AUD/USD pair’s successful breakout of a seven-week-old descending trend line and the 21-DMA, respectively near 0.6470 and 0.6445, keeps the buyers hopeful.

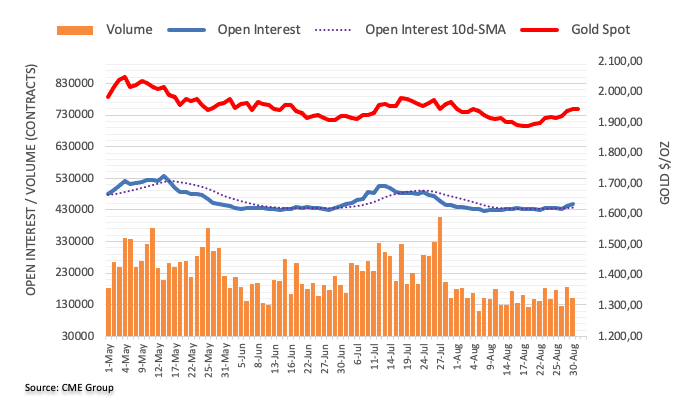

- XAU/USD traded with mild losses on Thursday, near the $1,940 area.

- Lower US yields limit the yellow metal´s downside potential.

- Strong NFP's on Friday may give US yields a boost.

On Thursday, Gold price slightly decreased as the recovery of the USD limited the upside potential. The Greenback found demand as people filing first-time claims for state unemployment insurance decreased at the end of August, while the Personal Consumption Expenditures inflation figures increased, just as expected. Markets are cautious ahead of critical Nonfarm Payrolls (NFPs) from August that will be released on Friday.

From the data side, the US Department of Labor released robust figures for Initial Jobless Claims from August that came in at 228,000, versus the expected 235,000 and the previous reading of 232,000, while the Core Personal Consumption Expenditures (PCE)(YoY) from July came as expected 4.2% but slightly lower than the previous 4.1%.

That said, the US dollar, measured by the DXY index, showed more than 0.40% of daily gains while the US treasury bond yields, often seen as the opportunity cost of holding non-yielding metals, decreased. The 2,5 and 10-year yields declined to 4.86%, 4.24% and 4.08%, respectively, limiting the XAU/USD downside. The focus now shifts to the August Nonfarm Payrolls, where investors will watch for further clues about the next interest rate decisions by the Federal Reserve (Fed). As for now, the CME FedWatch Tool suggests that investors expect the Fed won't hike on September 20, while the odds of 25 basis points (bps) stand 40% on November 1 and December 13. It's worth highlighting that Chair Powell from the Fed stated that the bank is expecting the US labour market to soften and that ongoing decisions will be "carefully" decided, so the outcomes of the NFPs will likely dictate the pace of the mentioned expectations and the US Treasury yields on Friday.

XAU/USD Levels to watch

According to the daily chart, the XAU/USD trades neutral to bearish in the short term, near the $1,940 area. The Relative Strength Index (RSI) trades flat, while the Moving Average Convergence Divergence (MACD) continues to print strong green bars, suggesting that the buyers are resilient. On the general outlook, the XAU/USD trades above the 20-day and 200-day Simple Moving Average (SMA) and is approaching the 100-day SMA, which indicates that the bulls are comfortably are command.

Resistance levels: $1,945, $1,954 (100-day SMA), $1,970

Support levels: $1,935, $1,915 (20 and 200-day convergence), $1,900.

XAU/USD Daily chart

-638291158495413289.png)

- EUR/GBP bulls failed to defend the 20-day SMA, and the cross fell near 0.8555.

- So far, the pair lost 0.50% since Wednesday.

The daily chart suggests the EUR/GBP has a bearish technical bias for the short term, with technical indicators suggesting that the bears have taken the lead for the short term. The Euro traded weak against most of it rivals on Wednesday, which contributed to the cross failing to consolidate above the 20-day Simple Moving Average (SMA) of 0.8580.

The daily Relative Strength Index (RSI) also exhibits a southward slope below its midline, emphasising the presence of intense selling pressure. At the same time, the Moving Average Convergence Divergence (MACD), with its red bars, highlights the strengthening bearish momentum for the EUR/GBP. Similar signals are seen in the four-hour chart, with both indicators comfortably standing in negative territory.

On the bigger time frame, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), suggesting that the buyers are struggling to overcome the overall bearish trend and the bears are still in charge.

Support levels: 0.8560, 0.8640, 0.8495.

Resistance levels: 0.8580 (20-day SMA), 0.8600, 0.8615.

EUR/GBP Daily Chart

-638291121743906111.png)

The final Manufacturing PMIs, including Japan, Australia, and China, are due. The key focus will be on the US Nonfarm Payrolls report. Additionally, the US ISM Manufacturing PMI will be released. Canada will also report GDP data.

Here is what you need to know on Friday, September 1:

On the first day of the new month, the primary focus will be on the US official employment report. Nonfarm Payrolls are expected to show a 170,000 increase in jobs, while the Unemployment Rate is anticipated to remain at 3.5%. Following the release of the NFP, the ISM Manufacturing PMI will be published, with an expected rebound from 46.4 to 47.

Nonfarm Payrolls Preview: Four scenarios for a jobs report set to test US economic resilience

Data released on Thursday showed that Initial Jobless Claims declined to 228,000, below the expected 232,000, marking the lowest reading in four weeks. However, Continuing Claims rose to the highest level in six weeks. The Core Personal Consumption Expenditure Price Index, a highlight of the day, showed an increase in the annual rate from 4.1% to 4.2% in July, in line with expectations. These figures did not have a significant impact on the market. The US Dollar made modest gains.

The US Dollar posted mixed results, as it rose against its main European rivals but weakened against the Yen. It ended the day flat against the AUD and NZD. The Canadian Dollar outperformed. The US Dollar Index (DXY) rebounded from 103.00 and moved back above 103.50.

US Treasury yields declined again but at a modest pace. The 10-year yield hit a fresh two-week low at 4.07% before rebounding to 4.11%.

The Euro lagged on Thursday, despite softer inflation figures and expectations regarding tightening from the European Central Bank (ECB). The upcoming ECB meeting appears to be a close call. EUR/USD failed to hold above 1.0900 and finished below 1.0850. EUR/GBP fell for the second consecutive day, approaching 0.8550.

"No room for complacency on inflation," said Bank of England Chief Economist Huw Pill. Depository rising against the Euro, the Pound lost ground versus the US Dollar, causing GBP/USD to slide below 1.2700. The pair offers no clear signs regarding its future direction.

USD/JPY reached weekly lows below 145.50, influenced by US yields remaining near recent lows and US stocks failing to sustain in positive territory.

On Thursday, USD/CHF experienced a significant surge, bouncing back from its weekly lows and rising above the 0.8800 level. On Friday, Switzerland will release the August Consumer Price Index (CPI).

USD/CAD declined for the fourth consecutive day and tested the 20-day Simple Moving Average around 1.3500. If consolidation occurs below that level, it could open the door for further losses. Canada is scheduled to report June and Q2 GDP growth figures.

Analysts at TD Securities on Canada GDP:

Q2 GDP growth is forecast to slow to 1.2%, giving the BoC more evidence that higher rates are working to slow demand. Household goods consumption will provide the main catalyst for the slowdown, while softer construction and net exports should also weigh on growth. We also look for GDP to decline by 0.1% in June, with new flash estimates pointing to another muted performance in July.

NZD/USD has been trading sideways below 0.6000 and the 20-day Simple Moving Average (SMA). The pair currently holds a neutral outlook in the short-term, with key support seen at 0.5900.

AUD/USD posted another daily close around 0.6470, slightly above the 20-day Simple Moving Average (SMA) for the second consecutive day. The pair currently maintains a modest bullish bias. However, to further solidify this outlook, it needs to hold above the key level of 0.6500.

US August Nonfarm Payrolls Preview: Analyzing Gold price's reaction to NFP surprises

Like this article? Help us with some feedback by answering this survey:

- USD/MXN trades around 17.00, up significantly from a daily low of 16.7083, as month-end flows and mixed US economic data favor the Greenback.

- Banxico announces the winding down of its hedge program settled in Mexican Pesos, adding fuel to the USD/MXN rally; traders eye a daily close above 17.0000.

- Banxico Governor Victoria Rodriguez Ceja rules out rate cuts and raises Mexico’s 2023 growth estimates, while Atlanta’s Fed President Raphael Bostic comments on US inflation policy.

The Mexican Peso (MXN) plunged more than 1.62% against the US Dollar (USD) late in the New York session due to month-end flows favoring the USD, mixed US data, as well as Bank of Mexico (Banxico) news. Therefore, the USD/MXN is trading at 17.0079 after hitting a daily low of 16.7083.

Mexican Peso drops over 1.60% vs. USD amid mixed US data, Banxico’s decision to wind down hedge program

Wall Street trades mixed as investors brace for August’s Nonfarm Payrolls report release. Analysts estimate the US economy added 170K jobs, 17K less than July’s data, while Average Hourly Earnings are foreseen at 4.4% YoY, unchanged. Later in the day, the Institute for Supply Management (ISM) will reveal the Manufacturing PMI, estimated at 47, above July 46.4, with most subcomponents seen increasing except for the employment index.

Aside from this, the US economic agenda on Thursday revealed the Federal Reserve’s preferred gauge for inflation, the Personal Consumption Expenditure (PCE), was 3.3% YoY, as expected, but exceeded June’s 3%. Core PCE, sought by Fed members as its focal point, is stickier than what policymakers were projecting, stands at 4.2% YoY as foreseen but above the previous month’s 4.1%. At the same time, the unemployment claims came below estimates of 235K, at 229K, contrary to earlier data revealed during the week, that underscored the labor market was losing traction.

That said, the USD/MXN edged higher, not only on US data. Banxico reported that it’s winding down its hedge program settled in Mexican Pesos.

The exotic pair rallied sharply and touched a daily high of 17.1114 before reversing its course below the 17.0000 mark. However, traders are eyeing a daily close above 17.0000, with USD/MXN buyers setting their sights on the 100-day Moving Average (DMA) at 17.3072.

In the meantime, the US Dollar Index, which measures the buck’s value against a basket of six currencies, rises by 0.41%, at 103.606. US Treasury bond yields and worldwide remain depressed as traders prepare for Friday’s Nonfarm Payrolls report.

Aside from this, Banxico’s Governor Victoria Rodriguez Ceja took off from the table rate cuts, as she added, “The outlook ahead continues to be complex and uncertain. It’s important to remember that disinflation periods are not linear.” Should be said, Banxico raised growth estimates for Mexico’s economy in 2023 to 3%, above the previous estimate of 2.3%.

On the central bank front, Atlanta’s Fed President Raphael Bostic said the policy was appropriately restrictive to bring inflation towards the US central bank’s 2% target over a “reasonable” period.

USD/MXN Price Analysis: Technical outlook

After the USD/MXN breached the 50 and 20-DMAs, the pair must clear resistance levels if buyers want to regain control. A daily close above 17.0000 could spur a rally toward the August 17 high of 17.2073. A breach of the latter would expose the May 17 daily low, at 17.4038, seen as a crucial level for traders. Once cleared, the USD/MXN would achieve successive series of higher highs and lows, opening the door to test the 200-(DMA) at 18.0671.

- GBP/USD retreated towards the 1.2670 area, below the 20-day SMA.

- Core PCE from July rose to 3.3%, matching expectations.

- Focus shifts to Friday’s NFPs, expected to have decelerated to 170k.

On Thursday, the GBP/USD lost ground as the USD traded strongly against most of its rivals after the release of July's Core Personal Consumption Expenditures (PCE) figures. The GBP’s losses are limited by tightening expectations on the Bank of England remaining high.

Core PCE rose in July, and Jobless Claims decelerated at the end of August

The Core PCE from July came in at 3.3%, up from its previous 3% and matched the consensus. In addition, the US reported that the Jobless Claims for the week ending in August 25 decelerated to 228,000, vs the 235,000 expected and the previous 232,000 and hinted at some resilience of the labour market after the US reported soft employment figures on Tuesday.

All eyes are now on the Nonfarm Payrolls (NFP) report from August from the US to be reported on Friday, which will likely cause market volatility as that report is the ultimate gauge of the US labour market situation. As the Federal Reserve (Fed) expects a cooling labour market, its outcome will help investors place bets on the next decisions.

On the GBP’s side, no relevant data was released, but its losses are limited by the tightening expectations of the Bank of England (BoE), and markets still bet on a terminal rate between 5.75%-6% for this cycle.

GBP/USD Levels to watch

Based on the daily chart, GBP/USD maintains a neutral technical perspective as indicators send mixed signals. The Relative Strength Index (RSI) displays a negative slope in the bullish territory, hinting at a potential shift in momentum, while the Moving Average Convergence (MACD) displays shorter red bars. Moreover, the pair is below the 20-day Simple Moving Average (SMA) but above the 100 and 200-day SMAs, indicating a favourable position for the bulls in the bigger picture.

Support levels: 1.2645 (100-day SMA), 1.2600, 1.2550.

Resistance levels: 1.2700 (20-day SMA), 1.2730, 1.2750.

GBP/USD Daily Chart

-638291050712846991.png)

- AUD/USD trades flat after falling to a daily low of 0.6461.

- US PCE inflation meets expectations at 3.3% YoY, while Initial Jobless Claims come below estimates, providing a brief boost to the Greenback.

- China’s mixed PMI data and Atlanta’s Fed President Raphael Bostic’s comments complicate the currency pair’s outlook.

The Australian Dollar (AUD) trims some of its losses against the US Dollar (USD) after falling to a daily low of 0.6461 ahead of the London fix, while the Greenback gives back some of its earlier gains. Traders booking profits ahead of market-moving data from the United States (US) is the main reason behind the recent US Dollar weakness. The AUD/USD is trading at 0.6474, flat in the day.

Aussie Dollar stages a comeback from daily lows, as traders book profits before August’s NFP

The financial markets remain quiet so far, past the mid-New York session. The economic agenda in the US spurred some volatility in the early trading session, courtesy of the latest inflation report. The Fed’s preferred gauge for inflation, the Personal Consumption Expenditure (PCE), was 3.3% YoY, as expected above June’s 3%. Regarding core PCE, sought by Fed officials, as its focal point is stickier than what policymakers were projecting, it stands at 4.s% YoY as foreseen but above the previous month’s 4.1%.

That data and the latest unemployment claims for the week ending August 26, coming below estimates of 235K, at 229K, sponsored a leg-up in the US Dollar. Initial Jobless Claims were the first positive news in the labor market during the week, as job openings plummeted, while private hiring disappointed analysts.

In the meantime, the US Dollar Index, which measures the buck’s value against a basket of six currencies, rises by 0.41%, at 103.606. US Treasury bond yields dropped

An upbeat market sentiment cushioned the AUD/USD as China revealed that Manufacturing PMIs improved but remained in contractionary territory. The non-manufacturing PMI deteriorateds from 51.5 to 51.0, below estimates of 51.1.

On the central bank front, Atlanta’s Fed President Raphael Bostic said the policy was appropriately restrictive to bring inflation towards the US central bank’s 2% target over a “reasonable” period.

In the week ahead, the Australian economic docket will feature S&P Global Manufacturing PMI for August. On the US front, the economic agenda is set to be busy, highlighted by the release of Nonfarm Payrolls and the ISM Manufacturing PMI, both of which are figures for August.

AUD/USD Price Analysis: Technical outlook

From a technical standpoint, the AUD/USD remains neutral to downward bias, as it remains below the 50 and 200-day Moving Averages (DMAs). Nevertheless, recent price action suggests the current leg-up could be viewed as a correction that pierced the 61.8% Fibonacci (Fib) retracement at 0.6520. That, alongside back-to-back spinning tops candlesticks, could pave the way for further losses, with traders eyeing the year-to-date (YTD) low of 0.6364

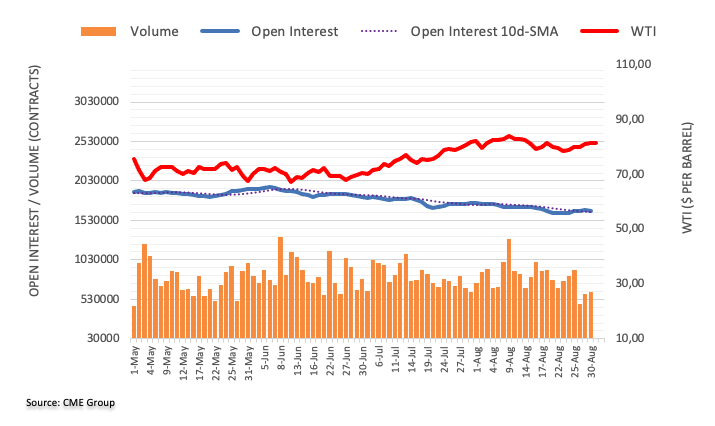

- WTI rose near the $82.90 zone, setting a three-day winning streak.

- Supply crunch fears amid the Hurracain Idalia tractions Oil prices.

- A stronger USD and the fragile Chinese situation may limit the upside.

The West Texas Intermediate (WTI) rose on Wednesday and threatened the $83.00 resistance.

What is driving the price upwards is Hurricane Idalia approaching the Gulf of Mexico, where the US concentrates 15% of its Oil production and supply crunch fears are increasing crude prices. In addition, the report of lower-than-expected US crude stockpiles released on Tuesday and the continuing manoeuvres by OPEC+ to extend its voluntary production cuts also contributes to the upside.

Moreover, China reported soft economic data during the Asian session, with the Non-Manufacturing PMI decreasing to 51.00, vs. the 51.1 expected, and the weak Chinese outlook may limit the black gold’s gains. In line with that, the USD is trading strong against most of its rivals, which could also hold back the WTI bulls.

WTI Levels to watch

Analysing the daily chart, it is apparent that the WTI has a neutral to bullish technical stance, with the bulls gradually recovering ground. The Relative Strength Index (RSI) has a positive slope above its midline, while the Moving Average Convergence (MACD) lays out decreasing red bars. Moreover, the pair is above the 20,100,200-day Simple Moving Average (SMA), implying that the bulls retain control on a broader scale.

Support levels: $81.25, $80.00, $78.50.

Resistance levels: $83.00, $83.50, $84.50.

WTI Daily Chart

-638290999752187056.png)

- The NZD/USD consolidates below the 20-day SMA of 0.5973 towards the 0.5950 area, tallying a second consecutive day of losses.

- Core PCE rose in July to 3.3%, as the markets expected.

- Fed’s tightening expectations eased somewhat, but they remain high—eyes on NFPs.

On Thursday, the NZD/USD saw losses, driven by robust economic data, making the USD recover against most of its rivals. During the week, the US economy has been sending mixed, and the markets eagerly await Friday’s Nonfarm Payrolls report to continue placing their bets on the next Federal Reserve’s (Fed) decisions.

The Core Personal Consumption Expenditures (PCE), one of the Fed’s preferred gauges for inflation, rose to 3.3% YoY in July, matching the market’s expectations. In addition, Initial Jobless Claims for the week ending on August 25 came in at 228,000, lower than the 235,000 expected and the previous figures of 232,000. Other data showed that the Chicago PMI increased to 48.7, bearing both the expected and previous figures.

Reacting to the strong PCE and Claims figures, the USD, measured by the DXY index, rose to 103.70, seeing more than 0.50% gains, while the US Treasury yields recovered somewhat, but they are still in decline.

Regarding the Federal Reserve (Fed) expectations, the World Interest Rates Probabilities tool suggests that markets the odds of a 25 bps increase stand at 50%, down from 70% on Tuesday, for the November meeting. However, those bets will likely change after Friday’s Nonfarm Payrolls release, as a hot reading may push investors to bet on higher chances of a hike.

NZD/USD Levels to watch

Upon analyzing the daily chart, a neutral to bearish trend becomes evident for NZD/USD, with the bears are seen gradually taking control. The Relative Strength Index (RSI) reveals a selling momentum with a downward slope below its middle point, while the Moving Average Convergence (MACD) lays out flat green bars. Plus, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), indicating that the sellers dominate the broader perspective, and the buyers need to increase their efforts.

Support levels: 0.5940, 0.5930, 0.5900.

Resistance levels: 0.5973 (20-day SMA), 0.6000, 0.6030.

NZD/USD Daily Chart

-638290954544566729.png)

- USD/CHF trades at 0.8842, recovering from a daily low of 0.8771, as US PCE inflation aligns with forecasts and Swiss retail sales plunge -2.3% MoM.

- Mixed US employment data sets the stage for a crucial Nonfarm Payrolls report, while a ‘morning star’ chart pattern suggests a potential upside for USD/CHF.

- Swiss National Bank faces pressure as retail sales disappoint and inflation remains below target; money market futures give a 68% chance of rates staying unchanged.

The Swiss Franc (CHF) losses momentum vs. the US Dollar (USD) after Swiss economic data was weaker than expected, but US inflation remains steady although decelerated. That, alongside month-end flows, bolstered the US Dollar. Hence, the USD/CHF is trading at 0.8842 after hitting a daily low of 0.8771.

US Dollar gains ground as PCE inflation meets estimates and on month-end flows

The US economic docket revealed better-than-expected data on Thursday, contrary to Tuesday and Wednesday. A soft US jobs openings report, consumer confidence deteriorating, ADP Employment Change below estimates, and the GDP for the second quarter downward revised reignited recession fears. Nevertheless, never count out consumers, portraying America’s resilience.

The US Federal Reserve’s favorite inflation gauge, the Personal Consumption Expenditure (PCE), came as expected at 3.3%, a tick higher than June’s data, while on a monthly basis, it stood at 0.2% MoM. Core PCE, which excludes volatile items, rose by 4.2% YoY, aligned with the consensus, but above June 4.1%.

Initial Jobless Claims for the last week showed the labor market remains tight despite recent data linked to the jobs market depicting the opposite. People filling for unemployment aid rose by 228K, below estimates of 235K. Hence, mixed employment data makes tomorrow’s US Nonfarm Payrolls report for August crucial. That could clear some of the clouds, spurred by recent data.

That and month-end flows triggered a recovery, with the USD/CHF reclaiming the 0.88 figure, as the daily chart portrays a three-candle ‘morning star’ chart pattern, which, although it warrants further upside, a downslope resistance trendline looms, drawn from March 2023 highs.

In the meantime, the US Dollar Index, which measures the buck’s value against a basket of six currencies, climbs 0.51%, at 103.707.

On the Swiss front, retail sales for July were worse than estimated, plunging -2.3% MoM, below the upward revised June 1.5% gain. Even though the data portrays the increasing borrowing costs of the Swiss National Bank (SNB), it could also lead to a faster economic slowdown. USD/CHF traders’ focus shifts toward Switzerland’s inflation report, expected to drop to 1.5% in August after July’s 1.5% fall.

Despite Swiss inflation remaining below the SNB 2% target, the central bank foresees CPI to rise to 2.2% in 2023 and 2024. Due to its scarce monetary policy meetings, with the central bank hosting four, one in each quarter, the next reunion possesses additional importance. In the meantime, money market futures expect the SNB to keep rates unchanged, with odds at a 68% chance.

In the meantime, Atlanta’s Fed President Raphael Bostic said the policy was appropriately restrictive to bring inflation towards the US central bank’s 2% target over a “reasonable” period.

USD/CHF Price Analysis: Technical outlook

Given the fundamental backdrop, the USD/CHF is neutral-biased. But from a technical standpoint, the pair is neutral to downward. The next resistance emerged at around 0.8830/60, with a five-month-old downslope resistance trendline looming, which could pave the way for further upside if broken. The next resistance would emerge at 0.8900, followed by the 0.9000 figure. Conversely, downside risks emerge below 0.8771, followed by the current week’s low of 0.8745

- USD/JPY trades at 145.60, down 0.42%, as positive US data fails to lift the pair; DXY advances 0.51% to 103.718 but can't buoy USD/JPY.

- CME FedWatch Tool suggests the Fed will keep rates unchanged in September.

- Japan's retail sales exceed expectations with a 6.8% YoY increase, but a disappointing 2.4% contraction in Industrial Production adds to BoJ's policy dilemma.

The Greenback (USD) prints losses against the Japanese Yen (JPY) after reaching a daily high of 146.22, back below 146.00. Data from the United States (US) came better than expected but failed to bring the USD/JPY to life. The pair is trading at 145.60, down 0.42%

Greenback struggles to attain gains vs. the Yen despite better-than-expected data

A busy weekly economic agenda keeps most US Dollar pegged currency pairs trading volatile. Following Tuesday and Wednesday’s session, the buck was under a lot of stress. However, it regained some of its composure against most G10 FX currencies, except for the Japanese Yen.

The US Commerce Department revealed that the US Federal Reserve’s (Fed) preferred gauge for inflation, the Core Personal Consumption Expenditure (PCE), came as expected, climbing 4.2% YoY and 0.2% MoM as both figures aligned with the street’s forecasts. Regarding headline inflation, PCE remained unchanged at 3.3% YoY and 0.2%.

Other data showed that Initial Jobless Claims for the week ending August 26 came at 228K, below its forecast of 235K, according to the US Department of Labor. This, is contrary to the latest jobs data released, which pointed out the labor market was losing steam.

Today’s data added to past jobs releases in the US, alongside month-end flows, underpin the US Dollar (USD), which reached a bottom and is climbing according to the US Dollar Index (DXY). The DXY, an index that tracks a basket of six currencies’ performance vs. the USD, advances 0.51%, up at 103.718.

Even though economic growth has lost a step, it remains above the prior estimate of 2%, at 2.1% in the second quarter. That, alongside the US Commerce Department saying that consumer spending remains steady, jumping 0.8% in July, could keep the Fed in check. The CME FedWatch Tool, which depicts traders’ beliefs about increasing borrowing costs in the US, portrays that the Fed will keep rates unchanged at the September meeting. However, for November, the odds remain at 44.1% for a 25 bps increase.

In the meantime, Atlanta’s Fed President Raphael Bostic said the policy was appropriately restrictive to bring inflation towards the US central bank’s 2% target over a “reasonable” period.

On the Japanese front, Bank of Japan (BoJ) policymakers split between seeking a normalization of monetary policy and continued stimulus. BoJ’s board member Toyoaki Nakamura said it’s premature to tighten monetary conditions, as high import prices have driven inflation. He added that once the “deflationary mindset” is eradicated, the BoJ won’t need the Yield Curve Control (YCC).

Data-wise, Japan’s retail sales grew higher than the 5.4% YoY expected and rose by 6.8% in July, while Industrial Production plunged -2.4%, disappointing investors, which were expected a contraction of -1.4%.

USD/JPY Price Analysis: Technical outlook

The pair remains upward biased despite falling below the Tenkan-Sen, which has been recovered by buyers early in Thursday’s session. Even though the bulls are in charge, the USD/JPY must climb above yesterday’s high of 146.53 to pave the way for further upside, eyeing the year-to-date (YTD) high of 147.37. Otherwise, downside risks emerge below 145.55, which, once cleared, the major can dive and test the August 23 swing low of 144.54.

- AUD/USD strives for stability above 0.6500 for a fresh upside ahead of US NFP.

- The Australian Dollar as a proxy to Chinese economy might come under pressure if China’s factory activities remain below 50.0.

- AUD/USD has been consolidating in a wider range of 0.6336-0.6525 for the past 15 trading sessions.

The AUD/USD pair consolidates in a narrow range near the psychological resistance of 0.6500 in the New York session. The Aussie asset remains topsy-turvy as investors await the US Nonfarm Payrolls (NFP) for August, which will be published on Friday. In addition to the US NFP, ISM Manufacturing PMI will be keenly watched.

After US Automatic Data Processing (ADP) Employment report, investors hope that the labor market is losing resilience. Firms are operating with the current labor force due to the deteriorating demand environment.

Meanwhile, the Australian Dollar will dance to the tunes of the Caixin Manufacturing PMI data. The Australian Dollar as a proxy to the Chinese economy might come under pressure if China’s factory activities remain below the 50.0 threshold.

AUD/USD has been consolidating in a wider range of 0.6336-0.6525 for the past 15 trading sessions. The Aussie asset is aiming to stabilize above the 200-period Exponential Moving Average (EMA), which trades around 0.6480.

Momentum would turn bullish after the Relative Strength Index (RSI) (14) shifts into the 60.00-80.00 range.

A recovery move above August 15 high around 0.6522 will drive the asset to August 9 high at 0.6571. Breach of the latter will drive the asset towards August 10 high at 0.6616.

In an alternate scenario, a fresh downside would appear if the Aussie asset dropped below August 17 low around 0.6360. This would expose the asset to the round-level support of 0.6300 followed by 03 November 2022 low at 0.6272.

AUD/USD two-hour chart

-638290879451093207.png)

- Silver price corrects sharply from $25.00 as the US PCE price index remains sticky.

- The US Dollar Index (DXY) holds gains around 103.60 as persistent PCE data offsets the impact of the softer labor demand.

- Silver price is approaching the horizontal resistance plotted from July 20 high around $25.27

Silver price (XAG/USD) faces selling pressure near the psychological resistance of $25.00 as the US Bureau of Labor Statistics reported that the Personal Consumption Expenditure (PCE) price index remained stubborn in July.

The monthly headline and core PCE grew at a stable pace of 0.2%. Also, the annual headline and core PCE accelerated marginally to 3.3% and 4.2% as expected by market participants.

Apart from that, the US Department of Labor reported weekly jobless claims data. For the week ending August 25, individuals claiming jobless benefits dropped to 228K vs. expectations of 235K and the former reading of 232K.

The US Dollar Index (DXY) holds gains around 103.60 and is looking to extend gains further as persistent PCE data offsets the impact of the softer labor demand reported by US Automatic Data Processing (ADP) for August, released on Wednesday.

After Fed’s preferred inflation measure, investors shift focus to the US Nonfarm Payrolls (NFP) data for August, which will be published on Friday at 12:30 GMT. As per the expectations, US labor formed witnessed a fresh addition of 170K payrolls, lower than July’s reading of 187K. The Unemployment Rate is seen unchanged at 3.5%. Apart from that, Average Hourly Earnings data will be keenly focused.

Silver technical analysis

Silver price is approaching the horizontal resistance plotted from July 20 high around $25.27 on a two-hour scale. Upward-sloping 50-period Exponential Moving Average (EMA) indicates that the upside momentum is extremely bullish.

The Relative Strength Index (RSI) (14) oscillates in the bullish range of 60.00-80.00, which indicates that the upside momentum is active.

Silver two-hour chart

-638290858912922388.png)

- EUR/USD sharply reverses part of the recent three-day advance.

- Next on the downside comes the 200-day SMA (1.0812).

EUR/USD faces strong headwinds and slips back to the 1.0860 zone on Thursday following tops near 1.0950 recorded in the previous session.

Despite the daily knee-jerk, the pair’s current momentum seems to be favouring the continuation of the march north for the time being. That said, there is a temporary hurdle at the 55-day SMA at 1.0968, which precedes the psychological 1.1000 mark and the August top of 1.1064 (August 10).

In case losses gather extra impulse, a pullback to the 200-day SMA, today at 1.0812, should not be ruled out.

In the meantime, the pair is likely to keep the bullish outlook unchanged while above the 200-day SMA.

EUR/USD daily chart

Economists at Nordea share their view on the European Central Bank's (ECB) policy outlook following the release of the July Monetary Policy Meeting Accounts.

ECB will pause hiking in September, while retaining a tightening bias

"The monetary policy account from the ECB’s July meeting did not offer much guidance on what the ECB would do at its September meeting."

"The activity data since the July meeting has been weak, while inflation has proved to be sticky. In fact, stagflation risks were mentioned twice in the account. A few of the more hawkish Governing Council members have talked in favour of another hike lately, while most, including Executive Board member Schnabel today, have kept an open mind."

"We stick to our long-held baseline that rates have peaked at 3.75%, and think the ECB will pause hiking in September, while retaining a tightening bias. It will be a close call, though, and there may be an intense battle ahead between those in favour of hiking and the ones wanting to keep rates unchanged at the ECB’s September meeting."

- DXY makes a U-turn following three daily drops in a row.

- Further upside retargets the monthly highs near 104.50.

DXY halts a three-session negative streak and manages to regain some composure and retest the 103.50/60 band on Thursday.

Once the recovery gathers steam, the index should shift its focus to another visit to the monthly peak of 104.44 (August 25) just before the May top of 104.69 (May 31). The breakout of this level could prompt a probable test of the 2023 high at 105.88 (March 8) to re-emerge on the horizon.

While above the key 200-day SMA, the outlook for the index is expected to remain constructive.

DXY daily chart

- EUR/JPY comes under pressure following new 2023 peaks.

- The next up barrier remains at the key round level at 160.00.

EUR/JPY reverses a five-day positive streak and breaks below the 159.00 support on Thursday.

The continuation of the uptrend could see the cross challenging the recent 2023 peak at near 159.76 (August 30) ahead of the key round level at 160.00. The surpass of the latter should not see any resistance level of note until the 2008 high at 169.96 (July 23)

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 147.92.

EUR/JPY daily chart

- Initial Jobless Claims in the US decreased by 4K in the week ending August 26.

- Continuing Jobless Claims rise by 28K, to 1.725 million in the week ending August 19.

- US Dollar Index stays around 103.40 following Core PCE and Jobless Claims.

Initial Jobless Claims totaled 228,000 in the week ending August 26, the weekly data published by the US Department of Labor (DOL) showed on Thursday. It is the lowest reading in four weeks. This follows the previous week's print of 232,000 (revised from 230,000) and came in below the market expectation of 235,000.

Further details of the publication revealed “The 4-week moving average was 237,500, an increase of 250 from the previous week's revised average. The previous week's average was revised up by 500 from 236,750 to 237,250.”

Continuing claims rose by 28K in the week ending August 19 to 1.725 million, above market expectations of 1.7 million; the highest level in six weeks. “The 4-week moving average was 1,704,250, an increase of 8,250 from the previous week's revised average”, the DOL further noted in its publication.

Market reaction

The US Dollar Index declined modestly below 103.40 after the release of the Jobless Claims data and the Core Personal Consumption Expenditure Price Index.

- USD/CAD gauges support near 1.3520 while the US Dollar’s recovery remains swift.

- The oil price rallied above $82.00 on Thursday as the oil market is expected to tighten further.

- As per expectations, Canada’s Q2 GDP expanded at a 0.3% pace, slower than Q1’s growth rate of 0.8%.

The USD/CAD pair found a cushion near 1.3520 and defended its psychological support of 1.3500 after a recovery move in the US Dollar. The Loonie asset delivered a nominal recovery while the pace of rebound in the US Dollar Index (DXY) was higher. The rebound move in the Lonnie asset remained modest as the Canadian Dollar strengthened due to a rally in oil prices.

S&P500 futures remain lackluster in Europe as investors await Personal Consumption Expenditure (PCE) price index data for July.

Analysts at CMC markets said July inflation numbers could prompt further concern about sticky inflation on the recording of sizeable ticks higher in the monthly as well as annual headline numbers. August CPI numbers were evidence that prices might struggle to move much lower after headline CPI edged higher to 3.2%. Investors can see a similar move in this week’s numbers, with a move to 3.3% in the deflator and to 4.3% in the core deflator.”

The US Dollar Index recovered swiftly to near 103.60 after discovering the 103.00 figure as a crucial support. After the Fed’s preferred inflation tool, investors will focus on the Nonfarm Payrolls (NFP) data, which will be published on Friday. Scrutiny of the US ADP Employment Change report indicates that fresh payrolls were weaker than anticipated and wage growth remained slowest since October 2021.

The oil price rallied above $82.00 on Thursday as the oil market is expected to tighten further. Bloomberg reported that Saudi Arabia is expected to extend a million-barrel oil supply cut into October, as it seeks to shore up prices against a faltering economic backdrop.

It is worth noting that Canada is the leading exporter of oil to the United States and higher oil prices strengthen the Canadian Dollar.

The Canadian Dollar will remain in action on Friday amid the release of Q2 Gross Domestic Product (GDP) data. Investors hope that the April-June quarter expanded at a 0.3% pace, slower than Q1’s growth rate of 0.8%.

The accounts of the European Central Bank's (ECB) July policy meeting revealed on Thursday that there was broad agreement on the assessment that there are signs of a possible downward surprise in economic activity.

Key takeaways

"Members concurred with Mr Lane that the near-term economic outlook for the euro area had deteriorated."

"It was argued that the deterioration in the outlook showed that monetary transmission was working."

"There had been no material surprise in the latest inflation outcomes compared with the June projections."

"The risk of second-round effects leading to wage-price spirals seemed to be contained."

"the Governing Council needed clearer signs of whether inflation would converge to target once the effects of recent shocks had faded."

"Underlying inflation could be expected to remain high for an extended period."

"A further rate hike in September would be necessary if there was no convincing evidence that the effect of the cumulative tightening was strong enough."

Market reaction

The Euro remains under constant selling pressure following this publication. As of writing, EUR/USD was down 0.6% on the day at 1.0858.

Analysts at BBH note that the European Central Bank tightening expectations remain subdued following the latest Eurozone inflation data.

ECB may stop hiking before the Fed

"Eurozone August CPI data came in hot. Headline came in at 5.3% y/y vs. 5.1% expected and 5.3% in July, while core came in as expected at 5.3% y/y vs. 5.5% in July."

"Basically, disinflation has stalled out in the eurozone and so the policy debate will most likely swing to the hawks’ favor. Indeed, Holzmann said today that the ECB may extend its tightening cycle by “another hike or two.” Schnabel was more nuanced, noting that recent data “point to growth prospects being weaker than foreseen in the baseline scenario. But underlying price pressures remain stubbornly high, with domestic factors now being the main drivers of inflation in the euro area.”

Yet European Central Bank tightening expectations remain subdued. WIRP suggest odds of a 25 bp hike stand just below 30% September 14, rise to over 50% October 26 and top out near 65% December 14. What’s very interesting to us is that these odds have actually fallen since the start of this week, meaning that neither the higher than expected August CPI data nor hawkish ECB comments have had any impact on ECB expectations whatsoever. Market chatter regarding stagflation risks is picking up. If this dynamic is sustained, it would be a game-changer for the euro. Lastly, we stress again that the ECB may stop hiking before the Fed does and we don't think the markets have priced this risk in yet."

Economist at UOB Group Lee Sue Ann reviews the latest inflation figures in Australia.

Key Takeaways

Australia’s monthly CPI rose 4.9% y/y in Jul, easing from 5.4% in Jun, and the peak of 8.4% in Dec 2022. On a month-on-month basis, CPI rose 0.3% in Jul, also lower from the 0.7% m/m increase in Jun.

The latest monthly inflation print vindicates the Reserve Bank of Australia (RBA)’s decision to stay pat earlier this month (1 Aug), when it held the cash rate target unchanged at 4.10%,

However, we believe there is a chance it will hike one last time this year, taking the cash rate target to a peak of 4.35%. In terms of timing, this is likely to occur at the 7 Nov meeting, following the release of the 3Q23 CPI on 25 Oct.

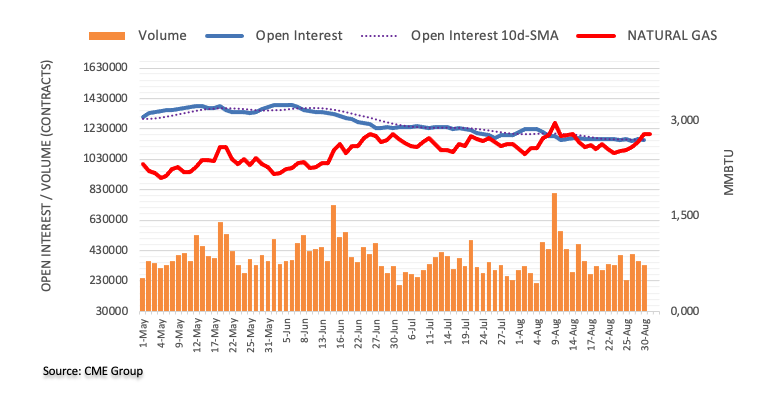

- Natural Gas is set to fall as demand remains tepid and stockpiles high.

- The US Dollar is under pressure after weak US data ahead of the jobs report.

- Expect a sideways to lower gas price as supply issues start to soothe.

Natural Gas has jumped substantially this week after Chevron received notice of strikes to take place at the start of September in several important LNG terminals in Australia. As the week progresses, another local exporter was able to broker a deal and avoid any future strike actions. This opens the door for Chevron to strike a deal as well, which would mean that any supply issues are to be limited in the near future.

Meanwhile, the demand side is staying steady to lower as the European bloc is way ahead of its target for this winter in filling up the strategic gas storages. The European bloc is committed to shun away from fossil fuels by 2027 out of Russia. However, EU countries have bought a record 52% of all cubic metres of LNG that Russia has exported this year.

At the time of writing, Natural Gas is trading at $2.926 per MMBtu.

Natural Gas news and market movers

- The Energy Information Administration (EIA) is due to publish the weekly Natural Gas Storage Changes for this week at 14:30 GMT. In line with recent headlines, another build is expected from 18 to 29 billion cubic feet.

- Oman LNG has signed a new deal with Shell and OQ to deliver LNG.

- China’s LNG consumption for July has risen 9.6% year-on-year.

- The recent batch of weaker data from the US, with a lower than expected US Gross Domestic Product and a substantial decline in US JOLTS job openings, could point to less LNG demand in the coming quarters.

- European gas storage is at 93% and saw further stockpile growth this week.

- Australian local exporter Woodside Energy Group Limited has reached a breakthrough agreement with unions. This could mean that Chevron might broker a deal as well soon and still alleviate any possible strike actions at the start of September.

- Tropical storm Idalia is heading over Georgia as it weakens to a Category 1 hurricane.

- All eyes remain on the market moving US jobs report on Friday.

Natural Gas Technical Analysis: topping out

Natural Gas has been on a tear this week and starts to face a few headwinds. With the demand side not picking up any further and the supply side possibly not as tight as first foreseen, a small rebalancing of the gas price could be at hand. Expect to see some profit taking into the rally of this week, which means that the $3 handle looks out of reach.

On the upside, $3 is still the level to watch once Natural Gas prices can reclaim $2.9. Should prices recover, look for a close above $2.935, the high of August 15, in order to confirm that demand is picking up again. More upside toward $3 and $3.065 (high of August 9) would be targets or levels to watch.

On the downside, the trend channel has done a massive job underpinning the price action. Aside from one small false break, ample support was provided near $2.60. The 55-day Simple Moving Average (SMA) needs to give that much needed support at $2.69 ahead of the ascending trend channel at $2.61. Any falling knives can still be caught by the 100-day SMA near $2.55.

-638290701082320192.png)

XNG/USD (Daily Chart)

Natural Gas FAQs

What fundamental factors drive the price of Natural Gas?

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

What are the main macroeconomic releases that impact on Natural Gas Prices?

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

How does the US Dollar influence Natural Gas prices?

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

- EUR/GBP gauges support near 0.8550 as Eurozone HICP for August remained sticky.

- Eurozone headline inflation expanded at a higher pace of 0.6% while investors anticipated a deflation of 0.1% as recorded for July.

- BoE Pill said that that policy must be sufficiently restrictive for long enough.

The EUR/GBP pair discovers support near 0.8550 propelled by the sticky Eurozone preliminary Harmonized Index of Consumer Prices (HICP) for August.

Eurostat reported that monthly headline inflation expanded at a higher pace of 0.6% while investors anticipated a deflation of 0.1% as recorded for July. Annual headline HICP remained sticky at 5.3% against expectations of a deceleration to 5.1%.

Core inflation that excludes volatile food and oil prices expanded at a 0.3% pace as expected by market participants. In July prices of core goods were softened by 0.1%. On an annual basis, the economic data softened to 5.3% as expected from July’s reading of 5.5%.

Stubborn Eurozone inflation indicates that the European Central Bank (ECB) is not in a position to discuss pausing the rate-tightening spell. ECB policymaker Robert Holzmann said that “we are not yet at the highest level for rates," adding that "another hike or two are possible.” He further added, “As long as the labor market remains hot, it is difficult to convince workers to accept lower wage rises.”

After Eurozone inflation, investors will shift focus to the Manufacturing PMI for August, which will be published on Friday at 08:00 GMT. The economic data is expected to remain steady at 43.7.

On the Pound Sterling front, improvement in the United Kingdom’s business confidence indicates that recession fears are easing. Lloyds Bank Business Barometer survey showed that business confidence jumped by 10 points in August to 41%, its highest since Russia’s invasion of Ukraine. The survey also showed that businesses will keep raising job pay and prices of goods.

About the interest rate guidance, Bank of England (BoE) Chief Economist Huw Pill said on Thursday that policy must be sufficiently restrictive for long enough. The BoE is widely expected to raise interest rates further by 25 basis points (bps) in its September monetary policy to 5.50%.

- Gold price oscillates above $1,940.00 as investors await US NFP data.

- The US ADP Employment report suggests that the NFP report could show job creation is slowing.

- US ADP report also showed the slowest wage growth since October 2021.

Gold price (XAU/USD) trades sideways after a rally inspired by soft labor demand due to the deteriorating economic outlook. The precious metal is expected to remain on the sidelines as investors are likely to make an informed decision after the release of US Nonfarm Payrolls (NFP) data on Friday.

The US ADP Employment report released on Wednesday showed that the labor market is not as resilient as previously thought. Firms have slowed down their hiring process, adding to evidence of an uncertain economic outlook. Lower labor demand boosted hopes of a soft landing from the Federal Reserve (Fed) as Chair Jerome Powell conveyed at the Jackson Hole Symposium that inflation has become more responsive to labor markets.

Daily Digest Market Movers: Gold price turns sideways ahead of US NFP

- Gold price turns rangebound, near a four-week high, after ensuring stability above $1,940.00 as investors await US NFP and ISM Manufacturing PMI data for August, which will be released on Friday.

- The precious metal continues its three-day winning spell and is expected to extend its recovery as labor demand from US firms starts softening due to deteriorating demand.

- After fewer job vacancies, US ADP Employment Change data showed the effects of higher interest rates. The ADP report for August showed the US private sector added 177K employees, lower than expectations of 195K and less than half of the upwardly revised July’s reading of 371K.

- The slowdown in job growth majorly came from the leisure and hospitality sector. Job creation by hotels, restaurants, and other employers in the sector fell by 30K in August after months of strong hiring.

- Wage growth also slowed in August. Job stayers saw an annual pay growth of 5.9%, while job changers pay growth slowed to 9.5%.

- August numbers are consistent with the pace of job creation before the pandemic, said Nela Richardson, chief economist at ADP. “After two years of exceptional gains tied to the recovery, we're moving toward more sustainable growth in pay and employment as the economic effects of the pandemic recede,” she said.

- Fed Chair Jerome Powell conveyed in his commentary at the Jackson Hole Symposium that inflation is getting more responsive to the job market. Therefore, softening labor market conditions might ease upside risks to inflation.

- As per the CME Group FedWatch Tool, interest rates are widely expected to remain unchanged in September. Also, the Fed is seen keeping rates steady at 5.25%-5.50% by year-end.

- Atlanta Fed Bank President Raphael Bostic said that the policy is restrictive enough to bring inflation to 2% over a reasonable time frame.

- The US Dollar sees a pullback move after an intense sell-off to near 103.00. However, more downside seems favored as investors hope that interest rates by the Fed have peaked. 10-year US Treasury yields rebounded moderately to 4.12%.

- US housing demand remains under pressure as higher mortgage rates are increasing again. Still, the worst of the housing sector correction appears to have passed due to tight supply.

- According to property analysts polled by Reuters, forecasts for a price fall this calendar year have wiped out and the short US housing market correction is now over.

- Going forward, investors will focus on the weekly Jobless Claims for the week ending August 25 and the core Personal Consumption Expenditure (PCE) Price Index for July.

- Monthly core PCE inflation is expected to grow at a steady 0.2% pace, while the annual reading is seen accelerating to 4.2%.

Technical Analysis: Gold price upside seems restricted near $1,950.00

Gold price continues its three-day winning spell but the upside seems restricted near $1,950.00 as investors await US NFP data to get in-depth information about labor market conditions. The precious metal gathers strength to deliver a breakout of the Rising Channel chart pattern formed on a lower time frame. The yellow metal secures stability above the 20-day and 50-day Exponential Moving Averages (EMAs), supporting more upside ahead.

Central banks FAQs

What does a central bank do?

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

What does a central bank do when inflation undershoots or overshoots its projected target?

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

Who decides on monetary policy and interest rates?