- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- USD/CAD gains ground near 1.3435 on the rebound In US Dollar.

- The FOMC kept rates on hold at 5.25%–5.50% at its January meeting on Wednesday, as widely expected.

- Canada's Gross Domestic Product (GDP) expanded by 0.3% in December, implying an annualized growth rate of 1.2% in Q4.

- Investors await the US weekly Initial Jobless Claims and ISM Manufacturing PMI ahead of the Nonfarm Payrolls on Friday.

The USD/CAD pair recovers some lost ground below the mid-1.3400s during the early Asian trading hours on Thursday. The US Dollar (USD) gathers strength in response to Federal Reserve (Fed) Chairman Jerome Powell closing the door to a potential rate cut in the March meeting after the widely expected decision to leave rates unchanged. At press time, USD/CAD is trading at 1.3435, losing 0.05% on the day.

The Federal Reserve's Open Market Committee (FOMC) kept rates on hold at 5.25%–5.50% for a fourth consecutive meeting in January, as widely expected by market participants. Powell suggested that a March rate cut is unlikely. The markets believe the Fed is likely to start easing policy at its May meeting. The delay of the rate cut provides some support to the US Dollar (USD) in the near term, which acts as a tailwind for the USD/CAD pair.

On Wednesday, the US ADP employment report showed the private sector added 107K jobs in January from the previous reading of 158K, lower than the market consensus of 145K. Meanwhile, the Employment Cost Index rose 0.9% QoQ in Q4 from the previous quarter's 1.1% QoQ gain, worse than the expectation of 1.0%.

According to a preliminary estimate from Statistics Canada on Wednesday, Canada's Gross Domestic Product (GDP) expanded by 0.3% in December, implying an annualized growth rate of 1.2% in Q4. In the third quarter, Canada's GDP number contracted by 1.1%. The upbeat data suggests that the Bank of Canada (BoC) might be able to hold rates steady until closer to the middle of the year. Investors pared bets for an April rate cut to 42% odds from 51% before the GDP growth numbers were released.

Investors will keep an eye on the US weekly Initial Jobless Claims and ISM Manufacturing PMI on Thursday. The Manufacturing PMI is estimated to decline from 47.4 in December to 47.0 in January. On Friday, US Nonfarm Payrolls will be in the spotlight. Traders will take cues from the data and find trading opportunities around the USD/CAD pair.

- US indexes saw red on Wednesday after Fed waffled on early rate cuts.

- Market expectations of faster, sooner rate cuts ran against a hard wall.

- US Fed continues to wait for further signs that inflation will ease.

US equity indexes declined across the board on Wednesday, faltering after market hopes for a faster pace of rate cuts from the Federal Reserve (Fed) discovered just how far ahead of policymakers they’ve run. Before the Fed’s monetary policy statement and Fed chairman Jerome Powell’s press conference, money markets were pricing in nearly a 60% chance of a rate cut from the US central bank by the beginning of March.

Jerome Powell speaks on policy outlook after deciding to keep interest rate unchanged

Post-Fed, rate swaps have receded on rate trim expectations, with March priced in at 64% chance of another rate hold, but May’s Fed rate call is now fully priced in for at least 25 basis points in rate cuts according to the CME’s FedWatch Tool.

The Dow Jones Industrial Average (DJIA) trimmed 317 points to close down 0.82% at $38,150.30, with the Standard & Poor’s 500 (SP500) index shedding nearly 80 points, ending Wednesday at $4,845.65, down 1.61%.

The NASDAQ Composite equity index got hit the hardest amidst a tech sector pullback, tumbling over 345 points to end Wednesday at $15,164.01, down a blustery 2.23%.

S&P 500 technical outlook

The S&P 500 large-cap index saw it’s lowest bids in over a week, ending firmly planted in the red after falling back below the $4,900.00 handle. Intraday momentum has the SP500 geared for a downside run at the 200-hour Simple Moving Average (SMA) near $4,835.00, with the next technical support zone priced in from last week’s intraday swing highs into $4,800.00.

Despite Wednesday’s turnaround, the SP500 remains firmly planted in bull country, with the index facing its second down week out of the last 14 consecutive trading weeks, assuming investors are unable to drag the index back over Monday’s opening bids near $4,886.00 before Friday’s closing bell.

S&P 500 hourly chart

S&P 500 daily chart

- NZD/USD trades in negative territory for the second consecutive day near 0.6115.

- The FOMC kept the target range for the Federal Funds Rate unchanged at 5.25–5.50%, as widely expected.

- The markets anticipate the RBNZ to cut OCR sooner rather than later, with three cuts already priced in this year.

- Traders will watch the US weekly Initial Jobless Claims and ISM Manufacturing PMI, due on Thursday.

The NZD/USD pair remains on the defensive above the 0.6100 mark during the early Asian session on Thursday. The Federal Reserve (Fed) left rates unchanged at its January meeting and opened the door to rate cuts. However, Fed Chairman Jerome Powell indicated that the rate cut in March is too early. The pair currently trades around 0.6115, adding 0.03% on the day.

Following the Fed interest rate decision, the US central bank maintained its benchmark interest rate on Wednesday in a range of 5.25%–5.50% and stated that it won't begin lowering the target range until it sees further progress on inflation moving sustainably toward the 2% target. Investors had been anticipating a possible rate cut cycle at the March meeting, but Fed Chair Powell said that's probably not the most likely case.

On the other hand, the Reserve Bank of New Zealand (RBNZ) targets maintaining inflation within the 1% to 3% range, with its focus on keeping future inflation around the 2% midpoint. With inflation easing, financial markets expect the Official Cash Rate (OCR) to be cut sooner rather than later, with three cuts already priced in this year.

Moving on, the January Chinese Caixin Manufacturing PMI, US weekly Initial Jobless Claims and ISM Manufacturing PMI will be due on Thursday. The attention will shift to US employment data on Friday, including Nonfarm Payrolls, Unemployment Rate, and Average Hourly Earnings for January.

- AUD/USD steady near 0.6566 post-Fed decision to hold rates, signaling cautious 2024 policy outlook.

- Jerome Powell's remarks on inflation, rate cuts contribute to USD recovery, affect Treasury yields.

- Australia's cooling inflation, steady manufacturing PMI inform RBA rate decision prospects, impacting AUD.

The Aussie Dollar (AUD) begins Thursday’s Asian session unchanged versus the US Dollar (USD) as the US Federal Reserve (Fed) decides to hold rates and opens the door to ease policy in 2024. Even though the initial reaction to the statement was muted, Fed’s Chair Powell press conference underpinned the Greenback (USD). At the time of writing, the AUD/USD exchanges hands at 0.6566, almost flat.

Aussie tumbled post Fed decision, though begins Asian session near weekly lows

Risk aversion is driving the financial markets. in the monetary policy statement, the Fed acknowledged that inflation has eased over the last year but remains elevated. Therefore, they stated that rates might have peaked while adding they could ease policy if inflation “moves sustainable toward 2 percent.”

In his press conference, the Fed Chair Jerome Powell adopted a more balanced approach, adding that it’s too early to declare victory on inflation. He added that Fed officials are not confident of lowering rates at the upcoming March meeting, adding that a March cut is not the base case for officials.

After that, the US Dollar paired some of its earlier losses, but US Treasury yields plunged. The AUD/USD edged below the 200-day moving average (DMA) at 0.6574, and achieved a daily close below the latter.

Data-wise, US labor market data witnessed the ADP report showing that private hiring slowed from 158K in December to 107K jobs, below estimates. The Employment Cost Index (ECI) sought by Fed officials as a measure of wages inflation, rose 0.9% QoQ, below estimates of 1.1%. The data suggests the jobs market is easing.

On the Australia front, inflation slowed sharply in the fourth quarter of 2023, from 5.4% YoY to 4.1%, and trimmed mean fell from 5.1% YoY to 4.2%. According to ANZ analysts, this could prevent the Reserve Bank of Australia (RBA) from hiking rates, suggesting the cash rate might have peaked.

Recently, Australia’s Judo Bank Manufacturing PMI final reading for January rose to 50.1 from the preliminary reading of 47.6.

AUD/USD Key Technical Levels

The Australian Judo Bank Manufacturing Purchasing Managers' Index (PMI) for January showed business growth eked out a crawl of 50.1 MoM, stepping up from December's 47.6 as Australia heads further into a soft landing economic scenario.

The seasonally-adjusted Manufacturing PMI saw a slight revision from the preliminary 50.3 that was previously posted, but the figure remains in positive territory above the key 50.0 level.

Broadly softer economic conditions in Australia have led to a general slowdown in business activity, including new business orders, including exports.

According to Warren Hogan, Chief Economic Advisor at Judo Bank:

While manufacturing activity was much weaker than service sector activity in late 2023, the jump in output and new orders in January has eased concerns that a manufacturing sector recession was developing. Business confidence also improved among manufacturers in January, with the future output index reaching its highest level since last August.

About the Australian Judo Bank Manufacturing PMI

The Manufacturing Purchasing Managers Index (PMI), released on a monthly basis by Judo Bank and S&P Global, is a leading indicator gauging business activity in Australia’s manufacturing sector. The data is derived from surveys of senior executives at private-sector companies. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the Australian Dollar (AUD). Meanwhile, a reading below 50 signals that activity among goods producers is generally declining, which is seen as bearish for AUD.

As expected, the Federal Reserve left its interest rates unchanged at its event on Wednesday, removing wording regarding potential rate hikes, reiterating that inflation remains elevated and that economic activity has been expanding at a robust pace.

Here is what you need to know on Thursday, February 1:

The greenback derived further strength in response to the hawkish tilt by Chief Powell at its press conference following the widely anticipated decision to leave rates unchanged by the Fed, motivating the USD Index (DXY) to fade the initial pessimism and regain upside traction. Moving forward, Initial Jobless Claims and the ISM Manufacturing PMI should take centre stage on February 1.

EUR/USD challenged YTD lows in the sub-1.0800 region following the Fed gathering, extending at the same time its multi-session consolidative theme. In the euro docket, the final Manufacturing PMI is due on Thursday, along with the flash Inflation Rate in the bloc and the speech by ECB President Lagarde.

It will be a big day for the British pound, as the BoE meets and is largely anticipated to keep its monetary status quo on February 1. Further data will show the final Manufacturing PMI for the month of January. GBP/USD, in the meantime, remained stuck within the so-far yearly range between 1.2600 and 1.2800.

Diminishing US yields prompted a slight drop in USD/JPY, which briefly flirted with the 146.00 support. On Thursday, the only release of note in Japan will be the weekly Foreign Bond Investment.

Further range bound remains the most likely scenario in the near term for AUD/USD. Thursday’s calendar in Oz includes the advanced prints for Building Permits during December.

Crude oil prices dropped markedly in response to a larger-than-expected build of US weekly stockpiles, while Chinese concerns also helped with the downside.

Gold prices rose to two-week highs around the $2050 mark per troy ounce just to end the session around $2030, while Silver prices added to Tuesday’s losses and breached the $23.00 yardstick.

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"Not in a position to put a number on number of months of low inflation needed to have confidence."

"We have growing confidence in the inflation data but we have to get it right."

"We want to make sure we get the job on inflation done in a sustainable way."

"We won't keep it a secret when we have confidence on inflation."

"If we get very strong inflation data and it heads back up, we will go slower or later or both."

"If inflation data is better than expected, we would do the opposite."

"Not so worried that growth is too strong and inflation could come back."

"Continued declines in inflation are what we are looking for."

"Growth only matters in how it interacts with our dual mandate."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

- GBP/USD sees a downturn, trading between 1.2660 and 1.2690, after Fed maintains rates and Chair Powell downplays immediate rate cut prospects.

- Powell's remarks indicate rate cuts depend on economic conditions, with no immediate plans for reduction, adding pressure on the Pound.

- The Fed's unanimous decision to hold rates steady and focus on inflation targets influences currency markets, with mixed responses in Treasury yields and the Dollar Index.

The GBP/USD extended its losses late in the North American session, as the Federal Reserve (Fed) decided to keep rates unchanged, while Fed Chair Powell poured cold water on rate cut speculations for March. At the time of writing, the major trades were volatile, around 1.2660 – 1.2690, as Fed Chair Powell is taking the stance

Fed Chair Powell comments

Fed Chair Jerome Powell stated that policy rates have likely reached their peak, suggesting the possibility of rate reductions within the year. However, he emphasized that any decision on rate cuts would be contingent on the progression of the economy. Powell highlighted the ongoing uncertainty in the economic outlook and clarified that decisions on monetary policy would be determined on a meeting-by-meeting basis.

He also mentioned that the topic of rate cuts was not a subject of discussion in the recent meeting, indicating that the Federal Reserve is not in a hurry to declare success in its battle against inflation. Additionally, Powell recently expressed his view that a rate cut in March is unlikely to be considered.

Summary of the Fed’s monetary policy statement

During their monetary policy meeting, Federal Reserve officials unanimously agreed to maintain interest rates as they currently are. They emphasized the need to wait for greater assurance that inflation is steadily moving towards the 2% target before considering any rate reductions. The Fed also noted that the prospects of meeting their dual mandate are improving and stressed their ongoing vigilance concerning inflation risks.

As for the balance sheet reduction, the plan will continue as previously outlined, coupled with stricter controls on Federal Open Market Committee (FOMC) confidential information for all Fed staff with access to it.

Following this announcement, rate cut expectations for the March meeting are at 50% odds vs. May. The US 10-year Treasury note yield briefly surged to 4% before settling back to around 3.97%. Concurrently, the US Dollar Index (DXY) initially moved towards 103.50 but then slightly retreated to 103.35.

GBP/USD Reaction to Fed’s Chair Jerome Powell remarks

The GBP/USD spiked towards 1.2730 before aiming lower as US Treasury bond yields advanced, followed by the Greenback (USD). Once it cleared the 1.2700 figure, it exposed the 50-day moving average (DMA) at 1.2668, followed by the 1.2600 mark. On the upside, the first resistance would be 1.2700, followed by the day’s high at 1.2750 before 1.2800.

- Gold price dips within the $2030 - $2040 range following Federal Reserve Chair Jerome Powell's comments post-rate decision.

- Powell indicates potential rate cuts depending on economic progress, stressing no rush in shifting the current monetary policy.

- XAU/USD reacts to Powell's dismissal of a March rate cut and his emphasis on a cautious approach to managing inflation.

Gold price trims earlier gains and retreats after the US Federal Reserve decided to keep rates unchanged while pushing back against speculation of rate cuts. In addition, the US Federal Reserve Chair Jerome Powell, pushed back against rate cuts in March, driving the yellow metal price towards the day lows. At the time of writing, XAU/USD trades volatile within the $2030 - $2040 area as market participants diggest Fed Chairman Jerome Powell’s comments.

Fed Chair Powell comments

Fed Chair Jerome Powell commented that policy rates likely peaked and has opened the door to rate cuts this year, adding that it would depend on the evolution of the economy. He added the economic outlook remains uncertain, and would decide meeting by meeting. He added that no rate cuts were discussed in the meeting, and they’re in no rush to declare victory on the fight on inflation.

Recently, he said that he doesn’t think a rate cut in March is on the table.

Sumary of the monetary policy statement

In its monetary policy meeting, Fed officials voted unanimously to keep rates unchanged. They noted that it would be appropriate to reduce rates until there is greater confidence that inflation is sustainably moving toward its 2% goal. The Fed added that risks of achieving the Fed dual mandate are moving into better balance and emphasized that the committee will remain “highly attentive” to inflation risks.

Regarding the reduction of the balance sheet, it would remain as previously described while tightening restrictions on all Fed staff with access to confidential FOMC information.

After the data, the US 10-year Treasury note yield spiked to 4% before retreating somewhat towards 3.97%. At the same time, the US Dollar Index (DXY) aimed toward 103.50 before getting back to 103.35.

XAU/USD Reaction to Fed’s Powell Press conference

Gold is puking toward $2030, extending its losses sharply after Powell’s remarks disregarding a rate cut in March, at around 19:02 GMT. That said, if sellers push prices below the lows of the day of $2032, look for a drop to January 25 low of $2009.66.

On the flip side, if the daily high is taken out, $2050 is up next, followed by the $2090 and $2100 figure.

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"Supply side has been recovering, that won't go on forever."

"A lot of the economic growth we are seeing is due to post-pandemic healing."

"When that peters out, our restrictive rate will show up more sharply."

"Labor market by many measures is at or near normal."

"Economy is broadly normalizing and that process will take some time."

"Wage setting will probably take a couple of years to get all the way back."

"If inflation moves back up, that would be a surprise at this point."

"More concerned inflation will stabilize at an elevated level."

"Growth is solid to strong last year, labor market is strong."

"We do expect economic growth will moderate."

"12-month inflation is above target, but seem to be getting on track to it."

"Overall it's a pretty good picture on the economy."

"We are not looking for inflation to tap 2% once; we are looking for it to settle out at 2%

"Based on the meeting today, I don't think likely we will have a rate cut in March."

"That's to be seen but I don't think we'll have enough confidence."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"Economy is broadly normalizing."

"I think lower rent costs are coming and will feed through."

"Supply chains are not yet back fully to where they were."

"There may still be a tailwind on disinflation from goods."

"I would not say we have achieved soft landing yet."

"I am encouraged though by the progress we've made."

"We are not declaring victory."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

- The AUD/USD recovered above 0.6600.

- The Fed held rates steady as expected at 5.50%.

- Chair Powell embraced policy normalization "at some point" in 2024.

In Wednesday's session, trends in the AUD/USD recovered above 0.6600 from 0.6585 during Chair Powell's presser. The Federal Reserve (Fed) didn't change its policy as expected while but markets took the Chairman's words as dovish validating the expectations of the easing cycle to start in May which boosted the pair.

Jerome Powell noted that the inflation data from the last six months was welcomed but that the committee need's to see further data in order to be confident. He also added that it seems likely that the bank will achieve that mentioned confidence and that the officials consider appropiate eventually cutting rates.

AUD/USD levels to watch

Indicators on the daily chart indicate that buyers are holding their ground but as long as the fail to conquer the 20-day Simple Moving Average (SMA), the outlook won't be totally bullish for the immediate short term. On the downside, as long as it holds above the 200 and 100-day SMA, the overall trend will remain positive

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"If we saw unexpected weakening in the labor market, that would make us cut rates sooner."

"In the base case, where the economy is healthy with a strong labor market, we can be careful as we think about rate cut timing."

"There was no proposal to cut rates today."

"SEP is good evidence of where FOMC is at in terms of forecasts."

"There is a wide disparity of views on the Committee."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"Almost everyone on the Committee believes it will be appropriate to reduce rates."

"We are trying to identify a place we are confident on inflation to begin the process of dialing back the restrictive level."

"In theory, real rates go up as inflation goes down, but can't mechanically adjust policy."

"We don't know where the neutral rate of interest is."

"We are really in a risk management mode."

"We are managing risks of moving too soon vs moving too late."

"Timing of cuts is linked to our confidence."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"We need greater confidence that inflation is moving sustainably down."

"We have confidence, but we want to see more data, continuation of good data."

"We had very strong growth last year."

"A year ago we thought we needed some economic softening."

"We want to see strong growth, strong labor market."

"We don't think we necessarily need to see weaker growth for inflation to come down."

"We want inflation to continue to come down."

"We need to see more evidence that confirms what we think we are seeing, gives us confidence we are on sustainable path to 2% inflation."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"Highly attentive to risks inflation poses to both sides of mandate."

"Our restrictive stance is putting downward pressure on economic activity and inflation."

"Our policy rate is likely at its peak."

"Will likely be appropriate to begin reducing rates sometime this year."

"If economy evolves as expected, we will dial back policy rate this year."

"Economic outlook though is uncertain, ongoing progress on inflation is not assured."

"Prepared to maintain current policy rate for longer if needed."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25%-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"Economy has made good progress, inflation has eased."

"Path forward is uncertain, fully committed to returning inflation to 2%."

"Over the past two years monetary policy significantly tightened."

"Risks to achieving goals moving into better balance."

"Activity in housing sector is subdued."

"Labor market remains tight."

"Job gains are still strong, labor demand still exceeds supply."

"Inflation has eased notably, remains above goal."

"Lower inflation readings are welcome but we need to see continuing evidence to have confidece returning to target."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

- GBP/USD shows limited movement, trading between 1.2690 and 1.2730 after the Fed decided to hold interest rates.

- Federal Reserve's unanimous vote to keep rates steady focuses on inflation control and delays rate cuts.

- Investors now look to Fed Chair Jerome Powell's press conference for further direction, with US Treasury yields and Dollar Index reflecting the recent Fed stance.

The GBP/USD is virtually unchanged in the mid-North American session, as the Federal Reserve (Fed) decided to keep rates unchanged, while pouring cold water on rate cut speculations. At the time of writing, the major trades were volatile, around 1.2690 – 1.2730, ahead of the Chair Powell's press conference.

GBP/USD erased its gains following Fed’s decision

During their monetary policy meeting, Federal Reserve officials unanimously agreed to maintain interest rates as they currently are. They emphasized the need to wait for greater assurance that inflation is steadily moving towards the 2% target before considering any rate reductions. The Fed also noted that the prospects of meeting their dual mandate are improving and stressed their ongoing vigilance concerning inflation risks.

As for the balance sheet reduction, the plan will continue as previously outlined, coupled with stricter controls on Federal Open Market Committee (FOMC) confidential information for all Fed staff with access to it.

Following this announcement, rate cut expectations for the March meeting are at 50% odds vs. May. The US 10-year Treasury note yield briefly surged to 4% before settling back to around 3.97%. Concurrently, the US Dollar Index (DXY) initially moved towards 103.50 but then slightly retreated to 103.35.

GBP/USD Reaction to Fed’s Decision

The GBP/USD spiked towards 1.2730 before aiming lower as US Treasury bond yields advanced, followed by the Greenback (USD). Once it cleared the 1.2700 figure, it exposed the 50-day moving average (DMA) at 1.2668, followed by the 1.2600 mark. On the upside, the first resistance would be 1.2700, followed by the day’s high at 1.2750 before 1.2800.

- Gold price oscillates in the $2030 - $2050 range following the Fed's decision to hold interest rates steady.

- Fed officials voted unanimously and emphasized the need to see inflation lowering toward 2%.

- Investors now turn to Fed Chairman Jerome Powell for further insights, with US Treasury yields and the Dollar Index responding to the latest Fed update.

Gold price trims earlier gains and retreats after the US Federal Reserve decided to keep rates unchanged while pushing back against speculation of rate cuts. At the time of writing, XAU/USD trades volatile within the $2030 - $2050 area as market participants await Fed Chairman Jerome Powell’s decision.

XAU/USD trades volatile following Fed’s decision

In its monetary policy meeting, Fed officials voted unanimously to keep rates unchanged. They noted that it would be appropriate to reduce rates until there is greater confidence that inflation is sustainably moving toward its 2% goal. The Fed added that risks of achieving the Fed dual mandate are moving into better balance and emphasized that the committee will remain “highly attentive” to inflation risks.

Regarding the reduction of the balance sheet, it would remain as previously described while tightening restrictions on all Fed staff with access to confidential FOMC information.

After the data, the US 10-year Treasury note yield spiked to 4% before retreating somewhat towards 3.97%. At the same time, the US Dollar Index (DXY) aimed toward 103.50 before getting back to 103.35.

XAU/USD Reaction to Fed’s Decision

Gold dived toward the $2040 area after the Fed’s decision, though it remains seesawing, as mentioned in the first paragraph, capped at $2050. Although XAU/USD hovers at around $2040, downside risks remain, as the Fed’s statement was perceived as hawkish, though the Fed’s Chair Jerome Powell would cross the wires at around 19:30 GMT.

Key resistance lies at the daily high at $2055.98, followed by $2090, ahead of $2100. On the flip side, support emerges at $2032.14, the day’s low, followed by the January 25 low of $2009.66.

- USD/JPY rebounds after a sharp fall as Dollar bids recover post-Fed.

- Fed leaves rates unchanged, cautions uncertainty in economic outlook.

- Markets await Fed chair Powell press conference for dovish hints.

The USD/JPY rebounded in rough chart action after the Federal Reserve (Fed) left rates unchanged with additional cautionary concerns about needing the economic outlook to be more certain and better indicators that US inflation will fall to and stay at 2% moving forward. The Fed sparked a risk-off run that bolstered the US Dollar (USD) on reaction as markets await further details from Fed Chairman Jerome Powell, due to speak at the bottom of the hour.

Fed leaves policy rate unchanged at 5.25%-5.5% as expected

Money markets are now pricing in a 52% chance of no rate cut in March as swap rates pivot to focus on odds of a first cut from the Fed in May, according to the CME's FedWatch Tool.

USD/JPY technical outlook

USD/JPY tumbled into the 146.00 handle early Wednesday, backsliding 1.22% peak-to-trough from the day's peak bids near 147.88.

The pair is pulling back into the midrange below the 147.00 handle after the pair tested its lowest prices in almost three weeks.

USD/JPY Hourly Chart

- AUD/JPY making a decisive downshift with a 0.95% drop, currently stationed at 96.50.

- As the bears push the cross below the 20-day SMA, the outlook turned negative for the cross.

- Despite recent bearish activities, pair remains above both 100 & 200-day SMAs, signalling an overall bullish trend.

In Wednesday's trading session, the AUD/JPY fell to 96.50 after a strong 0.95% decline. The daily chart outlook for the pair appears neutral to bearish, indicative of bears gaining ground. Reinforcing this sentiment, the four-hour chart also leaned towards the bearish side with indicators near the oversold zone.

The daily Relative Strength Index (RSI) shows a downward inclination yet remaining in the positive region, indicating slight selling pressure as well as the rising red bars of the Moving Average Convergence Divergence (MACD). Furthermore, the bears have made an apparent show of power, pushing the cross price below its 20-day Simple Moving Averages (SMA). However, the AUD/JPY remains firm on higher ground, as demonstrated by its position above both the 100 and 200-day SMAs. This solidifies the notion that despite recent bearish challenges, the overall buying force still commands the roost.

Switching to a shorter time frame, the four-hour outlook seems to be also favoring a bearish narrative for the moment. Technical indicators appear oversold, reflecting a growing bearish bias among traders. Simultaneously, the Relative Strength Index (RSI) is on the cusp of the oversold threshold, while the Moving Average Convergence Divergence (MACD) exhibits rising red bars, another pointer to the growing clout of bears in the short-term.

AUD/JPY daily chart

-638423234426074039.png)

AUD/JPY levels to watch

- GBP/JPY falls over 0.60%, impacted by cautious sentiment before Fed policy decision.

- Drop below Tenkan-Sen (187.45) suggests more decline; watch supports at 186.00, 185.64.

- Recovery hinges on surpassing 187.00; resistance at 187.45, 188.00, and January 23 high of 188.91.

The GBP/JPY plunged sharply during the North American session, down by more than 0.60% as market participants shifted risk-averse ahead of the US Federal Reserve’s (Fed) monetary policy decision. That, alongside the Bank of England (BoE) meeting on Thursday, keeps the Pound Sterling (GBP) downward pressured while the Japanese Yen (JPY) advances. At the time of writing, the cross exchanges hands at 186.15 after hitting a high of 187.59.

The pair is neutral biased but tilted to the downside after diving below the Tenkan-Sen at 187.45, That exacerbated the GBP/JPY fall below 187.00, which opened the door for further downside. The next support surfaces at 186.00, followed by the Senkou Span A at 185.64. Further downside is seen at 185.00.

On the other hand, if buyers step in, they must reclaim 187.00. Once that level is cleared, up next would be the Tenkan-Sen at 187.45, ahead of challenging 188.00, before testing fresh highs at 188.91, the January 23 high.

GBP/JPY Price Action – Daily Chart

GBP/JPY Technical Levels

- EUR/USD saw a hard rally above 1.0880 on ECB rate cut hopes.

- US ADP labor miss drove the pair back into Wednesday’s opening range.

- US Fed head Jerome Powell due at 19:30 GMT after Fed rate call.

EUR/USD saw a hard rally in early Wednesday trading, rising three-quarters of a percent bottom-to-top after misses in German Consumer Price Index (CPI) inflation figures missed the mark, with markets pivoting back into a cautious stance ahead of the Federal Reserve’s (Fed) rate call and following press conference. EUR/USD fell back into the day’s opening bids near 1.0850 as the pair remains stuck in the middle of near-term consolidation.

German Retail Sales backslid early Wednesday, followed by German CPI inflation easing faster than expected, helping to bolster investor sentiment in the midweek that the European Central Bank (ECB) would see the way forward towards a faster pace of rate cuts.

Daily digest market movers: EUR/USD draws into the middle ahead of Powell appearance

- The EUR/USD rallied into 1.0880 after German Retail Sales came in at -1.7% for the year ended December, adding to the previous period’s -2.4% as consumer spending cools off, reinforcing an economic slowdown that will push the ECB towards rate cuts.

- German CPI inflation also declined faster than expected, with annualized German CPI for the year ended January printing at 2.9% versus the forecast 3.3% and the previous period’s 3.7%.

- Pan-European Harmonized Index of Consumer Prices (HICP) figures are due on Thursday.

- European money markets are now pricing in 150 basis points in ECB rate cuts through 2024, up from Tuesday’s swap rate balance of 140 bps.

- Fed chair Jerome Powell due at 19:30 GMT, markets will be straining to find hints of the Fed cutting rates sooner rather than later.

- US ADP Employment Change slumped to 107K in January versus the forecast 145K, declining from the previous month's 158K (revised from 164K).

- US Nonfarm Payroll (NFP) figures due on Friday to cap off the trading week.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.03% | -0.15% | -0.04% | 0.04% | -0.64% | -0.10% | -0.19% | |

| EUR | 0.03% | -0.13% | 0.00% | 0.08% | -0.62% | -0.06% | -0.15% | |

| GBP | 0.16% | 0.14% | 0.13% | 0.20% | -0.47% | 0.06% | -0.01% | |

| CAD | 0.03% | 0.00% | -0.15% | 0.06% | -0.62% | -0.07% | -0.15% | |

| AUD | -0.03% | -0.05% | -0.19% | -0.07% | -0.67% | -0.13% | -0.22% | |

| JPY | 0.64% | 0.60% | 0.46% | 0.60% | 0.70% | 0.52% | 0.45% | |

| NZD | 0.09% | 0.09% | -0.07% | 0.07% | 0.13% | -0.60% | -0.12% | |

| CHF | 0.19% | 0.15% | 0.02% | 0.15% | 0.22% | -0.46% | 0.08% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: EUR/USD poised for a run post-Fed

EUR/USD pulled in both direction on Wednesday, sagging early into 1.0806 before rallying above 1.0880 and settling back where it started near 1.0850 as the market awaits central bank appearances.

The 200-hour Simple Moving Average (SMA) remains a key technical barrier, capping off upside momentum near 1.0860. The EUR/USD has cycle familiar levels since the middle of January, but downside pressure has been mounting as swing highs continue to lag lower.

Daily candlesticks have the pair stuck on the low end of a congestion pattern at the 200-day SMA near 1.0850, with topside price action capped by the 50-day SMA just north of 1.0900.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- GBP/USD rebounds from a low, as subdued US employment figures influence Fed rate decision expectations.

- ADP employment growth slows and the Employment Cost Index falls short of projections, fueling speculations for a rate cut.

- Investors also focus on the Bank of England's upcoming decision and economic outlook, with Governor Bailey's remarks closely watched for policy clues.

The GBP/USD edges higher during the North American session on Wednesday after softer-than-expected economic data from the United States (US) could prompt the US Federal Reserve (Fed) to cut rates. However, market participants seem cautious ahead of the Fed’s decision around 19:00 GMT. The pair exchanges hands at 1.2728 after bouncing from a daily low of 1.2666.

GBP/USD post decent gains as soft US data sparks rate cut speculations

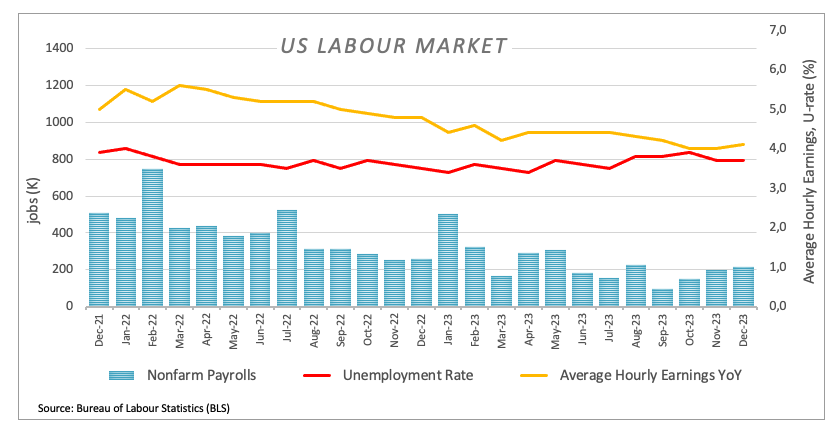

The US economic calendar featured two employment reports in early trading ahead of the FOMC. Private hiring rose less than expected, according to ADP data, with figures dipping from 158K to 107K, also below estimates. The Employment Cost Index for the last quarter of 2023 was 0.9% QoQ, below forecasts and Q3’s number, suggesting the risks of a wage-price spiral.

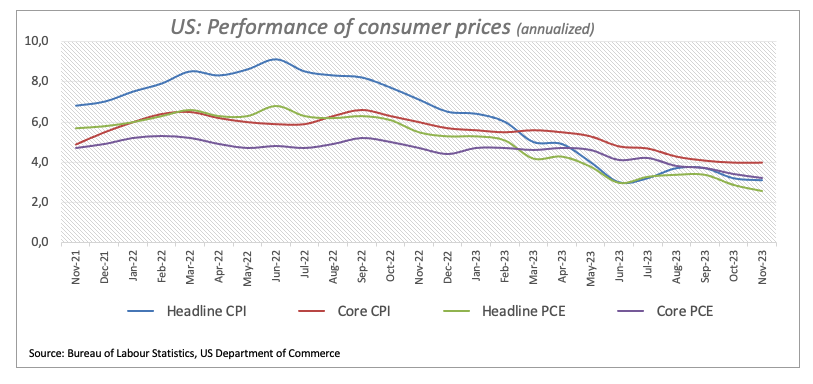

Aside from this, traders are awaiting the release of the Federal Reserve’s decision, with market participants estimating the US central bank would keep rates unchanged. Instead, they're looking for clues of the beginning of the easing cycle. This was after Fed Chair Jerome Powell and Co. embarked on a tightening cycle that witnessed more than 500 basis points of tightening to curb inflation that reached 9.1% YoY.

On the other side of the Atlantic, the Bank of England is expected to stay pat and release its latest economic projections That along with the BoE’s Governor Andrew Bailey press conference, would be scrutinized by market participants.

GBP/USD Price Analysis: Technical outlook

The major is neutral biased but mildly tilted to the downside, but buyers lifting the exchange rate above 1.2700 could open the door to challenge the next resistance level at 1.2774, toe January 24 cycle high. Once cleared, the pair could resume its path toward 1.3000 but must clear the next resistance at 1.2900. On the other hand, if GBP/USD sellers move in, they could drag the exchange rate below 1.2700, ahead of testing the 50-day moving average (DMA) at 1.2669. Further downside is seen at 1.2600.

- The DXY Index trades with losses on Wednesday at 103.20.

- ADP Employment change figures were lower than expected in January.

- The Fed is expected to hold its policy unchanged in Wednesday’s meeting, messaging will be key.

The US Dollar (USD), as reflected by the DXY Index, is currently trading at 103.20, experiencing losses as a result of weak data from the Automatic Data Processing (ADP) Employment Change report for January. Markets remain cautious ahead of the announcement of the Federal Reserve (Fed) decision later in the session.

Market anticipation regarding the Fed's future decisions are shifting but remain restrained due to robust recent economic data, suggesting that earlier rate cuts are unlikely. The upcoming FOMC decision and jobs data are expected to further steer market sentiment and shape the easing cycle from the Fed.

Daily Digest Market Movers: US Dollar dragged down by disappointing ADP figures

- The ADP Employment Change for January reported by the US significantly missed expectations, with only 107K jobs added as compared to the consensus of 145K and previous figure at 158K.

- On Thursday, markets will receive additional weekly Jobless Claims data; and on Friday, January’s Nonfarm Payrolls figures.

- Market's perspective on the Federal Reserve's next move, as gauged by the CME FedWatch Tool, suggest that investors are confident that the bank won’t change its policy on Wednesday. As for now, markets are seeing the easing cycle starting in May.

- However, the bank’s messaging and tone may change those expectations, setting the pace of the US Dollar for the rest of the week.

Technical Analysis: DXY loses momentum, bulls fail to defend the 200-day SMA

The indicators on the daily chart are reflecting a mixed bag of signals. The Relative Strength Index (RSI), despite its negative slope, is in positive territory. This typically indicates dwindling bullish momentum as buyers lose strength. The Moving Average Convergence Divergence (MACD) presents a similar view as the diminishing green bars could suggest that buying momentum is struggling to keep up its pace.

The Simple Moving Averages (SMAs) reveal a somewhat bearish scenario in the larger picture. The DXY's position under both the 100 and 200-day SMAs showcases the bears' dominance in longer time frames. However, the index still remaining above the 20-day SMA reinforces that the bears still aren’t fully in command and will act as strong support in case of further downward movements.

Support Levels: 103.15, 103.00, 102.90.

Resistance Levels: 103.4 (200-day SMA),103.90,104.00,104.20.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Tech rally comes under threat as chipmaker expectations outrun earnings.

- Automotive sector sees downside pressure after EU regulators raid tire manufacturers.

- Germany CPI inflation came in below expectations, pan-EU CPI due Thursday.

European equities saw some weakness on Wednesday with Germany’s DAX index declining four-tenths of a percent after German Consumer Price Index (CPI) inflation missed forecasts, and rising costs associated with developing AI-based hardware and software products irks investors who aren’t seeing as much gain in revenues as hoped for on the back of rising demand for AI-powered products.

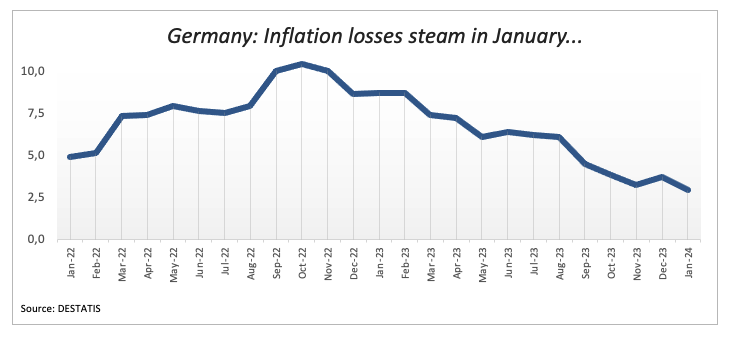

Germany’s annualized CPI inflation came in below expectations, printing at 2.9% YoY in January versus the 3.2% forecast and falling even further from the previous period’s 3.8%. With inflation in the German economy receding faster than expected, the Euro area’s key economic powerhouse within the union, markets are stepping into bets of higher and faster rate cuts from the European Central Bank (ECB) ahead of Thursday’s broader EU Harmonized Index of Consumer Prices (HICP).

pan-EU annualized HICP inflation for the year ended in January is forecast to tick down from 2.9% to 2.8% YoY. Money markets now see 150 basis points in rate cuts from the ECB through the end of 2024, up from Tuesday’s 140 bps rate trim forecast.

Germany: Inflation decelerates further in January

Growing protests and demonstrations across Europe threaten stability in the agriculture sector as farmers organize into larger blockades, protesting a lack of support from European government agencies. Farmers are looking for the EU to trim back planned declines in subsidies, as well as seeking additional tariff controls on imports from Ukraine, who has diverted the majority of their foreign-bound agriculture products into European markets since the start of the Russian invasion last year that shut Ukraine out from key export markets to the East.

Automotive and car parts markets got weighed down this week by a raid on tire manufacturers by the EU Commission that are accusing the key parts producers of cartel-like behavior. Major producers including Pirelli, Michelin, and Nokian saw their offices raided by UE antitrust regulators on Tuesday, and markets are awaiting an update from the EU Commission, who have a mandate to remain silent on matters until their initial investigation concludes. European tire manufacturers have been accused of price fixing and colluding against the interest of European consumers.

Major tech giants including Microsoft and Alphabet have reported significant revenue increases in AI-associated spaces recently, but costs are rising quickly in the cutting-edge tech sphere, weighing down investor sentiment. Pivots into supplying AI-focused chips and software see prices and costs soaring faster than income gains, and demand for non-AI chips are weighing down semiconductor players.

The Pan-European STOXX600 major equity index eked out a slim gain of 0.07%, gaining a third of a point to close Wednesday at €485.97, bolstered by mega-cap stock gains in the healthcare and utilities sectors offsetting declines in financials and technology.

France’s CAC40 fell nearly 21 points to end Wednesday down 0.27% at €7,656.75, and Germany’s DAX fell 0.4%, shedding 68.58 points to close at €16,903.76.

London’s FTSE also saw accelerated downside, tumbling 0.47% to close down 35.74 points at £7,630.57.

DAX technical outlook

The German DAX equity index trimmed back into the €16,875.00 level on Wednesday, slipping back from the day’s peak near €16,975.00, losing 0.65% peak-to-trough in the process.

The index recovered back into the €16,900.00 handle heading into the market close, but the index finds itself trading on the south side of the 50-hour Simple Moving Average (SMA) for the second time in a week.

Hesitation in German equities has the DAX struggling to chalk in further gains above December’s peak just shy of the €17,000.00 major price handle, but the major index is still trading firmly into bullish territory well above the 200-day SMA just below €16,000.00.

DAX hourly chart

DAX daily chart

- Mexican Peso depreciates as broader market caution remains before Fed decision.

- US employment data and a low Employment Cost Index shows the labor market is cooling.

- USD/MXN traders eye FOMC, which is expected to adopt a neutral interest rate stance.

The Mexican Peso (MXN) weakens against the US Dollar (USD) on Wednesday and posts losses of more than 0.10% as risk aversion drives the financial markets ahead of the US Federal Reserve’s (Fed) monetary policy decision. Mexico’s economic docket is empty. In the United States, employment data was soft, and the Employment Cost Index (ECI) sought by Fed officials as a measure of inflation in wages dipped below estimates. The USD/MXN trades at 17.16 after hitting a daily low of 17.09.

Wall Street trades with losses as investors prepare for the Fed. The US central bank is expected to keep rates at the 5.25%-5.50% range with the tone of the statement remaining neutral. Following that, Fed Chairman Jerome Powell's press conference is expected to strike a more balanced approach, recalling last December’s ultra-dovish conference.

Daily digest market movers: Mexican Peso virtually unchanged ahead of Fed meeting

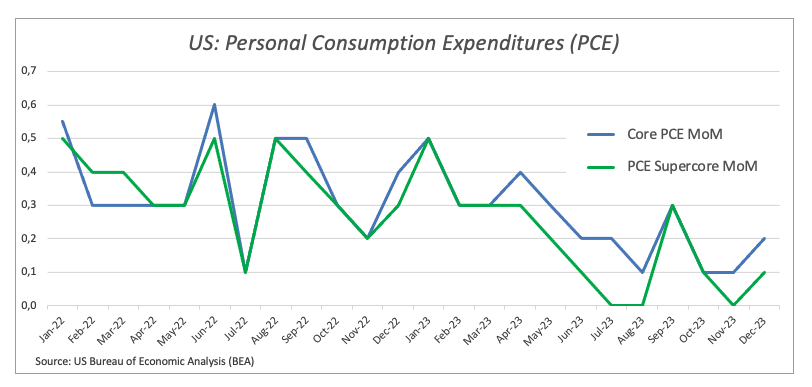

- The Employment Cost Index (ECI), a key indicator of wage inflation monitored by Federal Reserve officials, fell from 1.1%QoQ to 0.9% in the fourth quarter, indicating a cooling in the labor market.

- The ADP Employment Change report for the United States showed weaker performance in January, with private hiring rising only 107K jobs, falling short of December’s 158K and the predicted 145K. The report mentioned, “Progress on inflation has brightened the economic picture despite a slowdown in hiring and pay.” As wages had improved in the last semester, “the economy looks like it’s headed toward a soft landing.”

- Mexico’s economy grew below forecasts in the last quarter of 2023. GDP expanded 0.1% QoQ, trailing Q3 1.1% growth and forecasts of 0.4%.

- Given that the Mexican economy remains solid, according to the data revealed in January, the Bank of Mexico (Banxico) could delay easing monetary policy as conditions remain hotter than expected.

- However, if Banxico’s officials remain determined to begin its easing cycle in Q1 of 2024, that could depreciate the emerging market currency due to the reduction of interest rate differentials. That could also underpin the USD/MXN pair toward the psychological 18.00 figure.

- The US labor market remains solid as the latest JOLTS report revealed vacancies exceeded estimates, which could prevent Fed officials from easing policy in the near term.

- Consumer Confidence was higher than the previous month’s data, courtesy of slower inflation, expectations for lower interest rates and “generally favorable employment conditions as companies continue to hoard labor,” said Dana Peterson, Chief Economist at The Conference Board.

- Additional factors that might depreciate the Mexican currency are geopolitical risks and risk aversion.

- Across the border, the US economy remains resilient as GDP in Q4 of last year crushed forecasts despite easing from Q3’s 4.9%. That could force Fed officials to refrain from easing policy, but the latest inflation data suggests they’re close to getting inflation to its 2% target.

- Nevertheless, mixed readings in other data suggest that risks have become more balanced. That is reflected by investors speculating that the Fed will cut rates by 139 basis points during 2024, according to the Chicago Board of Trade (CBOT) data.

Technical Analysis: Mexican Peso steady as USD/MXN looms around 17.15

The USD/MXN trades range-bound, slightly tilted to the upside, capped by key Simple Moving Averages (SMAs), with the 50-day SMA at 17.13 and the 200-day SMA at 17.33. Although it appears closer to the 50-day SMA, market sentiment could lift the exchange rate to the 200-day SMA at 17.33, which, once cleared, could open the door for higher prices. Next resistance would be the 100-day SMA at 17.41, followed by the December 9 high at 17.56. Last of all sits the May 23 high from last year at 17.99.

On the flip side, if the USD/MXN exchange rate drops below the 50-day SMA at 17.13, that will expose the January 22 low at 17.05, followed by the 17.00 psychological level.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- The Canadian Dollar recovered some ground after GDP surprised to the upside.

- Canada saw 0.2% GDP growth in November, which beat consensus.

- Fed rate call and press conference due in the latter half of the US trading session.

The Canadian Dollar (CAD) edged higher on Wednesday after Canadian Gross Domestic Product (GDP) figures beat expectations to post growth for the first time since May. The Federal Reserve’s latest rate call is due at 19:00 GMT, with a press conference to be headed by Fed Chairman Jerome Powell at 19:30 GMT.

Canada saw growth in its MoM GDP for the first time in seven months on Wednesday, sending the Canadian Dollar into recovery mode against the US Dollar (USD), but the CAD still remains in the red against several of its major currency peers. Loonie traders will be looking ahead to Thursday’s January Canadian Purchasing Managers Index (PMI) figures for Canada’s manufacturing sector after the Fed rate call dust settles.

Daily digest market movers: Canadian Dollar surges against the Greenback on GDP growth

- Canadian November GDP growth was a surprise on Wednesday, coming in at 0.2% MoM versus the forecast of 0.1%.

- Canadian GDP printed above 0.0% for the first time in seven months after revisions.

- S&P Global’s Canadian Manufacturing PMI for January is due Thursday, last MoM Manufacturing PMI printed in contraction territory at 45.4.

- US Fed broadly expected to hold rates steady on Wednesday, market focus to pivot to Federal Open Market Committee (FOMC) Press Conference at 19:30 GMT.

- Investors will be looking for hints about when the Fed will cut rates.

- Rate swap bets on a Fed cut in March lurched higher early Wednesday, now pricing in 65% chance of at least a 25 basis point rate trim by March 20 meeting.

- The US Dollar backslid after ADP Employment Change figures came in well below expectations and an unexpected backslide in the Chicago PMI.

- ADP Employment Change in January fell to 107K versus the forecast for 145K, December’s 158K (revised down from 164K).

- January’s Chicago PMI declined to 46.0 instead of the forecasted uptick to 48.0 against December’s 47.2 (revised up from 46.9).

- Volatile ADP figures are prone to steep revisions and has a sketchy-at-best track record for previewing the US Nonfarm Payrolls (NFP) print slated for Friday.

- ADP Employment Change has seen revisions in all but a single month since 2007.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.10% | -0.22% | -0.20% | -0.15% | -0.72% | -0.32% | -0.33% | |

| EUR | 0.10% | -0.13% | -0.10% | -0.03% | -0.61% | -0.21% | -0.21% | |

| GBP | 0.24% | 0.12% | 0.00% | 0.09% | -0.51% | -0.08% | -0.09% | |

| CAD | 0.21% | 0.11% | -0.04% | 0.06% | -0.50% | -0.07% | -0.08% | |

| AUD | 0.18% | 0.06% | -0.05% | -0.06% | -0.53% | -0.14% | -0.16% | |

| JPY | 0.71% | 0.62% | 0.47% | 0.53% | 0.58% | 0.42% | 0.42% | |

| NZD | 0.32% | 0.23% | 0.08% | 0.08% | 0.17% | -0.40% | -0.01% | |

| CHF | 0.30% | 0.19% | 0.06% | 0.09% | 0.14% | -0.42% | 0.01% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Canadian Dollar climbs over the Greenback on Canadian GDP upshot

The Canadian Dollar (CAD) has chalked in some gains on Wednesday, climbing around a fifth of a percent against the US Dollar as the Greenback recedes across the broader market. The CAD is still softer against the Japanese Yen (JPY), the market’s single best-performing currency in the mid-week trading session. The Loonie has shed over half a percent against the Yen for Wednesday.

USD/CAD tumbled to 1.3360 in early US trading, falling 0.6% from the day’s peak of 1.3437. Intraday momentum is dragging the pair back into the 1.3400 handle ahead of the Fed’s policy statement, and investors will be bracing for whips in the USD/CAD.

If the Canadian Dollar achieves a bullish close against the US Dollar on Wednesday, the USD/CAD will etch in its fifth consecutive down day as the pair pulls away toward the downside from the 200-day Simple Moving Average (SMA) near the 1.3500 handle.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

The Bank of England (BoE) will announce its Interest Rate Decision on Thursday, February 1 at 12:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of nine major banks.

The BoE is widely expected to leave the policy rate at 5.25% for the fourth straight time. Market participants will majorly focus on the interest rate outlook.

SocGen

The boring part of the meeting should be the MPC voting to keep rates unchanged. What will be more interesting is the vote split, new economic forecasts and possible changes to the guidance. While many underlying assumptions are being updated, the major shift will be the lower Bank Rate path that will likely make it harder to achieve the 2% inflation target. However, we believe this could be partially offset by the softer wage data increasing the MPC’s confidence in the “swathe of wage models” that point to a sharper fall in pay growth than the Bank’s current forecast. Coupled with softer GDP growth and inflation data, it should allow all members of the MPC to vote to keep rates unchanged, although we have low conviction with this latter call.

Danske Bank

We expect the BoE to keep the Bank Rate unchanged at 5.25%. Overall, we expect the MPC to deliver a dovish tilt to its guidance coupled with a downward revision to its inflation forecast. We expect EUR/GBP to move modestly higher upon announcement.

TDS

The BoE is almost guaranteed to hold Bank Rate unchanged at 5.25%. We look for all nine MPC officials to vote for hold and for the Bank to finally drop its explicit hiking bias.

Deutsche Bank

We expect the central bank to stay on hold for a fourth meeting in a row, keeping the Bank Rate at 5.25%, but signal a soft dovish pivot. Further out, we see the first rate cut in May but acknowledge risks are skewed to a later start.

Rabobank

We expect the BpE to keep rates on hold at 5.25%. One or two known hawks could affirm the tightening bias by dissenting in favour of a hike. December’s rise in headline inflation serves as a useful reminder that caution is warranted and the disinflationary process isn’t going to be smooth. The risk of an inflationary impulse stemming from the Red Sea, the lack of an accurate read on the state of the labour market and the prospect of tax cuts in the run-up to the general election are three factors to exercise patience. However, the wider data flow should eventually persuade the BoE that it could ease its policy stance from the summer onwards. We now see a first cut in September instead of November.

ING

The reality is that defending a ‘higher for longer’ stance on interest rates is getting harder to defend as the inflation backdrop shows signs of improving. Even so, we expect the Bank will still want to tread carefully. Lower market rates will at least offset the recent improvement in inflation and the BoE’s two-year ahead forecast may be a little above 2%. What really matters for markets though is what the Bank does to its policy statement. We suspect it will drop the suggestion that it could raise rates further, but keep the signal that rates need to stay restrictive for an extended period. As for the vote split, we suspect the hawks will finally throw in the towel and stop voting for a rate hike. At the same time, we think it’s probably too early to see the doves voting for a cut. That leads us to expect a unanimous decision to keep rates on hold.

ABN Amro

We expect the BoE to keep policy on hold. While the statement is likely to acknowledge the progress on inflation, the MPC will want to see further progress on wage growth before being ready to start cutting rates. Our base case is that rate cuts start in August.

Citi

The main aim of the meeting may be to endorse this year’s hawkish re-pricing (which has re-opened a gap between BoE cut pricing (later vs Fed/ECB). Headline dovish developments might be dropping the tightening bias in the policy summary (in line with the global trend and given it looks stale) and/or a dovish shift in the 6-3 vote split. On the other side, the hawkish push back could come via CPI projections. UK inflation is currently undershooting BoE’s forecasts, but another major development is lower front-end re-pricing. The market-implied path for Bank Rate has likely added around 100 bps of additional cuts since November, making it about 200 bps of cuts in total. This will likely open up a wide gap between CPI projections using constant Bank Rate vs the market-implied path, especially at the 3yr horizon. In November, the CPI forecasts using the market-implied path were clustered around 2% (modal and mean), although the 3yr mode was some way below. The new market-implied policy path clearly adds upward pressure, and this could be how the BoE opts to push back.

Wells Fargo