- Analytics

- News and Tools

- Market News

Новини ринків

- EUR/GBP slides as UK bond yields surpass German bond yields, strengthening the Pound.

- From a technical perspective, the pair exhibits a neutral to downward bias, with long-term daily EMAs standing above exchange rates.

- The EUR/GBP must regain the 0.8600 level and surpass the May 24 daily low resistance of 0.8648 to shift its bias.

- The pair’s immediate support is at 0.8500, a breach below, which could lead to a decline toward 0.8535.

EUR/GBP slid during the Friday session as UK bond yields surpassed German bond yields, the strongest of the Eurozone (EU), bolstering the appetite for the Pound Sterling (GBP). That, alongside a dark-cloud conver technical chart pattern, exacerbated the EUR/GBP’s fall below the 0.8600 figure. At the time of writing, the EUR/GBP is trading at 0.8585, down 0.33%.

EUR/GBP Price Analysis: Technical outlook

From a technical perspective, the EUR/GBP is still neutral to downward biased, with long-term daily Exponential Moving Averages (EMAs) standing above the exchange rates; while the EUR/GBP remains unable to break the May 24 daily low support area turned resistance at around 0.8648, and seen as the latest swing low needed to be broken, to change the pair’s bias.

However, on its way toward that level, the EUR/GBP must reclaim the 0.8600 figure. A breach of the latter will expose the 0.8648 May low, which, If broken decisively, it could pave the way toward the confluence of the 100 and 200-day Exponential Moving Averages (EMAs) at 0.8693/95 before challenging 0.8700.

Conversely, and the path of least resistance, the EUR/GBP first support would be the 0.8500 mark. A dip below will send the cross toward the June 23 daily low of 0.8535 before testing the June 19 swing low of 0.8518 before slumping to the 0.85 figure.

EUR/GBP Price Action – Daily chart

- Despite daily gains, the XAU/USD is set to close a third consecutive week of losses, near the $1,920 area.

- Declining yields amid soft PCE figures weakened the USD favouring Gold prices.

On Friday, the gold spot XAU/USD traded with nearly 0.50% gains, jumping near the $1,920 area. Soft Personal Consumer Expenditures from the US fueled a decline in US yields and, thereby, a weaker US Dollar, which boosted the yellow metal. Moreover, the Gold’s short-term trajectory will be determined by bets on the next Federal Reserve (Fed) decision, which will have an impact with crucial labour market data to be released next week.

US reported soft PCE figures. Eyes on labour market data

After the US Bureau of Economic Analysis showed the Core Personal Consumption Expenditures (PCE), the Federal Reserve's preferred measure of inflation, unexpectedly decelerated to 4.6% YoY in May. As attention now shifts to labour market data, Investors are trying to decipher the next moves by the Fed after Chair Powell commented that Federal Open Market Committee (FOMC) foresee additional hikes, driven by a hot labour market.

In that sense, Non-farm payrolls (NFP) are expected to decline to 200K in June. In addition, Average Hourly Earnings are foreseeing remaining steady at 4.3% YoY and the Unemployment rate at 3.7%.

As for now, markets are discounting 25 basis points (bps) hike in the next Fed meeting in July but disagree when the second hike Jerome Powell hinted will come. Is worth noticing that non-yielding yellow metals tend to be negatively correlated with interest rates so hawkish bets on the Fed would apply further selling pressure.

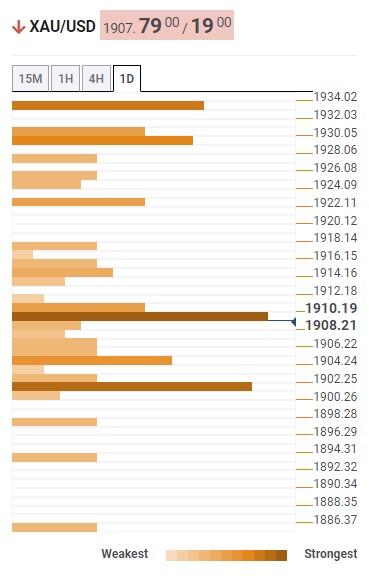

XAU/USD levels to watch

The technical outlook, according to the daily chart, for the XAU/USD remains neutral to bearish for the short term. The Relative Strength Index (RSI) holds below its midline but with a positive slope, while the Moving Average Convergence Divergence (MACD) prints rising red bars.

Support levels to watch: $1,905, $1,900, $1,890.

Resistances levels to watch: $1,930, $1,938 (20-day Simple Moving Average), $1,945 (100-day Simple Moving Average)

XAU/USD Daily chart

-638237573946047023.png)

- The USD/JPY pulls back from YTD high as Japan’s Finance Minister Suzuky warns against excessive yen depreciation.

- The slowdown in the US Core PCE, the Fed’s preferred inflation indicator, reduces investor expectations for a double Fed rate hike.

- Despite Tokyo Core CPI exceeding the BoJ’s 2% target for thirteen months, the BoJ reaffirms its commitment to ultra-loose monetary policy.

USD/JPY retreats from a year-to-date (YTD) high at 145.07 as Japanese authorities warned that “excessive yen weakening” could trigger action by Japanese authorities. That spooked USD/JPY buyers, which have been riding a rally that witnessed a 13% depreciation of the Japanese Yen (JPY) during the year. The USD/JPY is trading at 144.28, down 0.31%, as Wall Street closes.

Japanese authorities halt the USD/JPY rally; softer US inflation weighed on the US Dollar

The US Dollar (USD) remains pressured by an inflation report released by the Department of Commerce. The US Federal Reserve (Fed) preferred gauge for inflation, the Core PCE eased from highs around 4.7% YoY to 4.6% in May, while headline PCE decelerated at a faster pace, with monthly data slowing to 0.1% from 0.4% in April, and annually based numbers at 3.8% from 4.4%.

US Treasury bond yields tumbled after the data as investors see less likely the Fed will increase rates twice, as the dot-plot portrays. Meanwhile, the Fed’s 25 bps increase in July remains priced in, as shown by the CME FedWatch Tool odds at 84.3%.

Consequently, the US Dollar Index, a basket of peers that tracks its value against the greenback, dropped 0.41%, down to 102.933.

Other data witnessed the Chicago PMI improving to 41.5 but remaining in contractionary territory. The University of Michigan (UoM) revealed June’s latest poll, with Consumer Sentiment hitting the 64.4 threshold, above the preliminary reading of 63.9.

On the Japanese front, the Tokyo Core CPI, a critical inflation gauge, edged higher in June, with the index coming at 3.2% YoY, up from 3.1% in May. Even though the CPI stood higher than the Bank of Japan’s (BoJ) 2% target for the thirteen-month, the BoJ remains committed to keeping its ultra-loose monetary policy stance. The BoJ Governor Kazuo Ueda stated the bank would keep its current path unless inflation proves to be sustainable over the long term.

Given the backdrop, the USD/JPY was set to continue to rally. Still, Japanese Finance Minister Suzuky’s comments that Tokyo “would respond appropriately if the moves become excessive” capped the USD/JPY advancement.

USD/JPY Technical Levels

- WTI bulls move to test the bear's commitments at dynamic resistance.

- $72.700 vs. 66.80s in play within the bear's lair.

Commodity demand is slacking into the close of the month with market expectations of continued hawkish central bank policy that has dented sentiment in the oil market and saw investors maintain a bearish tilt.

However, WTI's daily chart paints a different picture as the structure on the downside holds yet again. We broke daily resistance at $70 which could be significant on a break of the upper quarter of the $72 handle and daily target:

WTI daily chart

On the other hand:

It's been a cautious move by the bulls, lacking conviction!

- The GBP/JPY cross regained ground after two days of losses, poised for the seventh consecutive weekly gain.

- British Q1 GDP’s revision showed no surprises and came in at 0.2% YoY.

- Japanese inflation figures unexpectedly decelerated in May.

The GBP/JPY jumped to a high of 183.87 level and then stabilized at 183.25, after experiencing two consecutive days of losses – though still on track for its seventh consecutive weekly gain. The revised British Q1 GDP figures revealed no surprises, with a year-on-year growth rate of 0.2%. On the other hand, Japanese inflation data for May unexpectedly showed a deceleration, thereby continuing to support a dovish stance by the Bank of Japan (BoJ).

Monetary policy divergence set to weaken the JPY further

On Friday, the National Statistics Office of the UK, confirmed that the GDP from the UK in Q1 expanded at an annualized rate of 0.2%, just as expected. It's worth noting that Andrew Bailey from the Bank of England (BoE), stated on Wednesday that he expects economic activity “to flatten” but that the bank will do whatever is necessary to bring inflation down. As a result of his comments, in the previous days Sterling had faced some selling pressure as traders worried about the impact of the aggressive stance of the BoE on economic activity. Friday’s GDP figures, however, brought some calm to markets.

In contrast, the Tokyo Consumer Price Index (CPI) for June displayed a lower-than-expected headline figure of 3.1% year-on-year, compared to the anticipated 3.8%. The Core CPI figure reached 3.8% (previously projected at 4.1%). The results aligned with comments made by Governor Kazuo Ueda of the Bank of Japan (BoJ) during his Wednesday statement, when he emphasized that once inflation aligns with the Bank's forecast, he will consider a potential policy shift. The declining inflationary pressure in Japan, however, supports a more dovish stance, consequently, a less attractive Yen.

GBP/JPY Levels to watch

According to the daily chart, the GBP/JPY’s positive trajectory is intact, but the cross remains overbought, suggesting a need to consolidate gains. The Relative Strength Index (RSI) holds a positive slope above 70. At the same time, the Moving Average Convergence Divergence (MACD) prints decreasing green bars suggesting that the bullish momentum is slowly fading and possibly suggesting that a correction may be on the horizon.

On the downside, support levels line up at 183.00, followed by the 182.30 zone and the 181.00 psychological mark. On the flip side, in case of gaining more ground, the cross will face resistances at 183.70, 184.00 and 184.50.

GBP/JPY Daily chart

- GBP/USD bears are licking their lips for the open next week.

- Supply structure is testing bearish commitments.

As per the prior analysis, GBP/USD Price Analysis: Bears are waiting to pounce below 1.2800 we have seen a classic squeeze to end the month as follows:

GBP/USD prior analysis

GBP/USD daily chart

It was noted that the daily chart showed the price structure as an M-formation. The neckline was regarded as a resistance area around 1.2770/1.2800. Wednesday was expected to be a sell-off to below the lows of the week's initial balance which left trendline support vulnerable looking ahead.

GBP/USD update

The price moved into a demand area and subsequently reverted to the support area. We are now testing dynamic resistance and set for the week ahead.

While the impulse is strong, the 78.6% holds. Bears will be looking for a deceleration on the lower time frames for a reversion in the impulse. A break of the lower lows opes risk into the 1.2550s.

Data released on Friday showed that the Canadian economy stagnated during April, against expectations of a 0.2% expansion. Analysts at CIBC point out that the Canadian economy wasn't quite as resilient to the headwinds it was facing in April as was first indicated.

Key quotes:

“While the strike by federal workers has created some noise within the data, the underlying trend still appears to show a weakening of growth following the very swift start to the year. With absolute levels of activity getting closer to pre-pandemic norms in some of the sectors that have been recovering over the past year, and with interest rate hikes still having a lagged impact, growth rates for the economy as a whole will likely weaken further during the second half of the year and into 2024.”

“For now we retain our call for no hike in July, and a final 25bp move in September, but the BoC's surveys later this morning and labour force survey next week could still tip the balance on that call.”

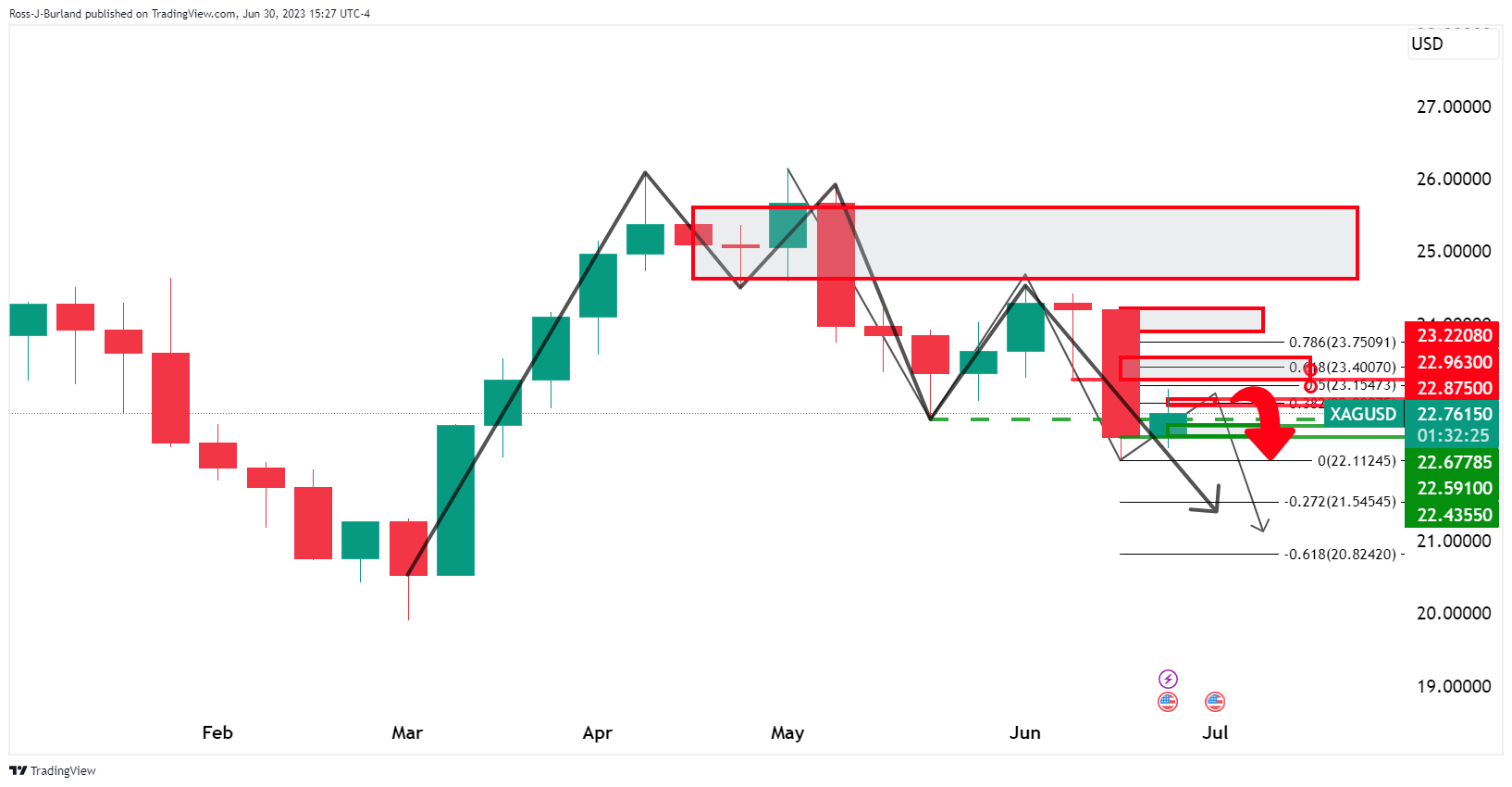

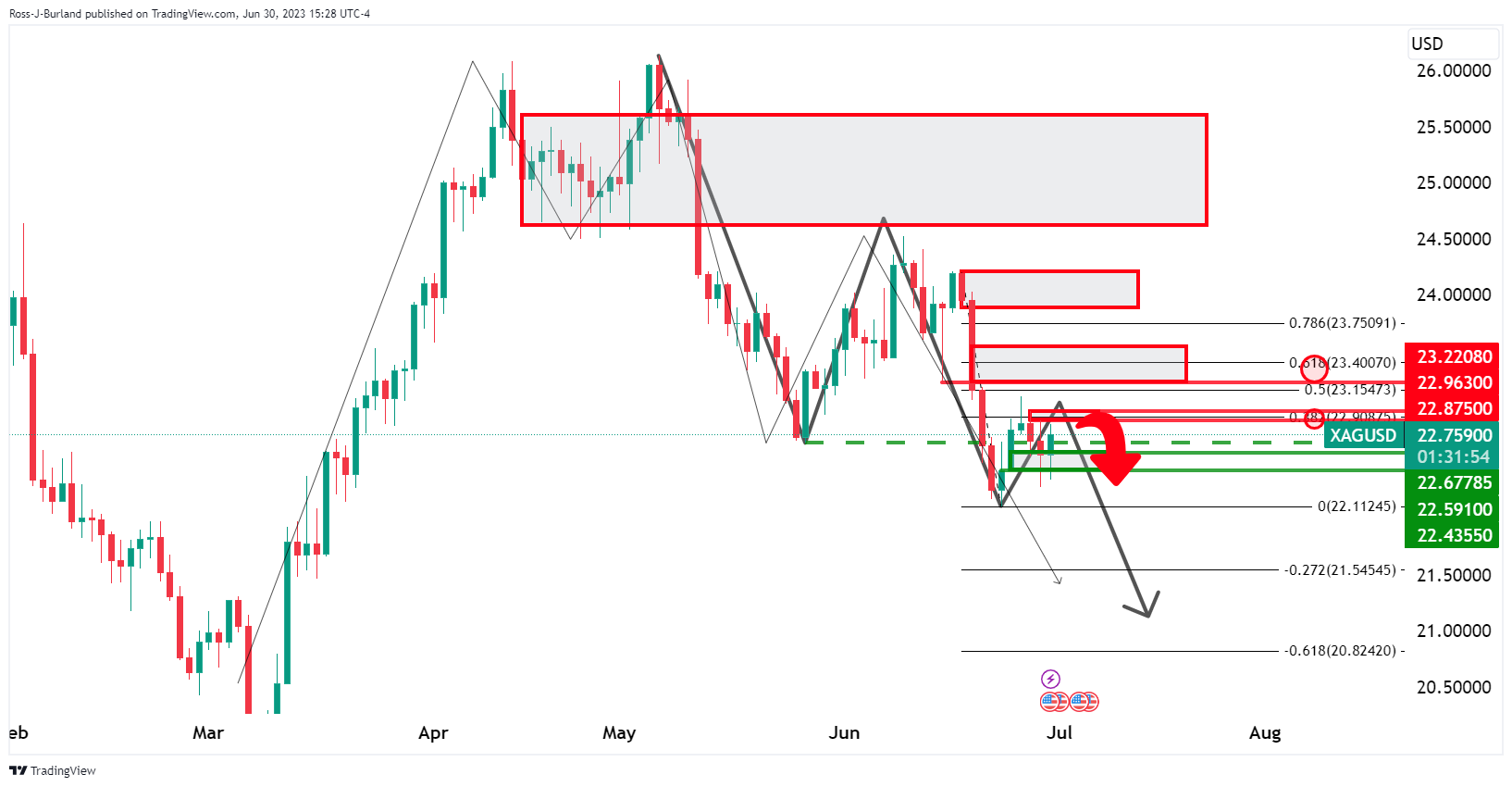

- Silver bears are licking their lips at key structures.

- The 38.2% Fibo is playing its resistance role.

Silver shot up in a correction on Friday with a high of $22.844 from $22.3474 the low. The bulls are correcting the week's sell-off into month's end. The focus is on the Federal Reserve as data continues to offer mixed messages. The Federal Reserve's preferred inflation gauge rose 0.3% MoM, in line with forecasts and below 0.4% in April while the annual core rate slowed to 4.6% and the headline PCE rate reached the lowest in nearly two years.

This came in contrast to this week's firmer data, profit-taking has ensued as the following illustrates:

Silver weekly chart

We are seeing a classic rejection of the M-formations neckline followed by a bearish continuation to crack structure to the downside.

Silver daily chart

A bullish correction is in play to test a 38.2% Fibonacci that is so far acted as resistance. Bears are eyeing prospects of a downside continuation for the days ahead.

Next Friday, the US will release the June official employment report. The market consensus is for an increase of 200K in payrolls. Analysts at Wells Fargo forecast a 245K gain.

Key quotes:

“May's employment report delivered a strong rise in nonfarm payrolls with a 339K gain. However, the household survey added weight to the view that the labor market continues to gradually soften, with household employment contracting by 310K and the unemployment rate ticking up to 3.7%.”

“We expect nonfarm payroll growth to moderate in June. Demand for workers continues to subside, with initial jobless claims moving up between survey weeks and the four-week average up nearly 20% over the past year. Meanwhile, job postings in June continued to slide.”

“Cooling in the jobs market remains incremental rather than abrupt. Therefore, we look for what we would consider to be a still robust gain of 245K new jobs in June, but will be closely watching revisions to May given the 22-year low in the survey response rate.”

“We look for the unemployment rate to tick back down to 3.6% in anticipation of some bounce-back in the household measure of employment.”

- USD/CAD bulls move in for the easy money into month end.

- The support area was a foundation for a short squeeze ahead of a new month.

USD/CAD has come up for air as the following analysis will show. It's month's end so traders look to square up following a disappointment in US data to cap the stronger performance this week. The Federal Reserve's preferred inflation gauge rose 0.3% MoM, in line with forecasts and below 0.4% in April while the annual core rate slowed to 4.6% and the headline PCE rate reached the lowest in nearly two years.

In contrast to this week's firmer data, profit-taking has ensued and bears have thrown in the towel in preparation for a new month in the ebbs and flows of the market testing prior lows of the week's opening balance.

CAD is therefore pressured as follows:

The daily chart hits the upper end of the 1.32 area and bull eye a significant correction towards key resistance.

- USD/CHF drops below key 0.90 level, extending losses as sellers eye a test of the 0.8900 mark.

- Despite losses, fading selling pressure indicated by RSI and positive three-day RoC signals potential recovery.

- If breached, initial resistance at 20-day EMA opens path to 50-day EMA at 0.9007 and beyond.

USD/CHF fails to decisively crack the 50-day Exponential Moving Average (EMA) at 0.9007, drops beneath the 0.90 figure, and extends its losses below technical support levels, as sellers see a test of the 0.8900 mark. At the time of writing, the USD/CHF trades at 0.8947, down 0.51%.

USD/CHF Price Analysis: Technical outlook

The USD/CHF is neutral to downward biased, as price action remains constrained within the 0.89/0.90 area for the last two trading weeks. The Relative Strength Index (RSI) indicator portrays sellers in charge, but it should be said the RSI has printed higher throughs, suggesting selling pressure is fading. In the meantime, the three-day Rate of Change (RoC) remains positive despite the USD/CHF is printing losses.

If USD/CHF continues to edge lower, the first support would be 0.8900. A breach of the latter will expose the year-to-date (YTD) low of 0.8819. Conversely, if buyers reclaim the 20-day EXMA at 0.8979, that will expose the 50-day EMA at 0.9007. Once cleared, the next resistance would be the 100-day EMA at 0.9080 before challenging the 0.9100 mark.

USD/CHF Price Analysis: Price Action – Daily chart

- EUR/JPY found support at a low at 156.70 and then recovered towards 157.50.

- Japan reported soft inflation data supporting a dovish stance from the BoJ.

- German yields retreated after soft EZ HICP and mixed German data.

EUR/JPY has regained momentum and is positioned for a weekly gain as it finds support around 156.70 and rebounds towards the 157.50 area. The JPY has lost appeal after soft inflation data from Japan, which is set to reinforce further the dovish stance of the Bank of Japan (BoJ). On the other hand, German yields are in retreat due to disappointing Eurozone (EZ) HICP (Harmonized Index of Consumer Prices) and weak economic data from Germany.

EZ and Japan reported soft inflation figures. Dovish BoJ weighs on the Yen

Following the hot inflation figures reported by Spain and Germany, the Eurozone’s Core HICP increased by 5.4%, but below the 5.5% expected, with a 0.3% monthly increase falling short of the 0.7% expected. Earlier in the session, Germany reported that Retail Sales contracted by 3.6% in May, but this was better than the forecasted 4.3% decline, while the Unemployment Rate picked up to 5.7% vs the 5.6% expected.

Meanwhile, according to the World Interest Rate Probability (WIRP) tool, markets discount rate hikes for July, September and December. It's worth noticing that Christine Lagarde from the European Central Bank (ECB) sounded hawkish earlier this week, showing concern with inflation being “uncomfortably high”, suggesting that additional hikes may be appropriate.

On the other hand, the Tokyo Consumer Price Index’s (CPI) headline figure fell to 3.1% YoY in June vs the 3.8% expected and the Core figure to 3.8% (4.1%) expected. That being said, BoJ’S Governor Kazuo Ueda commented on Wednesday that once inflation aligns with the Bank’s forecast, he’ll consider a pivot. As inflationary pressure declines in Japan, they support a more dovish stance, weakening the Yen.

EUR/JPY Levels to watch

According to the daily chart analysis, the EUR/JPY pair remains bullish. Buyers have the upperhand in both the daily and weekly chart; in the latter, they are close to a third consecutive week of gains. However, the cross remains overbought, so a correction shouldn’t be discarded.

In a technical correction, support levels are 157.00, 156.50, and 156.00. On the flip side, if bulls gain further ground, there are resistance levels to monitor at 158.00, 158.50, and 159.00.

EUR/JPY Daily chart

-638237458007560724.png)

- USD/MXN holds steady near 17.1200 as easing US inflation slows US Dollar’s climb, despite concerning Mexican jobs data.

- US Dollar Index drops more than 0.50% after the softer-than-expected inflation report, allowing breathing space for the peso.

- Expectations of unchanged rates from Banxico favor MXN, potentially signaling further downside for the USD/MXN pair.

USD/MXN stays firm around the 17.1200 region as softer-than-expected inflation data in the United States (US) weighed on the US Dollar (USD), putting a lid on the USD/MXN advancement. Jobs data revealed in Mexico showed some deterioration, though the Unemployment Rate remains at 3%. At the time of writing, the USD/MXN is trading at 17.1204, almost flat, after hitting a daily low of 17.0440.

US Dollar’s rally tempers despite the deterioration in the Mexican labor market, as easing US inflation weighs on the buck

According to the US Department of Commerce report, US inflation decelerated in May. The US Federal Reserve (Fed) preferred gauge for inflation, the Core PCE, slowed from 4.7% to 4.6% YoY, aligned with estimates, as monthly figures edged lower, flashing signs of cooling down. The Personal Consumption Expenditure (PCE) as a whole edged lower sharply, past the 4% threshold, at 3.8% YoY from April 4.4%, with MoM data slowing to 0.3% from 0.3%.

Later the Chicago PMI improved to 41.5 but remained in contractionary territory. The University of Michigan (UoM) revealed June’s latest poll, with Consumer Sentiment hitting the 64.4 threshold, above the preliminary reading of 63.9.

On the Mexican front, unemployment increased and damaged the Mexican Peso (MXN) prospects. The labor market lost 648,340 jobs in May, its worst performance for a May report since records began in 2005, as reported by the Encuesta Nacional de Ocupación y Empleo (ENOE). The seasonally adjusted unemployment rate hit 3.0% in May, though headline figures were 2.9%.

After the US and Mexican data release, the USD/MXN climbed from 17.0600 to a four-day high of 17.1712 before trimming 5 cents, as the USD/MXN slid to the 17.1200 area. US Treasury bond yield continued to edge lower and weighed on the greenback. The US Dollar Index (DXY), which tracks the performance of a basket of six currencies against the US Dollar, drops more than 0.50%, slumping to 102.830.

Regarding central banks and expectations for monetary policy, the Fed is foreseen to raise rates in July, with odds at 87%, as reported by the CME FedWatch Tool. However, estimates for an additional quarter of percentage raise in November slid compared to yesterday’s odds at around 36%. The Bank of Mexico (Banxico) is expected to keep rates unchanged after two back-to-back meetings holding rates at 11.25%. That said, the interest rate differential still favors the MXN; hence further downside is expected in the USD/MXN pair.

USD/MXN Price Analysis: Technical outlook

The USD/MXN remains in choppy trading price action, capped within the 17.00-17.20 area, unable to pierce the 20-day Exponential Moving Average (EMA) at 17.2303, seen as the first resistance level for buyers. That would not be enough to shift the USD/MXN’s downtrend, as the May 17 low turned resistance at 17.4038 remains in a safe place and is the next price level to watch for buyers and sellers if the USD/MXN surpasses the 20-day EMA. Conversely, a fall below 17.0500 will expose the year-to-date (YTD) low of 17.0219 before the USD/MXN challenges 17.00.

- The XAG/USD jumped above $22.70, seeing more than 0.80% gains and is set to close a winning week.

- Core PCE declined to 4.6% YoY in May, lower than expectations.

- Following the data the USD and US bond yields retreated.

The XAG/USD surpassed the $22.70 mark on Friday and registered an increase of over 0.80%. This positive momentum positions it for a week of gains after two weeks of losses. The boost in Silver prices can be explained by the release of soft Core Personal Consumption Expenditures (PCE) data from the US from May, which revealed a decline to 4.6% year-on-year in May, falling short of expectations. As a result, the US dollar and US bond yields retreated in response to the data favoring the precious metal.

USD weakened after soft Core PCE figures

The US's Core Personal Consumption Expenditures (PCE), which measures the amount of money consumers spend in a month excluding seasonally volatile products such as food and energy, witnessed a decline in May. The figure decelerated from 4.7% to 4.6% YoY in May, while the headline dropped from 4.6% to 3.8%.

As a reaction, the DXY Index dropped from 103.55 to 102.90 while US bond yields which could be considered the opportunity cost of holding non-yielding precious metals retreated from daily highs. In that sense, the yield on the 2-year Treasury Bond reached a peak of 4.93%, marking its highest level since March 9 and subsequently pulled back to 4.85%. In addition, the 5-year and 10-year rates experienced declines, with the former falling to 4.13% and the latter dropping to 3.83%.

Focus now shifts to next week’s labor market data from the US, including ADP, Jobless Claims on Thursday, and the Nonfarm Payrolls report on Friday.

XAG/USD Levels to watch

According to the daily chart, the XAG/USD appears bearish in the short term. The Relative Strength (RSI) and Moving Average Convergence Divergence (MACD) both remain in negative territory, suggesting that the sellers have the upperhand. In addition, traders should eye a bearish cross performed by the 20 and 100-day Simple Moving Average (SMA) of $23.35, which could fuel further downside.

On the downside, support levels to watch stand up at the 200-day SMA at $22.53, followed by $22.30 and June lows at $22.15. On the flipside, resistances are seen at $23.00 followed by $23.10 and the mentioned convergence of SMA’s at $23.35.

XAG/USD Daily chart

-638237414349722126.png)

- AUD/USD surges 0.66%, eyes 0.6700 as US inflation shows signs of slowing, softening the US dollar.

- Despite weaker Chinese data and lower CPI, AUD finds support from diminished expectations of aggressive Fed hikes.

- Aussie’s surge and the US Dollar Index’s 0.48% drop reflect a reassessment of the Fed’s future tightening stance.

AUD/USD climbs sharply and eyes a test of the 0.6700 figure after economic data from the United States (US) showed that inflation is cooling, weakening the US Dollar (USD) despite solid data revealed on Thursday. Hence, the Australian Dollar (AUD) gets a respite, and the AUD/USD pair exchanges hands at 0.6658, gaining 0.66% after hitting a daily low of 0.6603.

Cooling inflation in the US softens the greenback and boosts the Aussie, despite weaker Chinese data, subdued RBA expectations

The US economic docket showed plentiful data as the week, month, and quarter-end approaches. The US Department of Commerce delivered the US Federal Reserve (Fed) preferred gauge for inflation, the Core Personal Consumption Expenditures (PCE), which rose by 0.3% MoM, in line with estimates, below April’s 0.4%. Yearly data pointed lower to 4.6%, from 4.7% in the previous month, showing that inflation is becoming entrenched and not slowing at the pace projected by the Fed. Headline data showed that inflation edged much lower than monthly figures.

In other data, the Chicago National Activity Index PMI rose by 41.5, exceeding May’s 40.4 print, a slight improvement but shy of getting to expansionary territory. At the same time, the University of Michigan (UoM) Consumer sentiment survey rose by 64.4, above estimates and the preliminary reading of 63.9.

On the Australian front, the Aussie (AUD) remains pressured by weaker Chinese data, as factory data dented market sentiment during the Asian session. Expectations for additional tightening by the Reserve Bank of Australia (RBA) sank after the latest CPI report showed inflation dipping to a 13-month low. Hence, money market futures show six basis points of tightening by July, but investors expect rates to peak at around 4.50% by December 2023.

Following the release of the US data, the AUD/USD soared from around 0.6620 to 0.6650. That reflects traders expect the Fed to hike rates, but not as aggressively as expected, following upbeat Thursday’s data. Consequently, US Treasury bond yields are falling, while the US Dollar Index, a measure of the buck’s performance against a basket of six currencies, edged lower by 0.48%, exchanging hands at 102.925.

Regarding monetary policy by the Fed, odds for a 25-bps hike are still up at 87%, as shown by the CME FedWatch Tool, with traders still expecting another rate increase towards November 2023.

AUD/USD Price Analysis: Technical outlook

After diving to a weekly low of 0.6595, the AUD/USD bounced off the lows and rose above 0.6650, a psychological level. It should be said that for a bullish continuation, the AUD/USD must crack June’s 23 daily low of 0.6662 turned resistance to open the way to a confluence of daily EMAs, with the 20, 50, and 100 hoovering around the 0.6700 figure. Otherwise, the AUD/USD pair will be exposed to further selling pressure, with sellers eyeing the 0.6600 figure, the weekly low of 0.6590s, and the May 30 daily high turned support at 0.6559.

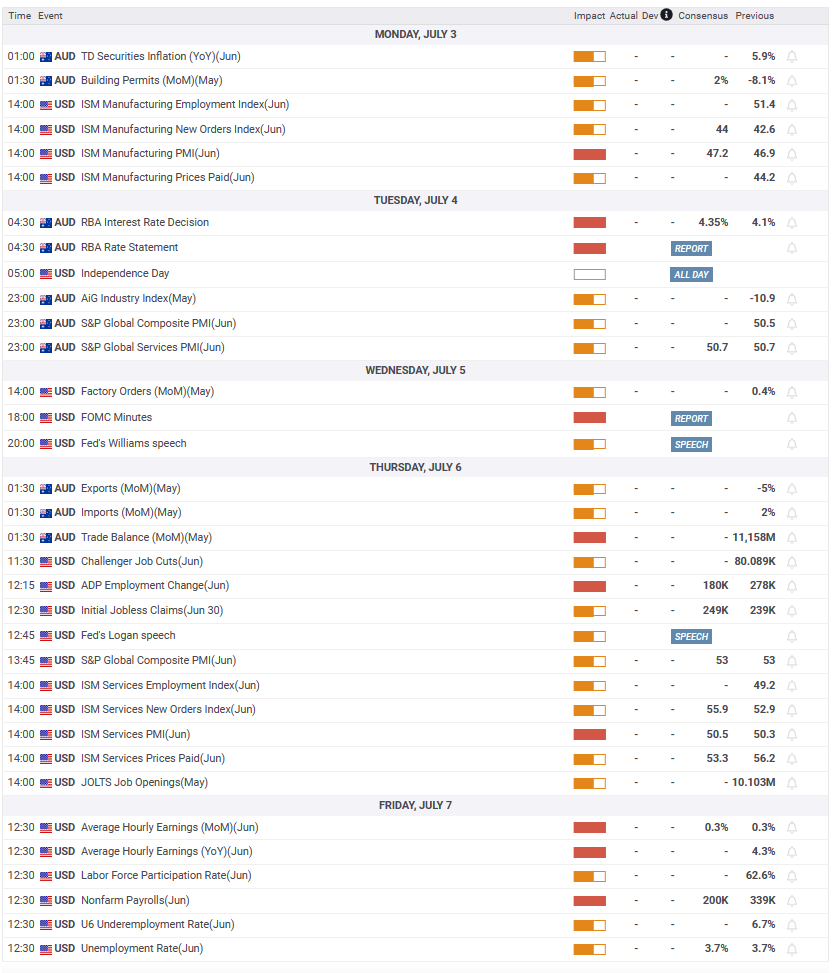

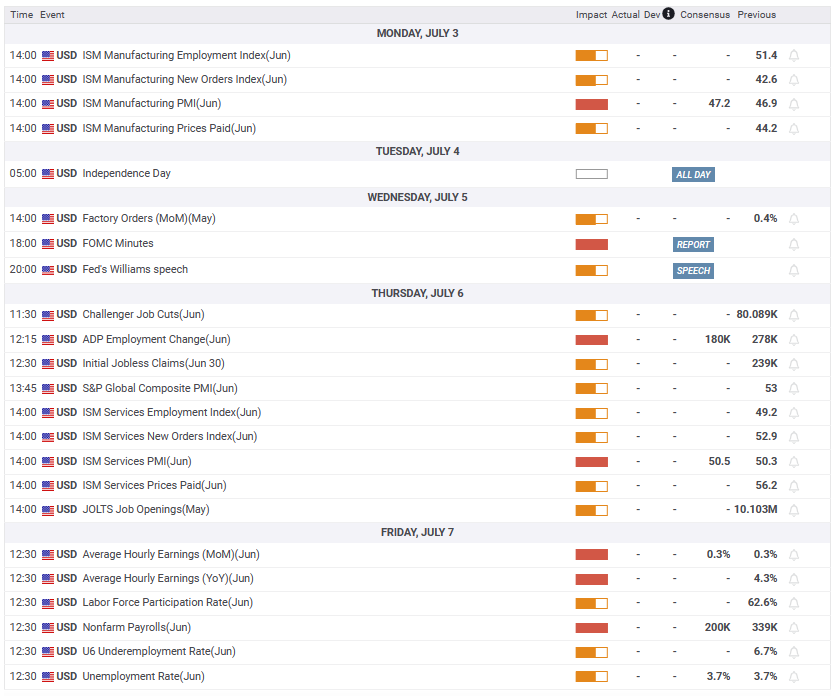

Upcoming events

- NZD/USD cleared part of it previous day’s losses and climbed to 0.6130, 0.90% up on the day.

- Core PCE came in at 4.6% YoY vs the 4.7% expected in May.

- US bond yields retreated, weakening the US Dollar.

On Friday, following the release of soft Personal Consumption Expenditures (PCE) data from the US, the NZD/USD pair staged a recovery, erasing a portion of its previous day's losses. The pair advanced to 0.6120, marking an increase of 0.80% for the day. Following the data, US bond yields retreated, weakening the US Dollar, but remained in positive territory.

US reported soft PCE figures.

On Friday, the US Bureau of Economic Analysis reported that the Core PCE, the Federal Reserve’s (Fed) preferred gauge of inflation from May from the US, slightly decelerated. The figure declined to 4.6% YoY from its previous 4.7% reading, failing to meet the expectations of 4.7% and tallying a 0.3% MoM increase vs the 0.4% expected.

As a reaction, US bond yields retreated from daily highs as investors seemed to be betting on a less aggressive Fed. In that sense, the 2-year bond yield peaked at 4.93%, its highest level since March 9, retreating to 4.85%, while the 5 and 10-year rates fell to 4.13% and 3.83%.

However, more evidence of inflation deceleration must be seen for the Fed to pivot from its hawkish stance. As for now, according to the CME FedWatch tool market is almost completely discounting a 25 basis points (bps) hike on July 31 and still trying to figure out when the second hike Jerome Powell hinted will come.

NZD/USD Levels to watch

According to the daily chart, the technical outlook for the NZD/USD got better as the Relative Strength (RSI) and Moving Average Convergence Divergence (MACD) gained traction in negative territory. In addition, traders should eye the convergence of the 200 and 20-day Simple Moving Averages (SMA). Moreover, traders should eye the 200,100 and 20-day Simple Moving Averages (SMA) convergence towards the 0.6140-0.6200 area as they seem to be about to perform a bearish cross.

On the downside, support levels to watch align at 0.6100,0.6050 and at 0.6030 (strong support seen at the beginning of June).

NZD/USD Daily chart

-638237374217696610.png)

.

- The US dollar weakened following consumer inflation data.

- DXY drops 0.4%, retreating from two-week highs.

- XAU/USD reached its highest level in three days.

Gold prices are having their best day in weeks on Friday, boosted by a decline in the US dollar across the board. XAU/USD jumped from near $1,905 to $1,920 following the release of the US Core Personal Consumption Expenditure Price Index.

The consumption inflation figures showed a decline slightly higher than expected and triggered a retreat in US yields and boosted equity and commodity prices. The US Core PCE fell in May to 4.6% on an annual basis from 4.7%, while the headline dropped from 4.6% to 3.8%.

These figures softened Federal Reserve rate hike expectations for the next meeting. The focus now turns to next week's US labor market data, which includes the ADP, Jobless Claims (Thursday), and the Nonfarm Payrolls report (Friday).

XAU/USD rebounding

XAU/USD is hovering around $1,915, up less than $10 but enough to make it the best day in weeks. The recovery took place after reaching a low on Thursday at $1,892, the lowest level in three months.

On the upside, XAU/USD is breaking a short-term downtrend line. The next resistance area is $1,920. On the downside, a decline below $1,905 would weaken the short-term outlook for the yellow metal.

Technical levels

MXN has been Credit Suisse’s favourite EM currency throughout H123. The bank remains constructive on the Peso.

Banxico is expected to cut ahead of the Fed

Soft CPI data surprises have driven markets to expect Banxico to cut rates ahead of the Fed, starting in Q4. This would be at odds with the previous history of Banxico waiting for the Fed to cut rates before initiating its own easing cycle.

Given the bank’s focus on FX stability under the Rodriguez leadership, we are skeptical these expectations will realize and remain therefore constructive on the Peso.

A US activity slowdown would pose a bigger threat to MXN's strength.

Economists at TD Securities analyze the Yuan outlook.

Slowdown in China's recovery and widening rate differentials will add pressure on the Yuan

The slowdown in China's recovery and widening rate differentials will add pressure on the Yuan and we think USD/CNY could revisit the high last year around 7.30.

However, we expect authorities to show their discomfort with the pace of depreciation via the daily fixings to slow the pace of the USD/CNY climb.

See: USD/CNH to top around 7.30 during the third quarter – Rabobank

The outlook for USD/CAD is now very muddy. Tthe confirmed close below 1.3260 is a major event. Economists at Rabobank have updated their forecasts.

Short term forecasts revised lower to reflect a move back to 1.33 in the coming weeks

In light of recent price action, we have revised our short term forecasts lower to reflect a move back to 1.33 in the coming weeks, and then a return to the 1.35 magnet on a three-month basis but this will require a confirmed close above that critical 1.3260 that implies the move down through the bullish trend was a false breakout.

Should we see a move below 1.30, we will need to revise our outlook substantially to reflect a sustained period of trading within the 1.28 to 1.30 region. But to be clear, this is not our base case, and instead, we expect the demagnetizing of the 1.35 handle to prove to be a short-lived phenomenon.

- GBP/USD surges more than 0.50% following strong UK economic data and easing US inflation.

- US Core PCE inflation cools, while UK Q1 GDP dodges recession, giving GBP the upper hand.

- Sterling’s rally fueled by expectations of less aggressive Fed action; US Dollar Index drops by 0.50%.

GBP/USD recovered lost ground on the last day of the week, month, and quarter, rising more than 0.80% after hitting a daily low of 1.2599. Upbeat data from the United Kingdom (UK) and inflation edging lower in the United States (US) boosted the Pound Sterling (GBP), set to finish the month with gains of 2%. At the time of writing, the GBP/USD is trading at 1.2717.

Stellar UK GDP data and slowing US inflation bolstered the Pound Sterling, past 1.2700 vs. the US Dollar

The latest inflation report in the US eased some pressure on the Federal Reserve (Fed) as the central bank struggles to curb sticky inflation. The Fed’s preferred gauge for inflation, the Core PCE, rose less than expected, coming at 0.3% MoM, below the prior’s month 0.4%, while annual-based figures diminished to 4.6% from 4.7%. Headline inflation rose by 3.8% YoY, below April’s 4.4%, while PCE climbed 0.1% month-over-month, lower than 0.4% in the previous report.

Across the pond, the UK economic docket featured the Gross Domestic Product (GDP) release of the first quarter, with the country missing a recession, expanded by 0.1% QoQ, as high inflation hurts households’ disposable income, as shown by the Office for National Statistics (ONS) figures. Given that inflation remains at around 8.7%, the Bank of England (BoE) is expected to raise rates to 5.5%, as shown by money market futures, though investors remain worried that higher Bank Rates would tip the UK economy into a recession.

Following the release of the US data, the GBP/USD increased from around 1.2640s to 1.2690s as investors began to price in a less aggressive Fed. Consequently, US Treasury bond yields dropped, while a measure of the buck’s value, the US Dollar Index, has dropped more than 0.50%, exchanging hands at 102.769 on Friday.

GBP/USD Price Analysis: Technical outlook

After falling for two straight days, the GBP/USD bounced off the weekly lows. On its recovery, GBP/USD must surpass the June 21 daily low turned resistance at 1.2691, so they can recapture 1.2700 and resume its uptrend. In that outcome, the GBP/USD’s next resistance levels would be the June 28 daily high at 1.2752, followed by the 1.2800 figure.

Conversely, if GBP/USD prints a daily close below 1.2690, it will exacerbate a re-test of the current week’s low of 1.2590.

Of note, the Relative Strength Index (RSI) aims upward after dipping to its neutral line, while the three-day Rate of Change (RoC) shows sellers losing momentum, opening the door for further upside.

Upcoming events

For the Yen, economists at Wells Fargo see potential for stronger appreciation next year.

Likely hawkish monetary policy shift from the BoJ later this year

The Japanese currency has remained a significant underperformer so far this year, especially as the US economy has remained resilient, prospects for Fed easing have been pushed out, and the BoJ has not adjusted monetary policy settings. Accordingly, the prospects for significant Yen strength have also been pushed out.

That said, a likely hawkish monetary policy shift from the Bank of Japan later this year, combined with a weak US economy and lower US interest rates next year, should see the Yen strengthen to 133.00 by late 2024.

Economists at TD Securities expect the US Dollar to struggle in the coming months.

Ding, dong the Fed is done

The end of the Fed cycle is normally quite bearish for the USD for the first few months. It normally drops >2% in the first two months.

For the US, disinflation is the main driver and sending the strongest directional H2 cue for the USD: choppy but lower, yet with a few USD baskets in play.

Our out of consensus call that US disinflation is strong enough for the Fed to skip July, effectively ending the cycle, would reinforce lower macro vol, late cycle growth dynamics and boost carry.

To tell the truth, Antje Praefcke, FX Analyst at Commerzbank, would have liked the Riksbank to do more. Thus, the SEK is set to struggle.

The Riksbank stays on the ball – but no more than that

The Riksbank partially delivered yesterday, but only partially. It will reduce its assets holdings more rapidly as of September, but it was only able to decide on a 25 bps rate step to 3.75%, which had been generally expected and therefore did not constitute a restrictive signal for the market.

Moreover, Riksbank now signaled interest rates to peak at just over 4%, which only entails one further rate step in the autumn, and which does not constitute a restrictive surprise. The Swedish central bankers now signal first rate cuts (at this point from slightly higher levels) for the summer of 2025. Restrictive surprise? Not exactly!

In my view the Riksbanks stay on the ball when it comes to fighting inflation, but no more than that. That is why to my mind yesterday’s decision does not look like a proactive move, but more like an ‘overdue reaction to past developments’. Compared with the ECB it is significantly less courageous. Therefore, it does not come as a surprise that there is pressure on the Krona.

A bullish GBP view has been among Credit Suisse’s most consistent positions of 2023 so far. More gains are likely.

EUR/GBP to target 0.8450

Looking ahead, the biggest questions are: 1) can UK core inflation fall quickly given the tightness in the UK labour market and 2) is the UK housing market so fragile as to make it impossible for the BoE to hike as much as priced in and/or hold rates at a high level for a meaningful period of time?

We take the view that, if the ECB is worried about wage-price spiral risks in the Euro-area, the far-graver situation confronting the BoE in the UK should be defined as a genuine emergency that precludes excessive concern about the health of the UK housing market.

While GBP has clearly appreciated a great deal already in 2023, we see room for further gains, with EUR/GBP having scope to push to at least 0.8450 while GBP/USD can test 1.3000 too.

The main risk to our view is a sudden freeze/collapse in UK asset markets.

Economists at Wells Fargo still see potential for moderate gains in the Euro over the medium term.

Slower pace of rate cuts from the ECB relative to the Fed in 2024

We forecast a resumption of modest Eurozone economic growth over time, and a much slower pace of rate cuts from the European Central Bank, relative to the Fed in 2024.

Against this backdrop, we forecast the Euro to strengthen to 1.15 by late 2024.

See: EUR/USD to finish the year around 1.13 – TDS

- The US Core PCE annual rate slowed from 4.7% to 4.6% in May.

- The US dollar weakened modestly after the report.

- The EUR/USD turned positive for the day after rebounding from two-week lows.

The EUR/USD rebounded further after US consumer inflation data and climbed above 1.0880, hitting fresh daily highs, boosted by a weaker US dollar. The greenback pulled back after the report, and commodities and US equities futures rose.

The US Bureau of Economic Analysis reported on Friday that inflation, as measured by the change in Personal Consumption Expenditures (PCE) Price Index, fell to 3.8% YoY in May from 4.3% in April, below the market consensus of 4.6%. The Fed's preferred measure, the Core PCE, also fell from 4.7% to 4.6%.

As a result of the report, the US Dollar weakened. The DXY retreated from weekly highs above 103.50 towards 103.00, and US Treasury yields dropped back to neutral territory for the day. The US 10-year yield fell from three-month highs at 3.89% to 3.84%.

Later on Friday, the University of Michigan releases the final estimate for consumer sentiment, and also the Chicago PMI is due.

EUR/USD holding above the 20-day SMA

The EUR/USD bottomed on Friday at 1.0835, the lowest level since June 15. It started to rebound and after US data accelerated towards 1.0900, boosted by a weak US dollar and risk appetite. The combination is favorable for the upside.

The rebound in EUR/USD took place from near the 20-day Simple Moving Average (SMA) line at 1.0855. A daily close below that level could point to weakness ahead for the Euro from a technical perspective. On the upside, the next areas to watch are 1.0900 and then the 20-period SMA in the 4-hour chart, which is waiting at 1.0910. A recovery above that level would strengthen the short-term outlook for the Euro.

Technical levels

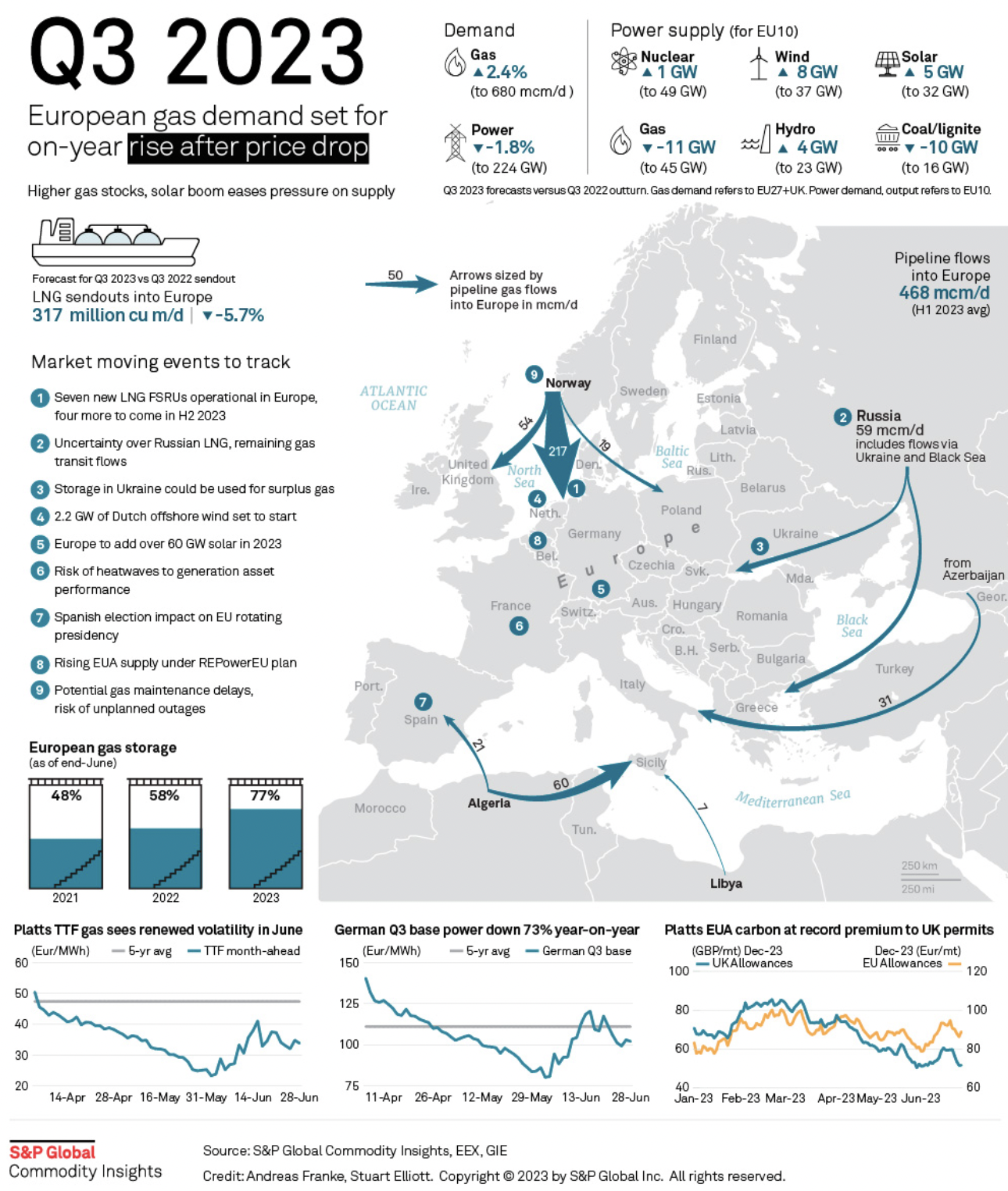

- Natural Gas price trades flat-to-lower on Friday as supply concerns ease because of greater-than-expected stockpiles in Europe.

- This largely eclipses US data out on Thursday showing a fall in inventories last week.

- The end of a threat of civil war in major producer Russia and forecasts that the heatwave will pass further cap gains.

Natural Gas price edged down on Friday at the start of the US session on the back of easing supply concerns after data showed European stockpiles at 77% capacity, reassuring traders that storage tanks will be full in time for the winter demand glut. This undoes the gains made on Thursday after US data showed a surprise fall in inventories last week.

The avoidance of a civil war in Russia has further relieved supply concerns, killing the rally that began at the same time as the Wagner Group’s mutiny. In addition, the heatwave in the US, which drove up demand for Natural Gas more recently (for use in air conditioning), is forecast to pass next week.

XNG/USD is trading in the $2.600s/MMBtu as America wakes up.

Natural Gas news and market movers

-

European storage levels of Natural Gas – built up in preparation for the winter – are substantially higher than in previous years, easing supply concerns and putting a lid on prices.

-

Natural Gas storage capacity in Europe has reached 77%, according to the latest data from S&P Global, which compares to 58% in 2022 for the same time of year and 48% in 2021.

-

S&P Global’s article suggests demand may still rise in Q3 (2023), however, because of low prices.

-

Its infographic for Q3 (see below) forecasts an increase of 2.4% in Natural Gas demand in the quarter to 680 million cubic meters of Gas per day (mcm/d).

-

S&P Global says that the higher Natural Gas stocks and boom in solar energy will “ease pressure on supply”.

-

The current relatively low Natural Gas prices are themselves a result of an overall lower level of demand so far in 2023, according to Irina Slav, a reporter for Oilprice.com.

-

Reduced consumption has become the norm in Europe after energy bills skyrocketed in 2022, and pressure from some governments to lower consumption have combined to force consumers to be more prudent, says Slav.

-

The 2022-2023 winter was also relatively mild in both the US and Europe, reducing demand for Natural Gas and leaving stockpiles high from last year. This means less is required to top them up in 2023, Slav writes.

-

“The reason for the lower prices is, as could be expected, lower demand. It is true that Europe is buying liquefied natural gas. But it is buying a lot less than last year: because its storage caverns are not infinite, and there is still quite a lot of gas left in them from last year,” reports Slav on Friday.

-

Natural Gas has also fallen after the return of geopolitical stability to Russia, which is still a major producer. When the Wagner mutiny began, prices rose on fears supply would be disrupted by a civil war. However, now that the mutiny is over, they have fallen back.

-

Norwegian supply concerns, after outages at the Hammerfest LNG export terminal and the processing plants at Nyhamna and Kollsnes, continue to underpin prices. However, the high storage levels witnessed in Europe mean that the outages in Norway are now less of a concern.

-

Volatility from traders shuffling positions ahead of the expiration date for front-month Futures and Options contracts might be impacting prices as the month of June comes to an end, according to Natural Gas Intelligence (NGI).

-

Moving to the US, the Natural Gas price gapped higher on Thursday after EIA data showed a lower-than-forecast change in US Storage data in the week ending June 23.

-

The sudden recovery came after an almost 10% decline in price from the June highs.

-

Demand for Natural Gas to power air conditioning may be about to moderate following reports that temperatures in the US are set to return to average ranges for this time of year next week.

Natural Gas: S&P Global Infographic

Natural Gas Technical Analysis: Recovery stalls near significant trend-determination level

Natural Gas price is trading just below a key trend-determination level on longer-term charts. Although the commodity remains in a long-term downtrend since turning lower at the August 2022 peak, bearish momentum has tapered off considerably.

The Relative Strength Index (RSI) momentum indicator is converging bullishly with price on the weekly chart, something that occurs when price makes new lows but RSI does not.

A break above the last lower high of the long-term downtrend at $3.079 MMBtu would indicate a reversal in the broader downtrend.

-638237258617255695.png)

Natural Gas: Weekly Chart

Given this level has not been breached yet, however, the downtrend remains intact, and a break below the $2.110 year-to-date lows would provide a confirmation of a continuation down to a target at $1.546. This target is the 61.8% Fibonacci extension of the height of the roughly sideways consolidation range that has been unfolding during 2023 (marked 161.8% on charts).

On the daily chart, price has been climbing within a roughly sideways market, although it has broken above both the 50 and the 100-day Simple Moving Averages (SMA).

-638237259147690923.png)

Natural Gas: Daily Chart

Nevertheless, a break above the last lower high of the long-term downtrend at $3.079 MMBtu would be required to indicate a reversal in the broader trend.

Such a move might then see prices rally higher to the next key resistance level at the 200-week SMA, situated at $3.813.

Until that happens, however, price will probably continue to consolidate within its range.

Natural Gas FAQs

What fundamental factors drive the price of Natural Gas?

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

What are the main macroeconomic releases that impact on Natural Gas Prices?

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

How does the US Dollar influence Natural Gas prices?

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

Economists at Scotiabank analyze USD/CAD technical outlook.

Net gains on the week for the big Dollar will tilt technical risks somewhat higher

Short-term price trends in USD/CAD are flat but the USD has made progress on the week and, after last week’s stalling signal, net gains on the week for the big Dollar will tilt technical risks somewhat higher.

There remains some uncertainty around the technical outlook for the USD, however; late week gains in funds have held above 1.3240 and a break below that point today could still dump the USD back to the 1.32 area and blunt some of the positive price action that has developed on the longer run chart this week.

Resistance is 1.3275/80 and – firm – at 1.3315/25.

GBP/USD losses steady around 1.26 but needs to regain 1.2665 to strengthen, economists at Scotiabank report.

Cable is trying to carve out a base

Choppy price action in Cable in the past two sessions suggests that the Pound is trying to carve out a base.

GBP support around the 1.26 point has steadied losses and intraday gains so far today imply better demand is developing ahead of the weekend.

Gains through 1.2665 in the next day or so should see spot strengthen back toward the 1.2725 resistance.

S&P 500 may yet test resistance at 4,513/35, but analysts at Credit Suisse continue to look for a cap here.

Direct break above 4,535 to suggest we can see a further acceleration higher

We still see scope for a test of resistance next at 4,513/4,535 – the 78.6% retracement of the 2022 fall and late April 2022 high. We continue though to look for a fresh attempt to set a cap here for a consolidation/corrective phase, especially if a new high is not confirmed by weekly RSI momentum.

Below support at 4,350/28 is needed to ease the immediate upside bias to suggest a correction lower has already begun, with support then seen next at 4,261/41, and more importantly at the rising 63-day average, currently seen at 4,192. Only a close below here though would be seen to suggest a more important peak has been posted, for support next at 4,104.

A direct break above 4,535 though would suggest we can see a further acceleration higher with resistance seen next at the 4,636 March 2022 high, potentially even the 4,819 record high.

CAD slips on the week but GDP and BoC survey could provide support, economists at Scotiabank report.

Little or limited progress on inflation expectations will support the outlook for more tightening

Signs of resilient growth in the GDP report should be CAD-supportive, given the Bank’s concern about the economy running relatively hot. But the BOS will also likely have some sway in policymakers’ thinking.

Recent reports have pointed to slowing growth momentum but extremely resilient inflation expectations which reflect very little faith in the business community that price stability will be restored anytime soon. Little or limited progress on inflation expectations in the Q2 survey will also support the outlook for more tightening.

See – USD/CAD: Business Outlook Survey to provide a lift to the Loonie – ING

A second week of net losses for EUR/USD has pushed the pair back to retest the 40-Day Moving Average point at 1.0844 today. Economists at Scotiabank analyze the pair’s technical outlook.

Resistance seen at 1.0875/85

Short-term trend signals are EUR bearish but the daily DMI is flat and the weekly signal remains bullish. This is not obviously the set-up for a sustained EUR decline now. But a sustained push under the mid-108 area would point to weakness extending and a drop back towards key support at 1.0675/00.

Resistance is 1.0875/85 on the day.

USD is mixed on the day but broader gains extend ahead of price data. Economists at Scotiabank discuss the Dollar outlook.

Month and quarter-end portfolio rebalancing flows could still drive USD selling

Spreads have moved a little in the USD’s favour at the short-end of the curve but the DXY looks relatively fairly valued (based on its correlation with weighted 2-year yield differentials), suggesting limited scope for gains, absent significant new impulses from rates.

Firm PCE data could give the USD a lift but month and quarter-end portfolio rebalancing flows should have driven – and could still drive – USD selling, given US equity market outperformance.

Stocks are broadly firmer on the day and crude oil prices are a little stronger, implying a risk-friendly backdrop generally for investors.

See – US Core PCE Bank Expectations: Fed preferred inflation measure to make little progress

Economists at Wells Fargo now anticipate a broadly stable to slightly stronger Dollar over the remainder of 2023. They continue to forecast broad-based Dollar depreciation over the course of next year.

Subdued moves in the second half of 2023, but Dollar depreciation to resume in 2024

Given our expectation for a later and shallower US recession and later Fed easing, we expect later and more gradual depreciation of the US Dollar than previously.

We forecast the trade-weighted US Dollar to be little changed from current levels by the end of 2023, and to decline by 4.5% through 2024.

Economists at Crédit Agricole expect EUR/USD to experience downside pressure in the near term. However, the pair is set to recover toward 1.11 in the coming months.

Near term downside risks for EUR/USD

We see downside risks for EUR/USD from its current levels in the near term and project a recovery only going into Q4 2023. This near-term weakness is due to the positive impact from the widening of the EUR-USD 2-year rate spread being more than offset by wider peripheral spreads to Bunds and the falling EUR-USD box yields spread.

Beyond the near term, we expect EUR/USD to experience a gradual increase towards 1.11 over the next 6 to 12 months.

Copper (LME) is falling sharply again. Strategists at Credit Suisse analyze the metal outlook.

Initial resistance is seen at $8,477/79

With weekly MACD momentum trending lower and now negative we look for a more sustained decline to emerge and a more meaningful turn lower.

We look for a fall to test the $7,867 YTD low, a break of which would be seen to add further momentum to the sell-off for support next at $7,220 and eventually a test of the $6,955 low of last year.

Resistance is seen at $8,477/79 initially, with $8,712 now ideally capping.

Lower rates and disappointing economic data have resulted in a sharp depreciation of the Yuan. The accelerated pace of Yuan weakening lead economists at Rabobank to revisit their FX forecast.

Modest and gradual strengthening of the Yuan against the Dollar in Q4

We now expect USD/CNH to top around 7.30 during the third quarter in anticipation of worse-than-expected economic data.

During the last quarter of this year, we see a modest and gradual strengthening of the Yuan against the Dollar, bringing the currency pair back to 7.25, since we expect markets to price in Fed rate cuts for the second quarter of next year.

USD/CAD has completed a top to warn of a more significant turn lower, economists at Credit Suisse report.

Resistance at 1.3387 to cap to maintain the top

USD/CAD has broken key price support and the 38.2% retracement of the 2021/2022 uptrend at 1.3227/25 which in our view marks a top and important change of trend lower.

The current bounce is thus seen as temporary and corrective and we look for this to be followed by a fall back to 1.3116, then the 50% retracement and uptrend from 2021 at 1.2993/80. Whilst we would look for a floor to be found here, should weakness directly extend, we would see support next at 1.2760.

Resistance at 1.3387 ideally caps to maintain the top.

- The US Dollar rolls on after a very choppy trading day on Thursday.

- Friday’s focus is on PCE, the Fed’s preferred inflation metric .

- The US Dollar Index closed nearly at session’s high on Thursday and clings on to minor gains at 103.35.

The US Dollar (USD) is enjoying the inflow seen since Thursday after a very choppy trading session. Upside inflation surprises in European countries made the Euro outperform the Greenback for most part of the European session, while US Gross Domestic Product numbers wiped recession fears off the table and made the Greenback the flavor of the day again. Overnight, People’s Bank of China (PBoC), the Chinese central bank, issued again a much stronger fixing for its Yuan against the US Dollar, but markets are ignoring it in full, sending USD/CNY up to possibly set a new six-month high on Friday. There are no real trends to distillate on the quote board as the US Dollar posts modest gains against most currencies.

There aren’t any Federal Reserve (Fed) speaking on Friday, so traders can mainly go into data-trading. At 12:30 GMT, the Personal Consumption Expenditures (PCE) Price Index numbers will come out. This is the preferred inflation measure for Fed Chairman Jerome Powell to assess how or where inflation is at the moment in the US. Later, the Chicago Purchase Managers Index is due at 13:45 GMT, while at 14:00 GMT the final reading of the University of Michigan Consumer Sentiment Index for June will be released. Depending on their outcome, these two data points could support some more follow-through on the current trend in the US Dollar or trigger a turnaround.

Daily digest: US Dollar to see if strength is justified

- The US State department approved a possible military sale to Taiwan, adding tension against China after the earlier AI chip export curbs out of the US toward China. The sale would still need to pass several security checks and approvals before actually taking place.

- The Japanese Yen weakened to $145 for the first time since November and is at risk of a market intervention by the Japanese finance ministry.

- China’s PBoC fixed the USD/CNY at 7.2258, quite far below the expected 7.2485 from market consensus. Markets ignored the fixing and even sent USD/CNY completely the other way to peak at $7.27.

- The most expected market moving event for Friday is at 12:30 GMT, namely the Personal Consumption Expenditures Price Index data for May. The PCE Index on a monthly basis is expected to come in at 0.5%, accelerating from 0.4% in April. On a yearly basis, PCE inflation is expected to increase 4.6%, more than the 4.4% rise seen a month earlier. Both the monthly and yearly Core PCE are seen stable at 0.4% and 4.7%, respectively. . Any bigger jump in PCE, both Core or headline , would strengthen the US Dollar as it would increase the chances of more Fed hikes. Personal Income is expected to increase at a steady pace of 0.4%, while the Personal Spending is expected to decelerate significantly, from 0.8% to only 0.2%.

- At 13:45 GMT, Chicago Purchasing Managers Index for June is expected to head from 40.4 to 44. An uptick, though still below 50 and thus pointing to a contraction in the region’s business activity.

- Just 15 minutes later, at 14:00 GMT, the Michigan Consumer Sentiment Index for June will come out, which is expected to remain unchanged at 63.9. Participants for the survey had the opportunity as well to pencil in inflation expectations over the next year and for the next 5-to-10 years. Currently, the one-year inflation forecast is at 3.3%. An uptick or lower number could move the US Dollar in either direction.

- Equities are mixed, with minor gains and losses. In Asia, the Hang Seng is up 0.10% while the Japanese Topix closed down 0.33%. In Europe, the German DAX and the Stoxx 50 are mildly green. US Futures are mixed, with the Dow Jones Industrial below zero but the S&P 500 and Nasdaq futures registering mild gains.

- The CME Group FedWatch Tool shows that markets are pricing in a 86.8% chance of a 25 basis points (bps) interest-rate hike on July 26. The Fed hike is very much locked in as US GDP numbers showed that the US economy can whistand and endure some more rate hikes. Still, markets are reluctant to price in a second rate hike in the last meetings for 2023.

- The benchmark 10-year US Treasury bond yield trades at 3.85%.. The proof of the US economy being in good health made investors reduce their safe haven positions and pushed US yields higher.

US Dollar Index technical analysis: USD to end the week with a bang

The US Dollar trades overall very much in the green against the most common currencies, with one or two outliers. No real symmetry to be noticed either as we have seen the past week, when often Asia was weaker while currencies in Central and Eastern Europe were substantially stronger.. Expect for traders to keep their powder dry and see the US Dollar index reside where it is at the moment, near Thursday’s high at 103.40.

On the upside, look for 103.50 as the next key resistance level in order to lock in some solid support and a safe region where the Dollar index can take a breather before heading higher. The 200-day Simple Moving Average (SMA) at 104.98 is still quite far away. So the intermediary level to look for is the psychological level at 104.00 and May 31 peak at 104.70.

On the downside, the 55-day SMA near 102.67 is up for proving its reliability as a support after being chopped up that much in the last two weeks. A touch lower, 102.50 will be vital to hold from a psychological point of view. In case the DXY slips below 102.50, more weakness is expected with a full slide to 102.00 and a retest of June’s low at 101.92.

What is US Dollar Index (DXY)?

The US Dollar Index, also known as DXY or USDX, is a benchmark index that was established by the US Federal Reserve in 1973. DXY is widely used as a tool measuring the US Dollar (USD) value in global markets. The index is calculated by measuring the US Dollar’s performance against a basket of six foreign currencies, the Euro, the Japanese Yen (JPY), Swedish Krona (SEK), the British Pound (GBP), the Swiss Franc (CHF) and the Canadian Dollar (CAD).

With 57.6%, the Euro has the biggest weight in the index followed by the JPY (13.6%), GBP (11.9%), CAD (9.1%), SEK (4.2%), and CHF (3.6%). Hence, a sharp decline in the EUR/USD pair could help the US Dollar Index rise even if the US Dollar weakens against some of the other currencies in the basket.

The gold price has shed $150 as compared with its early-May high and is trading at a new three-month low of around $1,900. Economists at Commerzbank discuss XAU/USD outlook.

Gold ETFs have seen increasing outflows since the end of May

It is above all the ETF investors, who had only just begun returning tentatively to the market, that are now already on the retreat again. Gold ETFs have seen increasing outflows since the end of May.

The prospect of higher US interest rates and a reversal of the Fed’s policy likely to be pushed further into the future have dampened interest in Gold as a non-interest-bearing investment.

Against this backdrop, Gold could again dip below the $1,900 mark in the short term. Gold should regain ground as soon as a turnaround in interest rate policy is on the cards, however.

In the United States and the Eurozone, economies are protected against the risk of recession by several mechanisms. The risk of persistently high inflation is therefore greater than the risk of recession, analysts at Natixis report.

The US and Eurozone are actually protected against the risk of recession

Many mechanisms are protecting the US and the Eurozone against the risk of recession: strong job creation, high corporate profitability, the fall in the household savings rate in the United States, government programmes to support investment and the energy transition.

As a result, the major risk in the US and the Eurozone is not the risk of recession, but the risk of persistently high inflation, caused by the tightness of the labour market, which is rapidly pushing up wages, and by the lack of productivity gains.

Dollar strength emerged across the board yesterday. It is hard to argue with the strong Dollar, economists at ING report.

Strong data goes head-to-head with rebalancing flows

May's core PCE deflator is expected at a firm 0.3-0.4% MoM, consistent with the Fed's view that core inflation is not falling quickly enough. That should keep US rates and the Dollar firm.

The challenge today will be month and quarter-end portfolio rebalancing flows. The outperformance of US equity benchmarks over the last month and quarter could generate some Dollar selling. We prefer to see rebalancing as more of a risk to a preferred view that the Dollar stays strong given what seems a clear macro story.

DXY could edge up to the 103.65 area unless fixing flows take their toll.

See – US Core PCE Bank Expectations: Fed preferred inflation measure to make little progress

- EUR/USD drifts lower for the third straight day and drops to over a two-week low on Friday.

- The softer Euro Zone consumer inflation figures fail to impress the Euro bulls or lend support.

- The USD hits a fresh three-week high and contributes to the slide ahead of the US inflation data.

The EUR/USD pair attracts fresh sellers following a modest intraday uptick to the 1.0875 region on Friday and turns lower for the third successive day. Spot prices drop to over a two-week low following the release of the Euro Zone consumer inflation figures and trade around the 1.0840-1.0835 region during the early part of the European session.

The preliminary report published by Eurostat showed that the annual Euro Zone Harmonised Index of Consumer Prices (HICP) climbed 0.3% in June as compared to a flat reading anticipated. This, however, was offset by a sharp deceleration in the yearly rate to 5.5% from 6.1% in the previous month. Adding to this, the Core HICP rose by 0.3% MoM and edged higher to 5.4% on a yearly basis, missing consensus estimates. The data reaffirms bets for another 25 bps lift-off by the European Central Bank (ECB) in July, albeit fails to impress the Euro bulls or lend any support to the EUR/USD pair in the wake of worries about economic headwinds stemming from rising borrowing costs.

The US Dollar (USD), on the other hand, hits a fresh three-week high and remains supported by the Federal Reserve's (Fed) hawkish outlook, signalling that interest rates may still need to rise as much as 50 bps by the end of this year. The outlook was reinforced by the upbeat US macro data released on Thursday and Fed Chair Jerome Powell's hawkish remarks earlier this week. This, in turn, continues to push the US Treasury bond yields higher, which, in turn, underpins the USD and further contributes to the offered tone surrounding the EUR/USD pair.

With the latest leg down, spot prices have dropped nearly 150 pips from the weekly high touched on Tuesday and moved back closer to the 100-day Simple Moving Average (SMA). Any further decline, however, seems limited as traders now seem to wait on the sidelines ahead of the release of the US Core PCE Price Index - the Fed's preferred inflation gauge - due later during the early North American session. The crucial data should influence the USD price dynamics and provide some meaningful impetus to the EUR/USD pair on the last day of the week.

Technical levels to watch

EUR/USD strength has stalled at the 78.6% retracement of the April/May fall at 1.0998. Economists at Credit Suisse analyze the pair’s outlook.

Close below 1.0585/1.0501 would see an important top established

We already hold a negative outlook for EUR/USD and are looking for resistance at 1.0998 to ideally cap for a test and then break of the uptrend from last September at 1.0766. This would then be seen to clear the way for a fall back to the 1.0634 late May low, then medium-term support, starting at 1.0585 and stretching down to 1.0501: the 200-DMA, March low, the lower end of the uptrend channel from the beginning of the year, and the 38.2% retracement of the 2022/2023 uptrend.

Whilst this key support should continue to be respected, a break lower would indeed see a major top established, clearing the way for a more sustained decline with support then seen initially at 1.0317 ahead of 1.0133.

The Canadian Dollar has been one of the better G10 performers this year. Economists at ING analyze CAD outlook ahead of the release of the quarterly Business Outlook Survey.

CAD to continue to perform well – as should the Mexican Peso

One important input into the BoC's decision will be today's release of the quarterly Business Outlook Survey. This will help the BoC better understand both business inflation expectations but also the environment for corporates to be able to push higher prices onto consumers. With Canada's unemployment rate still relatively low by historical standards, corporates may still see opportunities to push on higher prices or restore profit margins. Let's see.

In general, we expect the Canadian Dollar to continue to perform well (as should the Mexican Peso) and today's outlook survey could help to see the Canadian Dollar withstand US Dollar strength better than some.

- Gold price fails to build on the overnight bounce and comes under fresh selling pressure on Friday.

- Hawkish central banks, along with a bullish US Dollar, continue to act as a headwind for the metal.

- Investors now look to the US Core PCE Price Index to determine the next leg of a directional move.

Gold price meets with a fresh supply on the last day of the week and extends its steady intraday descent through the early part of the European session. The XAU/USD currently trades around the $1,900 round-figure mark, down nearly 0.40% for the day, and remains well within the striking distance of its lowest level since mid-March touched on Thursday.

A more hawkish stance adopted by major central banks and the prospects for further rate increases continue to act as a headwind for the non-yielding Gold price. Apart from this, the emergence of fresh US Dollar buying turns out to be another factor driving flows away from the XAU/USD. In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, climbs to a fresh two-and-half-week high in the last hour and continues to draw support from expectations for further policy tightening by the Federal Reserve (Fed).

It is worth recalling that the US central bank had signalled that borrowing costs may still need to rise as much as 50 bps by the end of this year. Adding to this, the upbeat US macro data released on Thursday reaffirmed market bets for a 25 bps lift-off at the next FOMC policy meeting on July 25-26. Furthermore, Fed Chair Jerome Powell said earlier this week that he does not see inflation coming down to the Fed's 2% target until 2025. This, in turn, continues to push the US Treasury bond yields higher and lends support to the USD.

It, however, remains to be seen if the USD bulls can maintain their dominant position or opt to take some profits off the table ahead of the release of the US Core PCE Price Index - the Fed's preferred inflation gauge. The crucial data is due later during the early North American session and influence expectations about the future rate-hike path. This, in turn, will drive the USD demand and provide a fresh directional impetus to Gold price, which seems poised to end the quarter in the negative territory for the first time since September 2022.

Technical levels to watch

Economists at Nordea still expect EUR/NOK to trade around 12.00 during the summer.

Continuing on a bumpy ride

The volatile and bumpy ride in NOK is likely to continue in the short term and we see EUR/NOK trading around 12.00 during the summer.

While we remain bearish on the NOK in the short-term, we believe that NOK will be less weak towards year-end than during the summer (we see EUR/NOK around 11.50 at end-2023). One reason for our view is that gas prices are likely to rise during autumn/winter, implying higher NOK purchases from oil companies.

- AUD/USD gains positive traction for the second straight day, though lacks follow-through.

- Economic woes continue to act as a headwind for the risk-sensitive Aussie amid a bullish USD.

- Investors now look forward to the US Core PCE Price Index for some meaningful impetus.

The AUD/USD pair attracts some intraday buying near the 0.6600 round-figure mark, albeit struggles to capitalize on the move and retreats a few pips from the daily peak. Spot prices currently trade around the 0.6620-0.6625 region, up less than 0.15% for the day, and remain well within the striking distance of a nearly four-week low touched on Thursday.

Investors remain worried about economic headwinds stemming from rapidly rising borrowing costs and the fears were further fueled by rather unimpressive Chinese macro data. In fact, the official Chinese Manufacturing PMI improved slightly to 49 for June, from 48.8 previous, though remained in contraction territory for the third straight month. Meanwhile, the gauge for the services sector surpassed consensus estimates and came in at 53.2 for the reported month, though was lower than the 54.5 recorded in May. This, in turn, acts as a headwind for the China-proxy Aussie and caps the AUD/USD pair.

The Australian Dollar (AUD) is further undermined by expectations that the Reserve Bank of Australia (RBA) will refrain from hiking interest rates in July. The bets were lifted by softer domestic data released on Wednesday, which showed that consumer inflation slowed to a 13-month low in May. The US Dollar (USD), on the other hand, stands tall near its highest level since June 13 and remains well supported by the Federal Reserve's (Fed) hawkish outlook. This, along with the upbeat US macro data released on Thursday, reaffirmed market bets for a 25-bps lift-off at the next FOMC meeting on July 25-26.

The prospects for further policy tightening by the US central bank remain supportive of a further rise in the US Treasury bond yields and continue to lend support to the USD. Market participants, however, seem reluctant to place aggressive bets and prefer to wait for the release of the US PCE Price Index, which will play a key role in influencing expectations about the Fed's future rate hike path. This, in turn, will drive the USD demand and provide a fresh directional impetus to the AUD/USD pair. Nevertheless, spot prices remain on track to register losses for the second successive week.

Technical levels to watch

The US Dollar advanced yesterday and has stabilised today. For the Fed, the PCE inflation data today will be one key piece of info. Economists at MUFG Bank how the figures could impact FX market.

Key data still to come

A stronger inflation print would certainly further increase pricing of a 25 bps hike on 26th July although with NFP next week, we would not expect a substantial shift in rate hike expectations. The market is currently priced at about an 85% probability of a 25 bps hike – so there is limited further scope for yields from here in pricing fully a 25 bps hike next month. The FX fallout will likely also be limited given the German inflation data yesterday saw the harmonised rate rebound from 6.3% YoY to 6.8%.

The US Dollar performance is likely to remain more mixed from here consistent with its performance through the first half of the year.

Near-term there are downside risks for EUR/USD but an active ECB and higher core inflation through the summer should provide support.

See – US Core PCE Bank Expectations: Fed preferred inflation measure to make little progress

June was almost a mirror image of May’s price action as EUR/USD recouped the majority of the losses it suffered during the prior month. Economists at Rabobank analyze the pair’s outlook.

Upside for EUR/USD is likely to be capped at this juncture

We expect another 25 bps hike from the ECB in July, but that is largely in the price, and with EUR/USD pushing back up towards the 1.10 handle, we think upside for the pair is likely to be capped at this juncture.

Our forecast is for EUR/USD to trade down through support at the 50-Day Moving Average (DMA) at 1.0875 and the 100-DMA at 1.0816 to an area of heavy price congestion around the 1.07 handle.

Japan Chief Cabinet Secretary, Hirokazu Matsuno, said on Friday, “closely watching FX moves with a high sense of urgency.”