- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- USD/JPY weakens around 153.90 in Tuesday’s early Asian session.

- The Fed will likely keep an interest rate on hold at its July meeting on Wednesday.

- The BoJ is expected to raise rates at its July 31 meeting, according to a Reuters poll of economists.

The USD/JPY pair trades on a weaker note near 153.90 during the early Asian session on Tuesday. The pair trims gains after retreating from 153.35 amid the risk-off mood and rising speculation of a rate hike by the Bank of Japan (BoJ). The BoJ and Federal Reserve (Fed) Interest Rate Decision on Wednesday will take center stage ahead of US employment data on Friday.

The markets don’t expect the US Fed to cut the interest rate at its July meeting this week, but they expected the Fed officials to set the stage for an easing policy at its September meeting. Traders are now pricing in 100% odds of a Fed rate cut by at least a quarter percentage point in September, according to data from the CME FedWatch Tool. The rising bets on the Fed rate cut continue to weigh on the Greenback against the Japanese Yen (JPY) in the near term.

On the other hand, a Reuters poll of economists anticipates the Japanese central bank will raise rates by 10 basis points (bps) to 0.1%. ING noted that the BoJ might lift rates by 15 bps and reduce its bond-buying program simultaneously. OCBC FX strategists said, “The combination of BoJ policy normalization and Fed possibly cutting rate in due course is a case of monetary policy convergence and should underpin USD/JPY downside.”

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

- EUR/USD lost grip of the 1.0850 level, poised for further downside.

- EU GDP data due on Tuesday as Fed rate call looms ahead.

- US NFP jobs data dump slated for Friday as markets bet on September rate cut.

EUR/USD lost control of a near-term bullish recovery, testing into fresh two-week lows near the 1.0800 handle as momentum drains out of the pair ahead of an update to pan-EU Gross Domestic Product (GDP) figures. The Federal Reserve’s (Fed) latest rate call is due on Wednesday, with another round of US Nonfarm Payrolls (NFP) on the books for Friday.

Forex Today: Flash GDPs in Europe and US jobs in the spotlight

A slew of European data is slated for Tuesday, with both German and pan-EU GDP update figures due during the Europe market session. QoQ German GDP is expected to ease to 0.1% in Q2 compared to the previous print of 0.2%, while annualized pan-EU GDP growth is forecast to increase to 0.6% from the previous 0.4%, though the QoQ figure for the second quarter is expected to tick down to 0.2% from the previous 0.3%.

Preliminary EU Harmonized Index of Consumer Prices (HICP) inflation is due on Wednesday, with YoY HICP inflation forecast to tick down to 2.8% from the previous 2.9%. After that, global markets will be pivoting to see the latest outing from the Fed.

The Federal Reserve's upcoming rate call on Wednesday will be closely watched by investors who are hoping for signs that the Fed is gearing up to implement a widely-anticipated rate cut when the Federal Open Market Committee (FOMC) meets again in September. The market is generally expecting a minimum 0.25% rate cut on September 18, with rate markets indicating a 90% likelihood of a 25 basis point reduction and a hopeful 10% chance of a larger cut, according to the CME's FedWatch Tool.

In addition, US Nonfarm Payroll (NFP) data is set to be released on Friday, which is an important factor in the Fed's employment criteria. Investors will be monitoring these figures closely in the hope of seeing a continued slowdown in hiring, which could encourage the Fed to initiate a new cycle of rate cuts in September. ADP Employment Change figures for July will be published on Wednesday, providing a forecast for Friday's NFP jobs report, but this forecast is somewhat unreliable due to its inconsistent track record for accuracy.

EUR/USD technical outlook

Fiber’s downside push into the 1.0800 region sees the pair coming back into range of the 200-day Exponential Moving Average (EMA) at 1.0795 as markets add in to EUR/USD’s near-term decline from multi-month highs that fell just short of breaking through 1.0950.

EUR/USD has fallen 1.3% top-to-bottom as bids backslide into long-term averages, and buyers are struggling to find a foothold as intraday price action battles with the 50-day EMA at 1.0818.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- USD/CAD trades on a flat note near 1.3850 in Tuesday’s early Asian session.

- The Fed is expected to keep rates unchanged at its July meeting on Wednesday.

- Lower crude oil prices and the expectation of more rate cuts by the BoC continue to weigh on the Loonie.

The USD/CAD pair trades flat around 1.3850 during the early Asian session on Tuesday. The Greenback is likely to be supported by the risk-off sentiment. Traders await on the sidelines ahead of the US Federal Reserve (Fed) Interest Rate Decision on Wednesday.

Meanwhile, the USD Index (DXY), which measures the value of the USD versus a basket of global currencies, climbs to the highest level in nearly three weeks above the 104.50 barrier. The Fed monetary policy on Wednesday will be a closely watched event, which is anticipated to keep rates unchanged. Investors are now seeing that the first rate cut will come by mid-September, pricing in 100% of the Fed rate cut by least a quarter-percentage-point by then, according to data from the CME FedWatch Tool.

Fed officials said that they are getting closer to having confidence that inflation is sustainably moving towards its 2% target. However, the central bank will take more cues from the rising unemployment, another sign that cuts may be nearing.

On the Loonie front, the fall in crude oil prices exerts some selling pressure on the commodity-linked Canadian Dollar (CAD). Lower oil prices generally drag the CAD lower as Canada is the leading exporter of Oil to the United States (US). Additionally, the expectation that the Bank of Canada (BoC) will continue to ease policy after its latest interest rate cut last week might further undermine the Loonie. Investors have priced in one more 25 basis points (bps) rate cut this year, with nearly 60% probability that the BoC will cut rates again in its September meeting.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- Fed and BoE both slated to make rate calls this week.

- Fed expected to hold, BoE forecast to cut rates 25 bps.

- US NFP jobs report looms ahead on Friday.

GBP/USD pulled into the midrange on Monday as Cable traders brace for a double-header of rate calls from both the Federal Reserve (Fed) and the Bank of England (BoE) later in the week. The Fed is broadly expected to hold steady on rates one more time on Wednesday, while markets are hoping for a first quarter-point rate cut from the BoE on Thursday.

Forex Today: Flash GDPs in Europe and US jobs in the spotlight

The Fed’s upcoming rate call on Wednesday will be closely watched as investors look for signs that the Fed is on pace to deliver a hotly-anticipated rate cut when the Federal Open Market Comittee (FOMC) convenes again in September. Markets are broadly anticipating at least a quarter-point rate cut on September 18, with rate markets pricing in 90% odds of a 25 bps trim and hopeful 10% bets for a double-cut according to the CME’s FedWatch Tool.

The BoE is broadly expected to deliver a quarter-point rate trim later this week on Thursday, but odds are still up in the air with the Monetary Policy Committee (MPC) forecast to vote 5–to-4 in favor of a 25 bps rate cut. At the BoE’s previous rate meeting, the MPC voted 7-to-2 in favor of keeping rate cuts on hold.

US Nonfarm Payrolls (NFP) are also due on Friday. They are a key component of the Fed’s employment mandate, and investors will be looking for a continued cooling in hiring figures to help push the Fed into a new rate-cutting cycle in September. ADP Employment Change figures for July will be published on Wednesday and will serve as a forecast for Friday’s NFP jobs report, albeit a shaky one with a spotty track record for accuracy.

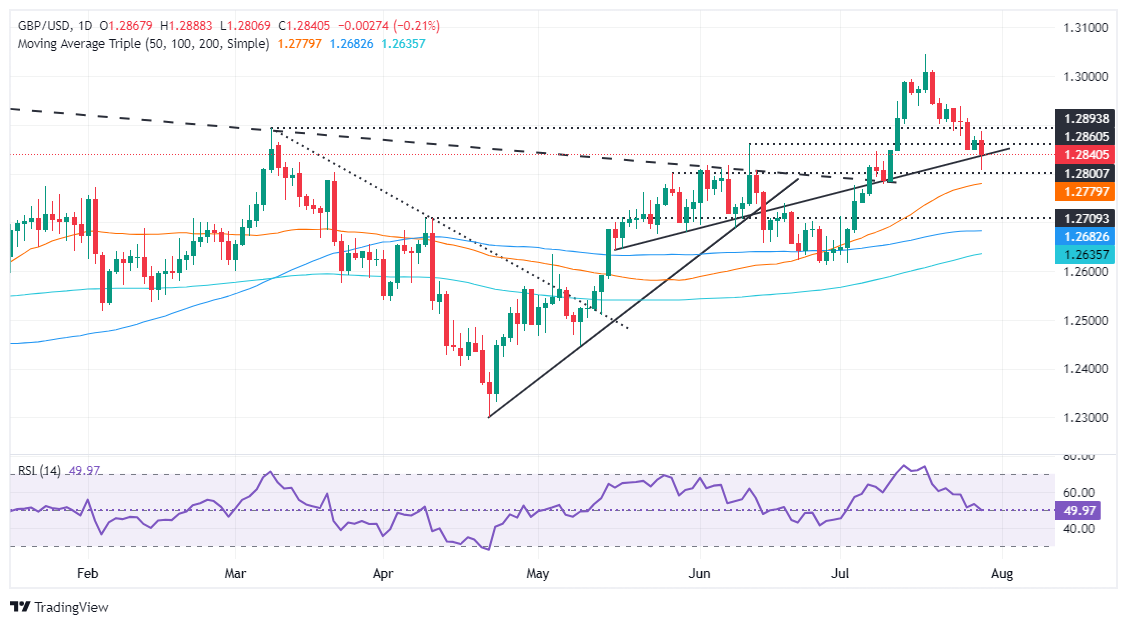

GBP/USD technical outlook

Cable explored the low side on Monday, dipping into a fresh two-week low of 1.2807, but GBP bidders are still not ready to let the pair slip below the 1.2800 handle. The pair is holding north of the 50-day Exponential Moving Average (EMA) at 1.2787, with price action still pinned into the bullish side of the 200-day EMA at 1.2651.

GBP/USD punched in a fresh 12-month high the week before last, but a lack of bullish momentum has dragged bids back down and the pair has pared back -1.82% top-to-bottom. Significant headwinds from the 1.3000 handle are keeping bullish action on the low side, and it won’t take much for sellers to form a cluster and push Cable below the last swing low and challenge the 1.2600 handle.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

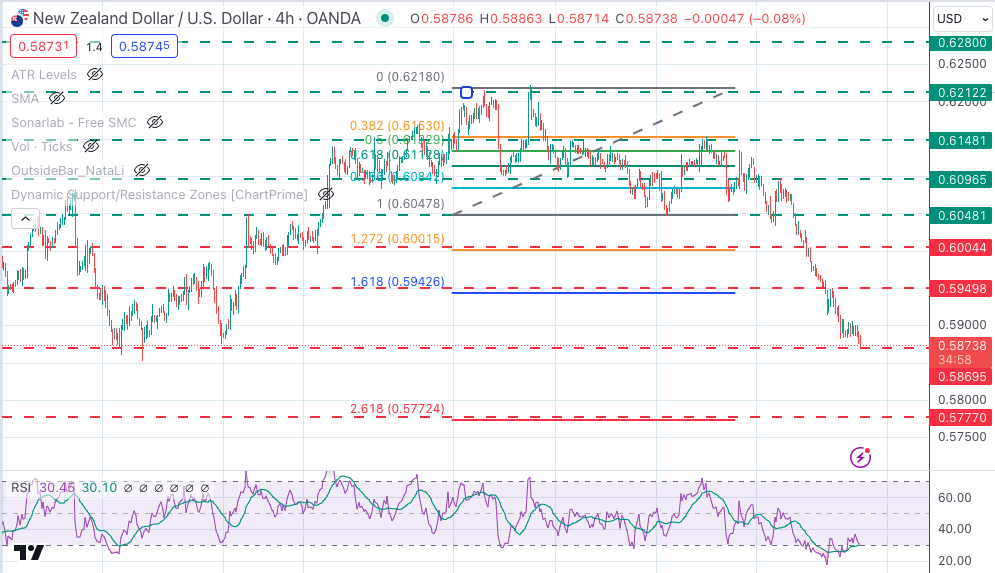

- NZD/USD experiences further losses, slipping to the 0.5875 mark.

- The 0.5880-0.5870 region continues to be a firm support.

- The daily RSI continues deep in oversold terrain, which hints at a looming correction.

In Monday's trading session, the NZD/USD pair slipped further down to 0.5875, tallying a 0.25% decline. This is in hand with a trailing bearish trend, which saw the pair shed more than 4% of its value in July. Traders were bombarded with selling signals last week, especially with the bearish crossover of the 20-day Simple Moving Average (SMA) at 0.6050 with the 100-day SMA but indicators now hint at a possible onset of a consolidation period.

The daily Relative Strength Index (RSI) remains within the oversold domain, currently registering a value of 2r which indicates persistent selling pressure. Furthermore, the Moving Average Convergence Divergence (MACD) continues to print flat red bars, underlining the bearish outlook. Nevertheless, given the recent southward journey of the RSI, there may be a corrective momentum in the making.

NZD/USD daily chart

A significant batch of support remains at the May lows around the 0.5880-0.5870 range. On the other hand, resistance levels were identified at the previous support value of 0.6000, followed by the 0.6050 mark. Should the sellers breach that area, the pair could slip to yearly lows while buyers could use that support to gear up for the next upwards leg.

- Silver prices tumble below 100-DMA at $28.49, trading at $27.86.

- Bearish RSI suggests further declines, with first support at $27.31 and psychological level at $27.00.

- Resistance seen at $29.00, with potential for higher prices if buyers regain control.

Silver prices traded within the 80 cents trading range, yet they lost close to 0.20% on Monday, as traders braced for a busy US economic schedule that would include crucial events such as the Federal Reserve’s monetary policy decision and the latest Nonfarm Payrolls report. The XAG/USD exchanged hands at $27.86, below its opening price.

XAG/USD Price Analysis: Technical outlook

Silver's price tumbled below the 100-day moving average (DMA) at $28.49, opening the door for lower spot prices. Momentum is bearish, as depicted by the Relative Strength Index (RSI), an indication that the non-yielding metal could test lower prices.

The XAG/USD's first support would be the July 29 low of $27.31, followed by the $27.00 psychological level. A breach of the latter will expose the latest cycle low, the May 2 bottom at $26.02, before testing the 200-DMA at $25.89.

Conversely, if buyers moved in and pushed Silver’s price above $29.00, that could pave the way for higher prices. The next resistance would be the July 24 high at $29.44, ahead of $30.00.

XAG/USD Price Action – Daily Chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

- Monday's trading session saw a mild downward deviation in the NZD/JPY.

- Losses materialized in thirteen of the past fourteen sessions, pointing to an intensifying bearish tendency.

- Sellers retain the upper hand, having plummeted beyond the pivotal 200-day SMA.

In Monday's trading session, the NZD/JPY pair slightly declined and dropped to 90.50, marking a continuation of the downward trend. The pair has witnessed losses in thirteen out of the last fourteen sessions, strengthening the bearish trend substantially. Since the beginning of July, the cross has now plunged by over 7%, positioning itself significantly below the vital 200-day Simple Moving Average (SMA).

Despite this seemingly relentless journey south, daily technical indicators deep in oversold territory suggest a potential for a looming side-ways trading period. The Relative Strength Index (RSI) is now at 14, sinking further into oversold territory. Moreover, the Moving Average Convergence Divergence (MACD) continues to print decreasing red bars, indicating that the selling pressure is easing off.

NZD/JPY daily chart

With the pair now below 91.00, bulls will need to defend levels at 90.50, 90.30, and 90.00 to prevent further losses. On the other hand, resistance levels reside at the previous points of 92.15 (200-day SMA), 92.50, and 94.20 (100-day SMA).

- USD/JPY trades with 0.18% gains, consolidating above 154.00 amid bearish momentum.

- Technical outlook shows bearish bias with first support at 154.00 and next at 153.00.

- Resistance seen at 154.74; a climb above could trigger a rally to 155.00 and beyond.

The USD/JPY consolidates at around last week's lows yet trades with minuscule gains of 0.18% amid lower US Treasury yields and a risk-on impulse. The Greenback strengthens due to month-end flows, while the major clings above the 154.00 figure ahead of crucial

USD/JPY Price Analysis: Technical outlook

The USD/JPY pair shifted downward bias once the major breached the Ichimoku Cloud (Kumo) yet remains shy of cracking the latest cycle low of 151.86, the May 3 low.

It is worth noting that momentum is bearish, as depicted by the Relatives Strength Index (RSI), buried near oversold territory.

Given the backdrop, the path of least resistance is downwards. The USD/JPY first support would be 154.00. Once surpassed, the next stop would be the 153.00 mark, followed by the July 25 low at 151.93, ahead of 151.86. Once those levels are cleared, the next demand zone would be an upslope support trendline drawn from the beginning of 2023 that passes at around 149.00-150.00.

Conversely, if USD/JPY climbs above last Friday’s peak of 154.74, that will exacerbate a rally to 155.00. Further gains lie overhead, at around the Tenkan-Sen at 155.27.

USD/JPY Price Action – Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.33% | 0.06% | 0.20% | 0.15% | -0.03% | 0.23% | 0.28% | |

| EUR | -0.33% | -0.31% | -0.13% | -0.16% | -0.32% | -0.12% | -0.03% | |

| GBP | -0.06% | 0.31% | 0.14% | 0.13% | -0.01% | 0.21% | 0.28% | |

| JPY | -0.20% | 0.13% | -0.14% | -0.08% | -0.21% | 0.04% | 0.12% | |

| CAD | -0.15% | 0.16% | -0.13% | 0.08% | -0.15% | 0.03% | 0.16% | |

| AUD | 0.03% | 0.32% | 0.00% | 0.21% | 0.15% | 0.24% | 0.29% | |

| NZD | -0.23% | 0.12% | -0.21% | -0.04% | -0.03% | -0.24% | 0.07% | |

| CHF | -0.28% | 0.03% | -0.28% | -0.12% | -0.16% | -0.29% | -0.07% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

- AUD/JPY pair continues a steady ascent in Monday's session, settling at 100.85, yet still displays a losing pattern over several weeks.

- Despite a minor upward correction, the medium-term bearish trend persists as the pair sheds above 7% in July.

- The 200-day SMA near 100.00 remains a critical support level to ward off added losses.

During Monday's trading, the AUD/JPY pair recorded a minor gain of 0.15%, landing at 100.85. However, sellers are still in control, as the pair concluded last Friday with a 4.30% loss for the week, reaffirming the bearish bias. Although there is a mild upward correction taking place, the bears seem to be taking a breather, suggesting potential sideways trade unless a key fundamental catalyst comes into play.

The daily Relative Strength Index (RSI) appears to be losing momentum, yet it remains securely in the oversold territory, indicating a continued possibility of a corrective move. Concurrently, the Moving Average Convergence Divergence (MACD) continues to exhibit red bars, signifying a persistent selling activity despite the slight decrease in intensity.

AUD/JPY daily chart

Next, the pair needs to establish a firm base at the 200-day SMA found at 100.00—this remains a vital support level. On the downside, traders must keep an eye on levels around 99.50 and 99.30. For potential recovery, buyers should target surpassing the immediate resistance at 101.00 and then aim at the 102.70 point where the 100-day SMA converges, as these could help offset any potential losses.

- Gold price drops from daily high of $2,403 to $2,377 as Greenback gains 0.20%.

- High retail prices dampen gold demand in Asia; China's economic concerns persist.

- Investors eye FOMC decision, JOLTS report, ADP data, and key US economic indicators this week.

Gold price dropped on Monday as the Greenback advances some 0.20% as investors brace for the Federal Open Market Committee (FOMC) monetary policy decision, which starts on July 30 and ends the next day, with the statement release and Federal Reserve Chair Jerome Powell's press conference. The XAU/USD trades at $2,377 after hitting a daily high of $2,403.

Wall Street depicts a slightly upbeat market sentiment, and a strong US Dollar keeps bullion prices pressured. Reports that Gold consumer demand in Asia was hampered due to high retail prices and China’s economic growth woes.

Meanwhile, geopolitical risks capped the golden metal losses after Hezbollah’s rocket strike on Israel, which threatens to escalate the conflict in the Middle East.

In addition, traders are eyeing the release of crucial economic data from the US. Investors are eyeing the release of the JOLTS Job Openings report, followed by ADP Employment Change data and the FOMC’s decision.

The Federal Reserve is expected to hold rates unchanged, yet market participants expect the US central bank to lay the groundwork for the beginning of the easing cycle. Traders had priced in a 100% chance for a quarter of a percentage interest rate cut at the September meeting via data from the CME FedWatch Tool.

Forex.com's market analyst Fawad Razaqzada wrote, "If the Fed confirms a dovish stance, predictions could escalate to potentially three cuts before the end of the year.”

In addition to the abovementioned data, the docket will finish the week with the release of the Institute for Supply Management (ISM) Manufacturing PMI and the Nonfarm Payrolls report, both July figures.

Daily digest market movers: Gold price depressed and might test 50-day SMA

- Last week’s US inflation data indicated continued progress towards the 2% target; however, inflation appears stickier than anticipated, as June's Core PCE figures exceeded estimates for both monthly and yearly numbers.

- Alongside the Fed’s decision, two other major central banks would feature monetary policy decisions: the Bank of Japan and the Bank of England.

- The BoJ, the outlier of the major G7 central banks, is widely expected to raise rates by 15 basis points at the upcoming monetary policy meeting.

- The BoE is foreseen to begin its easing cycle on August 1.

- Data by the Chicago Board of Trade (CBOT) shows that traders are pricing in 54 basis points (bps) of easing towards the end of the year, as shown by the December 2024 fed funds rate futures contract.

Technical analysis: Gold price retreats below $2,400

Gold price is upward biased, and despite forming a ‘bullish harami’, buyers failed to decisively clear the $2,400 figure, which exacerbated a drop toward the current spot price. Momentum depicts buyers taking a breather, as shown by the Relative Strength Index (RSI).

The XAU/USD is consolidating at around $2,370-$2,380, with little direction as traders prepare for the Fed’s meeting.

If XAU/USD buyers reclaim $2,400, that could push prices above the psychological $2,450 area. A breach of the latter will expose the all-time high (ATH) at around $2,483, followed by the $2,500 mark.

On the flip side, if XAU/USD continues to edge lower and drop below the 50-day moving average (DMA) at $2,358, further losses are on the cards. The next support would be the July 25 daily low of $2,353. Once those levels are removed, the 100-DMA would be up next at $2,326, ahead of diving to the $2,300 mark.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- GBP/JPY gets comfortable near 198.00 as Guppy traders wait for a reason to move.

- BoJ and BoE rate calls due this week, UK rate cut expected.

- JPY traders on the lookout for signs of a shift from BoJ, confirmation of “Yenterventions”.

GBP/JPY is in the process of drawing a second straight spinning top daily candle on Monday as Guppy traders await signals to move in either direction with rate decisions from both the Bank of Japan (BoJ) and the Bank of England (BoE) on the books for this week.

The BoE is broadly expected to deliver a quarter-point rate trim later this week on Thursday, but odds are still up in the air with the Monetary Policy Committee (MPC) forecast to vote 5–to-4 in favor of a 25 bps rate cut. At the BoE’s previous rate meeting, the MPC voted 7-to-2 in favor of keeping rate cuts on hold.

The BoJ is also due for a rate call this week and slated for the early Wednesday market session, but markets have broadly lower expectations for the Japanese central bank. The BoJ remains bound and determined to keep Japanese interest rates at or near zero until they figure out a way to spark healthy, long-run inflation near 2%, and steadily declining Japanese inflation figures are keeping rate hikes at bay even as headline inflation figures continue to run above the 2% target.

Market participants will also be looking for official confirmation from BoJ officials that the Japanese central bank stepped directly into foreign currency markets to defend the beleaguered Yen, which was abruptly bolstered in several sessions in recent weeks.

GBP/JPY technical outlook

The Guppy is set to price in a second straight spinning top daily candle as investors await changes in the rate differential between the Pound Sterling and the Yen. GBP/JPY bottomed out near the 196.00 handle after a series of suspected “Yenterventions” dragged the pair down nearly 6% from 16-year highs at 208.11.

The Guppy is still trading in bull territory north of the 200-day Exponential Moving Average (EMA) at 192.71, but buyers will have to work hard to push bids back above the 50-day EMA at 201.00.

GBP/JPY daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- Aussie kicks off the week on soft note ahead of key data.

- Retail Sales and Inflation figures will guide market expectations.

- Economic concerns over China limit the Aussie’s upside.

The AUD saw a further decline against the USD on Monday as AUD/USD fell to 0.6545. Despite the expectations of a future rate hike by the Reserve Bank of Australia (RBA), issues with the local economy and Chinese economic woes persist, preventing any significant upward movement.

As the Australian economy shows signs of weakness, the persistent high inflation has prompted the Reserve Bank of Australia (RBA) to delay rate cuts. As per the current forecasts, the RBA stands to be among the last G10 nations to introduce a rate cut, potentially extending the gains of the AUD, but the economic concerns also push the currency down.

Daily digest market movers: Aussie looks weak ahead of Inflation and Retail Sales data

- The risk-off sentiment continues to dominate with Australia's economic climate being influenced by concerns over Chinese economic stress.

- This week, investors will be eyeing Australian June Q2 CPI data, due to be released on Wednesday.

- For Q2, the headline CPI is expected to match Q1's rise of 1.0% QoQ and accelerate to 3.8% YoY from 3.6% in Q1. Meanwhile, the June headline CPI is anticipated to fall to 3.8% YoY.

- With the inflation rate still above the 2-3% target range, the RBA is unlikely to rush toward a policy change. The swaps market predicts stability for the rest of the year with the first significant 25 bps cut expected next summer.

- Tuesday will also see Q2's Retail sales data release. Retail Sales volume is expected to show a less severe decline of 0.2% QoQ in Q2, compared to 0.4% in Q1.

AUD/USD Technical analysis: Bearish outlook underpins, the pair lies below major SMAs

The AUD/USD's movement below the 20,100 and 200-day Simple Moving Averages (SMAs) signals concern, indicating a probable persistence of the downward trend. In July, the pair recorded an extensive nine-day losing streak and fell nearly 3.50%.

Indicator signals are deeply entrenched in the negative, but the oversold scenario may stimulate a correction. However, the bulls' momentum remains weak, and technicals suggest a sideways trade period rather than an upsurge, barring any fundamental catalysts.

Key support levels line up at 0.6530 and 0.6500, while resistance levels lie at 0.6600 (200-day SMA), 0.6610 and 0.6630.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

The persistent risk-off sentiment propelled the Greenback to multi-day highs on Monday, while investors have started to warm up ahead of key central bank events and crucial US data releases.

Here is what you need to know on Tuesday, July 30:

The USD Index (DXY) regained upside traction and rose to multi-day peaks near 104.80 amidst diminishing US yields. The Consumer Confidence gauged by the Conference Board takes centre stage on July 30 along the June JOLTs Job Openings, the FHFA’s House Price Index, and the weekly report on US crude oil inventories by the API.

EUR/USD came under renewed downside pressure and put the 1.0800 support to the test amidst the marked rebound in the Greenback. Germany’s advanced Inflation Rate is expected on July 30 seconded by preliminary Q2 GDP Growth Rate in Germany and the broader Euroland.

GBP/USD traded in an inconclusive fashion and ended Monday’s session barely changed near 1.2860. The next risk event on the UK docket will be the BoE interest rate decision on August 1.

Fresh selling pressure in the Japanese yen propped up the rebound in USD/JPY beyond the 154.00 barrier. Japan’s Unemployment Rate will be published on July 30.

AUD/USD resumed its decline and rapidly left behind Friday’s bullish attempt. On July 30, advanced Building Permits are only due in Australia.

Prices of WTI accelerated their downward trend and reached fresh seven-week lows near the $75.00 mark per barrel.

The Dollar’s rebound kept Gold prices depressed near $2,380 per ounce troy on Monday. Silver followed suit and retreated to two-month lows near $27.30 per ounce.

- Dow Jones churns chart paper as investors jostle for position ahead of Fed.

- Fed set to hold rates steady this week, markets on the lookout for forward guidance.

- Investors have fully priced in a rate trim in September.

The Dow Jones Industrial Average (DJIA) spun in circles on Monday, churning around 40,600.00 as investors buckle down for the wait to the Federal Reserve’s (Fed) latest rate call. The Fed is broadly expected to hold rates steady on Wednesday, but markets will be keeping an eye out for any adjustments to forward guidance ahead of the key September rate call.

The Fed’s upcoming rate call on Wednesday will be closely watched as investors look for signs that the Fed is on pace to deliver a hotly-anticipated rate cut when the Federal Open Market Comittee (FOMC) convenes again in September. Markets are broadly anticipating at least a quarter-point rate cut on September 18, with rate markets pricing in 90% odds of a 25 bps trim and hopeful 10% bets for a double-cut according to the CME’s FedWatch Tool.

US Nonfarm Payrolls (NFP) are also due on Friday, a key component of the Fed’s employment mandate and investors will be looking for a continued cooling in hiring figures to help keep pushing the Fed into a new rate-cutting cycle in September. ADP Employment Change figures for July will be published on Wednesday, and will serve as a forecast for Friday’s NFP jobs report, albeit a shaky one with a spotty track record for accuracy.

Dow Jones news

The Dow Jones is stuck in the midrange amid quiet Monday trading, with roughly half of the index in the green for the day and the other half easing into the low end. McDonald’s Inc. (MCD) reported a miss in quarterly revenue and earnings per share, but the stock rallied 4.4% and rose above $263.00 per share as the company vows to make more efforts to engage in competition by taking a “forensic look” at pricing options and expects per-restaurant traffic to increase with the addition of value offerings.

Dow Jones technical outlook

The Dow Jones is holding steady near the 40,600.00 handle on Monday, cycling in a tight range for the day as investors grapple with keeping a near-term recovery on-balance. The DJIA briefly tumbled below the 40,000.00 major price handle last week after US markets pulled back from record highs.

The Dow Jones dug in its heels to put in a fresh near-term bottom near 37.395.00, but is still trading on the low side of recent record highs set at 41,371.38. Long-term momentum still leans firmly into the bullish side as the Dow Jones trades well above the 200-day Exponential Moving Average (EMA) at 38,011.80.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- Mexican Peso falls to seven-week low as trade deficit hits worst level since August 2020.

- INEGI data shows Mexican exports and imports plunged, with exports contracting 5.7% YoY.

- Upcoming US economic reports and FOMC decision expected to keep USD/MXN rally alive.

The Mexican Peso depreciated sharply as the week began after data revealed Mexico’s Balance of Trade deficit widened — its worst reading since August 2020, according to data revealed by the Instituto Nacional de Estadistica, Geografia e Informatica (INEGI). This, along with the strength of the US Dollar, keeps the USD/MXN trading at 18.67, gaining more than 1.20%.

INEGI revealed that Mexico’s Exports and Imports plunged, though the former contracted -5.7% YoY, the steepest drop in 46 months. The data weighed on the Mexican Peso, which weakened to a seven-week low as the USD/MXN accelerates toward testing the year-to-date (YTD) high of 18.99.

The US economic docket will be busy. Market participants prepare for the Federal Open Market Committee (FOMC) monetary policy decision, the release of the Institute for Supply Management (ISM) Manufacturing PMI, and the Nonfarm Payrolls (NFP) report, both figures for August and July, respectively.

This and month-end flows favoring the Greenback will likely keep the USD/MXN exotic pair upwardly pressured. Although the FOMC is expected to hold rates unchanged and lay the ground for the Federal Reserve's (Fed) first interest rate cut, investors underpinned the buck ahead of the decision.

MUFG Bank wrote in a note, “The unwind of high-yielding Latam FX carry trades over the past week has also been triggered by more risk-off trading conditions.” Wall Street confirmed this, with most US equity indices retreating from all-time highs, while safe-haven currencies like the Japanese Yen, the Swiss Franc and the Greenback advanced.

Daily digest market movers: Mexican Peso undermined by wider deficit

- Mexico’s Balance of Trade in June was $-1.073 billion, missing the consensus of $1 billion.

- According to Citi Research, analysts now estimate that annual inflation will end at 4.30%, up from the previous forecast of 4.20%, with core inflation expected to finish 2024 at 4.0%. Mexico's economic growth is projected to slow with an expected growth rate of 1.9%, down from 2.0% in the last poll.

- Last week’s US inflation data suggested that progress toward lowering it to 2% continues, yet it seems stickier than expected after June’s Core PCE figures were above estimates in monthly and yearly figures.

- USD/MXN traders are awaiting the release of JOLTs Job Openings for June, ahead of the ADP Employment Change and FOMC’s decision on Wednesday.

- Data by the Chicago Board of Trade (CBOT) shows that traders are pricing in 54 basis points (bps) of easing toward the end of the year, as shown by the December 2024 fed funds rate futures contract.

Technical analysis: Mexican Peso extends losses as USD/MXN closes to 18.70

The uptrend continues, as shown by the USD/MXN hitting the 18.70 mark due to month-end flows and risk-aversion, which has undermined high-yielding currencies like the Peso. Momentum is bullish, confirmed by the Relative Strength Index (RSI) reading above the 50-neutral line.

If bulls challenge the YTD high at 18.99, that could open the door to test 19.00. Once surpassed, the next resistance would be the March 20, 2023, peak at 19.23 before challenging 19.50.

Conversely, if USD/MXN retreats beneath 18.00, that would pave the way to challenge the 50-day Simple Moving Average (SMA) at 17.89, the first support level. The next support would be the latest cycle low of 17.58; the July 12 high turned support. A breach of the latter will expose the January 23 peak at 17.38.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- US Dollar displays strength ahead of Wednesday Fed decision and labor market data

- Fed is expected to remain data-dependant but leave door open for September cut

- Markets are extremely confident about a September cut of 25 bps

The US Dollar represented by the DXY index charged forward on Monday despite looming uncertainties. The market remains on edge with September's potential rate cut by the Federal Reserve (Fed) somewhat uncertain, but optimism surrounding the US economy's strength is tempering anxieties. The Fed decision on Wednesday and labor market data will guide markets this week.

There is growing evidence of disinflation in the current US economic landscape, which solidifies the market's belief in a prospective rate cut in September. However, the broader economy demonstrates strength, as is made evident by recent data surprises like the Q2 Gross Domestic Product (GDP) and July S&P Global PMIs, which might give the Fed reasons not to rush a rate cut.

Daily digest market movers: US Dollar firms ahead of July labor data and FOMC meeting

- Two-day FOMC meeting concludes on Wednesday with a plausible commitment to unchanged rates

- Market players recognize the solid performance of the US economy warrants no immediate action by the Fed, but September FOMC meeting is predicted to bring a potential rate cut into the spotlight

- Chair Powell's press conference has the potential to sway markets, but his precedent of focusing on labor market uncertainty is likely to continue

- In that sense, labor market data to be released throughout the week will guide market bets regarding the September decision

DXY technical outlook: Bearish signs stall as index inches toward 20-day SMA

Pushing past initial signs of struggle, DXY Index is now rebounding from 200-day Simple Moving Average (SMA). The 20-day SMA is now viewed as the next target. However, key indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), though still in the red, are inching toward positive terrain.

Continued support is noted at 104.30 and 104.15 levels, while resistances are observed at 104.60 and 104.80 levels.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- The Canadian Dollar eased against key counter-currencies to start the new week.

- Canada is sparsely represented on the economic calendar this week.

- Mid-tier Canadian data leaves the CAD at the mercy of key central bank appearances.

The Canadian Dollar (CAD) softened on Monday, falling behind an uptick in the Greenback as investors jostle for position ahead of the Federal Reserve’s (Fed) upcoming rate call later in the week. The CAD is under-represented on the economic calendar this week, and a hefty batch of central bank appearances through the midweek will leave the Canadian Dollar at the mercy of broader market flows.

With a lean economic data docket on the cards, CAD traders will be looking ahead to Wednesday’s Canadian Gross Domestic Product (GDP) for the month of May, expected to ease to 0.1% MoM from April’s 0.3% as Canada’s economy continues to slow. S&P Global Canadian Manufacturing Purchasing Managers Index (PMI) figures for June are slated for Thursday, which have consistently printed in contraction territory below 50.0 since May of 2023.

Daily digest market movers: Canadian Dollar takes a backseat to central bank expectations

- The Canadian Dollar is on pace to shed weight against the US Dollar for a ninth consecutive session, and has declined against the Greenback for all but one of the last 13 straight trading days.

- After the Bank of Canada (BoC) delivered another quarter-point rate trim last week, CAD traders are immediately pivoting to focus on the odds of yet another rate cut from the BoC in September, with odds currently priced in at roughly even.

- The US Federal Reserve will be the market mover this week as markets clamor for a 25-basis-point rate cut in the near future.

- The Fed is fully priced in as a hold on rates this week, but traders will be looking for verbal cues from Fed Chairman Jerome Powell regarding September’s rate call.

- According to the CME’s FedWatch Tool, rate traders have fully priced in 100% odds of at least a quarter-point cut when the Federal Open Market Committee gathers on September 18.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.37% | 0.15% | 0.18% | 0.18% | 0.16% | 0.37% | 0.29% | |

| EUR | -0.37% | -0.26% | -0.18% | -0.17% | -0.17% | -0.02% | -0.06% | |

| GBP | -0.15% | 0.26% | 0.04% | 0.05% | 0.09% | 0.25% | 0.19% | |

| JPY | -0.18% | 0.18% | -0.04% | -0.03% | 0.00% | 0.19% | 0.14% | |

| CAD | -0.18% | 0.17% | -0.05% | 0.03% | 0.02% | 0.17% | 0.13% | |

| AUD | -0.16% | 0.17% | -0.09% | -0.00% | -0.02% | 0.18% | 0.10% | |

| NZD | -0.37% | 0.02% | -0.25% | -0.19% | -0.17% | -0.18% | -0.06% | |

| CHF | -0.29% | 0.06% | -0.19% | -0.14% | -0.13% | -0.10% | 0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Technical analysis: Another day, another green candle for USD/CAD

The Canadian Dollar (CAD) gave a lopsided performance on Monday as traders look elsewhere for inspiration. The CAD fell back roughly one-fifth of one percent against the Greenback, while backsliding one-third of one percent against the recovering Japanese Yen. Gains remain thin, with the CAD rising a scant one-sixth of one percent against the Euro and the New Zealand Dollar.

USD/CAD continues to march up the charts, chalking in a ninth straight gain as the Canadian Dollar slides against the Greenback. The pair has risen 2% since hitting a near-term low of 1.3589, sparking a rally after a technical rejection from the 200-day Exponential Moving Average (EMA).

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Recent decline in USD/JPY shows tentative signs of taking a pause but the decline has also seen a recoupling of USD/JPY back to UST-JGB yield differentials, OCBC FX strategists Frances Cheung and Christopher Wong note.

USD/JPY trades bearishly towards the 153.66 support

“During the period of May - Jul, USD/JPY has gone one way higher while UST-JGB yield differentials narrowed – a decoupling of its traditionally positive correlation – which was unusual. The recent sharp decline in USD/JPY has somewhat reset that anomaly. And if we do expect USD/JPY to play catchup to the historical correlation with UST-JGB yield differentials, then USDJPY may still have room to trade lower.”

“The combination of BoJ policy normalization and Fed possibly cutting rate in due course is a case of monetary policy convergence and should underpin USD/JPY downside. The risk is that BoJ fails to live up to expectations and USDJPY risks a sharp correction upwards. Bearish momentum on daily chart intact while RSI fell into near oversold conditions.”

Cautious of rebound risks for USDJPY from oversold conditions but at the same time, JPY shorts remain at record and uncertainty may see continued unwinding of stretched short position in JPY. Bias to fade rallies. Resistance at 155.50 (100 DMA), 156.80 (76.4% fibo). Support at 153.66 (61.8% fibo retracement of 2024 low to high), 151.60 (200DMA) and 151.10 (50% fibo).

DXY started the week on a softer footing as risk sentiments held up for Asian equities, OCBC FX strategists Frances Cheung and Christopher Wong note.

Closing in on the 104.80 resistance

“Focus this week on JOLTS report (Tue), ADP employment (Wed), FOMC (Thu 2am SGT), ISM mfg (Thu) and payrolls report (Fri). Markets will keep a look out on whether the tightness in labour markets continue to ease and on FOMC, what the guidance may be. Markets expect the Fed to lay the groundwork for a Sep cut especially with data coming in softer and Fed’s rhetoric turning less hawkish.”

“The US Dollar (USD) bears would face disappointment if Fed restraints dovish guidance. That said, the bigger driver for USD would be on payrolls report and the next few inflation readings – to get a sense of the possible extent of rate cuts. Another surprise for the USD would be an unexpected Fed cut at the upcoming FOMC.”

“Bearish momentum on daily chart faded but RSI shows signs of turning lower. Bearish crossover observed earlier as 21 DMA cuts 50, 100 DMAs to the downside. Support at 103.98 (50% fibo), 103.65 (recent low) and 103.20 (38.2% fibo). Resistance at 104.80/90 (61.8% fibo retracement of Oct high to 2024 low, 21, 50, 100 DMAs), 105.40 levels.”

USD/JPY plunged from 162 to 152 in the fortnight to July 25. The sell-off was triggered by the third decline in US CPI inflation fuelling bets for a Fed cut in September, suspected currency interventions from the Bank of Japan, and US Republican presidential candidate Donald Trump’s decrying of the JPY’s massive weakness, DBS senior FX strategist Philip Wee notes.

JPY carry trade continues to unwind

“Japan sees an opportunity to reverse the JPY’s weak fortunes at this week’s BOJ-FOMC meetings on July 31. The Liberal Democratic Party believes that the JPY’s multi-decade lows sank the Kishida Cabinet’s approval ratings by adding to the consumers’ cost of living crisis and hurting small and midsize companies via higher raw and energy prices.”

“Over the weekend, Japan successfully pushed for the G20 joint communique to include the commitment against excessive foreign exchange volatility. Given the potential for a dovish Fed tilt, the BOJ will need to heed the call by LDP Secretary-General Toshimitsu Motegi for an unequivocal resolve to normalize monetary policy.”

“We see the BOJ halving its monthly JGB purchases to JPY 3 trillion but markets want the BOJ to hike rates a second time this year.”

The DXY Index was volatile last week, trading in a tight 104.1-104.6 range, due to conflicting currency market themes, DBS senior FX strategist Philip Wee notes.

Fed to keep the door open to lower interest rates

“Despite the futures market pricing a more than 100% chance for a Fed cut in September, the USD’s outlook was obscured by the twists and turns in the US Presidential Elections and the unwinding of JPY carry trades. Additionally, the JPY and the CHF became havens amid a sell-off in tech stocks.”

“At its FOMC meeting on July 30-31, the Fed should keep the door open to lower interest rates but avoid endorsing the market’s bet for a September cut. The guidance on the timing will likely come at the Kansas City Fed’s Jackson Hole Symposium on August 24-26, following the US unemployment rate data on August 2 and the CPI data on August 14.”

The Pound Sterling (GBP) edged lower in Asian trade but steadied and recovered somewhat in European dealing, Scotiabank’s chief FX strategist Shaun Osborne notes.

GBP/USD is steadying around the low 1.28 area

“UK data reports earlier reflected more or less as expected lending and mortgage approvals but the CBI’s (volatile) retail survey data looked soft for July. Swaps are pricing in marginally more risk of a rate cut this week (14bps) than last week (when pricing indicated 10-11bps of easing risk factored in).”

“GBP’s drift from the mid-July peak above 1.30 suggests some rate cut potential may already be factored in to spot.”

“Spot retains a soft undertone but losses may be steadying around the low 1.28 area (50% retracement support from the June/July rally). Regaining 1.29 intraday would be a positive but it is possible that the soft undertone will persist for another few days and perhaps extend to 1.2775 or so before steadying.”

The Euro (EUR) is tracking a little weaker on the session but losses are limited and Euro (EUR) dips to the low 1.08 area remain well-supported, Scotiabank’s chief FX strategist Shaun Osborne notes.

Loss of support in the low 1.08s is likely

“More range trading seems likely in the near-term. While markets are mainly focused on central bank developments elsewhere this week, key Eurozone data prints—GDP, inflation—may provide some insight into the ECB policy outlook and influence spot movement to some degree.”

“Flat trading over the past four sessions for the EUR has defined a clear range trade between 1.0825 support and 1.070/75 resistance. The lower end of the range is bolstered by a gently rising 200-day MA at 1.0820.”

“Loss of support in the low 1.08s would suggest more weakness to the 1.0725/75 range in the short run. Intraday trend momentum is bearish but the daily and weekly studies remain bullishly-aligned which should help prop up the lower end of the trading range for a bit longer at least.”

- GBP/USD retreats 1.70% from YTD high of 1.3043, trading at 1.2826.

- Technical outlook shows bearish momentum, with key support at 1.2800 and potential further losses to 1.2612-1.2622 area.

- Buyers need to push past 1.2893 to challenge 1.2900 and higher resistance levels.

The GBP/USD begins the week on the back foot ahead of the Bank of England’s monetary policy decision on August 1. Market participants seem convinced that the BoE would cut interest rates, yet the odds are around 59%. The pair trades at 1.2826, down 0.28%

GBP/USD Price Analysis: Technical outlook

The GBP/USD extended its losses after hitting a year-to-date (YTD) high of 1.3043, retreating some 1.70%, clearing some support levels. However, further losses beneath 1.2800 could drive the price toward the confluence of the June 27 cycle low and the 200-day moving average (DMA) at around the 1.2612-1.2622 area.

Momentum shows sellers are in charge, as depicted in the Relative Strength Index (RSI), turning bearish, with a downward slope and under the 50-neutral line.

Therefore, the first support for GBP/USD would be the 1.2800 mark, followed by the 50-DMA at 1.2778. Once cleared, the next stop would be the 100-DMA at 1.2681, followed by the aforementioned area.

Conversely, if buyers moved in and pushed the exchange rate past the March 8 peak at 1.2893, that could pave the way to challenge 1.2900 and higher prices.

GBP/USD Price Action – Daily Chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.