- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- The S&P 500 rose on Thursday alongside the other major US indices as equities recover from recent losses.

- Equities have struggled in September, and the month is set to be the worst-performing of the year for stocks.

- Upcoming US PCE inflation figures could see volatility jump as equity traders fear Fed moves.

The Standard & Poor's (S&P) 500 major equity index eked out a reasonable gain on Thursday, closing up almost 0.60% just shy of $4,300.00.

The Dow Jones Industrial Average (DJIA) also finished in the green, up 116 points on Thursday to end the day at $33,666.34 (0.35%); The Nasdaq Composite also beat the bids on Thursday, climbing over 0.80% to close at $13,201.28.

A recovery in US equities was a welcome change of pace for investors on Thursday; the S&P has dropped rapidly in recent weeks, and is currently down over 5.0% from September's highs near $4,540.00.

September is on pace to be the year's single worst-performing month for equities, with the majority of indexes broadly off of the summer highs.

Overboiling selling pressure eased off on Thursday alongside a reprieve for US Treasury yields, giving equities a chance to rebound heading into Friday's bumper US Personal Consumption Expenditure (PCE) Price Index data release.

On the docket: US PCE inflation measure to close out trading week

Recession worries and investors rattled by a possible US government shutdown over partisan grandstanding have weighed heavily on equities. US yields initially hit a fresh 15-year high on Thursday after US data showed better-than-expected Initial Jobless Claims.

US PCE inflation is broadly expected to hold steady at 0.2% for the month of August.

S&P 500 technical outlook

The S&P 500 has fallen away from the 34-day Exponential Moving Average (EMA) in the last few weeks' fast drop from the month's peak near $4,540.00. The 200-day Simple Moving Average (SMA) is sitting just north of the $4,200.00 level.

Despite Thursday's rebound, the S&P is still in the red for the week which started near $4,325.00, and markets will be looking to firm up a bullish rally into the year's top at $4,600.00.

On the short side, there's little in the way of technical support beyond the 200-day SMA, and the bottom opens up towards the last major swing low at March's bottom at the $3,800.00 handle.

S&P 500 daily chart

S&P 500 technical levels

According to the latest data published by the Statistics Bureau of Japan, the headline Tokyo Consumer Price Index (CPI) for September eased to 2.8%% YoY from 2.9% in the previous reading. Meanwhile, the Tokyo CPI ex Fresh Food, Energy came in at 3.8% YoY from 4.0% in August.

Additionally, Tokyo CPI ex Fresh Food eased from 2.8% to 2.5% for the said month compared to analysts’ estimations of 2.6%.

Market reaction

As of writing, the USD/JPY pair was down 0.01% on the day at 149.29.

About Tokyo Consumer Price Index (CPI)

The Tokyo Consumer Price Index is released by the Statistics Bureau and it's a measure of price movements obtained by comparison of the retail prices of a representative shopping basket of goods and services. The index captures inflation in Tokyo. CPI is the most significant way to measure changes in purchasing trends. The purchase power of JPY is dragged down by inflation. Generally a high reading is seen as positive.

Federal Reserve Bank of Richmond President Thomas Barkin stated earlier on Friday that the Fed holding steady at the September FOMC meeting was appropriate

Key quotes

“Fed holding steady at the September FOMC meeting was appropriate”

“Fed has time to see data before deciding what’s next for rates”

“The path forward depends on what happens with inflation”

“Will be watching the job market closely for clues”

“Cautions against reading too much into Federal Reserve forecasts”

“The job market has remained very healthy”

“Not sure how the economy will perform over coming months”

“There is still a lot of uncertainty about how the Fed's balance sheet influences the economy”

Market reaction

The US Dollar stays on the back foot after this comment, As of writing, the US Dollar Index was unchanged on the day at 106.14.

- AUD/USD recovers its recent losses around 0.6428 amid the weakening of the US Dollar.

- US real Gross Domestic Product (GDP) grew at an annual rate of 2.1% in Q2, as expected.

- Australian Retail Sales rose 0.2% in August MoM vs. the 0.3% rise expected.

- Market players await the US Core Personal Consumption Expenditure Price Index report.

The AUD/USD pair recovers some lost ground and consolidates near 0.6428 during the early Asian session on Friday. The rebound of the pair is supported by a correction of the US Dollar (USD) and lower US Treasury yields. Meanwhile, the US Dollar Index (DXY) edges lower to 106.10 after retreating from 106.83, the highest since November.

Data released on Thursday revealed that the US real Gross Domestic Product (GDP) expanded at an annual rate of 2.1% in the second quarter, as expected. Additionally, Initial unemployment claims rose from 202,000 to 204,000, below the 215, 000 anticipated. The pending home sales fell 7.1% MoM in August, compared to estimates for a 1.0% drop MoM.

Chicago Federal Reserve (Fed) President Austan Goolsbee said on Thursday that the Fed will return inflation to target and has a chance to do something rare by accomplishing that without a recession. Richmond Fed President Thomas Barkin remarked that the past five months of inflation data have been upbeat but that it is too early to determine what monetary policy would be next. Barkin added that lost data due to the government shutdown would complicate understanding the economy. Investors will assess the narrative of a higher for longer rate in the US against the growth risks posed by the possibility of an imminent US government shutdown. This, in turn, might cap the upside of the Greenback.

On the other hand, data published by the Australian Bureau of Statistics (ABS) on Thursday showed that the nation’s Retail Sales rose 0.2% in August on a monthly basis from a 0.5% increase in July, below the market consensus of 0.3% rise. The softer-than-expected Retail Sales data in August might convince the Reserve Bank of Australia (RBA) to hold the interest rate next week.

Looking ahead, the Australian Private Sector Credit will be due later on Friday. However, market players will closely watch the US Core Personal Consumption Expenditure Price Index, the Federal Reserve's preferred inflation gauge. The annual figure is expected to decline from 4.25% to 3.9%. The stronger data could potentially lift the US Dollar.

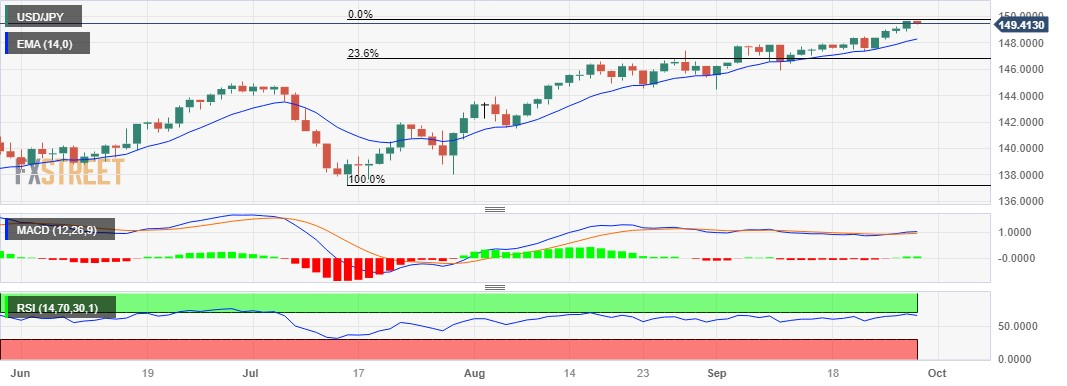

- The USD/JPY got strung along the middle for Thursday, cycling 149.30.

- The pair closed down 20 pips on the day but missed any major moves.

- Friday sees Japanese Tokyo CPI, US PCE inflation numbers.

The USD/JPY went sideways on Thursday ahead of Friday's inflation double-feature. The pair is off the week's peak near 149.70, and analyst bets of USD/JPY hitting 150.00 are holding steady.

Despite a broad-market US Dollar (USD) Index retreat on firming risk appetite, the USD/JPY remains mostly flat for Thursday. The pair started Thursday trading off with an early high of 149.50 before falling back to familiar territory near 149.30.

Officials from the Bank of Japan (BoJ) has put some significant effort into trying to jawbone the JPY to hold steady, but visibly-empty threats of tightening monetary policy have provided little effect thus far.

Read More:

USD/JPY: It remains dangerous to bet on the patience of the MOF – Commerzbank

USD/JPY: A move to 150 now appears on the horizon – UOB

Friday sees Japan's Tokyo Consumer Price Index (CPI) reading for the annualized period into September, and the core CPI element (CPI less food but still including energies) is forecast to print at 2.6%, versus the previous reading of 2.8%.

Japanese inflation remains well above the BoJ's 2% target, but the BoJ continues to hold off on any rate adjustments until they are "convinced" that inflation will remain above their minimum target heading into a potential slowdown period in price growth.

Friday will also see US Personal Consumption Expenditure (PCE), which is expected to hold steady at the previous quarter's 0.2%.

USD/JPY technical outlook

The USD/JPY remains firmly bullish from a technical standpoint, having closed in the green or flat for ten of the eleven last consecutive trading weeks.

The pair is up over 13% from the year's early lows near 127.20, and currently remains well above major moving averages, with the 34-day Exponential Moving Average (EMA) sitting far below current price action near the 147.00 handle.

USD/JPY daily chart

USD/JPY technical levels

- The GBP/USD caught some lift on Thursday, rising back to the 1.2200 handle.

- Friday sees UK GDP figures amidst a slew of low-tier data.

- The Pound Sterling is broadly expected to continue weakening looking out long-term.

The GBP/USD managed to eke out a minor recovery on Friday, owing more to a step back in the broad-market US Dollar Index (DXY) than any intrinsic strength to be found in the Pound Sterling (GBP).

Market analysts broadly expect the GBP to continue to weaken moving forward, and a continued backslide to the 1.2000 major handle is all but a foregone conclusion for many instutitions.

The upcoming Friday trading session will kick things off for the GBP/USD with UK Gross Domestic Product figures due at 06:00 GMT. The UK GDP for the second quarter is forecast to hold steady at 0.2%, and a miss for headline economic growth in the British economy is all set to see the Pound lose what little gains it's recovered for Thursday.

Friday also brings high-impact data for the USD, most notably the Personal Consumption Expenditure (PCE) Price Index at 12:30 GMT. The PCE numbers are expected to hold steady at 0.2% for the month of August, with the annualized figure for the same period seen ticking down from 4.2% to 3.9%.

US figures hit a middling note on Thursday, with US Initial Jobless Claims clocking in at 204K versus the previous 202K; US annualized GDP for the second quarter came in exactly at expectations at 2.1%.

The big miss for Thursday was US Pending Home Sales, which surprised to the downside by not-insignificant -7.1%, far below the forecast -0.8% and dropping away from the previous 0.9%.

Read More:

GBP/USD remains vulnerable to the 1.20/1.21 area – ING

The Pound and Euro should weaken substantially through early 2024 – Wells Fargo

GBP/USD needs to surpass 1.2350 to show more meaningful technical strength – Scotiabank

GBP/USD technical outlook

The GBP/USD rose half a percent on Thursday, lifting to a session high of 1.2220 after pinging into six-month lows at 1.2110 the previous day.

Hourly candles have the pair rising into technical support coming down from the bearish 200-hour Simple Moving Average (SMA) near 1.2260.

On daily candlesticks the GBP/USD is firmly bearish and potentially primed for a minor relief rally. Price action will be capped off by the 200-day SMA above 1.2400, and the 34-day Exponential Moving Average (EMA) is racing to make a bearish cross of the longer moving average.

the GBP/USD is over 7% off its last meaningful swing high in July at 1.3140.

GBP/USD hourly chart

GBP/USD daily chart

GBP/USD technical levels

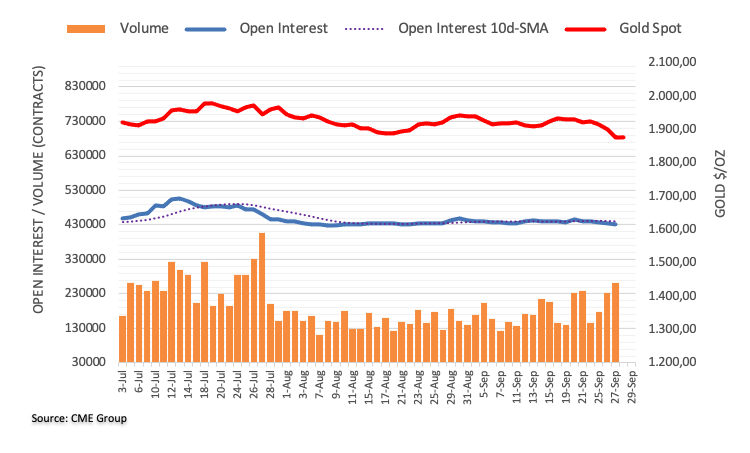

- Gold spot trims losses, trading at $1866.44, after US Treasury bond yields retract from multi-year highs, causing the USD to weaken.

- US GDP for Q2 meets expectations at 2.1%, with inflation dropping to 1.7%, below the previous 3.9%, indicating economic stability.

- Federal Reserve officials hint at potential further rate hikes if inflation progress stalls, adding another layer of uncertainty to gold’s outlook.

Gold spot tumbles as Wall Street closes, but earlier printed a six-month low of $1857.82, as US Treasury bond yields skyrocketed, a headwind for the yellow metal. Nevertheless, the XAU/USD trimmed some of its losses as US bond yields retraced. At the time of writing, the non-yielding metal trades at $1866.44 after hitting a daily high of $1879.58, down 0.49%

Gold prices experience a tumble, reaching a six-month low of $1857.82, as rising US Treasury bond yields and a strong USD are headwinds for the precious metal

Market sentiment improved on Thursday, while US Treasury bond yields retreated from multi-year highs of around 4.68% to 4.577%. Consequently, the Greenback (USD) is weakening, as portrayed by the US Dollar Index (DXY), down 0.49%, at 106.13.

Data in the United States (US) came as expected, particularly Gross Domestic Product (GDP) for Q2 on its final reading at 2.1%, aligned with the consensus but below the previous reading, which was upward revised to 2.2%. Inflation for the second quarter dropped to 1.7%, below the previous reading at 3.9%.

At the same time, the US Department of Labor revealed that Americans filing for unemployment on the week ending on September 23 rose by 204K, below estimates of 215K but more than last week’s 202K, portraying a robust labor market.

Aside from this, Federal Reserve officials continued to cross newswires. Chicago Fed’s President Austan Goolsbee said if the US central bank sees lack of progress on inflation, it would have to raise rates further while saying he’s not decided what to do at the next meeting. Meanwhile, Richmond’s Fed President Thomas Barkin stated the latest five months of inflation data have been encouraging, though he commented that it’s too soon to say what’s next on monetary policy.

XAU/USD Price Analysis: Technical outlook

After dropping to a new cycle low on Wednesday, Gold slumped below $1860, but it remains shy of the March 8 swing low at $1809.48. It should be said a death-cross in Gold’s daily chart, formed since Tuesday, cementing the XAU/USD bearish bias, but If it achieves a weekly close below $1900, that could exacerbate a drop to the latter and $1800. Otherwise, the yellow metal could pose a threat and test the 20-day moving average (DMA) at $1916.57

During the Asian session, Japan will release critical economic reports including the September Tokyo Consumer Price Index, the August Unemployment Rate, Industrial Production, Retail Sales, and Housing Starts. In Australia, Private Sector Credit data is due. Later in the day, a new estimate of UK Q2 GDP and Consumer Credit will be reported, while Germany will release Retail Sales and the Unemployment Rate. The key report to watch will be the Eurozone CPI. The focus will then shift to the US Core Personal Consumption Expenditures and Canada's monthly GDP.

Here is what you need to know on Friday, September 29:

It is the last day of September and the end of the third quarter, which could contribute to increased volatility on Friday due to end-of-month flows. The key economic report will be the US Core Personal Consumption Expenditure Price Index, the Federal Reserve's preferred inflation gauge. It is expected to show a decline from 4.25% to 3.9%. A higher-than-expected number could potentially trigger further gains for the US Dollar. The report also includes personal income and personal spending data. Later, the University of Michigan's final reading of Consumer Sentiment for September is due.

US Core PCE Preview: Forecasts from seven major banks, losing speed

The US Dollar index (DXY) experienced a correction lower on Thursday, declining by 0.50%. After rallying for five consecutive days and reaching a monthly high, the index pulled back toward the 106.00 area.

The Greenback weakened amid improved risk sentiment and lower US Treasury yields. Second-quarter US GDP growth data aligned with expectations, while Initial Jobless Claims rose less than expected. The US 10-year Treasury yield fell from 4.69% (the highest since 2007) to 4.57%.

A US government shutdown is looming as bills to fund the government have yet to become law in both the House and Senate. A government shutdown could have a negative impact on economic growth and delay the publication of key economic reports.

EUR/USD rebounded from below 1.0500 toward 1.0600. The overall trend is still down, but the short-term outlook has improved for the Euro. A break above 1.0580 would strengthen the common currency. The Eurozone Harmonized Index of Consumer Prices is due on Friday, although its impact may be limited considering that Germany has already released its inflation numbers. Additionally, German Retail Sales and the Unemployment Rate are also due on Friday.

Analysts at Commerzbank on German inflation:

German inflation fell from 6.1% to 4.5% in September. This is partly due to the fact that the 9-euro ticket and the tax cuts on fuel ("petrol rebate") expired a year ago. But even without this base effect, headline inflation and the core rate excluding energy and food would have fallen significantly. This trend is likely to continue in the months ahead. Next year, underlying inflation is expected to stabilize well above the ECB's target of 2%, as wage growth picks up noticeably.

GBP/USD had its best day in over a month, benefiting from a weaker US Dollar, hovering around the 1.2200 area. The correction could continue in the next sessions, but the outlook is bearish as long as it stays below 1.2460. The UK is set to release a new estimate of Q2 GDP growth and later Consumer Credit data.

USD/JPY experienced a modest drop despite the reversal in US yields. The pair is still holding above 149.00. Japan has several economic data releases scheduled for Friday, including the Tokyo Consumer Price Index for September, Unemployment Rate, Industrial Production, and Retail Sales for August.

AUD/USD gained nearly 80 pips on Thursday, recovering from monthly lows and moving back above the 20-day Simple Moving Average (SMA). It consolidated around 0.6420. Australia will release Private Sector Credit data.

The Canadian Dollar (CAD) lagged behind on Thursday because of the correction in crude oil prices. USD/CAD essentially remained unchanged near 1.3500 despite the weaker US Dollar. Canada will report July GDP data on Friday.

Analysts at TD Securities on Canada's GDP

We look for GDP to rise by 0.1% in July, unwinding half of June's pullback, with the goods sector leading the rebound. Manufacturing/mining will provide a source of strength, while services should underperform with a muted performance for retail/wholesale trade. New flash estimates should point to another soft (+0.1%) print in August, providing more evidence that higher rates are working to slow demand. We would need a sizeable miss to shake the additional hike priced in for the BoC out of the market.

Gold extended its decline, printing fresh monthly lows at $1,857 before rebounding to the $1,866 area. The recovery can be attributed to the reversal in US yields. Although the yellow metal remains under pressure, the potential for a weaker Dollar and lower yields could support a stabilization.

Like this article? Help us with some feedback by answering this survey:

- The EUR/USD saw gains for Thursday as the DXY recedes.

- Analysts expect further weakness from the Euro moving forward on the end of rate hike cycles.

- Friday to close out the trading week with EU & US key inflation measures.

The EUR/USD tapped into an intraday high of 1.0580 on Thursday before settling to close out the US trading session down near 0.10550. The US Dollar (USD) has gained across the board with the US Dollar Index (DXY) catching a broad-market lift as risk appetite sours on weakening economic data, spiking Treasury yields, and recession concerns.

Investors are gearing up for a full data docket on Friday, with European Consumer Price Index (CPI) figures kicking things off.

European inflation is expected to decline moderately. with the annualized CPI reading for September forecast to tick down from 5.3% to 4.8%.

Market forecasters are expecting a half-percent cut in the rate of price growth for Europe as the continental economy wobbles, with a dovish European Central Bank (ECB) looking entirely set to start looking for rate cuts if the economy continues to sour.

Friday will also see US Personal Consumption Expenditure (PCE) Price Index numbers. US PCE inflation is forecast to hold steady for the month of August at 0.2%, while the annualized figure for the same period is seen ticking lower from 4.2% to 3.9%.

Analysts broadly expect both EU and US inflation readings to step lower, but the weak-side bet goes to Europe as price growth is expected to slump noticeably in the coming months.

Read More:

The Pound and Euro should weaken substantially through early 2024 – Wells Fargo

EUR/USD Price Analysis: A drop to the YTD low appears on the table

Eurozone HICP Preview: Forecasts from five major banks, overall inflation-slowing trend

EUR/USD technical outlook

The EUR/USD is testing around 1.0555 after taking a downside rebound from the 100-hour Simple Moving Average (SMA) near 1.0580 in mid-Thursday trading. Hourly candles have broken to the upside of a descending intraday trendline from last week's swing high near 1.0730.

Technical resistance comes from the 200-hour SMA near 1.0620, while near-term price action will see support from the 34-hour Exponential Moving Average (EMA) near 1.0540.

On the daily candlesticks, the EUR/USD is desperate for a green day after closing flat or in the red for the past seven straight trading sessions, and price action still remains firmly bearish with upside momentum capped by a descending trendline from July's peak near 1.1275.

The EUR/USD daily candles have accelerated away from the 200-day SMA, which is turning bearish from just north of the 1.0800 handle.

EUR/USD hourly chart

EUR/USD daily chart

EUR/USD technical levels

- USD/CHF retreats to around 0.9150 after reaching a new cycle high at 0.9225.

- To resume the uptrend, the pair must rally past 0.9225, allowing buyers to challenge the year-to-date highs at 0.9440.

- If USD/CHF fails to reclaim 0.9200, a drop towards 0.9100 is likely, with the 200-hour moving average eyed at 0.9071.

USD/CHF reverses its direction after rallying for 16 straight days, though the pair loses steam as technical indicators signal the major is overbought. Hence, the USD/CHF is trading at around 0.9150s, down 0.57%.

The uptrend remains intact, as shown by the daily chart, as the USD/CHF reached a new cycle high at 0.9225 and broke above the 200-day moving average (DMA) at 0.9029. However, to resume its uptrend, the major must rally past the former, so buyers can challenge the year-to-date (YTD) highs at 0.9440. A breach of the latter can open the door for parity.

In short, the USD/CHF hourly chart portrays the break of market structure on the downside. After hitting a multi-month high, the major retraced below 0.9200, extending its losses past the 50-hour moving average (HMA) at 0.9182. That exacerbated a fall below the 61.8% Fibonacci retracement, though lately buyers stepped in, and lifted the spot price above 0.9159. If the USD/CHF reclaims 0.9200, a test of September’s high at 0.9225 is on the cards. Otherwise, expect a drop towards 0.9100, followed by the 200-HMA at 0.9071.

USD/CHF Price Action – Hourly chart

USD/CHF Key Technical Levels

- The Kiwi is facing upside momentum, climbing nearly a percent against the Greenback for Thursday.

- Ongoing market unease over China property woes is capping upside potential for the NZD.

- A broad-market DXY selloff sees the NZD/USD up around 50 pips for the day.

The NZD/USD has ticked about five basis points higher through Thursday's market trading, driven by a receding Greenback (USD). Ongoing economic concerns and spiking US Treasury yields has seen the USD bolstered across the broader market this week, but Thursday sees a step back in US Dollar action, giving the Kiwi (NZD) a brief reprieve and recovering some recent losses.

China's ongoing property debacle continues to sap confidence in the Asia sector currencies. Evergrande, the world's single most indebted property developer, had its chairman Hui Ka Yan placed under police watch this week as funding and liquidity concerns grip China's real estate sector. China's real estate and property development segment has reached such an outsized proportion of China's domestic economy that increased instability in construction could threaten the rest of the economy.

Next Up: US PCE inflation reading to close out the week

There is little of note on the economic calendar for the Kiwi, and market participants will be looking ahead to the US Personal Consumption Expenditure (PCE) Price Index figures due on Friday at 12:30 GMT.

The US PCE inflation reading is forecast to hold steady for the month of August at the previous print of 0.2%, with the annualized figure for the same period seen tipping back from 4.2% to 3.9%.

A beat on the Federal Reserve's (Fed) favorite inflation indicator could see the USD spike further on the charts, as higher-than-expected inflation will be increasingly likely to push the Fed into holding higher interest rates for even longer than anticipated.

NZD/USD technical outlook

The Kiwi is currently capped under the 0.5970 handle after reaching an intraday high of 0.5975. The NZD/USD has broken to the north side of a minor descending trendline on hourly candles, and near-term support is baked in at the 200-hour Simple Moving Average (SMA) near 0.5940.

On daily candlesticks, the NZD/USD is pinned to the 34-day Exponential Moving Average, and the pair is pricing in a floor from the 0.5900 major handle. Long-term moving averages are rolling over bearish, and the 200-day SMA is settling to the low side of 0.6200.

Bidders will first have to crack the 34-day EMA and the 0.600 major psychological level before moving higher, while a resurgence of downside pressure will see the pair set to take a new run at ten-month lows below 0.5845.

NZD/USD hourly chart

NZD/USD daily chart

NZD/USD technical levels

- Loonie is tracking crude barrel prices, USD closely.

- Canada GDP is expected to see sluggish growth.

- Canadian inflation remains sticky, keeping the BoC on its toes.

The Canadian Dollar (CAD) is seeing minor gains against the US Dollar (USD) on Thursday as the Greenback eases off from recent gains. With Oil barrel prices also taking a quick breather, and crude Canada’s main export, the CAD is seeing limited momentum. The USD/CAD is largely flat for Thursday, down a scant 0.2% at its lowest point as the pair threatens consolidation near 1.3500.

Canada's economic data remains thin on the calendar, with Friday’s Gross Domestic Product (GDP) figures closing out an otherwise data-empty trading week. Canadian GDP for the month of July is forecast to print a meager 0.1% versus the previous month’s -0.2%. Oil prices and the broad-market US Dollar Index (DXY) are set to remain the CAD’s main drivers on the charts.

Daily Digest Market Movers: Canadian Dollar twisting into the middle

- The CAD gained nearly 2.3% against the USD in September, bolstered by scorching Oil prices.

- The USD/CAD is currently down 1.5%, with surging DXY winning the head-to-head battle with crude barrel prices in the near term.

- Canadian GDP is seen struggling to firm up growth as stubborn inflation remains.

- Bank of Canada (BoC) officials have been routinely hitting the wires trying to jawbone inflation lower with threats of higher interest rates.

- The BoC’s Governor Macklem and Deputy Governor Kozicki have made appearances, reiterating calls for rates to remain higher for longer as inflation still remains too high.

- Canada was the world’s second-largest oil exporter in Dollar-adjusted terms, exporting over $120 billion USD of crude in 2022, nearly 9% of the entire global oil export market.

- One of the top oil exporting countries globally, the Loonie sees a majority of its momentum dictated by barrel prices.

Technical Analysis: Canadian Dollar

The Canadian Dollar (CAD) has gained against the US Dollar (USD) from September’s peak in the USD/CAD near 1.3695, and is set to close out the month near where it started at 1.3500, if directional momentum remains elusive heading into the final days of September’s trading.

The USD/CAD is currently pinned to the 34-day Exponential Moving Average (EMA) at the 1.3500 handle, with near-term support from the 200-day Simple Moving Average near 1.3450. A floor is priced in from the last swing low into 1.3380, while 1.3650 remains a significant technical resistance barrier that has rejected price action multiple times this year.

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

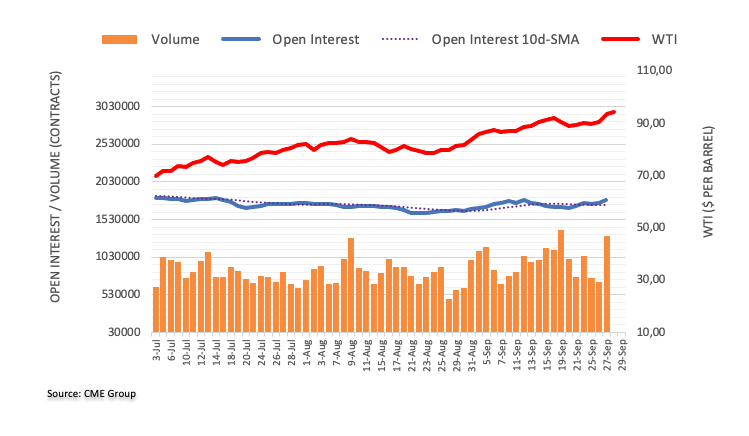

- WTI dips 1.30% to $92.45, retracting from a 12-month high of $94.99, as traders speculate on profit-booking and the potential economic impact of rate hikes.

- US economy exhibits resilience with a 2.1% growth in Q2 and an anticipated 4.9% GDP growth in Q3, amidst decelerating inflation.

- A possible US government shutdown looms, adding uncertainty to the markets, as Republicans and Democrats debate the 2024 Federal Government budget.

West Texas Intermediate (WTI), the US crude oil benchmark, retreats after rising to a new 12-month high on Thursday at $94.99 on speculations that traders book profits. That alongside worries that high-interest rates would weigh on global economies, dented Oil’s demand. WTI is trading at $92.45, losses 1.30%.

West Texas Intermediate faces a setback amid profit-booking speculations and concerns over high-interest rates impacting global economies, despite positive US economic data

Market sentiment improved, as seen by US equities trading in positive territory. The latest data from the United States (US) showed the economy grew steadily by 2.1% in the second quarter of 2023, while inflation decelerated. Also, growth estimates for the third quarter Gross Domestic Product (GDP) stand at 4.9%.

However, the story could be different if the US faces a shutdown, as Republicans and Democrats discuss the Federal Government budget for 2024, threatening to halt the government’s function if the bill hasn’t passed past Saturday night.

Most Federal Reserve officials remained hawkish during the week, with some taking a more neutral approach. Market participants are eyeing Fed’s Chair Jerome Powell's speech, later at 20:00 GMT.

Data-wise the latest US crude oil inventories fell by 2.2 million barrels last week, to their lowest level since July 2022, announced the US Energy Information Administration (EIA) office.

US crude draws followed cuts by Saudi Arabia and Russia, of 1.3 million combined, as the Organization of Petroleum Exporting Countries (OPEC) brings demand and supply into balance.

WTI Price Analysis: Technical outlook

After registering gains of more than 22% from August 24 lows toward the year-to-date (YTD) high of $94.99, WTI’s pullback was necessary. The Relative Strength Index (RSI) is exiting overbought conditions, aiming lower, while oil is expected to remain trading above $90.00 per barrel, though it’s currently testing the September 19 daily high of $92.63. A breach of the latter would expose the $90.00 mark, while an upward resumption and prices might challenge the psychological $95.00 level.

- The AUD/USD has rebounded from recent lows, pushed higher by a retreating US Dollar.

- Australian economic data remains on the weak side, but broader market flows are determining direction.

- Markets are looking ahead to US PCE inflation figures on Friday.

The AUD/USD has caught a much-needed bounce from near-term lows around 0.6340, and the pair is up over 1% after reclaiming the 0.6400 handle in Thursday trading. The Aussie-Dollar pairing is currently taking a breather and marking in territory near 0.6420.

Australian Retail Sales came in below expectations early Thursday, printing at a seasonally-adjusted 0.2% for the month of August. The previous reading saw 0.5%, and the actual headline figure failed to meet market forecasts of 0.3%.

US data came in mixed on Thursday, with Gross Domestic Product (GDP) hitting the middle at expectations.

US GDP for the second quarter printed as-expected at 2.1% over the previous quarter; Initial Jobless Claims improved slightly, from 202K to 204K.

The downside came from US Pending Home Sales for August, which clocked in an abysmal -7.1%, far below the forecast -0.8% and a complete reversal from the previous print of 0.9%.

All that's left on the economic calendar data docket for the US Dollar is Friday's Personal Consumption Expenditure (PCE) Price Index. August's PCE is forecast to hold steady at 0.2%.

AUD/USD technical outlook

The Aussie broke loose from recent intraday bearish action, jumping up a full percentage point to ping against the 200-hour Simple Moving Average near 0.6420.

Near-term technical resistance sits at the last swing high last week near 0.6460, and bidders will be looking to catch support from the 100-hour SMA currently drifting into the 0.6400 handle.

The overall trend still remains firmly bearish, and the AUD/USD remains well off recent highs on the daily candlesticks. Price action will see resistance from the 34-day Exponential Moving Average (EMA) just north of 0.6450, while downside momentum will see a support zone baked in at recent swing lows between 0.6400 and 0.6350.

AUD/USD hourly chart

AUD/USD daily chart

AUD/USD technical levels

- The Mexican Peso recovers some ground despite a risk-off impulse, with traders eyeing Banxico’s decision.

- The economy in Mexico remains resilient, though the recent economic budget for 2024 could undermine the MXN.

- Nearshoring and interest rate differentials between Mexico and the US, favors USD/MXN downside.

The Mexican Peso (MXN) is recovering early in the North American session after losing nearly 3.50% in the week due to risk aversion and the Federal Reserve's (Fed) hawkish rhetoric, as most officials expect another rate hike for 2023. The emerging market currency hit a four-month low at 17.8161 against the Greenback (USD) on Wednesday. Still, the looming central Bank of Mexico (Banxico) decision boosted Mexico’s currency, a headwind for the USD/MXN pair.

The latest economic data revealed the Mexican economy remains robust, benefiting from nearshoring opportunities after the COVID-19 pandemic. It should be said the country’s inflation remains “stable” thought in the upper band of Banxico's goal of 3% plus or minus 1%, at around 4.64% YoY in August. Nevertheless, the recent economic budget for 2024 raises analysts' eyebrows, as it projects an increase in the deficit to 4.9%. Speculations grow around the Mexican central bank's opinion and measures to consider the proposed budget.

Daily Digest Market Movers: Mexican Peso halts its slide on US Dollar correction

- The Mexican Peso recovered some ground after depreciating to levels last seen in late May 2023 and approached the 200-day Simple Moving Average (SMA) at 17.88411 on risk aversion.

- The Bank of Mexico is expected to keep its monetary policy restrictive and hold rates unchanged at 11.25%.

- September’s first-half inflation report in Mexico was 4.44%, down from 4.64% in August, according to the National Statistics Agency, INEGI.

- Being an emerging market currency, the Mexican Peso weakens on risk aversion. Therefore, news emerging of a possible US government shutdown triggered a flow toward safe-haven assets, weakening the Mexican Peso.

- The drop in Oil prices weakens the Mexican currency, as its economy relies on crude exports.

- Moody’s rating agency warned the fiscal strategy of the Mexican government in 2024 must be credible after the June elections in defining the country’s stable outlook.

- In July, Moody lowered Mexico's rating to “Baa2” with a “stable” outlook but warned of fiscal pressures for the next government due to the 2024 economic budget.

- US Treasury bond yields jumped after September’s Federal Reserve Open Market Committee (FOMC) decision to hold rates unchanged. However, the dot plots above 5% in 2024 confirmed the Federal Reserve’s higher-for-longer mantra.

- Recent US Dollar strength weighed on the Mexican currency after printing multi-month highs.

Technical Analysis: Mexican Peso

The Mexican Peso found its foot after depreciating to 17.8161 versus the US Dollar, near the 200-day Simple Moving Average (SMA) at 17.8410, though it is staging a comeback and trimming some of its losses, currently below the 17.6000 area. Nevertheless, further upside is expected after printing a new cycle high, while the 50-day SMA reduces the distance to the 100-day SMA. Near-term, actual price action could be seen as a pullback, as the Relative Strength Index (RSI) aims lower, though the uptrend remains intact.

Interest rates FAQs

What are interest rates?

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%.

If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

How do interest rates impact currencies?

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

How do interest rates influence the price of Gold?

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank.

If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

What is the Fed Funds rate?

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure.

Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

The Mexican Peso has suffered significant losses in recent days. Economists at Commerzbank analyze USD/MXN outlook.

Support for MXN from Banxico's restrictive monetary policy may have peaked

Although the real interest rate outlook remains attractive for the time being, the support for the Peso from Banxico's restrictive monetary policy may have peaked.

Other issues are likely to come to the fore for the exchange rate: In addition to the US outlook, we think the main one will be the elections due in the summer. In this context, Mexico's persistent structural problems are likely to come to the fore again. The exchange rate developments of recent weeks confirm our view that the depreciation risks for the MXN are slowly increasing.

Economists at Wells Fargo expect further weakness in the major European currencies.

ECB and BoE have signaled that policy rates have likely reached their peak

Sentiment surveys for both economies have softened sharply in recent months, and European underperformance relative to the US should weigh on both currencies.

The European Central Bank and Bank of England have also signaled that policy rates have likely reached their peak, thus lessening interest rate support for their respective currencies.

We see a softer Pound and Euro through early 2024, targeting a low for Cable around 1.1600 and a low for EUR/USD around 1.0200.

- Pending Home Sales in the US declined sharply in August.

- US Dollar Index stays deep in negative territory below 106.30.

Pending Home Sales in the US declined 7.1% in August, the National Association of Realtors reported on Thursday. This reading followed a 0.9% increase recorded in July and came in much worse than the market expectation for a decrease of 0.8%.

On a yearly basis, Pending Home Sales fell 18.3%.

Commenting on the data, "mortgage rates have been rising above 7% since August, which has diminished the pool of home buyers," said Lawrence Yun, NAR chief economist.

"Some would-be home buyers are taking a pause and readjusting their expectations about the location and type of home to better fit their budgets," he added.

Market reaction

The US Dollar stays on the back foot after this report. As of writing, the US Dollar Index was down 0.4% on the day at 106.23.

The Fed’s preferred inflation gauge, the Core Personal Consumption Expenditure (PCE), will be released by the US Bureau of Economic Analysis (BEA) on Friday, September 29 at 12:30 GMT and as we get closer to the release time, here are the forecasts of economists and researchers of seven major banks.

Core PCE is expected at 3.9% year-on-year vs. 4.2% in August. On a monthly basis, it is seen steady at 0.2%.

Deutsche Bank

We expect core PCE to hold on to +0.2% MoM gains, which would have the effect of lowering the YoY growth rate by a little over 30 bps (to 3.9%).

ING

We are also aware that the Fed’s favoured measure of inflation, the core PCE deflator, could come in a little higher than the market is forecasting. The core PCE deflator could come in a little higher than the market is forecasting. We look for a 0.3% MoM increase in prices, similar to the CPI report, whereas the consensus is for a more benign 0.2% MoM print.

TDS

We expect core PCE inflation to register a third consecutive 0.2% MoM increase in August; undershooting the core CPI's stronger 0.3% gain. The YoY rate likely also fell to 3.9%, while we expect the key core svcs ex-housing series to slow to 0.2% MoM following July's 0.5% surge.

NBF

The annual core PCE deflator may have progressed 0.5% in August, a result which should translate into a three-tick increase of the 12-month rate to 3.9%.

SocGen

We forecast a more modest decline in US core PCE to 3.9% YoY.

Citi

Elements of 0.28% MoM US core CPI in August but some softer details of PPI data lead Citi Research to forecast a more modest 0.14% MoM increase in core PCE inflation. Core services prices ex-housing, which rose a solid 0.37% MoM in CPI, should rise 0.17% MoM in PCE inflation while goods prices should decline modestly as in CPI. Shelter prices should continue to slow over the coming months, but this will have less of a disinflationary impact on PCE inflation than on CPI. Meanwhile, headline PCE inflation should rise 0.4% MoM due to higher energy prices and rebound modestly to 3.4% YoY.

Wells Fargo

We forecast the PCE deflator increased 0.4% in August, and the core PCE deflator rose 0.2%. This, along with our forecasts for personal income to rise 0.5% and personal spending to rise 0.5% in the month, should bring real disposable income growth back to the black.

- USD/CAD finds buying interest near 1.3500 as the US Dollar attempts to recover and oil price falls.

- Investors await Canada’s GDP and US PCE price index data, which are scheduled for Friday.

- USD/CAD tests the breakout region of the Symmetrical Triangle pattern near 1.3500.

The USD/CAD pair found support after a corrective move to near the psychological support of 1.3500 in the early New York session. The recovery in the Loonie asset is supported by a rebound in the US Dollar and a sharp decline in oil prices.

Earlier, the US Dollar Index (DXY) corrected to near 106.20 as the risk appetite of the market participants improved. While the broader bias in the US Dollar remains upbeat as the US economy is absorbing the consequences of higher interest rates by the Federal Reserve (Fed).

Going forward, the Canadian Dollar will dance to the tune of the monthly Gross Domestic Product (GDP) data for July, which will be published on Friday at 12:30 GMT. As per estimates, the Canadian economy grew by a nominal pace of 0.1%. In June, the GDP data contracted by 0.2%.

USD/CAD tests the breakout region of the Symmetrical Triangle chart pattern formed on a two-hour scale. A breakout of the aforementioned chart pattern results in wider ticks and heavy buying volume. The broader trend is still bearish as the asset is trading below the 200-day Exponential Moving Average (EMA), which trades around 1.3512.

The Relative Strength Index (RSI) (14) trades in the 40.00-60.00 range, which signifies consolidation.

A decisive break above September 21 high at 1.3524 would drive the asset towards September 11 low around 1.3560, followed by the round-level resistance at 1.3600.

In an alternate scenario, a breakdown below September 25 low around 1.3450 would drag the asset toward September 20 low near 1.3400. A further breakdown could expose the asset to six-week low near 1.3356.

USD/CAD two-hour chart

-638315073762594618.png)

Economists at ANZ Bank analyze the correlation between the US yield and Gold and discuss the yellow metal’s outlook.

USD strength is likely to wane in 2024

History suggests Gold returns remain decent during rate hiking cycles and outperform during easing and a lower rate environment.

The negative beta with the US yield weakens during hiking cycles and strengthens during easing cycles.

USD strength is likely to wane in 2024. While we think appreciation in the USD will sustain to year-end, firmer expectations of rate cuts and slowing economic growth momentum will see the USD dropping again next year.

- EUR/USD rebounds from new eight-month lows around 1.0490.

- Further selling pressure should target the YTD low at 1.0481.

EUR/USD manages to regain some pace soon after hitting fresh multi-month lows in the 1.0490 region on Thursday.

The continuation of the downward bias should leave the pair vulnerable to further losses with the immediate target at the 2023 low at 1.0481 (January 6).

While below the key 200-day SMA at 1.0827, the pair is likely to face extra weakness.

EUR/USD daily chart

- Silver price delivers volatile moves near $22.50 as US Dollar attempts recovery.

- Weekly jobless claims increased by 2K to 204K this week but remained below expectations of 215K.

- Silver price forms a Head and Shoulder pattern whose breakdown triggers a bearish reversal.

Silver price (XAG/USD) demonstrates a volatile action near $22.50 after the release of lower-than-anticipated weekly Jobless Claims data for the week ending September 22. The US Department of Labor reported that individuals claiming jobless claims for the first time increased by 2K to 204K from the previous week’s release but remained lower than expectations of 215K.

Meanwhile, the final reading of real Gross Domestic Product (GDP) for the April-June quarter remained in line with the previous estimate and the market expectation of 2.1% on an annualized basis.

The US Dollar Index (DXY) corrects to 106.20 after refreshing a six-month high near 106.80 as profit-booking kicks in. The broader bias for the US Dollar is still bullish as the US economy is resilient due to falling inflation, an upbeat labor market, and robust consumer spending. The 10-year US Treasury yields jump to near 4.65%, showing strength in expectations of one more interest rate hike from the Federal Reserve (Fed).

Minneapolis Federal Reserve Bank President Neel Kashkari said on Wednesday that he is unsure whether the central bank has hiked enough to bring down core inflation to 2%.

For further guidance, investors will focus on the US core Personal Consumption Expenditure (PCE) price Index data for August, which will be published on Friday at 12:30 GMT.

Silver technical analysis

Silver price forms a Head and Shoulder chart pattern on a daily scale, which indicates a prolonged consolidation whose breakdown triggers a bearish reversal. The neckline of the aforementioned chart pattern is plotted from June 23 low at $22.11. The white metal trades below the 20-day Exponential Moving Average (EMA) at $23.15, which indicates that the short-term trend is bearish.

The Relative Strength Index (RSI) (14) slips below 40.00, indicating no signs of divergence and oversold, warranting more downside.

Silver daily chart

-638315056464856305.png)

US-Japanese yield differentials are wider than they were last October when USD/JPY surged above 150. Kit Juckes, Chief Global FX Strategis at Société Générale, analyzes Yen’s outlook and its implications for the AUD/USD pair.

AUD would be a loser if – when – USD/JPY breaks 150

US-Japanese yield differentials, real or nominal, five or ten years, are wider today than they were when USD/JPY spiked briefly above 150, 11 months ago. Only fear of a policy reaction is holding the Yen here. A break would complicate things, adding downward pressure to the Yuan (which the Chinese authorities are resisting vigorously) and the rest of the Asia/Pacific currencies as well. And if the Japanese start intervening in earnest, that will add to upward pressure on US yields too.

USD/JPY will probably break 150 in October and the next week or so.

Today’s small AUD bounce is unlikely to represent a low. Last October we saw a break below 0.62 shortly after USD/JPY reached 150 and we expect a repeat this year.

- DXY comes under pressure after printing new YTD tops.

- Extra gains target the 107.00 hurdle and beyond.

DXY faces some downside pressure and abandons the area of 2023 highs in the 106.80/85 band on Thursday.

Despite the ongoing technical correction, extra gains appear likely for the time being. The surpass of the year high could encourage the index to challenge the weekly top at 107.19 (November 30, 2022) prior to another weekly peak at 107.99 (November 21 2022).

In the meantime, while above the key 200-day SMA, today at 103.08, the outlook for the index is expected to remain constructive.

DXY daily chart

The Federal Reserve (Fed) will return inflation to target and has a chance to do something 'rare' by accomplishing that without a recession, Chicago Fed President Austan Goolsbee said on Thursday, as reported by Reuters.

Key takeaways

"Holding to inevitability that job losses are needed to slow inflation risks a near-term policy error."

"Some analysis shows inflation reaching target soon, without further policy tightening and only a modest slowdown in growth."

"Fed needs to be extra careful of tying policy to historical relationships that may not hold up in the current economy."

"Recent data, with inflation slowing without job losses, have run against past US patterns."

"Long-run inflation expectations are well-anchored, can help lower inflation with less economic pain than previously."

"Importance of expectations and Fed credibility makes proposals to raise the inflation target from 2% quite risky."

"Risks to the outlook include oil prices, slowdown in China, possibility of a protracted US auto strike, or a disruptive government shutdown."

"Housing will be key to continued inflation progress in the next few quarters, with risk that rising home prices could also boost market rents."

"Wages typically lag prices, so short-term movements should not be used to predict inflation."

Market reaction

The US Dollar stays on the back foot following these comments. As of writing, the US Dollar Index was down 0.3% on the day at 106.30.

Eurostat will release the preliminary estimate of Eurozone Harmonised Index of Consumer Prices (HICP) data for September on Friday, September 29 at 09:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of five major banks regarding the upcoming EU inflation print.

It appears that inflationary pressures will continue to ease. Headline is expected at 4.5% year-on-year vs. 5.2% in August, while core is expected at 4.8% YoY vs. the prior release of 5.3%. If so, headline would decelerate for the fifth straight month to the lowest since October 2021.

Commerzbank

Euro area inflation is expected to have fallen sharply by 0.8 percentage points to 4.4% in September. The core rate, which excludes the volatile prices of energy, food, alcohol and tobacco, is also expected to have fallen from 5.3% to 4.7%. However, half of this is due to the expiry of the three-month €9 ticket in Germany in September 2022. This price increase is now excluded from the YoY comparison. But even without this effect, the trend in the core rate is down.

Deutsche Bank

We expect a 4.6% reading for the headline (5.2% in August) and 4.9% for core (5.3%).

Danske Bank

We expect a decline in headline HICP to 4.4% from 5.3% in August driven by negative energy inflation, lower food prices, and a downtick in core inflation from 5.3% to 4.8%.

SocGen

We expect headline inflation to fall by 0.7pp to 4.5%, due to energy base effects, while core could fall by 0.5pp to 4.7%, with an upside risk of 4.8%.

Citi

Headline and core inflation rates should drop back sharply on base effects (gas spike and German train ticket in Sep-22), to 4.5% and 4.8%, respectively. However, sequential growth is more interesting to gauge price pressures – energy HICP should be up again this month, by 1.3% MoM, and we pencil in another gain of 0.3% (seas adj) for core HICP (0.5% MoM NSA). September is usually a month with a high concentration of price changes, which should allow those sub-sectors still lagging behind in the price adjustment to hike their prices.

Peso’s September correction continues. Economists at ING analyze USD/MXN outlook.

Good Peso buying interest should USD/MXN trade over 18

High US interest rates are proving a headwind to emerging currencies worldwide – even to the mighty Mexican Peso. In addition, the Peso this month is facing the unwind of Banxico's FX intervention book – a front-loaded exercise that we felt could weigh on the MXN this month and perhaps into October, too.

With the Dollar set to stay strong for the next few weeks, USD/MXN could head up to the 200-Day Moving Average at 17.85 or even briefly trade above 18. However, we like the Peso multi-quarter and expect good Peso buying interest should USD/MXN trade over 18.

- US Initial Jobless Claims in the US advanced by 2,000 in the week ending September 23.

- Continuing Claims declined/increased by 12,000 in the week ending September 16.

- US Dollar Index remains in negative territory below 106.30.

Initial Jobless Claims totaled 204,000 in the week ending September 23, the weekly data published by the US Department of Labor (DOL) showed on Thursday. It is the second-lowest reading since late January. This follows the previous week's print of 202,000 (revised from 201,000) and came below the market expectation of 215,000. "The 4-week moving average was 211,000, a decrease of 6,250 from the previous week's revised average"; the DOL revealed.

Continuing claims decreased by 12,000 in the week ending September 16 to 1.670 million, below market expectations of 1.675 million.

Market reaction

The US Dollar Index printed fresh daily lows under 106.30 after the release of US data that included a new estimate of Q2 GDP growth.

- The US economy grew at an annual rate of 2.1% in Q2 as expected.

- The US Dollar Index stays in negative territory below 106.50.

The real Gross Domestic Product (GDP) of the United States expanded at an annual rate of 2.1% in the second quarter, the US Bureau of Economic Analysis' (BEA) final estimate showed on Thursday. This reading came in line with the previous estimate and the market expectation.

"The update primarily reflected a downward revision to consumer spending that was partly offset by upward revisions to nonresidential fixed investment, exports, and inventory investment," the BEA said.

"Imports, which are a subtraction in the calculation of GDP, were revised down," the publication read.

Market reaction

The US Dollar stays on the back foot after this data. As of writing, the US Dollar Index was down 0.4% on the day at 106.24.

- EUR/JPY extended upside near 157.50 as German HICP remained softer than expectations.

- German HICP expanded at a slower pace despite rising energy prices.

- The odds for BoJ’s intervention are high as Kazuo Ueda conveyed it is premature to ditch easy monetary policy.

The EUR/JPY pair stretched upside to near 157.50 in the late European session. The asset rallies as the preliminary German Harmonized Index of Consumer Price (HICP) report for September remained softer than expectations.

Monthly HICP expanded at a slower pace of 0.2% against expectations of 0.3% and August’s reading of 0.4%. On an annualized basis, the headline HICP softened to 4.3% vs. the estimates of 4.5% and the former release of 6.4%. Inflation in the German economy decelerated despite rising energy prices. This indicates that households’ demand is weakening as inflation bites real income.

In spite of inflation softening in Germany, the odds for one more interest rate hike from the European Central Bank (ECB) remain intact. ECB President Christine Lagarde said this week that despite progress on inflation it is seen too high for too long as the labor market has so far remained resilient. She made it very clear that interest rates will remain sufficiently restrictive for long enough till inflation comes down to near 2%.

For further guidance, investors will focus on the Eurozone HICP data, which will be published on Friday at 09:00 GMT.

On the Japanese Yen front, expectations for a stealth intervention by the Bank of Japan (BoJ) in the FX domain due to excessive currency volatility have deepened. The Japanese Yen has dropped to near 150.00 against the US Dollar. The odds for BoJ’s stealth intervention are high as Governor Kazuo Ueda conveyed that it is premature to ditch expansionary monetary policy as inflation needs to stabilize above the 2% target.

A decent move lower in the USD broadly greets traders today. Economists at Scotiabank analyze Greenback’s outlook.

Month-end in focus

Passive rebalancing for month and quarter-end may be checking the USD advance.

There is little more coverage on the screens of the USD’s broader advance looking stretched and some major currencies slipping deeper into undervaluation versus the USD but this has been a factor for a while and the USD is not relenting.

High absolute and relative yields and firm Oil prices remain broadly USD supportive and while we have a down session for the USD today, it will take a lot more to signal any sort of correction or sustained weakness in the USD at this point.

DXY gains might still extend towards 107/109.

EUR/USD has tested sub-1.05 levels twice in the past few hours. Economists at Scotiabank analyze the pair’s outlook.

Headwinds remain

A minor low/reversal may have been reached in the short run after the EUR tested the upper 1.04 area twice since Wednesday. A minor double bottom is in play but upside may be limited to the 1.0550/1.0600 area.

The Euro does appear to be deeply oversold in the short run at least but the pair will need to regain 1.06+ to suggest a more sustained rebound is unfolding.

Support is 1.0475/1.0480.

Loonie is underperforming but that essentially means no movement in USD/CAD around the 1.35 level. Shaun Osborne, Chief FX Strategist at Scotiabank, analyzes the pair’s outlook.

USD/CAD remains in consolidation mode

Technically, USD/CAD remains in consolidation mode; gains extended a little more than I had expected on Wednesday but price action still appears to be consolidating (bear wedge/flag pattern) after the mid-September slide in the USD.

Weakness below short-term support at 1.3490 should see the USD give up a little more ground to low/mid-1.34s.

Resistance is 1.3540/1.3550.

GBP/USD is putting in a solid session – by recent standards – so far today. Economists at Scotiabank analyze the pair’s outlook.

Cable looks heavily oversold in the short run

The GBP/USD pair looks heavily oversold in the short run and intraday price signals are bullish which may point to gains extending to the mid/upper 1.22s.

Cable would need to surpass the 1.2350 mark to show more meaningful technical strength.

Support is seen at 1.2100/1.2110.

See: GBP/USD remains vulnerable to the 1.20/1.21 area – ING

- The US Dollar keeps squeezing markets with new highs.

- All eyes on US GDP numbers on Thursday.

- The US Dollar Index reaches a new 10-month high above 106.75.

The US Dollar (USD) is on track to lock in an eleventh consecutive week of gains as the interest-rate differential between the US and other countries gets bigger by the day. This differential keeps backing the US Dollar as it does the flight to safe havens, where the Greenback is the place to be. King Dollar’s rally hasn’t likely finished and might head toward the 52-week high when measured by the DXY US Dollar Index.

Investors' eyes are on the final estimate of US Gross Domestic Product numbers for Q2, due at 12:30 GMT.. Although the number is of big importance, analysts do not expect any market-moving reaction, as it is the third reading for the second quarter. Rather keep an eye on the usual weekly Initial Jobless Claims, which might be the devil in the detail.

Daily digest: US Dollar racks in piles of money

- Two big data points hit the markets at 12:30 GMT. The US Gross Domestic Product (GDP) annualised growth rate for the second quarter is expected at 2.1%, while the Price Index is set to remain unrevised at 2%. Core Personal Consumption Expenditures is seen growing at 3.7%. Bear in mind that this is the third reading, so big moves aren’t expected even as the GDP basket is facing its five-year reshuffling.

- The second big data point are the Jobless Claims: Initial claims are expected to head from 201,000 to 215,000. The Continuing Claims are seen heading from 1,662,000 to 1,675,000.

- Around 13:00 GMT, markets expect to hear comments from Austan D. Goolsbee, the president of the Federal Reserve Bank of Chicago.

- At 14:00 GMT, Pending Homes Sales data will come out. The monthly reading is expected to fall 0.8%, swinging from a 0.9% increase a month earlier..

- The Kansas City Fed Manufacturing Activity Index for September is expected to come in at 15:00 GMT. Previous was at -12.

- A big slew of US Federal Reserve (Fed) speakers are set to speak. Fed Board Governor Lisa D. Cook will speak at around 17:00 GMT, Richmond Fed President Thomas Barkin will do so at 19:00 and, lastly, Fed Chairman Jerome Powell will speak at 20:00 GMT.

- Equities are dropping again with Asian markets registering falls of more than 1%. European and US equities are mildly in the red.

- The CME Group FedWatch Tool shows that markets are pricing in an 80.4 % chance that the Federal Reserve will keep interest rates unchanged at its meeting in November.

- The benchmark 10-year US Treasury yield traded as high as 4.62% and takes a small step back from Monday’s peak as investors start to buy safe bonds as a shield for any possible US government shutdown.

US Dollar Index technical analysis: 107.00 as target this week

The US Dollar looks to be on a mission this week, surprising friends and foes with yet again a firm winning streak. Another weekly gain is almost locked in, making it an eleven straight week of gains for the US Dollar. With the US Dollar Index (DXY) breaking above 106.00, traders are eyeballing 107.00 next.

The US Dollar Index opened around 106.50, though the overheated RSI might make it difficult to maintain this level. Traders that want to hit a new 52-week high need to be aware that a lot of road needs to be covered towards 114.78. Rather look for 107.19, the high of November 30, 2022, as the next profit target on the upside.

On the downside, the recent resistance at 105.88 should be seen as first support. Still, it has just been broken to the upside, so it isn’t likely to be a strong barrier. Rather look for 105.12 to do the trick and keep the DXY above 105.00.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

EUR/USD traded below 1.05 for the first time since January. Economists at Rabobank analyze the pair’s outlook.

EUR/USD could remain lower for longer into 2024

The USD is likely to remain well supported until the market has the confidence to move back into higher risk assets. In our view, this suggests that the USD is set to find support on safe-haven demand even as the US economy slows. As a result, EUR/USD could remain lower for longer.

Our forecasts for the Eurozone indicate technical recession for H2 and a slow recovery next year. The backdrop suggests scope for further downside pressure for the EUR. On the margin, rising concerns about the fiscal pledges of Italy’s right-wing government could also become a EUR negative factor since this has the potential to create tensions with Brussels going forward.

Having breached our former 1.06 target, we have revised our forecasts lower and now expect EUR/USD to move to 1.02 on a three-month view and remain lower for longer into 2024.

AUD/USD finally attracts buyers after 2.7% swoon since last week. Economists at Société Générale analyze the pair’s outlook.

Support 0.6310, Resistance 0.6440

AUD/USD has failed to overcome the hurdle of 0.6525 representing high of late August and the 50-DMA. It is attempting a break below recent consolidation zone denoting a regain of downward momentum.

Inability to cross above 0.6440, the 61.8% retracement of recent dip could mean persistence in decline.

Next potential objectives are located at 0.6310, the trend line connecting lows of March and May and projections near 0.6200/0.6170.

Strategists at ANZ Bank analyze Copper’s outlook.

Upward pressure on prices remains in place

Copper demand is likely to grow by nearly 4% this year, which will keep the market marginally undersupplied.

With inventories sitting near multi-year lows, upward pressure on prices remains in place.

We expect Copper to trade near the $9,000 level by the end of this year.

See:

- Gold Price Forecast: XAU/USD to trade near $2,000 by year-end – ANZ

-

Gold Price Forecast: Positive real US yields reduce the attractiveness of XAU/USD – Erste

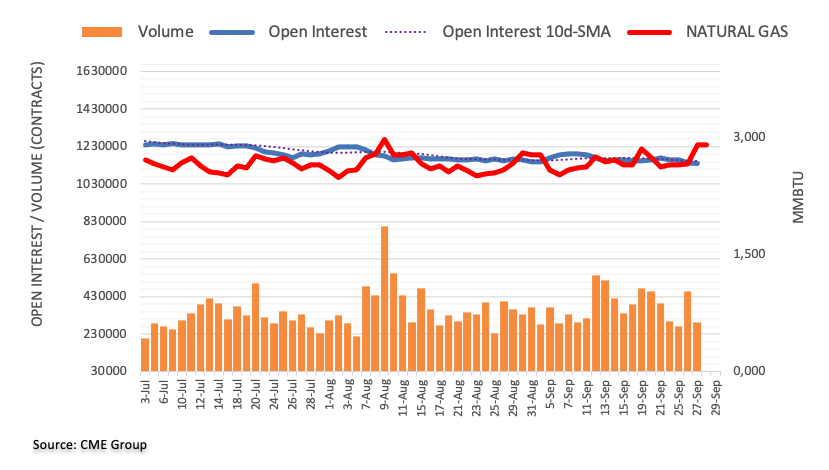

- Natural Gas pops higher towards $3.

- The US Dollar looks set for an eleventh straight week of gains.

- US Natural Gas prices are in an ascending trendline formation and could break to $3.3.

Natural Gas prices are trending higher despite Oil attracting all the attention in the energy market. Gas prices are soaring on more negative news out of Norway, raising concerns over gas supply from the Scandinavian bloc to Europe. Mounting supply problems could leave the old continent on balance of falling short of gas to fill up its reserves full ahead of the winter season.

The US Dollar (USD) is on track to lock in an eleventh consecutive week of gains as the interest-rate differential between the US and other countries gets bigger by the day. This differential keeps backing the US Dollar as it does the flight to safe havens, where the Greenback is the place to be. King Dollar’s rally hasn’t likely finished and might head toward the 52-week high when measured by the DXY US Dollar Index.

Natural Gas is trading at $2.99 per MMBtu at the time of writing.

Natural Gas news and market movers

- The Norwegian Asgard field is having unforeseen capacity reductions due to a delayed ramp up after maintenance, network manager Gassco AS said Thursday.

- Also in Norway, the works at the Kvitebjorn field are extended to October 1.

- The Norwegian Oseberg field and the Emden terminal are as well signalling issues and delays in reopening by another three days until after October 1.

- Contracts for September are rolling off on Thursday. Looking back at their performance, the September contracts have moved up 15% in value, with a 4.2% gain solely on Wednesday.

- With October set to get underway, the first big drawdowns from European gas storages might start.

- All eyes are on the weekly Energy Information Administration (EIA) publication of US gas storage changes. Expectations are for another build from 64 billion to 88 billion cubic feet.

Natural Gas Technical Analysis: Seasonal pop

Natural Gas is grinding higher at the moment when bigger brother Oil is hijacking all the headlines. The surprise delays and cuts in gas supply from Norway to Europe disrupts the supply side briefly, which grants an upside move. On the technical front, the current bullish triangle is an element to watch as a breakout might see Natural Gas trading near $3.3 soon.

Awaiting the breakout of the triangle, $3 remains a key level that needs to be broken. Seeing the current equilibrium, a catalyst is needed to move the needle upwards. Gas prices could rally to $3.25 in a bullish triangle breakout, testing the upper band of the ascending trend channel.

On the downside, the ascending trendline at $2.90 should support any attempts to break lower. The 200-day Simple Moving Average (SMA) at $2.80 could act as a circuit breaker in case there is a nosedive move. Should that give way, some area will be crossed before the next support kicks in at $2.75. This level aligns with the 55-day SMA, which is likely to step in to avoid any price crashes in the commodity.

-638314926457806390.png)

XNG/USD (Daily Chart)

Natural Gas FAQs

What fundamental factors drive the price of Natural Gas?

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

What are the main macroeconomic releases that impact on Natural Gas Prices?

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

How does the US Dollar influence Natural Gas prices?

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

Since mid-July, AUD/USD has weakened significantly. Economists at Commerzbank analyze the pair’s outlook.

The main focus of the RBA is inflation

The data currently paints a picture of a fairly resilient economy that is still surprisingly able to withstand interest rate increases. Ultimately, the still-strong economic indicators suggest that the risks to the RBA's monetary policy are tilted towards a tighter stance.

The market is currently undecided whether there will be another rate hike this year. The best time for this would probably be at the November meeting, as the new quarterly inflation figures will be published shortly before. If these surprise to the upside, indicating that underlying inflationary pressures remain strong, there is a chance that the RBA will react and hike again.

However, it is likely to focus on ‘higher for longer’ for now – supported by the strong economy. In our view, this should support the Aussie in the coming months.

- USD/JPY fails to recapture 150.00 for now as profit-booking hits US Dollar, more upside seems favored.

- Broader appeal for the US Dollar is still bullish amid resilient US economy and Fed’s hawkish stance.