- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:00 | New Zealand | ANZ Business Confidence | August | -44.3 | |

| 01:30 | Australia | Private Capital Expenditure | Quarter II | -1.7% | 0.5% |

| 05:00 | Japan | Consumer Confidence | August | 37.8 | |

| 06:45 | France | Consumer spending | July | -0.1% | 0.3% |

| 06:45 | France | GDP, q/q | Quarter II | 0.3% | 0.2% |

| 07:55 | Germany | Unemployment Rate s.a. | August | 5% | 5% |

| 07:55 | Germany | Unemployment Change | August | 1 | 4 |

| 09:00 | Eurozone | Consumer Confidence | August | -6.6 | -7.1 |

| 09:00 | Eurozone | Economic sentiment index | August | 102.7 | 102.3 |

| 09:00 | Eurozone | Industrial confidence | August | -7.4 | -7.4 |

| 09:00 | Eurozone | Business climate indicator | August | -0.12 | 0.08 |

| 12:00 | Germany | CPI, m/m | August | 0.5% | -0.1% |

| 12:00 | Germany | CPI, y/y | August | 1.7% | 1.5% |

| 12:30 | U.S. | Continuing Jobless Claims | 1674 | 1680 | |

| 12:30 | U.S. | Goods Trade Balance, $ bln. | July | -74.16 | |

| 12:30 | Canada | Current Account, bln | Quarter II | -17.35 | -9.8 |

| 12:30 | U.S. | PCE price index, q/q | Quarter II | 0.4% | 2.3% |

| 12:30 | U.S. | PCE price index ex food, energy, q/q | Quarter II | 1.1% | 1.8% |

| 12:30 | U.S. | Initial Jobless Claims | 209 | 215 | |

| 12:30 | U.S. | GDP, q/q | Quarter II | 3.1% | 2% |

| 14:00 | U.S. | Pending Home Sales (MoM) | July | 2.8% | 0% |

| 22:45 | New Zealand | Building Permits, m/m | July | -3.9% | |

| 23:01 | United Kingdom | Gfk Consumer Confidence | August | -11 | -12 |

| 23:30 | Japan | Unemployment Rate | July | 2.3% | 2.4% |

| 23:30 | Japan | Tokyo CPI ex Fresh Food, y/y | August | 0.9% | 0.7% |

| 23:30 | Japan | Tokyo Consumer Price Index, y/y | August | 0.9% | |

| 23:50 | Japan | Retail sales, y/y | July | 0.5% | -0.8% |

| 23:50 | Japan | Industrial Production (MoM) | July | -3.3% | 0.3% |

| 23:50 | Japan | Industrial Production (YoY) | July | -3.8% |

U.S. major stock indexes rose moderately as energy stocks rose amid rising oil prices, but bond market movements further curtailed, raising fears of a recession due to the ongoing fierce trade war between the US and China.

Oil prices jumped by almost 2%. The oil market was supported by weekly data from the US Department of Energy, which showed that oil reserves in the country fell 10 million barrels last week. Analysts on average expected a decrease in reserves of 2.1 million barrels.

However, fear of a potential recession holds back the general positive. The closely tracked spread between the yield of 10-year and 2-year US government bonds fell to -6 basis points on Wednesday for a short time, the lowest level since 2007. Meanwhile, the yield on 30-year US Treasury bonds is held just above its record low set earlier in today's session.

Corporate reporting also triggered several notable movements in the stock market. Autodesk (ADSK), a software development company, crashed almost 7% as it lowered its forecast for the full year. On the contrary, Hewlett Packard Enterprise (HPE) shares jumped 3.4% after the company announced that it had exceeded expectations for quarterly earnings.

Most DOW components completed trading in positive territory (26 out of 30). The biggest gainers were Dow Inc. (DOW; + 3.23%). Outsiders were Johnson & Johnson (JNJ; -0.99%).

Almost all S&P sectors recorded an increase. The exception is the utilities sector (-0.1%). The raw materials sector grew the most (+ 1.3%).

At the time of closing:

Dow 26,035.49 +257.59 +1.00%

S&P 500 2,887.94 +18.78 +0.65%

Nasdaq 100 7,856.88 +29.94 +0.38%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:00 | New Zealand | ANZ Business Confidence | August | -44.3 | |

| 01:30 | Australia | Private Capital Expenditure | Quarter II | -1.7% | 0.5% |

| 05:00 | Japan | Consumer Confidence | August | 37.8 | |

| 06:45 | France | Consumer spending | July | -0.1% | 0.3% |

| 06:45 | France | GDP, q/q | Quarter II | 0.3% | 0.2% |

| 07:55 | Germany | Unemployment Rate s.a. | August | 5% | 5% |

| 07:55 | Germany | Unemployment Change | August | 1 | 4 |

| 09:00 | Eurozone | Consumer Confidence | August | -6.6 | -7.1 |

| 09:00 | Eurozone | Economic sentiment index | August | 102.7 | 102.3 |

| 09:00 | Eurozone | Industrial confidence | August | -7.4 | -7.4 |

| 09:00 | Eurozone | Business climate indicator | August | -0.12 | 0.08 |

| 12:00 | Germany | CPI, m/m | August | 0.5% | -0.1% |

| 12:00 | Germany | CPI, y/y | August | 1.7% | 1.5% |

| 12:30 | U.S. | Continuing Jobless Claims | 1674 | 1680 | |

| 12:30 | U.S. | Goods Trade Balance, $ bln. | July | -74.16 | |

| 12:30 | Canada | Current Account, bln | Quarter II | -17.35 | -9.8 |

| 12:30 | U.S. | PCE price index, q/q | Quarter II | 0.4% | 2.3% |

| 12:30 | U.S. | PCE price index ex food, energy, q/q | Quarter II | 1.1% | 1.8% |

| 12:30 | U.S. | Initial Jobless Claims | 209 | 215 | |

| 12:30 | U.S. | GDP, q/q | Quarter II | 3.1% | 2% |

| 14:00 | U.S. | Pending Home Sales (MoM) | July | 2.8% | 0% |

| 22:45 | New Zealand | Building Permits, m/m | July | -3.9% | |

| 23:01 | United Kingdom | Gfk Consumer Confidence | August | -11 | -12 |

| 23:30 | Japan | Unemployment Rate | July | 2.3% | 2.4% |

| 23:30 | Japan | Tokyo CPI ex Fresh Food, y/y | August | 0.9% | 0.7% |

| 23:30 | Japan | Tokyo Consumer Price Index, y/y | August | 0.9% | |

| 23:50 | Japan | Retail sales, y/y | July | 0.5% | -0.8% |

| 23:50 | Japan | Industrial Production (MoM) | July | -3.3% | 0.3% |

| 23:50 | Japan | Industrial Production (YoY) | July | -3.8% |

The U.S. Energy

Information Administration (EIA) revealed on Wednesday that crude inventories tumbled

by 10.027 million barrels in the week ended August 23. Economists had forecast

a drop of 2.850 million barrels.

At the same

time, gasoline stocks reduced by 2.090 million barrels, while analysts had

expected a decline of 0.400 million barrels. Distillate stocks fell by 2.063

million barrels, while analysts had forecast an increase of 1.400 million

barrels.

Meanwhile, oil

production in the U.S. increased by 200,000 barrels a day to 12.500 million

barrels a day.

U.S. crude oil

imports averaged 5.9 million barrels per day last week, down by 1,290,000 barrels

per day from the previous week.

Nick Kounis, the head financial markets research at ABN AMRO, expects the ECB to cut all its policy rates by 10bp at the September meeting, followed by another 10bp step at the December meeting.

- “Both moves are more than priced in by financial markets. Economists – according to the Bloomberg Poll – expect a 10bp cut in the deposit rate in September, but no change in December.

- For the ECB to surprise on the upside, it would need to cut policy rates by 20bp next month. However, it will likely be reluctant to do so. As it moves policy rates into unchartered territory, with uncertainty about the impact of more deeply negative rates on banks and the transmission mechanism, it may well decide to move in smaller steps. The last four ECB reductions in the deposit rate have each equalled 10bp, probably reflecting this reasoning.”

- Abolition of the backstop is something that we can't and won't support

U.S. stock-index futures rose moderately on Wednesday as investors remained cautious about declining U.S. Treasuries yields and uncertainty in U.S.-China trade relations.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,479.42 | +23.34 | +0.11% |

Hang Seng | 25,615.48 | -48.59 | -0.19% |

Shanghai | 2,893.76 | -8.44 | -0.29% |

S&P/ASX | 6,500.60 | +29.40 | +0.45% |

FTSE | 7,081.66 | -7.92 | -0.11% |

CAC | 5,343.02 | -44.07 | -0.82% |

DAX | 11,623.18 | -106.84 | -0.91% |

Crude oil | $56.03 | +1.98% | |

Gold | $1,551.60 | -0.01% |

According to the latest CFTC Commitment of Traders Report, net long USD positions were virtually unchanged after falling modesty for the first time in the previous week since the middle of June.

- “Bullish sentiment towards the dollar is unlikely to change as the prospects of prolonged trade war between the US and China do not bode well for emerging markets.

- Speculators trimmed their bearish bets against the euro to the lowest level since June. We, however, are of the view that it is too early to adopt a far more constructive view on the single currency due to various challenges the Eurozone faces, including weak economic activity in Germany and political uncertainty in Italy.

- Net short GBP positions fell further as investors took profits amid growing optimism that the worst-case scenario of a hard Brexit may be avoided.

- CAD net long positions fell further amid rising expectations that the BoC will respond to the significant escalation in trade tensions lowering interest rates in the coming months.”

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 155.53 | -0.22(-0.14%) | 1844 |

ALTRIA GROUP INC. | MO | 45.19 | -0.06(-0.13%) | 39143 |

Amazon.com Inc., NASDAQ | AMZN | 1,754.00 | -7.83(-0.44%) | 16313 |

Apple Inc. | AAPL | 203.81 | -0.35(-0.17%) | 134396 |

AT&T Inc | T | 34.66 | -0.06(-0.17%) | 2033 |

Boeing Co | BA | 353 | -1.73(-0.49%) | 8716 |

Caterpillar Inc | CAT | 112.66 | -0.72(-0.64%) | 4990 |

Chevron Corp | CVX | 116.2 | 0.37(0.32%) | 1740 |

Cisco Systems Inc | CSCO | 46.71 | -0.08(-0.17%) | 7511 |

Citigroup Inc., NYSE | C | 60.96 | -0.70(-1.14%) | 7786 |

Facebook, Inc. | FB | 180.75 | -0.55(-0.30%) | 27224 |

FedEx Corporation, NYSE | FDX | 148.81 | -0.72(-0.48%) | 327 |

Ford Motor Co. | F | 8.74 | -0.02(-0.23%) | 77762 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 8.68 | -0.03(-0.34%) | 29004 |

General Electric Co | GE | 7.92 | -0.01(-0.13%) | 163107 |

General Motors Company, NYSE | GM | 35.8 | -0.09(-0.25%) | 1073 |

Goldman Sachs | GS | 196.55 | -1.52(-0.77%) | 3545 |

Hewlett-Packard Co. | HPQ | 17.61 | -0.12(-0.68%) | 875 |

Home Depot Inc | HD | 217.5 | -0.71(-0.33%) | 889 |

Intel Corp | INTC | 45.69 | -0.10(-0.22%) | 14080 |

International Business Machines Co... | IBM | 131.1 | -0.07(-0.05%) | 682 |

Johnson & Johnson | JNJ | 129 | -0.64(-0.49%) | 5233 |

JPMorgan Chase and Co | JPM | 104.6 | -1.14(-1.08%) | 8282 |

Merck & Co Inc | MRK | 85.92 | 0.40(0.47%) | 304 |

Microsoft Corp | MSFT | 135.25 | -0.49(-0.36%) | 24495 |

Nike | NKE | 81.8 | -0.23(-0.28%) | 1877 |

Pfizer Inc | PFE | 34.5 | 0.16(0.47%) | 8186 |

Procter & Gamble Co | PG | 120.23 | -0.32(-0.27%) | 479 |

Starbucks Corporation, NASDAQ | SBUX | 95.85 | -0.24(-0.25%) | 829 |

Tesla Motors, Inc., NASDAQ | TSLA | 213.24 | -0.84(-0.39%) | 31068 |

Twitter, Inc., NYSE | TWTR | 41.88 | -0.26(-0.62%) | 31605 |

UnitedHealth Group Inc | UNH | 221.83 | -1.10(-0.49%) | 2292 |

Visa | V | 177.4 | -0.98(-0.55%) | 4512 |

Walt Disney Co | DIS | 133.81 | -0.68(-0.51%) | 16047 |

Yandex N.V., NASDAQ | YNDX | 36.25 | -0.24(-0.66%) | 4100 |

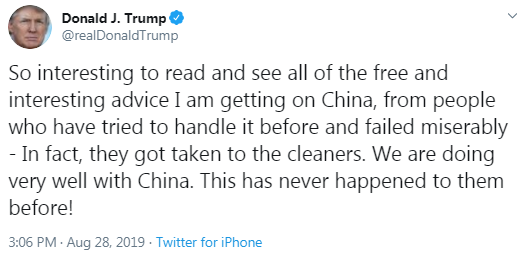

- Says China has been stealing intellectual property for decades

- Countries must be wary of Chinese debt diplomacy

Hewlett Packard Enterprise (HPE) target lowered to $15 from $17 at Maxim Group

- We will then bring a no-confidence vote at some point

- PM Johnson needs to be held to account by parliament

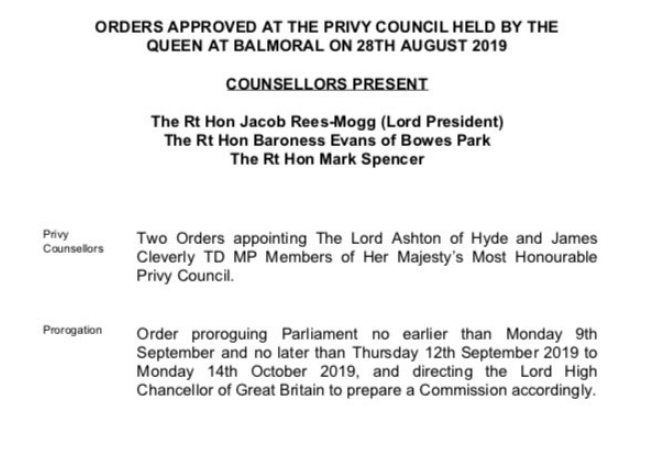

James Rossiter, the head of global macro strategy at TD Securities, notes that the UK's PM Boris Johnson has requested that Parliament be prorogued from the week beginning September 9 until October 14.

- “The Queen is likely to grant this request later today.

- This means that Parliament will not sit during these dates, and will have less of a window to prevent No Deal Brexit.

- We believe this actually increases the odds of a deal being done by the end of October, and decreases the odds of an "accidental" No-Deal Brexit. We continue to think No Deal odds are around 40%.”

Hewlett Packard Enterprise (HPE) reported Q3 FY 2019 earnings of $0.45 per share (versus $0.44 in Q3 FY 2018), beating analysts’ consensus estimate of $0.40.

The company’s quarterly revenues amounted to $7.217 bln (-7.0% y/y), generally in line with analysts’ consensus estimate of $7.286 bln.

The company issued upside guidance for Q4, projecting EPS of $0.43-0.47 (versus analysts’ consensus estimate of $0.43).

It also raised FY 2019 non-GAAP EPS to $1.72-1.76 from $1.62-1.72 (versus analysts’ consensus estimate of $1.68).

HPE rose to $13.62 (+5.34%) in pre-market trading.

- We have not abandoned 60%-target for 2019

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. fell 6.2 percent in the week ended August 23, following a 0.9

percent drop in the previous week.

According to

the report, refinance applications declined 7.6 percent, while applications to

purchase a home dropped 4 percent.

Meanwhile, the

average fixed 30-year mortgage rate increased to 3.94 percent from 3.90 percent.

“U.S. Treasury

yields were volatile over the course of the week, as the ongoing trade dispute

between the U.S. and China continued to generate uncertainty among investors,” noted

Joel Kan, MBA’s associate vice president of economic and industry forecasting.

“Rates increased for the first time since the week of July 12.”

Analysts at TD Securities are forecasting Australia’s Q2 CAPEX to come in softer, down 0.5% q/q, led by decreases in building and structures.

- “Plant and Equipment which directly feeds into GDP is also expected to be softer, -0.5% q/q. Accompanying this data, we get final CAPEX for 2018/19, which we forecast to be A$124b, nearly 4% up on 2017/18.

- The 3rd estimate for 2019/20 raw CAPEX is expected to be A$117b, +18% on the 2ndestimate on gains in mining, manufacturing and services CAPEX.”

TD Securities' analysts note that the UK government has confirmed that it's requesting to prorogue parliament from around September 11th until the Queen's Speech scheduled for October 14th.

- “Downing Street is selling this as a "bog-standard" prorogue, in line with what normally happens before a Queen's Speech. However, the timing is obviously rather convenient for a government that wants to thwart any attempts by the opposition to take control of parliament and rule out a no-deal Brexit.

- So parliament sits as normal next week, and we can expect opposition parties to be putting all efforts toward passing some sort of legislation to prevent No Deal Brexit, if not calling an outright confidence vote (and it's very unclear which way that confidence vote would fall).

- We think that there are two main implications: 1) This reduces the odds of the Parliament forcing a Brexit deadline extension on the government. 2) With parliament less likely to be able to stop a no-deal Brexit, this increases the odds that the EU is willing to bend on re-opening the Withdrawal Agreement, and that the UK leaves the EU with a deal on 31 October."

- We will engage with UK on any constructive Brexit proposals

Deutsche Bank analysts note that the US economic data ended up surprising to the upside and was particularly the case for the August consumer confidence report which saw consumer confidence print at 135.1 compared to expectations of 129.0.

“The present situations component jumped 6.7pts to 177.2 which shows some resilience to the recent trade noise, and in fact puts it at the highest level since 2000. The expectations component did nudge a little lower though. On the other hand another plus was the jobs-plentiful/jobs hard-to-get series which rose to the highest since 2000 too. Interestingly the data goes against that of the University of Michigan survey and in fact the gap between the two consumer confidence readings is the largest since 1969 and second largest on record. Meanwhile, the Richmond Fed manufacturing index climbed yesterday, jumping 13pts to +1 in August (vs. -4 expected). So that further complicates the picture from the mixed PMIs and regional Fed surveys. The only other data came from the housing market where the S&P CoreLogic house price index rose +0.04% mom in June and a little less than expected.”

Karen Jones, analyst at Commerzbank, explains that USD/JPY has sold off to and so far reversed from the 104.51/10 January low and the 2013-2019 uptrend and this support is reinforced by the 200 month ma at 104.44.

“Currently we have few clues how far the bounce will extend, however interim resistance is the 107.21 18th July low and the market remains capped here. A recovery above here is needed to alleviate immediate downside pressure. This guards the 108.99/109.32 recent highs. Failure at 104.10 would target 99.00 the 2016 low, but for now we would allow for consolidation and look for the market to hold at circa 104.50/10.”

According to the report from Italian National Institute of Statistics (ISTAT), in August 2019, the consumer confidence index worsened from 113.3 to 111.9. The worsening in confidence was spread across all its components: in particular, the economic one decreased from 129.6 to 127.8, the personal one from 108.0 to 107.0, the current one from 111.1 to 110.0 and, finally, the future one from 117.4 to 115.4.

With regard to the business confidence climate, the related index (economic sentiment Indicator) decreased from 101.2 to 98.9.

The confidence index in manufacturing deteriorated from 100.1 to 99.7. The confidence index in construction went down from 142.8 to 140.4. The market services confidence index diminished from 100.0 to 97.4. The retail trade confidence index remained practically unchanged, moving from 110.0 to 109.9. The retail trade confidence index improved slightly in the large scale distribution, passing from 111.6 to 112.3 but decreased in the small and medium scale one moving from 104.0 to 100.9.

Get ready for a further weakness in the Chinese yuan, but look for Beijing to limit the drop even as the U.S.-China trade war intensifies, analysts said after the currency this week fell to an 11 1/2-year low versus the U.S. dollar.

The fear of a sharp, continued fall in the yuan is one item keeping investors and policy makers awake at night after the yuan’s 2015 devaluation sparked global financial market volatility. While rising U.S. tariffs on imported Chinese goods further muddy China’s economic outlook, and warrant a weaker yuan, Beijing is likely to ensure that the decline is “both controlled and limited,” wrote analysts at UBS.

They offered three reasons:

Rapid yuan depreciation would likely further provoke the White House. When USDCNY climbed past the 7.0 mark in early August the U.S. Treasury in turn labeled China a “currency manipulator.” China this week called for “calm negotiations” in the wake of the latest trade escalation, and is unlikely to pursue a currency policy that would fuel U.S. claims of yuan weaponization.

Beijing is well aware of the potential negative consequences of currency depreciation. It needs to adopt a balancing act that weakens the yuan quietly to offset the effects of U.S. import tariffs without creating expectations for a sharp fall that could spur a repeat of the capital outflows of 2015-16.

USDCNY (U.S. dollar/yuan) trade is a two-sided affair. A stronger monetary easing bias from the Fed amid heightened trade tensions could potentially limit USDCNY upside. At the same time, if the U.S. continues to raise tariffs, China might find holding a specific line on the yuan to be counterproductive and unfeasible.

Nevertheless, the direction for the yuan is likely to be to the downside barring any significant improvement in U.S. - China trade relations, said analysts who look for the yuan to weaken to 7.4 per dollar over the next three and six months and 7.3 per dollar over the next 12 months.

Danske Bank analysts point out that yesterday, we saw a more significant inversion of the US 2s10s yield curve indicating that investors have become more concerned about an US recession 1-2 years down the road.

“Based on yesterday's release of the consumer confidence indicator from the Conference Board, it is difficult to see the recession near-term. Current situation jumped to a new cycle high and while the expectations component dropped, it remains relatively high (at the same level as the averages in 2017 and 2018) and significantly higher compared to the drop early 2019. Consumer confidence is not the best leading indicator but a recession needs some element of negative animal spirits effects, which is not present yet, at least. The consumer side of the US economy still looks solid, but manufacturing is struggling.”

Deteriorating Sino-U.S. trade ties and interest rate reforms are fueling speculation China will start cutting key rates from next month, but bankers expect borrowing costs to come down only gradually, offering limited support for the slowing economy.

Chinese policymakers need to kickstart flagging investment to save jobs, but big rate cuts could fuel a further build-up in debt and squeeze banks’ profit margins, heightening financial sector risks.

Still, as the economy cools, analysts say landmark reforms launched last week have paved the way for the first cuts in major China policy rates in four years, with a move seen by mid-September, coinciding with expected easing by the U.S. Federal Reserve.

Initial rate cuts are expected to be modest, however, as banks and regulators get used to the new, more market-oriented loan pricing system. The People’s Bank of China (PBOC) will not push lenders too hard to lower rates at first, analysts said.

To reduce the pressure on banks, the central bank is expected to first reduce their funding costs by lowering the rate on its medium-term lending facility (MLF). That will open the door for a cut in the PBOC’s new benchmark lending rate, the loan prime rate (LPR), the next time it is set on Sept. 20. The MLF forms the basis for the new LPR rate, but banks can add a premium to reflect funding costs and credit risks.

According to the report from European Central Bank, the annual growth rate of the broad monetary aggregate M3 increased to 5.2% in July 2019 from 4.5% in June, averaging 4.8% in the three months up to July. The components of M3 showed the following developments. The annual growth rate of the narrower aggregate M1, which comprises currency in circulation and overnight deposits, increased to 7.8% in July from 7.2% in June. The annual growth rate of short-term deposits other than overnight deposits (M2-M1) increased to 0.1% in July from -0.1% in June. The annual growth rate of marketable instruments (M3-M2) was -1.2% in July, compared with -4.7% in June.

Annual growth rate of adjusted loans to households stood at 3.4% in July, compared with 3.3% in June

Annual growth rate of adjusted loans to non-financial corporations stood at 3.9% in July, unchanged from previous month

According to Danske Bank analysts, today we have a light calendar in terms of data releases, hence markets will look out for any statements regarding the ongoing trade war between the US and China as well as progress in the Italian coalition talks.

“Fed's Barkin and Daly both speak today (18:20 and 23:30, respectively). While they are both non-voters, they are in our view centrists, so the speeches may give an indication of how concerned the Fed is about the current situation.”

“In the euro area, M3 money growth and credit growth figures for July are on the agenda . So far credit growth has remained robust in light of the economic slowdown and with its stimulus package unveiled in September, ECB will be keen to avoid any tightening of credit conditions.”

“Swedish retail sales figures are due out and we expect another gain in July as the weather was less good compared to last year. That probably let shoppers spend more time in shopping malls rather than on the beach. We expect +0.5 % mom/3.8% yoy cal adj.”

New data from the Recruitment & Employment Confederation (REC) shows that employers’ confidence in the UK economy remains low, with confidence levels now at net: -26 – a fall of 1 percentage point from the previous rolling quarter.

The REC’s latest report shows that despite low confidence levels in the economy, employers are still looking to hire. Forecast demand for permanent staff increased to net: +19 in the short-term and net: +21 in the medium-term in May-July 2019, compared to the net: +16 and net: +18 recorded in the previous quarter (February-April 2019).

However, almost half (46 per cent) of employers of permanent staff expressed concern about finding enough suitable candidates for hire, with Health & Social Care skills being the area they were most concerned about being able to access. This should sound alarm bells as 45 per cent of public sector employers reported having no spare workforce capacity at all.

Tom Hadley, Director of Policy and Campaigns at the REC, said:

“Our flexible labour market continues to be one of the strongest elements of the UK economy. This most recent survey shows employers are still looking to take on both permanent and temporary workers as they seek to maintain stability amidst the Brexit uncertainty. More employers also seem to be trying to transfer their best temps into permanent roles as candidate shortages continue to bite across many sectors.”

According to the report from Federal Statistical Office (Destatis), the index of import prices decreased by 2.1% in July 2019 compared to the corresponding month of the preceding year. Economists had expected a 1.7% decrease. In June 2019 and in May 2019 the annual rates of change were -2.0% and -0.2%, respectively. From June 2019 to July 2019 the index fell by 0.2%. Economists had expected the index to remain unchanged.

The index of import prices, excluding crude oil and mineral oil products, decreased in July 2019 by 1.7% compared to July 2018 and in comparison with June 2019 it fell by 0.3%.

The index of export prices increased by 0.2% in July 2019 compared to the corresponding month of the preceding year. In June 2019 and in May 2019 the annual rates of change were +0.2% and +0.7%, respectively. From June 2019 to July 2019 the index slightly rose by 0.1%.

Karen Jones, analyst at Commerzbank, suggests that EUR/USD’s intraday Elliott wave counts remain neutral to negative.

“Attention remains still on the 1.1027 recent low and the base of its down channel at 1.0948. Below here lies the 78.6% retracement at 1.0814. Nearby resistance is the 200 day ma at 1.1280, but key resistance is 1.1339/58, the 2018-2019 down channel and the 55 week ma. A weekly close above this latter level is needed for us to adopt an outright bullish stance. The market will need to regain the 55 week ma and channel at 1.1339/58 to generate upside interest.”

According to the report from GfK Group, German consumer confidence paints a mixed picture for August. While there has been an increase in propensity to buy, income expectations have dropped slightly. By contrast, the economic outlook suffered a significant decline. GfK forecasts that the consumer climate in September will remain unchanged from the previous month at 9.7 points.

The global economic downturn, trade wars and the ongoing discussions surrounding Brexit are all putting increasing pressure on the economic outlook of consumers. This has resulted in the economic indicator for August dropping to its lowest level in more than six and a half years. So far, the propensity to buy has stood firm, even increasing for August. By contrast, income expectations suffered a small decline after last month's recovery.

The economic expectation indicator lost 8.3 points in August, falling to -12. The last time a lower value was recorded was more than six and a half years ago in January 2013, when it fell to -12.5 points. This means that the figure is now 30 points lower when compared to the same period last year.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1208 (2239)

$1.1168 (2446)

$1.1139 (918)

Price at time of writing this review: $1.1085

Support levels (open interest**, contracts):

$1.1037 (4141)

$1.1016 (1474)

$1.0994 (7442)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date September, 6 is 109588 contracts (according to data from August, 27) with the maximum number of contracts with strike price $1,1400 (8823);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2379 (2239)

$1.2337 (1173)

$1.2316 (772)

Price at time of writing this review: $1.2282

Support levels (open interest**, contracts):

$1.2226 (1243)

$1.2200 (1535)

$1.2168 (1129)

Comments:

- Overall open interest on the CALL options with the expiration date September, 6 is 30700 contracts, with the maximum number of contracts with strike price $1,2750 (4128);

- Overall open interest on the PUT options with the expiration date September, 6 is 26098 contracts, with the maximum number of contracts with strike price $1,2100 (2016);

- The ratio of PUT/CALL was 0.85 versus 0.84 from the previous trading day according to data from August, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 59.59 | 2.35 |

| WTI | 55.53 | 3.45 |

| Silver | 18.16 | 3.01 |

| Gold | 1542.472 | 1 |

| Palladium | 1478.2 | 0.13 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 195.04 | 20456.08 | 0.96 |

| Hang Seng | -16.26 | 25664.07 | -0.06 |

| KOSPI | 8.29 | 1924.6 | 0.43 |

| ASX 200 | 31.1 | 6471.2 | 0.48 |

| FTSE 100 | -5.4 | 7089.58 | -0.08 |

| DAX | 71.98 | 11730.02 | 0.62 |

| Dow Jones | -120.93 | 25777.9 | -0.47 |

| S&P 500 | -9.22 | 2869.16 | -0.32 |

| NASDAQ Composite | -26.79 | 7826.95 | -0.34 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67507 | -0.34 |

| EURJPY | 117.287 | -0.43 |

| EURUSD | 1.10906 | -0.08 |

| GBPJPY | 129.94 | 0.21 |

| GBPUSD | 1.22871 | 0.55 |

| NZDUSD | 0.63621 | -0.46 |

| USDCAD | 1.3283 | 0.23 |

| USDCHF | 0.98093 | 0.21 |

| USDJPY | 105.743 | -0.35 |

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.