- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The headline Tokyo Consumer Price Index (CPI) for September rose 2.2% YoY, compared to a 2.6% rise in the previous reading, the Statistics Bureau of Japan showed on Friday. Meanwhile, the Tokyo CPI ex Fresh Food, Energy increased 1.6% YoY, compared to the previous reading of 1.6% rise.

Additionally, Tokyo CPI ex Fresh Food rose 2.0% YoY in September, compared to a 2.4% rise in August, and was in line with the market consensus of 2.0%.

Market reaction to the Tokyo Consumer Price Index

As of writing, the USD/JPY pair was up 0.19% on the day at 145.10.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

- EUR/USD recovered ground on Thursday, sticking close to near-term highs.

- Despite recovery, Fiber remains on the south side of 1.1200.

- US PCE inflation to be the week’s key data print.

EUR/USD tuned back into the high end on Thursday, getting bolstered by a broad-market selloff in the Greenback. US data that printed better than expected helped to ease concerns of a possible economic slowdown within the US economy looming over the horizon.

The US economy still isn’t out of the woods yet, with key activity data still easing, but the hard edge of recession fears has been filed off. Friday still has one final hurdle for data-hounds to lurch over, however. US Personal Consumption Expenditure (PCE) inflation figures due during the last trading session of the week could throw a spanner in the works if they come out wildly out-of-tune with forecasts.

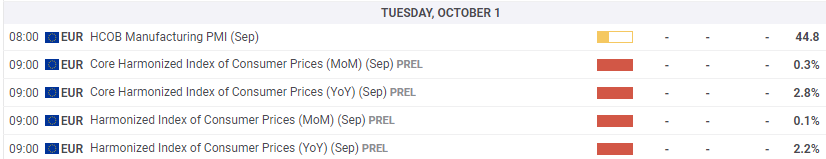

Across the Atlantic, pan-EU confidence indicators are also expected on Friday, but most of these indexed surveys are expected to stick close to previous figures. EUR traders will be much more interested in European Harmonized Index of Consumer Prices (HICP) inflation numbers for September, which are due next Tuesday.

The Federal Reserve's recent decision to cut interest rates by 50 basis points raised apprehensions in global markets, with some investors fearing that the drastic move was a response to an impending economic downturn in the US. However, Fed Chair Jerome Powell clarified that the rate cut was a proactive measure aimed at supporting the US labor market, rather than a reactive response to recessionary signals.

Positive data on US Durable Goods Orders and weekly Initial Jobless Claims further reinforced the Fed's position, with both indicators surpassing expectations. The narrative of a "soft landing" for the economy remained intact. The upcoming release of the Personal Consumption Expenditure (PCE) inflation data on Friday will serve as a crucial litmus test for evaluating the impact of the recent rate cut by the Fed.

In August, US Durable Goods Orders stagnated at 0.0% month-on-month, falling short of the previous month's significant growth but still outperforming the projected contraction of 2.6%. Additionally, the Initial Jobless Claims for the week ending September 20 showed a decrease to 218K, beating the anticipated 225K and signaling a decline from the revised figure of 222K in the preceding week.

EUR/USD price forecast

Despite Thursday’s bullish bounceback, Fiber remains capped below the 1.1200 handle. Bidders are struggling to muscle EUR/USD back into the high end, but a lack of meaningful momentum in the hands of sellers is limiting options for a downside swing.

The pair remains well-bid on the north side of the 50-day Exponential Moving Average (EMA) near 1.1040, while price action still has plenty of room to move into the top end and reclaim chart paper above 1.1200.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Federal Reserve (Fed) Governor Lisa Cook said on Thursday that she endorsed the 50 basis points (bps) interest rate cut last week as a way to address increased "downside risks" to employment, per Reuters.

Key quotes

"I wholeheartedly supported the decision.“

"That decision reflected growing confidence that, with an appropriate recalibration of our policy stance, the solid labor market can be maintained in a context of moderate economic growth and inflation continuing to move sustainably down to our target.”

"In thinking about the path of policy moving forward, I will be looking carefully at incoming data, the evolving outlook, and the balance of risks.”

"As labor demand and supply are now more evenly balanced, it may become more difficult for some individuals to find employment.”

"The return to balance in the labor market between supply and demand, as well as the ongoing return toward our inflation target, reflects the normalization of the economy after the dislocations of the pandemic.”

"This normalization, particularly of inflation, is quite welcome, as a balance between supply and demand is essential for sustaining a prolonged period of labor-market strength."

Market reaction

The US Dollar Index (DXY) is trading 0.02% higher on the day at 100.58, as of writing.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- USD/CAD weakens to around 1.3470 in Friday’s early Asian session.

- The US August PCE data will be in the spotlight on Friday.

- The softer US Dollar weighs on the pair, but lower crude oil prices might cap its downside.

The USD/CAD pair edges lower to near 1.3470 during the early Asian session on Friday, pressured by the weaker US Dollar (USD) broadly. Investors await bigger clues about the economy's health after upbeat US economic data on Thursday. The US Personal Consumption Expenditures (PCE) Price Index for August will take center stage on Friday.

With its larger-than-normal reduction last week, the Federal Reserve (Fed) sent a clear message that interest rates are heading considerably lower in the future. This, in turn, exerts some selling pressure on Greenback against the Canadian Dollar (CAD).

Fed Officials penciled in another 50 basis points (bps) rate cuts by the end of the year and another 100 bps reductions by the end of 2025. Nonetheless, the release of US PCE data, the Fed’s preferred price metric, could give them hints about the US central bank’s path ahead. The headline PCE is expected to show an increase of 2.3% YoY in August, while the core PCE is projected to show a rise of 2.7% YoY in the same report. In the case of the hotter-than-expected inflation data, this could help limit the USD’s losses.

On the Loonie front, Bank of Canada (BoC) Governor Tiff Macklem said on Tuesday that it is reasonable to expect more rate cuts as the BoC has made progress in bringing inflation back down to the 2% target. Meanwhile, the fall in crude oil prices could weigh on commodity-linked CAD as Canada is the largest oil exporter to the United States (US), and lower crude oil prices tend to have a negative impact on the CAD value.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- GBP/USD edged into a fresh multi-year high on Thursday.

- Despite a lack of UK data, GBP continues to grind higher.

- Better-than-expected US data keeps Greenback short pressure elevated.

The GBP/USD currency pair reached a 31-month high of 1.3434 on Thursday, marking a significant milestone in its upward trajectory. This surge was primarily driven by a widespread selloff of the US dollar, buoyed by improved economic indicators that alleviated concerns about a potential economic slowdown.

The data docket remains light on the UK side for the remainder of the week, and Cable traders will be forced to sit on their hands and wait for GBP-centric data due next week, starting with UK Gross Domestic Product (GDP) figure slated for Monday.

The Federal Reserve's recent decision to cut interest rates by 50 basis points raised apprehensions in global markets, with some investors fearing that the drastic move was a response to an impending economic downturn in the US. However, Fed Chair Jerome Powell clarified that the rate cut was a proactive measure aimed at supporting the US labor market, rather than a reactive response to recessionary signals.

Positive data on US Durable Goods Orders and weekly Initial Jobless Claims further reinforced the Fed's position, with both indicators surpassing expectations. The narrative of a "soft landing" for the economy remained intact. The upcoming release of the Personal Consumption Expenditure (PCE) inflation data on Friday will serve as a crucial litmus test for evaluating the impact of the recent rate cut by the Fed.

In August, US Durable Goods Orders stagnated at 0.0% month-on-month, falling short of the previous month's significant growth but still outperforming the projected contraction of 2.6%. Additionally, the Initial Jobless Claims for the week ending September 20 showed a decrease to 218K, beating the anticipated 225K and signaling a decline from the revised figure of 222K in the preceding week.

GBP/USD price forecast

The GBP/USD, also known as Cable, has been steadily reaching multi-year highs, and there are few significant technical obstacles in the way for Pound bulls. However, the strong upward momentum has made GBP/USD vulnerable to a possible downward correction as market dynamics come into play. If there is a significant buildup of selling pressure in the current price region, it could easily push the price below the key support level at 1.3100 and towards the 50-day Exponential Moving Average (EMA) at 1.3076.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- EUR/JPY rises to 161.79 after surpassing the 50-DMA, marking its third consecutive day of gains.

- Momentum shows signs of consolidation ahead, with resistance at 162.45/65 and the 200-DMA at 164.10.

- A break below 160.74 could expose the pair to support at 158.99/98, near the Tenkan Sen level.

The EUR/JPY printed solid gains of over 0.40% on Thursday, extending its rally to three consecutive days. Data from the United States (US) improved risk appetite and consequently weighed on the Japanese Yen due to its safe-haven status. At the time of writing, the cross-pair trades at 161.79.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY uptrend remains intact, although the pair aimed higher to the bottom of the Ichimoku Cloud (Kumo) after surpassing the 50-day moving average (DMA) at 161.19.

Momentum hints that buyers are losing some steam, as depicted by the Relative Strength Index (RSI) slope turning flat, meaning the consolidation lies ahead.

If EUR/JPY clears the bottom of the Kumo at around 162.45/65, the next resistance level would be the Senkou Span B at 163.13, followed by the 200-day moving average (DMA) at 164.10.

Conversely, if EUR/JPY dives below the September 26 low of 160.74, the next support would be the confluence of the September 24 daily low of and the Tenkan Sen at around 158.99/98

EUR/JPY Price Action – Daily Chart

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.00% | 0.00% | 0.01% | 0.01% | 0.03% | -0.00% | -0.04% | |

| EUR | -0.00% | -0.01% | 0.00% | -0.03% | 0.03% | -0.02% | -0.04% | |

| GBP | -0.00% | 0.01% | 0.02% | -0.01% | 0.04% | 0.00% | -0.03% | |

| JPY | -0.01% | 0.00% | -0.02% | -0.01% | 0.04% | -0.01% | -0.01% | |

| CAD | -0.01% | 0.03% | 0.00% | 0.00% | 0.00% | 0.00% | -0.04% | |

| AUD | -0.03% | -0.03% | -0.04% | -0.04% | -0.01% | -0.02% | -0.05% | |

| NZD | 0.00% | 0.02% | -0.01% | 0.01% | -0.00% | 0.02% | -0.04% | |

| CHF | 0.04% | 0.04% | 0.03% | 0.01% | 0.04% | 0.05% | 0.04% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

- The NZD/USD pair recovered on Thursday, settling at 0.6330.

- The RSI and MACD indicators are turning bullish, supporting the prospect of further gains.

- Buyers cleared most of Wednesday’s losses.

On Thursday, the NZD/USD pair recovered from Wednesday's losses, gaining by 0.95% and settling at 0.6330. The pair is moving in a sideways trading pattern, indicating indecision between the bulls and bears. That being said,bulls seem to have an advantage.

The technical indicators suggest that the buying pressure behind NZD/USD is increasing. The Relative Strength Index (RSI) is rising above 50 the Moving Average Convergence Divergence (MACD) histogram prints rising green bars, also giving arguments to the buyers.

NZD/USD daily chart

The overall outlook for the NZD/USD is bullish. The pair is trading above its key moving averages, and the technical indicators are regaining strength. Buyers seem to have hit a solid resistance at 0.6350 but seem to be gearing up for a retest. In that sense a break above could pave the way for for upside and the pair could test the 0.6400 level. On the other hand, if the pair runs out of steam, the 0.6300 area can act as a barrier to selling pressure.

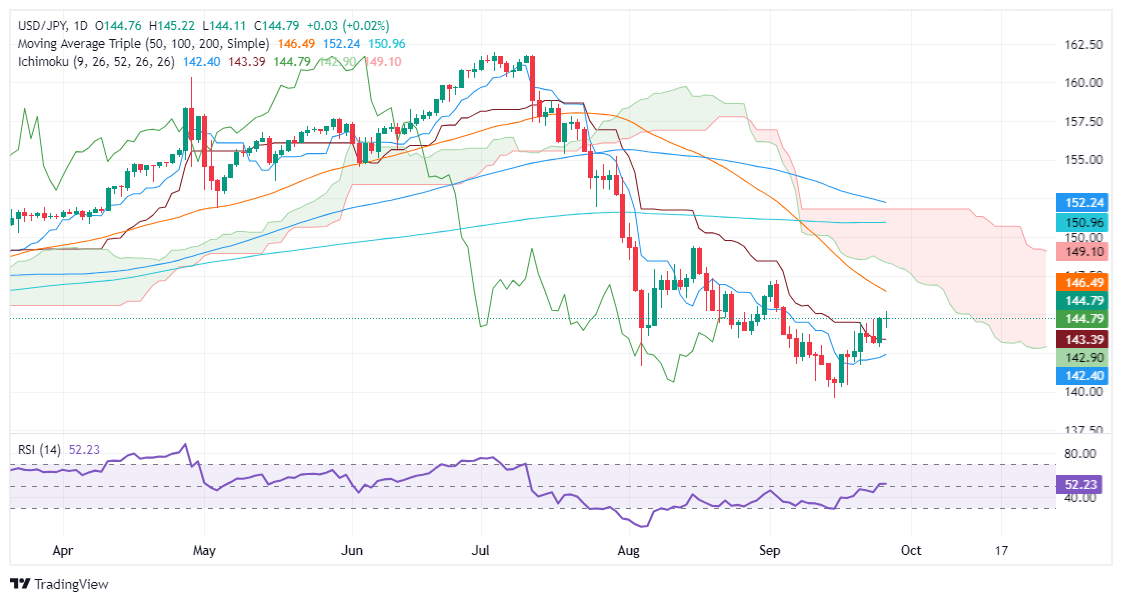

- USD/JPY trades flat at 144.72 after hitting a three-week high of 145.21, as election uncertainty dampens momentum.

- Doji candlestick and flat RSI suggest market indecision, with key resistance at the 50-DMA of 146.49.

- A break below 144.11 could lead to further declines, testing support levels at 143.39 and 142.39.

The USD/JPY remains subdued after seesawing within a 110-pip range, where the pair hit a three-week high of 145.21. Uncertainty around the Japanese election has overshadowed speeches by Bank of Japan (BoJ) officials, who decided to hold rates unchanged last week. At the time of writing, the major trades at 144.72, flat.

USD/JPY Price Forecast: Technical outlook

From a technical standpoint, the downtrend is set to continue. Thursday’s price action forms a ‘doji’, meaning neither buyers nor sellers commit to solid positions. Even the Relative Strength Index (RSI), despite showing bulls in charge, the RSI slope is flat at 51.

If USD/JPY buyers push prices above the September 26 high at 145.21, that could prompt a challenge of the 50-day moving average (DMA) at 146.49 before testing the 147.00 mark. The next resistance would be the bottom of the Ichimoku Cloud (Kumo) at around 148.20-50.

Conversely, if the pair slumps below the September 26 low of 144.11, that will test the Kijun-Sen at 143.39, followed by the Senkou Span A at 142.89. On further weakness, the Tenkan-Sen will be the Bulls' last line of defense at 142.39.

USD/JPY Price Action – Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.38% | -0.65% | 0.01% | -0.06% | -1.00% | -1.00% | -0.51% | |

| EUR | 0.38% | -0.28% | 0.39% | 0.32% | -0.62% | -0.62% | -0.13% | |

| GBP | 0.65% | 0.28% | 0.66% | 0.60% | -0.34% | -0.36% | 0.15% | |

| JPY | -0.01% | -0.39% | -0.66% | -0.06% | -1.02% | -1.02% | -0.53% | |

| CAD | 0.06% | -0.32% | -0.60% | 0.06% | -0.93% | -0.94% | -0.44% | |

| AUD | 1.00% | 0.62% | 0.34% | 1.02% | 0.93% | 0.00% | 0.50% | |

| NZD | 1.00% | 0.62% | 0.36% | 1.02% | 0.94% | -0.00% | 0.50% | |

| CHF | 0.51% | 0.13% | -0.15% | 0.53% | 0.44% | -0.50% | -0.50% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

- AUD/USD surges higher amidst positive Australian economic data.

- Monetary policy divergence continues to favor the Aussie.

- Focus shifts to US PCE data, which may influence market expectations for Fed rate cuts in November.

The AUD/USD pair surged higher on Thursday, rising by 0.90% to 0.6890. The Australian Dollar strengthened after the release of positive economic data and the hawkish stance of the Reserve Bank of Australia (RBA) this week. Meanwhile, the US Dollar weakened as markets are hopping for a larger cut by the Federal Reserve (Fed) in November.

Amidst a multifaceted economic landscape in Australia, the Reserve Bank of Australia's (RBA) assertive stance on inflation has led markets to anticipate a modest reduction in interest rates by only 0.25% in 2024.

Daily digest market movers: Australian Dollar rises sharply on RBA's rate hold

- The Aussie advanced significantly against the US Dollar after the RBA kept its interest rates unchanged at 4.35%, but maintained a hawkish message.

- In fact, RBA Governor Michelle Bullock stated that the bank isn’t considering rate cuts.

- Market participants anticipate that the Fed may implement another 50 basis point (bps) interest rate cut in November, following its initial 50 bps reduction to 4.75%-5.00% last week.

- Investors are closely watching the upcoming release of the United States (US) Personal Consumption Expenditure Price Index (PCE) data for August.

- The core PCE inflation data, which is the Fed's preferred inflation gauge, is expected to increase from 2.6% in July to 2.7%.

- A sustained increase in inflation could reinforce expectations for the Fed to reduce interest rates by 50 bps in November, while a stronger-than-expected reading may dampen those expectations.

AUD/USD technical outlook: Aussie regains momentum after Wednesday’s decline

After a decline to around 0.6800, the AUD/USD pair gained momentum, rising to near 0.6900. Indicators including the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators suggest a steady bullish momentum and the pair may be set to retest the area above 0.6900.

If the Aussie resumens its downside it might retest the 0.6800 area which proved to be a strong support. Below, 0.6750 and 0.6730 line up.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- Gold reaches an all-time high of $2,685, buoyed by China’s stimulus and Middle East tensions.

- Despite strong US Dollar, Fed’s recent 50 bps rate cut fuels bullish sentiment for continued gains in Bullion.

- US economic data points to a ‘soft landing’ scenario, keeping market optimism high for further Gold upside.

Gold hit a new all-time high of $2,685 on Thursday as the Greenback began to recover from earlier losses sustained in the Asian and European sessions. US data portrays a ‘soft landing’ scenario, while China’s stimulus and rising tensions in the Middle East boosted Bullion prices. At the time of writing, the XAU/USD trades at $2,670.

Sentiment remains positive as portrayed by US equities. US Treasury bond yields remained firm, with the 10-year T-note yielding 3.798%, up one basis point (bps), while the Greenback, as portrayed by the US Dollar Index (DXY), is flat at 100.91.

China’s news supports Gold’s upward move. The Politburo remains firm in stabilizing the real estate market, adding more fiscal stimulus after the People’s Bank of China (PBoC) lowered the 7-day reverse repo rates by 20 bps, bringing rates from 1.70% to 1.50%.

This and last week's 50 bps rate cut by the Federal Reserve (Fed) pushed the golden metal to print subsequent record highs as global central banks cut borrowing costs. Even though the US Dollar remained strong, expectations that the Fed would embark on an ‘aggressive’ easing cycle kept bulls riding the trend.

The US economy grew sharply in the second quarter of 2024, according to the Bureau of Economic Analysis (BEA). Meanwhile, the US Department of Labor revealed that fewer people asked for unemployment benefits last week, a sign that the labor market remains strong.

Daily digest market movers: Gold price stays firm amid high US yields

- Missile strikes between Israel and Hezbollah underpin Gold prices.

- The US Gross Domestic Product (GDP) for Q2 in its final reading was 3%, exceeding estimates of 2.9%.

- US Durable Goods Orders in August were unchanged at 0%, exceeding forecasts of a -2.6% contraction, but missed July’s 9.8% increase.

- Initial Jobless Claims for the week ending September 21 were 218K, below estimates for a 225K jump and the previous reading of 222K.

- According to the World Gold Council, global physically-backed Gold ETFs saw modest net inflows of 3 metric tons last week.

- Market participants have fully priced in at least a 25 bps rate cut by the Fed. However, according to the CME FedWatch Tool, the odds of a 50 bps cut have decreased to 51.3%, down from a 60% chance the previous day.

XAU/USD technical outlook: Gold price advances past $2,660

Gold price hit a record high of $2,685 on Thursday, but it has retreated to current spot prices. However, the momentum favors buyers, though the rally seems overextended, as portrayed by the Relative Strength Index (RSI) climbing further to overbought territory, close to testing the extreme levels above 80.

If XAU/USD extends its rally past the current year-to-date (YTD) peak of $2,685, the next resistance would be the $2,700 mark. Up next would be the $2,750 level, followed by $2,800.

On the flip side, if XAU/USD drops below $2,650, look for a test of the September 18 daily high at $2,600. The following key support levels to test will be the September 18 low of $2,546, followed by the 50-day Simple Moving Average (SMA) at $2,488.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

The Greenback navigated quite a bearish session on Thursday, giving away a big chunk of Wednesday’s gains despite higher yields and amidst a persistently firm sentiment in the risk-associated universe.

Here is what you need to know on Friday, September 27:

The US Dollar Index (DXY) dropped markedly and revisited the a100.50 region in a context favourable to the risk-related galaxy. The PCE data will gather all the attention seconded by the final print of the Michigan Consumer Sentiment, Personal Income and Personal Spending.

EUR/USD managed to regain some composure and faded most of Wednesday’s steep retracement, revisiting the 1.1190 zone. The German labour market report takes centre stage, along with the final Consumer Confidence, Consumer Inflation Expectation and Economic Sentiment. In addition, the ECB’s Cipollone and Lane are due to speak.

GBP/USD reclaimed the 1.3400 barrier and above and clinched fresh yearly peaks on the back of the better tone in the risk-associated space. The next important data release across the Channel will be the GDP figures on September 30 along with Mortgage Approvals.

USD/JPY rose to three-week highs north of the 145.00 mark before giving away most of those gains towards the end of the day. Inflation figures in Tokyo are due along with weekly Foreign Bond Investment figures and the final Coincident Index and Leading Economic Index.

AUD/USD rose markedly and flirted once again with the key 0.6900 barrier on the back of news of fresh stimulus in China and the vacillating tone in the greenback. Next on tap in Oz will be the Housing Credit figures, and Private Sector Credit.

Another negative day saw prices of WTI tumble below the $67.00 mark per barrel to clinch new two-week lows on the back of OPEC+ plans to hike oil output.

Gold prices maintained their uptrend well in place and clocked an all-time high near the $2,690 mark per ounce troy despite higher US yields. Silver followed suit and climbed to the $32.70 zone per ounce for the first time since December 2012.

- Durable Goods Orders remained almost flat in August.

- US GDP grew at an annual rate of 3.0% in the second quarter of 2024.

- Initial Jobless Claims in the US fell to 218K in the week ending September 21.

The US Dollar Index (DXY), which measures the value of the USD against a basket of six currencies, is flat after a muted market reaction to a slew of robust US economic data. The DXY is trading at 100.88 at the time of writing.

Economic data this week showed evidence of resilience in the US economy. To add to that, the Fed has already stated that its response will depend on the interplay between these contrasting signals, balancing the need to address potential risks while ensuring the ongoing health of the economy.

Daily digest market movers: US Dollar sees losses after data points, Fed speakers

- New Orders for US manufactured durable goods remained virtually unchanged in August, rising by a marginal $0.1 billion to $289.7 billion, marking the sixth increase in the last seven months.

- Excluding transportation, New Orders increased by 0.5%, driven by a 1.9% rise in electrical equipment, appliances, and components. Excluding defense, new orders declined by 0.2%.

- Gross Domestic Product (GDP) in the US grew at an annual rate of 3.0% in the second quarter of 2024, in line with the initial estimate.

- Initial Jobless Claims in the US fell to 218K in the week ending September 21, below both the consensus estimate of 225K and the previous week's revised figure of 222K.

- The data supports the notion that the economy holds steady with no need of aggressive easing.

- In the meantime, Fed speakers are trying to push more dovish rhetoric.

- Atlanta Fed President Raphael Bostic highlighted that a 50-basis-point cut puts the central bank in a stronger position to handle economic uncertainties.

- Similarly, Minneapolis Fed President Neel Kashkari pointed out that a larger cut provides the Fed with more aggressive tools if inflation continues to ease.

- Chicago Fed President Austan Goolsbee echoed this sentiment, noting that a significant cut now gives the Fed greater room to adjust if economic conditions worsen.

- Fed Governor Michele Bowman dissented, favoring a more cautious 25-basis-point reduction, reflecting concerns about moving too aggressively.

DXY technical outlook: DXY momentum reverses with continued bearish dominance

Technical analysis of the DXY index reveals that the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators suggest bearish momentum, with the RSI remaining in negative territory and the MACD printing flat green bars. This indicates weak buying pressure and suggests a continuation of bearish dominance.

Additionally, the strong resistance level at 101.00 limits the upside potential for the US Dollar. Key support levels include 100.50, 100.30 and 100.00, while resistance levels are located at 101.00, 101.30 and 101.60.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- The Dow Jones rallied 200 points on Thursday as investors recover footing.

- US data came in broadly better than expected, easing recession fears.

- Despite a litany of Fed speakers, almost none addressed monetary policy.

The Dow Jones Industrial Average rebounded around 200 points on Thursday, with investors reinvigorated after US economic data eased rising fears of an economic slowdown. A better-than-expected Durable Goods Orders print has assuaged fears that the Federal Reserve (Fed) might have aggressively cut rates last week in response to a deteriorating economic outlook. However, investors will still be keeping a close eye on monthly jobs report figures in the coming weeks.

US Durable Goods Orders held flat at 0.0% in August, well below the previous month's revised 9.9%, but still beat the forecast of a 2.6% contraction. Initial Jobless Claims for the week ended September 20 also beat forecasts, printing at 218K versus the expected 225K and easing down from the previous week's revised 222K.

The recent 50 bps rate cut by the Federal Reserve (Fed) has caused some concerns in global markets. Some investors are worried that the large rate cut might be a response to a potential economic slowdown in the US. However, Fed Chair Jerome Powell stated last week that the rate cut was not a hasty reaction to signs of a recession, but rather a proactive measure to support the US labor market.

US Durable Goods Orders and week-on-week Initial Jobless Claims helped to bolster the Fed head's case, with both figures printing better than expected and the "soft landing" economic rhetoric holding steady. However, Friday's Personal Consumption Expenditure (PCE) inflation print will draw plenty of attention, and will be the real test of last week's Fed rate cut.

Dow Jones news

The Dow Jones is tilted firmly into the bullish side on Thursday, with over two-thirds of the equity index firmly planted in the green. Caterpillar (CAT) is trading firmly higher on the day, rising 3.3% near $391 per share following reports that China has unveiled another massive stimulus package meant to reinvigorate the Chinese housing and construction industries, a move that Caterpillar is widely expected to benefit from.

Dow Jones price forecast

Despite Thursday’s bullish tilt, the Dow Jones is struggling to make headway after the midweek’s bearish pullback. Still, price action is within arm’s reach of recent all-time highs, and bidders will have their sights set on the next leg up.

Dow Jones buyers have stubbornly staked their claim on the 42,000 handle, shrugging off signs of overbought conditions. On the low side, sellers will be looking to drag the equity board back down toward the 50-day Exponential Moving Average (EMA) near 40,870.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- GBP/USD got pushed into another multi-year high on Thursday.

- Broad-market Greenback weakness has bolstered Cable further.

- The Pound Sterling rally is continuing unabated despite a lack of UK data.

GBP/USD clipped another multi-year peak on Thursday, hitting a 31-month high bid 1.3434 as Cable gets pushed into the high end by broad-market Greenback selling. Risk appetite has swung back into the high end on the back of better-than-expected US economic figures, easing investor concerns of a potential economic slowdown.

The Federal Reserve's (Fed) recent 50 bps rate trim sparked an undercurrent of concern in global markets, with some investors spooked by the possibility that the Fed's jumbo rate cut might have been in response to a looming economic slowdown with the US. Fed Chair Jerome Powell insisted last week that the Fed's double cut was not a rapid response to potential recession data, but rather a pre-emptive move to help shore up the US labor market.

US Durable Goods Orders and week-on-week Initial Jobless Claims helped to bolster the Fed head's case, with both figure printing better than expected and the "soft landing" economic rhetoric holding steady. However, Friday's Personal Consumption Expenditure (PCE) inflation print will draw plenty of attention, and will be the real test of last week's Fed rate cut.

US Durable Goods Orders in August printed a flat 0.0% MoM, well below the previous month's revised 9.9%, but still beat the forecast of a 2.6% contraction. Initial Jobless Claims for the week ended September 20 also beat forecasts, printing at 218K versus the expected 225K and easing down from the previous week's revised 222K.

GBP/USD price forecast

With Cable continuing to grind through multi-year highs, little relevant technical resistance lies in the way of Pound bulls. However, an extremely one-sided push into the high end has left GBP/USD price action exposed to a potential downside snap as market velocity takes hold. A buildup of short pressure at the current region could easily shoot bids back below the 1.3100 handle and into the 50-day Exponential Moving Average (EMA) at 1.3076.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- Mexican Peso is virtually unchanged after hitting a daily high of 19.46.

- Banxico expected to cut rates by 25 bps, but a larger cut could push USD/MXN toward the 20.00 level.

- Mexico's inflation continues to ease, boosting hopes for further rate cuts to stimulate the economy.

The Mexican Peso recovered slightly against the US Dollar on Thursday after data from the United States (US) suggested the economy fares well despite decelerating. Traders' eyes are on the Bank of Mexico (Banxico) monetary policy decision at around 19:00 GMT. The USD/MXN trades at 19.64, virtually unchanged.

Mexico’s economic docket remains absent, though mixed Retail Sales and Economic Activity figures could prompt Banxico to lower rates to stimulate the economy, though it isn’t in the Mexican central bank's mandate. Furthermore, Tuesday’s inflation report was positive, with the headline and underlying readings continuing to slow down in July.

In the last meeting, Banxico’s Governing Board decided to lower interest rates by 25 basis points (bps) from 11.00% to 10.75% in a 3-2 vote split. Governor Victoria Rodriguez and Deputy Governors Galia Borja and Omar Mejia supported a cut. At the same time, Deputy Governors Irene Espinosa and Jonathan Heath favored a pause on its easing cycle.

The question is: How much would Banxico ease policy after the Federal Reserve (Fed) slashed rates by 50 basis points? In the latest Bloomberg survey, 20 of 25 analysts had priced in a 0.25% cut, but four expect a 0.50% cut while one expects the board to hold rates unchanged.

A higher-than-expected rate cut could sponsor a leg-up in the USD/MXN toward the psychological 20.00 figure. Conversely, if Banxico maintains the status quo, it could be positive for the Peso, which could test the 19.50 figure and below.

Across the south of the border, the US schedule revealed final Gross Domestic Product (GDP) figures for Q2 2024, which were better than expected, while jobs data showed that the number of Americans filing for unemployment benefits was lower than anticipated and also below the previous number.

Meanwhile, Fed speakers had crossed the newswires but failed to comment on monetary policy.

Daily digest market movers: Mexican Peso stays firm amid lack of catalysts

- Mexican political turmoil eases as market participants prepare for the change of president on October 1, a bank holiday in Mexico. President-Elect Claudia Sheinbaum’s speech will be watched for hints about her economic plan.

- USD/MXN whipsawed and erased earlier losses, boosted by the buck’s recovery.

- Banxico is expected to lower borrowing costs by 175 bps toward the end of 2025, according to the swaps markets.

- US Dollar Index (DXY), which tracks the buck’s performance against a basket of six peers, is virtually unchanged at 100.90.

- Market participants have fully priced in at least a 25 bps rate cut by the Fed. However, the odds for 50 bps of easing are 51.3%, lower than the 60% chance a day ago, according to the CME FedWatch Tool.

USD/MXN technical analysis: Mexican Peso hovers at around 19.60

The uptrend remains in place, with USD/MXN eyeing further upside, which could happen if they push the spot price above the current weekly high of 19.68, opening the door to challenge the September 12 peak at 19.84 ahead of the psychological 20.00 figure. Momentum favors further upside as the Relative Strength Index (RSI) is bullish.

Failure to conquer 19.68 could pave the way for lower prices. The first support would be the 19.50 mark, followed by the September 24 swing low of 19.23, before the pair moves toward the September 18 low of 19.06. Once those levels are surpassed, the 19.00 figure emerges as the next line of defense.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- The EUR/GBP has steadily declined over the past trading days.

- The RSI and MACD are both suggesting that selling pressure is rising.

- Oversold conditions might prompt an upward correction.

The EUR/GBP pair has been in a steady decline over the past trading days and fell to 0.8330 on Thursday with 0.30% losses.

The Relative Strength Index (RSI) is suggesting that selling pressure is rising, with the RSI value at 33, in the near oversold area, and a declining slope. The Moving Average Convergence Divergence (MACD) also suggests that selling pressure is rising, with the MACD histogram red and rising.

EUR/GBP Daily Chart

Based on the current technical picture, the EUR/GBP pair is likely to remain under pressure in the near term. The bears seem to be in control, and the bulls need to break above the 0.8400 resistance level to regain control. If the bears manage to break below the 0.8300 support level, the pair could fall further. However, with indicators flashing oversold signals, traders shouldn't take off the table an upward correction.

- GBP/USD gains 0.59%, trading at 1.3394 after rebounding from a daily low of 1.3312.

- Break above 1.3400 could push the pair towards the YTD high of 1.3437 and further resistance at 1.3500.

- Failure to reclaim 1.3400 may lead to testing the September 25 low of 1.3312.

The Pound Sterling climbs over 0.59% against the Greenback, boosted by an improvement in risk appetite, sponsored by China’s stimulus to its economy and increasing odds for a ‘soft landing’ in the US after revealing robust economic data. The GBP/USD trades at 1.3394 after bouncing off daily lows of 1.3312.

GBP/USD Price Forecast: Technical outlook

The GBP/USD resumed its uptrend after diving below the top trendline of an ascending channel, which, in the short term, was a sign of sellers’ strength. However, bulls emerged around the week's lows and lifted the exchange rate. Still, it remains shy of the crucial 1.3400 figure, today’s high.

If GBP/USD reclaims 1.3400, the next resistance will be the 1.3429-1.3437 area, the confluence of the current year-to-date (YTD) high and March 1, 2022 daily high, followed by 1.3450. On further strength, 1.3500 will emerge as the next key resistance level.

Conversely, GBP/USD failure at 1.3400 will sponsor a test of the September 25 daily low of 1.3312. A decisive break will expose the August 27 high turned support at 1.3266, followed by the September 23 low of 1.3248.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.36% | -0.61% | 0.04% | -0.06% | -0.93% | -0.89% | -0.40% | |

| EUR | 0.36% | -0.26% | 0.39% | 0.30% | -0.57% | -0.53% | -0.04% | |

| GBP | 0.61% | 0.26% | 0.64% | 0.56% | -0.31% | -0.29% | 0.23% | |

| JPY | -0.04% | -0.39% | -0.64% | -0.08% | -0.97% | -0.95% | -0.44% | |

| CAD | 0.06% | -0.30% | -0.56% | 0.08% | -0.86% | -0.83% | -0.33% | |

| AUD | 0.93% | 0.57% | 0.31% | 0.97% | 0.86% | 0.05% | 0.54% | |

| NZD | 0.89% | 0.53% | 0.29% | 0.95% | 0.83% | -0.05% | 0.50% | |

| CHF | 0.40% | 0.04% | -0.23% | 0.44% | 0.33% | -0.54% | -0.50% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Crude oil prices are slumping as the left tail continues to fatten, TDS macro analyst Daniel Ghali notes.

Supply risk premia is melting

“OPEC+ is backed into a corner. Supply risk premia is melting, and further delays to planned output increases won't do the trick. Global oil demand growth is weakening, and not necessarily exclusively owing to slowing global growth.”

“There's still a massive risk premium baked into oil prices, a legacy of critically-low spare capacity during the pandemic-era bull market, suggesting the combination of weakening demand growth and rising supply threatens to inflict a lot more damage to prices than anticipated given expected balances.”

- AUD/USD recovers sharply from 0.6820 as the Australian Dollar strengthens.

- Investors await Fed Powell’s speech for fresh interest rate guidance.

- The core PCE inflation is expected to have accelerated to 2.7% in August.

The AUD/USD pair bounces back strongly from Wednesday’s low of 0.6820 to near the round-level resistance of 0.6900 in Thursday’s North American session. The Aussie asset strengthens amid upbeat Australian Dollar (AUD).

The Aussie Dollar performs strongly as the Reserve Bank of Australia (RBA) is expected to leave interest rates at their current levels for the entire year. In the monetary policy on Tuesday, the RBA kept its Official Cash Rate (OCR) steady to 4.35% and conveyed that the option of more rate hikes was not on the table.

Meanwhile, the US Dollar (USD) exhibits a sluggish performance near the crucial resistance of 101.00. The US Dollar struggles to extend recovery as investors look for Federal Reserve (Fed) Chair Jerome Powell’s speech to get fresh cues on the interest rate outlook.

Currently, financial market participants expect that the Fed could deliver one another 50 basis points (bps) interest rate cut in November. Last week, the Fed started the policy-easing cycle with a larger-than-usual interest rate cut of 50 bps to 4.75%-5.00%.

Going forward, investors will focus on the United States (US) Personal Consumption Expenditure Price Index (PCE) data for August, which will be published on Friday.

Economists estimate the core PCE inflation data, a Fed’s preferred inflation gauge, to have grown at a faster rate of 2.7% from 2.6% in July. Signs of inflation remaining persistent would prompt market expectations for the Federal Reserve (Fed) to cut interest rates by 50 basis points (bps) in the November meeting. On the contrary, hot figures would dampen them.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- USD/CAD has pulled back within a strong downtrend.

- It will probably continue falling as the wave C of a Measured Move unfolds.

USD/CAD has pulled back within the midst of a strong downtrending move. On Wednesday the pair recouped about half the losses from the previous day and formed a Marubozu Japanese candlestick continuation pattern. These are long red candles that close near their lows.

It is often the case that the market will retrace 50% of the Marubozu, which is what happened on Wednesday. Thursday sees a renewal of weakness so far.

USD/CAD Daily Chart

USD/CAD’s move down from the range high, which started on August 5, looks like an ABC pattern, otherwise known as a “Measured Move” (see labels on chart above). Such patterns are like large zig-zags. The wave C usually reaches a similar length to wave A, or at a minimum a Fibonacci 61.8% of A.

Assuming USD/CAD is in a wave C it will probably continue to unfold despite the present pullback. It should reach at least the conservative target for the pattern at 1.3326, the Fibonacci 61.8% extrapolation of wave A. In a very bearish case it could fall to the zone of the range lows (orange shaded rectangle on chart above).

A break below the low of the Marubozu candle at around 1.3419 would provide bearish confirmation of more downside to the aforesaid targets.

- Initial Jobless Claims rose to 218K, up from the previous week's 222K.

- Continuing Jobless Claims increased to 1.834M in the week ending September 14.

US citizens that newly applied for unemployment insurance benefits reached 218K in the week ending September 21, according to the US Department of Labor (DoL) on Thursday. The prints came in below initial consensus (225K) and were lower than the previous weekly figure of 222K (revised from 219K).

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average was 224.75K, a decrease of 3.5K from the previous week's revised average.

In addition, Continuing Claims rose by 13K to 1.834M in the week ending September 14.

Market reaction

The US Dollar Index (DXY) trades in an inconclusive day around the 100.90 region following the release of US data.

- Durable Goods Orders in the US stayed pat in August, beating expectations.

- The US confirmed that the economy grew at an annualized pace of 3% in Q2.

- The US Dollar Index gains upward momentum with the news, approaching 101.00.

“New orders for manufactured durable goods in August, up six of the last seven months, increased $0.1 billion or virtually unchanged to $289.7 billion,” the US Census Bureau reported.

“This followed a 9.9 per cent July increase. Excluding transportation, new orders increased by 0.5 per cent. Excluding defense, new orders decreased 0.2 percent. Electrical equipment, appliances, and components, up two of the last three months, drove the increase, $0.3 billion or 1.9 per cent to $14.4 billion.”

At the same time, Real Gross Domestic Product (GDP) increased at an annual rate of 3.0 per cent in the second quarter of 2024, as previously estimated, according to the US Bureau of Economic Analysis (BEA).

Market reaction

The US Dollar Index jumped with the positive news and hovers around 100.80 ahead of the American opening.

- Bitpanda Deputy CEO expects more clarity on US crypto regulation no matter the winner of the US presidential elections.

- Favorable macroeconomic conditions should support crypto markets in 2025, the executive says.

- The approval of more spot ETFs is likely despite Bitcoin, Ethereum’s slow start, he says.

Lukas Enzersdorfer-Konrad is the deputy CEO at Bitpanda, a crypto exchange based in Europe with more than five million users. At the European Blockchain Convention held in Barcelona, the executive shared with FXStreet his views on the current state of the crypto industry and its regulation, how the upcoming US presidential elections can affect markets and what traders need to consider when investing in crypto.

-638629502681756718.jpg)

Lukas Enzersdorfer-Konrad. Source: Bitpanda.

Q: It has been an eventful year in the crypto market. How do you assess the market behavior in 2024?

If we look at 2024 and the outlook for 2025, it has been quite macroeconomically driven. We saw for the first time [interest] rate cuts by the US Federal Reserve and by the European Central Bank in Europe, which are potentially to be continued over the next year. This means that money is getting less expensive, which is a good starting point for a high-risk asset class such as crypto.

Also, with the US elections coming up, no matter who wins we will get more clarity on how crypto in the US is going to be dealt with. This year we still saw a lot of confusion in the US market. So these are two events that will potentially have a positive impact on crypto sentiment.

Q: And what about the technical developments within the crypto space?

A different aspect is that we have seen a lot of development in Layer 1 and Layer 2 chains. Ecosystems are growing on Ethereum and Solana (SOL), so the next wave will be a very interesting one, with real applications and real use-case applications for on-chain activity that will drive Web3 as part of the next cycle.

Next US administration set to bring clarity on crypto, no matter Trump or Harris

Q: About the US presidential election, do you see it as a binary event for crypto? Is it a “Trump positive and Kamala negative,” or it isn’t that clear?

It does not matter if it is Kamala Harris or Donald Trump, there will be more clarity for a five-year planning cycle, which will support the institutional adoption of crypto. There can be speculation about how Trump is more pro-crypto than Harris, but this is something we will not know until one of them is elected.

Q: What is your opinion on the current US Securities and Exchange Commission (SEC) crackdown on the crypto industry?

It is very interesting to follow. There are so many different interests in the US playing into the many SEC trials that go beyond what is beneficial for crypto. It is interesting to see the personal opinions of the people involved.

Clarity will only come after the US presidential election and with the end of all these trials. So, it’s the right thing that these legal battles are happening instead of being postponed forever.

Q: Does crypto need SEC Chair Gary Gensler gone?

I would say yes.

Crypto market is becoming more transparent

Q: Besides more clarity in regulation, what does crypto need to bring as added value to increase adoption?

For crypto as an asset class, two things are needed: first, building Web3 interactions and on-chain applications that people start to use. We are still right at the beginning of this process.

The other one is real-world interaction with regulated stablecoins to have remittance, payment services and facilitators. Bitcoin is not a vehicle for payments, it is a vehicle for storing value. Like with Gold, it won’t be used to pay, but stablecoins will, and they are now seeing momentum in Europe with MiCA, which is a regulatory catalyst. That’s a very interesting play for next year.

Q: Crypto trading is still a mysterious world if you compare it to Forex, where fundamentals are more clear. How can exchanges help traders understand what is going on?

Crypto markets are very immature and untransparent. Still, if you think about crypto ten or five years ago, it was a much more untransparent market than it is now. From a nature perspective, Forex markets are very similar to crypto. It is just that FX already is optimized and there is much more history.