- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- EUR/USD fell four-tenths of a percent after flubbing the 1.12 handle on Wednesday.

- Markets pivoted into Greenback bids in the midweek market session.

- US economic data and Fedspeak to dominate market cycle for the rest of the week.

EUR/USD pulled back on Wednesday, tumbling back through the 1.1200 handle and falling into familiar near-term congestion just north of 1.1100. Fiber shed nearly half of a percent after briefly setting a new 14-month high this week.

Thursday brings an entire raft of speeches from central banks, with an appearance from European Central Bank (ECB) President Christine Lagarde, as well as talking points from ECB Executive Board Member Isabel Schnabel. Friday will follow with a full slates of consumer and business sentiment surveys for September from the pan-EU economic area.

US consumer confidence indicators fell this week as the average US consumer doesn’t share in the stock market’s exuberance over Fed rate cuts, with key confidence readings falling to their lowest levels in three years and consumer inflation expectations for the next 12 months ticking higher. This Friday will see a fresh update to US Personal Consumption Expenditure (PCE) inflation figures.

New home sales also fell in August, declining 4.7% to 716K from the previous month’s revised 751K. Meanwhile, investors will see another print of US Gross Domestic Product (GDP) growth for the second quarter, expected to hold steady at 3.0% on an annualized basis. Thursday will also bring a slew of speeches and public appearances from several Fed officials, including Fed Chair Jerome Powell.

Economic Indicator

New Home Sales Change (MoM)

The number of New Home sales released by the US Census Bureau is an important measure of housing market conditions. House buyers spend money on furnishing and financing their homes so as a result the demand for goods, services and the employees is stimulated. Generally, a high reading is seen as bullish for the USD, whereas a low reading is seen as bearish.

Read more.Last release: Wed Sep 25, 2024 14:00

Frequency: Monthly

Actual: -4.7%

Consensus: -

Previous: 10.6%

Source: US Census Bureau

EUR/USD price forecast

Despite notching in a quick, fresh 14-month high on Wednesday, Fiber tumbled back through the 1.1200 handle in short order, plunging back into near-term consolidation after markets pivoted back into bidding the Greenback higher. EUR/USD is still deep in bull country, trading well north of the 50-day Exponential Moving Average (EMA) near 1.1030.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- GBP/USD turned bearish and dropped back below 1.34 on Wednesday.

- Markets pared back their recent tilt into a Pound Sterling bull run.

- The US Dollar recovered ground as investors weigh the state of the US economy.

GBP/USD struck an abnormally nearish tone on Wednesday, plunging back below the 1.3400 handle amid a broad-market pullback from full-bore risk appetite. The Pound Sterling paused its recent one-sided trend into the high side, while the Greenback pared recent losses.

The Pound Sterling will be entirely absent from the economic calendar data docket for the remainder of the week, leaving GBP/USD traders to grapple with Friday’s upcoming US inflation print.

US consumer confidence indicators fell this week as the average US consumer doesn’t share in the stock market’s exuberance over Fed rate cuts, with key confidence readings falling to their lowest levels in three years and consumer inflation expectations for the next 12 months ticking higher. This Friday will see a fresh update to US Personal Consumption Expenditure (PCE) inflation figures.

New home sales also fell in August, declining 4.7% to 716K from the previous month’s revised 751K. Meanwhile, investors will see another print of US Gross Domestic Product (GDP) growth for the second quarter, expected to hold steady at 3.0% on an annualized basis. Thursday will also bring a slew of speeches and public appearances from several Fed officials, including Fed Chair Jerome Powell.

Economic Indicator

New Home Sales Change (MoM)

The number of New Home sales released by the US Census Bureau is an important measure of housing market conditions. House buyers spend money on furnishing and financing their homes so as a result the demand for goods, services and the employees is stimulated. Generally, a high reading is seen as bullish for the USD, whereas a low reading is seen as bearish.

Read more.Last release: Wed Sep 25, 2024 14:00

Frequency: Monthly

Actual: -4.7%

Consensus: -

Previous: 10.6%

Source: US Census Bureau

GBP/USD price forecast

Wednesday’s bearish reversal has pulled Cable back below 1.3400, and price action is poised for a continuation into the low side. Particularly brassve short sellers will be targeting the 50-day Exponential Moving Average (EMA) all the way down at 1.3062. GBP/USD bidders will be looking to recover ground back into 30-month highs set this week at 1.3430.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Federal Reserve Governor Adriana Kugler said on Wednesday that she “strongly supported” the Fed’s decision to cut the interest rates by a half point last week. Kugler further stated that it will be appropriate to make additional rate cuts if inflation continues to ease as expected, per Bloomberg.

Key quotes

Says she will support additional rate cuts going forward.

Fed should keep focusing on reducing inflation and also shift attention to maximum employment.

Estimates of PCE inflation at 2.2% in August, Core PCE at 2.7% in signs of progress towards goal.

May take some time to feel that prices are back to normal.

There has been a significant moderation in the labor market recently.

Expect spending to grow at a somewhat more moderate pace moving forward.

Fed must now ‘balance. Its focus' is to continue to make progress on inflation while avoiding unnecessary pain in the economy.

We're at a place where we don't want labor market to weaken further.

Makes sense to shift attention to the employment mandate.

Inflation measures excluding housing are near 2%, but that's not what we target.

We are making very good progress, but not at 2% yet.

I don't see that we will overshoot on inflation.

It will still take us some time to get to 2% inflation.

We have begun to recalibrate rates.

We need to continue normalizing rates.

Maybe some Fed policymakers would be willing to move expected 2025 rate cuts forward to 2024, or vice versa, depending on data.

We don't pay a whole lot of attention to the neutral rate because there is a lot of uncertainty about it.

Below 100K monthly job gain would be 'very low', must be mindful of potential downward revisions.

The breakeven number for monthly job gains is anywhere from 100K to 240K.

The policy is restrictive.

With disinflation, we need to cut even to just keep where we are in terms of restiveness.

Market reaction

The US Dollar Index (DXY) is trading 0.01% higher on the day at 100.93, as of writing.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- USD/CAD trades flat near 1.3485 in Thursday’s early Asian session.

- Dovish Fed might continue to undermine the US dollar in the near term.

- BoC’s Macklem said it's reasonable to expect more rate cuts.

The USD/CAD pair flatlines around 1.3485 after retracing to 1.3420, the lowest level since March 8, during the early Asian session on Thursday. Investors ponder the Federal Reserve’s (Fed) path of rate cuts and digest US housing market data. The Fed’s Chair Jerome Powell speech will take center stage later in the day.

Traders await fresh catalysts after last week’s jumbo rate cut by 50 basis points (bps) by the US central bank. Fed Governor Adriana Kugler said on Wednesday that she “strongly supported” the central bank’s decision last week, adding that it would be appropriate to cut further rates if inflation continues to ease as expected. The dovish comments from the Fed officials are likely to exert some selling pressure on the Greenback in the near term.

Sales of new homes in the US fell 4.7% MoM to 716,000 in August from a revised 751,000 in July, the Commerce Department reported Wednesday. This figure came in better than the expectations.

Later on Thursday, the Fed’s Susan Collins, Adriana Kugler, Michelle Bowman, John Williams, Michael Barr, Neel Kashkari and Jerome Powell are scheduled to speak. Traders will take cues from the remarks as they might offer some hints about the US interest rate outlook. Also, the US weekly Initial Jobless Claims, Durable Goods Orders and final US Gross Domestic Product (GDP) Annualized for the second quarter (Q2) will be published.

The Bank of Canada (BoC) Governor Tiff Macklem said on Tuesday that the central bank has made in bringing inflation back down to the 2% target, so it is reasonable to expect more rate cuts. The BoC’s next interest rate decision is scheduled for October 23, and the money markets see over 58% possibility of 50 bps rate cuts. Another 25 bps cut is priced in for its last meeting of the year in December.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- NZD/JPY snaps a seven-day streak and consolidates above 90.00.

- RSI holds near 60, indicating bullish momentum; MACD flat, suggests flattening buying pressure.

- Bulls target resistance at 91.00, breakout could extend gains.

The NZD/JPY pair, after posting a 0.20% drop on Wednesday, continues to consolidate above the 90.00 mark. The bulls are holding on to their control of the market, with the technical indicators indicating a still-bullish outlook. The Relative Strength Index (RSI) currently stands at 60, suggesting that buying pressure persists. On the other hand, the Moving Average Convergence Divergence (MACD), a momentum indicator, is showing flat green bars, which points to a flattening of buying pressure. Overall, the NZD/JPY outlook remains positive, with the bulls looking towards a potential breakout above the 91.00 mark.

Since mid-September, the cross tallied a seven-day winning streak which improved the short-term outlook as it positioned the pair above the 20-day Simple Moving Average (SMA). With the buying pressure weakening the pair could find support at 90.00, 89.30, and 89.00 as well as resistance levels at 90.50, 90.80, and 91.00.

NZD/JPY daily chart

- USD/CHF rises over 0.84%, nearing the weekly high of 0.8500 amid strong US Dollar momentum.

- Markets estimate a 63% chance of a 25 bps rate cut by the Swiss National Bank at Thursday’s meeting.

- Falling SNB currency reserves signal intervention efforts to weaken the Franc ahead of leadership changes.

The USD/CHF edges higher during the North American session, registering gains of over 0.84% as traders brace for the Swiss National Bank (SNB) monetary policy decision. This and a strong US Dollar, kept the major at around the highs of the week at around 0.8500.

Traders brace for a possible 25 bps SNB rate cut, as the Swiss Franc weakens on intervention rumors and falling currency reserves

Data-wise, the Swiss and US economic dockets remained scarce, as US housing data showed a deterioration in the sector, though a strong recovery of the US Dollar offset it.

Meanwhile, the Swiss National Bank (SNB) is expected to lower rates by 25 basis points to 1.25% on Thursday. Interest Rate Probabilities suggest that market players estimate a 63% chance of a quarter-percentage-point cut by the SNB, while for a larger one, the chances are at 37%.

According to FX Street Analyst Joaquin Monfort: “Complaints from Swiss exporters who claim the strength of CHF is making them uncompetitive have put pressure on the SNB to directly intervene in FX markets to weaken the CHF.”

“Last week data revealed that the SNB’s Foreign Currency Reserves fell to CHF 694 billion in August, down from CHF 704 billion in July. This marks the fourth consecutive decline, suggesting the SNB continues selling the Franc to dampen its value,” Monfort added.

Worth noting that this meeting would be the last for SNB Chairman Jordan, which will be replaced by the Vice-Chair Schlegel

Swiss Franc FAQs

The Swiss Franc (CHF) is Switzerland’s official currency. It is among the top ten most traded currencies globally, reaching volumes that well exceed the size of the Swiss economy. Its value is determined by the broad market sentiment, the country’s economic health or action taken by the Swiss National Bank (SNB), among other factors. Between 2011 and 2015, the Swiss Franc was pegged to the Euro (EUR). The peg was abruptly removed, resulting in a more than 20% increase in the Franc’s value, causing a turmoil in markets. Even though the peg isn’t in force anymore, CHF fortunes tend to be highly correlated with the Euro ones due to the high dependency of the Swiss economy on the neighboring Eurozone.

The Swiss Franc (CHF) is considered a safe-haven asset, or a currency that investors tend to buy in times of market stress. This is due to the perceived status of Switzerland in the world: a stable economy, a strong export sector, big central bank reserves or a longstanding political stance towards neutrality in global conflicts make the country’s currency a good choice for investors fleeing from risks. Turbulent times are likely to strengthen CHF value against other currencies that are seen as more risky to invest in.

The Swiss National Bank (SNB) meets four times a year – once every quarter, less than other major central banks – to decide on monetary policy. The bank aims for an annual inflation rate of less than 2%. When inflation is above target or forecasted to be above target in the foreseeable future, the bank will attempt to tame price growth by raising its policy rate. Higher interest rates are generally positive for the Swiss Franc (CHF) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken CHF.

Macroeconomic data releases in Switzerland are key to assessing the state of the economy and can impact the Swiss Franc’s (CHF) valuation. The Swiss economy is broadly stable, but any sudden change in economic growth, inflation, current account or the central bank’s currency reserves have the potential to trigger moves in CHF. Generally, high economic growth, low unemployment and high confidence are good for CHF. Conversely, if economic data points to weakening momentum, CHF is likely to depreciate.

As a small and open economy, Switzerland is heavily dependent on the health of the neighboring Eurozone economies. The broader European Union is Switzerland’s main economic partner and a key political ally, so macroeconomic and monetary policy stability in the Eurozone is essential for Switzerland and, thus, for the Swiss Franc (CHF). With such dependency, some models suggest that the correlation between the fortunes of the Euro (EUR) and the CHF is more than 90%, or close to perfect.

- The NZD/USD pair declined by more than 1% on Wednesday, from highs since January.

- The RSI and MACD indicators are both pointing to decreasing buying momentum.

- Despite the pullback, the pair remains in a strongly bullish outlook.

On Wednesday, the NZD/USD pair encountered selling pressure, declining by 1.20% and settling at 0.6260. This reversal halted a five-day winning streak and marked a retreat from multi-month highs reached on Tuesday.

The technical indicators suggest that the buying pressure behind NZD/USD is decreasing. The Relative Strength Index (RSI) has risen near the overbought threshold, but it is currently declining sharply, indicating that buying pressure is easing. Similarly, the Moving Average Convergence Divergence (MACD) histogram remains green, but it is also decreasing, aligning with the RSI's bearish signals.

NZD/USD daily chart

Despite the pullback, the NZD/USD pair maintains a strongly bullish outlook. The pair is trading above its key moving averages, and still near its yearly highs. On the upside, resistance levels to watch include 0.6300, 0.6350, and 0.6400. If the pair fails to jump back above 0.6300, it could experience a deeper correction, probably toward 0.6200.

- Silver drops 0.85%, retreating from a daily peak of $32.26, pressured by rising US Treasury yields.

- XAG/USD must decisively clear $32.00 for a bullish continuation toward the YTD high of $32.51.

- Failure to hold above $32.00 risks a slide towards $31.44, with $31.00 as key support.

Silver price retraces after matching the September 24 daily peak of $32.26 and drops beneath the $32.00 figure, losing over 0.85%, weighed by higher US Treasury yields. Also, a recovery of the US Dollar and investors' reluctance to push the grey metal prices higher kept XAG/USD at familiar levels.

XAG/USD Price Forecast: Technical outlook

The uptrend on Silver remains in place, but price action suggests that buyers are struggling to keep the spot price above the $32.00 mark. During the year, XAG/USD has cracked the $32.00 barrier eight times, but after that, the non-yielding metal, dove.

For a bullish continuation, the XAG/USD must decisively clear the $32.00 mark. After that, traders need to test the year-to-date (YTD) high at $32.51, followed by the $33.00 mark. On further strength, XAG/USD could aim towards the October 1, 2012, peak at $35.40.

Conversely, if XAG/USD falls below $32.00, the next support would be the September 20 daily high at $31.44 before testing $31.00.

XAG/USD Price Action – Daily Chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

- Gold price steadied at $2,660 after hitting a record high of $2,670.

- Traders assign a 60% chance for another 50 bps of Fed rate cuts in November.

- US Treasury yields and a stronger US Dollar limited Gold's upside despite bullish momentum.

Gold price remains steadily above $2,650 for the second straight session on Wednesdayas traders increased the odds for another big interest rate cut by the Federal Reserve (Fed) at the upcoming November meeting. That and high US Treasury yields kept the XAU/USD from rising further, and it mostly traded near $2,660, up 0.14%.

Market sentiment shifted slightly sour during the US session as Wall Street traded in the red. Hence, Bullion prices hit a record high of $2,670 but retreated as US Treasury yields rose four and a half basis points (bps) to 3.775%.

In the meantime, the US Dollar Index (DXY), which tracks the buck’s value against another six currencies, bounced off a 14-month low and edged up 0.54% to 100.88.

During the week, US economic data showed that business activity in the manufacturing sector cooled while services remained resilient. However, a deterioration in Consumer Confidence via the Conference Board (CB) suggests that conditions in the labor market could be worse than projected.

Last week, the Fed lowered borrowing costs by 50 bps to 4.75%-5.00%, and traders seemed confident about back-to-back cuts of the same size. According to the CME FedWatch Tool, the odds for a 50 bps Fed cut are 60%, while 25 bps stands at 40%.

Bullion prices had risen 29% in 2024, sponsored by Gold’s physical demand and major central banks beginning their easing cycles. This and geopolitical tensions could keep traders setting their sights at $2,700.

Bullion has risen over 29% so far in 2024, with gains attributed to central bank easing and geopolitical issues.

Daily digest market movers: Gold price stays firm amid high US yields

- Gold price is capped by US Treasury bond yields.

- Tensions in the Middle East between Israel and Hezbollah underpin Gold prices.

- An uneventful US economic schedule on Wednesday left traders adrift to past data while they prepared for Fed Chair Jerome Powell's speech on Thursday.

- ETF flows, geopolitical tensions across the Middle East and China’s massive stimulus measures could drive Gold prices higher.

- According to the World Gold Council, global physically-backed Gold ETFs saw modest net inflows of 3 metric tons last week.

XAU/USD technical outlook: Gold price consolidates around $2,650-$2,660

Gold prices are set to extend the gains. However, price action turned sideways on Wednesday amid the lack of catalysts, which could push XAU/USD above its current record high toward $2,700.

From a momentum standpoint, the Relative Strength Index (RSI) signals that Gold is overbought, which could cause a leg-down before the rally resumes.

If XAU/USD extends its rally past the current year-to-date (YTD) peak of $2,670, look for a challenge of $2,675, followed by $2,700. Up next would be the $2,750 level, followed by $2,800.

On the flip side, if XAU/USD drops below $2,650, look for a test of the September 18 daily high at $2,600. The following key support levels to test will be the September 18 low of $2,546, followed by the 50-day Simple Moving Average (SMA) at $2,488.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- AUD/USD retreats on resurgent demand for safe-haven US Dollar amid lingering global economic concerns.

- Hawkish RBA stance and market expectations of 50 bps Fed rate cut in November support the pair.

- Despite softer Australian CPI data, near-term RBA rate cuts remain unlikely.

The AUD/USD retreated on Wednesday, declining by 0.70% to 0.6850. The pair's decline came as the US Dollar regained its safe-haven appeal amidst persistent global economic concerns. Despite the weaker Australian Consumer Price Index (CPI) data, near-term RBA rate cuts remain unlikely, limiting the AUD/USD's downside potential. The upcoming speech from Federal Reserve (Fed) Chair Jerome Powell on Thursday and the US PCE Price Index on Friday will be closely watched for further cues on the central banks' monetary policy stance.

The Australian economy's outlook is uncertain due to contrasting indicators and the Reserve Bank of Australia's (RBA) aggressive stance on inflation. As a result, markets are anticipating a modest interest rate cut of only 0.25% in 2024, signaling a shift away from previous expectations of more significant easing.

Daily digest market movers: Australian Dollar declines as markets digest soft CPI, USD strength

- Despite positive news about China's new stimulus measures, global economic downturn concerns and geopolitical risks make investors cautious, leading to a weaker open in European equity markets.

- The safe-haven US Dollar rebounds from its lowest point this year, benefiting from risk aversion and driving flows away from the risk-sensitive Australian Dollar.

- The market predicts a 50-basis-point rate cut by the Fed in November, contrasting with the Reserve Bank of Australia's hawkish stance, supporting AUD/USD.

- RBA Governor Michele Bullock indicates that recent data has not significantly affected the policy outlook, reinforcing the hawkish stance and limiting AUD/USD downside.

- Australian CPI data showed a decline to 2.7% YoY in headline inflation to its lowest level since early 2022, offering some relief but insufficient to warrant RBA rate cuts.

AUD/USD technical outlook: AUD/USD take a breather, no sell signal

The AUD/USD saw sharp upward movements which propelled the pair to multi-month highs near 0.6900 in the last sessions. That improved the outlook which remains bullish.

The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) took a big hit on Wednesday, but they shouldn't be considered a sell signal. The buyers seem to be taking a breather after reaching highs since December. A correction was necessary.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- Market continues to overestimate Fed easing with the central bank pushing back against dovish expectations.

- Economic data remains solid as S&P Global preliminary September PMIs come in above expectations.

- Fed officials will try to push back on the dovish rhetoric.

The US Dollar Index (DXY), which measures the value of the USD against a basket of currencies, whipsaws in a volatile session on Wednesday, hovering around a 14-month low due to intensifying recession fears. Despite the market's persistent higher estimation of Federal Reserve (Fed) easing, the central bank has countered dovish expectations. Friday’s Personal Consumption Expenditures (PCE) figures from August will be closely watched.

While the US economy exhibits a slowdown in certain sectors, other areas remain resilient, supporting overall economic activity. Despite this mixed picture, the Fed emphasizes that the path of interest rate adjustments will hinge on forthcoming economic data.

Daily digest market movers: US Dollar gains despite steady dovish bets, markets await PCE figures

- Market continues to overestimate the extent of Fed easing despite some Fed Governors’ efforts to curb dovish expectations.

- Market is pricing in 75 bps of easing by year-end and 175-200 bps of total cuts over the next 12 months.

- On Thursday, Gross Domestic Product (GDP) and Friday’s PCE figures will be key for the USD dynamics.

- It is worth noticing that Jerome Powell stated that the pace of the easing cycle will depend on incoming data, so their outcome might shake the USD. Fed Chair Jerome Powell will be on the wires on Thursday.

DXY technical outlook: Bearish momentum persists, bulls lack strength

The DXY has largely bearish tradewinds casting it about on the technical charts.

The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) gained some momentum, but the RSI remains below the negative zone, and the MACD continues to indicate flat green bars. These technical indicators suggest that the bears are in control and that buying pressure is weak.

Support levels can be found at 100.50, 100.30 and 100.00, while resistance levels are located at 101.00, 101.30 and 101.60.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

The Greenback staged a robust comeback after flirting with 14-month lows, prompting quite a meaningful knee-jerk in the risk complex ahead of key data releases and the speech by Chair Powell.

Here is what you need to know on Thursday, September 26:

The US Dollar Index (DXY) rose markedly after bottoming out in new 2024 lows around 100.20. The final Q2 GDP Growth Rate figures are due, seconded by the usual weekly Initial Jobless Claims, Durable Goods Orders, and Pending Home Sales. In addition, the Fed’s Kugler, Barr, Kashkari, Collins, Williams, and Chief Powell are all due to speak.

EUR/USD failed to advance further north of the 1.1200 barrier and eventually succumbed to the strong reversal of the US Dollar. The German GfK’s Consumer Confidence is due along with the ECB’s M3 Money Supply. In addition, the ECB’s Elderson, Buch, Schnabel, McCaul, and Lagarde will also speak.

GBP/USD rose past 1.3400 the figure, although the move failed to consolidate and the pair corrected markedly lower in line with the Dollar’s bounce. Car Production will be the only release on the UK calendar.

The strong recovery in the US Dollar and US yields across the board motivated USD/JPY to leave behind two daily pullbacks in a row and retest the upper-144.00s. The BoJ will publish its Minutes, while weekly Foreign Bond Investment data are also expected.

Following a brief trespass of the 0.6900 barrier, AUD/USD embarked on a deep decline following the strong bounce in the Greenback. The RBA will release its Financial Stability Review (FSR).

WTI prices came under heavy pressure and tumbled to new four-day lows well south of the $70.00 mark per barrel.

Prices of Gold charted an all-time high around $2,670 per ounce troy amidst firm speculation of extra rate cuts by the Fed in the next few months. Silver retested the area of recent tops past the $32.00 mark per ounce, although they later succumbed to the generalized bid bias in the US Dollar.

- The Dow Jones tilted into the bearish side, falling 300 points.

- Exhaustion plays are on the cards with indexes deep in overbought territory.

- Despite a trim off the top, the Dow Jones is on pace for another record month.

The Dow Jones Industrial Average (DJIA) pulled back on Wednesday, shedding around 300 points and easing back below the 42,000 handle as the heavyweight equity index takes a breather after a period of repeated breaks into record territory.

Treasury yields ticked higher on Wednesday and most of the US indexes are testing into the red, with the Dow Jones taking the brunt of the damage, falling 0.8% through the US trading session. Market focus is shifting back to the state of the US economy following the Federal Reserve’s (Fed) bumper 50 bps rate cut last week.

US consumer confidence indicators fell this week as the average US consumer doesn’t share in the stock market’s exuberance over Fed rate cuts, with key confidence readings falling to their lowest levels in three years and consumer inflation expectations for the next 12 months ticking higher. This Friday will see a fresh update to US Personal Consumption Expenditure (PCE) inflation figures.

New home sales also fell in August, declining 4.7% to 716K from the previous month’s revised 751K. Meanwhile, investors will see another print of US Gross Domestic Product (GDP) growth for the second quarter, expected to hold steady at 3.0% on an annualized basis. Thursday will also bring a slew of speeches and public appearances from several Fed officials, including Fed Chair Jerome Powell.

Dow Jones news

Most of the Dow Jones equity index tilted into the red on Wednesday, with around two-thirds of the stock board easing for the day. Intel (INTC) still managed to extend a near-term rally, stretching another 2.5% to $23.40 per share, but the battered chipmaker still remains down over 53% YTD.

Amgen (AMGN) tumbled nearly 5% on Wednesday, dragging the Dow Jones lower overall and fell below $315 per share for the second time since the beginning of August. The pharmaceutical company’s recent exploration into a new eczema drug called rocatinlimab yielded results that undershot efficacy expectations, and also underperformed competitors’ products that already exist for treating atopic dermatitis.

Dow Jones price forecast

Wednesday’s bearish performance for the Dow Jones puts the index at risk of closing in the red for the week as over-exerted buyers run out of gas and give short pressure a chance to build back up. However, despite a near-term snap, the index is still planted firmly in the long side of the trend, and a buildup of short positions could give way to a snap back into record chart territory.

If the bears win the near-term tug-of-war, the Dow Jones could backslide to the 50-day Exponential Moving Average (EMA) near 40,800.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- Mexican Peso declines as USD/MXN climbs over 1.40%, driven by expectations of further Banxico rate cuts.

- Cooling inflation in early September bolsters the case for a Banxico rate reduction at the September 26 meeting.

- Bloomberg survey: 20 of 25 analysts expect Banxico to cut 25 bps to 10.50%, with some predicting a 50 bps reduction.

The Mexican Peso tumbles against the Greenback on Wednesday as the latter appreciates sharply against most emerging market currencies. There are expectations for further easing by the Bank of Mexico (Banxico) at its September 26 meeting. This environment has sponsored a leg-up in the exotic pair. At the time of writing, the USD/MXN trades at 19.58, a gain of over 1.40%.

Mexico’s economic docket remained absent on Wednesday, but data revealed on Monday and Tuesday paint a mixed economic picture. In annual data, Economic Activity improved in July, but Retail Sales extended its agony to three consecutive months of registering negative readings.

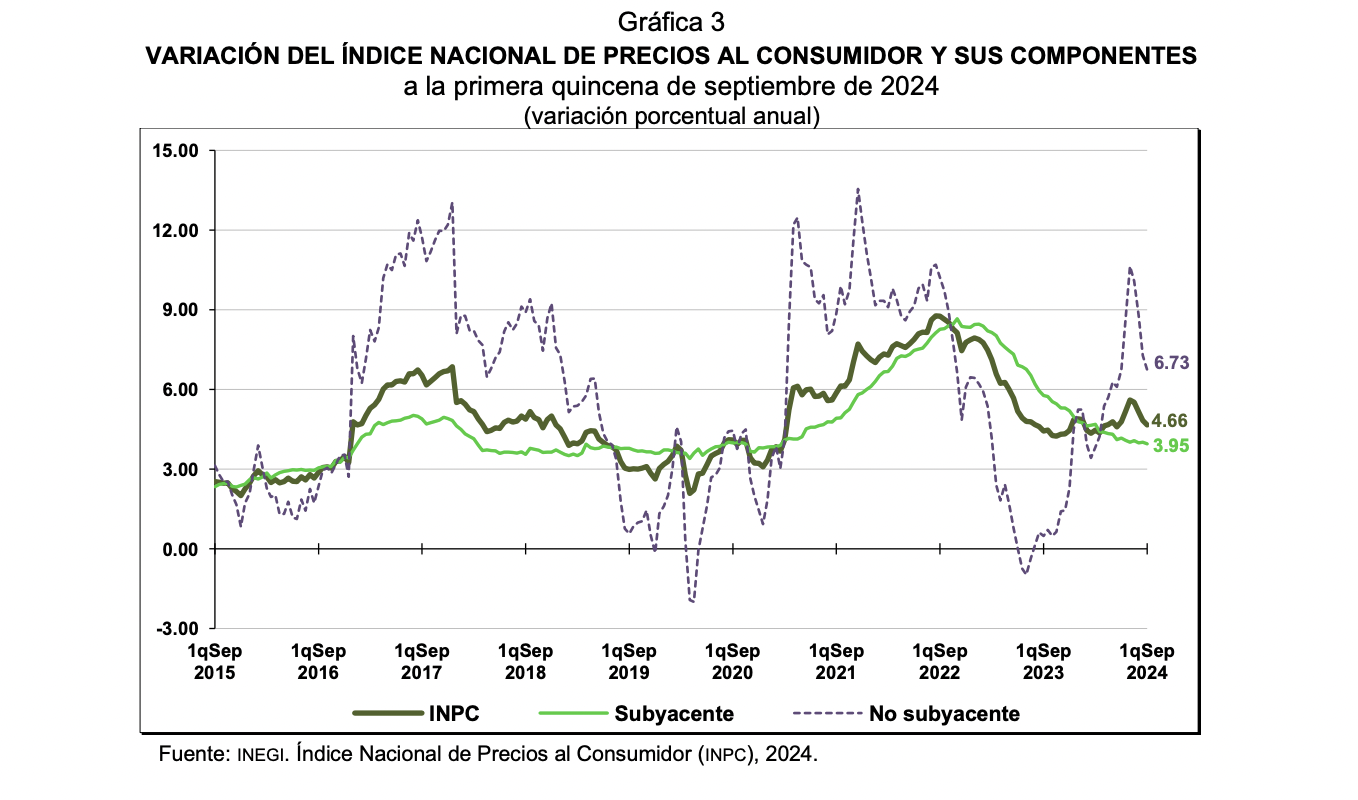

On Tuesday, the Instituto Nacional de Estadistica Geografía e Informatica (INEG) announced that monthly and yearly inflation figures for September's first half cooled.

The latest data set should allow Banxico to cut its interest rate by at least 25 basis points (bps) on Thursday. According to Bloomberg, 20 out of 25 analysts estimate that the central bank will lower borrowing costs to 10.50%. One expects rates to remain unchanged, and four estimate a 50 bps rate cut, following the Fed's footsteps.

If Banxico eases its policy, that would be negative for the Peso. Hence, the USD/MXN could extend its uptrend, with traders setting their sights on the psychological 20.00 figure.

Christian Lawrence, senior cross-asset strategist at Rabobank, noted, “We see room for bouts of downside on the back of tactical carry trade flows during periods of vol suppression. Still, our base is for further MXN weakness over the coming months as reforms and US elections add to MXN risk premia.”

Meanwhile, data in the United States (US) show that although the economy is slowing down, most market participants estimate a soft-landing scenario. On Tuesday, the Conference Board (CB) revealed that Consumer Sentiment in September deteriorated and hit its lowest level since August 2021 at 98.7, down from 105.6.

Daily digest market movers: Mexican Peso dips amid scarce economic docket

- USD/MXN extended its rally on Banxico rate cut expectations, alongside the Greenback’s recovery.

- US Dollar Index (DXY), which tracks the buck’s performance against a basket of six peers, climbs 0.56% and exchanges hands at 100.91.

- Banxico is expected to lower borrowing costs by 175 bps toward the end of 2025, according to the swaps markets.

- Market participants had fully priced in a 100% chance of a 25 bps rate cut by the Fed. However, the odds for 50 bps of easing are 60.8%, according to the CME FedWatch Tool.

USD/MXN technical analysis: Mexican Peso slumps as USD/MXN surpasses 19.50

The USD/MXN resumed its uptrend on Wednesday and hit a daily high of 19.64 before stabilizing at current levels. Momentum favors further upside as the Relative Strength Index (RSI) is bullish.

The first key resistance level that buyers need to clear is the August 6 high at 19.61. Once surpassed, the next stop is 20.00, followed by the year-to-date (YTD) peak at 20.22.

On the flip side, if sellers drive USD/MXN below the September 23 low of 19.29, it will expose the confluence of the 50-day Simple Moving Average (SMA) and the September 18 low between 19.08 and 19.06.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- EUR/GBP retraced Monday’s sharp downward movements.

- The daily RSI and MACD signals a stabilizing selling pressure.

- The pair might extend its current sideways trend in the next sessions.

EUR/GBP rose to 0.8370 on Wednesday, displaying some volatility during the European trading session. Nevertheless, the pair failed to hold on to gains, and it currently trades at 0.8350. The cross seems to be consolidating the start of the week’s sharp downward movements with sellers taking a breather.

The Relative Strength Index (RSI) on the daily chart stands at 37, suggesting that buyers are starting to take control after Monday’s selloff, and the RSI is gradually increasing. However, the RSI is still below the midline, indicating that the market is in a negative trend. The Moving Average Convergence Divergence (MACD) is flat, with the signal line above the MACD line, suggesting that selling is losing steam.

EUR/GBP daily chart

Based on the current technical picture, the EUR/GBP pair is likely to remain in a consolidation phase in the near term. With the pair in lows since 2022, the bears seem to have already done their part and they might step away to consolidate their movements. In the meantime, the bullish traction gained on Wednesday continues to be weak so the current bearish scenario isn’t threatened.

Support levels: 0.8315, 0.8330, 0.8340

Resistance levels :0.8400, 0.8430, 0.8440

- USD/JPY climbs over 0.90% to 144.54, buoyed by a rise in the US 10-year Treasury yield.

- Despite the uptick, the pair shows a downward trend, remaining below the Ichimoku Cloud and 200-DMA.

- RSI crosses above the neutral line, suggesting potential for continued gains in the short term.

- Key resistance at 145.00, with subsequent levels at 146.73 (50-DMA) and 147.00.

- A fall below 144.00 could find support at 143.39 (Kijun-Sen), 142.76 (Senkou Span A), and 142.13 (Tenkan-Sen).

The USD/JPY edges up during the North American session, registering gains of over 0.90% as the US Dollar stages a comeback. The rise in the US 10-year T-note yield sponsored a leg-up in the pair, which trades at 144.54 at the time of writing.

USD/JPY Price Forecast: Technical outlook

Despite rallying during the session, the USD/JPY remains downward biased, as the exchange rate persists below the Ichimoku Cloud (Kumo) and the 200-day moving average (DMA).

The Relative Strength Index (RSI) has just pierced its neutral line, opening the door for further upside in the near term.

With that said, the USD/JPY next resistance would be the 145.00 psychological figure ahead of testing the 50-DMA at 146.73. On further strength, the pair could hit the 147.00 figure.

Conversely, if USD/JPY tumbles below 144.00, this could pave the way to challenge the Kijun-Sen at 143.39, followed by the Senkou Span A at 142.76 and the Tenkan Sen at 142.13.

USD/JPY Price Action – Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.22% | 0.51% | 0.82% | 0.26% | 0.75% | 0.91% | 0.68% | |

| EUR | -0.22% | 0.29% | 0.60% | 0.04% | 0.53% | 0.70% | 0.45% | |

| GBP | -0.51% | -0.29% | 0.27% | -0.25% | 0.24% | 0.37% | 0.18% | |

| JPY | -0.82% | -0.60% | -0.27% | -0.56% | -0.07% | 0.09% | -0.14% | |

| CAD | -0.26% | -0.04% | 0.25% | 0.56% | 0.49% | 0.66% | 0.43% | |

| AUD | -0.75% | -0.53% | -0.24% | 0.07% | -0.49% | 0.17% | -0.07% | |

| NZD | -0.91% | -0.70% | -0.37% | -0.09% | -0.66% | -0.17% | -0.24% | |

| CHF | -0.68% | -0.45% | -0.18% | 0.14% | -0.43% | 0.07% | 0.24% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

The SNB is widely expected to cut rates by 25 bps at Thursday’s quarterly policy meeting. The Bloomberg survey suggests that all but three forecasters expect a 25 bp cut, with only one predicting that the Bank will opt for a larger 50 bps move. The risk of the larger move from the SNB should not be overlooked, Rabobank’s FX strategist Jane Foley notes.

A 50 bp surprise would likely weaken the CHF

“This morning the Swiss KOP Economic Institute lowered its growth forecasts for Switzerland to 1.1% and predicted that inflation would be 1.2% in 2024 and just 0.7% in both 2025 and 2026. Swiss August CPI inflation registered a softer than expected 1.1% y/y, down from 1.3% y/y in July.”

“This suggests that inflation is on course to undershoot the 1.5% Q3 inflation forecast that the SNB published in June. It then forecast that inflation would be a 1.4% in 2024, assuming rates stayed at 1.25%. Clearly a strong exchange rate brings downside risks to inflation.”

“As a result, we see the SNB as incentivise to undermine the CHF bulls with a larger than expected rate cut this quarter, particularly since its next policy meeting is not scheduled until December. A 50 bp surprise would likely weaken the CHF, though the reaction may not be sustained.”

- GBP/USD drops to 1.3389 from a yearly high of 1.3429 as the US Dollar strengthens.

- Pullback to the top of an ascending channel at 1.3363 may offer buying opportunities, with RSI still favoring buyers.

- Maintaining above 1.3363 could push GBP/USD to retest the yearly high of 1.3429 and aim for 1.3437, 1.3450, and 1.3500.

- Falling below 1.3363 might lead to testing the week’s low at 1.3248 and further support at the September 19 low of 1.3153.

The Pound Sterling lost some steam against the US Dollar in early trading during Wednesday’s North American session after hitting a yearly peak of 1.3429. The GBP/USD trades at 1.3389, down 0.18%, as the Greenback recovers some ground.

GBP/USD Price Forecast: Technical outlook

From a technical standpoint, the GBP/USD pullback toward the top of an ascending channel at 1.3363 opened the door for further buying, as seen by price action.

The Relative Strength Index (RSI) hints that buyers remain in charge. However, in the short term, the GBP/USD might print another leg-down before resuming its rally, which could put the March 1, 2022, peak at 1.3437 to the test.

If GBP/USD remains above 1.3363, this could pave the way to challenge the current yearly high of 1.3429. On further strength, that will expose 1.3437, followed by the 1.3450 figure, ahead of 1.3500.

Conversely, if the pair slumps past 1.3363, it could hit the current week’s low of 1.3248. On further weakness, the bulls’ following line of defense will be the September 19 daily low of 1.3153.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.06% | 0.29% | 0.79% | 0.20% | 0.43% | 0.60% | 0.66% | |

| EUR | -0.06% | 0.24% | 0.74% | 0.14% | 0.37% | 0.56% | 0.59% | |

| GBP | -0.29% | -0.24% | 0.48% | -0.10% | 0.13% | 0.28% | 0.36% | |

| JPY | -0.79% | -0.74% | -0.48% | -0.58% | -0.35% | -0.19% | -0.13% | |

| CAD | -0.20% | -0.14% | 0.10% | 0.58% | 0.23% | 0.41% | 0.46% | |

| AUD | -0.43% | -0.37% | -0.13% | 0.35% | -0.23% | 0.19% | 0.23% | |

| NZD | -0.60% | -0.56% | -0.28% | 0.19% | -0.41% | -0.19% | 0.05% | |

| CHF | -0.66% | -0.59% | -0.36% | 0.13% | -0.46% | -0.23% | -0.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

- Silver price clings to gains near $32.00 as Fed large rate cut bets swell.

- The next move in the US Dollar will be guided by the US core PCE inflation data.

- Silver price aims to recapture the decade-high of $32.50.

Silver price (XAG/USD) grips gains near the key resistance of $32.00 in Wednesday’s New York session. The white metal holds strength as the US Dollar remains under pressure amid growing speculation that the Federal Reserve (Fed) will deliver another sizable interest rate cut in any of the remaining two policy meetings this year.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, hovers near the yearly low of 100.20. Meanwhile, 10-year US Treasury yields jump to near 3.77%. Historically, higher yields on interest-bearing assets increase the opportunity cost of holding an investment in non-yielding assets, such as Silver. But, in this case, the Silver price remains firm.

According to the CME FedWatch tool, the central bank is expected to reduce its key borrowing rates further by 75 bps in the remainder of the year, suggesting that there will be one 50 bps and one 25 bps rate cut. 30-day Federal fund futures pricing data shows that the probability of the Fed reducing interest rates by a larger-than-usual margin in November has increased to 59% from 37% a week ago.

Going forward, investors will focus on the United States (US) core Personal Consumption Expenditure price index (PCE) data for August, a Fed’s preferred inflation gauge, which will be published on Friday. Economists estimate the annual inflation measure to have accelerated to 2.7% from 2.6% in July.

Silver technical analysis

Silver price approaches the decade high of $32.50. The white metal strengthened after the breakout of the downward-sloping trendline from May 21 high of $32.50. Upward-sloping 20-day Exponential Moving Average (EMA) near $30.20 suggests that the near-term outlook of the Silver price is bullish.

The 14-day Relative Strength Index (RSI) strives to sustain in the 60.00-80.00. A bullish momentum would trigger if the oscillator manages to do so.

Silver daily chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Year-to-date Gold returns are currently staging their third-best performance since 1980, and, in reality, are only a rounding error away from the best all-time performance in the last 44 years.

A rounding error away from the best all-time performance

“While we can argue that fund FOMO is hard to account for, there is evidence of notable OTC interest in physical markets hitting the tapes with BOE Gold simultaneously trading tight. Since the Fed kickstarted its easing cycle with a 50bp cut, commodities prices, inflation swaps, and US long-end yields have simultaneously risen, and have even outpaced the rally in risk assets by some measures.”

“The cross-section of commodities prices continues to send signals of significant improvement in demand expectations, and while survey-based measures of consumer confidence are deteriorating, consumer spending patterns have remained strong. While this could easily ultimately be seen as an overreaction to the Fed's 50bp start to its cutting cycle, a persistence in this trend could signal more worrying signs that it may not be as easy as the Fed hopes to bring rates lower without reflation.”

“Conversely, if these trends simply reflect an overreaction to the start of the easing cycle, then it is worth highlighting that in the years that followed such a remarkable performance in Gold, drawdowns for the following year have averaged -27%.”

- AUD/USD struggles to extend its upside above 0.6900, while its upside remains firm.

- The Australian Dollar remains firm as the RBA is expected to keep interest rates steady at their current levels for the entire year.

- Firm Fed large rate cut bets weigh on the US Dollar.

The AUD/USD pair edges lower after posting a fresh yearly high around 0.6900 in Wednesday’s North American session. The broader outlook of the Aussie asset remains firm as the Reserve Bank of Australia (RBA) signaled in its monetary policy meeting on Tuesday that interest rates will remain at their current levels by the year-end.

The Australian Dollar (AUD) is also strengthened by the announcement of China’s massive stimulus to boost household spending and revive the real estate sector. Being a proxy for China’s economic growth, the AUD receives higher flows if China’s outlook improves.

Meanwhile, the US Dollar (USD) has fallen back after a short-lived recovery. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, retreats to 100.20, the lowest level seen in more than a year.

The US Dollar would continue to face pressure as market participants expect that the Federal Reserve (Fed) will cut interest rates consecutively for the second time by 50 basis points (bps) in the November monetary policy.

AUD/USD reclaims the horizontal resistance plotted from 28 December 2023 high of 0.6870 on a daily timeframe. The near-term trend is bullish as the 20-day Exponential Moving Average (EMA) at 0.6770 is sloping higher.

The 14-day Relative Strength Index (RSI) shifts above 60.00, suggesting an active bullish momentum.

The Aussie asset will witness a fresh upside move if it breaks above the intraday high of 0.6910, which will drive the asset to near the 16 February 2023 high of 0.6936, followed by the psychological resistance of 0.7000.

On the flip side, a downside move below September 19 of 0.6738 will drag the asset toward round-level support of 0.6700 and a September 12 low of 0.6656.

AUD/USD daily chart

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- EUR/GBP is rising for the second day in a row after comments from BoE’s Bailey

- The BoE Governor’s comments suggested interest rates would continue falling gradually as inflation eased.

- The Euro remains under pressure by weak data and rising bets of the ECB cutting rates in October.

EUR/GBP continues its recovery, trading up 0.40% in the 0.8360s on Wednesday. The Pound started losing ground against the single currency after commentary from Bank of England (BoE) governor Andrew Bailey, in which he said that he saw interest rates continuing to fall gradually. This, in turn, put pressure on Sterling since lower interest rates attract less capital inflows.

“I'm very encouraged that the path of inflation is downwards therefore I do think the path for interest rates will be downwards, gradually, to the ´neutral’ rate,” Bailey said on Tuesday. The neutral rate of interest is the long run equilibrium level, or “ideal” level for interest rates in the economy.

His remarks come after a close call five-to-four vote at the BoE’s August meeting backed up a quarter point cut from the bank, pushing borrowing costs down to 5.00%. Financial markets, meanwhile, are pricing in a drop to 4.5% by the end of 2024, and lower to 3.5% by the end of 2025.

BoE policymaker Megan Greene was more hawkish than Bailey on Wednesday when she said that a “cautious, steady-as-she-goes approach to monetary policy easing is appropriate.”

Greene added “I believe the risks to activity are to the upside, which could suggest that the long-run neutral rate is higher and - all else equal - our stance of policy isn’t as restrictive as we had thought.” Greene was one of four on the MPC who voted to hold rates in August.

EUR/GBP rebounds despite increasing odds of an ECB Autumn cut