- Analytics

- News and Tools

- Market News

Новини ринків

- Gold price attracts some sellers around $1,915 amid the USD demand.

- Most Fed officials still expect the additional rate rises later this year, which weigh on gold price.

- Market players await the US growth number and the Core Personal Consumption Expenditure (PCE) Price Index.

Gold price (XAU/USD) struggles to gain around $1,915 during the early Asian session on Tuesday. Gold price is weighed by a rally in US Dollar (USD) and US higher yield.

Meanwhile, the US Dollar Index (DXY), a measure of the value of the USD relative to a basket of foreign currencies, hovers around 105.95 after retreating from the highest level since November of 106.09 amid the higher for longer narratives in the US. Additionally, the 10-year yield climbed to 4.53%, a level not seen since October 2007.

Most Fed officials still expect the additional rate to rise later this year. The Federal Reserve Banks of Boston and San Francisco Presidents, Susan Collins and Mary Daly, emphasized that although inflation is cooling down, additional rate hikes would be necessary. While the Chicago Fed President Austan Goolsbee said that a soft landing is possible, inflation risks remain tilted to the upside and the Fed should have 100% commitment to returning inflation to 2%. It’s worth noting that rising interest rates raise the opportunity cost of investing in non-yielding assets, implying a negative outlook for XAU/USD.

Moving on, the US Gross Domestic Product (GDP) Annualized for the second quarter will be due on Thursday. The closely watched event this week will be the Core Personal Consumption Expenditure (PCE) Price Index, the Fed's preferred measure of consumer inflation, due on Friday. The annual figure is expected to drop from 4.2% to 3.9%. Market players will take cues from these figures and find a clear direction in XAU/USD.

XAU/USD technical outlook

On the one-hour chart, gold price holds below the 50- and 100-hour Exponential Moving Averages (EMAs), which mean the past of least resistance is to the downside. Meanwhile, the Relative Strength Index (RSI) is located in bearish territory below 50, activating the bearish momentum for gold price.

Resistance level: $1,925, $1,945 and $1,970

Support level: $1,900, $1,885 and $1,865

-638312830668322460.png)

- The NZD/USD rebounded in Monday action, ending the day just south of 0.5970 after falling to 0.5940.

- The US Dollar remains well-bid across the broader market.

- The economic calendar for this week is decidedly USD-heavy.

The NZD/USD is seeing some consolidation in the short term after slipping from the last swing high into 0.5985.

The Kiwi (NZD) has recovered 2% against the US Dollar (USD) from September's lows near 0.5850, but remains firmly bearish, down over 7% from July's peak near the 0.6400 handle.

With little data to drive the Kiwi on the economic calendar, market flows will be driven from the Greenback side.

Economic calendar sees all Greenback, little Kiwi for the week

Tuesday will bring US Housing Price Index growth for July, which is forecast to decline slightly from 0.3% to 0.1%. On Wednesday, US Durable Goods Orders for August are seen declining by 0.4%, but still an improvement on the previous month's -5.2%.

High-impact data kicks off on Thursday with US Gross Domestic Product (GDP) numbers for the second quarter; annualized quarter-on-quarter GDP growth is expected to improve slightly from 2.1% to 2.3%.

Improving GDP growth figures could see further gains for the US Dollar if the numbers manage to meet or beat forecasts.

Thursday will also be bringing a speech from Federal Reserve (Fed) Chair Jerome Powell, followed by New Zealand's only representation on the economic calendar this week with mid-tier consumer confidence figures.

The ANZ Roy Morgan Consumer Confidence survey index for September will be landing at 21:00 GMT on Thursday. The indicator last printed at 85 back in August.

NZD/USD technical outlook

The Kiwi-Dollar pair is slowly recovering on daily candlesticks, and the NZD/USD is currently pinned to the 34-day Exponential Moving Average (EMA). Overall trend momentum remains decidedly bearish, with current price action trading well below the 200-day Simple Moving Average (SMA) crossing below 0.6200.

If bears manage to regain control of the NZD/USD, prices will be set to break into new lows for the year, and little technical support would remain until last's years lows near 0.5600.

NZD/USD daily chart

NZD/USD technical levels

US President Joe Biden and one of his senior advisers warned on Monday that a federal government shutdown may result in widespread difficulties, including the loss of food benefits for almost 7 million low-income women and children, per Reuters.

He said he and House Speaker Kevin McCarthy had agreed a few months ago on spending levels for the government. The Republican-controlled House of Representatives may seek this week to approve drastic budget cutbacks that the Democratic-controlled Senate would almost likely reject. While the changes would not become law, a failure by both houses to reach an agreement might result in a partial government shutdown by next Sunday.

Market reaction

As of writing, the US Dollar Index (DXY) was down 0.02% on the day at 105.92.

- AUD/USD trades at 0.6423, experiencing a 0.25% drop on Monday, as the US Dollar Index (DXY) reaches a ten-month high at 106.09, driven by elevated US bond yields.

- US Treasury bond yields touch multi-year highs, with the 10-year T-bond rate hitting 4.533%, reflecting the US Federal Reserve’s 'higher for longer' stance on interest rates.

- Federal Reserve officials, advocate for a cautious and patient approach to monetary policy, not ruling out the possibility of another rate hike, while Australian traders await key economic releases.

The Australian Dollar (AUD) lost some ground against the US Dollar (USD) as the latter strengthened the most in nine months, underpinned by elevated US bond yields. Hence, the AUD/USD is trading at 0.6423, printing minuscule gains as the Asian session begins, but on Monday, it dropped 0.25%.

AUD/USD faces pressure as the buck’s climbs to multi-month rise

Wall Street finished Monday’s session with gains led by the Nasdaq and followed by the S&P 500. The Greenback remains in the driver’s seat as investors brace for the US Federal Reserve’s mantra “higher for longer,” as US Treasury bond yields touch multi-year highs. The US 10-year T-bond rate hit 4.533% during the session, while the US Dollar Index (DXY) rose to a ten-month high at 106.09.

Data-wise, the Chicago Fed National Activity Index plunged to -0.16 in August from 0.07 in July, while the Dallas Fed Manufacturing Index plummeted to -18.1 in September from -17.2 the prior month.

Federal Reserve speakers in the central bank adopted a cautious stance, mainly Boston and San Francisco Fed Presidents Susan Collins and Mary Daly. Both stressed the Fed should be patient on monetary policy but haven’t ruled out another rate hike. Recently, the Chicago Fed President Austan Goolsbee said that a soft landing is possible, but inflation risks remain tilted to the upside.

Meanwhile, AUD/USD traders would take cues from the Australian economic docket with the release of the Reserve Bank of Australia (RBA) Conference in inflation. On the US front, the docket would release the S&P/Case-Shiller Home Prices, alongside housing data and the CB Consumer Confidence.

AUD/USD Price Analysis: Technical outlook

The Aussie’s daily chart portrays the currency pair as neutral to downward biased. Currently is consolidated at around the 0.6400 mark, but a bearish-harami candlestick chart pattern could pave the way for further losses. The first support is seen at the current exchange rate, at around two and a half years of support trendline. A breach of the latter would open the door to test the September 4 low of 0.6357, followed by the November 22 swing low of 0.6272. Conversely, if the pair climbs past the 0.6500 figure, the next resistance is at the 50-day moving average (DMA) at 0.6671.

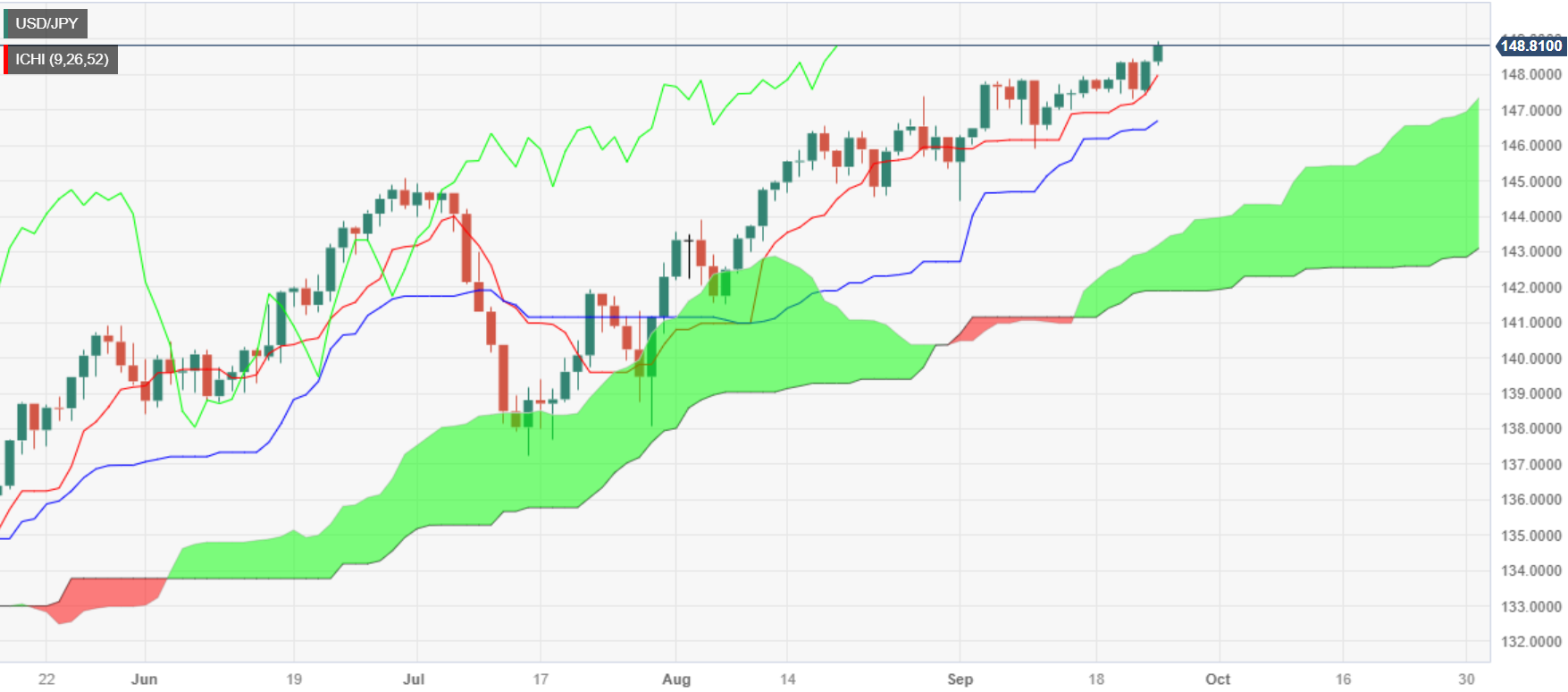

- USD/JPY takes a breather near 148.81 amid the cautious mood and fear of intervention.

- The higher for longer narratives in the US boosts the Greenback broadly, the highest since November.

- Bank of Japan (BoJ) policymakers said the central bank needs to patiently continue monetary easing.

- Japan’s Tokyo Consumer Price Index (CPI) and US Core Personal Consumption Expenditure (PCE) Price Index will be closely watched events.

The USD/JPY pair consolidates its recent gains after reaching the highest since October of 149.00 during the early Asian session on Tuesday. The stronger US Dollar (USD) is the main driver for the pair as the 10-year yield climbed to 4.53%, a level not seen since October 2007. The pair currently trade around 148.81, losing 0.04% on the day.

Meanwhile, the US Dollar Index (DXY), a measure of the value of the USD relative to a basket of foreign currencies, hovers around 105.95 after retreating from the highest level since November of 106.09 amid the fear of intervention by the Japanese authorities.

The higher for longer narratives in the US boosts the Greenback broadly. The Federal Reserve (Fed) is expected to hike rates one more time by the end of the year. The Federal Reserve Banks of Boston and San Francisco Presidents, Susan Collins and Mary Daly, emphasized that although inflation is cooling down, additional rate hikes would be necessary. While the Chicago Fed President Austan Goolsbee said that a soft landing is possible, inflation risks remain tilted to the upside and the Fed should have a 100% commitment to returning inflation to 2%.

On the other hand, Bank of Japan (BoJ) Deputy Governor Shinichi Uchida said on Monday, that the central bank needs to patiently continue monetary easing and needs to closely watch currency market moves. Similarly, the Bank of Japan (BoJ) Governor Ueda emphasized the need to spend more time assessing data before raising interest rates. This, in turn, might cap the upside of the US Dollar (USD) and act as a headwind for the USD/JPY pair.

Looking ahead, Japan’s Tokyo Consumer Price Index (CPI) for September, Industrial Production, and Retail Sales will be released on Friday. The attention will shift to the highly-anticipated US Core Personal Consumption Expenditure (PCE) Price Index, the Fed's preferred measure of consumer inflation. The annual figure is expected to drop from 4.2% to 3.9%. Traders will take cues from these figures and find trading opportunities around the USD/JPY pair.

- USD/CAD testing into the 1.3450 level after cycling on Monday.

- The US Dollar is broadly higher, but the CAD is catching a late-day bump in crude oil prices.

- Economic calendar is mostly devoid of CAD data, leaving things open for US GDP figures on Thursday.

The USD/CAD slipped a scant 0.2% for Monday, after tapping into a mild intraday high of 1.3491.

The pair has fallen about 1.7% from September's peak near 1.3694. Oil prices have been squeezing higher on market-wide supply constraint fears, which has been bolstering the commodity-based Loonie (CAD) despite the US Dollar's (USD) broad rise across the market.

There is little of note on the economic calendar for Canada this week, and focus will squarely be on USD data impact.

Thursday will see US Gross Domestic Product (GDP) figures, as well as a speech from Federal Reserve (Fed) Chair Jerome Powell. Annualized GDP for the second quarter is forecast to tick higher from 2.1% to 2.3%.

On Friday, we will see US Personal Consumption Expenditure (PCE) data, which is expected to hold steady for the month of August at 0.2%.

Canadian GDP numbers will also land on Friday, but market impact is likely to be muted as US data churns the charts.

Canadian GDP for the month of July is expected to print at a flat 0%, but still an improvement over the previous month's 0.2% decline.

USD/CAD technical outlook

The USD/CAD saw a clean rejection of the 200-hour Simple Moving Average (SMA) in intraday trading, and is set for a challenge of a rising near-term trendline from last Wednesday's swing low near 1.3400.

On daily candlesticks, the USD/CAD is strung along the 200-say SMA. A bearish push from this region will see the pair lose the 1.3400 major handle, while a bullish rebound will need to reclaim the 1.3600 level before pushing to new highs.

USD/CAD daily chart

USD/CAD technical levels

- S&P 500 and Nasdaq closed with gains of 0.40% and 0.45%, respectively, despite the Fed’s decision to hold rates and upward revised rate forecasts.

- US Treasury bond yields soared, with the 10-year benchmark note reaching a 16-year high at 4.533%.

- Energy, Materials, and Consumer Discretionary sectors were the biggest gainers.

Wall Street finished Monday’s session with solid gains, while the Greenback extended its gains to a new year-to-date (YTD) high; at the same time, US Treasury bond yields climbed.

US equities register gains despite the Federal Reserve's upward revised rate forecasts, with Energy, Materials, and Consumer Discretionary sectors leading the way

The S&P 500 registered gains of 0.40% and ended at 4,337.44, while the heavy-tech Nasdaq led US equities gains with a .45% advance, closing at 13,271.32. The Dow Jones Industrial barely missed gains and was last up 0.13%, at 34,006.88.

Sector-wise, the biggest gainers were Energy, Materials, and Consumer Discretionary, each gaining 1.28%, 0.80 %, and 0.67%. The laggards were Consumer Staples, Utilities, and Real Estate, erasing from its value 0.43%, 0.20%, and 0.17%, respectively.

Equities climbed despite last week’s US Federal Reserve’s (Fed) decision to hold rates unchanged but upward revised forecast for the following year. The Federal Fund Rates (FFR) is expected to stay above 5% for 2023 and 2024, as revealed by the latest “dot-plots.”

Therefore, US Treasury bond yields exploited to the upside, with the 10-year benchmark note touching a 16-year high at 4.533%. The Greenback followed suit, with the US Dollar Index (DXY), which tracks the buck’s performance versus six currencies, touching 106.10, a level last seen in November 2022.

Federal Reserve speakers continued to cross newswires with Austan Goolsbee from the Fed of Chicago, saying the path for a soft landing is possible, though a “lot of risks and the path is long and winding.” Last week, two Fed officials called for patience on the US central bank, Boston and San Francisco’s Fed Presidents Sussan Collins and Mary Daly.

In the meantime, Fed Governor Michelle Bowman stressed an additional rate hike is needed, maintaining her hawkish stance.

Data-wise, the US economic agenda, the Dallas Fed Manufacturing Index plunged -18.1 in September, from a -10.2 drop in August.

Gold remained pressured at around the $1,915.00 zone in the commodity space, weighed by the rise in US bond yields. WTI lost 0.50% in the day, as a strong US Dollar and Russia’s lifting fuel ban weighed on the “black gold” price, despite being underpinned by tight supplies after Saudi Arabia and Russia’s 1.3-million-barrel crude oil cut.

S&P 500 Price Action – Daily Chart

S&P 500 Technical Levels

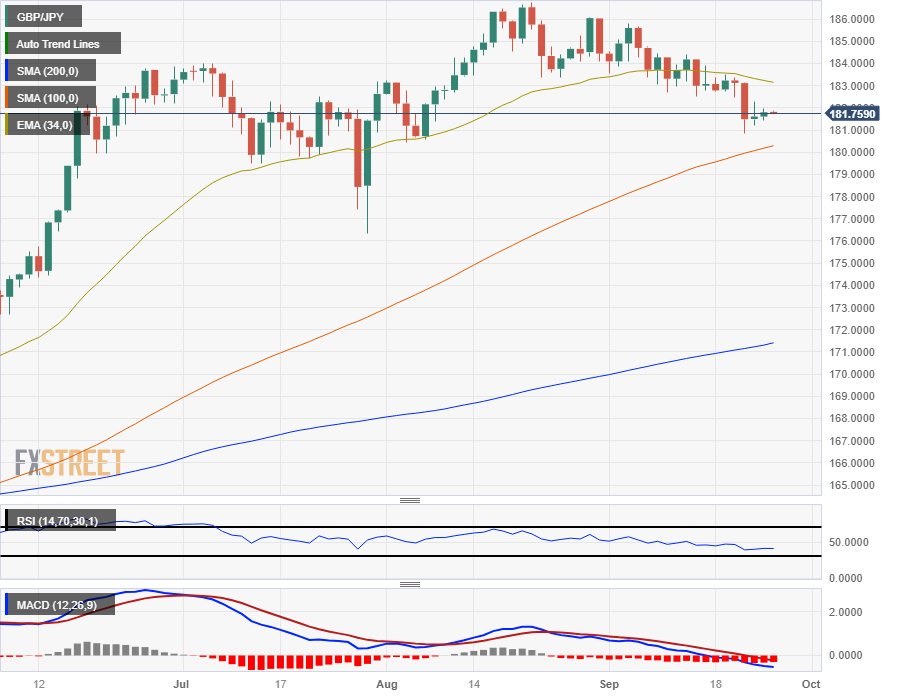

- The GBP/JPY saw thin trading on Monday, heading into Tuesday testing the upper bounds just below 182.00.

- The Pound Sterling continues to sag against the Yen in the short-term, down over 2.5% from August's peak.

- The long term remains notably bullish, and the GBP/JPY is still up almost 18% for 2023.

The GBP/JPY spread the middle for Monday, with neither the Pound Sterling (GBP) nor the Yen (JPY) finding momentum to get the chart kickstarted for the new trading week.

The GBP has struggled to find support on the charts after the Bank of England (BoE) held rates steady last week in a split vote, and it appears the end of the rate hike cycle for the UK has landed much sooner than many analysts expected. With the UK's domestic economy teetering in the fundamental data, the BoE is hoping interest rates are high enough to keep inflation capped moving forward.

On the JPY side, the Bank of Japan (BoJ) Governor Kazuo Ueda and Deputy Governor Shinichi Uchida hit news wires on Monday. The BoJ officials talked down any hawkish expectations, reiterating the BoJ policy stance that inflation is at risk of dipping below 2%, the Japanese central bank's minimum target before a reversal of the BoJ's negative rate regime can be considered.

Read more:

BoJ’s Ueda: Stable, sustainable achievement of 2% inflation not yet in sight

BoJ’s Uchida: Central bank needs to patiently continue monetary easing

BoJ’s Ueda: Our basic stance is that we must patiently maintain monetary easing

Economic calendar looking light on the data docket until Thursday

The early week sees little of note for the GBP/JPY on the economic calendar, and traders will be looking towards Thursday's Tokyo inflation reading and Friday's Gross Domestic Product (GDP) figures for the UK.

Japan's Tokyo Consumer Price Index (CPI) reading is slated for 23:30 GMT late Thursday, and the core annualized figure is forecast to tick lower from 2.8% to 2.6%.

On the UK side, GDP numbers are forecast to hold steady, with the annualized GDP growth rate for the second quarter expected to print at 0.4%, in-line with the previous reading.

GBP/JPY technical outlook

Intraday action has the GBP/JPY hamstrung just below the 182.00 major handle, and the pair is set to build in a floor from 181.00 as bidders look for a re-challenge of the 200-hour Simple Moving Average (SMA) settling into 182.70.

Daily candlesticks see the Guppy settling back into the 100-day SMA, with the long-term bull trend leaving the GBP/JPY well above the 200-day SMA near 172.00. The pair has slipped below the 34-day Exponential Moving Average (EMA) in the near-term, and buyers will need to remount the 186.00 handle from August's last swing high before establishing a continuation of the bull trend.

GBP/JPY daily chart

GBP/JPY technical levels

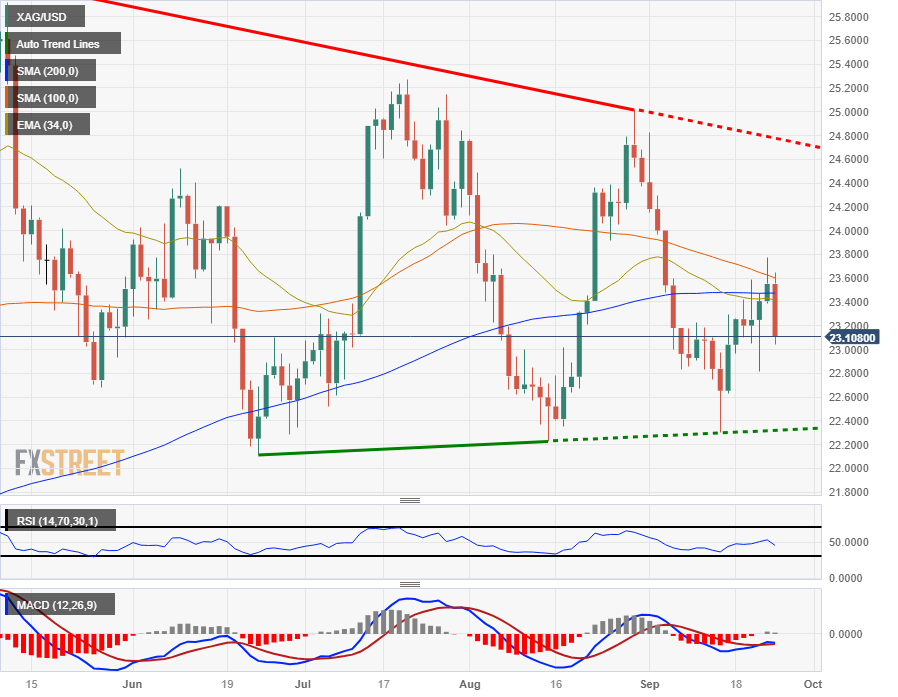

- Gold buyers are struggling to hang on to $1,915.00 for Monday.

- A well-bid US Dollar is seeing the XAU/USD flounder into recent lows.

- Analysts see Gold reaching $2,200 by the end of the year, but policy risks remain.

The XAU/USD took a step lower on Monday, knocking into $1,915.00 and seeing little relief pressure as the US Dollar (USD) catches bids across the board.

Spot gold prices have steadily drifted lower in 2023, peaking just below $2,080.00 back in early May. The XAU/USD is down almost 8% from the year's high, but still remains well-supported looking long-term, with Gold up nearly 20% from last October's lows of $1,650.00

Gold's long-standing relationship with US Treasury yields has softened in recent months; while the yellow metal has a tendency to closely track with US yields, that relationship has broken down for most of 2023. US yields have appreciated considerably, but Gold remains unable to capitalize on bond momentum.

$2,000 by end-2023, $2,200 by end-2024?

Despite downward price pressure, analysts are forecasting lofty end-of-year Gold spot valuations.

Commodity analysts from Société Générale (SocGen) see Gold capped under $2,000 to end the trading year, but 2024 is expected to see Gold prices improve to $2,200 by the end of 2024, on the back of easing inflation expectations and a slipping US Dollar Index.

XAU/USD technical outlook

Hourly candles see Gold flubbing to last week's swing lows below $1,915.00, while the upside is set to be constrained by near-term resistance from the 100-hour Simple Moving Average (SMA) near $1,925.00.

On the daily candlesticks, the XAU/USD is seeing a notable lack of meaningful momentum, with Gold stuck near the 200-day SMA which is still moving bullish into $1,930.00.

Bidders will be looking to shove Gold back above $,1930.00 to continue a push higher, while sellers will be looking to take the XAU/USD down to August's lows below $1,890.00.

XAU/USD daily chart

XAU/USD technical levels

The US Dollar Index is flirting with the 106.00 area at monthly highs. The economic calendar for the Asian and European sessions is empty on Tuesday. Later in the day, the US will release housing and consumer confidence data.

Here is what you need to know on Tuesday, September 26:

The US Dollar Index (DXY) rose to 106.09, reaching the highest level since November, before pulling back to 105.90. The Greenback remains firm, supported by cautious market sentiment and higher US Treasury yields. The 10-year yield climbed to 4.54%, a level not seen since October 2007.

The expectation of high interest rates persisting for longer is based on the resilience of the US economy. Market participants are eagerly awaiting the release of the Federal Reserve's preferred inflation gauge, the Core Personal Consumption Expenditures Price Index, on Friday.

During the American session, the Chinese Yuan consolidated its losses amid ongoing concerns about the Evergrande situation, which will likely continue to be in the spotlight.

EUR/USD posted its lowest close since March, falling below 1.0600 after five consecutive days of decline. The Euro weakened despite European Central Bank (ECB) President Lagarde's comments at the European Parliament, where she mentioned that rates will remain restrictive for as long as necessary. EUR/GBP pulled back from 0.8700 to 0.8670.

The Pound dropped to fresh lows against the US Dollar, briefly reaching levels below 1.2200. The currency is still affected by the Bank of England's dovish stance in its recent policy decision.

USD/JPY broke above 148.50, reaching the highest levels since October and approaching 149.00. Despite concerns about an intervention from Japanese authorities, the pair's rally remains largely unabated.

The Canadian Dollar outperformed on Monday, with USD/CAD modestly falling to 1.3450. In contrast, the Australian Dollar lagged among commodity currencies, with AUD/USD approaching 0.6400. However, the pair trimmed its losses and settled around 0.6420.

Metals tumbled, with Gold breaking below the $1,920 level and approaching the $1,915 support area. Silver also experienced a decline of 1.85%, falling from $23.55 to the $23.00 mark.

Like this article? Help us with some feedback by answering this survey:

- EUR/JPY holds losses of 0.19% on fundamental reasons while it remains subdued for ten consecutive days.

- Upside risks remain, but are capped at around 158.17, 158.65 and 159.00.

- Short-term, EUR/JPY is bearish biased, as price action tumbles below the Kumo.

The EUR/JPY remains subdued for the tenth-straight day, capped on the upside by the Kijun-Sen at 158.17, while the distance between the spot price and the Ichimoku Cloud (Kumo) shrinks, suggesting that downside risks are emerging. Hence, the cross-pair is trading at 1573.60, down 0.19%.

A fundamental reason behind the recent Euro (EUR) weakness is data showing the bloc is headed to a recession. At the same time, the European Central Bank (ECB) holds rates as fears of economic growth are tilted to the downside. Nevertheless, the ECB is adopting the Fed’s mantra of keeping rates higher for longer. That and fears that Japanese authorities could intervene in the Forex market and propel the Yen keeps traders parked on the sidelines.

The daily chart portrays the EUR/JPY trades sideways, with immediate resistance at the Kijun-Sen at 158.17. A breach of that level would expose the September 13 high of 158.65 before rallying to 159.00. Conversely, the pair’s first support would be the September 21 daily low of 157.03, followed by the top of the kumo at 156.86.

The hourly chart portrays the pair as neutral to downward biased, as it has achieved a successive series of lower highs, though it’s pending a lower low below September 21 at 157.03. In addition, the exchange rate is below the Kumo, while the Chikou Span sits below the price action and the Kumo, further confirming the bearish bias.

The EUR/JPY first support would be the daily low of today at 157.48, followed by last Friday’s low of 157.11. A breach of the latter would expose the 157.03, followed by the 157.00 figure. Conversely, the first resistance would be the Senkou Span B at 157.69, followed by the Tenkan-Sen's confluence and the Kumo's top at 157.79 before challenging 158.00.

EUR/JPY Price Action – Hourly chart

EUR/JPY Key Technical Levels

- WTI crude oil trades with over 0.50% losses after hitting a high of $90.34.

- Federal Reserve's decision to hold rates but project higher rates for the next year has snapped WTI’s three-week rally.

- Oil prices were cushioned by a drop in oil rigs count in the US, along with China’s economic recovery accelerating.

West Texas Intermediate (WTI), the US crude oil benchmark, traded with more than 0.50% losses on Monday as Russia tweaked its fuel ban. At the same time, higher interest rates in the United States (US) boosted the Greenback (USD), a headwind for US dollar-denominated assets. WTI is trading at $89.35 per barrel, late in the North American session.

West Texas Intermediate dips on Russia’s relaxing fuel ban, strong USD

Investors' mood remains downbeat as speculations the US central bank would increase rates one more time. According to some banks on Wall Street, Russia’s approval of changes to its fuel export ban was a headwind to oil prices, which were set to hit $100 per barrel.

Last week’s Fed decision to hold rates but upward revise the dot-plots for the next year, foreseeing rates above 5%, snapped oil’s three-week rally that witnessed WTI gaining more than 10%, as Saudi Arabia and Russia extended its crude oil output cuts toward December 2023.

The Fed sent US bond yields skyrocketing, underpinning the Greenback to a year-to-date high of 106.09, as drafted by the US Dollar Index (DXY). Nevertheless, WTI’s fall was cushioned by the oil rig's count falling last week to 507 from 515, despite higher oil prices.

In the meantime, speculations of better economic data from China keep oil traders’ spirits higher, following last week’s data. China is the world’s largest oil importer, and if economic activity slows down, it could weigh on global oil prices.

WTI Price Analysis: Technical outlook

WTI remains upward biased but fails to pierce the top-Bollinger band, while the Relative Strength Index (RSI) exits from overbought conditions, opening the door for a pullback. Support is seen at the September 21 daily low of $88.15 before the US crude oil price tests the 20-day Exponential Moving Average (DMA) at $87.31. Contrarily, WTI would resume its uptrend but must clear last Friday's high at $90.93 before challenging the year-to-date (YTD) high at $92.26.

- The EUR/USD skidded to a Monday low of 1.0575 as the Euro slips and the Greenback steps higher.

- US Dollar Index is broadly higher across the board to kick off the new trading week.

- ECB's Lagarde pulls the rug out from under the Euro on "further weakness in economic activity.

The EUR/USD fell off of recent action to settle at a fresh six-month low at the 1.0660 handle. Broadbase US Dollar (USD) support is helping to exacerbate Euro (EUR) declines sparked by dovish central bank comments coming out of Europe on Monday.

The European Central Bank's (ECB) President Christine Lagarde hit newswires on Monday, noting lagging job growth, broadly weaker economic activity, and an overall decline in momentum.

Despite recent declines in inflation, the ECB's President Lagarde noted that inflation is expected to remain "too high for too long", but the ECB is evidently unable to do anything to help assuage those forecasts, with an uneven domestic economy for the pan-European region threatening to tip over into recession if the ECB raises rates too much.

Read more:

Lagarde speech: Recent indicators point to further weakness in third quarter

Lagarde speech: Recession is not part of baseline

Economic Calendar looking thin until Friday's key data drop

The later end of the trading week sees Consumer Price Index (CPI) figures for both the EU and the US slated for Friday, but the midweek is a nominally lighter affair.

The US will see Personal Consumption Expenditure (PCE) figures on Thursday, as well as Gross Domestic Product (GDP) numbers. Annualized GDP for the US' second quarter is expected to improve from 2.1% to 2.3%.

EUR/USD technical outlook

Intraday action sees the EUR/USD sharply off near-term swing highs near 1.0670, tumbling 0.76% peak-to-trough on Monday.

The Euro slipped to a fresh six-month low of 1.0575 against the US Dollar, and rebound bids are struggling to regain the 1.06000 handle.

On daily candlesticks, a bearish trend is firmly baked in, with a declining trendline from July's swing high near 1.1200.

The 200-day Simple Moving Average (SMA) is turning bearish just north of 1.0800, and the 34-day Exponential Moving Average (EMA) is accelerating into a bearish cross, providing technical resistance from 1.0750.

EUR/USD daily chart

EUR/USD technical levels

- The major traders with losses of 0.16%, as central bank divergence an interest rate differentials favor the Greenback.

- The DXY hit a new YTD high at 106.09, reflecting US strong economy, as soft-landing prospects grow.

- Despite holding rates unchanged, the Fed delivered a hawkish posture, as witnessed by the reaction in the financial markets.

The British Pound (GBP) remains under pressure following a surprising decision by the Bank of England (BoE) to keep rates unchanged, which caught off guard traders, expecting further tightening. US Treasury bond yields edged to multi-year highs, underpinning the Greenback (USD), as seen by the GBP/USD trading at 1.2215, registering losses of 0.16%.

Pound Sterling struggles as the BoE adopts a dovish stance as inflation slowdown, but growth risks are tilted downwards

Last week’s spurred broad Sterling (GBP) weakness after data showed inflation slowing down. The Bank of England reacted accordingly, keeping the Bank Rate at 5.25%, though stressed that further meetings remain open, meaning the BoE could hike or pauser rates if needed.

Further data revealed in that week witnessed Retail Sales came above estimates but remained unchanged compared to July data, while S&P Global/CIPS PMIs showed further deterioration in business activity. Hence, the Pound Sterling is set to remain downward pressured as an economic recession looms.

Across the pond, the US economy remains solid, as shown by last week’s data, while the Federal Reserve’s decision to hold rates unchanged and foresee another interest rate increase keeps investors flowing toward the Greenback. US Treasury bond yields skyrocket to multi-year highs, while the Greenback (USD) printed a new year-to-date (YTD) high, according to the US Dollar Index (DXY), at 106.09.

Federal Reserve officials in the central bank space adopted a cautious stance, mainly Boston and San Francisco Fed Presidents Susan Collins and Mary Daly. Both stressed the Fed should be patient on monetary policy but haven’t ruled out another rate hike. Recently, the Chicago Fed President Austan Goolsbee said that a soft landing is possible, but inflation risks remain tilted to the upside.

Money market futures remain skeptical the Fed would raise rates, as shown by the CME FedWatch Tool, with odds for a 25-bps hike seen at 21% for November, 34.2% for December, and 35.9% for January 2024. Nevertheless, the interest rate differential favoring the Fed could weigh on the GBP/USD soon and send the pair diving toward the 1.2000 figure.

GBP/USD Price Analysis: Technical outlook

The daily chart portrays the pair is struggling to break below the 1.2200 figure, though it remains well below the 200 and 50-day moving averages (DMAs), a bearish signal. If traders drag prices below that level, the GBP/USD next stop would be the March 15 low of 1.2010 before challenging the 1,20 figure. Conversely, a rally towards the 200-DMA at 1.2432 is seen if the major reclaims the 1.2300 mark.

- European equities broadly moved lower on Monday, testing into new lows for the month.

- FTSE, CAC40 lose 60 points apiece, DAX tumbles 151 points.

- Rising yields, economic concerns weighing European equities down.

European stock indexes closed broadly lower for Monday, with the German DAX taking pride-of-place as the biggest loser for the day, shedding 151 points to end the day down just shy of a percent, near €15,405.00.

Exporters with notable exposure to Chinese markets slipped in Monday trading, with equities pressured by rising bond yields for the European Central Bank (ECB) on the back of interest rates that rose to 4% last week.

Equities looking weaker to keep Monday on the bearish side

Weakening metal prices also saw mining equities decline, with rising inventories hampering price growth for precious metals.

Monday overall is striking bearish notes across the board for equities after the Shanghai Composite and Hang Seng indexes closed in the red at -0.48% and -1.82% respectively. The FTSE shed 0.85% and the CAC40 declined 0.85%.

FTSE technical outlook

The FTSE is at risk of taking a bearish turn on daily candlesticks, with the UK's main equity index continuing to slip from near-term highs at the £7,750.00 level.

the 200-day Simple Moving Average is acting as a price magnet, keeping the index hamstrung near £7,650.00.

Swing highs are getting capped, and swing lows are routinely running into a floor pricing in near £7,250.00.

Near-term traders will want to keep an eye out for a run-in with the 34-day Exponential Moving Average (EMA), currently lifting into £7,550.00.

FTSE daily chart

FTSE technical levels

- The EUR/GBP is falling in Monday trading, stepping away from the 0.8700 handle.

- The ECB's Lagarde sees further weakness in the European economy.

- Analysts expect the EUR/GBP to gain ground heading into the end of the year on UK headwinds.

The EUR/GBP is losing ground on Monday, with the Euro slipping following dovish comments from the European Central Bank's (ECB) President Christine Lagarde.

Lagarde: further weakness in third quarter

ECB President Lagarde noted that there has been an overall slowdown in momentum for the EU economy, and job creation continues to moderate.

The ECB sees further weakness for the third quarter, and the EU's central bank has also delayed the completion of its policy framework review, which has been pushed out to sometime by the spring of 2024.

Despite Monday's backslide, the Euro (EUR) continues to trade well against the Pound Sterling (GBP) overall looking longer-term. The EUR/GBP managed to swing into a fresh four-month high before falling back to 0.8670.

Analysts at Danske Bank expect the trend to continue, with the EUR/GBP forecast to hit 0.8800 by the end of the year, citing greater headwinds for the Pound Sterling thanks to a dovish Bank of England (BoE).

Read More:

Lagarde speech: Recent indicators point to further weakness in third quarter

EUR/GBP to move only modestly higher to 0.88 over the coming year – Danske Bank

The economic calendar is notably thin for both the Euro and the Pound Sterling for the first half of the trading week with very little on the data docket.

Euro traders will be making note of the ECB's monthly bulletin due on Thursday, while Friday brings UK Gross Domestic Product (GDP) and EU Consumer Price Index (CPI) figures.

Market forecasts see the annualized GDP growth rate for the UK holding steady in the 2nd quarter at 0.4%.

On the EU CPI side, median estimates expect the harmonized CPI index to lag slightly, forecast to print at an annualized 4.8% for the month of September.

EUR/GBP technical outlook

The EUR/GBP slipped in Monday trading to test the 0.8670 region, and intraday technical support currently sits at the 100-hour Simple Moving Average (SMA) near 0.8660, with a rising trendline marked into hourly candles from last week's swing low into 0.8610.

Daily candlesticks see the Euro-Pound pair trading back from the 200-day SMA that currently sits just beneath 0.8720, and failure to capture fresh bullish territory from here will see the pair set to re-challenge near-term swing lows between 0.8580 and 0.8520.

EUR/GBP daily chart

EUR/GBP technical levels

- Silver trips and tumbles in Monday trading, heading towards $23.00.

- The XAG/USD failed to capture $23.80 on Friday, and Silver is heading back into recent swing low territory.

- A bouncing US Dollar Index is seeing the XAG/USD take a step lower.

Silver is falling further back to kick off the new trading week, testing into familiar lows after last Friday's bounce couldn't be sustained.

The Federal Reserve (Fed) is set to see interest rates holding higher for longer than previously expected, and the boost to the US Dollar Index (DXY) is capping off recent upside swings for the XAG/USD.

After the Fed upped their interest rate forecast, or "dot plot" last week, the US central bank expects interest rates to only decline half a percent by the end of 2024. The Federal Open Market Committee (FOMC) previously saw end-2024 rates at 4.6%, but sticky inflation complications saw the Fed up their forecast to 5.1%.

XAG/USD technical outlook

On the hourly candles, Silver is looking to build a floor near the 200-hour Simple Moving Average (SMA) near $23.15 after tumbling around 2.5% from Monday's highs near $23.65.

Intraday upside momentum will be looking to recapture familiar territory north of the 100-hour SMA currently settling near $23.35.

Silver is suffering from a notable lack of meaningful trend momentum in the long-term, with the XAG/USD cycling the 200-day SMA on daily candlesticks.

Price action is constrained to the middle as Silver consolidates, with lower highs and slightly higher lows trapping XAG/USD into the midrange.

Swing lows are pricing in near $22.40, with the top end set to run into a descending trendline near $24.40.

XAG/USD daily chart

XAG/USD technical levels

- USD/MXN trades with solid gains due to a strong US Dollar, elevated US bond yields, and concerns over China’s property sector, particularly Evergrande’s debt restructuring failure.

- Inflation in Mexico is on a deceleration path, with headline inflation for the first half of September dropping to 4.44% from August’s 4.64%, nearing the Bank of Mexico’s (Banxico) target of 3% ± 1%.

- Potential US government shutdown looms as budget talks stall, with US policymakers utilizing the budget as a political tool, adding to the fragile market sentiment.

The Mexican Peso (MXN) loses territory against the US Dollar (USD) on Monday, as the last week of Q3 starts with risk-aversion. A strong US Dollar due to higher US bond yields, worries about China’s property sector, and falling commodity prices are the reasons that weakened the MXN. The USD/MXN is trading at 17.3762 after hitting a daily low of 17.1704.

Mexican Peso struggles amid lower oil prices, as high US bond yields underpin the Greenback

Sentiment remains fragile, though of late, Wall Street has turned green, while the American Dollar (USD), though positive, is back below the 106.00 mark. Us Treasury bond yields remain elevated, with the 10-year at 4.519%.

In the Asian session, news that China’s most prominent developer, Evergrande, failed to restructure its debt deteriorated investors' sentiment. Meanwhile, minuscule losses in global oil prices weighed on the Mexican currency, which is closely correlated, as a part of its economy heavily depends on oil exports.

Meanwhile, inflation in Mexico continues to decelerate, as reported by the National Statistics Agency, known as INEGI. Headline inflation for the first half of September dropped to 4.44% compared to August’s 4.64%, approaching the Bank of Mexico (Banxico) goal of 3% plus or minus 1%. Meanwhile, analysts are not expecting any rate cuts by Banxico for the rest of 2023. However, if the pace of inflation slows down sharply, that could trigger Banxico adjustments on its monetary policy and cause a depreciation of the Mexican Peso.

Investors' mood deteriorated as they embraced the “higher for longer" stance. With the US Federal Reserve expected to hike rates again this year, US Treasury bond yields are surging while Wall Street is experiencing difficulties clinging to its gains. The US 10-year Treasury bond yield has reached a level of 4.533%, a level last observed in 2007, a tailwind for the USD/MXN.

Federal Reserve officials, particularly Governor Michelle Bowman, emphasized the need for more rate hikes. In contrast, Boston and San Francisco Fed Presidents Susan Collins and Mary Daly suggested that patience is required but haven’t ruled out another hike. Recently, the Chicago Fed President Austan Goolsbee said that a soft landing is possible, but inflation risks remain tilted to the upside.

Another reason market sentiment is shifting sour is that US lawmakers are warning that the US is headed for a shutdown as budget talks stalled. Once again, US policymakers use the budget as a political tool to push their agenda.

USD/MXN Price Analysis: Technical outlook

The USD/MXN climbed past the 20- and 100-day moving average (DMA), with the former rising above the latter and the 50-DMA, suggesting that the uptrend could accelerate and the pair has found its foot. If the exotic pair crosses the September 7 swing high at 17.7074, the most likely scenario would see the USD/MXN challenging the 200-DMA at 17.8716 before challenging the 18.0000 figure. Conversely, the pair could retest last week’s low of 16.9925 if sellers reclaim the 17.1851/19.55 area.

- The USD/CHF differential continues to widen as the US Dollar gains strength and the Swiss Franc swoons.

- The SNB's dovish pivot last week continues to drain investor interest in bidding up the CHF.

- The Swiss National Bank held off on further rate hikes last Thursday amidst slumping Swiss inflation data.

The USD/CHF is pinned to the high side in Monday trading, reaching the 0.9130 region. Another move higher will have the pair testing into new five-month highs.

Last week, the Swiss National Bank (SNB) was unceremoniously knocked off its rate hike cycle, surprising markets and flubbing investor expectations when the SNB failed to raise rates another 25 basis points last Thursday.

Inflation figures for the Swiss domestic economy have been unwinding much faster than the SNB initially thought, and the Swiss central bank was forced to pull the plug on its current rate hike schedule.

Central bank tone determining market momentum with rates unmoving

The Greenback (USD) continues to firm up in markets, bolstered by last week's hawkish Federal Reserve (Fed) showing; while both central banks held rates steady last week, it's the Fed that gets the benefit of the doubt in markets, with the US central bank seeing interest rates staying higher for longer than previously forecast.

This week sees a quiet start to things on the economic calendar, with mid-tier data on offering until Thursday's US Gross Domestic Product (GDP) printing.

Tuesday will bring US housing and consumer confidence figures, while CHF traders will want to keep an eye on Wednesday's ZEW sentiment expectations and the SNB's quarterly bulletin.

USD/CHF technical outlook

Bullish momentum for the US Dollar is pushing the USD/CHF pair higher, and hourly candles are accelerating into the top end. The pair is up over 2% from last week's low near 0.8930, and a fresh push higher will put the pair into new five-month highs.

Daily candlesticks see the USD/CHF pushing above the 200-day Simple Moving Average (SMA) which currently sits near 0.9050, and the 34-day Exponential Moving Average (EMA) has turned bullish, crossing over the 100-day SMA near 0.8900 and set to give prices technical support.

The next significant resistance zone sits at March's swing highs near the 0.9400 handle.

USD/CHF daily chart

USD/CHF technical levels

- USD/JPY marks a 0.38% gain, as the Bank of Japan (BoJ) holds rates and maintains its accommodative monetary policy, questioning the sustainability of rising inflation.

- Soaring US Treasury bond yields, reaching levels unseen since 2007, bolster the US Dollar, pushing it above the 106.00 figure.

- Potential US government shutdown looms as budget talks stall, with lawmakers utilizing the budget as a political tool, potentially leading to a strengthened Japanese Yen and a subsequent downside for USD/JPY.

the US Dollar (USD) rises sharply against the Japanese Yen (JPY) following last week’s Bank of Japan’s (BoJ) decision to hold rates unchanged while delivering a dovish statement. That, alongside a risk-off impulse and soaring US bond yields, is a tailwind for the major. The USD/JPY is trading at 148.91, gaining 0.38%.

American Dollar gains momentum against the Yen, on BoJ’s maintaining it’s monetary policy, despite high inflation lurking

Last Friday, the BoJ kept rates in negative territory and pledged to support its ultra-loose monetary policy despite the latest inflation reports, which suggest inflation is above the bank’s goal of 2%. Still, BoJ policymakers question if it would be sustainable for a more extended period.

The BoJ Governor Kazuo Ueda said there’s “very high uncertainty” on companies to continue to lift prices and wages as the bank continues to stick to its accommodative posture. Ueda said the BoJ is not “fully convinced” that wages would continue to accelerate, seen as a reason for the BoJ, to stay pat on its posture.

In the meantime, threats of intervention continue, as the Japanese Prime Minister said that excessive forex moves are undesirable and that authorities would continue to monitor Forex moves closely with a sense of urgency.

Meanwhile, the higher for longer mantra is felt in the financial markets. With the US Federal Reserve set to hike once more in the year, US Treasury bond yields are soaring while Wall Street dives. The US 10-year Treasury bond yield touched a high of 4.533%, a level last seen in 2007, underpins the Greenback above the 106.00 figure for the first time since November of last year.

The USD/JPY continues to trend up as Federal Reserve officials stressed the need for more rate hikes, particularly Governor Michelle Bowman. Contrarily, Boston and San Francisco Fed Presidents Susan Collins and Mary Daly said patience is required but didn’t talk about disregarding another hike. Recently, the Chicago Fed President Austan Goolsbee said that a soft landing is possible, but inflation risks remain tilted to the upside.

Another reason market sentiment is shifting sour is that US lawmakers are warning that the US is headed for a shutdown, as budget talks stalled. Once again, US policymakers use the budget as a political tool to push their agenda. Usually, lawmakers fix this until the last moment, so traders must be aware of this. In the event of a shutdown, look for Japanese Yen (JPY) strength, so the USD/JPY could be headed to the downside.

USD/JPY Price Analysis: Technical outlook

After breaking the 148.00 figure, the USD/JPY is set to test the 149.00 figure, followed by the 150.00 handle. However, traders should be nimble as the threat of intervention looms. Based on October of last year’s Japanese authorities stepping in, the pair printed a 560-pip daily candle on October 21, followed by another 500 pip on November 10. On the flip side, the USD/JPY first support would be the Tenkan-Sen at 147.99, followed by the 47.00 mark, and the Kijun-Sen at 146.70

While speaking before the European Parliament's Committee on Economic and Monetary Affairs on Monday, European Central Bank (ECB) President Christine Lagarde said that a recession was not a part of the baseline scenario.

Lagarde added that the ECB was not talking about rate cuts and noted that the European labor market was finally adjusting.

Market reaction

The Euro stays under persistent selling pressure in the second half of the day on Monday. As of writing, the EUR/USD pair was trading at its lowest level since March at 1.0580, losing 0.7% on a daily basis.

Analysts at Danske Bank, de do not see the global investment environment nor the relative growth outlook creating significant divergence between the Euro and the Pound. They forecast the EUR/GBP pair to move only modestly higher to 0.88 over the coming year.

End to the hiking cycle, but not to the GBP headwinds

The Bank of England (BoE) decided to keep the Bank Rate unchanged at 5.25% at its September meeting after hiking the Bank Rate by a total of 515bp over the past meetings. We expect this to mark the peak in the Bank Rate. This is slightly below current market pricing, which is pricing a peak at 5.45%. On balance, we continue to see relative rates as a moderate positive for EUR/GBP, although GBP has been largely decoupled from moves in relative rates the past month.

Over the past month, EUR/GBP has moved to the upper part of recent months’ trading range of 0.85-0.87. On one hand, GBP has gained support from an overall USD-positive global investment environment and higher energy prices. On the other hand, a dovish BoE and lower than expected inflation have acted as a headwind.

We do not see the global investment environment nor the relative growth outlook create significant divergence between EUR and GBP. We expect the cross to move only modestly higher to 0.88 over the coming year.

- Euro hits fresh daily lows across the board.

- ECB Lagarde speaks at the European Parliament

- EUR/USD falls for the fifth consecutive day.

The EUR/USD dropped below 1.0600 for the first time since March. The pair bottomed at 1.0581, and remains under pressure on the back of a stronger US Dollar.

Greenback remains firm

The US Dollar is up across the board on Monday. The US Dollar Index (DXY) is trading slightly below 106.00, at the highest level since November of last year. The US 10-year Treasury yields reached a new high at 4.52%. Stock in Wall Street opened mixed.

European Central Bank (ECB) President Christine Lagarde is speaking at the Hearing of the Committee on Economic and Monetary Affairs of the European Parliament. She mentioned that the labor market is “finally adjusting”.

Regarding economic data, earlier on Monday, the German IFO survey slightly exceeded market consensus. The Current Assessment Index dropped from 89 to 88.7, while the Expectation Index rose from 82.6 to 82.9. In the US, the Chicago Fed National Activity Index declined to -0.16 in August from 0.07. The key reports of the week will be the inflation figures from the Eurozone and the US.

Levels to watch

The EUR/USD is holding below 1.0600, under pressure. The next support level is seen around the 1.0580 area, followed by 1.0550.

Despite falling for the fifth consecutive day, no signs of stabilization are observed. In the short term, a recovery above 1.0645 would improve the outlook for the Euro.

Technical levels

- USD/CAD discovers buying interest near 1.3460, supported by a fresh upside in the US Dollar.

- S&P500 opens on a flat-to-negative note as investors remain worried about economic prospects.

- Fed Collins said on Friday that a further rate hike is certainly not off the table.

The USD/CAD pair finds buying interest near 1.3460 amid sheer strength in the US Dollar. The Loonie asset aims to recapture the psychological resistance of 1.3500 as the market mood dampens amid deepening fears of a global slowdown.

S&P500 opens on a flat-to-negative note as investors remain worried about economic prospects. The Federal Reserve (Fed) is expected to keep interest rates higher for a longer period as inflationary pressures in excess of the desired rate of 2% would be a hard nut to crack.

The US Dollar Index (DXY) prints a fresh nine-month high near 105.90 as the US economy is absorbing the consequences of higher interest rates by the Fed comfortably. Slowing inflation and a resilient labor market allowed the Fed to keep interest rates unchanged last week. Also, hawkish guidance from Boston Fed President Susan Collins strengthened the US Dollar.

Fed Collins said on Friday that a further rate hike is certainly not off the table. She further added that inflation can fall with only a modest rise in unemployment and that core services excluding shelter have not yet shown a sustained improvement.

Meanwhile, the oil price remains sideways around $90.00 as global central bankers are pausing the rate-tightening spell sooner to avoid risks of economic slowdown. It is worth noting that Canada is the leading exporter of oil to the United States and maintains a positive relationship with the Canadian Dollar.

Last week, the Canadian Dollar remained in action after a mixed Retail Sales report for July. Consumer spending expanded at a slower pace of 0.3% vs. expectations of 0.4%. In June, Retail Sales expanded nominally by 0.1%. Retail Sales excluding automobiles expanded strongly by a full one percent, doubling expectations of 0.5%. The economic data was contracted by 0.7% in June. Scrutiny of the Retail Sales report shows that demand for automobiles remained weak. Households postponed demand for automobiles to avoid higher interest obligations.

"The current, unusual contraction in monetary aggregates is unlikely to foreshadow a deep recession but rather reflects a significant rebalancing of portfolios after a long period of low interest rates," European Central Bank (ECB) Governing Council member Isabelle Schnabel said on Monday.

"Hence, there is not yet an all-clear for the inflation problem," she added.

Market reaction

EUR/USD stays under persistent bearish pressure in the second half of the day on Monday and the pair was last seen trading at its lowest level since March at 1.0610, losing 0.38%.

In her prepared remarks for delivery to the European Parliament's Committee on Economic and Monetary Affairs, European Central Bank (ECB) President Christine Lagarde noted that recent indicators point to a further weakness in the economic activity in the third quarter.

Lagarde elaborated by noting a moderation in job creation in the services sector and an overall slowdown of momentum.

Commenting on inflation developments, she said that inflation is forecast to remain "too high for too long" despite the recent decline.

ECB President also said that they are aiming to conclude the monetary policy framework review by Spring 2024, later tan the end-2023 previously planned.

Market reaction

EUR/USD stays under pressure following these comments and it was last seen losing 0.35% on the day at 1.0615.

- EUR/GBP eyes fresh upside above 0.8700 as ECB Lagarde sees inflation risks skewed upside.

- Eurozone’s headline and core inflation are seen softening to 4.5% and 4.8% respectively.

- The BoE unexpectedly paused interest rate hikes last week amid potential slowdown risks.

The EUR/GBP pair gathers strength to surpass the immediate resistance of 0.8700 in the late European session. More upside is anticipated in the cross as European Central Bank (ECB) President Christine Lagarde said that despite progress on inflation it is seen as too high for too long as the labor market has so far remained resilient.

This week, investors will focus on the Eurozone preliminary Harmonized Index of Consumer Prices (HICP) for September, which will be published later this week. The headline and core inflation are seen softening to 4.5% and 4.8% respectively.

The asset has been consistently moving higher for the past three trading sessions as the Bank of England (BOE) surprisingly paused the policy-tightening spell on Thursday while investors anticipated an interest rate hike by 25 basis points (bps).

BoE Governor Andrew Bailey skipped hiking interest rates after raising them consecutively for 14 times as higher interest rates have dampened the economic outlook. Labor demand has slowed as firms are focusing on achieving higher efficiency through controlling costs. Like Manufacturing PMI, Services PMI also landed below the 50.0 threshold consecutively for the second month, as per the preliminary S&P Global PMI report for September.

With a pause in the historically aggressive rate-tightening cycle by the BoE, the risks of a rebound in inflation and a slowdown in the growth rate have skewed to the upside. BoE policymakers came out with weak guidance on the Q3 Gross Domestic Product (GDP). The BoE conveyed that Q3 GDP now is expected to rise by a meager 0.1% (Aug: +0.4%), with underlying growth in H2 2023 likely weaker than forecast in August.

"It feels like rates will have to stay higher for longer than markets had expected," Chicago Federal Reserve Bank President Austan Goolsbee told CNBC on Monday.

Key takeaways

"Risk of inflation staying higher is still the bigger risk."

"Current path is Unusual for inflation to fall like it is without unemployment rising."

"Fed should have 100% commitment to returning inflation to 2%; the target will not change."

"One view is that monetary policy takes a long time to work through the economy."

"At some point, the question shifts from how high to raise rates to how long they will stay there."

Market reaction

The US Dollar Index continued to edge higher after these comments and was last seen rising 0.17% on the day at 105.76.

- AUD/USD trades back and forth near 0.6420, following the footprints of the sideways US Dollar.

- The Australian Dollar will dance to the tune of the monthly CPI data, which is seen hotter at 5.2% vs. July’s reading of 4.9%.

- The 20-day EMA is overlapping the Aussie asset, indicating a broader sideways trend.

The AUD/USD pair remains inside the woods above the round-level support of 0.6400. The Aussie asset struggles to find a direction as the US Dollar has turned sideways amid uncertainty over the Federal Reserve’s (Fed) interest rate outlook for the remaining 2023.

The US Dollar Index (DXY) is broadly upbeat amid fears of a slowdown in the global economy. The Chinese economy is facing deflation risks as household demand remains weak due to a rising jobless rate. The Australian Dollar is facing the headwinds of weak China’s economic growth, being a proxy player.

Going forward, the Australian Dollar will dance to the tune of the monthly Consumer Price Index (CPI) data for August, which will be published on Wednesday. The economic data is seen hotter at 5.2% vs. July’s reading of 4.9%. Acceleration in the inflation data could elevate troubles for Reserve Bank of Australia (RBA) policymakers and force them to raise interest rates one more time.

AUD/USD rebounds after discovering buying interest near the horizontal support plotted from August 17 low around 0.6364 on a two-hour scale. While the upside seems restricted near the horizontal resistance placed from August 15 high around 0.6522. The 20-day Exponential Moving Average (EMA), which trades around 0.6340 is overlapping the Aussie asset, indicating a sideways trend.

The Relative Strength Index (RSI) (14) jumps above 60.00, which indicates that the bullish impulse has been triggered.

A decisive break above August 15 high around 0.6522 will drive the asset to August 9 high at 0.6571. Breach of the latter will drive the asset towards August 10 high at 0.6616.

On the flip side, fresh downside would appear if the Aussie asset would drop below August 17 low around 0.6360. This would expose the asset to the round-level support of 0.6300 followed by 03 November 2022 low at 0.6272.

AUD/USD two-hour chart

-638312415539078022.png)

Analysts at Danske Bank maintain their strategic case for a lower EUR/USD pair based on relative terms of trade, real rates and relative unit labour costs. However, they warn that in the near-term, they see some potential for topside risk on the back of peak policy rates, an improving manufacturing sector backdrop relative to the service sector, and/or easing China pessimism.

Near-term risk of higher EUR/USD

We maintain the strategic case for a lower EUR/USD based on relative terms of trade, real rates (growth prospects) and relative unit labour costs. Hence, we maintain our 12M forecast at 1.03.

In the near-term, we see some potential for topside risk to the cross. Peak policy rates, an improving manufacturing sector relative to the service sector, and/or easing China pessimism could add some support to EUR/USD in the near-term.

- The US Dollar trades mixed on Monday as US government shutdown risk escalates.

- In the background traders will be on edge for US GDP numbers later this week.

- The US Dollar Index resides near the six-month highs.

The US Dollar (USD) confirmed its status as king after a quite volatile week. The US Federal Reserve could not have been more clear and confirmed yet again that rates in the US will stay higher for longer. This puts the US Dollar as the strongest partner in most trading pairs due to interest rate differentials.

Amidst all the noise on the macroeconomic front, traders did not really care about the US government shutdown until this coming Friday evening. When House Speaker Kevin McCarthy sent all Representatives packing for the weekend last Friday, traders became aware that a deal might again not happen until the final hour. This means some risk premium, on the back of a weaker US Dollar, might emerge as days pass without any hopeful signals from Capitol Hill on a possible deal.

Daily digest: US Dollar to see GDP hit by strikes

- A very calm start of the week has begun with the Chicago Fed National Activity Index for August being released at 12:30 GMT. The previous number was 0.12.

- The US Dallas Fed Manufacturing Business Index for August is expected to come out near 14:30 GMT and was in contraction at -17.2 for July.

- The US Treasury will be auctioning 3-month and 6-month bills at 15:30 GMT at elevated rates.

- A big dispersion in the equity markets shows its face at the start of the week in Asia: Japanese stocks rally with both the Topix and the Nikkei in the green. China, meanwhile, sees Hong Kong’s Hang Seng Index tank near 1.5% as Evergrande cancelled a meeting with creditors to renegotiate terms. European and American futures are down and show signs of risk off, seeing all the current tail risks taking over sentiment.

- The CME Group FedWatch Tool shows that markets are pricing in a 77% chance that the Federal Reserve will keep interest rates unchanged at its meeting in November. The recent turmoil on Capitol Hill and the United Auto Workers (UAW) strike could force the Fed to keep rates unchanged through the end of the year.

- The benchmark 10-year US Treasury yield traded as high as 4.69% and resides near the highest level since October 2007.

US Dollar Index technical analysis: Can it get there?

The US Dollar looks to be stuck in a stalemate with the rate differential keeping the US Dollar holding an advantage against most major G20 currencies. On the other side, the automaker strike in Detroit and possible US government shutdown could weigh on the Greenback over the short term. The US Dollar Index (DXY) is looking for direction in this difficult environment.

The US Dollar Index opens up above 105.50 this Monday and shows small signs of possibly going higher. Should the DXY close above the yearly high near 105.88, expect the US Dollar to follow on with more bullish moves in the medium term. US yields and the unwinding of the US strike and government shutdown will remain crucial to support current levels in the DXY.

On the downside, the 104.44 level seen on August 25 kept the Index supported on Monday, halting the DXY from selling off any further. Should the uptick that started on September 12 reverse and 104.44 give way, a substantial downturn could take place to 103.04, where the 200-day Simple Moving Average (SMA) comes into play for support.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Natural Gas starts the week mildly in the green, up 0.25%.

- The US Dollar faces headwinds with UAW strikes and US Government shutdown tail risk.

- US Natural Gas prices are in an ascending trendline formation and could break above $3.

Natural Gas prices are mildly ticking higher this Monday at the start of the week with few headlines to report from the weekend. Most noticeable is that EU gas storage has risen yet again over the weekend. Europe is now at 94.74% full ahead of the winter season.

The US Dollar (USD) confirmed its status as king after a quite volatile week. The US Federal Reserve could not have been more clear and confirmed yet again that rates in the US will stay higher for longer. This puts the US Dollar as the strongest partner in most trading pairs due to interest rate differentials.

Natural Gas is trading at $2.93 per MMBtu at the time of writing.

Natural Gas news and market movers

- Uniper SE, the German utility service, has sealed a deal for US LNG (Liquified Natural Gas) deliveries until 2030 as the company does not expect demand to tail off anytime soon.

- European gas storage levels are nearly 95% full ahead of the winter. This keeps a lid on any jumps in demand.

- Further cuts at the Skarv gas field in Norway are taking place due to process problems. These outages will be lasting until early next month, according to network operator Gassco AS.

- More news out of Norway, flows from the country should continue to increase as capacity at the giant Troll field is further coming online after a prolonged period of outages due to maintenance.

- European gas prices locally should be easing in the upcoming colder months as contracts for that period are becoming less expensive. November and December contracts in particular saw a contraction in prices.

- Australian strikes have been called off, which could now risk breaking the equilibrium in the market toward an oversupply of LNG.

Natural Gas Technical Analysis: Will bullish triangle hold?

Natural Gas appears to be in a bullish triangle on the daily chart with a triple top at $3.06 on the top side. Meanwhile, higher lows are being formed with the green ascending trendline showing support since the beginning of September. Expect to see a breakout above $3.06, which means natural gas prices are set to jump higher.

Awaiting the breakout of the triangle, $3 remains a key level that needs to be broken. Seeing the current equilibrium, a catalyst is needed to move the needle upwards. Gas prices could rally to $3.25 in a bullish triangle breakout, testing the upper band of the ascending trend channel.

On the downside, the ascending trendline at $2.90 should support any attempts to break lower. The 200-day Simple Moving Average (SMA) at $2.80 could act as a circuit breaker in case there is a nosedive move. Should that give way on a downside move, some area will be crossed before the next support kicks in at $2.75. This level aligns with the 55-day SMA, which is likely to step in to avoid any price crashes in the commodity.

-638312277946152975.png)

XNG/USD (Daily Chart)

Natural Gas FAQs

What fundamental factors drive the price of Natural Gas?

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

What are the main macroeconomic releases that impact on Natural Gas Prices?

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

How does the US Dollar influence Natural Gas prices?

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

- Silver price trades sideways near $23.50 after a hawkish Fed guidance.

- The US Dollar Index struggles to extend recovery despite a risk-off market mood.

- Silver price aims to shift auction above the 50% Fibonacci retracement at $23.66.

Silver price (XAG/USD) corrects gradually to near $23.50 after hawkish commentary from Federal Reserve (Fed) policymakers. The white metal failed to extend a rally above $23.80 after Boston Fed President Susan Collins cited on Friday that a further rate hike is certainly not off the table.

Fed Collins also commented that inflation can fall with only a modest rise in unemployment and that core services excluding shelter have not yet shown a sustained improvement. Investors are still worried about the inflation outlook as the labor demand in the United States economy is resilient and consumer spending is robust due to solid wage growth.

Meanwhile, S&P500 futures generated some losses in the London session, portraying a risk-off market mood. Investors remain concerned about the economic outlook as the Fed vowed to keep interest rates sufficiently restrictive until the accomplishment of the 2% inflation target.

The US Dollar Index (DXY) struggles to extend recovery above the immediate resistance of 105.80 as traders still bet that the Fed is done with hiking interest rates. As per the CME Fedwatch tool, traders see almost a 75% chance for interest rates remaining steady at 5.25%-5.50% at the November monetary policy meeting.

Silver technical analysis

Silver price aims to shift auction above the 50% Fibonacci retracement (plotted from August 30 high at $25.00 to September 14 low at $22.30) at $23.66 on a two-hour scale. Upward-sloping 20-period Exponential Moving Average (EMA) at $23.50 indicates that the short-term trend is bullish.

The Relative Strength Index (RSI) (14) aims to shift into the bullish range of 60.00-80.00. If the RSI (14) manages to do so, a bullish impulse would get activated.

Silver two-hour chart

-638312333673295720.png)

- NZD/USD falls to near 0.5950 amid strength in the US Dollar.

- The strength of the USD Index is backed by a strong US economy.

- The NZ economy grew at a robust pace of 0.9% in the April-June quarter.

The NZD/USD pair dropped sharply to near 0.5950 after facing severe selling pressure near the psychological resistance of 0.6000. The Kiwi asset corrects as the appeal for risk-sensitive currencies weakens due to the deepening risks of a global slowdown.

S&P500 futures added decent gains in the European session, portraying some improvement in the risk appetite of the market participants while the overall market mood is still risk-off. The US Dollar Index (DXY) jumps to a near six-week high of around 105.80 as the US economy is resilient in comparison with European and Asian economies.

China’s property sector remained vulnerable as households postponed fresh demand for real estate due to the rising jobless rate and deteriorating demand environment. The Chinese economy is exposed to upside deflation risks while European economies are struggling to bear the consequences of high inflation.

On the other hand, the US economy is materially strong backed by easing inflation, steady labor demand, decent wage growth, and robust consumer spending. Meanwhile, investors shifted focus to the US Durable Goods Orders for August, which will be published on Wednesday.

On the New Zealand front, the growth rate in the April-June quarter remained upbeat despite higher interest rates by the Reserve Bank of New Zealand (RBNZ). The Q2 Gross Domestic Product (GDP) grew by 0.9% vs. estimates of 0.5%. In the January-March quarter, the economy remained stagnant. The annual Q2 GDP rose at a slower pace of 1.8% vs. Q1 GDP growth at 2.2% but outperformed expectations of a 1.2% growth rate.

Japanese Prime Minister (PM) Fumio Kishida said on Monday that he will instruct ministers to compile an economic package on Tuesday.

Additional quotes

Aim to move from cost cut-led economy to one with active investments.

Economic package aims to protect people's lives from rising prices.

Private consumption, capex lack strength, being unstable.

To swiftly compile extra budget to fund new economic package.

To strengthen tax breaks to boost wage hikes.

No plan at the moment to call a snap election.

Important for currency market to move stably, reflecting fundamentals.

Will continue to monitor forex moves closely with high sense of urgency.

Excessive forex moves undesirable.

Market reaction

At the press time, USD/JPY is testing intraday highs near 148.60, up 0.12% on the day. The Japanese Yen fails to draw any support from the above comments.

- GBP/JPY lacks any firm intraday direction on Monday and oscillates in a narrow trading band.

- Intervention fears, China's economic woes benefit the JPY and act as a headwind for the cross.

- The BoE’s surprise pause contributes to cap, though the BoJ’s dovish stance limits the downside.

The GBP/JPY cross struggles to gain any meaningful traction on Monday and seesaws between tepid gains/minor losses through the early part of the European session. Spot prices currently trade just above mid-181.00s and remain well within the striking distance of the lowest level since August 7 touched last Thursday.

Speculations that Japanese authorities will intervene in the foreign exchange market to support the domestic currency, along with persistent worries over China, benefit the safe-haven Japanese Yen (JPY) and act as a headwind for the GBP/JPY cross. In fact, Japan’s Finance Minister Shunichi Suzuki issued a fresh warning against the recent JPY weakness and said last week that the government will not rule out any options in addressing excess volatility in currency markets.

The British Pound (GBP), on the other hand, continues with its relative underperformance in the wake of the Bank of England's (BoE) surprise pause last Thursday, which, in turn, is seen as another factor capping the upside for the GBP/JPY cross. The UK central bank ended a run of 14 straight interest rate hikes in the wake of the recent deceleration of inflation. That said, a more dovish stance adopted by the Bank of Japan (BoJ) limits any meaningful downside for spot prices.

The Japanese central bank refrained from offering any hints about potential alterations to its negative interest rate policy in the near future. In the post-meeting press conference, BoJ Governor Kazuo Ueda noted that there is no change to the way of the policy decision-making process and that the central bank is yet to foresee inflation reaching the 2% target in a stable manner. This, in turn, suggests that the BoJ is more likely to maintain an ultra-loose monetary policy.