- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- The USD/JPY continues to pin into the 150.00 handle as investors await a potential BoJ market intervention.

- Calls are rising for the BoJ to take action to protect consumers from inflationary pressures.

- Despite defensive concerns, the BoJ remains skittish about possible deflationary issues in the future.

The USD/JPY continues to cycle close to the 150.00 major handle, and the pair has constrained into a tight holding pattern after failing to make a meaningful break after tipping into 150.16 at the beginning of October.

As the Bank of Japan (BoJ) continues to remain fearful of Japanese inflation descending back into deflationary levels in the future, consumers and investors continue to call for the Japanese central bank to do something to protect consumers from inflation that is currently eating away at citizens' purchasing power in the here and now.

USD/JPY: Japanese officials to intervene at the earliest feasible moment – MUFG

The US saw a clean beat on Purchasing Managers' Index (PMI) figures on Tuesday, keeping the US Dollar well-elevated as the US economy continues to see a firming up of growth indicators. US PMI headline figures came in above expectations, printing at 50.0 and climbing over the previous month's 49.8 as purchasing managers across the manufacturing and services sectors see the US economy seeing firmer growth in the coming month.

JPY traders will be looking ahead to Japan's Tokyo Consumer Price Index (CPI) inflation figures early Friday, with Core Tokyo CPI (headline inflation less volatile food prices) forecast to hold steady at 2.5% for the year into October.

The headline Tokyo CPI annualized figure for September last came in at 2.8%, and the BoJ will be looking for evidence that inflation will not decline past the central bank's 2% minimum target.

USD/JPY Technical Outlook

With the USD/JPY pair trapped just south of 150.00, technical indicators are beginning to break down on the intraday level and daily candlesticks are churning out successive spinning top candle signals as the pair moves nowhere fast.

The pair remains incredibly well-bid in the long-term, with the USD/JPY testing into all-time highs and up nearly 18% from 2023's lows of 127.22 set back in January.

USD/JPY Daily Chart

USD/JPY Technical Levels

The Chinese government intends to issue an additional 1 trillion yuan ($137 billion) in treasury bonds during the fourth quarter (Q4). This effort aims to bolster the nation's overall resilience to natural disasters and support post-disaster reconstruction. The decision was approved by the sixth session of the Standing Committee of the 14th National People's Congress (NPC).

Over 7.5 trillion yuan worth of bonds have been issued by China in the first three quarters. The additional $1 trillion is added to this amount. The sum is significantly substantial when compared to other figures.

According to Xinhua News Agency, the new issuance is anticipated to drive the nation's fiscal deficit ratio to approximately 3.8 percent in 2023, which is historically high, from the target of 3% set at the start of the year.

- EUR/USD remains on the defensive under the 1.0600 psychological mark.

- The US S&P Global PMI data for October came in better than expected.

- Eurozone economic data on Tuesday revealed a contraction in PMI and lower inflation in October.

- Traders will closely watch the US Q3 GDP, ECB rate decision on Thursday.

The EUR/USD pair holds below the 1.0600 mark after retracing from near 1.0700 during the early Asian session on Wednesday. The sell-off of the major pair is supported by the rebound of the US dollar (USD) broadly and the optimistic US data. EUR/USD currently trades near 1.0593, gaining 0.03% on the day.

The US PMI data on Tuesday came in better than expected and boosted the Greenback, according to the latest Purchasing Management Index (PMI) reports. The October flash Composite PMI climbed to 51.0 from 50.2. The Services PMI rose to 50.9, while Manufacturing PMI grew to 50.0. This is the first time in six months that manufacturing has not fallen below 50. Additionally, the Richmond Manufacturing Index for October fell to 3 from 5 in the previous reading, below the market expectation.

That being said, the robust US economic figures alleviated fears that tighter monetary policy and higher borrowing rates would dampen investment and industrial activity. However, traders will take more cues from the release of US growth numbers on Thursday. If the report shows weaker-than-expected data, it could drag the USD lower and cap the downside of the EUR/USD pair.

On the Euro docket, Eurozone economic data on Tuesday revealed a contraction in PMI and lower inflation in October. These reports support the anticipation that the European Central Bank (ECB) will maintain interest rates unchanged on Thursday.

The flash Composite PMI for the eurozone dropped to 46.5 in October from 47.2 in September. It was the sixth straight reading below 50, showing that the slowdown is ongoing. Meanwhile, the Manufacturing PMI decreased to 43.0 versus 43.4 prior, worse than expected of 43.7. The Services PMI fell to 47.8 versus 48.7 prior. The downbeat Eurozone data exerts some selling pressure on the Euro and acts as a headwind for the pair.

Market participants will monitor the German IFO data and ECB’s President Lagarde's speech on Wednesday. On Thursday, the attention will shift to the preliminary estimate of the US Q3 Gross Domestic Product (GDP) and ECB rate decision. The US Core Personal Consumption Expenditure Index (PCE) will be due on Friday. These events could give a clear direction to the EUR/USD pair.

- The AUD/NZD is strung along the topside just below 1.0900 heading into Wednesday's Aussie CPI inflation reading.

- The Aussie has been gaining firmly against the Kiwi, closing flat or higher for ten straight trading days.

- RBA's closely-watched Trimmed Mean CPI inflation indicator to be a make-or-break for AUD momentum.

The AUD/NZD has been grinding up the chart paper with the Aussie (AUD) gaining 0.34% in Tuesday's trading window and climbing 2.4% against the Kiwi (NZD) since hitting the last bottom of 1.0624 two weeks ago.

intraday trading has the pair catching some firm lift on the hourly candles, with prices consistently getting bolstered by technical support from the near-term 50-hour Simple Moving Average (SMA), currently huddled near 1.0852 after the AUD/NZD caught another rebound from the MA at the outset of Wednesday's trading.

The AUD/NZD has been bound in a rough range for most of 2023, cycling the 1.0800 major handle as the pair consolidates long-term.

Australia CPI Forecast: Core inflation expected to slow in Q3

Early Wednesday sees the latest round of Consumer Price Index (CPI) inflation figures for Australia, with markets broadly expecting an uptick in the headline annualized Monthly Consumer Price Index for September, forecast to print at 5.4% versus the previous month's 5.2%. Core inflation, meanwhile, is expected to show a minor decline, with the Reserve Bank of Australia's (RBA) Trimmed Mean CPI for the year into 3Q expected to slow to 5% from 5.9%.

The AUD/NZD has been rotating around the 200-day SMA for the past five months, and the long-term moving average is currently settling flat just north of 1.0800.

The pair's constrained chart patterns sees the 50-day SMA coiling around the long-run MA as the AUD/NZD struggles to develop any meaningful long-term momentum, and investors will be looking for wider deviations between the Aussie and Kiwi central bank rates to kick the pair back into trend territory.

AUD/NZD Hourly Chart

AUD/NZD Daily Chart

AUD/NZD Technical Levels

- EUR/GBP remains within a narrow range, trading at 0.8709, up 0.02%, and above the 200-DMA.

- Eurozone economic data shows business conditions deteriorating, with PMIs in recessionary territory.

- UK labor market loses steam, with employment data showing the economy shedding -82K workers and unemployment at 4.2%.

The EUR/GBP remains subdued amid the lack of a catalyst, trading within a narrow range of 40 pips and printed losses of 0.02%, though it remained above the 200-day moving average (DMA). At the time of writing, as the Asian session begins, the cross-pair exchanges hands at 0.8709, up 0.02%.

EUR/GBP trades above 0.8700 as economic data from both Eurozone and UK paints a gloomy picture

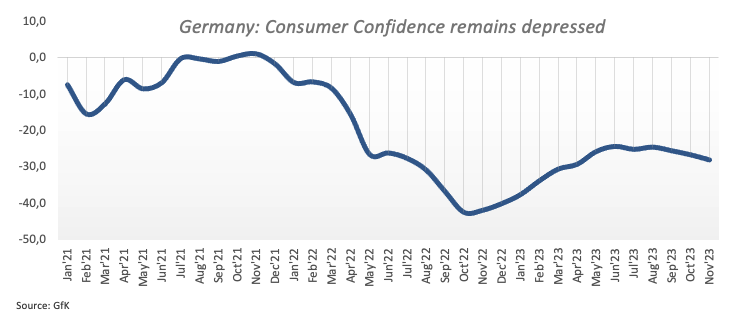

Economic data from the Eurozone (EU) revealed that business conditions continued deteriorating. Manufacturing, Services, and Composite PMIs, announced by S&P Global, remained in recessionary territory, below forecasts and the previous month’s data. That and Germany’s GfK Consumer Confidence plummeting were a headwind for the EUR/GBP.

On the UK front, the labor market is losing steam while business activity deteriorated in October, increasing the odds of a recession. S&P Global/CIPS Manufacturing and Services PMI remained in recessionary territory. Employment data showed the jobs market is cooling, as the economy shed -82K workers, while the unemployment rate stood at 4.2%.

Meanwhile, according to a Reuters poll, expectations for further tightening are fading, with most economists foreseeing the Bank of England (BoE) to keep rates unchanged at 5.25% on November 2.

Ahead of the week, the European Central Bank (ECB) is expected to hold rates unchanged, though it is projected to leave the door open for further hikes if needed.

EUR/GBP Technical Levels

- S&P 500 index climbs back into the 200-day SMA after declining for four straight trading days.

- US equities broadly reversed recent declines following a data beat for US PMI figures.

- US Treasuries saw an uptick in volatility but settled lower, 10-year T-note settled at 4.819% after cracking 5%.

The Standard & Poor's 500 major equity index gained ground on Tuesday, with equities bolstered by firm earnings reporting and a better-than-expected printing for US Purchasing Managers' Index (PMI) figures, with the indicator firmly beating expectations and sending the S&P and other indexes into the green for the first time in over a week.

The headline US Composite PMI reading for October broadly beat the Street, printing at 51 against the previous month's 50.2, and the individual components of the PMI indicator both soundly beat expectations, reversing an expected decline to print higher than August's reading.

US Manufacturing PMI came in at a flat 50.0 versus the expected decline into 49.5, and stepping over September's 49.8 figure; on the Services component, things improved soundly from 50.1 to 50.9, handily crunching the market's forecast of 49.9.

After the US soundly beat the Street, crunching PMI expectations major equities proceeded to rally for the day, snapping a week-long losing streak and sending the S&P 500 back towards $4,260 before settling the day near $4,245.

The S&P climbed 30.64 points to finish the day up 0.73%, while the Dow Jones Industrial Average rose 204.97 points to close out Tuesday at $33,141.38, up 0.0.62%. The big winner for Tuesday was the NASDAQ Composite, which rose 121.55 points to close at $13,139.87, climbing over 0.9% on the day after earnings reports also beat Wall Street expectations.

About 150 companies listed on the S&P are reporting earnings this week, with 23% of the indexes having already reported earnings figures, with 77% of reporters beating analyst estimates.

S&P 500 Technical Outlook

Despite Tuesday's moderate gain, the S&P 500 remains firmly buried in bear country, with the index sticking close to the 200-day Simple Moving Average (SMA) while a descending 50-day SMA adds downside pressure from $4,375.

On the bottom end, Monday's dip into $4,189 saw the index etch in a new four-month as investors continue to weigh their option.

The last swing high sees a technical barrier at the $4,400 handle, while bears will want to establish a medium-term run into the $4,000 major psychological handle in the coming weeks.

S&P 500 Daily Chart

S&P 500 Technical Levels

- AUD/JPY reaches a new four-day high at 95.37, trading at 95.22 as the Asian session begins.

- The pair remains neutral-biased, tilted to the upside, with potential resistance at October 12 high 95.83.

- Sellers must clear the 94.96/85 area and the top of the Kumo at 94.65 to shift momentum downwards.

The AUD/JPY reached a new four-day high at 95.37 on Tuesday, registering solid gains of 0.46%. However, as Wednesday’s Asian session begins, the cross-pair exchanges hands at 95..22, down a minimal 0.04%.

The daily chart portrays the pair as neutral-biased, tilted to the upside due to remaining above the Ichimoku Cloud (Kumo), which has narrowed, as the AUD/JPY is trendless. For a bullish continuation, buyers must reclaim the October 12 high at 95.83, followed by the latest cycle high at 96.92.

On the flip side, AUD/JPY sellers would need to clear the 94.96/85 area, where the Kijun and Tenkan-Sen levels lie, followed by the top of the Kumo at 94.65. A breach of the latter and the cross would slip inside the cloud, with the following support seen at the bottom of the Kumo at 94.00, followed by the October 3 low of 93.01.

AUD/JPY Price Action – Daily chart

AUD/JPY Technical Levels

- The AUD/USD saw a slight gain on Tuesday, tapping 0.6379 before settling at the halfway point near 0.6350.

- US PMIs firmly trounced market expectations, but Aussie traders are looking ahead to early Wednesday CPI inflation figures.

- Next up on the data docket: Australia 3rd quarter CPI inflation, RBA Governor Bullock speech later in the day.

The AUD/USD saw an early climb on Tuesday after hawkish comments from Reserve Bank of Australia (RBA) Governor Michelle Bullock propped up the Aussie (AUD) ahead of Wednesday's Australian Consumer Price Index (CPI) inflation data due early in the Asia market session, while policy watchers will also be keeping an eye out for RBA Governor Bullock's statements on the state of the Australian economy when she testifies before the Senate Economics Legislative Committee in Canberra early Thursday.

Australia CPI Preview: Inflation data could challenge RBA tolerance

The AUD/USD climbed from Tuesday's opening bids of 0.6336 to tap into an intraday high of 0.6379 before settling back to the halfway mark near 0.6350, and Aussie investors are now gearing up for an early reading of the Aussie CPI release.

As Australia's domestic economy continues to struggle with sticky inflation that refuses to drop into the RBA's desired levels, an acceleration of Aussie inflation data could see the RBA pushed one step closer to making additional rate hikes.

AUD will receive additional upside momentum if inflation eases less quickly than expected – Commerzbank

Australia's Monthly Consumer Price Index for the annualized period into September is forecast to chalk in a slight uptick to 5.4% against August's print of 5.2%, while the quarterly CPI figure is expected to likewise step up from 0.8% to 1.1% for the third quarter.

The RBA's Trimmed Mean CPI indicator for the year into September, meanwhile, is expected to show an adjusted decline from 5.9% to 5.0%, and investors will be watching this number closely to get a bead on where the RBA will be looking before making any decision on policy adjustments.

AUD/USD Technical Outlook

The AUD/USD has been drifting back down steadily after pinging a fresh intraday high, but still remains capped by last week's peak just north of 0.6390, and Aussie bulls will be waiting for a spark from the Australian CPI headliner before making another drive into the topside.

On the low end, technical support is building out a price floor from the 50- and 200-hour Simple Moving Averages (SMAs) after a bullish cross on the charts just above 0.6330, and a drop into the chart territory could see an extended rebound higher, while a bearish breakdown will see the Aussie set for a renewed challenge of Monday's swing low into 0.62190.

AUD/USD Hourly Chart

AUD/USD Technical Levels

- The NZD/JPY advanced above the 100-day SMA, closing at 87.60.

- The cross tallied its third consecutive day of gains.

- Indicators start to tilt in favour of the bulls as the cross may face a period of consolidation.

In Tuesday's session, the NZD/JPY gained some reactions and closed just above the 100-day Simple Moving Average (SMA) at 87.60.

Observing the daily chart, the pair displays a bearish technical outlook for the short term as the bears gained significant momentum and asserted their presence in the latest session. However, the cross lost more than 1% last week, and the pair may consolidate those losses in the next sessions. In the meantime, the Relative Strength Index (RSI) shows a flat slope in the negative territory, while the Moving Average Convergence (MACD) histogram lays out lower red bars.

If the bears push the cross back below the 100-day Simple Moving Average (SMA), they may target multi-month lows around 85.80. On the other hand, the pair may trade sideways to consolidate the recent downward movements.

Support levels: 87.58 (100-day SMA), 87.13, 86.50.

Resistance levels: 87.80, 88.30, 88.50.

NZD/JPY Daily Chart

-638337799940062701.png)

- The Australian Monthly Consumer Price Index is forecast to rise to 5.4% in September, up from the 5.2% recorded in August.

- The Quarterly CPI is expected to show a decline in the annual inflation rate from 6% in the second quarter to 5.3% in the third quarter.

- The figures will be critical for the Australian Dollar ahead of the November RBA meeting.

The Australian Bureau of Statistics (ABS) will release two reports on inflation on Wednesday at 00:30 GMT. These reports include the quarterly Consumer Price Index (CPI) and the monthly CPI. These numbers will be crucial for the Australian Dollar (AUD) ahead of the Reserve Bank of Australia (RBA) meeting scheduled for November 7.

Inflation in Australia is expected to remain above the RBA’s target range of 2%-3% during the third quarter. Since reaching its peak in December 2022, when the monthly rate showed an 8.4% annual increase, inflation has been trending down. The upcoming inflation numbers on Wednesday could indicate that the quarterly annual rate is at its lowest since the first quarter of 2022 or even the fourth quarter of 2021.

However, there is a possibility that the pace of inflation during the third quarter might have accelerated, potentially reaching the "failure to make satisfactory progress" threshold mentioned by the RBA in its latest meeting. This could signal the potential for another rate hike. Market participants will closely monitor these numbers.

What to expect from Australia’s August inflation rate numbers?

On Wednesday, ABS will release the Consumer Price Index (CPI), which is a quarterly measure of inflation, as well as the monthly CPI. According to the RBA, the monthly CPI is considered more timely as it includes updated prices for around two-thirds of the CPI basket each month.

The Consumer Price Index is expected to show a 1.1% increase during the third quarter, an acceleration from 0.8% in the second quarter. This rise is attributed to higher fuel and electricity costs. The annual inflation rate is expected to decline from 6% to 5.3%. The Trimmed Mean CPI, a core inflation measure that excludes the most volatile items, is projected to rise by 1.1% in the third quarter, with the annual rate slowing from 5.9% to 5%.

The Monthly CPI is anticipated to show a rebound in the annual rate, increasing from 5.2% in August to 5.4% in September, which would be the highest level since June.

If the numbers align with expectations, the RBA would welcome the decline in the core inflation measure. However, higher headline inflation figures could raise concerns and challenge the RBA's tolerance for inflation to remain above the target range. Even if the numbers match market consensus, it could trigger expectations of another rate hike from the RBA before the end of the year.

The next monetary policy meeting is scheduled for November 7. Currently, the interest rate market suggests that the probability of a rate hike is below 25%, but it climbs to nearly 50% for the December meeting. Higher inflation figures could alter the entire outlook.

In her first prepared speech on Tuesday, RBA Governor Michele Bullock said that "the board will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation. Our focus remains on bringing inflation back to target within a reasonable timeframe while keeping employment growing."

In its latest statement, the RBA reiterated that the central forecast is for CPI inflation to continue declining and return to the 2-3% target range by late 2025. The meeting minutes noted that further policy tightening may be required if inflation proves more persistent than expected. The RBA Board “has a low tolerance for a slower return of inflation to the target than currently expected. Whether or not a further increase in interest rates is required would, therefore, depend on the incoming data and how these alter the economic outlook and the evolving assessment of risks.”

How could the Consumer Price Index reports affect AUD/USD?

The inflation numbers could significantly impact the Australian Dollar (AUD). If the numbers come in higher than expected, it would fuel expectations of another interest rate hike and strengthen the AUD. However, excessively high numbers may not be sustainably positive for the currency, as they could indicate the need for higher interest rates, potentially affecting the overall economy. Additionally, if the economic outlook worsens significantly, the RBA may have to prioritize controlling inflation even at the expense of other economic factors.

On the other hand, if inflation slows more than expected, it would suggest that there is no immediate need for the RBA to raise interest rates. This could be initially negative for the Australian Dollar in the short term. However, it could also indicate a more optimistic outlook for the Australian economy, with no requirement for further monetary policy tightening. As a result, the overall impact on the AUD could be positive.

The AUD/USD pair trades near year-to-date lows, with crucial support at 0.6280. A break below this level could trigger further bearish acceleration, potentially targeting the 0.6200 level and even the 2022 low of 0.6169.

On the other hand, the pair is approaching a downtrend line and the significant 55-day Simple Moving Average (SMA) at 0.6410. A firm break above this level could strengthen the outlook for the Australian Dollar, potentially leading to further gains and a test of the 0.6500 level, which has been a notable resistance in previous months. A break higher could change the outlook from negative to neutral.

Economic Indicator

Australia Consumer Price Index (QoQ)

The Consumer Price Index released by the RBA and republished by the Australian Bureau of Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services . The purchase power of AUD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. A high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or Bearish).

Read more.Next release: 10/25/2023 00:30:00 GMT

Frequency: Quarterly

Source: Australian Bureau of Statistics

Why it matters to traders

The quarterly Consumer Price Index (CPI) published by the Australian Bureau of Statistics (ABS) has a significant impact on the market and the AUD valuation. The gauge is closely watched by the Reserve Bank of Australia (RBA), in order to achieve its inflation mandate, which has major monetary policy implications. Rising consumer prices tend to be AUD bullish, as the RBA could hike interest rates to maintain its inflation target. The data is released nearly 25 days after the quarter ends.

- The EUR/CHF is down 0.5% on Tuesday as Euro traders pull back.

- EU PMIs came in broadly mixed with German and pan-EU Composite PMIs missing the mark.

- Next up on Wednesday: ZEW Swiss business expectations for October, ECB President Lagarde speech.

The EUR/CHF has pared back Monday's gains as the Euro (EUR) falls back against the Swiss Franc (CHF) following a pan-EU Purchasing Managers' Index (PMI) data print that came in with mixed results on forecasts, souring European investors' appetite on Tuesday.

German Preliminary Manufacturing PMI jumps to 40.7 in October vs. 40.0 expected

Germany's PMIs for October came in mixed, with the headline Composite PMI declining unexpectedly, with a minor uptick in the Manufacturing component failing to offset a steeper-than-expected decline in the Services side of the indicator.

While Germany's manufacturing sector saw a continuation of recent growth, the expansion was moderate at best, with the Manufacturing PMI printing at 40.7 against the expected 40.0, and gaining ground over September's reading of 39.6, though the improved manufacturing figure leaves purchasing manager expectations still deeply in contraction territory below 50.0.

The German Services PMI broadly scratched market expectations, falling into contraction territory once more and printing at 48.0 versus the forecast 50.0 and steepening the decline from September's 50.3.

Eurozone Preliminary Manufacturing PMI unexpectedly drops to 43.0 in October vs. 43.7 expected

On the pan-EU side, PMIs came in broadly red, missing market estimates with the headline PMI Composite for October declining to 45.8, flubbing the expected uptick to 46.7 and falling further into the red from the previous month's 47.2.

Purchasing manager expectations across the European Bloc's manufacturing sectors are expecting conditions to continue to deteriorate, while PMIs for the services component ticked lower, failing to hold steady at September's index print.

EU-wide Manufacturing PMIs settling into 43.0 versus the expected uptick into 43.7, flubbing the previous reading of 43.4, while the Services component printed at 47.8, failing to hold at 48.7 as markets expected.

With EU PMI figures out of the way, EUR/CHF traders will be looking ahead to Switzerland's latest ZEW business expectations survey due on Wednesday, followed by a speech from European Central Bank (ECB) President Christine Lagarde. The Swiss expectations survey last printed at a begrudging -27.6, while ECB President Lagarde will be speaking while attending a dinner hosted in Athens by the Bank of Greece.

Euro traders will also be keeping an eye out for the ECB's latest rate call and Monetary Policy Statement landing at 12:15 GMT on Thursday, where the ECB is broadly expected to keep their main reference rate on hold at 4.5% as the EU grapples with a wobbly domestic economy.

Forex Today: Dollar strengthens as US PMI beats expectations; AUD outperforms ahead of AUS inflation data

EUR/CHF Technical Outlook

The Euro remains firmly underbid against the CHF after setting a new low of 0.9417 for 2023 last Friday, and the EUR/CHF has done little but decline steadily since the year's early peak at 1.0097.

A bearish continuation of the long-term trend will see the pair set to crack new lows for the year below 0.915, opening up the way to make a run at 2022's bottom bids of 0.9409. A break below this level would represent new all-time lows for the EUR/CHF since the creation of the EU currency bloc.

On the top side, technical barriers are piling up from a resistance zone between 0.9540 and 0.9600, with the last notable swing high near 0.9693.

EUR/CHF Daily Chart

EUR/CHF Technical Levels

During the Asian session, the key data to watch will be Australian inflation figures. Later in the day, Japan will release the Leading Economic Index. Additionally, the German IFO survey results are due. The Bank of Canada will announce its decision on monetary policy.

Here is what you need to know on Wednesday, October 25:

The US Dollar rebounded on Tuesday, supported by positive economic data. The US PMIs exceeded expectations and highlighted the divergence between the US economy and others, indicating that fundamentals still favor the US Dollar.

The US Dollar Index (DXY) rebounded from monthly lows below 105.50 to 106.30. US Treasury yields remained relatively steady, with the 10-year yield below the 5% level and the 2-year yield rising to 5.10%. Key US data, including Q3 GDP and consumer inflation, is scheduled for release on Thursday.

Despite improved risk sentiment, the Greenback strengthened during the American session. The Dow Jones gained 0.62% and the Nasdaq rose by 0.93%.

Eurozone PMIs indicated a significant contraction in Gross Domestic Product in October and lower inflation. These data further reinforce expectations that the European Central Bank (ECB) will keep interest rates unchanged on Thursday.

EUR/USD reversed Monday's gains, falling from near 1.0700 to below 1.0600. The pair managed to hold above the 20-day Simple Moving Average (SMA), but upward momentum evaporated.

Analysts at Commerzbank on Eurozone PMI:

The signs of a recession in the euro area are growing. The Purchasing Managers' Index for the service sector, the most reliable economic barometer for the euro area, fell again in October by 0.9 points to 47.8. It has thus been clearly in recession territory for three months. The index for the manufacturing sector, at 43.0, also gives no hope of a turnaround. Another ECB interest rate hike in the coming months is becoming increasingly unlikely.

The UK PMIs came in mixed, with a moderate recovery in Manufacturing to 45.2. However, the Services and Manufacturing sectors remained in contraction territory. GBP/USD experienced a 130-pip drop from its peak, reaching the 1.2150 area. The pair is now trading within a familiar congestion zone, with short-term technical indicators showing weakness.

USD/JPY rose from 149.30 back toward 150.00, boosted by a stronger US Dollar following positive US data. The Japanese Yen is moving around speculations, trading near intervention levels, with reports suggesting that the Bank of Japan may consider adjusting its Yield Curve Control policy next week. The BoJ did a new round of bond buying.

The Australian Dollar outperformed on Tuesday. AUD/USD closed higher despite Dollar strength, hovering around 0.6350, supported by hawkish comments from Reserve Bank of Australia (RBA) Governor Michele Bullock. Australia will report the Monthly Consumer Price Index and the quarterly CPI on Wednesday.

USD/CAD rebounded from the 20-day SMA and climbed to 1.3754, reaching the highest level in two weeks. The Bank of Canada will announce its monetary policy decision on Wednesday, with the interest rate expected to remain unchanged at 0.5%.

BoC Preview: Forecasts from nine major banks, keeping rates on hold and prospect of further hikes alive

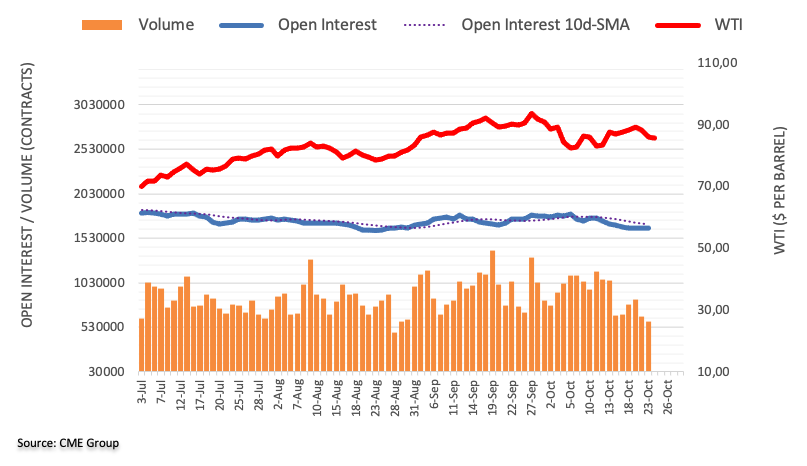

Crude oil prices dropped by more than 2% as Israel delayed its ground invasion in Gaza. The price of WTI crude hit fresh weekly lows near $83.00.

Metals initially hit fresh weekly lows but then trimmed losses. Gold bottomed near $1,950 and rebounded, rising above $1,970. Silver fell to $22.65 and closed at $22.90.

Like this article? Help us with some feedback by answering this survey:

- EUR/JPY retreats from weekly high on gloomy Eurozone economic data.

- Despite losses, EUR/JPY remains upward biased, but intervention risks may cap gains at around 160.00.

- If EUR/JPY drops below Tenkan-Sen at 158.45, it could aim for the top of the Ichimoku cloud at 157.90/158.00.

EUR/JPY retreats from the weekly high hit on Tuesday at around 159.91 after economic data from the Eurozone (EU) painted a gloomy outlook for the whole economy in the bloc. Hence, as a bearish-engulfing candle pattern emerges, the cross-pair drops 0.64% and trades at 158.81, below the 159.00 figure.

Despite registering solid losses, the EUR/JPY remains upward biased, but risks of intervention would likely cap the pair at around 160.00. If that level is cleared, the cross could aim toward August’s 2008 high at 169.47 but, firstly, would need to crack the 165.00 figure on its way to the former.

Conversely, If EUR/JPY drops below the Tenkan-Sen level at 158.45, the pair could aim toward the top of the Ichimoku cloud at 157.90/158.00. Up next, a drop inside the Kumo, and sellers can drag the spot prices towards the Kijun-Sen at 157.13.

EUR/JPY Price Action – Daily chart

EUR/JPY Technical Levels

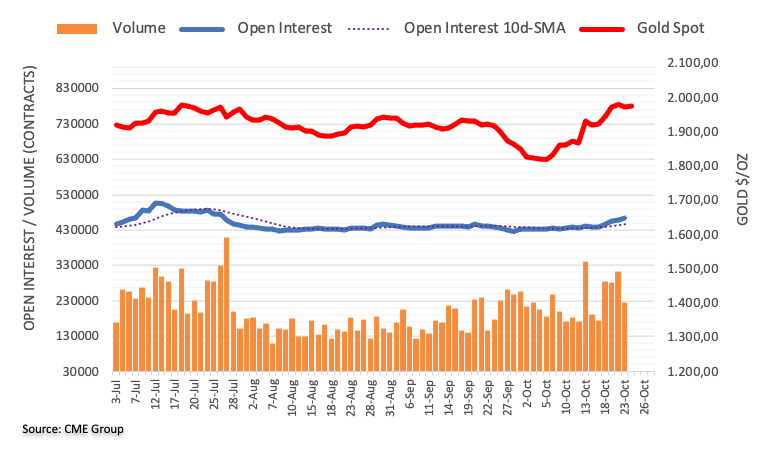

- Gold price recovers after hitting a weekly low of $1953 following positive US economic data release.

- US Treasury bond yields surge, with the 10-year reaching 4.88%, while US real yields drop to 2.43%.

- Geopolitical risks, upcoming US GDP figures, and inflation data are expected to influence XAU/USD prices.

Gold price (XAU/USD) pares some of its earlier losses and climbs back above the $1970 mark after hitting a new weekly low at around $1953 after the release of US economic data. The XAU/USD is trading at around $1974.30 above its opening price by a minuscule 0.09%.

XAU/USD climbs back above $1970, trading at $1974.30, up by 0.09%

US economic data sent US bond yields surging, a headwind for XAU/USD, initially heading toward the day’s low, as business activity in October improved. S&P Global revealed that Manufacturing PMI expanded to 50, surpassing expectations, while the Services PMI reached 50.9, also above forecasts. This resulted in a Composite PMI of 51, indicating overall growth in business activity.

The market reacted, sending US Treasury bond yields rising, with the 10-year reaching a high of 4.88% before retreating five basis points to 4.84%. In the meantime, US real yields, which inversely correlate to Gold prices, dropped 0.33% and sit at 2.43% after reaching a year-to-date (YTD) of 2.61%.

Meanwhile, geopolitical risks would likely continue to underpin XAU/USD prices as the conflict gathers momentum, with Israel intensifying its attacks on Gaza’s strip.

Aside from this, traders' focus shifts toward the release of additional economic data from the United States, with third-quarter Gross Domestic Product (GDP) figures pending to be released on Thursday, along with unemployment claim numbers. On Friday, the Federal Reserve’s (Fed) preferred gauge for inflation is expected to show inflation continues to slow down amid speculation of the end of the Fed’s tightening cycle.

XAU/USD Price Analysis: Technical outlook

Technically speaking, the XAU/USD remains upward biased after testing support earlier in the day, with prices bouncing at a September 1 high of $1953. Following that, Gold jumped toward the current spot price and could soon challenge the $2000 mark. Once that level is cleared, the year-to-date (YTD) high of $2081.82 will be up next. Conversely, if Gold slides below the October 23 low of $1963.29, expect a drop to $1950.l followed by the 200-day moving average (DMA) at $1931.61.

- The NZD/USD retreated from a high of 0.5870 to 0.5840.

- The green currency gained momentum after higher-than-expected S&P Global PMIs.

- US data, including S&P PMIs from October, Q3 GDP and PCE inflation from September figures, will be the next highlights.

On Tuesday, the NZD/USD failed to hold its momentum, which saw the pair rising to 0.5870 and then settling at 0.5840 trading with mild losses. Following the release of strong Manufacturing and Services PMIs the US Dollar gained interest as its economy is holding strong. In addition, US Treasury yields are rising, benefiting the green currency.

The S&P Global revealed that the S&P Global Manufacturing PMI from October came in above the consensus. The headline figure came in at 50, above the consensus of 49.5 and rose from its previous figure of 49.8. Likewise, the Services PMI is at 50.9, above the expected 49.8 and rose from its previous figure of 50.1.

As a reaction, the USD, measured by the DXY index, recovered from a low of around 105.35 and rose above 106.00. Furthermore, the 2,5 and 10-year yields increased to 5.12%,4.84% and 4.87% respectively. That said, the green currency’s upside is limited by markets betting on a less aggressive Federal Reserve (Fed) after Chair Powell’s speech last week. He highlighted that the high bond yields will be considered and that the bank will proceed “carefully”. As for now, according to the CME FedWatch tool, the odds of a 25 bps hike in the December meeting remain low and stand around 25%, while investors have practically priced in a pause in November.

For further guidance, markets await Q3 Gross Domestic Product (GDP) data on Thursday and Personal Consumption Expenditures (PCE) figures from September on Friday. In addition, Jerome Powell will be on the wires on Wednesday. It is worth noticing that last week, the USD faced selling pressure after the Fed Chair's speech, where he pointed out that higher yields will be taken into account in the next decisions and that the bank will proceed "carefully".

NZD/USD Levels to watch

Considering the daily chart, the NZD/USD shows a bearish outlook for the short term.

The Relative Strength Index (RSI), positioned below its midline in negative territory with a southward slope, supports this view along with the negative indication from the Moving Average Convergence Divergence (MACD), which is displaying red bars, pointing towards a strengthening bearish trend. Also, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs),indicating that on the broader picture, the bears are in command, and that the buyers have some work to do.

Support levels: 0.5820,0.5800,0.5770.

Resistance levels: 0.5890,0.5900,0.5930 (200-day SMA).

NZD/USD Daily Chart

-638337698837635956.png)

- The GBP/USD flubbed a one-week high after UK PMIs missed expectations.

- The Greenback extended its gains after US PMI figures broadly beat forecasts.

- Next up for the US Dollar will be a speech from Fed head Powell tomorrow, Thursday GDP.

The GBP/USD is shedding pips on Tuesday, declining from a one-week high just shy of the 1.2300 handle after UK Purchasing Managers' Index (PMI) figures printed red while US PMI data broadly beat the Street, climbing over market forecasts and chalking in accelerating economic activity in the US economy.

With the US economy continuing to gain ground while the rest of the global economy stagnates or begins to show cracks, market sentiment is prone to downside risk-off shocks as steadily-improving economic indicators for the US decrease chances of the Federal Reserve (Fed) picking up the pace of rate cuts moving forward.

Markets are currently hoping for Fed rate cuts to begin sometime in the back half of 2024, but a lack of weakness in the US economy bodes poorly for interest rate decrease hopes. Investors flocked to the safe-haven US Dollar on reaction to US PMI figures coming in green across the board.

UK Preliminary Services PMI inches lower to 49.2 in October vs. 49.5 expected

The seasonally-adjusted S&P Global/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) gave a slight uptick to 45.2 in October, just barely beating the anticipated value of 45.0 and climbing over September's final reading of 44.3.

At the same time, the Preliminary UK Services Business Activity Index declined to a nine-month low, printing at 49.2 for October, as compared to the final print of 49.3 in September and falling short of the expected figure of 49.5.

US S&P Global Manufacturing PMI edges higher to 50 in October, Services PMI improves to 50.9

In early October, economic activity within the US private sector showed a steady yet moderate expansion. The S&P Global Composite PMI advanced from 50.2 in September to 51.

October also saw the Manufacturing PMI climb from 49.8 to 50, while the Services PMI stepped higher, to 50.9 from 50.1. Both components of the US PMI forward-looking indicator beat expectations set by industry analysts.

With another batch of Greenback-bullish data in the books, GBP/USD traders will be looking ahead to a speech from Fed Chairman Jerome Powell on Wednesday, who will be giving opening remarks at the Moynihan Lecture in Social Science and Public Policy in Washington, DC.

Thursday will also see an advance reading of US Gross Domestic Product (GDP) figures, alongside US Unemployment Claims.

The Preliminary GDP for the US' third quarter of 2023 is expected to increase appreciably from 2.1% to 4.3%, while Initial Jobless Claims for the week into October 20th is expected to print a slight increase of new jobless benefits seekers, from 198K to 208K, a net increase of 10K.

GBP/USD Technical Outlook

Tuesday's backslide sees the GBP/USD facing a rejection from a bearish trendline from July's peaks near 1.3141 after the pair failed to recapture the 1.2300 handle, and the immediate downside sees a price floor from the last major swing low into 1.2037 in early October.

Topside momentum will face stiff resistance from the downside trendline, as well as the last swing high into 1.2337, and the Sterling-Dollar pair is set for near-term consolidation if market risk appetite recovers, or an extension of bearish declines if US data continues to snub investor hopes for rate-cut inspiring weakness.

GBP/USD Daily Chart

GBP/USD Technical Levels

- The GBP/JPY is seeing a rapid decline back into near-term consolidation after a miss for the UK Composite PMI.

- The Guppy is down 0.9% top-to-bottom on the day so far.

- Tuesday's downside push sees the GBP/JPY trading back into familiar territory.

The GBP/JPY is down around 150 pips from Tuesday's early peak at 183.75, sliding 0.9% on the day as the Pound Sterling (GBP) pares away all of Monday's gains for the early week against the Japanese Yen (JPY).

The GBP has waffled its market stance after a miss for UK Purchasing Manager Index (PMI) figures on Tuesday.

UK Preliminary Services PMI inches lower to 49.2 in October vs. 49.5 expected

The UK's PMI reading on Tuesday exposed the Pound Sterling to the downside after missing expectations in the headline figure, with the Composite PMI printing at 48.6 for October, a minor improvement from September's 48.5 but missing Wall Street's forecast 48.8.

The UK Manufacturing PMI beat expectations slightly, coming in at 45.2 against the expected 45, improving markedly over the previous month's 44.3, but the Services component of the UK PMI reading failed to spark confidence after an unexpected downtick from 49.3 to 49.2, missing the expected increase into 49.5.

With the GBP floundering following the missed forward-looking growth measure, GGBP/JPY traders will be looking ahead to Japan's Tokyo Consumer Price Index (CPI) inflation reading due early in the Asia Friday market session.

The annualized Tokyo CPI last came in at 2.8% for September, and markets are forecasting the Tokyo Core CPI (CPI inflation minus volatile fresh food prices) to hold steady at 2.5%; a miss for the indicator will make it increasingly difficult for the Bank of Japan (BoJ) to look ahead to ending their negative rate regime with inflation broadly expected to decline below the Japanese central bank's lower target band of 2%.

GBP/JPY Technical Outlook

The Pound Sterling has shed 0.9% against the Yen on Tuesday, tumbling from an eight-day high of 183.75 as the GBP/JPY starts to treat the 50-day Simple Moving Average (SMA) as a price ceiling on the charts.

As the daily candlesticks continue to churn, chances for a firm bullish break are evaporating, and the Guppy is looking poised for possible declines back towards the 200-day SMA currently rising into the 174.00 handle.

A topside break will need to reclaim the 186.00 psychological level before gearing up for another run at 2023's highs beyond 186.77 set back in August.

GBP/JPY Hourly Chart

GBP/JPY Daily Chart

GBP/JPY Technical Levels

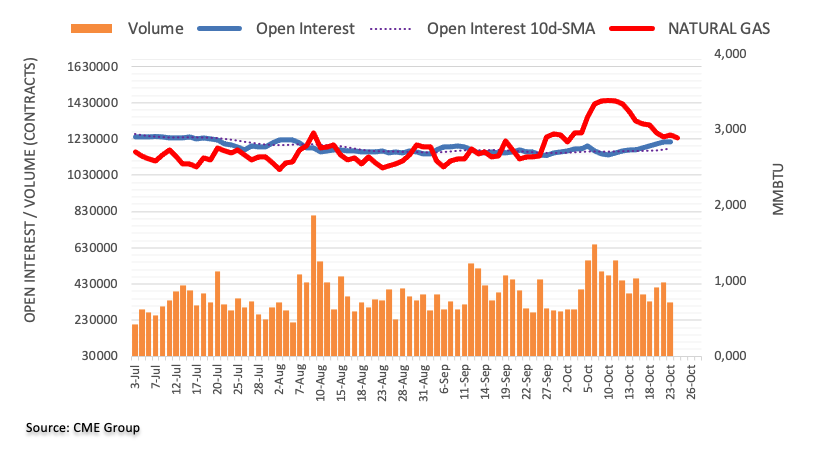

- Crude Oil markets are extending downside moves, WTI tips below $83.00 on Tuesday.

- Despite the US PMI data beat, broad forecast misses for EU PMIs are souring the outlook on crude demand.

- Geopolitical tensions from the Middle East continue to wane, further pushing down barrel costs.

West Texas Intermediary (WTI) Crude Oil prices are seeing extended declines on Tuesday, continuing Monday's downside push and sending WTI barrels into a new low of $82.76, a fresh one-week low as energies markets rethink their expectations of EU-led fossils demand after a broad miss on Purchasing Manager Index (PMI) figures early Tuesday.

US Manufacturing PMI edges higher to 50 in October, Services PMI improves to 50.9

US PMIs came in well above expectations, sending the US Dollar (USD) higher on Tuesday and adding to downside Crude Oil pressure; the US Composite PMI for October printed a surprise uptick into a flat 51, compared to September's 50.2 printing. Markets were expecting a decline in both the Manufacturing and Services components of the PMI, but US PMIs came in green across the board and investors lurched back into the USD.

The Pan-European PMI, on the other hand, printed broadly in the red, missing Wall Street forecasts and flubbing the latest set of forward-looking growth indicators for the EU.

Eurozone Manufacturing PMI unexpectedly drops to 43.0 in October vs. 43.7 expected

The EU HCOB Manufacturing PMI for October came in at just 43, well below the forecast 43.7 and completely snubbing the expected increase, coming in even worse than September's print of 43.4. The Services component likewise missed forecasts, printing at 47.8 against the expected steady reading of 48.7. The combined PMI Composite headline missed the anticipated 47.4, coming in at 46.5 versus the previous month's 47.2.

The big miss for EU PMI figures, combined with a USD-boosting US PMI beat, is increasing USD-denominated barrel costs and crumbling investor expectations for rising EU-based Crude Oil demand moving forward.

WTI Technical Outlook

Tuesday's decline for WTI Crude Oil sees US barrel prices tapping a fresh one-week low at $82.76, and the current downside barrier for barrel sellers will be early October's price floor of $80.63, with the 200-day Simple Moving Average (SMA) sitting near $78.00.

WTI has tumbled nearly 7% from Friday's near-term high of $89.64, and Crude Oil bulls will need to recover back to late September's highs for the year near the $94.00 major handle.

WTI Daily Chart

WTI Technical Levels

- XAG/USD trades flat, around $22.90, after peaking at a high around $23.15.

- US Manufacturing and Services PMIs lived up to expectations, while the European figures disappointed.

- Rising US Treasury yields favoured the downward movements. Hawkish bets on the Fed are still low.

In Tuesday’s session, the XAG/USD struggled to gather momentum as the USD traded strong against its rivals after the release of strong S&P Global PMIs. As a reaction, US Treasury yields slightly rose but hawkish bets on the Federal Reserve (Fed) still remain low, which could limit the losses for the grey metal. The US will release additional high-tier figures this week, and Chair Powell will speak on Wednesday.

The S&P Global Manufacturing PMI from October from the US came in at 50, beating the expected 49.5 and rising from its previous figure of 49.8. The Services Index also met expectations, coming in at 50.9, beating the consensus of 49.8 and increasing to expansion territory concerning its last reading of 50.1 and both indexes suggest an optimistic and robust outlook for the US economy.

As a reaction, the USD measured by the DXY index rose from a low of 105.35 towards 106.20, fueled by rising US yields. However, hawkish bets on the Federal Reserve (Fed) remain low, which could limit the upside potential for the green currency. Additional catalysts include key data to be released this week, consisting of Personal Consumption Expenditures figures on Friday, which is expected to have decelerated in September and with the Core PCE Price, the Fed’s preferred gauge of inflation, expected to come in at 3.7% YoY from the previous 3.9%. In addition, Gross Domestic Product (GDP) is expected to have significantly risen in Q3 with an annualised rate growth of 4.2%.

XAG/USD Levels to watch

Observing the daily chart, the outlook is neutral to bullish for the short term as the metal may continue consolidating the recent movements using the convergence of the 100 and 200-day Simple Moving Averages (SMA) as a resistances around $23.30. Meanwhile, the Relative Strength Index (RSI) shows a flat slope above its midline, while the Moving Average Convergence (MACD) lays out lower green bars.

As long as the bulls fail to conquer the $23.30 area, the outlook on the broader outlook will favour the bears.

Support levels: $22.65, $22.50, $22.30.

Resistance levels: $23.30, $23.50, $23.70.

XAG/USD Daily Chart

-638337646844135834.png)

- USD/CHF registers solid gains, bouncing from a weekly low of 0.8878 to trade at 0.8936.

- A breach of the 50-DMA at 0.5965 could test the 200-DMA at 0.9009.

- First support levels are at 0.8900, and the October 23 swing low of 0.8878, with further support at 0.8819 and 0.8800.

The USD/CHF advances steadily, registering solid gains of 0.33%, after bouncing from a weekly low of 0.8878. Upbeat data from the United States (US) strengthened the Greenback and lifted the major past the 0.8900 figure, currently exchanging hands at 0.8936.

From a daily chart perspective, after dropping below the 50-day moving average (DMA) at 0.5965, the downtrend remains intact unless USD/CHF breaches the latter, which could put into play a test of the 200-DMA at 0.9009. Once cleared, the USD/CHF could aim toward 0.9100.

Conversely, and the path of least resistance, the USD/CHF first support would be 0.8900, followed by the October 23 swing low of 0.8878. IF sellers reclaim those levels, the next stop would be the August 30 swing low of 0.8819, ahead of the 0.8800 mark.

USD/CHF Price Action – Daily chart

USD/CHF Technical Levels

- Canadian Dollar falls back as investors pile into USD once more.

- Crude Oil extends Monday’s losses, evaporating CAD support with it.

- The Bank of Canada is due for its latest rate statement on Wednesday.

The Canadian Dollar (CAD) has slipped back into its lowest bids in almost three weeks against the US Dollar (USD) as broad-market flows reverse direction and pile back into the Greenback following a bumper reading for the US Purchasing Managers’ Index (PMI) that soundly thumped market expectations.

The Bank of Canada (BoC) is set to announce its latest rate call on Wednesday, and Loonie traders will be looking for the Canadian central bank to hold their reference rate at 5% while leaving the way open for more potential hikes to come later on. Market participants expect little change in the BoC’s forward guidance as Canadian policymakers grapple with a domestic economy that is seeing flagging growth indicators but still high inflation on the back of soaring energy prices.

Crude Oil prices are seeing a downside snap on Tuesday, with West Texas Intermediate (WTI) adding to Monday’s decline. The oil-backed Loonie is seeing its supportive base go up in smoke as crude barrels backslide, pushing the CAD into its lowest prices against the USD since October 5.

Daily Digest Market Movers: Canadian Dollar slips as broader market picks up the Greenback

- CAD fumbles to an almost three-week low as investors bid the USD.

- US October PMIs beat the Street, climbing over Wall Street’s forecasts to chalk in gains for the productivity indicator.

- The US Manufacturing PMI printed at a flat 50 versus the expected 49.5 decline from the previous 49.8 reading.

- The US Services PMI gave an impressive reading, coming in at 50.9 and handily vaulting over the forecasted 49.9 against September’s 50.1.

- The dual PMI beats sent the Composite PMI back to 51, its highest reading since July.

- Crude Oil continues to slide, dragging down CAD support with it.

- WTI barrels are down over 7.5% from Friday’s peak.

- BoC Preview: keeping rates on hold and the prospect of further hikes alive

Technical Analysis: Canadian Dollar gives up more ground as investors favor the US Dollar, USD/CAD taps 1.3755

The Canadian Dollar (CAD) is down almost 0.7% against the US Dollar (USD) in Tuesday’s trading session as markets go broadly USD bullish, taking the USD/CAD pair to its highest bids in almost three weeks.

The USD/CAD pinged 1.3755 on Tuesday after reversing direction from an intraday low of 1.3661. The next immediate barrier for USD/CAD bulls will be October’s early high of 1.3785, while the floor for sellers currently sits at the last swing low near 1.3569.

The US Dollar has gained nearly 5% against the Canadian Loonie since July’s low point near 1.3090, and the USD/CAD continues to find technical support from the 50-day Simple Moving Average (SMA) currently lifting into 1.3600.

An extended rally will see the USD/CAD set for a challenge of 2023’s highs at 1.3862, while a full bearish reversal will find the floorboards near the 200-day SMA currently parked just south of 1.3500.

USD/CAD Daily Chart

US Dollar price today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Euro.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.79% | 0.76% | 0.46% | -0.12% | 0.00% | 0.31% | 0.34% | |

| EUR | -0.79% | -0.02% | -0.33% | -0.93% | -0.78% | -0.48% | -0.46% | |

| GBP | -0.77% | 0.03% | -0.30% | -0.91% | -0.76% | -0.45% | -0.44% | |

| CAD | -0.46% | 0.32% | 0.31% | -0.60% | -0.45% | -0.14% | -0.13% | |

| AUD | 0.12% | 0.88% | 0.88% | 0.57% | 0.15% | 0.43% | 0.45% | |

| JPY | -0.01% | 0.78% | 0.75% | 0.47% | -0.18% | 0.29% | 0.32% | |

| NZD | -0.31% | 0.47% | 0.45% | 0.14% | -0.44% | -0.30% | 0.01% | |

| CHF | -0.31% | 0.44% | 0.43% | 0.16% | -0.47% | -0.35% | -0.01% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- EUR/USD reverses course at 50-DMA, sliding below 1.0600 as US Treasury bond yields rise.

- US economy gains momentum with S&P Global Manufacturing PMI at 50 and Services PMI at 50.9.

- Eurozone business conditions continue to deteriorate, with Manufacturing, Services, and Composite PMIs in recessionary territory.

EUR/USD reverses its course at the 50-day moving average (DMA) and slides below the 1.0600 psychological level as Treasury bond yields in the United States (US) rise following business activity data. At the time of writing, the EUR/USD is trading at 1.0591 after hitting a high of 1.0694, down 0.72%.

EUR/USD trades at 1.0591, down 0.72%, as positive US data contrasts with Eurozone's economic struggles

The US economy continues to gather momentum, as revealed by S&P Global, as business activity picked up, according to the latest Purchasing Management Index (PMI) reports. S&P Global Manufacturing PMI expanded by 50, exceeding the forecast of 49.5, while the Services component stood at 50.9, above the projected 49.8. Consequently, the S&P Global Composite PMI was above the prior’s 50.2 figure at 51.

Consequently, US Treasury bond yields advanced to 4.88% as a reaction to the data, underpinning the Greenback as shown by the US Dollar Index (DXY), gaining 0.64%, up at 106.27. Therefore, the EUR/USD extended its losses past the 1.0600 figure.

On the Eurozone (EU) front, the calendar revealed that business conditions continued deteriorating. Manufacturing, Services, and Composite PMIs, revealed by S&P Global, remained at recessionary territory, below forecasts and the previous month’s data. That and Germany’s GfK Consumer Confidence plunging weighed on the Euro (EUR), which fell off the cliff after hitting a daily high shy of 1.0700.

Ahead of the week, the European Central Bank (ECB) is expected to hold rates unchanged, though it is projected to leave the door open for further hikes if needed.

EUR/USD Price Analysis: Technical outlook

The EUR/USD remains downward biased, although upward corrected shy of reclaiming the 1.0700 mark. As the fundamental picture deteriorates in the EU, further downside is expected. First, support is seen at the October 23 low of 1.0571, followed by the previous cycle low of 1.0495, slightly below the 1.0500 mark. Once those two areas are cleared, the next stop would be the year-to-date (YTD) low of 1.0448. On the other hand, if EUR/USD stays above 1.0600, that could open the door to test the October 12 high of 1.0639 before challenging 1.0700.

- Mexican Peso reverses its course, weakens against the US Dollar, losing more than 0.40%

- Mexico’s CPI for October’s first half eases as Banxico has held rates unchanged since March 2023.

- US business activity improves, exiting contractionary territory as per S&P Global PMIs.

Mexican Peso (MXN) gave up some of its Monday’s gains against the US Dollar (USD) after data from the United States (US) boosted the Greenback (USD).Additionally, US Treasury bond yields jumped, even though there is growing consensus amongst investors that the US Federal Reserve (Fed) will keep rates unchanged once again when it meets on November 1. Therefore, the emerging market currency is on the defensive as the USD/MXN is trading at 18.22, up 0.49% on the day.

Mexico reported inflation data before Wall Street opened, with the Consumer Price Index (CPI) rate for the first half of October continuing to ease. That is welcomed news, as the Bank of Mexico (Banxico) has held rates at 11.25% since March 2023, though market players expect the first rate cut in 2024. Aside from this, data from the United States showed that business activity, as revealed by S&P Global PMIs, bounced from the contractionary territory, with most indicators expanding above the contraction/expansion 50 threshold.

Daily Digest Market Movers: Mexican Peso surrenders Monday’s gains, USD/MXN back above 18.20

- Mexico's National Statistics Agency INEGI reported annual headline inflation hit 4.27%, down from 4.45% at the end of September, below forecasts of 4.38%.

- Mexico’s core inflation rate YoY was 5.54%, beneath forecasts of 5.6%.

- US S&P Global Manufacturing PMI for October jumped to 50, exceeding forecasts of 49.5, while the Services PMI exceeded the contractionary consensus of 49.9, reaching 50.9.

- US S&P Global Composite PMI was 51, above the prior 50.2.

- The Overall Index of Economic Activity in Mexico grew by 0.4% in August, exceeding the estimated 0.3%, data showed on Monday.

- Annually based, the Mexican economic activity expanded by 3.7%, smashing forecasts of 3.4%.

- The Bank of Mexico (Banxico) held rates at 11.25% in September and revised its inflation projections from 3.50% to 3.87% for 2024, above the central bank’s 3.00% target (plus or minus 1%).

Technical Analysis: Mexican Peso loses steam as USD/MXN buyers re-enter the market

The USD/MXN is upward biased, and price action of the last couple of days could form a ‘bullish-harami’ candlestick chart pattern on the daily chart, a bullish pattern. The USD/MXN pair's first resistance would be the October 23 high at 18.37 before buyers lift the spot price to last week’s high at 18.46, before challenging 18.48, October’s high. Once those levels are cleared, the 18.50 figure would be up for grabs. On the flip side, the USD/MXN must drop below the 18.00 psychological figure for sellers to reclaim the 200-day Simple Moving Average (SMA) at 17.73.

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- The US Dollar cleared Monday’s losses, and the DXY Index jumped above 106.00.

- The S&P Manufacturing and Services PMI rose to expansion territory above 50.00 in October.

- US Treasury yields recover, allowing the USD to find demand.

The US Dollar (USD) measured by the US Dollar Index (DXY) rose toward 106.30 on Tuesday, seeing nearly a 0.50% gain. While Europe’s S&P PMIs came in weak, the American figures beat expectations, and the US economy appears to be holding onto resilience, which is strengthening the green currency. In addition, US Treasury yields recovered, favouring the upward momentum.

Despite the Federal Reserve’s (Fed) contractionary policies, the United States economy seems to be the last man standing. Focus now shifts to Gross Domestic Product (GDP) preliminary estimates from Q3 on Thursday and Personal Consumption Expenditures (PCE) figures from September on Friday for investors to continue modeling their expectations on the next Fed decisions. Only a minority of traders expect the central bank to change current interest rates, but attention will still be paid to Chair Powell’s speech on Wednesday.

Daily Digest Market Movers: US Dollar recovers from multi-month lows thanks to strong economic activity figures

- After falling to a low since late September, around 105.35 earlier in the session, the DXY Index increased toward 106.30.

- The S&P Global Manufacturing PMI from October came in at 50, beating the expected 49.5, accelerating from its prior reading of 49.8.

- The Services PMI also came in higher than expected at 50.9 vs the expected 49.8 and increasing from its prior reading of 50.1.

- In the meantime, US yields are rising, and the 2 and 5-year rates marched toward 5.10%, and 4.81%.

- According to the CME FedWatch Tool, the odds of a 25 bps hike in December are still low, around 25%. In addition, the Tool suggests that a pause in November is near to being priced in. Focus now shifts to the high-tier data released on Thursday and Friday.

- The US Q3 GDP is expected to have accelerated and the PCE inflation to have decelerated in September.

Technical Analysis: US Dollar Index’s bulls need to retake the 20-day SMA to confirm a recovery

Observing the daily chart, the outlook is neutral to bearish for the short term as bulls are gaining momentum but still are yet to reclaim the 20-day Simple Moving Average (SMA) at 106.30. In the meantime, indicators recovered ground, with the Relative Strength Index (RSI) standing with a positive slope in bullish territory, while the Moving Average Convergence (MACD) gives out decreasing red bars.

On the broader picture, the pair is below the 20-day SMA but above the 100 and 200-day SMAs, indicating a favorable position for the bulls in the bigger picture.

Supports: 106.00, 105.70, 105.50.

Resistances:106.33 (20-day SMA),106.50, 107.00.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Gold price is continuing to profit from the Middle East crisis. Economists at Commerzbank analyze the yellow metal’s outlook.

Gold in demand as safe haven

The news coming out of the Middle East is likely to continue to dictate the direction for Gold, whereas previously dominant factors such as changes in bond yields have taken a back seat.

The normally negative correlation with the US Dollar has also been loose of late because both Gold and the USD are regarded as safe havens.

Australia Consumer Price Index (CPI) report will be decisive for the next Reserve Bank of Australia (RBA) decision and, therefore, for the Aussie, economists at Commerzbank report.

Inflation data will be decisive for the RBA

The Australian inflation data for Q3, due for publication on Wednesday, are likely to be decisive for the RBA when it comes to deciding whether it will hike the key rate again next week (or at the latest in December).

If inflation eases less quickly than expected, rate hike expectations for next week (or December) and thus AUD will receive additional upside momentum. However, the RBA will then have to deliver either with actions or at least with clear words, signalling a rate hike for December. Otherwise, AUD would suffer all the more.

See – Australia CPI Preview: Forecasts from seven major banks, rebound in inflation to continue

- NZD/USD falls back to near 0.5850 amid recovery in the US Dollar.

- S&P Global reported that the US Manufacturing PMI kisses the 50.0 threshold for the first time since November 2022.

- This week, the US Q3 GDP and core PCE price index data will be keenly watched.

NZD/USD faces a sell-off near the 0.5880 resistance as the US Dollar rebounds strongly. The Kiwi asset retreats as investors rush to the US Dollar. The appeal for the US Dollar improves as investors shift focus to the crucial US economic readings this week.

The S&P500 opens on a bullish note as the market mood improves amid a delay in Israel’s ground assault plan in Gaza. However, a stock-specific action is widely expected as the third-quarter earnings season has kicked off. The US Dollar Index (DXY) climbs above 106.00 after the release of the US preliminary S&P Global PMI data for October.

S&P Global reported that the Manufacturing PMI kisses the 50.0 threshold for the first time since November 2022. The factory data at 50.0, outperformed expectations of 49.5 and September's reading of 49.8. The Services PMI landed at 50.9, better than the consensus of 49.9 and the prior release of 50.1.

This week, the Q3 Gross Domestic Product (GDP) and core Personal Consumption Expenditure (PCE) price index data for September will be keenly watched. Economists expect the US economy to have grown by 4.2% on an annualized basis, doubling the growth rate of 2.1% in the former reading.

As per the estimates, annual core PCE decelerated to 3.7% against the former reading of 3.9%. On a monthly basis, the Fed’s preferred inflation gauge expanded at a higher pace of 0.3% vs. 0.1% growth recorded in August.

On the New Zealand Dollar front, investors hope that the Reserve Bank of New Zealand (RBNZ) is done with hiking interest rates as the economic recovery has faltered.

The Bank of Canada (BoC) is set to announce its Interest Rate Decision on Wednesday, October at 14:00 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of nine major banks regarding the upcoming announcement.

The BoC is expected to keep rates steady at 5% while leaving the door open to further hikes. Wednesday’s rate statement will be published alongside an updated Monetary Policy Report.

ING

Slower-than-expected inflation, a clouded growth outlook and higher bond yields mean the BoC is likely to overlook jobs tightness and keep rates on hold. There is still interest in keeping a higher-for-longer narrative alive, but markets may start to shed some doubts on it.

TDS

We look for the BoC to stay the course and hold the overnight rate at 5.00%. The key issue will be how the Bank attempts to reconcile a significant downgrade to its growth outlook with signs of more persistent inflation, which should preclude any change in tone. We look for the Bank to maintain a hawkish tone, with an emphasis on persistence of inflation/wage pressures and no change to forward guidance.

RBC Economics

Economic data releases since the Bank of Canada opted to forego an interest rate hike in September have been mixed, but we expect that they on net have made a hike unlikely. Near-term inflation projections will very likely be revised higher given the rise in energy prices into the fall. But with signs the economy is cooling, we expect the BoC will likely maintain their call for a more gradual return back to the target inflation rate, somewhere in late 2024 or early 2025.

NBF

We expect the BoC to leave the overnight target rate unchanged. Saying that, there remain some problematic elements of the inflation outlook that might argue for additional tightening and as such, we’d caution that this is not an open-and-shut decision. At a minimum, policymakers should leave the door open to further tightening via an explicit threat to hike further if needed. That hiking bias will likely remain until more durable progress on inflation is made. It is worth noting that Wednesday’s rate statement will be published alongside an updated Monetary Policy Report. Here we’ll see a material downgrade to the GDP trajectory and an inflation profile that will need to be marked up to reflect stronger-than-expected price pressures in the summer. Governor Macklem and Senior Deputy Governor Rogers will also have media availability shortly after the decision where they’ll be able to fine tune their messaging. We’re particularly interested in hearing how they think of policymaking in a stagflationary environment, which we appear to be in the early stages of.

MUFG

We expect the BoC to leave rates on hold while maintaining guidance that they ‘are prepared to increase the policy rate further if needed’.

CIBC

We look for the BoC to keep the overnight rate on hold at 5%. The statement will cite the ample evidence that economic growth has been curtailed by the rate hikes delivered thus far. We don’t share the Bank’s worry that inflation will prove sticky in the face of an evident economic slowdown, as it’s too soon in the move from a tight economy to one with slack to have expected to see a drop in price pressures tied to domestic demand. But we sense that those worries, and references in the statement to the lack of downside momentum in key core inflation metrics, will see the Bank maintain a somewhat hawkish tone, with the statement’s conclusion leaving the door open to further hikes if we don’t see progress towards the 2% target in the months ahead.

Wells Fargo