- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

Rannella Billy-Ochieng, the economist at Royal Bank of Canada (RBC), notes that Canada’s retail sales were held flat by lower vehicles sales & weaker energy prices as absent price effects, volume increased by 0.4%.

- “Today’s report had few surprises. As expected, headline sales were weighed down by a decline in gasoline station sales on account of lower energy prices. Controlling for price changes, sale volumes increased 0.4% June, bouncing back after a drop in May that was probably depressed by weather-related factors. Sale volumes still only increased 0.3% (annualized) in Q2 as a whole but the June increase leaves a stronger handoff for Q3.

- The June gain was boosted in by a partial rebound in food sales after a big May drop as well as a lift from apparel and sporting goods that Statistics Canada credited in part to the Toronto Raptors championship victory. In all, Statistics Canada reported sales increased in 7 of 11 categories.”

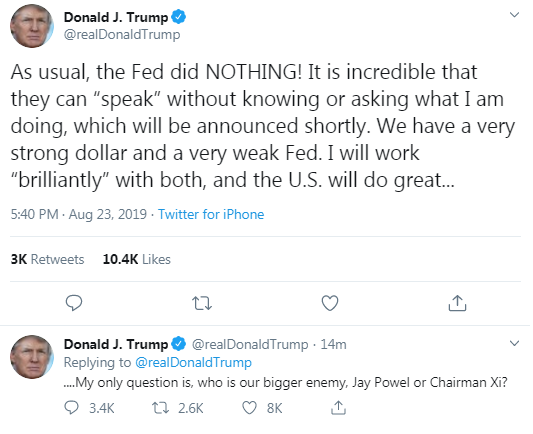

- Fed is working to sustain favourable economic conditions in the face of significant risks

- Does not repeat mid-cycle adjustment

- U.S. economy is close to both of Fed's goals

- Our challenge now is to do what monetary policy can do to sustain the expansion

- We are carefully watching developments as we assess their implications for the U.S. outlook and the path of monetary policy

- Says three weeks since FOMC latest meeting were eventful

- Slowing global growth, trade policy uncertainty, muted inflation weigh on favorable outlook

- Inflation is moving up towards 2%

- U.S. job market is historically strong

- Low inflation seems to be the problem of this era, not high inflation

The U.S.

Commerce Department announced on Friday that the sales of new single-family

homes tumbled 12.8 percent m-o-m to a seasonally adjusted annual rate of 635,

000 units in July. That was the biggest monthly fall since July 2013.

Economists had

forecast the sales pace of 649,000 last month.

June’s sales

pace was revised up to 728,000 units from the originally reported 646,000

units.

According to

the report, new home sales in the South, the largest area, slumped 16.1 percent

in July. Sales of new homes also decreased in the Midwest and West in the

Midwest. Meanwhile, sales in the Northeast jumped 50 percent to 39,000.

In y-o-y terms,

new home sales recorded a 4.3 percent advance in July.

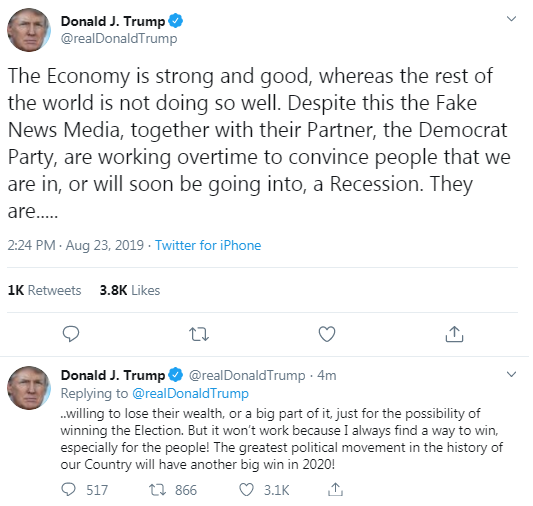

- Trade war with China does not mean the U.S. economy is going to slow

- Businesses are concerned about tariffs

- I would like to wait and see to how firms are reacting to consumer tariffs before reacting

- I think inflation is in a pretty good spot, we're clearly below our mandate but we've been stable

- Cyclical prices have been moving up, I'm more confident that prices are moving towards our goal. Patience is called for

- There is a lot about inflation dynamics that we need to learn about

- Business contacts are wondering if we're talking ourselves into recession

- There's a difference between sentiment and the reality on the ground

U.S. stock-index futures fell on Friday after China said it would impose new tariffs on $75 billion worth of U.S. goods and resume duties on American autos. Investors also awaited Fed Chair Powell's speech in Jackson Hole (14:00 GMT).

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,710.91 | +82.90 | +0.40% |

Hang Seng | 26,179.33 | +130.61 | +0.50% |

Shanghai | 2,897.43 | +13.99 | +0.49% |

S&P/ASX | 6,523.10 | +21.30 | +0.33% |

FTSE | 7,128.91 | +0.73 | +0.01% |

CAC | 5,361.95 | -26.30 | -0.49% |

DAX | 11,678.30 | -68.74 | -0.59% |

Crude oil | $53.80 | -2.80% | |

Gold | $1,512.00 | +0.23% |

- I haven't made a decision about the September meeting yet

- By the time weakness spreads from manufacturing to consumer, it might be too late

- Every business says available and cost of capital is not my problem

- I don't think monetary policy is causing a slowdown, and I don't think it would be enough to arrest a severe decline

- I'm open to an adjustment in September or in the next few meetings

- I noticed that August consumer sentiment numbers were a bit weaker

- So long as the U.S. consumer is strong, the economy will stay strong

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 160.17 | -0.71(-0.44%) | 695 |

ALCOA INC. | AA | 17.75 | -0.30(-1.66%) | 2757 |

ALTRIA GROUP INC. | MO | 47 | 0.41(0.88%) | 15964 |

Amazon.com Inc., NASDAQ | AMZN | 1,794.90 | -10.70(-0.59%) | 46428 |

Apple Inc. | AAPL | 209.42 | -3.04(-1.43%) | 368390 |

AT&T Inc | T | 35.23 | -0.16(-0.45%) | 53578 |

Boeing Co | BA | 354.24 | -0.17(-0.05%) | 118277 |

Caterpillar Inc | CAT | 115.69 | -2.20(-1.87%) | 11818 |

Chevron Corp | CVX | 116.4 | -1.33(-1.13%) | 1844 |

Cisco Systems Inc | CSCO | 47.8 | -0.38(-0.79%) | 16424 |

Citigroup Inc., NYSE | C | 63.15 | -0.76(-1.19%) | 14806 |

Deere & Company, NYSE | DE | 152.25 | -3.12(-2.01%) | 5084 |

Exxon Mobil Corp | XOM | 68.7 | -0.87(-1.25%) | 6631 |

Facebook, Inc. | FB | 180.85 | -1.19(-0.65%) | 64855 |

FedEx Corporation, NYSE | FDX | 158.22 | 0.12(0.08%) | 444 |

Ford Motor Co. | F | 8.87 | -0.17(-1.88%) | 318143 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9 | -0.13(-1.42%) | 47528 |

General Electric Co | GE | 8.1 | -0.09(-1.10%) | 221660 |

General Motors Company, NYSE | GM | 36.5 | -0.76(-2.04%) | 22316 |

Goldman Sachs | GS | 201 | -1.42(-0.70%) | 2120 |

Google Inc. | GOOG | 1,185.00 | -4.53(-0.38%) | 2339 |

Hewlett-Packard Co. | HPQ | 17.23 | -1.70(-8.98%) | 203045 |

Home Depot Inc | HD | 219.29 | -1.73(-0.78%) | 23188 |

Intel Corp | INTC | 46.16 | -0.62(-1.33%) | 39644 |

International Business Machines Co... | IBM | 133.78 | -0.54(-0.40%) | 3096 |

Johnson & Johnson | JNJ | 131.25 | -0.02(-0.02%) | 4093 |

JPMorgan Chase and Co | JPM | 108 | -0.72(-0.66%) | 10393 |

McDonald's Corp | MCD | 219.8 | 0.31(0.14%) | 4403 |

Merck & Co Inc | MRK | 86.22 | -0.50(-0.58%) | 1552 |

Microsoft Corp | MSFT | 137 | -0.78(-0.57%) | 70204 |

Nike | NKE | 82 | -1.31(-1.57%) | 11522 |

Pfizer Inc | PFE | 35.05 | -0.03(-0.09%) | 7216 |

Procter & Gamble Co | PG | 119.71 | 0.29(0.24%) | 2056 |

Starbucks Corporation, NASDAQ | SBUX | 96 | -0.49(-0.51%) | 3583 |

Tesla Motors, Inc., NASDAQ | TSLA | 219.12 | -3.03(-1.36%) | 158388 |

The Coca-Cola Co | KO | 54.46 | -0.03(-0.06%) | 1461 |

Twitter, Inc., NYSE | TWTR | 41.83 | -0.35(-0.83%) | 42073 |

UnitedHealth Group Inc | UNH | 232 | -0.94(-0.40%) | 2116 |

Verizon Communications Inc | VZ | 56.63 | -0.15(-0.26%) | 1744 |

Visa | V | 178.75 | -1.34(-0.74%) | 9158 |

Wal-Mart Stores Inc | WMT | 111.51 | -0.40(-0.36%) | 7230 |

Walt Disney Co | DIS | 135.15 | -0.93(-0.68%) | 5490 |

Yandex N.V., NASDAQ | YNDX | 36.37 | -0.18(-0.49%) | 1300 |

Altria (MO) upgraded to Equal-Weight from Underweight at Morgan Stanley; target $44

HP (HPQ) target lowered to $17 from $19 at BofA/Merrill

HP (HPQ) target lowered to $20 from $23 at Wells Fargo

HP (HPQ) target lowered to $21 from $23 at Morgan Stanley

HP (HPQ) target lowered to $26 from $28 at UBS

HP (HPQ) target lowered to $20 from $21 at Barclays

HP (HPQ) target lowered to $20 from $21 at Citigroup

Statistics

Canada reported on Friday that the Canadian retail sales remained unchanged

m-o-m at CAD51.46 billion in June, following a revised 0.2 percent m-o-m drop

in May (originally a 0.1 percent m-o-m decrease).

The result was above

economists’ forecast, suggesting a 0.1 percent m-o-m drop for June.

According to

the report, sales declined in 4 of 11 subsectors, representing 48 percent of

retail trade.

The June flat

m-o-m performance came as stronger sales across most subsectors were offset by

lower sales at motor vehicle and parts dealers (-2.5 percent m-o-m) and

gasoline stations (-3.4 percent m-o-m). Excluding motor vehicle and parts

dealers, retail sales rose 0.9 percent m-o-m in June compared to a revised 0.4

percent m-o-m decline in May (originally a drop of 0.3 percent m-o-m) and

economists’ forecast of flat m-o-m performance. Excluding motor vehicle and parts dealers and gasoline

stations, retail sales surged 1.7 percent m-o-m in June.

In y-o-y terms,

Canadian retail sales jumped 1.0 percent in June, the same pace as in May.

- China plans to raise import tariff rate on some U.S. goods

- New tariffs will range from 5% to 10%

- New tariffs will go into effect on September 1 and December 15

- A total of 5,078 U.S. products will be affected, notably autos

- To resume 25% tariffs rate on U.S. autos from December 15

- Market has expectations for low inflation

- Labour market is doing well, retail sales very good

- There are still downside risks, want to take out more insurance

- We have been below inflation target since 2012

- Would like to focus on hitting inflation target

- Lower rates would help us hit inflation target

HP (HPQ) reported Q3 FY 2019 earnings of $0.58 per share (versus $0.52 in Q3 FY 2018), beating analysts’ consensus estimate of $0.55.

The company’s quarterly revenues amounted to $14.603 bln (+0.1% y/y), generally in line with analysts’ consensus estimate of $14.583 bln.

The company also issued in-line guidance for Q4, projecting EPS of $0.55-0.59 versus analysts’ estimate of $0.58.

HPQ fell to $17.40 (-8.08%) in pre-market trading.

Sonia Meskin, the U.S. economist at Standard Chartered, suggests that the July FOMC minutes were noncommittal regarding future rate cuts, which Standard Chartered analysts believe is largely due to a relatively quick stabilization of financial markets following volatility in the first week of August.

- “We note that members who opposed the July rate cut viewed international trade risks as having diminished over the intermeeting period. We believe trade tensions have re-escalated since. We see two more 25bps cuts in 2019.

- The minutes also included a discussion of money-market dynamics, but no clear guidance on the potential for and timing of a standing repo facility. We believe that the FOMC expects lower rates, the ability to widen the fed funds target rate-interest on excess reserves (FFTR-IOER) band at least once more, and a likely expansion of the balance sheet later this year to help alleviate pressures in the repo and fed funds markets.

- The minutes laid out three reasons for July’s 25bps rate cut, in the following order:

- Deceleration in business investment and manufacturing, domestically and globally

- Prudent risk management, given the limited policy space of foreign authorities

- Concerns about the inflation outlook and inflation expectations.

- Importantly for the policy outlook, the minutes validated a pre-emptive approach to monetary policy. Many participants noted that an improved understanding of asset purchases and forward guidance justifies using these tools “more confidently and pre-emptively” in the future. This is consistent with market pricing of a prolonged period of relatively low rates.”

Analysts at TD Securities suggest Canada’s retail sales will provide the final update on growth conditions for June ahead of Q2 national accounts on August 30.

- “TD looks for a 0.1% decline, as a pullback in motor vehicle sales offsets strength in core measures (ex. auto: +0.1%). Volumes should post a more substantial decline, leaving them slightly lower for Q2 as a whole, consistent with a deceleration in household consumption from Q1.”

- Position on Brexit among EU members remains united

The Barclays research team reports it has revised its expectations on the U.S. Federal Reserve’s interest rate cut outlook, in the face of the looming Brexit risks.

- Expects deeper cuts from the FOMC because of the Brexit recession

- Sees 3 Fed rate cuts by the end of this year vs. the previous forecast of 2 cuts

- Says the no-deal Brexit will be an added drag on global growth

- Now is time to use clever methods to ensure the economy grows

According to Patrick Artus, analyst at Natixis, the slowdown in Chinese growth is having considerable effects on the rest of the world.

“All indicators currently show a markedly greater slowdown in Chinese growth than shown by GDP growth. This marked slowdown in Chinese growth is having very significant international consequences:

Declining oil price due to the weak growth in oil demand in China;

Weak growth in global trade as a result of weak Chinese imports; resulting weakness in the economies of countries related to global trade;

Weak capital goods production worldwide as a result of weak industrial investment in China, and the global weakness in industry.”

The pound’s sudden surge Thursday made one thing clear: after an almost 9% tumble from the year’s highs, it may now be close to a floor where value hunters are waiting.

In a market that’s overwhelmingly short the currency, a further decline of about 4% may tempt buyers back in, according to some strategists. Such a drop would take it to levels unseen since 1985.

For State Street Bank and Union Bancaire Privee, it’s not yet time to make a bet on a pound recovery but further declines into the Oct. 31 Brexit deadline could add to its appeal. Strategists at both institutions point to $1.17 as a level that looks attractive to enter long positions, although that would depend on their verdict on the extent of the bad news behind the drop..

“It’s been an incredibly popular trade to sell sterling -- at a certain point, if everybody sold sterling, who else is there left to sell?” Monique Wong, a senior portfolio manager at Coutts & Co., said.

According to ANZ analysts, UK Prime Minister Johnson has been doing the rounds of the European parliamentary heads as he looks to resolve the Irish backstop issue which is the main sticking point for a Brexit agreement.

“European leaders have indicated they are willing to listen and negotiate an agreement. The EU has indicated the UK has 30 days to present its suggestions, although German Chancellor Merkel later indicated negotiations can continue until 31 October. She also cautioned that any agreement can’t differ materially from the one already on the table. Johnson has suggested a trusted trader framework, electronic pre-clearing for customs and checking rules of origin as ways to get around the backstop and avoid a hard border in Ireland. Any proposals will have to be endorsed by Dublin and guarantee no hard border. A no-deal Brexit could severely disrupt the dairy industry of Northern Ireland as 25% of its milk is processed in the Republic.”

He should emphasise on caution, going slowly and being data dependent.

Trump shouldn't intervene with the Fed's job.

The more interventions there are, the more markets will realize they are ineffective.

There is a huge amount of uncertainty caused by the trade war among other factors.

Trade war, Brexit, political risks should not be only handled by monetary policy.

Trade war has been affecting businesses in a very negative way.

Services is still okay; manufacturing and business investment are not okay.

By counting heads, it looks like the Fed may cut by 25 bps in September.

But the Fed has to be wary, they are not equipped to deal with the next recession.

There is also a need to have insurance in keeping monetary policy ammunition.

China is likely to keep a key loan rate steady next week, but a cut is expected by mid-September after a policy review by the U.S. Fed, as Beijing steps up efforts to lower borrowing costs to support growth.

Analysts say a cut in the People’s Bank of China’s (PBOC) medium-term lending facility (MLF), which reflects commercial banks’ long-term liability cost, will likely signal a reduction in the new revamped Loan Prime Rate (LPR), launched this week. However, they don’t expect a cut in the MLF rate on Monday when the next batch of loans mature. The MLF now acts as a guide for the LPR, which is set on the 20th of each month.

The LPR was reduced by 6 basis points on Tuesday, following its weekend designation by the PBOC as the new lending benchmark for all fresh loans to households and businesses.

The central bank is “likely to cut the one-year MLF rate by around 10 basis points before September 20,” said Lu Ting, Greater China economist at Nomura in Hong Kong.

“We thus expect LPRs to drop by around 10 bp on September 20.”

According to Danske Bank analysts, the global macroeconomic backdrop has weakened significantly, following the escalation of the trade war between China and the US.

“We see further downside for the global economy in the coming months, followed by a stabilisation and modest rebound on the back of monetary and fiscal stimulus and we have downgraded our growth trajectory for both advanced and several emerging markets with the risk of a more pronounced slowdown having increased, but there is also positive risk, including a sudden resolution of the trade war.”

Bank of England Governor Mark Carney will deliver a keynote address on Friday at the Kansas City Federal Reserve Bank's annual symposium in Jackson Hole, Wyoming.

Carney is scheduled to speak at 1900 GMT, following an address from Fed Chairman Jerome Powell earlier in the day.

An external member of the BoE's Monetary Policy Committee, Silvana Tenreyro, will present a paper on commodity price shocks at the event on Saturday at 1400 GMT.

Danske Bank analysts suggest that today, markets will continue to focus on the Jackson Hole conference in the US and especially Powell's speech at 14:00 GMT.

“The FOMC minutes from Wednesday showed a highly divided Fed on the question of rate cuts. Remember this was before the even weaker global macro data, inversion of the yield curve (albeit only briefly) and even lower inflation expectations. Hence, we look for any statements on the latest developments and/or discrepancies among the FOMC board. ECB GC members Lane and Coeuré are also participating in the conference.”

Arturo Estrella, the economist who first discovered the predictive power of the yield curve, has a message for recession naysayers: It could hit sooner than you think.

“It’s been 50 years and 7 recessions with a perfect record,” Estrella told CNBC. “It’s impossible to be 100% sure about the future but I’d say the chances of a recession in the second half next year are pretty high.”

Estrella was a professor of economics at Rensselaer Polytechnic Institute and was once an economist at the New York Federal Reserve. Working at the Fed, Estrella studied the spread between the 10-year Treasury note and the 3-month Treasury bill as a recession predictor and found that particular part of the curve was the most accurate. It dipped below zero this year and is still inverted.

“Those who say things are different each time are probably counting on the fact that it will take about 2 years to know for sure, so who’s going to remember?” Estrella added in the message.

Credit Suisse found that it took, on average, 22 months before a recession hit following a 2-year and 10-year inversion going back the last four decades.

The world’s second biggest economy, which is slowing, is past a point where it cannot ignore its enormous debt anymore, according to an analyst.

Fraser Howie, an independent analyst, told CNBC that there’s a “whole host of hidden debt” in China, which had kick started stimulus this year as its economy slowed.

“China is very much past the tipping point where the debt simply no longer can be ignored. The cost of servicing the debt ... simply distracts from almost everything else,” said Howie.

China’s total debt — corporate, household and government — rose to over 300% of its GDP in the first quarter of 2019, slightly up from the same period a year earlier, according to a report by the Institute of International Finance.

“China ... (had) this huge stimulus and turn on the credit taps and they drove all this global demand,” Howie said. “But there clearly was going to be a cost ... and now they are suffering (from) it.”

China’s debt levels rapidly shot up a few years ago as its banks extended record amounts of credit to drive growth, which led to the Asian giant undertaking deleveraging efforts, or the process of reducing debt. But the trade war has put a dent in its efforts to pare its massive debt as Beijing sought ways to boost its slowing economy, which was at its lowest growth in 27 years.

Bill Evans, analyst at Westpac, suggests that the RBA’s forecasts in the August Statement on Monetary Policy are downbeat for wages employment and inflation despite factoring in 50bps of cuts in the cash rate.

“As such, two moves look assured, consistent with Westpac’s forecast for cuts in October and February. However, if global conditions deteriorate further, more stimulus is likely to be required. The minutes of the Reserve Bank Board meeting for August provided one significant surprise. In the Governor’s decision statement following the meeting on August 6, the conclusion included “the Board would continue to monitor developments in the labour market closely and adjust monetary policy if needed to support sustainable growth in the economy and the achievement of the inflation target over time. That statement was repeated almost verbatim in the Statement on Monetary Policy on August 9. Consequently we remain comfortable with our call that the next move will be in October – a respectable pause from the last cut in July but never indicating any doubt that another move was required. A second respectable gap between October and February would also indicate a clear intention to move just based on the domestic outlook.”

The Trump administration is studying tax cuts to buttress long-term U.S. economic growth that could be rolled out during the 2020 election campaign but is not looking at action to counter any perceived economic weakness now, the White House economic adviser said.

"We're not looking for any near-term tax cuts. We're not looking for short-run stimulus. We don't anticipate anything but a solid, strong economy," Larry Kudlow told reporters.

"We have for a while been looking at ... additional tax relief incentives for the middle class, for blue-collar workers, small businesses and so forth - additional relief on top of the bill that passed in late 2017," he added. "We're not unfolding that bill anytime soon. My guess is it's likely to appear during the campaign."

Kudlow told reporters the administration had long been considering additional tax moves as a follow-on to the tax cuts approved in 2017.

He said it was not likely to do anything short-term or temporary like a payroll tax cut because officials believe the economy is strong and recession talk is overblown. Instead, he said, the administration was considering adjusting marginal tax rates for the middle class, shrinking tax brackets and changing capital gains taxes.

According to Mitul Kotecha, senior emerging markets strategist at TD Securities, Asia's growth outlook is unlikely to improve soon as a plethora of global factors allied with weaker Chinese activity and ongoing trade tensions, suggests further pressure on regional activity.

“The only silver lining is that the pace of decline is slowing, amid improvements in the second derivative of data releases, while there are some indications that semiconductor prices are stabilising. Many countries in the region have revised their growth forecasts lower, while embarking on more aggressive monetary and fiscal stimulus. We expect further rate cuts across the region, alongside more fiscal stimulus. China continues to play a key role, with China's July data dump disappointing expectations, while USDCNY continues to push higher. This is particularly negative for KRW, SGD and TWD and we look for further deprecation. We also think Asian high yielders will be more vulnerable as market volatility rises, and expect both INR to IDR to struggle to make much headway.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.1213 (2523)

$1.1175 (2117)

$1.1147 (892)

Price at time of writing this review: $1.1068

Support levels (open interest**, contracts):

$1.1026 (4145)

$1.0987 (6994)

$1.0943 (2853)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date September, 6 is 104462 contracts (according to data from August, 22) with the maximum number of contracts with strike price $1,1400 (8858);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2328 (1179)

$1.2298 (833)

$1.2283 (144)

Price at time of writing this review: $1.2228

Support levels (open interest**, contracts):

$1.2193 (1078)

$1.2170 (1536)

$1.2141 (969)

Comments:

- Overall open interest on the CALL options with the expiration date September, 6 is 29996 contracts, with the maximum number of contracts with strike price $1,2750 (4128);

- Overall open interest on the PUT options with the expiration date September, 6 is 24597 contracts, with the maximum number of contracts with strike price $1,2100 (1879);

- The ratio of PUT/CALL was 0.82 versus 0.82 from the previous trading day according to data from August, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 59.55 | -0.7 |

| WTI | 55.27 | -0.88 |

| Silver | 17.02 | -0.47 |

| Gold | 1497.996 | -0.28 |

| Palladium | 1484.48 | 1.08 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 9.44 | 20628.01 | 0.05 |

| Hang Seng | -221.32 | 26048.72 | -0.84 |

| KOSPI | -13.64 | 1951.01 | -0.69 |

| ASX 200 | 18.5 | 6501.8 | 0.29 |

| FTSE 100 | -75.79 | 7128.18 | -1.05 |

| DAX | -55.81 | 11747.04 | -0.47 |

| Dow Jones | 49.51 | 26252.24 | 0.19 |

| S&P 500 | -1.48 | 2922.95 | -0.05 |

| NASDAQ Composite | -28.82 | 7991.39 | -0.36 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67565 | -0.39 |

| EURJPY | 117.913 | -0.22 |

| EURUSD | 1.10798 | -0.07 |

| GBPJPY | 130.334 | 0.82 |

| GBPUSD | 1.22484 | 0.99 |

| NZDUSD | 0.63672 | -0.55 |

| USDCAD | 1.32949 | 0.07 |

| USDCHF | 0.98346 | 0.16 |

| USDJPY | 106.407 | -0.16 |

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.