- Analytics

- News and Tools

- Market News

Новини ринків

New Zealand’s Trade Balance came in at NZD $-10.11B YoY in April versus $-9.98B prior, according to the latest data released by Statistics New Zealand on Friday.

Further details suggest that Exports increased to $6.42B during the said month versus $6.38B prior whereas Imports rose to $6.32B compared to $5.90B in previous readings.

Market reaction

At the press time, the NZD/USD pair is up 0.01% on the day to trade at 0.6099.

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- EUR/USD eases lower as risk-off flows bolster the Greenback.

- A spike in US Services PMIs reignite fears of sticky inflation.

- Fed rate cut hopes hinging in easing services inflation stumble.

EUR/USD headed lower on Thursday, driven closer to the 1.0800 handle after an unexpected upswing in US Services Purchasing Managers Index (PMI) figures sparked renewed fears of fewer Federal Reserve (Fed) rate cuts. This sent investors into the safe-haven US Dollar and deflated the Euro despite better-than-expected HCOB PMI figures earlier in the day.

European and US PMI figures on Thursday both beat market expectations, with figures broadly printing above expectations and improving on previous figures, but a higher-than-forecast upswing in US Services PMIs from 51.3 to 54.8 pummeled broad-market expectations for a Fed rate cut in September.

Forex Today: Data continues to rule the sentiment

According to the CME’s FedWatch Tool, rate traders are pricing in barely even odds of at least a quarter-point cut at the September Federal Open Market Committee (FOMC) meeting. Significantly lower than the 70% odds that were priced in at the beginning of the trading week, investors are grappling with the possibility of no Fed cuts in 2024.

Traders’ broad hopes for Fed rate trims have been slowly ground to a paste through 2024. In December, markets were broadly pricing in at least six rate cuts from the Fed through the end of the year. Fast forward to late May, and investors are scrambling to hold onto hopes of a single cut, potentially as late as December.

Friday brings a Gross Domestic Product (GDP) update for Germany, which is expected to hold steady at 0.2% for the first quarter. US Durable Goods Orders in April are slated to print during Friday’s US market session, and are forecast to backslide -0.8% MoM compared to the previous month’s 2.6%.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the weakest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.51% | 0.05% | 0.88% | 0.83% | 1.34% | 0.56% | 0.58% | |

| EUR | -0.51% | -0.50% | 0.41% | 0.32% | 0.86% | 0.08% | 0.07% | |

| GBP | -0.05% | 0.50% | 0.76% | 0.82% | 1.34% | 0.56% | 0.55% | |

| JPY | -0.88% | -0.41% | -0.76% | -0.06% | 0.47% | -0.27% | -0.29% | |

| CAD | -0.83% | -0.32% | -0.82% | 0.06% | 0.47% | -0.24% | -0.25% | |

| AUD | -1.34% | -0.86% | -1.34% | -0.47% | -0.47% | -0.79% | -0.78% | |

| NZD | -0.56% | -0.08% | -0.56% | 0.27% | 0.24% | 0.79% | -0.01% | |

| CHF | -0.58% | -0.07% | -0.55% | 0.29% | 0.25% | 0.78% | 0.01% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

EUR/USD technical outlook

EUR/USD is waffling into reach of the 1.0800 handle, trading on the south side of the 200-hour Exponential Moving Average (EMA) at 1.0833. The Euro took an early run at a high bid on Thursday of 1.0860, but short pressure quickly dragged the Fiber down into fresh lows for the trading week.

On daily candlesticks, EUR/USD is getting dragged back into consolidation at the 200-day EMA at 1.0801, and the pair has declined for all but one of the last five trading days.

EUR/USD hourly chart

EUR/USD daily chart

- GBP/USD weakens to 1.2695 on the firmer USD on Friday.

- The US PMI accelerated to the highest level in just over two years in May.

- The UK inflation data dashed hopes of BoE rate cuts in June.

The GBP/USD pair loses its recovery momentum near 1.2695 during the early Asian session on Friday. The major pair edges lower after retracing from the recent top around 1.2760 amid renewed US Dollar (USD) demand. Later on Friday, the UK Retail Sales, US Durable Goods Orders, and Michigan Consumer Sentiment Index will be due.

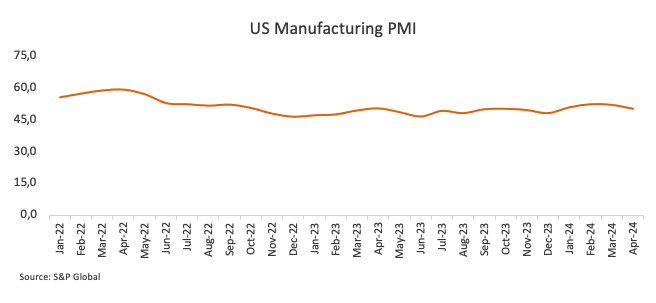

On Thursday, the flash US S&P Global Composite PMI climbed to 54.4 in May from 51.3 in April, above the market consensus of 51.1. This figure registered the highest level since April 2022. Meanwhile, the Manufacturing PMI rose to 50.9 in April from the previous reading of 50.0. The Services PMI improved to 54.8 in the same period from 51.3 prior. Both figures came in better than market expectations.

A surge in prices of inputs in the manufacturing sector suggested that inflation could pick up in the months ahead, which might prompt the US Federal Reserve (Fed) to delay the interest rate cut this year. This, in turn, provides some support to the Greenback and creates a headwind for the GBP/USD pair.

On the other hand, the UK CPI inflation report earlier this week prompted investors to lower their bets on the Bank of England (BoE) rate cut next month. Investors see nearly 50% odds of a first-rate cut in August, and a quarter-point move is not fully priced in until November.

- AUD/USD falls 0.20% to 0.6605, continuing its third day of losses.

- US economic resurgence evident with S&P Global Composite PMI at a 12-month high of 54.4.

- Strong US Services PMI at 54.8 and Manufacturing PMI at 50.9 dampen hopes for a Fed rate cut.

The Australian Dollar lost 0.20% against the US Dollar for the third straight day on Thursday as investors digested the latest S&P Global PMI report in the US, hinting the economy is reaccelerating. Consequently, Federal Reserve rate cut hopes were hurt, with traders expecting 27 basis points of easing toward the end of the year. The AUD/USD trades at 0.6605, virtually unchanged.

Aussie Dollar slumped as the Greenback got underpinned by strong PMIs

Wall Street ended the session with losses. US Treasury bond yields jumped following the release of the S&P Global Composite PMI, rising to 54.4, its highest level in twelve months. The Services PMI rose to 54.8, its highest level since October 2022, while the Manufacturing PMI expanded by 50.9, exceeding estimates and forecasts of 50.0.

The data propelled the AUD/USD from around 0.6650 toward 0.6618 on the data release. Earlier, the US Department of Labor (DOL) revealed that Initial Jobless Claims rose less than expected, to 215K, below 220K, and much less than the 223K of the previous reading.

Thursday data, along with the latest FOMC minutes, revealed that Fed officials are ready to tighten policy “should risks to outlook materialize and make such action appropriate.” They added that the disinflation process “would take longer than previously anticipated,” warranting higher rates for longer.

On the Aussie’s front, Thursday’s economic docket featured the release of the Judo Bank Manufacturing and Services PMIs final readings for May. The Services PMI came at 49.6, unchanged while the Manufacturing PMI stood at 53.1, lower than the 53.6 on its preliminary release.

AUD/USD Price Analysis: Technical outlook

After trading within a narrow range of 0.6640-0.6700, the AUD/USD broke below the bottom of the range and extended its losses towards the 0.6610 region. Buyers appear to be losing momentum, as indicated by the Relative Strength Index (RSI) flattening out despite being in bullish territory, suggesting potential for lower price levels.

The first support for AUD/USD is at 0.6600. If this level is breached, it will expose the 100-day moving average (DMA) at 0.6562, followed by the 50 and 200-DMAs at 0.6553 and 0.6526, respectively. Conversely, if buyers regain control and push prices above 0.6640, it could pave the way towards 0.6700.

Australian Dollar PRICE This week

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies this week. Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.51% | 0.04% | 0.88% | 0.82% | 1.33% | 0.59% | 0.58% | |

| EUR | -0.51% | -0.50% | 0.42% | 0.31% | 0.86% | 0.07% | 0.07% | |

| GBP | -0.04% | 0.50% | 0.78% | 0.82% | 1.35% | 0.56% | 0.56% | |

| JPY | -0.88% | -0.42% | -0.78% | -0.08% | 0.45% | -0.29% | -0.30% | |

| CAD | -0.82% | -0.31% | -0.82% | 0.08% | 0.47% | -0.24% | -0.24% | |

| AUD | -1.33% | -0.86% | -1.35% | -0.45% | -0.47% | -0.79% | -0.78% | |

| NZD | -0.59% | -0.07% | -0.56% | 0.29% | 0.24% | 0.79% | -0.01% | |

| CHF | -0.58% | -0.07% | -0.56% | 0.30% | 0.24% | 0.78% | 0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

- NZD/USD eased to the bottom of a sideways pattern on Thursday.

- Resurging fears of fewer Fed cuts bolstered Greenback.

- NZ Consumer Confidence, Inflation Expectations recover ground but remain low.

NZD/USD descended to the bottom of recent consolidation as broad-market risk appetite turned sour on Thursday after rising US Purchasing Manager Index (PMI) figures re-ignited concerns that sticky inflation from the services sector could keep price growth elevated for much longer than rate-cut-hungry investors had initially hoped. Rate cut expectations knocked lower through the day, dragging risk assets lower and bumping the US Dollar into higher bids on the day.

Forex Today: Data continues to rule the sentiment

The Kiwi is heading into the early Friday market session on the low end, but could find thin support from a slight improvement in New Zealand Consumer Confidence figures. ANZ Roy Morgan Consumer Confidence in May rose to 84.9 from April’s 81.9. Despite the rebound, New Zealand consumer confidence remains on the low side in the aggregate, sticking close to values seen during the pandemic response.

Read more: ANZ Roy Morgan Consumer Confidence rebounds to 84.9 in May

Consumer Inflation Expectations in May also eased further, declining to 3.8% compared to April’s 4.4%. On the other hand, Consumer House Price Inflation rose further to 3.5% from 3.2%.

NZD/USD technical outlook

The Kiwi has been churning sideways recently, with a technical ceiling hardening from 0.6140. Bids are catching technical support from the 200-hour Exponential Moving Average (EMA) near 0.6089.

Daily candlesticks are catching a squeeze pattern into the midrange with the pair trading just north of the 200-day EMA at 0.6070.

NZD/USD hourly chart

NZD/USD daily chart

- Silver falls 2.18%, trading at $30.10, as strong US business activity data impacts the market.

- Key support levels: $30.00 psychological level, April 12 high at $29.79, and $29.00.

- Additional support at May 18, 2021, high of $28.74 and June 10, 2021, high of $28.28.

Silver price tumbled more than 2% on Thursday as economic data from the United States showed that business activity is faring well amid a high interest rates economy. At the time of writing, the XAG/USD trades at $30.10, down 2.18%.

XAG/USD Price Analysis: Technical outlook

Silver’s uptrend remains intact, but the rapid and strong movement has led to a mean reversion. The buyer’s momentum is fading, as hinted by the Relative Strength Index (RSI) falling below the 70.00 level, aiming toward the 50-midline. This suggests that sellers are gathering control.

Given this context, the first support level for XAG/USD would be the $30.00 psychological level. If further weakness occurs, the next support level would be the April 12 high, now turned support, at $29.79, followed by $29.00. Additional key support levels include the May 18, 2021, high at $28.74, and the June 10, 2021, high at $28.28.

XAG/USD Price Action – Daily Chart

New Zealand's ANZ Roy Morgan Consumer Confidence in May rebounded to 84.9 from the previous 11-month low of 81.9. May's thin rebound still leaves aggregate consumer confidence near pandemic lows, but consumer inflation expectations also eased to 3.8% from 4.4%, printing at its lowest level since October of 2020.

Market reaction

The Kiwi (NZD/USD) is trading on the low side of near-term consolidation in the early Friday market session, pushed to an intraday bottom as broad-market flows bolster the Greenback. NZD/USD is trading near 0.6100 amidst a stubborn sideways pattern.

About ANZ Roy Morgan Consumer Confidence

The Consumer Confidence released by the ANZ is a leading index that measures the level of consumer confidence in economic activity. A high level of consumer confidence stimulates economic expansion while a low level drives to economic downturn. A high reading is seen as positive (or bullish) for the NZD, while a low reading is seen as negative (or bearish).

- USD/SGD rose to 1.3515 and managed to clear all of its daily losses.

- The US saw an uptick in manufacturing and services PMI data which bolstered the Dollar.

- Strong Jobless Claims figures are also painting a resilient US economy which justifies the delay of rate cuts by the Fed.

The USD/SGD recovered from daily lows, and ahead of the Asian session is trading with slight gains. The pair's movements have been influenced primarily by the cautious posture of the Federal Open Market Committee (FOMC) seen in Wednesday’s minutes, and the strong US Manufacturing and Services PMI figures. Strong Unemployment data released during the European session contributed to the recovery.

While the US Federal Reserve maintains its cautious approach towards monetary easing, strong manufacturing and service sector data seem to justify the bank’s stance. May's S&P Global Manufacturing PMI surpassed market expectations, increasing to 50.9 compared to April's figure of 50.0. Furthermore, a robust increase was also seen in the services PMI, which accelerated to 54.8 from 51.3, undermining market expectations. Additionally, the US Department of Labor reported a rise in Jobless Claims, which was below the expected estimates, suggesting that the labor market remains strong.

The strong economic figures fueled a rise in US Treasury yields which seems to be signalling that markets are delaying the start of the easing cycle. This is corroborated by the CME FedWatch Tool which indicated that the odds of a cut in September declined just below 40%. Next week, the US will release April’s Personal Consumption Expenditures (PCE) data which will provide additional insights into the US economy..

USD/SGD technical analysis

Within the daily overview, the Relative Strength Index (RSI) is treading in negative territory, inclining slightly towards a neutral trend while oscillating around the 50 mark. However, a recovery was seen after bottoming at 44 which may imply that the buyers are gaining ground. The decreasing red bars of the Moving Average Convergence Divergence (MACD) histogram reveals a decreasing selling momentum, providing a signal that the bear's time might be over.

USD/SGD daily chart

- USD/JPY rises, trading at 156.86, nearing the key psychological resistance at 157.00.

- U.S. economic data showing rapid business growth since 2022 bolsters the pair.

- Technical analysis: Resistance at 157.00, 158.44 (April 26 high), and YTD high of 160.32.

- Supports identified at Tenkan-Sen (156.05), Senkou Span A (155.61), and Kijun-Sen (155.18).

The USD/JPY registered gains for the second consecutive trading day but were marginal. The pair trades at 156.86, up by 0.03%, as economic indicators in the United States showed that business activity remains resilient, growing at the fastest pace since 2022.

USD/JPY Price Analysis: Technical outlook

The USD/JPY uptrend is persisting, but it is encountering strong resistance at the psychological 157.00 after clearing the May 14 high of 156.76. If buyers manage to surpass 157.00. that could lead to further gains. The next resistance emerges at 158.44, the April 26 high, and eventually challenges the year-to-date (YTD) high of 160.32.

On the downside, if the pair falls below the Tenkan-Sen at 156.05, it will expose the Senkou Span A at 155.61, followed by the Kijun-Sen at 155.18.

USD/JPY Price Action – Daily Chart

- The daily chart shows that the bulls are taking their foot off the gas and started to take profits.

- The hourly chart shows signs of short-term selling pressure ahead of the Asian session.

- The main support to hold is the 20-day SMA at 196.00.

On Thursday's session, the GBP/JPY declined to 199.20 but holds an overall positive outlook. This theory is backed up by the pair approaching near-cycle highs. If the cross holds the 20-day Simple Moving Average (SMA) at 196.00, the downward movements could be considered corrective.

In the daily chart, the Relative Strength Index (RSI) exhibits heightened bullish momentum as it comfortably resides in positive territory nearing overbought conditions but seems to be flattening. Simultaneously, the Moving Average Convergence Divergence (MACD) reveals a decreasing bullish momentum, distinguished by falling green bars. This indicates that while buyers currently hold the reins, their influence may be abating.

GBP/JPY daily chart

Switching to the hourly chart, the RSI portrays a contrasting bearish tendency, with the latest reading of approximately 44, dipping into negative territory. A declining trend is corroborated by the MACD's ascending red bars, suggesting a surge in negative momentum as sellers gain influence in the short term.

GBP/JPY hourly chart

To conclude, the GBP/JPY pair rose near cycle highs, and indicators reached overbought conditions which may trigger a corrective phase. Ahead of the Asian session, investors are taking profits, evident in the hourly chart where indicators are in the red. However, as long as the pair holds above the 20,100 and 200-day SMAs, the outlook will be bullish.

- Gold price declines for third straight day, now at $2,332, down from high of $2,383.

- Strong US economic data boosts Treasury yields and US Dollar, impacting Gold prices.

- Fed minutes suggest more rate hikes possible if inflation continues, rate cut expectations reduced to 27 basis points by end of 2024.

- Emerging market central banks have acquired 2,200 tons of gold since Q3 2022, influenced by sanctions on Russia.

Gold price tanks for the third straight day on Thursday, refreshing one-week lows after economic data from the United States spurred a jump in US Treasury yields and boosted the American Dollar. That hurt the Federal Reserve's (Fed) rate cut hopes with investors expecting just 27 basis points of easing toward the end of 2024, based on Chicago Board of Trade (CBOT) data.

At the time of writing, the XAU/USD trades at $2,332, plunging 1.90% after reaching a high of $2,383.

US business activity is gathering pace, revealed S&P Global on its May final reading of the Manufacturing, Services, and Composite PMIs. Earlier, the US Bureau of Labor Statistics (BLS) showed that the number of Americans filing for unemployment benefits was shy of estimates and less than the previous reading, indicating strength in the labor market.

The data boosted the Greenback, which, according to the US Dollar Index (DXY), gained 0.18% and is back above 105.00. In addition, the Fed Minutes revealed on Wednesday showed that some officials were ready to raise rates if inflation warranted, a headwind for the non-yielding metal.

Gold prices were underpinned by emerging markets' central bank buying, according to an article in The Wall Street Journal. The catalyst that sparked the buying was Western sanctions on Russia after its invasion of Ukraine.

The World Gold Council revealed that central banks added around 2,200 tons of the golden metal since Q3 2022.

Daily digest market movers: Gold price falls as US yields climbed following upbeat US PMIs

- Gold prices are undermined by the rise in US Treasury yields. The US 10-year Treasury note yield edges up five basis points to 4.477%, a headwind for the yellow metal.

- Initial Jobless Claims in the US reached 215K for the week ending May 18, which was lower than the estimated 220K and the previous week's reading of 223K.

- S&P Global released the final US PMI readings for May. The Manufacturing PMI rose to 50.9, surpassing both estimates and April's figure of 50.0. The Services PMI significantly outperformed forecasts and April's 51.3, increasing to 54.8.

- S&P Global Composite PMI also improved, climbing from 51.3 to 54.4, and exceeded the forecast of 51.1.

- The FOMC Minutes showed that Fed officials remained uncertain about the degree of policy restrictiveness. They added that “it would take longer than previously anticipated to gain greater confidence in inflation moving sustainably to 2%.”

- Data from the Chicago Board of Trade shows investors are expecting 27 basis points of Fed easing toward the end of the year.

Technical analysis: Gold price slides below $2,350 as bears target $2,300

Gold price remains upwardly biased despite posting losses for the third straight day. In the short term, momentum has shifted negatively. This is shown by the Relative Strength Index (RSI), which dropped below the 50-midline, an indication that sellers are in charge.

That said, the XAU/USD’s first support would be the May 13 low at $2,332, followed by the May 8 low of $2,303. Once those levels are surpassed, the 50-day Simple Moving Average (SMA) at $2,307 will be up next.

On the other hand, if buyers push prices above $2,350, the $2,400 mark could be exposed. Gold prices could rally and, on further strength, retest the year-to-date (YTD) high at $2,450.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- WTI falls back below $77 per barrel as investor sentiment sours.

- Broad-market risk appetite evaporates, dragging broader markets lower.

- US production continues to threaten hopes of supply shortage.

West Texas Intermediate (WTI) US Crude Oil slid to fresh lows on Thursday in a risk-off bid sparked by rate cut hopes drying up on the back of fresh concerns that services-side inflation will continue to run hotter than hoped. US Crude Oil production has once again threatened to outpace demand, leading to a fresh buildup in week-on-week barrel counts and renewing concerns that a US-led overhang of Crude Oil could push barrel prices paid even lower.

US Services Purchasing Managers Index (PMI) figures rebounded to a 12-month high in May, printing at 50.9 MoM compared to the forecast steady hold at 50.0. A climbing services activity outlook mixes poorly with a fresh warning from Fitch Ratings on Wednesday that services-side inflation will remain higher for much longer than broadly anticipated. With services activity possibly sparking further services inflation, investors are seeing fresh concerns that interest rates will remain higher for longer, sapping risk appetite on Thursday.

According to the CME’s FedWatch Tool, rate markets are now pricing in roughly equal odds of at least a quarter-point cut in September. This is down sharply from nearly 70% at the beginning of the trading week.

According to the American Petroleum Institute (API) and the Energy Information Administration (EIA), US Crude Oil barrel counts have risen once again week-on-week, eating away at the previous week’s declines. API Crude Oil Stocks for the week ended May 17 rose 2.48 million barrels, well above the forecast -3.1 million drawdown and refilling most of the previous week’s -3.104 million decline. EIA Crude Oil Stocks change also climbed over the same weekly period, adding 1.825 million barrels and snubbing the forecast -3.1 million drawdown. The previous week had seen a -2.508 million barrel decline.

WTI technical outlook

Crude Oil is sharply lower on Thursday, falling into negative territory after reaching an intraday peak with WTI testing $78.50. US Crude Oil has fallen to its lowest bids in over a week, knocking into $76.50 after backsliding through the $77.00 handle.

Thursday’s bearish reversal sends WTI into the red for a fourth consecutive trading day, and US Crude Oil is extending a bearish rejection from the 200-day Exponential Moving Average (EMA) at $79.22.

WTI hourly chart

WTI daily chart

Federal Reserve (Fed) Bank of Atlanta President Raphael Bostic hit newswires on Thursday cautioning that the inflation outlook may not ease as quickly as market participants continue to hope for.

Key highlights

It would not surprise me if it took longer to get to 2% inflation in the US than elsewhere.

There is considerable upward pressure on prices, we're not past the worry point.

We may need to be more patient to avoid heating the economy.

We are not in danger of falling into a more contractionary environment.

Job growth has been robust, which gives me comfort in staying at more restrictive levels.

Low-cost debt makes people less sensitive to rate hikes.

Households and homeowners have locked in low rates, this limits the sensitivity of the economy to Fed policy rate hikes.

The post-pandemic economy may be less sensitive to rates.

The couple of inflation numbers suggest it's going back to 2%, but going slow.

The US Dollar climbed to multi-day highs on the back of diminishing bets of a rate cut in September, strong data from US business activity in May and a hawkish tilt from the FOMC Minutes.

Here is what you need to know on Friday, May 24:

The USD Index (DXY) rose to multi-session tops north of the 105.00 hurdle underpinned by the tighter-for-longer narrative around the Fed and higher yields. On May 24, Durable Goods Orders will take centre stage along with the final Michigan Consumer Sentiment and the speech by FOMC’s Waller.

EUR/USD clocked its fourth consecutive session of losses and challenged the 1.0800 support. The final Q1 GDP Growth Rate in Germany will be in the spotlight on May 24.

GBP/USD reversed four daily advances in a row and retreated from recent peaks near 1.2760. On May 24, the Consumer Confidence tracked by GfK comes in the first turn seconded by Retail Sales.

USD/JPY surpassed the 157.00 barrier and printed two-week tops amidst the dollar’s rebound and rising US yields. In Japan, the Inflation Rate, Core Inflation Rate and Inflation Rate Ex-Food and Energy for the month of April are due on May 24.

Further weakness saw AUD/USD add to the ongoing weekly retracement and breach the 0.6600 support on the back of the stronger Dollar and the generalized sour sentiment in the risk complex.

WTI prices remained on the back foot and reached new lows near the $76.00 mark per barrel following further buying pressure in the greenback and renewed speculation that the Fed might keep its restrictive stance for longer.

Prices of Gold charted heavy losses and revisited the $2,330 zone per troy ounce following the Dollar’s bounce and increasing yields. By the same token, prices of the ounce of Silver extended the drop to the boundaries of the $30.00 mark.

- The USD/THB bulls gain momentum, with the pair showing a 0.56% spike.

- Favorable PMI data and stable unemployment figures, coupled with the Federal Reserve's unwavering stance favor the USD.

- Markets are giving up their hopes of a cut in September by the Fed.

The USD/THB pair is gaining strength rising to 36.60 on Thursday due to the Federal Reserve's (Fed) persistent hawkish stance on maintaining high interest rates. This is backed by better-than-expected Manufacturing PMI data and low unemployment claims in the US, providing a favorable economic environment.

The latest US data showed a robust PMI reading for May, exceeding expectations with manufacturing PMI at 50.9, up from April's 50.0, and outpacing the forecast of 50.0. The Services PMI also saw an impressive surge, reaching 54.8 from April’s figure of 51.3, significantly beating a 51.3 forecast.

In addition, the US Labor Department declared a smaller-than-anticipated rise in unemployment benefits, which marked another positive note for the US economy. All these factors, combined with the Federal Reserve's steadfast commitment to high interest rates, benefited the Greenback against its peers on Thursday. In that sense, according to the CME FedWatch tool, markets have practically given up the hopes of a cut by the Fed until September. In that month’s meeting, investors now see just a 40% chance of the easing cycle starting.

USD/THB technical analysis

Within the daily view, the Relative Strength Index (RSI) shows a transition from negative to positive territory. The market dynamics quickly flipped from an oversold to a positive trend with the latest RSI reading standing above the mid-line. The buyers appear to have gained control, offsetting prior losses and establishing a more optimistic outlook.

Supporting this is the trend witnessed in the Moving Average Convergence Divergence (MACD) histogram, which displays declining red bars. This indicates a diminishing negative momentum, aligning with the bullish context presented by the RSI above.

USD/THB daily chart

- Mexican Peso drops versus US Dollar amid GDP slowdown and Banxico Minutes highlighting inflationary pressure.

- Banxico revises inflation outlook and expects convergence to 3% target by Q4 2025.

- Mexico's quarterly GDP exceeds expectations but slowed down; mid-month inflation data reflects ongoing disinflation.

- US economic data shows resilience with fewer unemployment claims and strong activity in manufacturing and service sectors.

The Mexican Peso tumbles against the US Dollar on Thursday amid a busy economic docket in Mexico and the United States. Mexico's Gross Domestic Product (GDP) shows the economy slowing, while business activity in the US improved. That, alongside the release of Banxico’s Meeting Minutes, exerts pressure on the Mexican currency. The USD/MXN trades at 16.68, up 0.17%.

The Bank of Mexico revealed its latest Meeting Minutes. The board revealed that headline inflation most likely edged up due to persistent inflationary pressure in the services sector. Regarding underlying prices, “Most members noted that core inflation continued decreasing at the margin, having declined from 4.64[%] to 4.37% between February and April.”

In the minutes, all the members expect inflation to converge to Banxico’s target of 3% in the fourth quarter of 2025. Alongside that, "All members highlighted that, considering that inflationary shocks are foreseen to take longer to dissipate, the forecasts for headline and core inflation have been revised upwards.”

Earlier, the National Statistics Agency (INEGI for its acronym in Spanish) revealed that GDP figures exceeded forecasts on a quarterly basis, but on a yearly basis they decelerated as expected in the first quarter of 2024.

At the same time, headline inflation for the first half of May slowed on a monthly basis but increased on an annual basis, compared to the last reading. Mid-month core inflation was aligned with the consensus in monthly and yearly numbers, depicting the evolution of the disinflation process.

Across the border, the US economic docket was also busy. Unemployment claims came in below estimates, while business activity in the manufacturing and services segments smashed the consensus, expanding sharply and showing the US economy’s resilience.

Daily digest market movers: Mexican Peso depreciates as core inflation slows and US business activity reaccelerates

- Mexico’s Gross Domestic Product (GDP) for the first quarter of 2024 was 1.6% YoY as expected, down from Q4 2023’s 2.5% growth. On a quarterly basis, the country expanded 0.3% above estimates and the previous reading of 0.1%.

- Mid-month inflation for May was 4.78% YoY, up from 4.63% estimate. On a monthly basis, it decreased from 0.09% to -0.21%. Core inflation for the same period dipped from 4.39% to 4.31% YoY, as expected, and edged down from 0.16% to 0.15% MoM, in line with consensus.

- Across the border, the May Citibanamex survey showed that 26 analysts estimate Banxico will lower rates at the upcoming meeting on June 27. Eight estimate the Mexican central bank will lower rates until the second half of 2024. Inflation expectations for 2024 were revised upward from 4.17% to 4.21%, while underlying prices are expected to fall from 4.10% to 4.07%.

- Initial Jobless Claims in the US reached 215K in the week ending May 18, below the estimate and the previous reading of 220K and 223K, respectively.

- S&P Global revealed May’s final readings of US PMIs. The Manufacturing PMI expanded to 50.9, exceeding estimates and April’s 50.0, while the Services PMI crushed forecasts and April’s 51.3, improving to 54.8. The Composite PMI improved from 51.3 to 54.4, exceeding forecasts of 51.1.

- The latest Federal Open Market Committee minutes highlighted, "Various participants mentioned willingness to tighten policy further should risks to outlook materialize and make such action appropriate.” Regarding the tightness of the monetary policy, officials remained uncertain, adding that “it would take longer than previously anticipated to gain greater confidence in inflation moving sustainably to 2%.”

- Data from the Chicago Board of Trade shows investors are expecting 27 basis points (bps) of Fed easing, down from 31 bps estimated on Wednesday toward the end of 2024.

Technical analysis: Mexican Peso loses ground as USD/MXN hovers near 16.70

Despite remaining downwardly biased, the USD/MXN has printed three days of consecutive gains, opening the door to challenging higher prices. Once the exotic pair breached 16.60, momentum showed that selling pressure was waning as the Relative Strength Index (RSI) aims for the 50-midline.

For a bullish continuation, USD/MXN must clear the 50-day Simple Moving Average (SMA) at 16.76. A breach of the latter would exacerbate a rally toward the 100-day SMA at 16.91, followed by the 17.00 psychological level. In that event, the next stop would be the 200-day SMA at 17.17.

Conversely, a drop below 16.52 could exacerbate a challenge of the 16.50 psychological level, ahead of the year-to-date low of 16.25.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Dow Jones sheds almost a full percent, falls further away from 40,000.00.

- US Services PMI rose to a 12-month high, in a cautionary reminder of services inflation.

- Investors will be hoping for good news from Friday’s US Durable Goods Orders.

The Dow Jones Industrial Average (DJIA) tumbled on Thursday, falling -380 points and tumbling below 39,300.00 as investors pullback in the face of declining hopes for a September interest rate cut from the Federal Reserve (Fed).

May’s S&P Global Services Purchasing Managers Index (PMI) rose to a 12-month high of 50.9 on Thursday, well above the forecast steady print at 50.0. Accelerating services activity bodes poorly for investors desperate for signs of a rate trim from the Fed. Fitch Ratings warned the entire market on Wednesday that services inflation will likely remain sticky for some time, keeping rates elevated for much longer than many investors have been hoping for.

Read more: US S&P Global Manufacturing PMI surprised to the upside in May

According to the CME’s FedWatch Tool, rate traders are pricing in barely 50% odds of at least a quarter-point cut from the Fed in September, down significantly from the 70% odds priced in at the beginning of the trading week. US data will have one last chance to throw investors a bone on Friday, with US Durable Goods on the table.

US Durable Goods in April are expected to decline -0.8% MoM, down sharply from the previous month’s 2.6%. The University of Michigan’s Consumer Sentiment Index in May is forecast to tick upwards to 67.5 from the previous period’s 67.4, while UoM 5-year Consumer Inflation Expectations are expected to remain pinned at 3.1% in May.

Dow Jones news

The Dow Jones is sharply lower on Thursday as the US market’s worst-performing equity index. All but two of the Dow Jones’ constituent securities are in the red, with Amgen Inc. (AMGN) rising less than half a percent to $310.78 per share as the single meaningful gainer for the day.

On the downside, Boeing Co. (BA) is getting absolutely shattered on Thursday, tumbling -6.75% to $173.68 per share after the company announced negative cash flow with no expectations of the battered airplane manufacturer’s deliveries recovering in the second quarter.

Dow Jones technical outlook

The Dow Jones sees accelerating losses as the index turns bearish, falling back from record highs above 40,000.00. Thursday has been incredibly one-sided intraday trading, tumbling from the day’s early peaks near 39,760.00.

The DJIA is slipping back towards the 50-day Exponential Moving Average (EMA) at 38,908.36. Despite near-term declines, the index is still buried deep in bull country, with the index trading well above the 200-day EMA at 37,141.05.

Dow Jones five minute chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- Canadian Dollar broadly weaker, loses ground across board.

- Canada brings little meaningful data to the table.

- CAD traders forced to wait until Friday’s Retail Sales.

The Canadian Dollar (CAD) backslid once again on Thursday, piling on further weakness and dipping to 30-week lows. A lack of meaningful Canadian economic data is giving the CAD little support, and markets are focusing on an upside surprise in US Purchasing Managers Index (PMI) figures in May.

Canada will print March Retail Sales on Friday, alongside US Durable Goods Orders. The latest update from the University of Michigan’s Consumer Sentiment Index will also be delivered on Friday. Investors are broadly expecting Canadian Retail Sales to rebound slightly, while US Durable Goods are expected to soften slightly. Meanwhile, UoM Consumer Sentiment is expected to tick upwards, while Consumer Inflation Expectations are forecast to hold steady at 3.1%.

Daily digest market movers: Canadian Housing sees little impact against US PMI figures

- Canadian New Housing Price Index rises 0.2% MoM in April versus the previous 0.0%. Investors expected a print of 0.1%.

- US Initial Jobless Claims eased to 215K in the week ended May 17, down from the previous week’s 223K (revised from 222K) and below the forecast of 220K.

- US S&P Global Manufacturing PMI recovered to 50.9 in May, climbing over the forecasted hold of 50.0.

- The Services PMI component also rose to a 12-month high of 54.8.

- Market hopes for a September rate cut from the Federal Reserve (Fed) are evaporating. According to the CME FedWatch Tool, rate markets are pricing in barely over 50% odds of a quarter-point cut in September, down sharply from over 70% odds at the beginning of the week.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.04% | 0.04% | 0.16% | 0.10% | -0.00% | -0.15% | -0.08% | |

| EUR | -0.04% | 0.00% | 0.14% | 0.06% | -0.04% | -0.19% | -0.13% | |

| GBP | -0.04% | -0.00% | 0.14% | 0.05% | -0.04% | -0.20% | -0.13% | |

| JPY | -0.16% | -0.14% | -0.14% | -0.07% | -0.18% | -0.38% | -0.26% | |

| CAD | -0.10% | -0.06% | -0.05% | 0.07% | -0.10% | -0.25% | -0.19% | |

| AUD | 0.00% | 0.04% | 0.04% | 0.18% | 0.10% | -0.15% | -0.10% | |

| NZD | 0.15% | 0.19% | 0.20% | 0.38% | 0.25% | 0.15% | 0.07% | |

| CHF | 0.08% | 0.13% | 0.13% | 0.26% | 0.19% | 0.10% | -0.07% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Technical analysis: Softer CAD eases further, sends USD/CAD higher to 1.3700

The Canadian Dollar (CAD) is broadly weaker on Thursday, shedding weight across the board. The CAD is down three-tenths of one percent against the New Zealand Dollar (NZD) and a fifth of one percent against the Australian Dollar (AUD).

USD/CAD rose to the 1.3700 handle on Thursday as the mixed-performance Greenback outpaces the softening Canadian Dollar. The pair has risen into a two-week high and is on pace to close higher for a fourth straight day. Four of the last five daily candles have closed in the green.

USD/CAD is extending a bullish rebound from the 1.3600 handle as the pair rises further from the 200-day Exponential Moving Average (EMA) at 1.3551. However, the pair still remains down from the last major swing high into 1.2850 in mid-April.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- May’s PMI and weekly Jobless Claims data outperformed expectations and provided the USD with a lift.

- The USD is also registering gains following Wednesday’s relatively hawkish FOMC minutes.

- The odds of a cut in September continue to decline.

The US Dollar Index (DXY) is currently trading at 104.90, modestly higher, and managed to clear all its daily losses. This upward trajectory is driven by robust S&P surveys known as the Purchasing Managers Index (PMI) and encouraging weekly Jobless Claims figures, both indicative of a healthier US economy.

The US economy displays strength, and the Fed's cautious approach keeps the Greenback afloat. Next week’s US Personal Consumption Expenditures (PCE) figures for April will determine the short-term trajectory.

Daily digest market movers: DXY strengthens on upbeat PMI data

- S&P Global Manufacturing PMI for the US increased to 50.9 in May, up on a monthly basis from 50.0 in April, surpassing economists' forecast of 50.0.

- Service sector PMI rose to 54.8 from 51.3 in the previous month, exceeding the prediction of 51.3 on a monthly basis.

- Composite PMI for May was reported at 54.4, a significant leap on a monthly basis from 51.3 in April, and surpassed the anticipated decline to 51.1.

- US Department of Labor reports 215K employment insurance beneficiaries in the week ending May 18, lower than the estimated 220K and the prior week's figure of 223K, implying a resilient labor market.

- Fed maintains a reserved approach toward monetary policy alterations while advocating for continued patience before starting cutting.

- Odds of a cut in the September meeting declined below 40%, according to the CME FedWatch Tool.

DXY technical analysis: DXY faces a conflicting medium-term outlook as bears and bulls tussle for dominance

The indicators on the daily chart reflect a sort of stalemate between bullish and bearish perspectives. Despite the bears working to gain ground, the index remains above the 100 and 200-day Simple Moving Averages (SMAs), a strong testament to the presence and resiliency of buying momentum. However, the Relative Strength Index (RSI) flirting with negative territory suggests that a bearish pinch may be on the way.

Moreover, the Moving Average Convergence Divergence (MACD) presents flat red bars, a neutral to bearish sign that could indicate a potential shift in momentum or continued sideways movement.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- GBP/USD slides 0.04%, peaking at 1.2746 in early North American trading.

- Technicals show a bearish trend with a 'shooting star' pattern and momentum with sellers.

- Support on May 21 low of 1.2686, May 16 low of 1.2643, and 1.2600 psychological level.

- Resistance at 50-hour SMA (1.2721), 100-hour SMA (1.2712), weekly high of 1.2761; potential target at 1.2800.

Early during the North American session, the British Pound dropped against the Greenback after data from the United States showed that business activity was picking up. Alongside that, inflationary pressures rose, sparking investors' fears that the Fed would delay cutting rates later during the year. The GBP/USD trades at 1.2711 after hitting a high of 1.2746, down 0.04%

GBP/USD Price Analysis: Technical outlook

The GBP/USD edges are lower after printing a ‘shooting star’ on Wednesday, a prelude to lower prices. Today’s price action witnessed a jump toward a high of 1.2750, but it still failed to crack the current week’s high of 1.2761, which opened the door for further losses.

In the short term, the GBP/USD one-hour chart suggests the pair is range-bound, capped on the upside by the 50-hour SMA at 1.2721 and the 100-hour SMA at 1.2712. However, momentum supports sellers, as shown by the Relative Strength Index (RSI), which remains bearish and hovers at its lowest level since May 17.

Therefore, if the major drops beneath 1.2700, the next support would be the May 21 low of 1.2686, followed by the May 16 low of 1.2643 and the psychological 1.2600 mark.

Conversely, if buyers lift the exchange rate above 1.2746, that will sponsor a test of the weekly high of 1.2761. Further strength and the pair could aim for 1.2800.

GBP/USD Price Action – Hourly Chart

- AUD/USD gives up majority of intraday gains as the US Dollar revives after upbeat US early PMI report for May.

- The pace at which the US PMI expanded was the fastest pace in more than two years.

- AUD/USD turns volatile after a Rising Channel breakdown.

The AUD/USD pair retreats from the intraday high of 0.6650 in Thursday’s New York session. The Aussie asset comes under pressure as the US Dollar witnesses a strong buying interest after the S&P Global published an upbeat preliminary United States (US) PMI report for May. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, recovers entire intraday losses and jumps to 104.90.

According to the early US PMI report, Manufacturing PMI rose to 50.9, outperforming expectations and the prior reading of 50.0. The Services PMI also beat the consensus, jumped to 54.8 from the estimates and the former release of 51.3. The agency noted that the pace at which PMI increased was fastest in more than two years and the economy is on track to post a strong Gross Domestic Product (GDP) gain.

Strong preliminary PMI reading has dent investors’ confidence about the Federal Reserve (Fed) that it will begin reducing interest rates from their current levels in the September meeting. The CME FedWatch tool shows that traders see a 53% chance for the Fed lowering borrowing rates in September, which has come down from 58% after the release of the early PMI report.

Meanwhile, the Australian Dollar fails to maintain a firm-footing despite the communication from Reserve Bank of Australia (RBA) policymakers through May policy minutes was hawkish. The RBA minutes indicated that the board also discussed raising interest rates again.

AUD/USD has come under pressure after a breakdown of the Rising Channel chart pattern formed on a four-hour timeframe. A breakdown of the above-mentioned pattern suggests an establishment of a bearish reversal. The near-term outlook of the Aussie asset would worsen as the 20- and 50-period Exponential Moving Averages (EMAs) are on the verge of delivering a bearish crossover.

The 14-period Relative Strength Index (RSI) has shifted into the 20.00-60.00 range from the 40.00-80.00 zone, suggesting a bearish reversal.

More downside will appear if he major breaks below May 22 low at 0.6608, which will expose it to May 14 low at 0.6580, followed by May 1 high at 0.6540.

On the flip side, a decisive move above May’s high at 0.6714 will drive the asset towards January 3 high at 0.6771 and the round-level resistance of 0.6800

AUD/USD four-hour chart

Economic Indicator

S&P Global Composite PMI

The S&P Global Composite Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging US private-business activity in the manufacturing and services sector. The data is derived from surveys to senior executives. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the private economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity is generally declining, which is seen as bearish for USD.

Read more.Last release: Thu May 23, 2024 13:45 (Prel)

Frequency: Monthly

Actual: 54.4

Consensus: 51.1

Previous: 51.3

Source: S&P Global

- USD/CAD recovers from early weakness on Thursday after the release of US PMI data beats estimates in May.

- The Services PMI beat which may be critical to interest-rate expectations given the sector was singled out as an inflation hotspot by the Fed.

- The Bank of Canada is expected to cut interest rates in either June or July – the Fed not till September at the earliest.

USD/CAD is trading in the 1.3680s at the time of writing after a sharp rise following the release of preliminary US Purchasing Manager Index (PMI) data for both the Services and Manufacturing sector. The PMI survey data showed a higher-than-expected reading in May, indicating an expansion of economic activity that bodes well for the US Dollar (USD) and gives USD/CAD an extra boost.

US S&P Global Manufacturing PMI came out at 50.9 in May, up from the 50.0 in April and the 50.0 forecast by economists. Services PMI, meanwhile, rose to 54.8 from 51.3 in the previous month and 51.3 forecast. Composite PMI came out at 54.4 in May, up from 51.3 in April – and beating the decline to 51.1 economists had expected.

The higher-than-expected Services PMI data, in particular, will have supported the US Dollar (USD) as the Federal Reserve (Fed) has highlighted Services-sector inflation as a key hotspot in the economy that needs to cool down before it moves to cut interest rates. The maintenance of higher interest rates supports the USD since it attracts higher inflows of foreign capital compared to lower interest rates.

USD/CAD had been trading significantly down for the day prior to the data on the back of a mixture of higher Crude Oil prices (CAD positive), positive risk appetite (CAD positive), better-than-expected Canadian Housing data and technical chart resistance. Following the data, however, it made up a substantial portion of its earlier losses.

The Canadian Dollar (CAD) is likely to see limited upside against the US Dollar (USD) putting a floor under downside for the pair, as interest rate differentials, a key FX driver, remain favorable for USD. Recent Canadian inflation data for the month of April showed price pressures cooling in line with analysts’ estimates. The data brought the date when the Bank of Canada (BoC) is likely to cut interest rates closer. The money markets are pricing in a 53% chance of a 25 basis point (bps) cut in June, while the possibility of a July rate cut is fully priced in.

The US Federal Reserve (Fed) in contrast keeps delaying an expected cut in interest rates. Most recently, the Minutes from the Fed’s April-May meeting revealed that policymakers thought interest rates should remain at their current level “at least until September,” and even discussed the possibility that they might need to be increased. A key determining factor for the course of future policy would be the evolution of the labor market, they added.

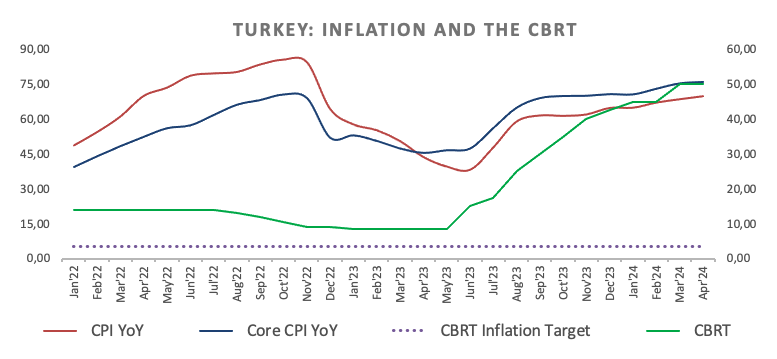

- The Turkish lira depreciates slightly around 32.20 vs. the Dollar.

- The CBRT kept the One-Week Repo Rate unchanged at 50.0%.

- The central bank sees a disinflationary scenario in H2 2024.

The Turkish lira maintains its consolidative phase well in place on Thursday, hovering around the low-32.00s in the wake of the CBRT’s interest rate decision.

USD/TRY faces extra consolidation in the near term

So far, there have been no changes to the side-lined theme around the Turkish currency, which has remained trapped within the 32.00–32.60 range since mid-March.

On Thursday, the Turkish central bank (CBRT) maintained its One-Week Repo Rate unchanged at 50.00%, as broadly anticipated.

The CBRT stated that its decision on rates came after taking into account the delayed impacts of monetary tightening, adding that it is closely monitoring the effects on credit conditions and domestic demand.

In the statement, the bank emphasized its vigilance regarding inflation risks, citing a "limited decline in the underlying trend of monthly inflation in April."

In addition, the bank also indicated that it would tighten its policy stance if a significant and persistent increase in inflation was anticipated.

Moving forward, market expectations see a nearly 72 bps increase at the bank’s next gathering on June 27.

It is worth noting that headline inflation in Türkiye rose by 69.80 in the year to April.

USD/TRY key levels to watch

So far, the pair is advancing 0.10% to 32.1950 and faces the next up barrier at the all-time high of 32.6461 (April 19). On the flip side, a break below the weekly low of 31.9722 (April 29) would expose another weekly bottom of 31.7390 (March 21) and finally the temporary 100-day SMA of 31.4788.

- Silver price finds cushion near $30.20 as investors had already priced in hawkish interest rate guidance in FOMC minutes.

- US weekly jobless claims were lower at 215K from the estimates of 220K in the week ending May 17.

- The US Dollar and bond yields remain under pressure on firm Fed rate-cut prospects.

Silver price (XAU/USD) stabilizes near $30.20 after a vertical downfall in Thursday’s New York session. The sharp downside in the white metal was driven by hawkish Federal Open market Committee (FOMC) minutes of the May policy meeting, which indicated that officials also discussed over hiking interest rates again as progress in the disinflation process stalled in the first quarter of the year.

However, the impact of the hawkish FOMC communication is supposed to be temporary on bullions as views of policymakers were based on stubborn higher inflation data of the first quarter of this year. The consumer price inflation data for April was declined as expected and indicated that price pressures are on course to return to the desired rate of 2%.

10-year US Treasury yields drop to 4.42% as soft inflation data is an unfavorable scenario for interest rates remaining higher for a longer period. A decline in yields on interest-bearing assets diminishes the opportunity cost of holding an investment in non-yielding assets such as Silver.

The US Dollar Index (DXY) is down by 0.2%, trades near 104.70 as investors remain firm that the Federal Reserve (Fed) will start reducing interest rates from the September meeting.

The USD Index struggles to stabilize despite the United States (US) Department of Labor has posted lower Initial Jobless Claims than estimates for the week ending May 17. Number of individuals claiming jobless benefits for the first time were lower at 215K from the estimates of 220K.

Silver technical analysis

Silver price trades in a Rising Channel chart pattern formed on a daily timeframe in which each pullback move is considered as a buying opportunity by the market participants. Upward-sloping 20 and 50-day Exponential Moving Averages (EMAs) suggest that the near-term trend is bullish.

The 14-period Relative Strength Index (RSI) oscillates in the bullish range of 60.00-80.00, indicating that momentum has leaned on the upside.

Silver daily chart

- Initial Jobless Claims rose by 215K vs. the previous week.

- Continuing Jobless Claims rose by almost 1.8M.

US citizens that applied for unemployment insurance benefits increased by 215K in the week ending May 18 according to the US Department of Labor (DoL) on Thursday. The prints came in short of initial estimates (220K) and below the previous weekly gain of 223K (revised from 232K).

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average stood at 219.75, an increase of 1.75K from the previous week's revised average.

In addition, Continuing Claims increased by 8K to 1.794M in the week ended May 11.

Market reaction

The US Dollar Index (DXY) maintains its negative bias so far on Thursday, coming under pressure after hitting multi-day peaks near the 105.00 barrier in the previous session. The corrective decline in the Greenback also comes amidst a mixed performance of US yields across the curve.

- Oil is in a short-term downtrend but is showing signs that could be early evidence of a reversal.

- Oil has formed a bullish Doji candlestick reversal pattern at the day’s lows which could hail a stronger recovery.

- A break above the major trendline would be required for confirmation – as things stand the downtrend remains intact.

West Texas Intermediate (WTI) US Crude Oil is trading up over a percent at $78.01 on Thursday.

The commodity is in a short-term downtrend on the 4-hour chart (below) which given the old saying “the trend is your friend” would be expected to continue, favoring shorts over longs.

WTI Oil, however, is showing some early bullish reversal signs. It formed a Doji Japanese candle at Thursday’s 76.74 lows (shaded rectangle). This was followed by two bullish candles in a row. Although it is too early to say for sure, the candlestick formation could be an indication of a short-term change of trend.

Oil 4-hour Chart

If Oil can continue rising up and definitively pierce above the green down trendline at roughly $79.00 it would be a sign that the short-term trend had reversed.

A definitive break above the trendline would be one accompanied by a longer-than-average green candle that closed near its highs or three green candles in a row that broke above the trendline.

Such a break would be expected to climb to a target at about $80.00, the resistance level of the May 20 lower high.

The Moving Average Convergence Divergence (MACD) momentum indicator is below the zero-line indicating a bearish environment. The blue MACD line is looking like it is about to cross above its red signal line, however, which would give a buy signal in line with the possibility of a reversal indicated by the Japanese candlestick pattern.

Alternatively, a capitulation and continuation of the still-intact downtrend would see WTI Oil price extend lower. A break below the May 15 monthly low at $76.38 would add confirmation to the bear trend and probably result in a move down to support from an older low at roughly $75.75 initially, with deeper declines attacking major historic support at $71.50.

- The US Dollar has entered a patch of volatility since the Fed Minutes release.

- Markets will be chasing PMI’s from several countries throughout the day.

- The US Dollar Index trades just below 105.00 and could snap above if US PMI surprises.

The US Dollar (USD) is in the red after earlier being in the green when it had gained momentum after the release of the US Federal Reserve (Fed) Minutes overnight, which frightened markets after several concerns were communicated on inflation by Fed officials in the paper. Markets got scared and started to head into safe havens like the Greenback. Although Nvidia earnings pushed the Nasdaq higher, a general wave of Risk On was not rippling through markets where even the Chinese semiconductor index crashed 2% in the Asia-Pacific session.

On the economic data front, a very packed agenda where markets can again revalue currencies next to each other with both European, United Kingdom’s and US Purchase Manager Index numbers for May. This will give traders a base of comparison and might see these currencies move against each other higher or lower. Besides that, weekly Jobless numbers and some Fed Activity indicators could add fuel to the fire.

Daily digest market movers: Comparing performances

- German Services Purchase Managers Index (PMI) surprised with an upbeat release of 53.9 against 53.2 for April, where 53.5 was expected for May. The move is particularly supportive for the Euro with Germany being labelled ‘the sick man in Europe’ these past few months.

- French Services PMI stole a bit of the boost from Germany’s outperformance, because it fell back into contraction from April’s 51.3 to 49.4 against an expected 51.7 for May.

- The US data kicks off at 12:30 GMT:

- Chicago Fed National Activity Index for April will be released. The March number was at 0.15.

- The weekly Jobless Claims are due to be released:

- Initial Jobless Claims expected to stay steady from 222,000 to 220,000.

- Continuing Jobless Claims were last week at 1.794 million, with no forecast pencilled in.

- The S&P Global preliminary PMI release for May is expected near 13:45 GMT:

- Manufacturing PMI should remain stable at 50.

- Services PMI should remain stable as well at 51.3.

- The Composite should ease a touch from 51.3 in the final April’s reading to 51.1.

- Near 14:00 GMT, New Home Sales are expected to ease a touch from 0.693 million to 0.680 million for April.

- The Kansas Fed Manufacturing Activity for May will come out at 15:00 GMT. The previous number was at -13, no consensus available.

- To close off this Thursday, Federal Reserve Bank of Atlanta President Raphael Bostic participates in a Q&A session with students in a MBA macroeconomic class at the Stanford Graduate School of Business near 19:00 GMT.

- Equities are very mixed with the Hong KongHang Seng down near 2% near its closing bell. The European equities are up near 0.50% while US equities are in the green ahead of the US opening bell.

- The CME Fedwatch Tool is pricing 95.8% for no change in the policy rate for June. September futures are now seeing a 49.7% chance for a 25-basis-points cut.

- The benchmark 10-year US Treasury Note trades around 4.44%, near the high for this week.

US Dollar Index Technical Analysis: Surge in volatility

The US Dollar Index (DXY) attempted to surge towards 105.00, though saw its rally stalling just ahead of the number. The move comes after markets got concerned when reading that several Fed members had issued concerns on current inflation levels in the recent Fed Minutes. Markets were disregarding the fact that these Minutes are already nearly a month old and in the meantime several data elements have proven that disinflation is back on track, which could mean that the DXY is set to ease further from here.

On the upside, the DXY Index has broken two technical elements which were keeping price action in check on the topside. The first level was the 55-day Simple Moving Average (SMA) at 104.78 and secondly that red descending trend line crossing at 104.79 on Wednesday . From now further up, the following levels to consider are 105.12 and 105.52.

On the downside, the 100-day SMA around 104.25 is the last man supporting the decline. Once that level snaps, an air pocket is placed between 104.11 and 103.00. Should the US Dollar decline persist, the low of March at 102.35 and the low from December at 100.62 are levels to consider.

US Dollar FAQs