- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(raw materials / closing price /% change)

Oil 64.47 +1.42%

Gold 1,341.00 +0.68%

(index / closing price / change items /% change)

Nikkei +307.82 24124.15 +1.29%

TOPIX +19.15 1911.07 +1.01%

Hang Seng +537.29 32930.70 +1.66%

CSI 300 +46.01 4382.61 +1.06%

Euro Stoxx 50 +7.01 3672.29 +0.19%

FTSE 100 +16.39 7731.83 +0.21%

DAX +95.91 13559.60 +0.71%

CAC 40 -6.73 5535.26 -0.12%

DJIA -3.79 26210.81 -0.01%

S&P 500 +6.16 2839.13 +0.22%

NASDAQ +52.26 7460.29 +0.71%

S&P/TSX +9.57 16357.55 +0.06%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2297 +0,30%

GBP/USD $1,3999 +0,08%

USD/CHF Chf0,95762 -0,45%

USD/JPY Y110,28 -0,58%

EUR/JPY Y135,63 -0,29%

GBP/JPY Y154,384 -0,50%

AUD/USD $0,7999 -0,22%

NZD/USD $0,7352 +0,35%

USD/CAD C$1,24187 -0,19%

00:30 Japan Manufacturing PMI (Preliminary) January 54.0 53.8

05:00 Japan Leading Economic Index (Finally) November 106.5 108.6

05:00 Japan Coincident Index (Finally) November 116.4 118.1

08:00 France Manufacturing PMI (Preliminary) January 58.8 58.7

08:00 France Services PMI (Preliminary) January 59.1 58.9

08:30 Germany Services PMI (Preliminary) January 55.8 55.6

08:30 Germany Manufacturing PMI (Preliminary) January 63.3 63.0

09:00 Eurozone Manufacturing PMI (Preliminary) January 60.6 60.6

09:00 Eurozone Services PMI (Preliminary) January 56.6 56.4

09:30 United Kingdom Average earnings ex bonuses, 3 m/y November 2.3% 2.3%

09:30 United Kingdom Average Earnings, 3m/y November 2.5% 2.5%

09:30 United Kingdom Claimant count December 5.9 5.4

09:30 United Kingdom ILO Unemployment Rate November 4.3% 4.3%

14:00 U.S. Housing Price Index, m/m November 0.5% 0.4%

14:45 U.S. Manufacturing PMI (Preliminary) January 55.1 55.0

14:45 U.S. Services PMI (Preliminary) January 53.7 54

15:00 U.S. Existing Home Sales December 5.81 5.7

15:30 U.S. Crude Oil Inventories January -6.861 -1.3

21:45 New Zealand CPI, y/y Quarter IV 1.9% 1.9%

21:45 New Zealand CPI, q/q Quarter IV 0.5% 0.4%

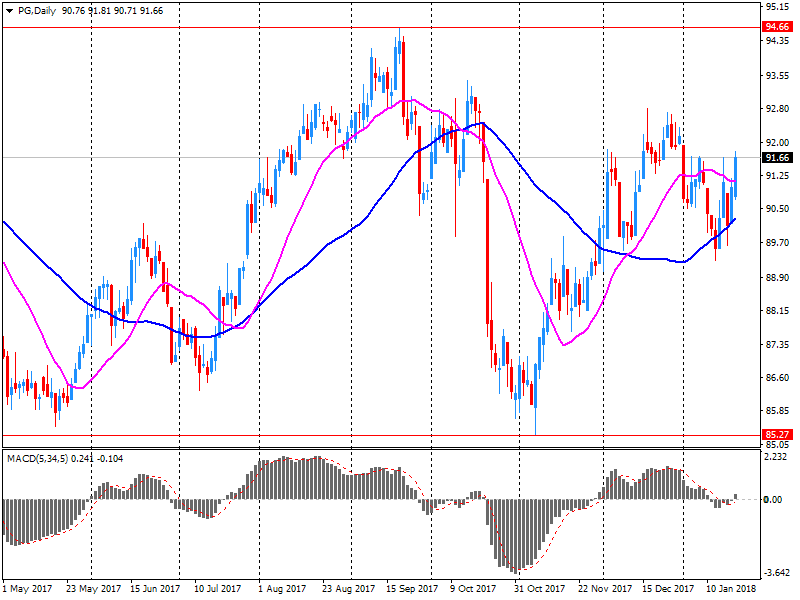

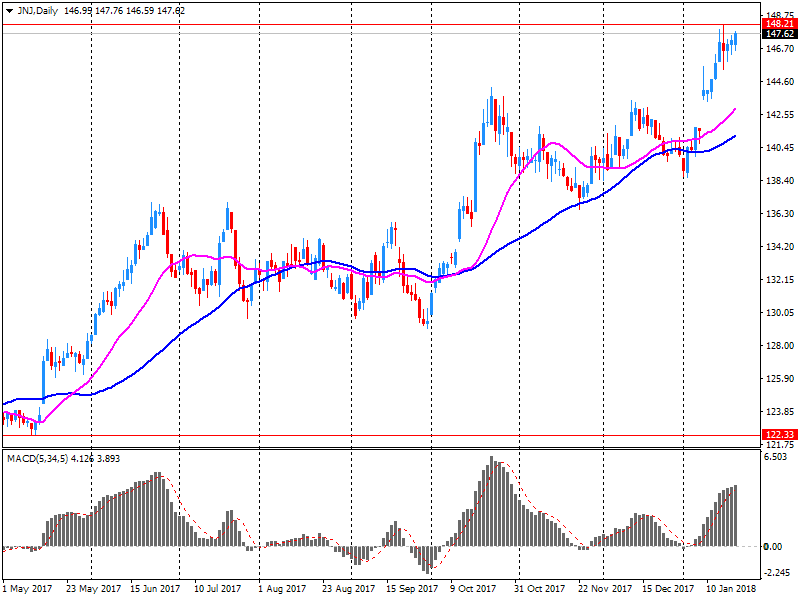

The main US stock indexes mostly rose on Tuesday, as optimistic results from Netflix (NFLX) stimulated the growth of the technology sector, while Dow was under pressure from the decline in shares of Johnson & Johnson (JNJ) and Procter & Gamble (PG).

In addition, a review by the Federal Reserve Bank of Richmond showed that activity of manufacturing firms in the Fifth Circuit slowed in January, despite the fact that each of the indicators remained positive. The composite index of business activity fell from 20 to 14. This decline was caused by a fall in the indicators of supply and employment. The third component, new orders, kept steadily. However, manufacturing firms were faced with an increase in unfulfilled orders in January, after a decline in December, as the index rose from -4 to 5.

Quotes of oil increased by more than 1.5% on Tuesday, supported by favorable prospects for world economic growth and expectations of further oil production constraints on the part of OPEC, Russia and their allies.

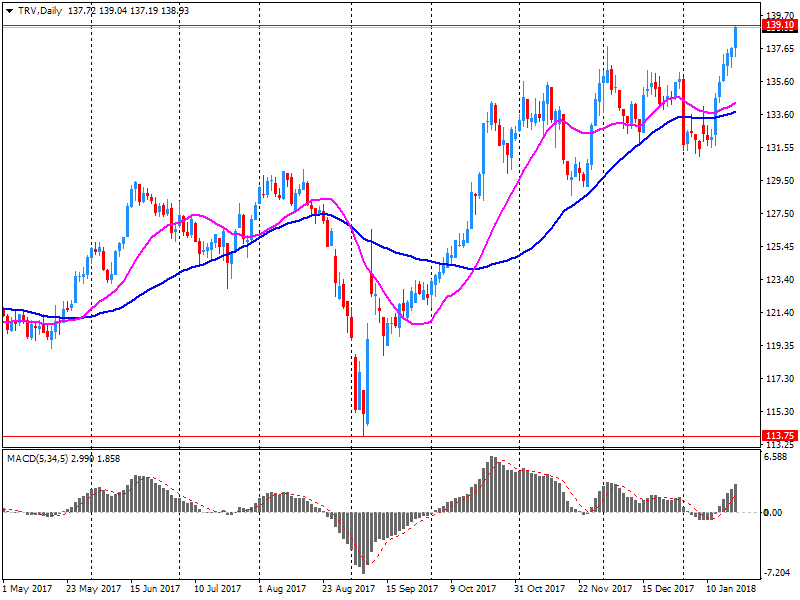

Most components of the DOW index finished trading in positive territory (17 out of 30). The leader of growth was the shares of The Travelers Companies, Inc. (TRV, + 4.66%). Outsider were shares of Johnson & Johnson (JNJ, -4.31%).

Almost all S & P sectors showed an increase. The conglomerate sector grew most (+ 0.9%). Nil change was recorded in the commodities sector, the health sector, and the consumer goods sector.

At closing:

DJIA -0.01% 26,210.81 -3.79

Nasdaq + 0.71% 7.460.29 +52.26

S & P + 0.22% 2.839.15 +6.18

U.S. stock-index futures were flat on Tuesday,following Monday's rally, which lifted stocks to new records.

Global Stocks:

текущий момент демонстрируют рост.

Nikkei 24,124.15 +307.82 +1.29%

Hang Seng 32,930.70 +537.29 +1.66%

Shanghai 3,546.98 +45.62 +1.30%

S&P/ASX 6,037.00 +45.10 +0.75%

FTSE 7,742.86 +27.42 +0.36%

CAC 5,545.51 +3.52 +0.06%

DAX 13,565.74 +102.05 +0.76%

Crude $64.16 (+0.93%)

Gold $1,336.30 (+0.33%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 248 | 0.70(0.28%) | 221 |

| ALCOA INC. | AA | 52.5 | -0.44(-0.83%) | 5328 |

| Amazon.com Inc., NASDAQ | AMZN | 1,335.20 | 7.89(0.59%) | 34519 |

| Apple Inc. | AAPL | 177.61 | 0.61(0.34%) | 139879 |

| AT&T Inc | T | 38.25 | 0.38(1.00%) | 37072 |

| Barrick Gold Corporation, NYSE | ABX | 14.55 | 0.04(0.28%) | 8250 |

| Boeing Co | BA | 338.49 | 0.49(0.15%) | 11909 |

| Caterpillar Inc | CAT | 172 | 1.11(0.65%) | 13599 |

| Chevron Corp | CVX | 132.84 | 0.28(0.21%) | 383 |

| Cisco Systems Inc | CSCO | 41.65 | -0.01(-0.02%) | 10015 |

| Citigroup Inc., NYSE | C | 78.4 | -0.19(-0.24%) | 19915 |

| Deere & Company, NYSE | DE | 169.88 | -0.50(-0.29%) | 203 |

| Facebook, Inc. | FB | 186.51 | 1.14(0.62%) | 124808 |

| Ford Motor Co. | F | 12.03 | 0.01(0.08%) | 34287 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.62 | -0.37(-1.85%) | 63817 |

| General Electric Co | GE | 16.31 | 0.14(0.87%) | 334801 |

| General Motors Company, NYSE | GM | 43.12 | -0.17(-0.39%) | 1195 |

| Goldman Sachs | GS | 259.25 | -2.27(-0.87%) | 9871 |

| Google Inc. | GOOG | 1,159.00 | 3.19(0.28%) | 6791 |

| Hewlett-Packard Co. | HPQ | 23.56 | -0.29(-1.22%) | 3971 |

| Home Depot Inc | HD | 204.89 | 0.43(0.21%) | 437 |

| HONEYWELL INTERNATIONAL INC. | HON | 158.55 | 0.01(0.01%) | 721 |

| Intel Corp | INTC | 45.97 | 0.22(0.48%) | 29328 |

| International Business Machines Co... | IBM | 162.73 | 0.13(0.08%) | 6304 |

| Johnson & Johnson | JNJ | 148.86 | 0.72(0.49%) | 73819 |

| JPMorgan Chase and Co | JPM | 114 | -0.33(-0.29%) | 6122 |

| McDonald's Corp | MCD | 175.7 | -0.51(-0.29%) | 6752 |

| Merck & Co Inc | MRK | 61.38 | 0.13(0.21%) | 778 |

| Microsoft Corp | MSFT | 91.8 | 0.19(0.21%) | 43031 |

| Nike | NKE | 66.11 | -0.28(-0.42%) | 564 |

| Pfizer Inc | PFE | 36.96 | 0.03(0.08%) | 7797 |

| Procter & Gamble Co | PG | 90.65 | -1.24(-1.35%) | 69667 |

| Starbucks Corporation, NASDAQ | SBUX | 61.3 | -0.11(-0.18%) | 3479 |

| Tesla Motors, Inc., NASDAQ | TSLA | 359.63 | 8.07(2.30%) | 91282 |

| Travelers Companies Inc | TRV | 141.5 | 2.15(1.54%) | 11455 |

| Twitter, Inc., NYSE | TWTR | 23.39 | 0.07(0.30%) | 33801 |

| United Technologies Corp | UTX | 135.9 | 0.69(0.51%) | 1904 |

| Verizon Communications Inc | VZ | 54.86 | 1.40(2.62%) | 1814900 |

| Visa | V | 124.89 | 0.56(0.45%) | 3827 |

| Wal-Mart Stores Inc | WMT | 106 | 0.55(0.52%) | 2436 |

| Walt Disney Co | DIS | 111.3 | 0.20(0.18%) | 6605 |

| Yandex N.V., NASDAQ | YNDX | 37.59 | -0.38(-1.00%) | 6200 |

Honeywell (HON) initiated with a Buy at UBS

3M (MMM) initiated with a Neutral at UBS

General Electric (GE) initiated with a Neutral at UBS

HP (HPQ) downgraded to Equal-Weight from Overweight at Morgan Stanley

Caterpillar (CAT) upgraded to Buy from Neutral at Seaport Global Securities

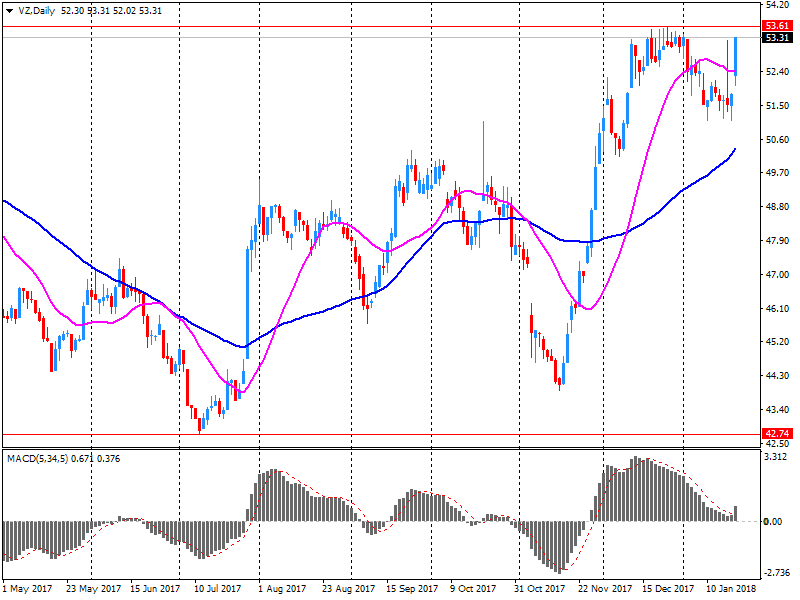

Verizon (VZ) reported Q4 FY 2017 earnings of $0.86 per share (versus $0.86 in Q4 FY 2016), missing analysts' consensus estimate of $0.88.

The company's quarterly revenues amounted to $33.955 bln (+2.2% y/y), beating analysts' consensus estimate of $33.198 bln.

The company also announced it expected its 2018 EPS and sales would grow at low-single-digit percentage rates.

VZ rose to $53.95 (+0.92%) in pre-market trading.

Travelers (TRV) reported Q4 FY 2017 earnings of $2.28 per share (versus $3.20 in Q4 FY 2016), beating analysts' consensus estimate of $1.42.

The company's quarterly revenues amounted to $7.451 bln (+3.6% y/y), beating analysts' consensus estimate of $6.466 bln.

TRV rose to $140.75 (+1.00%) in pre-market trading.

Procter & Gamble (PG) reported Q4 FY 2017 earnings of $1.19 per share (versus $1.08 in Q4 FY 2016), beating analysts' consensus estimate of $1.14.

The company's quarterly revenues amounted to $17.395 bln (+3.2% y/y), in-line with analysts' consensus estimate of $17.390 bln.

The company also announced it expected its 2018 EPS to increase by 5-8% y/y to ~$4.12-4.23 compared to earlier forecast growth of 5-7% y/y and analysts' consensus estimate of $4.17. At the same time, the 2018 revenues guidance was reaffirmed $67.0 bln (+3% y/y) versus analysts' consensus estimate of $67.12 bln.

PG fell to $90.45 (-1.57%) in pre-market trading.

Johnson & Johnson (JNJ) reported Q4 FY 2017 earnings of $1.74 per share (versus $1.58 in Q4 FY 2016), beating analysts' consensus estimate of $1.72.

The company's quarterly revenues amounted to $20.195 bln (+11.5% y/y), generally in-line with analysts' consensus estimate of $20.080 bln.

The company also issued guidance for FY 2018, projecting EPS of $8.00-8.20 (versus analysts' consensus estimate of $7.87) and revenues of $80.6-81.4 bln (versus analysts' consensus estimate of $80.71 bln).

JNJ rose to $149.50 (+0.92%) in pre-market trading.

The ZEW Indicator of Economic Sentiment for Germany climbed 3.0 points in January 2018, currently standing at 20.4 points. The indicator thus still remains slightly below the long-term average of 23.7 points. The assessment of the current economic situation in Germany increased by 5.9 points, with the corresponding indicator currently standing at 95.2 points.

Public sector net borrowing (excluding public sector banks) decreased by £6.6 billion to £50.0 billion in the current financial year-to-date (April 2017 to December 2017), compared with the same period in 2016; this is the lowest year-to-date net borrowing since 2007.

The Office for Budget Responsibility (OBR) forecasts that public sector net borrowing (excluding public sector banks) will be £49.9 billion during the financial year ending March 2018, an increase of £3.9 billion on the outturn net borrowing in the financial year ending March 2017.

-

Q4 loan demand rose in all categories

-

Banks expect net demand to rise for corporate loans, mortgages, consumer credit in q1

-

Banks see easing credit standards for all types of loans in q1

-

Q4 credit standards were unchanged for corporates, consumer credit; eased for mortgages

EUR/USD

Resistance levels (open interest**, contracts)

$1.2344 (4131)

$1.2320 (5520)

$1.2302 (3098)

Price at time of writing this review: $1.2247

Support levels (open interest**, contracts):

$1.2187 (2067)

$1.2156 (1702)

$1.2120 (2085)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 115452 contracts (according to data from January, 22) with the maximum number of contracts with strike price $1,1850 (7086);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4071 (2265)

$1.4055 (1642)

$1.4034 (2994)

Price at time of writing this review: $1.3968

Support levels (open interest**, contracts):

$1.3894 (304)

$1.3867 (226)

$1.3836 (456)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 37676 contracts, with the maximum number of contracts with strike price $1,3600 (3482);

- Overall open interest on the PUT options with the expiration date February, 9 is 32649 contracts, with the maximum number of contracts with strike price $1,3400 (3057);

- The ratio of PUT/CALL was 0.87 versus 0.81 from the previous trading day according to data from January, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Need to maintain strong monetary easing

-

Still some distance to meeting inflation target

-

See no need to change etf purchases

-

No need to change joint statement between govt, BoJ

-

No need to change 2 pct price target

-

Keeps monetary policy steady, rate decision stays flat at -0.1 % (fcast -0.1 %) vs prev -0.1 %

-

Will maintain qqe with yield curve control for as long as needed to stably hit 2 pct inflation

-

Risks to economy roughly balanced

-

Board member Kataoka says BoJ should buy jgbs so yields of bonds with maturities of 10 years or longer fall broadly

-

Inflation likely to continue increasing towards 2 pct

-

Momentum for hitting 2 pct inflation is maintained but lacks strength

-

Cpi accelerating but moves remain weak

-

Inflation expectations and job market pose both upside, downside risks

-

Japan's economy expected to expand moderately

Europeans stocks pushed higher Monday, with Spanish and Greek shares gaining in the wake of sovereign ratings upgrades and closing at a 5-month and almost three-year highs, respectively. The Stoxx Europe 600 index SXXP, +0.31% ended up 0.3% at 402.11, closing at its highest since August 2015. Last week, the pan-European gauge rose for a third consecutive week.

U.S. stock-market indexes closed at records on Monday after the Senate approved a procedural bill that would allow the government to end a multiday shutdown. The S&P 500 SPX, +0.81% rose 22.67 points, or 0.8%, to 2,832.97. The tech-heavy Nasdaq Composite index COMP, +0.98% advanced 71.65 points, or 1%, to 7,408.03, largely fueled by gains in biotech shares.

Most Asian stock markets rose further Tuesday morning, with strong U.S. earnings lifting investor confidence. Major stock indexes in Japan, Hong Kong and South Korea SEU, +0.98% rose as much as 1% by midday after the U.S. Congress voted to end a government shutdown.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.