- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- The EUR/GBP made a late-week break for the 0.87 handle.

- The Pound Sterling continues to give up ground after a dovish BoE shrank from rate hikes,

- EU PMI figures came in mixed, keeping Euro gains restrained.

The EUR/GBP stretched for the 0.8700 major handle in Friday trading, closing the week with over a full percent of upside gains with the Euro (EUR) seeing its best trading week against the Pound Sterling (GBP) since early February.

BoE balks on rate hike, EU Manufacturing PMI misses the mark

The Bank of England (BoE) pulled back from a broadly-anticipated rate hike this Thursday after inflation figures for the UK economy came in broadly lower than expected. The UK central bank is seeing inflation fall away faster than previously expected, and the BoE is set to see a "none and done" end to the rate hike cycle.

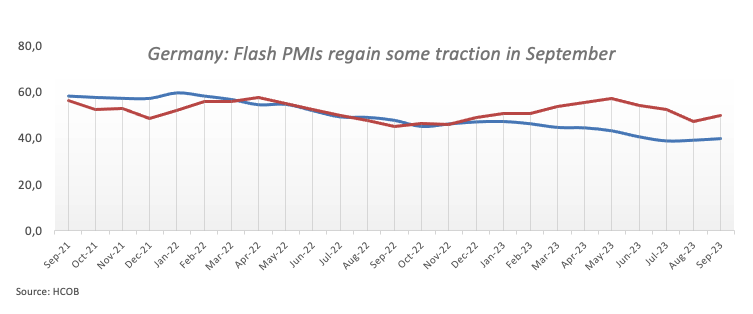

Eurozone Purchasing Manager Index (PMI) figures came in mixed early Friday, with the headline Composite PMI for September printing at 47.1, reversing the forecast decline 46.5 and climbing further from the previous period's 46.7.

The underlying components were less positive, leaving the Euro with limited upside following the release.

The EU Services PMI printed at 48.4, well above the forecast 47.7 and improving from the previous 47.9.

The Manufacturing component flubbed market forecasts, printing a disappointing 43.4, ticking down from the previous 43.5 and entire missing the market's expected improvement to 44.0.

Read more:

BoE holds interest rate steady at 5.25% in split vote

Eurozone Preliminary Manufacturing PMI unexpectedly falls to 43.4 in September vs. 44.0 expected

Next week is particularly anemic for both the Euro and the Pound Sterling, though next Friday will be seeing Gross Domestic Product (GDP) figures for the UK, to be closely followed by Consumer Index Price (CPI) numbers for the Eurozone.

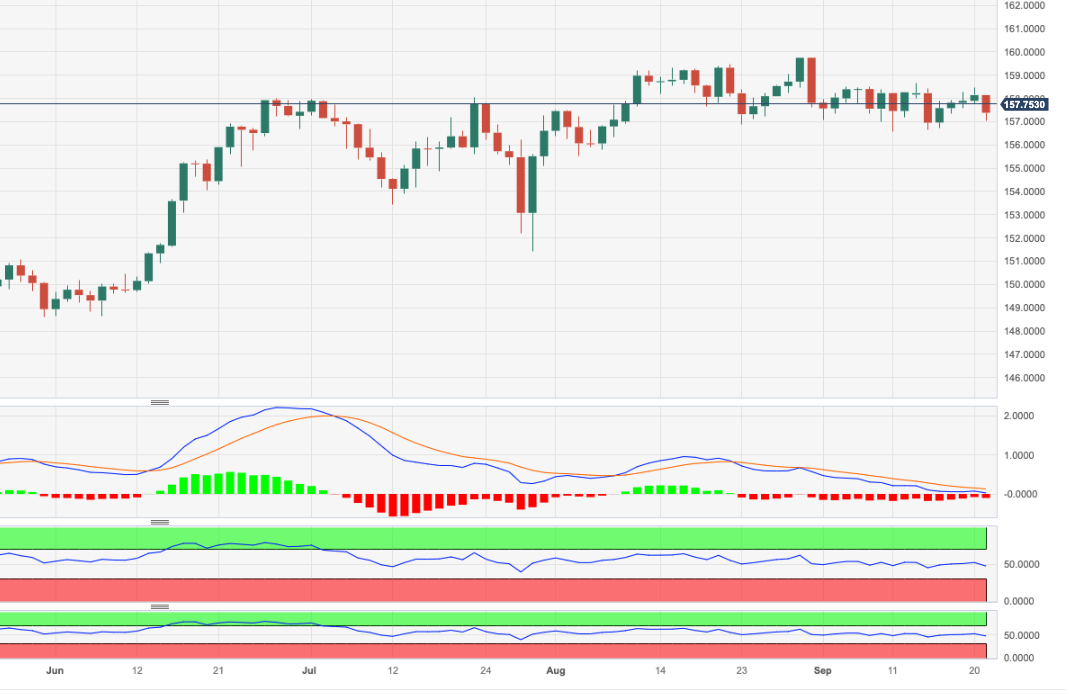

EUR/GBP technical outlook

The EUR/GBP managed to etch in another gainer week, coming within sight of the 200-day Simple Moving Average (SMA) currently treading water near 0.8720.

The pair has accelerated cleanly through the descending trendline from July's swing high into the 0.8700 handle, and continued buying pressure will see the pair mount the psychological level and stage further gains.

On the downside, immediate technical support is coming from the 100-day SMA, currently turning bullish from 0.8600, and the bottom of recent consolidation is sitting further below near 0.8520.

EUR/GBP daily chart

EUR/GBP technical levels

- S&P 500 concluded the week at 4,320.06, marking a 0.23% daily and a 3.02% weekly drop, reaching levels last seen in June, with Nasdaq and Dow Jones also incurring losses

- Federal Reserve’s decision to hold rates but revise upward projections for the Federal Funds rate for 2023 and 2024 spurred a sharp reaction in financial markets.

- Sector-wise, Technology and Energy emerged as gainers, while Consumer Discretionary, Financials, and Real Estate were the laggards.

Wall Street finished the week on a lower note, mixed with the S&P 500, the Nasdaq, and the Dow Jones printing losses. Additionally, US equities plunged, led by the S&P 500 dropping to levels last seen in June.

S&P 500 plunges weekly, Nasdaq and Dow follow suit, as markets react to Federal Reserve’s upward revision of Federal Funds Rate projections

The S&P finished Friday’s session at 4,320.06, dropping 0.23%, but plunged -3.02% weekly. The heavy-tech Nasdaq edged lower by a minimal 0.09% and sank 3.21% weekly, while the Dow Jones Industrial dived 0.31% at 33,963.84 and slumped -1.89% in the week.

Sector-wise, the biggest gainers were Technology and Energy, each gained 0.26% and 0.15%. The laggards were Consumer Discretionary, Financials, and Real Estate, erasing from its value 0.87%, 0.74%, and 0.72%, respectively.

During the week, the Federal Reserve held the sixth monetary policy meeting, in which the US central bank decided to hold rates but upward revised their projections to the Federal Funds rate (FFR). For 2023, policymakers expect the FFR to end at 5.60%; for 2024, they increased their estimates from 4.6% to 5.1%.

The data spurred an aggressive reaction in the financial markets, with US equities plummeting sharply after hitting fresh weekly highs. US Treasury bond yields touched 16-year highs, led by 2s, 5s and 10s. Nevertheless, as traders booked profits before the weekend, US bond yields retraced, though they failed to undermine the Greenback.

Data-wise, S&P Global announced the final PMI readings in the United States (US). Manufacturing PMI improved to 48.9 but stood at recessionary territory. Contrarily, Services and Composite PMI showed signs of losing steam, though it expanded but continued to aim towards the 50 expansion/contraction threshold.

US Treasury bond yields finished the session with the 10-year benchmark note rate at 4.36%, lost 1.33%. The Greenback, as shown by the US Dollar Index, ended positively, climbing 0.19% to 105.58.

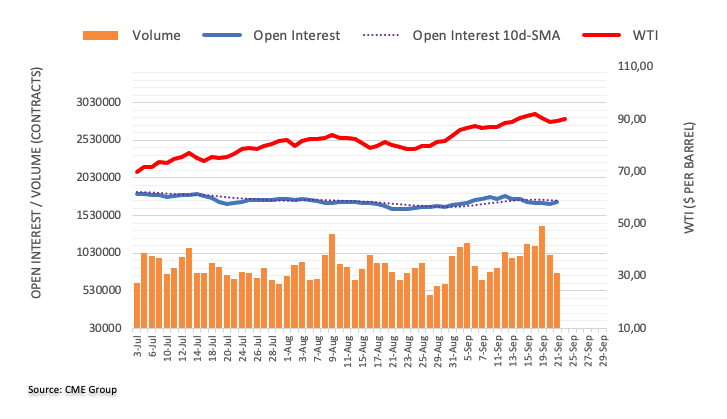

WTI rose by 0.85% daily in the commodity space underpinned by tight supply concerns stemming from Russia’s fuel export ban.

S&P 500 Price Action – Daily Chart

S&P 500 Technical Levels

- The USD/CAD is recovering for Friday after slipping to 1.3425.

- Rising oil prices are bolstering the CAD, but the USD has been finding market support.

- Canadian Retail Sales rose for July, but slightly less than expected, reducing CAD upside.

The USD/CAD is set to finish out Friday near where it started, trading just south of 1.3490.

The Loonie (CAD) has twisted through the back half of the trading week, with the CAD and (Greenback) playing tug-of-war.

Rising oil prices have been boosting the CAD lately, but a break in crude gains sees the USD/CAD testing back into recovery territory.

Canadian Retail Sales rose 0.3% in July, slightly below market expectations of 0.4% but an improvement on the previous month's -0.7%, which was revised upwards from -0.8%.

Core Retail Sales (retail sales figures less automobiles) rose 1% for the same period, breezing past analyst forecasts of 0.5%.

On the US side, Purchasing Manager Index (PMI) figures came in mixed, seeing a brief slip in the US Dollar but capping off the potential for a determined move in either direction for the USD.

The preliminary US S&P Global Manufacturing PMI for September climbed to 48.9 against the expected 48, easily clearing expectations. The Services PMI component slipped analyst forecasts, dipping to 50.2 and reversing the expected improvement to 50.6.

Read more:

US S&P Global Manufacturing PMI improves to 48.9, Services PMI declines to 50.2 in September

The economic calendar is on the thin side for next week, but investors will be keeping one eye out for US Durable Goods Orders next Wednesday. Markets are expecting durable goods orders for August to print at -0.4%, a declining figure but still an improvement from the previous period's 5.2% decline.

USD/CAD technical outlook

The USD/CAD is trying to recover from near-term lows into 1.3380, and is seeing the 200-hour Simple Moving Average (SMA), currently capping off intraday action from 1.3500.

The pair is 1.6% down from September's peak just below the 1.3700 handle.

Daily candlesticks sees the USD/CAD stuck into the 200-day SMA, and market sentiment could flow in either direction moving forward.

USD/CAD daily chart

USD/CAD technical levels

- USD/CHF is on a bullish trajectory, ending the week with over 1% gains,

- Pair is eyeing the 0.9100 mark, with a breach potentially exposing the May 31 cycle high at 0.9147, following a rally to the March 16 daily high at 0.9340.

- Key support levels for sellers include the 200-DMA and the 0.9000 mark; breaching these could lead to a test of the September 20 daily low at 0.8931.

USD/CHF is set to end the week with decent gains of more than 1%, while breaking above the 200-day moving average (DMA), which could open the door for further upside, with buyers eyeing a new cycle high. Therefore, the pair is trading at 0.9071, edges up 0.30% late in the New York session.

The daily chart portrays the pair extending its gain past the 0.9032 (200-DMA), and puts a challenge of the 0.9100 figure into play. A breach of the latter will expose the May 31 cycle high at 0.9147, which, if cleared, the USD/CHF could rally back to the March 16 daily high at 0.9340.

Conversely, sellers would face the 200-DMA and the 0.9000 mark. Those two levels hurdled, and the USD/CHF would dive and test the September 20 daily low of 0.8931 before testing the 0.8900 figure.

USD/CHF Price Action – Daily chart

USD/CHF Key Technical levels

- The GBP/USD tumbled on a dovish BoE on Thursday.

- Mixed PMIs for the US saw the USD take a step back, but Pound Sterling traders couldn't capitalize.

- UK Retail Sales missed the mark, keeping the GBP in a bearish stance.

The GBP/USD is looking for further downside to end the trading week, probing chart space below 1.2250 heading into the final hours of Friday's trading session.

The UK's Bank of England (BoE) came in dovish this week after British inflation came in much lower than previously anticipated. The BoE held its benchmark rate at 5.25%, waffling on a market-expected 25-basis-point increase to 5.5%.

UK Retail Sales on Friday missed expectations, printing at 0.4%. The figure rebounded from the previous reading of -1.1%, but failed to capture the market forecast of 0.5%.

UK Purchasing Manager Index (PMI) figures mixed towards the downside, capping any upside potential for the Pound Sterling (GBP).

The preliminary UK S&P Global/CIPS Composite PMI for September declined to 46.8, missing the expected increase to 48.7. The previous month's PMI came in at 48.6.

The manufacturing component of the UK PMI came in better than expected at 48.9 versus the forecast 48.0, but the services sector PMI declined to 47.2 compared to the forecast 49.2.

On the US side, PMIs also came in mixed. The composite ticked lower to 50.1 from 50.2. The manufacturing PMI jumped to 48.9 from the previous 47.9, while the services component slipped to 50.2 from 50.5 and walking back the expected uptick to 50.6.

Read more:

BoE holds interest rate steady at 5.25% in split vote

UK Preliminary Services PMI declines to 47.2 in September vs. 49.5 expected

US S&P Global Manufacturing PMI improves to 48.9, Services PMI declines to 50.2 in September

GBP/USD technical outlook

The Pound Sterling continues to struggle against the US Dollar, with the GBP/USD down almost 1.5% from the week's high near 1.2425.

The pair briefly pierced the 100-hour Simple Moving Average (SMA) on Wednesday but has fallen to the downside, now trading beneath the 34-hour Exponential Moving Average (EMA) currently drifting to the low side of 1.2280.

Daily candlesticks have the GBP/USD piercing the 200-day SMA just above 1.2400, and continued downside will see the pair set to challenge six-month lows, with little technical support between current prices and 2023's lows near 1.1825.

GBP/USD daily chart

GBP/USD technical levels

- Gold prices see a recovery, achieving gains of 0.25%, driven by a reversal in US bond yields, with the 10-year note coupon dropping from a 16-year high of 4.51% to 4.44%.

- Federal Reserve officials express a cautious stance, emphasizing the need for patience despite the necessity for further rate hikes to control inflation.

- The US Dollar Index (DXY) continues to print modest gains, sitting at 105.56, potentially impacting gold’s rally, with

- Next week, US data includes Consumer Confidence, Durable Goods Orders, and Initial Jobless Claims to provide further direction.

Gold price recovers some ground after hitting a weekly low of $1913.99, though it remains shy of breaking solid resistance at around the 50-day moving average (DMA) at $1929.79. Factors like dropping US T-bond yields and an upbeat market sentiment drive XAU/USD’s price toward the current spot at $1924.56, achieving gains of 0.25%.

Gold price nudges upwards despite a firm US Dollar

XAU/USD prices is being driven up by the reversal in US bond yields. The US 10-year benchmark note coupon reversed from a 16-year high of 4.51% towards 4.44%. Consequently, US real yields are edging lower from five basis points from 2.11% to 2.06%.

In the meantime, Federal Reserve officials had turned cautiously, led by Boston and San Francisco Fed Presidents Susan Collins and Mary Daly, stressing that although inflation is cooling down and further rate hikes would be needed, the Fed must be patient. Fed Governor Michelle Bowman commented that more increases are needed to control inflation.

Data-wise, S&P Global announced the final PMI readings in the United States (US). Manufacturing PMI improved to 48.9 but stood at recessionary territory. Contrarily, Services and Composite PMI showed signs of losing steam, though it expanded but continued to aim towards the 50 expansion/contraction threshold.

Meanwhile, the US Dollar Index prints modest gains of 0.17%, stalling Gold’s rally. The DXY sits at 105.56, set to print solid gains for the tenth straight week.

On the US front, Consumer Confidence, Durable Goods Orders, Initial Jobless Claims, and the Fed’s preferred gauge for inflation the core PCE.

XAU/USD Price Analysis: Technical outlook

From a technical standpoint, the XAU/USD is set to continue to trade sideways, within the $1913-$1948 range, with most daily moving averages (DMAs) hovering around the current exchange rate. However, as the yellow metal remains below the 200-DMA, which sits at $1926.24, the path of least resistance is tilted to the downside. First support would be the September 21 low of $1913.99, followed by the September 14 $1901.11 swing low. Conversely if the non-yielding metal surpass the 100-DMA at $1941.86, a challenge of the $1950 mark is expected.

- GBP/JPY trading into the 181.50 handle, on the low side for the week.

- The Pound Sterling lost ground across the board this week after a dovish twist from the BoE.

- The BoJ continues to maintain their easy monetary policy stance.

The GBP/JPY is ticking into the south side of the 181.50 handle after the Pound Sterling (GBP) failed to recover any meaningful ground from Thursday's backslide. The Guppy is down almost a full percentage point this week.

The Bank of England (BoE) struck a notably dovish tone this Thursday, standing pat on its benchmark interest rate after inflation data for the UK came in much softer than expected earlier this week. The BoE is holding its reference rate at 5.25% for the time being, and it's increasingly looking like a 'none and done' scenario for the UK's rate hike cycle.

The Bank of Japan (BoJ) also held its main policy rate, maintaining a negative rate regime at -0.1%. The BoJ is keeping steady on its hyper-easy monetary policy mechanisms, and the BoJ is determined to try and keep Japanese inflation up above the 2% mark.

Japanese inflation is currently riding on the high end of policymakers' target level, but Japanese inflation is broadly expected to plummet in the coming months, and the BoJ is not in a rush to start reversing their negative rate policy until the central bank is assured that inflation will remain above their minimum target.

Read more:

BoE holds interest rate steady at 5.25% in split vote

BoJ’s Ueda: Could consider policy change when achievement of 2% inflation is in sight

The economic calendar for the upcoming week is looking sparsely-populated through the first half of the week, and the only notable release on the data docket will be the BoJ's meeting minutes on Tuesday, which will reveal the Japanese central bank's inner monologue on the interest rate decision that just passed.

GBP/JPY technical outlook

The GBP/JPY failed to hold onto rebound gains, etching in a high of 182.30 on Friday before settling lower, looking to establish a break of 181.50 to close out the week's trading session.

The pair remains firmly bearish below the 200-hour Simple Moving Average (SMA) which is currently pricing in resistance from 183.00.

Daily candlesticks see the Guppy waffling towards the 100-day SMA near the 180.00 major handle, and the pair is down almost 3% from August's peak near 186.70.

Investors will be keeping an eye out for a sustained bearish push into the 100-day SMA, where a recovery rally could see a rebound back into the 34-day Exponential Moving Average that is currently capping off upside potential and sitting just north of near-term highs near 183.30.

GBP/JPY daily chart

GBP/JPY technical levels

- AUD/USD is up 0.51%, benefiting from the overall weakness of US Dollar.

- Despite hawkish remarks from various Fed officials, the US Dollar remains subdued, with the DXY showing modest gains at 105.55.

- Solid PMIs in Australia and considerations of rate hikes by the RBA support the AUD.

- Key economic data scheduled for release next week, including Consumer Price Index and Retail Sales for Australia, and Consumer Confidence and Durable Goods Orders for the US.

The Australian Dollar (AUD) stages a comeback versus the Greenback (USD) on Friday, and it remains set to finish the week with decent gains. Overall US Dollar weakness, along with investors seeking risk, and dropping US Treasury bond yields, are the reasons behind the buck’s reaction. Hence, the AUD/USD is posting gains of 0.51%, trading at 0.6448 once the pair bounced off the 0.6403 low.

Aussie Dollar gains traction as business activity in the US takes a hit, US bond yields retreat

S&P Global revealed that business activity in the United States (US) remains subdued, failing to gather momentum, instead decelerating. Manufacturing PMI, despite improvement, remained below the 50 threshold that divides expansion from contraction, while the Services and Composite PMIs, clung to expansionary territory, despite printing lower readings compared to August.

Aside from this, Federal Reserve officials remained hawkish, led by Fed Governor Michell Bowman saying more rate hikes are needed, while Susan Collins called for patience. Recently, San Francisco Fed President Mary Daly noted that the gradual rebalancing of labor market data is good news, but more is needed to determine further policy tightening. She echoed Collins's words that “Patience is a good strategy.”

That said, the Greenback continues to print modest gains as shown by the US Dollar Index (DXY) at 105.55, gains 0.16%. Nevertheless, traders booking profits seem the reason behind the AUD/USD’s strength, alongside the recent economic data revealed on the Aussie’s side.

PMIs in Australia were solid, showing a slight improvement compared to August PPMIs, particularly the Composite one. The Index rose by 50.2, crushing estimates of 47, boosted by the jump in the Services segment, while manufacturing activity continued to deteriorate. That alongside the Reserve Bank of Australia’s (RBA) monetary policy minutes showed the central bank considered hiking rates in September, cushioned the AUD/USD pair's fall, past the current week’s low of 0.6385.

For the next week, tier 1 data would feature on the Australia side the Consumer Price Index (CPI) monthly, Retail Sales, and Housing Credit. On the US front, Consumer Confidence, Durable Goods Orders, Initial Jobless Claims, and the Fed’s preferred gauge for inflation, the core PCE.

AUD/USD Price Analysis: Technical outlook

The AUD/USD remains consolidated at around the year's lows, unable to record a new cycle high, which could trigger a rally. However, a triple-bottom chart pattern is emerging, suggesting that further upside is expected. If the pair crosses the confluence of the 50-day moving average (DMA) and the latest swing high of August 30 at 0.6522, that could confirm its validity. The next resistance would be the 0.6600 figure, followed by the 200-DMA and the triple-top objective at 0.6695. Conversely, if price action remains subdued and drops below 0.6400, a re-test of the YTD low at 0.6357 is on the cards.

Next week, markets will continue to digest the outcomes of recent central bank meetings. Additionally, market participants will closely monitor the release of economic data, with a particular focus on inflation figures from the Eurozone and the US Core Personal Consumption Expenditure (PCE) index.

Here is what you need to know for next week:

The US Dollar Index recorded its tenth consecutive weekly gain, ending around 105.50. The DXY continues to trend upward, supported by US economic data and the recent Federal Reserve (Fed) meeting.

During the FOMC meeting, interest rates were left unchanged in the range of 5.25% to 5.50%. In terms of macroeconomic projections, most members still see the possibility of further rate hikes later this year. Economic data in the US showed mixed results, with housing data coming in weaker while Jobless Claims dropped to the lowest level since January.

Next week, the key focus in the US will be on Friday's release of the Fed's preferred measure of consumer inflation, the Core Personal Consumption Expenditure (PCE) Price Index. It is expected to show a decline from an annual rate of 4.2% to 3.9%. The third estimate of Q2 GDP will be released on Thursday.

The Japanese yen was among the worst-performing major currencies. The Bank of Japan (BoJ) left its monetary policy unchanged at the September meeting, with Governor Ueda stating that any change would only occur when the achievement of 2% inflation is in sight. Japan will release several economic indicators next Friday, including the Tokyo Consumer Price Index, Unemployment Rate, Industrial Production, Retail Sales, Consumer Confidence, and household spending for August. However, the focus will remain on the potential intervention from Japanese authorities to curb the yen's weakness. USD/JPY reached its highest level in decades above 148.00, supported by higher US yields and the BoJ's policy stance.

The British Pound lagged following the Bank of England's decision to keep interest rates unchanged after a slowdown in inflation in August. Next Friday, the UK will release a new estimate of Q2 GDP growth. GBP/USD declined for the third consecutive week, reaching its lowest level since March at 1.2232, before closing around 1.2260. The pair has strong support around 1.2200. EUR/GBP surged from below 0.8600 to 0.8700, marking its biggest weekly gains since February.

EUR/USD finished the week near 1.0650 after hitting fresh monthly lows at 1.0614. The Eurozone PMI provided some relief with a rebound on Friday. Inflation data will be crucial next week, with Spain and Germany kicking off with CPI on Thursday, followed by France, Italy, and the Eurozone on Friday.

The Swiss franc lost ground against major currencies after the Swiss National Bank (SNB) left its key interest rate unchanged at 1.75%. The Swissy was also influenced by the dovish stance of the European Central Bank. USD/CHF accelerated to the upside, breaking decisively above 0.9000 to its highest level since June. EUR/CHF surged from around 0.9550 to 0.9660.

AUD/USD continued to trade within a range between 0.6500 and 0.6350. Australia will release the Monthly Consumer Price Index on Wednesday, with the annual rate expected to rebound from 4.9% in July to 5.2% in August. Retail sales data will be released on Thursday.

The New Zealand Dollar was the best-performing major currency during the week. NZD/USD gained almost 1%, rising to 0.5975 but was unable to reclaim the 0.6000 level.

On a volatile week for metals market, Gold ended the week flat around $1,925 after recovering ground on Friday. Silver remained above $23.00 and closed around $23.50.

Like this article? Help us with some feedback by answering this survey:

- EUR/USD spends Friday trading into familiar territory.

- US PMIs kept the USD capped with a mixed print.

- USD on track to close out with weekly gains, but capped for the end of the week.

The EUR/USD is trading into neutral ground heading into the end of the trading week, testing well-trodded ground near the 1.0660 handle.

US Purchasing Manager Index (PMI) figures came in off-kilter, triggering a soft walkback for the Greenback (USD) during the Friday trading session, but keeping losses limited to intraday boundaries.

European PMI figures earlier on Friday saw the Euro (EUR) ease back after an unexpected drop, with the manufacturing component printing at 43.4 versus the forecast 44.0.

The US Manufacturing PMI printed above expectations at 48.9 for September, compared to 47.9 for August, but the Services PMI component fell back to 50.2, reversing the market forecast increase to 50.6.

Read more:

Eurozone Preliminary Manufacturing PMI unexpectedly falls to 43.4 in September vs. 44.0 expected

US S&P Global Manufacturing PMI improves to 48.9, Services PMI declines to 50.2 in September

EUR/USD corkscrews on PMIs that disappoint on both sides of the pond

The economic calendar looking forward is notably thin for the first half of next week, though traders will want to keep at least one eye on US Consumer Confidence on Tuesday, as well as Wednesday's Durable Goods Orders.

Market analysts see Durable Goods Orders for August slipping back only 0.4% after the previous reading of -5.2%.

EUR/USD technical outlook

The Euro has been cycling the 1.0660 level but has so far been unable to meaningfully mount the technical level, and is pacing familiar territory to close out the trading week.

The EUR/USD fell to a Friday low of 1.0615 but recovered to the top side near Friday's peak just north of 1.0670.

Hourly candles see the EUR/USD trading just south of the 200-hour Simple Moving Average (SMA) near 1.0685.

On the daily candlesticks, the Euro is decidedly bearish, continuing to decline through the 200-day SMA and down almost 5.5% from July's peak near 1.1275.

The 34-day Exponential Moving Average (EMA) is set to confirm a bearish cross of the 200-day SMA, and investors might be looking out for a relief rally to a major technical level before resuming another leg down.

EUR/USD daily chart

EUR/USD technical levels

Federal Reserve Bank of San Francisco President Mary C. Daly said on Friday that the Fed kept interest rates unchanged this week in recognition that “we are closer to our destination”. She added that inflation is coming down, and the labor market is gradually adjusting.

Regarding interest rates, Daly mentioned that they do not know if they need to hold interest rates at their current level or introduce more monetary tightening.

Market reaction

The US Dollar Index is holding onto weekly gains, hovering around 105.45, after being unable to consolidate above 105.50.

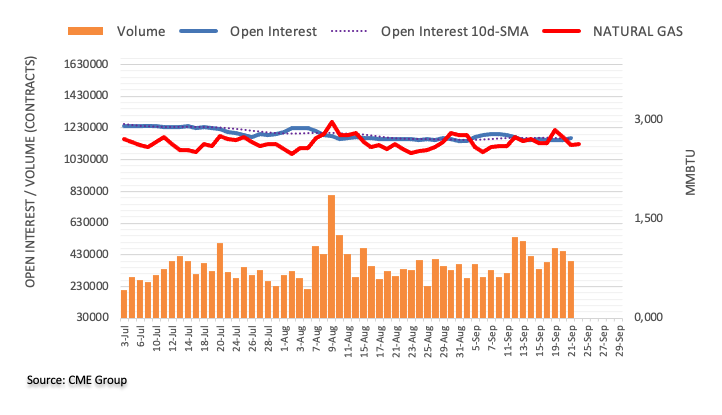

- WTI is strung up near $89.00/bbl after slipping off of recent highs.

- US crude barrels briefly saw $92.00 in the midweek on continuing supply concerns.

- Price pressures have eased heading into the weekend, but prices are set to continue rising.

West Texas Intermediary (WT) US crude oil is struggling to hold onto the $90.00 price level as Friday trading leaves crude oil barrels trading mostly flat for the day, briefly piercing the major handle before falling back to near where the day's trading began.

Crude oil prices are seeing strong support looking forward, with global supply set to leave oil demand chronically undersupplied for the near future.

WTI US crude oil prices are up over 11% on the year, and have gained nearly 40% from the year's low at $64.31.

Market analysts broadly expect crude barrels to reach $100 in the future as global reserves of crude barrels dwindle away in what some experts calculate to be a 2 million bpd deficit in global production.

Ongoing production cuts to buoy crude prices towards the upside

Saudi Arabia and Russia have extended production cuts worth a combined 1.3 million bpd through the end of the year, bolstering prices across the globe and sending production facilities into a buying frenzy to eat up the expanded margins on oil accumulation, further constraining available supply.

WTI technical outlook

US crude oil has closed in the green for ten of the last twelve months. Daily candles see crude prices well above technical support, with the 200-day Simple Moving Average (SMA) near $77.00, well below current price action.

A rising trendline from late June's lows near $67.00 remains in place, and bullish momentum is currently running far away from the technical pattern.

The Relative Strength Index (RSI) and Moving Average Convergence-Divergence (MACD) indicators are both firmly planted in overbought territory, and it will take a significant profit-taking reversal to recover the indicator patterns.

WTI daily chart

WTI technical levels

- USD/MXN edges lower by 0.48% on positive market sentiment and a weakened US Dollar.

- Despite hawkish remarks from Fed officials, the US Dollar remains under pressure, with the DXY marking minimal gains at 105.45.

- Upcoming political developments and potential credit rating revisions in Mexico may affect the Peso's trajectory.

The emerging market currency the Mexican Peso (MXN) counterattacks the US Dollar (USD) after the exotic pair reached a weekly high of 17.2489, but it has trimmed those gains. At the time of writing, the USD/MXN changes hands at 17.1478, down 0.48%.

MXN strengthens to 17.1400ish on soft US Dollar due to a drop in US Treasury bond yields

Market sentiment remains positive, as shown by US equities trading with gains. Business activity in the United States (US) presented minuscule changes as revealed by S&P Global, with Manufacturing activity improving but standing in recessionary territory. Although expanded, the Services and Composite PMIs portrayed the country's economic slowdown.

Federal Reserve’s officials had been unleashed on the central bank space, led by the Boston Fed President Susan Collins. She suggested the possibility of further tightening while emphasizing the need for patience. Fed Governor Michell Bowman strongly determined that more rate hikes are necessary to control inflation.

Despite US central bank policymakers' hawkish rhetoric, the buck stands pressured. The US Dollar Index (DXY), which tracks the buck’s value vs. a basket of six currencies, prints minimal gains of 0.07%, at 10.45. Plunging US Treasury bond yields are a headwind for the USD/MXN, while also a tranche of upbeat Mexican data, supported the Peso.

Inflation in Mexico slowed down for the first half of September, hitting 4.44% YoY, down from 4.64% in August, below 4.46% forecasts. At the same time, the core Consumer Price Index rose 5.78%, above estimates of 5.76% YoY, but below August’s 6.21%. It should be said the Bank of Mexico (Banxico) held rates unchanged at 11.25% in the latest monetary policy meeting and emphasized the need to hold rates for a long period of time.

Given the backdrop, further USD/MXN downside is expected but capped around the 17.0000 figure. Traders should know about political developments, as Mexico is headed for general elections. That, alongside the latest economic budget beginning to generate worries about a revision of the country’s credit rating, can weigh on the Mexican Peso.

USD/MXN Price Analysis: Technical outlook

Although the USD/MXN pair is set to finish the week with gains, price action has failed to achieve a new cycle high, with buyers eyeing the September 7 high at 17.7074. A breach of that level could open the door to test the 18.0000 figure, but it must reclaim the 100-day moving average (DMA) at 17.1888. On the downside, the pair’s fall is cushioned by the 50-DMA at 17.0302, before challenging 17.0000.

- The USD/JPY is seeing recovery on Friday into the top end of the week's trading.

- The BoJ maintained its negative rate policy regime, as markets broadly expected.

- US PMIs came in mixed, capping any decisive moves for the Greenback.

The USD/JPY is set to close out the trading week just south of the 148.50 level after peaking at an intraday high of 148.40 as the US Dollar (USD) covers its bids on a mixed Purchasing Manager Index (PMI) reading.

The Bank of Japan (BoJ) kept the bottom band of its main policy rate at -0.1% early on Friday, which shook off some bullish momentum for the Yen (JPY).

Read more:

BoJ’s Ueda: No change to way of policy decision making process

US S&P Global Manufacturing PMI improves to 48.9, Services PMI declines to 50.2 in September

Yen bulls found little love from the BoJ on Friday as the Japanese central bank reaffirmed its easy monetary policy stance until they see Japanese inflation maintaining 2% "in a stable manner". Inflation in the Japanese economy is on the high end for the time being, but price growth is expected to decline appreciably in the coming months, and the BoJ continues to be far off of a hawkish policy change.

US PMI figures came in somewhere in the middle, with manufacturing showing a minor improvement and services backsliding.

The US S&P Global Manufacturing PMI jumped further than expected, printing at 48.9 versus the expected 48, but the Services component missed to the downside, printing at 50.2 compared to the forecast 50.6. The mixed printing helped prop up the Greenback against the Yen, but kept gains restrained within the previous day's highs.

USD/JPY technical outlook

Thursday's backslide saw the USD/JPY fall to the 200-hour Simple Moving Average (SMA) before giving a rebound through early Friday trading.

The pair has gained steadily through the week, and is set to finish on the high end, currently looking for a foothold just beneath the week's peak of 148.46.

On the daily candlesticks the USD/JPY is decidedly bullish, up nearly 8% from July's bottom near 137.20. Bullish price momentum is seeing technical support from the 34-day Exponential Moving Average (EMA), and the US Dollar has gained over 13% against the Japanese Yen so far this year.

USD/JPY technical levels

- NZD/USD rebounds from a daily low of 0.5919 to 0.5977, driven by improved risk appetite and a softer US Dollar.

- Mixed US economic data and hawkish yet cautious remarks from Fed officials fail to bolster the Greenback, with the DXY slightly up at 105.47.

- Upcoming economic indicators, including Consumer Confidence and Core PCE in the US, and Business and Consumer Confidence in NZ, are in focus for the next week.

The New Zealand Dollar (NZD) stages a recovery against the US Dollar (USD) ahead of the weekend as investors' sentiment improved, while the Greenback is trading soft, undermined by a fall in US Treasury bond yields. The NZD/USD is trading at 0.5977 after bouncing from a daily low of 0.5919.

Kiwi recovers to 0.5977 as US Dollar weakens amid falling Treasury yields and mixed PMIs

Wall Street is trading in the green due to improved risk appetite. A report from S&P Global showed that business activity in the United States (US) was almost unchanged in September. The S&P Global Manufacturing PMI improved to 48.9 from 47.9 a month earlier, exceeding estimates but remained in contractionary territory, while the Services PMI dipped to 50.2 from 50.5 in July, below forecasts. The Composite reading, which offers a general view of business activity, was aligned with estimates at 50.1 but trailed August’s 50.2

Aside from this, US central bank officials had been unleashed, with Boston Fed President Susan Collins saying that further tightening is possible, though “patience” is required. Echoing some of her comments was Fed’s Governor Michell Bowman, who was more determined, saying that more rate hikes are needed to control inflation.

Although Fed officials' comments were hawkish, the Greenback failed to gain traction. The US Dollar Index (DXY), which measures the buck’s value against its peers, climbs just 0.09%, at 105.47, after dropping from 10578 high. US Treasury bond yields continued to weaken across the short and long end of the curve.

On the New Zealand (NZ) front, data revealed on Friday’s session that consumer confidence weakened in the third quarter regarding the economic outlook, with the index falling to 80.2 from 83.1. The agenda revealed the Trade Balance showed an improvement in the annual trade deficit to $15.54B for August $-1588B from prior figures.

For the next week, the economic agenda in the US would feature the Conference Board (CB) Consumer Confidence, Durable Good Orders, Initial Jobless Claims, and the Fed’s preferred gauge for inflation, the Core PCE. The docket would feature the Business and Consumer Confidence on the NZ front.

NZD/USD Price Analysis: Technical outlook

The pair bottomed out at around 0.5859, and since then, the NZD/USD has staged a comeback despite recent US Dollar strength. During the last three days, the currency pair has remained volatile, unable to get a clear direction, though it remains slightly tilted to the downside. However, further upside is expected if buyers lift the exchange rate past the September 1 swing high at 0.6015. Conversely, sellers must reclaim the September 21 low of 0.5895.

EUR/USD is approaching 1.06. Economists at Commerzbank analyze the pair’s outlook.

Interest rate cuts could become concretely apparent in the US

In the medium term, we expect the Fed to lower its key rate again next year as the US economy cools. At the same time, the ECB is likely to keep interest rates on hold despite declining inflation and increasing headwinds for the Eurozone economy. This means that the ECB is taking a much more hawkish stance than the Fed, which should benefit the Euro. However, it is unclear when exactly the FX market will react to the divergence in monetary policy. As a result, the EUR is likely to appreciate less gradually than our forecast suggests.

In the long run, however, EUR strength is unlikely to be sustainable. According to our economists, the ECB is likely to succeed in controlling inflation to a lesser extent than the Fed in the long term. Regardless of which of the two central banks offers the highest real interest rate on its respective currency, this is likely to result in the Euro suffering from an increased inflation risk premium.

EUR/USD – Sep-23 1.10 Dec-23 1.14 Mar-24 1.15 Jun-24 1.15 Sep-24 1.14 Dec-24 1.12

GBP dropped this week on the back of the BoE’s unchanged policy decision. Economists at Rabobank have revised down their six-month EUR/GBP forecast modestly.

Gloomy economic outlook for the Eurozone

The dip in GBP after the steady policy decision from the BoE this week has lifted EUR/GBP towards the top of its range, just shy of 0.87.

This month, the ECB revised lower its growth projections for the region significantly. However, these still seem optimistic compared with our own forecast for the Eurozone of technical recession in H2 2023 followed by a very shallow recovery next year. In view of this outlook, we see risk of EUR/GBP dipping to 0.85 on a three-to-six-month view.

We continue to expect Cable to languish around 1.23 into year-end, with downside risk to this view on the back of the resilience of the US economy and a strong USD.

Further interest rate increases will likely be appropriate, with inflation still being too high, Federal Reserve Governor Michelle Bowman said on Friday, per Reuters.

Key quotes

"Fed policy will need to be held at a restrictive level for some time to return inflation to 2% 'in a timely way."

"Continued risk of a further increase in energy prices could reverse some of the recent progress on lowering inflation."

"The economy is still growing at a solid pace, with robust consumer spending and solid job gains."

"Bank lending standards have tightened but there is no sign of a sharp contraction of credit that would significantly slow the economy."

"Expecting progress on inflation to be slow under current conditions, suggesting the need for even tighter policy."

Market reaction

These comments failed to trigger a noticeable market reaction and the US Dollar Index was last seen posting small daily losses at 105.36.

Economists at Crédit Agricole highlight uncertainties surrounding a potential US government shutdown and its implications for the USD.

Some relief and support to the USD if a resolution to prevent the shutdown is reached before the deadline

The expectation is that a resolution will be reached before the 1 October deadline, possibly by pushing the spending bill to early December. Post this deadline, non-essential federal agencies will cease their operations. However, increasing uncertainty is being introduced by the Freedom Caucus, who have indicated that they might vote against any interim solutions.

If a resolution to prevent the shutdown is reached before the deadline, it could potentially offer some relief and support to the USD. On the other hand, the increasing political uncertainty brought on by parties like the Freedom Caucus could cast a shadow over the USD's near-term outlook. If market participants believe that a shutdown is becoming more likely or if the situation turns more contentious, we could see heightened volatility and possibly a weaker USD in the short term.

Signs of stabilisation in China’s economy should provide some support to commodity markets. Nevertheless, the adjustment to a lower growth profile will ultimately cap the upside, strategists at ANZ Bank report.

Upside limitations

Expectations of a soft landing in China are providing some hope for commodity markets. This should boost sentiment and lead to stronger demand that will extend the recent rally into year-end.

However, there are some upside limits. China’s structural issues – worsening demographics, lack of productivity improvement and trade tension – remain. Nevertheless, a stabilisation in its economic activity should be a welcome relief for commodity markets, and we expect them to track higher in Q4.

Ultimately, the strength of the rally will be determined by the broader macro backdrop.

The price of a barrel of Brent Oil rose to a good $90 at the beginning of September. Strategists at Commerzbank analyze Oil’s outlook.

Limited upside potential for the price of Crude Oil in the short term

The Oil market should be significantly undersupplied in the second half of the year and inventories should continue to fall appreciably in the coming months.

Demand concerns stand in the way of a further price increase. For example, the economic recovery in China has noticeably lost momentum, so Oil demand should rise more slowly from now on. Oil demand in the US and Europe is likely to be curbed by the expected recession.

We see only limited upside potential for the price of Crude Oil in the short term and a price level of $85 per barrel at the end of the year.

- Silver price turns back and forth after an upside move following the choppy US Dollar.

- The Fed delivered a hawkish commentary on interest rates and sees inflation getting controlled in 2026.

- S&P Global reported subdued preliminary PMIs for September.

Silver price (XAG/USD) turns sideways after a vertical upside move to near crucial resistance of $23.70 in the early New York session. The white metal struggles for a direction as the US Dollar Index (DXY) demonstrates a squeeze in volatility after an unchanged interest rate decision by the Federal Reserve (Fed) as expected.

The Fed delivered a hawkish commentary on interest rates and sees inflation getting controlled in 2026. Interest rates are expected to remain lofty long enough’ till the achievement of price stability.

S&P500 opened on a positive note on Friday, portraying some improvement in appeal for risk-sensitive currencies. While the broader bias is bearish as fears of a global slowdown are intact. The USD Index remains choppy despite the subdued preliminary PMI report for September, released by the S&P Global. The 10-year US Treasury yields rebounded sharply to

The Manufacturing PMI landed at 48.0 in line with expectations and slightly higher than the former reading of 47.9. The economic data has been contracting for a long period, a figure below 50.0 is itself considered a contraction in economic activities. The Services PMI, which tracks a sector that accounts for two-thirds of the US economy, dropped to 50.2 vs. expectations of 50.6 and the former release of 50.5.

Silver technical analysis

Silver price trades in a Rising Wedge chart pattern on a two-hour scale, in which pullbacks are considered buying opportunities by market participants till the volatility contraction. Upward-sloping 20-period Exponential Moving Average (EMA) at $23.48 indicates that the short-term trend is bullish.

The Relative Strength Index (RSI) (14) shifts into the bullish range of 60.00-80.00, which indicates that the bullish impulse has been triggered.

Silver two-hour chart

-638309889087436425.png)

"I expect rates may have to stay higher, and for longer, than previous projections had suggested," Federal Reserve Bank of Boston President Susan Collins said on Friday and added that further tightening is certainly not off the table, per Reuters.

Key takeaways

"Optimistic inflation can fall with only a modest rise in unemployment."

"Current policymaking requires considerable patience to get the right signal from data."

"Inflation remains too high despite encouraging news from recent readings."

"Important aspects of inflation, like core services excluding shelter, have not yet shown a sustained improvement."

"Continued above-trend economic activity means it's too soon to be confident inflation is beaten."

Market reaction

The US Dollar Index lost its traction and declined below 105.50 in the American session, erasing its daily gains in the process.

Economists at TDS analyze the implications of interventions from Japan for the USD/JPY pair.

USD/JPY on a path towards 150

Mof officials (e.g., Suzuki, Matsuno) repeated the JPY jawboning today in a warning to speculators that imminent intervention is on the table, especially with USD/JPY on a path towards 150.

The JPY weakness is taking a hit on Kishida's popularity in the polls which probably nudged the government to unveil a new set of economic measures next week. We doubt authorities want media headlines on JPY weakness to overshadow the fiscal announcements, and lean towards them pulling the intervention trigger.

If they intervene >150, watching 146.5 as first support before a retest of the psychological 145 level again – past intervention efforts usually have an initial effect of a 5 big-figure drop in USD/JPY.

The Fed left key interest rates unchanged. The dot plot has a more hawkish tilt, economists at Société Générale report.

Option for hike retained through year-end

We side with no further tightening.

While inflation remains elevated and employment markets tight, the Fed should hold a bias for hikes.

The communications accompanying the FOMC meeting – the statement, the summary of economic projections and the press conference – signal a modestly higher chance of one more hike.

Data dependency remains.

See: The Fed’s updated guidance should reinforce the USD’s upward momentum in the near-term – MUFG

- US private sector's business activity nearly stagnated in early September.

- US Dollar Index holds steady near 105.50 after PMI data.

S&P Global Manufacturing PMI improved to 48.9 in early September from 47.9 in August, pointing to an ongoing contraction in the manufacturing sector's business activity at a softening pace. The Services PMI edged lower to 50.2 from 50.5 in the same period and the Composite PMI arrived at 50.1, down slightly from 50.2 in August.

Commenting on PMI surveys' findings, “PMI data for September added to concerns regarding the trajectory of demand conditions in the US economy following interest rate hikes and elevated inflation," said Siân Jones, Principal Economist at S&P Global Market Intelligence.

"Although the overall Output Index remained above the 50.0 mark, it was only fractionally so, with a broad stagnation in total activity signalled for the second month running," Jones added and said that the service sector lost further momentum, with the contraction in new orders gaining speed.

Market reaction

The US Dollar Index edged slightly lower after these data and was last seen gaining 0.1% on the day at 105.48.

Gold price yo-yoing after Fed meeting. Strategists at Commerzbank analyze the yellow metal’s outlook.

Longer-term-oriented ETF investors remain on the retreat

Short-term-oriented financial investors are probably chiefly to blame for the price fluctuations. The somewhat longer-term-oriented ETF investors remain on the retreat in any case: outflows have now been reported again on an almost continuous basis since the start of the quarter.

We assume that the price performance in the coming weeks will continue to be dictated by US economic and inflation data because they will mainly determine the Fed’s interest rate policy.

Until there are clear signs that an interest rate turnaround is on the cards, the Gold price – as driven by data – is likely to fluctuate without any clear direction.

The European Central Bank's (ECB) 4% policy rate has to be held sufficiently long, ECB Chief Economist Phillip Lane said on Friday and reiterated that the central bank is still very data-dependent.

Lane noted that the Euro area economy this year will be "fairly muted" and added that there are a lot of reasons for the economy to stagnate this year.

Market reaction

These comments don't seem to be having a significant impact on the Euro's performance against its major rivals. As of writing, the EUR/USD pair was down 0.1% on the day at 1.0648.

What will happen if US inflation remains permanently lower than Eurozone inflation? Economists at Natixis see three main consequences.

US inflation likely to remain permanently lower than Euzone inflation

It is possible that inflation in the US will remain lower than inflation in the Eurozone for a long time, due to: The Federal Reserve’s faster response to inflation than that of the ECB; The weaker bargaining power of wage earners in the US; Changes in labour productivity and corporate profit margins.

What would be the consequences of persistently lower inflation in the US than in the Eurozone? We can expect: A faster fall in interest rates in the US than in the Eurozone; An appreciation of the Euro against the Dollar and a cost competitiveness problem for the Eurozone; A penalisation of investment in the Eurozone.

- EUR/USD clinches new six-month lows near 1.0610.

- Further decline opens the door to a drop to the 1.0515 zone.

EUR/USD keeps the negative price action well in place and retreats to fresh multi-month lows around 1.0615 on Friday.

If the pair breaches this level in the short-term horizon, it could then open the door to a potential retracement to the March low of 1.0516 (Mar 8), which is the last defence ahead of an assault on the 2023 low at 1.0481 (January 6).

While below the key 200-day SMA at 1.0828, the pair is likely to face extra weakness.

EUR/USD daily chart

"Based on the information available today and using a range of analytical tools, we can say that the interest rate level we have now reached, if maintained for a sufficiently long time, is broadly consistent with achieving our inflation target in the medium term," European Central Bank (ECB) policymaker Pablo Hernandez de Cos told Germany's Börsen-Zeitung on Friday, per Reuters.

He added that the underlying inflation in the Eurozone was now easing and said that it was too early to talk about interest rate cuts.

Market reaction

EUR/USD showed no immediate reaction to these comments and was last seen trading virtually unchanged on the day at 1.0655.

Mexico's central bank (Banxico) will meet next week to decide on its interest rate. Economists at Commerzbank analyze MXN outlook.

Banxico will maintain its hawkish stance

Banxico's cautious stance to date and the Fed's ‘higher for longer’ outlook suggest that Banxico will maintain its hawkish stance for the time being.

After all, the Mexican economic outlook should also benefit from the improved chances of a soft landing in the US, and further upside risks to inflation could arise from the government's more expansionary spending plans in the upcoming election year. In our view, this all points to continued MXN strength for the time being.

- USD/CAD discovers buying interest near 1.3430 after Canada’s Retail Sales excluding automobiles remained stronger.

- Consumer spending for automobiles remained weak as households avoided higher installment obligations.

- The US Dollar struggles to find a direction as investors remain mixed about the Fed’s interest rate peak.

The USD/CAD pair finds interim support near 1.3430 after Statistics Canada reported mixed Retail Sales report for July. Consumer spending expanded at a slower pace of 0.3% vs. expectations of 0.4%. In June, Retail Sales expanded nominally by 0.1%.

Retail Sales excluding automobiles expanded strongly by a full one percent, doubling expectations of 0.5%. The economic data was contracted by 0.7% in June. Scrutiny of the Retail Sales report shows that demand for automobiles remained weak. Households postponed demand for automobiles to avoid higher interest obligations.

The Canadian Dollar remains strong as the oil price is preparing for a fresh upside above the immediate resistance of $91.00. More upside in the oil price is anticipated due to deepening supply concerns and expectations of an end to the global rate-hike cycle. It is worth noting that Canada is the leading exporter of oil to the United States and higher oil prices support the Canadian Dollar.

This week, Canada’s inflation data for August remained mixed. Headline Consumer Price Index (CPI) expanded at a higher pace of 0.4% vs. expectations of 0.2% due to rising energy prices. The Bank of Canada (BoC) takes core inflation into account for the monetary policy framework, therefore, the impact of the recovery in gasoline prices would be limited.

Meanwhile, the US Dollar struggles to find a direction as investors remain mixed about whether the Federal Reserve (Fed) will keep interest rates unchanged in the remainder year or will hike one more time. As per the CME Fedwatch tool, traders see a 71% chance for interest rates remaining steady at 5.25%-5.50% in the November monetary policy meeting.

- DXY advances further and clinches new multi-month tops.

- Extra upside is expected to retest the 2023 top near 105.90.

DXY resumes the uptrend and reaches fresh six-month highs in the 105.75/80 band at the end of the week.

The continuation of the upside momentum in the index is expected to challenge the 2023 top at 105.88 (March 8) sooner rather than later. The surpass of this level could put a move to the round level at 106.00 rapidly back on the radar.

While above the key 200-day SMA, today at 103.04, the outlook for the index is expected to remain constructive.

DXY daily chart

The Bank of Japan left the policy settings unchanged. The Yen has weakened following the decision. Economists at TD Securities analyze USD/JPY outlook.

Bboring BoJ meeting with no fireworks

It was a boring BoJ meeting with no fireworks, as all members voted unanimously to leave policy levers unchanged. The statement was also largely similar to July and there was no change in forward guidance.

Ueda's press conference also disappointed JPY bulls and those looking for hints of an exit from YCC/negative rates (including ourselves). He didn't lean against JPY weakness and just reiterated that FX should reflect fundamentals and move in a stable manner. As such the task lies with MoF officials to cap JPY weakness and there is little resistance for USD/JPY to break above 150 given the drift higher in US yields.

- Retail Sales in Canada at a modest pace in July.

- USD/CAD stays in negative territory below 1.3450 after the data release.

Retail Sales in Canada rose 0.3% on a monthly basis in July, Statistics Canada reported on Friday. This reading came in slightly below the market expectation for an increase of 0.4% and followed the 0.7% decrease (revised from 0.8%) recorded in June.

Retail Sales ex-Autos grew 1% in the same period, surpassing analysts' estimate of 0.5%.

Market reaction

USD/CAD pair stays under modest bearish pressure after this report and was last seen losing 0.4% on a daily basis at 1.3430.

- USD/CHF consolidates around 0.9050 amid uncertainty over the Fed’s interest rate peak.

- The SNB kept interest rates unchanged at 1.75% for the first time since March 2022.

- Going forward, investors will focus on US S&P Global PMIs for September.

The USD/CHF pair traded in a narrow range near 0.9050 in the late European session. The Swiss Franc asset has remained in the grip of bulls broadly as the Swiss National Bank (SNB) announced a steady interest rate decision on Thursday, keeping interest rates at 1.7% while investors anticipated an interest rate increase by 25 basis points (bps) to 2%.

SNB Chairman Thomas J. Jordan and other policymakers decided to deliver a steady monetary policy for the first time since March 2022 when the central bank initiated its rate-tightening cycle to cool down inflationary pressures.

About the interest rate outlook, the SNB left doors open for further policy tightening. SNB Jordan cited that the current inflation situation has bought us time to assess whether measures taken to date are sufficient to keep inflation comfortably below 2%.

Meanwhile, S&P500 futures generated some decent gains in the London session, portraying nominal improvement in appeal for risk-perceived assets. The US Dollar Index (DXY) demonstrates a sideways trend as uncertainty about the interest rate peak elevated after the Federal Reserve’s (Fed) hawkish outlook.

The upside in the USD Index seems restricted for now as investors see no signs of a hike by the Fed in its November monetary policy. Going forward, investors will focus on preliminary PMIs for September from the S&P Global, which will be published at 13:45 GMT.

According to a preliminary report, The Manufacturing PMI is seen improving marginally to 48.0 from the August reading of 47.9. The Services PMI, which tracks a sector that accounts for two-thirds of the US economy, is anticipated to rise to 50.6 from 50.5 in August.

GBP weakness extends. Economists at Scotiabank analyze Cable’s outlook.

More downside risk for Sterling

New cycle lows for the GBP and strongly aligned bear signals on the short, medium and long-term trend strength oscillator imply more downside risk for Sterling.

Loss of support in the 1.24 zone targets additional losses to 1.21/1.22.

Resistance is 1.2350.

See:

-

Prospects for Sterling remain subdued – Commerzbank

-

If EUR/USD trades down to 1.05, GBP/USD could be trading near 1.21 – ING

-

The Pound is still vulnerable to further near-term weakness – MUFG

The USD remains firm. Economists at Scotiabank analyze Greenback’s outlook.

The high for longer narrative is USD supportive

The DXY looks poised to lock in a tenth, consecutive weekly gain. US yields popped to new cycle highs following the Fed decision Wednesday and are maintaining gains through their former 2023 highs across the curve.

The high for longer narrative that has emerged after the FOMC decision is USD supportive but even with yields above recent highs, the USD’s broader valuation looks a little overdone; stretched valuation, even in the short run, plus the extended USD run higher over the past 2 1/2 months leaves the door pretty wide open for some deeper USD consolidation ahead (particularly considering strike, government shutdown risks).

Loonie resists US Dollar’s advance. Economists at Scotiabank analyze the USD/CAD technical outlook.

The 1.3375/1.3395 area remains firm support

Spot gains through 1.35 were strongly rejected on the short-term chart on Thursday and funds retain a firm downward bias in the short run on the back of still bearishly-aligned DMI oscillators for the USD.

Intraday losses through 1.3465 should extend further back to the 1.34 area in the next day or so. The 1.3375/1.3395 area remains firm support, however.

Resistance is seen at 1.3500/1.3520.

- The US Dollar trades mixed on Friday with some profit taking after another ferocious week.

- The focal point to end the week will be the PMI numbers for the US.

- The US Dollar Index resides near new six-month high

The US Dollar (USD) had another strong day on Thursday, booking gains against nearly every major G20 currency. Backed by higher US yields, the Greenback advances in an environment where the rate differential seems to be the driving factor to determine which currency weakens and which appreciates. With the US 10-year yield hitting 4.51%, breaking above the high of October 2007, it looks like King Dollar is affirming its earned title.

There might be some tempering to this party depending on the US Purchasing Managers Index (PMI) data released by S&P Global later Friday. The data will provide fresh insight on the state of the country’s key manufacturing and services in September, after August data showed that manufacturing activity dropped into contraction and services recorded a very mild expansion.. Should both numbers fall fully into contraction, expect to see some unwinds from those US Dollar long positions toward the weekend.

Daily digest: US Dollar seeks confirmation from PMIs

- Strikes are continuing in the major three car procedures with no positive headlines to report ahead of this Friday’s deadline.

- No breakthrough to report neither on the looming US Government shutdown.

- Traders will be on edge near 13:45 GMT for the S&P Global Purchasing Managers Index (PMI) numbers: the Manufacturing PMI is expected to head from 47.9 to 48, while the Services PMI is anticipated to edge up from 50.5 to 50.6. The Composite PMI, which tracks performance of both manufacturing and services, is also seen little changed around the previous 50.2 reading.

- Baker Hughes US Oil Rig Count data will come at 17:00 GMT. Previous number was 515. Energy remains a weak spot in the inflation bag that the Fed can not control in order to get inflation back to 2%. With the Baker Hughes Rig Count numbers remaining very low in the past few months, an energy deficit could linger in the US during the winter, pushing energy prices further up.

- Big dispersion in the equity markets: Japanese Nikkei and Topix reside in the red, down 0.50%. In China, both the Hang Seng and the CSI 300 indexes are up over 1.50%. In Europe, equities are opening flat while US futures are pointing to the green .

- The CME Group FedWatch Tool shows that markets are pricing in a 73.8% chance that the Federal Reserve will keep interest rates unchanged at its meeting in November. The last rate hike is expected for either December or January.

- The benchmark 10-year US Treasury yield traded at one point at 4.51%, the highest level since October 2007. It later fell back to 4.48%. The rate differential story remains the main driver in the forex space.

US Dollar Index technical analysis: getting tired

The US Dollar looks set to close this week with another positive print in the US Dollar index (DXY). King Dollar has yet again confirmed its status, though there looks to be some fatigue creeping in the price action. This afternoon’s PMI numbers will be crucial to either see a final attempt for a new yearly high or rather a drop back to 105.00 or lower.

The US Dollar Index (DXY) goes sideways after reaching 105.68 on Thursday. Should the DXY close above the yearly high near 105.88, expect the US Dollar to follow on with more bullish moves in the medium term. US yields will remain crucial to support current levels in the DXY.

On the downside, the 104.44 level seen on August 25 kept the Index supported on Monday, halting the DXY from selling off any further. Should the uptick that started on September 12 reverse and 104.44 give way, a substantial downturn could take place to 103.04, where the 200-day Simple Moving Average (SMA) comes into play for support.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

EUR/USD losses continue to coalesce around the low 1.06 support zone. Economists at Scotiabank analyze the pair’s outlook.

Support in low 1.06 area remains solid

The EUR is weak but, with 10 weeks of consecutive losses under it now and support in the low 1.06 area (long-term retracement support at 1.0612) holding, there is a chance of some stabilization or recovery in the EUR in the near-term.

Short-term price action suggests solid demand on dips to the 1.0620 zone.

Gains through 1.0670/1.0675 should signal additional gains ahead.

- EUR/JPY resumes the uptrend and surpasses 158.00.

- Extra gains remain focused on the monthly high around 158.65.

EUR/JPY reverses Thursday’s marked pullback and resumes the upside momentum past the 158.00 hurdle at the end of the week.

In the meantime, the cross remains stuck within the consolidative range and the breakout of it exposes a visit to the so far monthly high of 158.65 (September 13) prior to the 2023 top at 159.76 (August 30), which precedes the key round level at 160.00.

The surpass of the latter should not see any resistance level of note until the 2008 high at 169.96 (July 23).

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 149.09.

EUR/JPY daily chart

Economist Lee Sue Ann at UOB Group assesses the latest GDP figures in New Zealand.

Key Takeaways

GDP rose by 0.9% q/q in 2Q23, surpassing expectations for a reading of 0.4% q/q. 1Q23 GDP was revised to unchanged from a 0.1% q/q contraction, meaning the economy did not shrink for two straight quarters and narrowly avoided a recession. Compared to the same period one year ago, GDP rose by 1.8% y/y. This follows a 2.2% y/y print in 1Q23, more than expectations of 1.2% y/y

Overall, we are cautioning against reading too much into today’s GDP report as it is difficult to ascertain how much of upside is noise-driven from the rebound due to the cyclone disruption. Our view is that the economy is likely to experience further weakness ahead, despite unemployment remaining close to record-lows of 3.4%. We have, nonetheless revised our growth forecast for 2023 to 0.9%, from 0.7% previously.

There is a risk that the Reserve Bank of New Zealand (RBNZ) may raise its official cash rate (OCR) once more by 25bps. But we think the RBNZ will opt to pause in Oct, and will likely wait till the 29 Nov monetary policy meeting, with the benefit of having the 2Q23 CPI figures (17 Oct). We will hence be waiting for 2Q23 CPI figures next month, before making any changes to our OCR forecasts.

- Oil (WTI) goes sideways in the range between $88 to $93.

- The US Dollar consolidates a new six-month high and is set to close a tenth consecutive week in the green.

- Headline decline from Saudi Arabia or Russia guides oil prices in a calmer regime.

Oil prices are entering a calmer pattern that is more than welcome to the overheated rally in both WTI Crude and Brent oil prices. Traders will want to see the print of the Baker Hughes Rig Count later this Friday if it has bottomed out and a more gradual rise is being noticed with more rigs coming online. Some demand could pick up next week as recent reports show China crude inventories are at their lowest level since June.

The US Dollar (USD) had another strong day on Thursday, booking gains against nearly every major G20 currency. Backed by higher US yields, the Greenback advances in an environment where the rate differential seems to be the driving factor to determine which currency weakens and which appreciates. With the US 10-year yield hitting 4.51%, breaking above the high all the way back in October 2007, it looks like King Dollar is affirming its earned title.

Crude Oil (WTI) price trades at $89.46 per barrel, and Brent Oil trades at $92.37 at the time of writing.

Oil news and market movers

- Onshore Chinese crude inventories are at their lowest level since June. Meanwhile, China hit a record volume of Russian oil imports during August.

- Russia temporarily bans diesel exports, triggering a firm rise in European prices.

- The US Keystone crude pipeline is coming back online after a few days of outage.

- The weekly Baker Hughes US Oil Rig Count is due this Friday at 17:00 GMT. Previous number last week was at 515 and at 512. A gradual rise would be bearish for oil prices.

Oil Technical Analysis: Take a breather

Oil prices are entering a bit of a calm path after the very steep and headline-driven moves seen in the past few weeks. At the moment it looks like WTI Crude price will fade ahead of making a new yearly high. A technical floor is identified and would cool down the Relative Strength Index (RSI) and might see crude breaking $93 later this year.

On the upside, the double top from October andNovember of last year at $93.12 remains the level to beat. Although this looks very much in reach, markets have already priced in a lot of possible supply deficits and a bullish outlook. Should $93.12 be taken out, look for $97.11, the high of August 2022.

On the downside, a new floor is formed near $88 with the high of September 5 and 11 underpinning the current price action. Proof of that already exists with the dip of September 21 that reversed ahead of $88. Should $88 break nonetheless, the peak of August 10 needs to be enough to catch the dip near $84.20.

-638309728299049865.png)

WTI US OIL daily chart

Natural Gas FAQs

What fundamental factors drive the price of Natural Gas?

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

What are the main macroeconomic releases that impact on Natural Gas Prices?

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

How does the US Dollar influence Natural Gas prices?

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

The BoE delivered a surprise by leaving their policy rate unchanged at 5.25% at the latest MPC meeting. The BoE’s policy update has reinforced the recent correction lower for the Pound. Economists at MUFG Bank analyze GBP outlook.

BoE stands pat as focus shifting to higher rates for longer

Slim majority (5 vs. 4) of MPC members voted to leave policy rate unchanged. Decision was finely balanced but case for another hike was not as compelling. Updated guidance signals shift towards keeping rates high for longer. Modest pick-up planned for pace of QT in year ahead.

While the UK rate market has already moved a long way now to price out further BoE hikes, the Pound is still vulnerable to further near-term weakness with evidence building that the UK economy is responding more to tighter monetary policy.

- USD/MXN shifts comfortably above $17.00 as the US Dollar remains resilient.

- The appeal for risk-sensitive currencies remains weak due to the upside risks of a global slowdown.

- Investors await the interest rate decision from the Banxico, which will be announced next week.

The USD/MXN pair has shifted its auction above the crucial resistance of 17.00 on Friday. The asset strengthens as the US Dollar remains firm despite the Federal Reserve (Fed) announcing an unchanged interest rate decision on Wednesday as anticipated by market participants.

S&P500 futures added some gains in the European session, portraying an ease in the risk-off market mood. The broader trend is still opposing the appeal for risk-sensitive currencies due to the upside risks of a global slowdown.

The US Dollar Index (DXY) remains directionless near a six-month high around 105.70 amid uncertainty over the interest rate peak. Fed policymakers delivered a hawkish interest rate outlook at the Federal Open Market Committee (FOMC) meeting, hinting at one more interest rate increase of 25 basis points (bps), which will push interest rates to 5.50%-5.75%.

Meanwhile, investors will focus on the release of the preliminary S&P Global PMIs for September, which will be released at 13:15 GMT. The Manufacturing PMI is expected to improve marginally to 48.0 from the August reading of 47.9. The Services PMI, which tracks a sector that accounts for two-thirds of the US economy, is anticipated to rise to 50.6 from 50.5 in August.

On the Mexican Peso, investors focus on the interest rate decision from the Bank of Mexico (Banxico), which will be announced next week. The Mexico central bank has maintained interest rates unchanged at 11.25% in the past three monetary policies.

Economists at Société Générale cited strong growth outperformance and progress on inflation containment have helped MXN to eclipse the EM currency complex this year. However, headwinds are accumulating from currently rich valuations, shifts in the Developed Markets rates paradigm, and changes to domestic policies regarding currency intervention.

USD/JPY has risen above 148. Economists at Société Générale analyze the pair’s technical outlook.

Break below 145.90 crucial to affirm a short-term down move

USD/JPY has staged recent leg of uptrend within two converging lines resembling a rising wedge; the pattern generally denotes receding upward momentum. This is also highlighted by daily MACD which has turned flat. However, signals of reversal in price action are not yet visible.

A break below recent pivot low at 145.90 is crucial to affirm a short-term down move.

Next potential hurdles are located at projections of 149.20 and 150.30.

The Yuan (CNY) is increasingly being used for trade, investment and as a reserve currency in Africa. Strong trade trends support more trade settled in CNY, economists at Standard Chartered report.

CNY internationalisation gathers pace

CNY is being used for trade and investment in Africa and features as a reserve currency.

Strong trade links, especially African imports from China, mean trade settled in CNY is likely to grow further.