- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- USD/CHF gains momentum near 0.8802 ahead of the US S&P Global PMI data.

- US Existing Home Sales declined 2.2% vs a 3.3% drop in June; Richmond Fed's Manufacturing Index fell to -7 from -9.

- Swiss Trade Balance narrowed to 3,129M against the market consensus of 4,300 M.

- Market players await Jackson Hole's annual symposium, Fed Chair Powell's speech.

The USD/CHF pair recovers its recent loss and reclaims the 0.8800 area during the early Asian session on Wednesday. Meanwhile, the US Dollar Index (DXY), a measure of the value of USD against six other major currencies, bounces off the weekly low of 103.01 and hovers around 103.60. The US 10-year yield climbs above 4.30%, marking a new multi-year high.

On Tuesday, the US Existing Home Sales in the US fell 2.2% in July, compared to a 3.3% decline in June. The Richmond Fed Manufacturing Index for August decreased from -9 to -7, in accordance with market expectations.

Along with the stronger US data, Federal Reserve Bank of Richmond President Thomas Barkin's hawkish comments on Tuesday supports the Dollar's recovery. Barkin stated that monetary policy would have to be tightened if inflation remained elevated and there were no indications that demand would decrease.

The Swiss Federal Customs Administration reported on Tuesday that the country’s Trade Balance narrowed to 3,129M against the market consensus of 4,300M. Meanwhile, Exports were down 16.7% in July. In the same period, Imports dropped by 12.5%. The Swiss franc weakened against its rivals in response to the weaker data.

Furthermore, the US Commerce Department’s statement reported late Tuesday that US Commerce Secretary Gina Raimondo met the Chinese ambassador Xie Feng, and had a productive discussion before her departure to China, according to Reuters. Market participants will keep an eye on the prospects for collaboration between the two countries. The renewed tension between the US-China could benefit the traditional safe-haven Swiss France and acts as a headwind for the USD/CHF pair.

In the absence of any relevant market-moving economic releases from Switzerland, the USD/CHF pair remains at the mercy of USD price dynamics. Market players await the US S&P Global PMI data due later in the day. The highlight of the week will be Jackson Hole annual symposium on Thursday and Fed Chair Powell's speech on Friday. The events could offer hints for further monetary policy. Investors now expect the Fed to pause interest rates in September and bet on a 25 basis point (bps) rate hike in its November meeting.

- AUD/USD stays defensive while keeping three-day rebound from yearly low.

- Australia’s S&P Global PMIs for August came in softer but headlines suggesting improvement in US-China ties help Aussie buyers.

- Market’s preparations for top-tier US data/events also underpin AUD/USD recovery.

- US PMI, Fed talks eyed ahead of Friday’s Jackson Hole speeches.

AUD/USD holds onto the previous gradual recovery despite witnessing softer Australian activity data for August, picking up bids to 0.6430 amid early Wednesday. That said, the recently upbeat headlines suggesting an improvement in the US-China ties seem to underpin the Aussie pair’s cautious rebound from the yearly low since Friday. Apart from that, the market’s preparations for the top-tier US data/events and the annual Jackson Hole event also allow the risk-barometer pair to edge higher.

Australia’s preliminary readings of the S&P Global Manufacturing PMI eases to 49.4 from 49.6 expected and prior while the Services counterpart drops to 46.7 from 47.9 market forecasts and previous readings. With this, the first reading of the S&P Global Composite PMI weakens to 47.1 for the said month from 48.2 marked in July.

Elsewhere, the US Commerce Department mentioned Commerce Secretary Gina Raimondo’s meeting with the Chinese Ambassador, as well as the Vice Foreign Minister, Xie Feng. The news states that the policymakers had a ‘productive discussion’ ahead of her trip to China. Earlier in the week, the US Commerce Department’s Bureau of Industry and Security (BIS) also removed 27 Chinese entities from its Unverified List, removing sanctions from those entities and flagged hopes of improving US-China ties.

While the hopes of the US-China ties put a floor under the AUD/USD price, mixed concerns about the economic recovery in China and recently firmer US Dollar cap the Aussie pair’s upside momentum.

On Tuesday, US Dollar Index (DXY) prods the 10-week high marked Friday, around 103.60 at the latest, as improvements in the US Existing Home Sales for July and the Richmond Fed Manufacturing Index for August joins firmer Treasury bond yields. That said, the US Existing Home Sales came in as -2.2% MoM versus -3.3% prior while the Richmond Fed Manufacturing Index matched -7.0 market forecast compared to -9.0% previous readings.

Apart from the firmer US data, hawkish statements from Federal Reserve Bank of Richmond President Thomas Barkin also underpin the US Dollar’s rebound and weigh on the AUD/USD Price. On Tuesday, Fed’s Barkin emphasized achieving the 2.0% inflation target while challenging the US recession concerns by stating, per Reuters, “If the US were to have a recession, it would likely be a ‘less-severe’ one.” The policymaker also added, “Fed must be open to the possibility that the economy will begin to reaccelerate rather than slow, with potential implications for the US central bank's inflation fight.”

Elsewhere, Bloomberg came out with an analytical piece suggesting the market’s lack of confidence in China’s efforts to restore economic transition. Further, news from Russian media claimed Moscow’s destruction of a US-made military vessel near Snake Island, which in turn triggered the risk-off mood initially before restoring the sentiment amid concerns that the vessel was operating under a US flag.

Amid these plays, Wall Street closed mixed but the S&P500 Futures printed mild gains by the press time. That said, the US 10-year Treasury bond yields rose to the highest level since late 2007, before retreating to 4.33% and hence flagging the market’s indecision.

Looking ahead, the preliminary readings of the US PMIs for August and Existing Home Sales for July will join the updates about the aforementioned risk catalysts to entertain the AUD/USD traders. That said, the US S&P Global Manufacturing PMI is likely to improve to 49.3 from 49.0 but the Services counterpart may edge lower to 52.2 versus 52.3 prior. As a result, the S&P Global Composite PMI is expected to reprint the 52.0 number and can test the Aussie pair buyers. Above all, Friday’s Jackson Hole Symposium is the key event that can offer clear directions.

Technical analysis

A daily closing beyond a one-month-old descending resistance line, now immediate support around 0.6400, directs AUD/USD towards May’s low of near 0.6460.

- GBP/USD remains on the sideline after reversing from two-week low.

- Three-week-old symmetrical triangle restricts immediate moves between 1.2710 and 1.2800.

- Steady RSI, two-month-old rising support line also challenge Cable pair’s trading moves.

- Upbeat UK PMIs will need validation from softer US PMIs, downbeat Fed talks to keep Pound Sterling firmer.

GBP/USD edges lower past 1.2750 after reversing from the highest level in a fortnight the previous day, mostly quiet around 1.2750 amid the early hours of Wednesday’s Asian session. In doing so, the Cable pair portrays the market’s cautious mood ahead of the preliminary readings of the August month Purchasing Managers Indexes (PMIs) for the UK and the US.

That said, a three-week-old symmetrical triangle formation restricts immediate Pound Sterling moves between 1.2710 and 1.2800. It’s worth noting that the steady RSI (14) also portrays the market’s indecision.

Apart from the symmetrical triangle, an ascending support line from late June and the 200-SMA hurdle, respectively near 1.2680 and 1.2835, also act as additional trading filters for the GBP/USD pair.

It’s worth noting, however, that an upside break of the 200-SMA won’t hesitate to challenge the late July swing high of around 1.3000 whereas the Pound Sterling’s fall below 1.2680 will aim for the June 29 swing low of surrounding 1.2590.

Above all, the GBP/USD maintains the gradual downtrend from the mid-July peak despite the latest inaction. That said, a likely softer UK PMIs can keep the Cable bears even if the US activity data matches the unimpressive forecasts.

Also read: GBP/USD post losses amidst risk aversion, China’s economic woes

GBP/USD: Four-hour chart

Trend: Gradual downside expected

- EUR/GBP trades between 0.8500 and 0.8550 for the fifth day, briefly touching a YTD low of 0.8504.

- Sellers eye the 0.8500 level for further downside, with next support at last year’s August 22 low of 0.8408.

- Short-term bearish outlook supported by 50-HMA and daily pivot at 0.8522/26; resistance at 0.8540 and support at 0.8504.

According to the daily chart, the EUR/GBP currency pair remains locked in a narrow range between 0.8500 and 0.8550 for the fifth consecutive day. Despite this sideways action, the Euro (EUR) briefly dipped to a year-to-date low of 0.8504 before recovering slightly to the 0.8520 area as Wednesday’s Asian session began.

EUR/GBP Price Analysis: Technical outlook

The EUR/GBP daily chat portrays the pair in sideways action, within the 0.8500/0.8550 for the fifth consecutive day, though Euro (EUR) weakness triggered a fall to crack year-to-date (YTD) lows of 0.8504 and bounced towards the 0.8520 area. Sellers could extend the cross fall once they reclaim 0.8500. In that outcome, the EUR/GBP’s next support would be last year’s August 22 low at 0.8408. Conversely, the EUR/GBP could shift upwards if it reclaims 0.8600.

In the short term, the EUR/GBP hourly chart portrays a bearish continuation, as the intersection of the 50-hour Moving Average (HMA) with the daily pivot point at 0.8522/26 would be challenging to overcome. In addition, the downslope resistance trendline passes around 0.8540. If EUR/GBP breaks above those levels, the next resistance would be the 100-HMA at 0.8533, followed by the R1 pivot at 0.8537. Contrarily, and on the path of least resistance, the EUR/GBP’s first support would be the YTD low of 0.8504. Once cleared, the next support would be the S2 pivot at 0.8494, followed by the S3 daily pivot point at 0.8475.

EUR/GBP Price Action – Daily chart

- US Existing Home Sales declined 2.2% vs a 3.3% drop in June. Richmond Fed's Manufacturing Index fell to -7 from -9.

- New Zealand Retail Sales improved to -1.0 versus market expectations of -2.6% and -1.4% prior.

- Investors await US S&P Global PMI data ahead of Jackson Hole symposium

The NZD/USD pair remains flat around 0.5945 during the early Asian session on Wednesday. Markets turn cautious ahead of the Jackson Hole symposium. Meanwhile, the US Dollar Index (DXY), a measure of the value of USD against six other major currencies, rebounds and holds above 103.60.

On Tuesday, Existing Home Sales in the US declined 2.2% in July versus a 3.3% drop in June. Meanwhile, the Richmond Fed Manufacturing Index for August fell to -7 from -9, in line with market expectations.

In addition to the upbeat US data, hawkish comments from Federal Reserve Bank of Richmond President Thomas Barkin support the Dollar's recovery. Barkin said on Tuesday that monetary policy would need to be tightened if inflation remained elevated and there was no evidence that demand would fall.

On the other hand, the latest data from Statistics New Zealand revealed on Wednesday that the nation’s Retail Sales QoQ for the second quarter improves to -1.0 versus market expectations of -2.6% and -1.4% prior. Apart from the data, the Reserve Bank of New Zealand (RBNZ) Chief Economist stated that the central bank is aware of the decline in the New Zealand Dollar. In addition, policymakers would lower the OCR sooner than we have signaled if China experienced a more significant deceleration than the RBNZ anticipates.

Market players will take cues from China's developments and market sentiment. the US Commerce Department’s statement reported on late Tuesday that US Commerce Secretary Gina Raimondo met the Chinese ambassador Xie Feng, and had a productive discussion before her departure to China, according to Reuters. However, the renewed tension between the US-China could exert pressure on the Kiwi and acts as a headwind for the NZD/USD pair.

Looking ahead, US S&P Global PMI data will be released later on Wednesday. The key event will be Jackson Hole annual symposium on Thursday and Fed Chair Powell's speech on Friday. The event will be critical for determining a clear movement for the NZD/USD pair.

Early Wednesday in Asia, Statistics New Zealand released the quarterly Retail Sales data for the second quarter (Q2) of 2023.

As per the details, New Zealand’s (NZ) headline Retail Sales figures improves to -1.0% QoQ compared to the market expectations of -2.6% and -1.6% previous readings (revised from -1.4%).

That said, the Real Retail Sales also improved to -3.5% YoY from -4.1% prior details.

However, the Retail Sales ex Autos, also known as the core Retail Sales, drops to -1.8% QoQ for the same period from -1.1% prior but came in better than -2.5% market forecasts.

It’s worth noting that Reserve Bank of New Zealand Chief Economist Paul Conway crossed wires, via NZ media, earlier in the day and said they’re (RBNZ) mindful of the latest fall in the New Zealand Dollar (NZD), as the Kiwi drops to the yearly bottom.

RBNZ’s Convay also defended the central bank’s inaction by saying that they would lower the OCR sooner than they have signaled if there was a more significant slowdown in China than the RBNZ expects.

Market reaction

NZD/USD initially refreshed the intraday low to 0.5938 on the data release before recently picking up bids to 0.5945.

About New Zealand Retail Sales

The retail Sales released by Statistics New Zealand measures the total receipts of retail stores. Quarterly percent changes reflect the rate of changes in such sales. Changes in Retail Sales are widely followed as an indicator of consumer spending. A high reading is seen as positive (or bullish) for the NZD, while a low reading is seen as negative (or bearish).

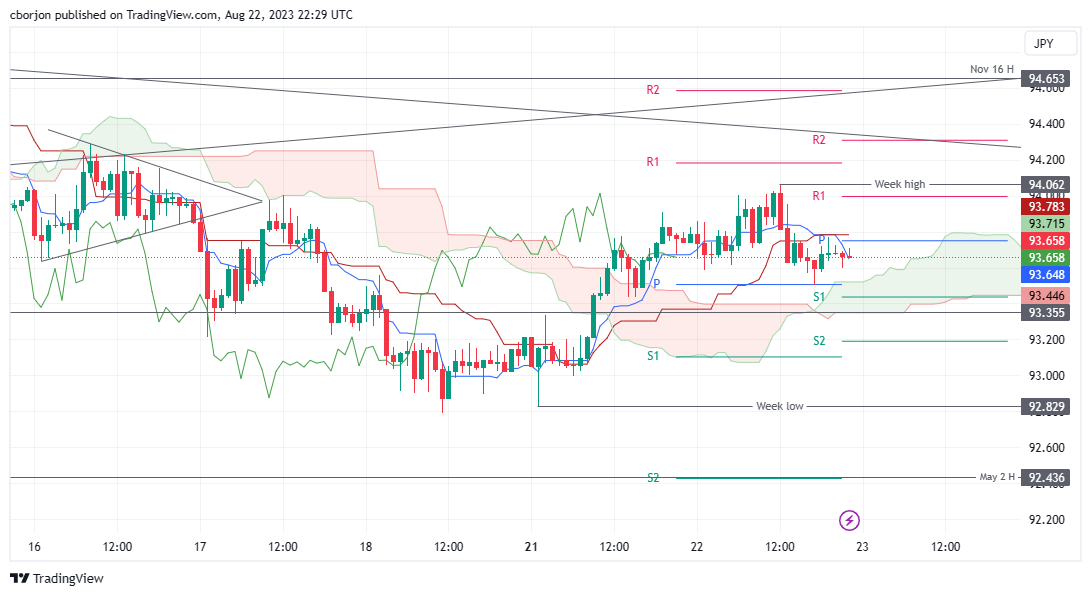

- AUD/JPY down 0.10%, trading at 93.67, influenced by China’s economic woes and US interest rate concerns.

- Technical indicators show resistance at 93.82, with further downside possible if the pair falls below last week’s low of 92.78.

- Intraday outlook is bearish, with key resistance at 93.75; a break below 93.50 could trigger further declines.

The AUD/JPY trimmed some of Monday’s gains, post losses of 0.10% on Tuesday, though it opens Wednesday’s Asian session with a lower not, exchanging hands at 93.67, down a minuscule 0.01%, at the time of writing. The main drivers for the AUD/JPY fall are risk aversion on China’s woes, US banks feeling the pain of higher interest rates and uncertainty about the US Federal Reserve Chair Powell’s speech at the Jackson Hole Symposium.

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY daily chart portrays the pair continuing its downtrend as the cross-currency pair fell below the Ichimoku Cloud (Kumo). Also, the confluence of the Tenkan and Kijun-Sen lines, at around 93.82, would cap buyers’ intentions of reclaiming the 94.00 figure. Further downside is warranted once the AUD/JPY dives below the last week’s low of 92.78, with the 92.00 psychological level up next, followed by the July 28 low of 91.79.

From an intraday perspective, the AUD/JPY is set to extend its gains, as Monday’s price action lifted the exchange rates from below 92.89, with the pair reaching a week high of 94.06. Buyers’ failure to hold prices above 94.00 exacerbated AUD/JPY’s fall toward the top of the Kumo, with prices bouncing off the day’s low. It should be said that Tenkan and Kijun-Sen portray the pair as bearish, with the latter sitting on top of the former, and intersecting with the daily pivot point at 93.75, seen as a first resistance level. A breach of that level will expose the R1 pivot point at the 94.00 mark.

Conversely, a break below Tuesday’s low of 93.50 could put into play the bottom of the Kumo at 93.30, followed by the S2 pivot level at 93.19, and then the current week’s low of 92.83.

AUD/JPY Price Action – Hourly chart

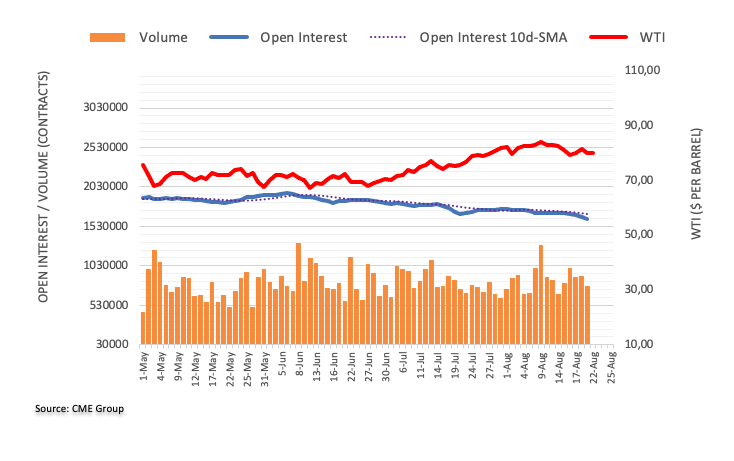

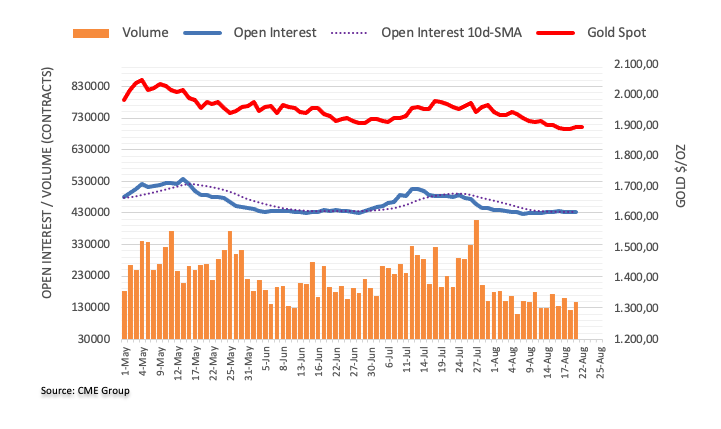

- Gold Price edges higher towards short-term key resistance confluence despite firmer US Dollar.

- Strong US Treasury bond yields, less acceptance for dedollarization at BRICS underpin Greenback’s run-up, challenging XAU/USD price.

- Mixed concerns about China, Russia and hawkish Fed talks prod Gold traders.

- Preliminary Purchasing Managers Index figures for August eyed for fresh impulse.

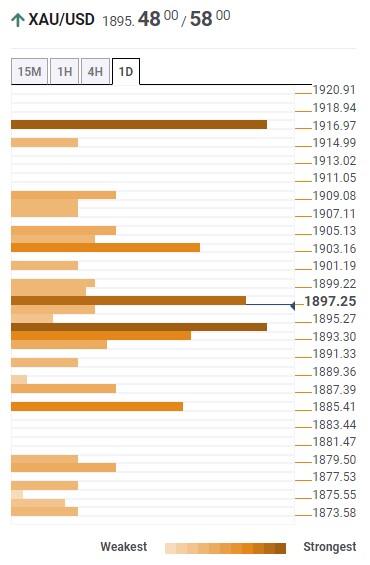

Gold Price (XAU/USD) portrays an upward grind around the $1,900 threshold, approaching the $1,910 resistance confluence, as market players brace for multiple central bankers’ speeches at the annual Jackson Hole Symposium event.

The precious metal remains cautiously positive after posting minor gains in the last two consecutive days even as the US Dollar remains firmer amid upbeat United States data and the hawkish commentary from the Federal Reserve (Fed). Adding strength to the recovery moves could be the mixed geopolitical and trade concerns, as well as positioning for Wednesday’s preliminary readings of the August month Purchasing Managers Indexes (PMIs) for major economies.

Gold Price drops as US Dollar traces firmer Treasury bond yields

Gold Price returns to the bear’s radar, after the week-start failure to lure the bulls, as the US Dollar regains buyer’s attention amid firmer United States data, hawkish Federal Reserve (Fed) talks and upbeat Treasury bond yields.

US Dollar Index (DXY) prods the 10-week high marked Friday, around 103.60 at the latest, as improvements in the US Existing Home Sales for July and the Richmond Fed Manufacturing Index for August joins firmer Treasury bond yields.

That said, the US Existing Home Sales came in as -2.2% MoM versus -3.3% prior while the Richmond Fed Manufacturing Index matched -7.0 market forecast compared to -9.0% previous readings.

Apart from the firmer US data, hawkish statements from Federal Reserve Bank of Richmond President Thomas Barkin also underpin the US Dollar’s rebound and weigh on the Gold Price. On Tuesday, Fed’s Barkin emphasized achieving the 2.0% inflation target while challenging the US recession concerns by stating, per Reuters, “If the US were to have a recession, it would likely be a ‘less-severe’ one.” The policymaker also added, “Fed must be open to the possibility that the economy will begin to reaccelerate rather than slow, with potential implications for the US central bank's inflation fight.”

It’s worth noting that the expectations of witnessing strong wage growth in the US, per the Federal Reserve Bank of New York’s SCE Labor Market Survey, also favor the US Dollar’s retreat and capped the Gold Price.

It’s worth noting that the US 10-year Treasury bond yields rose to the highest level since late 2007, before retreating to 4.33% and hence flags the market’s indecision, which in turn challenges the XAU/USD traders.

China, Dedollarization exert additional downside pressure on XAU/USD

Apart from the US Dollar moves, the mixed concerns about China, dedollarization and Russia also prod the Gold Price.

On Tuesday, Bloomberg came out with an analytical piece suggesting the market’s lack of confidence in China’s efforts to restore economic transition.

Alternatively, the latest headlines from Reuters suggest the US-China talks on businesses and commercial ties, which in turn flags hope of pausing the tit-for-tat moves by the world’s top-two economies, which in turn puts a floor under the Gold Price.

Further, news from Russian media claimed Moscow’s destruction of a US-made military vessel near Snake Island, which in turn triggered the risk-off mood initially before restoring the sentiment amid concerns that the vessel was operating under a US flag.

However, concerns about the dedollarization at the BRICS Summit, currently held in South Africa to facilitate diplomatic discussion among Brazil, Russia, India, China and South Africa, gain little acceptance from India and South Africa, which in turn favors sentiment. The same keep the US Dollar on the front foot, favoring the Gold bears in turn.

August PMI in the spotlight ahead of Jackson Hole

To sum up, the firmer US Dollar and challenges to sentiment keep the Gold sellers hopeful as market players await the preliminary readings of the August month Purchasing Managers Indexes (PMIs) for major economies. Should the activity numbers improve, the odds of witnessing a sooner end to the restrictive monetary policies increase, which in turn challenge the Gold sellers.

That said, the US S&P Global Manufacturing PMI is likely to improve to 49.3 from 49.0 but the Services counterpart may edge lower to 52.2 versus 52.3 prior. As a result, the

S&P Global Composite PMI is expected to reprint the 52.0 number and can let the current Gold Price weakness prevail.

It’s worth noting, however, that Friday’s Jackson Hole Symposium is the key event that can offer clear directions to the Gold Price.

Also read: Jackson Hole Preview: Powell poised to keep markets on edge, three scenarios for the US Dollar

Gold Price Technical Analysis

Gold Price fades the bounce off a multi-month low marked the last week amid failures to cross the convergence of 200-DMA and 61.8% Fibonacci retracement of February-May upside, around $1,910 by the press time. That said, the bearish signals from the Moving Average Convergence and Divergence (MACD) indicator add credence to the downside bias.

However, the nearly oversold conditions of the Relative Strength Index (RSI) line, placed at 14, suggests limited room towards the south for the XAU/USD, which in turn highlights a downward-sloping support line from late June, close to $1,880 by the press time.

In a case where the Gold Price breaks the stated support line, the early March swing high of around $1,858 will act as the last defense of the XAU/USD buyers before directing the bullion toward the yearly low surrounding $1,805.

Meanwhile, a successful run-up beyond the $1,910 resistance confluence enables the Gold buyers to aim for the 50-DMA hurdle of around $1,935.

Following that, a downward-sloping resistance line from early May, close to $1,950 at the latest, should check the Gold buyers for one last time.

Overall, the Gold Price remains on the back foot unless crossing $1,950. The XAU/USD downside, however, appears to have limited room.

Gold Price: Daily chart

Trend: Further downside expected

Late Tuesday, Reuters quotes the US Commerce Department’s statement saying, “US Commerce Secretary Gina Raimondo met with Chinese Ambassador, as well as the Vice Foreign Minister, Xie Feng and had a ‘productive discussion’ ahead of her trip to China.”

While conveying the details of the meeting, the news also states that US Commerce Secretary Raimondo highlighted the importance to the US businesses and workers.

The news also states the policymakers’ discussion about issues relating to the US–China commercial ties and the challenges faced by US businesses, as well as the areas for potential cooperation.

Earlier in the week, the US Commerce Department’s Bureau of Industry and Security (BIS) removed 27 Chinese entities from its Unverified List, removing sanctions from those entities and flagged hopes of the improving US-China ties.

Market reaction

The news seems to have underpinned the latest pause in the risk aversion and put a floor under the AUD/USD prices, edging higher to 0.6425 by the press time of early Wednesday morning in Asia.

- USD/JPY closed near the 145.80 area as bulls showed signs of exhaustion.

- US and Japan’s PMIs from August will be Wednesday’s highlights.

- Investors await fresh catalysts to model their expectations on the Fed and BoJ.

In Tuesday’s session, the JPY traded strongly against most of its rivals, mainly driven by the 10-year Japanese bond yield rise, which rose to its highest level since 2014, past 0.60%. On the USD side, the Greenback traded mixed against its rivals, while investors remain cautios ahead of the Jackson Hole Symposium kick-off on Thursday, followed by Jerome Powell’s speech on Friday to continue placing their bets regarding the next Federal Reserve (Fed) decisions.

On Wednesday, investors will pay close attention to the S&P Global PMIs from the US from August, which will also help investors model their expectations in relation to the US economic outlook. During the early Asian session, the Jibun Bank will release the Japanese PMIs from the same month.

Regarding the Federal Reserve (Fed) decisions, markets continue to bet to a no-hike in the September meeting and place nearly 40% bets of a 25 basis point (bps) hike on the November meeting. On the Bank of Japan (BoJ) side, the rise in the Japanese yields indicates that markets are hoping for a tweak, but as for now, the bank hasn’t given any signals about leaving its monetary policy.

USD/JPY Levels to watch

The USD/JPY suggests a neutral to bearish technical outlook on the daily chart as bullish momentum wanes. The Relative Strength Index (RSI) indicates a negative slope above its midline, and the Moving Average Convergence Divergence (MACD) displays fading green bars. .On the other hand, the pair is above the 20,100,200-day Simple Moving Average (SMAs), suggesting that the bulls are firmly in control of the bigger picture.

Support levels: 145.00. 144.50, 143.97 (20-day SMA)

Resistance levels: 146.00, 146.50, 147.00

USD/JPY Daily chart

-638283388524527848.png)

- EUR/JPY retreated near the 158.00 area, seeing more than 0.70% losses on the day.

- Alongside the NZD, the JPY is one of the session’s top-performer.

- Tightening expectations for the ECB remain low. Eyes on Lagarde, August PMIs.

In Tuesday’s session, the EUR/JPY lost ground and retreated near the 158.20 area. Higher Japanese yields contributed to the JPY trading strong while the Euro traded soft. Investors await fresh catalyst in the August PMIs figures from August from Germany and Japan to be released on Wednesday.

On the Euro front, the European currency is trading weak against most of its rivals, as investors are taking profits following back-to-back sessions of tallying gains against most of its rivals. For the rest of the week, investors will eye Manufacturing and Services S&P Global and Hamburg Commercial Bank (HCOB) figures from August, which are expected to decelerate. On Friday, Christine Lagarde will speak at the Jackson Hole Symposium, and Germany will release its final Q2 Gross Domestic Product figures estimates.

As for now, tightening expectations from the European Central Bank (ECB) remains low. World Interest Rates Probabilities (WIRP) indicates that markets are discounting 55% odds of a 25bps increase in the upcoming September 14, 2023 meeting from the ECB. Looking forward, the chances of a 25 bps hike stand at 75% in October, followed by an 85% probability of a 25 bps hike in the December meeting. This rate hike path would leave the target rate at 5%.

On the other hand, the Yen recovered ground against its rivals, as the Japanese Government Yields (JGB) rose to their highest level since 2014, including the 10-year rate rising past 0.60%. Those moves may suggest that markets are expecting a potential pivot, but the Bank of Japan (BoJ) hasn’t delivered any signs of leaving its accommodative approach. As for now, they expect higher inflation and wages to start tightening, so in the meantime, monetary policy divergences may continue weakening the JPY in the short term.

EUR/JPY Levels to watch

The EUR/JPY suggests a neutral to bearish technical outlook on the daily chart as bullish momentum wanes. The Relative Strength Index (RSI) shows a negative slope above its midline, and the Moving Average Convergence Divergence (MACD) displays fading green bars. On the bigger picture, the pair is above the 20,100,200-day Simple Moving Average (SMAs), indicating that the buyers are in command.

Support levels: 158.00, 157.50, 157.00.

Resistance levels: 159.00, 160.00, 160.50.

EUR/JPY Daily chart

-638283346261619101.png)

The Global PMIs will provide the first insight into economic activity during August. Apart from the Australian and Japanese PMIs in the Asian session, New Zealand will report Q2 Retail Sales. Later in the day, Canada will release Retail Sales data, and there will be housing data from the US.

Here is what you need to know on Wednesday, August 23:

Stocks in Asia recovered, with the Shanghai index rising 0.88% after Monday's slide. However, a cautious tone still prevails following the People's Bank of China's smaller-than-expected interest rate cut. On Wall Street, the Dow Jones lost 0.51%, the S&P 500 fell by 0.28%, and the Nasdaq gained 0.06%. The cautious sentiment continues to dominate.

Concerns regarding China, coupled with additional downgrades for US banks by S&P, and expectations of prolonged high interest rates, are exerting downward pressure on market sentiment. The upcoming Jackson Hole annual symposium, commencing on Thursday, holds significant importance, with Fed Chair Powell's speech on Friday. Prior to the symposium, US yields edged higher, reaching new multi-year highs, with the 10-year yield surpassing 4.30%.

Data released on Tuesday showed that US Existing Home Sales tumbled 2.2% in July to an annual rate of 4.07 million, falling below the market consensus of 4.15 million. The Richmond Fed Manufacturing Index improved in August from -9 to -7, in line with market consensus.

Analysts at Wells Fargo on Existing Home Sales

The impact of the recent resurgence in mortgage rates is becoming increasingly apparent. Existing home sales declined 2.2% during July, the second straight monthly decline. Since existing home sales reflect contract closings, July's data largely reflect activity in June when mortgage rates averaged 6.8%, but rates have marched higher since.

In the US, more housing data is due on Wednesday with New Home Sales. Additionally, the S&P Global PMI is scheduled to be released, with the Composite Index expected to remain at 52. The primary focus remains on central bankers ahead of the Jackson Hole Symposium.

EUR/USD initially rose to 1.0930 but then turned downwards, falling to test the support area at 1.0830. The pair remains under pressure and is approaching the 200-day Simple Moving Average (1.0799).

Eurozone PMI data is due on Wednesday. The Composite PMI is forecasted to decline from 48.6 to 48.5. Weaker-than-expected numbers could weigh on the Euro. Additionally, Eurostat will release the preliminary August reading of Consumer Confidence later in the day.

UK government borrowing came in below forecasts in July at £4.3 billion, £3.4 billion more than in July 2022. From April to July, the budget deficit was £56.6 billion, £11.3 billion less than what the Office for Budget Responsibility had forecasted in March. This provides some grounds for the government to consider tax cuts. GBP/USD traded above the 20-day Simple Moving Average (SMA), but it then pulled back below 1.2750. The pair is consolidating with a bullish bias in the short-term. The UK S&P Global/CIPS Composite PMI is expected to decline from 50.8 to 50.3, with contractions in both Services (51.5 to 50.8) and Manufacturing (45.3 to 45).

USD/JPY remains steady near 146.00 and above the key short-term area of 145.00, supported by higher US Treasury yields.

USD/CAD continues to trade near monthly highs above 1.3550 with a bullish bias. On Wednesday, Canada will report June Retail Sales, which are expected to remain unchanged compared to May.

AUD/USD finished far from the daily highs on Tuesday, trading around 0.6420. The pair rose for the third consecutive day, but the momentum faded. The Australian S&P Global Manufacturing PMI is expected to remain unchanged at 49.6, and the Services PMI at 47.9.

NZD/USD rebounded after finding support at 0.5900. It peaked at 0.5970 but then pulled back to 0.5940. New Zealand will report Q2 Retail Sales, which are expected to show a 2.6% decline.

Gold rose marginally but was unable to retake the $1,900 mark. Despite the rebound, risk sentiment continues to lean towards the downside. Silver rose for the fourth consecutive day, reaching levels above the 20-day SMA, and settled around $23.40.

Cryptocurrencies edged lower, with Bitcoin falling more than 1% to $25,800, and Ethereum losing almost 3% to $1,625.

Like this article? Help us with some feedback by answering this survey:

- EUR/USD drops 0.43%, reaching a monthly low of 1.0832, with eyes on the 200-day Moving Average.

- US Dollar Index (DXY) climbs 0.26% to 103.591 as US Treasury bond yields bolster the greenback.

- Eurozone’s light economic agenda keeps EUR/USD steady; S&P Global PMIs release awaited for directional cues.

EUR/USD lost traction and registered losses of 0.43% on Tuesday, printing a new monthly low of 1.0832 and set to extend its fall toward the 200-day Moving Average (DMA) at 1.0795. However, late EUR/USD buyers stepped into the market and lifted the pair, which trades at 1.0848 after hitting a daily high of 1.0930.

US Stocks Uncertain; Richmond Fed’s Data and NAR’s Home Sales Report Influence Market Sentiment

US stocks waver amidst traders’ fragile sentiment as they brace for the US Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole Symposium. US Treasury bond yields underpinned the greenback, with the 3-month, two, and 5-year Treasuries posting gains within the 0.28% - 0.78% range. Consequently, the buck climbs, as depicted by the US Dollar Index (DXY), which measures the buck’s value against a basket of six currencies, gains 0.26%, at 103.591.

Data-wise, the National Association of Realtors (NAR) released data indicating a -2.2% decrease in Existing Home Sales for July. However, it represents an improvement compared to the prior month’s -3.3%. NAR Chief Economist Lawrence Yun attributed this decline to factors such as limited “inventory availability” and elevated “mortgage rates,” according to the report.

The Richmond Fed revealed its Manufacturing Index for August, which plummeted -7 as expected in August, though its Services Index exceeded estimates of a -4 contraction, came at 4.

In recent statements by Richmond Fed President Thomas Barkin, he emphasized that the yield shift does not indicate “inappropriate” market tightening. Instead, he views it as a reaction to robust economic data. Barkin further stated that if inflation maintains its elevated levels and the economy continues showing signs of strength, it would bolster the argument for additional tightening measures.

Across the pond, a light Eurozone (EU) economic docket keeps the EUR/USD pair trading within familiar levels but set to test the next dynamic support at 200-DMA. On Wednesday, the release of S&P Global PMIs could dictate the direction of the EUR/YSD. On the US front, the economic docket would feature Fed speakers, S&P Global PMIs, Durable Good Orders, and New Home Sales.

EUR/USD Price Analysis: Technical outlook

The EUR/USD is still neutral to downward biased, as price action achieved successive series of lower highs and lower lows, with the August 3 daily low of 1.0912, seen as the first resistance level, crucial for buyers if they want to resume the uptrend. In that outcome, the next resistance would be the 50-DMA at 1.0980 before challenging 1.1000. Nonetheless, the EUR/USD’s path of least resistance is downwards. The first support would be the August 22 low of 1.0832, followed by the 1.0800 mark. A breach of the latter will expose the 200-DMA at 1.0795, and the mid-point between 1.07/1.08.

- The S&P 500 retreated below 4,400 after two consecutive days of gains.

- Ahead of Powell’s speech on Friday, hawkish words from Thomas Barkin boosted tightening expectations on the Fed.

- Eyes on S&P Global PMI data on Wednesday.

In Tuesday's session, the market sentiment remains mixed as investors await fresh catalysts to define their short-term trajectory.

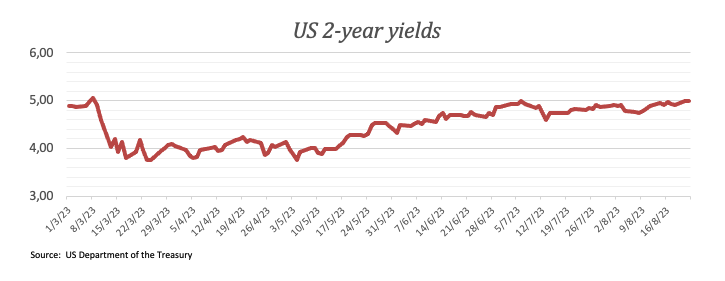

On the downside, the US Treasury yield recovered during the mid-American session following Thomas Barkin's hawkish remarks, where he pointed out that if inflationary pressures don’t show evidence of giving in, more tightening would be necessary. In the meantime, the 2-year yield recovered back above 5% to its highest level since early July making the American stock market lose interest.

For the rest of the week, investors will closely watch US S&P Global Manufacturing and Service PMI figures from August, which will be released on Wednesday. It's worth noticing that a strong economy tends to favour the stock market. Still, due to the Federal Reserve (Fed) stance, evidence of a hot economy may make investors discount a more aggressively Fed, and in that case, it would apply pressure on the S&P.

According to the CME FedWatch tool, markets still expect a pause in September, followed by a 25 basis point (bps) hike in the November meeting. However, those odds may change following Jerome Powell’s speech on Friday at the Jackson Hole Symposium, where investors will look for clues regarding forward guidance.

SPX Levels to watch

According to the daily chart, the technical outlook for SPX remains bearish for the short term. The Relative Strength Index (RSI) remains deep in negative territory while the Moving Average Convergence Divergence (MACD) prints higher red bars. Additionally, the index is below its 20-day Simple Moving Averages (SMA) but above the 100 and 200-day averages, suggesting that on the bigger picture, the bulls still have the upperhand over the bears.

Supports: 4,370, 4,350, 4,300 (100-day SMA).

Resistances: 4,400, 4,420, 4,450.

SPX Daily Chart

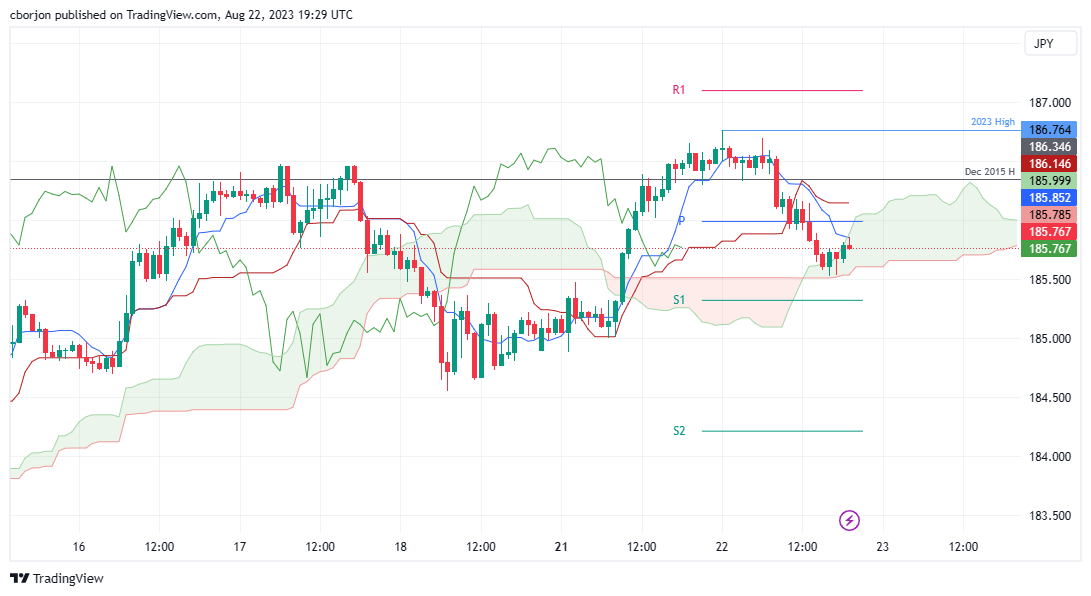

- GBP/JPY dropped 0.34%, trading at 185.80, influenced by a dip in US 10-year Treasury bond yield.

- Despite a daily low of 185.52, GBP/JPY is poised to challenge the 187.00 mark amid potential Yen intervention.

- Short-term analysis shows support at Senkou Span B (185.50); a close below 186.00 may signal further declines.

GBP/JPY hits a new year-to-date (YTD) high but retraces as the Japanese Yen (JPY) strengthens during Tuesday’s session and remains the second strongest currency in the day. A drop in the US 10-year Treasury bond yield undermined the USD/JPY pair; hence the GBP/JPY dropped. At the time of writing, the GBP/JPY is trading at 185.80, with losses of 0.34%.

GBP/JPY Price Analysis: Technical outlook

From a daily chart perspective, the GBP/JPY remains upward biased, though it seems that some buyers book profits, as Japanese authorities remain vocal about a possible intervention to boost the Yen. Despite dipping to a daily low of 185.52, the pair would likely test the 186.00 figure, followed by a challenge of the 187.00 psychological level.

In the short term, the GBP/JPY hourly chart portrays the pair peaked around the new YTD high and retraced below the Asian session low of 186.29, plunging 70 pips toward its daily low. It should be said the GBP/JPY dive was cushioned by the Senkou Span B support at around 185.50; since then, the cross-currency pair edged towards the confluence of the top of the Ichimoku Cloud (Kumo) and the Tenkan-Sen line at 185.85. Once those levels are cleared, the next stop would be the daily pivot point at 185.99. A daily close below 186.00 could pave the way for further losses.

GBP/JPY Price Action – Hourly chart

- GBP/USD faces a 0.12% loss, influenced by high US Treasury bond yields and global trade apprehensions.

- US Existing Home Sales dropped 2.2% in July; limited inventory and high mortgage rates cited as causes.

- Richmond Fed’s Manufacturing Index meets expectations with -7, while the Services Index surprises with a positive 4.

GBP/USD retreated after testing the 50-day Moving Average (DMA) but dropped mainly on high US Treasury bond yields and risk aversion spurred by the recent developments surrounding China. Fears that the country with the second largest economy in the world can sharply slow down could weigh on global trade. Hence, the GBP/USD is trading at 1.2741, registering losses of 0.12% at the time of writing.

US stocks decline, Greenback strengthens: global trade tensions rise with China’s economic uncertainties.

US stocks are experiencing a decline due to the prevailing fragile market sentiment. The National Association of Realtors (NAR) released data indicating a 2.2% decrease in Existing Home Sales for July. This, however, represents an improvement compared to the preceding month’s figure of -3.3%. NAR Chief Economist Lawrence Yun attributed this decline to factors such as limited “inventory availability” and elevated “mortgage rates,” according to the report.

Other data revealed by the Richmond Fed, the Manufacturing Index plummeted -7 as expected in August, though its Services Index exceeded estimates of a -4 contraction, came at 4.

US bond yields are mixed as the short-end of the curve continues to bull-steepen, while the 10s, 20s, and 30s drop between 0.18 and 0.47 percent. However, the Greenback (USD) continues to rise, with the US Dollar Index (DXY) measuring the buck’s value vs. six currencies, advancing 0.26%, at 103.588.

In recent statements by Richmond Fed President Thomas Barkin, he emphasized that the yield shift does not indicate “inappropriate” market tightening. Instead, he views it as a reaction to robust economic data. Barkin further stated that if inflation maintains its elevated levels and the economy continues showing signs of strength, it would bolster the argument for additional tightening measures.

On the US front, the economic docket would feature Fed speakers, S&P Global PMIs, Durable Good Orders, and New Home Sales.

In the meantime, the UK economic docket would feature the release of S&P Global/CIPS PMIs, which are expected to continue to weaken; in services and manufacturing. The Manufacturing PMI is expected to slide for six consecutive months, while the services PMI is expected to climb to 51.3.

GBP/USD Price Analysis: Technical outlook

The GBP/USD remains neutrally biased but trading within the 50-day Moving Average (DMA) and the 1.2600 figure for the latest month-to-date (MTD). A bullish resumption would happen once buyers reclaim the 1.2800 mark, exacerbating a rally towards 1.3000, with 1.2900 seen as initial resistance. Conversely, if GBP/USD drops below 1.2600, that could expose the GBP/USD pair to selling pressure. Key support levels to test would be 1.2500, followed by the 200-DMA at 1.2387.

GBP/USD Price Action - Daily chart

- USD/CHF shows mild gains near the 0.8800 area.

- The pair continues to trade sideways since early August.

- Hawkish comments from Fed’s Thomas Barking gave the USD a boost.

- Investors await Powell’s speech on Friday and Wednesday’s US August PMIs.

On Tuesday, the USD/CHF traded with mild gains, near the critical 0.8800 zone. On the US side, Thomas Barking from the Federal Reserve (Fed) commented that more tightening may be needed while investors await Wednesday’s PMIs from August and Jerome Powell’s Friday speech. On the CHF side, Switzerland reported a higher than expected Trade Balance deficit in July, which seems to be pressuring the CHF. Besides that, no relevant data will be released on the Swiss front for the rest of the week.

That said, the USD measured by the DXY index upside potential is limited in a risk-positive market environment, with major US stock indexes closing green on Monday’s session. On a positive note, Thomas Barkin from the Fed delivered hawkish comments and stated , “If inflation remains high and demand gives no signal that it is likely to drop, that would require a tighter monetary policy”. As a reaction, US Treasury yields recovered some ground, and hawkish bets may limit further losses for the USD.

Attention is now set to the Jackson Hole Symposium, which will kick off on Thursday, and S&P Global Manufacturing figures from the US from July on Wednesday. Those figures are expected to show a decelerating economic activity but remain in expansion territory and will help investors model their expectations towards the next Federal Reserve (Fed) meeting. As for now, markets are still confident that the Fed will pause in September and then bet on higher odds of a hike in November of 25 basis points (bps)

USD/CHF Levels to watch

Analysing the daily chart, it is apparent that the USD/CHF has a neutral to bullish technical stance, with the bulls gradually recovering ground but still not in command. The Relative Strength Index (RSI) indicates positive momentum with an ascending slope above its midline, while the Moving Average Convergence (MACD) lays out flat green bars.On the other hand, the pair is above the 20-day Simple Moving Average (SMA) but below the 100 and 200-day Simple Moving Average (SMAs), suggesting that despite the recent bearish sentiment, the bulls are still resilient, holding some momentum.

Support levels: 0.8750 (20-day SMA), 0.8730, 0.8715.

Resistance levels: 0.8800, 0.8820, 0.8850.

USD/CHF Daily chart

-638283228211823782.png)

- US Existing Home Sales contract by -2.2% in July, with inventory constraints and rising mortgage rates as key drivers.

- Richmond Fed Manufacturing Index meets expectations with a -7 drop, while the Services Index surprises positively at 4.

- Richmond Fed President Barkin suggests solid economic data drives yield movements, hinting at potential further tightening.

- Mexico’s upcoming economic data includes August 1st half inflation, expected to show a decrease.

The Mexican Peso (MXN) registered solid gains on Tuesday, as the USD/MXN pair plummeted below the 17.0000 figure amidst the lack of a catalyst, even though the mood has deteriorated. US Treasury bond yields are almost flat, but the greenback gains ground against most G7 currencies. The USD/MXN is trading at 16.9288, down 0.44%.

Despite a deteriorating mood and gains in the greenback against G7 currencies, the MXN stands firm

Wall Street turned negative as the North American session progressed. Existing Home Sales in the US slumped less than expected, still contracted at a -2.2% pace in July, driven by inventory availability and higher mortgage rates. At the same time, Richmond Fed Manufacturing Index dropped to -7 as estimated, while its Services index posted a positive figure, coming at 4, crushing estimates for a -4 plunge.

The USD/MXN is also falling as US bond yields at the long end of the curve fall. The exception is US 3-month and 2-year Treasuries, yielding 5.30% and 5.02%, respectively. According to recent words from Richmond Fed President Thomas Barkin noted, the move in yields is not a sign of “inappropriate” market tightening; instead, he said is a response to strong economic data.

Barkin added that if inflation stays high and the economy strengthens further, “that would make the case” for additional tightening.

In the meantime, the US Dollar Index (DXY), a gauge of the buck’s value against a basket of six currencies, has risen 0.25%, up at 103.579, but so far failed to gain traction against emerging market currencies.

Aside from this, the Mexican economic docket would feature August 1st half inflation on August 24, which is estimated to decrease to 4.67% YoY and 0.28% on monthly figures. Meanwhile, Mexico’s economy minister Raquel Buenrostro told Reuters, “Mexico rules out modifying a decree on genetically modified (GM) corn ahead of a dispute settlement panel requested by the United States through the USMCA trade pact.”

On the US front, the economic docket would feature Fed speakers, S&P Global PMIs, Durable Good Orders, and New Home Sales.

USD/MXN Price Analysis: Technical outlook

Today, the USD/MXN resumed its downtrend, after standing above the 17.0000 figure for the last 14 days, after clashing with the confluence of the 20 and 50-day Moving Averages (DMAs) at the 17.0000 figure, spurring a fall toward a daily low of 16.8930. Should be said a decisive break below that level, and the pair would challenge the year-to-date (YTD) low of 16.6238. Nevertheless, if USD/MXN reclaims the 17.00 figure, that could pave the way for a test of the 100-DMA at 17.4011.

USD/MXN Price Action – Daily chart

"If inflation remains high and demand gives no signal it is likely to drop, that would require tighter monetary policy," Federal Reserve Bank of Richmond President Thomas Barkin said on Tuesday, as reported by Reuters.

"Consumer spending, economic strength make it possible the US economy could reaccelerate before inflation cools," Barkin added but noted that he will not prejudge the outcome of the Fed's September 19-20 policy meeting.

Market reaction

The US Dollar Index clings to daily gains above 103.50 following these comments.

- USD/CAD sets a six out of the last seven days of gains and rose to 1.3550, trading its highest since early June.

- The USD gained momentum during the American session, and the DXY index rose to 103.56.

- Lower Oil prices apply pressure on the CAD.

In Tuesday’s session, the USD/CAD continued to gain ground, mainly driven by the broad-based CAD weakness. On the other hand, investors await key manufacturing and services sector PMIs from August to be released. Eyes are also set on Powell’s speech on Friday at the annual Jackson Hole Symposium.

The USD is trading somewhat weak against most of its rivals, primarily due to investors showing more interest in risk-sensitive assets. On the data front, Existing Home Sales from the US came in slightly lower than expected at 4.07M in July vs the 4.15M expected and the previous 4.16M but failed to impact the Greenback significantly.

For the rest of the week, the focus shift to the Jackson Hole Symposium, which will kick off on Thursday, and on Wednesday, the American economic calendar will feature S&P Global PMI data which is expected to show a deceleration in the US service and manufacturing sector.

On the CAD front, no relevant data will be released during the session, and the weakness of Oil prices is contributing to the Canadian currency decline. In that sense, due to Chinese economic concerns, the black gold prices continue to retreat and fell to their lowest point since early August.

USD/CAD Levels to watch

Evaluating technical indicators, the USD/CAD displays a short-term bullish outlook. Nevertheless, traders should take caution due to the emergence of overbought signals, which may lead to a technical correction in the near term. The Relative Strength Index (RSI) is in overbought territory above 70.00, while the Moving Average Convergence (MACD) histogram exhibits more oversized green bars. In addition, the pair is above the 20,100,200-day Simple Moving Averages (SMAs), indicating a favourable position for the bulls in the bigger picture.

Support levels: 1.3530, 1.3500, 1.3490.

Resistance levels: 1.3570, 1.3590, 1.3600.

USD/CAD Daily chart

-638283168427154063.png)

- US Existing Home Sales drop by -2.2% in July, with "inventory availability" and higher "mortgage rates" cited as reasons.

- Richmond Fed's Manufacturing Index meets expectations with a drop of -7, while the Services Index surprises positively.

- US bond yields show mixed dynamics, but the Greenback continues its ascent with the DXY at 103.588.

NZD/USD recovers some ground though exchanges hands off the highs of the day of 0.5972, trading at 0.5941, amidst a mixed market mood spurred by fears about recent developments in China and uncertainty about the outcome of US Federal Reserve Chair Jerome Powell’s speech at Jackson Hole.

The Kiwi recovers slightly but remains under pressure due to concerns over China and US economic data

US equities dwindle as market sentiment remains fragile. The National Association of Realtors (NAR) revealed that Existing Home Sales plunged -2.2% in July but improved compared to June’s -3.3% figures. According to the report, “inventory availability” and higher “mortgage rates” are the drivers behind the latest report drop, revealed NAR Chief Economist Lawrence Yun.

In other data revealed by the Richmond Fed, the Manufacturing Index plummeted -7 as expected in August, though its Services Index exceeded estimates of a -4 contraction, came at 4.

US bond yields are mixed as the short-end of the curve continues to bull-steepen, while the 10s, 20s, and 30s drop between 0.18 and 0.47 percent. However, the Greenback (USD) continues to rise, with the US Dollar Index (DXY), a measure of the buck’s value vs. six currencies, advancing 0.26%, at 103.588.

Meanwhile, Richmond Fed President Thomas Barkin emphasized that reaching the 2% target is crucial to Fed’s credibility. Later on the day, further, Fed policymakers will cross the wires, with Bowman and Golsbee up next.

On the New Zealand (NZ) front, the lack of economic data keeps traders seeking direction on China’s latest developments and market sentiment. Nevertheless, Retail Sales for the Second Quarter will be revealed on Wednesday, estimated to exceed the prior’s quarter yearly figures, while quarter-on-quarter (QoQ) is foreseen to disappoint investors. Hence, further NZD/USD could be expected.

On the US front, the economic docket would feature Fed speakers, S&P Global PMIs, Durable Good Orders, and New Home Sales.

NZD/USD Price Analysis: Technical outlook

The NZDUSD remains downward biased even though it bounced off year-to-date (YTD) lows of 0.5896. If NZD/USD buyers want to shift the trend to neutral, they must reclaim May 31 daily low turned resistance at 0.5985, followed by the 0.6031 June 8 daily low. Nevertheless, the NZD/USD’s path of least resistance is downwards, and it could test the November 10 daily low of 0.5840, followed by the November 3 swing low of 0.5741.

NZD/USD Daily chart

EUR/SEK has hit multidecade highs around the 11.96 level. Economists at Rabobank analyze the pair’s outlook.

Breman’s hawkish tone should help provide some support for the SEK

While the 12.00 level is within sight, Riksbank Deputy Governor Breman’s hawkish tone and the possibility that rate rises could extend beyond September should help provide some support for the SEK.

Given market expectations for a modest recovery in Swedish GDP growth in Q4, ahead of a recovery in domestic consumption growth in 2024, we see the potential for a return to the 11.50 area on a three-month view.

With the path of least resistance for stocks seemingly lower for now, key to watch will be a stabilization in interest rate volatility and clarity on the path of monetary policy, economists at Charles Schwab report.

Fed Chair Powell could try to establish some calm in the Treasury market

The upside breakout in Treasury yields has weighed on equity multiples, which expanded since last October without the benefit of earnings growth. The pressure has been more acute on the more richly valued mega-cap tech and tech-oriented stocks. Some reversal is likely needed to establish a better footing for stocks.

Better-than-expected recent economic activity, coupled with sticky inflation, is likely to keep uncertainty regarding Federal Reserve policy elevated. Fed Chair Jerome Powell has his much-anticipated speech at the Fed's annual confab in Jackson Hole later this week. It's possible he could try to establish some calm in the Treasury market.

China to put AUD further at risk, economists at Société Générale report.

AUD/USD at risk of further losses

Antipodean currencies are very exposed to China’s economic problems. While the Australian Dollar has already lost 7% since the double-top it formed in June and July at 0.69, further losses are possible.

Almost all the July data missed market expectations by a wide margin. The message is loud and clear: China is experiencing all-out deflation. Contracting Chinese demand for Australian commodities (iron ore) and, more directly, softer Chinese stocks are putting AUD/USD more at risk.

- Existing Home Sales in the US continued to decline in July.

- US Dollar Index stays in positive territory above 103.50.

Existing Home Sales in the US declined 2.2% in July to an adjusted annual rate of 4.07 million, the National Association of Realtors (NAR) reported on Tuesday. This reading followed the 3.3% decrease recorded in June.

"The median existing-home sales price rose 1.9% from one year ago to $406,700. It was the fourth time the monthly median sales price eclipsed $400,000, joining June 2023 ($410,000), June 2022 ($413,800) and May 2022 ($408,600)," the NAR noted in its press release. "The inventory of unsold existing homes increased 3.7% from the previous month to 1.11 million at the end of July, or the equivalent of 3.3 months’ supply at the current monthly sales pace."

Market reaction

The US Dollar preserves its strength following this report and the US Dollar Index was last seen rising 0.3% on the day at 103.60.

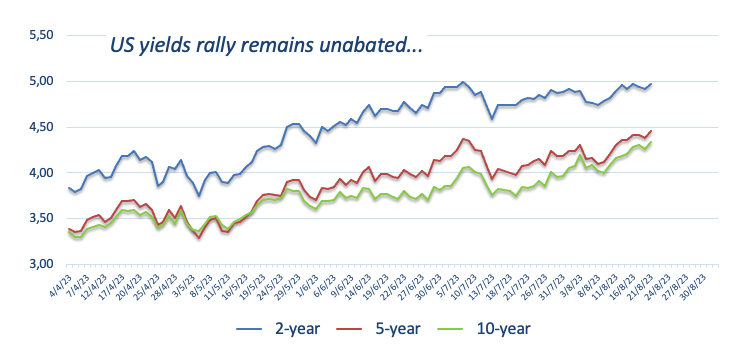

Rising US yields continue to offer more support for the USD, economists at MUFG Bank report.

Long-term US yields continue to move higher

The resilience of the US economy to higher rates continues to surprise market participants and has prompted market participants to scale back expectations for rate cuts next year. Even after the recent scaling back of rate cut expectations, market participants are still expecting around 100 bps of cuts next year.

The sharper-than-expected slowdown in US inflation and lagged impact of monetary tightening are expected to create room for the Fed to make policy less restrictive in 2024. In the near term though the resilience of the US economy and higher long-term US yields are proving more support for the US Dollar.

- Silver price finds selling pressure near $23.50 as investors turn cautious ahead of Jackson Hole.

- US equities found buying interest despite Moody’s and S&P Global downgraded the credit ratings of US commercial banks.

- Fed Barkin said that the central bank needs to achieve the 2% inflation target to ensure its credibility.

Silver price (XAG/USD) faces fragile barricades around $23.50 after a sharp recovery in the early New York session. The white metal struggles to extend recovery as the US Dollar rebounds after remaining lackluster. The US Dollar attracts some bets amid caution ahead of the Jackson Hole Symposium, which will start on Thursday.

S&P500 is expected to open on a positive note, following positive cues from overnight futures. US equities find interest despite Moody’s and S&P Global downgrading the credit ratings of US commercial banks, citing risks of rising outflows in a high-interest rate environment. The 10-year US Treasury yields oscillate above 4.3%.

The US Dollar Index (DXY) recovers sharply and is looking to test the immediate resistance of 103.50 as Federal Reserve (Fed) chair Jerome Powell at Jackson Hole is likely to deliver a hawkish commentary. Fed Powell is expected to keep interest rates higher for a longer period as United States inflationary pressures are still far from the desired rate of 2%.

Meanwhile, Richmond Fed President Thomas Barkin said on Tuesday that the Fed needs to achieve the 2% inflation target to ensure its credibility, per Reuters. Fed Barkin expects that the US recession will be a ‘less severe’ one.

Silver technical analysis

Silver price finds an intermediate resistance after a solid recovery to near the 38.2% Fibonacci retracement (plotted from July 20 high at $25.27 to August 15 low at $22.23) at $23.40. The asset shifts auction above the 20-period Exponential Moving Average (EMA), which trades around $23.20.

The Relative Strength Index (RSI) (14) climbs into the bullish range of 60.00-80.00, which indicates more upside ahead.

Silver hourly chart

-638283088949194721.png)

Gold has so far been unable to recover significantly from the five-month low of $1,885 that it registered last week. Economists at Commerzbank analyze XAU/USD outlook.

Fed Chair Powell could help Gold price pick up again

Gold will doubtless find it difficult to come out of the defensive in the near future. That said, sentiment is now already so bearish that it wouldn’t take much to spark a price recovery.

It is possible that Fed Chair Powell will help prices pick up again at the Fed’s Jackson Hole symposium if he sounds less hawkish in his speech on Friday than people clearly expect him to.

- EUR/USD gives away the initial uptick to the 1.0930 zone.

- Next on the downside emerges the August low at 1.0844.

EUR/USD resumes the downside after climbing to the 1.0930 region earlier on Tuesday.

Further losses are expected to challenge the August low of 1.0844 (August 18) prior to the July low of 1.0833 (July 6). In addition, the loss of this region leaves the pair vulnerable to a probable test of the critical 200-day SMA at 1.0795 in the short-term horizon.

In the meantime, the pair’s positive outlook remains unchanged while above the 200-day SMA.

EUR/USD daily chart

Senior Economist Julia Goh and Economist Loke Siew Ting at UOB Group assess the larger-than-expected drop in Malaysian exports in July.

Key Takeaways

Gross exports maintained a double-digit contraction of 13.1% y/y in Jul (Jun: 14.1%), steeper than our estimate (-10.5%) and Bloomberg consensus (-11.1%). Imports also kept a double-digit decline at 15.9% (UOB est: -18.5% vs Bloomberg est: -15.4%, Jun: -18.7%). This resulted in a smaller trade surplus of MYR17.1bn (Jun: +MYR25.8bn).

Jul’s export decline was brought by a broad-based weakness across all three export sectors for a second consecutive month. Within the manufacturing sector, shipments of commodity-based products (i.e. refined petroleum, chemicals & chemical products, and manufactures of metal) dropped the most during the month as a consequence of subdued global demand and lower commodity prices. A persistent fall in shipments to key export destinations that included the EU, Japan, Hong Kong, India and ASEAN region fully offset the effects of a positive growth rebound in exports to the US and China.

Meanwhile, there are no signs of trade rebounding as yet given risks ranging from softening global growth momentum, increasing trade restrictions to climate shocks. China’s sagging economy further poses perils for countries around the globe while the possibility of a slightly more restrictive policy path in the developed markets would further tighten global financial and credit conditions that will subsequently weigh on global trade. This coupled with unfavourable base effects continue to reinforce our 2023 full-year export outlook at -7.0% (BNM est: +1.5%, 2022: +24.9%).

- DXY makes a U-turn and regains the 103.50 region.

- The next up barrier comes at the August high at 103.68.

DXY manages to regain composure and reverse three consecutive sessions of losses on Tuesday.

The index seems to be attempting a consolidative range following the recent multi-week rally. Against that, the resumption of the uptrend should retarget the August peak of 103.68 (August 18) ahead of the May top of 104.69 (May 31) and the 2023 peak of 105.88 (March 8).

It is worth noting that this area of monthly highs appears reinforced by the proximity of the key 200-day SMA, today at 103.16.

Looking at the broader picture, a convincing breakout of the 200-day SMA should shift the outlook for the index to a more constructive one.

DXY daily chart

Economists at ING look out for BRICS expansion news today.

Expansion tops the agenda

Expansion tops the agenda and names in the frame we think could be the United Arab Emirates, Egypt, and Bangladesh – all of which joined the BRICS New Development Bank in 2021.

It would be a massive surprise were Saudi Arabia to join the grouping, which would inevitably lead to speculation over Oil being priced in non-Dollar currencies and a headline that may temporarily hit the US Dollar.

USD/MXN rebound has faltered near recent pivot high of 17.42. Economists at Société Générale analyze the pair’s technical outlook.

A pullback can be expected towards 16.80 in the short-term

Daily MACD is struggling to maintain above its trigger denoting lack of steady upward momentum.

A break above 17.42 is essential to affirm an extended bounce.

Short-term, a pullback can be expected towards 16.80, the 76.4% retracement of recent bounce. If the pair fails to defend this, one more down leg can’t be ruled out.

- AUD/USD rebounds after consolidating around 0.6400 as US Dollar loses resilience.

- The USD Index turns sideways this week after a five-week winning spell as investors await a trigger for further action.

- AUD/USD delivers a breakout of the Symmetrical Triangle chart pattern.

The AUD/USD pair rebounds after building a base near the round-level support of 0.6400 in the European session. The Aussie asset manages to defend the downside bias as the US Dollar loses resilience ahead of the Jackson Hole Symposium. Also, investors shrugged off deflation risks associated with the Chinese economy as the People’s Bank of China (PBoC) lowered the one-year Prime Lending Rate (PLR) to 3.45%.

The US Dollar Index (DXY) struggles to find a direction after sensing a severe upside restriction near 103.50. The USD Index turns sideways this week after a five-week winning spell as investors await a trigger for further action.

Meanwhile, Economists at UOB Group expect that the RBA has held rates unchanged for two consecutive months, and following the slew of data we think they will keep policy unchanged at its next two meetings on 5 Sep and 3 Oct, unless we get upside inflation surprises from Jul CPI data on 30 Aug and Aug CPI data on 27 Sep.

AUD/USD delivers a breakout of the Symmetrical Triangle chart pattern formed on an hourly scale. A breakout of the aforementioned chart pattern results in wider ticks and heavy volume. The asset stabilizes above the 50-period Exponential Moving Average (EMA) at 0.6420 but still faces barricades near the 200-EMA around 0.6455.

The Relative Strength Index (RSI) (14) shifts into the bullish range of 60.00-80.00, which indicates that the upside impulse has been activated.

A decisive break above August 16 high around 0.6480 will drive the asset toward August 15 high at 0.6522, followed by August 10 high at 0.6616.

In an alternate scenario, a downside move below August 18 low at 0.6380 will negate the triangle breakout and will expose the asset to a fresh nine-month low around 0.6300. Slippage below the latter will expose the asset to 03 November 2022 low at 0.6272.

AUD/USD hourly chart

-638283042091576958.png)

- EUR/JPY now partially fades Monday’s strong advance.

- The resumption of the upside bias could visit 160.00.

EUR/JPY now faces some renewed downside pressure and erodes part of the strong gains recorded at the beginning of the week.

So far, the emergence of some consolidation seems probable in the very near term ahead of the continuation of the upside. That said, the immediate target remains at the round level of 160.00.

The surpass of the latter should not see any resistance level of note until the 2008 high at 169.96 (July 23)

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 147.45.

EUR/JPY daily chart

Federal Reserve Bank of Richmond President Thomas Barkin said on Tuesday that the Fed needs to achieve the 2% inflation target to ensure its credibilitiy, per Reuters.

Commenting on the economic outlook, Barkin noted that if the US were to have a recession, it would likely be a "less-severe" one. He further added that they try not to focus too much on short-term market moves.

Market reaction

These comments don't seem to be having a noticeable impact on the US Dollar's performance against its major rivals. As of writing, the US Dollar Index was virtually unchanged on the day at 103.30.

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the latest interest rate decision by the BSP.

Key Takeaways

Bangko Sentral ng Pilipinas (BSP) extended a pause in its tightening cycle for the third straight meeting, as widely expected. It left the overnight reverse repurchase (RRP) rate untouched at 6.25%, the overnight deposit rate at 5.75% and the lending facility rate at 6.75%.

Today’s (17 Aug) monetary policy decision came after the national inflation decelerated to a 16-month low in Jul and the country’s economy grew at a slower-than-expected pace in 2Q23 with a broad-based slowdown in domestic demand. The Monetary Board (MB) added that an extended rate pause would further allow the central bank to assess the lagged effects of past interest rate hikes since May 2022 while continuing to guard against the emerging risks to the inflation outlook. On that note, the central bank revised up its inflation projections through 2025, mainly reflecting higher oil price forecasts, persistent food supply constraints and domestic policy changes.

In the latest monetary policy statement (MPS), we sense that BSP is now prioritizing the domestic growth outlook over a potential return of inflation risk. This is premised on two additional lines specifically highlighting weaker growth prospects compared to Jun’s statement, with a same inflation storyline. Given the overall tone of the latest MPS and forward guidance remain in line with our expectation (refer to our 2Q23 GDP report for details), we maintain our view that BSP will continue to leave its RRP rate unchanged at 6.25% in the remaining months of the year, and no rate cuts ahead of the US Fed. The MB will next meet on 21 Sep, right after the US Fed announces its Sep interest rate decision.

CAD needs to push below 1.35 against the USD to improve, economists at Scotiabank report.

Recent rally is running out of momentum

Monday’s snap higher off the intraday low for the USD retested the break under trend support that the market had established earlier in the session. Trend support-turned-resistance effectively held but easy gains for the USD remain a feature of this market and gives the clear impression that higher is the path of least resistance for USD/CAD.

But there are signs from daily price action (after the USD still closed net lower on the day Monday) that the recent rally in the USD is running out of momentum.

The 1.3575 zone is resistance and a potential double top; a break under 1.3500 triggers that signal and implies downside potential to 1.3425.

GBP/USD holds in high 1.27s. Economists at Scotiabank analyze the pair’s technical outlook.

More sideways range trading on failure to push on through the low 1.28s

Sterling continues to grind higher. The market’s objective has to be a clear push through 1.2820, the high from August 10 and a 1.2620 double bottom trigger. A break above here targets a measured move rally to 1.3020.

Failure to push on through the low 1.28s in the next few days may see the GBP slip back into more, sideways range trading, however.

EUR/USD slides under 1.09. Economists at Scotiabank analyze the pair’s technical outlook.

Gains stall around 100-DMA

Weak, early price action gives the short-term chart a negative look on the face of it. Spot gains stalled around 1.0930 (100-DMA) in European trade, dumping spot back to the upper 1.08s. There is, however, a clear, rounded low developing on the intraday chart this week and minor setbacks are common for these sorts of technical features.

Minor consolidations are typically followed by a more dynamic phase (bullish, in this case) of market movement.

Support is 1.0875/1.0880. Resistance is 1.0935/1.0940.

Economists at Credit Suisse expect equity markets to see reduced headwinds and forecast S&P 500 at 4,700 by June 2024.

Modestly positive scenario over the next 12 months

We forecast an acceleration in earnings growth in 2024 after the earnings slowdown in 2023. At the same time, we do not expect valuation multiples to move higher given their already generous levels. Overall, this suggests a modestly positive scenario over the next 12 months, though it will likely be accompanied by volatility.

For the S&P 500 Index, we set our June 2024 target at 4,700, offering a return outlook of approximately 7% from today.

EUR/USD has made it back to the 1.09 level. But there is actually a very strong argument in favor of the Dollar at this point: US yields. The measure Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank, prefers to look at here is the real 5Yx5Y Treasury yields.

The USD advantage has increased

What does it mean that the real 5Yx5Y for the Euro area is zero? It means that, from today's perspective, capital cannot be invested profitably in the period from 2028 to 2032. I contrast, even without credit risk, it can be invested in the US with a return of 1.5% per year. That makes the Dollar more attractive than the Euro. Because you need Dollars to make these more attractive investments.

This discrepancy has existed since 2014 and has long been discounted in EUR/USD exchange rates. But it has widened in recent days. The USD advantage has increased. And that is why EUR/USD is no longer trading above 1.12 but around 1.09.

- US Dollar price action declines substantially and retreats in every major pair.

- Traders will likely keep their powder dry for the main event on Friday, with US Fed Chair Powell's speech at Jackson Hole.

- The US Dollar Index could drop further as it breaks below important technical support.

The US Dollar (USD) weakens on Tuesday morning, with the Greenback retreating in full against almost every major G10-peer. On Monday, the US Dollar seemed to remain steady and unphased with nervousness building towards Friday’s important speeches at the Jackson Hole Symposium. It now rather seems that traders remain absent or are again doubling down on the possibility of US Fed Chairman Jerome Powell announcing those long-awaited rate cuts.

Patience is a virtue though, certainly in financial markets and trading. Traders that remained disciplined on Monday and Tuesday can get some clarity on what to do next as two of Fed speakers are to hit the wires. Some additional economic data points are due as well, namely Redbook, US Existing Home Sales and the Richmond Fed Manufacturing Index. These data could confirm the current retreat in the US Dollar Index and signal future trends.

Daily digest: US Dollar at risk

- The US Redbook Index will be released at 12:55 GMT. The previous number was 0.7%.

- Existing Home Sales data will come out at 14:00 GMT. Sales for July expected to slide marginally from 4.16M to 4.15M.

- The Richmond Fed Manufacturing Index for August will come in together with the Existing Home Sales data. The index is expected to stay negative, from -9 to -7.

- Michelle Bowman from the Fed will take the stage at around 18:30 GMT. Austan Goolsbee from the Federal Reserve bank of Chicago is set to speak around that same time. Any headlines might give an insight or prelude on what to expect from US Fed Chairman Jerome Powell on Friday.

- The BRICS convention starts its second day in South Africa with the organisation welcoming nearly 20 new members. the major theme will be the discussion on dedollarization and the setup of a payment system between the nations. India and South Africa already came out opposing the idea of disregarding the US Dollar.

- Equities are up across the board, with both Japan and China up over 1%. European markets are taking over the positive sentiment and are flirting as will with 1% gains. US equity futures are all in the green and the fear gauge VIX index is sliding lower.

- The CME Group FedWatch Tool shows that markets are pricing in an 85.5% chance that the Federal Reserve will keep interest rates unchanged at its meeting in September.

- The benchmark 10-year US Treasury bond yield trades at 4.33% after touching a new yearly high on Monday in late US trading. The bond market will be very sensitive to any news on Friday at the Jackson Hole Symposium. The whole US yield curve could move up or down depending on the speech from Fed Chairman Jerome Powell.

US Dollar Index technical analysis: breaking lower

The US Dollar snaps its winning streak and heads lower in every major pair or cross. The move in the wake of the main event of Friday points to a few traders doubling down on the possibility of a surprise dovish announcement from US Fed Chairman Powell. The moves are looking exaggerated as well as less volume is being traded with most traders sidelined until the main event Friday.

On the upside, 104.00 is the level to reach. The high of Friday at 103.68 is vital and needs to get a daily close above it in order for the DXY to eke out more monthly gains. Should this US Dollar strength persist for the last part of this year, May’s peak at 104.70 could become the reality again.

On the downside, several floors are likely to prevent a steep decline in the DXY. The first one is the 200-day Simple Moving Average (SMA) at 103.19, which already got broken this Tuesday morning. Passing below the 103.00 figure, some room opens up for a further drop. However, around 102.38 both the 55-day and the 100-day SMAs await to catch any falling knives.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.