- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- EUR/GBP fails to decisively break above the 100 and 200-day EMAs at 0.8664 and 0.8679, respectively, after hitting a two-month high at 0.8700.

- If EUR/GBP pulls back, support levels emerge at 50-day EMA at 0.8619, 0.8600, 20-day EMA at 0.8594, and July 10 high at 0.8584.

- A break above 0.8700 will set sights on the next resistance at the May 11 high of 0.8734, followed by the resistance trendline from the YTD high at 0.8978 around 0.8740/50.

The EUR/GBP finished Friday’s session almost flat, failing to decisively break above the 100 and 200-day Exponential Moving Averages (EMAs), each at 0.8664 and 0.8679, respectively after the cross hit a new two-month high at 0.8700. As we head into the weekend, the EUR/GBP is trading at 0.8650, gains 0.03%.

EUR/GBP Price Analysis: Technical outlook

With EUR/GBP remaining unable to breach the 0.8700 figure, the Euro (EUR) remains exposed to selling pressure, but the next week’s upcoming monetary policy meeting of the European Central Bank (ECB) could lend a lifeline to hover around the current exchange rate, as it happened on Thursday and Friday.

If EUR/GBP pullbacks, the first support would be the 50-day EMA at 0.8619, followed by the 0.8600 mark. If the cross extends its drop past those two levels, it’s almost certain that it would drop past the 0-day EMA at 0.8594, with sellers eying the July 10 high at 0.8584, followed by the year-to-date (YTD) low of 0.8504.

Conversely, if EUR/GBP breaks above 0.8700, the EUR/GBP's next resistance level would be the May 11 high at 0.8734, followed by a resistance trendline drawn from the YTD high at 0.8978 that passes at around 0.8740/50. A breach of the latter will expose the 0.8800 mark.

EUR/GBP Price Action – Daily chart

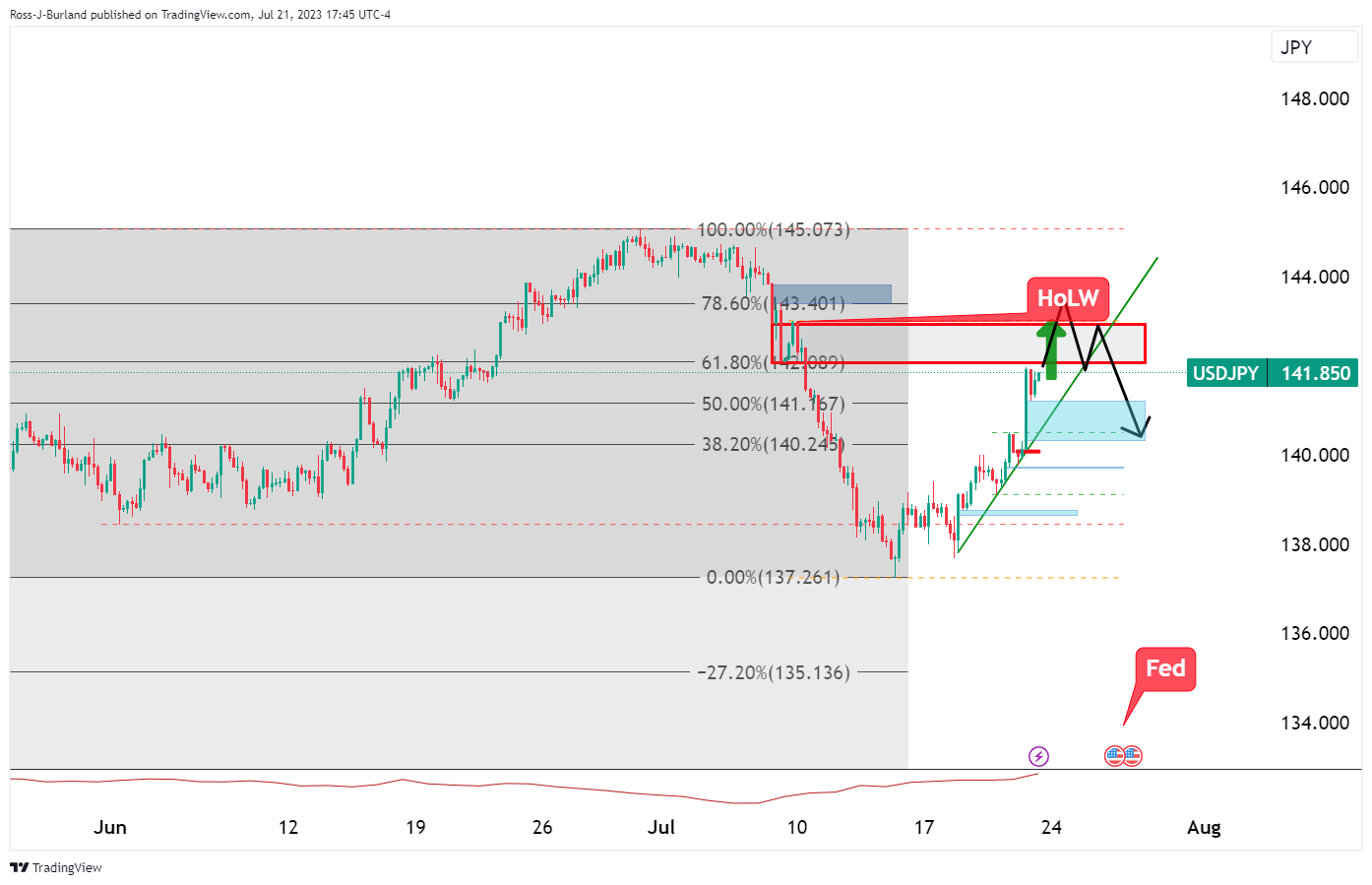

- USD/JPY bears are waiting to make the move.

- Bears eye key resistance near a 61.8% Fibonacci, but note higher prospects.

The yen dropped against the dollar on Friday after Reuters reported the Bank of Japan (BoJ) is leaning toward keeping its key yield control policy unchanged next week. We have seen a range of between 139.74 and 141.95 on Friday and this sets up next week for a possible correction from a 61.8% Fibonacci retracement area in the opening range:

USD/JPY technical analysis

USD/JPY H4 chart

However, the high of last week, HoLW, could be a target before where the area meets a 78.6% ratio. The current bullish trend line remains intact after all.

- XAU/USD fell near the 100-day SMA near $1,960 but held weekly gains.

- USD continued to gain ground on Friday following solid Jobless Claims data.

- All eyes are on the FOMC decision next week.

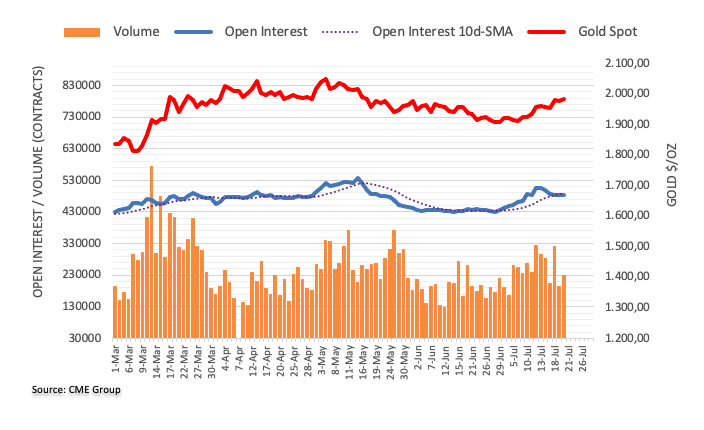

At the end of the week, the XAU/USD traded near the 100-day Simple Moving Average of $1,962, experiencing a 0.30% decline but recorded a weekly gain, its third in a row.

The prevailing strength of the US Dollar continues to exert downward pressure on XAU/USD. Notably, the recent release of Initial Jobless Claims data by the US Department of Labor revealed a lower figure of 228,000 people filing for unemployment benefits in the second week of July, below the market expectation of 242,000. These positive employment figures reflect a robust US economy, potentially prompting the Federal Reserve (Fed) to maintain a more aggressive stance. In that sense, the US bond yield rose sharply on Thursday, boosting the USD and applying the non-yielding metal selling pressure.

Ahead of next week’s Federal Open Market (FOMC) decision, markets have practically priced in a 25 basis point (bps) hike, and robust labour market data boosted the odds of an additional hike past July. However, those odds remain low, near 30%. In addition, Chair Powell’s presser will be closely watched as investors look for clues regarding forwards guidance.

XAU/USD Levels to watch

The daily chart of XAU/USD indicates a negative market sentiment dominated by bears. The Relative Strength Index (RSI) stands in positive territory above the midline but with a negative while the Moving Average Convergence Divergence (MACD) displays fading green bars, signalling exhaustion for the bulls. In the broader context, despite the bearish momentum, the price trading above the 20, 100, and 200-day Simple Moving Average (SMA) indicates that the overall trend remains to favour the bulls.

Support levels: $1,960 (100-SMA), $1,950, $1,936 (20-day SMA).

Resistance levels: $1,970, $1,987 (monthly high), $2,000.

XAU/USD Daily chart

-638255725391681048.png)

- AUD/USD point of control eyed near 0.6680.

- Bulls step in at key support area vs. heavily bearish price action.

As per the prior analysis, AUD/USD Price Analysis: Bears eye a break below key 0.6750, we have seen this play out. The bears moved in and took out the 0.6750s, printing a low of 0.6722, with last week's lows down in the 0.6620s on a break of 0.6700, 0.6690.

AUD/USD prior analysis

''The market has been giving two-way business and what we might see now is a downside continuation as follows:

AUD/USD H4 chart

The bears are lurking to fade rallies in the internal and external target areas. A downside target of 0.6750 is eyed that guards low-hanging fruit, LHF, below.''

AUD/USD updates

The daily chart is showing bearish momentum in the price action.

AUD/USD H1 chart

The bears moved in on the target area but there could be more to come and the hourly chart offers an insight to the bearish bias as per critical levels drawn above. A break beyond 0.6700 while below the significant levels opens risk towards last week's lows.

However, we the higher volumes below will not make life easy for the bears. The path of least resistance may turn out to be to the upside on failed attempts to the point of control near 0.6680.

- Initial GBP/USD gains, driven by upbeat UK retail sales data, were counteracted by increased strength in the US Dollar.

- Latest UK inflation report led to a repricing of BoE’s interest rates expectations, with a 50% chance of a 50 bps rate hike now projected by the swaps market.

- Robust US data, particularly lower-than-expected unemployment claims, reignited worries about the Federal Reserve (Fed) tightening monetary conditions post the upcoming meeting.

GBP/USD continued to drop late in the North American session following upbeat data in the United Kingdom (UK), but the market turned south as news emerging from Japan strengthened the greenback, which appreciated against most G7 currencies. The GBP/USD trades at 1.2851, losing 0012%, after hitting a daily high of 1.2904.

GBP/USD retreats from a high of 1.2904 following strong performance from the US dollar and lowered expectations of a significant rate hike from the Bank of England

News emerging during the Asian session triggered flows toward the US Dollar, as a Reuters report revealed the Bank of Japan (BoJ) would stick to its YCC program and maintain its dovish stance. That tumbled the GBP/USD, which had risen towards the 1.2900 mark after upbeat retail sales data in the UK, but overall US Dollar strength weighed on the GBP/USD.

Additionally, the most recent inflation report in the UK eased pressure on the Bank of England (BoE), which was expected to lift rates 50 bps at the August 3 meeting. However, inflation cooling down triggered a repricing of BoE’s interest rates expectations, with analysts backpedaling, as shown by the swaps market depicting a 50% chance of a 50 bps rate hike.

Across the pond, solid data from the United States (US), particularly last week’s unemployment claims, reignited concerns the Federal Reserve (Fed) will tighten monetary conditions after the following week’s meeting. Other data revealed during the day was mixed, with US retail sales missing estimates, but continued to show consumers resilience, while housing market data witnessed a dip after registering positive figures in May.

Meanwhile, expectations the Fed would raise rates past the July meeting surged to 28%, from last month’s 15.9% odds, as revealed by the CME FedWatch Tool.

Consequently, the greenback rose, registering more than 1% weekly gains. As of writing, the US Dollar Index (DXY), a measure that tracks the performance of the US Dollar against six peers, sits at 101.052, which advances 0.23%, on Friday.

The GBP/USD could remain sideways ahead of the FOMC’s monetary policy meeting. However, if Fed Chair Powell strikes a hawkish tone at his press conference, that could weigh on the GBP/USD before the BoE’s August 3 meeting.

GBP/USD Price Analysis: Technical outlook

The daily chart portrays the GBP/USD pair as upward biased, despite losing 1.84% during a pullback from yearly highs of 1.3160 toward 1.2815. In addition, the GBP/USD fall was capped by the 61.80% Fibonacci level at 1.2851, from the Fibo drawn from recent lows of July 6 to the YTD high, with price action forming a spinning-top candle, preceded by a bearish candle. If the next candle turns bullish and closes above 1.2906, that would create a three-candlestick chart pattern called ‘morning star,’ warranting further upside expected. In that outcome, the GBP/USD next resistance would be the 38.2% Fibonacci level at 1.2961, followed by a test of the 1.3000 mark.

Conversely, the GBP/USD might consolidate below the 20-day Exponential Moving Average (EMA) at 1.2865, with sellers eyeing the 78.6% Fibonacci retracement at 1.2773.

Retail Sales rose in Canada by 0.2% in May, below the 0.5% increase expected. Analysts at CIBC point out that retail sales seeing little growth in May, and the advance estimate suggests that the sideways trend continued into June, the report reflects sluggishness in Canadian consumer spending even before the Bank of Canada restarted its rate hiking cycle.

Key quotes:

“Canadian retail sales rose by a modest 0.2% in May, slightly below the 0.5% consensus forecast albeit following a strong 1.0% increase in the prior month. In volume terms, overall sales edged up by 0.1% on the month and were 1.3% higher on a year-over-year basis. Given strong population growth seen over the past 12 months, this year-over-year growth rate would still represent a decline in per capita terms.”

“While overall GDP in Q2 is still tracking close to the 1.5% Bank of Canada MPR forecast, today's data suggest that consumer spending likely wasn't a significant driver of that growth, even accounting for growth in services spending. Industry data showing strength in areas such as manufacturing and wholesale suggest that inventory accumulation or business investment may be more significant contributors, which wouldn’t be bad news from an inflation point of view.”

- The GBP/JPY cross soared above the 20-day SMA to a high of 182.58, clearing weekly losses.

- Reuters reported that the BoJ will hold its YCC policy steady next week.

- Robust Retail Sales data from the UK from June gave the GBP traction.

The GBP/JPY cross rose more than 1% on Friday to a high above the 20-day Simple Moving Average (SMA) and is poised to close a weekly gain. The JPY faced severe selling pressure amid dovish bets on the Bank of Japan (BoJ) before next week’s meeting, while the GBP strengthened on solid Retail Sales figures.

Retail Sales in the UK rose more than expected in June. BoJ to hold its YCC policy

Retail Sales from the UK in June rose more than the expectations. The headline figure came in at 0.7% MoM vs the 0.2% expected improvement from the previous 0.1% and provided some support to the GBP.

Regarding the Bank of England’s (BoE) next steps, markets are discounting low 45% odds of a 50 basis point (bps) hike following the soft inflation figures reported on Wednesday and foresee 25 basis point hikes in September, November and February 2024, which would see the terminal rate at 5.75%, lower than last week’s estimates of 6.5%.

On the Japanese side, June inflation data showed that the National Consumer Price Index (CPI) dropped to 3.3% YoY, below the 3.5% expected, while the Core measure remained steady at 4.2% YoY, just as expected.

Ahead of next week’s meeting, according to Reuters, the BoJ will maintain its Yield Control Curve (YCC) policy as the bank considers that inflation is rising but the key is whether the increase is sustainable. In that sense, policy divergences between the BoE and the BoJ is applying selling pressure on the JPY.

GBP/JPY Levels to watch

The daily chart indicates a neutral to bullish outlook for the short term. The indicators show resilience, with the Relative Strength Index (RSI) positioning jumping above the midline, pointing north. At the same time, the Moving Average Convergence Divergence (MACD) prints subtle red bars, indicating a fading selling momentum. Looking at the bigger picture, the cross remains well-positioned above the 100-day and 200-day Simple Moving Averages (SMA) and the pair holding above the longer-term averages indicates that the bulls have the upperhand.

Resistance levels: 182.60, 183.00, 184.00

Support levels: 180.00. 179.50, 179.00.

GBP/JPY Daily chart

-638255630015775534.png)

Analysts at Rabobank point out that softer-than-expected UK CPI inflation data have triggered a re-evaluation of the market’s Bank of England policy outlook, pushing the Pound lower. They expected the GBP/USD to be trading below 1.2600 on a three-month view.

Key quotes:

“After all, while the UK economy has outperformed last year’s forecasts, it remains far from strong. The outlook for cable will be deeply impacted by the relative strength of the USD. We expect GBP/USD to be trading lower on a 3- month view.”

“We see the risks for the pound vs. the EUR as well balanced, suggesting limited scope for EUR/GBP to significantly diverge from the ranges that have dominated in the year to date.”

“The EUR has underperformed GBP slightly in the year to date. However, there has been little net movement in EUR/GBP from early January, with the currency pair trading very close to its 1-year average. Fears that the UK economy could be tipped into recession suggest scope for the market to reduce its long GBP positions in the coming months.”

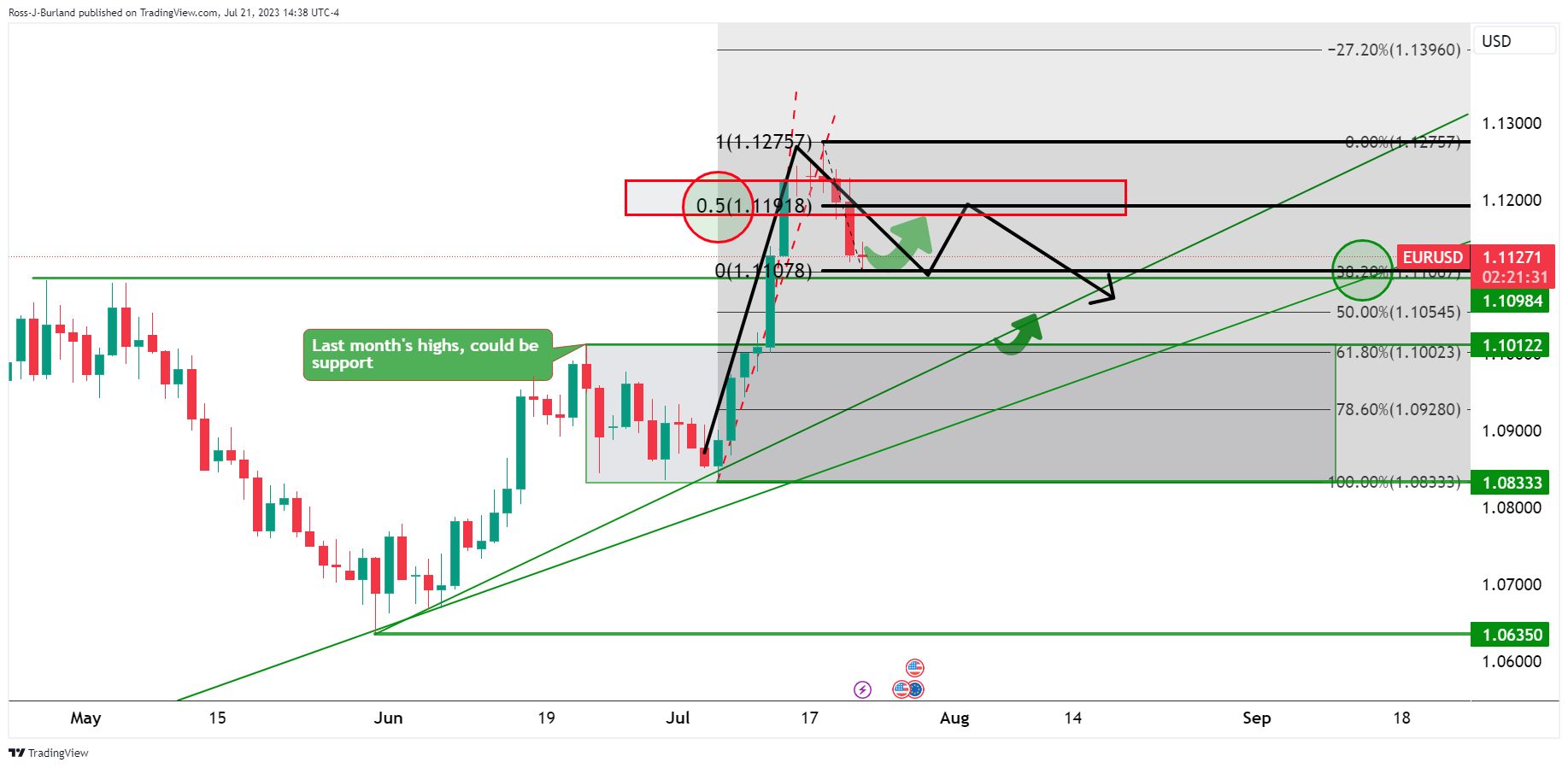

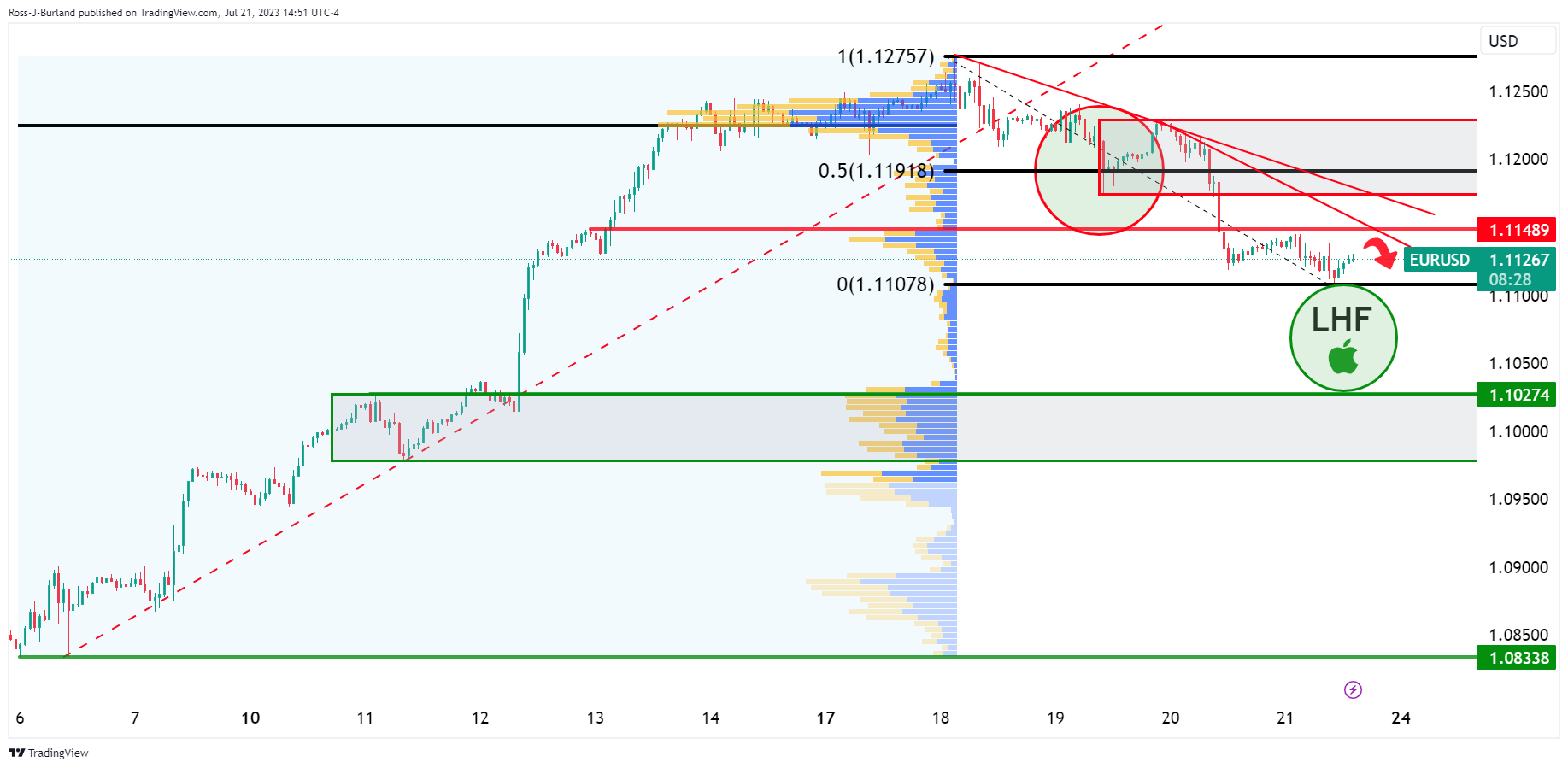

- EUR/USD bears on the front side of the bearish trendline.

- Bears look to the low-hanging fruit for the week ahead.

EUR/USD is back to flat on the day after moving between a range of 1.1107 and 1.1145. What will be key for the Euro is whether or not some of the dovish risks in next week's Federal Reserve meeting materialize. With both central banks expected to hike by 25bps, statements and pressers will be key next week. as for the charts, the following illustrates prospects of a move into low-hanging fruit towards the 1.1020s.

EUR/USD daily charts

The 50% mark of the range is important and bears could stay committed below here near 1.1190/00.

EUR/USD H4 chart

EUR/USD H1 chart

The 1.1150 is also a key area as we zoom in, so a commitment there will be heavily bearish for the open next week if bears stay frontside of the trendlines.

Next week, the focus will be on central banks as the Fed, ECB, and BoJ announce their monetary policy decisions. However, that's not all. Inflation figures from the US, Australia, and Europe will also be closely watched, along with global PMIs and US Q2 growth data.

Here is what you need to know for next week:

The week will kick off on Monday with the July preliminary PMIs. Generally, the manufacturing sector is expected to remain in contraction territory, while the services sector is expected to expand at a slower pace. These numbers will offer the first glimpse of global economic activity during the current month.

After a relatively quiet Tuesday in terms of economic data, during Wednesday's Asian session, Australia will release the Consumer Price Index (CPI) for June and the second quarter. This is a key measure ahead of the Reserve Bank of Australia (RBA) meeting on August 1st.

Later on Wednesday, the Federal Reserve (Fed) will announce its monetary policy decision. A 25 basis point rate hike is priced in, and the focus will be on the statement and Chair Powell's press conference. This event will trigger sharp moves across financial markets, even if it delivers as expected: a rate hike with the continuity of a hawkish bias.

As the markets continue to digest the FOMC decision, on Thursday, the European Central Bank (ECB) will announce its decision. Also, a 25 basis point rate hike is priced in, and President Lagarde is expected to signal that more rate hikes are likely. How strong the message regarding more tightening will be critical. The next ECB meeting is in September, and it may be too far away to have a clear perspective on what may happen there. However, the expectations will be relevant and should weigh on the EUR/USD.

Also on Thursday, the first reading of US growth performance during the second quarter is due, which is expected to expand at an annual rate of 1.6%, below the 2% of Q1. The report includes the Core Personal Consumption Expenditure for the second quarter. At the same time, the weekly Jobless Claims report and Durable Goods Orders for June are due. Considering the ECB meeting and the bulk of economic data from the US, Thursday is set to be another volatile day.

On Friday, more economic data is due from Australia with the Producer Price Index (Q2) and June Retail Sales. The key event during the Asian session will be the Bank of Japan (BoJ) decision. However, not much is expected from the central bank. A report from Reuters mentioned that despite accelerating inflation in Japan, the central bank is leaning towards leaving the yield curve control strategy unchanged.

The preliminary July inflation CPI from European countries will start to come out on Friday with Spain and Germany, with a slowdown expected on annual rates. That day, also US inflation data is due in the US with the Employment Cost Index for Q2 and the Core Personal Consumption Expenditure Price Index for June (however, no surprise will be expected considering that it is included in the GDP report due the day before). Canada will report monthly GDP growth (May).

During the week, more companies, including Microsoft, Alphabet, Meta Platforms, and Amazon, will report earnings which could weigh on market sentiment.

Currency performance

The US Dollar was among the top performers during the week, after the sharp decline of the previous week, supported by US economic data. The DXY rebounded from under 100.00, retaking 101.00. However, the outlook remains negative, and the positive results could be seen as a corrective movement. The next decisive leg will likely start following the FOMC meeting.

The Pound underperformed during the week following a bigger-than-expected drop in UK inflation. However, inflation remains elevated, and more rate hikes from the Bank of England (BoE) are expected. GBP/USD suffered the worst weekly result since January, retracting from one-year highs above 1.3100 to 1.2850. EUR/GBP posted the biggest weekly gains since January, but it was unable to break above the 20-week Simple Moving Average (SMA) and the 0.8700 area. The cross finished around 0.8650, and risks appear tilted to the upside, but the Euro needs to break and hold above 0.8700.

EUR/USD gave up half of last week's gains after retracting from one-year highs at 1.1275 toward 1.1100. The trend remains bullish, and the decline is seen as a correction.

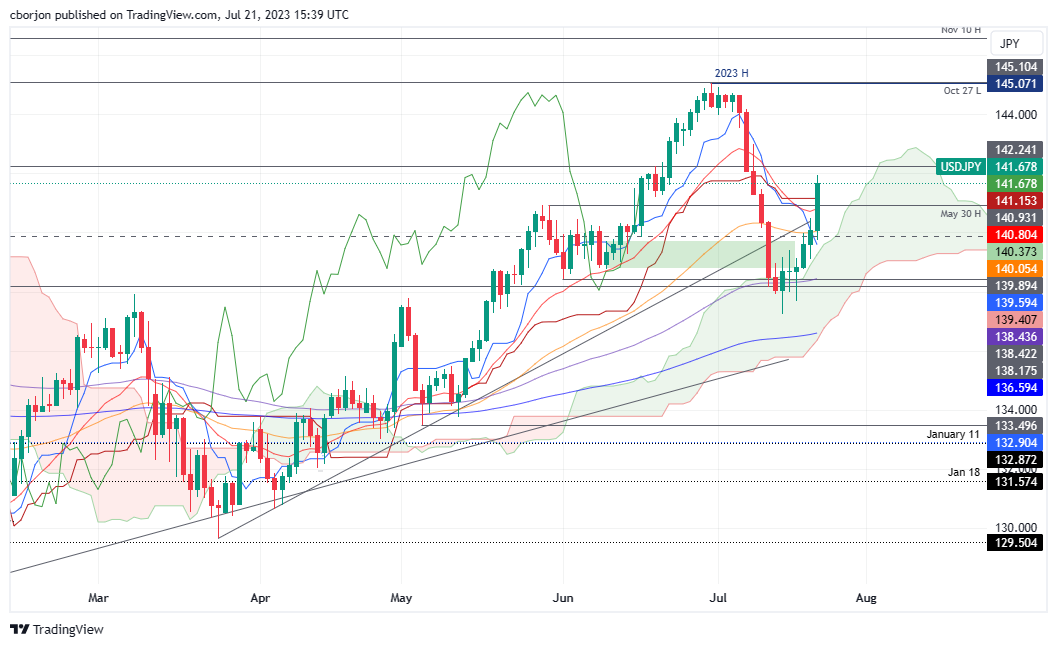

USD/JPY rebounded at the 20-week SMA, rising back above 140.00 and erasing most of the previous week's losses. The Japanese Yen dropped sharply on Friday after reports suggesting the Bank of Japan won't signal a change in July.

The loonie underperformed among commodity currencies, even after the decline in inflation in Canada. USD/CAD ended flat, hovering around 1.3200/20.

Upbeat employment data from Australia boosted the AUD/NZD, which rose from 1.0730 to 1.0900. However, the stronger US dollar pushed the AUD/USD back to the 0.6720 area from near 0.6900. It is slightly above the 20-day SMA.

The Turkish Lira was the worst performer during the week, not helped by the 250 basis point rate hike from the Central Bank of the Republic of Turkey, which was below expectations. USD/TRY posted a record weekly close slightly below 7.00. The Colombian peso and the South African rand were the biggest gainers.

Like this article? Help us with some feedback by answering this survey:

- Positive sentiment supports the Mexican Peso (MXN), but Fed tightening concerns arise due to last week’s US unemployment data.

- Expectations for a post-July Fed rate hike rise to 28%, a significant leap from last month’s 15.9% odds, as the CME FedWatch Tool reported.

- USD/MXN traders eye next week’s Mexican inflation data, with both readings expected to decelerate.

USD/MXN holds to its earlier gains after reaching the 17.00 figure on Friday but trimmed some as the USD/MXN pair edged towards the 20-day Exponential Moving Average (EMA) at 16.9666. At the time of writing, the USD/MXN is trading at 16.9494, climbing 0.47%, ahead of the weekend.

USD/MXN sees slight trim after peaking at 17.00, buoyed by solid US jobs data and mounting anticipation of Federal Reserve tightening

Sentiment remains upbeat, which usually favors the Mexican Peso (MXN). Nevertheless, last week’s US unemployment claims for the week ending July 15 spurred woes the Federal Reserve (Fed) would continue to tighten monetary conditions past the July meeting. Other data revealed during the day was mixed, with US retail sales missing estimates, but continued to show consumers resilience, while housing market data witnessed a dip after registering positive figures in May.

Meanwhile, expectations the Fed would raise rates past the July meeting surged to 28%, from last month’s 15.9% odds, as revealed by the CME FedWatch Tool.

Consequently, the greenback rose, registering more than 1% weekly gains. As of writing, the US Dollar Index (DXY), a measure that tracks the performance of the US Dollar against six peers, sits at 101.052, which advances 0.23%, on Friday.

That helped to offset some of the USD/MXN 4.27% losses during the last couple of weeks, with the pair briefly testing the 17.00 psychological barrier.

Retail sales disappointed USD/MXN traders on the Mexican front, which punished the peso as the pair climbed 1% on Thursday. On its latest two meetings, the Bank of Mexico (Banxico) kept rates unchanged at 11.25% and is expected to cut rates towards Q4 2023.

The following week’s highlight on the Mexican docket would be the inflation data report, with most traders expecting the Consumer Price Index (CP) at 4.77% in the first 15 days of the month, according to a Reuters poll. Core CPI is expected to slide to 6.73%. Although both figures remain above Banxico’s 3% plus or minus one percentage point target, the disinflationary process continues in the Mexican economy.

USD/MXN Price Analysis: Technical outlook

From a technical standpoint, the USD/MXN probed the 17.00 figure after reaching 7-year lows at 16.6899 but couldn’t break resistance, despite printing a high of 17.0502. Of note, the Relative Strength Index (RSI) indicator is gathering pace toward the 50-midline, suggesting that buyers are increasing their positions, while the three-day Rate of Change (RoC) printed its biggest daily gain since May 23, a major turning point. That could suggest the USD/MXN could be bottoming and preparing for an upward correction. Key resistance levels lie at the 20-day EMA at 16.9667, the 17.00 figure, and the 50-day EMa at 17.2416 in the near term. Contrarily, the first support level would be the YTD low of 16.6899 before testing 16.50.

- EUR/JPY rose more than 1% on Friday to its highest since early July.

- Reports indicate that the BoJ will stick to its YCC following the Japanese CPI.

- ECB tightening expectations remain steady.

The EUR/JPY gained significant momentum at the end of the week amid a broad-based JPY weakness. Japanese inflation is seeing some signs of deceleration in June and reports of the Bank of Japan sticking to its dovish monetary policy in next week's meeting makes the Yen lose interest.

Headline CPI decreased in Japan in June. All eyes on BoJ and ECB decisions next week

June inflation data from Japan saw the National Consumer Price Index (CPI) dropping to 3.3% vs the 3.5% YoY expected, while the Core measure came in at 4.2% YoY, just as expected. That being said, the JPY is losing ground amid the speculations that the BoJ will maintain its dovish stance in next week’s meeting. According to Reuters, the bank considers that inflation is increasing but is not confident if the increase is sustainable, putting a hold on a potential policy pivot.

On the other hand, the European Central Bank's (ECB) tightening expectations remain steady despite German yields decreasing. For next week’s meeting, a 25 basis point (bps) hike is largely priced in, while the probability of a similar hike in September is near 60%. In the meantime, the 2,5 and 10-year yields display more than 1% declines and fell to 3.23%,2.56% and 2.42%, respectively, limiting the EUR’s upside potential.

EUR/JPY levels to watch

The daily chart indicates that the bulls have taken the upper hand following Friday’s gains. The cross trades above the 20,100 and 200-day Simple Moving Averages (SMA) while indicators are recovering. The Relative Strength Index (RSI) is in positive territory, leaping towards overbought territory, while the Moving Average Convergence Divergence (MACD) prints lower red bars.

Resistance levels: 158.00, 158.50, 159.00.

Support level: 156.38 (20-day SMA), 156.00, 155.50.

EUR/JPY Daily chart

-638255595047470295.png)

- Wall Street sees partial recovery from Thursday’s losses due to disappointing tech company earnings, while a lack of US economic data keeps focus on the upcoming Federal Open Market Committee (FOMC) meeting.

- Expectations of a 25 bps hike by the Federal Reserve past the July meeting are increasing following a week of robust US labor market data.

- The Reserve Bank of New Zealand’s (RBNZ) decision to maintain current rates contributes to the NZD’s weekly losses of nearly 3%,

NZD/USD dives below the 0.6200 figure, extending its losses past the 200-day Exponential Moving Average (EMA) of 0.6226, with the pair extending its losses to six straight days on overall US Dollar strength. At the time of writing, the NZD/USD is exchanging hands at 0.6175 after dropping from a daily high of 0.6240.

NZD/USD extends losses for the sixth straight day, underpinned by robust US labor market data

Wall Street pares some of Thursday’s losses on disappointing earnings from megacap tech companies. The lack of economic data in the United States (US) keeps NZD/USD traders bracing for the next week’s Federal Open Market Committee (FOMC) monetary policy decision, with the Federal Reserve (Fed) expected to deliver a 25 bps increase to the Federal Funds Rate (FFR), toward the 5.25%-5.50% area.

That follows a week that witnessed solid US economic data, as unemployment claims fell below estimates portraying a strong labor market and sparking fears for further Fed tightening, even though US retail sales printed mixed results. Turning to house market data, Housing Starts, Building Permits, and Existing Home Sales witnessed a dip after printing solid figures in May.

According to data from the CME FedWatch Tool, market players have fully priced in the next week’s increase but revised their bets upward from last week’s 19.8% to 28.0%.

Elsewhere, the latest Reserve Bank of New Zealand (RBNZ) monetary policy keeping rates unchanged is weighing on the New Zealand Dollar (NZD), which extended its weekly losses for almost 3%. That, despite fears of a slower recovery in China, despite the People Bank of China’s (PboC) efforts to prod its economy and achieve its annual target, would keep the NZD pressured.

Given the backdrop, the NZD/USD is warranted to extend its losses, but it would depend on the Fed and its Chair Jerome Powell to sustain a hawkish posture to keep the downtrend in the near term. Otherwise, the NZD/USD could recover after the FOMC’s decision.

NZD/USD Price Analysis: Technical outlook

The NZD/USD shifted to a neutral bias once the major broke technical support level, like the 200, 20, 100, and 50-day EMAs on its way south, but its fall remains cushioned by the June 29 daily low of 0.6050. Once cleared, the NZD/USD could test the year-to-date (YTD) low of 0.5985. To keep their hopes of higher prices, buyers must reclaim the 0.6200 mark, but they need to clear the confluence of the 50 and 100-day EMAs at 0.6201/02 before testing the 20-day EMA at 0.6227.

With the Relative Strength Index (RSI) turning bearish and the three-day Rate of Change (RoC) suggesting sellers gather momentum, the NZD/USD might continue to trend lower.

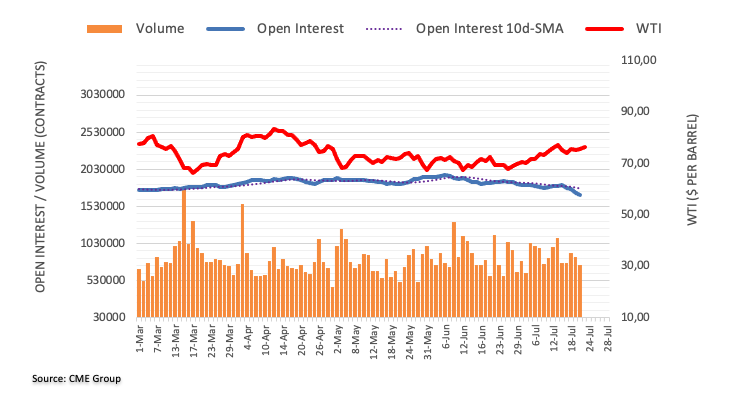

- WTI soared on Friday and rose towards the 200-day SMA at $76.82, tallying a fourth consecutive weekly gain.

- Chinese stimulus rumours bolstered Oil prices.

- All eyes are on next week’s Fed decision.

On Friday, the West Texas Intermediate (WTI) rose more than 1% near $76.80 and is set to close a 1.89% weekly gain. On the upside, prospects of a Chinese stimulus to bolster the economy supports the price, while a slight recovery of the USD may limit the upside potential.

After the People Bank of China (PBoC) decided to hold its key rates steady, Bloomberg reported that Chinese policy makers are up to ease mortgage rates to bolster homebuying in the second-largest economy in the world due to recent economic downturns. In that sense, lower rates in the most prominent Oil importer of the world favour the price as a less aggressive monetary policy may strengthen the economy.

On the other hand, the American calendar won’t have anything relevant to offer, and traders continue to assess the latest set of inflation, retail sales, the housing market and jobless claims data from the US. For next week’s decision, markets are mainly discounting a 25 basis point (bps) hike, but the odds of a second week past July have dropped nearly 35%. In addition, markets will closely watch Jerome Powell’s presser to look for clues regarding forward guidance.

WTI Levels to watch

The bulls managed to get a final chance to retake the 200-day Simple Moving Average (SMA). If they fail, the price could plunge as buying momentum displays weakness as per the indicators on the daily chart. Meanwhile, the Relative Strength Index (RSI) stand with a slight positive slope above its midline, while the Moving Average Convergence Divergence (MACD) prints lower green bars.

Resistance levels: $76.82 (200-day SMA), $78.00,$80.00.

Support levels: $73.50 (100-day SMA), $72.90 (20-day SMA), $72.00.

WTI Daily chart

-638255543687509356.png)

- XAG/USD retreated below the $24.70 level, poised to close a more than 1% weekly loss.

- USD gained some ground following lower-thank expected unemployment figures on Thursday.

- All eyes on next week’s Fed decision.

At the end of the week, the XAG/USD lost ground and is set to close a weekly loss following three weeks of gains. The USD measured by the DXY index, is recovering and tallied a fourth consecutive day of gains jumping above 101.00 making the grey metal struggle to find demand.

The USD gained some ground following labour market data on Thursday, which fueled hawkish bets on the Federal Reserve (Fed) and a rise in US yields, weakening metal prices. The US Bureau of Labor Statistics (BLS) released unemployment data, showing a decrease in jobless claims to 228,000, below the expected 242,000. Investors are speculating on a hawkish stance from the Fed, anticipating the need to maintain higher interest rates for a longer period as the labour market remains robust.

In today’s session, US yields trade mixed across the board following Thursday’s increase. The 2-year yield jumped to 4.85%, seeing mild gains while the 5 and 10-year rates slightly decreased to 4.08% and 3.82%.

Regarding next week’s decision, markets are mainly discounting a 25 basis point (bps) hike, but the odds of a second week past July have increased following Jobless Claims data but still remain low at nearly 35%. In addition, markets will closely watch Jerome Powell’s presser to look for clues regarding forward guidance.

XAG/USD Levels to watch

According to the daily chart, the technical outlook is starting to turn bearish for the short term as bulls are losing steam. The Relative Strength Index (RSI) got rejected at the overbought threshold on Wednesday, prints and points south, while the Moving Average Convergence Divergence (MACD) prints decreasing green bars.

Support levels: $24.60, $24.50, $24.10.

Resistance levels: $25.00, $25.30,$25.00.

XAG/USD Daily chart

-638255513869212688.png)

- Japan’s Consumer Price Index (CPI) for June reports a YoY increase of 3.3%, slightly above the previous 3.2% figure, but falls short of the anticipated 3.5%.

- Reuters report on BoJ’s monetary stance causes USD/JPY to break away from the 140.00 range seen through most of the Asian session.

- The USD/JPY uptrend could continue based on interest rate differentials, but next week’s Fed and BoJ decisions are eyed.

USD/JPY rallied back above the 141.00 figure after rumors the Bank of Japan (BoJ) would not change its Yield Curve Control (YCC) emerged, spurring an upward reaction in the USD/JPY due to Japanese Yen (JPY) softness. The USD/JPY is exchanging hands at 141.71 after diving as low as 139.74.

Reports of the BoJ's commitment to its dovish stance fuel USD/JPY rally, despite Japanese inflation data exceeding estimates

News emerging during the Asian session spurred JPY’s weakness on Reuters sources, saying the BoJ would stick to its YCC program and maintain its dovish stance. That comes after an earlier report that in Japan exceeded estimates by a tick, seen by traders as data that could trigger a reaction by the BoJ. The Consumer Price Index (CPI) for June came at 3.3% YoY, above the prior’s 3.2% reading but failed to overcome forecasts of 3.5%. Core CPI rose by 3.3% YoY, aligned with projections and above May’s number.

The USD/JPY seesawed around 140.00 throughout most of the Asian session before the Reuters report surfaced.

On the US front, data revealed during the week showed the economy is still resilient, despite Retail Sales slowing to 0.2%, below May’s 0.5%. Thursday’s US Initial Jobless Claims report for the week ending July 15 posted 228K unemployment fillings, below the 239K estimated, sparking fears the US Federal Reserve (Fed) might react to the numbers and increase rates past the following week’s monetary policy decision.

The CME FedWatch Tool, which tracks interest rate probabilities for the Fed, sees a 99.8% chance of a quarter of a percent hike on July 26, while for September, expects no change, and for November, odds moved from below 20% last week’s, to 28.0% as of writing.

To conclude, given the interest rate differentials, the USD/JPY uptrend might continue in the near term. But next week’s could be volatile, with the Fed and the BoJ set to deliver an update on their monetary policy. A hawkish surprise by the BoJ could rock the markets sharply, while the Fed is expected to maintain its “higher for longer” bias.

USD/JPY Price Analysis: Technical outlook

From a technical standpoint, the USD/JPY pair is set to continue upward biased, reclaiming during the session the Tenkan and Kijun-Sen level, with traders setting their eyes on the 142.00 mark. A breach of that level would expose last November’s 22 daily high at 142.24, followed by the top of the Ichimoku Cloud (Kumo) at 142.83, ahead of 143.00. Conversely, if USD/JPY drops below the Kijun-Sen level of 141.15, further downward action is expected, with the 20-day Exponential Moving Average (EMA) lying at 140.80, on top of the Senkou Span A level at 140.37.

Strategists at Credit Suisse maintain their existing bullish outlook for Gold.

A weekly close below $1,875 would reinforce the longer-term sideways range

With the USD completing a large bearish continuation pattern and expected to see further material weakness we maintain our long-held view for a major floor to be found at $1,900/1,890 and for an eventual retest of major resistance at the $2,063/2,075 record highs to be seen.

We still stay biased to an eventual break to new record highs later in the year, which would then be seen to open the door to a move to $2150 next, then $2,355/65.

A weekly close below $1,875 though would be seen to reinforce the longer-term sideways range, and a fall to support next at $1,810/05.

The clean energy technology sector is becoming an increasingly important driver of demand for base metals, economists at ANZ Bank report.

Clean energy powering metals

Critical minerals have taken the limelight amid the acceleration in energy transition. However, traditional base metals are likely to see a demand surge as they become increasingly important.

Demand has now reached critical volumes in Copper and Nickel, with its market hitting 22% and 27% respectively in 2022. More importantly, growth over the next three years is expected to see these levels significantly rise. So much so that even below-average growth from traditional sectors such as construction and manufacturing won’t stop total demand from recording strong growth rates.

For the moment, the impact of strong demand from clean energy technologies on market sentiment is likely to remain subdued. That could change once the broader market environment is not clouded by issues such as inflation and interest rates.

Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank, notes the weak arguments of the Dollar declinist

Announcements like that of invoicing in Renminbi remain pure propaganda

China Daily reports that Chinese trade with Argentina will soon be invoiced in Renminbi. Countries that enter such a deal with China are being taken to the cleaners. I cannot exclude that an increasing number of emerging countries – sometimes for merely political reasons – will make a similar mistake. That means the Dollar declinists might even turn out to be correct in the end, whereas my projections of continued Dollar dominance could turn out to be incorrect.

But I remain optimistic and rely on reason prevailing in the end. That would mean that announcements like that of invoicing in Renminbi remain pure propaganda and will not have factual consequences.

The Chilean Peso is lagging the rally of its Latam peers. Economists at ING analyze CLP outlook.

Chile may prove a test case for Latam FX and easing cycles

June saw the central bank warn that the easing cycle could start in the ‘short term’. A 50-75 bps rate cut is now expected at the 28 July rate meeting.

The central bank will cite inflation expectations anchored at 3% as the reason for the cut – even though core inflation is still 9% YoY. Chile may prove a test case for Latam FX and easing cycles.

Regarding Chile’s main export, Copper – we see it at neutral $8300-8600/MT this year. And we think USD/CLP stays near 800.

- EUR/USD trades in weekly lows near 1.1100.

- Next on the downside comes the 1.1000 key level.

EUR/USD remains well offered and navigates the lower end of the weekly range near the 1.1100 neighbourhood.

The recent upside bias now appears alleviated and further losses seem to be in store for the pair in the near term instead. That said, a sustained drop below the weekly low of 1.1111 could motivate the pair to dispute the psychological hurdle at 1.1000 the figure.

Looking at the longer run, the positive view remains unchanged while above the 200-day SMA, today at 1.0687.

EUR/USD daily chart

Recently, the Canadian Dollar has been able to make up some lost ground. Economists at Commerzbank analyze Loonie's outlook.

EUR/CAD should reflect the interim EUR strength expected

We see further limited CAD recovery potential against the USD due to the robust economy and a hawkish BoC. CAD should benefit if the interest rate differential between the Fed and the BoC narrows or turns positive in the medium term.

EUR/CAD should reflect the interim EUR strength we expect.

Source: Commerzbank Research

See – USD/CAD: Further BoC tightening could lead to a gradual decline – SocGen

- DXY adds to the weekly rebound and trespasses 101.00.

- Immediately to the upside emerges the 102.60 region.

DXY picks up further impulse and records weekly peaks north of the key 101.00 barrier at the end of the week.

A more serious bullish attempt in the index should clear the 102.60 zone, where the provisional 55-day and 100-day SMAs coincide. North from here aligns the July high in the mid-103.00s seconded by the key 200-day SMA at 104.06.

Looking at the broader picture, while below the 200-day SMA, the outlook for the index is expected to remain negative.

DXY daily chart

Economists at ING analyze EUR/USD outlook ahead of the Fed meeting.

Dollar could get a lift from hawkish Fed script

With the market positioning itself for a cyclical Dollar sell-off over coming months and quarters, we suspect another reading of the hawkish Fed script could send the Dollar a little higher.

Clearly, fireworks are not expected, but EUR/USD could dip back towards the 1.1050 area on the Fed event risk.

See: EUR/USD to see break above 1.1275 for strength to 1.1495 and eventually 1.1703/48 – Credit Suisse

- EUR/JPY accelerates gains to new 2023 peaks past 158.00.

- Extra upside looks likely in the near term.

EUR/JPY advances further and reaches a new 2023 high just above 158.00 the figure at the end of the week.

In the meantime, the cross keeps the recovery mode well in place and the continuation of the uptrend is expected to challenge the key round level at 160.00 sooner rather than later.

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 146.22.

EUR/JPY daily chart

Gold price is profiting from speculation about an end to the Fed rate hikes. Economists at Commerzbank analyze XAU/USD outlook.

Fed will hike interest rates for the last time by 25 bps next week

The recently weaker economic data and declining inflation suggest that the Fed will hike interest rates for the last time (for now) by 25 basis points next week.

That said, Fed Chair Powell will presumably leave the door open for another rate hike, meaning that the relevant data could well spark repeated speculation about another rate increase in the coming weeks. The Gold price will not be immune to setbacks, in other words.

- AUD/USD has slipped below 0.6750, however, the downside seems favored.

- The Fed is expected to raise interest rates by 25 bps to 5.25-5.50% as core inflation is still persistent.

- Tight labor market conditions in Australia are confirming the resumption of the policy-tightening spell by the RBA.

The AUD/USD pair has stretched its downside below the immediate support of 0.6750 in the European session. Weakness in the Aussie asset is backed by sheer strength in the US Dollar.

S&P500 futures have generated significant gains in London. US equities are expected to witness a stock-specific action amid corporate earnings season. The US Dollar Index (DXY) is facing some pressure after a north-side elevated move marginally above 101.00, however, the upside move is still favored considering the strength in the upside momentum.

After easing in United States inflationary pressures, loosening labor market conditions, and a decline in consumer spending growth in June, investors are shifting their focus toward the interest rate decision by the Federal Reserve (Fed), which will be announced on July 27.

The Fed is expected to raise interest rates by 25 basis points (bps) to 5.25-5.50% as core inflation is still persistent and more interest rates are appropriate to bring it down to desired rate. Discussions about the number of times the Fed will raise interest rates in July have heated. While Fed chair Jerome Powell in his last commentary said two more interest rate hikes are appropriate, expectations at the CME FedWatch tool have drummed only one more interest rate hike this year.

On the Australian Dollar front, tight labor market conditions are confirming the resumption of the policy-tightening spell by the Reserve Bank of Australia (RBA). Employment additions in June were recorded at 32.6K while investors estimated fresh addition of 15K. The Unemployment Rate remained steady at 3.5% vs. expectations of 3.6%

Investors should note that RBA skipped hiking interest rates in June and kept the Official Cash Rate (OCR) at 4.10%.

- Canadian Dollar declines versus the US Dollar on Friday after Canadian Retail Sales come out lower than expected in May.

- The USD also benefits from JPY outflows ahead of the BoJ meeting next week.

- The Greenback is supported by strong Initial Jobless Claims data on Thursday, which showed a sharp fall in new unemployment claimants.

- Technically the pair is trading in a range above a thick band of support in the upper 1.30s.

The Canadian Dollar (CAD) edges down against the US Dollar (USD) on Friday, after official data shows Canadian shoppers tightened their belts in May.

The US Dollar also benefits from outflows from the Japanese Yen as traders shed their JPY holdings in favor of the Buck ahead of the Bank of Japan policy meeting next week, at which the board of governors is seen as likely to maintain the current ultra-loose policy.

The USD/CAD pair trades in the 1.31s as the US session gets underway.

Canadian Dollar news and market movers

- The Canadian Dollar loses ground against the US Dollar after the release of Canadian Retail Sales on Friday, which comes out lower-than-expected, printing 0.2% in May versus the 0.5% forecast from 1.0% in the previous month of April.

- Retail Sales ex Autos also falls below expectations, printing a 0.0% change in May versus the 0.3% expected and the 1.2% rise registered in April.

- Canadian New Housing Price Index data, released at the same time, registers a 0.1% rise in June, which was higher than the 0.0% forecast but the same as the 0.1% previous.

- The lower-than-expected Retail Sales data weighs on the CAD (USD/CAD rises) because it indicates consumer spending is falling which will probably lead to lower inflation and lower interest rates – a negative for the Canadian Dollar.

- The Greenback benefits from outflows from the Japanese Yen (JPY), according to a report by Reuters, cited by FXStreet Lead Analyst, Eren Sengezer. Traders are dropping the Yen ahead of next week’s Bank of Japan (BoJ) policy meeting amidst expectations the BoJ will maintain its Yield Curve Control (YCC) at current levels when some tightening had been expected previously amid higher inflation.

- The US Dollar is further supported by lower-than-forecast US Initial Jobless Claims data for the week ending July 14. First-time applications for unemployment benefits in the US declined to 228,000, the Department of Labor announced on Thursday. This was well below the market expectation of 242,000. The strong jobs data suggests more persistent inflationary pressures ahead, which should keep interest rates higher for longer – a positive for the Buck.

Canadian Dollar Technical Analysis: Treading water near critical support level

USD/CAD is probably in a long-term uptrend on the weekly chart, which began at the 2021 lows. Since October 2022, the exchange rate has been in a sideways consolidation within that uptrend. Given the old saying that ‘the trend is your friend’, however, the probabilities favor an eventual continuation higher and longs over shorts.

USD/CAD appears to have completed a large measured move price pattern that began forming at the March highs. This pattern resembles a 3-wave ABC correction, in which the first and third waves are of a similar length (labeled waves A and C on the chart below).

-638255408669513147.png)

US Dollar vs Canadian Dollar: Weekly Chart

A confluence of support situated in the upper 1.3000s, which is made up of several longer moving averages and a major trendline, prevented last week’s decline from extending any lower and provided a foundation for the reversal on Friday and Monday.

-638255408238763146.png)

US Dollar vs Canadian Dollar: Daily Chart

The long green up-bar that formed on Friday is a bullish engulfing Japanese candlestick reversal pattern. When combined with the long red down bar that formed immediately before it, the two together also complete a two-bar bullish reversal pattern.

The Relative Strength Index (RSI) is converging bullishly with price at the July lows when compared to the June 27 lows. At the June 27 lows, RSI was lower than in July despite price being higher. This suggests underlying strength and is a bullish sign.

Monday’s weak close, however, failed to provide confirmation for the reversal, and since then, the price has been pulling back down.

It will take a decisive break above the 50-day Simple Moving Average (SMA) at circa 1.3400 to refresh and reconfirm the USD/CAD long-term uptrend. Nevertheless, bulls marginally have the upper hand, with the odds slightly favoring a recovery and a continuation higher.

Alternatively, a decisive break below 1.3050 would indicate the thick band of weighty support in the upper 1.30s has been definitively broken, bringing the uptrend into doubt.

The USD is extending its rebound into the weekend. Shaun Osborne, Chief FX Strategist at Scotiabank, analyzes Greenback's outlook.

Not yet signal a major reversal in the soft USD trend

The USD rebound this week provides some respite from recent losses and may reflect market positioning as investors start to focus on next week’s FOMC decision (Wednesday) and ECB announcement (Thursday).

The rebound this week has done enough to check the sell-off but does not (yet) signal a major reversal in the soft USD trend seen in recent weeks. I still rather think upside potential in the USD generally is limited.

- Retail Sales in Canada increase at a softer pace than expected in May.

- USD/CAD trades in positive territory above 1.3200 after the data.

Retail Sales in Canada rose 0.2% on a monthly basis in May, Statistics Canada reported on Friday. This reading followed the 1% increase recorded in April (revised from 1.1%) and came in below the market expectation of 0.5%.

Retail Sales ex Autos remained unchanged in the same period, compared to analysts' estimate for an increase of 0.3%.

Market reaction

USD/CAD edged higher with the initial reaction to this report and was last seen rising 0.25% on the day at 1.3205.

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting assess the latest performance of Malaysian exports.

Key Takeaways

Malaysia’s exports remained sluggish in Jun, contracting for the fourth straight month and by a double-digit pace for the second time this year at 14.1% y/y (May: -0.9%). The decline came in worse than our expectation (-11.5%) but in line with Bloomberg consensus (-14.0%). Imports also dropped for four months in a row by a double-digit rate of 18.9% (May: -3.7%), sharply below our estimate (11.0%) and Bloomberg consensus (-16.5%). This led to a larger trade surplus of MYR25.8bn (May: +MYR15.7bn).

In 2Q23, exports shrank for the first time in 11 quarters by 11.1% y/y (1Q23: +3.0%) while imports tumbled for the first time in nine quarters by 11.5% (1Q23: +3.4%), leaving a cumulative trade surplus of MYR54.1bn (1Q23: +MYR64.4bn). This is expected to translate into a smaller current account surplus of MYR3.5bn last quarter (1Q23: +MYR4.3bn). Actual 2Q23 current account data will be released on 11 Aug.

We maintain our view that the export contraction trend will likely persist for the greater part of 2H23 as a result of the unfavourable base effects, subdued global demand and easing global commodity prices. Tighter international financial conditions, volatile currency and escalating geopolitical risks add further downside risks to the near-term trade outlook. The 4.5% year-to-date decline also suggests that our 2023 full-year export forecast of -7.0% remains valid (BNM est: +1.5%, 2022: +24.9%).

- USD/CHF is oscillating around 0.8660 as investors await Fed policy for further guidance.

- One more interest rate hike from the Fed is highly required as core inflation is still persistent and will take a while in returning to 2%.

- SNB Jordan conveyed that the consequences of higher inflation are worse than the lower inflation scenario.

USD/CHF is demonstrating back-and-forth moves around 0.8660 in the European session. The Swiss Franc asset is trading inside the woods after a sharp rally to near 0.8680 as investors have shifted their focus towards the interest rate decision by the Federal Reserve (Fed), which will be announced on July 27.

S&P500 futures have shown a recovery move in London after a sheer sell-off on Thursday, indicating some ease in the risk-averse theme. The US Dollar Index (DXY) has jumped to near the 101.00 resistance and needs comfortable stability above the same. The yields offered on 10-year US Treasury bonds have dropped to near 3.83%.

As per the CME FedWatch tool, a 25 basis point (bp) interest rate hike to 5.25-5.50% looks real. Scrutiny of June’s economic growth indicates that inflationary pressures have cooled down significantly as producers have lowered prices of goods and services at factory gates. In addition to that, labor market conditions also eased and consumer spending momentum has slowed down too.

In spite of easing price pressures, one more interest rate hike from the Fed is highly required as core inflation is still persistent and will take a while in returning to 2%. Also, labor market conditions are still hot as initial jobless claims dropped last week.

The US Department of Labor reported that individuals who applied for jobless benefits for the first time dropped to 228K for the week ending July 16 vs. expectations of 242K and the former release of 237K.

On the Swiss Franc front, more interest rate hikes from the Swiss National Bank (SNB) are anticipated as SNB Chairman Thomas J. Jordan conveyed that the consequences of higher inflation are worse than the lower inflation scenario. Inflation in the Swiss economy landed at 1.7% in June but needs stabilization.

GBP/USD trades soft in the mid-1.28s. Economists at Scotiabank analyze the pair’s outlook.

A low close on the week will add to GBP headwinds

Five net down days and a sixth looking possible today leave the GBP undertone soft. A low close on the week will add to GBP headwinds.

Trend momentum has weakened on the short-term chart and a low weekly close (likely, at this stage) would add to broader headwinds.

Cable losses have steadied around the 1.2850 point that was resistance in June as the Pound rallied but a low close on the week could see losses extend to 1.27 trend support off the March low.

The CAD is little changed in the session. Economists at Scotiabank analyze Loonie's outlook ahead of Retail Sales.

Downside momentum may need a “refresh” from a break under 1.3070

Canadian Retail Sales are expected to rise 0.5% in May (0.2% for ex-auto sales). A 0.5% gain is in line with the flash estimate released alongside the strong April report last month. Firm data may give the CAD a modest lift on the session.

Intraday trends suggest firm support on dips to the low 1.31 area and resistance in the low 1.32s. Broader trends remain USD-bearish, however, and the USD may close out the week with another net loss.

Downside momentum may need a ‘refresh’ from a break under 1.3070 (200-Week Moving Average).

EUR/USD slips off earlier high to retest support in low 1.11s. Economists at Scotiabank analyze the pair’s outlook.

Underlying trend signals remain bullish on the daily and weekly oscillators

The EUR’s short-term technical undertone remains soft after losses picked up yesterday but Thursday’s low is holding the base of the range, at least for now, and underlying trend signals remain bullish on the daily and weekly oscillators.

Scope for EUR losses to extend much more should be limited.

We spot retracement support (38.2% of the July rally) at 1.1110. Resistance (minor bull trigger) is 1.1155.

Economists at ING analyze AUD/USD outlook.

A bullish “pocket” may emerge in September

We could see a bullish ‘pocket’ for the pair in September when Australian CPI readings could clearly show the impact of large electricity tariff increases due in July and force an RBA hike while the Fed holds on an improved inflation outlook.

The AUD swap curve prices in 14 bps to a peak, and the strict data-dependent approach by the RBA could leave more room for tightening speculation. China’s underwhelming growth story may still cap gains, but there is room for improvement thanks to Beijing’s added stimulus.

We target 0.72 in the first quarter of 2024.

- USD/CAD turns lackluster below 1.3200 as the focus shifts to Canadian Retail Sales data.

- Canada’s consumer spending is expected to expand at a slower pace.

- Market participants are anticipating the interest rate hike on July 27 by the Fed would be the last nail in the coffin.

The USD/CAD is demonstrating a non-directional performance below the round-level resistance of 0.3200 in the London session. The Loonie asset is awaiting the release of the Canadian Retail Sales data for May for meaningful action.

S&P500 futures have generated decent gains in Europe, portraying that overall negative market sentiment has started easing now. US equities are under pressure as corporate earnings season has kicked off. The US Dollar Index (DXY) is making efforts for stability above the crucial resistance of 101.00.

A power-pack action is expected in the Canadian Dollar as Statistics Canada will report monthly Retail Sales data for May at 12:30 GMT. As per the estimates, the economic data expanded at a pace of 0.5%, which is slower than the figure recorded for April at 1.1%. Retail Sales excluding automobiles are seen increasing by 0.3% but lower than the 1.3% pace recorded earlier.

This indicates that momentum in consumer spending might be slowed in May but remain resilient. Also, the preliminary data indicates that demand for automobiles is decent than other durable and non-durable goods. This would portray a rise in demand for big-ticket items in spite of higher interest rates by the Bank of Canada (BoC).

Meanwhile, the US Dollar Index is gaining strength amid a cautious market mood as investors seem convinced about one more 25 basis points (bps) interest rate hike from the Federal Reserve (Fed), which will push interest rates to 5.25-5.50%.

On the oil front, oil prices have sensed selling pressure above $76.50, however, the upside bias is intact as the market participants are anticipating the interest rate hike on July 27 by the Fed would be the last nail in the coffin.

It is worth noting that Canada is the leading exporter of oil to the United States and higher oil prices would strengthen the Canadian Dollar.

After the USD weakness had ended towards the end of last week, Thursday brought a notable correction of what had happened in the first half of the month. Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank, analyzes Greenback's outlook.

Impressively precise correction

In addition to the good reasons for USD weakness (the prospect of rate cuts early on next year), there were also bad reasons during the first half of the month: the assumption that there will be only one more Fed rate step rather than two (as had been expected not that long ago).

Why is this second reason ‘bad’ in my view? The reason is bad because a USD carry of 25 bps more or less is not a noteworthy argument for or against the Greenback.

If – as I hope – Thursday’s correction has removed the part of USD weakness that was due to these ‘bad’ reasons this was a ‘healthy’ correction that returned the levels of the USD exchange rates to an even keel to ensure that ahead of the coming week (with the Fed, ECB and BoJ rate decisions) the risks are more evenly spread once again.

Economist at UOB Group Lee Sue Ann reviews the latest release of the UK inflation figures.

Key Takeaways

Inflation in the UK fell by more than expected in Jun and was at its slowest in more than a year. While wages rose at the joint fastest pace on record, there are also signs that the inflationary heat in the labour market is cooling.

Policymakers in the UK are walking a tightrope as they attempt to tighten monetary policy sufficiently to quell inflationary pressures without triggering a full-scale mortgage crisis and recession.

We believe the outsized move in Jun by the Bank of England (BOE) will be a one off. The recent slew of economic data should ease some of the pressure to keep on raising interest rates sharply. We keep to our view that the BOE will likely hike by 25bps at each of its next two meetings (3 Aug and 21 Sep), culminating with a terminal rate of 5.50%.

Economists at ING analyze USD/CNY outlook.

The turn in the broad Dollar cycle may help cement a top in USD/CNY at 7.25/30

There seems to be little confidence that Chinese policymakers are prepared to jolt the economy into action.

The turn in the broad Dollar cycle may help cement a top in USD/CNY at 7.25/30, but the case for a markedly lower USD/CNY is hard to make right now.

USD/CNY – 1M 7.30 3M 7.25 6M 7.10 12M 6.80

See: USD/CNY to reach 7.00 by end-Q3, 2023, 6.80 by end-Q4 – MUFG

EUR/USD may be capped at 1.1275 for now, but analysts at Credit Suisse look for an eventual rise to 1.1700.

The 61.8% retracement of the 2021/2022 downtrend at 1.1275 is capping for now

Whilst we suspect the 61.8% retracement of the 2021/2022 fall at 1.1275 caps for now for a pullback/consolidation, we look for a clear and sustained break higher in due course. Resistance would then be seen next at 1.1391/96 ahead of 1.1495 and eventually, what is now our core objective at 1.1703/1.1748 – the March 2021 low and 78.6% retracement of the 2021/2022 fall.

Support for a pullback is seen at 1.1097/93 initially, then 1.1013, with 1.0943 now ideally holding deeper setbacks if seen.

Japan's top currency diplomat Masato Kanda came out with a verbal intervention to rescue the Japanese Yen after it plunged on reports that the Bank of Japan (BoJ) could leave its policy settings unchanged next week.

Key quotes

Watching FX market with a sense of urgency.

Excessive FX moves are undesirable.

Market reaction

USD/JPY trimmed gains on the above comments, trading at 141.65, at the time of writing. The spot is still up 1.18% on the day.

The US Dollar has continued to trade at stronger levels after staging a strong rebound on Thursday. Economists at MUFG Bank analyze USD outlook.

Slowing inflation should give the Fed more confidence that rates are now sufficiently restrictive

Slowing inflation should give the Fed more confidence that rates are now sufficiently restrictive, and if inflation continues to fall closer to the Fed’s inflation target it will begin to open up room for the Fed to begin to lower rates next year.

The combination of lower US rates in response to slowing US inflation and a softer landing for the US economy should be an unfavourable mix for US Dollar performance.

GBP/USD weakness is seen as temporary and corrective ahead of a fresh rally, analysts at Credit Suisse report.

A break under 1.2749/40 would suggest a more concerted pullback/consolidation

Whilst we see scope for a deeper pullback, our bias is to view this as a temporary setback ahead of strength back to the 1.3143 recent high ahead of 1.3299, then our core objective at the 78.6% retracement of the 2021/2022 fall at 1.3400/14.

Key support is seen at the uptrend from last September and low of last week at 1.2749/40, which we look to ideally hold on a closing basis. A break would suggest instead a more concerted pullback/consolidation with support seen next at 1.2672, but with the 1.2590 late June low ideally holding.

- EUR/JPY rallies near 80 pips to test 158.00 in the European session.

- BoJ is reportedly said to leave policy settings unchanged next week.

- The US Dollar recovers ground, tracking the upsurge in the USD/JPY pair.

The EUR/JPY pair has seen a vertical rise over the last hour, as the Japanese Yen came under intense selling pressure following the latest headlines on the potential Bank of Japan (BoJ) policy outlook.

Citing five sources familiar with the central bank's thinking, Reuters reported that the BoJ is unlikely to introduce any changes to its yield curve control (YCC) settings at its two-day monetary policy review meeting, concluding on July 28.

The cross jumped from near the 157.15 region to test the 158.00 level, in a knee-jerk reaction to the dovish chatter, before reversing to trade at 157.77, where it now wavers. The pair is still up 1.21% on the day.

Earlier this week, the central bank Governor Kazuo Ueda poured cold water on any likely tweaks next week after he said that “there was still some distance to sustainably achieve the 2% inflation target.” The Yen also met fresh supply following his comments, extending the rebound in the cross briefly above the 157 mark on Wednesday.

At the moment, the upsurge in the USD/JPY is offering some support to the US Dollar across the board, allowing the Greenback to resume its recovery, in turn, checking the rebound in the EUR/USD pair.

Amid a lack of fresh economic data from the US docket this Friday, the BoJ expectations will continue to drive the EUR/JPY cross, as investors resort to repositioning ahead of the critical BoJ and the Fed policy announcements next week.

EUR/JPY Technical levels to watch

- Gold price faces an intense sell-off as investors are confident that the Fed will raise interest rates further on July 27.

- More rate hikes are broadly anticipated as the United States' core inflation remains resilient.

- Support from BRICS’ gold-backed currency discussions is losing its appeal.

Gold price drops sharply as investors focus their attention on the Federal Reserve (Fed), which is likely to resume its policy tightening spell next week after skipping in June. In addition to the Fed, the Bank of England (BoE) and the European Central Bank (ECB) are also preparing for raising interest rates further so that inflation can return to the 2% target. The appeal for Gold is diminishing as more interest-rate hikes from the Fed would also propel fears of a recession in the United States.

It looks like Gold’s strength from discussions about introducing a new gold-backed currency by the BRICS (Brazil, Russia, India, China, and South Africa) is losing its appeal. The reasoning behind introducing a new gold-backed currency, an announcement which is expected in August, is that it might be used for international payments.

Daily Digest Market Movers: Gold price falls sharply ahead of Fed policy

- Gold price turns sideways after a corrective move from a two-month high of $1,987.50 as the US Dollar Index shows resilience ahead of the monetary policy by the Federal Reserve, whose decision will be announced on July 27.

- In spite of a significant decline in United States inflation, easing labor market conditions, and slow momentum in consumer spending growth, investors expect one more interest-rate hike of 25 basis points (bps) to 5.25-5.50%.

- Market participants expect that US inflation will decline, but it is far from the desired rate of 2%. Therefore, further policy tightening cannot be ruled out.

- Investors are anticipating that next week’s rate hike will be the last nail in the coffin and that interest rates will peak for the current year.

- The US Dollar Index has posted a three-day winning spell after nosediving last week as the room for more interest-rate hikes by the Fed is still open.

- Meanwhile, US labor market conditions are regaining strength again, according to weekly Jobless Claims data, which have surprisingly dropped.

- Individuals claiming jobless benefits for the first time declined to 228K for the week ending July 16, lower than the 242K expected and the former release of 237K.

- Loosening labor market conditions were decelerating inflationary pressures, and a recovery in the same could elevate overall consumer spending and slow down the current disinflation trend.

- The US housing market is facing the wrath of higher interest rates by the Fed as Existing Home Sales for June declined by 3.3% and Housing Starts decreased by 8.0% on a monthly basis.

- According to the latest data from the Federal Reserve, bank borrowings from the Fed’s emergency lending programs snapped their two-week decline and climbed in the week ended July 19.

- Despite tight credit conditions by commercial banks, the increase in the Fed’s lending data indicates that demand for credit by firms is resilient even in a high-interest-rate environment.

- Market mood has turned cautious as US tech stocks have come under pressure amid a disappointing second-quarter earnings season.

- US Treasury Yields follow the footprints of the US Dollar Index. The yields offered on 10-year US Treasury bonds are around 3.85%.

Technical Analysis: Gold price declines toward $1,960

Gold price faces pressure above $1,980.00 as the US Dollar Index rebounds meaningfully. However, the broader trend of Gold is bullish as it trades comfortably above the 20-day Exponential Moving Average (EMA) at $1,950.00. Investors should note that 20- and 50-day EMAs are on the verge of delivering a bullish crossover. This would strengthen the upside bias further. Fresh longs are expected in Gold price if it manages to climb above $1,980.00 convincingly.

Interest rates FAQs

What are interest rates?

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%.

If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

How do interest rates impact currencies?

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

How do interest rates influence the price of Gold?

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank.

If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

What is the Fed Funds rate?

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure.

Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

The Aussie received a brief boost from Thursday's employment data, but this quickly evaporated as the USD strengthened. Economists at Commerzbank analyze AUD outlook.

Between Australia's labour market data and inflation data

So far, the labor market does not seem to be feeling the effects of the RBA's significant interest rate hikes as expected.

Next week Wednesday's Q2 inflation figures will be the last data point before the next monetary policy meeting in early August. The reported inflation for Q2 is likely to weaken further. The interesting question should be: by how much? After all, that's the key data point for the RBA's upcoming policy decision.

So far, the currency market seems undecided on whether another rate hike will follow. The relatively strong labor market argues for another rate hike, which also explains the Aussie's initial strong reaction. More important, however, is inflation. If it doesn't fall as much as expected, the RBA is likely to follow up with another rate hike.

- GBP/JPY rallies hard to a nearly two-week high amid aggressive selling around the JPY.

- Reports indicate that the BoJ will stick to its dovish stance and weigh heavily on the JPY.

- The upbeat UK Retail Sales contribute to the British Pound’s relative outperformance.

The GBP/JPY cross catches aggressive bids on Friday and jumps back above the 182.00 round-figure mark during the early the European session, recovering its weekly losses registered over the past four days. Spot prices rally to a nearly two-week high in the last hour and currently trade around the 182.35-182.40 region, up over 1% for the day

The Japanese Yen (JPY) tumbles across the board in reaction to reports, citing sources familiar with the matter, that the Bank of Japan (BoJ) was leaning toward maintaining its yield curve control (YCC) strategy at its monetary policy meeting next week. This overshadows data showing that inflation in Japan remained above the central bank's 2% target for the 15th straight month in June and undermines the JPY, which, in turn, provides a strong boost to the GBP/JPY cross.

The British Pound's (GBP) relative outperformance could further be attributed to the better-than-expected release of the UK Retail Sales report released on Friday. That said, diminishing odds for more aggressive policy tightening by the Bank of England (BoE), bolstered by Wednesday's softer UK consumer inflation figures, might hold back traders from placing aggressive bullish bets around the GBP and cap the upside for the GBP/JPY cross, at least for the time being.

The market focus now shifts to the highly-anticipated two-day BoJ meeting starting next Thursday. The decision is scheduled to be announced next Friday, which should provide a fresh directional impetus to the GBP/JPY cross. Nevertheless, spot prices seem poised to register modest gains for the first time in the previous three-week and remain well within the striking distance of the highest level since December 2015, around the 184.00 mark touched earlier this month.

Technical levels to watch

- USD/JPY jumps to near 142.00 as the US Dollar rallies amid a cautious market mood.

- Fed-BoJ policy divergence is expected to widen further as the BoJ is expected to continue its dovish stance.

- Japan’s inflation is accelerating more than expected but the key is whether the increase is sustainable.

The USD/JPY pair is swiftly marching towards the critical resistance of 142.00 in the European session. The asset has shifted into a bullish trajectory amid strength in the US Dollar Index (DXY) and rising odds of an unchanged interest rate decision by the Bank of Japan (BoJ), which will be announced on July 28.

S&P500 futures have added decent gains in London, portraying ease in the overall risk-off mood. US equities were heavily sold on Wednesday, driven by an intense sell-off in technology stocks. Investors are cautious that guidance from tech-savvy stocks could remain weak amid higher interest rates by the Federal Reserve (Fed).

The rally in USD/JPY is backed by expectations that policy divergence between the Fed and the Bank of Japan (BoJ) would escalate further as the Fed is expected to raise interest rates further while the BoJ will continue maintaining its decade-long ultra-dovish policy stance. The context has sent the Japanese Yen sharply lower against the US Dollar.

Reuters reported on Friday that the BoJ was leaning toward maintaining its yield curve control (YCC) strategy at next week's policy meeting. "Inflation is accelerating more than expected. But the key is whether the increase is sustainable, which will depend largely on corporate profits and next year's wage outlook," one of the sources told Reuters.

The US Dollar Index has climbed to near the immediate resistance of 101.00 as investors are pumping money into safe-haven assets, knowing the fact that more interest rate hikes by the Fed would deepen fears of recession. Contrary, the 10-year US Treasury yields have dropped to near 3.84%.

Economists at ING analyze USD/JPY outlook ahead of next Friday's BoJ meeting.

Expectations of any Yield Curve Control policy tweak seem very low

Regarding the BoJ, expectations of any Yield Curve Control policy tweak seem very low (perhaps too low) given that the 30-year Japanese government bond (JGB) yield is drifting lower and the forward market prices 10-year JGB yields at 50 bps in three months and at only 55 bps in six months. These 10-year yields should be priced a lot higher were the market expecting a policy change.

USD/JPY may well drift to the 141.15/142.00 area before next Friday's BoJ meeting.

Here is what you need to know on Friday, July 21:

The Japanese Yen stays under strong selling pressure on Friday on reports claiming the Bank of Japan (BoJ) will not make any changes to its yield curve control strategy next week. The US Dollar Index continues to stretch higher following Thursday's strong recovery amid a cautious market stance. June Retail Sales from Canada will be the only data releases featured in the economic calendar ahead of the weekend.