- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- Kiwi tallies a three-day losing streak, end the week on a negative note with the pair stabilizing at 0.6115.

- NZD/USD outlook continues to skew bearish as bulls fail to maintain upward traction.

- Bucking the bearish trend, a break above 0.6150, the position of the 20-day SMA, is vital.

On Friday, the NZD/USD extended its losing streak to three days. Despite an attempt to rally which took the pair to a high of 0.6140, the bulls were unable to return to the positive side and the pair stabilized at 0.6115 The unsuccessful attempt to maintain gains solidifies the increasing bearish sentiment for the Kiwi. The currency pair must climb past the 20-day Simple Moving Average (SMA) situated at 0.6150 to brighten the otherwise negative outlook.

The Relative Strength Index (RSI) for the NZD/USD pair on the daily chart locates at 49, hinting at a shift of momentum towards more bearishness. Despite this downward shift, the RSI remains near the neutral zone. Furthermore, the Moving Average Convergence Divergence (MACD) continues to increase its red bars, indicating an amplified seller presence in the market.

NZD/USD daily chart

The NZD/USD finds immediate support near the 0.6100 level. Beneath that, additional support resides at the 100-day SMA at 0.6070 and the 200-day SMA at 0.6060. These levels could offer a robust defense should the pair extend its downside. A breach below these SMA convergence points might signal an intensifying sell-off scenario.

Conversely, the first resistance remains around the 20-day SMA level at 0.6150. Higher resistances are found at the 0.6170 and 0.6200 levels. A decisive breakout above these levels could possibly indicate an end to the current bearish market sentiment and start to favor the bulls.

- Silver declines 3.86% sparked by firm US Treasury yields and a strong US Dollar.

- Technical outlook shows a bearish engulfing pattern with RSI turning bearish, indicating potential further losses.

- Key support levels: 50-DMA at $29.09, $29.00, and MTD low of $28.66, with deeper support at 100-DMA of $26.60.

- Key resistance levels: June 7 high at $31.54, $32.00, and YTD high of $32.51.

Silver price dropped sharply and snapped two days of gains amid firm US Treasury bond yields and a strong US Dollar. The grey metal trades at $29.53 , down 3.86%

XAG/USD Price Analysis: Technical outlook

Silver is still bullish biased though joining today and yesterday price action completed a ‘bearish engulfing,’ chart pattern. Momentum shifted in sellers’ favor as the Relative Strength Index (RSI) turned bearish and opened the door for further losses.

That said, XAG/USD's first support would be the 50-day moving average (DMA) at $29.09; it will expose $29.00. Breaching this level could lead to the MTD low of $28.66, ahead of a potential drop towards the 100-DMA at $26.60.

On the flip side, if XAG/USD resumes its uptrend, the next resistance level is the June 7 high of $31.54. Clearing this level would target $32.00 before challenging the year-to-date (YTD) high of $32.51.

XAG/USD Price Action – Daily Chart

- GBP/USD hit fresh lows on Friday as Cable extended declines.

- Upbeat US PMIs drive off risk appetite, bolster Greenback.

- GBP traders buckle down for a long wait to next Friday’s GDP.

GBP/USD closed Friday at a fresh five-week low of 1.2622, marking the Cable's third straight down week. The Bank of England’s (BoE) midweek rate hold did little to spark confidence in the GBP, and a late-week upswing in US Purchasing Managers Index (PMI) kicked broad-market risk appetite lower, lifting the US Dollar heading into the trading week’s close.

UK Retail Sales lurched higher to 2.9% MoM in May, snubbing the forecast move down to 1.5% from the previous month’s revised -1.8% contraction. UK PMIs also came in mixed, with the S&P Global/CIPS Manufacturing PMI for June rising to 51.4 against the forecast 51.3 and the previous month’s 51.2. The Services PMI contracted sharply to a seven–month low of 51.2, entirely missing the forecast uptick to 53.0 from 52.9.

Forecasting the Coming Week: The US PCE will unlikely move the Fed’s dial

On the US side, the S&P Global Manufacturing PMI for June rose to 51.7 versus the forecast downtick to 51.0 from the previous 51.3. The Services PMI also thumped expectations, rising to almost a two-year high of 55.1 versus the expected softening to 53.7 from 54.8.

With upbeat US economic data crimping odds of an early rate cut from the Federal Reserve (Fed), market sentiment backed up into the safe haven Greenback on Friday.

UK economic remains thin heading into next week, leaving Sterling traders to wait for next Friday’s Gross Domestic Product (GDP) print. US economic data prints are also relegated to mid-tier releases early next week, with the US’ own GDP update slated for next Thursday.

GBP/USD technical outlook

GBP/USD has locked in a third straight down week as the Sterling extends a slump against the Greenback. The pair fell to a five-week low, setting a fresh low for the week early Friday at 1.2622. Cable tumbled -0.92% peak-to-trough from the week’s peak bids near 1.2740.

Daily candlesticks are facing a steepening bearish decline after a rejection from a supply zone near the 1.2800 handle. Candles are on pace to fall back to the 200-day Exponential Moving Average (EMA) at 1.2586.

GBP/USD hourly chart

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- The cross continued its upward journey, reaching new cycle highs above 97.50, levels not seen since July 2007.

- The daily chart shows intense bullish sentiment, with the Yen weakening against its peers.

- Indicators are approaching overbought conditions which might limit the upside.

On Friday, the NZD/JPY cross extended advances and established multi-year highs above 97.50. The 20-day Simple Moving Average (SMA), now at 96.60 continued as firm support at the beginning of the week, where buyers ward off sellers' strivings to breach this level.

The daily Relative Strength Index (RSI) for NZD/JPY is currently at 68, indicating an increase from Thursday's value and overall upward momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) for today shows decreasing red bars, implying decreased selling pressure. The RSI near 70 should flash caution to investors as it approaches the overbought threshold.

NZD/JPY daily chart

The bulls' tenacity to sustain their positions above the 20-day SMA remains unshaken. This, combined with the near-overbought daily technical indicators, reinforces the superior technical vim of the Kiwi against the Yen. The consecutive failed attempts from the sellers to breach the 96.30 point, a strong support, led to the bulls' momentum which catalyzed the surge to fresh highs.

For the following trading sessions, the cross may oscillate between the immediate support at 97.00 and the resistance target at 98.00. Investors need to keep an eye on a possible break above the mentioned range or a fall below the 20-day SMA mark which could signal a deeper correction.

- USD/JPY rises to 159.59, nearing the pivotal 160.00 mark, propelled by robust US PMI data.

- Key resistance at 160.00 and YTD high of 160.32; potential for Bank of Japan intervention looms.

- Support found at 159.00, June 14 high of 158.25, 158.00, with additional support at Tenkan-Sen (157.69) and Senkou Span A (157.40).

The US Dollar climbs against the Japanese Yen on Friday and approaches intervention levels ahead of the weekend. Stronger than expected US S&P Global Flash PMIs overshadowed weaker housing data and weighed the JPY. Therefore, the USD/JPY trades at 159.59, gains 0.42%.

USD/JPY Price Analysis: Technical outlook

The major has finally broken the barrier of 159.00 and closes to intervention levels reached on April 29, when the USD/JPY cleared the 160.00 figure. This triggered a reaction by the Bank of Japan, which intervened in the FX space, sending the pair tumbling 400 pips to 156.06 after hitting a daily high of 160.32.

Despite that, the USD/JPY remains upward biased, and the next resistance would be 160.00. Once cleared up, next would be the year-to-date (YTD) high of 160.32.

Conversely, the most likely scenario due to intervention threats is the USD/JPY first support of 159.00. Once cleared, the next support would be the June 14 high at 158.25, followed by 158.00. Further losses are seen at the Tenkan-Sen at 157.69, followed by Senkou Span A at 157.40, ahead of the Kijun-Sen at 157.11

USD/JPY Price Action – Daily Chart

- WTI tumbled back below $81.00 on Friday, tested $81.50.

- The EIA reported a surprise buildup in natural gas reserves, clipping drawdown hopes.

- US Crude Oil productivity remains close to all-time highs.

West Texas Intermediate (WTI) US Crude Oil hit a fresh high for the week early Friday before slumping back into negative territory for the day after the Energy Information Administration (EIA) noted that US Crude Oil production remains near all-time peaks and a larger-than-expected buildup in Natural Gas reserves.

The EIA reported a 71 billion cubic feet (Bcf) increase in the amount of available working natural gas in storage, bringing US reserves to a multi-month high of 3,045 Bcf for the week ended June 14. The previous week’s increase of 74 Bcf was expected to a steeper drop in buildup to only 69 Bcf.

With natural gas reserves filling up ahead of peak summertime cooling demand, Crude Oil is less likely to see meaningful increases in demand, trimming hopes of a steeper drawdown during the summer.

US Purchasing Managers Index (PMI) figures for June also beat the street on Friday, pressing down on broad-market hopes for rate cuts. With the Federal Reserve (Fed) unlikely to get forced into an accelerated pace of rate cuts in 2024, Crude Oil markets are second-guessing near-term bullishness as investors lean deeply into rate trim hopes to ease lending and financing costs.

WTI technical outlook

Hesitating bulls have crimped topside momentum in WTI on Friday, dragging intraday price action back into range of near-term rising trendlines. Firmer technical support is sitting at the 200-hour Exponential Moving Average (EMA) at $79.35. Despite a hesitation in the second-half of Friday’s US market session, US Crude Oil managed to etch out a fresh seven-week high above $81.60 before settling lower.

Daily candlesticks are beginning to show signs of exhaustion as WTI’s technical recovery above the 200-day EMA at $78.87 begins to run out of steam. Barring a resurgence in firm bidding, WTI could be primed for a tumble back to the last swing low near $72.50.

WTI hourly chart

WTI daily chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

- Australian Dollar has suffered extended declines in recent sessions as RBA gains slowly fade.

- PMI figures from Australia reveal weaker-than-expected data.

- Fragility in the Australian economy seems to be driving demand off the Aussie.

In Friday's session, the Australian Dollar (AUD) intensified its losses against its peers. The AUD/USD duo has been testing its notable support at the 0.6640 threshold, the 20-day Simple Moving Average (SMA). Selling pressure emerged from the Asian markets in light of soft June preliminary PMIs from Judo Bank in Australia. This weakness has been compounded by high US Treasury yields and optimistic PMI data from S&P in the US, lifting the USD.

Notwithstanding certain signs of frailty in Australia’s economic scene, the stubbornly high inflation continues to prompt the Reserve Bank of Australia (RBA) to delay potential rate cuts, potentially offsetting the Aussie's losses. The RBA is primed to be among the last G10 nation central banks to initiate rate cuts, which might perpetuate the Aussie's gains.

Daily digest market movers: Australian Dollar grapples with weakened data, awaits further cues

- Australia reported weaker preliminary data from the June Purchasing Managers Index (PMI) set, with Manufacturing at 47.5 versus May's 49.7, Services at 51.0 against 52.5, and the Composite rate falling for a third consecutive month to 50.6, from 52.1 in May.

- In contrast, US business activity in the private sector continued to showcase solid growth, with the S&P Global Composite PMI improving slightly to 54.6.

- Governor Bullock, during her latest press conference, confirmed that the Board discussed potential rate hikes, dismissing considerations of rate cuts in the near term.

- Bullock maintained, “Inflation remains above target and is proving persistent,” specifying that "the Board expects that it will be some time yet before inflation is sustainably in the target range."

- RBA affirmed its readiness to do "what is necessary" to guide inflation back within target parameters.

- Market anticipates nearly 50 bps of easing by December 2025, while rate hikes in August and September are yet to be ruled out on the RBA’s side.

- Fed signals only one cut in 2024, while markets continue to hope for a September cut.

Technical analysis: Signs of bullish strength waning, bears time now

The technical front reveals weakened momentum, with the Relative Strength Index (RSI) remaining above 50 but tilting downwards and the Moving Average Convergence Divergence (MACD) continuing to chart red bars. For further confirmation of a more solid buying stance, the AUD/USD pair needs to firmly support itself beyond the 20-day Simple Moving Average (SMA). Sellers might extend trials of the mentioned SMA support in ensuing sessions to test its resilience.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- Gold reverses gains after hitting daily high of $2,368, down more than 1.70%.

- Strong US S&P Global PMI data boosts the US Dollar, with the DXY rising 0.14% to 105.80.

- Mixed US economic data keeps Fed rate cut speculation alive.

Gold prices reversed course on Friday, moving down more than 1.70%. Economic data from the United States (US) spurred investors' reaction to pricing out fewer interest rate cuts by the Federal Reserve (Fed) due to the solid state of the economy. The XAU/USD trades at $2,317, below its opening price after hitting a daily high of $2,368.

The US economy continued to give mixed signals regarding its robustness. S&P Global revealed June’s Purchasing Managers Index (PMI) readings, which exceeded estimates and topped May’s data. However, the US housing sector continued to deteriorate after Existing Home Sales for May missed the mark and fell compared to April’s data.

On the PMI release, investors ditched Gold and bought the Greenback, which, according to the US Dollar Index (DXY), rose 0.14% at 105.80.

US data revealed during the week highlights uncertainty as some economic indicators reiterate that the economy is still solid. On the positive side, Industrial Production, S&P Flash PMIs, and Retail Sales advanced, though the latter were lower than the previous month.

Conversely, housing continued to deteriorate, while the jobs market, as measured by Americans filing unemployment claims, came in worse than expected. The data kept investors' chances of a September Fed rate cut alive.

Given the backdrop, Gold prices continued to drop, along with technical indicators, pointing to a correction following a three-month rally that began in March and lifted XAU/USD to its all-time high of $2,450.

The CME FedWatch Tool shows odds for a 25-basis-point Fed rate cut in September at 59.5%, up from 57.5% on Thursday. In the meantime, the December 2024 fed funds rate futures contract implies the Fed will cut 36 bps toward the end of the year.

Daily digest market movers: Gold price drops due to strong US Dollar

- US Treasury bond yields are firm, with the 10-year Treasury note yield flat at 4.261%.

- S&P Global Manufacturing and Services Flash PMIs in June expanded above estimates. The Manufacturing PMI rose to 51.7, up from 51.3 and exceeding the estimate of 51. The Services PMI increased from 54.8 to 55.1, surpassing the forecast of 53.7.

- US Existing Home Sales in May were lower than expected, falling to 4.11 million from 4.14 million in April, representing a contraction of -0.7%.

- Fed officials advised patience regarding interest rate cuts, emphasizing that their decisions would remain data-dependent. Despite last week's positive CPI report, policymakers reiterated the need to see more data similar to May's before considering any changes.

- Despite the US CPI report showing that the disinflation process continues, Fed Chair Jerome Powell commented that they remain “less confident” about the progress on inflation.

Technical analysis: Gold price drops below Head-and-Shoulders neckline, eyes $2,300

Gold’s downtrend resumed on Friday after buyers tested the Head-and-Shoulders pattern, dragging the XAU/USD price above the pattern’s neckline. Despite achieving a daily close above the latter, sellers defended the neckline and pushed the spot price to a new three-day low of $2,316.

That said, the path of least resistance is to the downside. The next support would be $2,300. Once cleared, XAU/USD would fall to $2,277, the May 3 low, followed by the March 21 high of $2,222. Further losses lie underneath, with sellers eyeing the Head-and-Shoulders chart pattern objective from $2,170 to $2,160.

Conversely, if Gold reclaims $2,350, that will expose additional key resistance levels like the June 7 cycle high of $2,387, ahead of challenging the $2,400 figure.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- Dow Jones struggles in flat territory as investors roil at upbeat US data.

- Rate-cut-hungry markets balk as US economic figures continue to beat the street.

- US PMIs rose in June as business activity expectations turn upbeat.

The Dow Jones Industrial Average (DJIA) is stubbornly flat on Friday, treading water after US equity markets were disappointed by a better-than-expected print in June’s US Purchasing Managers Index (PMI) figures. Markets hoping for a not-too-steep decline in US economic data to push the Federal Reserve (Fed) towards rate cuts were disappointed by upbeat activity survey results, leaning into the “bad news is good news” narrative driving financial markets singularly focused on achieving cheaper lending and financing rates from the Fed.

US PMIs broadly beat Wall Street forecasts in June, with the S&P Global Manufacturing PMI rising to 51.7 from the previous month’s 51.3, snubbing a forecast decline to 51.0. The Services component also increased, climbing to 55.1, it’s highest print since May 2022. The previous month had printed at 54.8, and markets had forecast a decline to 53.7.

On the downside, US Existing Home Sales eased back to 4.11 million units MoM in May, a -0.7% slip from the previous 4.14 million, but still a smaller decline than the forecast 4.10 million. Despite Friday’s mildly higher print in PMIs, markets continue to pin hopes on a September rate cut from the Fed. According to the CME’s FedWatch Tool, rate traders are still pricing in around 65% odds of at least a quarter-point rate trim at the Federal Open Market Committee’s (FOMC) September 18 rate decision.

Dow Jones news

On Friday, about two-thirds of the Dow Jones’ constituent securities were in the green, but gains remained tepid. McDonald’s Corp. (MCD) is leading the gainers, climbing 2.4% to $260.00 per share as the fast food chain wades into the social consciousness surrounding inflation pressures with competitive pricing on strategic menu offerings. The food chain also announced it was ditching AI integration after its bespoke “Automated Order Taker” proved woefully ill-equipped to handle real-world operations at scale.

On the downside, the banking sector is waffling as interest rate hopes battle upbeat US data; JPMorgan Chase & Co. (JPM) fell back 1.25% to $196.20 per share with Goldman Sachs Group Inc. (GS) falling around the same to $452.50 per share.

Dow Jones technical outlook

The Dow Jones is flat on Friday, trading in a tight range in intraday action as the index struggles to find the momentum to reclaim 39,200.00. The DJIA briefly set a fresh peak for the week near 39,260.00 before returning to the day’s opening range.

Daily candlesticks have lept back over the 50-day Exponential Moving Average (EMA) at 38,825.00, extending a recovery from a recent plunge to the 38,000.00 region.

Dow Jones five minute chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- US Dollar soars on back of robust PMI figures for June.

- Markets continue to exercise caution as Fed officials maintain a wary stance on easing cycles.

- Investors continue to leave the door open for a September cut.

On Friday, the US Dollar, benchmarked by the US Dollar Index (DXY), extended its gains, stemming primarily from robust Purchasing Managers Index (PMI) figures for June released by S&P.

Regarding the US economic outlook, there exist signs of some disinflation. Furthermore, Federal Reserve (Fed) officials' cautious comments regarding embracing easing cycles serve to keep market expectations in balance. Should the mixed signals from the economy continue, these could potentially impede any further gains in the USD.

Daily digest market movers: US Dollar rides high on strong PMIs

- US S&P Global Composite PMI for June rose slightly from 54.5 in May to a flash estimate of 54.6, indicating a healthy expansion in business activity within the private sector of the United States.

- Similarly, the S&P Global Manufacturing PMI rose from 51.3 to 51.7 within the same time frame, while Services PMI witnessed an increase to 55.1 from 54.8 in May. This data beat the estimates done by analysts.

- Probability of a rate cut as per CME Group's FedWatch Tool continues to stand around 65% for the meeting on September 18.

DXY technical analysis: Bullish momentum continues, technicals pave the way for more upside

Technical indicators for Friday's session demonstrated renewed bullish momentum backed by robust PMI figures. The Relative Strength Index (RSI) stood above 50, with the Moving Average Convergence Divergence (MACD) presenting green bars, pointing toward sustained bullish sentiment.

Additionally, the DXY Index maintains its footing above the 20-day, 100-day and 200-day Simple Moving Averages (SMAs). Coupled with the rising indicators, the US Dollar seems to be poised for additional gains.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- Mexican Peso strengthens for second consecutive day as USD/MXN drops close to 1%.

- Positive market reaction comes in response to choice of Marcelo Ebrard as economy minister.

- Banxico expected to hold rates unchanged amid inflation concerns and recent Peso depreciation.

The Mexican Peso rallied for the second straight day against the US Dollar on Friday after President-elect Claudia Sheinbaum revealed the first members of the cabinet on Thursday, which were cheered by investors. In the meantime, traders brace for next week’s Bank of Mexico (Banxico) monetary policy decision, which is expected to hold rates unchanged. The USD/MXN trades at 18.21, down 0.80%.

Mexico’s President-elect Sheinbaum revealed on Thursday the first six cabinet members to take office on October 1. She named Marcelo Ebrard as economy minister and Juan Ramon de la Fuente as foreign minister. Traders saw these appointments as positive since Ebrard will oversee the USMCA free trade agreement review.

Data-wise, the Mexican economic docket featured Economic Activity, which plunged in April, as shown by monthly figures. In the twelve months to April, it exceeded estimates.

In the meantime, most analysts estimate Banxico will keep rates unchanged after the 6.95% depreciation of the Mexican Peso following the June 2 general election. The consensus was expecting a 25-basis-point cut on June 27, though not unanimously, as Deputy Governors Jonathan Heath and Irene Espinosa expressed that inflation risks were skewed to the upside.

Across the border, June S&P Global Flash PMIs exceeded estimates, a sign of economic robustness. Nevertheless, the latest Existing Home Sales data suggests the housing market continues to cool down.

Daily digest market movers: Mexican Peso advances after mixed economic activity data

- Mexico’s April Economic Activity plunged -0.6% MoM, deeper than the expected -0.3% contraction. On an annual basis, Economic Activity expanded by 5.4%, up from -1.3%, and exceeded the consensus of 3.8%.

- Citibanamex Survey showed that most analysts estimate Banxico’s next rate cut will come at the August 8 meeting and that interest rates will be lowered from 11.00% to 10.25%, up from 10%.

- According to the poll, economists estimate inflation to finish 2024 down at 4.27%, core inflation at 4.02%, and the USD/MXN exchange rate at 18.70.

- USD/MXN stabilizes following last week’s verbal intervention by Banxico Governor Victoria Rodriguez Ceja, who said the central bank is attentive to volatility in the Mexican currency exchange rate and could act to restore “order” in markets.

- S&P Global Manufacturing and Services Flash PMIs in June expanded above estimates. Manufacturing PMI came at 51.7, up from 51.3 and the estimate of 51. The Services PMI jumped from 54.8 to 55.1 and was above forecasts of 53.7.

- US Existing Home Sales in May were lower than expected at 4.11 million from 4.14 million in April, a contraction of -0.7%.

- CME FedWatch Tool shows odds for a 25-basis-point Fed rate cut at 59.5%, up from 57.5% on Thursday.

Technical analysis: Mexican Peso climbs as USD/MXN falls below 18.30

The USD/MXN is upwardly biased as a Golden Cross emerged two days ago, but today’s dip below 18.30 has opened the door for a pullback with bears eyeing the 18.00 psychological level. At the time of writing, momentum favors sellers as the Relative Strength Index (RSI) almost vertically falls toward the 50-neutral line.

That said, the USD/MXN first support would be the 18.00 figure. Once cleared, the next stop would be the 50-day Simple Moving Average (SMA) at 17.29, ahead of the 200-day SMA at 17.23.

For a bullish continuation, the USD/MXN must clear 18.50 if buyers want to retest the year-to-date high of 18.99. A breach of the latter will expose the March 20, 2023, high of 19.23. If that price is cleared, this will sponsor an uptick to 19.50.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Canadian Dollar sheds a fifth of a percent against Greenback.

- Canada saw an upswing in core Retail Sales, but industrial prices cooled.

- US PMIs beat the street, snubbing forecasts and ticking higher in June.

The Canadian Dollar (CAD) is struggling to overtake the US Dollar (USD) on Friday, buckling under the weight of a thin, five-day win streak against the Greenback after the US Purchasing Managers Index (PMI) firmly beat forecasts, bolstering the Greenback and leaving the CAD to compete for second place.

Canada saw a better-than-expected print in core Retail Sales in April, but floundering industrial and raw materials prices in May limited the Canadian Dollar's upside moves on Friday. US PMIs lurched higher in June, pushing the US Dollar higher across the board. The CAD is still broadly higher on the week, holding onto a fifth of a percent against the USD from Monday’s opening bids.

Daily digest market movers: Mixed Canadian data flubs broad beats from US

- Canadian core Retail Sales surged 1.8% MoM in April, the highest MoM gain since July 2022. Markets had expected a print of 0.7% compared to the previous month’s revised -0.8%.

- Canadian Raw Material Price Index fell a full 1.0% in May, a steeper decline than the expected -0.6% contraction and falling back from the previous 5.3% (revised from 5.5%).

- Canadian Industrial Produce Prices came in flat in May, below the 0.5% forecast and clipping the previous month’s revised 1.4% as inflation continues to seep out of the Canadian economy at the industrial level.

- US S&P Global Manufacturing PMIs broadly beat forecasts with the Manufacturing PMI printing at 51.7 versus the forecast decline to 51.0 from the previous 51.3.

- US Services PMI also stepped higher, clipping into 55.1 compared to the median market forecast of 53.7 against the previous month’s 54.8.

- Coming up next week, Bank of Canada (BoC) Governor Tiff Macklem will be making a public appearance on Monday; Tuesday will follow up with Canada’s Consumer Price Index (CPI) inflation alongside the BoC’s own CPI core print.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.09% | 0.13% | 0.33% | 0.11% | 0.18% | -0.00% | 0.31% | |

| EUR | -0.09% | 0.03% | 0.26% | 0.04% | 0.11% | -0.07% | 0.22% | |

| GBP | -0.13% | -0.03% | 0.22% | -0.01% | 0.08% | -0.10% | 0.20% | |

| JPY | -0.33% | -0.26% | -0.22% | -0.23% | -0.17% | -0.34% | -0.00% | |

| CAD | -0.11% | -0.04% | 0.01% | 0.23% | 0.05% | -0.12% | 0.20% | |

| AUD | -0.18% | -0.11% | -0.08% | 0.17% | -0.05% | -0.21% | 0.12% | |

| NZD | 0.00% | 0.07% | 0.10% | 0.34% | 0.12% | 0.21% | 0.32% | |

| CHF | -0.31% | -0.22% | -0.20% | 0.00% | -0.20% | -0.12% | -0.32% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

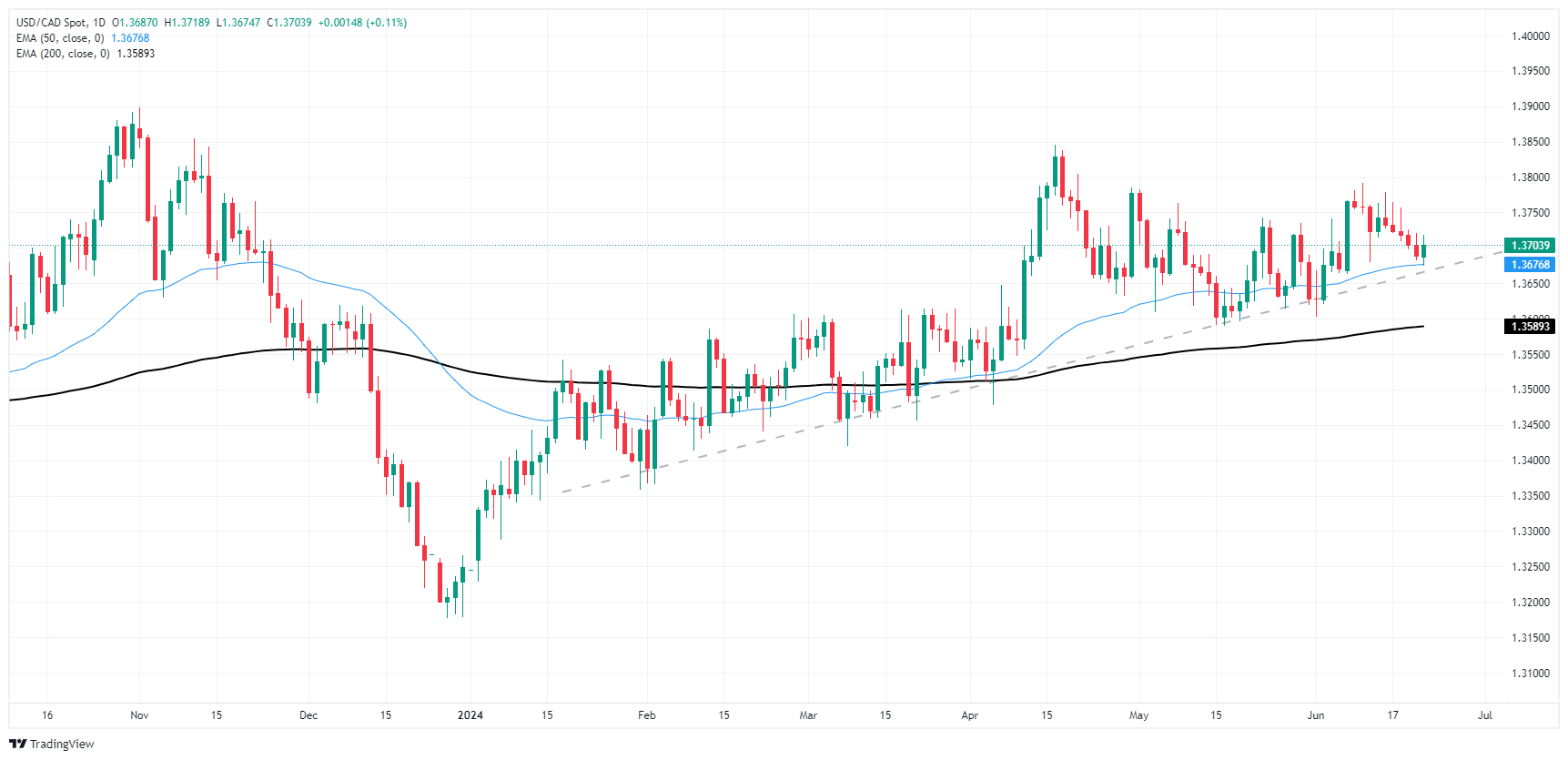

Technical analysis: Canadian Dollar gives mixed performance on Friday

The Canadian Dollar (USD) is trading tightly on Friday with gains and losses equally balanced. The CAD is up around a fifth of a percent against the Australian Dollar (AUD) and Japanese Yen (JPY), but struggling to limit losses against the US Dollar to one-fifth of one percent.

USD/CAD bumped higher on Friday, bouncing from a fresh weekly low of 1.3675 to briefly test back above the 1.3700 handle before running into intraday technical resistance at the 200-hour Exponential Moving Average (EMA) at 1.3715.

Daily candlesticks are on pace to chalk in a first green candle after soft declines for five straight trading days, rebounding from near-term support at the 50-day EMA near 1.3675. USD/CAD is mired in rough consolidation as traders grapple with a rough rising trendline, and long-term technical support continues to bolster bids as the 200-day EMA rises into 1.3600.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- Norges Bank kept rates steady at 4.5%, as expected.

- The bank is delaying the easing to Q1 of 2025.

- As long as the NB policy diverges with its peers the NOK might see further upside.

On Friday, the USD/NOK recovered towards 10.575 and cleared most of Thursday's losses. That being said, the NOK is holding strong against its peers as the Norges Bank will likely start the easing in Q1 of 2025.

The Norges Bank announced on Thursday that it will maintain its interest rate at 4.5%, a decision that was widely anticipated. This move is considered hawkish as the bank has delayed its initial rate cut projection to the first quarter of 2025, previously set for the third quarter of 2024. According to the new forecast, the policy rate will stay at 4.50% until the end of the year and will then begin to decrease gradually. This contrasts with the more aggressive rate-cutting strategies of neighboring central banks, which are grappling with different economic challenges.

Regarding the economic outlook, Norges Bank expressed concerns that reducing the rate too soon could lead to prolonged inflation above the target level despite the latest economic challenges. As a result, market expectations for a rate cut within the next six months have nearly vanished, with approximately 50 basis points of easing anticipated over the following half-year which fueled a rise of the Krone against its peers.

USD/NOK technical analysis

According to the daily chart, the outlook of the pair remains bearish with indicators flashing bearish signals. The Relative Strength Index (RSI) stands below 50 while the Moving Average Divergence Convergence (MACD) prints steady red bars.

The most clear of the bearish signals is that the pair has recently dipped below the 20,100 and 200-day Simple Moving Averages (SMA) as lost over 1% in the last four sessions.

USD/NOK daily chart

Thursday’s Bank of England (BoE) statement and minutes suggested officials are getting closer to cutting interest rates, ING’s FX Strategist Francesco Pesole notes.

August cut is a must, GBP/USD set to fall under 1.25

“The recent upside surprises in services inflation (5.7%) are attributed to volatility related to annual price hikes, not a significant trend, and while the BoE isn’t pre-committing to anything, an August rate cut is likely if the next inflation report doesn’t contain surprises.”

“Three rate cuts in 2024 starting from August remain ING’s base case, which is more dovish than the two cuts priced in by the market. An August move is only 60% priced in at the moment.”

“This makes us lean on the bearish side of sterling, although the political events in the eurozone mean that a EUR/GBP rebound may be delayed further. We expect most of Pund Sterling’s weakness to be channeled via GBP/USD, which we expect to trade back under 1.25.”

With dovish signals from the European Central Bank’s (ECB) major European counterparts (the Bank of England and Swiss National Bank) and investors' nerves still quite jittery on EU fiscal and political developments, the Euro is understandably under some pressure in the latter half of this week, Francesco Pesole, FX Strategist at ING argues.

EU activity indicators proved favorable for the Euro

“What had come to the help of the common currency in some instances recently was decent activity indicators, and PMIs are released today. It will be interesting to see whether political uncertainty in France has already taken a toll on French business sentiment at all: consensus doesn’t believe so.”

“We’ll hear from two ECB members today – Gediminas Simkus and the hawk Joachim Nagel – who could move the market on comments about the current turmoil in EU bond markets.”

“We still think EUR/USD can trade a bit lower into the US core PCE/French election events in late June. Risks of multiple days of trading below 1.07 are tangible.”

Central bank events in Europe gave the Dollar some support on Thursday, Francesco Pesole, FX Strategist at ING argues.

DXY may trade closer to 106.00

“The surprise rate cut by the Swiss National Bank and a dovish hold by the Bank of England reinforced the notion that central banks in Europe are way ahead of the Federal Reserve with rate cuts, a dollar-positive development. The hawkish revision in guidance by Norway’s Norges Bank went in the other direction.”

“A further softening in inflation and/or activity data in the US is now needed to close the rate gap between the Fed and other central banks, and ultimately fuel a new dollar downtrend. The next top-tier data for markets is the PCE May release on 28 June, but some activity indicators before then can steer rate expectations to a smaller extent.”

“The comparison between PMIs in Europe and the US should drive some market moves today, but we doubt there is enough to take the dollar meaningfully lower at this stage, also considering the lingering political risk in the EU. DXY may trade closer to 106.0 than 105.0 in the next few days.”

Crude Oil continues to prove resilient, with inventory draws offering modest support to the complex, TDS strategists say.

Crude Oil stays strong amid CTA buying

"We still argue that the rally could start to fade as Commodity Trading Advisors (CTA) buying flows taper off. Prices below $81.73/bbl and $85.46/bbl for WTI and Brent crude respectively, would see CTAs ease up on their buying and liquidate a portion of the recently acquired length."

"Aside from the resurgent CTA flows, there is still more relative concern about Q4 balances and beyond, which should serve as a resistance to major upside."

Precious metals have held gains despite the uncertainty surrounding Federal Reserve (Fed) policy. Top traders on the Shanghai Futures Exchange (SHFE) continue to hold large positions in Gold (XAU/USD) and Silver (XAG/USD), while inflows continue into Chinese Gold ETFs, TDS strategists say.

Gold turns lower, Palladium faces short covering

“Macro investors have remained underpositioned in the Yellow Metal relative to a typical cutting cycle and macro traders seem to be happy waiting on the sidelines until there is more certainty on the timing of the coming Fed cuts. Ater a brief period of slight gains in Gold ETF holdings, the trend has started to ease lower once again.”

“Elsewhere, a bout of tightness and concern on sanction risk has sparked some likely short covering from the bloated money manager shorts in Palladium. Today's price action though is making short covering from this cohort more likely, with a handful of key triggers within the $968/oz - $973/oz range.”

- USD/CHF might be beginning a new short-term uptrend.

- The evidence is building and includes a break above the last lower high, a trendline and the 50 Simple Moving Average.

- A break above 0.8989 would provide greater confirmation.

USD/CHF trades in the 0.8930s on Friday, after rising on the back of positive US Purchasing Manager Index (PMI) data, which showed a healthy expansion in the manufacturing and services sectors in June.

The direction of the short-term trend is unclear. Recent gains have brought into question the dominance of the down trend since the pair broke out of the rising channel it was in at the beginning of the year.

USD/CHF 4-hour Chart

Thursday’s rally off the 0.8827 lows was strong, indicating it could be the start of a reversal. The Relative Strength Index (RSI) exited oversold at the same time and rose up equally steeply, showing strong upside momentum, and further supporting a bullish reversal hypothesis.

USD/CHF has broken above the last lower higher of the prior downtrend at 0.8932 (June 17 high), the 50 Simple Moving Average (SMA) and the green down-trend line, adding further evidence a new uptrend might be evolving.

It could be argued USD/CHF is now in a very young short-term uptrend which, going by the saying “the trend is your friend”, is more likely than not to extend. However, for stronger confirmation it would need to break above major support and resistance at 0.8989.

Our gauge of commodity demand continues to weaken amid a precarious global macro landscape, TD Securities analysts note.

Base metal complex shifts lower

“Our return decomposition framework across the complex confirms the demand side is finally starting to weigh heavy on base metals as the early summer euphoria fades.”

“Inflows into broad commodity ETFs throughout May had lifted the complex, but an easing of inflows and modest outflows have also started to weigh on the base metal complex. In this sense, AUM for base metal specific ETFs have also notably declined.”

“For Copper, our return decomposition framework is also showing a major drag from idiosyncratic factors, such as positioning, which suggests that the Red Metal could still be prone to additional downside in the near-term as bloated positions are cut.”

- GBP/USD remains heavy as BoE delivers ‘dovish’ hold.

- UK Retail Sales crushed estimates, but PMIs were softer.

- Tested 50-DMA, bounced but remains above 100-DMA, sitting at 1.2638.

The Pound Sterling prolonged its agony and fell for the second straight day after the Bank of England’s decision to hold rates unchanged, signaling that the beginning of the easing cycle is coming. Additionally, mixed UK economic data, with Retail Sales exceeding estimates but flash PMIs softening, hints the economy might be slowing. The GBP/USD trades at 1.2636, down 0.16%.

GBP/USD Price Analysis: Technical outlook

After diving to its lowest level since May 15 at 1.2621, the GBP/USD trimmed some of its earlier losses yet remains beneath its opening price. Momentum favors sellers, with the Relative Strength Index (RSI) aiming downwards and below its 50-neutral line.

That said, a daily close below the May 3 high turned support at 1.2634 would pave the way to test 1.2600. A breach of the latter will expose the 200-day moving average (DMA) at 1.2552. Conversely, further upside would be seen once buyers lift the exchange rate above 1.2700.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.14% | 0.19% | 0.32% | 0.09% | 0.23% | 0.10% | 0.25% | |

| EUR | -0.14% | 0.05% | 0.22% | -0.04% | 0.12% | -0.02% | 0.10% | |

| GBP | -0.19% | -0.05% | 0.14% | -0.11% | 0.05% | -0.10% | 0.07% | |

| JPY | -0.32% | -0.22% | -0.14% | -0.24% | -0.09% | -0.23% | -0.04% | |

| CAD | -0.09% | 0.04% | 0.11% | 0.24% | 0.13% | -0.00% | 0.17% | |

| AUD | -0.23% | -0.12% | -0.05% | 0.09% | -0.13% | -0.16% | 0.03% | |

| NZD | -0.10% | 0.02% | 0.10% | 0.23% | 0.00% | 0.16% | 0.16% | |

| CHF | -0.25% | -0.10% | -0.07% | 0.04% | -0.17% | -0.03% | -0.16% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Data from the United Kingdom reflects a mixed picture of the economy. The Pound Sterling (GBP) has underperformed on the week relative to most of its core peers, Scotiabank’s Chief FX Strategist Shaun Osborne says.

GBP struggles to find foothold

“UK Retail Sales rose a stronger than expected 2.9% in May, reflecting a rebound in activity after a depressed April (revised slightly higher to 1.8%). PMI data reflected slightly stronger than expected Manufacturing (51.4) but the Services and Composite data were below consensus estimates.”

“Sterling’s technical tone has weakened in the past few sessions. Recall that the GBP closed bearishly on the week last Friday. Loss of support in the upper 1.26s leaves the Pound struggling for a foothold amid some clear deterioration in the intraday and daily trend strength oscillators.”

“Support is 1.2580 (50% retracement of the April/June rebound). Look for resistance on minor rebounds to the upper 1.26s from here.”

- USD/CAD bounces back strongly after upbeat US preliminary S&P Global PMI report for June.

- Canadian Retail Sales grew expectedly by 0.7%.

- The Fed is expected to deliver two rate cuts this year.

The USD/CAD pair recovers strongly from 11-day low near 1.3670 in Friday’s American session. The Loonie asset bounces back as the US Dollar (USD) extends its upside after the US S&P Global PMI data for June shows that the Composite PMI surprisingly outperformed expectations that were pointing to slowdown in activity.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, jumps to six-week high near 105.90.

However, investors are still uncertain about the US Dollar’s outlook as investors expect that the Federal Reserve (Fed) will start reducing interest rates from the September meeting. Market participants expect that the Fed will cut interest rates twice this year. On the contrary, Fed policymakers continue to argue in favor of reducing interest rates only once this year.

Meanwhile, the Canadian Dollar barely moved as Canada’s Retail Sales for April grew in line with expectations of 0.7% month-on-month. The Retail Sales data comes out positive after contracting for straight three months.

USD/CAD trades in a Symmetrical Triangle chart pattern, which indicates a sharp volatility contraction. Spot prices remain sticky to the 20-day Exponential Moving Average (EMA) near 1.3700, indicating a sideways trend.

The 14-period Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, suggesting indecisiveness among market participants.

Fresh buying opportunity would emerge if the asset breaks above April 17 high at 1.3838. This would drive the asset towards 1 November 2023 high at 1.3900, followed by the psychological resistance of 1.4000.

In an alternate scenario, a breakdown below June 7 low at 1.3663 will expose the asset to May 3 low around 1.3600 and April 9 low around 1.3547.

USD/CAD daily chart

EUR/USD dipped to retest the mid-June low at 1.0675 earlier after preliminary Eurozone PMI data reports reflected an unexpected softening in activity, Scotiabank’s Chief FX Strategist Shaun Osborne argues.

Spot may stabilize after quickly regaining 1.0750

“Focus fell on the French data, associating weakness with the French snap election, but German Manufacturing dropped two points to 43.4, instead of gaining one point as expected.”

“Preliminary Eurozone data for Manufacturing, Services and the Composite index were all weaker than expected but the Composite and Services readings held above 50 (52.6 and 50.8 respectively). French survey data reflected steady Business Confidence in June, meanwhile, but May Retail Sales plunged 1.4%.”

“Hefty losses over the latter part of the week leave the EUR testing key support again at 1.0675. Weakness below here leaves spot exposed to 1.06, or possibly lower. A strong, positive reaction to the upper 1.06s last week suggests the EUR may be able to stabilize but it needs to regain 1.0750 quickly in order to do that.”

The Canadian Dollar (CAD) is little changed on the session after edging through the upper 1.3600s in overnight trade, but it is having a decent week relatively speaking, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

Gains may be capped by 1.3720-1.3725 area

“A second consecutive weekly gain is on the cards, something it has not achieved since the middle of April. There is no clear reason for the CAD’s relatively firm performance this week and overnight movement leaves spot drifting the furthest from fair value (1.3784 today) since March.”

“The explanation may come from the Commodity Futures Trading Commission (CFTC) positioning data which show record net CAD shorts have accumulated in recent weeks. CAD bears have been persistent in recent months but positioning has not always been rewarded and has sometimes coincided with CAD rebounds, forcing CAD shorts to lightened up.”

“Steady USD losses this week may be finding a base in the upper 1.36 area. Intraday price signals suggest a USD rebound may be developing after spot based around 1.3675/80 in overnight. Gains may be capped by intraday resistance at 1.3720/25 with intraday trend momentum bearish and the daily DMI slipping into neutral now.”

- Silver price declines to $30.30 amid firm US Dollar.

- Investors await the preliminary US S&P Global PMI report for June.

- The Fed is expected to cut interest rates twice this year.

Silver price (XAG/USD) falls sharply to near $30.30 in Friday’s American session. The white metal is under pressure as the US Dollar (USD) clings to gains ahead of the preliminary United States (US) S&P PMI data for June, which will be published at 13:45 GMT.

The US Dollar Index (DXY) rises to a six-week high around 105.90 as global PMI figures have failed to meet market estimates, resulting in a dismal market sentiment. The USD Index could face pressure if the US PMI data also fails to match expectations.

Economists expect that the PMI report will show a slower growth in the Manufacturing as well as in Services activity.

Meanwhile, the overall appeal of the Silver price remains upbeat as investors expect that the Fed will start reducing interest rates from the September meeting. Financial markets expect that the Fed will deliver two rate cuts this year instead of one as signaled by policymakers in their latest interest rate projections report.

The expectations for the Fed reducing rates twice this year were prompted by soft US inflation report and slower than-expected growth in Retail Sales data for May. On the inflation outlook, Minneapolis Fed Bank President Neel Kashkari said on Thursday that inflation would return to bank’s target of 2% in up to two years. However, Kashkari remained concerned about high wage growth.

Silver technical analysis

Silver price rebounds after discovering buying interest near the lower border of the Rising Channel chart pattern formed on a daily timeframe. The white metal rises above the 20-day Exponential Moving Average (EMA) near $29.90, suggesting that the near-term trend has turned bullish.

The 14-period Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, indicating indecisiveness among investors.

Silver daily chart

- USD/JPY rallies to over 159 as US Dollar gains on hawkish Fedspeak and weakening Yen.

- Slide in Japanese underlying inflation suggests BoJ will not be able to raise rates much to support JPY.

- USD/JPY reenters intervention territory increasing chances authorities could intervene to push it lower.

USD/JPY continues its relentless climb, reaching the 159s on Friday – only one big figure away from the April highs of 160.32, where the Japanese authorities finally stepped in to prevent a further depreciation of their currency.

The pair is rallying off the back of a strengthening US Dollar (USD) due to rising US Treasury yields, as Federal Reserve (Fed) officials continue to spout hawkish commentary, playing down any market eagerness to see them cut interest rates any time soon.

USD/JPY gets further support from a weakening Japanese Yen (JPY), after the release of Japanese inflation data for May showed a fall in core inflation, and what gains there were, were mostly put down to rises in energy prices.

USD/JPY pushes higher on back of rising US Treasury yields

USD/JPY’s recent gains have been driven by the US Dollar due to “Higher (US) bond yields” which are highly correlated to USD, according to Westpac’s Pat Bustamante in his Friday morning report.

“The 2-year bond yield increased 3 basis points to 4.74%. The 10-year treasury yield increased 4 basis points to 4.26%,” says the Senior Economist, putting the gains down to, “some hawkish talk from a Fed official.”

The Fed official in question was Federal Reserve’s (Fed) Bank of Richmond President Tom Barkin, who urged patience as Fed rate cuts would “hit in time” but that the Fed needed “clearer inflation signals before a rate cut,” and reiterated that the bank would be taking a data-dependent approach.

According to Westpac’s Bustamente, “Interest-rate markets are pricing in just under two 25 basis points rate cuts this year, one in November and the other in December.”

The estimate is something of a backwards step from previous expectations that the Fed would make a cut in September as was the case immediately after US Retail Sales bombed earlier in the week.

Japanese underlying inflation continues to cool

Experts say the only way to reverse the long-term depreciation in the Yen is to increase interest rates, however, in order to do that, the Bank of Japan (BoJ) needs to to see inflation rising. Japanese Consumer Price Index (CPI) data for May released overnight will likely make them less inclined to begin raising interest rates, according to economists at Capital Economics.

Despite the headline rate of inflation rising to 2.8% from 2.5% previously, these gains were put mainly down to a 10% rise in utility bills after the government withdrew its subsidies for energy companies.

National CPI ex Food and Energy, however, cooled to 2.1% from 2.4% previously and showed underlying inflation continuing “to slow rapidly” according to Marcel Thieliant, Head of Asia-Pacific at Capital Economics.

“The upshot is that inflation excluding fresh food could already fall below the Bank of Japan’s 2% target in June and we still expect it to slow more sharply over coming months than the Bank has been anticipating. While that probably won’t forestall a rate hike at the Bank’s July meeting, it should convince the Bank to leave rates unchanged thereafter,” he concludes.

USD/JPY enters “intervention zone”

USD/JPY is now back on the edge of a cloudy “intervention zone” (red shaded area) where the Japanese authorities made direct purchases of Japanese Yen in the open market in late April and early May, to counteract its devaluation. The result was a deep correction in USD/JPY from 160 to 152.

USD/JPY Daily Chart

Given the increasing frequency of warnings from currency officials that further weakness will be countered by direct intervention, the chances of the same thing happening again has drastically increased. This, in turn, suggests a pullback may be in the offing.

- The US Dollar trades firmly higher for the week after late price action.

- Markets will focus on the US S&P Global PMI data for June on Friday.

- The US Dollar index trades in the green and could lock in a third consecutive week of gains.

The US Dollar (USD) continued edging higher on Friday ahead of the preliminary US S&P Global Purchasing Managers Index (PMI) report for June. The US Dollar shot higher in the last hours, with the Greenback outpacing the Japanese Yen (JPY) again, hitting 159.00 at USD/JPY, whilst tech wale Nvidia dove over 3% and lost $91 billion at the US closing bell.

On the economic data front, earlier in the day, S&P Global and Hamburg Commercial Bank (HCOB) released the Eurozone PMI data for June, showing lower-than-expected numbers. Manufacturing data further deepened into contraction at 45.6, while the services sector index fell to 52.6 from 53.2 in May. On the US side, traders will especially focus on the services component, as it accounts for two-thirds of the economy. Expectations for the US S&P Global Services PMI range from 55.00 to 52.00, with the previous month’s number at 54.8.

Daily digest market movers: Asia moving markets

- Masato Kanda, vice-minister for international affairs at Japan's Ministry of Finance, said that Japan is ready to take proper action on FX when needed. This comment sent the US Dollar back up to 159 against the Japanese Yen.

- Preliminary S&P Global/HCOB PMI data for France, Germany, and the Eurozone showed worst-than-expected numbers. As a result, the Euro retreats further against the US Dollar, falling below 1.07.

- At 13:45 GMT, S&P Global will release the June’s PMI preliminary reading per sector:

- Services sector is expected to ease to 53.7 from 54.8 in May.

- Manufacturing should remain rather stable, t showing 51.00 in June from 51.3 the previous month.

- The Composite Index was at 54.5 in May, with no consensus view available.

- At 14:00 GMT, in the slipstream of the US PMI release, Existing Home Sales data for May will be released. The expected number is 4.10 million in May, down from the 4.14 million seen in April.

- Equities are still trying to recover from the massive punch they received from the $91 billion value evaporating in Nvidia. There are red numbers across the board and across the globe for all major indices.

- The CME Fedwatch futures for September are backing a rate cut, with odds now standing at 57.9% for a 25 basis point cut. A rate pause stands at a 35.9% chance, while a 50-basis-point rate cut has a slim 6.2% possibility.

- The US 10-year benchmark rate is trading at 4.24%, right in the middle of this week’s range after briefly hitting 4.29% on Thursday.

US Dollar Index Technical Analysis: Gaining while not doing anything

The US Dollar Index (DXY) is breaking higher and has good odds to lock in a third consecutive week of gains. Although refraining from any soccer analogies, looking at the chart, it is quite clear that the Greenback has not played a good game this week. However, what counts is the end result, and that looks to be a win for the Greenback with a big thank you to the weaker Japanese Yen, France’s political turmoil, and the further contracting PMIs in Europe as main drivers.

On the upside, there are no big changes to the levels traders need to watch out for. The first level to watch is 105.88, which triggered a rejection at the start of May and will likely play its role as resistance again. Further up, the biggest challenge remains at 106.51, the year-to-date high from April 16.

On the downside, that 105.52 level is first support ahead of the trifecta of Simple Moving Averages (SMA) is still playing as support. First is the 55-day SMA at 105.14, safeguarding the 105.00 figure. A touch lower, near 104.61 and 104.48, both the 100-day and the 200-day SMA are forming a double layer of protection to support any declines. Should this area be broken, look for 104.00 to salvage the situation.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- USD/CAD witnesses buying interest below 1.3700 as the US Dollar rises further.

- The Fed is expected to begin lowering interest rates in September.

- Investors see the Canadian Retail Sales coming out of contraction trajectory.

The USD/CAD pair rebounds strongly after sliding slightly below the crucial support of 1.3700 in Friday’s European session. The Loonie asset recovers as the US Dollar (USD) exhibits strength on prospects that the Federal Reserve (Fed) will lag behind its peers in an attempt to commence its policy-easing process.