- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- EUR/USD backslid to the 1.0700 handle on Thursday, erasing the week’s gains.

- EU PMI figures expected to rise slightly on Friday.

- US PMIs to wrap up the trading week, expected to tick lower.

EUR/USD fell back to familiar technical levels on Thursday, clunking down to the 1.0700 handle after a miss in US economic figures bolstered the Greenback. Friday markets loom ahead with a packed data docket, with Purchasing Managers Index (PMI) figures for both the EU and the US on the cards.

Forex today: All the looks will be on PMI reports

In May, Germany's Producer Price Index (PPI) fell to 0.0% on a month-over-month basis, down from the previous 0.2% and missing the expected increase to 0.3%. On a year-over-year basis, the PPI also came in below expectations, declining to -2.2% for the year ending in May. Although the annual figure improved from the previous -3.3%, it still fell short of the forecasted recovery to -2.0%.

Read more: US Initial Jobless Claims rose more than estimated last week

The latest US Initial Jobless Claims numbers came in higher than expected, with 238,000 people filing for unemployment benefits in the week ending June 14, compared to the revised previous week's figure of 243,000. This increase also pushed the four-week average up to 242,750 from the previous 227,250.

The Philadelphia Fed Manufacturing Survey for June dropped to 1.3 from 4.5, falling short of the expected 5.0. Additionally, US Housing Starts decreased to 1.277 million new residential construction projects in May, lower than the forecast of 1.37 million and the revised previous month's figure of 1.352 million.

Coming up on Friday: EU & US PMI prints to close out the week

Friday’s pan-EU HCOB Purchasing Managers Index (PMI) activity surveys for June are expected to recover slightly. The EU’s June Manufacturing PMI is expected to move to 47.9 from 47.3, while the Services PMI component is forecast to rise to 53.5 from 53.2.

On the US side, Manufacturing and Services PMIs are both forecast to tick lower, with Manufacturing expected to slip to 51.0 from 51.3 and Services sliding to 53.7 from 54.8.

EUR/USD technical outlook

EUR/USD continues to follow technicals lower, driving intraday action further down the charts as the 200-hour Exponential Moving Average (EMA) presses down from 1.0750. The Fiber is bumping into the 1.0700 handle as selling pressure keeps the pair in reach of last week’s low point just below 1.0670.

EUR/USD continues to stagnate on daily candlesticks, and any fresh selling pressure will send the pair back into 2024 lows set in April near the 1.0600 handle. On the high side, a bullish recovery will run aground of the 200-day EMA at 1.0800.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Japan's National Consumer Price Index (CPI) rose on an annualized basis, with headline CPI inflation climbing 2.8% YoY versus the previous print of 2.5%.

Core CPI inflation, or headline CPI inflation less volatile food prices, rose less than median market estimates, climbed 2.5% versus the previous 2.2% compared to the market forecast of 2.6%.

Core-core Japanese CPI, or CPI inflation less both food and energy prices, eased back to 2.1% from the previous 2.4%.

Japan's national-level CPI inflation print tends to be previewed by Tokyo CPI inflation several weeks prior, leaving a muted market impact from nationwide aggregated inflation figures.

Economic Indicator

National CPI ex Fresh Food (YoY)

Japan’s National Consumer Price Index (CPI), released by the Statistics Bureau of Japan on a monthly basis, measures the price fluctuation of goods and services purchased by households nationwide excluding fresh food, whose prices often fluctuate depending on the weather. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Japanese Yen (JPY), while a low reading is seen as bearish.

Read more.Last release: Thu Jun 20, 2024 23:30

Frequency: Monthly

Actual: 2.5%

Consensus: 2.6%

Previous: 2.2%

Source: Statistics Bureau of Japan

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

Japan's top currency diplomat, Masato Kanda, who will instruct the BoJ to intervene, when he judges it necessary, said on Friday that he will take necessary action on foreign exchange (FX) if needed

Key quotes

To take necessary action on foreign exchange if needed.

Sees no problem with Japan's approach in US report on foreign exchange.

Yen slightly strengthens against US Dollar

FX intervention has been effective

Market reaction

At the time of writing, USD/JPY was trading at 158.85, losing 0.05% on the day.

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

Australia's Judo Bank Purchasing Manager Index (PMI) figures declined in June, with both the Manufacturing and Services components chalking in a fall back from previous periods.

June's Australian Manufacturing PMI declined to 47.5 from 49.7, returning to familiar lows. The Services PMI also backslid but remained in positive territory, falling to a five-month low of 51.0 from 51.2.

As noted by Judo Bank Chief Economist Warren Hogan, "The composite output index pulled back in June but remains in expansionary territory. The June flash reading was the lowest since January and has now eased back from the March high point. The June reading suggests that business activity is still growing, but slower than in March and April."

Economic Indicator

Judo Bank Composite PMI

The Composite Purchasing Managers Index (PMI), released on a monthly basis by Judo Bank and S&P Global, is a leading indicator gauging private-business activity in Australia for both the manufacturing and services sectors. The data is derived from surveys to senior executives. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the Australian private economy is generally expanding, a bullish sign for the Australian Dollar (AUD). Meanwhile, a reading below 50 signals that activity is generally declining, which is seen as bearish for AUD.

Read more.Last release: Thu Jun 20, 2024 23:00 (Prel)

Frequency: Monthly

Actual: 50.6

Consensus: -

Previous: 52.1

Source: S&P Global

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- USD/CAD trades in negative territory for the sixth consecutive day near 1.3690 in Friday’s early Asian session.

- Fed’s Birkin said central bank is well-positioned with necessary firepower for job but needs to maintain data-dependent approach.

- Higher crude oil prices due to renewed hopes of a summertime upswing in fuel demand support the Loonie.

The USD/CAD pair remains under some selling pressure around 1.3690 during the early Asian session on Friday. The pair edges lower despite the rise of the USD Index (DXY) to four-day highs near 105.70. The rally of crude oil prices continues to underpin the commodity-linked Loonie. On Friday, the advanced S&P Global Manufacturing and Services PMI will be in the stoplight.

The US Federal Reserve's (Fed) policymakers pushed out the timing of the first interest rate cut this year. Fed Bank of Richmond President Tom Barkin said on Thursday that the central bank is well-positioned with the necessary firepower for the job, but will learn a lot more over the next several months. Meanwhile, Fed Bank of Minneapolis President Neel Kashkari noted that it will probably take a year or two to get inflation back to 2%, per Reuters.

The financial markets have priced in around 10% odds of a rate cut in July, rising to nearly 70% in September and fully priced in for November, according to the CME FedWatch Tool. Even though the recent US Retail Sales last week prompted the expectation of two rate cuts from the Fed this year, a strict data-dependent approach from Fed officials might cap the downside for the Greenback against its rivals.

On the Loonie front, crude oil markets extend the rally on renewed hopes of a summertime upswing in fuel demand. It's worth noting that higher oil prices could underpin the Canadian Dollar (CAD) as Canada is the major crude oil exporter to the United States.

Furthermore, the Bank of Canada (BoC) cut its policy rate to 4.75% from 5% on June 5, the first cut in four years. The BoC Summary of Deliberations on Wednesday noted the risks of cutting too soon against the dangers of waiting too long. The BoC Governor Tiff Macklem said that it’s “reasonable” to expect further rate cuts, but that the decline in interest rates will likely be gradual.

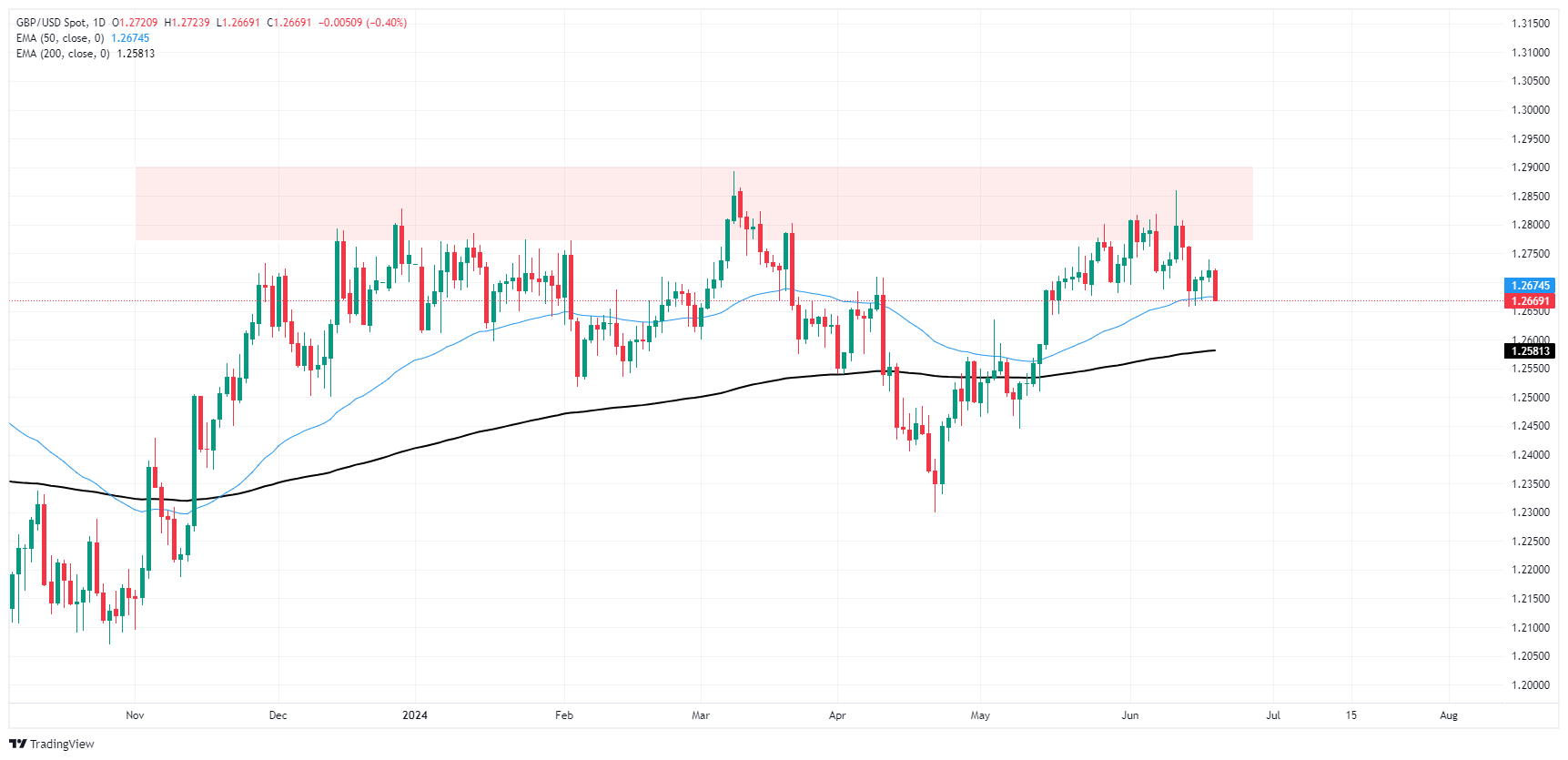

- GBP/USD eases back to 1.2650 as Sterling stumbles.

- UK Retail Sales, PMIs to close off the trading week with a bang.

- US PMI figures to add onto week’s data prints, expecting to soften.

GBP/USD is poised for a bumper Friday session. Key UK data is due during the European market session, and US Purchasing Managers Index (PMI) activity surveys set to wrap up the trading week. The Bank of England (BoE) held rates at 5.25% this week, with a stubbornly tepid stance on rate cuts that deflated broad-market rate cut expectations.

Forex Today: All the looks will be on PMI reports

The BoE was widely expected to keep interest rates unchanged in June. However, there was a focus on recent services inflation and a vague aim to keep inflation "sustainably" lower, which has left the value of the Sterling uncertain. Additionally, the BoE expressed a willingness to maintain restrictive policies for as long as necessary and emphasized that although the UK labor market is looser than before, it still remains historically tight.

Read more: BoE maintains policy rate at 5.25% as forecast

A miss in US economic figures softened investor risk appetite on Thursday, headlined by a worse-than-expected print in US Initial Jobless Claims coming in higher than expected for the week ended June 14. Week-on-week unemployment claimants are still lower, printing at 238K versus the previous 243K (revised from 242K), but still came in above the four-week trending average of 242.75K, which itself also rose from the previous 227.25K.

After the BoE voted seven-to-two to keep interest rates on hold at 5.25%, GBP traders will now focus on Friday's upcoming economic data. The scheduled releases include UK Retail Sales and updated S&P Global PMI figures for both the UK and the US. UK retail sales are expected to rebound to 1.5% MoM in May, compared to the previous decline of -2.3%. Additionally, UK PMIs are forecasted to show slight improvements. The Manufacturing PMI is expected to increase to 51.3 from 51.2, and the Services component is anticipated to rise to 53.0 from 52.9.

US Manufacturing and Services PMIs are both forecast to tick lower, with Manufacturing expected to slip to 51.0 from 51.3 and Services sliding to 53.7 from 54.8.

GBP/USD technical outlook

The value of the Pound Sterling dropped below the 1.2700 mark against the US Dollar on Thursday, showing a decline and moving lower towards recent lows at 1.2657. Technical indicators suggest a potential continuation of this bearish trend as the price failed to stay above the 200-hour Exponential Moving Average (EMA) at 1.2721. Further decreases in value are likely if there is no significant upward movement to reverse this trend.

The daily candlestick chart confirms a bearish rejection from a supply zone above the 1.2800 mark, indicating a potential return to the 200-day EMA, which is currently around 1.2580. The technical support provided by the 50-day EMA at 1.2674 is getting weaker, and if bearish pressure continues, GBP/USD could drop back to the 2024 lows around the 1.2300 level.

GBP/USD hourly chart

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- The cross resumed its gains, establishing new cycle highs at levels exceeding 97.00.

- The daily chart continues to display resilience, increasing chances for the upward trend to persist.

On Thursday, the NZD/JPY cross made further gains, moving past the previous resistance at 97.00 and setting a fresh cycle high. At the start of the week, support around the 20-day Simple Moving Average (SMA) at 96.30 held strong as buyers swiftly stepped in to overpower the sellers' efforts to breach this level.

The daily Relative Strength Index (RSI) for NZD/JPY currently stands at 62, denoting a climb from Wednesday's reading and overall positive momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) for today prints decreasing red bars, signifying a reduction in selling pressure.

NZD/JPY daily chart

The bull's resolve to keep its position above the 20-day SMA remains steadfast. This, coupled with the resilience of the daily technical indicators, highlights a clear technical strength of the Kiwi over the Yen. The three consecutive failed attempts from the sellers to breach the 96.30 mark fuelled the buyers' momentum, which paved the way for the climb to fresh highs.

Going forward, the trading sessions may witness the cross oscillate between the immediate support at 97.00 and the resistance target of 98.00. Close monitoring of the breach above the current consolidation range or a dip below the 20-SMA mark could potentially provide insights into future movements.

Federal Reserve (Fed) Bank of Richmond President Tom Barkin spoke to reports late Thursday, noting that the Fed has sufficient firepower to address policy issues looking forward, but will have to maintain a strict data-dependent approach as policymakers look to time rate cuts appropriately.

Key highlights

The impact of Fed rate increases will hit in time.

Need clearer inflation signals before rate cut.

Data to determine further moves after initial rate cut.

Fed Reserve is well-positioned with necessary firepower for job.

- GBP/JPY remains upward biased with support from a bullish yet trendless RSI, hinting at stable rates.

- Key resistance at YTD high of 201.61 and the 202.00 mark.

- Key support levels include 201.00, Tenkan-Sen at 200.26, Senkou Span A at 199.71, and Kijun-Sen at 199.15.

The GBP/JPY remained subdued on Thursday yet finished up 0.06%, virtually unchanged. As Friday’s Asian Pacific session begins, the cross trades at 201.11, flat.

GBP/JPY Price Analysis: Technical outlook

According to the daily chart, the GBP/JPY remains upward biased and is backed by momentum as the Relative Strength Index (RSI) is bullish, though trendless. This hints that the cross might remain at around current exchange rates amid the lack of catalysts and fears of Japanese authority's intervention.

On the upside, the GBP/JPY first resistance would be the year-to-date (YTD) high at 201.61, ahead of the 202.00 mark.

On further weakness, the cross could tumble below 201.00 and test the Tenkan-Sen at 200.26, the first support level, followed by the Senkou Span A at 199.71. Once surpassed, the next stop would be the Kijun-Sen at 199.15.

GBP/JPY Price Action – Daily Chart

- Despite NZD/USD's attempts to recover losses, another rejection at the 20-day SMA sees a retreat to 0.6122.

- The short-term outlook is increasingly bearish, with rising selling traction visible.

- For a break in the bearish outlook, the pair must recover the 20-day SMA at 0.6150.

On Thursday, the NZD/USD extended its losses below the 20-day Simple Moving Average (SMA), its fourth consecutive rejection at this strong support level this week. The pair retreated to 0.6122. Despite attempts to recover losses, indicators are signalling rising bearish traction potentially paving the way for further downside unless the pair can regain control over the 20-day SMA around the 0.6150 mark.

The Relative Strength Index (RSI) of the NZDUSD daily chart positions at 49, slightly below the neutral territory. Compared to Tuesday's reading of 51, the RSI indicators are pointing south, suggesting a potential decrease in the market momentum. Despite near-term downward dynamics, it remains distanced from the oversold conditions. The Moving Average Convergence Divergence (MACD) profile continues to print rising red bars indicating an elevated presence of sellers in the market.

NZD/USD daily chart

For the NZD/USD, immediate support remains near the 0.6100 level. Further support is available at the convergence of the 100-day and 200-day SMAs at 0.60695 and 0.60627 respectively. These levels could provide a solid foundation in the event of an extension of the downside move. A break below these SMA convergence points might be indicative of a strong sell-off scenario.

In stark contrast, resistance for the pair is entrenched around the 20-day SMA at 0.6150 level. Then higher up at 0.6170 and finally at the 0.6200 level. A decisive breakout above these levels could potentially signify the end of the current bearish market sentiment and a shift toward bullish dynamics.

- WTI edged into fresh highs near $81.40 as energy markets hope for drawdown.

- EIA barrel counts reported a larger-than-expected decline in US Crude Oil stocks.

- Barrel traders edge bids higher on extended hopes of a summertime supply crunch.

West Texas Intermediate (WTI) US Crude Oil inched into fresh highs on Thursday, clipping $81.40 and continuing its march towards the $82.00 handle. Crude Oil markets lurch forward on renewed hopes of a summertime upswing in fuel demand helping to chew away at a looming oversupply issue in global oil supplies.

The Energy Information Administration (EIA) reported an unexpected decline in US Crude Oil Stocks Change for the week ended June 14. EIA barrels counts printed a -2.547 million barrel decline, sharply down from the previous week’s 3.73 million barrel buildup and even lower than the forecast -2.0 million decline. Despite the drag on EIA barrel stocks, traders with a calculator handy will note that the week’s backslide brings EIA Crude Oil counts for the year to a 26 million barrel surplus.

Crude Oil markets are bidding up barrel prices as energy markets pin their hopes on a summertime uptick in fuel demand for cooling and travel purposes. This comes after an uptick in Chinese fossil fuel demand failed to materialize and a non-starter kickoff to the US Memorial Day “driving season.”

The Organization of the Petroleum Exporting Countries (OPEC) is set to phase out voluntary production cuts for its extended network of non-member ally states, OPEC+, later this year. OPEC+ nations that shouldered a significant burden in trying to bolster global Crude Oil prices by intentionally restricting the amount of unrefined Crude Oil they pull out of the ground has begun to weigh on government budgets that routinely rely on barrel-selling activity to balance accounts.

WTI technical outlook

WTI extended bullish momentum on Thursday, edging towards $81.50 as intraday bids accelerate above rising trendlines from the last major swing low into $72.50. US Crude Oil has climbed further above the 200-day Exponential Moving Average (EMA) at $78.85.

WTI has closed bullish for all but four of the last 12 consecutive trading days, climbing 12.34% from the last major low.

WTI hourly chart

WTI daily chart

- Silver climbs over 3%, despite higher US Treasury yields and a stronger US Dollar.

- Technical outlook shows bullish bias with momentum favoring buyers; RSI aims higher above the 50-neutral line.

- Key resistance levels: $31.54 (June 7 high) and $32.00, with YTD high at $32.51 in sight.

- Support levels at $29.09 (50-DMA) and $28.66 (MTD low).

Silver price rallied sharply for the second straight day and climbed past $30.00 on Thursday amid elevated US Treasury bond yields and a stronger US Dollar. The grey metal trades at $30.68 up by more than 3%.

XAG/USD Price Analysis: Technical outlook

Silver remains bullish biased and after consolidating during the last six days within the $28.60-$29.80, it has finally cleared the top of the range and surged past the $30.00 figure.

Momentum shifted in favor of the buyers after the Relative Strength Index (RSI) stood at around the 50-neutral line.

As XAG/USD resumed its uptrend, the next resistance level would be June 7 high at $31.54. Once cleared, the next stop would be $32.00 before challenging the year-to-date (YTD) high of $32.51.

On the other hand, if XAG/USD sellers drag spot prices below the 50-day moving average (DMA) at $29.09, it will expose $29.00. Once cleared, that could expose the MTD low of $28.66, ahead of plunging toward the 100-DMA at $26.60.

XAG/USD Price Action – Daily Chart

- AUD/JPY continues its rally, reaching fresh cycle highs around 105.70 on Thursday.

- Daily RSI and MACD stand deep in positive terrain.

- Indicators point towards more room for additional gains.

During Thursday's session, the AUD/JPY pair maintained its uptrend, achieving new cycle highs around 105.70, its the highest point reached since 2013. There has been a clear consolidation around the 104.00 level in the last sessions, and as the sellers failed to make a significant move, buyers stepped in.

On a daily scale, the Relative Strength Index (RSI) of the AUDJPY has risen to 68, up from 63 recorded on Wednesday. This increase suggests bullish momentum continues to gain strength. The Moving Average Convergence Divergence (MACD) marker persists in showing rising green bars, indicating the bullish momentum is far from plateauing.

AUD/JPY daily chart

In summary, the AUD/JPY pair's robust showing on Thursday endorses a broader bullish outlook, with the intensity of the trend validated by the pair's position above the 20-day, 100-day, and 200-day Simple Moving Averages (SMAs). Looking forward, traders can expect the pair to sustain its uptrend, potentially reaching into the 105.80-106.00 range, as current indicators do not suggest over-extended movements and hence provide space for subsequent gains.

In summary, the AUD/JPY pair's robust showing on Thursday endorses a broader bullish outlook, with the intensity of the trend validated by the pair's position above the 20-day, 100-day, and 200-day Simple Moving Averages (SMAs). Looking forward, traders can expect the pair to sustain its uptrend, potentially reaching into the 105.80-106.00 range, as current indicators do not suggest over-extended movements and hence provide space for subsequent gains.

On the off chance that the pair falls below the support level set at 105.00, followed by the 104.15 level (20-day SMA), it would likely seek new support thresholds. As such, the 102.50 and 100.35 levels may serve as potential support lines.

- Swiss Franc weakens as SNB cuts rates from 1.50% to 1.25%, with potential for another cut in September.

- USD/CHF jumps from 0.8833 to 0.8911, breaching a key resistance level post-rate cut.

- Softer US jobless claims and deteriorating housing data increase speculation of Fed rate cuts in 2024.

The Swiss Franc extended its losses on Thursday after the Swiss National Bank (SNB) decided to cut rates for the second time in the year, lowering rates from 1.50% to 1.25% during the European session. The USD/CHF trades at 0.8911, up 0.83%.

USD/CHF jumped above 0.8900 after the Swiss National Bank reduced rates to 1.25%, hinting further easing

According to Reuters, the SNB looks likely to follow Thursday’s second consecutive rate cut in September. SNB Chairman Thomas Jordan said the CHF strengthened significantly in recent weeks, adding that the central bank is ready to intervene in the FX market.

If the SNB wants to prevent the Swissie from appreciating, it could slash rates in September instead of intervening and selling Francs in the markets.

The USD/CHF rose from around 0.8833 to 0.8911 in the first two hours after the SNB cut and breached a key resistance level.

Aside from this, the latest US Initial Jobless Claims report showed that more people than expected filed for unemployment benefits, highlighting that the labor market is cooling. With US housing deteriorating further, traders' hopes remained higher, and the Federal Reserve could cut rates at least twice.

Swiss Franc PRICE Today

The table below shows the percentage change of Swiss Franc (CHF) against listed major currencies today. Swiss Franc was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.35% | 0.45% | 0.49% | -0.15% | 0.23% | 0.16% | 0.80% | |

| EUR | -0.35% | 0.09% | 0.17% | -0.50% | -0.12% | -0.20% | 0.42% | |

| GBP | -0.45% | -0.09% | 0.06% | -0.58% | -0.20% | -0.29% | 0.33% | |

| JPY | -0.49% | -0.17% | -0.06% | -0.69% | -0.27% | -0.36% | 0.27% | |

| CAD | 0.15% | 0.50% | 0.58% | 0.69% | 0.37% | 0.31% | 0.92% | |

| AUD | -0.23% | 0.12% | 0.20% | 0.27% | -0.37% | -0.08% | 0.55% | |

| NZD | -0.16% | 0.20% | 0.29% | 0.36% | -0.31% | 0.08% | 0.62% | |

| CHF | -0.80% | -0.42% | -0.33% | -0.27% | -0.92% | -0.55% | -0.62% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Swiss Franc from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CHF (base)/USD (quote).

- Dow Jones reclaims 39,000.00 handle as markets rebound post-Juneteenth holiday.

- Softening US data helps to bolster rate cut expectations.

- US PMIs still loom ahead on Friday.

The Dow Jones Industrial Average (DJIA) is surging upwards on Thursday as investors return to markets with a vengeance following the midweek Juneteenth holiday that shuttered US exchanges on Wednesday. US economic data cooled with May’s Building Permits and the Philadelphia Fed Manufacturing Survey for June both declining, while Initial Jobless Claims recovered less ground than expected to notch another print above the four-week average.

With US economic figures broadly missing the mark, investor hopes of the Federal Reserve (Fed) getting bullied into a rate cut sooner rather than later are pinned to the ceiling. According to the CME’s FedWatch Tool, rate markets are pricing in upwards of a 70% chance that the Fed will deliver at least a quarter-point cut on September 18.

Read more: US Initial Jobless Claims rose more than estimated last week

Despite recent economic data softening, the Fed continues to pursue a restrictive policy stance. Fed policymakers are determined to await several months of chilled inflation figures before considering policy rate shifts. Despite jiggles in week-on-week unemployment claims, the US jobs market remains incredibly tight, giving Fed officials a firm branch to lean on and avoid rushing into any abrupt policy adjustments.

US Purchasing Managers Index (PMI) figures will round out the trading week. Rate-cut-hungry investors are looking for a continued cooling effect in US economic data. The Manufacturing and Services PMIs are both forecast to etch in small losses, with June's Manufacturing PMI expected to tick down to 51.0 from 51.3 and the Services PMI component to shift down to 53.7 from 54.8.

Dow Jones news

The Dow Jones is firmly higher on Thursday, with all but five of the index’s constituent securities lower on the day. Apple Inc. (AAPL) is leading declines, shedding 2.0% and falling below $210.00 per share as investors rethink a recent splurge driven by Apple’s announcement of further integration of AI tech into pre-existing Apple software offerings. Apple also announced the closure of its Pay Later program, which allowed Apple customers to make purchases on an in-house financed installment plan.

On the high side, Salesforce Inc. (CRM) climbed 4.5% on Thursday after the digital customer data management firm announced its own fresh batch of AI-tech integrations to investors. CRM climbed over $242.00 per share as investors continue to scoop up AI tech announcements with little concern over how these companies will convert AI integrations into more sales.

Dow Jones tech outlook

The Dow Jones index climbed to fresh highs for the week on Thursday, testing its highest bids in almost four weeks to reclaim the 39,000.00 handle. The DJIA is testing chart territory north of 39,200.00 and has made significant one-day progress to grinding its way back to all-time highs set above 40,000.00 in May.

Daily candlesticks have lept back over the 50-day Exponential Moving Average (EMA) at 38,825.00, extending a recovery from a recent plunge to the 38,000.00 region.

Dow Jones five minute chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- Gold advances sharply, gaining over 1% amid weakening US economic indicators.

- Softer US jobs and housing data increase expectations of two 25-bps Fed rate cuts in 2024.

- Rising geopolitical tensions in the Middle East and North Korea-Russia pact enhance Gold's safe-haven appeal.

Gold prices advanced sharply by more than 1% on Thursday during the North American session as US Treasury bond yields advanced to underpin the Greenback. Data from the United States was softer than expected, boosting traders' confidence that the Federal Reserve (Fed) will ease policy at least twice in 2024. The XAU/USD trades at $2,356 at the time of writing.

The latest economic data from the US continued to show that the economy is decelerating, prompting investors to price in two 25-basis-point (bps) interest rate cuts. A worse-than-expected US jobs report revealed the number of Americans filing for unemployment benefits rose above estimates.

US housing data disappoints markets as Building Permits and Housing Starts cooled.

In the meantime, Minneapolis Fed President Neel Kashkari stated that it will likely take a year or two to bring core inflation down to 2%. He added that the trajectory of interest rates would depend on the economic conditions, emphasizing, "We are achieving disinflation despite remarkable economic growth."

Rising geopolitical risks helped the golden metal uptrend. Tensions in the Middle East are rising as Israel threatens to launch an attack on Hezbollah in Lebanon. That, along with the recently signed pact between Russia and North Korea, could increase the appeal for the yellow metal, which is trading near a crucial resistance level.

The CME FedWatch Tool shows that the odds for a 25 bps rate cut for September stand at 58%, down from 62% a day ago. In the meantime, the December 2024 fed funds futures contract implies the Fed will cut 36 bps toward the end of the year.

Daily digest market movers: Gold price rises amid high US yields and strong USD

- US Dollar Index prints gains of 0.405, up at 105.64, a headwind for Gold prices.

- US Treasury bond yields jumped, 10-year Treasury note yield is up more than four basis points to 4.257%.

- US Initial Jobless Claims for the week ending June 15 rose to 238K, exceeding estimates of 235K but lower than the previous reading of 243K.

- US Building Permits declined by 3.6% in May, dropping from 1.44 million to 1.386 million. Housing Starts for the same period fell by 5.5%, from 1.352 million to 1.277 million.

- Fed officials counseled patience on interest rate cuts and emphasized they would remain data dependent. Although last week's CPI report was positive, policymakers reiterated they need to see more reports like May’s data.

- Despite the US CPI report showing that the disinflation process continues, Fed Chair Jerome Powell commented that they remain “less confident” about the progress on inflation.

Technical analysis: Gold price challenges Head-and-Shoulders pattern, climbs past $2,350

Gold buyers are testing the Head-and-Shoulders pattern, dragging the golden metal above the pattern’s neckline. A daily close above the latter's confluence and the 50-day Simple Moving Averages (SMA) at around $2,343 could negate the bearish chart pattern and open the door for further gains.

In that event, Gold could extend its gains above $2,350, exposing additional key resistance levels. Next would be the June 7 cycle high of $2,387, ahead of challenging the $2,400 figure.

Conversely, if XAU/USD drops below $2,343, that would keep the Head-and-Shoulders chart pattern intact, and Gold could be headed to the downside. If XAU/USD slides drops below $2,300, the next support would be the May 3 low of $2,277, followed by the March 21 high of $2,222. Further losses lie underneath, with sellers eyeing the Head-and-Shoulders chart pattern objective from $2,170 to $2,160.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

The US Dollar regained strong upside traction and maintained the price action in the risk complex depressed amidst interest rate cuts speculation and soft US data releases. In addition, the BoE and the Norges Bank kept their policy rates unchanged vs. a surprising cut by the SNB.

Here is what you need to know on Friday, June 21:

The USD Index (DXY) rose to four-day highs near 105.70 on the back of the rebound in US yields across the curve and the dominating risk-off mood in the FX galaxy. On June 21, the advanced S&P Global Manufacturing and Services PMI will take centre stage seconded by the CB Leading Index and Existing Home Sales.

EUR/USD left behind part of the recent three-session advance and revisited the boundaries of the 1.0700 support amidst strong selling pressure. The EcoFin meeting is due on June 20, followed by the preliminary HCOB Manufacturing and Services PMI in Germany and Euroland.

GBP/USD followed its risky peers and retreated to multi-day lows well south of the 1.2700 support following a firm Dollar and the dovish hold by the BoE. The flash S&P Global advanced Manufacturing and Services PMI come on June 21, along with the GfK Consumer Confidence, Public Sector Net Borrowing, and Retail Sales.

USD/JPY maintained its robust bullish bias and challenged fresh tops near the 159.00 barrier amidst the stronger Greenback and higher yields. The advanced Jibun Bank Manufacturing and Services PMI will be published on June 21 followed by the Inflation Rate.

AUD/USD faced some renewed downside pressure and receded from recent weekly tops, revisiting the 0.6650 zone. In Australia, the flash Judo Bank Manufacturing and Services PMIs are expected on June 21.

WTI prices advanced to fresh highs and approached the $82.00 mark per barrel on the back of renewed geopolitical jitters and a weekly drop in US crude oil inventories.

Gold prices managed to gather fresh steam and advance to two-week highs around $2,365 per ounce troy. Silver rallied more than 3% to surpass the $30.00 mark per ounce and clinch a new two-week high.

- Australian Dollar has lost some momentum in recent sessions despite RBA’s hawkish hold.

- Treasury yields benefit US Dollar on Thursday.

- Australian economy's next crucial data set will be released in Friday's session with the June Judo PMI figures from Australia.

In Thursday's session, the Australian Dollar (AUD) met with some losses against its peers. This development follows the AUD/USD’s retreat after two consecutive sessions of gains heading toward 0.6670, ultimately succumbing to higher US Treasury yields that boost the USD.

Signs of fragility are emerging in the Australian economy, however, persistently high inflation is causing the Reserve Bank of Australia (RBA) to postpone potential rate cuts, potentially mitigating further losses. The RBA is primed to be among the last G10 nations to initiate rate cuts, a situation that might perpetuate the Aussie's gains.

Daily digest market movers: Australian Dollar consolidates RBA gains, eyes on PMIs

- RBA once more demonstrated a hawkish hold, retaining the official cash rate (OCR) at 4.35% without committing to a particular future stance, echoing their phrase “the Board is not ruling anything in or out.”

- In her subsequent press conference, Governor Bullock reiterated the Board’s discussions about potential rate hikes and dismissed considerations of rate cuts in the near term.

- In light of this, the RBA expressed readiness to do "what is necessary" to guide inflation back within target parameters.

- Market anticipates nearly 50 bps of easing by December 2025, while rate hikes in August and September are yet to be ruled out.

- Further indications will come from upcoming preliminary data from Australia’s Judo Bank Purchasing Managers Index (PMI) set for release on Friday.

- Expected signs of revival in the Australian economy might command the RBA to delay rate cuts, potentially uplifting the Australian Dollar against the USD.

- US Treasury yields saw a considerable rise, with gains exceeding 1%. The 2-year, 5-year and 10-year rates stood at 4.74%, 4.29%, and 4.27%, respectively, and seem to be driving demand toward the USD.

Technical analysis: Bullish signals ease off, confirmation still on hold

On the technical front, indicators are losing some intensity despite the recovery of the Relative Strength Index (RSI), which has surged back above 50, while the Moving Average Convergence Divergence (MACD) charts a fresh green bar.

However, it's worth mentioning that these are still buy signals. For a more solid buying confirmation, the AUD/USD pair needs to fully anchor itself above the 20-day Simple Moving Average (SMA). In that sense,sellers might retest the support in the next few sessions to test its strength.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- Canadian Dollar caught a bid on Thursday, but gains remain limited against USD.

- Canada sees better-than-expected recovery in unemployment claims.

- US Initial Jobless Claims fell, but less than expected; US PMIs loom ahead on Friday.

The Canadian Dollar (CAD) found some room on the high side on Thursday, adding to the week’s thin gains. The CAD is struggling to outperform the US Dollar (USD), which is climbing as US markets return to the fold following a midweek holiday that kept US exchanges dark and Greenback trading thin.

Canada reported a comparatively steep cut in the number of Canadians taking unemployment benefits. US Initial Jobless Claims also eased but less than expected, driving the four-week average higher. Canadian Retail Sales and US Purchasing Managers Index (PMI) figures are slated for Friday to wrap up the trading week.

Daily digest market movers: Jobless benefits figures drive market sentiment, CAD shifts higher

- Canadian Employment Insurance Beneficiaries Change declined 2.8% MoM in April, sharply below the previous 0.1% increase and the steepest decline in Canadian jobless benefits claimants since November 2022.

- US Initial Jobless Claims also declined from a week earlier but less than expected. New unemployment benefit seekers eased to 238K for the week ended June 14, less than the previous 243K but more than the expected 235K.

- US Initial Jobless Claims are still riding higher than the four-week average, which ticked up to 232.75K from 227.25K.

- Philadelphia Fed Manufacturing Survey backslid to 1.3 in June, missing the forecasted increase to 5.0 from the previous 4.5 as economic concerns continue to weigh on business sentiment.

- Canadian Retail Sales due on Friday are expected to recover to 0.7% MoM in April, up from the previous -0.2% decline.

- Friday’s US PMI will close out the trading week, with markets expecting a slight shift lower. The Manufacturing PMI is forecast to push down to 51.0 from 51.3, and the Services component is expected to slide to 53.7 from 54.8.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.34% | 0.46% | 0.46% | -0.01% | 0.32% | 0.25% | 0.75% | |

| EUR | -0.34% | 0.11% | 0.12% | -0.35% | -0.02% | -0.10% | 0.40% | |

| GBP | -0.46% | -0.11% | 0.00% | -0.46% | -0.13% | -0.22% | 0.27% | |

| JPY | -0.46% | -0.12% | 0.00% | -0.51% | -0.15% | -0.26% | 0.26% | |

| CAD | 0.00% | 0.35% | 0.46% | 0.51% | 0.31% | 0.26% | 0.74% | |

| AUD | -0.32% | 0.02% | 0.13% | 0.15% | -0.31% | -0.08% | 0.42% | |

| NZD | -0.25% | 0.10% | 0.22% | 0.26% | -0.26% | 0.08% | 0.49% | |

| CHF | -0.75% | -0.40% | -0.27% | -0.26% | -0.74% | -0.42% | -0.49% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Technical analysis: Canadian Dollar bounces, but remains trapped at key levels

The Canadian Dollar (CAD) is gaining ground across the board on Thursday, climbing nearly eight-tenths of one percent against the battered Swiss Franc (CHF), the day’s worst-performing currency. The CAD is also up over one-half of one percent against the Pound Sterling (GBP) and the Japanese Yen (JPY), but gains against the US Dollar remain limited as the Canadian Dollar trades within a tenth of a percent against the Greenback.

USD/CAD remains mired in near-term congestion at the 1.3700 handle, but momentum is tilting in favor of bears looking to push the Greenback lower against the Canadian Dollar. The pair is drifting steadily lower from a near-term supply zone above 1.3760, with eyes set on the recent swing low into 1.3680.

Daily candles are on pace to make a return to technical support from a confluence in a rough rising trendline and the 50-day Exponential Moving Average (EMA) at 1.3676, but a long-term price floor is baked in at the 200-day EMA rising into the 1.3600 handle. USD/CAD is down a full percent from the year’s peaks near 1.3850 but is still up a healthy 3.5% from 2024’s opening bids near 1.3250.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- US Dollar gets a boost from an increase in US Treasury yields on Thursday.

- Markets still show signs of caution as Fed officials express a conservative stance on embracing easing cycles.

- The mixed US economic outlook tempers upside in the Greenback.

On Thursday, the US Dollar, as gauged by the Dollar Index (DXY), saw significant strength on the back of rising US Treasury yields. This follows a dip midweek as market participants analyzed several recently released mid-tier data releases, including soft Retail Sales figures from May. On Thursday, the USD shrugged off weak labor and housing data.

In regard to the US economic outlook, while there are signs of disinflation, Federal Reserve (Fed) officials' measured comments are keeping the market's expectations in check. If the mixed signals from the economy persist, it could potentially hinder further USD strength.

Daily digest market movers: US Dollar gains despite weak data

- Building Permits declined from 1.44 million to 1.386 million, a dip below predictions.

- In addition, Housing Starts also decreased, moving from 1.352 million to 1.277 million, missing optimistic estimates.

- Initial Jobless Claims recorded a slight drop, trending from a revised 243K to 238K. Continuing Jobless Claims saw an increase from 1.813 million to 1.828 million.

- Philadelphia Fed Manufacturing Survey for June disappointed, posting a 1.3 instead of the projected 5, down from the previous 4.5.

- Minneapolis Fed President Neel Kashkari noted that returning inflation to the 2% target could take one to two years since current wage growth still outpaces the desired rate.

- Chances of an interest rate cut remain at about 67% for the upcoming Fed meeting on September 18, according to the CME Group's FedWatch Tool.

- US Treasury yields saw a considerable rise, with gains exceeding 1%. The 2-year, 5-year and 10-year rates stood at 4.74%, 4.29%, and 4.27%, respectively.

DXY technical analysis: Bullish sentiment gains traction, must recover 105.50

Technical indicators for Thursday's session showed renewed bullish momentum bolstered by increased US Treasury yields. The Relative Strength Index (RSI) held above 50, with a prevailing green histogram in the Moving Average Convergence Divergence (MACD), indicating sustained bullish sentiment.

Additionally, the DXY Index maintains above its 20-day, 100-day and 200-day Simple Moving Averages (SMA). This, combined with the rising indicators, suggests the potential for additional gains in the US Dollar. Yet, given the mixed economic outlook, investors should remain attentive to changes in the market landscape.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- EUR/GBP bounced from near-term lows to cross 0.8450.

- BoE keeps rates on hold, cites still-tight labor market and tricky inflation.

- Friday to wrap up the trading week with UK Retail Sales, PMIs in EU and UK.

EUR/GBP found some room on the high side on Thursday after the Bank of England kept rates on hold at 5.25%. Mid-tier EU data did little to spark much movement in either direction, though Euro traders will note a further softening in the German Producer Price Index (PPI) in May.

Germany’s PPI slipped to 0.0% MoM in May, down from the previous 0.2% and flubbing the forecast uptick to 0.3%. YoY PPI figures also missed the mark, declining to -2.2% for the year ended in May. The annualized figure rebounded from the previous -3.3%, but still failed to grab the forecast recovery to -2.0%.

The BoE held rates in place in June as was broadly expected, but a focus on recent services inflation coupled with an ambiguous goal to keep inflation “sustainably” at 2% has left the Sterling in the lurch. The BoE went on to note a willingness to keep policy restrictive for as long as needed and highlighted that the UK labor market, while looser than previous, still remains tight in comparison to historical figures. The Sterling lost ground against the Euro, pulling EUR/GBP back up from an intraday low of 0.8435 to retest 0.8460.

Read more: BoE maintains policy rate at 5.25% as forecast

Friday will see a fresh round of UK Retail Sales, forecast to recover to 1.5% MoM in May after April’s -2.3% decline. Pan-EU HCOB Purchasing Managers Index (PMI) and UK PMI numbers for June are expected to recover slightly. The EU’s June Manufacturing PMI is expected to move to 47.9 from 47.3, while the Services PMI component is forecast to rise to 53.5 from 53.2. On the UK side, June’s Manufacturing PMI is expected to tick to 51.3 from 51.2, while the Services PMI is forecast to clip into 53.0 from 52.9.

EUR/GBP technical outlook

EUR/GBP found the juice for an intraday bullish recovery, but the pair's outlook is still firmly bearish. 0.8460 represents a significant near-term hurdle for bulls to overcome, and the pair has only just started clawing back ground after last week’s tumble into a 22-month low at the 0.8400 handle.

The pair has closed flat or down for five consecutive weeks, and despite recovering 0.80% from nearly two-year lows, bullish momentum remains anemic. If bidders are able to recover their balance, the 0.8500 handle will be waiting further above.

EUR/GBP hourly chart

EUR/GBP daily chart

- Mexican Peso remains stable against US Dollar alongside solid April Retail Sales data.

- Political uncertainty over AMLO's judiciary reforms limits further gains, with key announcements expected from President-elect Sheinbaum.

- US housing sector weakens and softer jobs data emerge.

- Fed's Kashkari suggests disinflation may take a year or two.

The Mexican Peso clung to gains against the US Dollar on Thursday after economic data showed the country’s economy remains robust. However, political uncertainty about a pending judiciary reform caps the emerging market currency's advance. The USD/MXN exchanges hands at 18.40, virtually unchanged.

Mexico’s economic docket revealed solid Retail Sales in April, exceeding estimates and March’s figures. Later on Thursday, President-elect Claudia Sheinbaum will reveal the names of six cabinet members who have collaborated with her since October 1.

In the meantime, political noise about President Andres Manuel Lopez Obrador's (AMLO) reforms submitted to the congress had waned, as reflected by the USD/MXN stabilizing at around 18.40-18.50. Nevertheless, this consolidation could be the calm before the storm, as the newly elected Mexican congress will begin on September 1.

Across the border, the US housing sector continued to deteriorate, while jobs data was softer than expected. Federal Reserve speakers continued to cross the newswires, with Minneapolis Fed President Neel Kashkari speaking.

Kashkari stated that it will probably take a year or two to lower core inflation to 2%. He added the path of interest rates would depend on the economy, emphasizing, “We are getting disinflation despite remarkable economic growth.”

Daily digest market movers: Mexican Peso remains flat despite posting strong Retail Sales

- Mexican Retail Sales in April increased from 0% to 0.5%, above estimates of -0.3% MoM. They jumped from -1.7% to 3.2%, more than doubling projections by analysts for the 12 months to April.

- USD/MXN stabilizes following last week’s verbal intervention by Banxico Governor Victoria Rodriguez Ceja, who said the central bank is attentive to volatility in the Mexican currency exchange rate and could act to restore “order” in markets.

- Volatility in the USD/MXN exchange rate could prevent Banxico from cutting interest rates for the second time in the year at the upcoming meeting on June 27. A rate cut could weaken the Mexican Peso and expose the USD/MXN year-to-date high at 18.99.

- US Initial Jobless Claims for the week ending June 15 climbed 238K, exceeding estimates of 235K but lower than the previous reading of 243K.

- US Building Permits plunged 3.6% in May, from 1.44 million to 1.386 million. Housing Starts for the same period dropped from 1.352 million to 1.277 million, a fall of 5.5%.

- The CME FedWatch Tool shows odds for a 25-basis-point Fed rate cut at 58%, down from 62% on Wednesday.

Technical analysis: Mexican Peso consolidates at around 18.30-18.50

The USD/MXN shifted upward bias despite consolidating within the 18.30-18.50 range during the last four days. Momentum supports buyers as the Relative Strength Index (RSI) remains bullish.

For a bullish continuation, the USD/MXN must clear 18.50 if buyers want to retest the year-to-date high of 18.99. A breach of the latter will expose the March 20, 2023, high of 19.23. If that price is cleared, this will sponsor an uptick to 19.50, ahead of the psychological 20.00 mark.

Conversely, if sellers push prices below the April 19 high of 18.15, the exotic pair will be kept within the 18.00-18.15 range.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- GBP/USD back below 1.2675 after BoE keeps rates pinned.

- BoE voting split remains unchanged at seven-to-two.

- Softer US data further eroded market sentiment, bolstering Greenback.

GBP/USD slipped lower on Thursday after the Bank of England (BoE) held rates at 5.25%, citing ongoing concerns about the central bank’s ability to sustainably keep inflation at or below the 2.0% target. US data was broadly softer than investors had expected in early American trading, igniting a soft patch of risk aversion which kept the US Dollar bid and Sterling pinned into the low end.

Read more: BoE maintains policy rate at 5.25% as forecast

The BoE was broadly expected to keep rates held in place in June, but a focus on recent services inflation coupled with an ambiguous goal to keep inflation “sustainably” lower has left the Sterling in the lurch. Adding onto this, the BoE also noted a willingness to keep policy restrictive for as long as needed, and highlighted that the UK labor market, while looser than previous, still remains historically tight. The Sterling is down around a third of a percent against the extending US Dollar as Thursday’s market action rolls on.

US Initial Jobless Claims missed the mark, coming in higher than expected for the week ended June 14. Week-on-week unemployment claimants are still lower, printing at 238K versus the previous 243K (revised from 242K), but still came in above the four-week trending average of 242.75K, which itself also rose from the previous 227.25K.

The Philadelphia Fed Manufacturing Survey for June backslid to 1.3 from the previous 4.5, entirely missing the forecast 5.0. US Housing Starts also softened, falling back to 1.277 million new residential construction projects MoM in May versus the forecast 1.37 million and the previous month’s 1.352 million (revised from 1.36 million).