- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

Japan's Merchandise Trade Balance Total for January fell by less than expected, printing at ¥-1.75 trillion after an unexpected upswing in Japanese Exports, which rose to a 14-month high of 11.9% YoY versus the forecast decline to 9.5% from the previous period's 9.7% (revised from 9.8%).

Japanese Imports for the same period also declined more than expected, keeping Japan's overall trade balance, coming in at -9.6% versus the forecast -8.4% against the previous period's -6.9% (revised from -6.8%).

Despite beating expectations, Japan's Merchandise Trade Balance Total for the year ended in January beat the forecast ¥-1.92 trillion, but is still well back from the previous period's ¥68.9 billion surplus (revised even higher from ¥62.1 billion), and is the worst print for the figure since last February's plunge to ¥-3.5 trillion.

Market reaction

The USD/JPY is holding steady in early Wednesday churn just below the 150.00 handle as the Asian market session comes online.

About Japan's Merchandise Trade Balance Total

The Merchandise Trade Balance Total released by the Ministry of Finance is a measure of balance amount between import and export. A positive value shows a trade surplus while a negative value shows a trade deficit. Japan is so much dependant on exports that the Japanese economy heavily relies on a trade surplus. Therefore, any variation in the figures influences the domestic economy. If a steady demand in exchange for Japanese exports is seen, that would turn into a positive.

- NZD/USD trades on a softer note near 0.6162 in Wednesday’s early Asian session.

- Investors have priced in four rate cuts in 2024, beginning in June.

- The New Zealand Producer Price Index (PPI) Output Q4 came in at 0.7% QoQ versus 0.8% prior, better than expected.

The NZD/USD pair snaps the five-day winning streak above the mid-0.6100s during the early Asian session on Wednesday. Investors await the FOMC Minutes on Wednesday for fresh impetus. At press time, NZD/USD is trading at 0.6162, losing 0.08% on the day.

The markets are pricing in four rate cuts in 2024, beginning in June. The odds for a 25 basis points (bps) March rate cut had decreased to 34.4%, while the rate cuts in June increased to 55.1%, according to the CME Group FedWatch Tool. The FOMC will release the latest meeting minutes on Wednesday. The minutes of the meeting are likely to offer some hints about what Fed officials considered in their latest meeting to dismiss a March rate cut and the timing for first-rate cuts.

On the other hand, the latest data from Statistics New Zealand on late Tuesday showed that the Producer Price Index (PPI) Output for the fourth quarter (Q4) came in at 0.7% QoQ from 0.8% in the previous reading while the PPI Input figure arrived at 0.9% QoQ versus 1.2% prior. Both figures were better than the expectation.

Moving on, the highlight for traders on Wednesday will be the FOMC Minutes for January 30-31 meeting. Six Fed officials are set to speak on Thursday, with the focus on the Fed governor Christopher Waller's speech. Also, the New Zealand Trade Balance will be due on Thursday. These data could give a clear direction to the NZD/USD pair.

- USD/JPY hovers at 149.96, influenced by a dip in US Treasury yields and a subdued Dollar.

- Market's tight range near 150.00 may shift, watching for Japanese authority interventions.

- A move below 150.00 might steer USD/JPY towards 149.00, as an uptrend seeks to top 150.00 again.

The USD/JPY is almost flat as Wednesday’s Asian session begins after posting minuscule losses of 0.09% on Tuesday, at the time of writing trades at 149.96. The drop in US Treasury bond yields and a subdued US Dollar (USD) were the two reasons that favored the Japanese Yen (JPY).

The pair has consolidated at around the 149.90-150.00 area for the last three trading sessions, capped on the upside by fears that Japanese authorities might intervene. However, if bulls push prices decisively above 150.00, that will pave the way toward the February 13 high at 150.88, followed by the 151.00 mark.

Conversely, if the USD/JPY tumbles below the Tenkan-Sen at 149.91, that would exacerbate the pair’s fall toward the Senkou Span A area at 149.15 before testing the 149.00 area. A breach of the latter will expose the Kijun-Sen at 148.39, ahead of the 148.00 mark.

USD/JPY Price Action – Daily Chart

New Zealand's Producer Price Index (PPI) beat expectations, printing higher than forecasts for both the Output and Input components, but still receded from the previous quarter's figures.

According to Stats NZ, the Output PPI rose 0.7% for the quarter ended in December versus the forecast decline to 0.4%, edging down from the previous quarter's 0.8%. New Zealand's Input PPI for the same period printed at 0.9% compared to the expected 0.4%, but still fell back from the previous print of 1.2%.

Stats NZ noted that the largest output contributors were dairy cattle farming, up 7.3%, and real estate services which rose 1.1, helping to offset a 4.5% decline in dairy product manufacturing.

On the Input PPI side, dairy product manufacturing prices rose 5.5% while electrical and gas supply prices climbed 5.8%, with basic chemical and chemical product manufacturing adding a further 2.8%.

Market reaction

The NZD/USD is struggling to arrest a fall into 0.6165 in early Wednesday trading after the pair peaked above 0.6190 on Tuesday before pulling back in the midday rollover.

About New Zealand's Producer Price Index

The Producer Price Index Out released by the Statistics New Zealand is a measurement of the price changes of goods produced by the producers in New Zealand. Generally speaking, a price hike generates higher retail prices for consumers. Thus, a high reading is seen as positive (or bullish) for the NZD, while a low reading is seen as negative (or bearish).

The Producer Price Index Input released by the Statistics New Zealand is a measurement of the rate of inflation experienced by producers. PPI Input captures changes in the average price of a fixed basket of goods and services purchased by the producers in New Zealand. A high reading is positive (or bullish) for the NZD, while a low reading is seen as negative (or bearish).

- The NZD/USD trades at 0.6168 with a 0.28% gain during Tuesday's session.

- Markets await the FOMC minutes from January’s meeting.

In Tuesday's session, the NZD/USD was viewed at 0.6168, marking a modest gain of 0.28% mainly driven by a weak US Dollar.

In line with that, the US Dollar's strength has slightly declined as well as Treasury yields before the release of the Federal Open Market Committee (FOMC) minutes. These minutes, set for release in Wednesday’s session, hold market attention as they provide insights into the central bank's perspective on inflation and the potential need for policy adjustments. It's noteworthy that markets currently predict around four rate cuts in 2024, totaling to an estimated 100bps, set to start from June.

NZD/USD technical analysis

On the daily chart, the Relative Strength Index (RSI) recently turned neutral to positive, increasing from negative territory over the last few days. This suggests an uptick in buying activity as buyers regained some control from sellers. However, the RSI remains within positive territory indicating the market could still fluctuate from balanced to buyer-dominated conditions. The Moving Average Convergence Divergence (MACD) also suggests that the buyers are in command with its rising green bars.

The broader upward trend (evidenced by the pair being above the 20, 100, and 200-day Simple Moving Averages) further supports the bullish signals from the RSI and MACD.

NZD/USD daily chart

The Fitch Ratings agency has revised its 'Nowcast' modelling to track and forecast Gross Domestic Product (GDP) growth.

According to the ratings agency's release, a more accurate forecasting model now sees higher US GDP growth at 0.6% QoQ and German growth at -0.1% QoQ.

Key quotes

The enhanced framework introduces new nowcast models for the US, Japan and the eurozone ‘Big4’ economies (Germany, France, Italy and Spain).

The new methodology employs a mixed-data sampling (MIDAS) regression model, which uses monthly indicators to predict GDP growth.

The new models point towards a positive surprise for US GDP at 0.6% qoq (non-annualised), compared to our December 2023 Global Economic Outlook report, and a negative surprise for Germany at -1.0% qoq.

- Silver rises slightly to $22.99, supported by lower US Treasury yields and a weaker Dollar, boosting demand for precious metals.

- Facing technical resistance at $23.13-15, with the 200-DMA at $23.28 posing a major obstacle for further gains.

- Downside risk if silver breaches $23, eyeing February's lows; success above immediate resistances critical for upward momentum.

Silver clings to minuscule gains late in the New York session on Tuesday, up 0.04%, and is trading at around $22.99 a troy ounce. Falling US Treasury bond yields and the Greenback are the main catalysts for the rise in precious metals, while technical resistance levels capped the XAG/USD upside.

XAG/USD rose briefly toward the confluence of the 50 and 100-day Moving Averages (DMAs) at around $23.13-15 during Tuesday’s session but failed to challenge the 200-DMA at $23.28. As a ‘dark cloud cover’ looms, bears dragged Silver’s price below $23.00, which could open the door to test the February 18 low of $22.80. A breach of the latter will accelerate the downtrend towards the February 15 low of $22.35, followed by the $22.00 figure.

Conversely, if buyers reclaim $23.15, that will open the door for further gains. The first resistance would be the 200-DMA at $23.28, followed by the current year-to-date (YTD) high at $24.09.

XAG/USD Price Action – Daily Chart

- Crude Oil markets shrugged off the Houthi’s most successful ship attack to date.

- API Weekly Crude Oil Stocks figures due late in the day.

- Lagging Crude Oil demand in China is stepping up energy market concerns.

West Texas Intermediate (WTI) US Crude Oil softened on Tuesday, receding to $72.00 per barrel on renewed concerns that global production of Crude Oil will outpace growth by a much wider margin than initially expected. In 2023, Crude Oil markets initially anticipated that global production would undercut demand by a wide margin, drastically constraining supplies and sending barrel prices soaring, but lagging growth in key demand markets, specifically China, have sen market expectations of a supply rout about-face into renewed concerns of a worsening supply glut on the back of record pumping numbers from countries outside of the Organization of the Petroleum Exporting Countries (OPEC).

OPEC’s efforts to trim Crude Oil production have run up against a hard wall of increasing production from non-OPEC nations, specifically the US which hit a record production level in November and continues to cement itself as the world’s single largest barrel producer. China’s growth figures continue to come in below expectations, and wobbly Chinese Crude Oil demand leaves energy markets with far higher supply counts than anticipated.

The American Petroleum Institute (API) will be releasing a weekly update on US barrel counts, which last showed a surprise upswing of over 8.5 million barrels last week. The Energy Information Administration’s (EIA) own weekly barrel counts will print on Wednesday, and last saw a massive upswing in weekly Crude Oil stocks of over 12 million barrels.

A ceasefire in the Gaza conflict still seems unlikely, and Iranian-backed Houthi rebels in Yemen saw their largest ship attack victory yet when they forced the crew of the bulk carrier Rubymar to abandon ship on Monday. Houthis have struck at least four separate civilian vessels in the Red Sea since last week.

Despite multiple Middle East conflict concerns, Crude Oil markets hesitated on Tuesday, keeping Crude Oil pinned into rough, near-term consolidation.

WTI technical outlook

Near-term action in US Crude Oil has been rough, with WTI testing into $78.50 over the past week and barrel bids struggling to keep on the bullish side after Tuesday’s dip saw prices get hung up on the 200-hour Simple Moving Average (SMA) near $77.00.

Overall momentum has gone to the bulls as Crude Oil bids claim higher ground after dipping to $71.50 in February, but downside shocks remain a technical hazard for bidders.

Despite a halting recovery from recent lows near $68.00 per barrel, WTI remains down nearly 18% from 2023’s October highs near $94.00.

WTI hourly chart

WTI daily chart

- The GBP/JPY stands at 189.24 reflecting a moderate gain of 0.11% in Tuesday's trading session.

- The Bank of England maintains its neutral stance, with Governor Bailey hinting at potential rate cuts even before inflation reaches the bank’s target.

- Japanese and British preliminary PMIs from February are due on Thursday.

In Tuesday's session, the GBP/JPY pair recorded modest gains, trading at 189.24. Influences on the pair's movement encompass the ongoing shifts in both UK and Japanese financial and economic landscapes which are shaping the Bank of England (BoE) and the Bank of Japan (BoJ) monetary policy decisions. The British bank remains cautious warning about the resilient local economy while the BoJ doesn’t give clear signals on when it will leave its ultra-loose policy.

On the British front, Bank of England (BoE) officials, including Governor Andrew Bailey, gave no fresh policy guidance during their testimony before the UK Treasury Select Committee. Bailey perceived an upturn in the economy and advised that the central bank could consider rate cuts even before inflation hits their target levels. However, as for now, markets are pricing in that the first rate cut will be in the August meeting but incoming data will continue shaping the timing of the easing cycle.

GBP/JPY daily chart

The daily Relative Strength Index (RSI) for GBPJPY is currently situated in positive territory, marking a slight uptrend, with a mild surge further cementing bullish control. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram, complementing the bullish cues from the RSI, has continued to print green bars, reflecting consistently positive momentum in recent days, although the flattening slopes point towards potential slowing of the current bullish momentum.

Finally, it's worth noting that GBPJPY remains above its 20, 100, and 200-day Simple Moving Averages (SMAs), hinting at the bullish command in the overall trend, despite indicators showing some signs of flattening. This technical position largely backs the continued dominance of buyers, with any near-term pullbacks likely serving as technical corrections for further climbs in the medium-to-long term.

GBP/JPY daily chart

What you need to take care of on Wednesday, February 21:

The US Dollar edged lower on Tuesday, extending its slide after the long weekend amid mounting speculation the Fed will further delay the first rate cut. The CME Group FedWatch Tool now shows market players are moving their bets towards June. The odds for a 25 basis points (bps) March rate cut had decreased to 34.4%, while June ones increased to 55.1%.

Stock markets traded with a tepid tone, with Wall Street spending most of the day in the red.

Bank of England (BoE) policymakers testified on inflation and the economic outlook before Parliament's Treasury Committee. Governor Andrew Bailey said that the UK economy is at full employment and added it is already showing distinct signs of an upturn. He added inflation does not need to fall back to 2% before rate cuts materialize, and commented it’s not unreasonable to expect a rate cut this year, although he refrained from providing a specific date.

Canada reported the January Consumer Price Index (CPI), which rose by 2.9% YoY s in January down from 3.4% in December, according to Statistics Canada

The Federal Open Market Committee (FOMC) will release the latest meeting Minutes on Wednesday. The document will likely provide fresh clues on what policymakers considered in their latest meeting to dismiss a March rate cut, while speculative interest will try to assess the odds and dates for upcoming cuts.

The EUR/USD pair neared 1.0840, holding above the 1.0800 level early Wednesday. GBP/USD settled around 1.2620. The Canadian Dollar was the worst performer vs the Greenback, as the pair trades around 1.3520. The AUD/USD, on the other hand, is up for a fifth consecutive day and trades around 0.6550. Finally, CHF and JPY posted modest losses vs the USD, while Gold topped $2,030 a troy ounce.

US Dollar price today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the .

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.29% | -0.25% | 0.19% | -0.30% | -0.13% | -0.42% | -0.11% | |

| EUR | 0.29% | 0.02% | 0.47% | 0.00% | 0.15% | -0.13% | 0.18% | |

| GBP | 0.25% | -0.04% | 0.43% | -0.05% | 0.10% | -0.18% | 0.14% | |

| CAD | -0.19% | -0.47% | -0.43% | -0.48% | -0.34% | -0.60% | -0.30% | |

| AUD | 0.30% | 0.00% | 0.04% | 0.47% | 0.16% | -0.13% | 0.18% | |

| JPY | 0.14% | -0.13% | -0.12% | 0.31% | -0.13% | -0.28% | 0.01% | |

| NZD | 0.41% | 0.13% | 0.17% | 0.60% | 0.13% | 0.28% | 0.31% | |

| CHF | 0.11% | -0.18% | -0.14% | 0.29% | -0.20% | -0.03% | -0.31% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

- EUR/USD climbed above 1.0800 early Tuesday, testing the 1.0840 region.

- Broad market US Dollar sell-off props up the Fiber.

- Markets await Fed Meeting Minutes, EU PMIs.

EUR/USD climbed to a two-week high just shy of 1.0840 on Tuesday after the US Dollar (USD) broadly fell before recovering in the US trading session after American markets returned to the fold following an extended weekend. EUR/USD reclaimed the 1.0800 handle for the first time in a week as the pair grapples with jump-starting a bullish recovery.

Markets are gearing up for the latest Meeting Minutes from the Federal Reserve’s (Fed) Federal Open Market Committee (FOMC). European markets are also buckling down for the wait to euro area Purchasing Managers Index (PMI) figures due on Thursday.

Daily digest market movers: EUR/USD recovers ahead of Fed minutes, EU PMI activity data

- Broad market flows dominate EUR/USD as investors await the Fed’s latest Meeting Minutes.

- Investors continue to hope for faster, sooner rate cuts from the FOMC.

- According to the CME’s FedWatch Tool, money markets are pricing in a first rate cut in June of at least 25 basis points.

- Markets still see five rate cuts in 2024 compared to the Fed’s own expectations of three.

- European PMIs on Thursday broadly expected to improve but still remain in contraction territory as the pan-European economy grapples with sluggish growth and a softening landscape.

- Germany’s HCOB Composite PMI in February expected to recover to 47.5 in February compared to January’s 47.0.

- The euro area’s broader HCOB Composite PMI is forecast to bounce to 48.5 from 47.9 in February.

- Europe’s final Harmonized Index of Consumer Prices (HICP) for the year ended in January is expected to reiterate the preliminary print of 3.3% YoY.

- US PMIs will follow on Thursday but are expected to soften with the Services component forecast to decline to 52.0 from 52.5, while the Manufacturing component is expected to tick down to 50.5 from 50.7.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Canadian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.32% | -0.29% | 0.12% | -0.34% | -0.19% | -0.44% | -0.13% | |

| EUR | 0.32% | 0.03% | 0.44% | -0.02% | 0.12% | -0.11% | 0.19% | |

| GBP | 0.29% | -0.03% | 0.41% | -0.05% | 0.10% | -0.15% | 0.16% | |

| CAD | -0.12% | -0.44% | -0.39% | -0.45% | -0.31% | -0.56% | -0.25% | |

| AUD | 0.34% | 0.02% | 0.05% | 0.46% | 0.15% | -0.10% | 0.21% | |

| JPY | 0.19% | -0.13% | -0.11% | 0.31% | -0.14% | -0.26% | 0.06% | |

| NZD | 0.42% | 0.12% | 0.15% | 0.54% | 0.11% | 0.18% | 0.30% | |

| CHF | 0.13% | -0.19% | -0.17% | 0.25% | -0.19% | -0.07% | -0.32% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: EUR/USD approaches 1.0840 before buckling under pressure

The EUR/USD came within range of 1.0840 in Tuesday’s early recovery before paring back into the 1.0800 zone. The pair remains bolstered by the 200-hour Simple Moving Average (SMA) near 1.0760. The Fiber continues to grind out a near-term bullish recovery, but technical resistance continues to build as lower highs weigh.

EUR/USD remains trapped on the bearish side of the 200-day SMA at 1.0830, and the pair’s recent descent into 1.0700 represents the EUR/USD’s lowest bids since November. The pair is set for a fifth consecutive bullish close but is still down around 3% from December’s peak at 1.1140.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- The DXY index shows weakness as the US returns from holiday, trading modestly lower.

- No relevant reports were released during the session, while markets await fresh catalysts.

- All eyes are now on FOMC minutes from January’s Federal Reserve meeting on Wednesday.

The US Dollar (USD), as measured by the DXY index, is trading modestly lower at 104.05 with no relevant highlights seen during the European and American sessions.

Despite a post-holiday dip, the US Dollar's stance remains firm amidst a resilient US economy and a seemingly unshakeable Federal Reserve (Fed), whose reluctance to resort to monetary easing may eventually limit the Greenback’s losses.

Daily digest market movers: The US Dollar trades mildly lower ahead of FOMC minutes

- Markets await fresh drivers to continue timing the start of the Fed’s easing cycle. FOMC’s January Meeting Minutes are due on Wednesday.

- Market anticipation is also brewing for upcoming speeches from Federal Reserve members Bowman (Wednesday) and Kashkari (Thursday) to gather additional insights.

- According to the CME FedWatch Tool, the odds of a Fed cut have significantly declined for the March and May meeting as markets push the projected start of easing to June.

Technical analysis: DXY gives up 100-day SMA, more downside may be on the horizon

The daily chart indicators reflect the somewhat conflicted picture of the current technical landscape. Despite the Relative Strength Index (RSI) sitting in positive territory, its negative slope signals a weakening of bullish momentum, hinting at potential downside risks. Simultaneously, the green bars in the Moving Average Convergence Divergence (MACD) histogram are decreasing, indicating a slowdown in buying pressure and a potential shift in sentiment.

Furthermore, although the pair is trading above the 20 and 200-day Simple Moving Averages (SMAs), which suggests a traditionally bullish stance, the struggle of the bulls to effectively consolidate above the 100-day average puts the strength of the uptrend in doubt.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Gold reaches $2,028.44, climbing for the fourth day on China's rate moves and US inflation figures.

- US Treasury yields fall, showing market caution and adjusted expectations for Fed rate cuts amid inflation.

- Market anticipates FOMC minutes for clues on Fed's policy stance, bolstering Gold as an uncertainty hedge.

Gold price rallied for the fourth straight day during the mid-North American session as traders from the United States (US) got back to their desks and digested the latest economic news. News that China lowered interest rates sponsored Gold’s leg-up alongside the drop in US Treasury bond yields.

Meanwhile, last week’s data from the US, with the Consumer Price Index (CPI) and the Producer Price Index (PPI) smashing estimates, sounded alarms that inflation remains stickier than expected. The XAU/USD trades at $2,028.44, up 0.52%.

Trading resumed in the US on Tuesday after Monday's Presidents' Day holiday. US Treasury bond yields edged lower as depicted by the 10-year note yield down four basis points to 4.256%. This is despite investors adopting a cautious stance on the US Federal Reserve (Fed) as data from the Chicago Board of Trade (CBOT) expects the Fed to lower rates by 102 basis points in 2024, less than the 180 bps estimated in mid-January.

Nevertheless, the Greenback (USD) is treading water amid the lack of economic data on the US docket. Traders await the release of the last Federal Open Market Committee (FOMC) Meeting Minutes.

Daily digest market movers: Gold advanced despite investors pushing Fed rate cuts to June

- The CME FedWatch Tool sees traders expect the first 25 bps rate cut by the Fed in June 2024.

- Investors are pricing in 102 basis points of easing throughout 2024.

- The US Dollar Index, tracking the performance of the US Dollar against a basket of six major currencies, is currently trading within a narrow range around 104.20.

- The latest inflation reports from the US triggered a change of language from Fed officials, who struck a “cautious” tone. Atlanta Fed President Raphael Bostic suggested the Fed is in no rush to ease policy.

- San Francisco Fed President Mary Daly stated, “We will need to resist the temptation to act quickly when patience is needed and be prepared to respond agilely as the economy evolves.”

- This week the US economic schedule will feature the release of the latest Federal Reserve Open Market Committee (FOMC) Minutes alongside Fed officials' speeches beginning on Wednesday.

- Traders will get further cues from US S&P Global PMIs, Initial Jobless Claims data and the Chicago Fed National Activity Index, usually a prelude to the Institute for Supply Management's (ISM) Manufacturing PMI.

Technical Analysis: Gold stays above 100-day SMA, eyes key resistance near 50-day SMA

Gold´s daily chart portrays the non-yielding metal as neutral to downwardly biased despite staying above the 200-day Simple Moving Average (SMA) at $1,965.46 and extending its gains toward the 50-day SMA at $2,033.69. A breach of the latter will expose $2,050 ahead of the latest cycle high at $2,065.60.

On the flip side, if sellers step in and push prices below the $2,000 figure, that will expose the 100-day SMA at $1,998. The next stop would be the December 13 low at $1,973.13, followed by the 200-day SMA at $1,965.47.

Gold FAQs

Why do people invest in Gold?

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Who buys the most Gold?

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

How is Gold correlated with other assets?

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

What does the price of Gold depend on?

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- AUD/USD climbed after the RBA pondered rate cuts.

- The Aussie’s extended recovery got hampered after falling just short of 0.6580.

- Fed watchers will be pivoting to Wednesday’s FOMC Meeting Minutes.

The AUD/USD climbed on Tuesday, rebounding from the day’s low near 0.6520 to fall just shy of 0.6580 before pulling back into the day’s range. The Reserve Bank of Australia (RBA) held rates steady early Tuesday as markets broadly expected, but another rate hike is still in the ether and investors will be looking to suss out how close the Federal Reserve (Fed) is to cuttign interest rates when the Federal Open Market Committee’s latest Meeting Minutes drop on Wednesday.

The RBA held rates for the time being, but the Australian central bank’s internal dialogue appears to be leaning towards further rate cuts if faster progress isn’t made on inflation soon. With Australia’s lop-sided economy grappling with a tight labor market and still-high services inflation, the RBA expects it could take until well into 2025 before inflation reaches target levels.

RBA Minutes: Board considered a hike of 25bp or an on hold decision

With the potential for another rate hike on the table, the Aussie (AUD) climbed through Tuesday’s early trading session, before getting pared back during the US market window.

The mid-week trading session will see eyes on the Fed and its FOMC’s latest Meeting Minutes, slated to release at 19:00 GMT on Wednesday. Investors will be looking to see how close the Fed is to delivering interest rate cuts, with the market broadly expecting a first rate trim in June or July, according to the CME’s FedWatch Tool.

AUD/USD technical outlook

The AUD/USD found its highest bids in nearly three weeks on Tuesday, climbing towards 0.6580 but falling just short of the interim level before getting pulled back into 0.6550 on stiffer US Dollar (USD) flows. The pair is grappling with a low-conviction recovery from the last swing low into 0.6450, and bullish momentum is running into a technical ceiling at the 200-day Simple Moving Average near 0.6565.

Beyond near-term price action, a heavy resistance zone from 0.6620 to 0.6600 weighs on bullish momentum into the medium-term.

AUD/USD hourly chart

AUD/USD daily chart

- The EUR/GBP pair stands at 0.8555, suffering mild losses in Tuesday's session.

- Divergences between the ECB and BoE are driving the pair.

- Markets are fully pricing in a cut by the BoE in August.

In Tuesday's session, the EUR/GBP traded mildly lower at 0.8555 with the cross easing from daily highs following Andrew Bailey’s comments.

The Bank of England (BOE) Governor Andrew Bailey warned on Tuesday that the bank need not wait for inflation to reach the target before cutting rates and other than that he didn’t provide any fresh guidance stating that “I can't say when or how much rates will be cut”. Current market expectations perceive virtually no chance of a cut on March 21, rising to nearly 25% by May 9 and rising past 60% by June 20. Rate reductions are fully priced in by August 1.

On the European Central Bank (ECB) side, investors are seeing more easing than the BoE, between 100 and 125 bps, priced in to start in June. However, incoming data will shape the expectations and timing of the easing cycles.

EUR/GBP technical analysis

On the technical front, the Relative Strength Index (RSI) for the EURGBP pair shows a cooling momentum as it hovers within neutral territory. There's been a slight decrease in the daily RSI level suggesting a market slowdown. Meanwhile, as for the Moving Average Convergence Divergence (MACD), the histogram prints flat green bars, aligning with the RSI. Moreover, the overall trend is still negative as the pair trades below the 100 and 200-day Simple Moving Averages (SMA), but if the buyers hold above the 20-day average, the pair could see some additional upside.

EUR/GBP daily chart

- GBP/USD rises to 1.2643, driven by BoE Governor's positive outlook on UK economy and policy shifts.

- BoE's balanced view on inflation and rates boosts optimism, suggesting possible rate reductions amid employment achievements.

- US Leading Index and imminent FOMC minutes expected to offer more insights for GBP/USD in light of worldwide economic adjustments.

The Pound Sterling rose against the US Dollar in the mid-North American session as US traders got back to their offices. Reasons like the Bank of England (BoE) Governor Andrew Bailey stating that Britain’s economy could fare better than expected propelled the GBP/USD pair up. At the time of writing, the major exchanges hands at 1.2643, up 0.40%.

GBP/USD gains on positive economic signals from BoE officials, eyes Fed minutes

UK’s economic calendar featured BoE speakers. BoE’s Michael Broadbent said the question has moved on from the degree of policy restrictiveness to its duration. He added that more persistent components of inflation “may have peaked” while not ruling out policy easing at some time.

The BoE Governor Andrew Baily commented that the economy is recovering, highlighting that it is at full employment. He added, “We don’t need inflation to be back at target before cutting rates,” while noting that he can’t say when the BoE will ease policy.

At the same time, BoE’s member Swati Dhingra, which voted to cut rates, noted that downside risks to the UK economy are substantial due to the restrictiveness of the economy and added that consumption is still very weak.

A Reuters poll revealed the Bank of England would cut the Bank Rate to 4.75% in Q3 2024, while the UK economy is expected to expand by 0.3% in 2024 and 1.1% in 2025.

In the US, the economic docket remains light, though the US Conference Board is expected to reveal the Leading Index for January, which is estimated to plunge by 0.3% MoM. On Wednesday, the schedule will gather pace, with the release of the latest Federal Open Market Committee (FOMC) minutes and Fed speakers crossing the wires.

GBP/USD Price Analysis: Technical outlook

The GBP/USD is still range-bound but has edged towards the 50-day moving average (DMA) At 1.2671, the peak of that area, but retraced. However, a daily close above the February 19 high of 1.2629 could open the door for further gains. The next resistance would be the 50-DMA and 1.2700. Conversely, if sellers push the exchange rate below 1.2600, look for a fall to the 200-DMA at 1.2563.

- Mexican Peso faces pressure amid economic contraction concerns; falling US yields limit USD/MXN upside.

- INEGI's report shows Mexico's economy shrinking by 0.7% MoM, with a modest annual growth of 1.3%.

- US Treasury yield decline offers limited support to US Dollar as Conference Board's LEI dispels recession fears.

The Mexican Peso (MXN) lost traction against the US Dollar (USD) on Tuesday as traders from the United States (US) returned from the Presidents’ Day holiday. Monday’s data from Mexico suggests the economy most likely contracted in the first month of 2024, while a fall in US Treasury bond yields caps the USD/MXN upside. The pair exchanges hands at 17.04, up by a minuscule 0.06%.

A report from Mexico’s National Statistics Agency (INEGI) on Monday released the Indicator of Economic Activity (IOAE), which revealed the economy contracted -0.7% MoM, even though yearly figures grew by 1.3%. While data could have triggered weakness in the Mexican Peso, the US holiday capped the emerging market (EM) currency’s fall.

Across the border, US Treasury bond yields dropped, keeping the US Dollar pressured against most currencies, except EMs. In the meantime, the Conference Board (CB) revealed its Leading Economic Index (LEI), which no longer signals an upcoming recession in the US.

Daily digest market movers: Mexican Peso trips down as traders digest Monday’s data

- Mexico´s failure to resolve the steel and aluminum conflict with the US could weigh on the Mexican currency as US trade representative Katherine Tai warned Mexico that the US could reimpose tariffs on imports of the aforementioned commodities if the Mexican government doesn’t stop the increase in exports. US authorities question Mexico’s lack of transparency on imports of steel and aluminum from third countries.

- Mexico’s economic schedule will gather pace on Wednesday with the release of Retail Sales, Gross Domestic Product (GDP) and February’s Mid-Month inflation data.

- Mexico’s Retail Sales are expected to rise 0.2% MoM in December and 2.5% YoY.

- GDP is projected to have grown 0.1% in Q4 2023 and 2.4% YoY.

- Mid-month underlying inflation for February is foreseen cooling from 4.78% to 4.67 YoY, while headline inflation is projected to drop from 4.9% to 4.7%.

- On Wednesday, the US Federal Reserve (Fed) releases the latest Federal Open Market Committee (FOMC) Minutes alongside Fed officials crossing the wires.

- Traders will get further cues from US S&P Global PMIs, Initial Jobless Claims data and the Chicago Fed National Activity Index. The latter is usually a prelude to the Institute for Supply Management’s (ISM) Manufacturing PMI.

- US economic data related to price pressure should greatly influence Federal Reserve officials. Although opening the door to easing policy, Fed officials have expressed numerous times that they will not rush rate cuts.

- Fed’s Bostic said patience is required, and he foresees two rate cuts, which could begin in the summer if the data justifies it. Fed’s Daly said, “We will need to resist the temptation to act quickly when patience is needed and be prepared to respond agilely as the economy evolves.”

- Market players are expecting the first rate cut by the Federal Reserve at the June monetary policy meeting as they have trimmed odds for March and May.

Technical analysis: Mexican Peso prints minimal losses as USD/MXN breaks above 17.05

On Monday, I wrote, “The USD/MXN seesaws near the 17.05 mark, below the 50-day Simple Moving Average (SMA) at 17.09.” At the time of writing, the pair remains within the aforementioned level, though the Relative Strength Index (RSI) has begun to edge higher at the risk of shifting bullish. That and the USD/MXN clearing the 50-day SMA could open the door to test the 200-day SMA at 17.28. Further upside lies at the 100-day SMA at 17.38, before the pair rallies toward 17.50.

Conversely, sellers must drag the exchange rate below the 17.00 figure if they would like to remain hopeful of challenging last year’s low of 16.62.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

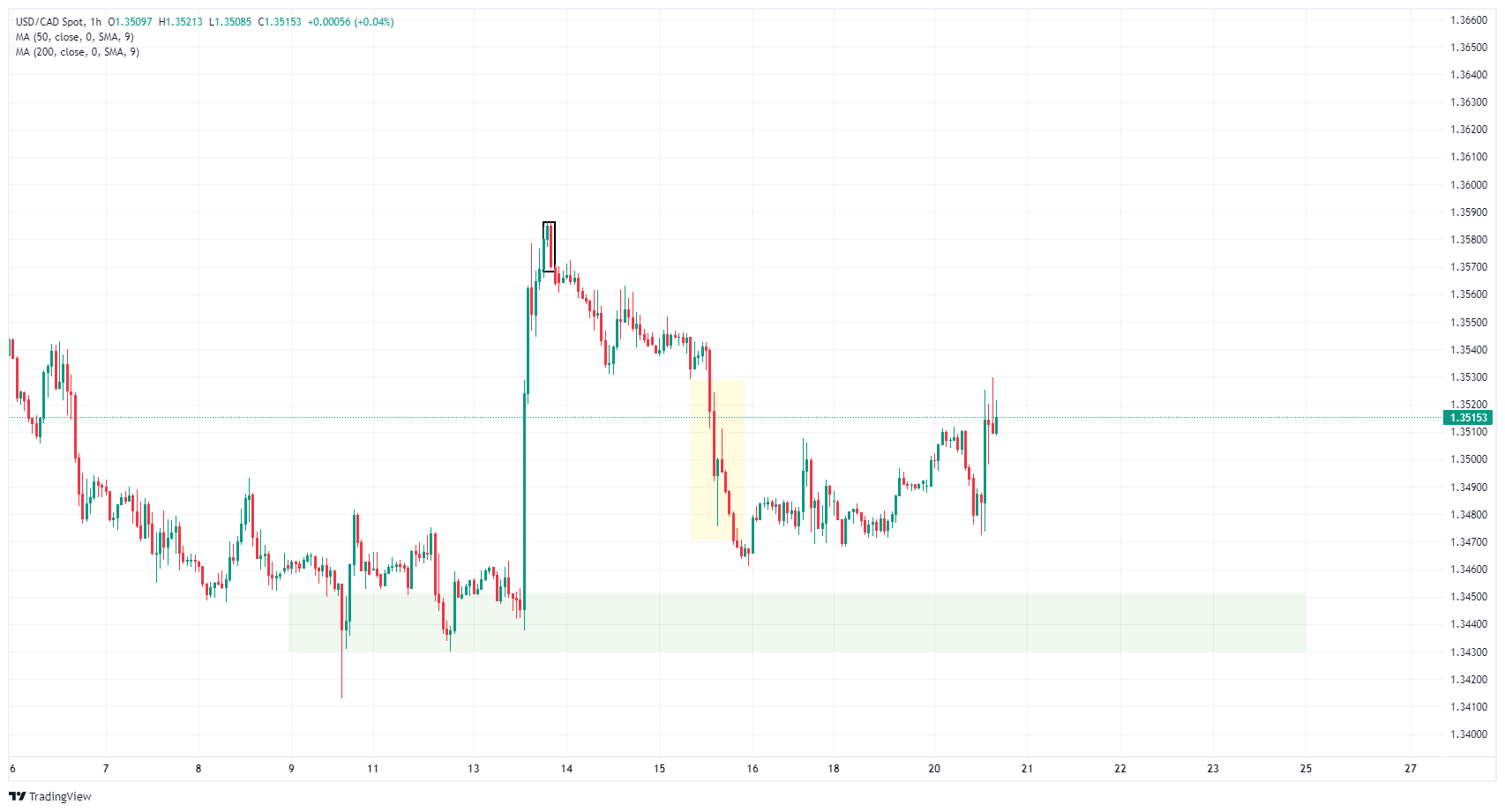

- USD/CAD saw early declines before getting bolstered by a weak Canadian CPI.

- Canadian CPI inflation fell to 2.9% from the previous 3.4% YoY.

- Wednesday’s FOMC Meeting Minutes in the barrel as investors focus on rates.

USD/CAD fell to a daily low of 1.3472 on Tuesday before rebounding into an intraday high of 1.3530 after Canadian Consumer Price Index (CPI) inflation fell faster than markets expected. A weaker-than-expected Canadian inflation print softened the Canadian Dollar (CAD) across the board.

Canadian Retail Sales figures are due Thursday, and markets will be pivoting to focus on the Federal Reserve (Fed) and the Federal Open Market Committee (FOMC). The FOMC’s latest Meeting Minutes will drop on Wednesday.

Daily digest market movers: USD/CAD grapples with 1.3500 after Canadian inflation recedes

- Canadian CPI inflation declined to 2.9% for the year ended January, well below the forecast tick down to 3.3% from the previous period’s 3.4%.

- January’s MoM Canadian CPI printed unexpectedly at 0.0% versus the forecasted rebound to 0.4% from the previous month’s -0.3%.

- The Bank of Canada’s (BOC) Consumer Price Index Core for the year through January also declined to 2.4% from 2.6%.

- Canada CPI inflation falls to 2.9% vs. 3.3% expected

- Investors will be focusing on the FOMC’s latest Meeting Minutes on Wednesday as traders hope for signs the Fed will move closer to rate cuts.

- According to the CME’s FedWatch Tool, money markets are giving a 60% chance of no rate cut in May and 80% odds of at least a 25 basis point cut in June.

- Markets are expecting Thursday’s Canadian Retail Sales to bounce in December.

- MoM Retail Sales are expected to print at 0.8% versus the previous -0.2%, while Retail Sales Excluding Automobiles is forecast to recover to 0.7% from -0.5%.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.40% | -0.47% | 0.10% | -0.46% | -0.28% | -0.52% | -0.30% | |

| EUR | 0.39% | -0.07% | 0.51% | -0.06% | 0.12% | -0.11% | 0.10% | |

| GBP | 0.47% | 0.08% | 0.59% | 0.00% | 0.19% | -0.04% | 0.17% | |

| CAD | -0.10% | -0.52% | -0.58% | -0.57% | -0.40% | -0.63% | -0.42% | |

| AUD | 0.47% | 0.07% | 0.00% | 0.57% | 0.18% | -0.05% | 0.17% | |

| JPY | 0.29% | -0.10% | -0.19% | 0.38% | -0.18% | -0.22% | -0.02% | |

| NZD | 0.51% | 0.11% | 0.04% | 0.63% | 0.06% | 0.23% | 0.22% | |

| CHF | 0.31% | -0.10% | -0.17% | 0.41% | -0.16% | 0.02% | -0.21% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: USD/CAD bounces on post-CPI CAD weakness

Tuesday’s climb into 1.3530 filled the Fair Value Gap (FVG) from 1.3530 to 1.3470, and the pair hangs in the midrange surrounding the 1.3500 handle. The nearest supply zone rests just below 1.3450 and represents a significant buy zone, while top-side pressure sees heavy selling around the Order Block (OB) near 1.3580.

Daily candlesticks remain caught in a significant congestion zone as bids consolidate near the 200-day Simple Moving Average (SMA). The pair is caught between December’s lows near 1.3177 and last November’s peak just shy of 1.3900.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Gold has almost recovered its losses which it had suffered following the strong US inflation data. Analysts at Commerzbank analyze the yellow metal’s outlook.

Gold investments would continue to be at a significant disadvantage relative to interest-bearing US assets

It appears that interest rate cuts are still likely this year, albeit at a slightly later date. This has been confirmed by statements from FOMC members. They had recently only questioned the market's early timing of a turnaround in interest rates, but not rate cuts per se.

Nevertheless, Gold's further upside potential is likely to remain limited. This is because a persistently robust US economy, coupled with stubbornly high inflation, argues against a pronounced cycle of rate cuts, meaning that Gold investments would continue to be at a significant disadvantage relative to interest-bearing US assets.

In Canada, the first Consumer Price Index (CPI) report in 2024 came in softer than expected. Economists at TD Securities analyze if the Bank of Canada (BoC) could pivot to interest rate cuts.

The BoC will continue to proceed cautiously

The January CPI report surprised to the downside with inflation falling 0.5pp to 2.9% YoY as prices held unchanged on the month. Airfares and core goods helped drive the deceleration while telecoms provided a source of strength. January also brought further progress on CPI-trim/median with 3m rates of core inflation running at 3.2%.

Today's report is a meaningful event for the near-term BoC outlook and should help reinforce rate cuts are coming. Still, we think the Bank will proceed cautiously and require further evidence of moderation before it shifts its stance.

Today's report will not be enough for the Bank to declare mission accomplished in March, but it does move the goalposts a little closer.

The US Dollar (DXY) Index climbed to a three-month high last week. However, economists at UBS do not expect the US Dollar (USD) rally to last.

USD to remain strong in the near term

While we expect the US currency to remain strong in the near term, we think it will weaken as Fed easing approaches-albeit at a slower pace than markets had been expecting in the first weeks of the year.

A renewed period of Dollar depreciation is especially likely given signals from other top central banks.

The Mexican Peso (MXN) continues to perform well and ride out Trump's fears. Economists at ING analyze MXN outlook.

Investors will favour the Mexican Peso

A 25 bps rate cut in March now looks likely. However, Banxico has said it will be very cautious in its rate cutting cycle and the starting point for real rates in the 6%+ area suggests the Peso does not have to sell off as easing starts.

Fourth quarter growth slightly disappointed last year, but consensus 2024 GDP growth is still 2.2% – which should be supported by loose fiscal policy this year. Elections in Mexico are held in June.

Factoring US elections is a tough call into the Peso, but a variety of positive factors suggests MXN outperforms its forward curve.

- EUR/USD climbs to 1.0833, lifted by Eurozone's widened current account surplus and quiet US market.

- ECB wage data and Lagarde's remarks indicate a measured easing stance, awaiting Q1 insights.

- US Leading Index and forthcoming FOMC minutes anticipated to guide EUR/USD amidst varying expectations.

The Euro extended its losses during the North American session, climbing above the 1.0800 figure after current account data in the Eurozone (EU) surpassed estimates. An absent economic calendar in the United States (US) after a holiday weakened the Greenback. The EUR/USD trades at 1.0833, up 0.52%.

EUR/USD gains on EU’s strength, eyes on Fed minutes

The EU’s Current Account surplus widened in December, exceeding estimates, rising to EUR 31.9 billion from EUR 22.5 billion a month earlier in seasonally adjusted figures. This means that, according to the yearly figures, the EU’s surplus increased to 1.8% of the bloc’s GDP from a deficit of 0.6% in the previous year.

Aside from this, the European Central Bank (ECB) revealed its indicator of wage settlements for last year’s Q4. Settlements dipped from 4.7% YoY to 4.5%. ECB’s President Christine Lagarde said that wage data will be vital in deciding when to begin monetary easing. According to BBG analysts, “ECB officials would probably like to see Q1 wage settlements (due out in May) before cutting rates, which points to June as the most likely choice. The market is pricing in less than 10% odds of a cut March 7, rising to 45% April 11 and fully priced on June 6.”

Across the pond, the US economic docket remains light, though the US Conference Board is expected to reveal the Leading Index for January, which is estimated to plunge by 0.3% MoM. On Wednesday, the schedule will gather pace, with the release of the latest Federal Open Market Committee (FOMC) minutes and Fed speakers crossing the wires.

EUR/USD Price Analysis: Technical outlook

The pair has jumped to the upside, in fundamental news from the EU, and is testing stir resistance at the 200-day moving average (DMA) at 1.0826. A daily close above that level could exacerbate a rally toward 1.0900 but, firstly, would need to reclaim the 50-DMA at 1.0891. Further upside is seen at around 1.0950. Conversely, if EUR/USD sellers keep the exchange rate below the 200-DMA, that could open the door to push the price below the 1.0800 mark. Once cleared, the next stop would be the February 20 low of 1.0761.

A host of economic releases and central bank communications have economists and markets pushing back the timing of interest rate cuts. National Bank of Canada’s forecast revisions respond to these same cues.

Patience and prudence pay off

While we never endorsed a March FOMC rate cut, the ongoing resilience of the US economy – combined with the most recent setback on the road to price stability – suggests Chair Powell & Co. could be in even less of a hurry to ease. True, the Fed is at least willing to discuss lower rates and most (all?) FOMC members believe less-restrictive policy will be appropriate before the year is out. But we now see July as a more likely timeframe for the first FOMC cut, the proverbial policy pivot pushed back one meeting vs. our prior forecast.

In starting later, we view it likely that cumulative policy rate relief will be on the order of 100 bps in the second half of this year, surpassing the median amount of easing implied by December’s ‘dot plot’ but less forceful than our prior thinking. Notwithstanding a non-trivial upgrade to our US growth forecast, distinctly sub-potential growth and a rising incidence of joblessness would make an argument for additional easing into 2025.

- USD/JPY falls to near 150.00 amid a sell-off in the USD Index.

- Fed policymakers warned that over-focusing on a one-time inflation increase could be a tremendous mistake.

- The BoJ may postpone plans of exiting the expansionary monetary policy stance.

The USD/JPY pair falls slightly below the psychological support of 150.00 in the early New York session on Tuesday. The asset has faced selling pressure as the US Dollar Index (DXY) has extended its downside to 104.00.

The USD Index has dropped to a weekly low as Federal Reserve (Fed) policymakers are confident that inflation is in the right direction despite a one-time stubborn-than-anticipated consumer price inflation data for January.

Fed policymakers advised that over-focusing on one-time blips in inflation data could be a tremendous mistake. As per the CME FedWatch tool, investors see interest rates remaining unchanged in the range of 5.25%-5.50% till the July policy meeting as the Fed needs more good inflation data for months.

The Japanese Yen performs better against the US Dollar despite easing hopes for the Bank of Japan (BoJ) quitting the decade-long ultra-dovish monetary policy stance. The Japanese Yen entered a recession in the second half of 2023. The situation of a poor domestic economy is an unfavorable situation for exiting the expansionary policy stance.

USD/JPY oscillates in a Symmetrical Triangle formation on an hourly time frame. The upward and downward-sloping borders of the aforementioned chart pattern are plotted from February 13 low and high at 149.27 and 150.88, respectively.

The triangle could breakout in either direction, however, the odds marginally favor a move in the direction of the trend before the formation of the triangle – in this case up.

The 50-period Exponential Moving Average (EMA) around 150.20 remains sticky to spot prices, indicates indecisiveness among market participants.

Going forward, a decisive break above February 13 high at 150.88 would drive the asset towards November 16 high at 151.43, followed by November 13 high at 151.90.

On the flip side, a breakdown below February 13 high at 149.27 would drag the asset towards February 5 high at 148.90. Breach of the latter would expose the asset to January 29 high at 148.32.

USD/JPY hourly chart

The 2024 US presidential and congressional elections are scheduled for 5 November. Strategists at HSBC list out some key dates to watch, together with moving parts that could impact the US Dollar.

Likely implications of US elections for the USD appear mixed

The multiple channels of influence mean the election can impact the USD in various ways, ensuring it cannot be ignored, even if the takeaways from each element end up creating a mixed picture for the USD. However, it is also important to remember that the USD’s path is not only determined by the election and that politics is just one part of the equation.

In summary, likely implications of US elections for the USD appear mixed, but, for now, we expect heightened uncertainty to support the USD.

Source: HSBC forecasts

Gold has been trading in a narrow range awaiting clues on the prospects for US interest rates. Economists at ING analyze the yellow metal’s outlook

Gold awaits clues on Fed outlook

Gold has been trading above $2,000 so far this week, with the market awaiting clues on the outlook for US interest rates.

The Federal Reserve is set to release minutes of its recent meeting midweek. We believe Fed policy will remain key to the outlook for Gold prices in the months ahead.

Higher borrowing costs are typically negative for Gold.

- USD/CAD rebounds strongly to 1.3500 as soft Canadian inflation data raise BoC rate-cut hopes.

- The USD Index remains under pressure as the Fed sees inflation moving in the right direction.

- Investors await the FOMC minutes for fresh guidance on interest rates.

The USD/CAD pair rises as Statistics Canada has reported softer-than-forecasted inflation data for January. The monthly headline inflation remained stagnant while investors anticipated a sharp rise of 0.4%. In December, the inflation data was contracted by 0.3%. The annual headline inflation rose at a slower pace of 2.9% from expectations of 3.3% and the former reading of 3.4%.

The core Consumer Price Index (CPI), published by the Bank of Canada (BoC), which excludes volatile food and oil items, decelerated to 2.4% from 2.6% in December. Monthly, the underlying inflation data rose slightly by 0.1% after deflating by 0.5% in December.

A slower-than-projected increase in inflation data is expected to push back expectations for the BoC, maintaining interest rates at 5% for longer.

Meanwhile, the market mood remains upbeat as the Federal Reserve (Fed) is confident that inflation is declining towards 2%, and the one-time increase in the Consumer Price Index (CPI) data for January is insignificant.

Investors see different price actions in risk-perceived assets. S&P500 futures have posted significant losses in the European session while risk-sensitive currencies have been underpinned against the US Dollar. The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, has printed a fresh five-day low near 104.00.

The US Dollar (USD) is losing ground as North American markets return from the long weekend. Economists at Scotiabank analyze Greenback’s outlook.

There is little or no faith in the USD’s new year rebound being sustained

USD sentiment had firmed up in the early part of this year; Friday’s CFTC data show large speculative trading accounts have slashed EUR longs and shifted to a small net USD long in aggregate through mid-February, the first bullish bet on the USD since November. However, risk reversals suggest weakening demand for topside USD protection in the past couple of weeks, rather suggesting there is little or no faith in the USD’s new year rebound being sustained. That would be in keeping with the typical seasonal pattern of trade (early year gains in the USD typically give way to weakness in Q2/Q3).

USD losses so far this week warrant attention as some currencies are starting the threaten the weak trend in place since the start of the year.

GBP/USD is little changed after pivoting narrowly around the 1.2600 level. Economists at Scotiabank analyze the pair’s outlook.

GBP pivots around mid-point of its recent trading range

Cable is trading about midway between recent range extremes (1.2525/1.2685).

Broader price trends are tilting somewhat bearish and trend momentum signals are supporting the soft undertone in price action. Recent Sterling losses towards 1.2500 have attracted better demand, however, and scope for significant GBP weakness looks limited in the context of some softening in the broader USD trend.

Look for more range trading for now.

- Major equity indexes in the US look to open modestly lower.

- Walmart and Home Depot reported quarterly earnings ahead of the opening bell.

- Federal Reserve will release the minutes of the January policy meeting on Wednesday.

Following a three-day weekend, US stock index futures opened on a bearish note but managed to erase a portion of the earlier losses.

At the time of press, S&P 500 futures were down 0.27%, Dow Jones futures were losing 0.28%, and Nasdaq futures were falling 0.36%.

What to know before stock market opens

- Dow Jones (DJIA) closed the previous week virtually unchanged at 38,628. S&P 500 lost 0.42% to close at 5,005.56 and Nasdaq fell 0.82% to 15,775.65.

- Retailer giant Walmart Inc. (WMT) reported an adjusted earning per share of $1.8 ahead of the opening bell on Tuesday. The company said that it expects consolidated net sales to rise in the range of 3%-4% and announced that it will buy smart-TV producer Vizio (VZIO) for about $2.3 billion.

- Home Depot Inc. (HD) said net income in Q4 was $2.8 billion and the adjusted earnings per share was $2.82. The company, however, said that if projects sales for the fiscal year 2024 to be below estimates, citing slowing demand for discretionary items such as flooring, furniture and kitchen, per Reuters.

- The Communication Services sector ended Friday in the red by 1.56% as the worst-performing major S&P sector, followed by the Real Estate Sector that shed 0.99% by the closing bell. On the flip side, Friday's largest-gaining sector was the S&P's Materials Sector, climbing 0.51% on the day.

- Applied Materials Inc. (AMAT) was the top S&P 500 gainer on Friday, rising 6.3% to end the day at $199.57. Digital Realty Trust Inc. (DLR) lost 8.3%, wrapping up Friday's trading at $136.22 as the biggest decliner.

- Palo Alto Networks Inc. (PANW), Public Storage (PSA) and Realty Income Corp. (O) will be among the top companies that will release quarterly earnings reports after the closing bell on Tuesday.

- The Federal Reserve will release the minutes of the January policy meeting on Wednesday. On Thursday, preliminary February Manufacturing and Services PMI reports for Germany, the Euro area, the UK and the US will be scrutinized by market participants.

- The Bureau of Labor Statistics reported on Friday that the Producer Price Index (PPI) for final demand in the US rose 0.9% on a yearly basis in January. This reading followed the 1% increase recorded in December but came in above the market expectation of 0.6%. The annual Core PPI rose 2% in the same period, compared to December's increase of 1.8%. On a monthly basis, the Core PPI was up 0.5% following the 0.1% decline recorded in the previous month.

- The University of Michigan's Consumer Sentiment Index improved modestly to 79.6 in February's flash estimate from 79.0 in January. The Current Conditions Index edged lower to 81.5 from 81.9 and the Consumer Expectations Index rose to 78.4 from 77.1.

- Inflation in the US, as measured by the change in the Consumer Price Index (CPI), softened to 3.1% on a yearly basis in January from 3.4% in December, the BLS reported on Tuesday. This reading came in above the market expectation of 2.9%. The Core CPI, which excludes volatile food and energy prices, rose 3.9% in the same period and matched December's increase, surpassing analysts' estimate of 3.7%.

S&P 500 FAQs

What is the S&P 500?

The S&P 500 is a widely followed stock price index which measures the performance of 500 publicly owned companies, and is seen as a broad measure of the US stock market. Each company’s influence on the computation of the index is weighted based on market capitalization. This is calculated by multiplying the number of publicly traded shares of the company by the share price. The S&P 500 index has achieved impressive returns – $1.00 invested in 1970 would have yielded a return of almost $192.00 in 2022. The average annual return since its inception in 1957 has been 11.9%.

How are companies chosen to be included in the S&P 500?

Companies are selected by committee, unlike some other indexes where they are included based on set rules. Still, they must meet certain eligibility criteria, the most important of which is market capitalization, which must be greater than or equal to $12.7 billion. Other criteria include liquidity, domicile, public float, sector, financial viability, length of time publicly traded, and representation of the industries in the economy of the United States. The nine largest companies in the index account for 27.8% of the market capitalization of the index.

How can I trade the S&P 500?

There are a number of ways to trade the S&P 500. Most retail brokers and spread betting platforms allow traders to use Contracts for Difference (CFD) to place bets on the direction of the price. In addition, that can buy into Index, Mutual and Exchange Traded Funds (ETF) that track the price of the S&P 500. The most liquid of the ETFs is State Street Corporation’s SPY. The Chicago Mercantile Exchange (CME) offers futures contracts in the index and the Chicago Board of Options (CMOE) offers options as well as ETFs, inverse ETFs and leveraged ETFs.

What factors drive the S&P 500?

Many different factors drive the S&P 500 but mainly it is the aggregate performance of the component companies revealed in their quarterly and annual company earnings reports. US and global macroeconomic data also contributes as it impacts on investor sentiment, which if positive drives gains. The level of interest rates, set by the Federal Reserve (Fed), also influences the S&P 500 as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

EUR/USD regains 1.0800. Economists at Scotiabank analyze the pair’s outlook.

Minor new cycle highs are adding to short-term technical strength

EUR/USD is trading higher for a fifth trading session on the trot and bearish pressure that had been accumulating on the chart since the start of January has been blunted by EUR progress to – and just about through – trend resistance (1.0785) off the late December peak.

Minor new cycle highs (above Feb 12th’s 1.0806) are adding to short-term technical strength in the EUR.

A squeeze higher towards 1.0900 may develop if the EUR can hold these gains.

- The US Dollar mildly in the red against most major peers.

- Markets are not moving on Loan Prime Rate cuts by China.

- The US Dollar Index trades away from the 104 marker and moves slightly higher.

The US Dollar (USD) is turning red with markets not applauding the overnight move by the People’s Bank of China (PBoC) to cut its 5-year Loan Prime Rate. China is playing in a whole other ballpark in terms of economic data with deflation, a sluggish job market, a haunted housing market and abating growth. The cuts are bigger than expected, though the market reaction is signalling more needs to be done in order to give China the boost to head back to its pre-pandemic growth and economic levels.

On the economic data front, The US Treasury will have its work cut out this Tuesday with no less than three bond auctions coming up. For more economic data, most data points are pushed forward to Wednesday due to the public holiday on Monday. All eyes are on the retailers in the stock markets this week with Walmart and Home Depot releasing earnings this Tuesday.

Daily digest market movers: Tuesday is the new Monday

- European bond yields are jumping higher against US bond yields this Tuesday after the European Central Bank (ECB) released a report that revealed wages in the Eurozone are still remaining elevated, which could add to sticky inflatoin in the coming months, pushing back on current rate cut expectations. This pushes the Euro up against the US Dollar to 1.08, a level not seen since February 2nd.

- China has lowered its Loan Prime Rate in the following maturities:

- 1-year tenor unchanged at 3.45% where 3.40% was expected.

- the 5-year tenor cut from 4.20% to 3.95%, where 4.10% was expected.

- European car sales jumped 11% in January.

- Near 13:55 GMT the Redbook Index is due to be released. Previous was for 2.5%.

- The US Treasury department is doing a triple auction at 16:30 GMT. A 3-month, a 6-month and a 52-week bill will be auctioned.

- Equities are looking for direction ahead of the retailer earnings in the US before the US opening bell. Chinese equities are not really jumping on the Loan Prime Rate cut in China. European equities are mildly lower in European trading together with US equity futures.

- The CME Group’s FedWatch Tool is now looking at the March 20th meeting. Expectations for a pause are 91.5%, while 8.5% for a rate cut.

- The benchmark 10-year US Treasury Note trades a little bit higher, near 4.29%, after its close on Friday at 4.28% and being closed over Monday due to the US public holiday.

US Dollar Index Technical Analysis: Do not get trapped

The US Dollar Index (DXY) is holding its ground above 104 though pressure is mounting again on the support level. This does not mean anything substantial as this Tuesday is actually Monday after the US was closed due to President’s Day. Expect to see traders catch up, with the first moves taking place on Wednesday in the buildup to the US Federal Reserve Minutes release on Wednesday evening.

Should the US Dollar jump to 105.00 by Friday, 105.12 is a key level to keep an eye on. One step beyond there comes 105.88, the high of November 2023. Ultimately, 107.20 – the high of 2023 – could even come back into scope, but that would be when several inflation measures are coming in higher than expected for several weeks in a row.