- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- NZD/USD edges higher to 0.5920, gaining 0.08% on the day.

- A Federal Reserve (Fed) pause is widely expected while keeping one more rate hike on the table.

- Market players will monitor the Fed policy meeting, New Zealand growth data this week.

The NZD/USD pair posts modest gains and trades in positive territory for the second consecutive day during the early Asian session on Tuesday. The modest uptick in the Kiwi (NZD) is supported by a weaker US Dollar (USD) as the markets anticipate that the Federal Reserve (Fed) to maintain the interest rate unchanged at its meeting on Wednesday.

In the quiet day of New Zealand's economic docket, the headline surrounding China’s economic woes remains in focus. Any signs of an economic slowdown in China could drag the China-proxy Kiwi lower against the US Dollar and act as a headwind for the NZD/USD pair. Statistics New Zealand will release the nation’s Gross Domestic Product (GDP) for the second quarter on Thursday. The previous growth number came in at -0.1% and 2.2% on quarter and annual basis, respectively.

On the other hand, a Fed pause is widely expected, while keeping one more rate hike on the table. According to the CME Fedwatch tools, the Fed is not expected to surprise the markets, with the probability of keeping rates unchanged at 99%. The press conference by Fed Chairman Jerome Powell could offer hints about future interest rates path Any dovish stance from officials might trigger a decline in the US Dollar (USD).

Moving on, market participants will closely watch the Fed policy meeting on Wednesday at 18:00 GMT with the Fed widely expected to hold interest rates unchanged at 5.5%. The attention will shift to the press conference by Fed Chairman Jerome Powell at 18:30 GMT for some hints about the ‘dot plot’ and inflation expectations. Later this week, the New Zealand Gross Domestic Product (GDP) for the second quarter (Q2) will be due on Thursday. These figures could give a clear direction to the NZD/USD pair.

- Copper down to $8,375 per ton, or $8.30 per kilogram.

- Copper has come under downside pressure throughout the year as demand remains weak.

- The market is struggling to increase copper demand as the Chinese economy risks stalling out.

Copper price per kilogram fell back to $8.30 on Monday after rising to a weekly high of $8.42 last Friday, and the red metal continues to struggle on the low end after the year’s rapid climb to $9.435 in January.

China’s beleaguered economic recovery has seen copper rangebound for the last quarter as prices struggles to gain traction. Chinese officials have spent significant time, effort, and resources trying to keep the Chinese economy in a successful ‘jumpstart’ state, but buyers have thus far remained largely unconvinced.

Copper down on Chinese weakness

Nearly a quarter of all Chinese copper demand comes from the construction and housing industries, with another fifth coming from consumer goods demand. Both sectors have been hammered recently, with a short-term crisis sprouting in the housing sector and waning consumer demand.

The fourth quarter is expected to bring further declines in Chinese demand growth, keeping copper prices pinned to the low end.

Chinese smelters and metal processors have posted some of their worst profitability in over ten years, driven by both a lack of domestic demand and export figures that have struggled to accelerate growth.

China is expected to resume providing stimulus programs that are targeted at bolstering domestic demand, but copper investors will be waiting for solid evidence that efforts from Chinese central planners have taken hold before stepping up prices meaningfully.

- AUD/JPY remains largely unchanged at 95.01, but recent price action suggests a possible correction could be on the horizon.

- The pair has formed a ‘bearish-harami’ candlestick pattern on the daily chart, indicating potential downside risks.

- Short-term outlook turns bearish as the pair falls below the Kumo.

The Australian Dollar (AUD) trimmed some of its last week’s gains versus the Japanese Yen (JPY), which dropped 0.05% on Monday. However, as the Tuesday Asian session begins, the AUD/JPY hovers at around 95.01, unchanged.

From a daily chart perspective, the AUD/JPY is neutral to upward biased. Still, price action during the last couple of days suggests the cross-currency pair is headed for a correction, as it formed a ‘bearish-harami’ candlestick pattern formed by an inverted hammer and a doji. Hence, the cross-first support would be the 95.00 figure, followed by the top of the Ichimoku Cloud (Kumo) at 94.74, followed by the Tenkan-Sen line at 94.56, and followed by the Kijun-Sen at 94.17.

Short-term, the cross-currency pair has fallen below the Kumo, suggesting the pair turned bearish bias. To resume its downtrend, AUD/JPY sellers must drag prices below the September 18 swing low of 94.78. That would reaffirm the bearish bias and open the door to test the September 14 swing low of 94.50, followed by an upslope support trendline around 94.20/40. A decisive break and the 94.00 threshold would be next.

AUD/JPY Price Action – Hourly chart

AUD/JPY Technical Levels

Foreign holdings of US Treasuries rose in July for a second straight month despite an uncertain interest rate outlook muddied by a mixed set of economic figures, the Treasury Department showed on Monday, according to Reuters.

Key quotes

"Total holdings of U.S. Treasuries climbed to $7.655 trillion in July, up from $7.562 trillion in the previous month. Compared to a year earlier, overseas holdings were up 2.2%."

"China's stash of Treasuries dropped to $821.8 billion, the lowest since May 2009, when it had $776.4 billion."

"Analysts said China has been under pressure to defend its weakening currency, the yuan, and the selling of US debt may have been used for intervention purposes to prop it up."

"There is a huge inflow into US Treasury debt despite a lot of volatility in rates in July,"

"Japan is still the largest non-U.S. holder of Treasuries with $1.112 trillion in July, up from $1.105 trillion in June."

Market reaction

The above statement fails to move the needle around the Australian Dollar. AUD/USD is trading at 0.6437, gaining 0.01% on the day.

- AUD/USD trades sideways around 0.6437 amid the cautious mood.

- Markets expect the Reserve Bank of Australia (RBA) to keep its cash rate at 4.10% for the third consecutive month.

- Federal Reserve (Fed) is not expected to surprise the markets, with the probability of keeping rates unchanged at 99%.

- Market players await the RBA Meeting Minutes ahead of the Fed rate decision.

The AUD/USD pair consolidates in a tight range below the mid-0.6400s during the early Asian session on Tuesday. Markets turn cautious ahead of the Reserve Bank of Australia (RBA) interest rate decision later in the day. The pair currently trades near 0.6437, gaining 0.01% on the day.

Michele Bullock began her seven-year term as RBA governor after taking over from Philip Lowe on Monday. She stated that she will inherit an economy with moderating inflation, robust employment, and continued development. The RBA Minutes are scheduled for Tuesday, and markets expect the Australian central bank to keep its cash rate at 4.10% for the third month in a row. However, the possibility of a rate hike in November cannot be ruled out, if inflation remains sticky. Furthermore, investors will take cues from the board's views on the downside economic risks as well as the spillover effects of China's economic downturn on Australia.

On the other hand, market participants await the US Federal Reserve's (Fed) policy announcement on Wednesday, while the central bank is widely expected to halt interest rates. According to the CME Fedwatch tools, the Fed is not expected to surprise the markets, with the probability of keeping rates unchanged at 99%. Nonetheless, the press conference by Fed Chairman Jerome Powell could offer hints about future interest rates path and this event will be closely watched by traders.

Looking ahead, the RBA Meeting Minutes will be the highlight on Tuesday and might trigger the volatility in the major pair. Later in the day, the US Housing Starts and Building Permits will be due. The attention will shift to the Fed policy meeting on Wednesday. Traders will take cues from the statement and find trading opportunities around the AUD/USD pair.

- DXY retreats 0.25% to 105.06, marking consecutive days of losses, as falling US Treasury yields and risk-on sentiment weigh on the greenback.

- Technical indicators point to a golden cross, with the 50-day and 200-day Moving Averages nearing convergence.

- A hawkish hold from the Fed could propel the DXY towards March highs, while a dovish tone may send it tumbling to key support levels.

The US Dollar Index (DXY), a basket of six currencies that trades against the US Dollar, retreats a minuscule 0.25%, sponsored on a risk-on impulse and falling US Treasury bond yields, ahead of the Federal Reserve’s September meeting. Hence, the DXY is trading at 105.06, printing back-to-back days of losses.

From a technical perspective, the DXY is about to achieve a golden cross, with the 50-day Moving Average (DMA) closing into the 200-DMA, each at 102.83 and 103.02, respectively. In addition, the DXY reached a new five-month high at 105.43, breaking the previous resistance, so the trend is up from a market structure perspective.

If the Fed delivers a hawkish hold, the DXY could test the March 8 swing high at 105.88, followed by the 106.00 threshold. A breach of the latter could expose the November 30 daily high at 107.19

Conversely, the DXY first support would be the 105.00 mark. If sellers reclaim that level, the next support would be a three-month-old upslope support trendline at around 104.40/60, followed by the 104.00 figure.

US Dollar Index Price Action – Daily chart

US Dollar Index: Technical levels

- The AUD/NZD lacks conviction for Monday, ending near where it started.

- The RBA is due early Tuesday with a new face at the helm of the organization.

- NZ GDP, Aussie PMIs to round out the thin data week.

The AUD/NZD pair spread to the middle for Monday, unable to develop momentum as the Reserve Bank of Australia (RBA) comes in for a landing early Tuesday.

The RBA held rates on pause for the third straight month at the Australian central bank’s last meeting, which was also the last appearance of Phillip Lowe as the RBA’s Governor.

Former Deputy Governor Michelle Bullock replaces Lowe at the helm of the RBA today. Markets are broadly not expecting Bullock to rock the boat with any policy changes for her first appearance as the RBA’s Governor.

Lowe's out, Bullock's in at the RBA

Governor Bullock has already stated that the RBA’s stance moving forward will be firmly data-dependent, and Governor Bullock will be preoccupied with significant structural changes underway at the RBA.

At the urging of the Australian government, the RBA will be implementing operational adjustments that are expected to streamline the central bank. Most notably, the RBA will be moving to a twice-quarterly appearance schedule, from the current monthly outing.

Wednesday will bring New Zealand’s Gross Domestic Product (GDP) figures into focus. Quarter-on-quarter figures for the diminutive Antipodean economy last printed a meager 0.1% decline, and Kiwi traders will want to keep an eye on the updated figures for 2023’s second quarter.

NZ trade balance figures and Australia’s Purchasing Manager Index (PMI) data will also be dropping on Thursday to round out the week’s Oceania economic data docket.

AUD/NZD technical outlook

The AUD/NZD pair has twisted to the upside in recent weeks, clipping into a seven-week high last Thursday, but the Aussie-Kiwi pairing remains constrained by unconvinced market sentiment in either direction.

Daily candlesticks have the pair supported by the 200-day Simple Moving Average (SMA) from 1.0817. Higher lows from August’s opening prices near 1.0750 are bolstering upside gains, with price action getting a bump from the 34-day Exponential Moving Average climbing into the 1.0850 neighborhood.

AUD/NZD daily chart

AUD/NZD technical levels

- EUR/JPY advanced near 158.00, setting a consecutive day of gains.

- Bullish momentum is fading, and indicators signal further downside.

- Bulls are struggling to gain the 20-day SMA.

On Monday, the EUR/JPY cross slightly advanced, near the 157.80 zone. Still, the pair could see further consolidation if the bull fails to reclaim the 20-day Simple Moving Average (SMA) at 158.00.

In line with that, indicators on the daily chart exhibit signs of bullish exhaustion, contributing to a neutral to bearish technical perspective. The Relative Strength Index (RSI), despite seeing a positive slope above its midline, displays a clear downward trend since mid-August, while the Moving Average Convergence (MACD) shows neutral red bars. Additionally, the pair is below the 20-day Simple Moving Average (SMA) but above the 100 and 200-day SMAs, indicating that the bulls still have the upper hand when looking at the broader picture. However, the pair got rejected by the 20-day SMA at 158.00 during September, which contributed to the pair losing momentum and left the door open for further downside.

Support levels: 157.00, 155.00, 154.60 (100-day SMA)

Resistance levels: 158.00 (20-day SMA), 158.50, 159.00.

EUR/JPY Daily Chart

-638306707527807935.png)

- US equities take a minute to digest, spreading into the middle for Monday.

- S&P 500, DJIA, and NASDAQ all post slim gains for Monday as markets go quiet.

- Fed rate call promises plenty of action for the mid-week.

The Standard & Poor’s (S&P) 500 US equity index wrapped up Monday markets barely changed on the day, near $4,453.00 as US equities take a breather before the Federal Reserve (Fed) drops their latest rate call on Wednesday.

Fed to bring rate call, economic projections in the mid-week

The S&P saw thin trading for Monday as investors gear up for the latest showing from the Fed and its Federal Open Market Committee, which is expected to hold rates steady at the next meeting slated for Wednesday.

The US central bank is set to stand pat on interest rates, and investors will be paying close attention to the FOMC press conference to follow the rate call, looking for any hints about the path forward on the rate hike cycle.

The FOMC will also be releasing their updated inflation expectations for the US economy alongside the Fed’s latest monetary policy statement.

American equities spread their bets on Monday, with the S&P 500, Dow Jones Industrial Average (DJIA), and NASDAQ Composite indexes all wrapping up the day near where they started. The S&P finished the big winner, gaining a scant 0.07% during market hours.

The DJIA and the NASDAQ competed in a slow race, with the indexes closing +0.02% and 0.01% respectively. The DJIA heads into the overnight session trading into $34,625.00 while the NASDAQ sits just above $13,710.00.

S&P 500 technical outlook

The S&P 500 is tipping into support from the rising trendline baked in from March’s lows near $3,800.00, and continued downside will see support from the 100-day Simple Moving Average (SMA) at $4,376.00.

The 200-day SMA sits well below price action near $4,190.00, and market prices are being constrained by a sideways 34-day Exponential Moving Average (EMA), and a lack of meaningful directional momentum is seeing technical indicators drift into their midpoints.

Current chart patterns see a floor from the last swing low eat $4,350.00 and the ceiling marked in from September’s high point near $4,540.00.

S&P 500 daily chart

S&P 500 technical levels

- USD/SEK soared to 11.249, its highest since early November 2022.

- Riskbank is expected to hike 25 bps to 4%.

- The Fed will likely deliver a hawkish pause.

The USD/SEK saw volatility on Monday, rising to a high since November 4, 2022, then settling at 11.122, securing daily losses. The USD trading somewhat soft, and the Krona holding its ground ahead of one last hike by the Riksbank on Thursday contributed to the pair movements.

In line with that, markets are confident that the Riksbank will deliver its last hike of 25 bps of its tightening cycle to 4%. The Swedish bank will also release updated macro forecasts, and Governor Thedeen will be on the wires on Friday. For the rest of the year, investors are discounting that there won’t be any more hikes and that the policy rate will peak at 4.05% in Q2 2024.

On the Fed’s side, markets practically priced in a pause on Wednesday but a hawkish one. The bank will likely try to convince markets that the policy will still depend on incoming data and will leave the door open for further hikes. In the meantime, according to the CME FedWatch tool, investors are placing 35% odds on one last hike of 25 bps in November or December, but those odds will rise and fall according to the outcome of the incoming data.

In addition, the Fed will release an updated macro forecast and revised dot plot, which will likely set the pace of the USD price dynamics and the expectations for the upcoming meetings.

USD/SEK Levels to watch

The daily chart highlights a neutral technical outlook for USD/SEK as signs of bullish exhaustion become evident, but still, the pair remains in multi-month highs. The Relative Strength Index (RSI) indicates a decrease in upward momentum with a negative slope above its midline, while the Moving Average Convergence (MACD) lays out neutral green bars. Furthermore, the pair is above the 20,100,200-day Simple Moving Average (SMA), indicating buyers command the broader perspective.

Support levels: 11.0960, 11.0650, 11.0550.

Resistance levels: 11.175, 11.205, 11.249.

USD/SEK Daily Chart

-638306679294940708.png)

- The EUR/GBP pair is set to confirm a bullish breakout as the Pound Sterling steps lower.

- With the ECB’s latest rate call in the rearview mirror, focus turns to the BoE’s upcoming rate hike.

- The trading week will cap off action with PMI data for both the EU and the UK.

The EUR/GBP is grinding higher to kick off the trading week, decisively climbing over the 0.8600 handle and extending upwards as the Bank of England (BoE) looms over the horizon.

Sterling bulls need to survive Wednesday's inflation figures before BoE rate call

The BoE is broadly expected to lift the benchmark interest rate 25 basis points to 5.5% on Thursday, but market action will be positioning early as inflation figures for the British economy will land on Wednesday beforehand.

The UK’s Consumer Price Index (CPI) will hit markets at 06:00 on Wednesday, with the headline inflation figure for August forecast to show a step up to 0.7%, compared to the previous decline of -0.4%.

Thursday sees the BoE lifting interest rates once more as the UK’s central bank struggles to gain firm control of inflation, with prices continuing to tick higher despite already-high interest rates threatening to tip over the British economy.

The European Central Bank’s (ECB) rate hike last week hit the Euro hard after the ECB’s President Christine Lagarde noted that this is looking like the end of the ECB’s rate hike cycle. Investors will now be turning to the BoE’s upcoming showing to reposition the EUR/GBP exchange rate.

Further into the week, both the EUR and the GBP will see Purchasing Manager Index (PMI) figures. The EU’s pan-continent activity outlook is expected to tick slightly lower to 46.3 versus the previous 46.7. On the UK side, purchasing manager expectations are expected to hold steady at 48.6.

EUR/GBP technical outlook

The Euro-Pound Sterling pair is bounding higher for Monday, clipping into six-week highs as the GBP waffles ahead of the week’s central bank showing.

The EUR/GBP has broken north of a descending trendline from mid-July’s peak of 0.8700, and continued bullish momentum will be capped off by the 200-day Simple Moving Average (SMA) currently floating just above 0.8710.

Despite Monday’s bullish bust-out, prices remain relatively consolidated for the EUR/GBP pair, and market sentiment will be quick to pull the plug and reverse direction if bullish momentum hesitates too strongly from 0.8660, and level that has capped the pair recently.

EUR/GBP daily chart

EUR/GBP technical levels

The Reserve Bank of Australia will release the minutes of its September meeting on Tuesday. Later in the day, Eurostat will release the final CPI (Consumer Price Index). Canada is scheduled to release August inflation data, while the US will report on Housing Starts and Building Permits.

Here is what you need to know on Tuesday, September 19:

The US Dollar Index (DXY) experienced a modest decline but remained above 105.00 on a calm Monday. It marked the first daily loss after nine consecutive days of gains. This correction occurred during a quiet trading session as market participants awaited central bank meetings. On Wall Street, stocks opened the week with marginal gains, while US Treasury yields remained relatively stable.

On Tuesday, housing data including Housing Starts and Building Permits will be released. The FOMC (Federal Open Market Committee) meeting begins. No change in interest rates is expected, but market focus will be on the dot plot, which represents policymakers' projections of future interest rates, as well as the press conference by Fed Chair Powell.

ANZ on FOMC meeting:

We continue to see Fed policy as highly data-dependent, at the same time patient, with most officials open to further rate hikes if appropriate. Our view is the Fed is done with its tightening cycle, but risks remain that further rate hikes may be needed.

EUR/USD rose for the second consecutive day, encountering resistance at the 1.0700 area. However, the overall trend remains bearish. Eurostat will release the final reading of the Eurozone Consumer Price Index (CPI), which is expected to offer no surprises. Also, they will publish the July Current Account figures.

The Pound continued to show weakness; GBP/USD failed to recover beyond the 1.2400 level. It ended the day unchanged after reaching new monthly lows. Meanwhile, EUR/GBP recorded its highest daily close in a month, surpassing the 0.8600 mark. UK consumer inflation data will be released on Wednesday, and the Bank of England will announce its monetary policy decision on Thursday.

USD/JPY traded in a sideways manner and recorded slight losses. The crucial resistance level to watch is around 148.00. The Bank of Japan will announce its monetary policy decision on Friday.

USD/CHF held near September highs and settled around 0.8670; it continues to look at the 0.9000 area. Switzerland will report trade data on Tuesday, and on Wednesday, the Swiss National Bank (SNB) will hold its monetary policy meeting; a 25 basis points rate hike is expected.

The Canadian Dollar continued to outperform, causing USD/CAD to reach its lowest daily close in over a month, falling below 1.3500. The following key support level to monitor on the downside is the 200-day Simple Moving Average (SMA) at 1.3460. On Tuesday, Canada is set to release the August Consumer Price Index (CPI), with expectations of an annual rate rebounding to 3.8% from 3.3%. This would signal a second consecutive acceleration in CPI.

AUD/USD maintained a sideways movement, hovering around the 20-day Simple Moving Average (SMA) at 0.6420. The Reserve Bank of Australia (RBA) is scheduled to release the minutes of its August policy meeting, during which policymakers decided to keep the cash rate unchanged at 4.1%.

NZD/USD climbed back above 0.5900. The pair lacks a clear direction and remains tilted towards the downside as the price remains below the 20-day SMA. The Westpac Q3 Consumer Survey is set to be released on Tuesday.

Like this article? Help us with some feedback by answering this survey:

- USD/CHF trades at 0.8977, a marginal gain of 0.01%, as investors await the Federal Reserve’s policy decision and updated economic projections.

- Market odds for a November rate hike by the Fed dip below 30%, potentially setting the stage for USD weakness.

- Swiss National Bank expected to hike rates by 25 basis points to 2%.

The US Dollar (USD) posts minuscule gains against the Swiss Franc (CHF), ahead of monetary policy decisions by the US Federal Reserve (Fed) and the Swiss National Bank (SNB). At the time of writing, the USD/CHF is trading at 0.8977, gaining 0.01% after hitting a daily low of 0.8949.

US Dollar and Swiss Franc locked in a tight range ahead of pivotal monetary policy updates from the Federal Reserve and Swiss National Bank

Market sentiment improved, as shown by Wall Street’s finishing with solid gains as investors await the Federal Reserve to keep rates unchanged at Wednesday’s meeting. The Fed Chair Powell and Co will also update its Summary of Economic Projections (SEP), which drafts the US central bank economic outlook for the remainder of 2023 and subsequent years.

The outcome of the US central bank is crucial, as investors expect no further hikes, as odds for the November meeting dropped below 30%, as outlined by the CME FedWatch Tool. That could pave the way for US Dollar weakness, hence a headwind for the USD/CHF pair.

On the other hand, the Swiss National Bank (SNB) would likely hike rates by 25 bps, towards 2%, seen as investors as peak rates, according to money market futures. Although the latest inflation report in Switzerland witnessed a 1.6% YoY uptick, it remains below the central bank’s 2% target. Nevertheless, the SNB would likely maintain its restrictive stance to stabilize prices.

USD/CHF Price Analysis: Technical outlook

From a technical standpoint, the major is set to extend its rally, reaching a new multi-month high of around 0.8982. Buyers are still eyeing the 0.9000 figure, followed by the 200-day Moving Average (DMA) at 0.9038. On the flip side, if USD/CHF breaks below 0.8949, that could open the door to test 0.8900.

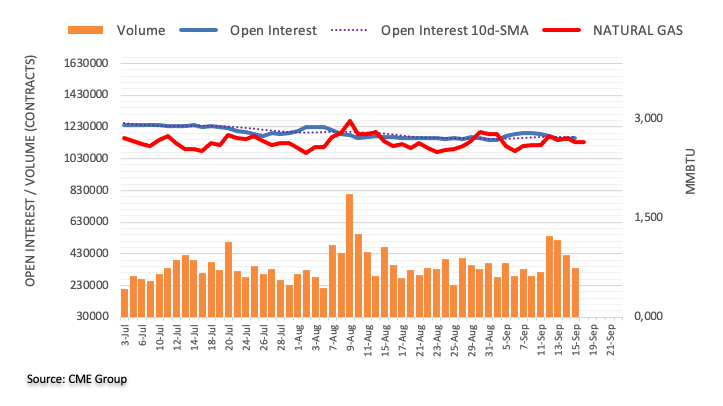

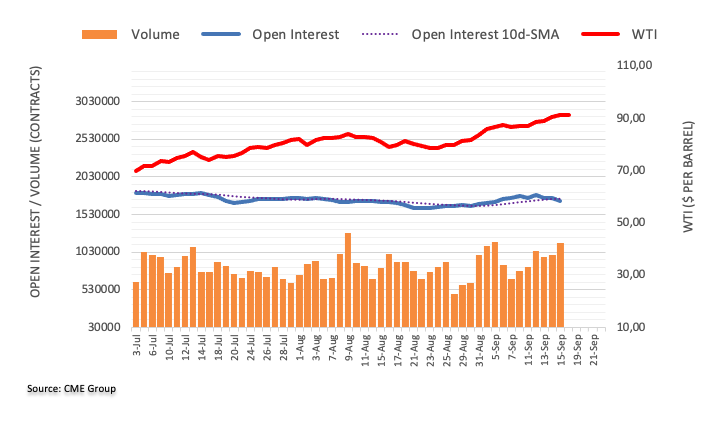

- WTI trades at $90.48 per barrel, up 0.09%, amid Saudi Arabia and Russia’s 1.3 million barrel production cuts aimed at market stabilization.

- Citi Bank and Chevron’s CEO predict Brent crude could surpass the $100 per barrel mark, signaling bullish sentiment in the oil market.

- Upcoming central bank decisions, particularly from the Fed, could impact WTI prices; a hawkish hold may strengthen the USD and pressure oil lower.

Western Texas Intermediate (WTI), the US crude oil benchmark, rises courtesy of supply tightness. At the same time, uncertainty about global demand sparked a jump in WTI, which trades above the $90 per barrel at $90.48, printing modest gains of 0.09%.

Western Texas Intermediate (WTI) hovers near year-to-date highs, bolstered by OPEC+ production cuts and market speculations on future demand

Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman, defended the Organization of Petroleum Export Countries and its allies (OPEC+) crude oil cuts needed to stabilize the markets amid uncertainty on China’s demand.

A few months ago, Saudi Arabia and Russia established cuts of 1.3 million barrels of crude production to stabilize oil prices as demand remains fragile. Since then, the Brent and WTI crude oil have climbed for three consecutive weeks.

In the meantime, analysts begin to upwardly revise oil prices for the end of 2023 and 2024. Citi was the last bank that predicts Brent would surpass $100 a barrel this year, echoing comments made by Chevron’s CEO Mike Wirth, who said oil would cross that threshold.

Aside from this, WTI could witness a dip as the global economic agenda would feature central bank decisions, mainly focused on the Fed. If the US Federal Reserve delivers a hawkish hold, that could underpin the Greenback (USD) to the detriment of US dollar-denominated assets.

WTI Price Analysis: Technical outlook

Since August 24, WTI has gained close to 18% and has reached a new year-to-date (YTD) high of $91.29. Oil price is set to extend its gains towards the November 2022 high at $92.92, but price action appears to have peaked, as WTI is forming a doji, meaning that neither buyers nor sellers are in charge. Further upside is seen at $92.00 before the November 2022 high is tested. Conversely, a drop below today’s low of $89.85 could open the door toward a deeper correction, with sellers eyeing $88.00.

- USD/BRL declined towards 4.8475 and has already lost more than 2% in September.

- On Tuesday, markets expect the central bank's primary surplus to come in at BRL 16.8 billion.

- The USD trades soft, consolidating ahead of Wednesday’s Fed meeting.

In Monday’s session, the USD/BRL continued to lose ground and has already tallied a 2.17% decline in September, falling to its lowest point since mid-August at 4.8475.

On the BRL’s side, it is gaining ground as the Brazilian government has taken up fiscal reforms, which are expected to positively impact the government’s account. On Tuesday, budget data will be reported, with the primary surplus expected to have doubled to BRL 16.8 billion in relation to March’s BRL 7.1 billion. In addition, the Real may also gather momentum on the outcome of Gross Domestic Product (GDP) and Trade data on Thursday.

On the USD side, it is trading soft against its rivals, with its DXY index consolidating. However, the US Treasury yields are still high, cushioning its losses. Regarding the Wednesday Federal Reserve (Fed) meeting, markets expect a hawkish pause, with the bank signalling that the tightening cycle isn’t done yet. Investors will also monitor fresh macro forecasts and revised dot plots to continue modelling their expectations towards the upcoming meetings. In that sense, the tone of the Fed will impact the price dynamics of the US Dollar and hence could limit the downside of the pair.

USD/BRL Levels to watch

Technical indicators on the daily chart indicate that the USD/BRL sellers hold the upper hand. The downward slope of the Relative Strength Index (RSI) reinforces this negative sentiment, as does the MACD, which is displaying red bars, indicating a strengthening bearish momentum. Moreover, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), suggesting that the bears are firmly in control of the bigger picture.

Support levels: 4.8427, 4.8115, 4.7880.

Resistance levels: 4.8902 (100-day SMA), 4.9143 (20-day SMA), 4.9450.

USD/BRL Daily Chart

-638306600159444624.png)

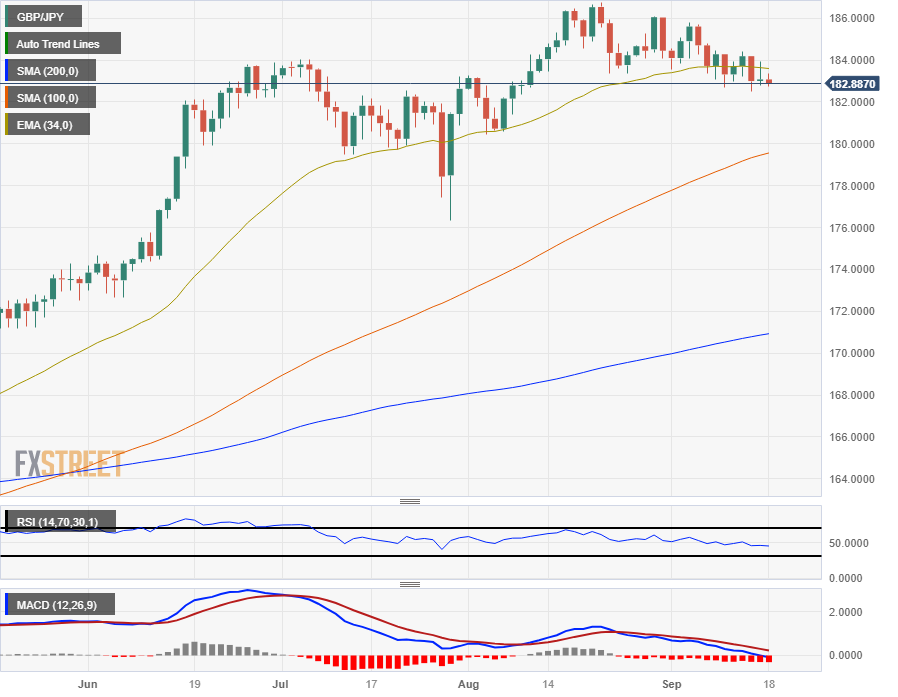

- The GB/JPY is flubbing trading on Monday, down near the day’s lows of 182.80.

- The early week sees inflation figures for the UK ahead of Thursday’s BoE rate call.

- The UK’s rates are expected to climb at least one more time in the current rate cycle.

The GBP/JPY is pinned to the low end through Monday’s trading, failing to establish bullish momentum and sliding into familiar bearish territory below 183.00.

The Consumer Price Index (CPI) figures for the United Kingdom (UK) slated for early Tuesday at 06:00 GMT are expected to show that inflation remains a sticky mess for the UK’s economy. August’s CPI is forecast to bounce to 0.7%, a notable rebound from the previous month’s 0.4% decline.

Inflation remains a problematic area for the Bank of England (BoE) even as data for the UK’s economy flashing warnings that growth is stumbling. The BoE is expected to raise benchmark interest rates by 25 basis points to 5.5% on Thursday.

BoE & BoJ both scheduled for this week, UK inflation figures landing on Friday

The Guppy sees a central bank double-feature this week, with the Bank of Japan (NoJ) scheduled to hold their interest rates steady at -0.1% on Friday.

The BoJ’s negative rate cycle has been a key feature for the Japanese economy as the country struggles to develop long-term fundamental growth. Inflation in Japan briefly soared in recent months, but price increases are expected to slump through the fourth quarter, and the Japanese central bank will be hoping to keep inflation above their minimum target of 2%.

BoJ officials have made comments recently hinting that the Japanese central bank could be set to end its negative rate regime heading into 2024, but that will require firm data suggesting that the Japanese domestic economy has finally solved its problematic lack of inflation.

Friday will also see Retail Sales data for the UK, with retail activity for August expected to jump up 0.5% compared to the previous month’s 1.2% backslide.

Preliminary UK Consumer Price Index (CPI) figures are also slated for Friday, which are forecast to hold steady at 48.6 for the composite component. The Manufacturing PMI is forecast to hold steady at 43, with the Services PMI component expected to tick slightly lower from 49.5 to 49.

Any upside surprises for inflationary data could send the GBP soaring against the JPY as spiraling costs will mean the BoE still has hurdles to overcome using further hikes.

GBP/JPY technical outlook

Despite the near-term flattening for the Guppy, the GBP/JPY pair is firmly at the top end of the charts. The Pound Sterling (GBP) has chalked in gains against the Yen (JPY) for the past eight months, rising firmly from January’s lows near 155.35.

Daily candlesticks have the GBP/JPY slipping the 34-day Exponential Moving Average (EMA), and set to test recent support at the 180.00 major handle.

Long-term bullish momentum for the Guppy has left the pair stranded well above the 200-day Simple Moving Average, currently far below price action near 171.00, and GBP bulls will be looking to mount a recovery rally from here to take a run at reclaiming territory near the 186.00 level.

GBP/JPY daily chart

GBP/JPY technical levels

- NZD/USD trades at 0.5917, up 0.37%, as US Treasury bond yields retreat, providing a tailwind for the Kiwi currency.

- Federal Reserve expected to hold rates steady; markets keenly await updates to the 'dot-plot' and Summary of Economic Projections.

- Busy week for New Zealand economic data, including Current Account and GDP, could further influence the NZD/USD direction.

The New Zealand Dollar (NZD) trims some of its losses vs. the American Dollar (USD) and prints solid gains of 0.37% as US Treasury bond yields retrace from last week’s high, ahead of the following US Federal Reserve’s monetary policy decision. Hence, the NZD/USD is trading at 0.5917 after hitting a daily low of 0.5895.

New Zealand Dollar gains against the US Dollar, buoyed by falling US Treasury yields and optimism ahead of the Federal Reserve's policy update

Market sentiment is upbeat ahead of the Fed’s decision, bolstering the Kiwi, though it remains near the day’s lows. Improvement on last week’s Chinese data sponsored a slim recovery on the NZD/USD pair amid an absent US economic docket on Monday.

Jerome Powell and Co. are expected to keep rates unchanged while updating their monetary policy path, as he and his colleagues would actualize the ‘dot-plot.’ Additionally, Fed officials would update their economic forecasts, included in the Summary of Economic Projections (SEP).

Should be said the latest US economic data showed inflation ticked up, retail sales hold the fort, growing at solid levels, while the labor market remains tight. Even though consumer sentiment deteriorated, they remain optimistic that prices would edge lower, as shown by the University of Michigan (UoM) Consumer Sentiment report.

Nevertheless, as US economic activity continues to slow down at a moderate pace, market participants have begun to price in a possible soft landing. In the meantime, the US Dollar Index, which tracks the Greenback’s performance against a basket of six currencies, dropped 0.17%, down at 105.15, a tailwind for the NZD/USD. Falling US Treasury bond yields are to be blamed, as the 10-year note coupon falls 0.39%, at 4.317%.

Aside from this, the New Zealand (NZ) economic docket during the current week could delineate the NZD’s direction. The release of the Current Account, the Westpac Consumer Survey, the Gross Domestic Product (GDP), and the Trade Balance would give us some clues regarding the status of NZ’s economy.

NZD/USD Price Analysis: Technical outlook

Last week, the NZD/USD remained in sideways trading, unable to break to new year-to-date (YTD) lows of 0.589, but unable to reclaim the 0.6000 figure. Nevertheless, the pair is still downward biased as the 50 and 200-day Moving Averages (DMAs) slopes aim downwards. That and price action remaining below the September 1 daily high at 0.6015 could pave the way for further upside and test the 50-DMA at 0.6047. On the downside, the 0.5900 threshold is the first support, followed by the YTD low.

- XAG/USD going higher as the metal turns bullish from the floor near $$22.40.

- Precious metals, commodities recovering ahead of Fed rate call.

- The Federal Reserve is set to stand pat on rate hikes, bolstering risk assets.

The price of Silver has recovered from the recent backslide into the $22.30 region, reclaiming $23.20 in Monday trading. Commodities are broadly turning higher ahead of the Federal Reserve (Fed) rate call on Wednesday, where the Federal Open Market Committee (FOMC) is expected to hold rates at 5.5%.

Silver's bullish turnaround to get support from a Fed holding pattern

The Fed’s recent rate hike cycle has left Silver to tumble to the floor as the United States (US) central bank lifts rates to combat an intense inflationary environment. As interest rates and the US Dollar (USD) have soared, the XAG/USD has struggled, slumping from recent highs of $26.00 set earlier in the year.

Silver has steadily rebounded against the USD from $22.50 in recent months, but lower highs continue to push the precious metal, and XAG bulls will be looking to snap the losing streak by breaking out of the descending trendline marked in by the last swing high at the $25.00 major handle.

XAG/USD technical outlook

Silver has turned bullish and is looking to claim further ground, with the Relative Strength Index (RSI) and Moving Average Convergence-Divergence (MACD) indicators both flashing upside momentum and showing some room for prices to run.

Any nasty surprises from the economic calendar this week could see the XAG/USD stumble, but overall market momentum is leaning firmly bullish with Silver set to make a hard run at the 200-day Simple Moving Average (SMA) currently treading water near $23.50.

Renewed selling pressure from here will see prices set to challenge recent lows near $22.30, while extended bidding will see the XAG/USD set to battle the descending trendline marked in from May’s peak of $26.00.

XAG/USD daily chart

XAG/USD technical levels

- The EUR/USD is hunting for an upshot to reclaim the 1.0700 handle ahead of a midweek Fed showing.

- The Euro has been belted by the Greenback for nine straight weeks, and bidders will be looking for a foothold.

- EU & US economic data to feature heavily to cap off the trading week.

The EUR/USD is shifting higher to kick off the new trading week, claiming ground that was recently lost in last week’s backslide.

The Euro (EUR) has managed to turn Monday into the green against the Greenback (USD) after opening the day near 1.0668, and the pair is currently tapping into the ceiling near 1.0700.

Fed rate call coming down the chute on Wednesday

It’s going to be a Dollar-dominant week for the EUR/USD with the economic calendar notably thin for the European Union (EU) side of the equation, and the Federal Reserve (Fed) slated for another rate call in the midweek.

The Fed is largely expected to stand pat on interest rates at 5.5%, but investors will be keeping a close eye on the Fed’s ‘dot plot’ and inflation expectations, as well as looking for any forward-looking indications during the Federal Open Market Committee (FOMC) press conference. The Fed’s rate call drops at 18:00 GMT on Wednesday, with the press conference slated for half an hour later at 18:30.

US Initial Jobless Claims for the week into September 15th land on Thursday at 12:30 GMT, followed by preliminary Consumer Confidence figures at 14:00. US jobless claims last printed at 220K, while EU consumer sentiment is expected to decline slightly from -16 to -16.5.

Both releases are expected to be medium impact and market participants will largely be focused on Friday’s Purchasing Manager Indexes (PMI) for both the EU and the US.

The EU’s Composite PMI, scheduled early Friday at 08:00 GMT is expected to decline slightly from 46.7 to 46.3, while the US side sees similar expectations at 13:45 GMT. The US Manufacturing PMI is forecast to slide from 47.9 to 47.8, while the services component is expected to tick down to 50.3 from 50.5.

EUR/USD technical outlook

Euro bulls will be looking to mark in a green week after the EUR/USD pair has closed bearish for the past nine consecutive weeks, and daily candlesticks have the pair firmly on the downside.

The 200-day Simple Moving Average (SMA) sits above current prices, parked near 1.0830, and the 34-day Exponential Moving Average (EMA) has given a bearish cross, gaining downside momentum into 1.0800.

Both the Relative Strength Index (RSI) and the Moving Average Convergence-Divergence (MCAD) indicator are on the low end, implying oversold conditions, and it’s the bulls’ game to lose if the Federal Reserve gives any surprises that could send the USD higher.

EUR/USD daily chart

EUR/USD technical levels

- XAU/USD rose to the $1,930 area, up by 0.40%.

- Markets remain cautious ahead of central bank decisions this week.

- US yields remaining high limit the metal’s upside.

On Monday, the Gold spot price XAU/USD is holding above the 20 and 200-day Simple Moving Average (SMA) convergence at $1,922-1,923, rising to $1,930. Markets remain cautious ahead of the Federal Reserve (Fed), Bank of England (BoE) and Bank of Japan (BoJ), where the British bank is the only one expected to hike rates.

In line with that, similar to the European Central Bank (ECB) last week, the (BoE) is expected to deliver a dovish 25 basis point hike, highlighting stagflation risks. Likewise, investors are discounting that the BoJ will maintain its ultra-dovish stance.

On the Fed’s side, it is widely expected to deliver a hawkish pause and try to convince markets that it isn’t the end of the tightening cycle. For the November and December meetings, investors are placing some bets for one last hike as economic activity remains strong while the labour market sees a mixed outlook. In addition, the Fed will release updated dot plots and fresh macro forecasts.

In the meantime, US Yields, often seen as the opportunity cost of holding Gold, are trading mixed but remain high, limiting the XAU/USD upside. The 10-year bond yield is 4.33%, with mild losses on the day. The 2-year yield stands at 5.06%, up by 0.50%, and the 5-year yield is at 4.45%, down by 0.30%.

XAU/USD Levels to watch

Considering the daily chart, XAU/USD presents a neutral to bullish outlook, with the bulls showing resilience and gaining momentum. The Relative Strength Index (RSI) exhibits a bullish inclination with a positive slope above the 50 threshold, while the Moving Average Convergence (MACD) histogram presents rising green bars. Additionally, the pair is above the 20 and 200-day Simple Moving Average (SMAs), implying that the bulls retain control on a broader scale. Still, the buyers should target the 100-day SMA at $1,946 to confirm the recovery.

Support levels: $1,923 - $1,920 (200 and 20-day SMA), $1,910, $1,900.

Resistance levels: $1,946 (100-day SMA), $1,970, $2,000.

XAU/USD Daily chart

-638306552182673905.png)

- USD/MXN trades at 17.1182, rebounding from a daily low of 17.0296, as markets anticipate key central bank decisions this week.

- US Federal Reserve expected to hold rates steady, but last week’s uptick in inflation keeps options open; traders await updated ‘dot-plots.’

- Mexican Private Consumption slows to 4.3% YoY in Q2 2023, while upcoming data could show a decline in Retail Sales and a slowdown in inflation.

The Mexican Peso (MXN) loses ground versus the Greenback (USD) on Monday, ahead of a busy week in the central bank space, as three of the most important are set to deliver their decisions. At the time of writing, the USD/MXN is trading at 17.1182 after printing a daily low of 17.0296.

Mexican Peso weakens against the US Dollar ahead of a pivotal week for central banks, with focus on the Fed’s ‘dot-plots’ and inflation data

Investors’ mood depreciated the Mexican currency as the US Federal Reserve (Fed) is expected to deliver its decision on Wednesday, at around 18:00 GMT, followed by Jerome Powell’s press conference. According to data, the swaps market sees the Fed holding rates unchanged, at 5.25%-5.50%, thought would likely keep their options open due to last week’s inflation uptick. USD/MXN traders would look at the update of the so-called ‘dot-plots.’

The US economy witnessed a slight jump in consumer and producer price indices. As fewer Americans filed for unemployment benefits, the jobs market remains hot. That was depicted by Retail Sales, which expanded at a slower rate, while consumer sentiment deteriorated, blamed on high gasoline prices. Notably, inflation expectations were pushed lower, as revealed by the University of Michigan.

On the Mexican front, Private Consumption in Mexico grew by 4.3% YoY in Q2 2023, below the previous reading of 4.8%, according to figures revealed by the Instituto Nacional de Estadistica Geografia e Informatica (INEGI).

Sentiment amongst investors improved as Chinese data witnessed the economy has found its bottom after the Government’s efforts to stimulate the economy, which faltered to recover as expected by most financial market analysts.

In the week ahead, the US economic docket will feature housing data, \the Fed’s decision, jobs data, and S&P Global PMIs. Retail Sales are expected to deteriorate on the Mexican front, while inflation for the first half of September is foreseen to slow down.

USD/MXN Price Analysis: Technical outlook

The pair found its foot at around 17.0297 before testing the 50-day Moving Average (DMA), which has risen above the 20-DMA at 17.0992, exacerbating a test of the 100-DMA at 17.2188. A breach of the latter will expose the 17.50 area, followed by the September 7 swing high at 17.7074. ahead of challenging the 18.0000 psychological level. Conversely, if the pair slides toward the 20-DMA, it could pave the way for a crack under 17.0000. The next support will emerge at August’s 28 daily low of 16.6923.

- Oil prices are surging thanks to ongoing supply constraint concerns, sending the CAD soaring against the USD.

- The Federal Reserve's latest rate call is expected to hold steady in the midweek.

- Economic Calendar sees several high-impact figures for both the USD and CAD this week.

The USD/CAD continues to tip to the downside as the Loonie (CAD) gets pushed higher by rising oil prices.

Oil prices continue to chew through chart paper, with West Texas Intermediary (WTI) US crude oil marking a fresh high of $91/bbl in Monday trading.

The USD/CAD is testing into five-week lows as the US Dollar (USD) gives up ground against the commodity-supported CAD, but the midweek sees the Federal Reserve (Fed) landing with another rate call. Markets are broadly expecting the Federal Open Market Committee (FOMC) to hold steady with interest rates at 5%.

Fed's rate call in the pipe for the mid-week, US data to dominate market reactions

Oil prices will be driving the USD/CAD for the early week, but the economic calendar will see plenty of Greenback-based momentum from Wednesday onwards. However, before any of that can happen, the CAD will see Consumer Price Index (CPI) figures for Canada on Tuesday.

The Canadian CPI is scheduled for 12:30 GMT Tuesday, and is expected to climb to 3.8% from the previous 3.3% as the Bank of Canada (BoC) struggles to contain inflation largely bolstered by rising energy prices.

Thursday will bring US Initial Jobless Claims which lasted printed at 220K, while Friday sees Canadian Retail Sales for July, forecast to tick higher from 0.1% to 0.4%.

US Manufacturing and Services Purchasing Manager Index (PMI) data is also slated for Friday. The Manufacturing PMI is expected to decline slightly from 47.9 to 47.8, while the services component is seen declining from 50.5 to 50.3.

USD/CAD technical outlook

The Dollar-Loonie pairing is trading to the midpoint of familiar territory initially reached in late 2022, and the pair is rapidly approaching the 200-day Simple Moving Average (SMA) near 1.3464 as prices slip past the 34-day Exponential Moving Average (EMA), currently turning bearish into 1.3505.

The Relative Strength Index (RSI) and Moving Average Convergence-Divergence (MACD) indicators are firmly bearish on daily candlesticks, and the indicators are warning buyers that there could still be plenty of room to run towards the downside before a successful bullish offensive can be mounted.

USD/CAD daily chart

USD/CAD technical levels

- GBP/USD stuck near major psychological level with dual central bank rate calls in the barrel.

- Heavily-populated economic calendar for this week promises plenty of volatility.

- Lopsided rate calls could see the currency pair twist into the midweek.

It’s a heavy showing for the GBP/USD pair this week with both the Federal Reserve (Fed) and Bank of England (BoE) on-deck with interest rate calls slated for the midweek, and the Pound Sterling (GBP) is jostling for position against the Greenback (USD) as investors gear their positioning.

The Fed is broadly expected to hold rates steady 5.5% at the upcoming Federal Open Market Committee (FOMC) meeting on Wednesday at 18:00 GMT, while the BoE is forecast to give one last 25-basis-point rate hike, bringing the UK’s main rate to 5.5% from 5.25%.

The BoE’s rate call is slated for 11:00 GMT on Thursday.

Plenty of US & UK data on the economic calendar

It’s a bumper week for the GBP/USD on the economic calendar. For the UK, Consumer Price Index (CPI) numbers print on Wednesday, BoE Thursday, and Friday sees Retail Sales and Preliminary Purchasing Manager Index (PMI) figures.

United Kingdom (UK) CPI figures on Wednesday are expected to increase from -0.4% to 0.7%, while Friday’s Retail Sales for August are likewise forecast to bump to 0.5% after the previous month’s 1.2% decline.

On the United States (US) side of the data docket, Wednesday’s Fed showing will be followed by employment figures on Thursday and the Preliminary PMI printing on Friday.

Thursday’s Initial Jobless Claims for the week into September 15th and the Philadelphia Manufacturing Survey for September are scheduled for 12:30 GMT. Initial Jobless Claims last printed at 220K, and the manufacturing survey is expected to decline 0.7% versus the last showing of 12.

Friday’s preliminary PMI numbers, scheduled for 13:45 GMT, are broadly expected to show a minor slip, with the manufacturing PMI forecast to tick down to 47.8 from the previous 47.9, and the services sector PMI is forecast to move slightly lower from 50.5 to 50.3.

GBP/USD technical outlook

On the technical side, the GBP/USD is knocking sideways in early week trading. The pair opened the week near the 1.2400 handle and has so far struggled to find momentum. The intraday action sees a sideways skid between 1.2400 and 1.2380.

The GBP/USD has closed red or flat for eight of the past nine consecutive weeks from early July’s peak of 1.3142, and Daily candlesticks see the pair decidedly bearish, slipping just below the 200-day Simple Moving Average (SMA) currently parked near 1.2433.

The 34-day Exponential Moving Average (EMA) has turned bearish into the 1.2600 major level, and as long as markets remain on-balance traders will want to keep an eye on the Relative Strength Index (RSI) and Moving Average Convergence-Divergence (MACD) indicators, both of which are flashing oversold conditions on daily candlesticks.

GBP/USD daily chart

GBP/USD technical levels

- USD/JPY slightly declined towards 147.70, and bulls seem to be losing traction.

- US yields are rising as markets await a hawkish pause from the Fed on Wednesday.

- Investors also await fresh macro forecasts and revised dot plots from the Fed.

At the start of the week, the USD/JPY saw some losses and declined to 147.70, mainly driven by the USD trading somewhat weak against its rivals. Both the Federal Reserve (Fed) and Bank of Japan (BoJ) will meet this week on Wednesday and Friday but no hikes are expected from either bank. Powell and Ueda’s stances will be closely watched. No relevant data will be released on Monday.

On the Fed’s side, markets anticipate that the bank will announce a hawkish, similar to the June meeting decision, in which the Fed decided to hold rates steady to asses the lags of monetary policy and their impact on the US economy. In that sense, the bank will try to convince the market that they will remain data-dependent but that the tightening cycle isn’t over.

In line with that, US Yields are seeing gains across the curve and remain high. The 10-year bond yield rose to 4.33% while the 2-year yield stands at 5.06%, up by 0.50%, and the 5-year yielding 4.46%.

On the other hand, the Bank of Japan (BoJ) has clarified that a monetary policy shift will only be considered once local wage and inflation metrics align with their anticipated outcomes. In addition, amid the local economy's ongoing struggles and the added weight of Chinese economic troubles, the central bank remains hesitant to pivot its dovish stance. In that sense, the policy statement will be closely watched for clues on forward guidance.

USD/JPY Levels to watch

The technical analysis of the daily chart suggests a shift towards a neutral to a bearish outlook for USD/JPY, with indications of bullish exhaustion. Having turned flat in positive territory, the Relative Strength Index (RSI) suggests a potential market equilibrium with balanced buying and selling pressure. The Moving Average Convergence (MACD), on the other hand, presents flat red bars. Furthermore, the pair is above the 20,100,200-day Simple Moving Average (SMAs), suggesting that the bulls are firmly in control of the bigger picture.

Support levels: 147.00, 146.60 (20-day SMA), 146.00.

Resistance levels: 148.00, 149.00, 150.00.

USD/JPY Daily Chart

-638306503190990672.png)

- AUD/USD trades at 0.6435, recovering from a daily low of 0.6416, as Chinese economic data boosts market sentiment.

- US Federal Reserve expected to hold rates steady, with a 99% chance of no change, as investors await ‘dot-plots’ for future rate path.

- Michelle Bullock to begin her term as the new RBA Governor with Australian economic data, including PMIs and inflation, on the week’s docket.

The Australian Dollar (AUD) recovers some ground against the US Dollar (USD) as investors brace for a busy week in the central bank space, as the US Federal Reserve is expected to hold rates unchanged. Improvement in Chinese economic data, propelled by its government, cushioned the Aussie’s fall. The AUD/USD is trading at 0.6435 after hitting a daily low of 0.6416.

Australian Dollar gains against the US Dollar ahead of a busy central bank week, buoyed by positive economic data from China

Market sentiment has improved due to Chinese data portraying a more optimistic outlook, which was threatened by deflation and a sudden economic slowdown. That boosted the Aussie Dollar (AUD), which is staging a recovery amid an absent economic docket.

Last week, the US economy witnessed an uptick in inflation on the consumer and producer side while the jobs market remains hot. Retail sales expanded slower than estimated but remained solid above the 2% threshold. Nevertheless, consumer sentiment slipped, blamed on elevated gasoline prices, as revealed by a University of Michigan poll (UoM).

A tranche of US housing data will be revealed ahead in the week, but all eyes are set on Jerome Powell and co. Money markets are not expecting a surprise by the Fed, with the odds of holding rates unchanged at 99%. Aside from the monetary policy statement, traders are looking for the ‘dot-plots’ to see Fed officials’ expectations regarding the Federal Funds Rate (FFR) path.

On the Australian front, the calendar would reveal the Judo Bank Services and Manufacturing PMIs alongside inflation data. However, the main highlight of the week is that Michelle Bullock is beginning her term as the new Reserve Bank of Australia (RBA) Governor.

AUD/USD Price Analysis: Technical outlook

Price action portrays the pair printed a hammer preceded by a slim uptrend, peaking at around last week’s high of 0.6475. However, if buyers clear that area, the pair could test 0.6500 and resume its upward direction to test the 50-day Moving Average (DMA) at 0.6551. Conversely, and in the most likely scenario, the AUD/USD could extend its losses, but first, sellers must drag prices below the 0.6400 mark. A breach of the latter, and the pair could slip towards the yearly lows of 0.6357.

Statistics Canada will release August Consumer Price Index (CPI) data on Tuesday, September 19 at 12:30 and as we get closer to the release time, here are the forecasts by the economists and researchers of five major banks regarding the upcoming Canadian inflation data.

Headline inflation is expected at 3.8% year-on-year vs. 3.3% in July. If so, headline would accelerate for the second straight month to the highest since April and further above the 2% target. On a monthly basis, CPI is seen at 0.2% vs. the prior release of 0.6%.

RBC Economics

Higher energy prices will push headline price growth higher. We expect a 3.7% YoY rate in August, up from 3.3% in July. The BoC’s preferred core measures may tick higher on a YoY basis due to soft year-ago ‘base effects’ (the month-over-month increase in those measures a year ago was relatively small). But it’ll be more focused on the recent three-month average growth rate for the ‘median’, ‘trim’, and trim services ex-shelter (sometimes called ‘super core’) measures. All of these are still ‘sticky’ at rates above the top end of the BoC’s inflation target. But we continue to expect signs of softening in the economy to spill over into softer price growth over the remainder of the year – preventing additional BoC interest rate hikes.

NBF

An increase in gasoline prices could have translated into a 0.2% increase in the CPI in August (before seasonal adjustment). If we’re right, the 12-month rate of inflation should come up from 3.3% to a 4-month high of 3.8%. Similarly to the headline print, the core measures preferred by the Bank of Canada should increase in the month, with CPI-med likely moving from 3.7% to 3.8% and CPI-trim from 3.6% to 3.7%.

Citi

We expect a solid 0.4% MoM increase in headline CPI in August, with base effects implying the YoY reading climbs to 4.1%. Part of the strength in August will be due to further increases in energy prices. A pick-up in mortgage costs with higher interest rates should help support shelter prices. However, the most substantial upside risks to CPI in August are likely to be due to various service prices. The most important elements of August inflation data will be the core inflation measures. The three-month run rate of core inflation has been stably in a 3.5-4% range for a year, implying that annual measures will also remain around this range in August. Higher three-month inflation would understandably increase the chance of further BoC rate hikes, possibly as soon as October.

CIBC

The jump in oil prices that saw consumers paying more at the pump in August will be behind a likely 0.2% MoM NSA advance in the total CPI in that month. That would boost the annual rate of inflation to 3.8%, magnified by a weak year-ago reading falling out of the calculation. Higher gas prices will have left less money for spending elsewhere, and weaker demand could have prevailed in categories outside of food and energy, leaving 12-month ex. food and energy prices at 3.4%, and validating the Bank of Canada’s hold in September.

TDS

We look for headline CPI to rise by 0.2% MoM in August as inflation jumps 0.5pp to 3.8% from a combination of base effects and higher energy prices. Gasoline and other energy products will contribute ~0.2pp on the month or 0.1pp on a year-ago basis, with the latter improving from a 0.6pp drag in July. Setting aside the impact of higher energy prices, we expect the August report to show modest progress on the path to 2%. Seasonal headwinds should hold food prices to a minor increase, and we also look for another muted performance across core goods as households pare back discretionary spending. However, these improvements are unlikely to translate into softer core inflation pressures with CPI-trim/median expected to edge 0.05pp higher to 3.7% YoY (+0.1pp for CPI-trim). This would leave 3m rates of core inflation to persist in their recent (3.5-4.0%) range, although our forecast would see the ex. food/energy measure edge lower by 0.1pp to 3.3% YoY.

While speaking at the World Petroleum Congress in Canada, Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman said that they are targeting less volatility in energy markets rather than prices, per Reuters.

Key takeaways

"Whole world should focus on energy security.",

"Main pillar for energy security is sustainable markets."

"OPEC conduct is benign, no different from central bank actions."

"International energy markets need light handed regulation."

"We want to be proactive, pre-emptive, precautious."

"Jury still out on Chinese demand, European growth, what central bankers will do."

"IEA has moved from market forecaster to political advocate."

"World could go from one type of energy crisis to another if supply chains for critical minerals aren't well planned."

Market reaction

Crude oil prices continue to edge higher following these comments and the barrel of West Texas Intermediate was last seen rising nearly 1% on the day at $92.00.

Monetary policy argues for further weakness of Yen, analysts at Erste Group Research report.

There is still a lot to be said for the Euro from a fundamental perspective

The Bank of Japan's control of the yield level of 10-year Japanese government bonds (within a target corridor of 50 bps above or below a yield level of 0%) continues to be the determining factor for the development of the JPY. By contrast, German 10-year government bonds are currently comparatively attractively priced with a yield level of around 2.6%. Since core inflation in both currency areas is close to the same level, there is still a lot to be said for the Euro from a fundamental perspective.

The Yen's weakness can therefore continue, provided there are no fundamental changes in the BoJ's monetary policy.

In the event of an escalation of crises, the Yen can also quickly strengthen against the Euro again at any time.

The Dollar is going into the September Fed meeting at the strongest levels since March. Economists at ING analyze USD outlook.

Few reasons for Dollar to hand back gains, yet

The concept of US ‘exceptionalism’ (both in growth and interest rates) looms large over the market and as yet there have been few reasons to bet against the Dollar.

The event risk of the September FOMC meeting does not seem a particularly bearish one for the Dollar. We are not expecting the Fed to call time on its tightening cycle. And by leaving one more hike in the dot plot, the Fed can avoid yields at the long end of the bond market slipping too far and providing premature stimulus. Indeed, the greater risk might be the Fed scaling down its dot plot median forecast of a 100 bps easing cycle in 2024.

A hawkish September FOMC does not mean the USD has to rally a lot. But assuming there are no surprises, it probably means ideas of a prolonged pause in the policy cycle will see interest rate volatility fall even further and demand for the carry trade stay strong.

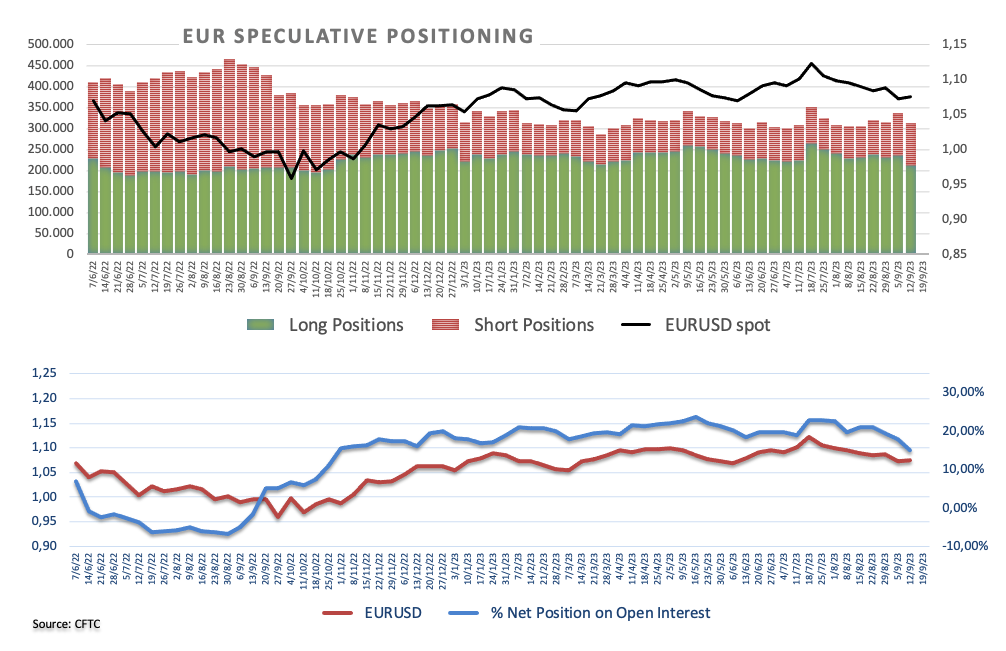

ECB gave its clearest indication yet that the peak in policy interest rates might have been reached. Economists at Wells Fargo believe the risks for the Euro remain tilted to the downside for the balance of 2023.

Recovery in EUR/USD to around 1.1100 by Q4-2024

Given the likely end to ECB rate hikes and underwhelming Eurozone growth performance, the risks to our Euro forecast, which envisaged a low around 1.0600 during Q4-2023, are clearly – and perhaps significantly – tilted to the downside.

Our forecast also envisages a recovery in the Euro to around 1.1100 by Q4-2024, although that rebound has much more to do with a turn in US economic fortunes than any emphatic recovery in the Eurozone economy.

We expect that a mild US recession and relatively pronounced Federal Reserve rate cuts should see the USD weaken versus the Euro. However, if the US economy continues to display surprising resilience and the Fed adopts a more gradual approach to monetary easing, we also view the risks as tilted towards a more gradual Euro rebound than our current outlook.

In an interview with CNBC on Monday, US Treasury Secretary Janet Yellen said that she doesn't see any signs suggesting that the US economy is in a downturn, as reported by Reuters.

Key takeaways

"US had good, strong labor market and it is important for workers to be able to realize gains."

"Labor market is cooling but without significant layoffs."

"Consumer spending remains robust."

"Would expect to see some impact of Fed tightening, already seen in the housing market."

"I think we're achieving lower inflation."

"Watching oil prices very closely."

"There's absolutely no reason for a government shutdown."

"We want congress to stay focused and avoid anything that could cause the economy to lose momentum."

Market reaction

These comments failed to trigger a noticeable market reaction and the US Dollar Index was last seen losing 0.05% on the day at 105.25.

Strategists at Société Générale continue to like gold in a multi-asset portfolio

Gold is driven by nominal rates and inflation

Real rates are a major driver of the Gold price. The price is driven by two components: nominal rates and inflation.

With nominal rates close to peak levels, gold should continue to see some selling pressure.

While we are structurally bullish on Gold, due to structural buying from central banks, geopolitics, and some renewed trend towards de-dollarisation, we are reducing the allocation to Gold by 1pp, before reverting to a full weighting when US growth materially slows.

- EUR/USD gathers upside traction and advances to 1.0680.

- The resumption of the selling pressure could retest 1.0630.

EUR/USD extends Friday’s recovery and hovers around the 1.0680 region on Monday.

Despite the so far two-day bounce, the pair’s underlying bearish sentiment remains unchanged and leaves the door open to extra pullbacks in the short-term horizon. Against that backdrop, further losses could see the September low at 1.0631 (September 14) revisited ahead of the March low of 1.0516 (March 15).

In the meantime, further losses remain in the pipeline while below the key 200-day SMA, today at 1.0827.

EURUSD daily chart

The European Central Bank raised interest rates on Thursday but signalled that the move may be the last one in the current cycle. Economists at ING analyze EUR/USD outlook.

November and December are seasonally weak months for the Dollar

Expect EUR/USD to trade on the soft side now that the ECB has told us that rates have peaked. However, we suspect good demand will emerge near the 1.05 level. Our house call is that US ‘exceptionalism’ does not last and that US growth converges on the weak Eurozone story into 2024.

Typically, November and December are seasonally weak months for the Dollar. Our call is that weaker US activity data will become evident over time and that the current period will come to be viewed as ‘as good as it gets’ both for US growth and the Dollar. We are sticking with our call that EUR/USD will be trading above 1.10 by year-end.

- DXY comes under some mild selling pressure on Monday.

- Immediately to the upside emerges the yearly peak.

DXY adds to Friday’s small losses and revisits the 105.20/15 band at the beginning of the week.

The continuation of the multi-month rally appears well and sound and a breakout of the monthly high of 105.43 (September 14) should encourages the index to retest the 2023 peak of 105.88 (March 8), just before the round level of 106.00.

While above the key 200-day SMA, today at 103.02, the outlook for the index is expected to remain constructive.

DXY daily chart

Economist at UOB Group Ho Woei Chen, CFA, comments on the latest PBoC’s move on rates.

Key Takeaways

The PBOC has lowered financial institutions’ reserve requirement ratio (RRR) by 25 bps effective today (15 Sep). The move is within expectation as policymakers doubled down their efforts to boost the economy.

It also surprised markets by injecting a larger than expected amount of liquidity via the 1Y Medium-Term Lending Facility (MLF) today despite keeping the rate unchanged as expected. Looking ahead, there will be a further need to boost market liquidity as CNY3.76 tn of 1Y MLF will mature in the next two quarters.

Despite no further reduction in the 1Y MLF, we could still see the benchmark loan prime rates (LPRs) being adjusted lower at the upcoming rate setting on 20 Sep as the earlier MLF cut in Aug has not been fully passed through to the LPRs. Our forecast for the 1Y LPR is at 3.40% end-3Q23 and 3.35% end-4Q23 while our forecast for the 5Y LPR is at 4.05% end-3Q23 and 4.00% end-4Q23.

Plenty of central bank meetings this week, none likely to derail the Dollar rally, in the view of Kit Juckes, Chief Global FX Strategist at Société Générale.

A soft Euro will help keep EUR/CHF down

In G10, I don’t think central banks dominate the currency outlook quite as much now, as they did six months ago. The growth outlook matters more and, in that sense, perhaps the long end of the yield curve matters more than policy rates, too.

The Euro got no help from last week’s ECB rate hike and Sterling may not get much from the MPC meeting. An announcement on gilt sales is likely, but would rising yields from here bring in buyers or trigger a loss of confidence? GBP/USD has 1.20 in its sights. CPI (Wednesday and Retail Sales (Friday) are worth watching, too.

As for the SNB, Riksbank and Norges Bank, if we get 25 bps hikes from all three, SEK may be the currency that benefits least. Domestic concerns are too great. NOK is helped by Oil prices even if global nerves don’t help and a soft Euro will help keep EUR/CHF down.

- EUR/JPY trades within a tight range around 157.50.

- The cross faces further side-lined trading for the time being.

EUR/JPY navigates within a tight range above the 157.00 yardstick at the beginning of the week.

In the meantime, the cross continues to face some consolidative range. Against that, a minor hurdle emerges at the so far monthly high of 158.65 (September 13) ahead of the 2023 top at 159.76 (August 30), which precedes the key round level at 160.00. The surpass of the latter should not see any resistance level of note until the 2008 high at 169.96 (July 23).

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 148.77.

USD/JPY has soared toward 148.00 ahead of the latest policy update from the BoJ in the week ahead. Economists at MUFG Bank analyze the pair’s outlook.

Will BoJ Governor Ueda push back further against JPY weakness by talking up rate hike risks?

Market attention will now turn to comments from Governor Ueda at this week’s policy meeting to see what message he delivers over the future timing of rate hikes and what level of unease he displays over recent Yen weakness.

If BoJ Governor Ueda steps back from providing a strong signal over the possibility of rate hikes by the turn of the year, it will increase the burden on the Japanese government to support the Yen through intervention like late last year if the USD/JPY jumps back above the 150.00 level and moves to retest last year’s high at 151.95.

Economists at Société Générale analyze USD/MXN technical outlook.

16.60 remains important support

USD/MXN rebound petered out near the trend line drawn since September 2022 at 17.73. It has staged a steady pullback and is now challenging 50-DMA near 17.00. It would be interesting to see if the pair can carve out a higher low as compared to the ones in July/August at 16.60. Defence of this level can lead to a short-term bounce towards 17.42 and the trend line near 17.73.

Only if the support at 16.60 gets violated would there be risk of a deeper downtrend.

The CAD booked a gain on the USD last week. Economists at Scotiabank analyze USD/CAD outlook.

CAD shorts building again

The USD’s recent appreciation seems to have run out of gas again in the 1.36/1.37 range, perhaps not unlike the spring. Historically, USD/CAD forays above 1.35 tend to be limited in terms of scope and duration.

CAD gains – so far – are limited and there is enough event risk ahead to keep markets cautious on the prospects for the CAD recovery to extend. But it remains somewhat undervalued and perhaps oversold on the charts.

Friday’s CFTC data reflected a further build-up on net CAD short positioning – just as the CAD is showing tentative signs of steadying – again, similar to the March/April period. A push under 1.35 may put some heat on some of the more freshly minted short CAD positions.

GBP/USD remains relatively soft in the low 1.24 area. Economists at Scotiabank analyze the pair’s outlook.

Markets eye BoE decision

UK markets have a fair bit to contend with this week – CPI on Wednesday and the BoE policy decision on Thursday. A ‘dovish hike’ a la ECB would pressure the GBP and, at the margin, add to price pressures.

The GBP is soft but intraday price action is – right now – showing some signs of relative strength via a bullish outside range session on the six-hour chart.

If the GBP can sustain gains through 1.24, a deeper squeeze may develop towards 1.2450 resistance. A clear move above this point is needed to indicate more GBP strength.

Support is 1.2375.

Loonie holds gains to the 1.35 area. Economists at Scotiabank analyze the USD/CAD outlook.

Short-term technical trends are leaning positive for the CAD

Short-term technical trends are leaning positive for the CAD. The USD has been trading more defensively since peaking and turning lower from the 1.37 zone and the bear trend is developing some decent momentum on the short-term chart. Noted support at 1.3495/1.3500 is, however, hampering additional CAD gains.

A break under the 1.3495 point should see the CAD progress to the low 1.34 area and, possibly, test stronger USD support in the upper 1.33s.

EUR/USD trades little changed in a tight range. Economists at Scotiabank analyze the pair’s outlook.

Technical undertone is weak

EUR/USD is consolidating but there is little positive to say about short-term trends on the face of it.

The pair remains below 1.07 and the market is carving out a bear wedge on the intraday chart which points to more losses ahead.

A break under 1.0650 may see further softness in price action develop.

Resistance is 1.07.

See – EUR/USD: Outside risk to the 1.04/1.05 area on a break below 1.0610/1.0630 support – ING

Economist at UOB Group Lee Sue Ann comments on the latest ECB interest rate decision.

Key Takeaways

The European Central Bank (ECB) decided to raise its three key interest rates by 25bps. After a total of 450 bps rate hikes, the ECB’s main policy rates are now at a record high.

The ECB’s new projections show inflation slowing from a current rate of 5.3% to 3.2% next year and 2.1% in 2025, making only slow progress towards the bank's 2.0% target. The growth outlook continued to sour and the ECB now sees a 2023 expansion of just 0.7% after predicting 0.9% three months ago. For 2024, it sees the economy growing by 1.0%.

While we believe the door to future rate hikes remains open, we prefer keeping to our view of a pause in the current tightening cycle, implying terminal rates of 4.50%, 4.75% and 4.00% for main refinancing operations, the marginal lending facility and the deposit facility, respectively.

- The US Dollar trades mixed at the opening on Monday.

- Traders will likely keep powder dry for the main Fed event on Wednesday.

- The US Dollar Index resides above 105.00, struggling to make new highs.

The US Dollar (USD) was able to close a ninth consecutive week in the green, which makes it almost one of its longest winning streaks. Despite the strength, some signs are starting to mount that the rally might come to an end soon. Although last week got closed in the green for the USD, the University of Michigan inflation expectations components showed that participants believe the US Federal Reserve (Fed) should be nearly done hiking – and this isn’t good news for the Dollar.

The week presents a very light economic calendar that is unlikely to have much impact on current levels. Until Wednesday, some selling pressure is expected, particularly if the US Dollar is unable to break higher. This means that the US Dollar Index (DXY) is at risk of retreating, easing a touch away from a new six-month high.

Daily digest: US Dollar softens

- There is a very light calendar on Monday, in a week in which the focal point will be the US Federal Reserve rate decision.

- The National Association of Home Builders will issue its Housing Market Index for September at 14:00 GMT. Expectations are for an unchanged number at 50.

- The US Treasury Department will auction a 3-month and a 6-month bill.