- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

You-Na Park-Heger, an analyst from Commerzbank, is out with a note detailing why the Euro (EUR) could see appreciation against the Swiss Franc (CHF) next year.

CHF: Low inflation

The inflation rate in Switzerland has already been within the SNB's target corridor (0 to under 2%) for several months. We even assume that interest rates in Switzerland have peaked at the current level of 1.75%, as inflation is likely to remain low.

In the short term, the Swiss franc is likely to remain firm against the EUR. Next year, however, we see moderate upside potential in EUR-CHF.

Contrary to market expectations, the ECB is not likely to cut its key interest rate in mid-2024. The market will therefore have to adjust its expectations.

- AUD/USD struggles to gain ground above 0.6500 and trades near 0.6468, adding 0.07% on the day.

- The US weekly Initial Claims climbed to the highest level in nearly three months.

- Employment growth in Australia came in better than the estimation.

- Traders will focus on the US housing data on Friday.

The AUD/USD pair failed to reclaim the 0.6500 mark and hovers around 0.6468 during the early Asian session on Friday. The US Dollar (USD) gains ground despite softer US economic data and the fall in US yields.

On Thursday, the US Initial Claims for the week ending November 11 climbed to 231K, the highest level in nearly three months. While Continuing Jobless Claims reached the highest level since 2022. US Industrial Production dropped 0.6% m/m in October. Finally, the Kansas City Fed Manufacturing Index rose to -2.0 in November vs -8.0 prior. The softer US job supports the speculation that the Federal Reserve (Fed) is done with the tightening cycle.

Employment growth in Australia came in better than expected, climbing by 55k in October. The Unemployment Rate increased from 3.6% to 3.7%. The markets expect another 25 basis points (bps) hikes in February. However, the rate cut is unlikely to begin until November 2024.

Looking ahead, the US housing data, including Building Permit and Housing Start will be released. The Housing Starts is expected to decline from 1.358M to 1.35M and the Building Permits are forecast to drop from 1.471M to 1.45M.

- The AUD/NZD continues to grind it out towards the midrange just north of 1.0800.

- The Aussie-Kiwi pairing has been getting a little frothy on the intraday charts.

- Topside momentum goes to the AUD for the time being amidst NZD weakness.

The AUD/NZD is leaning towards the topside on the intraday charts, with hourly candles grasping to climb over the 200-hour Simple Moving Average (SMA) descending into 1.0820. Bids on the pair have been pushing to reclaim the week's peaks near 1.0870.

Near-term momentum has been tilting towards the upside, but not enough to send the 50-hour SMA into a bullish stance, and the moving average is hesitating on the bearish side of the 200-hour SMA.

On the daily candlesticks, the AUD/NZD has been churning around the 200- and 50-day SMAs, which are similarly grinding sideways while stacked bearishly, with the 50-day SMA paddling just south of the longer moving average.

The pair's last two price level breaks in either direction resulted in failed breakouts, and constraining volatility peaks on both sides of the bids is setting up a technical breakout that could develop legs with firm chart support forming up in either direction.

Directional momentum remains low for the meantime, and technical indicators have ground to a halt in their midranges. The Relative Strength Index (RSI) is cycling the 50.0 non-directional level and the Moving Average Convergence-Divergence (MACD) has its long-run histogram bleeding towards the middle ground.

AUD/NZD Hourly Chart

AUD/NZD Daily Chart

AUD/NZD Technical Levels

- USD/JPY slightly retraces following Wednesday's gains, as US Dollar weakness and a shift to safe-haven assets favor the Japanese Yen.

- Short-term bearish bias with a potential deeper pullback if the pair falls below the Tenkan-Sen at 150.92, with key support levels targeted at 150.32 and 150.00.

- A recovery above 150.91 could renew buying interest, targeting the 151.00 level and possibly retesting the year-to-date high at 151.91.

USD/JPY retraces some of Wednesday’s 0.60% gains on Thursday due to overall US Dollar (USD) weakness amid a risk-off impulse. Worse than expected, fundamental data from Japan’s triggered flows toward safe-haven assets, boosting appetite toward the Japanese Yen (JPY). At the time of writing, the major trades at 150.61, virtually unchanged in the early Asian Friday session.

According to the daily chart, the USD/JPY remains upward biased for the long term, but in the short term, the drop below the Tenkan-Sen at 150.92 could open the door for a deeper pullback, and test key support levels.

The first support would be the Kijun-Sen at 150.32, before diving to the 150.00 psychological figure. The correction would extend further, once traders clear the latter, with intermediate support seen at the November 3 low of 149.18, before sliding toward the Senkou Span B level at 148.91.

On the other hand, if USD/JPY buyers reclaim the Tenkan-Sen at 150.91, that would sponsor a leg-up above the 151.00 mark, opening the door to retesting the year-to-date (YTD) high at 151.91.

USD/JPY Price Analysis – Daily Chart

USD/JPY Technical Levels

- EUR/JPY falls over 0.30%, retreating from the week's high as risk aversion grips markets, highlighted by losses in US equities.

- Technical analysis reveals a 'tweezers-top' pattern, suggesting potential for further decline if the pair breaches the 163.07 support.

- A failure to break below 163.00 could lead to a rebound, with resistances at 164.00 and the year-to-date high of 164.31 as key targets for buyers.

EUR/JPY retreats from a weekly high hit earlier during the Asian session and drops more than 0.30% on Thursday amid a risk-off impulse, as witnessed by US equities printing losses, despite falling US Treasury bond yields.

From a technical standpoint, a ‘tweezers-top’ formed in the EUR/JPY daily, though further downside is needed below the November 15 swing low of 163.07 to sponsor a leg lower. If sellers push prices below that level, the next stop would be the Tenkan-Sen at 162.31, the Senkou Span A at 161.51, and the Kijun-Sen level at 160.64.

On the other hand, EUR/JPY sellers' failure to crack below 163.00 could open the door for further upside, with the first resistance seen at the 164.00 figure. A decisive break would expose the year-to-date (YTD) high at 164.31, followed by the 165.00 figure.

EUR/JPY Price Analysis – Daily Chart

EUR/JPY Technical Levels

- The EUR/GBP saw a brief rally on Thursday, but momentum proved short-lived.

- The Euro continues to sniff out higher ground against the Pound, but upside gains continue to get filtered.

- Friday to close out the trading week with UK Retail Sales on offering.

The EUR/GBP waffled on Thursday, clipping into a six-month high of 0.8766 before slipping back to the day's opening bids on the south side of 0.8750.

The economic calendar was a thin showing for the EUR/GBP, with a collection of low-impact speeches from policymakers at the European Central Bank (ECB) and the Bank of England (BoE). Most of the speeches were prepared remarks.

Friday will wrap up the trading week with UK Retail Sales and EU inflation figures.

UK Retail Sales in October are expected to rebound from September's -0.9% decline, forecast to print at 0.3%, while pan-EU Harmonized Index of Consumer Prices (HICP) for October are pretty much set in stone.

As a non-preliminary report, Friday's EU HICP is a confirmation of previously-released figures, and are firmly expected to print as-reported. EU October HICP is forecast at 0.2% for the month-on-month figure and annualized HICP inflation is seen at 2.9%.

EUR/GBP Technical Outlook

The Euro's march up the charts against the Pound Sterling has run into consolidation pressure above the 200-day Simple Moving Average (SMA) grinding down into the 0.860 level. Despite ticking into consecutive new highs, the EUR/GBP is spending most of its time trapped within familiar price levels.

A rising trendline from late August's lows near the 0.8500 handle is providing additional support alongside the 50-day SMA, which is accelerating into the 0.8680 level and is set for a bullish crossover of the 200-day SMA.

Barring a bearish breakdown in the near- to medium-term, prices can be expected to continue catching a ride on technical momentum slowly pushing the pair higher.

EUR/GBP Daily Chart

EUR/GBP Technical Levels

- The NZD/JPY declined to 90.00, seeing 1.20% losses and clearing most of Wednesday’s losses.

- Investors are taking profits after hitting highs since 2015.

- Indicators still suggest that the bulls are in command, but in the short-term, it could correct further.

The NZD/JPY sharply declined in Thursday’s session, seeing more than 1% losses and trimming all of Wednesday’s gains as the cross consolidated the rally which took it to a multi-year high of 91.20.

In that sense, according to the daily chart, the NZD/JPY has a neutral to bullish technical outlook, with indicators signalling a short-term pause in the bulls' upward after hitting overbought conditions and the Relative Strength Index (RSI) exhibits a negative slope still above its midline, while the Moving Average Convergence (MACD) presents lower green bars. In line with that, the cross trades above the 20,100,200-day Simple Moving Average (SMAs) suggest that the bulls are in command over the sellers in the larger context.

In the four-hour chart, indicators are tilting in favour of the bears, with the RSI and MACD standing in negative territory, suggesting that the cross may face further consolidation in the near term.

Support levels: 89.25, 89.00, 88.60 (20-day SMA).

Resistance levels: 90.00, 90.30, 91.20.

NZD/JPY daily chart

-638357678692305805.png)

- The NZD/USD has dropped back beneath 0.6000 as markets turn back into the US Dollar.

- The Kiwi's recovery pattern is beginning to calcify into consolidation.

- NZ PPI to close out the Kiwi's data for the week, US Housing Starts in the barrel for Friday.

The NZD/USD is slipping back on Thursday and is set for its worst trading day in a month, down over 1.2% from the day's high of 0.6037.

A broad miss for US economic data soured market risk appetite, pushing the US Dollar (USD) higher against riskier assets like the Kiwi (NZD). US Initial Jobless Claims for the week into November 10th increased to 231K, higher than the 220K expectation and stepping over the previous week's 218K showing (revised upwards from 217K).

US Industrial Production also missed the mark, with October's production declining by 0.6%, falling back from September's meager 0.1% growth (revised downward from 0.3%) and blowing right past the market's forecast of -0.3%.

New Zealand's Producer Price Index (PPI) will land in the early Friday session when NZ markets open ahead of the pack. NZ PPI in the third quarter last came in at -0.2% for Input and 0.2% for Output.

NZD/USD Technical Outlook

The Kiwi's pullback below the 0.6000 handle leaves the NZD/USD exposed to further downside, with the pair at risk of getting pulled back through the 50-day Simple Moving Average (SMA) and into the 0.5900 handle, with the last swing low sitting near 0.5860.

On the topside, This week's peak at 0.6050 represents a technical resistance level due to repeated rejections from the region since falling into the sub-0.6100 zone in August. Long-term technical resistance will be capping off any upside runs at the 200-day SMA near 0.6100.

NZD/USD Daily Chart

NZD/USD Technical Levels

During the Asian session, New Zealand will release Producer Inflation data. Later in the day, attention will turn to the UK Retail Sales report. In the US, housing data is due with Housing Starts and Building Permits.

Here is what you need to know on Friday, November 17:

The US Dollar Index (DXY) rose marginally on Thursday and finished around 104.40. The Greenback recovered ground despite weak US economic data and the decline in US yields.

US Continuing Jobless Claims reached the highest level since 2022, and Initial Claims rose to 231,000, the highest level in nearly three months. Industrial Production declined by 0.6% in October, exceeding the 0.3% contraction expected. On the positive side, the Philadelphia Fed Manufacturing Survey Index rose from -9 to -5.9, and the Kansas Fed Manufacturing Activity index recovered from -8 to -3 in November.

The Dollar bottomed after the data but then recovered even as US yields headed towards weekly lows, with the 10-year falling to 4.43%. The data released on Thursday pointed to a softer labor market and, combined with recent inflation data, reinforced the perspective that the Federal Reserve is unlikely to raise interest rates further. On Friday, the US will report Building Permits and Housing Starts.

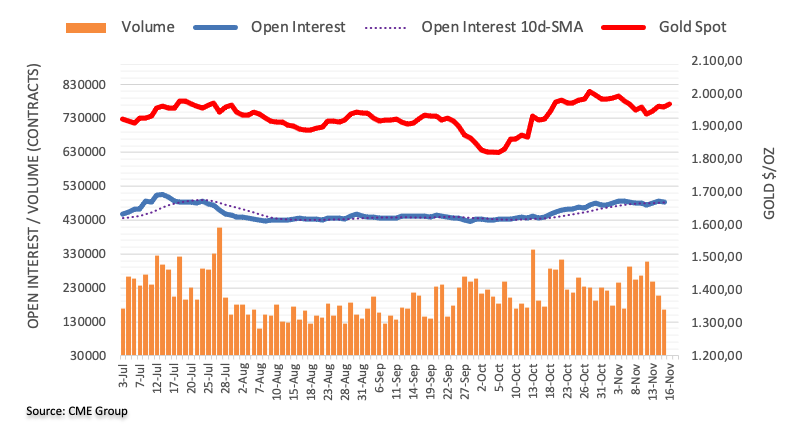

Gold jumped and posted the highest close in over two weeks, above $1,980. The yellow metal peaked at $1,987 and then pulled back moderately. The decline in yields helped XAU/USD gain momentum after breaking above the 20-day Simple Moving Average (SMA) and the $1,975 level. Silver reached the highest level in two months but failed to hold above $24.00 and trimmed gains, retreating to $23.75.

Oil prices tumbled, falling around 5%. The WTI settled near $73.00, the lowest in four months, affected by concerns about global oil demand.

EUR/USD finished practically flat around 1.0850. The pair hit a fresh monthly high just below 1.0900 and then pulled back. The bullish momentum is fading as the US Dollar strengthens. Eurostat will release the final reading of the October Consumer Price Index, which is expected to show no surprises. European Central Bank (ECB) President Christine Lagarde will speak at the Frankfurt European Banking Congress. Her words will likely have little impact as the market expects the central bank to keep rates unchanged in the upcoming meetings.

GBP/USD lost ground but managed to finish above 1.2400. The bias is towards the upside, but the Pound faces resistance at the 100-day SMA at 1.2500. UK October Retail Sales data is due on Friday, with a 0.3% monthly increase expected.

NZD/USD traded significantly lower as the Kiwi weakened, falling below 0.6000. The third quarter's New Zealand Producer Price Index is due on Friday.

The Australian Dollar failed to benefit from an upbeat jobs report and higher inflation expectations. AUD/USD fell from above 0.6500 to 0.6460.

The Canadian Dollar was among the worst performers, hit by the decline in oil prices. USD/CAD rose from 1.3685 to 1.3775. The key support is the 55-day SMA at 1.3655. The Industrial Product Price Index and the Raw Materials Price Index are due on Friday.

Like this article? Help us with some feedback by answering this survey:

- The XAG/USD trades at $23.80, its highest since early September.

- The USD and Treasury yields tumbled after soft economic data was reported from the US.

- As long as investors bet on a less aggressive Fed, it will benefit the grey metal.

The XAG/USD saw significant upward movements in Thursday's session, soaring to $23.80, seeing more than 1.50% gains. The metal increased amid soft Industrial Production and Jobless Claims, which fuelled a decline in US yields, allowing the metal to gain interest.

The Initial Jobless Claims for the week ending November 10 in the US experienced a significant rise to 231,000, surpassing the projected 220,000 and setting a three-month high. Additionally, Industrial Production for October fell short of expectations, showing a 0.6% drop on a month-on-month basis, beating the 0.3% decrease expected. Following the release of the data, the US Treasury yields, typically viewed as the cost of holding non-yielding metals, sharply declined. The 2-year bond rate decreased to 4.83%, while the 5-year and 10-year yields dropped by 4.42% and 4.44%, respectively.

It's worth noticing that the US economy has recently reported evidence of inflation and job creation cooling down, making investors confident that the Federal Reserve (Fed) won't take a more aggressive stance in its next meetings. Adding to that, the bank official also stated that they needed to see further evidence of the economy decelerating so the reports of soft Consumer and Producer Price Indexes, the rising Jobless Claims and weakening Industrial Production, strengthened the case of a more dovish monetary policy. Meanwhile, the CME FedWatch tool indicates that the market has already factored in a pause in December and is now pricing in rate cuts for April- May 2024. Consequently, as long as the US Dollar weakens and investors anticipate a less aggressive Federal Reserve, the price of silver could continue to rise.

XAG/USD levels to watch

On the daily chart, the XAG/USD now holds a bullish technical bias, as indicators suggest that the buyers are in command. The Relative Strength Index (RSI) indicate positive momentum with an ascending slope above its midline, while the Moving Average Convergence (MACD) histogram prints larger green bars. Zooming out, the pair is above the 20,100,200-day Simple Moving Average (SMA), suggesting that the bulls are also firmly in control of the overall trend.

Supports: $23.50, $23.30 - $23.20 (200 and 100-day SMA convergence).

Resistances: $24.00, $24.30, $24.50.

XAG/USD daily chart

-638357621255543462.png)

- GBP/JPY retreats from the week's peak of 188.24, trading around 187.00 amid emerging bearish chart patterns.

- The formation of an 'evening star' pattern near yearly highs indicates potential for further downside, with key supports at 186.41 and 186.04 in focus.

- A rebound above 188.00 could negate the bearish outlook, setting the stage for a test of the year-to-date high at 188.24 and possibly the 190.00 level.

GBP/JPY retraces from weekly highs reached on Wednesday at around 188.24 and hovers around the 187.00 figure late in the New York session, as a three-candle chart pattern emerges that could warrant further downside pressure on the pair.

In the near term, the GBP/JPY is consolidating near the year's highs, though it’s forming an ‘evening-star’ chart pattern. However, sellers must reclaim the Tenkan-Sen at 186.41, alongside the November 14 swing low of 186.04 to exacerbate a deeper pullback below the Senkou Span A seen at 185.47, ahead of the Kijun-Sen at 184.52.

On the other hand, if buyers reclaim 188.00, that could open the door for further upside, with buyers targeting the year-to-date (YTD) high at 188.24, followed by the 190.00 mark.

GBP/JPY Price Analysis – Daily Chart

GBP/JPY Technical Levels

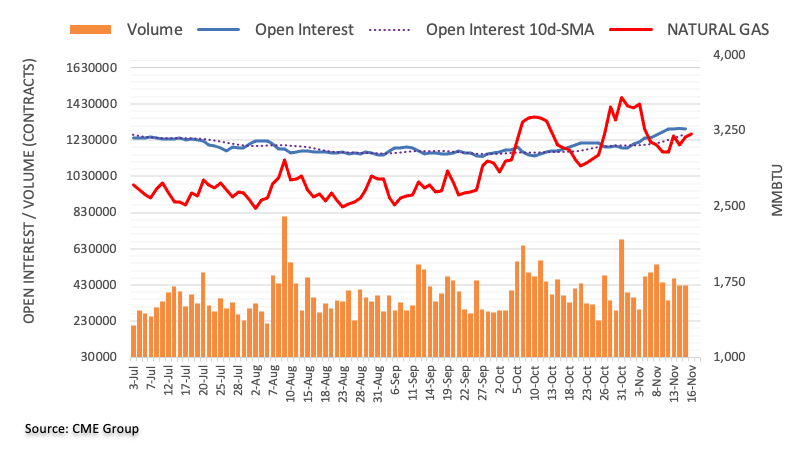

- WTI crude oil plummets to $72.55 per barrel, as US crude inventories build more than expected.

- Soft US economic indicators, including rising unemployment claims and a dip in industrial production, fuel concerns over weakening oil demand.

- Despite the downward trend, potential production cuts by Saudi Arabia and Russia and optimistic forecasts from Commerzbank offer some support to oil prices.

West Texas Intermediate (WTI), the US crude oil benchmark, plummets to a four-month low of $72.22 in late trading during the New York session. Worries amongst investors and the US oil inventory build dragged WTI prices down by more than 5%, as it is changing hands at $72.55 after hitting a high of $76.58.

WTI prices pressured by soft US economic data, global demand concerns

Wednesday’s data from the US Energy Information Administration (EIA) revealed a large build in the crude oil of more than 3.6 million barrels in the United States last week, spurring a leg-down in the black gold. That, alongside soft data in the US painting a scenario of a faster economic deceleration, caused a drop in WTI due to increased concerns demand would diminish.

US industrial production plunged on Thursday due to the United Auto Workers (UAW) strike. At the same time, unemployment claims for the last week rose the most in three months and peaked at around 230K, exceeding forecasts of 220K, suggesting the labor market is easing. Wednesday’s US Retail Sales report came soft, suggesting American households are beginning to spend less, ahead of the Christmas season.

OPEC and the International Energy Agency (IEA) predicted that fourth-quarter supply would tighten, though US data proves the contrary.

Meanwhile, China´s expected slowdown in oil refineries added to the list of headwinds dragging WTI prices lower. Yet, Industrial Production in China advanced, as well as Retail Sales. Nevertheless, weak economic growth in Japan’s economy during Q3, damages the prospects of higher oil prices, as Japan is one of the world's largest energy importers.

Therefore, WTI prices would be under pressure. Still, Saudia Arabia and Russia’s pledge to cut production by 1.3 million barrels toward the end of the year would cushion oil prices.

Analysts at Commerzbank expect oil prices to climb above $80 in Q1 2024. They wrote that “If Saudi Arabia were to stick with its current output level, this would substantially reduce the risk of an oversupply and thus allow the price to recover slightly to $85 per barrel (from its current level; the previous forecast assumed a drop to $85).”

WTI Price Analysis: Technical outlook

From a daily standpoint, WTI has shifted bearishly after dropping below the latest cycle low seen on August 24, at $77.64, opening the door for further losses. Rallies could be seen as better entry prices for shorts, which could be looking to push prices toward the June 28 swing low of $67.10, well below the $70.00 mark. On the flip side, if buyers lift prices above the November 8 daily low of $74.96, that could pave the way for a leg-up toward the $80.00 mark.

- The USD/CHF is cycling 0.8880 with the Franc frozen in place after recent gains.

- The CHF is up almost 2.2% against the USD peak-to-trough on the week.

- Safe haven appetite remains a key theme underpinning market flows, to the benefit of the Franc.

The USD/CHF is spreading around the 0.8880 level as market risk appetite sours, but risk flights pull just short of moving their bets on the Swiss Franc (CHF).

The Franc (CHF) has gained appreciably against the US Dollar (USD) recently, with the CHF's safe haven popularity in the EU bloc apparent and the Swiss National Bank (SNB) determined to defend the CHF using outright market purchases as much as necessary.

Despite a backlog of short bets on the CHF, the SNB's backstopping has prevented any meaningful depreciation on the Franc, and despite inflation near 1.7% in the Swiss economy, Switzerland is enjoying an enviable position.

The SNB's steadily hawkish tone and Switzerland's large net account surplus is keeping the USD/CHF pinned in place despite broad-market sentiment shifts.

USD/CHF Technical Outlook

The USD/CHF dropped sharply this week into the 0.8850 neighborhood frrom the 200-day Simple Moving Average (SMA) at the 0.9000 handle, and the pair is testing into multi-month lows, with September's low bids near 0.8800 within reach.

The pair has been etching in a pattern of lower highs since peaking near 0.9250 in early October. The last swing high sits at 0.9050, near the congestion zone of the 200- and 50-day SMAs.

USD/CHF Daily Chart

USD/CHF Technical Level

Reuters reported that the three newest Federal Reserve governors, Vice Chair Philip Jefferson, Lisa Cook and Adriana Kugler told US Senator Rick Scott in a letter that it is unclear how much further the Fed’s balance sheet wind-down process will run. They explained the process faces no imminent end.

"The size of our balance sheet ultimately will depend on the public's demand for our liabilities, particularly currency and reserves and we cannot specify in advance what that demand will be, hence we are not targeting any particular dollar value for our balance sheet," the letter said according to Reuters.

The governors consider that “under plausible assumptions, the size of the balance sheet could decline considerably further before reserves reach the level consistent with the ample reserves operating framework."

Market reaction

The US Dollar is posting mixed results on Thursday, holding firm with weekly losses as market participants consider that the Federal Reserve is done raising interest rates. The DXY is down by 0.10% at 104.30.

- The AUD/USD is getting yanked back towards 0.6450 on Thursday.

- Market sentiment is twisting towards the downside following US data misses.

- US housing data to wrap up the trading week.

The AUD/USD saw some early gains on Thursday following better-than-expected data figures for Australia, but a miss in the print for US economic numbers is sending market sentiment lower across the board.

Upbeat labor & employment data sent the Aussie (AUD) up to 0.6508 against the US Dollar (USD) before a broad miss for US unemployment claims and industrial capacity shuttered risk appetite for Thursday. The AUD/USD is now testing back toward 0.6450 in the back half of Thursday's trading.

Australia added 55K jobs in October, an upside beat of the expected 20K and handily vaulting over September's print of 7.8K, which was revised upwards from 6.7K.

On the US side, Initial Jobless Claims for the week into November 10th showed 231K new claims for unemployment benefits, nearly a two-year high for the figure. Markets were forecasting 220K, a tick above the previous week's 218K (revised from 217K).

US Industrial Production declined in October by 0.6%, worse than the expected 0.1% contraction, eating away at the previous month's meager 0.1% (revised down from 0.3%).

Friday brings US Housing Starts and Building Permits for October. Median market forecasts are expecting slight declines in both figures, with Housing Starts seen dipping from 1.358M to 1.35M; US Building Permits are forecast to decline from 1.471M to 1.45M.

AUD/USD Technical Outlook

With the Aussie slipping back towards the 0.6450 level, a sustained drop in the AUD will take the pair back down towards the 0.6400 handle where the 50-day Simple Moving Average (SMA) currently awaits.

The topside ceiling currently sits just below 0.6550, with a descending 200-day SMA piling on downside pressure from 0.660.

AUD/USD Daily Chart

AUD/USD Technical Levels

- EUR/USD remains stable, trading around 1.0850, despite a dip to 1.0895 earlier in the session.

- US economic indicators show signs of strain from higher interest rates, with rising unemployment claims and a drop in industrial production.

- Euro's resilience is bolstered by a weaker US Dollar and improved risk sentiment despite concerns of stagflation in the Eurozone.

EUR/USD stays firm during the North American session, almost unchanged, printing gains of 0.06%, and exchanging hands at around 1.0850s after hitting a daily low of 1.0895, shy of challenging the 1.0900 figure.

Euro keeps gains vs. weakening US Dollar, market eyes EU’s inflation, Lagarde speech

Economic data in the United States (US) continues to feel the lagging impact of higher interest rates set by the Federal Reserve. The US Bureau of Labor Statistics (BLS) revealed that unemployment claims for the last week rose the most in the last three months while Industrial Production plunged. US export and import prices cooled down, signs that the inflation battle continued to be won by the US central bank.

Nevertheless, Fed officials pushed back against estimates for more than 88 bps of rate cuts next year. Cleveland’s Fed President Loretta Mester added that whether further tightening is needed would be data-dependent. Lately, Fed Governor Lisa Cook said, “a soft landing is possible,” though added that continued demand could slow the pace of disinflation.

In the meantime, the Greenback is feeling the pain, depreciating further against most G8 currencies, including the Euro (EUR). The US Dollar Index (DXY) is a measurement of the performance of six currencies against the buck, favoring the former, as the DXY drops 0.06%, down at 104.32.

On the Eurozone (EU) front, the European Central Bank (ECB) President Christine Lagarde crossed the wires but failed to comment on monetary policy. The Euro’s rise could be attributed by overall US Dollar weakness and risk appetite improvement. Recent data from the EU, with soft PMI, GDP for Q3 contracting, and Industrial Production sinking, paints a stagflation scenario in the bloc. Hence, that could weigh on the single currency.

Ahead in the economic calendar, the EU’s docket will feature the Harmonized Index of Consumer Prices (HICP), and a speech of the ECB’s President Lagarde. In the US, housing data, Building Permits, and Fed speakers are expected to offer fresh impetus to EUR/USD traders.

EUR/USD Technical Levels

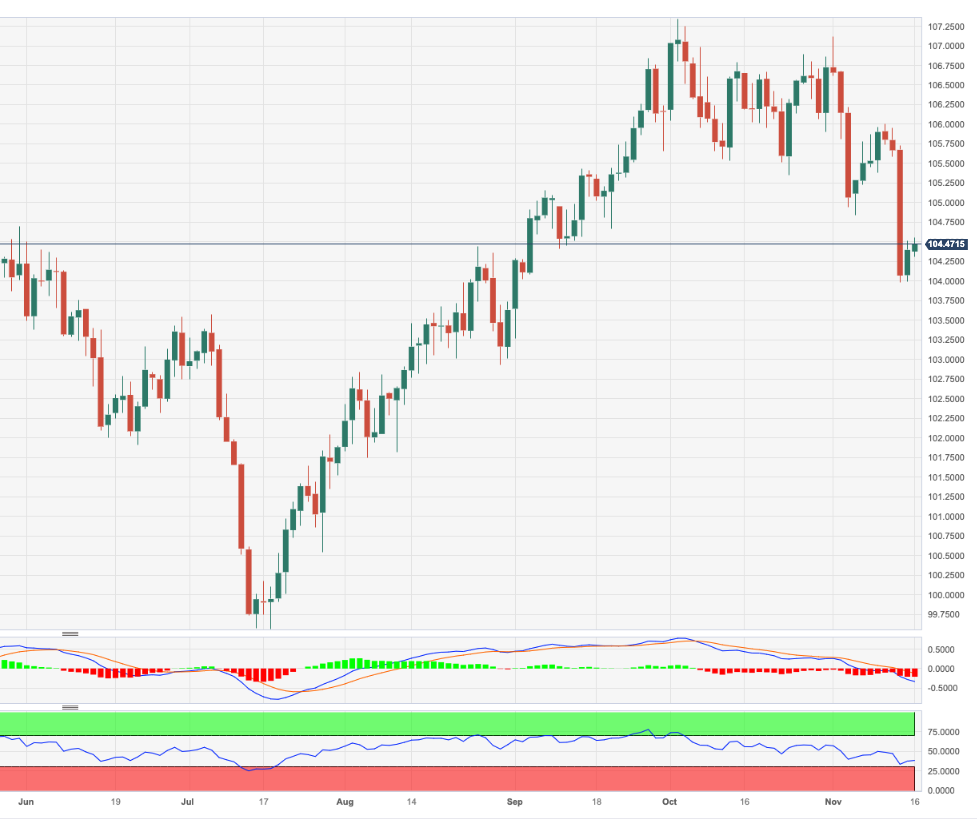

- The DXY index first declined to 104.00 and then jumped back to 104.30.

- Jobless Claims accelerated in the first week of November, while Industrial Production from October disappointed.

- The mix of the labor market cooling down and inflation retreating is making investors believe Fed rate hiking cycle is over.

The US Dollar (USD) traded flat on Thursday and rotated within the 104.00 to 104.30 range. The USD remains pressured as markets place additional bets on the Federal Reserve (Fed) being less aggressive than expected after weak Jobless Claims and Industrial Production figures from the US.

The United States economy is showing signs of cooling down with a weakening labor market and inflation retreating, which makes it highly unlikely that the Federal Reserve (Fed) will raise interest rates at the upcoming December meeting. That being said, the bank will receive additional CPI and Nonfarm Payrolls reports before its last decisions of 2023, which could impact whether they ultimately decide to hike or not.

Daily Digest Market Movers: US Dollar struggles to gather momentum after weak data

- The US Dollar Index recovered to 104.30 from a low of around 103.98 and stands at its lowest point since September.

- During the week ending November 11, the number of US Initial Jobless Claims increased to 231,000, surpassing the predicted 220,000.

- The Philadelphia Fed Manufacturing Index slightly improved, reaching -5.9 instead of the expected -9 points.

- Industrial Production in the United States fell short of expectations, experiencing a 0.6% MoM decline, higher than the -0.3% expected. It also tallied a year-on-year decrease of 0.7%.

- US Treasury yields extended their decline, with the 2-year rate increasing to 4.86%, while the 5 and 10-year rates rose to 4.43% and 4.43%, respectively.

- According to the CME FedWatch Tool, the odds of a 25-basis-point hike in December are zero. Markets are betting on rate cuts appearing sooner than expected in May 2024, if not March.

Technical Analysis: US Dollar bulls do battle and defend 100-day SMA

The daily chart suggests that the DXY has a neutral to bearish technical outlook, with bulls having lost significant ground this week and struggling to gather momentum. The Relative Strength Index (RSI) points south below 50, while the Moving Average Convergence Divergence (MACD) histogram exhibits larger red bars.

Zooming out, despite the bears gaining ground and pushing the index below the 20-day Simple Moving Average (SMA), the bulls are defending the 100-day average, indicating that if the sellers fail to conquer it, the outlook will still be positive in the larger context.

Support levels: 104.15 (100-day SMA),103.60 (200-day SMA), 103.30.

Resistance levels: 104.50, 105.00,105.30.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- The USD/JPY has slipped back into the 150.50 region.

- The pair couldn't hold onto gains above the 151.00 handle.

- US data sours market sentiment mood on Thursday.

The USD/JPY slipped to a Thursday low of 150.30 after a batch of bad US data soured risk appetite. The pair slipped from the 151.40 region as the USD/JPY whipsaws through the trading week.

US Initial Jobless Claims for the week into November 10th missed the mark, showing nearly a two-year high of 231 thousand new unemployment benefit seekers versus the expected 220 thousand. The previous week showed 218 thousand new jobless claimants, and investors have rotated their perspective to now be concerned about the state of the US economy.

United States Industrial Production (MoM) falls 0.6% in October

US Industrial Production for October also declined past expectations, printing at -0.6% compared to the forecast -0.1%. US capacity fell from September's 0.1% soft reading, which was revised downwards from 0.3%.

The trading week will round out with Friday's US Building Permit and Housing Starts figures, where investors will be looking to take a pulse reading of the US economy.

USD/JPY Technical Outlook

The USD/JPY is churning near the extreme top-end of long-term trading, cycling the 151.00 level. The pair remains extremely well-bid, and the pair looks set for another fresh run at multi-decade highs above 152.00.

Medium-term support is coming from the 50-day Simple Moving Average (SMA) rising into 149.50, and the USD/JPY's long-term bull run has seen price action pull well away from the long-run 200-day SMA near 141.25.

USD/JPY Daily Chart

USD/JPY Technical Levels

- The Canadian Dollar is getting dragged down by declining Crude Oil bids.

- Housing Starts in Canada tick upward, overshadowed by US unemployment figures.

- WTI Crude Oil slumps below $74 per barrel.

The Canadian Dollar (CAD) is getting pushed back into recent lows against the US Dollar (USD) as declining Crude Oil and softening risk appetites weighed on the Loonie.

Canada saw a welcome bump in annualized Housing Starts in October, but the figure was entirely overshadowed by a miss for US Initial Jobless Claims, which is dragging down market sentiment.

Daily Digest Market Movers: Canadian Dollar on the back foot with no support from Crude Oil

- US Initial Jobless Claims rise to their highest level in nearly two years, market narrative tilts back toward fears of a harder-than-soft landing.

- 231K new unemployment benefit claims are reported in the US for the week of November 10 versus forecast 213K; previous week revised from 217K to 218K.

- US Industrial Production also declined past forecast, printing at -0.6% for October against the forecast decline to -0.3%. September’s Industrial Production printed at just 0.1% after being revised down from 0.3%.

- Canadian Housing Starts for the year into October ticked upward, 274.7K new homes started construction, well over the expected 252.9K, climbing over September’s reading of 270.7K.

- Despite production cap quotas, OPEC member countries continue to export more oil than expected, sending Crude Oil lower on Thursday.

- West Texas Intermediate (WTI) Crude Oil is trading back down below $74.00/barrel, pulling the plug on CAD support in the markets.

- CAD: Limited scope for near-term gains – Scotiabank

Technical Analysis: Canadian Dollar bounces off 50-day SMA, USD/CAD sees rejection from rising trendline

The USD/CAD reclaimed the 1.3700 handle during Thursday trading, setting the pair up for a fresh run at 1.3800.

The early week’s declines saw the USD/CAD ease into a near-term low of 1.3654 before getting a clean bounce off of the 50-day Simple Moving Average (SMA) and a rising trendline drawn from July’s lows near 1.3100.

Long-term technical support comes from the 200-day SMA sitting near the 1.3500 handle. A bullish extension for the USD/CAD will see bidders looking to take another run at cracking the 1.3900 handle at November’s high bids.

USD/CAD Daily Chart

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.04% | -0.03% | 0.64% | 0.71% | -0.39% | 0.82% | 0.13% | |

| EUR | -0.04% | -0.06% | 0.60% | 0.66% | -0.44% | 0.77% | 0.07% | |

| GBP | 0.03% | 0.07% | 0.68% | 0.73% | -0.36% | 0.85% | 0.15% | |

| CAD | -0.65% | -0.57% | -0.68% | 0.04% | -1.03% | 0.17% | -0.51% | |

| AUD | -0.70% | -0.66% | -0.74% | -0.05% | -1.10% | 0.11% | -0.59% | |

| JPY | 0.39% | 0.44% | 0.35% | 1.04% | 1.09% | 1.20% | 0.51% | |

| NZD | -0.81% | -0.76% | -0.85% | -0.15% | -0.11% | -1.21% | -0.69% | |

| CHF | -0.13% | -0.07% | -0.14% | 0.53% | 0.58% | -0.51% | 0.69% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- GBP/USD rises more than 0.20% due to a deteriorating economic outlook in the US.

- US jobless claims exceeding forecasts portray the labor market is easing.

- Federal Reserve officials pushed back against rate cuts next year, with investors pricing 88 bps of Fed cuts.

The Pound Sterling (GBP) clings to its earlier gains versus the US Dollar (USD) on Thursday as the economy in the United States (US) deteriorates further, warranting no additional tightening by the Federal Reserve. In price action terms, the GBP/USD jumped from daily lows of 1.2370 and trades at 1.2447, up 0.26%.

Pound Sterling gains as US data weakens US Dollar, GBP/USD traders eye UK Retail Sales

Investors' sentiment deteriorated after US economic data portrayed that the economy is losing steam faster than expected. US Initial Jobless Claims for the last week rose by 231K more than the 220K expected, revealed the US Department of Labor. Further data revealed by the US Federal Reserve noted that Industrial Production in October contracted, hurt by the auto strike.

In the meantime, Federal Reserve speakers crossed newswires, they’re trying to push back against rate cut expectations, led by Cleveland Fed President Loretta Mester, who said the US central bank is data dependent on whether to raise rates further. Meanwhile, interest rates traders have priced in 88 basis points of rate cuts for 2024.

The GBP/USD rise is also courtesy of the broad weakness of the Greenback. The US Dollar Index (DXY) dropped 0.01%, at 104.38, undermined by the fall in US Treasury bond yields.

Aside from this, the latest UK inflation report revealed that consumer inflation dropped to 4.6%, down from 6.7%, the lowest since October 2021. Even though the Bank of England (BoE) has stressed rates need to be higher for longer, money market futures are not expecting more rate hikes.

Ahead in the calendar, UK Retail Sales are expected to print a recovery after plunging -0.9% in September monthly data. Annually, estimates are at -1.5% contraction, worse than the September data. In the US, housing data, Building Permits, and Fed speakers, are expected to offer fresh impetus to GBP/USD traders.

GBP/USD Price Analysis: Technical outlook

The daily chart portrays the pair as neutral to upward biased, though the GBP/USD failed to remain above the 200-day moving average (DMA) at 1.2440, which could exacerbate a dip below the 1.2400 figure. A breach of the latter would expose the 1.2300 mark, head of testing the 50-DMA at 1.2256, with next support seen at a November 13 low of 1.2209. On the upside, if buyers reclaim the 200-DMA, a test of 1.2500 is on the cards.

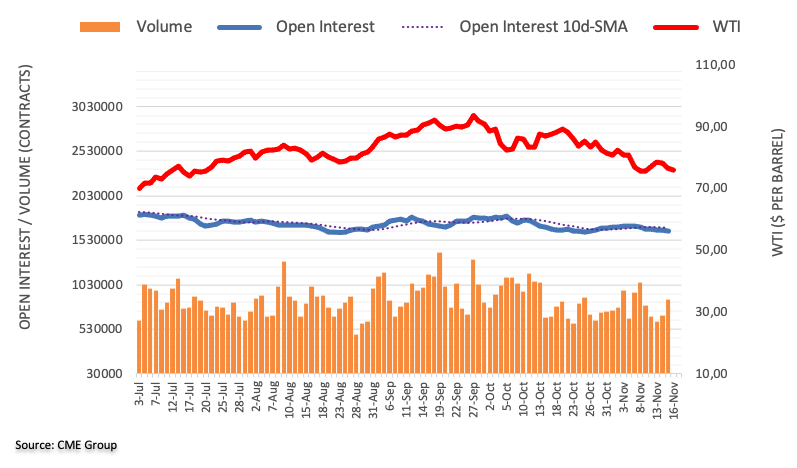

- The XAU/USD escalated to a high of $1,987, seeing 1.35% gains.

- US Industrial Production from October came in lower than expected. Jobless claims rose to their highest in three months.

- US yields are sharply falling.

The XAU/USD Gold spot price experienced an impressive upward spike on Thursday, rising toward $1,985 and seeing a daily gain of 1.35%. The metal’s momentum was driven by a decline in US Treasuries, which fell after the report of weak US data suggesting that markets are betting on lower odds of additional tightening by the Federal Reserve (Fed).

On the data front, the Initial Jobless Claims for the week ending November 10 from the US saw a noticeable increase to 231,000, surpassing the predicted 220,000. Furthermore, Industrial Production did not meet expectations for October, as it showed a 0.3% decline and a 0.6% drop in MoM expected by the markets. These unfavourable US economic figures fuelled a decline in the US Treasuries, often seen as the cost of holding non-yielding metals, which allowed the price to spike. The 2-year bond rate fell to 4.83%, and the 5 and 10-year yields declined by 4.43% and 4.45%, respectively.

In the meantime, the CME FedWatch tool suggests that markets have already priced in a pause in December and are now pricing rate cuts in April-May of 2024. In that sense, as long as the US Dollar weakens and investors bet on a less aggressive Fed, the yellow metal could see further upside.

XAU/USD levels to watch

On the daily chart, the XAU/USD displays a bullish bias after the price cleared most of November's losses. The Relative Strength Index (RSI) indicates positive momentum with an ascending slope above its midline, while the Moving Average Convergence (MACD) histogram displays rising green bars. Zooming out, the pair is above the 20,100,200-day Simple Moving Average (SMAs), suggesting that the bulls are also in control on the broader context.

Supports: $1,975 (20-day SMA), $1,930 (100 and 200-day SMA),$1,915.

Resistances:$2,000,$2,030, $2,050.

XAU/USD daily chart

-638357485062704553.png)

The BoE is unlikely to raise Bank Rate further amid deteriorating growth conditions in the UK. Therefore, the GBP could struggle, economists at TD Securities report.

GBP downside vs. AUD with moderation in UK data

Growth expectations for the UK are starting to correct lower and a lot of the good news that had been priced into GBP has started to recede.

Looking at market expectations of cuts over the next year, there is still more optimism on the UK vs the Euro-area, whereas we expect the BoE to lead the global cutting cycle amongst peers. Accordingly, we see some EUR/GBP upside as markets keep moderating hawkish UK expectations.

We also like GBP lower vs. AUD and NZD where the macro outcomes don't look as meek and where some catch-up is forthcoming.

- Mexican Peso continues its five-day rally as the USD/MXN drops below the key support at the 100-day SMA.

- Banxico’s officials comments suggest the central bank would adopt a slightly dovish stance in 2024.

- The US inflation downward path continues as export and import prices plunge.

- Industrial Production in the United States suggests the economy could slow down faster than expected.

Mexican Peso (MXN) extended its gains for the fifth consecutive day against the US Dollar (USD) after a raft of economic data from the United States (US) continues to cement a scenario of no more rate hikes by the US Federal Reserve (Fed). The USD/MXN pair hit a daily high at around 17.33, below the 100-day Simple Moving Average (SMA) of 17.34, before resuming its downtrend, which was positive for the Peso.

Mexico's economic docket remains scarce, with traders leaning to the latest comments from Bank of Mexico (Banxico) officials, its Governor Victoria Rodriguez Ceja, and Deputy Governor Jonathan Heath. Both stressed rate cuts could begin in 2024 but emphasized that monetary policy would continue to be restrictive despite that.

On the US front, inflation extended its downtrend after prices paid by producers followed the path of lower consumer prices, though the latter remained above the Fed’s 2% target. Thursday’s US economic docket featured export and import prices, both figures easing more than expected, while industrial production (IP) contracted in October, according to data revealed by the Fed.

Daily digest movers: Mexican Peso on its path to test the psychological 17.00 figure

- In October, Industrial Production in the United States missed estimates for a 0.3% plunge and dropped 0.6% MoM and following September’s 0.1% expansion. On a yearly basis, it fell 0.7%.

- The Philadelphia Fed Manufacturing Index improved lightly to -5.9 versus expectations of -9 points.

- US Initial Jobless Claims for the week ending November 11 rose 231K, exceeding forecasts of 220K, the highest jump in nearly three months.

- The US Producer Price Index and Consumer Price Index reports in October, suggests prices are cooling down, which has increased the odds for an end of the US Federal Reserve tightening cycle.

- Interest rates swap traders, expect 100 basis points of rate cuts by the Fed in 2024.

- Banxico’s Deputy Governor Jonathan Heath said the Government Board continues to monitor real rates, which currently lie at around 7%.

- Heath said Banxico wouldn’t rely on other countries – usually, Banxico reacts to the US Federal Reserve’s decisions – and said they would depend on incoming data and how inflation expectations evolve.

- On Monday, Banxico’s Governor Victoria Rodriguez Ceja commented that the easing inflationary outlook could pave the way for discussing possible rate cuts. She said that monetary policy loosening could be gradual but not necessarily imply continuous rate cuts, adding that the board would consider macroeconomic conditions, adopting a data-dependent approach.

- The latest inflation report in Mexico, published on November 9, showed prices grew by 4.26% YoY in October, below forecasts of 4.28% and prior rate of 4.45%. On a monthly basis, inflation came at 0.39%, slightly above the 0.38% consensus and September’s 0.44%.

- Mexico’s economy remains resilient after October’s S&P Global Manufacturing PMI improved to 52.1 from 49.8, and the Gross Domestic Product (GDP) expanded by 3.3% YoY in the third quarter.

- Banxico revised its inflation projections from 3.50% to 3.87% for 2024, which remains above the central bank’s 3.00% target (plus or minus 1%).

Technical Analysis: Mexican Peso extends its rally, with USD/MXN sliding below the 100-day SMA

The USD/MXN pair bias has shifted downwards in the short term, as the pair broke below the 100-day Simple Moving Average (SMA) at 17.34. The next support level would be the psychological 17.00 figure. The pair has shifted bearishly, with the 20-day SMA approaching the 17.70-17.65 area, where the 50- and 200-day SMAs converge. If the bearish cross is completed, it could pave the way for a test of the psychological 17.00 figure, ahead of challenging the year-to-date (YTD) low of 16.62, printed in July.

On the other hand, if USD/MXN buyers reclaim the 100-day SMA at 17.34, that could put into play a test of the 17.50 mark in the near term. A breach of the latter would expose key resistance levels, like the 200-day SMA at 17.64, ahead of the 50-day SMA at 17.69. Once cleared, the next resistance emerges at the 20-day SMA at 17.87 before buyers could lift the spot price towards the 18.00 figure.

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

2024 should be the year US exceptionalism wanes and currencies outside of the US are allowed to refloat, economists at ING report.

The end of US exceptionalism

Our simple thesis is that tighter interest rates finally catch up with the US economy next year, growth registers a paltry 0.5% and the Fed, in line with its dual mandate to focus on inflation and maximum employment, cuts rates back into less restrictive territory. We forecast 150 bps of Fed easing next year starting in the second quarter.

Our baseline view for 2024 sees the Dollar bear trend picking up pace through the year.

Compared to year-end 2024 forwards, currencies could be as little as 2% (China’s Renminbi) to as much as 13% (Scandinavian FX) firmer against the Dollar.

Silver prices are sustaining above $20 despite lack of support from investment demand. Strategists at ANZ Bank analyze XAG/USD outlook.

Investment in Silver to turn positive going into next year

Silver’s fundamentals look supportive, as the market is in structural deficit. However, investors are not yet turning to Silver.

We expect investment in Silver to turn positive going into next year when the macro backdrop becomes more supportive as the Fed draws to the end of its hiking cycle.

However, slow economic growth next year is likely to have limited impact on industrial demand for Silver from energy transition projects.

Australian Dollar is one of ING’s favourite currencies for next year.

AUD in a very advantageous position

Our favourite currency in 2024 is the Australian Dollar. High US rates and weak Chinese growth have repressed it and made it the most undervalued currency in the G10 space.

The release valve of lower US rates should allow the Aussie to lead the currency recovery against the US Dollar. A hawkish Reserve Bank of Australia should not hurt either.

AUD/USD – 4Q23 0.64 1Q24 0.65 2Q24 0.67 3Q24 0.69 4Q24 0.71

Industrial Production (MoM) in the United States dipped 0.6% in October, missing the 0.3% drop expected by markets. In September, United States Industrial Production (MoM) had advanced by a revised 0.1% compared with the 0.3% rise previously estimated.

In the same period, Capacity Utilization narrowed to 78.9% from 79.5%.

What is the United States Industrial Production (MoM)?

The Industrial Production released by the Board of Governors of the Federal Reserve shows the volume of production of US industries such as factories and manufacturing. Up trend is regarded as inflationary which may anticipate interest rates to rise. If High industrial production growth comes out, this may generate a positive sentiment (or bullish) for the USD.

When is the next United States Industrial Production (MoM) report released?

The next United States Industrial Production (MoM) data will be published on December 15 at 14:15 GMT. For more information, check the United States Industrial Production (MoM) entry in FXStreet Calendar.

US Dollar price today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.12% | -0.01% | 0.42% | 0.37% | -0.24% | 0.50% | 0.06% | |

| EUR | 0.12% | 0.10% | 0.54% | 0.48% | -0.13% | 0.61% | 0.16% | |

| GBP | 0.01% | -0.10% | 0.44% | 0.38% | -0.27% | 0.53% | 0.06% | |

| CAD | -0.42% | -0.51% | -0.44% | -0.08% | -0.68% | 0.09% | -0.37% | |

| AUD | -0.36% | -0.50% | -0.38% | 0.06% | -0.63% | 0.14% | -0.33% | |

| JPY | 0.25% | 0.13% | 0.23% | 0.68% | 0.61% | 0.74% | 0.30% | |

| NZD | -0.51% | -0.62% | -0.52% | -0.07% | -0.15% | -0.76% | -0.46% | |

| CHF | -0.08% | -0.16% | -0.05% | 0.39% | 0.32% | -0.29% | 0.47% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

An automation tool was used in creating this post.

Strategists at Société Générale explore the five major drivers of Gold prices

Rates volatility

As interest rates in the US peak, volatility in the rates space is likely affecting the march higher in Fold. If and when rates markets calm down, this will likely create a drag on Gold prices.

Rates cresting

US rates can come off more and sooner than rates in other OECD economies, signalling possible dollar weakness ahead, creating a tailwind for Gold.

US recession

With a recession in the US looming – however mild – there is a risk that the Fed will have to start lowering rates before sticky inflation budges, lowering carrying costs and elevating the expected return for Gold.

Geopolitics

Risk premium is based on the low-probability, high-impact scenario of Iran becoming directly involved in the conflict. This risk, while not our base case, should continue to provide medium-term support to Gold prices.

Central bank

We expect strong central bank Gold purchases and the broad de-dollarisation theme that will accompany that to remain a long-term supporting driver for Gold, but most of the impact should be felt beyond our forecasting horizon.

XAU/USD – 4Q23 $2,000 1Q24 $2,100 2Q24 $2,200 3Q24 $2,200 4Q24 $2,200

The Canadian Dollar is drifting a bit lower on the day. Economists at Scotiabank analyze the USD/CAD pair’s outlook.

Narrower spreads are CAD-supportive

Soft stocks and crude are minor constraints on the CAD in the short-run but some improvement in short-term yield differentials in the CAD’s favour this week rather suggest scope for a little more strength.

Modest gains on the session so far are taking the USD further away from key support (trend and potential Head & Shoulders bear trigger) at 1.3655.

USD gains through 1.3705/1.3710 may extend modestly to the mid-1.37s, although short-term trend oscillators are starting to align bearishly for the USD which really should limit scope for near-term gains.

- Philadelphia Fed Manufacturing Index rose to -5.9 in November.

- US Dollar Index slides toward 104.30 after US data.

The Diffusion Index for current general activity of the Federal Reserve Bank of Philadelphia's Manufacturing Survey rose to -5.9 in November from -9 in October. This reading came in better than the market expectation of -9.

“The survey’s indicator for general activity rose but remained negative. The indicator for shipments turned negative, while the indicator for new orders was positive but low. The employment index suggests steady employment overall, and both price indexes indicate overall increases in prices. The future indicators suggest that firms’ expectations for growth over the next six months remain subdued”, mentioned the publication.

Further detail of the report revealed that the employment index declined three points to 0.8; the new orders fell three points to 1.3; and the price paid declined from 23.1 to 14.8.

Market reaction

The US Dollar pulled back after the US Jobless Claims and the Philly Fed reports. The US Dollar Index turned lower after the reports, falling under 104.30.

- Initial Jobless Claims in the US increased by 13,000 in the week ending November 11.

- US Dollar Index stays in daily range below 104.50.

There were 231,000 initial jobless claims in the week ending November 11, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 218,000 (revised from 217,000) and came in worse than the market expectation of 220,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.3% and the 4-week moving average stood at 220,250, an increase of 7,750 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending November 4 was 1,865,000, an increase of 32,000 from the previous week's revised level."

Market reaction

The US Dollar Index stays in its daily range below 104.50 following this data.

GBP/USD slips. Economists at Scotiabank analyze the pair’s outlook.

Underlying trend dynamics remain supportive

Cable’s slide from the 1.25 peak reached earlier this week is steadying but there are few signs of positive impulses on the short-term chart at the moment.

Trend momentum oscillators remain bullishly aligned for the GBP on the intraday and daily studies and are edging positive on the weekly DMI – which should help limit GBP losses at least in the near-term.

Regaining 1.2430 intraday would be a modest positive for the Pound.

Support is 1.2375.

- EUR/USD trades in a vacillating mood around 1.0850.

- Further upside could see the next hurdle at 1.0945.

EUR/USD trades without clear direction in the mid-1.0800s following the previous daily decline on Thursday.

The continuation of the upward bias could see the weekly high of 1.0945 (August 30) revisited sooner rather than later. Once cleared, spot could challenge the psychological threshold of 1.1000.

So far, while above the significant 200-day SMA, today at 1.0803, the pair’s outlook should remain constructive.

EUR/USD daily chart

The USD’s consolidation is extending a little further. Economists at Scotiabank analyze Greenback’s outlook.

Stronger stocks mean stronger headwinds for the USD

There is a busy session ahead for the USD. Key data reports may be soft – weekly claims have been nudging higher and may be affected by seasonal factors while industrial production could be weighed down by the auto strikes. The USD may come under light pressure at least as a result of weak data.

The S&P is up more than 10% from the late October low and seasonal trends suggest that jingling you can hear might be the ‘Santa Clause rally’ that typically gains traction about now after a mid-year stutter in risk appetite steadies. Stronger stocks mean stronger headwinds for the USD.

- The Greenback marginally recovers Tuesday’s meltdown.

- Traders are gasping for air, looking for clues on what is the next longer term.

- The US Dollar Index is steady above 104 and off this week’s low.

The US Dollar (USD) traded in a tight range on Wednesday where both buyers and sellers were not budging after the meltdown from Tuesday. Traders will want to look for further clues and confirmation if the Fed is truly done hiking, with bets mounting on when the Fed will cut first. Meanwhile yields are sinking lower and equities are soaring, which means that the rate differential story between the Greenback and other currencies is losing its importance.

The calendar this Thursday is a very packed one with all eyes on US Federal Reserve speakers: no less than five members of the Board of Governors are expected to speak. Add a few lighter data points that could confirm and reassure traders that the Fed is really done hiking, and some more Greenback devaluation might be at hand. In the background the clock is ticking on the US debt ceiling with no concrete solution yet nearby.

Daily digest: US Dollar calms the nerves

- The US budget deadline is due to kick in on November 17. Sentiment was further boosted on Tuesday by growing hopes that a US government shutdown can be avoided.

- US President Joe Biden met Chinese President Xi Jinping at the historic Filoli estate south of San Francisco on Wednesday: Initial reports appear to be quite positive, with the two superpowers agreeing to reopen communication lines and China to regulate chemical exports used in the manufacture of the opioid fentanyl. Differences over Taiwan, however, remain a sore spot.

- No less than five US Federal Reserve members are due to speak this Thursday:

- Lisa D. Cook, a member of the Federal Reserve Board of Governors is due to speak at 11:00 GMT.

- Cleveland Fed President Loretta Mester will speak near 13:30.

- At 14:25, New York Fed President John Williams will speak.

- Federal Reserve Board Governor Christopher Waller will take the stage near 15:30..

- Loretta Mester will speak for a second time this Thursday near 17:00, together with Lisa Cook.

- Around 13:30 GMT, the weekly Jobless Claims report is due:

- Initial Jobless Claims are set to rise from 217,000 to 220,000.

- Continuing Claims are expected to pick up as well from 1,834,000 to 1,847,000.

- At the same time, the Import/Export Price Index will be released:

- The Monthly Export Price Index for October is set to decline from 0.7% to -0.5%.

- The Yearly Export Price Index was at -4.1% with no forecast for the October number.

- The Monthly Import Price Index for October is set to decline from 0.1% to -0.3%.

- The Yearly Import Price Index was at -1.7% with no forecast for the October number.

- The last bit of information to come out at 13:30 GMT is the Philadelphia Fed Manufacturing Survey for November, expected to remain unchanged at -9.

- Industrial Production for the month of October is due to come out near 14:15 GMT, heading from 0.3% to -0.3%.

- At 15:00 GMT the National Association of Home Builders (NAHB) Housing Market Index for November will be released: A steady 40 number is expected.

- The last number of importance this Thursday will be the Kansas Fed Manufacturing Activity Index for November. The previous number was at -8, no forecast foreseen.

- Equities are undergoing some profit taking after their two-day rally. The Hang Seng slides over 1%, while Japan was able to contain losses to less than 1%. European equities are opening marginally in the red, while US equity futures see the Nasdaq leading the decline.

- The CME Group’s FedWatch Tool shows that markets are pricing in a 100% chance, up from 85.7% on Tuesday morning, that the Federal Reserve will keep interest rates unchanged at its meeting in December.

- The benchmark 10-year US Treasury yield trades at 4.50%, and is starting to tick up a bit, little by little.

US Dollar Index technical analysis: US Dollar technical bounce

The US Dollar is trying to continue its recovery from Tuesday's meltdown. The recovery is not going as speedy as hoped for, however, as only baby steps are visible in the US Dollar Index (DXY). It looks like traders have been unwinding their US Dollar long positions and only a substantial catalyst in favour of the Greenback will help to bring the DXY back to 105 and higher.

The DXY was able to bounce off the 100-day Simple Moving Average (SMA) near 104.20. Expect to see a bounce from there with 105.29, the low of November 6, as the market level where the DXY should try to close above this week. From there, the 55-day SMA at 105.71 is the next price point on the topside that needs to be reclaimed by US Dollar bulls before starting to think of more US Dollar strength to come into play.

Traders were warned that when the US Dollar Index would slide below that 55-day SMA, a big air pocket was opening up that could see the DXY fall substantially. This materialised on Tuesday. For now the 100-day SMA is trying to hold, at 103.62, although the 200-day SMA is a much better candidate for support. Should that level even be broken substantially, a long term sell-off could get underway with the DXY falling between 101.00 and 100.00.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

EUR/USD is just about trading in the green on the day. Economists at Scotiabank analyze the pair’s outlook.

Upside risks remain

In broad terms, data surprise trends are improving for the EUR and weakening somewhat for the USD – a trend that may continue in the near term, with the US economy showing clear signs of slowing and anticipated headwinds for Europe (mild weather is once again easing energy concerns) failing to develop so far.

EUR/USD gains through 1.0885 should trigger another leg higher in spot.

Support is 1.0810 and 1.0750.

- DXY adds to Wednesday’s recovery and revisits the mid-104.00s.

- The resumption of the selling pressure initially targets 103.98.

DXY manages to pick up extra pace and extends further the bounce off multi-week lows around 104.00 on Thursday.

In case bears regain the upper hand, the breakdown of the November low of 103.98 (November 14-15) should pave the way for a quick test of the critical 200-day SMA at 103.61 prior to the weekly low of 102.96 (August 30).

In the meantime, while above the key 200-day SMA, the outlook for the index is expected to remain constructive.

DXY daily chart

- EUR/JPY clinches new highs past 164.00.

- A corrective move appears on the cards near term.

EUR/JPY advances further north of the 164.00 level and prints new yearly highs on Thursday.

Further upside appears well on the cards for the cross in the short-term horizon. Against that, the surpass of the 2023 high of 164.30 (November 16) is expected to face the next significant resistance level not before the 2008 top of 169.96 (July 23).

In the meantime, the daily RSI remains well within the overbought territory near 75, opening the door to a potential near-term corrective move.

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 152.58.

EUR/JPY daily chart

Australia’s October employment was strong. The developments have though had little to no impact on the performance of the Australian Dollar. Economists at MUFG Bank analyze Aussie’s outlook.

AUD/USD’s next important resistance level remains the 200-DMA at 0.6596

Employment increased by 55K in October. The trend for employment growth remains strong enough (it has averaged 36.5K/month so far this year vs. an average of 43K/month in 2022) to keep the unemployment rate broadly stable. The unemployment rate increased by 0.2 points to 3.7% in October and has been fluctuating in a narrow range between 3.4% and 3.7% since the middle of last year. Overall, the report will keep alive expectations that the RBA could deliver one final hike later this year.

It appears to be more of a correction for the Aussie after strong gains in recent days. The AUD/USD rate jumped from an intra-day low of 0.6360 on Tuesday prior to the US CPI release to a high on Wednesday of 0.6542. The next important resistance level remains the 200-DMA which comes in 0.6596. The Australian Dollar has strengthened even more notably against the yen this week resulting in the AUD/JPY rate breaking above the 98.00 level for the first time since September 2022. The next important resistance levels are provided by the 100.00 level which was last broken back in late 2014 and before that in Q2 2013.

- The New Zealand Dollar corrects back after the big gains made midweek.

- The Kiwi retreats as China property bubble woes persist despite positive economic data and the pledge of a government bailout.

- NZD/USD almost touches the key October highs at 0.6055 before retreating, though the uptrend is still in play.

The New Zealand Dollar (NZD) pares the strong gains made midweek as the European session gets underway on Thursday. The NZD retreats on negative sentiment: the Hang Seng index closed 1.41% lower at the end of the Asian session, due to lingering concerns about China’s vulnerable property sector.

As New Zealand’s largest trading partner, bad news for China is usually bad for New Zealand too, and the Kiwi fell from the 0.6050s to trade back in the 0.5990s at the time of publication.

Daily digest market movers: China property woes spoil market cheer

- The New Zealand Dollar weakens on Thursday as concerns about the state of China’s property sector spoil the positive Retail Sales and Industrial Production data released on Wednesday, according to a report by Reuters.

- This comes after data showed a slowdown in Fixed Asset Investment in China, an umbrella term encompassing property.

- Fixed Asset Investment showed a 2.9% rise in October – below the 3.1% forecast by experts (YoY YTD in October) and the 3.1% previous, data from the National Bureau of Statistics of China showed on Wednesday.

- Despite concerns, the Chinese government has purportedly pledged 1 trillion Yuan in low-cost financing for the property sector, according to a report from Bloomberg News.